UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22975

AllianzGI Institutional Multi-Series Trust

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices) (Zip code)

Lawrence G. Altadonna

1633 Broadway, New York, NY 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: September 30

Date of reporting period: March 31, 2017

Item 1. Report to Shareholders

AllianzGI Institutional Multi-Series Trust

Semi-Annual Report

March 31, 2017

Table of Contents

| 2 - 9 | ||

| 10-11 | ||

| 12-38 | ||

| 39-40 | ||

| 41 | ||

| 42-43 | ||

| 44-45 | ||

| 46-61 | ||

| 62-63 | ||

AllianzGI Advanced Core Bond Portfolio

(unaudited)

For the period of October 1, 2016 through March 31, 2017, as provided by Christian Tropp, CFA, Portfolio Manager.

| Portfolio Insights |

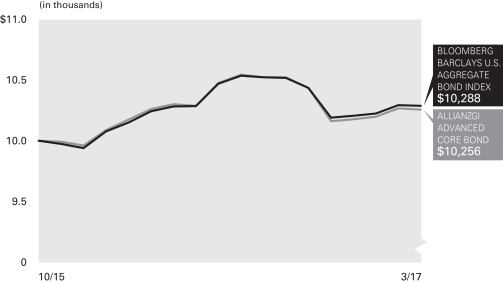

| Average Annual Total Return for the period ended March 31, 2017 |

| 6 Month* | 1 Year | Since Inception† | ||||||

| AllianzGI Advanced Core Bond Portfolio | -2.54% | -0.06% | 1.80% | |||||

| Bloomberg Barclays US Aggregate Bond Index †† | -2.18% | 0.44% | 2.02% | |||||

* Cumulative Returns

† The Portfolio began operations on 10/30/15. Benchmark return comparisons began on the portfolio inception date.

†† The Bloomberg Barclays US Aggregate Bond Index is composed of securities from the Bloomberg Barclays Government/Credit Bond Index, Mortgage-Backed Securities Index, and Asset-Backed Securities Index. It is generally considered to be representative of the domestic, investment grade fixed rate, taxable bond market (as of March 31, 2017). Index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns do not reflect deduction of taxes that a shareholder would pay on portfolio distributions or redemption of portfolio shares. Total return performance assumes that all dividends and capital gain distributions were reinvested on the payable date. The Portfolio’s gross expense ratio is 0.55%. This ratio does not include an expense reduction, contractually agreed to through January 31, 2018. The Portfolio’s expense ratio net of this reduction is 0.35%. Expense ratio information is as of the Portfolio’s current Private Placement Memorandum (“PPM”) dated February 1, 2017.

Portfolio Review commentary is based on the Wilshire Axiom Performance Attribution Analysis. Wilshire Axiom uses a position based approach and performance is linked daily. Please note that the different prices and different methodologies used in this attribution report, among others, may cause deviation in return figures to official performance.

| 2 | Semi-Annual Report / March 31, 2017 |

AllianzGI Advanced Core Bond Portfolio

(unaudited) (continued)

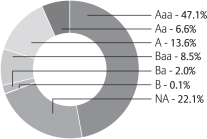

* As a percentage of total investments. Bond ratings refer to the underlying holdings of the Portfolio and are categorized from highest to lowest credit quality using ratings provided by Moody’s. Moody’s ratings have been selected for several reasons, including the access to information and materials provided by Moody’s, as well as the Portfolio’s consideration of industry practice. See “Important Information” for more detail on the selection of Moody’s for the Portfolio’s ratings presentation. Bonds not rated by Moody’s and bonds that do not currently have a rating available are designated in the chart above as “NR” and “NA”, respectively.

| Shareholder Expense Example | Actual Performance | |

| Beginning Account Value (10/1/16) |

$1,000.00 | |

| Ending Account Value (3/31/17) |

$ 974.60 | |

| Expenses Paid During Period |

$ 1.72 | |

| Hypothetical Performance | ||

| (5% return before expenses) | ||

| Beginning Account Value (10/1/16) |

$1,000.00 | |

| Ending Account Value (3/31/17) |

$1,023.19 | |

| Expenses Paid During Period |

$ 1.77 | |

Expenses (net of reimbursement, if any) are equal to the annualized expense ratio (0.35%), multiplied by the average account value over the period, multiplied by 182/365.

| 3 | Semi-Annual Report / March 31, 2017 |

AllianzGI Best Styles Global Managed Volatility Portfolio

(unaudited)

For the period of October 1, 2016 through March 31, 2017, as provided by Christian McCormick, Senior Product Specialist.

| Portfolio Insights |

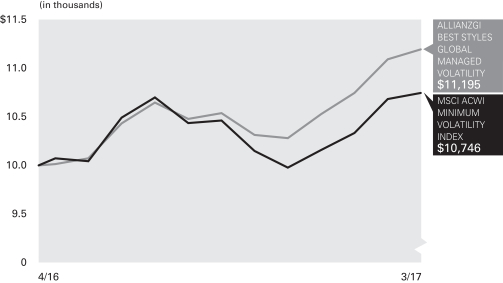

| Cumulative Return for the period ended March 31, 2017 |

| 6 Month | Since Inception† | |||

| AllianzGI Best Styles Global Managed Volatility Portfolio | 6.22% | 11.96% | ||

| MSCI ACWI Minimum Volatility Index †† | 2.72% | 7.46% | ||

† The Portfolio began operations on April 11, 2016. Benchmark return comparisons began on the portfolio inception date.

†† The MSCI ACWI Minimum Volatility Index aims to reflect the performance characteristics of a minimum variance strategy applied to large and mid cap equities across Developed Markets and Emerging Markets countries. The index is calculated by optimizing the MSCI ACWI Index, its parent index, for the lowest absolute risk (within a given set of constraints). Historically, the index has shown lower beta and volatility characteristics relative to the MSCI ACWI Index.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns do not reflect deduction of taxes that a shareholder would pay on portfolio distributions or redemption of portfolio shares. Total return performance assumes that all dividends and capital gain distributions were reinvested on the payable date. The Portfolio’s gross expense ratio is 0.95%. This ratio does not include an expense reduction, contractually agreed to through January 31, 2018. The Portfolio’s expense ratio net of this reduction is 0.45%. Expense ratio information is as of the Portfolio’s current PPM dated February 1, 2017.

| 4 | Semi-Annual Report / March 31, 2017 |

AllianzGI Best Styles Global Managed Volatility Portfolio

(unaudited) (continued)

| Shareholder Expense Example | Actual Performance | |

| Beginning Account Value (10/1/16) |

$1,000.00 | |

| Ending Account Value (3/31/17) |

$1,062.20 | |

| Expenses Paid During Period |

$ 2.31 | |

| Hypothetical Performance | ||

| (5% return before expenses) | ||

| Beginning Account Value (10/1/16) |

$1,000.00 | |

| Ending Account Value (3/31/17) |

$1,022.69 | |

| Expenses Paid During Period |

$ 2.27 | |

Expenses (net of reimbursement, if any) are equal to the annualized expense ratio (0.45%), multiplied by the average account value over the period, multiplied by 182/365.

| 5 | Semi-Annual Report / March 31, 2017 |

AllianzGI Discovery U.S. Portfolio

(unaudited)

For the period of October 1, 2016 through March 31, 2017, as provided by Raymond Cunha, CFA, Lead Portfolio Manager.

| Portfolio Insights |

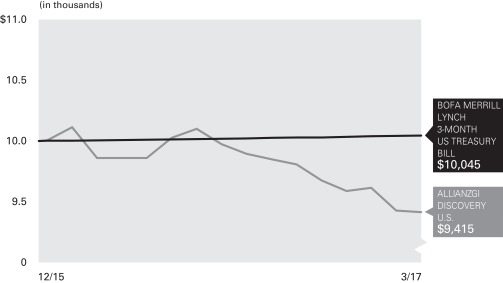

| Average Annual Total Return for the period ended March 31, 2017 |

| 6 Month* | 1 Year | Since Inception† | ||||||||

| AllianzGI Discovery U.S. Portfolio | -4.40% | -4.53% | -4.62% | |||||||

| BofA Merrill Lynch 3-Month US Treasury Bill Index †† | 0.19% | 0.36% | 0.35% | |||||||

* Cumulative Returns

† The Portfolio began operations on December 21, 2015. Benchmark return comparisons began on the portfolio inception date.

†† The BofA Merrill Lynch 3-Month US Treasury Bill Index tracks the performance of the 3-month US Treasury markets. Index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns do not reflect deduction of taxes that a shareholder would pay on portfolio distributions or redemption of portfolio shares. Total return performance assumes that all dividends and capital gain distributions were reinvested on the payable date. The Portfolio’s gross expense ratio is 5.55%. This ratio does not include an expense reduction, contractually agreed to through January 31, 2018, where the manager agrees to irrevocably waive its management fee and/or reimburse the Portfolio to the extent that gross expense ratio, excluding interest, tax, dividend expenses on short sales, and extraordinary expenses, and certain credits and other expenses , exceed 1.50%. The Portfolio’s expense ratio net of this reduction is 3.20%, which includes dividend expenses on short sales which are estimated to be 1.70%. Expense ratio information is as of the Portfolio’s current PPM dated February 1, 2017.

| 6 | Semi-Annual Report / March 31, 2017 |

AllianzGI Discovery U.S. Portfolio

(unaudited) (continued)

| Shareholder Expense Example | Actual Performance | |

| Beginning Account Value (10/1/16) |

$1,000.00 | |

| Ending Account Value (3/31/17) |

$ 956.00 | |

| Expenses Paid During Period |

$ 15.46 | |

| Hypothetical Performance | ||

| (5% return before expenses) | ||

| Beginning Account Value (10/1/16) |

$1,000.00 | |

| Ending Account Value (3/31/17) |

$1,009.12 | |

| Expenses Paid During Period |

$ 15.88 | |

Expenses (net of reimbursement, if any) are equal to the annualized expense ratio (3.17%, multiplied by the average account value over the period, multiplied by 182/365.

| 7 | Semi-Annual Report / March 31, 2017 |

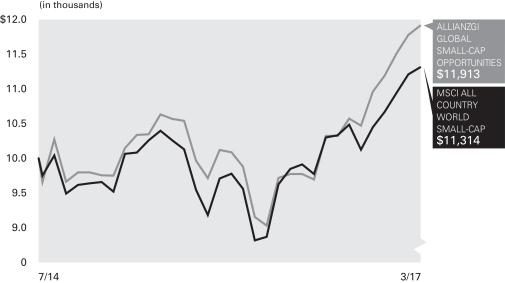

AllianzGI Global Small-Cap Opportunities Portfolio

(unaudited)

For the period of October 1, 2016 through March 31, 2017, as provided by Mark P. Roemer, Portfolio Manager.

| Portfolio Insights |

| Average Annual Total Return for the periods ended March 31, 2017 |

| 6 Month* | 1 Year | Since Inception† | ||||||||

| AllianzGI Global Small-Cap Opportunities Portfolio | 12.67% | 22.57% | 6.73% | |||||||

| MSCI All Country World Small-Cap Index †† | 7.90% | 17.50% | 4.70% | |||||||

* Cumulative Returns

† The Portfolio began operations on July 23, 2014. Benchmark return comparisons began on the portfolio inception date.

