Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22975

AllianzGI Institutional Multi-Series Trust

(Exact name of registrant as specified in charter)

1633 Broadway, New York, New York 10019

(Address of principal executive offices) (Zip code)

Scott Whisten

1633 Broadway

New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3367

Date of fiscal year end: September 30

Date of reporting period: March 31, 2020

Table of Contents

ITEM 1. REPORT TO SHAREHOLDERS

AllianzGI Institutional Multi-Series Trust

Semiannual Report

March 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Portfolios’ website (us.allianzgi.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a Portfolio electronically anytime by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at us.allianzgi.com/edelivery.

If you prefer to receive paper copies of your shareholder reports after January 1, 2021, direct investors may inform a Portfolio at any time. Paper copies are provided free of charge and your election to receive reports in paper will apply to all funds held with the fund complex.

Table of Contents

|

|

||||

| 2-7 | ||||

| 8-9 | ||||

| 10-28 | ||||

| 29 | ||||

| 30 | ||||

| 31-32 | ||||

| 33-35 | ||||

| 36-48 | ||||

| 49 | ||||

| 50-52 | ||||

Table of Contents

AllianzGI Best Styles Global Managed Volatility Portfolio

(unaudited)

For the period of October 1, 2019 through March 31, 2020, as provided by Christian McCormick, Senior Product Specialist.

| Portfolio Insights |

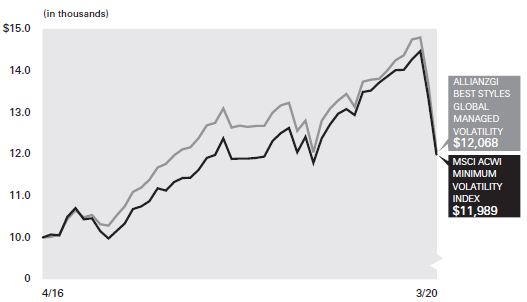

| Average Annual Total Return for the period ended March 31, 2020 | ||||||||||

| 6 Month* | 1 Year | Since Inception† | ||||||||

| AllianzGI Best Styles Global Managed Volatility Portfolio |

-13.82% | -9.14% | 4.85% | |||||||

| MSCI ACWI Minimum Volatility Index†† |

-13.51% | -7.52% | 4.68% | |||||||

* Cumulative return

† The Portfolio began operations on April 11, 2016. Benchmark return comparisons began on the portfolio inception date.

†† The MSCI ACWI Minimum Volatility Index aims to reflect the performance characteristics of a minimum variance strategy applied to large and mid-cap equities across developed markets and emerging markets countries. The index is calculated by optimizing the MSCI ACWI Index, its parent index, for the lowest absolute risk (within a given set of constraints). Historically, the index has shown lower beta and volatility characteristics relative to the MSCI ACWI Index. Index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns do not reflect deduction of taxes that a shareholder would pay on portfolio distributions or redemption of portfolio shares. Total return performance assumes that all dividends and capital gain distributions were reinvested on the payable date. The Portfolio’s gross expense ratio is 0.70%. This ratio does not include an expense reduction, contractually agreed to through January 31, 2021. The Portfolio’s expense ratio net of this reduction is 0.45%. Expense ratio information is as of the Portfolio’s current PPM dated February 1, 2020, as further revised or supplemented from time to time.

| 2 | Semiannual Report / March 31, 2020 |

Table of Contents

AllianzGI Best Styles Global Managed Volatility Portfolio

(unaudited) (continued)

|

Country Allocation (as of March 31, 2020) |

Cumulative Returns through March 31, 2020 | |||||

| United States |

51.7% |

| ||||

| Japan |

14.1% | |||||

| Taiwan |

5.1% | |||||

| Switzerland |

4.6% | |||||

| China |

2.6% | |||||

| Singapore |

1.6% | |||||

| Korea (Republic of) |

1.5% | |||||

| Germany |

1.5% | |||||

| Other |

15.6% | |||||

|

Cash & Equivalents — Net |

1.7% | |||||

| Shareholder Expense Example | Actual Performance | ||||

| Institutional Class | |||||

| Beginning Account Value (10/1/19) |

$ | 1,000.00 | |||

| Ending Account Value (3/31/20) |

$ | 861.80 | |||

| Expenses Paid During Period |

$ | 2.09 | |||

| Hypothetical Performance | |||||

| (5% return before expenses) | |||||

| Institutional Class | |||||

| Beginning Account Value (10/1/19) |

$ | 1,000.00 | |||

| Ending Account Value (3/31/20) |

$ | 1,022.75 | |||

| Expenses Paid During Period |

$ | 2.28 | |||

Expenses (net of reimbursement, if any) are equal to the annualized expense ratio 0.45%, multiplied by the average account value over the period, multiplied by 183/366

| 3 | Semiannual Report / March 31, 2020 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

(unaudited)

For the period of October 1, 2019 through March 31, 2020, as provided by Kunal Ghosh, Portfolio Manager.

| Portfolio Insights |

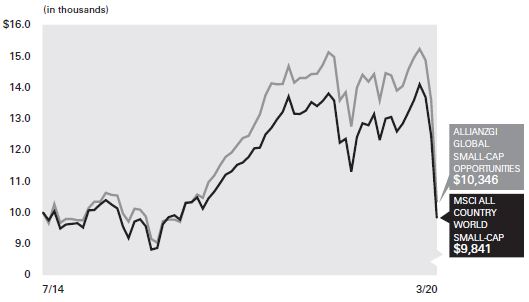

| Average Annual Total Return for the period ended March 31, 2020 | ||||||||

| 6 Month* | 1 Year | 5 Year | Since Inception† | |||||

| AllianzGI Global Small-Cap Opportunities Portfolio |

-26.35% | -27.08% | 0.01% | 0.60% | ||||

| MSCI All Country World Small-Cap Index†† |

-23.39% | -23.06% | -0.49% | -0.28% | ||||

* Cumulative return

† The Portfolio began operations on July 23, 2014. Benchmark return comparisons began on the portfolio inception date.

†† The MSCI All Country World Small-Cap Index captures small-cap representation across developed markets and emerging markets countries. The Index covers about 14% of the free float-adjusted market capitalization in each country. Index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns do not reflect deduction of taxes that a shareholder would pay on portfolio distributions or redemption of portfolio shares. Total return performance assumes that all dividends and capital gain distributions were reinvested on the payable date. The Portfolio’s gross expense ratio is 3.44%. This ratio does not include an expense reduction, contractually agreed to through January 31, 2021. The Portfolio’s expense ratio net of this reduction is 1.20%. Expense ratio information is as of the Portfolio’s current PPM dated February 1, 2020, as further revised or supplemented from time to time.

| 4 | Semiannual Report / March 31, 2020 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

(unaudited) (continued)

|

Country Allocation (as of March 31, 2020) |

Cumulative Returns through March 31, 2020 | |||||

| United States | 51.2% |

| ||||

| Japan | 12.3% | |||||

| Taiwan | 6.4% | |||||

| China | 3.2% | |||||

| Korea (Republic of) | 3.1% | |||||

| Netherlands | 2.6% | |||||

| Australia | 2.4% | |||||

| United Kingdom | 2.3% | |||||

| Other | 15.9% | |||||

|

Cash & Equivalents — Net |

0.6% | |||||

| Shareholder Expense Example | Actual Performance | ||||

| Institutional Class | |||||

| Beginning Account Value (10/1/19) |

$ | 1,000.00 | |||

| Ending Account Value (3/31/20) |

$ | 736.50 | |||

| Expenses Paid During Period |

$ | 5.21 | |||

| Hypothetical Performance | |||||

| (5% return before expenses) | |||||

| Institutional Class | |||||

| Beginning Account Value (10/1/19) |

$ | 1,000.00 | |||

| Ending Account Value (3/31/20) |

$ | 1,019.00 | |||

| Expenses Paid During Period |

$ | 6.06 | |||

Expenses (net of reimbursement, if any) are equal to the annualized expense ratio 1.20%, multiplied by the average account value over the period, multiplied by 183/366.

| 5 | Semiannual Report / March 31, 2020 |

Table of Contents

AllianzGI International Growth Portfolio

(unaudited)

From inception on October 1, 2019 through March 31, 2020, as provided by Laura Villani, Product Specialist, Equities.

| Portfolio Insights |

| Cumulative Return for the period ended March 31, 2020 |

| 6 Month* | Since Inception† | |||

| AllianzGI International Growth Portfolio |

-6.65% | -7.77% | ||

| MSCI ACWI ex USA Index†† |

-16.52% | -14.71% | ||

| MSCI AC World Index ex USA Growth Index |

-10.41% | -7.31% | ||

* Cumulative return

† The Portfolio began operations on May 15, 2019. Benchmark return comparisons began on the portfolio inception date.

