SIMPSON THACHER & BARTLETT LLP

425 LEXINGTON AVENUE

NEW YORK, NY 10017-3954

(212) 455-2000

FACSIMILE (212) 455-2502

| DIRECT DIAL NUMBER (212) 455-3352 |

|

E-MAIL ADDRESS KWALLACH@STBLAW.COM |

|

July 6, 2015

VIA EDGAR

| Re: | Blue Buffalo Pet Products, Inc. |

| Amendment No. 1 to Registration Statement on Form S-1 |

| Filed June 25, 2015 |

| CIK No. 0001609989 |

H. Roger Schwall

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington D.C. 20549

Ladies and Gentlemen:

On behalf of Blue Buffalo Pet Products, Inc. (the “Company”), we are submitting this letter on a supplemental basis in order to facilitate the review by the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) of the Company’s Registration Statement on Form S-1 (Form No. 333-204847) (the “Registration Statement”).

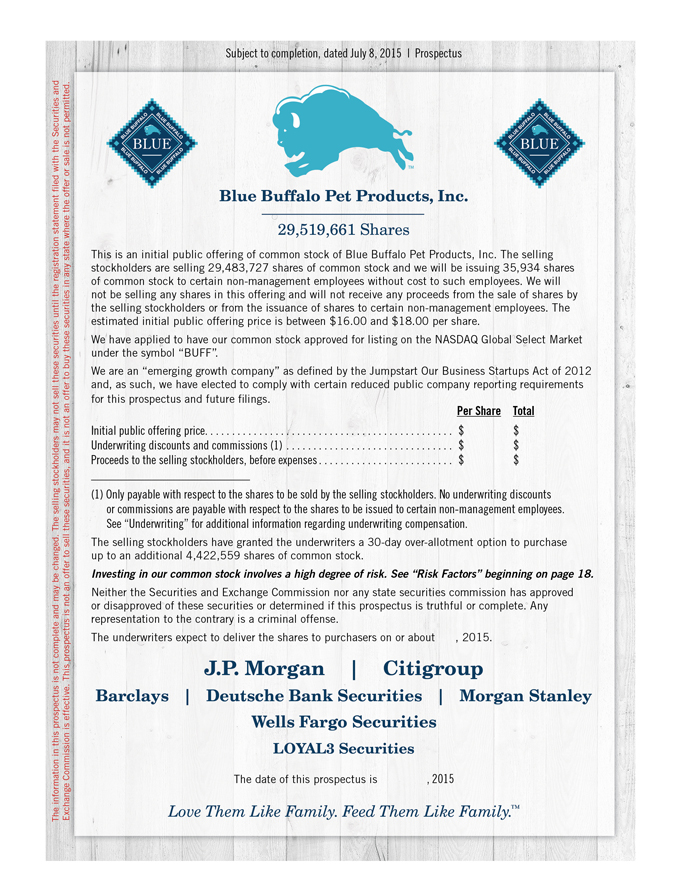

We have attached as Exhibit A to this letter versions of the “Summary—The Offering,” “Use of Proceeds,” “Capitalization,” “Executive Compensation,” “Principal and Selling Stockholders,” “Shares Eligible for Future Sale” and “Underwriting” sections of the Registration Statement and the Company’s financial statements that reflect (i) an estimated initial public offering price per share between $16.00 and $18.00 per share, (ii) a 4.2-for-1 stock split and (iii) an assumed offering size of 29,519,661 shares (before giving effect to the underwriters’ over-allotment option to purchase additional shares). For convenient reference, we will also supplementally provide to the Staff marked versions of these sections of the Registration Statement to show all changes from the corresponding sections in Amendment No. 1 to the Registration Statement filed on June 25, 2015.

We are also providing a form of the “Summary—Recent Developments” section that presents a range of the Company’s estimated net sales, net income and adjusted net income

| Securities and Exchange Commission | July 6, 2015 |

(including a reconciliation of the mid-point of the estimated range for net income to the mid-point of the estimated range for adjusted net income) for the six months ended June 30, 2015, compared to the Company’s net sales, net income and adjusted net income for the six months ended June 30, 2014. The Company expects to provide this information to potential investors by including it in the preliminary prospectus for the offering. The form of “Summary—Recent Developments” section is attached to this letter as Exhibit B.

The Company respectfully acknowledges the comment regarding the inside cover art that the Staff related orally. In response to the Staff’s comment, the Company has revised the inside cover art and expects to include the revised cover art in the preliminary prospectus for the offering. The revised cover art is attached to this letter as Exhibit C.

Please do not hesitate to call Ken Wallach at (212) 455-3352 with any questions or further comments regarding this filing.

| Very truly yours, |

| /s/ Simpson Thacher & Bartlett LLP |

| Simpson Thacher & Bartlett LLP |

| cc: | Securities and Exchange Commission |

Joseph Klinko

Lily Dang

Parhaum J. Hamidi

Norman von Holtzendorff

Blue Buffalo Pet Products, Inc.

Michael Nathenson

2

Exhibit A

THE OFFERING

| Common Stock offered by the Selling Stockholders |

29,483,727 shares (or 33,906,286 shares if the underwriters exercise their over-allotment option to purchase additional shares from the selling stockholders in full). |

| Common Stock issued by us to Non-Management Employees |

35,934 shares. See “LOYAL3 platform” below. |

| Common Stock to be Outstanding after this Offering |

196,034,108 shares. |

| Use of Proceeds |

We will not receive any proceeds from the sale of shares of our common stock in this offering by the selling stockholders or from the issuance of shares to certain non-management employees. However, we will pay certain expenses, other than underwriting discounts and commissions, associated with this offering. See “Use of Proceeds.” |

| Controlled Company |

Upon the closing of this offering, our Sponsor will own approximately 121.9 million shares, or 62.2%, of our outstanding common stock. As a result, we will be a “controlled company” within the meaning of the listing rules, and therefore will be exempt from certain of the corporate governance listing requirements, of the NASDAQ Global Select Market, or NASDAQ. |

| LOYAL3 platform |

At our request, the underwriters have reserved up to 5% of the shares of common stock offered by this prospectus to be offered to our employees, customers and partners and individual investors through the LOYAL3 platform. Any purchases of shares in this offering through the LOYAL3 platform will be at the initial public offering price. Up to 35,934 of the shares offered through the LOYAL3 platform will be allocated among certain non-management employees in amounts determined by us. Such employees will not be required to pay for these shares. See “Underwriting.” |

| Risk Factors |

Investing in shares of our common stock involves a high degree of risk. See “Risk Factors” beginning on page 18 of this prospectus for a discussion of factors you should carefully consider before investing in shares of our common stock. |

| NASDAQ trading symbol |

“BUFF.” |

In this prospectus, the number of shares of our common stock to be outstanding after this offering is based on 195,749,011 shares of our common stock outstanding as of June 30, 2015, and:

| • | excludes 4,411,139 shares of common stock issuable upon exercise of stock options outstanding as of June 30, 2015 under our 2012 Blue Buffalo Pet Products, Inc. Stock Purchase and Option Plan, or the 2012 Plan (excluding shares of common stock that will be issued to holders of such options for sale in this offering), at a weighted average exercise price of $5.89 per share; |

| • | excludes 8,400,000 shares of common stock reserved as of the closing date of this offering for future issuance under our 2015 Omnibus Incentive Plan, or the 2015 Plan; and |

| • | is adjusted to reflect the issuance of 249,163 shares of our common stock to holders of stock options under the 2012 Plan upon exercise thereof, which shares are to be sold in this offering. |

12

Unless otherwise indicated, this prospectus reflects and assumes:

| • | the 4.2-for-1 stock split that we effectuated on July 7, 2015 and accounts for the adjustment of the exercise price of all outstanding stock options and the number of shares subject to such stock options; |

| • | the filing of our amended and restated certificate of incorporation and the adoption of our amended and restated bylaws, which will occur immediately prior to the effectiveness of the registration statement of which this prospectus forms a part; |

| • | no exercise by the underwriters of their over-allotment option to purchase additional shares of common stock; and |

| • | no exercise of outstanding options after June 30, 2015. |

13

The selling stockholders are selling 33,906,286 shares of our common stock in this offering, which includes the 4,422,559 shares, if any, that may be sold in connection with the exercise of the underwriters’ over-allotment option. We will be issuing 35,934 shares of our common stock to certain non-management employees without cost to such employees. See “Principal and Selling Stockholders” and “Underwriting.” We will not receive any proceeds from the sale of shares of our common stock in this offering by the selling stockholders or from the issuance of shares to certain non-management employees. However, we will pay certain expenses, other than underwriting discounts and commissions, associated with this offering.

