Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22975

AllianzGI Institutional Multi-Series Trust

(Exact name of registrant as specified in charter)

| 1633 Broadway, New York, New York | 10019 | |

| (Address of principal executive offices) | (Zip code) |

Lawrence G. Altadonna

1633 Broadway,

New York, New York 10019

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-739-3371

Date of fiscal year end: September 30, 2015

(Registrant changed its fiscal year end from November 30)

Date of reporting period: September 30, 2015

Table of Contents

Item 1. Report to Shareholders

AllianzGI Institutional Multi-Series Trust

Annual Report

September 30, 2015

Effective September 30, 2015, the Trust’s fiscal year end changed from November 30th to September 30th.

Table of Contents

| 2 - 3 | ||||

| 4 | ||||

| 5 - 8 | ||||

| 9 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 13 - 21 | ||||

| 22 | ||||

| Changes to the Board of Trustees/ Federal Income Tax Information |

23 | |||

| 24-25 | ||||

| 26 | ||||

| 27 | ||||

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

(unaudited)

For the period of October 1, 2014 through September 30, 2015, as provided by Mark Roemer, Portfolio Manager.

Fund Insights

Average Annual Return for the period ended September 30, 2015

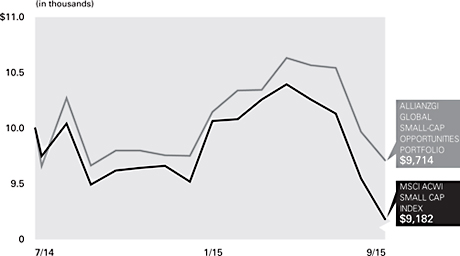

| 1 Year | Since Inception† | |||||||||

| AllianzGI Global Small-Cap Opportunities Portfolio | 0.51% | -2.40% | ||||||||

| MSCI All Country World Small-Cap Index †† | -3.28% | -6.93% | ||||||||

† The Portfolio began operations on 7/23/14. Benchmark return comparisons began on the portfolio inception date. Lipper performance comparisons began on 7/31/14.

†† The MSCI All Country World Small-Cap Index captures small cap representation across 23 developed market and 23 emerging market countries. With 6,108 constituents, the index covers about 14% of the free float-adjust market capitalization in each country (as of September 30, 2015). Index returns reflect the reinvestment of income dividends and capital gains, if any, but do not reflect fees, brokerage commissions or other expenses of investing. It is not possible to invest directly in an index.

Performance quoted represents past performance and is no guarantee of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value will fluctuate. Shares may be worth more or less than original cost when redeemed. Returns do not reflect deduction of taxes that a shareholder would pay on portfolio distributions or redemption of portfolio shares. Total return performance assumes that all dividends and capital gain distributions were reinvested on the payable date. The Portfolio’s gross expense ratio is 3.36%. This ratio does not include an expense reduction, contractually agreed through March 31, 2016. The Portfolio’s expense ratio net of this reduction is 1.20%. Expense ratio information is as of the Portfolio’s current PPM dated March 30, 2015, as supplemented to date.

| 2 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

(unaudited) (continued)

|

Country Allocation (as of September 30, 2015) |

|

Cumulative Returns Through September 30, 2015

| ||||||

|

United States |

52.1% |

| ||||||

|

Japan |

8.8% | |||||||

|

United Kingdom |

5.7% | |||||||

|

Australia |

4.6% | |||||||

|

Taiwan |

2.6% | |||||||

|

Switzerland |

2.6% | |||||||

|

China |

2.5% | |||||||

|

Korea (Republic of) |

2.4% | |||||||

|

Other |

15.8% | |||||||

|

Cash & Equivalents — Net |

2.9% | |||||||

|

Shareholder Expense Example

|

Actual Performance

| ||||

|

Beginning Account Value (4/1/15)

|

$

|

1,000.00

|

| ||

|

Ending Account Value (9/30/15)

|

$

|

939.40

|

| ||

|

Expenses Paid During Period

|

$

|

5.88

|

| ||

|

Hypothetical Performance

| |||||

| (5% return before expenses) | |||||

|

Beginning Account Value (4/1/15)

|

$

|

1,000.00

|

| ||

|

Ending Account Value (9/30/15)

|

$

|

1,019.00

|

| ||

|

Expenses Paid During Period

|

$

|

6.12

|

| ||

Expenses (net of reimbursement, if any) are equal to the annualized expense ratio (1.21%), multiplied by the average account value over the period, multiplied by 183/365.

| 3 | Annual Report / September 30, 2015 |

Table of Contents

Important Information (unaudited)

AllianzGI Institutional Multi-Series Trust

Effective September 30, 2015, the Trust’s fiscal year end changed from November 30th to September 30th.

As of September 30, 2015, AllianzGI Institutional Multi-Series Trust (the “Trust”) consisted of one investment series, AllianzGI Global Small-Cap Opportunities Portfolio (“Portfolio”). The Portfolio currently offers one share class.

The Cumulative Returns chart for the Portfolio assumes the initial investment was made on the first day of the Portfolio’s initial fiscal year. Results assume that all dividends and capital gain distributions, if any were reinvested. They do not take into account the effect of taxes. The benchmark cumulative return began on the last day of the month of the Portfolio’s inception date.

The following disclosure provides important information regarding the Portfolio’s Shareholder Expense Example, which appears on the Portfolio Summary page in this Annual report. Please refer to this information when reviewing the Shareholder Expense Example for the Portfolio.

Shareholder Expense Example

Shareholders incur two types of costs: (1) transaction costs; and (2) ongoing costs, including investment management fees and other Portfolio expenses. The Shareholder Expense Example is intended to help shareholders understand ongoing costs (in dollars) of investing in the Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds. The Shareholder Expense Example is based on $1,000.00 invested at the beginning and held for the entire period April 1, 2015 through September 30, 2015.

Actual Expenses

The information in the table for “Actual Performance” provides information about actual account values and actual expenses. You may use the information in this column, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.6), then multiply the result by the number in the row entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information in the table for “Hypothetical Performance (5% return before expenses)” provides information about hypothetical account values and hypothetical expenses based on the Portfolio’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Portfolio’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Portfolio and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the information for “Hypothetical Performance (5% return before expenses)” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Proxy Voting

The Trust’s Investment Manager and Sub-Adviser have adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940. The Proxy Policy has been adopted by the Trust as the policies and procedures that the Sub-Adviser will use when voting proxies on behalf of the Portfolio. Copies of the written Proxy Policy and the factors that the Sub-Adviser may consider in determining how to vote proxies for the Portfolio, and information about how the Portfolio voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling 1-800-498-5413, and on the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

Form N-Q

The Trust files its complete schedule of the portfolio holdings with the SEC on Form N-Q for the first and third quarters of each fiscal year, which are available on the SEC’s website at http://www.sec.gov. A copy of the Trust’s Form N-Q is available without charge, upon request, by calling 1-800-498-5413. In addition, the Trust’s Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| 4 | Annual Report / September 30, 2015 |