†† The MSCI ACWI ex USA Index captures large- and mid-cap representation across Developed Markets countries (excluding the U.S.) and Emerging Markets countries. The index covers approximately 85% of the global equity opportunity set outside the US.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns do not reflect deduction of taxes that a shareholder would pay on portfolio distributions or redemption of portfolio shares. Total return performance assumes that all dividends and capital gain distributions were reinvested on the payable date. The Portfolio’s gross expense ratio is 1.71%. This ratio does not include an expense reduction, contractually agreed to through January 31, 2021. The Portfolio’s expense ratio net of this reduction is 0.80%. Expense ratio information is as of the Portfolio’s current Private Placement Memorandum (“PPM”) dated February 1, 2020, as further revised or supplemented from time to time.

| 6 | Semiannual Report / March 31, 2020 |

Table of Contents

AllianzGI International Growth Portfolio

(unaudited) (continued)

|

Industry/Sectors (as of March 31, 2020) |

Cumulative Returns through March 31, 2020 | |||||

| China |

15.7% |

| ||||

| Denmark |

15.2% | |||||

| Germany |

10.7% | |||||

| Canada |

7.4% | |||||

| Sweden |

6.8% | |||||

| Netherlands |

4.9% | |||||

| Switzerland |

4.8% | |||||

| Israel |

4.7% | |||||

| Other |

27.6% | |||||

|

Cash & Equivalents — Net |

2.2% | |||||

| Shareholder Expense Example | Actual Performance | ||||

| Institutional Class | |||||

| Beginning Account Value (10/1/2019) |

$ | 1,000.00 | |||

| Ending Account Value (3/31/20) |

$ | 933.50 | |||

| Expenses Paid During Period |

$ | 3.87 | |||

| Hypothetical Performance | |||||

| Institutional Class | |||||

| (5% return before expenses) | |||||

| Beginning Account Value (10/1/19) |

$ | 1,000.00 | |||

| Ending Account Value (3/31/20) |

$ | 1,021.00 | |||

| Expenses Paid During Period |

$ | 4.04 | |||

Expenses (net of reimbursement, if any) are equal to the annualized expense ratio 0.80%, multiplied by the average account value over the period, multiplied by 183/366.

| 7 | Semiannual Report / March 31, 2020 |

Table of Contents

AllianzGI Institutional Multi-Series Trust

Important Information (unaudited)

As of March 31, 2020, AllianzGI Institutional Multi-Series Trust (the “Trust”) consisted of three investment series, AllianzGI Best Styles Global Managed Volatility Portfolio, AllianzGI Global Small-Cap Opportunities Portfolio and AllianzGI International Growth Portfolio (each a “Portfolio” and collectively the “Portfolios”). The Portfolios each currently offer one share class.

The Cumulative Returns charts for each Portfolio assume the initial investment was made on the first day of each Portfolio’s initial fiscal year. Results assume that all dividends and capital gain distributions, if any, were reinvested. They do not take into account the effect of taxes. The benchmark cumulative return began on the last day of the month of each Portfolio’s inception date.

“Cash & Equivalents-Net” in the Allocation Summaries may be comprised of cash, repurchase agreements, U.S. Treasury Bills, and other assets net of other liabilities including net unrealized appreciation (depreciation) on futures contracts, and forward foreign currency contracts, as applicable. Please refer to this information when reviewing the Shareholder Expense Example for each Portfolio.

Proxy Voting

The Portfolios’ Investment Manager, Allianz Global Investors U.S. LLC (“AllianzGI U.S.” or the “Investment Manager”), has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940. The Proxy Policy has been adopted by the Trust as the policies and procedures that the Investment Manager will use when voting proxies on behalf of each Portfolio. Copies of the written Proxy Policy and the factors that the Investment Manager may consider in determining how to vote proxies for each Portfolio, and information about how each Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling 1-800-498-5413, on the Allianz Global Investors website at us.allianzgi.com and on the Securities and Exchange Commission’s (the “SEC”) website at http://www.sec.gov.

Form N-PORT

The Trust files complete schedules of each Portfolio’s holdings with the SEC on Form N-PORT for the first and third quarters of the fiscal year; such filings are available on the SEC’s website at http://www.sec.gov.

A copy of the Trust’s Form N-PORT, when available, will be provided without charge, upon request, by calling 1-800-498-5413. In addition, the Trust’s Form N-PORT may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330. A description of the Trust’s policies and procedures with respect to the disclosure of each Portfolio’s portfolio holdings is available in the Trust’s Statement of Additional Information. The Investment Adviser will post each Portfolio’s holdings information on the Portfolio’s website at us.allianzgi.com. Each Portfolio’s website will contain a complete schedule of portfolio holdings as of the relevant month end. The information will be posted on the website approximately thirty (30) calendar days after the relevant month’s end. Portfolio holdings information for each Portfolio will remain accessible on its website until the Trust files its Form N-CSR, or Form N-PORT for the last month of the Portfolio’s first or third fiscal quarters, with the SEC for the period that includes the date as of which the website information is current. The Trust’s policies with respect to the disclosure of the portfolio holdings are subject to change without notice.

The following disclosure provides important information regarding each Portfolio’s Shareholder Expense Example, which appears on each Portfolio Summary page in this Semiannual report.

Shareholder Expense Example

Shareholders incur two types of costs: (1) transaction costs; and (2) ongoing costs, including investment management fees and other Portfolio expenses. The Shareholder Expense Example is intended to help shareholders understand ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Shareholder Expense Example is based on $1,000.00 invested at the beginning of the period, as indicated, and held for the entire period October 1, 2019 through March 31, 2020.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in this column, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the row titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| 8 | Semiannual Report / March 31, 2020 |

Table of Contents

Hypothetical Example for Comparison Purposes

The information in the tables for “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information for “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs may have been higher.

Allianz Global Investors Distributors LLC, 1633 Broadway, New York, NY, 10019, us.allianzgi.com, 1-800-498-5413.

| 9 | Semiannual Report / March 31, 2020 |

Table of Contents

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| COMMON STOCK - 98.1% |

||||||||

| Australia - 1.1% |

||||||||

| Brickworks Ltd. |

6,500 | $ | 53,173 | |||||

| Newcrest Mining Ltd. |

5,577 | 76,588 | ||||||

| Regis Resources Ltd. |

26,025 | 57,838 | ||||||

| Saracen Mineral Holdings Ltd. (e) |

32,229 | 72,473 | ||||||

| Silver Lake Resources Ltd. (e) |

34,544 | 29,416 | ||||||

| St. Barbara Ltd. |

14,103 | 18,621 | ||||||

| Telstra Corp. Ltd. |

54,738 | 102,751 | ||||||

| 410,860 | ||||||||

| Austria - 0.1% |

||||||||

| Flughafen Wien AG |

961 | 25,111 | ||||||

| Telekom Austria AG |

3,219 | 22,473 | ||||||

| 47,584 | ||||||||

| Belgium - 0.7% |

||||||||

| Ageas |

1,893 | 78,885 | ||||||

| Elia Group S.A |

925 | 90,098 | ||||||

| Proximus SADP |

3,622 | 83,177 | ||||||

| 252,160 | ||||||||

| Bermuda - 0.2% |

||||||||

| Arch Capital Group Ltd. (e) |

2,859 | 81,367 | ||||||

| Brazil - 0.1% |

||||||||

| Banco do Brasil S.A. |

5,200 | 27,911 | ||||||

| Canada - 1.1% |

||||||||

| Cascades, Inc. |

673 | 6,011 | ||||||

| Cogeco Communications, Inc. |

1,223 | 82,967 | ||||||

| Emera, Inc. |

2,423 | 95,557 | ||||||

| Empire Co., Ltd., Class A |

2,490 | 48,710 | ||||||

| Fairfax Financial Holdings Ltd. |

222 | 68,058 | ||||||

| InterRent Real Estate Investment Trust REIT |

2,995 | 28,326 | ||||||

| Killam Apartment Real Estate Investment Trust REIT |

2,174 | 24,377 | ||||||

| Restaurant Brands International, Inc. |

1,104 | 44,488 | ||||||

| 398,494 | ||||||||

| China - 2.6% |

||||||||

| BOC Aviation Ltd. (a) |

11,300 | 71,390 | ||||||

| China Construction Bank Corp., Class H |

130,748 | 106,278 | ||||||

| China Dongxiang Group Co., Ltd. |

68,883 | 5,925 | ||||||

| China Everbright Greentech Ltd. (a) |

66,000 | 27,566 | ||||||

| China Mobile Ltd. |

22,500 | 168,621 | ||||||

| China SCE Group Holdings Ltd. |

184,000 | 81,205 | ||||||

| China Telecom Corp., Ltd., Class H |

72,000 | 21,815 | ||||||

| China Water Affairs Group Ltd. |

30,000 | 22,405 | ||||||

| Golden Eagle Retail Group Ltd. |

20,000 | 19,606 | ||||||

| Jiangsu Expressway Co., Ltd., Class H |

16,811 | 18,685 | ||||||

| Lenovo Group Ltd. |

198,000 | 104,889 | ||||||

| Shenzhen Expressway Co., Ltd., Class H |

94,300 | 95,339 | ||||||

| Shenzhen Investment Holdings Bay Area Development Co., Ltd. |

41,000 | 14,271 | ||||||

| Tencent Holdings Ltd. |

1,500 | 74,141 | ||||||

| Yadea Group Holdings Ltd. (a) |

58,000 | 16,243 | ||||||

| Yuexiu Real Estate Investment Trust REIT |

43,000 | 21,038 | ||||||

| Yuexiu Transport Infrastructure Ltd. |

80,000 | 48,415 | ||||||

| Yuzhou Properties Co., Ltd. |

63,204 | 26,625 | ||||||

| 944,457 | ||||||||

| Czech Republic - 0.4% |

||||||||

| CEZ AS |

4,930 | 80,425 | ||||||

| Moneta Money Bank AS (a) |

14,893 | 30,673 | ||||||

| O2 Czech Republic AS |

4,201 | 38,222 | ||||||

| 149,320 | ||||||||

| Denmark - 0.5% |

||||||||

| Scandinavian Tobacco Group A/S, Class A (a) |

884 | 8,876 | ||||||

| Solar A/S, Class B |

333 | 9,751 | ||||||

| Spar Nord Bank A/S |

733 | 4,425 | ||||||

| Topdanmark A/S |

787 | 31,580 | ||||||

| See accompanying Notes to Financial Statements | 10 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Tryg A/S |