40

The following table sets forth our cash and cash equivalents and capitalization as of March 31, 2015, on:

| • | an actual basis; and |

| • | an as adjusted basis to give effect to the following, as if each had occurred on March 31, 2015: (1) the issuance of 249,163 shares of our common stock to holders of stock options under the 2012 Plan upon exercise thereof, which shares are to be sold in this offering and (2) the issuance of 35,934 shares of common stock to certain non-management employees in connection with this offering based on an assumed price of $17.00 per share, which is the mid-point of the price range set forth on the cover page. |

You should read this table together with “Prospectus Summary—Summary Consolidated Financial Data,” “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Underwriting” and our audited consolidated financial statements and unaudited condensed consolidated financial statements and the related notes included elsewhere in this prospectus.

| (in thousands) | As of March 31, 2015 |

|||||||

| Actual | As Adjusted | |||||||

| Cash and cash equivalents (1) |

$ | 149,044 | $ | 150,471 | ||||

|

|

|

|

|

|||||

| Long-term debt (including current maturities) |

||||||||

| Revolving credit facility (2) |

— | — | ||||||

| Term loan facilities |

390,067 |

|

390,067 |

| ||||

|

|

|

|

|

|||||

| Total long-term debt |

390,067 | 390,067 | ||||||

|

|

|

|

|

|||||

| Stockholders’ deficit: |

||||||||

| Common stock, $0.01 par value; authorized 207,060,000 shares, issued and outstanding 195,747,774 shares, actual; authorized 207,060,000 shares, issued and outstanding 196,032,871 shares, as adjusted |

1,957 | 1,960 | ||||||

| Additional paid-in capital |

58,164 | |

60,200 |

| ||||

| Accumulated deficit |

(116,891) | (117,270) | ||||||

|

|

|

|

|

|||||

| Total stockholders’ deficit |

(56,770) | (55,110) | ||||||

|

|

|

|

|

|||||

| Total capitalization |

$ | 482,341 | $ | 485,428 | ||||

|

|

|

|

|

|||||

| (1) | Does not reflect offering expenses, which we estimate to be approximately $6.6 million. |

| (2) | Our revolving credit facility consists of a $40.0 million revolving credit facility maturing on August 8, 2017. As of March 31, 2015, there were no outstanding borrowings under our revolving credit facility. |

42

Overview

This compensation discussion provides an overview of our executive compensation program and compensation for our named executive officers, or NEOs, for fiscal 2014. Our NEOs for fiscal 2014 were Kurt Schmidt, our Chief Executive Officer and Director, Mike Nathenson, our Chief Financial Officer, and Billy Bishop, our President and Chief Operating Officer.

Compensation Philosophy and Objectives

The Company is committed to achieving long-term, sustainable growth and increasing shareholder value. The primary objectives of our executive compensation program are as follows:

| • | to attract, motivate and retain superior executive talent as the Company continues to execute its growth initiatives; |

| • | to encourage strong financial performance on an annual and long-term basis; and |

| • | to align the interests of our executive officers and stockholders by rewarding executive officers for behaviors which drive shareholder value creation. |

The Company’s compensation program for our NEOs is designed to support these objectives and encourage strong financial performance on an annual and long-term basis by linking a significant portion of our NEOs’ total compensation to Company performance in the form of incentive compensation and long-term equity compensation. The principal elements of the compensation structure for our NEOs are base salary, annual cash incentive compensation and long-term equity incentive compensation.

Summary Compensation Table

The following table sets forth information regarding compensation awarded to, earned by, or paid to our NEOs during the years ended December 31, 2014 and December 31, 2013.

| Name and principal position |

Year | Salary ($) | Non-equity incentive plan compensation ($) (1) |

All other compensation ($) (2) |

Total ($) | |||||||||||||||

| Kurt Schmidt |

2014 | 631,905 | 366,505 | 27,722 | 1,026,132 | |||||||||||||||

| Chief Executive Officer |

2013 | 609,000 | 913,500 | 24,732 | 1,547,232 | |||||||||||||||

| Mike Nathenson |

2014 | 318,270 | 123,071 | 26,642 | 467,983 | |||||||||||||||

| Chief Financial Officer |

2013 | 304,500 | 319,741 | 30,072 | 654,313 | |||||||||||||||

| Billy Bishop |

2014 | 269,088 | 104,052 | 18,724 | 391,864 | |||||||||||||||

| President and |

2013 | 253,750 | 266,451 | 13,620 | 533,821 | |||||||||||||||

| Chief Operating Officer |

||||||||||||||||||||

| (1) | Reflects amounts earned under the Company’s fiscal 2014 and 2013 annual incentive compensation plans, respectively. |

| (2) | Amounts reported for Kurt and Mike reflect Company-paid life insurance premiums, 401(k) Plan matching contributions and a car allowance. The amount reported for Mike also reflects reimbursement for relocation costs in fiscal 2013. The amount reported for Billy reflects Company-paid life insurance premiums and a car allowance. |

103

Employment Agreements

We do not have formal employment agreements with any of our NEOs. However, we typically enter into offer letters with our executive officers. In connection with the commencement of their employment in 2012, we entered into offer letters with Kurt and Mike setting forth their initial compensation and benefits. In addition, under the terms of the their offer letters, Kurt and Mike are entitled to change of control benefits, which are described in detail below. See “—Potential Payments Upon a Change of Control.”

Base Salary

We provide base salary to our NEOs and other employees to compensate them for services rendered during the year. The base salaries of our NEOs are reviewed on an annual basis and adjustments are made to reflect performance-based factors, as well as competitive conditions. We do not apply specific formulas to determine increases. Generally, executive officers’ base salaries are adjusted during the first quarter of each year.

The 2014 base salaries were set by our Compensation Committee based on the recommendations of our CEO, other than with respect to his own salary, which was set by the Board of Directors upon the recommendations of the Compensation Committee.

Annual Cash Incentive Compensation

Fiscal 2014

Our annual cash incentive award is designed to reward our NEOs based on Company performance. Our Compensation Committee establishes a target award opportunity for each NEO on an annual basis, usually in the first quarter of each year. In March 2015, our Compensation Committee approved annual cash incentive awards payable under the fiscal 2014 annual incentive compensation plan.

Each NEO’s target annual bonus is typically expressed as a percentage of base salary. For fiscal 2014, the NEOs’ target bonus opportunities (as a percentage of each executive’s base salary) were as follows: Kurt, 100%, Mike, 66.7% and Billy, 66.7%. The NEOs’ maximum bonus opportunities (as a percentage of such executives’ target bonus opportunities) were as follows: Kurt, 150%, Mike, 200% and Billy, 200%.

For fiscal 2014, annual cash incentive awards were based on achievement of a combination of net sales and bank adjusted EBITDA goals (with bank adjusted EBITDA calculated as it is calculated pursuant to our credit agreement). The Compensation Committee has reserved the ability to adjust the actual bank adjusted EBITDA results to exclude the effects of extraordinary, unusual or infrequently occurring events. No such adjustments were made by the Compensation Committee with respect to fiscal 2014 results. The net sales component composed 50% of the total award opportunity, and the bank adjusted EBITDA component composed 50% of the total award opportunity.

The actual fiscal 2014 annual cash incentive awards for the NEOs were determined by multiplying their respective target annual bonus amounts by the sum of (1) the net sales component weighted achievement factor (50% multiplied by the net sales payout percentage) and (2) the bank adjusted EBITDA component weighted achievement factor (50% multiplied by the bank adjusted EBITDA component payout percentage). The financial performance component payout percentages were determined by calculating our achievement against the net sales and bank adjusted EBITDA targets based on the pre-established scales set forth in the following tables:

| Threshold | Target | Maximum | ||||

| Net Sales Performance Percentage of Target |

90% | 100% | 110% | |||

| Net Sales Payout Percentage |

0% | 100% | 200% |

104

| Threshold | Target | Maximum | ||||

| Bank adjusted EBITDA Performance Percentage of Target |

85% | 100% | 115% | |||

| Bank adjusted EBITDA Payout Percentage |

0% | 100% | 200% |

For performance percentages between the specified threshold, target and maximum levels, the resulting payout percentage would have been adjusted on a linear basis.

The Company’s fiscal 2014 net sales performance as a percentage of target net sales performance was 98%, which resulted in a payout percentage of 80% and a weighted achievement factor of 40%. The Company’s fiscal 2014 bank adjusted EBITDA performance as a percentage of target bank adjusted EBITDA performance was 90.4%, which resulted in a payout percentage of 36% and a weighted achievement factor of 18%. This resulted in a combined achievement factor of 58%.

