UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

|

¨

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2015

|

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

OR

|

¨

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

for the transition period from __________ to ___________

|

|

Commission file number 001-36848

Check-Cap Ltd.

(Exact name of the Registrant as specified in its charter)

Israel

(Jurisdiction of incorporation or organization)

Check-Cap Building

Abba Hushi Avenue

P.O. Box 1271

Isfiya, 30090

Mount Carmel, Israel

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class

Ordinary Shares, par value NIS 0.20

Name of each exchange on which registered

NASDAQ Capital Market

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

As of December 31, 2015, the registrant had 11,811,709 ordinary shares outstanding, NIS 0.2 par value per share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer.

|

o Large Accelerated filer

|

o Accelerated filer

|

x Non-accelerated filer

|

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

x US GAAP

|

o International Financial Reporting Standards as issued by the International Accounting Standards Board

|

o Other

|

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No x

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of the securities under a plan confirmed by a court.

Yes o No o

ii

TABLE OF CONTENTS

|

PART I

|

Page

|

|

| 3 | ||

| 3 | ||

| 3 | ||

|

A.

|

Selected financial data

|

3 |

|

B.

|

Capitalization and indebtedness

|

4 |

|

C.

|

Reasons for the offer and use of proceeds

|

4 |

|

D.

|

Risk factors

|

4 |

| 34 | ||

|

A.

|

History and Development of the Company

|

34 |

|

B.

|

Business Overview

|

35 |

|

C.

|

Organizational Structure

|

61 |

|

D.

|

Property, Plants and Equipment

|

61 |

| 61 | ||

| 62 | ||

|

A.

|

Operating Results

|

65 |

|

B.

|

Liquidity and Capital Resources

|

69 |

|

C.

|

Research and development, patents and licenses, etc.

|

78 |

|

D.

|

Trend Information

|

78 |

|

E.

|

Off-balance Sheet Arrangements

|

78 |

|

F.

|

Tabular Disclosure of Contractual Obligations.

|

78 |

| 79 | ||

|

A.

|

Directors and senior management

|

79 |

|

B.

|

Compensation

|

84 |

|

C.

|

Board Practices

|

88 |

|

D.

|

Employees

|

101 |

|

E.

|

Share Ownership

|

101 |

| 105 | ||

|

A.

|

Major shareholders

|

105 |

|

B.

|

Related party transactions

|

107 |

|

C.

|

Interests of experts and counsel

|

111 |

| 111 | ||

|

A.

|

Statements and Other Financial Information

|

111 |

|

B.

|

Significant Changes

|

111 |

| 112 | ||

|

A.

|

Offer and listing details

|

112 |

|

B.

|

Plan of distribution

|

112 |

|

C.

|

Markets

|

112 |

|

D.

|

Selling shareholders

|

112 |

|

E.

|

Dilution

|

113 |

|

F.

|

Expenses of the issue

|

113 |

iii

| 113 | ||

|

A.

|

Share capital

|

113 |

|

B.

|

Memorandum and articles of association

|

113 |

|

C.

|

Material contracts

|

118 |

|

D.

|

Exchange controls

|

118 |

|

E.

|

Taxation

|

118 |

|

F.

|

Dividends and paying agents

|

130 |

|

G.

|

Statement by experts

|

130 |

|

H.

|

Documents on display

|

130 |

|

I.

|

Subsidiary Information

|

130 |

| 131 | ||

| 131 | ||

|

PART II

|

||

| 131 | ||

| 131 | ||

| 131 | ||

| 132 | ||

| 132 | ||

| 132 | ||

| 133 | ||

| 133 | ||

| 133 | ||

| 133 | ||

| 133 | ||

| 134 | ||

|

PART III

|

||

| 135 | ||

| 135 | ||

| 135 | ||

| 137 |

iv

CERTAIN INFORMATION

In this Annual Report on Form 20-F, or the Annual Report, unless the context indicates otherwise, references to “NIS” are to the legal currency of Israel, “U.S. dollars,” “$” or “dollars” are to United States dollars, and the terms “we,” “us,” “our company,” “our,” and “Check-Cap” refer to Check-Cap Ltd. Unless otherwise indicated, U.S. dollar translation of NIS amounts presented in this Annual Report are translated using the rate of $1.00 = NIS 3.902, the exchange rate published by the Bank of Israel on December 31, 2015, and U.S. dollar translation of Euro amounts presented in this Annual Report are translated using the rate of $1.00 = Euro 0.9208, the exchange rates published by the Wall Street Journal on December 31, 2015.

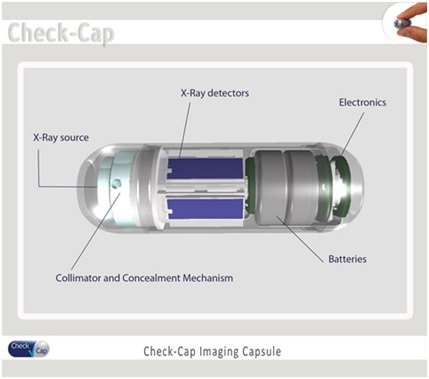

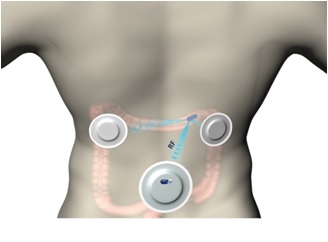

We are a clinical stage medical diagnostics company engaged in the development of an ingestible capsule system that utilizes ultra low-dose X-rays for the detection and imaging of colonic polyps and colorectal cancers, or CRC. While CRC is the second leading cause of death from cancer for both sexes combined in the United States and is largely preventable with early detection, according to 2013 National Health Interview Survey, only 58% of Americans between the ages of 50 to 75 reported being current with CRC screening recommendations. Unlike other screening modalities that are designed to generate structural information of the internal colon for the detection of colonic polyps and CRC, such as optical colonoscopy, computed tomographic colonography, or CTC, and other capsule-based technologies, our system is designed to be ingested without any cathartic preparation of the colon, and to travel through the gastrointestinal tract naturally while the patient continues his or her normal daily routine. Furthermore, unlike existing CRC imaging modalities currently on the market, all of which require the patient to fast for several hours prior to administration, the procedure for the Check-Cap system is designed to enable patients to continue eating normally. Our system is comprised of three main components: (1) ingestible scanning capsule; (2) Capsule Positioning System, or CPS, a recorder worn on the patient’s back; and (3) a PC-based work station for data reconstruction and image processing. We believe that this solution will be attractive to both physicians and patients, with the potential to increase the number of people undergoing CRC screening.

Beginning with the fourth quarter of 2015, we prepared our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP. We recast the comparative amounts included in our financial statements and in this report to U.S. GAAP. Prior to the fourth quarter of 2015, we prepared our financial reports in accordance with International Financial Reporting Standards as issued by International Accounting Standard Board, or IFRS. We elected to use U.S. GAAP to increase transparency and comparability of our financial reports and facilitate research and analysis by shareholders, analysts and other participants in the U.S. capital markets.