Table of Contents

September 30, 2015

AllianzGI Global Small-Cap Opportunities Portfolio

| Shares | Value | |||||||

|

|

||||||||

| COMMON STOCK - 97.1% |

||||||||

| Australia - 4.6% |

||||||||

| Austal Ltd. |

18,300 | $ | 29,040 | |||||

| Blackmores Ltd. |

300 | 30,841 | ||||||

| Echo Entertainment Group Ltd. |

20,473 | 70,054 | ||||||

| Qantas Airways Ltd. (c) |

34,954 | 91,767 | ||||||

|

|

|

|||||||

|

|

221,702

|

| ||||||

|

|

|

|||||||

| Belgium - 0.3% |

||||||||

| Gimv NV |

350 |

|

15,959

|

| ||||

|

|

|

|||||||

| Canada - 1.3% |

||||||||

| Cascades, Inc. |

4,972 | 32,079 | ||||||

| Just Energy Group, Inc. |

4,909 | 30,237 | ||||||

|

|

|

|||||||

|

|

62,316

|

| ||||||

|

|

|

|||||||

| China - 2.5% |

||||||||

| Bank of Chongqing Co., Ltd., Class H |

42,500 | 29,387 | ||||||

| Chongqing Rural Commercial Bank Co., Ltd., Class H |

36,000 | 20,608 | ||||||

| Sohu.com, Inc. (c) |

835 | 34,486 | ||||||

| Yuzhou Properties Co., Ltd. |

159,000 | 37,036 | ||||||

|

|

|

|||||||

|

|

121,517

|

| ||||||

|

|

|

|||||||

| Denmark - 1.1% |

||||||||

| SimCorp A/S (b) |

587 | 29,565 | ||||||

| Spar Nord Bank A/S |

2,204 | 25,140 | ||||||

|

|

|

|||||||

|

|

54,705

|

| ||||||

|

|

|

|||||||

| France - 2.3% |

||||||||

| Altran Technologies S.A. |

3,214 | 37,368 | ||||||

| Boiron S.A. |

276 | 26,615 | ||||||

| Ipsen S.A. |

546 | 33,870 | ||||||

| Synergie S.A. |

592 | 15,460 | ||||||

|

|

|

|||||||

|

|

113,313

|

| ||||||

|

|

|

|||||||

| Germany - 1.7% |

||||||||

| Aareal Bank AG (b) |

2,364 |

|

84,080

|

| ||||

|

|

|

|||||||

| Hong Kong - 1.8% |

||||||||

| Champion REIT |

125,000 | 62,446 | ||||||

| Shun Tak Holdings Ltd. |

64,000 | 24,364 | ||||||

|

|

|

|||||||

|

|

86,810

|

| ||||||

|

|

|

|||||||

| India - 1.6% |

||||||||

| WNS Holdings Ltd. ADR (c) |

1,550 | 43,322 | ||||||

| Wockhardt Ltd. |

1,407 | 32,923 | ||||||

|

|

|

|||||||

|

|

76,245

|

| ||||||

|

|

|

|||||||

| Israel - 0.5% |

||||||||

| Orbotech Ltd. (c) |

1,505 |

|

23,252

|

| ||||

|

|

|

|||||||

| Italy - 0.4% |

||||||||

| ASTM SpA |

1,385 |

|

18,402

|

| ||||

|

|

|

|||||||

| Japan - 8.8% |

||||||||

| Aisan Industry Co., Ltd. |

1,900 | 17,434 | ||||||

| Alps Electric Co., Ltd. |

3,600 | 101,664 | ||||||

| Ashikaga Holdings Co., Ltd. |

8,000 | 33,421 | ||||||

| Chiyoda Integre Co., Ltd. |

900 | 19,272 | ||||||

| Fields Corp. |

1,800 | 24,461 | ||||||

| Gunze Ltd. |

6,000 | 18,150 | ||||||

| Kuroda Electric Co., Ltd. |

1,400 | 25,985 | ||||||

| Nichiha Corp. |

1,500 | 20,729 | ||||||

| Nippon Synthetic Chemical Industry Co., Ltd. |

4,000 | 25,018 | ||||||

| Ryobi Ltd. |

8,000 | 29,927 | ||||||

| T-Gaia Corp. |

4,400 | 68,556 | ||||||

| Towa Pharmaceutical Co., Ltd. |

300 | 19,255 | ||||||

| Yorozu Corp. |

1,100 | 22,513 | ||||||

|

|

|

|||||||

|

|

426,385

|

| ||||||

|

|

|

|||||||

| 5 | Annual Report / September 30, 2015 |

Table of Contents

Schedule of Investments

September 30, 2015

AllianzGI Global Small-Cap Opportunities Portfolio

| Shares

|

Value

|

|||||||

|

|

||||||||

| Korea (Republic of) - 2.4% |

||||||||

| BNK Financial Group, Inc. |

1,648 | $ | 19,108 | |||||

| KB Insurance Co., Ltd. |

768 | 15,321 | ||||||

| Kwang Dong Pharmaceutical Co., Ltd. |

2,104 | 23,069 | ||||||

| OCI Materials Co., Ltd. |

445 | 34,477 | ||||||

| Tongyang Life Insurance Co., Ltd. |

2,157 | 25,932 | ||||||

|

|

|

|||||||

|

|

117,907

|

| ||||||

|

|

|

|||||||

| Mexico - 0.3% |

||||||||

| Controladora Vuela Cia de Aviacion S.A.B. de C.V., Class A (c) |

9,100 |

|

13,581

|

| ||||

|

|

|

|||||||

| Netherlands - 0.7% |

||||||||

| Accell Group |

1,655 |

|

35,377

|

| ||||

|

|

|

|||||||

| New Zealand - 0.7% |

||||||||

| Kiwi Property Group Ltd. |

41,965 |

|

34,593

|

| ||||

|

|

|

|||||||

| Poland - 1.8% |

||||||||

| Kernel Holding S.A. |

7,460 |

|

88,545

|

| ||||

|

|

|

|||||||

| South Africa - 0.9% |

||||||||

| Astral Foods Ltd. |

2,336 | 29,373 | ||||||

| Cashbuild Ltd. |

705 | 15,516 | ||||||

|

|

|

|||||||

|

|

44,889

|

| ||||||

|

|

|

|||||||

| Switzerland - 2.6% |

||||||||

| BKW AG |

812 | 30,994 | ||||||

| Cembra Money Bank AG (b)(c) |

250 | 14,784 | ||||||

| Swiss Life Holding AG (c) |

360 | 80,304 | ||||||

|

|

|

|||||||

|

|

126,082

|

| ||||||

|

|

|

|||||||

| Taiwan - 2.6% |

||||||||

| Farglory Land Development Co., Ltd. |

36,000 | 38,094 | ||||||

| Grand Pacific Petrochemical |

51,000 | 23,361 | ||||||

| Huaku Development Co., Ltd. |

14,000 | 24,380 | ||||||

| Pou Chen Corp. |

28,000 | 42,121 | ||||||

|

|

|

|||||||

|

|

127,956

|

| ||||||

|

|

|

|||||||

| Thailand - 0.4% |

||||||||

| Tipco Asphalt PCL |

21,300 |

|

17,331

|

| ||||

|

|

|

|||||||

| United Kingdom - 5.7% |

||||||||

| Clinigen Group PLC (c) |

4,026 | 41,763 | ||||||

| Derwent London PLC REIT |

1,164 | 64,161 | ||||||

| JD Sports Fashion PLC |

1,323 | 19,113 | ||||||

| Micro Focus International PLC |

1,250 | 22,774 | ||||||

| Shaftesbury PLC REIT |

4,239 | 58,857 | ||||||

| UNITE Group PLC |

2,000 | 19,774 | ||||||

| Workspace Group PLC REIT |

3,518 | 49,966 | ||||||

|

|

|

|||||||

|

|

276,408

|

| ||||||

|

|

|

|||||||

| United States - 52.1% |

||||||||

| Advanced Energy Industries, Inc. (c) |

3,440 | 90,472 | ||||||

| Alaska Air Group, Inc. |

400 | 31,780 | ||||||

| Allscripts Healthcare Solutions, Inc. (c) |

1,270 | 15,748 | ||||||

| American Eagle Outfitters, Inc. |

1,700 | 26,571 | ||||||

| Amsurg Corp. (c) |

1,205 | 93,641 | ||||||

| Ares Commercial Real Estate Corp. REIT |

3,160 | 37,888 | ||||||

| Armour Residential REIT, Inc. REIT |

625 | 12,525 | ||||||

| Beneficial Bancorp, Inc. (c) |

3,095 | 41,040 | ||||||

| Bob Evans Farms, Inc. |

440 | 19,074 | ||||||

| CBIZ, Inc. (c) |

3,435 | 33,732 | ||||||

| Express, Inc. (c) |

5,210 | 93,103 | ||||||

| First Bancorp |

1,110 | 18,870 | ||||||

| Flagstar Bancorp, Inc. (c) |