The following table illustrates the calculation of the annual cash incentive awards payable to each of our NEOs under the fiscal 2013 annual incentive compensation plan based on the financial performance results. These awards are also reported under the Non-Equity Incentive Plan Compensation column of the Summary Compensation Table.

| 2014 Salary |

Bonus Target Percentage |

Bonus Target Amount |

Combined Achievement Factor |

Actual Bonus Paid |

||||||||||

| Kurt Schmidt |

$631,905 | 100% | $631,905 | 58% | $ | 366,505 | ||||||||

| Mike Nathenson |

$318,270 | 66.7% | $212,286 | 58% | $ | 123,071 | ||||||||

| Billy Bishop |

$269,088 | 66.7% | $179,482 | 58% | $ | 104,052 | ||||||||

Long-term Cash Incentive Compensation

In 2015, the Compensation Committee approved a one-time long-term cash incentive program designed to reward our NEOs, along with other members of management, for long-term corporate performance based upon the Company’s adjusted net income growth in advance of what we anticipate will be an annual long-term equity incentive program beginning in 2016. Each NEO’s target long-term cash incentive award is expressed as a percentage of base salary as of January 1, 2015 and were as follows: Kurt, 250%, Mike, 125% and Billy, 125%.

The long-term cash incentive awards were granted on January 1, 2015 and will vest after 3 years in varying degrees based upon the Company’s adjusted net income compounded annual growth rate, or CAGR, at December 31, 2017 relative to our adjusted net income for fiscal 2014. Depending on the CAGR achieved, the amount of cash incentive compensation received at the end of the performance period will range from 0% of the target award for below threshold performance up to 150% of the target award for maximum performance.

Long-term Equity Incentive Compensation

We use equity awards to incentivize and reward our executive officers for long-term corporate performance based on the value of our common stock and, thereby, to align the interests of our executive officers with those of our stockholders.

We currently have a long-term equity incentive plan: the 2012 Stock Purchase and Option Plan of Blue Buffalo Pet Products, Inc., or the 2012 Plan, which is described below under the heading “—Equity Compensation and Stock Purchase Plans.” Pursuant to the 2012 Plan we have provided long-term equity compensation to Kurt and Mike in the form of incentive stock options.

105

Options Granted in Previous Fiscal Years

There were no long-term equity incentive awards granted to our NEOs in fiscal 2014 and 2013. In fiscal 2012, in connection with the commencement of their employment with us, each of Kurt and Mike was granted incentive stock options that are subject solely to time-based vesting restrictions. The time-based vesting criteria will be satisfied in equal installments on the first five anniversaries of the grant date, subject to continued employment with us through the applicable vesting dates.

Any fully vested options will generally remain outstanding and exercisable for 90 days after termination of employment, although this period is generally extended to one year if the termination of employment is due to death, “permanent disability” or “retirement” (as such terms are defined in the incentive stock option agreement), and any fully vested options will immediately terminate if the named executive officer’s employment is terminated by us for “cause” (as defined in the incentive stock option agreement). Any vested options that are not exercised within the applicable post-termination exercise window will terminate.

In connection with the option grants, Kurt and Mike became parties to the investor rights agreement, which has been amended and restated. See “Certain Relationships and Related-Party Transactions—Investor Rights Agreement.” In addition, Kurt and Mike also executed standard confidentiality, non-competition and proprietary rights agreements with the Company. These agreements subject Kurt and Mike to restrictive covenants, including an indefinite covenant on confidentiality of information, and covenants related to non-competition, non-disparagement and non-solicitation of our employees, consultants and customers at all times during employment, and for one year after any termination of employment.

Outstanding Equity Awards at 2014 Fiscal Year-End

The following table sets forth information regarding outstanding option awards held by our NEOs under the 2012 Plan as of December 31, 2014.

| Option Awards | ||||||||||||||||||||

| Name |

Grant date | Number of securities underlying unexercised options (#) exercisable (1) |

Number of securities underlying unexercised options (#) unexercisable (1) |

Option exercise price ($ per share) |

Option expiration date |

|||||||||||||||

| Kurt Schmidt |

12/18/2012 | 1,204,954 | 1,807,428 | 5.60 | 12/18/2022 | |||||||||||||||

| Mike Nathenson |

12/18/2012 | 321,316 | 481,983 | 5.60 | 12/18/2022 | |||||||||||||||

| Billy Bishop |

— | — | — | — | — | |||||||||||||||

| (1) | Reflects options subject solely to time-based vesting restrictions. The time-vesting options granted to the NEOs vest in five equal installments on each anniversary of the respective grant dates. Billy does not hold any options. |

401(k) Plan

The Company has established a tax-qualified Section 401(k) retirement savings plan, or the 401(k) Plan, for employees, including our NEOs, who satisfy certain eligibility requirements. The 401(k) Plan permits employee contributions up to statutory limits, of which we provide matching contributions of up to 4% of the employee’s eligible compensation contributed to the 401(k) Plan, at a rate of 100% on the first 3% of the

106

employee’s eligible compensation contributed to the 401(k) Plan and 50% on the next 2% of the employee’s eligible compensation contributed to the 401(k) Plan. Employees are 100% vested in matching Company contributions when such contributions are made. The Company may make non-elective contributions to employees. Employees become 20% vested in non-elective contributions per year of service up to 100% vested after five years of service.

Potential Payments Upon Change of Control

Kurt’s offer letter provides that, in the event of a change of control all his unvested options will become fully vested and exercisable. In addition, in the event of a change of control all of his account balances in the Company’s 401(k) plan, including any unvested balances from Company matches, will automatically and fully vest. The Company will also reimburse him for the actual cost of COBRA coverage for up to the maximum period of time permitted by law if his employment terminates following a change of control.

Mike’s offer letter provides that, solely in the event of his termination without “cause” or for “good reason” (as such terms are defined in Mike’s offer letter) in connection with or within 12 months of a change of control, subject to his signing a standard release of claims, all his unvested options will become fully vested and exercisable. In addition, all of his account balances in the Company’s 401(k) plan, including any unvested balances from Company matches, will automatically and fully vest and the Company will reimburse him for the actual cost of COBRA coverage for up to the maximum period of time permitted by law.

We currently have no formal change of control arrangements with Billy.

The Company expects to adopt a formal executive severance policy in connection with this offering.

Equity Compensation Plans and Stock Purchase Plans

The following description of each of our equity compensation plans is qualified by reference to the full text of those plans, which will be filed as exhibits to the registration statement of which this prospectus forms a part. Our equity compensation plans are designed to continue to give our company flexibility to make a wide variety of equity awards to reflect what the compensation committee believes at the time of such award will best motivate and reward our employees, directors, consultants and other service providers.

2012 Stock Purchase and Option Plan of Blue Buffalo Pet Products, Inc.

The purpose of the 2012 Plan is to align the interests of the officers, employees, directors, consultants and other key persons of Blue Buffalo with the interests of Blue Buffalo. The 2012 Plan is administered by the Compensation Committee of the Board of Directors of Blue Buffalo. The Compensation Committee has the authority to determine eligible participants in the 2012 Plan. Awards granted under the 2012 Plan may be in the form of stock options, stock appreciation rights, restricted stock awards, performance units, performance shares, or other awards not expressly provided for under the 2012 Plan. Stock options granted under the 2012 Plan may be either incentive stock options or nonqualified stock options. Stock option grants are made with exercise prices as determined by the Compensation Committee but shall not be less than the grant date fair market value in the case of incentive stock options. The Compensation Committee, in its sole discretion, may grant stock appreciation rights which allow the grantee to elect to receive upon the exercise of the option shares of stock with an aggregate fair market value equal to the excess of the fair market value of the shares of stock with respect to which the option is exercised over the aggregate exercise price of the option as determined on the exercise date. Restricted stock awards granted under the 2012 Plan are made with purchase prices as determined by the Compensation Committee and subject to conditions and restrictions as determined by the Compensation Committee on the grant date.

107

2015 Omnibus Incentive Plan

In connection with this offering, our Board of Directors expects to adopt, and our stockholders expect to approve, our 2015 Omnibus Incentive Plan, or the 2015 Plan, prior to the completion of this offering.

Purpose. The purpose of our 2015 Plan is to provide a means through which to attract and retain key personnel and to provide a means whereby our directors, officers, employees, consultants and advisors can acquire and maintain an equity interest in us, or be paid incentive compensation, including incentive compensation measured by reference to the value of our common stock, thereby strengthening their commitment to our welfare and aligning their interests with those of our stockholders.