4,652 | 113,229 | ||||||

| 167,861 | ||||||||

| Finland - 0.6% |

||||||||

| Elisa Oyj |

2,015 | 124,372 | ||||||

| Neste Oyj |

3,174 | 105,528 | ||||||

| 229,900 | ||||||||

| France - 1.4% |

||||||||

| Cegereal S.A. REIT |

1,840 | 72,576 | ||||||

| Eiffage S.A. |

1,063 | 75,455 | ||||||

| Hermes International |

243 | 165,340 | ||||||

| Orpea |

50 | 5,192 | ||||||

| SEB S.A. |

36 | 4,459 | ||||||

| Sodexo S.A. |

941 | 63,193 | ||||||

| Vinci S.A. |

1,328 | 108,510 | ||||||

| 494,725 | ||||||||

| Germany - 1.5% |

||||||||

| Deutsche Telekom AG |

9,593 | 123,898 | ||||||

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen |

964 | 193,832 | ||||||

| TAG Immobilien AG |

3,847 | 75,657 | ||||||

| Talanx AG (e) |

2,577 | 86,705 | ||||||

| TLG Immobilien AG |

1,775 | 28,150 | ||||||

| WCM Beteiligungs & Grundbesitz AG |

5,562 | 16,958 | ||||||

| 525,200 | ||||||||

| Hong Kong - 1.4% |

||||||||

| CITIC Telecom International Holdings Ltd. |

85,000 | 28,047 | ||||||

| CK Hutchison Holdings Ltd. |

8,203 | 54,674 | ||||||

| CLP Holdings Ltd. |

25,219 | 231,006 | ||||||

| Fairwood Holdings Ltd. |

11,000 | 20,835 | ||||||

| Hang Seng Bank Ltd. |

2,700 | 46,001 | ||||||

| Hui Xian Real Estate Investment Trust REIT |

50,000 | 15,733 | ||||||

| NWS Holdings Ltd. |

19,000 | 19,363 | ||||||

| Swire Pacific Ltd., Class A |

11,344 | 72,212 | ||||||

| Yue Yuen Industrial Holdings Ltd. |

2,802 | 4,282 | ||||||

| 492,153 | ||||||||

| Hungary - 0.3% |

||||||||

| Magyar Telekom Telecommunications PLC |

38,780 | 43,187 | ||||||

| MOL Hungarian Oil & Gas PLC |

5,827 | 34,192 | ||||||

| OTP Bank Nyrt |

994 | 28,512 | ||||||

| 105,891 | ||||||||

| Ireland - 0.0% |

||||||||

| Irish Residential Properties REIT PLC |

3,629 | 4,914 | ||||||

| Israel - 0.6% |

||||||||

| Bank Leumi Le-Israel BM |

13,965 | 77,002 | ||||||

| Israel Discount Bank Ltd., Class A |

21,161 | 61,703 | ||||||

| Mizrahi Tefahot Bank Ltd. |

3,586 | 66,003 | ||||||

| Shufersal Ltd. |

2,678 | 15,154 | ||||||

| 219,862 | ||||||||

| Italy - 1.3% |

||||||||

| Enav SpA (a) |

6,976 | 30,759 | ||||||

| Enel SpA |

23,558 | 162,499 | ||||||

| Eni SpA |

3,676 | 36,530 | ||||||

| Hera SpA |

2,579 | 9,331 | ||||||

| Snam SpA |

49,688 | 227,089 | ||||||

| 466,208 | ||||||||

| Japan - 14.1% |

||||||||

| Aoyama Trading Co., Ltd. |

189 | 1,617 | ||||||

| Asahi Group Holdings Ltd. |

3,400 | 110,307 | ||||||

| Astellas Pharma, Inc. |

15,508 | 238,937 | ||||||

| Bookoff Group Holdings Ltd. |

1,500 | 11,130 | ||||||

| Canon, Inc. |

3,190 | 69,322 | ||||||

| Cawachi Ltd. |

900 | 19,751 | ||||||

| See accompanying Notes to Financial Statements | 11 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Daiwa Office Investment Corp. REIT |

8 | 44,397 | ||||||

| DCM Holdings Co., Ltd. |

10,175 | 94,114 | ||||||

| Doutor Nichires Holdings Co., Ltd. |

3,649 | 55,364 | ||||||

| DTS Corp. |

3,502 | 60,804 | ||||||

| DyDo Group Holdings, Inc. |

974 | 32,875 | ||||||

| FamilyMart Co., Ltd. |

5,200 | 93,371 | ||||||

| FUJIFILM Holdings Corp. |

4,279 | 210,867 | ||||||

| Fukuyama Transporting Co., Ltd. |

554 | 19,714 | ||||||

| Geo Holdings Corp. |

864 | 10,460 | ||||||

| Ichigo Office REIT Investment Corp. REIT |

14 | 9,714 | ||||||

| ITOCHU Corp. |

7,400 | 153,140 | ||||||

| Japan Airlines Co., Ltd. |

3,680 | 67,629 | ||||||

| Japan Wool Textile Co., Ltd. |

5,300 | 45,850 | ||||||

| Kajima Corp. |

9,400 | 96,082 | ||||||

| Kamigumi Co., Ltd. |

2,700 | 45,575 | ||||||

| Kandenko Co., Ltd. |

3,000 | 23,842 | ||||||

| Kato Sangyo Co., Ltd. |

600 | 18,869 | ||||||

| KDDI Corp. |

5,200 | 153,601 | ||||||

| Kintetsu Group Holdings Co., Ltd. |

2,300 | 106,449 | ||||||

| LaSalle Logiport REIT |

70 | 94,888 | ||||||

| McDonald’s Holdings Co. Japan Ltd. |

1,700 | 76,673 | ||||||

| Mirait Holdings Corp. |

6,400 | 79,457 | ||||||

| Mitsubishi Corp. |

4,800 | 101,531 | ||||||

| Mitsubishi Research Institute, Inc. |

700 | 21,288 | ||||||

| Morinaga Milk Industry Co., Ltd. |

2,900 | 111,858 | ||||||

| NEC Corp. |

5,400 | 196,631 | ||||||

| NET One Systems Co., Ltd. |

3,600 | 74,907 | ||||||

| Nichias Corp. |

1,602 | 29,727 | ||||||

| Nihon Unisys Ltd. |

2,079 | 55,454 | ||||||

| Nippon REIT Investment Corp. REIT |

16 | 47,382 | ||||||

| Nippon Telegraph & Telephone Corp. |

15,588 | 372,812 | ||||||

| Nishimatsu Construction Co., Ltd. |

2,300 | 43,913 | ||||||

| Nisshin Seifun Group, Inc. |

5,200 | 86,748 | ||||||

| NTT DOCOMO, Inc. |

20,057 | 627,244 | ||||||

| Obayashi Corp. |

8,373 | 71,049 | ||||||

| Okumura Corp. |

2,100 | 43,420 | ||||||

| Raito Kogyo Co., Ltd. |

4,537 | 51,300 | ||||||

| Rengo Co., Ltd. |

3,800 | 29,538 | ||||||

| S Foods, Inc. |

728 | 15,038 | ||||||

| Sanki Engineering Co., Ltd. |

1,000 | 11,195 | ||||||

| Sankyo Co., Ltd. |

3,200 | 92,802 | ||||||

| Sawai Pharmaceutical Co., Ltd. |

1,100 | 58,939 | ||||||

| Sekisui House Ltd. |

6,400 | 105,549 | ||||||

| Senko Group Holdings Co., Ltd. |

5,604 | 43,353 | ||||||

| Shibaura Electronics Co., Ltd. |

200 | 3,760 | ||||||

| Sumitomo Corp. |

8,200 | 93,515 | ||||||

| Sumitomo Dainippon Pharma Co., Ltd. |

532 | 6,906 | ||||||

| Sumitomo Densetsu Co., Ltd. |

1,200 | 24,555 | ||||||

| Sushiro Global Holdings Ltd. |

6,000 | 87,959 | ||||||

| Suzuken Co., Ltd. |

1,700 | 61,764 | ||||||

| Takasago Thermal Engineering Co., Ltd. |

3,503 | 53,565 | ||||||

| Toho Co., Ltd. |

1,500 | 45,865 | ||||||

| Tokyo Gas Co., Ltd. |

3,700 | 87,184 | ||||||

| Tokyu Construction Co., Ltd. |

2,600 | 13,655 | ||||||

| Towa Pharmaceutical Co., Ltd. |

1,500 | 31,354 | ||||||

| Toyo Seikan Group Holdings Ltd. |

6,600 | 75,288 | ||||||

| Toyo Suisan Kaisha Ltd. |

2,800 | 135,331 | ||||||

| Tv Tokyo Holdings Corp. |

934 | 20,807 | ||||||

| Yurtec Corp. |

1,868 | 10,585 | ||||||

| 5,088,570 | ||||||||

| Korea (Republic of) - 1.5% |

||||||||

| Daeduck Electronics Co. |

5,033 | 29,755 | ||||||

| Daekyo Co., Ltd. |

2,318 | 11,245 | ||||||

| Easy Bio, Inc. |

1,107 | 3,231 | ||||||

| Hansol Paper Co., Ltd. |

1,424 | 12,169 | ||||||

| KC Co., Ltd. |

210 | 2,162 | ||||||

| KT Corp. |

660 | 10,682 | ||||||

| KT&G Corp. |

1,320 | 80,820 | ||||||

| Kukdo Chemical Co., Ltd. |

388 | 12,288 | ||||||

| Macquarie Korea Infrastructure Fund |

8,311 | 73,808 | ||||||

| Partron Co., Ltd. |

6,807 | 42,011 | ||||||

| Samsung Electronics Co., Ltd. |

3,199 | 124,382 | ||||||

| Samsung Fire & Marine Insurance Co., Ltd. |

616 | 77,907 | ||||||

| Shinhan Financial Group Co., Ltd. |

631 | 14,762 | ||||||

| SK Telecom Co., Ltd. |

154 | 22,399 | ||||||

| See accompanying Notes to Financial Statements | 12 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Ubiquoss Holdings, Inc. |

