Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

By and Among

GLOBAL NET LEASE, INC.,

GLOBAL NET LEASE OPERATING PARTNERSHIP,

L.P.,

MAYFLOWER ACQUISITION LLC,

AMERICAN REALTY CAPITAL GLOBAL TRUST II,

INC.

and

AMERICAN REALTY CAPITAL

GLOBAL II OPERATING PARTNERSHIP, L.P.

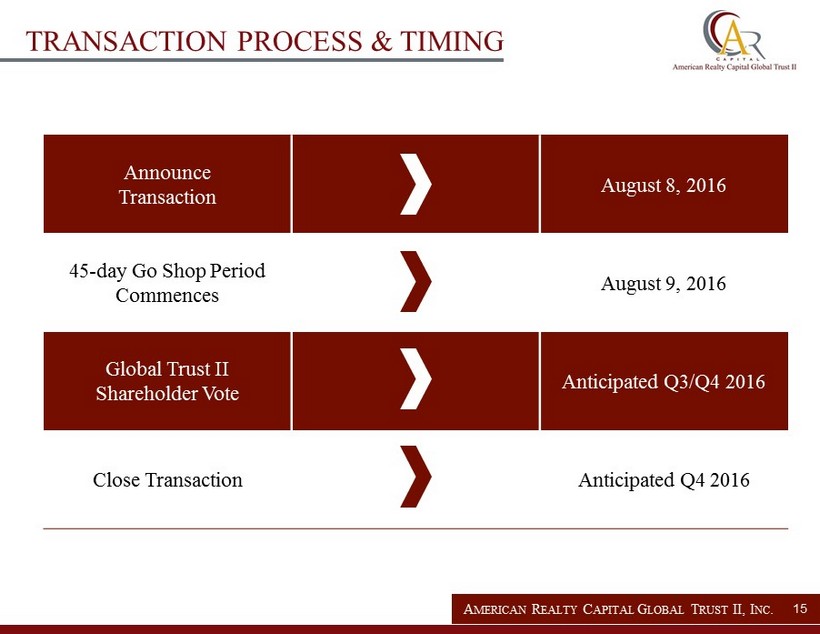

Dated as of August 8, 2016

TABLE OF CONTENTS

| |

|

Page |

| |

|

|

| Article I |

| |

|

|

| DEFINITIONS |

| |

|

|

| Section 1.1 |

Definitions |

3 |

| |

|

|

| Article II |

| |

|

|

| THE MERGERS |

| |

|

|

| Section 2.1 |

The Mergers |

15 |

| Section 2.2 |

Closing |

16 |

| Section 2.3 |

Effective Time |

16 |

| Section 2.4 |

Organizational Documents |

17 |

| Section 2.5 |

Tax Consequences |

17 |

| Section 2.6 |

Subsequent Actions |

17 |

| |

|

|

| Article III |

| |

|

|

| EFFECT OF THE MERGERS |

| |

|

|

| Section 3.1 |

Effect of the Mergers |

18 |

| Section 3.2 |

Exchange Fund; Exchange Agent |

20 |

| Section 3.3 |

Share Transfer Books |

20 |

| Section 3.4 |

Dividends with Respect to Parent Common Stock |

20 |

| Section 3.5 |

Termination of Exchange Fund |

21 |

| Section 3.6 |

No Liability |

21 |

| Section 3.7 |

Company Restricted Stock |

21 |

| Section 3.8 |

Withholding Rights |

21 |

| Section 3.9 |

Lost Certificates |

22 |

| Section 3.10 |

Dissenters’ Rights |

22 |

| Section 3.11 |

Fractional Shares |

22 |

| |

|

|

| Article IV |

| |

|

|

| REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

| |

|

|

| Section 4.1 |

Organization and Qualification; Subsidiaries |

23 |

| Section 4.2 |

Organizational Documents |

24 |

| Section 4.3 |

Capital Structure |

25 |

| Section 4.4 |

Authority |

26 |

| Section 4.5 |

No Conflict; Required Filings and Consents |

27 |

| Section 4.6 |

Permits; Compliance with Law |

28 |

| Section 4.7 |

SEC Filings; Financial Statements |

29 |

| Section 4.8 |

Disclosure Documents |

31 |

| Section 4.9 |

Absence of Certain Changes or Events |

32 |

| Section 4.10 |

Employee Benefit Plans and Service Providers |

32 |

| Section 4.11 |

Labor and Employment Matters |

33 |

| Section 4.12 |

Material Contracts |

33 |

| Section 4.13 |

Litigation |

35 |

| Section 4.14 |

Environmental Matters |

35 |

| Section 4.15 |

Intellectual Property |

36 |

| Section 4.16 |

Properties |

37 |

| Section 4.17 |

Taxes |

41 |

| Section 4.18 |

Insurance |

44 |

| Section 4.19 |

Opinion of Financial Advisor |

44 |

| Section 4.20 |

Takeover Statutes |

44 |

| Section 4.21 |

Vote Required |

45 |

| Section 4.22 |

Brokers |

45 |

| Section 4.23 |

Investment Company Act |

45 |

| Section 4.24 |

Affiliate Transactions |

45 |

| Section 4.25 |

Fees Contemplated by the Mergers |

45 |

| Section 4.26 |

No Other Representations or Warranties |

45 |

| |

|

|

| Article V |

| |

|

|

| REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB |

| |

|

|

| Section 5.1 |

Organization and Qualification; Subsidiaries |