1,320 | 27,139 | ||||||

| Foot Locker, Inc. |

600 | 43,182 | ||||||

| Fortinet, Inc. (c) |

2,280 | 96,854 | ||||||

| Group 1 Automotive, Inc. |

495 | 42,149 | ||||||

| Hanover Insurance Group, Inc. |

400 | 31,080 | ||||||

| HD Supply Holdings, Inc. (c) |

790 | 22,610 | ||||||

| Health Net, Inc. (c) |

1,460 | 87,921 | ||||||

| 6 | Annual Report / September 30, 2015 |

Table of Contents

Schedule of Investments

September 30, 2015

AllianzGI Global Small-Cap Opportunities Portfolio

| Shares

|

Value

|

|||||||

|

|

||||||||

| HomeStreet, Inc. (c) |

3,620 | $ | 83,622 | |||||

| Horizon Pharma PLC (c) |

2,380 | 47,172 | ||||||

| JetBlue Airways Corp. (c) |

4,425 | 114,032 | ||||||

| Knoll, Inc. |

1,350 | 29,673 | ||||||

| Leggett & Platt, Inc. |

900 | 37,125 | ||||||

| LifePoint Hospitals, Inc. (c) |

1,220 | 86,498 | ||||||

| Matrix Service Co. (c) |

1,115 | 25,054 | ||||||

| MEDNAX, Inc. (c) |

305 | 23,421 | ||||||

| Molina Healthcare, Inc. (c) |

550 | 37,867 | ||||||

| Oritani Financial Corp. |

2,875 | 44,907 | ||||||

| Owens Corning |

2,025 | 84,868 | ||||||

| Oxford Industries, Inc. |

770 | 56,888 | ||||||

| Palo Alto Networks, Inc. (c) |

200 | 34,400 | ||||||

| Panera Bread Co., Class A (c) |

100 | 19,341 | ||||||

| Premier, Inc., Class A (c) |

805 | 27,668 | ||||||

| Prestige Brands Holdings, Inc. (c) |

2,050 | 92,578 | ||||||

| ServiceMaster Global Holdings, Inc. (c) |

925 | 31,034 | ||||||

| Smith & Wesson Holding Corp. (c) |

1,450 | 24,462 | ||||||

| Solera Holdings, Inc. |

1,235 | 66,690 | ||||||

| Spirit AeroSystems Holdings, Inc., Class A (c) |

2,185 | 105,623 | ||||||

| Tableau Software, Inc., Class A (c) |

835 | 66,616 | ||||||

| Telephone & Data Systems, Inc. |

3,130 | 78,125 | ||||||

| Texas Roadhouse, Inc. |

500 | 18,600 | ||||||

| Total System Services, Inc. |

945 | 42,931 | ||||||

| Ulta Salon Cosmetics & Fragrance, Inc. (c) |

590 | 96,376 | ||||||

| USANA Health Sciences, Inc. (c) |

395 | 52,942 | ||||||

| Vail Resorts, Inc. |

905 | 94,735 | ||||||

| Vantiv, Inc., Class A (c) |

1,830 | 82,204 | ||||||

| VCA, Inc. (c) |

695 | 36,592 | ||||||

| Vocera Communications, Inc. (c) |

1,920 | 21,907 | ||||||

|

|

|

|||||||

| 2,529,330 | ||||||||

|

|

|

|||||||

| Total Common Stock (cost-$4,664,607) |

4,716,685 | |||||||

|

|

|

|||||||

| Principal Amount (000s) |

||||||||

| SHORT-TERM INVESTMENTS - 0.2% |

||||||||

| Certificate of Deposit - 0.2% |

||||||||

| Citibank Argentina, |

$9 | 9,273 | ||||||

|

|

|

|||||||

| Total Investments (cost-$4,673,880) (a)-97.3% |

4,725,958 | |||||||

| Other assets less liabilities-2.7% |

|

130,443

|

| |||||

|

|

|

|||||||

| Net Assets-100.0% |

$4,856,401 | |||||||

|

|

|

|||||||

Notes to Schedule of Investments:

| (a) | Securities with an aggregate value of $1,882,783, representing 38.8% of net assets, were valued utilizing modeling tools provided by a third-party vendor. See Note 1(a) and Note 1(b) in the Notes to Financial Statements. |

| (b) | Affiliated security. |

| (c) | Non-income producing. |

Glossary:

ADR - American Depositary Receipt

REIT - Real Estate Investment Trust

| 7 | Annual Report / September 30, 2015 |

Table of Contents

Schedule of Investments

September 30, 2015

AllianzGI Global Small-Cap Opportunities Portfolio

The industry classification of portfolio holdings and other assets less liabilities shown as a percentage of net assets were as follows:

| Specialty Retail |

8.3% | |||

| Health Care Providers & Services |

8.1% | |||

| Real Estate Investment Trust |

6.6% | |||

| Software |

5.9% | |||

| Thrifts & Mortgage Finance |

5.7% | |||

| Pharmaceuticals |

5.7% | |||

| Airlines |

5.2% | |||

| Hotels, Restaurants & Leisure |

4.6% | |||

| IT Services |

4.3% | |||

| Insurance |

3.1% | |||

| Banks |

3.0% | |||

| Electronic Equipment, Instruments & Components |

2.6% | |||

| Real Estate Management & Development |

2.5% | |||

| Food Products |

2.4% | |||

| Textiles, Apparel & Luxury Goods |

2.4% | |||

| Aerospace & Defense |

2.2% | |||

| Building Products |

2.1% | |||

| Semiconductors & Semiconductor Equipment |

1.9% | |||

| Leisure Equipment & Products |

1.7% | |||

| Personal Products |

1.7% | |||

| Chemicals |

1.7% | |||

| Wireless Telecommunication Services |

1.6% | |||

| Machinery |

1.2% | |||

| Professional Services |

1.0% | |||

| Trading Companies & Distributors |

1.0% | |||

| Life Sciences Tools & Services |

0.9% | |||

| Auto Components |

0.9% | |||

| Household Durables |

0.8% | |||

| Health Care Technology |

0.7% | |||

| Internet Software & Services |

0.7% | |||

| Communications Equipment |

0.7% | |||

| Containers & Packaging |

0.7% | |||

| Diversified Consumer Services |

0.6% | |||

| Electric Utilities |

0.6% | |||

| Multi-Utilities |

0.6% | |||

| Commercial Services & Supplies |

0.6% | |||

| Energy Equipment & Services |

0.5% | |||

| Industrial Conglomerates |

0.5% | |||

| Electrical Equipment |

0.4% | |||

| Transportation Infrastructure |

0.4% | |||

| Construction Materials |

0.4% | |||

| Capital Markets |

0.3% | |||

| Consumer Finance |

0.3% | |||

| Short-Term Investments |

0.2% | |||

| Other assets less liabilities |

2.7% | |||

|

|

|

|||

| 100.0% | ||||

|

|

|

See accompanying Notes to Financial Statements.

| 8 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Statement of Assets and Liabilities

September 30, 2015

| Assets: |

||||

| Investments, at value |

$4,597,529 | |||

|

|

|

|

||

| Investments in Affiliates, at value |

128,429 | |||

|

|

|

|

||

| Cash |

36,115 | |||

|

|

|

|

||

| Foreign currency, at value |

79,653 | |||

|

|

|

|

||

| Receivable from Investment Manager |

55,149 | |||

|

|

|

|

||

| Receivable for investments sold |

34,639 | |||

|

|

|

|

||

| Dividends and interest receivable (net of foreign withholding taxes) |

7,990 | |||

|

|

|

|

||

| Tax reclaims receivable |

183 | |||

|

|

|

|

||

| Investments in Affiliated Funds - Trustee Deferred Compensation Plan (see Note 4) |