†† The MSCI All Country World Small-Cap Index captures small-cap representation across developed markets and emerging markets countries. The Index covers about 14% of the free float-adjusted market capitalization in each country (as of September 30, 2016). Index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns do not reflect deduction of taxes that a shareholder would pay on portfolio distributions or redemption of portfolio shares. Total return performance assumes that all dividends and capital gain distributions were reinvested on the payable date. The Portfolio’s gross expense ratio is 5.48%. This ratio does not include an expense reduction, contractually agreed to through January 31, 2018. The Portfolio’s expense ratio net of this reduction is 1.20%. Expense ratio information is as of the Portfolio’s current PPM dated February 1, 2017.

| 8 | Semi-Annual Report / March 31, 2017 |

AllianzGI Global Small-Cap Opportunities Portfolio

(unaudited) (continued)

| Shareholder Expense Example | Actual Performance | |

| Beginning Account Value (10/1/16) |

$1,000.00 | |

| Ending Account Value (3/31/17) |

$1,126.70 | |

| Expenses Paid During Period |

$ 6.36 | |

| Hypothetical Performance | ||

| (5% return before expenses) | ||

| Beginning Account Value (10/1/16) |

$1,000.00 | |

| Ending Account Value (3/31/17) |

$1,018.95 | |

| Expenses Paid During Period |

$ 6.04 | |

Expenses (net of reimbursement, if any) are equal to the annualized expense ratio (1.20%), multiplied by the average account value over the period, multiplied by 182/365.

| 9 | Semi-Annual Report / March 31, 2017 |

AllianzGI Institutional Multi-Series Trust

Important Information (unaudited)

As of March 31, 2017, AllianzGI Institutional Multi-Series Trust (the “Trust”) consisted of four investment series, AllianzGI Advanced Core Bond Portfolio, AllianzGI Best Styles Global Managed Volatility Portfolio, AllianzGI Discovery U.S. Portfolio and AllianzGI Global Small-Cap Opportunities Portfolio, (each a “Portfolio” and collectively the “Portfolios”). The Portfolios each currently offer one share class.

The Cumulative Returns charts for each Portfolio assume the initial investment was made on the first day of each Portfolio’s initial fiscal year. Results assume that all dividends and capital gain distributions, if any, were reinvested. They do not take into account the effect of taxes. The benchmark cumulative return began on the last day of the month of each Portfolio’s inception date.

The following disclosure provides important information regarding each Portfolio’s Shareholder Expense Example, which appears on each Portfolio Summary page in this Semi-Annual report. Please refer to this information when reviewing the Shareholder Expense Example for each Portfolio.

Shareholder Expense Example

Shareholders incur two types of costs: (1) transaction costs; and (2) ongoing costs, including investment management fees and other Portfolio expenses. The Shareholder Expense Example is intended to help shareholders understand ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Shareholder Expense Example is based on $1,000.00 invested at the beginning of the period, as indicated, and held for the entire period through March 31, 2017.

Actual Expenses

The information in the table under the heading “Actual Performance” provides information about actual account values and actual expenses. You may use the information in this column, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the row titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the tables for “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on a Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not each Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in a Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information for “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Proxy Voting

The Portfolios’ Investment Manager has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940. The Proxy Policy has been adopted by the Trust as the policies and procedures that the Investment Manager will use when voting proxies on behalf of each Portfolio. Copies of the written Proxy Policy and the factors that the Investment Manager may consider in determining how to vote proxies for each Portfolio, and information about how each Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling 1-800-498-5413, on the Allianz Global Investors Distributions website at us.allianzgi.com and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

| 10 | Semi-Annual Report/ March 31, 2017 |

Form N-Q

The Trust files complete schedules of each Portfolio’s holdings with the SEC on Form N-Q for the first and third quarters of each fiscal year, which are available on the SEC’s website at http://www.sec.gov. A copy of the Trust’s Form N-Q is available without charge, upon request, by calling 1-800-498-5413. In addition, the Trust’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Credit Ratings

Bond ratings apply to the underlying holdings of a Portfolio and not the Portfolio itself and are divided into categories ranging from highest to lowest credit quality, determined for purposes of presentations in this report by using ratings provided by Moody’s Investors Service, Inc. (“Moody’s”).

Unless otherwise noted, presentations of credit ratings information in this report use ratings provided by Moody’s because of, among other reasons, the access to background information and other materials provided by Moody’s, as well as the Portfolios’ considerations of industry practice.

Bonds not rated by Moody’s or bonds that do not have a rating available are designated as “NR” and “NA”, respectively. Credit quality ratings assigned by a rating agency are subjective opinions, not statements of fact, and are subject to change periodically, even as frequently as daily. Ratings assigned by Moody’s or another rating agency are not absolute standards of credit quality and do not evaluate market risk. Rating agencies may fail to make timely changes in credit ratings, and an issuer’s current financial condition may be better or worse than a rating indicates. In formulating investment decisions for the applicable Portfolios, Allianz Global Investors U.S. LLC, the sub-adviser to the Portfolios, develops its own analysis of the credit quality and risks associated with individual debt instruments, rather than relying exclusively on rating agencies or third-party research.

All the information on the Portfolio Summary pages, including Portfolio Insights, Average Annual Total Return Tables, Cumulative Return Charts, Shareholder Expense Examples and Allocation/Credit Rating Summaries is unaudited.

Allianz Global Investors Distributors LLC, 1633 Broadway, New York, NY, 10019, us.allianzgi.com, 1-800-498-5413.

| 11 | Semi-Annual Report/ March 31, 2017 |

March 31, 2017 (unaudited)