46 |

| Section 5.2 |

Organizational Documents |

47 |

| Section 5.3 |

Capital Structure |

48 |

| Section 5.4 |

Authority |

49 |

| Section 5.5 |

No Conflict; Required Filings and Consents |

50 |

| Section 5.6 |

Permits; Compliance with Law |

51 |

| Section 5.7 |

SEC Filings; Financial Statements |

52 |

| Section 5.8 |

Disclosure Documents |

54 |

| Section 5.9 |

Absence of Certain Changes or Events |

54 |

| Section 5.10 |

Employee Benefit Plans and Service Providers |

55 |

| Section 5.11 |

Labor and Employment Matters |

55 |

| Section 5.12 |

Material Contracts |

56 |

| Section 5.13 |

Litigation |

57 |

| Section 5.14 |

Environmental Matters |

58 |

| Section 5.15 |

Intellectual Property |

59 |

| Section 5.16 |

Properties |

59 |

| Section 5.17 |

Taxes |

62 |

| Section 5.18 |

Insurance |

66 |

| Section 5.19 |

Vote Required |

66 |

| Section 5.20 |

Brokers |

66 |

| Section 5.21 |

Investment Company Act |

66 |

| Section 5.22 |

Ownership of Merger Sub; No Prior Activities |

67 |

| Section 5.23 |

Takeover Statutes |

67 |

| Section 5.24 |

Affiliate Transactions |

67 |

| Section 5.25 |

Fees Contemplated by the Mergers |

67 |

| Section 5.26 |

Opinion of Financial Advisor |

67 |

| Section 5.27 |

No Other Representations or Warranties |

67 |

| |

|

|

| Article VI |

| |

|

|

| COVENANTS AND AGREEMENTS |

| |

|

|

| Section 6.1 |

Conduct of Business by the Company |

68 |

| Section 6.2 |

Conduct of Business by Parent and Merger Sub |

73 |

| Section 6.3 |

Preparation of Form S-4 and Joint Proxy Statement; Stockholder Meetings |

76 |

| Section 6.4 |

Access to Information; Confidentiality |

78 |

| Section 6.5 |

Company Acquisition Proposals. |

79 |

| Section 6.6 |

Parent Change in Recommendation |

84 |

| Section 6.7 |

Appropriate Action; Consents; Filings |

84 |

| Section 6.8 |

Notification of Certain Matters; Transaction Litigation |

86 |

| Section 6.9 |

Public Announcements |

87 |

| Section 6.10 |

Directors’ and Officers’ Indemnification and Insurance |

87 |

| Section 6.11 |

Certain Tax Matters |

89 |

| Section 6.12 |

Dividends |

89 |

| Section 6.13 |

Merger Sub |

90 |

| Section 6.14 |

Section 16 Matters |

90 |

| Section 6.15 |

Stock Exchange Listing |

90 |

| Section 6.16 |

Voting of Shares |

90 |

| Section 6.17 |

Termination of Plans |

90 |

| Section 6.18 |

FIRPTA |

91 |

| Section 6.19 |

Board of Directors of Parent |

91 |

| |

|

|

| Article VII |

| |

|

|

| CONDITIONS |

| |

|

|

| Section 7.1 |

Conditions to the Obligations of Each Party |

91 |

| Section 7.2 |

Conditions to the Obligations of Parent and Merger Sub |

92 |

| Section 7.3 |

Conditions to the Obligations of the Company |

93 |

| |

|

|

| Article VIII |

| |

|

|

| TERMINATION, AMENDMENT AND WAIVER |

| |

|

|

| Section 8.1 |

Termination |

94 |

| Section 8.2 |

Notice of Termination; Effect of Termination |

96 |

| Section 8.3 |

Termination Fee |