Administration. Our 2015 Plan will be administered by the Compensation Committee of our Board of Directors. The Compensation Committee is authorized to interpret, administer, reconcile any inconsistency in, correct any defect in and/or supply any omission in our 2015 Plan and any instrument or agreement relating to, or any award granted under, our 2015 Plan; establish, amend, suspend, or waive any rules and regulations and appoint such agents as the Compensation Committee deems appropriate for the proper administration of our 2015 Plan; and to make any other determination and take any other action that the Compensation Committee deems necessary or desirable for the administration of our 2015 Plan. Except to the extent prohibited by applicable law or the applicable rules and regulations of any securities exchange or inter-dealer quotation system on which our securities are listed or traded, the Compensation Committee may allocate all or any portion of its responsibilities and powers to any one or more of its members and may delegate all or any part of its responsibilities and powers to any person or persons selected by it in accordance with the terms of our 2015 Plan. Unless otherwise expressly provided in our 2015 Plan, all designations, determinations, interpretations, and other decisions under or with respect to our 2015 Plan or any award or any documents evidencing awards granted pursuant to our 2015 Plan are within the sole discretion of the Compensation Committee, may be made at any time and are final, conclusive and binding upon all persons or entities, including, without limitation, us, any participant, any holder or beneficiary of any award, and any of our stockholders.

Shares Subject to our 2015 Plan. Our 2015 Plan provides that the total number of shares of common stock that may be issued under our 2015 Plan is 8,400,000. Of this amount, the maximum number of shares for which incentive stock options may be granted is 8,400,000; the maximum number of shares for which options or stock appreciation rights may be granted to any individual participant during any single fiscal year is 2,100,000; the maximum number of shares for which performance compensation awards denominated in shares may be granted to any individual participant in respect of a single fiscal year is 2,100,000 (or if any such awards are settled in cash, the maximum amount may not exceed the fair market value of such shares on the last day of the performance period to which such award relates); the maximum number of shares of common stock granted during a single fiscal year to any non-employee director, taken together with any cash fees paid to such non-employee director during the fiscal year, shall not exceed $500,000 in total value; and the maximum amount that may be paid to any individual participant for a single fiscal year under a performance compensation award denominated in cash is $10,000,000. Except for substitute awards (as described below), in the event any award terminates, lapses, or is settled without the payment of the full number of shares subject to such award, including as a result of net settlement of the award or as a result of the award being settled in cash, the undelivered shares may be granted again under our 2015 Plan, unless the shares are surrendered after the termination of our 2015 Plan, and only if stockholder approval is not required under the then-applicable rules of the exchange on which the shares of common stock are listed. Awards may, in the sole discretion of the Compensation Committee, be granted in assumption of, or in substitution for, outstanding awards previously granted by an entity directly or indirectly acquired by us or with which we combine (referred to as “substitute awards”), and such substitute awards shall not be counted against the total number of shares that may be issued under our 2015 Plan, except that substitute awards intended to qualify as “incentive stock options” shall count against the limit on incentive stock options described above. No award may be granted under our 2015 Plan after the tenth anniversary of the effective date (as defined therein), but awards theretofore granted may extend beyond that date.

108

Options. The Compensation Committee may grant non-qualified stock options and incentive stock options, under our 2015 Plan, with terms and conditions determined by the Compensation Committee that are not inconsistent with our 2015 Plan; provided, that all stock options granted under our 2015 Plan are required to have a per share exercise price that is not less than 100% of the fair market value of our common stock underlying such stock options on the date such stock options are granted (other than in the case of options that are substitute awards), and all stock options that are intended to qualify as incentive stock options must be granted pursuant to an award agreement expressly stating that the options are intended to qualify as an incentive stock options, and will be subject to the terms and conditions that comply with the rules as may be prescribed by Section 422 of the Code. The maximum term for stock options granted under our 2015 Plan will be ten years from the initial date of grant, or with respect to any stock options intended to qualify as incentive stock options, such shorter period as prescribed by Section 422 of the Code. However, if a non-qualified stock option would expire at a time when trading of shares of common stock is prohibited by our insider trading policy (or “blackout period” imposed by us), the term will automatically be extended to the 30th day following the end of such period. The purchase price for the shares as to which a stock option is exercised may be paid to us, to the extent permitted by law (i) in cash or its equivalent at the time the stock option is exercised; (ii) in shares having a fair market value equal to the aggregate exercise price for the shares being purchased and satisfying any requirements that may be imposed by the Compensation Committee; or (iii) by such other method as the Compensation Committee may permit in its sole discretion, including, without limitation, (A) in other property having a fair market value on the date of exercise equal to the purchase price, (B) if there is a public market for the shares at such time, through the delivery of irrevocable instructions to a broker to sell the shares being acquired upon the exercise of the stock option and to deliver to us the amount of the proceeds of such sale equal to the aggregate exercise price for the shares being purchased or (C) through a “net exercise” procedure effected by withholding the minimum number of shares needed to pay the exercise price and all applicable required withholding taxes. Any fractional shares of common stock will be settled in cash.

Stock Appreciation Rights. The Compensation Committee may grant stock appreciation rights, with terms and conditions determined by the Compensation Committee that are not inconsistent with our 2015 Plan. Generally, each stock appreciation right will entitle the participant upon exercise to an amount (in cash, shares or a combination of cash and shares, as determined by the Compensation Committee) equal to the product of (i) the excess of (A) the fair market value on the exercise date of one share of common stock, over (B) the strike price per share, times (ii) the number of shares of common stock covered by the stock appreciation right. The strike price per share of a stock appreciation right will be determined by the Compensation Committee at the time of grant but in no event may such amount be less than the fair market value of a share of common stock on the date the stock appreciation right is granted (other than in the case of stock appreciation rights granted in substitution of previously granted awards).

Restricted Shares and Restricted Stock Units. The Compensation Committee may grant restricted shares of our common stock or restricted stock units, representing the right to receive, upon the expiration of the applicable restricted period, one share of common stock for each restricted stock unit, or, in its sole discretion of the Compensation Committee, the cash value thereof (or any combination thereof). As to restricted shares of our common stock, subject to the other provisions of our 2015 Plan, the holder will generally have the rights and privileges of a stockholder as to such restricted shares of common stock, including, without limitation, the right to vote such restricted shares of common stock (except, that if the lapsing of restrictions with respect to such restricted shares of common stock is contingent on satisfaction of performance conditions other than or in addition to the passage of time, any dividends payable on such restricted shares of common stock will be retained, and delivered without interest to the holder of such shares when the restrictions on such shares lapse).

Other Stock-Based Awards. The Compensation Committee may issue unrestricted common stock, rights to receive grants of awards at a future date, or other awards denominated in shares of common stock (including, without limitation, performance shares or performance units), under our 2015 Plan, including performance-based awards, with terms and conditions determined by the Compensation Committee that are not inconsistent with our 2015 Plan.

109

Performance Compensation Awards. The Compensation Committee may also designate any award as a “performance compensation award” intended to qualify as “performance-based compensation” under Section 162(m) of the Code. The Compensation Committee also has the authority to make an award of a cash bonus to any participant and designate such award as a performance compensation award under our 2015 Plan. The Compensation Committee has sole discretion to select the length of any applicable performance periods, the types of performance compensation awards to be issued, the applicable performance criteria and performance goals, and the kinds and/or levels of performance goals that are to apply. The performance criteria that will be used to establish the performance goals may be based on the attainment of specific levels of our performance (and/or one or more affiliates, divisions or operational and/or business units, product lines, brands, business segments, administrative departments, or any combination of the foregoing) and are limited to specific criteria enumerated in our 2015 Plan.

Effect of Certain Events on 2015 Plan and Awards. In the event of (a) any dividend (other than regular cash dividends) or other distribution (whether in the form of cash, shares of common stock, other securities or other property), recapitalization, stock split, reverse stock split, reorganization, merger, consolidation, split-up, split-off, spin-off, combination, repurchase or exchange of our shares of common stock or other securities, issuance of warrants or other rights to acquire our shares of common stock or other securities, or other similar corporate transaction or event (including, without limitation, a change in control, as defined in our 2015 Plan) that affects the shares of common stock, or (b) unusual or nonrecurring events (including, without limitation, a change in control) affecting us, any affiliate, or the financial statements of us or any affiliate, or changes in applicable rules, rulings, regulations or other requirements of any governmental body or securities exchange or inter-dealer quotation system, accounting principles or law, such that in either case an adjustment is determined by the Compensation Committee in its sole discretion to be necessary or appropriate, then the Compensation Committee must make any such adjustments in such manner as it may deem equitable, including, without limitation, any or all of: (i) adjusting any or all of (A) the share limits applicable under our 2015 Plan with respect to the number of awards which may be granted thereunder; (B) the number of our shares of common stock or other securities which may be issued in respect of awards or with respect to which awards may be granted under our 2015 Plan and (C) the terms of any outstanding award, including, without limitation, (1) the number of shares of common stock or other securities subject to outstanding awards or to which outstanding awards relate, (2) the exercise price or strike price with respect to any award or (3) any applicable performance measures; (ii) providing for a substitution or assumption of awards, accelerating the exercisability of, lapse of restrictions on, or termination of, awards or providing for a period of time for participants to exercise outstanding awards prior to the occurrence of such event; and (iii) cancelling any one or more outstanding awards and causing to be paid to the holders holding vested awards (including any awards that would vest as a result of the occurrence of such event but for such cancellation) the value of such awards, if any, as determined by the Compensation Committee (which if applicable may be based upon the price per share of common stock received or to be received by other holders of our stock in such event), including, without limitation, in the case of options and stock appreciation rights, a cash payment equal to the excess, if any, of the fair market value of the shares of common stock subject to the option or stock appreciation right over the aggregate exercise price or strike price thereof.