1,318 | 22,117 | ||||||

| 539,738 | ||||||||

| Malaysia - 0.8% |

||||||||

| Axis Real Estate Investment Trust REIT |

36,500 | 15,462 | ||||||

| Bermaz Auto Bhd. |

30,800 | 8,022 | ||||||

| Hong Leong Bank Bhd. |

21,000 | 64,963 | ||||||

| Hong Leong Financial Group Bhd. |

2,400 | 7,537 | ||||||

| Malayan Banking Bhd. |

54,500 | 94,029 | ||||||

| MISC Bhd. |

15,800 | 27,107 | ||||||

| Syarikat Takaful Malaysia Keluarga Bhd. |

13,300 | 10,026 | ||||||

| Tenaga Nasional Bhd. |

19,400 | 53,993 | ||||||

| VS Industry Bhd. |

38,900 | 6,844 | ||||||

| 287,983 | ||||||||

| Mexico - 0.1% |

||||||||

| Banco del Bajio S.A. (a) |

18,100 | 15,626 | ||||||

| Qualitas Controladora S.A.B. de C.V. |

11,600 | 29,794 | ||||||

| 45,420 | ||||||||

| Morocco - 0.0% |

||||||||

| Douja Promotion Groupe Addoha S.A. (e) |

10,225 | 6,648 | ||||||

| Netherlands - 0.7% |

||||||||

| ASR Nederland NV |

2,813 | 70,728 | ||||||

| Coca-Cola European Partners PLC |

1,317 | 49,427 | ||||||

| Koninklijke Ahold Delhaize NV |

4,081 | 95,073 | ||||||

| Vastned Retail NV REIT |

1,069 | 17,940 | ||||||

| 233,168 | ||||||||

| New Zealand - 0.3% |

||||||||

| Air New Zealand Ltd. |

32,303 | 16,189 | ||||||

| Arvida Group Ltd. |

26,315 | 19,578 | ||||||

| Summerset Group Holdings Ltd. |

16,234 | 52,419 | ||||||

| Tourism Holdings Ltd. |

3,878 | 2,502 | ||||||

| 90,688 | ||||||||

| Norway - 0.1% |

||||||||

| B2Holding ASA |

5,084 | 1,758 | ||||||

| Elkem ASA (a) |

8,219 | 10,358 | ||||||

| Mowi ASA |

2,253 | 34,064 | ||||||

| 46,180 | ||||||||

| Peru - 0.1% |

||||||||

| Ferreycorp SAA |

40,342 | 14,811 | ||||||

| Philippines - 0.2% |

||||||||

| Altus San Nicolas Corp. (c)(d)(e) |

568 | 113 | ||||||

| Globe Telecom, Inc. |

605 | 22,928 | ||||||

| PLDT, Inc. |

1,115 | 24,663 | ||||||

| Robinsons Land Corp. |

29,500 | 8,582 | ||||||

| 56,286 | ||||||||

| Poland - 0.2% |

||||||||

| Asseco Poland S.A. |

4,650 | 64,959 | ||||||

| Ciech S.A. (e) |

1,701 | 10,979 | ||||||

| 75,938 | ||||||||

| Singapore - 1.6% |

||||||||

| Accordia Golf Trust UNIT |

37,500 | 12,681 | ||||||

| Cache Logistics Trust REIT |

21,200 | 6,909 | ||||||

| CapitaLand Mall Trust REIT |

79,400 | 99,557 | ||||||

| China Aviation Oil Singapore Corp., Ltd. |

6,900 | 4,146 | ||||||

| ComfortDelGro Corp. Ltd. |

36,200 | 38,547 | ||||||

| EC World Real Estate Investment Trust REIT |

21,200 | 8,320 | ||||||

| Fortune Real Estate Investment Trust REIT |

66,000 | 60,675 | ||||||

| Frasers Logistics & Industrial Trust REIT |

99,000 | 61,202 | ||||||

| Keppel DC REIT |

37,500 | 60,184 | ||||||

| Mapletree Commercial Trust REIT |

47,873 | 61,401 | ||||||

| Oversea-Chinese Banking Corp., Ltd. |

10,300 | 62,407 | ||||||

| See accompanying Notes to Financial Statements | 13 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Sheng Siong Group Ltd. |

16,400 | 13,703 | ||||||

| Singapore Airlines Ltd. |

19,200 | 77,935 | ||||||

| Sino Grandness Food Industry Group Ltd. (e) |

77,400 | 640 | ||||||

| 568,307 | ||||||||

| South Africa - 0.0% |

||||||||

| Astral Foods Ltd. |

1,214 | 13,030 | ||||||

| Spain - 0.5% |

||||||||

| Ebro Foods S.A. |

1,610 | 33,045 | ||||||

| Iberdrola S.A. |

13,691 | 133,912 | ||||||

| Lar Espana Real Estate Socimi S.A. REIT |

1,947 | 8,643 | ||||||

| 175,600 | ||||||||

| Sweden - 0.1% |

||||||||

| Castellum AB |

2,957 | 49,856 | ||||||

| Switzerland - 4.6% |

||||||||

| Baloise Holding AG |

636 | 82,917 | ||||||

| Banque Cantonale Vaudoise |

30 | 24,558 | ||||||

| Barry Callebaut AG |

50 | 100,077 | ||||||

| BKW AG |

111 | 9,039 | ||||||

| Cembra Money Bank AG |

883 | 80,514 | ||||||

| Intershop Holding AG |

32 | 16,799 | ||||||

| Nestle S.A. |

3,447 | 352,862 | ||||||

| PSP Swiss Property AG |

690 | 86,284 | ||||||

| Roche Holding AG |

971 | 312,411 | ||||||

| Swiss Life Holding AG |

307 | 103,043 | ||||||

| Swiss Re AG |

1,888 | 145,374 | ||||||

| Zurich Insurance Group AG |

977 | 343,227 | ||||||

| 1,657,105 | ||||||||

| Taiwan - 5.1% |

||||||||

| Asia Cement Corp. |

47,000 | 61,023 | ||||||

| Cheng Loong Corp. |

37,000 | 25,064 | ||||||

| China Airlines Ltd. |

69,000 | 15,030 | ||||||

| China Motor Corp. |

17,600 | 14,440 | ||||||

| China Petrochemical Development Corp. |

117,500 | 28,216 | ||||||

| CTBC Financial Holding Co., Ltd. |

195,000 | 114,824 | ||||||

| E.Sun Financial Holding Co., Ltd. |

140,665 | 112,287 | ||||||

| First Financial Holding Co., Ltd. |

332,659 | 214,965 | ||||||

| Formosa Chemicals & Fibre Corp. |

13,000 | 28,627 | ||||||

| Formosa Petrochemical Corp. |

50,000 | 133,493 | ||||||

| Formosa Plastics Corp. |

31,000 | 76,682 | ||||||

| Fulgent Sun International Holding Co., Ltd. |

8,000 | 22,085 | ||||||

| Getac Technology Corp. |

49,000 | 68,288 | ||||||

| Global Mixed Mode Technology, Inc. |

15,000 | 50,166 | ||||||

| Great Wall Enterprise Co., Ltd. |

31,458 | 38,402 | ||||||

| HannStar Display Corp. |

407,000 | 69,472 | ||||||

| Hua Nan Financial Holdings Co., Ltd. |

90,687 | 53,950 | ||||||

| International CSRC Investment Holdings Co. |

68,770 | 43,786 | ||||||

| King Yuan Electronics Co., Ltd. |

42,000 | 41,700 | ||||||

| Lien Hwa Industrial Holdings Corp. |

65,455 | 80,473 | ||||||

| Mega Financial Holding Co., Ltd. |

86,000 | 80,754 | ||||||

| Mercuries Life Insurance Co., Ltd. (e) |

48,594 | 13,172 | ||||||

| Oriental Union Chemical Corp. |

7,000 | 3,275 | ||||||

| Powertech Technology, Inc. |

37,000 | 104,784 | ||||||

| Sinbon Electronics Co., Ltd. |

18,139 | 74,670 | ||||||

| Taichung Commercial Bank Co., Ltd. |

65,224 | 22,233 | ||||||

| Taiwan Fertilizer Co., Ltd. |

18,000 | 24,727 | ||||||

| Taiwan PCB Techvest Co., Ltd. |

17,000 | 16,110 | ||||||

| Tripod Technology Corp. |

20,000 | 62,215 | ||||||

| Uni-President Enterprises Corp. |

29,000 | 62,768 | ||||||

| Wisdom Marine Lines Co., Ltd. (e) |

15,000 | 10,716 | ||||||

| WT Microelectronics Co., Ltd. |

10,003 | 11,275 | ||||||

| Yuanta Financial Holding Co., Ltd. |

132,000 | 67,393 | ||||||

| 1,847,065 | ||||||||

| Thailand - 1.1% |

||||||||

| Bangchak Corp. PCL (c)(d) |

50,300 | 22,790 | ||||||

| Bangkok Bank PCL (c)(d) |

15,600 | 47,629 | ||||||

| Electricity Generating PCL (c)(d) |

7,500 | 52,542 | ||||||

| IRPC PCL (c)(d) |

188,900 | 12,153 | ||||||

| PTT PCL (c)(d) |

58,600 | 54,176 | ||||||

| Siam Cement PCL (c)(d) |

8,300 | 81,438 | ||||||

| See accompanying Notes to Financial Statements | 14 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Siamgas & Petrochemicals PCL (c)(d) |