97 |

| Section 8.4 |

Amendment |

100 |

| Section 8.5 |

Waiver |

100 |

| Section 8.6 |

Fees and Expenses |

100 |

| Section 8.7 |

Transfer Taxes |

100 |

| |

|

|

| Article IX |

| |

|

|

| GENERAL PROVISIONS |

| |

|

|

| Section 9.1 |

Non-Survival of Representations and Warranties |

101 |

| Section 9.2 |

Notices |

101 |

| Section 9.3 |

Interpretation; Certain Definitions |

102 |

| Section 9.4 |

Severability |

103 |

| Section 9.5 |

Assignment; Delegation |

103 |

| Section 9.6 |

Entire Agreement |

103 |

| Section 9.7 |

No Third-Party Beneficiaries |

103 |

| Section 9.8 |

Specific Performance; Non-Recourse |

104 |

| Section 9.9 |

Counterparts |

104 |

| Section 9.10 |

Governing Law |

104 |

| Section 9.11 |

Consent to Jurisdiction |

105 |

| Section 9.12 |

WAIVER OF JURY TRIAL |

106 |

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND

PLAN OF MERGER, dated as of August 8, 2016 (this “Agreement”), is made by and among GLOBAL NET LEASE, INC.,

a Maryland corporation (“Parent”), GLOBAL NET LEASE OPERATING PARTNERSHIP, L.P., a Delaware limited partnership

and the operating partnership of Parent (the “Parent Operating Partnership”), MAYFLOWER ACQUISITION LLC, a Maryland

limited liability company and direct wholly owned subsidiary of Parent (“Merger Sub”), AMERICAN REALTY CAPITAL

GLOBAL TRUST II, INC., a Maryland corporation (the “Company”) and AMERICAN REALTY CAPITAL GLOBAL II OPERATING

PARTNERSHIP, L.P., a Delaware limited partnership and the operating partnership of the Company (the “Company Operating

Partnership”).

WITNESSETH:

WHEREAS, the Company

is a Maryland corporation operating as a real estate investment trust for U.S. federal income tax purposes that holds interests

in properties through the Company Operating Partnership and is the sole general partner of the Company Operating Partnership;

WHEREAS, Parent is

a Maryland corporation operating as a real estate investment trust for U.S. federal income tax purposes that holds interests in

properties through the Parent Operating Partnership and is the sole general partner of the Parent Operating Partnership;

WHEREAS, the parties

hereto wish to effect a business combination transaction in which (i) the Company will be merged with and into Merger Sub, with

Merger Sub being the surviving entity (the “Merger”), and each outstanding share of common stock, $0.01 par

value per share, of the Company (the “Company Common Stock”), will be converted into the right to receive the

Merger Consideration, upon the terms and subject to the conditions set forth in this Agreement and in accordance with the MGCL

and the MLLCA, and (ii) the Company Operating Partnership will be merged with and into the Parent Operating Partnership, with the

Parent Operating Partnership being the surviving entity (the “Partnership Merger” and together with the Merger,

the “Mergers”), and each outstanding Company Partnership Unit will be converted into the right to receive the