Nontransferability of Awards. An award will not be transferable or assignable by a participant otherwise than by will or by the laws of descent and distribution and any such purported assignment, alienation, pledge, attachment, sale, transfer or encumbrance will be void and unenforceable against us or any affiliate. However, the Compensation Committee may, in its sole discretion, permit awards (other than incentive stock options) to be transferred, including transfer to a participant’s family members, any trust established solely for the benefit of a participant or such participant’s family members, any partnership or limited liability company of which a participant, or such participant and such participant’s family members, are the sole member(s), and a beneficiary to whom donations are eligible to be treated as “charitable contributions” for tax purposes.

Amendment and Termination. Our Board of Directors may amend, alter, suspend, discontinue, or terminate our 2015 Plan or any portion thereof at any time; provided, that no such amendment, alteration, suspension, discontinuation or termination may be made without stockholder approval if (i) such approval is

110

necessary to comply with any regulatory requirement applicable to our 2015 Plan or for changes in GAAP to new accounting standards; (ii) it would materially increase the number of securities which may be issued under our 2015 Plan (except for adjustments in connection with certain corporate events) or (iii) it would materially modify the requirements for participation in our 2015 Plan; provided, further, that any such amendment, alteration, suspension, discontinuance or termination that would materially and adversely affect the rights of any participant or any holder or beneficiary of any award shall not to that extent be effective without such individual’s consent.

The Compensation Committee may, to the extent consistent with the terms of any applicable award agreement, waive any conditions or rights under, amend any terms of, or alter, suspend, discontinue, cancel or terminate, any award granted or the associated award agreement, prospectively or retroactively, subject to the consent of the affected participant if any such waiver, amendment, alteration, suspension, discontinuance, cancellation or termination would materially and adversely affect the rights of any participant with respect to such award; provided that without stockholder approval, except as otherwise permitted in our 2015 Plan, (i) no amendment or modification may reduce the exercise price of any option or the strike price of any stock appreciation right; (ii) the Compensation Committee may not cancel any outstanding option or stock appreciation right and replace it with a new option or stock appreciation right (with a lower exercise price or strike price, as the case may be) or other award or cash payment that is greater than the value of the cancelled option or stock appreciation right and (iii) the Compensation Committee may not take any other action which is considered a “repricing” for purposes of the stockholder approval rules of any securities exchange or inter-dealer quotation system on which our securities are listed or quoted.

Dividends and Dividend Equivalents. The Compensation Committee in its sole discretion may provide part of an award with dividends or dividend equivalents, on such terms and conditions as may be determined by the Compensation Committee in its sole discretion; provided, that no dividends or dividend equivalents shall be payable in respect of outstanding (i) options or stock appreciation rights or (ii) unearned performance compensation awards or other unearned awards subject to performance conditions (other than or in addition to the passage of time) (although dividends or dividend equivalents may be accumulated in respect of unearned awards and paid within 15 days after such awards are earned and become payable or distributable).

Clawback/Forfeiture. An award agreement may provide that the Compensation Committee may in its sole discretion cancel such award if the participant, while employed by or providing services to us or any affiliate or after termination of such employment or service, violates a non-competition, non-solicitation or non-disclosure covenant or agreement or otherwise has engaged in or engages in other detrimental activity that is in conflict with or adverse to our interests or the interests of any affiliate, including fraud or conduct contributing to any financial restatements or irregularities, as determined by the Compensation Committee in its sole discretion. Without limiting the foregoing, all awards shall be subject to reduction, cancellation, forfeiture or recoupment to the extent necessary to comply with applicable law.

Director Compensation

For fiscal 2014, among our directors, we only provided compensation to our Chairman Bill Bishop, Frances Frei and Amy Schulman. All of our directors are reimbursed for their reasonable out-of-pocket expenses related to their service as a member of the Board of Directors or one of its committees.

For his service as Chairman of the Board of Directors in 2014, Bill received an annual retainer of $174,580, which was paid on a twice a month basis. As Chairman of the Board of Directors, Bill also participated in the Company’s fiscal 2014 annual incentive compensation plan. See “—Annual Cash Incentive Compensation.” For fiscal 2014, Bill’s target bonus opportunity as a percentage of his cash compensation was 75% and his maximum bonus opportunity as a percentage of target was 200%. Bill also received Company-paid life insurance premiums and a car allowance for fiscal 2014.

Frances Frei and Amy Schulman joined our Board of Directors in November 2014 and were paid the pro-rated portion of their $145,000 annual retainer.

111

Director Compensation for Fiscal 2014

The following table sets forth information concerning the compensation of our directors (other than directors who are named executive officers) for fiscal 2014.

| Name | Fees earned or ($) |

Non-equity ($) (1) |

All other ($) (2) |

Total ($) | ||||

| Bill Bishop |

235,527 | 79,377 | 18,288 | 333,192 | ||||

| Philippe Amouyal |

— | — | — | — | ||||

| Evren Bilimer |

— | — | — | — | ||||

| Raymond Debbane |

— | — | — | — | ||||

| Michael Eck(3) |

— | — | — | — | ||||

| Frances Frei(4) |

18,931 | — | — | 18,931 | ||||

| Aflalo Guimaraes |

— | — | — | — | ||||

| Amy Schulman(4) |

18,931 | — | — | 18,931 |

| (1) | Reflects amounts earned under the Company’s fiscal 2014 annual incentive compensation plan. |

| (2) | Amount reported reflects Company-paid life insurance premiums and a car allowance. |

| (3) | Michael Eck joined our Board of Directors in February 2015 and therefore received no compensation for fiscal 2014. |

| (4) | Amount reported reflects pro-rated portion of their annual retainer. |

Director Compensation for Fiscal 2015

For fiscal 2015, our Chairman Bill Bishop will receive an annual retainer of $400,000 pro-rated up until our initial public offering. Michael Eck, Frances Frei and Amy Schulman will also receive an annual retainer of $145,000 up until our initial public offering. Concurrent with our initial public offering, Michael Eck, Frances Frei and Amy Schulman will receive a one-time fully-vested grant of our common stock with a three year holding restriction valued at approximately $85,000.

Subsequent to our initial public offering, our Chairman Bill Bishop will receive an annual retainer of $180,000, and each of our other directors will receive an annual retainer of $60,000 to be paid on a quarterly basis in arrears. In addition, as our Chairman, Bill will also receive an annual fully-vested grant of our common stock valued at approximately $220,000 and each of our other directors will receive a fully vested grant of our common stock valued at approximately $85,000, in each case, with a three year holding restriction. For fiscal 2015, the annual equity award will be pro-rated for the period from the expected consummation of the initial public offering to the annual shareholder meeting that is anticipated to occur in May 2016. Our Audit Committee Chairman and Audit Committee members will also receive an additional retainer of $15,000 and $7,500, respectively, to be paid on a quarterly basis in arrears. Our Compensation Committee Chairman and Compensation Committee members will also receive an additional retainer of $10,000 and $5,000, respectively, to be paid on a quarterly basis in arrears.

112

PRINCIPAL AND SELLING STOCKHOLDERS

The following table contains information about the beneficial ownership of our common stock as of June 30, 2015, (1) immediately prior to the consummation of this offering and after giving effect to the issuance of 249,163 shares of our common stock to holders of stock options under the 2012 Plan upon exercise thereof, which shares are to be sold in this offering and (2) as further adjusted to reflect (x) the issuance of 35,934 shares of our common stock to certain non-management employees in connection with this offering and (y) the sale of shares of our common stock offered by this prospectus by:

| • | each person, or group of persons, known to us who beneficially owns more than 5% of our capital stock; |

| • | each named executive officer; |

| • | each of our directors; |

| • | all directors and executive officers as a group; and |

| • | each person selling common stock in connection with this initial public offering. |

Unless otherwise indicated, our calculation of the percentage of beneficial ownership prior to the offering is based on 195,998,174 shares of common stock, which is comprised of 195,749,011 shares of common stock outstanding as of June 30, 2015, as adjusted to reflect the issuance of 249,163 shares of our common stock to holders of stock options under the 2012 Plan upon exercise thereof, which shares are to be sold in this offering.