We effected a 1-for-20 reverse stock split of our ordinary shares effective immediately prior to the consummation of our initial public offering on February 24, 2015, in accordance with the approval of our shareholders at a meeting held on January 15, 2015. All share numbers in this Annual Report are reflected on a post- reverse stock split basis.

FORWARD-LOOKING STATEMENTS

This Annual Report contains statements that may be deemed to be “forward-looking statements” within the meaning of the federal securities laws. These statements relate to anticipated future events, future results of operations and/or future financial performance. In some cases, you can identify forward-looking statements by their use of terminology such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “ought to,” “plan,” “possible,” “potentially,” “predicts,” “project,” “should,” “will,” “would,” negatives of such terms or other similar terms. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The forward-looking statements in this Annual Report include, without limitation, statements relating to:

|

•

|

our goals, targets and strategies;

|

|

|

•

|

the timing and conduct of the clinical trials for our scanning system, including statements regarding the timing, progress and results of current and future preclinical studies and clinical trials, and our research and development programs;

|

|

|

•

|

the clinical utility, potential advantages and timing or likelihood of regulatory filings and approvals of our system;

|

|

•

|

our future business development, results of operations and financial condition;

|

|

|

•

|

our ability to protect our intellectual property rights;

|

|

|

•

|

our plans to develop, launch and commercialize our system and any future products;

|

|

|

•

|

the timing, cost or other aspects of the commercial launch of our system;

|

|

|

•

|

market acceptance of our product;

|

|

|

•

|

our estimates regarding expenses, future revenues, capital requirements and our need for additional financing and strategic partnerships;

|

|

|

•

|

our estimates regarding the market opportunity for our system;

|

|

|

•

|

the impact of government laws and regulations;

|

|

|

•

|

our ability to recruit and retain qualified clinical, regulatory and research and development personnel;

|

|

|

•

|

unforeseen changes in healthcare reimbursement for any of our approved product;

|

|

|

•

|

difficulties in maintaining commercial scale manufacturing capacity and capability; our ability to generate growth;

|

|

|

•

|

our failure to comply with regulatory guidelines;

|

|

|

•

|

uncertainty in industry demand and patient wellness behavior;

|

|

|

•

|

general economic conditions and market conditions in the medical device industry;

|

|

|

•

|

future sales of large blocks or our securities, which may adversely impact our share price;

|

|

|

•

|

depth of the trading market in our securities; and

|

|

|

•

|

our expectations regarding the use of proceeds of our initial public offering and the concurrent private placement.

|

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties, including those described in Item 3D “Key Information - Risk factors.”

You should not unduly rely on any forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report, to conform these statements to actual results or to changes in our expectations.

2

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

|

A.

|

Directors and Senior Management

|

Not required.

|

B.

|

Advisers

|

Not required.

|

C.

|

Auditors

|

Not required.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not required.

ITEM 3. KEY INFORMATION

|

A.

|

Selected financial data

|

The following selected consolidated financial data should be read in conjunction with Item 5 “Operating and Financial Review and Prospects” and the consolidated Financial Statements and Notes thereto included elsewhere in this Annual Report.

The following table summarizes our historical consolidated financial data. We have derived the selected consolidated statements of operations data for the years ended December 31, 2015, 2014 and 2013 and the selected consolidated balance sheet data as of December 31, 2015 and 2014 from our audited consolidated financial statements included elsewhere in this Annual Report. We have derived the selected consolidated financial data as of December 31, 2013 and 2012 from our audited consolidated financial statements not included in this Annual Report. Selected financial data as of, and for the year ended, December 31, 2011 have been omitted from this Annual Report because of our status as an emerging growth company under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and as per related guidance provided by the SEC. Our Consolidated Financial Statements have been prepared in accordance with U.S. GAAP.

Certain factors that affect the comparability of the information set forth in the following table are described in Item 5 “Operating and Financial Review and Prospects” and the Consoliated Financial Statements and related notes thereto included elsewhere in this Annual Report.

Consolidated Statements of Operations Data

|

Year Ended December 31,

|

||||||||||||||||

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||

|

(US$ in thousands, except per share data)

|

||||||||||||||||

|

Operating expenses(1)

|

||||||||||||||||

|

Research and development expenses, net(2)

|

$ | 5,837 | $ | 2,832 | $ | 2,893 | $ | 2,377 | ||||||||

|

General and administrative expenses

|

6,626 | 1,703 | 1,090 | 1,118 | ||||||||||||

|

Other income (expenses)

|

- | - | 11 | (14 | ) | |||||||||||

|

Operating loss

|

12,463 | 4,535 | 3,972 | 3,509 | ||||||||||||

|

Finance income (expenses), net

|

173 | 3,925 | 604 | (841 | ) | |||||||||||

|

Net loss

|

$ | 12,290 | $ | 610 | $ | 3,368 | $ | 4,350 | ||||||||

|

Net loss per ordinary share of NIS 0.20 par value, basic and diluted(3)

|

$ | 1.06 | $ | 1.18 | $ | 3.27 | $ | 3.88 | ||||||||

|

Weighted average number of ordinary shares outstanding – basic and diluted (in thousands)(3)

|

11,918 | 2,181 | 1,627 | 1,627 | ||||||||||||

3

Consolidated Balance Sheet Data

|

As of December 31,

|

||||||||||||||||

|

2015

|

2014

|

2013

|

2012

|

|||||||||||||

|

(US$ in thousands, except per share data)

|

||||||||||||||||

|

Cash and cash equivalents

|

$ | 9,392 | $ | 1,075 | $ | 4,975 | 4,579 | |||||||||

|

Working capital(4)

|

12,856 | (1,622 | ) | 4,134 | 7,931 | |||||||||||

|

Total assets

|

15,298 | 2,985 | 5,374 | 8,975 | ||||||||||||

|

Capital stock

|

46,763 | 20,999 | 20,687 | 20,631 | ||||||||||||

|

Total shareholders’ equity (deficiency)

|

$ | 12,648 | $ | (826 | ) | $ | (528 | ) | 2,782 | |||||||

_____________________

|

(1)

|

Includes share-based compensation expense in the total amount of $3.7 million, $312,000 and $56,000 for the years ended December 31, 2015, 2014 and 2013, respectively. For additional information, see Item 5B “Operating and Financial Review and Prospects—Liquidity and Capital Resources—Application of Critical Accounting Policies and Estimates-Share-based compensation.”