AllianzGI Advanced Core Bond Portfolio

| Principal Amount (000s) |

Value | |||||||

| U.S. TREASURY OBLIGATIONS - 50.5% |

||||||||

| U.S. Treasury Bonds, |

||||||||

| 2.25%, 8/15/46 |

$ | 1,300 | $ 1,099,871 | |||||

| 2.50%, 2/15/45 |

1,170 | 1,051,264 | ||||||

| 3.125%, 2/15/42 |

1,305 | 1,335,306 | ||||||

| 3.125%, 2/15/43 |

1,300 | 1,325,822 | ||||||

| 3.50%, 2/15/39 |

1,550 | 1,705,969 | ||||||

| 4.75%, 2/15/41 |

1,260 | 1,649,887 | ||||||

| 5.50%, 8/15/28 |

1,300 | 1,688,197 | ||||||

| 6.00%, 2/15/26 |

650 | 840,226 | ||||||

| U.S. Treasury Notes, |

||||||||

| 0.75%, 9/30/18 |

5,600 | 5,564,451 | ||||||

| 1.125%, 9/30/21 |

3,000 | 2,902,266 | ||||||

| 1.25%, 10/31/18 (d) |

22,260 | 22,279,121 | ||||||

| 1.375%, 3/31/20 |

1,670 | 1,662,824 | ||||||

| 1.50%, 12/31/18 |

3,150 | 3,165,013 | ||||||

| 1.50%, 8/15/26 |

1,000 | 925,157 | ||||||

| 1.625%, 3/31/19 |

1,500 | 1,510,605 | ||||||

| 1.625%, 5/15/26 |

350 | 328,296 | ||||||

| 1.75%, 10/31/20 |

1,530 | 1,533,615 | ||||||

| 1.75%, 3/31/22 |

1,170 | 1,158,986 | ||||||

| 1.75%, 1/31/23 |

1,490 | 1,462,295 | ||||||

| 1.875%, 10/31/22 |

1,620 | 1,604,686 | ||||||

| 2.00%, 11/15/26 |

1,500 | 1,448,935 | ||||||

| 2.125%, 1/31/21 |

3,240 | 3,284,741 | ||||||

| 2.125%, 6/30/22 |

2,900 | 2,919,937 | ||||||

| 2.125%, 5/15/25 |

500 | 492,432 | ||||||

| 2.25%, 3/31/21 |

2,530 | 2,575,166 | ||||||

| 4.25%, 11/15/17 |

17,080 | 17,422,608 | ||||||

|

|

|

|||||||

| Total U.S. Treasury Obligations (cost-$83,935,827) |

|

82,937,676

|

| |||||

|

|

|

|||||||

| CORPORATE BONDS & NOTES - 35.0% |

||||||||

| Aerospace & Defense - 0.5% |

||||||||

| Boeing Co., |

||||||||

| 2.125%, 3/1/22 |

480 | 474,643 | ||||||

| United Technologies Corp., |

||||||||

| 1.95%, 11/1/21 |

400 | 392,322 | ||||||

|

|

|

|||||||

|

|

866,965

|

| ||||||

|

|

|

|||||||

| Agriculture - 0.7% |

||||||||

| Altria Group, Inc., |

||||||||

| 5.375%, 1/31/44 |

300 | 343,357 | ||||||

| Philip Morris International, Inc., |

||||||||

| 2.00%, 2/21/20 |

800 | 798,411 | ||||||

|

|

|

|||||||

|

|

1,141,768

|

| ||||||

|

|

|

|||||||

| Auto Manufacturers - 2.1% |

||||||||

| American Honda Finance Corp., |

||||||||

| 2.00%, 2/14/20 |

800 | 802,817 | ||||||

| Daimler Finance North America LLC, |

||||||||

| 2.00%, 8/3/18 |

400 | 401,002 | ||||||

| 2.00%, 7/6/21 (a)(b) |

500 | 486,549 | ||||||

| PACCAR Financial Corp., |

||||||||

| 1.65%, 8/11/21 |

900 | 867,615 | ||||||

| Toyota Motor Credit Corp., |

||||||||

| 1.70%, 2/19/19 |

300 | 300,614 | ||||||

| 2.25%, 10/18/23 |

600 | 580,221 | ||||||

|

|

|

|||||||

|

|

3,438,818

|

| ||||||

|

|

|

|||||||

| Banks - 12.9% |

||||||||

| Banco Bilbao Vizcaya Argentaria S.A., |

||||||||

| 3.00%, 10/20/20 |

1,000 | 1,013,498 | ||||||

| Bank Nederlandse Gemeenten NV (a)(b), |

||||||||

| 1.625%, 4/19/21 |

800 | 783,226 | ||||||

| 2.375%, 3/16/26 |

500 | 484,098 | ||||||

| Bank of America Corp., Ser. L, |

||||||||

| 2.65%, 4/1/19 |

800 | 809,601 | ||||||

| Bank of Montreal, |

||||||||

| 2.375%, 1/25/19 |

600 | 605,336 | ||||||

| See accompanying Notes to Financial Statements |

12 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Advanced Core Bond Portfolio

| Principal Amount (000s) |

Value | |||||||

| Bank of New York Mellon Corp., |

||||||||

| 2.60%, 2/7/22 |

800 | 801,223 | ||||||

| Bank of Nova Scotia, |

||||||||

| 1.875%, 4/26/21 |

1,500 | 1,471,380 | ||||||

| 2.80%, 7/21/21 |

300 | 303,777 | ||||||

| Barclays PLC, |

||||||||

| 4.375%, 1/12/26 |

550 | 558,416 | ||||||

| Citigroup, Inc., |

||||||||

| 8.125%, 7/15/39 |

500 | 736,713 | ||||||

| Commonwealth Bank of Australia (a)(b), |

||||||||

| 2.85%, 5/18/26 |

500 | 483,688 | ||||||

| Deutsche Bank AG, |

||||||||

| 3.375%, 5/12/21 |

400 | 402,772 | ||||||

| Dexia Credit Local S.A. (a)(b), |

||||||||

| 1.875%, 3/28/19 |

400 | 398,109 | ||||||

| Goldman Sachs Group, Inc., |

||||||||

| 2.375%, 1/22/18, Ser. GLOB |

500 | 502,844 | ||||||

| 2.55%, 10/23/19 |

500 | 504,819 | ||||||

| JPMorgan Chase & Co., |

||||||||

| 2.972%, 1/15/23 |

800 | 799,823 | ||||||

| 3.625%, 5/13/24 |

450 | 460,104 | ||||||

| 5.40%, 1/6/42 |

250 | 291,997 | ||||||

| KFW, |

||||||||

| 1.125%, 8/6/18 |

650 | 648,260 | ||||||

| 1.25%, 9/30/19 |

800 | 792,509 | ||||||

| Macquarie Bank Ltd. (a)(b), |

||||||||

| 2.35%, 1/15/19 |

300 | 301,409 | ||||||

| 3.90%, 1/15/26 |

700 | 723,277 | ||||||

| Morgan Stanley, |

||||||||

| 2.50%, 1/24/19 |

600 | 606,184 | ||||||

| 2.50%, 4/21/21 |

500 | 497,728 | ||||||

| National Australia Bank Ltd., |

||||||||

| 2.625%, 1/14/21 |

200 | 200,985 | ||||||

| Royal Bank of Canada, |

||||||||

| 2.125%, 3/2/20 |

800 | 800,594 | ||||||

| 2.30%, 3/22/21 |

1,500 | 1,502,289 | ||||||

| Svenska Handelsbanken AB, |

||||||||

| 2.50%, 1/25/19 |

500 | 505,363 | ||||||

| Swedbank AB, |

||||||||

| 1.75%, 3/12/18 |

400 | 400,031 | ||||||

| Toronto-Dominion Bank, |

||||||||

| 1.80%, 7/13/21 |

900 | 876,151 | ||||||

| UBS AG, |

||||||||

| 2.375%, 8/14/19 |

550 | 553,829 | ||||||

| Wells Fargo & Co., |

||||||||

| 2.50%, 3/4/21 |

600 | 598,574 | ||||||

| 3.45%, 2/13/23 |

400 | 403,917 | ||||||

| Westpac Banking Corp., |

||||||||

| 2.00%, 3/3/20 |

350 | 348,061 | ||||||

|

|

|

|||||||

|

|

21,170,585

|

| ||||||

|

|

|

|||||||

| Biotechnology - 0.5% |

||||||||

| Amgen, Inc., |

||||||||

| 2.25%, 8/19/23 |

900 | 863,123 | ||||||

|

|

|

|||||||

| Chemicals - 0.8% |

||||||||

| Dow Chemical Co., |

||||||||

| 7.375%, 11/1/29 |

300 | 407,410 | ||||||

| Potash Corp. of Saskatchewan, Inc., |

||||||||

| 4.00%, 12/15/26 |

500 | 512,831 | ||||||

| WPP Finance 2010, |

||||||||

| 4.75%, 11/21/21 |

300 | 323,211 | ||||||

|

|

|

|||||||

|

|

1,243,452

|

| ||||||

|

|

|

|||||||

| Diversified Financial Services - 0.2% |

||||||||

| General Electric Co., |

||||||||

| 3.10%, 1/9/23 |

300 | 308,552 | ||||||

|

|

|

|||||||

| Electric Utilities - 1.7% |

||||||||

| Consolidated Edison Co. of New York, Inc., Ser. 12-A, |

||||||||

| 4.20%, 3/15/42 |

300 | 304,277 | ||||||

| Electricite de France S.A. (a)(b), |

||||||||

| 2.15%, 1/22/19 |

600 | 600,804 | ||||||

| 4.875%, 1/22/44 |

600 | 598,391 | ||||||

| See accompanying Notes to Financial Statements |

13 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Advanced Core Bond Portfolio

| Principal Amount (000s) |

Value | |||||||

| Enel Finance International NV, |

||||||||

| 5.125%, 10/7/19 (a)(b) |

400 | 426,769 | ||||||

| 6.80%, 9/15/37 |

150 | 186,129 | ||||||

| Pacific Gas & Electric Co., |

||||||||

| 4.00%, 12/1/46 |

300 | 297,507 | ||||||

| 8.25%, 10/15/18 |

300 | 328,546 | ||||||

|

|

|

|||||||

|

|

2,742,423

|

| ||||||

|

|

|

|||||||

| Electronics - 0.2% |

||||||||

| Honeywell International, Inc., |

||||||||

| 1.85%, 11/1/21 |

400 | 392,404 | ||||||

|

|

|

|||||||

| Food & Beverage - 1.1% |

||||||||

| Anheuser-Busch InBev Finance, Inc., |

||||||||

| 2.65%, 2/1/21 |

500 | 504,161 | ||||||

| 4.90%, 2/1/46 |

300 | 325,200 | ||||||

| Diageo Capital PLC, |

||||||||

| 3.875%, 4/29/43 |

400 | 388,184 | ||||||

| Dr. Pepper Snapple Group, Inc., |

||||||||

| 4.42%, 12/15/46 |

300 | 302,203 | ||||||

| PepsiCo, Inc., |

||||||||

| 2.15%, 10/14/20 |

300 | 301,823 | ||||||

|

|

|

|||||||

|

|

1,821,571

|

| ||||||

|

|

|

|||||||

| Healthcare-Products - 0.3% |

||||||||

| Thermo Fisher Scientific, Inc., |

||||||||

| 3.00%, 4/15/23 |

500 | 496,809 | ||||||

|

|

|

|||||||

| Household Products - 0.2% |

||||||||

| Procter & Gamble Co., |

||||||||

| 2.45%, 11/3/26 |

400 | 383,079 | ||||||

|

|

|

|||||||

| Insurance - 0.7% |

||||||||

| Allstate Corp., |

||||||||

| 3.28%, 12/15/26 |

500 | 502,973 | ||||||

| MetLife, Inc., |

||||||||

| 5.70%, 6/15/35 |

550 | 661,075 | ||||||

|

|

|

|||||||

|

|

1,164,048

|

| ||||||

|

|

|

|||||||

| IT Services - 0.2% |

||||||||

| International Business Machines Corp., |

||||||||

| 1.80%, 5/17/19 |

300 | 301,389 | ||||||

|

|

|

|||||||

| Machinery-Construction & Mining - 0.5% |

||||||||

| Caterpillar Financial Services Corp., |

||||||||

| 2.40%, 8/9/26 |

900 | 852,566 | ||||||

|

|

|

|||||||

| Machinery-Diversified - 1.3% |

||||||||

| CNH Industrial Capital LLC, |

||||||||

| 3.875%, 7/16/18 |

600 | 612,000 | ||||||

| 4.875%, 4/1/21 |

500 | 526,250 | ||||||

| John Deere Capital Corp., |

||||||||

| 2.75%, 3/15/22 |

400 | 403,396 | ||||||

| 2.80%, 3/6/23 |

500 | 501,530 | ||||||

|

|

|

|||||||

|

|

2,043,176

|

| ||||||

|

|

|

|||||||

| Media - 1.9% |

||||||||

| CBS Corp., |

||||||||

| 2.30%, 8/15/19 |

400 | 401,728 | ||||||

| Comcast Corp., |

||||||||

| 6.45%, 3/15/37 |

300 | 383,071 | ||||||

| Discovery Communications LLC, |

||||||||

| 3.80%, 3/13/24 |

500 | 494,918 | ||||||

| 6.35%, 6/1/40 |

300 | 317,901 | ||||||

| Time Warner Cable LLC, |

||||||||

| 4.00%, 9/1/21 |

300 | 311,250 | ||||||

| 6.75%, 6/15/39 |

300 | 353,361 | ||||||

| Time Warner, Inc., |

||||||||

| 4.875%, 3/15/20 |

300 | 322,017 | ||||||

| Walt Disney Co., |

||||||||

| 2.45%, 3/4/22 |

500 | 501,440 | ||||||

|

|

|

|||||||

|

|

3,085,686

|

| ||||||

|

|

|

|||||||

| See accompanying Notes to Financial Statements |

14 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Advanced Core Bond Portfolio