Beneficial ownership and percentage ownership are determined in accordance with the rules and regulations of the SEC and include voting or investment power with respect to shares of stock. This information does not necessarily indicate beneficial ownership for any other purpose. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, shares of common stock subject to restrictions, options or warrants held by that person that are currently exercisable or exercisable within 60 days of the date of this prospectus are deemed outstanding. Such shares, however, are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as indicated in the footnotes to the following table or pursuant to applicable community property laws, we believe, based on information furnished to us, that each shareholder named in the table has sole voting and investment power with respect to the shares set forth opposite such shareholder’s name.

For further information regarding material transactions between us and certain of our shareholders, see “Certain Relationships and Related Party Transactions.”

115

Unless otherwise indicated in the footnotes, the address of each beneficial owner named below is: c/o Blue Buffalo Pet Products, Inc., 11 River Road, Wilton, Connecticut 06897.

| Shares beneficially owned prior to the offering |

Shares beneficially owned after the offering |

|||||||||||||||||||||||

| Name of Beneficial Owner |

Excluding exercise of the underwriters’ over-allotment option to purchase additional shares |

Including exercise in full of the underwriters’ over-allotment option to purchase additional shares |

||||||||||||||||||||||

| Number | Percent | Number | Percent(1) | Number | Percent(2) | |||||||||||||||||||

| Greater than 5% Stockholders |

||||||||||||||||||||||||

| Invus, L.P.(3) |

143,452,150 | 73.19 | % | 121,934,327 | 62.20 | % | 118,673,750 | 60.53 | % | |||||||||||||||

| Christopher T. Bishop(4)(5)(12)(14) |

23,888,788 | 12.19 | % | 20,305,469 | 10.36 | % | 19,762,490 | 10.08 | % | |||||||||||||||

| The Bishop Family Limited Partnership(5) |

19,924,846 | 10.17 | % | 16,936,119 | 8.64 | % | 16,483,239 | 8.41 | % | |||||||||||||||

| Named Executive Officers and Directors: |

||||||||||||||||||||||||

| Kurt T. Schmidt(6) |

1,204,954 | 0.61 | % | 1,024,211 | 0.52 | % | 996,823 | 0.51 | % | |||||||||||||||

| William W. Bishop, Jr.(5)(7)(12) |

22,689,272 | 11.58 | % | 19,285,881 | 9.84 | % | 18,770,166 | 9.57 | % | |||||||||||||||

| Michael Nathenson(8) |

321,316 | 0.16 | % | 273,119 | 0.14 | % | 265,815 | 0.14 | % | |||||||||||||||

| William W. Bishop |

— | — | — | — | — | — | ||||||||||||||||||

| Raymond Debbane(9) |

— | — | — | — | — | — | ||||||||||||||||||

| Philippe Amouyal(9) |

— | — | — | — | — | — | ||||||||||||||||||

| Evren Bilimer(9) |

— | — | — | — | — | — | ||||||||||||||||||

| Aflalo Guimaraes(9) |

— | — | — | — | — | — | ||||||||||||||||||

| Michael A. Eck |

— | — | — | — | — | — | ||||||||||||||||||

| Frances Frei |

— | — | — | — | — | — | ||||||||||||||||||

| Amy Schulman |

— | — | — | — | — | — | ||||||||||||||||||

| All executive officers and directors as a group (11 persons) |

24,215,542 | 12.36 | % | 20,583,211 | 10.50 | % | 20,032,804 | 10.22 | % | |||||||||||||||

| Other Selling Stockholders |

||||||||||||||||||||||||

| Green Family Limited Partnership(10) |

6,452,409 | 3.29 | % | 5,484,548 | 2.80 | % | 5,337,888 | 2.72 | % | |||||||||||||||

| R&K Edwards Investments, LLC(11) |

6,452,409 | 3.29 | % | 5,484,548 | 2.80 | % | 5,337,888 | 2.72 | % | |||||||||||||||

| The Orca Trust(12) |

1,935,099 | * | 1,644,834 | * | 1,600,850 | * | ||||||||||||||||||

| Timothy B. Smith(13)(18)(29) |

1,518,971 | * | 1,291,126 | * | 1,256,599 | * | ||||||||||||||||||

| American Phoenix Trust(14) |

1,420,192 | * | 1,207,163 | * | 1,174,883 | * | ||||||||||||||||||

| Charles Huffman(15)(28) |

1,269,874 | * | 1,079,393 | * | 1,050,529 | * | ||||||||||||||||||

| John-Matthew Roth(16)(30) |

1,269,873 | * | 1,079,392 | * | 1,050,528 | * | ||||||||||||||||||

| David Petrie |

905,247 | * | 769,460 | * | 748,884 | * | ||||||||||||||||||

| Donovan 2014 Annuity Trust(17) |

819,827 | * | 696,853 | * | 678,218 | * | ||||||||||||||||||

| Donovan 2014 Trust(18) |

819,823 | * | 696,850 | * | 678,215 | * | ||||||||||||||||||

| Becker Trading Company, Inc.(19) |

677,052 | * | 575,496 | * | 575,496 | * | ||||||||||||||||||

| Evans 2003 Family Limited Partnership(20) |

677,052 | * | 575,494 | * | 560,104 | * | ||||||||||||||||||

| Richard MacLean(21) |

564,575 | * | 479,888 | * | 467,055 | * | ||||||||||||||||||

| Joyce Novotny |

489,573 | * | 416,137 | * | 405,009 | * | ||||||||||||||||||

| Anthony E. Bakker(22) |

467,250 | * | 397,162 | * | 386,541 | * | ||||||||||||||||||

| Jane A. Buckiewicz(23)(34) |

397,185 | * | 337,607 | * | 328,580 | * | ||||||||||||||||||

| Thomas K. Morton |

353,866 | * | 300,786 | * | 292,742 | * | ||||||||||||||||||

| Dennis J. Farrell(24) |

341,388 | * | 290,180 | * | 282,420 | * | ||||||||||||||||||

| David C. Hentges(25) |

340,825 | * | 289,703 | * | 289,703 | * | ||||||||||||||||||

| Elson R. Smith, Jr.(26) |

338,528 | * | 287,749 | * | 280,054 | * | ||||||||||||||||||

| Elson R. Smith III(27) |

338,524 | * | 287,746 | * | 287,746 | * | ||||||||||||||||||

| Huffman Family LLC(28) |

325,773 | * | 276,907 | * | 269,502 | * | ||||||||||||||||||

| Philip C. Cheevers |

323,731 | * | 281,731 | * | 281,731 | * | ||||||||||||||||||

| The Smith 2014 Exempt Trust(29) |

315,000 | * | 267,750 | * | 260,589 | * | ||||||||||||||||||

| Roth Family Investments LLC(30) |

295,839 | * | 251,463 | * | 244,739 | * | ||||||||||||||||||

| Steven B. Gold(31) |

286,822 | * | 243,799 | * | 237,280 | * | ||||||||||||||||||

| Jeremy Brittain |

285,520 | * | 242,692 | * | 236,202 | * | ||||||||||||||||||

| Nancy C. Cook Trust(32) |

270,820 | * | 230,197 | * | 224,042 | * | ||||||||||||||||||

| Nigel W. Cooper(33) |

270,820 | * | 230,197 | * | 224,042 | * | ||||||||||||||||||

| Buckiewicz 2014 Trust(34) |

263,201 | * | 223,721 | * | 217,739 | * | ||||||||||||||||||

| Gil Fronzaglia(35) |

245,935 | * | 209,045 | * | 203,455 | * | ||||||||||||||||||

| Steven M. Raleigh(36) |

231,415 | * | 196,703 | * | 191,445 | * | ||||||||||||||||||

| Other Selling Stockholders as a Group(37) |

1,889,744 | * | 1,612,873 | * | 1,578,817 | * | ||||||||||||||||||

| * | Less than 1% |

| (1) | Based on 196,034,108 shares of common stock that will be outstanding immediately after the completion of this offering, which includes (i) 195,749,011 shares of common stock outstanding on June 30, 2015, (ii) 249,163 shares of our common stock to be issued to holders of stock options under the 2012 Plan upon exercise thereof, which shares are to be sold in this offering and (iii) 35,934 shares of our common stock to certain non-management employees without cost to such employees. |