|

|

(2)

|

Research and development expenses, net is presented net of amount of grants received from the Office of the Chief Scientist of the Ministry of Economy and Industry (formerly named the Ministry of Economy), or the OCS, and Israel-United States Binational Industrial Research and Development Foundation, or the BIRD Foundation. The effect of the participation by the OCS and BIRD totaled $354,000, $643,000 and $148,000 for the years ended December 31, 2015, 2014 and 2013, respectively. See Item 5A “Operating and Financial Review and Prospects—Operating Results - Financial Operations Overview—Research and Development, Expenses, Net” for more information.

|

|

(3)

|

Basic and diluted loss per ordinary share is computed based on the basic and diluted weighted average number of ordinary shares outstanding during each period. For purposes of these calculations, the following ordinary shares were deemed to be outstanding: (i) 99,774 ordinary shares that were issuable to Mr. Guy Neev upon exercise of options, referred to as the Neev Options, which options were exercised immediately prior to the consummation of our initial public offering on February 24, 2015; (ii) 375,204 ordinary shares issuable under warrants that are automatically exercised, for no consideration (unless the holder thereof objects to such exercise), upon the exercise by Mr. Guy Neev of the Neev Options, of which warrants to purchase 195,012 ordinary shares were exercised during the year ended December 31, 2015; (iii) 2,658,463 ordinary shares issuable upon the exercise of outstanding warrants with an exercise price of NIS 0.20 per share, of which warrants to purchase 1,557,507 ordinary shares were exercised during the year ended December 31, 2015; and (iv) 210,964 ordinary shares issuable upon the exercise of certain outstanding options and warrants with an exercise price of NIS 0.20 per share. For additional information, see Note 15 to our Consoliated Financial Statements for the year ended December 31, 2015 included elsewhere in this Annual Report.

|

|

(4)

|

Working capital is defined as total current assets minus total current liabilities.

|

|

B.

|

Capitalization and Indebtedness

|

Not required.

|

C.

|

Reasons for the Offer and Use of Proceeds

|

Not required.

|

D.

|

Risk factors

|

In conducting our business, we face many risks that may interfere with our business objectives. Some of these risks could materially and adversely affect our business, financial condition and results of operations. In particular, we are subject to various risks resulting from changing economic, political, industry, business and financial conditions. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially adversely affect our business operations.

You should carefully consider the following factors and other information in this Annual Report before you decide to invest in our ordinary shares. If any of the risks referred to below occur, our business, financial condition and results of operations could suffer. In any such case, the trading price of our ordinary shares could decline, and you may lose all or part of your investment.

4

Risks Related to Our Business

We have a history of losses, may incur future losses and may not achieve profitability.

We are a clinical and development-stage medical diagnostics company with a limited operating history. We have incurred net losses in each fiscal year since we commenced operations in 2009. We incurred net losses of $3.4 million in 2013, $610,000 in 2014 and $12.3 million in 2015. As of December 31, 2015, our accumulated deficit was $34.1 million. Our losses could continue for the foreseeable future as we continue our investment in research and development and clinical trials to complete the development of our technology and to attain regulatory approvals, begin the commercialization efforts for our system, increase our marketing and selling expenses, and incur additional costs as a result of being a public company in the United States. As discussed in Note 1B to the financial statements presented elsewhere in this Annual Report, successful completion of our development program and, ultimately, the attainment of profitable operations is dependent upon future events, including obtaining adequate financing to fulfill its development activities and achieving a level of sales adequate to support our cost structure. The extent of our future operating losses and the timing of becoming profitable are highly uncertain, and we may never achieve or sustain profitability.

We may not succeed in completing the development of our product, commercializing our product and generating significant revenues.

Since commencing our operations, we have focused on the research and development and limited clinical trials of our capsule. Our product is not approved for commercialization and has never generated any revenues. Our ability to generate revenues and achieve profitability depends on our ability to successfully complete the development of our product, obtain market approval and generate significant revenues. The future success of our business cannot be determined at this time, and we do not anticipate generating revenues from product sales for the foreseeable future. In addition, we have no experience in commercializing our capsule and face a number of challenges with respect to our commercialization efforts, including, among others, that:

|

•

|

we may not have adequate financial or other resources to complete the development of our product;

|

|

•

|

we may not be able to manufacture our products in commercial quantities, at an adequate quality or at an acceptable cost;

|

|

•

|

we may not be able to establish adequate sales, marketing and distribution channels;

|

|

•

|

healthcare professionals and patients may not accept our system;

|

|

•

|

we may not be aware of possible complications from the continued use of our system since we have limited clinical experience with respect to the actual use of our system;

|

|

•

|

other technological breakthroughs in colorectal cancer, or CRC screening, treatment and prevention may reduce the demand for our system;

|

|

•

|

changes in the market for CRC screening, new alliances between existing market participants and the entrance of new market participants may interfere with our market penetration efforts;

|

|

•

|

third-party payors may not agree to reimburse patients for any or all of the purchase price of our capsule, which may adversely affect patients’ willingness to purchase our capsule;

|

|

•

|

uncertainty as to market demand may result in inefficient pricing of our system;

|

|

•

|

we may face third-party claims of intellectual property infringement;

|

|

•

|

we may fail to obtain or maintain regulatory approvals for our system in our target markets or may face adverse regulatory or legal actions relating to our system even if regulatory approval is obtained; and

|

|

•

|

we are dependent upon the results of ongoing clinical studies relating to our system and the products of our competitors.

|

5

If we are unable to meet any one or more of these challenges successfully, our ability to effectively commercialize our system could be limited, which in turn could have a material adverse effect on our business, financial condition and results of operations.

Clinical failure can occur at any stage of clinical development. Our clinical experience to date does not necessarily predict future results and may not have revealed certain potential limitations of the technology and potential complications from our system and may require further clinical validation. Any product version we advance through clinical trials may not have favorable results in later clinical trials or receive regulatory approval

Clinical failure can occur at any stage of clinical development. To date, we have performed clinical studies with several versions of both scanning and non-scanning capsules, in conjunction with iterative versions of the tracking and recording systems (CPS). Our clinical trials have been conducted using prior versions of our scanning capsules and were conducted under differing protocols and using limited groups of patients. Therefore, we have a limited ability to identify potential problems and/or inefficiencies concerning current and future versions of our system in advance of its use in expanded groups of patients and we cannot assure you that its actual clinical performances will be satisfactory to support proposed indications and regulatory approvals, or that its use will not result in unanticipated complications. Furthermore, the results from laboratory, pre-clinical, and completed clinical studies, as well as preliminary analyses of the currently ongoing clinical studies, may not be indicative of final clinical results obtained from our current system or future versions of our system on expanded screening populations. In addition, the results of our clinical trials are subject to human analyses and interpretation of the data accumulated, which could be affected by various errors due to, among others, lack of sufficient clinical experience with our system, interpretation errors in the analysis of the clinical trials results, including the reconstructed images by our system, or due to uncertainty in the actual efficacy of our system in its current clinical stage. Therefore, the safety and efficacy of our system and the clinical results to date will require further independent professional validation and require further clinical study. If our system does not function as expected over time, we may not be able to develop our system at the rate or to the stage we desire, we could be subject to liability claims, our reputation may be harmed, our system may not achieve regulatory clearances, and our system may not be widely adopted.