64 | |||

|

|

|

|

||

| Prepaid expenses and other assets |

4,169 | |||

|

|

|

|

||

| Total Assets |

4,943,920 | |||

|

|

|

|

||

| Liabilities: |

||||

| Payable for investments purchased |

17,179 | |||

|

|

|

|

||

| Trustees Deferred Compensation Plan payable (see Note 4) |

64 | |||

|

|

|

|

||

| Accrued expenses and other liabilities |

70,276 | |||

|

|

|

|

||

| Total Liabilities |

87,519 | |||

|

|

|

|

||

| Net Assets |

$4,856,401 | |||

|

|

|

|

||

| Net Assets Consist of: Paid-in-capital |

$5,014,362 | |||

|

|

|

|

||

| Undistributed net investment income |

29,877 | |||

|

|

|

|

||

| Accumulated net realized loss |

(235,939) | |||

|

|

|

|

||

| Net unrealized appreciation |

48,101 | |||

|

|

|

|

||

| Net Assets |

$4,856,401 | |||

|

|

|

|

||

| Cost of Investments |

$4,548,659 | |||

|

|

|

|

||

| Cost of Investments in Affiliates |

$125,221 | |||

|

|

|

|

||

| Cost of Foreign Currency |

$83,570 | |||

|

|

|

|

||

| Shares Issued and Outstanding: |

334,321 | |||

|

|

|

|

||

| Net Asset Value and Redemption Price |

$14.53 | |||

|

|

|

|

||

| * | Net asset value and redemption price per share may not recalculate exactly due to rounding. |

| See accompanying Notes to Financial Statements | 9 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

|

|

|

|||||||

| Period from 12/1/14 | Period from 7/23/14 (2) | |||||||

| through 9/30/15(1) | through 11/30/14 | |||||||

|

|

|

|||||||

| Investment Income: |

||||||||

| Dividends, net of foreign withholding taxes* |

$90,004 | $35,116 | ||||||

|

|

|

|

|

|

||||

| Dividends from investments in Affiliates,net of foreign withholding taxes * |

681 | 976 | ||||||

|

|

|

|

|

|

||||

| Total Investment Income |

90,685 | 36,092 | ||||||

|

|

|

|

|

|

||||

| Expenses: |

||||||||

| Investment management |

38,321 | 15,633 | ||||||

|

|

|

|

|

|

||||

| Legal |

102,524 | 3,562 | ||||||

|

|

|

|

|

|

||||

| Custodian and accounting agent |

94,113 | 19,926 | ||||||

|

|

|

|

|

|

||||

| Audit and tax services |

31,902 | 31,906 | ||||||

|

|

|

|

|

|

||||

| Offering |

25,753 | 14,247 | ||||||

|

|

|

|

|

|

||||

| Shareholder communications |

14,206 | 1,959 | ||||||

| Transfer agent |

2,536 | 2,350 | ||||||

| Trustees |

468 | 213 | ||||||

| Insurance |

106 | – | ||||||

| Excise tax |

61 | – | ||||||

| Organizational |

– | 60,000 | ||||||

| Proxy |

28 | – | ||||||

| Miscellaneous |

2,789 | 3,340 | ||||||

| Total Expenses |

312,807 | 153,136 | ||||||

|

|

|

|

|

|

||||

| Less: Reimbursement from Investment Manager |

(260,824) | (132,292) | ||||||

|

|

|

|

|

|

||||

| Net Expenses |

51,983 | 20,844 | ||||||

|

|

|

|

|

|

||||

| Net Investment Income |

38,702 | 15,248 | ||||||

| Realized and Change in Unrealized Gain (Loss): |

| |||||||

| Net realized loss on: |

(103,734) | (96,797) | ||||||

| Investments in Affiliates |

(31,399) | (4,905) | ||||||

| Foreign currency transactions |

(6,171) | (2,644) | ||||||

| Net change in unrealized |

38,463 | 10,407 | ||||||

| Investments in Affiliates |

24,148 | (20,940) | ||||||

| Foreign currency transactions |

(2,993) | (984) | ||||||

| Net realized and change in unrealized loss |

(81,686) | (115,863) | ||||||

| Net Decrease in Net Assets Resulting from Investment Operations |

$(42,984) | $(100,615) | ||||||

| *Foreign withholding taxes |

$5,740 | $3,272 | ||||||

| (1) | Fiscal year end changed from November 30th to September 30th. |

| (2) | Commencement of operations. |

| See accompanying Notes to Financial Statements |

10 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities

Statements of Changes in Net Assets

|

| ||||||||||

| Period from | ||||||||||

| Period from 12/1/14 | 7/23/14(2) through | |||||||||

| through 9/30/15(1) | 11/30/14 | |||||||||

|

|

| |||||||||

| (Decrease) in Net Assets from: |

||||||||||

| Investment Operations: |

||||||||||

| Net investment income |

$38,702 | $15,248 | ||||||||

|

|

|

|

|

|

||||||

| Net realized loss |

(141,304) | (104,346) | ||||||||

|

|

|

|

|

|

||||||

| Net change in unrealized appreciation/depreciation |

59,618 | (11,517) | ||||||||

|

|

|

|

|

|

||||||

| Net decrease in net assets resulting from investment operations |

(42,984) | (100,615) | ||||||||

|

|

|

|

|

|

||||||

| Dividends to Shareholders from Net investment income: |

(14,423) | – | ||||||||

|

|

|

|

|

|

||||||

| Fund Share Transactions: |

||||||||||

| Issued in reinvestment of dividends |

14,423 | – | ||||||||

|

|

|

|

|

|

||||||

| Total decrease in net assets |

(42,984) | (100,615) | ||||||||

|

|

|

|

|

|

||||||

| Net Assets: |

||||||||||

| Beginning of period |

4,899,385 | 5,000,000 | ||||||||

|

|

|

|

|

|

||||||

| End of period* |

$4,856,401 | $4,899,385 | ||||||||

|

|

|

|

|

|

||||||

| *Including undistributed net investment income of: |

$29,877 | $13,155 | ||||||||

|

|

|

|

|

|

||||||

| Shares issued in reinvestment of dividends |

988 | – | ||||||||

|

|

|

|

|

|

||||||

| (1) | Fiscal year end changed from November 30th to September 30th. |

| (2) | Commencement of operations. |

| See accompanying Notes to Financial Statements | 11 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

For a share outstanding throughout each period:

|

| ||||

| Period from | ||||

| Period from | 7/23/14(2) | |||

| 12/1/14 through | through | |||

| 9/30/15(1) | 11/30/14 | |||

|

| ||||

| Net asset value, beginning of period |

$14.70 | $15.00 | ||

|

| ||||

| Investment Operations: |

||||

| Net investment income(a) |

0.12 | 0.05 | ||

|

| ||||

| Net realized and change in unrealized loss |

(0.25) | (0.35) | ||

|

| ||||

| Total from investment operations |

(0.13) | (0.30) | ||

|

| ||||

| Dividends to shareholders from net investment income |

(0.04) | - | ||

|

| ||||

| Net asset value, end of period |

$14.53 | $14.70 | ||

|

| ||||

| Total Return(b) |

(0.86)% | (2.00)% | ||

|

| ||||

| RATIOS/SUPPLEMENTAL DATA: |

||||

| Net assets, end of period (000s) |

$4,856 | $4,899 | ||

|

| ||||

| Ratio of expenses to average net assets with fee reimbursement(c)(d) |

1.22% | 1.20% | ||

|

| ||||

| Ratio of expenses to average net assets without fee reimbursement(c)(d) |

7.06% | 4.88% | ||

|

| ||||

| Ratio of net investment income to average net assets(c)(d) |

0.91% | 0.88% | ||

|

| ||||

| Portfolio turnover rate |

152% | 56% | ||

|

| ||||

| (1) | Fiscal year end changed from November 30th to September 30th. |

| (2) | Commencement of operations. |

| (a) | Calculated on average shares outstanding. |

| (b) | Total return is calculated assuming a purchase of a share on the first day of the period and a sale of a share on the last day of |

each period reported. Dividends and distributions, if any, are assumed, for purposes of this calculation, to be reinvested. Total return includes the effect of fee waivers and reimbursements. Total return may reflect adjustments to conform to U.S. GAAP. Total return for a period of less than one year is not annualized.

| (c) | Annualized. |

| (d) | Certain expenses incurred were not annualized. |

| See accompanying Notes to Financial Statements | 12 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

September 30, 2015

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

AllianzGI Institutional Multi-Series Trust (the “Trust”) was organized on June 3, 2014, as an open-end registered investment company organized as a Massachusetts business trust, and accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification (“ASC”) Topic 946 Financial Services-Investment Companies. As of September 30, 2015, the Trust consisted of one investment series, AllianzGI Small-Cap Opportunities Portfolio (the “Portfolio”). Allianz Global Investors Fund Management LLC (“AGIFM” or the “Investment Manager”) serves as the Portfolio’s investment manager and Allianz Global Investors U.S. LLC (“AllianzGI U.S.” or the “Sub-Adviser”) serves as the Portfolio’s sub-adviser. AGIFM and AllianzGI U.S. are indirect, wholly-owned subsidiaries of Allianz Asset Management of America L.P. (“AAM”). AAM is an indirect, wholly-owned subsidiary of Allianz SE, a publicly traded European insurance and financial services company. Shares of the Portfolio have not been registered for public sale and are currently offered and sold on a private placement basis in accordance with Rule 506(c) of Regulation D under the Securities Act of 1933, as amended. Currently, the Trust has authorized one class of shares.