151,900 | 35,341 | ||||||

| Star Petroleum Refining PCL (c)(d) |

179,100 | 23,879 | ||||||

| Tisco Financial Group PCL (c)(d) |

30,200 | 64,358 | ||||||

| 394,306 | ||||||||

| United Kingdom - 1.4% |

||||||||

| Berkeley Group Holdings PLC |

1,286 | 57,399 | ||||||

| Diageo PLC |

1,594 | 50,545 | ||||||

| Gamma Communications PLC |

5,158 | 63,093 | ||||||

| Highland Gold Mining Ltd. |

12,952 | 31,257 | ||||||

| Johnson Service Group PLC |

17,486 | 22,238 | ||||||

| Marston’s PLC |

18,438 | 9,327 | ||||||

| Primary Health Properties PLC REIT |

16,812 | 33,381 | ||||||

| Regional REIT Ltd. REIT (a) |

20,237 | 20,684 | ||||||

| Royal Dutch Shell PLC, Class A |

3,379 | 58,595 | ||||||

| Unilever PLC |

2,933 | 147,912 | ||||||

| 494,431 | ||||||||

| United States - 51.7% |

||||||||

| Accenture PLC, Class A |

519 | 84,732 | ||||||

| Adobe, Inc. (e) |

294 | 93,563 | ||||||

| Aflac, Inc. |

3,352 | 114,772 | ||||||

| AG Mortgage Investment Trust, Inc. REIT |

3,004 | 8,231 | ||||||

| AGNC Investment Corp. REIT |

10,756 | 113,798 | ||||||

| Alleghany Corp. |

178 | 98,318 | ||||||

| Allstate Corp. |

3,195 | 293,077 | ||||||

| Altria Group, Inc. |

3,855 | 149,073 | ||||||

| Amdocs Ltd. |

771 | 42,382 | ||||||

| Ameren Corp. |

2,416 | 175,957 | ||||||

| American Electric Power Co., Inc. |

2,333 | 186,593 | ||||||

| American Financial Group, Inc. |

996 | 69,800 | ||||||

| American Tower Corp. REIT |

245 | 53,349 | ||||||

| Amgen, Inc. |

791 | 160,359 | ||||||

| Annaly Capital Management, Inc. REIT |

16,695 | 84,644 | ||||||

| Anthem, Inc. |

486 | 110,341 | ||||||

| Apollo Commercial Real Estate Finance, Inc. REIT |

3,559 | 26,408 | ||||||

| Apple, Inc. |

1,301 | 330,831 | ||||||

| Ares Commercial Real Estate Corp. REIT |

4,387 | 30,665 | ||||||

| AT&T, Inc. |

10,669 | 311,001 | ||||||

| Atmos Energy Corp. |

188 | 18,655 | ||||||

| Automatic Data Processing, Inc. |

1,367 | 186,842 | ||||||

| AutoZone, Inc. (e) |

256 | 216,576 | ||||||

| AvalonBay Communities, Inc. REIT |

623 | 91,687 | ||||||

| Berkshire Hathaway, Inc., Class B (e) |

468 | 85,564 | ||||||

| Bright Horizons Family Solutions, Inc. (e) |

728 | 74,256 | ||||||

| Bristol-Myers Squibb Co. |

3,333 | 185,781 | ||||||

| Cadence Design Systems, Inc. (e) |

160 | 10,566 | ||||||

| Casey’s General Stores, Inc. |

272 | 36,037 | ||||||

| CBTX, Inc. |

1,720 | 30,564 | ||||||

| Centene Corp. (e) |

1,081 | 64,222 | ||||||

| Chemed Corp. |

228 | 98,770 | ||||||

| Cherry Hill Mortgage Investment Corp. REIT |

845 | 5,239 | ||||||

| Chimera Investment Corp. REIT |

3,274 | 29,793 | ||||||

| Church & Dwight Co., Inc. |

2,359 | 151,401 | ||||||

| Cincinnati Financial Corp. |

1,547 | 116,721 | ||||||

| Cisco Systems, Inc. |

5,855 | 230,160 | ||||||

| CMS Energy Corp. |

2,030 | 119,262 | ||||||

| Coca-Cola Co. |

1,148 | 50,799 | ||||||

| Consolidated Edison, Inc. |

5,662 | 441,636 | ||||||

| Costco Wholesale Corp. |

682 | 194,459 | ||||||

| DTE Energy Co. |

1,555 | 147,678 | ||||||

| Duke Energy Corp. |

3,713 | 300,307 | ||||||

| Eli Lilly & Co. |

2,618 | 363,169 | ||||||

| Ellington Financial, Inc. REIT |

1,999 | 11,414 | ||||||

| Encompass Health Corp. |

1,421 | 90,987 | ||||||

| Ennis, Inc. |

1,333 | 25,034 | ||||||

| Entergy Corp. |

1,735 | 163,038 | ||||||

| Equity LifeStyle Properties, Inc. REIT |

1,664 | 95,647 | ||||||

| Equity Residential REIT |

3,423 | 211,233 | ||||||

| Essex Property Trust, Inc. REIT |

586 | 129,061 | ||||||

| Exelon Corp. |

2,277 | 83,816 | ||||||

| Exxon Mobil Corp. |

395 | 14,998 | ||||||

| Facebook, Inc., Class A (e) |

947 | 157,960 | ||||||

| frontdoor, Inc. (e) |

1,870 | 65,039 | ||||||

| FTI Consulting, Inc. (e) |

785 | 94,019 | ||||||

| See accompanying Notes to Financial Statements | 15 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| General Mills, Inc. |

4,052 | 213,824 | ||||||

| Global Payments, Inc. |

1,007 | 145,240 | ||||||

| Granite Point Mortgage Trust, Inc. REIT |

406 | 2,058 | ||||||

| Hershey Co. |

1,444 | 191,330 | ||||||

| Humana, Inc. |

596 | 187,156 | ||||||

| Intel Corp. |

3,538 | 191,477 | ||||||

| Intuit, Inc. |

358 | 82,340 | ||||||

| Invesco Mortgage Capital, Inc. REIT |

3,841 | 13,098 | ||||||

| Johnson & Johnson |

4,381 | 574,481 | ||||||

| Kellogg Co. |

622 | 37,314 | ||||||

| Kimberly-Clark Corp. |

2,199 | 281,186 | ||||||

| Laboratory Corp. of America Holdings (e) |

809 | 102,250 | ||||||

| Leidos Holdings, Inc. |

1,386 | 127,027 | ||||||

| Lockheed Martin Corp. |

1,254 | 425,043 | ||||||

| ManTech International Corp., Class A |

1,303 | 94,689 | ||||||

| Marsh & McLennan Cos., Inc. |

527 | 45,564 | ||||||

| Mastercard, Inc., Class A |

1,349 | 325,864 | ||||||

| McDonald’s Corp. |

1,780 | 294,323 | ||||||

| McGrath RentCorp |

733 | 38,395 | ||||||

| Merck & Co., Inc. |

5,374 | 413,476 | ||||||

| MFA Financial, Inc. REIT |

8,361 | 12,960 | ||||||

| Microsoft Corp. |

1,791 | 282,459 | ||||||

| Motorola Solutions, Inc. |

856 | 113,780 | ||||||

| National CineMedia, Inc. |

706 | 2,302 | ||||||

| NextEra Energy, Inc. |

662 | 159,290 | ||||||

| Northfield Bancorp, Inc. |

396 | 4,431 | ||||||

| Northrop Grumman Corp. |

602 | 182,135 | ||||||

| NVR, Inc. (e) |

8 | 20,553 | ||||||

| O’Reilly Automotive, Inc. (e) |

477 | 143,601 | ||||||

| Occidental Petroleum Corp. |

3,706 | 42,915 | ||||||

| Old Republic International Corp. |

4,871 | 74,283 | ||||||

| Omega Healthcare Investors, Inc. REIT |

1,527 | 40,527 | ||||||

| Paychex, Inc. |

1,494 | 94,002 | ||||||

| Peoples Bancorp, Inc. |

669 | 14,818 | ||||||

| PepsiCo, Inc. |

2,645 | 317,664 | ||||||

| Pfizer, Inc. |

12,565 | 410,122 | ||||||

| Pinnacle West Capital Corp. |

1,356 | 102,771 | ||||||

| Portland General Electric Co. |

1,705 | 81,738 | ||||||

| Procter & Gamble Co. |

5,285 | 581,350 | ||||||

| Progressive Corp. |

3,428 | 253,124 | ||||||

| Prospect Capital Corp. |

9,920 | 42,160 | ||||||

| PS Business Parks, Inc. REIT |

605 | 81,990 | ||||||

| Public Storage REIT |

52 | 10,328 | ||||||

| QCR Holdings, Inc. |

286 | 7,742 | ||||||

| Quest Diagnostics, Inc. |

1,015 | 81,504 | ||||||

| Raytheon Co. |

572 | 75,018 | ||||||

| RBB Bancorp |

438 | 6,009 | ||||||

| Realty Income Corp. REIT |

1,402 | 69,904 | ||||||

| RenaissanceRe Holdings Ltd. |

1,252 | 186,949 | ||||||

| Republic Services, Inc. |

2,290 | 171,887 | ||||||

| Retail Properties of America, Inc., Class A REIT |

3,221 | 16,653 | ||||||

| Ross Stores, Inc. |

2,202 | 191,508 | ||||||

| S&P Global, Inc. |

386 | 94,589 | ||||||

| Shockwave Medical, Inc. (e) |

1,609 | 53,387 | ||||||

| Southern Co. |

2,326 | 125,930 | ||||||

| SP Plus Corp. (e) |

1,429 | 29,652 | ||||||

| Starbucks Corp. |

3,794 | 249,418 | ||||||

| STORE Capital Corp. REIT |

565 | 10,238 | ||||||

| Sysco Corp. |

2,288 | 104,401 | ||||||

| T-Mobile U.S., Inc. (e) |

1,758 | 147,496 | ||||||

| Target Corp. |

1,376 | 127,927 | ||||||

| TCG BDC, Inc. |

1,777 | 9,276 | ||||||

| TJX Cos., Inc. |

3,633 | 173,694 | ||||||

| TPG RE Finance Trust, Inc. REIT |

1,025 | 5,627 | ||||||

| Tyson Foods, Inc., Class A |

1,335 | 77,256 | ||||||

| United Therapeutics Corp. (e) |

929 | 88,092 | ||||||

| UnitedHealth Group, Inc. |

1,648 | 410,978 | ||||||

| Valley National Bancorp |

649 | 4,744 | ||||||

| Verizon Communications, Inc. |

8,660 | 465,302 | ||||||

| Visa, Inc., Class A |

501 | 80,721 | ||||||

| Walmart, Inc. |

2,030 | 230,649 | ||||||

| Walt Disney Co. |

401 | 38,737 | ||||||

| Waste Management, Inc. |

4,952 | 458,357 | ||||||

| Waterstone Financial, Inc. |

1,819 | 26,448 | ||||||

| WEC Energy Group, Inc. |

4,686 | 412,977 | ||||||

| Western Asset Mortgage Capital Corp. REIT |

3,885 | 8,897 | ||||||

| Xcel Energy, Inc. |

6,994 | 421,738 | ||||||

| See accompanying Notes to Financial Statements | 16 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Zoetis, Inc. |