We expect to derive most of our revenues from sales of one product or product line. Our inability to successfully commercialize this product, or any subsequent decline in demand for this product, could severely harm our ability to generate revenues.

We are currently dependent on the successful commercialization of our system to generate revenues. As a result, factors adversely affecting our ability to successfully commercialize, or the pricing of or demand for, this product could have a material adverse effect on our financial condition and results of operations. If we are unable to successfully commercialize or create market demand for our system, we will have limited ability to generate revenues.

Furthermore, and consequently, we are vulnerable to fluctuations in demand for our system. Such fluctuations in demand may be due to many factors, including, among others:

|

•

|

market acceptance of a new product, including healthcare professionals’ and patients’ preferences;

|

|

•

|

development of similarly cost-effective products by our competitors;

|

|

•

|

development delays of our system;

|

|

•

|

technological innovations in CRC screening, treatment and prevention;

|

|

•

|

adverse medical side effects suffered by patients using our system, whether actually resulting from the use of our system or not;

|

|

•

|

changes in regulatory policies toward CRC screening or imaging technologies;

|

|

•

|

changes in regulatory approval or clearance requirements for our product;

|

|

•

|

third-party claims of intellectual property infringement;

|

|

•

|

budget constraints and the availability of reimbursement or insurance coverage from third-party payors for our system;

|

|

•

|

increases in market acceptance of other technologies; and

|

6

|

•

|

adverse responses from certain of our competitors to the offering of our system.

|

If healthcare professionals do not recommend our product to their patients, our system may not achieve market acceptance and we may not become profitable.

CRC screening candidates are generally referred by their healthcare professional to a specified device and screening technologies are purchased by prescription. If healthcare professionals, including physicians, do not recommend or prescribe our product to their patients, our system may not achieve market acceptance and we may not become profitable. In addition, physicians have historically been slow to change their medical diagnostic and treatment practices because of perceived liability risks arising from the use of new products. Delayed adoption of our system by healthcare professionals could lead to a delayed adoption by patients and third-party payors. Healthcare professionals may not recommend or prescribe our system until certain conditions have been satisfied including, among others:

|

•

|

there is sufficient long-term clinical and health-economic evidence to convince them to alter their existing screening methods and device recommendations;

|

|

•

|

there are recommendations from other prominent physicians, educators and/or associations that our system is safe and effective;

|

|

•

|

we obtain favorable data from clinical and health-economic studies for our system;

|

|

•

|

reimbursement or insurance coverage from third-party payors is available; and

|

|

•

|

they become familiar with the complexities of our system.

|

We cannot predict when, if ever, healthcare professionals and patients may adopt the use of our system. Even if favorable data is obtained from clinical and health-economic studies for our system, there can be no assurance that prominent physicians would endorse it or that future clinical studies will continue to produce favorable data regarding our system. In addition, prolonged market exposure may also be a pre-requisite to reimbursement or insurance coverage from third-party payors. If our system does not achieve an adequate level of acceptance by patients, healthcare professionals and third-party payors, we may not generate significant product revenues and we may not become profitable.

If we are unable to market and sell our system, we may not become profitable.

We have not had any sales of our system to date. There can be no assurance that we will be able to receive regulatory clearance for our system in the foreseeable future or ever or that our system will be accepted as comparable or superior to existing technologies for the visualization, imaging or screening of the colon. Our ability to market and sell our system successfully depends on one or more of the following:

|

•

|

the existence of clinical and health-economic data sufficient to support the use of our system for the visualization, imaging, or screening of the colon as compared to other colon visualization, imaging or screening methods (if clinical trials indicate that our system is not as clinically effective as other current methods, or if our technology causes unexpected complications or other unforeseen negative effects, we may not obtain regulatory clearance or approval to market and sell our system or physicians may be reluctant to use it);

|

|

•

|

the availability of sufficient clinical and health-economic data for physicians to use our system in their practice and for private third-party payors to make an adequate reimbursement decision to provide coverage for our system; or

|

|

•

|

the availability of a reliable contrast agent for our system that is accepted by and health-economic physicians and patients.

|

If one or more of the above conditions is not satisfied, we may not be able to market and sell our system or the demand for our system may be lower than expected and sales of our system may not contribute to our growth at the rate we expect or at all.

7

We expect to face competition from large, well-established manufacturers of traditional technologies for detecting gastrointestinal disorders, as well as from other manufacturers of optical capsule endoscopy systems or new competitive technologies.

Competition for our system comes from traditional well-entrenched manufacturers of equipment for detecting gastrointestinal disorders and diseases, such as colonoscopy, sigmoidoscopy, optical capsule endoscopy and CTC. The principal manufacturers of equipment for optical colonoscopy, sigmoidoscopy and optical capsule endoscopy are Olympus, Pentax, Richo Company Ltd., Hoya, Covidien plc and Fuji Film. The principal manufacturers of equipment for CTC are General Electric Healthcare Systems, Siemens Medical Solutions, Philips Medical Systems Ltd. and Toshiba Corporation. All of these companies have substantially greater financial resources than we do, and they have established reputations as well as worldwide distribution channels for providing medical instruments to physicians.

In addition, several companies have developed or are developing technologies based on molecular diagnostics (from blood and other bodily fluids), or MDx, tests that investigate the link between genes and the function of metabolic pathways, drug metabolism and disease development with a primary focus on the study of DNA, RNA and proteins. Genetic markers can be traced within stool samples in minute quantities. A U.S. based company, Exact Sciences, has developed a special collecting kit for stool samples and an analyzer to detect neoplasia associated DNA markers and the presence of occult hemoglobin in human stool. The method of screening is included in colorectal cancer screening guidelines, including those of the American Cancer Society.

To our knowledge, certain companies are developing or commercializing optics-based capsule endoscopy systems. The existing capsule technology requires intense bowel cleansing, more so than is required for optical colonoscopy, and the potential ingestion of agents to boost capsule transit through the colon. Given Imaging, an Israeli-based company that was acquired by Covidien plc (NYSE: COV) in February 2014 (subsequently acquired by Medtronic), has developed visualization capsules for the detection of disorders of the esophagus, small bowel and colon. It received the CE Mark to market PillCam™ COLON throughout the European Union in 2006. In early 2014, the FDA cleared PillCam COLON 2 system with an indication to provide visualization of the colon. It may be used for detection of colon polyps in patients after an incomplete optical colonoscopy with adequate preparation, and when a complete evaluation of the colon was not technically possible. In Early 2016, the FDA cleared PillCam COLON2 system with an expended indication for use: High risk population to undergo colonoscopy. Patients with major risks for colonoscopy or moderate sedation, but who tolerate colonoscopy and moderate sedation in the event a clinically significant colon abnormality was identified on capsule endoscopy. Other companies, including Olympus, CapsoVision, Intromedic and RF System, are developing similar approaches for optical capsule endoscopy.