The Portfolio sold and issued shares of beneficial interest to Allianz Fund Investments, Inc. (“AFI”), an indirect wholly-owned subsidiary of Allianz SE, during the periods ended September 30, 2015 and November 30, 2014, as indicated:

| Date | Shares | Amount | ||||||||

|

|

||||||||||

| 7/23/14 |

333,333 | $ | 5,000,000 | |||||||

|

|

||||||||||

The investment objective of AllianzGI Global Small-Cap Opportunities is to seek long-term capital appreciation. There can be no assurance that the Portfolio will meet its stated objective.

The preparation of the Portfolio’s financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires the Portfolio’s management to make estimates and assumptions that affect the reported amounts and disclosures in the Portfolio’s financial statements. Actual results could differ from those estimates.

In the normal course of business, the Portfolio enters into contracts that contain a variety of representations that provide general indemnifications. The Portfolio’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Portfolio that have not yet occurred.

In June 2014, the FASB issued an Accounting Standards Update (“ASU”) 2014-11 that expands secured borrowing accounting for certain repurchase agreements. The ASU also sets forth additional disclosure requirements for certain transactions accounted for as sales, in order to provide financial statement users with information to compare to similar transactions accounted for as secured borrowings. ASU 2014-11 became effective for annual periods beginning after December 15, 2014, and for interim periods beginning after March 15, 2015. The adoption of ASU 2014-11 did not have an impact on the Portfolio’s financial statements.

In May 2015, the FASB issued ASU 2015-7 which removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured at net asset value per share (“NAV”) (or its equivalent) using the practical expedient. The ASU 2015-07 is effective for annual periods beginning after December 15, 2015, and interim periods within those annual periods. At this time, management is evaluating the implications of these changes on the Portfolio’s financial statements.

The following is a summary of significant accounting policies consistently followed by the Portfolio:

(a) Valuation of Investments. Portfolio securities and other financial instruments for which market quotations are readily available are stated at market value. Market value is generally determined on the basis of official closing prices, last reported sales prices, or if no sales or closing prices are reported, on the basis of quotes obtained from a quotation reporting system, established market makers, or independent pricing services. The Portfolio’s investments are valued daily using prices supplied by an independent pricing service or broker/dealer quotations, or by using the last sale or settlement price on the exchange that is the primary market for such securities, or the mean between the last bid and ask quotations. The market

| 13 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Notes to Financial Statements

September 30, 2015 (continued)

value for NASDAQ Global Market and NASDAQ Capital Market securities may also be calculated using the NASDAQ Official Closing Price instead of the last reported sales price. Independent pricing services use information provided by market makers or estimates of market values obtained from yield data relating to investments or securities with similar characteristics.

The Board of Trustees (the “Board”) has adopted procedures for valuing portfolio securities and other financial instruments in circumstances where market quotations are not readily available (including in cases where available market quotations are deemed to be unreliable), and has delegated primary responsibility for applying the valuation methods to the Investment Manager and the Sub-Adviser. The Trust’s Valuation Committee was established by the Board to oversee the implementation of the Portfolio’s valuation methods and to make fair value determinations on behalf of the Board, as instructed by the Board. The Sub-Adviser monitors the continued appropriateness of methods applied and identifies to the Investment Manager circumstances and events that may require fair valuation. The Investment Manager, in turn, determines if adjustments should be made in light of market changes, events affecting the issuer, or other factors. If the Investment Manager (in consultation with the Sub-Adviser) determines that a valuation method may no longer be appropriate, another valuation method may be selected or the Valuation Committee will be convened to consider the matter and take any appropriate action in accordance with procedures set forth by the Board. The Board shall review and ratify the appropriateness of the valuation methods and these methods may be amended or supplemented from time to time by the Valuation Committee.

Short-term debt instruments maturing in 60 days or less are valued at amortized cost, if their original term to maturity was 60 days or less, or by amortizing premium or discount based on their value on the 61st day prior to maturity, if the original term to maturity exceeded 60 days.

Investments initially valued in currencies other than the U.S. dollar are converted to the U.S. dollar using exchange rates obtained from pricing services. As a result, the NAV of the Portfolio may be affected by changes in the value of currencies in relation to the U.S. dollar. The value of securities traded in markets outside the United States or denominated in currencies other than the U.S. dollar may be affected significantly on a day that the New York Stock Exchange (“NYSE”) is closed.

The prices used by the Portfolio to value investments may differ from the value that would be realized if the investments were sold, and these differences could be material to the Portfolio’s financial statements. The NAV of the Portfolio is normally determined as of the close of regular trading (normally, 4:00 p.m. Eastern time) on the NYSE on each day the NYSE is open for business.

The prices of certain portfolio securities or financial instruments may be determined at a time prior to the close of regular trading on the NYSE. When fair-valuing the securities, the Portfolio may, among other things, consider significant events (which may be considered to include changes in the value of U.S. securities or securities indices) that occur after the close of the relevant market and before the time the NAV of the Portfolio is calculated. With respect to certain foreign securities, the Portfolio may fair-value securities using modeling tools provided by third-party vendors. The Portfolio has retained a statistical research service to assist in determining the fair value of foreign securities. This service utilizes statistics and programs based on historical performance of markets and other economic data to assist in making fair value estimates. Fair value estimates used by the Portfolio for foreign securities may differ from the value realized from the sale of those securities and the difference could be material to the financial statements. Fair value pricing may require subjective determinations about the value of a security or other assets, and fair values used to determine the NAV of the Portfolio may differ from quoted or published prices, or from prices that are used by others, for the same investments. In addition, the use of fair value pricing may not always result in adjustments to the prices of securities or other assets held by the Portfolio.

(b) Fair Value Measurements. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly transaction between market participants. The three levels of the fair value hierarchy are described below:

| ● | Level 1 – quoted prices in active markets for identical investments that the Portfolio has the ability to access |

| ● | Level 2 – valuations based on other significant observable inputs, which may include, but are not limited to, quoted prices for similar assets or liabilities, interest rates, yield curves, volatilities, prepayment speeds, loss severities, credit risks and default rates or other market corroborated inputs |

| 14 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Notes to Financial Statements

September 30, 2015 (continued)

| ● | Level 3 – valuations based on significant unobservable inputs (including the Sub-Adviser’s or Valuation Committee’s own assumptions and securities whose price was determined by using a single broker’s quote) |

The valuation techniques used by the Portfolio to measure fair value during the period ended September 30, 2015 were intended to maximize the use of observable inputs and to minimize the use of unobservable inputs.

The Portfolio’s policy is to recognize transfers between levels at the end of the reporting period. An investment asset’s or liability’s level within the fair value hierarchy is based on the lowest level input, individually or in aggregate, that is significant to the fair value measurement. The objective of fair value measurement remains the same even when there is a significant decrease in the volume and level of activity for an asset or liability and regardless of the valuation techniques used. Investments categorized as Level 1 or 2 as of period end may have been transferred between Levels 1 and 2 since the prior period due to changes in the valuation method utilized in valuing the investments.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following are certain inputs and techniques that the Portfolio generally uses to evaluate how to classify each major category of assets and liabilities within Level 2 and Level 3, in accordance with U.S. GAAP.