Partnership Merger Consideration, upon the terms and subject to the conditions set forth in this Agreement and in accordance with

the DRULPA;

WHEREAS, the Company

Board (based on the unanimous recommendation of the Company Special Committee) and the Parent Board (based on the unanimous recommendation

of the Parent Special Committee) have each separately approved this Agreement, the Merger and the other transactions contemplated

by this Agreement and declared that this Agreement, the Merger and the other transactions contemplated by this Agreement are advisable

on substantially the terms and conditions set forth herein;

WHEREAS, the Company,

as the sole general partner of the Company Operating Partnership, and Parent, as the sole general partner of the Parent Operating

Partnership, have each separately approved this Agreement, the Partnership Merger and the other transactions contemplated by this

Agreement and declared that this Agreement, the Partnership Merger and the other transactions contemplated by this Agreement are

advisable;

WHEREAS, Parent, as

the sole general partner of the Parent Operating Partnership, has approved this Agreement, the Partnership Merger, and the other

transactions contemplated by this Agreement;

WHEREAS, the Company

Board has directed that the Merger and, to the extent stockholder approval is required, the other transactions contemplated by

this Agreement be submitted for consideration at a meeting of the Company’s stockholders and has resolved to recommend that

the Company’s stockholders vote to approve the Merger and, to the extent stockholder approval is required, the other transactions

contemplated by this Agreement;

WHEREAS, the Parent

Board has directed that the issuance of shares of Parent Common Stock in connection with the Merger be submitted for consideration

at a meeting of Parent’s stockholders and has resolved to recommend that Parent’s stockholders vote to approve such

issuance;

WHEREAS, Parent, in

its capacity as the sole member of Merger Sub, has taken all actions required for the execution of this Agreement by Merger Sub

and to adopt and approve this Agreement and to approve the consummation by Merger Sub of the Merger and the other transactions

contemplated by this Agreement;

WHEREAS, concurrently

with the execution and delivery of this Agreement the Company, the Company Operating Partnership, the Company Advisor, and certain

other parties entered into a Termination Agreement pursuant to which the parties thereto agreed to terminate, among other things,

the Advisory Agreement concurrently with the consummation of the transactions contemplated by this Agreement;

WHEREAS, for U.S. federal

income tax purposes, it is intended that the Merger shall qualify as a “reorganization” under, and within the meaning

of, Section 368(a) of the Code, and this Agreement is intended to be and is adopted as a “plan of reorganization” for

the Merger for purposes of Sections 354 and 361 of the Code;

WHEREAS, for U.S. federal

income tax purposes, it is intended that the Partnership Merger shall qualify as and constitute an “asset-over” form

of merger under Treasury Regulations Section 1.708-1(c)(3)(i) with the Surviving Partnership as the continuation of the Parent

Operating Partnership and the termination of the Company Operating Partnership; and

WHEREAS, each of the

parties hereto desire to make certain representations, warranties, covenants and agreements in connection with the Mergers, and

also to prescribe various conditions to the Mergers.

NOW, THEREFORE, in

consideration of the foregoing and the mutual representations, warranties and covenants and subject to the conditions herein contained,

and intending to be legally bound hereby, the parties hereto hereby agree as follows:

Article I

DEFINITIONS

Section 1.1 Definitions.

(a) For

purposes of this Agreement:

“Acceptable

Confidentiality Agreement” shall mean a confidentiality agreement with such terms at least as favorable in the aggregate

to the Company Parties as the Confidentiality Agreement; provided that such confidentiality agreement shall permit compliance with

Section 6.5 or any other provision of this Agreement and need not contain any standstill or similar provision restricting

or prohibiting the making or modification of any Acquisition Proposal.

“Action”

shall mean any claim, action, suit, proceeding, arbitration, mediation or other investigation.

“Advisory

Agreement” shall mean the Advisory Agreement, dated as of August 26, 2014, between the Company, the Company Operating

Partnership and the Advisor, as amended by the First Amendment to Advisory Agreement dated March 22, 2016, and as further amended,

modified or supplemented through the date hereof.