Procedures for bowel cleansing that are less onerous are constantly being developed, which could make our entry into the market more difficult. For instance, bowel cleansing initiated by the ingestion of pills rather than through drinking large amounts of distasteful liquids may be viewed as an improvement to the cleansing process, but other screening methods may be even more palatable to patients.

If we are unable to convince physicians to adopt our system over the current technologies marketed by our competitors, our results of operations may suffer.

We are planning to rely on local distributors and/or strategic partners to market and distribute our system in those countries where we intend to market and distribute our system.

We are planning to rely on local distributors and/or strategic partners for the marketing and distribution of our system. Our success in generating sales in countries or regions where we will engage local distributors will depend in part on the efforts of third parties over whom we have limited control. If we are unable to identify suitable local distributors in the countries where we intend to market and distribute our system, our business, financial condition and results of operations could be negatively affected.

We have limited manufacturing capabilities and if we are unable to scale our manufacturing operations to meet anticipated market demand, our growth could be limited and our business, financial condition and results of operations could be materially adversely affected.

We currently have limited resources, facilities and experience in commercially manufacturing sufficient quantities of our system, external receiver and software application to meet the demand we expect from our expanded commercialization efforts. We expect to face certain technical challenges as we increase manufacturing capacity, including, among others, logistics associated with the handling of radioactive materials, equipment design and automation, material procurement, lower than expected yields and increased scrap costs, as well as challenges related to maintaining quality control and assurance standards. Furthermore, we may encounter similar or unforeseen challenges initiating and later expanding production of any new products. If we are unable to scale our manufacturing capabilities to meet market demand, our growth could be limited and our business, financial condition and results of operations could be materially adversely affected.

8

In addition, we have received and may receive in the future grants from the Government of the State of Israel through the OCS (for more information, see “Risks Related to Our Operations in Israel”), the terms of which require that products developed with OCS grants be manufactured in Israel and that the technology developed thereunder may not be transferred outside of Israel, unless prior approval is received from the OCS, which we may not receive. We are currently considering whether it would be possible to assemble the capsule without the X-ray source in Israel, and have the X-ray source subsequently inserted into our system at a reactor or cyclotron site or at a distribution center outside Israel. Even following the full repayment of any OCS grants, we must nevertheless continue to comply with the requirements of the Encouragement of Industrial Research and Development Law 5744-1984, or the Research Law. The foregoing restrictions may impair our ability to outsource or transfer development or manufacturing activities with respect to any product or technology outside of Israel.

Our reliance on single source suppliers could harm our ability to meet demand for our product in a timely manner or within budget.

We currently depend on single source supplier for some of the components necessary for the production of our system. For example, for the current version of the system used in clinical trials, we currently have a single supplier for the motor that we are using to rotate the collimated X-ray source in our system and for the X-ray detectors used in our system. There are a limited number of manufacturers worldwide who are capable of manufacturing the motor and the specially designed X-ray detectors that we currently use in our system. In addition, the application-specific integrated circuit, or ASIC, residing in our system is currently manufactured for us by a single semiconductor fabrication plant, or FAB. There are many alternative FABs worldwide and the design of our current ASIC could be adapted in the event it became necessary to use an alternative FAB. Our X-ray source manufacturer is considered a single source supplier. Our X-ray source is custom made and therefore, would require us to qualify an alternative supplier, if required. Our current suppliers have been able to supply the required quantities of such components to date. However, if the supply of these components is disrupted or terminated or if our current suppliers are unable to supply required quantities of components, we may not be able to find alternative sources for these key components in a timely manner. Although we are planning to maintain strategic inventory of key components, the inventory may not be sufficient to satisfy the demand for our system if such supply is interrupted or otherwise affected by catastrophic events such as a fire at our storage facility. As a result, we may be unable to meet the demand for our system, which could harm our ability to generate revenues, lead to customer dissatisfaction and damage our reputation. If we are required to change the manufacturer of any of these key components, there may be a significant delay in locating a suitable alternative manufacturer. In addition, we may be required to verify that the new manufacturer maintains facilities and procedures that comply with FDA and other applicable quality standards and with all applicable regulations and guidelines. The delays associated with the identification of a new manufacturer could delay our ability to manufacture our system in a timely manner or within budget. Furthermore, in the event that the manufacturer of a key component of our system ceases operations or otherwise ceases to do business with us, we may not have access to the information necessary to enable another supplier to manufacture the component. The occurrence of any of these events could harm our ability to meet demand for our system in a timely manner or within budget.

The use of any of our scanning capsule, cps or workstation could result in product liability or similar claims that could be expensive damage our reputation and harm our business.

Our business exposes us to an inherent risk of potential product liability or similar claims related to the manufacturing, marketing and sale of medical devices. The medical device industry has historically been litigious, and we face financial exposure to product liability or similar claims if the use of any of our scanning capsule, cps or workstation were to cause or contribute to injury or death, including, without limitation, harm to the body caused by the procedure or inaccurate diagnoses from the procedure that could affect treatment options. There is also the possibility that defects in the design or manufacture of any of these products might necessitate a product recall. Although we plan to maintain product liability insurance, the coverage limits of these policies may not be adequate to cover future claims. In the future, we may be unable to maintain product liability insurance on acceptable terms or at reasonable costs and such insurance may not provide us with adequate coverage against potential liabilities. A product liability claim, regardless of merit or ultimate outcome, or any product recall could result in substantial costs to us, damage to our reputation, customer dissatisfaction and frustration, and a substantial diversion of management attention. A successful claim brought against us in excess of, or outside of, our insurance coverage could have a material adverse effect on our business, financial condition and results of operations.

Our system is a complex medical device that requires training for qualified personal and care for data analysis.

Our system is a complex medical device that requires training for qualified personal, including physicians, and care for data analysis. Although our distributors will be required to ensure that our system is only prescribed by trained clinicians, the potential for misuse of our system still exists due to its complexity. Such misuse could result in adverse medical consequences for patients that could damage our reputation, subject us to costly product liability litigation and otherwise have a material adverse effect on our business, financial condition and results of operations.

9

We depend on third parties to manage our clinical studies and trials and to perform related data collection and analysis and to enroll patients for our clinical trials, and, as a result, we may face costs and delays that are beyond our control.

We rely on third parties, including clinical investigators and clinical sites, to manage our clinical trials and to perform data collection and analysis and to enroll patients for our clinical trials. Although we have and expect to continue to have contractual arrangements with these third parties, we may not be able to control the amount and timing of resources that these parties devote to our studies and trials or the quality of these resources. If these third parties fail to properly manage our studies and trials or enroll patients for our clinical trials, we will be unable to complete them at all or in a satisfactory or timely manner, which could prevent us from obtaining regulatory approvals for, or achieving market acceptance of, our product.