Equity Securities (Common and Preferred Stock) — Equity securities traded in inactive markets and certain foreign equity securities are valued using inputs which include broker-dealer quotes, recently executed transactions adjusted for changes in the benchmark index, or evaluated price quotes received from independent pricing services that take into account the integrity of the market sector and issuer, the individual characteristics of the security, and information received from broker-dealers and other market sources pertaining to the issuer or security. To the extent that these inputs are observable, the values of equity securities are categorized as Level 2. To the extent that these inputs are unobservable, the values are categorized as Level 3.

A summary of the inputs used at September 30, 2015 in valuing the Portfolio’s assets and liabilities is listed below (refer to the Schedule of Investments for more detailed information on Investments in Securities):

| Level 2 - | Level 3 - | |||||||||||||||

| Other Significant | Significant | |||||||||||||||

| Level 1 - | Observable | Unobservable | Value at | |||||||||||||

| Quoted Prices | Inputs | Inputs | 9/30/15 | |||||||||||||

|

|

||||||||||||||||

| Investments in Securities - Assets |

||||||||||||||||

| Common Stock: |

||||||||||||||||

| Australia |

— | $ | 221,702 | — | $ | 221,702 | ||||||||||

| Belgium |

— | 15,959 | — | 15,959 | ||||||||||||

| China |

$ | 34,486 | 87,031 | — | 121,517 | |||||||||||

| Denmark |

— | 54,705 | — | 54,705 | ||||||||||||

| France |

26,615 | 86,698 | — | 113,313 | ||||||||||||

| Germany |

— | 84,080 | — | 84,080 | ||||||||||||

| Hong Kong |

— | 86,810 | — | 86,810 | ||||||||||||

| India |

43,322 | 32,923 | — | 76,245 | ||||||||||||

| Italy |

— | 18,402 | — | 18,402 | ||||||||||||

| Japan |

— | 426,385 | — | 426,385 | ||||||||||||

| Korea (Republic of) |

— | 117,907 | — | 117,907 | ||||||||||||

| New Zealand |

— | 34,593 | — | 34,593 | ||||||||||||

| Poland |

— | 88,545 | — | 88,545 | ||||||||||||

| South Africa |

15,516 | 29,373 | — | 44,889 | ||||||||||||

| Switzerland |

30,994 | 95,088 | — | 126,082 | ||||||||||||

| Taiwan |

— | 127,956 | — | 127,956 | ||||||||||||

| Thailand |

— | 17,331 | — | 17,331 | ||||||||||||

| United Kingdom |

19,113 | 257,295 | — | 276,408 | ||||||||||||

| All Other |

2,663,856 | — | — | 2,663,856 | ||||||||||||

| Short-Term Investments |

— | 9,273 | — | 9,273 | ||||||||||||

|

|

||||||||||||||||

| Totals |

$ | 2,833,902 | $ | 1,892,056 | — | $ | 4,725,958 | |||||||||

|

|

||||||||||||||||

At September 30, 2015, the Portfolio had transfers of $49,966 from Level 1 to Level 2. This transfer was a result of securities trading outside the U.S. whose values were not adjusted by the application of a modeling tool at November 30, 2014, which was applied on September 30, 2015.

| 15 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Notes to Financial Statements

September 30, 2015 (continued)

(c) Investment Transactions and Investment Income. Investment transactions are accounted for on the trade date. Realized gains and losses on investments are determined on an identified cost basis. Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date, except for certain dividends from foreign securities where the ex-dividend date may have passed, and then are recorded as soon after the ex-dividend date as the Portfolio, using reasonable diligence, become aware of such dividends. Dividend and interest income on the Statement of Operations are shown net of any foreign taxes withheld on income from foreign securities. Payments received from real estate investment trust securities may be comprised of dividends, realized gains and return of capital. The payment may initially be recorded as dividend income and may subsequently be reclassified as realized gains and/or return of capital upon receipt of information from the issuer. Payments considered return of capital reduce the cost basis of the respective security.

(d) Federal Income Taxes. The Portfolio intends to distribute all of their taxable income and to comply with the other requirements of Subchapter M of the U.S. Internal Revenue Code of 1986, as amended, applicable to regulated investment companies. Accordingly, no provision for U.S. federal income taxes is required. The Portfolio may be subject to excise tax based on distributions to shareholders.

Accounting for uncertainty in income taxes establishes for all entities, including pass-through entities such as the Portfolio, a minimum threshold for financial statement recognition of the benefit of positions taken in filing tax returns (including whether an entity is taxable in a particular jurisdiction), and requires certain expanded tax disclosures. In accordance with provisions set forth under U.S. GAAP, the Investment Manager has reviewed the Portfolio’s tax positions for all open tax years. As of September 30, 2015, the Portfolio has recorded no liability for net unrecognized tax benefits relating to uncertain income tax positions they have taken. The Portfolio’s federal income tax returns since inception remain subject to examination by the Internal Revenue Service.

(e) Dividends and Distributions to Shareholders. The Portfolio declares dividends and distributions from net investment income and net realized capital gains, if any, annually. The Portfolio records dividends and distributions to their respective shareholders on the ex-dividend date. The amount of dividends from net investment income and distributions from net realized capital gains is determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These “book-tax” differences are considered either temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the capital accounts based on their federal income tax treatment; temporary differences do not require reclassification. To the extent dividends and/or distributions exceed current and accumulated earnings and profits for federal income tax purposes, they are reported as dividends and/or distributions to shareholders from return of capital.

(f) Foreign Currency Translation. The Portfolio’s accounting records are maintained in U.S. dollars as follows: (1) the foreign currency market values of investments and other assets and liabilities denominated in foreign currencies are translated at the prevailing exchange rate at the end of the period; and (2) purchases and sales, income and expenses are translated at the prevailing exchange rate on the respective dates of such transactions. The resulting net foreign currency gain (loss) is included in the Portfolio’s Statement of Operations.

The Portfolio does not generally isolate that portion of the results of operations arising as a result of changes in foreign currency exchange rates from the fluctuations arising from changes in the market prices of securities. Accordingly, such foreign currency gain (loss) is included in net realized and unrealized gain (loss) on investments. However, the Portfolio does isolate the effect of fluctuations in foreign currency exchange rates when determining the gain (loss) upon the sale or maturity of foreign currency denominated debt obligations pursuant to U.S. federal income tax regulations; such amount is categorized as foreign currency gain (loss) for both financial reporting and income tax reporting purposes.

(g) Repurchase Agreements. The Portfolio is a party to Master Repurchase Agreements (“Master Repo Agreements”) with select counterparties. The Master Repo Agreements maintain provisions for initiation, income payments, events of default, and maintenance of collateral.

The Portfolio enters into transactions, under the Master Repo Agreements, with its custodian bank or securities brokerage firms whereby it purchases securities under agreements to resell such securities at an agreed upon price and date (“repurchase agreements”). The Portfolio, through its custodian, takes possession of securities collateralizing the repurchase agreement.

| 16 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Notes to Financial Statements

September 30, 2015 (continued)

Such agreements are carried at the contract amount in the financial statements, which is considered to represent fair value. Collateral pledged (the securities received), which consists primarily of U.S. government obligations and asset-backed securities, is held by the custodian bank for the benefit of the Portfolio until maturity of the repurchase agreement. Provisions of the repurchase agreements and the procedures adopted by the Portfolio requires that the market value of the collateral, including accrued interest thereon, be sufficient in the event of default by the counterparty. If the counterparty defaults under the Master Repo Agreements and the value of the collateral declines or if the counterparty enters an insolvency proceeding, realization of the collateral by the Portfolio may be delayed or limited.

(h) Organizational and Offering Costs. Organizational costs are expensed at the inception of the Portfolio. Offering costs are amortized over a twelve-month period from the inception of the Portfolio.

2. PRINCIPAL RISKS

In the normal course of business, the Portfolio trades financial instruments and enters into financial transactions where risk of potential loss exists due to, among other things, changes in the market (market risk) or failure of the other party to a transaction to perform (counterparty risk). The Portfolio is also exposed to other risks such as, but not limited to, interest rate, foreign currency, credit and leverage risks.