| Principal Amount (000s) |

Value | |||||||

| Mining - 0.1% |

||||||||

| Barrick Gold Corp., |

||||||||

| 4.10%, 5/1/23 |

95 | 101,985 | ||||||

|

|

|

|||||||

| Miscellaneous Manufacturing - 0.2% |

||||||||

| Siemens Financieringsmaatschappij NV (a)(b), |

||||||||

| 4.40%, 5/27/45 |

300 | 314,166 | ||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels - 1.8% |

||||||||

| BP Capital Markets PLC, |

||||||||

| 2.315%, 2/13/20 |

800 | 806,925 | ||||||

| 3.723%, 11/28/28 |

400 | 407,136 | ||||||

| Occidental Petroleum Corp., |

||||||||

| 3.00%, 2/15/27 |

500 | 482,955 | ||||||

| Shell International Finance BV, |

||||||||

| 6.375%, 12/15/38 |

150 | 194,076 | ||||||

| Sinopec Group Overseas Development 2012 Ltd., |

||||||||

| 2.75%, 5/17/17 |

400 | 400,588 | ||||||

| Sinopec Group Overseas Development 2016 Ltd. (a)(b), |

||||||||

| 2.125%, 5/3/19 |

200 | 199,207 | ||||||

| Statoil ASA, |

||||||||

| 2.90%, 11/8/20 |

400 | 409,173 | ||||||

|

|

|

|||||||

|

|

2,900,060

|

| ||||||

|

|

|

|||||||

| Pharmaceuticals - 1.4% |

||||||||

| AstraZeneca PLC, |

||||||||

| 1.95%, 9/18/19 |

400 | 399,676 | ||||||

| Johnson & Johnson, |

||||||||

| 2.95%, 3/3/27 |

800 | 800,871 | ||||||

| 4.375%, 12/5/33 |

250 | 275,981 | ||||||

| Novartis Capital Corp., |

||||||||

| 1.80%, 2/14/20 |

800 | 801,025 | ||||||

|

|

|

|||||||

|

|

2,277,553

|

| ||||||

|

|

|

|||||||

| Pipelines - 0.4% |

||||||||

| Enterprise Products Operating LLC, |

||||||||

| 4.85%, 3/15/44 |

300 | 304,464 | ||||||

| TransCanada PipeLines Ltd., |

||||||||

| 7.125%, 1/15/19 |

350 | 380,818 | ||||||

|

|

|

|||||||

|

|

685,282

|

| ||||||

|

|

|

|||||||

| Retail - 1.0% |

||||||||

| CVS Health Corp., |

||||||||

| 4.00%, 12/5/23 |

300 | 315,015 | ||||||

| Macy’s Retail Holdings, Inc., |

||||||||

| 4.50%, 12/15/34 |

300 | 261,494 | ||||||

| McDonald’s Corp., |

||||||||

| 4.875%, 12/9/45 |

500 | 533,733 | ||||||

| Walgreens Boots Alliance, Inc., |

||||||||

| 2.70%, 11/18/19 |

300 | 304,164 | ||||||

| 4.50%, 11/18/34 |

300 | 300,392 | ||||||

|

|

|

|||||||

|

|

1,714,798

|

| ||||||

|

|

|

|||||||

| Software - 0.5% |

||||||||

| Microsoft Corp., |

||||||||

| 3.30%, 2/6/27 |

800 | 813,897 | ||||||

|

|

|

|||||||

| Technology Hardware, Storage & Peripherals - 1.1% |

||||||||

| Apple, Inc., |

||||||||

| 2.25%, 2/23/21 |

500 | 501,743 | ||||||

| 3.35%, 2/9/27 |

800 | 808,458 | ||||||

| 4.65%, 2/23/46 |

500 | 537,447 | ||||||

|

|

|

|||||||

|

|

1,847,648

|

| ||||||

|

|

|

|||||||

| Telecommunications - 2.1% |

||||||||

| AT&T, Inc., |

||||||||

| 4.25%, 3/1/27 |

800 | 813,240 | ||||||

| 4.80%, 6/15/44 |

900 | 846,214 | ||||||

| Cisco Systems, Inc., |

||||||||

| 2.45%, 6/15/20 |

700 | 711,524 | ||||||

| 5.50%, 1/15/40 |

250 | 306,041 | ||||||

| See accompanying Notes to Financial Statements |

15 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Advanced Core Bond Portfolio

|

Principal (000s) |

Value | |||||||

| Telefonica Emisiones SAU, |

||||||||

| 4.103%, 3/8/27 |

800 | 806,818 | ||||||

|

|

|

|||||||

|

|

3,483,837

|

| ||||||

|

|

|

|||||||

| Transportation - 0.6% |

||||||||

| CSX Corp., |

||||||||

| 2.60%, 11/1/26 |

400 | 375,856 | ||||||

| FedEx Corp., |

||||||||

| 4.10%, 4/15/43 |

600 | 557,097 | ||||||

|

|

|

|||||||

|

|

932,953

|

| ||||||

|

|

|

|||||||

| Total Corporate Bonds & Notes (cost-$57,369,932) |

|

57,388,593

|

| |||||

|

|

|

|||||||

| U.S. GOVERNMENT AGENCY SECURITIES - 27.6% |

||||||||

| Fannie Mae, MBS, TBA (c), |

||||||||

| 2.50%, 4/18/32, 15 Year |

1,630 | 1,630,637 | ||||||

| 3.00%, 4/18/32, 15 Year |

1,540 | 1,578,861 | ||||||

| 3.00%, 4/13/47, 30 Year |

4,660 | 4,621,774 | ||||||

| 3.50%, 4/18/32, 15 Year |

1,040 | 1,082,128 | ||||||

| 3.50%, 4/13/47, 30 Year |

4,730 | 4,839,012 | ||||||

| 4.00%, 4/13/47, 30 Year |

3,010 | 3,157,443 | ||||||

| 4.50%, 4/13/47, 30 Year |

1,220 | 1,308,402 | ||||||

| 5.00%, 4/13/47, 30 Year |

580 | 633,798 | ||||||

| 5.50%, 4/13/47, 30 Year |

770 | 855,411 | ||||||

| Freddie Mac, |

||||||||

| 2.50%, 4/18/32 MBS, TBA, 15 Year (c) |

1,220 | 1,220,834 | ||||||

| 3.00%, 4/18/32 MBS, TBA, 15 Year (c) |

1,060 | 1,086,987 | ||||||

| 3.00%, 4/13/47 MBS, TBA, 30 Year (c) |

3,110 | 3,081,087 | ||||||

| 3.50%, 4/18/32 MBS, TBA, 15 Year (c) |

560 | 583,228 | ||||||

| 3.50%, 4/13/47 MBS, TBA, 30 Year (c) |

3,050 | 3,119,697 | ||||||

| 4.00%, 8/1/44 |

158 | 165,601 | ||||||

| 4.00%, 4/13/47 MBS, TBA, 30 Year (c) |

1,680 | 1,762,425 | ||||||

| 4.50%, 4/13/47 MBS, TBA, 30 Year (c) |

720 | 771,651 | ||||||

| 5.00%, 4/13/47 MBS, TBA, 30 Year (c) |

370 | 402,910 | ||||||

| 5.50%, 4/13/47 MBS, TBA, 30 Year (c) |

410 | 454,879 | ||||||

| Ginnie Mae, MBS, TBA, 30 Year (c), |

||||||||

| 3.00%, 4/20/47 |

4,080 | 4,116,019 | ||||||

| 3.50%, 4/20/47 |

4,580 | 4,748,708 | ||||||

| 4.00%, 4/20/47 |

2,100 | 2,218,289 | ||||||

| 4.50%, 4/20/47 |

1,820 | 1,943,632 | ||||||

|

|

|

|||||||

| Total U.S. Government Agency Securities (cost-$45,138,733) |

|

45,383,413

|

| |||||

|

|

|

|||||||

| SOVEREIGN DEBT OBLIGATIONS - 12.5% |

||||||||

| Argentina - 0.2% |

||||||||

| Argentine Republic Government International Bond (a)(b), |

||||||||

| 6.25%, 4/22/19 |

250 | 264,625 | ||||||

|

|

|

|||||||

| Brazil - 0.2% |

||||||||

| Brazilian Government International Bond, |

||||||||

| 4.25%, 1/7/25 |

300 | 295,875 | ||||||

|

|

|

|||||||

| Canada - 0.5% |

||||||||

| Export Development Canada, |

||||||||

| 1.25%, 12/10/18 |

350 | 350,924 | ||||||

| Province of New Brunswick Canada, |

||||||||

| 2.75%, 6/15/18 |

500 | 507,680 | ||||||

|

|

|

|||||||

|

|

858,604

|

| ||||||

|

|

|

|||||||

| Chile - 0.3% |

||||||||

| Chile Government International Bond, |

||||||||

| 3.25%, 9/14/21 |

400 | 414,600 | ||||||

|

|

|

|||||||

| Colombia - 0.2% |

||||||||

| Colombia Government International Bond, |

||||||||

| 4.00%, 2/26/24 |

400 | 412,600 | ||||||

|

|

|

|||||||

| Croatia - 0.7% |

||||||||

| Croatia Government International Bond, |

||||||||

| 6.25%, 4/27/17 |

600 | 601,594 | ||||||

| 6.75%, 11/5/19 |

500 | 545,080 | ||||||

|

|

|

|||||||

|

|

1,146,674

|

| ||||||

|

|

|

|||||||

| See accompanying Notes to Financial Statements |

16 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Advanced Core Bond Portfolio