116

| (2) | Based on 196,071,126 shares of common stock that will be outstanding immediately after the completion of this offering, which includes (i) 195,749,011 shares of common stock outstanding on June 30, 2015, (ii) 249,163 shares of our common stock to be issued to holders of stock options under the 2012 Plan upon exercise thereof, which shares are to be sold in this offering, (iii) 35,934 shares of our common stock to be issued to certain non-management employees without cost to such employees and (iv) 37,018 shares of our common stock to be issued to holders of stock options under the 2012 Plan upon exercise thereof, which shares are to be sold in this offering if the underwriters’ over-allotment to purchase additional shares is exercised in full. |

| (3) | Invus Advisors, L.L.C., or Invus Advisors, is the general partner of Invus, L.P. Artal International S.C.A. is the managing member of Invus Advisors. Artal International Management S.A. is the managing partner of Artal International S.C.A. Artal Group S.A. is the sole stockholder of Artal International Management S.A. Westend S.A. is the sole stockholder of Artal Group S.A. Stichting Administratiekantoor Westend, or the Stichting, is the sole stockholder of Westend S.A. Pascal Minne is the sole member of the board of the Stichting. Accordingly, each of Invus Advisors, Artal International S.C.A., Artal International Management S.A., Artal Group S.A., Westend S.A., the Stichting and Pascal Minne may be deemed to beneficially own the shares of common stock held of record by Invus, L.P. The address of Invus, L.P. and Invus Advisors is c/o The Invus Group, LLC, 750 Lexington Avenue, 30th Floor, New York, NY 10022. The address of Artal International S.C.A., Artal International Management S.A., Artal Group S.A. and Westend S.A. is 10-12 avenue Pasteur, L-2310, Luxembourg, Luxembourg. The address of the Stichting is De Boelelaan 7, NL-1083 HJ Amsterdam, The Netherlands. The address of Pascal Minne is Place Ste. Gudule, 19, B-1000, Bruxelles, Belgium. |

| (4) | Includes (i) 608,651 shares of common stock held by Christopher T. Bishop, (ii) 1,420,192 shares of common stock held by the American Phoenix Trust, (iii) 19,924,846 shares of common stock held by The Bishop Family Limited Partnership and (iv) 1,935,099 shares of common stock held by The Orca Trust. Christopher T. Bishop is the sole trustee of the American Phoenix Trust and has voting and investment power over the shares of common stock held by the American Phoenix Trust. Christopher T. Bishop is a primary beneficiary of The William W. Bishop Children’s Spray Trust, or the Bishop Trust, which is the general partner of The Bishop Family Limited Partnership, and, collectively with William W. Bishop, Jr., our President and Chief Operating Officer, has the ability to remove and replace the trustee of the Bishop Trust. As a result, Christopher T. Bishop may be deemed to possess beneficial ownership of the shares of common stock held by The Bishop Family Limited Partnership. Christopher T. Bishop disclaims beneficial ownership of the shares of common stock held by The Bishop Family Limited Partnership. Christopher T. Bishop is the protector of The Orca Trust and has the ability to remove the trustee. As a result, Christopher T. Bishop may be deemed to possess beneficial ownership of the shares of common stock held by The Orca Trust. Christopher T. Bishop disclaims beneficial ownership of the shares of common stock held by The Orca Trust. |

| (5) | Stephen Saft is the sole trustee of the Bishop Trust, which is the general partner of The Bishop Family Limited Partnership. Accordingly, Stephen Saft may be deemed to possess beneficial ownership of the shares of common stock held by The Bishop Family Limited Partnership. Stephen Saft disclaims beneficial ownership of the shares of common stock held by The Bishop Family Limited Partnership. William W. Bishop, Jr. and Christopher T. Bishop are the primary beneficiaries of the Bishop Trust and they collectively have the ability to remove and replace the trustee of the Bishop Trust. As a result, William W. Bishop, Jr. and Christopher T. Bishop may be deemed to possess beneficial ownership of the shares of common stock held by The Bishop Family Limited Partnership. William W. Bishop, Jr. and Christopher T. Bishop each disclaim beneficial ownership of the shares of common stock held by The Bishop Family Limited Partnership. |

| (6) | Includes 1,024,211 shares of common stock underlying stock options exercisable within 60 days of the date of this prospectus held by Kurt T. Schmidt. |

| (7) | Includes (i) 829,327 shares of common stock held by William W. Bishop, Jr., (ii) 19,924,846 shares of common stock held by The Bishop Family Limited Partnership and (iii) 1,935,099 shares of common stock held by The Orca Trust. William W. Bishop, Jr. is a primary beneficiary of the Bishop Trust, which is the general partner of The Bishop Family Limited Partnership, and, collectively with Christopher T. Bishop, has the ability to remove and replace the trustee of the Bishop Trust. As a result, William W. Bishop, Jr. may be deemed to possess beneficial ownership of the shares of common stock held by The Bishop Family Limited Partnership. William W. Bishop, Jr. disclaims beneficial ownership of the shares of common stock held by The Bishop Family Limited Partnership. William W. Bishop, Jr. is the sole trustee of The Orca Trust and has voting and investment power over the shares of common stock held by The Orca Trust. |

| (8) | Includes 273,119 shares of common stock underlying stock options exercisable within 60 days of the date of this prospectus held by Michael Nathenson. |

| (9) | Raymond Debbane, Philippe Amouyal, Evren Bilimer and Aflalo Guimaraes are each officers of Invus Advisors, but each disclaims beneficial ownership of the shares beneficially owned by Invus, L.P. The address for each of Raymond Debbane, Philippe Amouyal, Evren Bilimer and Aflalo Guimaraes is c/o The Invus Group, LLC, 750 Lexington Avenue, 30th Floor, New York, NY 10022. |

| (10) | Green Family LLC is the general partner of the Green Family Limited Partnership. Leonard Green is the sole member of Green Family LLC. Accordingly, Leonard Green may be deemed to beneficially own the shares of common stock held by the Green Family Limited Partnership. The address of the Green Family Limited Partnership, Green Family LLC and Leonard Green is 900 Rte. 9 North, Ste. 601, Woodbridge, NJ 07095. |

| (11) | Ronald L. Edwards is the sole manager of R&K Edwards Investments, LLC and has voting and investment power over the shares of common stock held by R&K Edwards Investments, LLC. The address of R&K Edwards Investments, LLC and Ronald L. Edwards is 536 Point Lane, Vero Beach, FL 32963. |

| (12) | William W. Bishop, Jr., is the sole trustee of The Orca Trust and has voting and investment power over the shares of common stock held by The Orca Trust. Christopher T. Bishop is the protector of The Orca Trust and has the ability to remove and replace the trustee. As a result, Christopher T. Bishop may be deemed to possess beneficial ownership of the shares of common stock held by The Orca Trust. Christopher T. Bishop disclaims beneficial ownership of the shares of common stock held by The Orca Trust. |

117

| (13) | Includes (i) 226,648 shares of common stock held by Timothy B. Smith, (ii) 315,000 shares of common stock held by The Smith 2014 Exempt Trust, (iii) 157,500 shares of common stock held by The Cooper 2014 Exempt Trust and (iv) 819,823 shares of common stock held by the Donovan 2014 Trust. Timothy B. Smith, the settlor, has the ability to remove and replace the trustee of The Smith 2014 Exempt Trust and substitute trust assets and, as a result, may be deemed to possess beneficial ownership of the shares of common stock held by The Smith 2014 Exempt Trust. Timothy B. Smith is the sole trustee of The Cooper 2014 Exempt Trust and the Donovan 2014 Trust and has voting and investment power over the shares of common stock held by such trusts. As a result, Timothy B. Smith may be deemed to possess beneficial ownership of the shares of common stock held by The Cooper 2014 Exempt Trust and the Donovan 2014 Trust. Timothy B. Smith disclaims beneficial ownership of the shares of common stock held by The Cooper 2014 Exempt Trust and the Donovan 2014 Trust. The address of Timothy B. Smith is 2520 Raven Drive, Sullivan’s Island, SC 29482. |

| (14) | Christopher T. Bishop is the sole trustee of the American Phoenix Trust and has voting and investment power over the shares of common stock held by the American Phoenix Trust. |

| (15) | Includes (i) 944,101 shares of common stock held by Charles Huffman and (ii) 325,773 shares of common stock held by Huffman Family LLC. Charles Huffman is the sole manager of Huffman Family LLC and has voting and investment power over the shares of common stock held by Huffman Family LLC. |

| (16) | Includes (i) 974,034 shares of common stock held by John-Matthew Roth and (ii) 295,839 shares of common stock held by Roth Family Investments LLC. John-Matthew Roth is the managing member of Roth Family Investments LLC and has voting and investment power over the shares of common stock held by Roth Family Investments LLC. |

| (17) | Thomas C. Donovan is the sole trustee of the Donovan 2014 Annuity Trust and has voting and investment power over the shares of common stock held by the Donovan 2014 Annuity Trust. |