To the extent the Portfolio directly invests in foreign currencies or in securities that trade in, and receive revenues in, foreign currencies, or in derivatives that provide exposure to foreign currencies, it will be subject to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of hedging positions, that the U.S. dollar will decline in value relative to the currency being hedged. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including economic growth, inflation, changes in interest rates, intervention (or the failure to intervene) by U.S. or foreign governments, central banks or supranational entities such as the International Monetary Fund, or the imposition of currency controls or other political developments in the United States or abroad. As a result, the Portfolio’s investments in foreign currency-denominated securities may reduce the returns of the Portfolio. The local emerging markets currencies in which the Portfolio may be invested may experience substantially greater volatility against the U.S. dollar than the major convertible currencies in developed countries.

The Portfolio is subject to elements of risk not typically associated with investments in the U.S., due to concentrated investments in foreign issuers located in a specific country or region. Such concentrations will subject the Portfolio to additional risks resulting from future political or economic conditions in such country or region and the possible imposition of adverse governmental laws or currency exchange restrictions affecting such country or region, which could cause the securities and their markets to be less liquid and prices more volatile than those of comparable U.S. companies.

The market values of securities may decline due to general market conditions (market risk) which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, adverse changes to credit markets or adverse investor sentiment. They may also decline due to factors that affect a particular industry or industries, such as labor shortages or increased production costs and competitive conditions within an industry. Equity securities and equity-related investments generally have greater market price volatility than fixed income securities, although under certain market conditions fixed income securities may have comparable or greater price volatility. Credit ratings downgrades may also negatively affect securities held by the Portfolio. Even when markets perform well, there is no assurance that the investments held by the Portfolio will increase in value along with the broader market. In addition, market risk includes the risk that geopolitical events will disrupt the economy on a national or global level.

The Portfolio is exposed to counterparty risk, or the risk that an institution or other entity with which the Portfolio has unsettled or open transactions will default. The potential loss to the Portfolio could exceed the value of the financial assets recorded in the Portfolio’s financial statements. Financial assets, which potentially expose the Portfolio to counterparty risk, consist principally of cash due from counterparties and investments. The Sub-Adviser seeks to minimize the Portfolio’s counterparty risk by performing reviews of each counterparty and by minimizing concentration of counterparty risk by undertaking transactions with multiple customers and counterparties on recognized and reputable exchanges. Delivery of securities sold is only made once the Portfolio has received payment. Payment is made on a purchase once the securities have been delivered by the counterparty. The trade will fail if either party fails to meet its obligation.

| 17 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Notes to Financial Statements

September 30, 2015 (continued)

3. FINANCIAL DERIVATIVE INSTRUMENTS

Disclosure about derivatives and hedging activities requires qualitative disclosure regarding objectives and strategies for using derivatives, quantitative disclosure about fair value amounts of gains and losses on derivatives, and disclosure about credit-risk-related contingent features in derivative agreements. The disclosure requirements distinguish between derivatives which are accounted for as “hedges”, and those that do not qualify for such accounting. Although the Portfolio at times uses derivatives for hedging purposes, the Portfolio reflects derivatives at fair value and recognizes changes in fair value through the Portfolio’s Statement of Operations, and such derivatives do not qualify for hedge accounting treatment.

Forward Foreign Currency Contracts. A forward foreign currency contract is an agreement between two parties to buy and sell a currency at a set exchange rate on a future date. The Portfolio enters into these contracts for purposes of increasing exposure to a foreign currency or shifting exposure to foreign currency fluctuations from one country to another. The market value of a forward foreign currency contract fluctuates with changes in foreign currency exchange rates. All commitments are marked to market daily at the applicable exchange rates and any resulting unrealized appreciation or depreciation is recorded. Realized gains or losses are recorded at the time the forward contract matures or by delivery of the currency. Risks may arise upon entering into these contracts from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar. In addition, these contracts may involve market risk in excess of the unrealized appreciation (depreciation) reflected in the Portfolio’s Statement of Assets and Liabilities.

The following is a summary of the Portfolio’s derivatives categorized by risk exposure.

The effect of derivatives on the Statement of Operations for the period ended September 30, 2015:

| Location | Foreign Exchange Contracts |

|||||

|

| ||||||

| Net realized gain on: |

||||||

| Foreign currency transactions (forward foreign currency contracts) |

$ | 1,458 | ||||

|

| ||||||

There was no effect of derivatives on the Statement of Operations for the period ended November 30, 2014 as the Portfolio did not have any derivative activity during the year.

4. INVESTMENT MANAGER/DISTRIBUTOR FEES/DEFERRED COMPENSATION

Investment Management Fee. The Portfolio has an Investment Management Agreement (the “Agreement”) with the Investment Manager. Subject to the supervision of the Trust’s Board, the Investment Manager is responsible for managing, either directly or through others selected by it, the Portfolio’s investment activities, business affairs and administrative matters. Pursuant to the Agreement, the Investment Manager receives an annual fee, payable monthly (net of any fee waivers, reimbursements and recoupment), at an annual rate of 0.90% of the Portfolio’s average daily net assets.

The Investment Manager has retained the Sub-Adviser to manage the Portfolio’s investments. Subject to the supervision of the Investment Manager, the Sub-Adviser is responsible for making all of the Portfolio’s investment decisions. The Investment Manager, not the Portfolio, pays a portion of the fees it receives as Investment Manager to the Sub-Adviser in return for its services.

Distribution Fees. Allianz Global Investors Distributors LLC (the “Distributor”), an indirect, wholly owned subsidiary of AAM, the Investment Manager and the Sub-Adviser serves as the distributor of the Portfolio’s shares pursuant to a Distribution Contract. The Distributor currently receives no compensation in connection with the services it provides under the Distribution Contract.

Deferred Compensation. Trustees do not currently receive any pension or retirement benefits from the Trust. The Trust has adopted a deferred compensation plan for the Trustees that went into place at the beginning of this calendar year and permits the Trustees to defer their receipt of compensation from the Trust, at their election, in accordance with the terms of the plan. Under the plan, each Trustee may elect not to receive all or a portion of his or her fees from the Trust on a current basis but to

| 18 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Notes to Financial Statements

September 30, 2015 (continued)

receive in a subsequent period chosen by the Trustee an amount equal to the value of such compensation if such compensation had been invested in one or more series of Allianz Funds Multi-Strategy Trust or Allianz Funds selected by the Trustees from and after the normal payment dates for such compensation. The deferred compensation program is structured such that the Trust remains in substantially the same financial position whether Trustee fees are paid when earned or deferred.

5. EXPENSE LIMITATION AND RECOUPMENT

The Portfolio and the Investment Manager have entered into an Expense Limitation Agreement. The Investment Manager has contractually agreed, until March 31, 2016, to irrevocably waive its management fee and/or reimburse the Portfolio, to the extent that, Total Annual Portfolio Operating Expenses, excluding interest, taxes, and extraordinary expenses, and certain credits and other expenses, exceed 1.20%. Under the Expense Limitation Agreement, the Investment Manager may recoup waived or reimbursed amounts for three years, provided total expenses, including such recoupment, do not exceed the annual expense limit in effect at the time of such reimbursements. The Expense Limitation Agreement is terminable by the Trust upon 90 days’ prior written notice to the Investment Manager or at any time by mutual agreement of the parties.

During the periods ended November 30, 2014 and September 30, 2015, the Investment Manager did not recoup any expenses from the Portfolio. The following represents the amounts that still can be recouped by the Investment Manager:

| Unrecouped Expenses Waived/Reimbursed through | ||||||||||||

| Fiscal Year ended | ||||||||||||

|

|

|

|||||||||||

| 11/30/2014 | 9/30/2015 | Totals | ||||||||||

|

|

|

|||||||||||

| AllianzGI Global Small-Cap Opportunities |

$ 132,292 | $ 260,824 | $ 393,116 | |||||||||

6. INVESTMENTS IN SECURITIES

For the period ended September 30, 2015, purchases and sales of investments, other than short-term securities were $7,391,977 and $7,466,481, respectively.