In addition, termination of relationships with third parties may result in delays, inability to enter into arrangements with alternative third parties or do so on commercially reasonable terms. Switching or adding additional clinical sites involves additional cost and requires management time and focus. In addition, there is a natural transition period when a new clinical site commences work. As a result, delays occur, which can materially impact our ability to meet our desired clinical development timelines.

We intend to sell our products in the United States, Europe and Japan and, if we are unable to manage our operations in these territories, our business, financial condition and results of operations could be materially adversely affected.

Our headquarters and substantially all of our operations and employees are presently located in Israel, but we intend to market our products in the United States, Europe and Japan. Accordingly, we are subject to risks associated with international operations, and our international sales and operations will require significant management attention and financial resources. In addition, our international sales and operations will subject us to risks inherent in international business activities, many of which are beyond our control and include, among others:

|

•

|

foreign certification, registration and other regulatory requirements;

|

|

•

|

customs clearance and shipping delays;

|

|

•

|

import and export controls;

|

|

•

|

trade restrictions;

|

|

•

|

multiple and possibly overlapping tax structures;

|

|

•

|

difficulty forecasting the results of our international operations and managing our inventory due to our reliance on third-party distributors;

|

|

•

|

differing laws and regulations, business and clinical practices, third-party payor reimbursement policies and patient preferences;

|

|

•

|

differing standards of intellectual property protection among countries;

|

|

•

|

difficulties in staffing and managing our international operations;

|

|

•

|

difficulties in penetrating markets in which our competitors’ products are more established;

|

|

•

|

currency exchange rate fluctuations; and

|

|

•

|

political and economic instability, war or acts of terrorism.

|

If we are unable to manage our international operations effectively, our business, financial condition and results of operations could be materially adversely affected.

10

We will require additional funding and may license certain rights to third parties in order to complete the development and commercialization of our system and the development and commercialization of any future products.

Our operations have consumed substantial amounts of cash. We expect that we will need to continue to spend substantial amounts in order to complete the development, clinical development, regulation and commercialization of our system. Although we intend to use the proceeds of our initial public offering and the concurrent private placement to finance these efforts, we will need to raise additional funds and may license certain rights to third parties to obtain the required capital prior to completing the development and commercialization of our product. Additional financing may not be available to us on a timely basis on terms acceptable to us, or at all. In addition, any additional financing may be dilutive to our shareholders or may require us to grant a lender a security interest in our assets.

Furthermore, if adequate additional financing on acceptable terms is not available, we may not be able to develop our system at the rate or to the stage we desire and we may have to delay or abandon the commercialization of our system. Alternatively, we may be required to prematurely license to third parties the rights to further develop or to commercialize our system on terms that are not favorable to us. Any of these factors could materially adversely affect our business, financial condition and results of operations.

If we lose our key personnel or are unable to attract and retain additional personnel, our business and ability to compete will be harmed.

Our success relies upon the continued service and performance of the principal members of our management and research and development team. In order to implement our business strategy, we will need to retain our key personnel with expertise in the areas of research and development, clinical testing, government regulation, manufacturing, finance, marketing and sales. Our product development plans depend in part on our ability to retain engineers with expertise in a variety of technical fields. The loss of a number of these persons or our inability to attract and retain qualified personnel could harm our business and our ability to compete.

Substantially all of our operations are currently conducted at a single location near Haifa, Israel, and any disruption at our facility could materially adversely affect our business, financial condition and results of operations.

Substantially all of our operations are conducted at a single location near Haifa, Israel. We take precautions to safeguard our facility, including obtaining insurance coverage and implementing health and safety protocols. However, a natural or other disaster, such as a fire, flood or an armed conflict involving Israel, as detailed further below, could damage or destroy our facility and our manufacturing equipment or inventory, cause substantial delays in our operations and otherwise cause us to incur additional unanticipated expenses. In addition, the insurance we maintain against fires, floods and other natural disasters may not be adequate to cover our losses in any particular case and it does not cover losses resulting from armed conflicts or terrorist attacks in Israel. Damage to our facility, our other property or to any of our suppliers, whether located in Israel or elsewhere, due to fire, a natural disaster or casualty event or an armed conflict, could materially adversely affect our business, financial condition and results of operations, with or without insurance.

We have and will incur significant increased costs as a result of operating as a public company in the United States, and our management will be required to devote substantial time to compliance initiatives.

As a public company whose securities are traded in the United States, we have and will continue to incur significant legal, accounting and other expenses that we did not incur as a private company. The Sarbanes-Oxley Act of 2002, as well as rules and regulations implemented by the U.S. Securities and Exchange Commission and the NASDAQ Stock Market, impose various requirements on public companies, including requiring the establishment and maintenance of effective disclosure and financial controls. Our management and other personnel will need to devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations have and will increase our legal and financial compliance costs and will make some activities more time consuming and costly. These rules and regulations make it more difficult and more expensive for us to obtain certain types of insurance including director and officer liability insurance and we may be required to accept reduced policy limits and coverage or incur substantial costs to maintain the same or similar coverage. The impact of these requirements could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as executive officers. We cannot predict or estimate the amount or timing of additional costs we may incur in order to comply with such requirements.

11

We are required to develop and maintain proper and effective internal controls over financial reporting. We may not complete our analysis of our internal controls over financial reporting in a timely manner, or these internal controls may have one or more material weaknesses, which may adversely affect investor confidence in our company and, as a result, the value of our securities.

Ensuring that we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial statements on a timely basis will be a costly and time-consuming effort that will need to be evaluated frequently. Section 404 of the Sarbanes-Oxley Act requires the management of public companies to conduct an annual review and evaluation of their internal controls and to obtain an attestation report from their registered public accounting firm regarding the effectiveness of internal controls. We are required to perform the annual review and evaluation of our internal controls no later than in connection with the second annual report on Form 20-F filed after closing of our initial public offering, which occurred on February 24, 2015. However, if we qualify as a smaller reporting company and/or emerging growth company, which we expect to, we will be exempt from the auditors’ attestation requirement until such time as we no longer qualify as a smaller reporting company and/or emerging growth company. We would no longer qualify as a smaller reporting company if the market value of our public float exceeded $75 million as of the last day of our second fiscal quarter in any fiscal year following the date of our initial public offering. We would no longer qualify as an emerging growth company at such time as described in the risk factor immediately below.

We are in the early stages of the costly and challenging process of compiling the system and processing documentation necessary to evaluate and correct a material weakness in internal controls needed to comply with Section 404. The material weakness relates to our being a small company with a limited number of employees which limits our ability to assert the controls related to the segregation of duties. During the evaluation and testing process, if we identify one or more additional material weaknesses in our internal control over financial reporting, we will be unable to assert that our internal controls are effective. If we are unable to assert that our internal control over financial reporting is effective, we could lose investor confidence in the accuracy and completeness of our financial reports, which would cause the price of our securities to decline.