1,530 | 180,066 | ||||||

| 18,629,493 | ||||||||

| Total Common Stock (cost-$36,304,229) |

35,333,490 | |||||||

| PREFERRED STOCK - 0.2% |

||||||||

| Brazil - 0.2% |

||||||||

| Telefonica Brasil S.A.(cost-$101,254) |

7,700 | 73,279 | ||||||

| Total Investments (cost-$36,405,483) (b)-98.3% |

35,406,769 | |||||||

| Other assets less liabilities-1.7% |

625,751 | |||||||

| Net Assets-100.0% |

$ | 36,032,520 | ||||||

| See accompanying Notes to Financial Statements | 17 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

Notes to Schedule of Investments:

| (a) | 144A—Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $232,175, representing 0.6% of net assets. |

| (b) | Securities with an aggregate value of $15,602,362, representing 43.3% of net assets, were valued utilizing modeling tools provided by a third-party vendor. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (c) | Fair-Valued—Securities with an aggregate value of $394,419, representing 1.1% of net assets. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (d) | Level 3 security. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (e) | Non-income producing. |

Glossary:

REIT - Real Estate Investment Trust

UNIT - More than one class of securities traded together

| See accompanying Notes to Financial Statements | 18 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

The industry classification of portfolio holdings and other assets less liabilities shown as a percentage of net assets were as follows:

| Insurance |

7.7 | % | ||

| Pharmaceuticals |

7.7 | % | ||

| Electric Utilities |

6.9 | % | ||

| Diversified Telecommunication Services |

5.2 | % | ||

| Food Products |

4.5 | % | ||

| Equity Real Estate Investment Trusts (REITs) |

4.5 | % | ||

| IT Services |

4.4 | % | ||

| Banks |

4.2 | % | ||

| Multi-Utilities |

3.6 | % | ||

| Healthcare Providers & Services |

3.6 | % | ||

| Wireless Telecommunication Services |

3.2 | % | ||

| Household Products |

2.8 | % | ||

| Hotels, Restaurants & Leisure |

2.5 | % | ||

| Technology Hardware, Storage & Peripherals |

2.5 | % | ||

| Food & Staples Retailing |

2.4 | % | ||

| Specialty Retail |

2.4 | % | ||

| Commercial Services & Supplies |

2.1 | % | ||

| Aerospace & Defense |

1.9 | % | ||

| Construction & Engineering |

1.8 | % | ||

| Beverages |

1.6 | % | ||

| Oil, Gas & Consumable Fuels |

1.6 | % | ||

| Software |

1.5 | % | ||

| Real Estate Management & Development |

1.3 | % | ||

| Trading Companies & Distributors |

1.2 | % | ||

| Semiconductors & Semiconductor Equipment |

1.1 | % | ||

| Mortgage Real Estate Investment Trusts (REITs) |

1.0 | % | ||

| Communications Equipment |

1.0 | % | ||

| Gas Utilities |

0.9 | % | ||

| Electronic Equipment, Instruments & Components |

0.9 | % | ||

| Metals & Mining |

0.8 | % | ||

| Transportation Infrastructure |

0.8 | % | ||

| Biotechnology |

0.7 | % | ||

| Textiles, Apparel & Luxury Goods |

0.7 | % | ||

| Chemicals |

0.7 | % | ||

| Tobacco |

0.7 | % | ||

| Interactive Media & Services |

0.6 | % | ||

| Capital Markets |

0.6 | % | ||

| Road & Rail |

0.6 | % | ||

| Construction Materials |

0.5 | % | ||

| Household Durables |

0.5 | % | ||

| Airlines |

0.5 | % | ||

| Diversified Financial Services |

0.5 | % | ||

| Diversified Consumer Services |

0.4 | % | ||

| Personal Products |

0.4 | % | ||

| Multi-Line Retail |

0.4 | % | ||

| Containers & Packaging |

0.4 | % | ||

| Media |

0.3 | % | ||

| Professional Services |

0.3 | % | ||

| Leisure Equipment & Products |

0.3 | % | ||

| Entertainment |

0.2 | % | ||

| Building Products |

0.2 | % | ||

| Consumer Finance |

0.2 | % | ||

| Independent Power Producers & Energy Traders |

0.2 | % | ||

| Industrial Conglomerates |

0.2 | % | ||

| Healthcare Equipment & Supplies |

0.2 | % | ||

| Marine |

0.1 | % | ||

| Thrifts & Mortgage Finance |

0.1 | % | ||

| Automobiles |

0.1 | % | ||

| Water Utilities |

0.1 | % | ||

| Other assets less liabilities |

1.7 | % | ||

| 100.0 | % |

| See accompanying Notes to Financial Statements | 19 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Global Small-Cap Opportunities Portfolio

| Shares | Value | |||||||

| COMMON STOCK - 98.9% |

||||||||

| Australia - 2.4% |

||||||||

| BWP Trust REIT |

20,488 | $ | 42,156 | |||||

| Charter Hall Retail REIT |

7,665 | 14,639 | ||||||

| JB Hi-Fi Ltd. |

5,207 | 89,652 | ||||||

| 146,447 | ||||||||

| Belgium - 1.0% |

||||||||

| bpost S.A. |

8,895 | 62,711 | ||||||

| Brazil - 0.4% |

||||||||

| Cia Paranaense de Energia, Class P ADR |

2,040 | 21,236 | ||||||

| Canada - 2.0% |

||||||||

| Cogeco Communications, Inc. |

847 | 57,460 | ||||||

| Granite Real Estate Investment Trust REIT |

1,500 | 61,959 | ||||||

| 119,419 | ||||||||

| China - 3.2% |

||||||||

| China National Building Material Co., Ltd., Class H |

30,000 | 32,229 | ||||||

| Huaxin Cement Co., Ltd., Class B |

28,199 | 42,714 | ||||||

| Jiangsu Expressway Co., Ltd., Class H |

32,000 | 35,567 | ||||||

| Weichai Power Co., Ltd., Class H |

52,000 | 82,830 | ||||||

| 193,340 | ||||||||

| Denmark - 0.7% |

||||||||

| Pandora A/S |

1,244 | 39,971 | ||||||

| Hong Kong - 0.6% |

||||||||

| Hysan Development Co., Ltd. |

12,000 | 38,753 | ||||||

| India - 1.9% |

||||||||

| WNS Holdings Ltd. ADR (e) |

2,615 | 112,393 | ||||||

| Italy - 1.8% |

||||||||

| Unipol Gruppo SpA |

31,352 | 106,919 | ||||||

| Japan - 12.3% |

||||||||

| Advance Residence Investment Corp. REIT |

15 | 43,593 | ||||||

| AEON REIT Investment Corp. REIT |

21 | 20,185 | ||||||

| Daiwa Office Investment Corp. REIT |

4 | 22,198 | ||||||

| Dip Corp. |

2,500 | 40,153 | ||||||

| EDION Corp. |

9,200 | 75,892 | ||||||

| Fuji Soft, Inc. |

1,000 | 32,104 | ||||||

| GungHo Online Entertainment, Inc. |

1,990 | 27,738 | ||||||

| Hulic Co., Ltd. |

4,300 | 43,516 | ||||||

| IDOM, Inc. |

6,400 | 23,244 | ||||||

| IR Japan Holdings Ltd. |

600 | 32,095 | ||||||

| Jafco Co., Ltd. (e) |

1,300 | 33,798 | ||||||

| Japan Logistics Fund, Inc. REIT |

14 | 31,188 | ||||||

| Japan Rental Housing Investments, Inc. REIT |

21 | 17,778 | ||||||

| Nippon Accommodations Fund, Inc. REIT |

5 | 27,204 | ||||||

| Nippon REIT Investment Corp. REIT |

7 | 20,730 | ||||||

| Sankyu, Inc. |

3,500 | 130,410 | ||||||

| Sumitomo Forestry Co., Ltd. |

5,000 | 63,837 | ||||||

| T-Gaia Corp. |

2,900 | 54,833 | ||||||

| 740,496 | ||||||||

| Korea (Republic of) - 3.1% |

||||||||

| DB HiTek Co., Ltd. |

3,744 | 65,403 | ||||||

| LG Innotek Co., Ltd. |

940 | 86,504 | ||||||

| Macquarie Korea Infrastructure Fund |

3,675 | 32,637 | ||||||

| 184,544 | ||||||||

| Netherlands - 2.6% |

||||||||

| ASR Nederland NV |

2,437 | 61,274 | ||||||

| Signify NV (a) |

4,778 | 92,599 | ||||||

| 153,873 | ||||||||

| Norway - 0.3% |

||||||||

| BW LPG Ltd. (a) |

4,959 | 14,950 | ||||||

| See accompanying Notes to Financial Statements | 20 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Global Small-Cap Opportunities Portfolio