|

Principal (000s) |

Value | |||||||

| Germany - 0.2% |

||||||||

| FMS Wertmanagement AoeR, |

||||||||

| 1.00%, 11/21/17 |

300 | 299,622 | ||||||

|

|

|

|||||||

| Hungary - 0.3% |

||||||||

| Hungary Government International Bond, |

||||||||

| 4.00%, 3/25/19 |

500 | 519,362 | ||||||

|

|

|

|||||||

| Iceland - 0.4% |

||||||||

| Iceland Government International Bond, |

||||||||

| 5.875%, 5/11/22 |

600 | 678,367 | ||||||

|

|

|

|||||||

| Indonesia - 0.8% |

||||||||

| Indonesia Government International Bond, |

||||||||

| 3.75%, 4/25/22 |

550 | 562,083 | ||||||

| 11.625%, 3/4/19 |

600 | 710,286 | ||||||

|

|

|

|||||||

|

|

1,272,369

|

| ||||||

|

|

|

|||||||

| Latvia - 0.4% |

||||||||

| Latvia Government International Bond, |

||||||||

| 2.75%, 1/12/20 |

700 | 710,427 | ||||||

|

|

|

|||||||

| Lithuania - 0.8% |

||||||||

| Lithuania Government International Bond, |

||||||||

| 5.125%, 9/14/17 |

700 | 712,250 | ||||||

| 7.375%, 2/11/20 (a)(b) |

500 | 569,500 | ||||||

|

|

|

|||||||

|

|

1,281,750

|

| ||||||

|

|

|

|||||||

| Mexico - 0.6% |

||||||||

| Mexico Government International Bond, |

||||||||

| 4.75%, 3/8/44 |

400 | 390,000 | ||||||

| 5.95%, 3/19/19 |

600 | 647,250 | ||||||

|

|

|

|||||||

|

|

1,037,250

|

| ||||||

|

|

|

|||||||

| Morocco - 0.3% |

||||||||

| Morocco Government International Bond, |

||||||||

| 4.25%, 12/11/22 |

550 | 570,625 | ||||||

|

|

|

|||||||

| Panama - 0.4% |

||||||||

| Panama Government International Bond, |

||||||||

| 7.125%, 1/29/26 |

550 | 696,437 | ||||||

|

|

|

|||||||

| Peru - 0.5% |

||||||||

| Peruvian Government International Bond, |

||||||||

| 4.125%, 8/25/27 |

300 | 324,000 | ||||||

| 7.125%, 3/30/19 |

500 | 550,000 | ||||||

|

|

|

|||||||

|

|

874,000

|

| ||||||

|

|

|

|||||||

| Philippines - 0.2% |

||||||||

| Philippine Government International Bond, |

||||||||

| 6.50%, 1/20/20 |

300 | 336,611 | ||||||

|

|

|

|||||||

| South Africa - 0.2% |

||||||||

| Republic of South Africa Government International Bond, |

||||||||

| 4.875%, 4/14/26 |

290 | 292,103 | ||||||

|

|

|

|||||||

| Supranational - 4.7% |

||||||||

| African Development Bank, |

||||||||

| 1.375%, 12/17/18 |

1,000 | 999,302 | ||||||

| Asian Development Bank, |

||||||||

| 1.375%, 1/15/19 |

200 | 199,887 | ||||||

| 1.625%, 3/16/21 |

700 | 691,480 | ||||||

| Corp. Andina de Fomento, |

||||||||

| 2.00%, 5/10/19 |

300 | 299,599 | ||||||

| Council of Europe Development Bank, |

||||||||

| 1.00%, 3/7/18 |

1,000 | 997,469 | ||||||

| 1.00%, 2/4/19 |

1,400 | 1,386,388 | ||||||

| European Investment Bank, |

||||||||

| 1.00%, 3/15/18 |

1,700 | 1,696,489 | ||||||

| See accompanying Notes to Financial Statements |

17 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Advanced Core Bond Portfolio

|

Principal (000s) |

Value | |||||||

| Inter-American Development Bank, |

||||||||

| 3.20%, 8/7/42 |

400 | 385,426 | ||||||

| International Bank for Reconstruction & Development, |

||||||||

| 1.875%, 10/7/19 |

500 | 503,105 | ||||||

| Nordic Investment Bank, |

||||||||

| 0.75%, 1/17/18 |

500 | 498,140 | ||||||

|

|

|

|||||||

|

|

7,657,285

|

| ||||||

|

|

|

|||||||

| Turkey - 0.6% |

||||||||

| Turkey Government International Bond, |

||||||||

| 4.875%, 10/9/26 |

300 | 289,561 | ||||||

| 6.75%, 4/3/18 |

600 | 624,054 | ||||||

|

|

|

|||||||

|

|

913,615

|

| ||||||

|

|

|

|||||||

| Total Sovereign Debt Obligations (cost-$20,429,220) |

|

20,532,801

|

| |||||

|

|

|

|||||||

| Repurchase Agreements - 0.8% |

||||||||

| State Street Bank and Trust Co., |

1,258 | 1,258,000 | ||||||

|

|

|

|||||||

| Total Investments (cost-$208,131,712)-126.4% |

207,500,483 | |||||||

|

|

|

|||||||

| Liabilities in excess of other assets (e)-(26.4)% |

(43,300,691) | |||||||

|

|

|

|||||||

| Net Assets-100.0% |

$ 164,199,792 | |||||||

|

|

|

|||||||

Notes to Schedule of Investments:

| (a) | Private Placement—Restricted as to resale and may not have a readily available market. Securities with an aggregate value of $6,633,818, representing 4.0% of net assets. |

| (b) | 144A—Exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, typically only to qualified institutional buyers. Securities with an aggregate value of $6,633,818, representing 4.0% of net assets. |

| (c) | When-issued or delayed-delivery. To be settled/delivered after March 31, 2017. |

| (d) | All or partial amount segregated for the benefit of the counterparty as collateral for when-issued or delayed delivery securities. |

| (e) | Includes net unrealized appreciation (depreciation) of other financial instruments. See Note 6(a) in the Notes to Financial Statements. |

Glossary:

MBS - Mortgage-Backed Securities

TBA - To Be Announced

| See accompanying Notes to Financial Statements |

18 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| COMMON STOCK - 97.5% |

||||||||

| Australia - 1.5% |

||||||||

| Automotive Holdings Group Ltd. |

10,818 | $ | 34,036 | |||||

| Breville Group Ltd. |

3,781 | 29,840 | ||||||

| Brickworks Ltd. |

5,800 | 65,056 | ||||||

| Cochlear Ltd. |

1,871 | 193,279 | ||||||

| Harvey Norman Holdings Ltd. |

44,539 | 154,051 | ||||||

| Regis Resources Ltd. |

42,307 | 106,885 | ||||||

| Saracen Mineral Holdings Ltd. (d) |

36,737 | 27,685 | ||||||

| St. Barbara Ltd. (d) |

44,961 | 81,901 | ||||||

| Tassal Group Ltd. |

10,892 | 37,694 | ||||||

| Wesfarmers Ltd. |

8,595 | 295,908 | ||||||

|

|

|

|||||||

|

|

1,026,335

|

| ||||||

|

|

|

|||||||

| Austria - 0.2% |

||||||||

| BUWOG AG (d) |

2,405 | 60,606 | ||||||

| Flughafen Wien AG |

961 | 30,341 | ||||||

| Telekom Austria AG (d) |

6,385 | 43,512 | ||||||

|

|

|

|||||||

|

|

134,459

|

| ||||||

|

|

|

|||||||

| Belgium - 0.3% |

||||||||

| Elia System Operator S.A. |

999 | 52,624 | ||||||

| Groupe Bruxelles Lambert S.A. |

2,051 | 186,135 | ||||||

|

|

|

|||||||

|

|

238,759

|

| ||||||

|

|

|

|||||||

| Bermuda - 0.2% |

||||||||

| Genpact Ltd. |

4,493 | 111,247 | ||||||

|

|

|

|||||||

| Brazil - 0.0% |

||||||||

| Linx S.A. |

3,300 | 17,498 | ||||||

|

|

|

|||||||

| Canada - 3.6% |

||||||||

| AG Growth International, Inc. |

926 | 35,213 | ||||||

| Bank of Montreal |

2,013 | 150,356 | ||||||

| BCE, Inc. |

10,642 | 471,182 | ||||||

| Canadian Imperial Bank of Commerce |

2,043 | 176,163 | ||||||

| Canadian Real Estate Investment Trust REIT |

1,237 | 45,095 | ||||||

| Canadian Tire Corp., Ltd., Class A |

1,585 | 188,291 | ||||||

| Cascades, Inc. |

4,131 | 42,588 | ||||||

| Cogeco Communications, Inc. |

1,783 | 95,260 | ||||||

| Dorel Industries, Inc., Class B |

834 | 19,893 | ||||||

| George Weston Ltd. |

2,307 | 201,287 | ||||||

| Great-West Lifeco, Inc. |

3,093 | 85,707 | ||||||

| Intact Financial Corp. |

924 | 65,716 | ||||||

| Killam Apartment REIT |

2,174 | 20,729 | ||||||

| Laurentian Bank of Canada |

1,286 | 56,639 | ||||||

| Martinrea International, Inc. |

2,083 | 16,165 | ||||||

| Milestone Apartments Real Estate Investment Trust |

4,637 | 75,246 | ||||||

| NorthWest Healthcare Properties Real Estate Investment Trust |

3,841 | 30,471 | ||||||

| Power Corp. of Canada |

7,194 | 168,997 | ||||||

| Pure Industrial Real Estate Trust |

25,694 | 117,665 | ||||||

| Rogers Sugar, Inc. |

4,478 | 21,045 | ||||||

| Saputo, Inc. |

5,663 | 195,417 | ||||||

| Transcontinental, Inc., Class A |

2,390 | 44,175 | ||||||

| Valener, Inc. |

1,411 | 23,194 | ||||||

| Waste Connections, Inc. |

2,382 | 210,140 | ||||||

|

|

|

|||||||

|

|

2,556,634

|

| ||||||

|

|

|

|||||||

| China - 1.4% |

||||||||

| China Construction Bank Corp., Class H |

378,748 | 305,160 | ||||||

| China Dongxiang Group Co., Ltd. |

128,883 | 24,720 | ||||||

| China Evergrande Group |

68,517 | 63,528 | ||||||

| China Mobile Ltd. |

5,000 | 54,988 | ||||||

| Jiangsu Expressway Co., Ltd., Class H |

16,811 | 24,149 | ||||||

| Longfor Properties Co., Ltd. |

29,155 | 47,998 | ||||||

| Orient Securities Co., Ltd., Class H (a)(d) |

62,400 | 60,881 | ||||||

| Postal Savings Bank of China Co., Ltd., Class H (a)(d) |

194,000 | 120,073 | ||||||

| Shenzhen Expressway Co., Ltd., Class H |

46,300 | 41,969 | ||||||

| Tianneng Power International Ltd. |

79,658 | 72,415 | ||||||

| Tong Ren Tang Technologies Co., Ltd., Class H |

10,274 | 18,248 | ||||||

| XTEP International Holdings Ltd. |

23,349 | 9,196 | ||||||

| Yuzhou Properties Co., Ltd. |

264,204 | 110,590 | ||||||

|

|

|

|||||||

|

|

953,915

|

| ||||||

|

|

|

|||||||

| See accompanying Notes to Financial Statements |

19 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Colombia - 0.0% |

||||||||

| Corp. Financiera Colombiana S.A. |

1,034 | 10,128 | ||||||

|

|

|

|||||||

| Czech Republic - 0.0% |

||||||||

| O2 Czech Republic AS |

1,324 | 14,793 | ||||||

|

|

|

|||||||

| Denmark - 0.1% |

||||||||

| Matas A/S |

1,323 | 18,792 | ||||||

| Solar A/S, Class B |

333 | 18,384 | ||||||

| Spar Nord Bank A/S |

3,578 | 39,604 | ||||||

|

|

|

|||||||

|

|

76,780

|

| ||||||

|

|

|

|||||||

| Finland - 0.3% |

||||||||

| Neste Oyj |

5,147 | 201,262 | ||||||

|

|

|

|||||||

| France - 2.5% |

||||||||

| Atos SE |

1,863 | 230,230 | ||||||

| Cegereal S.A. REIT |

2,277 | 90,023 | ||||||

| Eiffage S.A. |

175 | 13,695 | ||||||

| Nexity S.A. (d) |

1,869 | 91,887 | ||||||

| SCOR SE |

4,592 | 173,546 | ||||||

| SEB S.A. |

1,216 | 169,847 | ||||||

| Sodexo S.A. |

2,023 | 237,695 | ||||||

| Teleperformance |

1,653 | 178,473 | ||||||

| Thales S.A. |

2,377 | 229,609 | ||||||

| Vinci S.A. |

3,906 | 310,170 | ||||||

|

|

|

|||||||

|

|

1,725,175

|

| ||||||

|

|

|

|||||||

| Germany - 0.4% |

||||||||

| Muenchener Rueckversicherungs-Gesellschaft AG in Muenchen |

216 | 42,282 | ||||||

| Rhoen Klinikum AG |

1,973 | 53,819 | ||||||

| Talanx AG (d) |

3,095 | 109,121 | ||||||

| TLG Immobilien AG |

1,393 | 27,123 | ||||||

| WCM Beteiligungs & Grundbesitz AG (d) |

5,562 | 18,168 | ||||||

|

|

|

|||||||

|

|

250,513

|

| ||||||

|

|

|

|||||||

| Hong Kong - 2.0% |

||||||||

| CK Hutchison Holdings Ltd. |

3,703 | 45,591 | ||||||

| CLP Holdings Ltd. |

74,219 | 776,959 | ||||||

| Fairwood Holdings Ltd. |

11,000 | 44,239 | ||||||

| Hang Seng Bank Ltd. |

2,600 | 52,745 | ||||||

| Link REIT |

17,508 | 122,709 | ||||||

| Swire Pacific Ltd., Class A |

14,344 | 143,372 | ||||||

| WH Group Ltd. (a) |

244,000 | 210,406 | ||||||

| Yue Yuen Industrial Holdings Ltd. |

2,802 | 11,011 | ||||||

|

|

|

|||||||

|

|

1,407,032

|

| ||||||

|

|

|

|||||||

| Hungary - 0.4% |

||||||||

| Magyar Telekom Telecommunications PLC |

28,291 | 46,922 | ||||||

| MOL Hungarian Oil & Gas PLC |

2,372 | 162,414 | ||||||

| Richter Gedeon Nyrt |

4,294 | 97,524 | ||||||

|

|

|

|||||||

|

|

306,860

|

| ||||||

|

|

|

|||||||

| Indonesia - 0.6% |

||||||||

| Telekomunikasi Indonesia Persero Tbk PT |

1,375,100 | 427,443 | ||||||

|

|

|

|||||||

| Ireland - 0.1% |

||||||||

| Irish Residential Properties REIT PLC |

15,872 | 20,996 | ||||||

| Origin Enterprises PLC |

5,430 | 38,597 | ||||||

|

|

|

|||||||

|

|

59,593

|

| ||||||

|

|

|

|||||||

| Israel - 0.9% |

||||||||

| Bank Hapoalim BM |

41,518 | 253,018 | ||||||

| Bank Leumi Le-Israel BM (d) |

23,092 | 101,946 | ||||||

| Elbit Systems Ltd. |

765 | 87,503 | ||||||

| Mizrahi Tefahot Bank Ltd. |

9,569 | 162,192 | ||||||

| Teva Pharmaceutical Industries Ltd. |

80 | 2,616 | ||||||

|

|

|

|||||||

|

|

607,275

|

| ||||||

|

|

|

|||||||

| See accompanying Notes to Financial Statements |

20 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Italy - 0.1% |

||||||||

| Fila SpA |

1,621 | 28,533 | ||||||

| Societa Iniziative Autostradali e Servizi SpA |

1,168 | 11,152 | ||||||

|

|

|

|||||||

|

|

39,685

|

| ||||||

|

|

|

|||||||

| Japan - 11.4% |

||||||||

| ADEKA Corp. |

374 | 5,465 | ||||||

| Alpen Co., Ltd. |

1,215 | 21,164 | ||||||

| ANA Holdings, Inc. |

111,543 | 341,155 | ||||||

| Aoyama Trading Co., Ltd. |

3,189 | 109,670 | ||||||

| Astellas Pharma, Inc. |

30,308 | 399,730 | ||||||

| Bandai Namco Holdings, Inc. |

4,200 | 125,898 | ||||||

| BML, Inc. |

1,682 | 37,168 | ||||||

| Canon, Inc. |

4,190 | 130,848 | ||||||

| Daiichi Sankyo Co., Ltd. |