While we currently qualify as an “emerging growth company” under the JOBS Act, we will cease to be an emerging growth company on or before the end of 2020, and at such time our costs and the demands placed upon our management will increase.

We will continue to be deemed an emerging growth company until the earliest of (i) the last day of the fiscal year in which our annual gross revenues exceed $1 billion (as indexed for inflation); (ii) the last day of the fiscal year in which the fifth anniversary of the date of the first sale of securities under this registration statement; (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; or (iv) the date on which we are deemed to be a ‘large accelerated filer,’ as defined by the U.S. Securities and Exchange Commission, which would generally occur upon our attaining a public float of at least $700 million. Once we lose emerging growth company status, we expect the costs and demands placed upon our management to increase, as we will be required to comply with additional disclosure and accounting requirements, particularly if we also no longer qualify as a smaller reporting company.

Risks Related to Regulations

If we are unable to obtain, or experience significant delays in obtaining, FDA clearances or approvals, CE Certificates of Conformity, or equivalent third country approvals for our system or future products or product enhancements, our ability to commercially distribute and market our products could suffer.

Our products are subject to rigorous regulation by FDA and numerous other federal, state and foreign governmental authorities and notified bodies. The process of obtaining regulatory clearances or approvals, CE Certificates of Conformity, or equivalent third country approvals to market a medical device can be costly and time consuming, and we may not be able to obtain these clearances or approvals, CE Certificates of Conformity, or equivalent third country approvals on a timely basis, if at all. In particular, we expect to eventually generate a portion of our revenues from sales of our system and future products in the United States, the European Union, or third countries. Before a new medical device, or a new use of, or claim for, an existing product can be marketed in the United States, it must first receive clearance under Section 510(k) of the Federal Food, Drug and Cosmetic Act, or FDA approval of a premarket approval application, or PMA, unless an exemption applies. FDA will clear marketing of a low to moderate risk medical device through the 510(k) process if sufficiently similar predicate devices have previously been cleared via this pathway. In the 510(k) clearance process, FDA must only determine that the proposed device is “substantially equivalent” to a device legally on the market, known as a “predicate” device, with respect to intended use/indications for use, technological characteristics and principles of operation in order to clear the proposed device for marketing. Clinical data is sometimes required to support substantial equivalence.

High risk devices deemed to pose the greatest risk, such as life-sustaining, life-supporting, or implantable devices, or devices not deemed substantially equivalent to a previously cleared device, require approval of a PMA. The PMA process is more costly, lengthy and uncertain than the 510(k) clearance process. The PMA pathway requires an applicant to demonstrate the safety and effectiveness of the device based, in part, on the data obtained in clinical trials. A PMA application must be supported by extensive data, including, but not limited to, technical, preclinical, clinical trial, manufacturing and labeling data, to demonstrate to FDA’s satisfaction the safety and efficacy of the device for its intended use.

12

In instances where a device is novel and there is no suitable predicate device, but that device is deemed to be of low to moderate risk, FDA can reclassify the device to class I or class II via de novo reclassification. This process involves the submission of a reclassification petition, and FDA accepting that “special controls” are adequate to ensure the product’s performance and safety. FDA now allows “direct” de novo reclassification petitions, a mechanism by which a sponsor can directly submit a detailed de novo reclassification petition as the device’s initial submission without having to first receive a not substantially equivalent, or NSE, decision on a 510(k) submission.

These processes can be expensive and lengthy. FDA’s 510(k) clearance process usually takes from 6 to 9 months, but it can last longer. Direct de novo reclassification typically takes at least 9 to 12 months from filing to clearance. The PMA pathway is much more costly and uncertain than the 510(k) clearance process or de novo reclassification, and generally takes at least 12 to 18 months, or even longer, from the time the application is filed with FDA to ultimate approval.

We are not aware of any legally marketed predicate device upon which FDA could base a determination of substantial equivalence under a 510(k) clearance process. Our strategy therefore is to submit a direct de novo reclassification petition for our system. To support this petition, our objective is to demonstrate that the device poses a low to moderate risk to patients. We cannot assure you that FDA will not demand that we obtain PMA approval of our system.

FDA can delay, limit or deny clearance or approval of an application for many reasons, including, among others:

|

•

|

we may not be able to demonstrate to FDA’s satisfaction that our products are safe and effective for their intended use;

|

|

•

|

the data from our pre-clinical studies and clinical trials may be insufficient to support clearance or approval;

|

|

•

|

in the case of a PMA submission, that the manufacturing process or facilities we use may not meet applicable requirements; and

|

|

•

|

changes in FDA’s 510(k) clearance, de novo reclassification, or PMA approval processes and policies, or the adoption of new regulations may require additional data.

|

We may not obtain the necessary regulatory clearances, approvals, CE Certificates of Conformity or equivalent third country approvals to market our system or future products in the United States or elsewhere. Any delay in, or failure to receive or maintain, clearance, approval or CE Certificates of Conformity for our system or other products under development could prevent us from generating revenue from these products or achieving profitability.

There is no guarantee that the FDA will grant de novo reclassification or PMA approval of our system and failure to obtain necessary 510(k) clearances or approvals for our future products would adversely affect our ability to grow our business.

Our system and some of our future products will require FDA clearance of a 510(k), de novo reclassification, or may require FDA approval of a PMA. The FDA may not approve or clear our system or our future products for the indications that are necessary or desirable for successful commercialization. Indeed, the FDA may refuse our requests for 510(k) clearance, de novo reclassification or PMA for our system or any other future product, new intended uses or modifications to these products once they are cleared or approved for marketing.

Our strategy is to submit a direct de novo reclassification petition for our system. A de novo reclassification generally applies where there is no predicate device and the FDA believes the device poses a low to moderate risk. De novo reclassifications can either be submitted in lieu of a 510(k) notice, such as in our case, or after a 510(k) notice has been filed and found NSE. If a 510(k) notice is found NSE, a de novo petition must be submitted within 30 days from the receipt of the NSE determination.

To support our direct de novo reclassification petition, our objective is to demonstrate that the device poses a low to moderate risk to patients. If the FDA determines that our system is not a candidate for de novo reclassification, it will require approval of the device for market through the PMA process. A PMA application must be supported by extensive data, including, but not limited to, technical, preclinical, clinical trial, manufacturing and labeling data, to demonstrate to the FDA’s satisfaction the safety and efficacy of the device for its intended use. By statute, the FDA has 180 days to review the “accepted application,” although, generally, review of the application can take between one and three years. During this review period, the FDA may request additional information or clarification of information already provided or even request new data that may require us to conduct additional tests. Also during the review period, an advisory panel of experts from outside the FDA may be convened to review and evaluate the application and provide recommendations to the FDA as to the approvability of the device. In addition, the FDA will conduct a preapproval inspection of the manufacturing facility to ensure compliance with quality system regulations. The FDA’s review of a PMA could significantly delay our plans to get to market. There is also no guarantee that the FDA would approve a PMA. Failure to receive clearance or approval for our system or future products would have an adverse effect on our ability to expand our business.