7. INCOME TAX INFORMATION

At September 30, 2015, the components of distributable earnings were:

|

Ordinary Income |

||||

| AllianzGI Global Small-Cap Opportunities |

$ | 29,788 | ||

The tax character of dividends and distributions paid was:

| Period ended | Period or Year ended | |||||||

| September 30, 2015 | November 30, 2014 | |||||||

|

|

|

|

|

|||||

| Ordinary Income | Ordinary Income | |||||||

|

|

|

|

|

|||||

| AllianzGI Global Small-Cap Opportunities |

$ | 14,423 | $ | - | ||||

| At September 30, 2015, capital loss carryforward amounts were: | ||||||||

| No Expiration(1) | ||||||||

|

|

|

|||||||

|

Short-Term |

Long-Term | |||||||

|

|

|

|||||||

| AllianzGI Global Small-Cap Opportunities |

$ | 235,613 | $ | - | ||||

| (1) | Carryforward amounts are subject to the provision of the Regulated Investment Company Modernization Act of 2010. |

| 19 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Notes to Financial Statements

September 30, 2015 (continued)

For the period ended September 30, 2015, permanent “book-tax” adjustments were:

| Undistributed | ||||||||||||

| (Dividends in Excess | Accumulated Net | |||||||||||

| of) Net Investment | Realized | |||||||||||

| Income | Gain(Loss) | Paid-in Capital | ||||||||||

|

|

|

|||||||||||

| AllianzGI Global Small-Cap Opportunities (a)(b)(c)(d) |

$ | (7,557) | $ | 7,618 | $ | (61) | ||||||

These permanent “book-tax” differences were primarily attributable to:

| (a) | Reclassification of non-deductible expenses |

| (b) | Reclassifications related to investments in Real Estate Investment Trusts (REITs) |

| (c) | Reclassification of gains and losses from foreign currency transactions |

| (d) | Reclassification of gains from securities classified as Passive Foreign Investment Companies (“PFICs”) for tax purposes |

Net investment income, net realized gains or losses and net assets were not affected by these adjustments.

At September 30, 2015, the aggregate cost basis and the net unrealized appreciation (depreciation) of investments for federal income tax purposes were:

| Net Unrealized | ||||||||||||||||

| Federal Tax Cost | Unrealized | Unrealized | Appreciation | |||||||||||||

| Basis(2) | Appreciation | Deprecation | (Depreciation) | |||||||||||||

|

|

|

|||||||||||||||

| AllianzGI Global Small-Cap Opportunities |

$ | 4,674,053 | $ | 329,300 | $ | 277,395 | $ | 51,905 | ||||||||

(2) Differences, if any, between book and tax cost basis are primarily attributable to wash sale loss deferrals, and return of capital distributions from REITs.

8. SIGNIFICANT ACCOUNT HOLDERS

From time to time, a Portfolio may have a concentration of shareholders, which may include the Investment Manager or affiliates of the Investment Manager, holding a significant percentage of shares outstanding. Investment activities of these shareholders could have a material impact to the Portfolio.

At September 30, 2015, AFI held 100% of the outstanding shares in the Portfolio.

9. AFFILIATED TRANSACTIONS

An affiliate includes any company in which a Sub-Adviser owns 5% or more of a company’s outstanding voting securities at any point during the fiscal year.

The table below represents transactions in and earnings from these affiliated issuers during the period ended September 30, 2015:

| Market Value 11/30/2014 |

Purchases at Cost |

Proceeds from Sales |

Unrealized Appreciation (Depreciation) |

Market Value 9/30/2015 |

Dividend Income |

Net Realized Gain(Loss) |

||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

| Aareal Bank AG |

$ | — | $ | 89,319 | $ | — | $ | (5,239) | $ | 84,080 | $ | — | $ | — | ||||||||||||||

| Andersons, Inc. † |

55,661 | — | (55,042) | — | — | — | (11,982) | |||||||||||||||||||||

| Cal-Maine Foods, Inc. † |

36,017 | — | (31,351) | — | — | 217 | (10,123) | |||||||||||||||||||||

| Cembra Money Bank AG†† |

— | 15,428 | — | (644) | 14,784 | — | — | |||||||||||||||||||||

| Meritor, Inc. †,†† |

22,387 | — | (18,775) | — | — | — | (2,460) | |||||||||||||||||||||

| Select Medical Holdings Corp. † |

44,733 | — | (42,018) | — | — | 182 | (6,834) | |||||||||||||||||||||

| SimCorp A/S †† |

— | 20,474 | — | 9,091 | 29,565 | 282 | — | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Totals |

$ | 158,798 | $ | 125,221 | $ | (147,186) | $ | 3,208 | $ | 128,429 | $ | 681 | $ | (31,399) | ||||||||||||||

|

|

|

|||||||||||||||||||||||||||

† Not affiliated at September 30, 2015.

†† Not affiliated at November 30, 2014.

| 20 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Notes to Financial Statements

September 30, 2015 (continued)

The tables below represents earnings from affiliated issuers during the period ended November 30, 2014:

| Dividend | Net Realized | |||||||

| Income | Gain(Loss) | |||||||

|

|

||||||||

| Andersons, Inc. |

$ | 193 | $ | (4,905) | ||||

| Cal-Maine Foods, Inc. |

164 | — | ||||||

| Select Medical Holdings Corp. |

619 | — | ||||||

|

|

|

|||||||

| Totals |

$ | 976 | $ | (4,905) | ||||

|

|

|

|||||||

The percentages and market values below represent portfolio holdings that were considered affiliated at September 30, 2015:

| Market Value | ||||||||

| Sub- | as a | |||||||

| Adviser’s | % of Fund’s | |||||||

| Issuer Name | % Holding | Market Value | Net Assets | |||||

|

| ||||||||

| Aareal Bank AG |

8.01% | $ | 84,080 | 1.73% | ||||

| Cembra Money Bank AG |

6.01% | 14,784 | 0.30% | |||||

| SimCorp A/S |

13.04% | 29,565 | 0.61% | |||||

|

| ||||||||

| Totals |

$ | 128,429 | 2.64% | |||||

|

| ||||||||

10. FUND EVENTS

On September 28, 2015, AllianzGI U.S. Unconstrained Equity Portfolio liquidated as series of the Trust.

11. BORROWINGS

On July 31, 2015, the Trust entered into a new credit agreement (the “Northern Trust Agreement”), among the Trust, AllianzGI Funds Multi-Strategy Trust, Allianz Funds and Premier Multi-Series VIT, as borrowers (collectively, the “AllianzGI Borrowers” and each series thereof, an “AllianzGI Borrower Fund”), and Northern Trust Company, as lender, for a committed line of credit. The Northern Trust Agreement has a 364 day term and permits the AllianzGI Borrowers to borrow up to $200 million in aggregate, subject to (i) a requirement that each AllianzGI Borrower Fund’s asset coverage with respect to senior securities representing indebtedness be 300% or higher, and (ii) certain other limitations and conditions. Each AllianzGI Borrower Fund will pay interest on any amounts borrowed under the facility at the greater of (i) the federal funds overnight rate plus 1.00% or (ii) 1.50%, subject to upward adjustment when any past-due payments are outstanding. The AllianzGI Borrowers will also pay a usage fee at an annualized rate of 0.15% on undrawn amounts, allocated pro rata among the AllianzGI Borrower Funds on the basis of net assets. Amounts borrowed may be repaid and reborrowed on a revolving basis during the term of the facility.

The Portfolio did not utilize the line of credit during the period ended September 30, 2015.

12. SUBSEQUENT EVENTS

In preparing these financial statements, the Portfolio’s management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued.

Effective October 30, 2015, AllianzGI Advanced Core Bond Portfolio commenced operations as a series of the Trust.

There were no other subsequent events identified that require recognition or disclosure.

| 21 | Annual Report / September 30, 2015 |

Table of Contents

AllianzGI Global Small-Cap Opportunities Portfolio

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Trustees of AllianzGI Institutional Multi-Series Trust