| (18) | Timothy B. Smith is the sole trustee of the Donovan 2014 Trust and has voting and investment power over the shares of common stock held by the Donovan 2014 Trust. As a result, Timothy B. Smith may be deemed to possess beneficial ownership of the shares of common stock held by the Donovan 2014 Trust. Timothy B. Smith disclaims beneficial ownership of the shares of common stock held by the Donovan 2014 Trust. Thomas C. Donovan is the grantor under the Donovan 2014 Trust and has the ability to appoint a protector of the Donovan 2014 Trust who has the ability to remove and replace the trustee. As a result, Thomas C. Donovan may be deemed to possess beneficial ownership of the shares of common stock held by the Donovan 2014 Trust. |

| (19) | R. William Becker is the sole shareholder of Becker Trading Company, Inc. and has voting and investment power over the shares of common stock held by Becker Trading Company, Inc. The address of Becker Trading Company, Inc. and R. William Becker is 582 Beachland Blvd., Suite 300, Vero Beach, FL 32963. |

| (20) | J.E. Evans, Jr. Revocable Trust and J.E. Evans, III, Revocable Trust are the general partners of the Evans 2003 Family Limited Partnership. J.E. Evans, Jr. is the trustee of the J.E. Evans, Jr. Revocable Trust and J.E. Evans, III is the trustee of the J.E. Evans, III, Revocable Trust. Accordingly, each of J.E. Evans, Jr. and J.E. Evans, III may be deemed to possess beneficial ownership of the shares of common stock held by the Evans 2003 Family Limited Partnership. The address of the Evans 2003 Family Limited Partnership, J.E. Evans, Jr. Revocable Trust, J.E. Evans, III, Revocable Trust, J.E. Evans, Jr. and J.E. Evans, III is 660 Beachland Blvd., Suite 301, Vero Beach, FL 32963. |

| (21) | Includes (i) 366,697 shares of common stock held by Richard MacLean and (ii) 197,878 shares of common stock held by R.E. MacLean, LLC. Richard MacLean is the sole manager of R.E. MacLean, LLC and has voting and investment power over the shares of common stock held by R.E. MacLean, LLC. |

| (22) | The address of Anthony E. Bakker is 5795 Selkirk Plantation Road, Wadmalaw Island, SC 29487. |

| (23) | Includes (i) 133,984 shares of common stock held by Jane A. Buckiewicz and (ii) 263,201 shares of common stock held by the Buckiewicz 2014 Trust. Jane A. Buckiewicz is the settlor under the Buckiewicz 2014 Trust and has the ability to appoint a protector of the trust who has the ability to remove and replace the trustee. As a result, Jane A. Buckiewicz may be deemed to possess beneficial ownership of the shares of common stock held by the Buckiewicz 2014 Trust. |

| (24) | The address of Dennis J. Farrell is 9812 SE Crape Myrtle Court, Hobe Sound, FL 33455. |

| (25) | The address of David C. Hentges is 6124 S.W. 38th Street, Topeka, KS 66610. |

| (26) | The address of Elson R. Smith III is 1320 Little Harbour Drive, Vero Beach, FL 32963. |

| (27) | The address of Elson R Smith, Jr. is 649 Lake Drive, Vero Beach, FL 32963. |

| (28) | Charles Huffman is the sole manager of Huffman Family LLC and has voting and investment power over the shares of common stock held by Huffman Family LLC. |

| (29) | Gary F. Thornhill is the sole trustee of The Smith 2014 Exempt Trust and has voting and investment power over the shares of common stock held by The Smith 2014 Exempt Trust. As a result, Gary F. Thornhill may be deemed to possess beneficial ownership of the shares of common stock held by The Smith 2014 Exempt Trust. Gary F. Thornhill disclaims beneficial ownership of the shares of common stock held by The Smith 2014 Exempt Trust. Timothy B. Smith, the settlor, has the ability to remove and replace the trustee of The Smith 2014 Exempt Trust and substitute trust assets and, as a result, may be deemed to possess beneficial ownership of the shares of common stock held by The Smith 2014 Exempt Trust. The address of The Smith 2014 Exempt Trust is c/o J.P. Wealth Management, Inc., 3401 Salterbeck Court, Suite 202, Mt. Pleasant, SC 29466 and the address of Timothy B. Smith is 2520 Raven Drive, Sullivan’s Island, SC 29482. |

| (30) | John-Matthew Roth is the managing member of Roth Family Investments LLC and has voting and investment power over the shares of common stock held by Roth Family Investments LLC. |

| (31) | The address of Steven B. Gold is 648 Bayview Drive, Longboat Key, FL 34228. |

| (32) | Nancy C. Cook is the sole trustee of the Nancy C. Cook Trust and has voting and investment power over the shares of common stock held by the Nancy C. Cook Trust. The address of the Nancy C. Cook Trust and Nancy C. Cook is 3213 Ocean Drive, Vero Beach, FL 32963. |

118

| (33) | Includes (i) 113,320 shares of common stock held by Nigel W. Cooper and (ii) 157,500 shares of common stock held by The Cooper 2014 Exempt Trust. Nigel W. Cooper, the settlor, has the ability to remove and replace the trustee of The Cooper 2014 Exempt Trust and substitute trust assets and, as a result, may be deemed to possess beneficial ownership of the shares of common stock held by The Cooper 2014 Exempt Trust. The address of Nigel W. Cooper is 86 Murray Boulevard, Charleston, SC 29401. |

| (34) | Lynn Corrigan is the sole trustee of the Buckiewicz 2014 Trust and has voting and investment power over the shares of common stock held by the Buckiewicz 2014 Trust. As a result, Lynn Corrigan may be deemed to possess beneficial ownership of the shares of common stock held by the Buckiewicz 2014 Trust. Lynn Corrigan disclaims beneficial ownership of the shares of common stock held by the Buckiewicz 2014 Trust. Jane A. Buckiewicz is the settlor under the Buckiewicz 2014 Trust and has the ability to appoint a protector of the trust who has the ability to remove and replace the trustee. As a result, Jane A. Buckiewicz may be deemed to possess beneficial ownership of the shares of common stock held by the Buckiewicz 2014 Trust. |

| (35) | The address of Gil Fronzaglia is 504 Marine Street, Boulder, CO 80302. |

| (36) | Includes (i) 3,570 shares of common stock underlying stock options exercisable within 60 days of the date of this prospectus held by Steven M. Raleigh and (ii) 17,215 shares of common stock held by BisMo LLC. Steven M. Raleigh is the sole manager of BisMo LLC and has voting and investment power over the shares of common stock held by BisMo LLC. |

| (37) | Shares shown in the table include shares owned by the selling stockholders other than those named in the table that in the aggregate beneficially own less than 1% of our common stock as of June 30, 2015. |

119

SHARES ELIGIBLE FOR FUTURE SALE

Prior to this offering, there has been no public market for shares of our common stock. We cannot predict the effect, if any, future sales of shares of common stock, or the availability for future sale of shares of common stock, will have on the market price of shares of our common stock prevailing from time to time. Future sales of substantial amounts of our common stock in the public market or the perception that such sales might occur may adversely affect market prices prevailing from time to time. Furthermore, there may be sales of substantial amounts of our common stock in the public market after the existing legal and contractual restrictions lapse. This may adversely affect the prevailing market price and our ability to raise equity capital in the future. See “Risk Factors—Risks Related to this Offering and Ownership of our Common Stock—Future sales, or the perception of future sales, by us or our existing stockholders in the public market following this offering could cause the market price of our common stock to decline.”

Upon completion of this offering, we will have a total of 196,034,108 shares of our common stock outstanding. Of the outstanding shares, the shares sold or issued in this offering will be freely tradable without restriction or further registration under the Securities Act, except that any shares held by our affiliates, as that term is defined under Rule 144 of the Securities Act, may be sold only in compliance with the limitations described below. The remaining outstanding 166,514,447 shares of common stock held by our existing stockholders after this offering will be deemed restricted securities under the meaning of Rule 144 and may be sold in the public market only if registered or if they qualify for an exemption from registration, including the exemptions pursuant to Rule 144 under the Securities Act, which we summarize below.

Lock-up Agreements

There are approximately 166,514,447 shares of common stock (including options) held by executive officers, directors and our existing stockholders, who are subject to lock-up agreements for a period of 180 days after the date of this prospectus, under which they have agreed not to sell or otherwise dispose of their shares of common stock, subject to certain exceptions. J.P. Morgan Securities LLC and Citigroup Global Markets Inc. may, in their sole discretion and at any time without notice, release all or any portion of the shares subject to any such lock-up agreements. See “Underwriting—Lock-up.”

Rule 144