13

If we or our future distributors do not obtain and maintain the necessary regulatory clearances or approvals, or CE Certificates of Conformity, or equivalent third country approvals in a specific country or region, we will not be able to market and sell our system or future products in that country or region.

We intend to market our system in a number of international markets. To be able to market and sell our system in a specific country or region, we and/or our distributors must comply with the regulations of that country or region. While the regulations of some countries do not impose barriers to marketing and selling part or all of our products or only require notification, others require that we and/or our distributors obtain the approval of a specified regulatory authorities or that we obtain CE Certificates of Conformity from a Notified Body. We are engaged with Dekra Certification as our Notified Body for such purposes. These regulations, including the requirements for approvals or CE Certificates of Conformity, and the time required for regulatory review, vary from country to country. Obtaining regulatory approvals or CE Certificates of Conformity is expensive and time-consuming, and we cannot be certain that we or our distributors will receive regulatory approvals or CE Certificates of Conformity for our system or any future products in each country or region in which we plan to market such products. If we modify our system or any future products, we or our distributors may need to apply for new regulatory approvals or our Notify Body may need to review the planned changes before we are permitted to sell them. We may not meet the quality and safety standards required to maintain the authorizations or CE Certificates of Conformity that we or our distributors have received. If we or our distributors are unable to maintain our authorizations or CE Certificates of Conformity in a particular country or region, we will no longer be able to sell our system or any future products in that country or region, and our ability to generate revenues will be materially and adversely affected.

Our system may be considered a drug-device combination product because of the preparatory use of Iodine or barium sulfate to provide a coating for colonic imaging. We cannot be sure how the FDA or the competent regulatory authorities of foreign countries will regulate this product. The review of combination products is often more complex and more time consuming than the review of products under the jurisdiction of only one center within the FDA.

Our system may be considered a combination product because of the preparatory use of barium sulfate or Iodine to provide a coating for colonic imaging. A combination product is the combination of two or more regulated components, i.e., drug/device, biologic/device, drug/biologic, or drug/device/biologic, that are combined or mixed and produced as a single entity; packaged together in a single package or as a unit; or a drug, device, or biological product packaged separately that according to its investigational plan or proposed labeling is intended for use only with an approved individually specified drug, device, or biological product where both are required to achieve the intended use, indication or effect. For a combination product, the FDA must determine which center or centers within the FDA will review the product and under what legal authority the product candidate will be reviewed. The combination product’s primary mode of action is used to determine which center within the FDA has primary regulatory jurisdiction over the product. The other centers within the agency also may provide consulting or collaborative reviews of the product as necessary. We believe that we have put forth a reasonable argument to the FDA that our system should be regulated as a device and or a combination product with a device primary mode of action. However, we cannot be sure as to whether the FDA will treat our system as a device or a combination product. The review of combination products is often more complex and more time consuming than the review of a product under the jurisdiction of only one center within the FDA. In the case of the system, should the FDA determine that the barium sulfate is not being used in accordance with its approved labeling, the Center for Drug Evaluation and Research may take a prominent role it its regulation. If the FDA does not approve or clear our system, or any future products, in a timely fashion, or at all, our business and financial condition will be adversely affected.

Similar obstacles may be encountered in foreign countries should our system be considered as a combination product.

14

If the indications for use or instructions for use for which the Iodine-based contrast agent or the barium sulfate- based contrast agent is approved are not sufficiently broad to support its use prior to the ingestion of our capsules, the FDA or the competent regulatory authorities in the EU Member States and other foreign countries may consider that contrast agent is being used off-label.

Ingestion of our system requires the preparatory use of Iodine or barium sulfate to provide a coating for colonic imaging. We cannot be sure that the indications for which Iodine-based contrast agent or the barium sulfate-based contrast agent are approved in the United States, the EU Member States or in other countries is sufficiently broad to cover such use. If the FDA or the competent regulatory authorities in the EU Member States and in other countries consider that Iodine and/or barium sulfate is not approved for the purpose for which it is used with the system, we may be considered to promote the off-label use of the Iodine and/or barium sulfate. Because the promotion of off-label use of drugs or medicinal products is prohibited in the United States, the EU Member States and in other countries, we could face both related issues with the FDA and/or the competent authorities of the EU Member States and/or other countries. In these circumstances, the FDA and/or the competent regulatory authorities in the EU Member States and/or other countries may require us to obtain appropriate regulatory approvals for the Iodine-based contrast agent or the barium sulfate-based contrast agent prior to marketing our system with such substances. Under such circumstances, should we fail to obtain approval of the contrast agent for use with our system, in a timely fashion, or at all, our business and financial condition will be adversely affected.

If we are unable to successfully complete clinical trials with respect to our system, we may be unable to receive regulatory approvals or clearances, CE Certificates of Conformity or equivalent third country approvals for our system and/or our ability to achieve market acceptance of our system will be harmed.

The development of medical devices typically includes pre-clinical studies. Certain other devices require the submission of data generated from clinical trials, which can be long, expensive and uncertain processes, subject to delays and failure at any stage. The data obtained from the studies and trials may be inadequate to support regulatory clearances or approvals, or to obtain CE Certificates of Conformity or equivalent third country approval, or to allow market acceptance of the products being studied. Our system technology is currently undergoing clinical development and clinical trials. To date, we have performed clinical studies with several versions of our system and with several versions of our non-scanning capsules.

The development of sufficient and appropriate clinical protocols to demonstrate safety and efficacy are required, and we may not adequately develop such protocols to support clearance, approval, or to obtain CE Certificates of Conformity or equivalent third country approval. The clinical trials that were conducted using prior versions of our system, were conducted under differing protocols and used groups of patients different from those we intend to study in future clinical trials. Further, FDA, the competent regulatory authorities of other countries, or our Notified Body in the EU may require us to submit data on a greater number of patients than we originally anticipated and/or for a longer follow-up period or they may change the data collection requirements or data analysis applicable to our clinical trials.

The commencement or completion of any of our clinical studies or trials may be delayed or halted, or be inadequate to support regulatory clearance, approval or product acceptance, or to obtain CE Certificates of Conformity or equivalent third country approval, for numerous reasons, including, among others:

|

•

|

patients do not enroll in the clinical trial at the rate we expect;

|

|

•

|

patients do not comply with trial protocols;

|

|

•

|

patient follow-up is not at the rate we expect;

|

|

•

|

undetected capsule retention in patients

|

|

|

•