8,453 | 190,709 | ||||||

| DCM Holdings Co., Ltd. |

11,975 | 110,724 | ||||||

| Doshisha Co., Ltd. |

1,215 | 22,548 | ||||||

| Doutor Nichires Holdings Co., Ltd. |

2,149 | 42,081 | ||||||

| DTS Corp. |

1,401 | 35,125 | ||||||

| DyDo Group Holdings, Inc. |

974 | 45,606 | ||||||

| EDION Corp. |

4,727 | 43,584 | ||||||

| Fuji Media Holdings, Inc. |

7,505 | 104,003 | ||||||

| Fuji Oil Holdings, Inc. |

6,184 | 145,044 | ||||||

| Fuji Soft, Inc. |

1,028 | 26,338 | ||||||

| FUJIFILM Holdings Corp. |

7,979 | 312,760 | ||||||

| Fukuyama Transporting Co., Ltd. |

9,274 | 55,652 | ||||||

| Geo Holdings Corp. |

4,164 | 45,799 | ||||||

| Hankyu Hanshin Holdings, Inc. |

4,730 | 154,344 | ||||||

| Heiwa Corp. |

4,397 | 109,593 | ||||||

| Hogy Medical Co., Ltd. |

561 | 35,337 | ||||||

| Honeys Holdings Co., Ltd. |

561 | 5,612 | ||||||

| Japan Airlines Co., Ltd. |

9,580 | 304,164 | ||||||

| Kagome Co., Ltd. |

5,300 | 138,016 | ||||||

| Kajima Corp. |

33,000 | 215,855 | ||||||

| KOMEDA Holdings Co., Ltd. (d) |

2,600 | 41,907 | ||||||

| Kyowa Exeo Corp. |

8,500 | 123,402 | ||||||

| LaSalle Logiport REIT |

68 | 63,010 | ||||||

| Mitsubishi Shokuhin Co., Ltd. |

841 | 26,129 | ||||||

| Mitsubishi Tanabe Pharma Corp. |

17,914 | 374,027 | ||||||

| NEC Networks & System Integration Corp. |

1,235 | 23,920 | ||||||

| Nichias Corp. |

5,604 | 56,436 | ||||||

| Nifco, Inc. |

654 | 32,868 | ||||||

| Nihon Unisys Ltd. |

9,379 | 128,335 | ||||||

| Nippon Flour Mills Co., Ltd. |

1,402 | 20,753 | ||||||

| Nippon Paper Industries Co., Ltd. |

6,571 | 118,284 | ||||||

| NIPPON REIT Investment Corp. |

31 | 80,542 | ||||||

| Nippon Telegraph & Telephone Corp. |

7,744 | 331,082 | ||||||

| Nisshin Oillio Group Ltd. |

6,538 | 37,277 | ||||||

| NTT Data Corp. |

4,557 | 216,396 | ||||||

| NTT DOCOMO, Inc. |

30,557 | 713,575 | ||||||

| Obayashi Corp. |

9,573 | 89,764 | ||||||

| Okamura Corp. |

3,269 | 29,077 | ||||||

| Pacific Industrial Co., Ltd. |

576 | 8,208 | ||||||

| Prima Meat Packers Ltd. |

6,538 | 28,947 | ||||||

| Raito Kogyo Co., Ltd. |

4,537 | 46,232 | ||||||

| Recruit Holdings Co., Ltd. |

3,900 | 199,468 | ||||||

| Right On Co., Ltd. |

943 | 8,149 | ||||||

| S Foods, Inc. |

2,728 | 79,381 | ||||||

| Sakata INX Corp. |

2,802 | 38,668 | ||||||

| Sanyo Chemical Industries Ltd. |

561 | 23,598 | ||||||

| Sawai Pharmaceutical Co., Ltd. |

1,875 | 101,797 | ||||||

| Sekisui House Ltd. |

11,700 | 192,919 | ||||||

| Senko Co., Ltd. |

5,604 | 36,185 | ||||||

| Stella Chemifa Corp. |

3,189 | 91,021 | ||||||

| Sumitomo Dainippon Pharma Co., Ltd. |

9,632 | 159,384 | ||||||

| Taisho Pharmaceutical Holdings Co., Ltd. |

700 | 56,997 | ||||||

| Takasago Thermal Engineering Co., Ltd. |

1,103 | 15,559 | ||||||

| Takeda Pharmaceutical Co., Ltd. |

4,457 | 209,823 | ||||||

| Tokyo Electron Ltd. |

1,000 | 109,476 | ||||||

| Toppan Printing Co., Ltd. |

16,679 | 170,479 | ||||||

| Toray Industries, Inc. |

9,274 | 82,539 | ||||||

| Toshiba Plant Systems & Services Corp. |

5,800 | 84,889 | ||||||

| Towa Pharmaceutical Co., Ltd. |

262 | 13,299 | ||||||

| Toyo Construction Co., Ltd. |

2,989 | 10,746 | ||||||

| Tv Tokyo Holdings Corp. |

934 | 21,395 | ||||||

| Unipres Corp. |

483 | 10,105 | ||||||

| See accompanying Notes to Financial Statements |

21 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Wacoal Holdings Corp. |

5,604 | 69,230 | ||||||

| West Japan Railway Co. |

3,199 | 208,618 | ||||||

| Yorozu Corp. |

841 | 12,954 | ||||||

| Yoshinoya Holdings Co., Ltd. |

7,025 | 102,189 | ||||||

| Yurtec Corp. |

1,868 | 12,863 | ||||||

|

|

|

|||||||

|

|

8,025,894

|

| ||||||

|

|

|

|||||||

| Korea (Republic of) - 1.7% |

||||||||

| CJ Hellovision Co., Ltd. |

2,652 | 24,077 | ||||||

| Daekyo Co., Ltd. |

2,318 | 16,686 | ||||||

| Easy Bio, Inc. |

6,217 | 33,619 | ||||||

| Hansol Paper Co., Ltd. |

1,424 | 24,258 | ||||||

| Hyundai Engineering Plastics Co., Ltd. |

2,575 | 19,431 | ||||||

| Hyundai Motor Co. |

1,906 | 268,616 | ||||||

| KC Tech Co., Ltd. |

519 | 6,384 | ||||||

| Kia Motors Corp. |

1,598 | 52,962 | ||||||

| KT Corp. |

660 | 18,839 | ||||||

| KT&G Corp. |

2,614 | 227,904 | ||||||

| Kukdo Chemical Co., Ltd. |

388 | 17,097 | ||||||

| Macquarie Korea Infrastructure Fund |

8,231 | 61,237 | ||||||

| Samjin Pharmaceutical Co., Ltd. |

1,581 | 45,879 | ||||||

| Samsung Electronics Co., Ltd. |

198 | 364,402 | ||||||

| Samyang Holdings Corp. |

267 | 29,486 | ||||||

| Ubiquoss Holdings, Inc. |

1,318 | 8,485 | ||||||

| Ubiquoss, Inc. (d) |

420 | 9,183 | ||||||

|

|

|

|||||||

|

|

1,228,545

|

| ||||||

|

|

|

|||||||

| Luxembourg - 0.2% |

||||||||

| RTL Group S.A. |

1,888 | 151,908 | ||||||

|

|

|

|||||||

| Malaysia - 0.5% |

||||||||

| KNM Group Bhd. (d) |

94,600 | 6,413 | ||||||

| Maxis Bhd. |

9,800 | 14,258 | ||||||

| MISC Bhd. |

33,000 | 54,552 | ||||||

| Supermax Corp. Bhd. |

59,900 | 26,953 | ||||||

| Tenaga Nasional Bhd. |

75,900 | 235,218 | ||||||

|

|

|

|||||||

|

|

337,394

|

| ||||||

|

|

|

|||||||

| Morocco - 0.1% |

||||||||

| Douja Promotion Groupe Addoha S.A. |

10,225 | 43,771 | ||||||

| Maroc Telecom |

2,136 | 29,177 | ||||||

|

|

|

|||||||

|

|

72,948

|

| ||||||

|

|

|

|||||||

| Netherlands - 0.3% |

||||||||

| NN Group NV |

5,675 | 184,308 | ||||||

| Vastned Retail NV REIT |

596 | 22,539 | ||||||

|

|

|

|||||||

|

|

206,847

|

| ||||||

|

|

|

|||||||

| New Zealand - 0.5% |

||||||||

| Air New Zealand Ltd. |

32,303 | 55,705 | ||||||

| Arvida Group Ltd. |

26,315 | 23,416 | ||||||

| Auckland International Airport Ltd. |

32,832 | 155,461 | ||||||

| Fonterra Co-operative Group Ltd. UNIT |

7,445 | 31,627 | ||||||

| Kiwi Property Group Ltd. |

20,620 | 20,598 | ||||||

| Summerset Group Holdings Ltd. |

16,234 | 58,827 | ||||||

| Tourism Holdings Ltd. |

9,034 | 23,748 | ||||||

|

|

|

|||||||

|

|

369,382

|

| ||||||

|

|

|

|||||||

| Norway - 0.4% |

||||||||

| Avance Gas Holding Ltd. (a) |

1,384 | 4,546 | ||||||

| Gjensidige Forsikring ASA |

4,268 | 65,019 | ||||||

| Marine Harvest ASA (d) |

2,103 | 32,080 | ||||||

| Orkla ASA |

18,550 | 166,172 | ||||||

|

|

|

|||||||

|

|

267,817

|

| ||||||

|

|

|

|||||||

| Philippines - 0.1% |

||||||||

| Aboitiz Equity Ventures, Inc. |

19,950 | 29,602 | ||||||

| Bank of the Philippine Islands |

2,810 | 5,668 | ||||||

| BDO Unibank, Inc. |

12,250 | 28,711 | ||||||

|

|

|

|||||||

|

|

63,981

|

| ||||||

|

|

|

|||||||

| See accompanying Notes to Financial Statements |

22 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Poland - 0.3% |

||||||||

| Asseco Poland S.A. |

1,494 | 20,456 | ||||||

| Ciech S.A. |

1,701 | 34,314 | ||||||

| Polski Koncern Naftowy Orlen S.A. |

6,512 | 164,246 | ||||||

|

|

|

|||||||

|

|

219,016

|

| ||||||

|

|

|

|||||||

| Portugal - 0.2% |

||||||||

| Jeronimo Martins SGPS S.A. |

6,202 | 110,825 | ||||||

|

|

|

|||||||

| Russian Federation - 0.1% |

||||||||

| PhosAgro PJSC GDR |

3,290 | 48,034 | ||||||

|

|

|

|||||||

| Singapore - 1.5% |

||||||||

| Accordia Golf Trust UNIT |

37,500 | 19,704 | ||||||

| BOC Aviation Ltd. (a) |

15,600 | 83,229 | ||||||

| China Aviation Oil Singapore Corp., Ltd. |

22,500 | 24,526 | ||||||

| Fortune Real Estate Investment Trust REIT |

32,000 | 35,832 | ||||||

| Frasers Logistics & Industrial Trust REIT |

106,900 | 75,271 | ||||||

| Keppel DC REIT |

39,000 | 33,453 | ||||||

| Mapletree Industrial Trust REIT |

24,100 | 30,667 | ||||||

| SATS Ltd. |

63,000 | 219,781 | ||||||

| Sheng Siong Group Ltd. |