| Shares | Value | |||||||

| Portugal - 0.6% |

||||||||

| NOS SGPS S.A. |

11,622 | 38,814 | ||||||

| Russian Federation - 0.7% |

||||||||

| Federal Grid Co. Unified Energy System PJSC (c)(d) |

21,610,000 | 44,517 | ||||||

| Singapore - 1.8% |

||||||||

| Mapletree Commercial Trust REIT |

32,200 | 41,299 | ||||||

| Mapletree Industrial Trust REIT |

26,400 | 44,832 | ||||||

| Mapletree North Asia Commercial Trust REIT |

37,700 | 21,216 | ||||||

| 107,347 | ||||||||

| South Africa - 0.4% |

||||||||

| Harmony Gold Mining Co., Ltd. ADR (e) |

11,160 | 24,329 | ||||||

| Spain - 0.6% |

||||||||

| Viscofan S.A. |

632 | 34,604 | ||||||

| Switzerland - 0.7% |

||||||||

| Galenica AG (a)(e) |

605 | 41,281 | ||||||

| Taiwan - 6.4% |

||||||||

| Powertech Technology, Inc. |

18,000 | 50,976 | ||||||

| Radiant Opto-Electronics Corp. |

14,000 | 36,228 | ||||||

| Silicon Motion Technology Corp. ADR |

2,930 | 107,414 | ||||||

| Sino-American Silicon Products, Inc. |

14,000 | 35,837 | ||||||

| Wistron Corp. |

191,000 | 154,410 | ||||||

| 384,865 | ||||||||

| Thailand - 1.0% |

||||||||

| Thanachart Capital PCL (c)(d) |

60,300 | 60,651 | ||||||

| Turkey - 0.9% |

||||||||

| Enerjisa Enerji AS (a) |

26,601 | 27,272 | ||||||

| Turkiye Sinai Kalkinma Bankasi AS (e) |

189,590 | 26,948 | ||||||

| 54,220 | ||||||||

| United Kingdom - 2.3% |

||||||||

| Computacenter PLC |

2,547 | 45,156 | ||||||

| Go-Ahead Group PLC |

2,533 | 25,652 | ||||||

| Greggs PLC |

3,261 | 64,894 | ||||||

| 135,702 | ||||||||

| United States - 51.2% |

||||||||

| Allied Motion Technologies, Inc. |

760 | 18,012 | ||||||

| Arcosa, Inc. |

1,275 | 50,668 | ||||||

| Aspen Technology, Inc. (e) |

870 | 82,711 | ||||||

| Balchem Corp. |

600 | 59,232 | ||||||

| Bancorp, Inc. (e) |

3,385 | 20,547 | ||||||

| Bruker Corp. |

720 | 25,819 | ||||||

| Cavco Industries, Inc. (e) |

265 | 38,409 | ||||||

| Century Communities, Inc. (e) |

3,720 | 53,977 | ||||||

| Charles River Laboratories International, Inc. (e) |

410 | 51,746 | ||||||

| Chemed Corp. |

300 | 129,960 | ||||||

| Cirrus Logic, Inc. (e) |

1,900 | 124,697 | ||||||

| Clean Harbors, Inc. (e) |

420 | 21,563 | ||||||

| Clearway Energy, Inc., Class A |

4,400 | 75,548 | ||||||

| Comfort Systems USA, Inc. |

1,650 | 60,307 | ||||||

| EMCOR Group, Inc. |

1,545 | 94,739 | ||||||

| Emergent Biosolutions, Inc. (e) |

820 | 47,445 | ||||||

| ePlus, Inc. (e) |

570 | 35,693 | ||||||

| GMS, Inc. (e) |

1,690 | 26,584 | ||||||

| HarborOne Bancorp, Inc. (e) |

3,445 | 25,941 | ||||||

| Hilltop Holdings, Inc. |

4,905 | 74,164 | ||||||

| Horizon Therapeutics PLC (e) |

3,795 | 112,408 | ||||||

| Inphi Corp. (e) |

2,535 | 200,696 | ||||||

| Integer Holdings Corp. (e) |

2,040 | 128,234 | ||||||

| M/I Homes, Inc. (e) |

1,270 | 20,993 | ||||||

| ManTech International Corp., Class A |

1,900 | 138,073 | ||||||

| Methode Electronics, Inc. |

4,190 | 110,742 | ||||||

| MGIC Investment Corp. |

13,255 | 84,169 | ||||||

| MSA Safety, Inc. |

1,240 | 125,488 | ||||||

| NewMarket Corp. |

380 | 145,491 | ||||||

| See accompanying Notes to Financial Statements | 21 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Global Small-Cap Opportunities Portfolio

| Shares | Value | |||||||

| Opus Bank |

3,075 | 53,290 | ||||||

| PRA Health Sciences, Inc. (e) |

1,230 | 102,139 | ||||||

| Prestige Consumer Healthcare, Inc. (e) |

1,800 | 66,024 | ||||||

| Progress Software Corp. |

3,500 | 112,000 | ||||||

| Rush Enterprises, Inc., Class A |

1,525 | 48,678 | ||||||

| SJW Group |

595 | 34,373 | ||||||

| South State Corp. |

505 | 29,659 | ||||||

| Teledyne Technologies, Inc. (e) |

500 | 148,635 | ||||||

| Tetra Tech, Inc. |

1,180 | 83,332 | ||||||

| Tompkins Financial Corp. |

390 | 28,002 | ||||||

| TopBuild Corp. (e) |

970 | 69,491 | ||||||

| United Therapeutics Corp. (e) |

665 | 63,059 | ||||||

| Vectrus, Inc. (e) |

1,280 | 53,005 | ||||||

| 3,075,743 | ||||||||

| Total Common Stock (cost-$6,985,792) |

5,937,125 | |||||||

| PREFERRED STOCK - 0.5% |

||||||||

| Brazil - 0.5% |

||||||||

| Cia Paranaense de Energia(cost-$29,286) |

3,100 | 31,918 | ||||||

| Total Investments (cost-$7,015,078) (b)-99.4% |

5,969,043 | |||||||

| Other assets less liabilities-0.6% |

33,502 | |||||||

| Net Assets-100.0% |

$ | 6,002,545 | ||||||

| See accompanying Notes to Financial Statements | 22 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Global Small-Cap Opportunities Portfolio

Notes to Schedule of Investments:

| (a) | 144A—Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $176,102, representing 2.9% of net assets. |

| (b) | Securities with an aggregate value of $2,317,203, representing 38.6% of net assets, were valued utilizing modeling tools provided by a third-party vendor. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (c) | Fair-Valued—Securities with an aggregate value of $105,168, representing 1.8% of net assets. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (d) | Level 3 security. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (e) | Non-income producing. |

Glossary:

ADR - American Depositary Receipt

REIT - Real Estate Investment Trust

| See accompanying Notes to Financial Statements | 23 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI Global Small-Cap Opportunities Portfolio

The industry classification of portfolio holdings and other assets less liabilities shown as a percentage of net assets were as follows:

| Semiconductors & Semiconductor Equipment |

10.3 | % | ||

| Equity Real Estate Investment Trusts (REITs) |

6.3 | % | ||

| Banks |

5.3 | % | ||

| IT Services |

4.9 | % | ||

| Household Durables |

4.1 | % | ||

| Specialty Retail |

4.1 | % | ||

| Electronic Equipment, Instruments & Components |

3.9 | % | ||

| Commercial Services & Supplies |

3.8 | % | ||

| Software |

3.8 | % | ||

| Construction & Engineering |

3.4 | % | ||

| Chemicals |

3.4 | % | ||

| Aerospace & Defense |

3.4 | % | ||

| Life Sciences Tools & Services |

3.0 | % | ||

| Pharmaceuticals |

3.0 | % | ||

| Healthcare Providers & Services |

2.8 | % | ||

| Insurance |

2.8 | % | ||

| Road & Rail |

2.6 | % | ||

| Technology Hardware, Storage & Peripherals |

2.6 | % | ||

| Healthcare Equipment & Supplies |

2.1 | % | ||

| Electric Utilities |

2.1 | % | ||

| Real Estate Management & Development |

1.9 | % | ||

| Electrical Equipment |

1.8 | % | ||

| Biotechnology |

1.8 | % | ||

| Thrifts & Mortgage Finance |

1.4 | % | ||

| Machinery |

1.4 | % | ||

| Independent Power Producers & Energy Traders |

1.3 | % | ||

| Trading Companies & Distributors |

1.3 | % | ||

| Construction Materials |

1.2 | % | ||

| Capital Markets |

1.1 | % | ||

| Hotels, Restaurants & Leisure |

1.1 | % | ||

| Air Freight & Logistics |

1.0 | % | ||

| Media |

1.0 | % | ||

| Interactive Media & Services |

0.7 | % | ||

| Textiles, Apparel & Luxury Goods |

0.7 | % | ||

| Diversified Telecommunication Services |

0.6 | % | ||

| Transportation Infrastructure |

0.6 | % | ||

| Food Products |

0.6 | % | ||

| Water Utilities |

0.6 | % | ||

| Professional Services |

0.5 | % | ||

| Entertainment |

0.5 | % | ||

| Metals & Mining |

0.4 | % | ||

| Oil, Gas & Consumable Fuels |

0.2 | % | ||

| Other assets less liabilities |

0.6 | % | ||

| 100.0 | % |

| See accompanying Notes to Financial Statements | 24 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI International Growth Portfolio