67,800 | 45,802 | ||||||

| Singapore Airlines Ltd. |

43,000 | 309,531 | ||||||

| Sino Grandness Food Industry Group Ltd. |

77,400 | 13,274 | ||||||

| Venture Corp., Ltd. |

19,300 | 158,252 | ||||||

|

|

|

|||||||

|

|

1,049,322

|

| ||||||

|

|

|

|||||||

| South Africa - 0.2% |

||||||||

| Harmony Gold Mining Co., Ltd. |

26,046 | 63,254 | ||||||

| Tsogo Sun Holdings Ltd. |

23,626 | 48,541 | ||||||

|

|

|

|||||||

|

|

111,795

|

| ||||||

|

|

|

|||||||

| Spain - 0.2% |

||||||||

| Axiare Patrimonio SOCIMI S.A. REIT |

630 | 9,403 | ||||||

| Ebro Foods S.A. |

5,628 | 113,718 | ||||||

| Lar Espana Real Estate Socimi S.A. REIT |

1,947 | 14,996 | ||||||

|

|

|

|||||||

|

|

138,117

|

| ||||||

|

|

|

|||||||

| Sweden - 0.0% |

||||||||

| Cloetta AB, Class B |

7,145 | 28,227 | ||||||

|

|

|

|||||||

| Switzerland - 2.5% |

||||||||

| Bachem Holding AG, Class B |

875 | 103,529 | ||||||

| Baloise Holding AG |

1,297 | 178,224 | ||||||

| Banque Cantonale Vaudoise |

79 | 54,503 | ||||||

| BKW AG |

433 | 23,408 | ||||||

| Cembra Money Bank AG (d) |

151 | 12,484 | ||||||

| Emmi AG (d) |

65 | 44,270 | ||||||

| Garmin Ltd. |

4,003 | 204,593 | ||||||

| Intershop Holding AG |

49 | 24,362 | ||||||

| Komax Holding AG |

287 | 69,769 | ||||||

| Kudelski S.A. |

1,293 | 21,161 | ||||||

| Nestle S.A. |

2,854 | 219,049 | ||||||

| Partners Group Holding AG |

421 | 226,251 | ||||||

| Schweiter Technologies AG |

24 | 26,620 | ||||||

| Siegfried Holding AG (d) |

141 | 37,126 | ||||||

| Swiss Life Holding AG (d) |

619 | 199,604 | ||||||

| Swiss Re AG |

2,733 | 245,467 | ||||||

| Valora Holding AG |

201 | 69,482 | ||||||

|

|

|

|||||||

|

|

1,759,902

|

| ||||||

|

|

|

|||||||

| Taiwan - 4.7% |

||||||||

| Accton Technology Corp. |

75,000 | 165,365 | ||||||

| Arcadyan Technology Corp. |

24,000 | 47,852 | ||||||

| Asia Vital Components Co., Ltd. |

37,000 | 31,893 | ||||||

| Chang Hwa Commercial Bank Ltd. |

44,520 | 27,133 | ||||||

| Cheng Uei Precision Industry Co., Ltd. |

16,000 | 20,721 | ||||||

| Chicony Power Technology Co., Ltd. |

16,000 | 25,655 | ||||||

| Chin-Poon Industrial Co., Ltd. |

21,000 | 42,704 | ||||||

| China Airlines Ltd. |

148,000 | 51,454 | ||||||

| China Metal Products |

25,000 | 25,577 | ||||||

| China Motor Corp. |

30,000 | 27,490 | ||||||

| Chunghwa Telecom Co., Ltd. |

158,000 | 536,549 | ||||||

| Elite Material Co., Ltd. |

41,000 | 159,438 | ||||||

| See accompanying Notes to Financial Statements |

23 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Farglory Land Development Co., Ltd. |

48,000 | 64,934 | ||||||

| First Financial Holding Co., Ltd. |

308,000 | 187,789 | ||||||

| Formosa Petrochemical Corp. |

120,000 | 419,164 | ||||||

| Formosa Plastics Corp. |

24,000 | 71,568 | ||||||

| Getac Technology Corp. |

49,000 | 70,405 | ||||||

| Gintech Energy Corp. (d) |

19,000 | 11,083 | ||||||

| Grape King Bio Ltd. |

5,000 | 31,456 | ||||||

| Hon Hai Precision Industry Co., Ltd. |

168,500 | 505,346 | ||||||

| Hua Nan Financial Holdings Co., Ltd. |

47,790 | 26,694 | ||||||

| King Yuan Electronics Co., Ltd. |

80,000 | 73,827 | ||||||

| Kinsus Interconnect Technology Corp. |

20,000 | 52,859 | ||||||

| Powertech Technology, Inc. |

48,000 | 139,683 | ||||||

| Sercomm Corp. |

37,000 | 92,692 | ||||||

| Sinbon Electronics Co., Ltd. |

43,139 | 105,933 | ||||||

| Sitronix Technology Corp. |

11,000 | 35,744 | ||||||

| Taiwan Business Bank |

211,350 | 58,505 | ||||||

| Taiwan Hon Chuan Enterprise Co., Ltd. |

17,000 | 32,938 | ||||||

| TXC Corp. |

42,000 | 60,078 | ||||||

| Wistron NeWeb Corp. |

15,450 | 43,436 | ||||||

| WT Microelectronics Co., Ltd. |

17,000 | 24,853 | ||||||

| Yageo Corp. |

11,206 | 30,544 | ||||||

|

|

|

|||||||

|

|

3,301,362

|

| ||||||

|

|

|

|||||||

| Thailand - 0.7% |

||||||||

| Bangkok Bank PCL |

31,800 | 172,208 | ||||||

| Charoen Pokphand Foods PCL (c) |

205,700 | 166,135 | ||||||

| Siam Cement PCL |

12,000 | 188,562 | ||||||

|

|

|

|||||||

|

|

526,905

|

| ||||||

|

|

|

|||||||

| United Kingdom - 1.6% |

||||||||

| British American Tobacco PLC |

1,406 | 93,282 | ||||||

| Burford Capital Ltd. |

4,254 | 41,040 | ||||||

| Compass Group PLC |

24,270 | 458,223 | ||||||

| Gamma Communications PLC |

6,635 | 40,817 | ||||||

| HSBC Holdings PLC |

12,133 | 98,967 | ||||||

| Imperial Brands PLC |

5,648 | 273,723 | ||||||

| Johnson Service Group PLC |

17,486 | 25,906 | ||||||

| Marston’s PLC |

15,385 | 25,880 | ||||||

| Northgate PLC |

2,990 | 20,604 | ||||||

| Primary Health Properties PLC REIT |

14,934 | 20,675 | ||||||

| RSA Insurance Group PLC |

7,011 | 51,488 | ||||||

|

|

|

|||||||

|

|

1,150,605

|

| ||||||

|

|

|

|||||||

| United States - 55.7% |

||||||||

| AbbVie, Inc. |

5,231 | 340,852 | ||||||

| Accenture PLC, Class A |

3,515 | 421,378 | ||||||

| Aetna, Inc. |

3,168 | 404,078 | ||||||

| Aflac, Inc. |

3,576 | 258,974 | ||||||

| AG Mortgage Investment Trust, Inc. REIT |

6,418 | 115,845 | ||||||

| AGNC Investment Corp. REIT |

20,807 | 413,851 | ||||||

| Agree Realty Corp. REIT |

2,485 | 119,181 | ||||||

| Align Technology, Inc. (d) |

1,701 | 195,122 | ||||||

| Altria Group, Inc. |

11,893 | 849,398 | ||||||

| American Electric Power Co., Inc. |

4,091 | 274,629 | ||||||

| American Financial Group, Inc. |

1,877 | 179,103 | ||||||

| American Public Education, Inc. (d) |

838 | 19,190 | ||||||

| AmerisourceBergen Corp. |

562 | 49,737 | ||||||

| Amgen, Inc. |

2,306 | 378,345 | ||||||

| AngioDynamics, Inc. (d) |

5,716 | 99,173 | ||||||

| Annaly Capital Management, Inc. REIT |

51,236 | 569,232 | ||||||

| Anthem, Inc. |

1,776 | 293,715 | ||||||

| Anworth Mortgage Asset Corp. REIT |

25,370 | 140,803 | ||||||

| Apollo Commercial Real Estate Finance, Inc. REIT |

6,001 | 112,879 | ||||||

| Ares Commercial Real Estate Corp. REIT |

5,619 | 75,182 | ||||||

| ARMOUR Residential REIT, Inc. |

3,566 | 80,984 | ||||||

| AT&T, Inc. |

28,368 | 1,178,690 | ||||||

| Atmos Energy Corp. |

2,195 | 173,383 | ||||||

| Automatic Data Processing, Inc. |

5,810 | 594,886 | ||||||

| AutoZone, Inc. (d) |

657 | 475,044 | ||||||

| AvalonBay Communities, Inc. REIT |

533 | 97,859 | ||||||

| AVX Corp. |

2,990 | 48,976 | ||||||

| Axis Capital Holdings Ltd. |

5,725 | 383,747 | ||||||

| Baxter International, Inc. |

9,529 | 494,174 | ||||||

| Becton Dickinson and Co. |

266 | 48,795 | ||||||

| Bemis Co., Inc. |

153 | 7,476 | ||||||

| See accompanying Notes to Financial Statements |

24 | Semi-Annual Report/ March 31, 2017 |

Schedule of Investments

March 31, 2017 (unaudited)

AllianzGI Best Styles Global Managed Volatility Portfolio

| Shares | Value | |||||||

| Blackstone Mortgage Trust, Inc., Class A REIT |

4,380 | 135,605 | ||||||

| Brixmor Property Group, Inc. REIT |

586 | 12,576 | ||||||

| CA, Inc. |

6,142 | 194,824 | ||||||

| Capitol Federal Financial, Inc. |

6,849 | 100,201 | ||||||

| Capstead Mortgage Corp. REIT |

9,708 | 102,322 | ||||||

| Cardinal Health, Inc. |

3,180 | 259,329 | ||||||

| Carriage Services, Inc. |

1,268 | 34,388 | ||||||

| CenturyLink, Inc. |

7,431 | 175,149 | ||||||

| Chimera Investment Corp. REIT |

7,430 | 149,937 | ||||||

| Chubb Ltd. |

2,543 | 346,484 | ||||||

| Cincinnati Financial Corp. |

3,104 | 224,326 | ||||||

| Cisco Systems, Inc. |

15,867 | 536,305 | ||||||

| Clorox Co. |

5,356 | 722,149 | ||||||

| CME Group, Inc. |

2,273 | 270,032 | ||||||

| CMS Energy Corp. |

4,735 | 211,844 | ||||||

| Colgate-Palmolive Co. |

2,734 | 200,101 | ||||||

| Computer Sciences Corp. |