| Shares | Value | |||||||

| COMMON STOCK - 97.8% |

||||||||

| Argentina - 2.1% |

||||||||

| MercadoLibre, Inc. (c) |

1,246 | $ | 608,771 | |||||

| Australia - 3.9% |

||||||||

| CSL Ltd. |

1,880 | 340,790 | ||||||

| Domino’s Pizza Enterprises Ltd. |

18,002 | 557,348 | ||||||

| Treasury Wine Estates Ltd. |

39,300 | 243,997 | ||||||

| 1,142,135 | ||||||||

| Brazil - 2.7% |

||||||||

| StoneCo Ltd., Class A (c) |

36,035 | 784,482 | ||||||

| Canada - 7.4% |

||||||||

| Alimentation Couche-Tard, Inc., Class B |

25,640 | 603,969 | ||||||

| Canadian National Railway Co. |

3,170 | 247,847 | ||||||

| Constellation Software, Inc. |

810 | 736,166 | ||||||

| Shopify, Inc., Class A (c) |

1,415 | 589,956 | ||||||

| 2,177,938 | ||||||||

| China - 15.7% |

||||||||

| Alibaba Group Holding Ltd. ADR (c) |

9,791 | 1,904,154 | ||||||

| TAL Education Group ADR (c) |

5,103 | 271,786 | ||||||

| Tencent Holdings Ltd. |

33,516 | 1,656,615 | ||||||

| Tencent Music Entertainment Group ADR (c) |

50,107 | 504,076 | ||||||

| Weibo Corp. ADR (c) |

8,805 | 291,534 | ||||||

| 4,628,165 | ||||||||

| Denmark - 15.2% |

||||||||

| Ambu A/S, Class B |

79,920 | 1,924,602 | ||||||

| Coloplast A/S, Class B |

1,213 | 175,917 | ||||||

| DSV PANALPINA A/S |

9,280 | 843,821 | ||||||

| Netcompany Group A/S (a)(c) |

23,875 | 1,096,548 | ||||||

| Novo Nordisk A/S, Class B |

7,626 | 455,394 | ||||||

| 4,496,282 | ||||||||

| Germany - 10.7% |

||||||||

| Adidas AG |

1,482 | 329,044 | ||||||

| Bechtle AG |

4,888 | 615,461 | ||||||

| GRENKE AG |

6,238 | 359,474 | ||||||

| Infineon Technologies AG |

54,171 | 781,999 | ||||||

| SAP SE |

7,612 | 849,864 | ||||||

| Zalando SE (a)(c) |

6,212 | 234,131 | ||||||

| 3,169,973 | ||||||||

| Hong Kong - 3.8% |

||||||||

| AIA Group Ltd. |

125,837 | 1,126,824 | ||||||

| India - 3.4% |

||||||||

| HDFC Bank Ltd. ADR |

26,154 | 1,005,883 | ||||||

| Indonesia - 1.2% |

||||||||

| Ace Hardware Indonesia Tbk PT |

1,561,724 | 124,250 | ||||||

| Bank Central Asia Tbk PT |

136,855 | 230,589 | ||||||

| 354,839 | ||||||||

| Ireland - 2.3% |

||||||||

| Kingspan Group PLC |

8,283 | 446,321 | ||||||

| Ryanair Holdings PLC ADR (c) |

4,376 | 232,322 | ||||||

| 678,643 | ||||||||

| Israel - 4.7% |

||||||||

| Wix.com Ltd. (c) |

13,720 | 1,383,250 | ||||||

| Japan - 3.6% |

||||||||

| Keyence Corp. |

2,079 | 668,424 | ||||||

| MonotaRO Co., Ltd. |

14,742 | 389,505 | ||||||

| 1,057,929 | ||||||||

| See accompanying Notes to Financial Statements | 25 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI International Growth Portfolio

| Shares | Value | |||||||

| Netherlands - 4.9% |

||||||||

| ASML Holding NV |

5,436 | 1,433,009 | ||||||

| New Zealand - 1.4% |

||||||||

| Mainfreight Ltd. |

20,396 | 419,370 | ||||||

| Philippines - 0.3% |

||||||||

| Jollibee Foods Corp. |

45,327 | 94,349 | ||||||

| South Africa - 1.3% |

||||||||

| PSG Group Ltd. |

54,795 | 394,627 | ||||||

| Sweden - 6.8% |

||||||||

| AddTech AB, Class B |

18,879 | 460,730 | ||||||

| Assa Abloy AB, Class B |

11,683 | 218,106 | ||||||

| Atlas Copco AB, Class A |

12,775 | 424,823 | ||||||

| Epiroc AB, Class A |

23,400 | 231,227 | ||||||

| Hexagon AB, Class B |

7,579 | 320,479 | ||||||

| Hexpol AB |

60,694 | 358,599 | ||||||

| 2,013,964 | ||||||||

| Switzerland - 4.8% |

||||||||

| Partners Group Holding AG |

609 | 416,962 | ||||||

| Sika AG |

2,572 | 422,355 | ||||||

| Temenos AG (c) |

1,959 | 255,355 | ||||||

| VAT Group AG (a)(c) |

2,284 | 311,405 | ||||||

| 1,406,077 | ||||||||

| United Kingdom - 1.6% |

||||||||

| DCC PLC |

7,598 | 474,504 | ||||||

| Total Common Stock (cost-$29,891,030) |

28,851,014 | |||||||

| Principal Amount (000s) |

||||||||

| Repurchase Agreements - 2.2% |

||||||||

| State Street Bank and Trust Co., dated 3/31/20, 0.00%, due 4/1/20, proceeds $656,000; collateralized by U.S Treasury Inflation Index, 0.625%, due 4/15/23, valued at $673,270 including accrued interest (cost-$656,000) |

$ | 656 | 656,000 | |||||

| Total Investments (cost-$30,547,030) (b)-100.0% |

29,507,014 | |||||||

| Other assets less liabilities-0.0% |

2,958 | |||||||

| Net Assets-100.0% |

$ | 29,509,972 | ||||||

| See accompanying Notes to Financial Statements | 26 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI International Growth Portfolio

Notes to Schedule of Investments:

| (a) | 144A—Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $1,642,084, representing 5.6% of net assets. |

| (b) | Securities with an aggregate value of $19,686,818, representing 66.7% of net assets, were valued utilizing modeling tools provided by a third-party vendor. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (c) | Non-income producing. |

Glossary:

ADR - American Depositary Receipt

| See accompanying Notes to Financial Statements | 27 | Semiannual Report / March 31, 2020 |

Table of Contents

Schedule of Investments

March 31, 2020 (unaudited)

AllianzGI International Growth Portfolio

The industry classification of portfolio holdings and other assets less liabilities shown as a percentage of net assets were as follows:

| IT Services |

11.4 | % | ||

| Software |

10.0 | % | ||

| Internet & Direct Marketing Retail |

9.3 | % | ||

| Semiconductors & Semiconductor Equipment |

7.5 | % | ||

| Healthcare Equipment & Supplies |

7.1 | % | ||

| Interactive Media & Services |

6.6 | % | ||

| Air Freight & Logistics |

4.3 | % | ||

| Banks |

4.2 | % | ||

| Insurance |

3.8 | % | ||

| Electronic Equipment, Instruments & Components |

3.4 | % | ||

| Machinery |

3.3 | % | ||

| Trading Companies & Distributors |

2.9 | % | ||

| Chemicals |

2.6 | % | ||

| Diversified Financial Services |

2.6 | % | ||

| Building Products |

2.3 | % | ||

| Hotels, Restaurants & Leisure |

2.2 | % | ||

| Food & Staples Retailing |

2.1 | % | ||

| Entertainment |

1.7 | % | ||

| Industrial Conglomerates |

1.6 | % | ||

| Pharmaceuticals |

1.5 | % | ||

| Capital Markets |

1.4 | % | ||

| Biotechnology |

1.2 | % | ||

| Textiles, Apparel & Luxury Goods |

1.1 | % | ||

| Diversified Consumer Services |

0.9 | % | ||

| Road & Rail |

0.8 | % | ||

| Beverages |

0.8 | % | ||

| Airlines |

0.8 | % | ||

| Specialty Retail |

0.4 | % | ||

| Repurchase Agreements |

2.2 | % | ||

| 100.0 | % |

| See accompanying Notes to Financial Statements | 28 | Semiannual Report / March 31, 2020 |

Table of Contents

Statements of Assets and Liabilities

March 31, 2020 (unaudited)

| AllianzGI Best Styles Global Managed Volatility |

AllianzGI Global Small-Cap Opportunities |

AllianzGI International Growth |

||||||||||||||||||||||

| Assets: |

||||||||||||||||||||||||

| Investments, at value |

$35,406,769 | $5,969,043 | $29,507,014 | |||||||||||||||||||||

| Cash |

91,764 | 72,129 | 967 | |||||||||||||||||||||

| Foreign currency, at value |

330,842 | 2,032 | 37,890 | |||||||||||||||||||||

| Dividends and interest receivable (net of foreign withholding taxes) |

148,286 | 14,996 | 10,417 | |||||||||||||||||||||

| Receivable for investments sold |

64,562 | – | 382,480 | |||||||||||||||||||||

| Receivable from Investment Manager |

9,401 | 6,066 | – | |||||||||||||||||||||

| Deferred offering costs |

– | – | 3,330 | |||||||||||||||||||||

| Tax reclaims receivable |

31,480 | 1,422 | 8,499 | |||||||||||||||||||||

| Investments in Affiliated Funds - Trustees Deferred Compensation Plan (see Note 4) |

7,302 | 686 | – | |||||||||||||||||||||

| Prepaid expenses and other assets |

1,407 | 1,094 | 304 | |||||||||||||||||||||

| Total Assets |

36,091,813 | 6,067,468 | 29,950,901 | |||||||||||||||||||||

| Liabilities: |

||||||||||||||||||||||||

| Payable for investments purchased |

– | – | 371,349 | |||||||||||||||||||||

| Investment management fees payable |

– | – | 4,294 | |||||||||||||||||||||

| Trustees Deferred Compensation Plan payable (see Note 4) |

7,302 | 686 | – | |||||||||||||||||||||