“Affiliate”

of a specified Person shall mean a Person who, directly or indirectly through one or more intermediaries, controls, is controlled

by, or is under common control with, such specified Person.

“Benefit Plan”

shall mean (a) any “employee benefit plan” (within the meaning of Section 3(3) of ERISA), or (b) any employment,

consulting, termination, severance, change in control, separation, retention stock option, restricted stock, profits interest unit,

outperformance, stock purchase, deferred compensation, bonus, incentive compensation, fringe benefit, health, medical, dental,

disability, accident, life insurance, welfare benefit, cafeteria, vacation, paid time off, perquisite, retirement, pension, or

savings or any other compensation or employee benefit plan, agreement, program, policy or other arrangement, whether or not subject

to either (i) ERISA or (ii) in respect to the Company Subsidiaries (and, in respect thereto, excluding any mandatory governmental

pension or welfare schemes, plans, or arrangements pursuant to the domestic laws of that jurisdiction, where applicable), any law,

regulation, rule, program, or policy in any relevant jurisdiction of the European Union.

“Business

Day” shall mean any day other than a Saturday, Sunday or a day on which all banking institutions in New York, New York

are authorized or obligated by Law or executive order to close (provided that, with respect to filings made with the SEC, a day

on which a filing is to be made is a Business Day only if the SEC is open to accept filings).

“Code”

shall mean the U.S. Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder.

“Company Advisor”

shall mean American Realty Capital Global II Advisors, LLC, a Delaware limited liability company.

“Company Class

B Unit” shall mean a Company Partnership Unit designated by the Company Operating Partnership as a Class B Unit under

the Company Partnership Agreement.

“Company Distribution

Rate” shall mean $0.0048497270.

“Company GP

Unit” shall mean a Company Partnership Unit designated by the Company Operating Partnership as a GP Unit under the Company

Partnership Agreement.

“Company Intervening

Event” shall mean a material event, circumstance, change or development that was not known to the Company Board prior

to the execution of this Agreement (or if known, the consequences of which were not known or reasonably foreseeable), which event

or circumstance, or any material consequence thereof, becomes known to the Company Board prior to the Effective Time; provided,

however, that in no event shall the receipt, existence or terms of an Acquisition Proposal or any matter relating thereto

or consequence thereof constitute a Company Intervening Event.

“Company LP

Unit” shall mean a Company Partnership Unit held by any Person other than the Company.

“Company Material

Adverse Effect” shall mean any event, circumstance, change or effect (a) that is material and adverse to the business,

assets, properties, liabilities, financial condition or results of operations of the Company and the Company Subsidiaries, taken

as a whole or (b) that will, or would reasonably be expected to, prevent or materially impair the ability of the Company to

consummate the Mergers before the Outside Date; provided, however, that for purposes of clause (a) “Company

Material Adverse Effect” shall not include any event, circumstance, change or effect to the extent arising out of or resulting

from (i) any failure of the Company to meet any projections or forecasts or any decrease in the net asset value of the Company

Common Stock (it being understood and agreed that any event, circumstance, change or effect giving rise to such failure or decrease

shall be taken into account in determining whether there has been a Company Material Adverse Effect), (ii) any events, circumstances,

changes or effects that affect the commercial real estate REIT industry generally, (iii) any changes in the United States

or global economy or capital, financial or securities markets generally, including changes in interest or exchange rates, (iv) any

changes in the legal or regulatory conditions, (v) the commencement, escalation or worsening of a war or armed hostilities

or the occurrence of acts of terrorism or sabotage, (vi) the negotiation, execution or announcement of this Agreement, or

the consummation or anticipation of the Mergers or other transactions contemplated hereby, (vii) the taking of any action

expressly required by, or the failure to take any action expressly prohibited by, this Agreement, or the taking of any action at

the written request or with the prior written consent of the Parent Special Committee, (viii) earthquakes, hurricanes or other

natural disasters, (ix) any damage or destruction of any Company Property that is substantially covered by insurance, or (x) changes

in Law or GAAP, which in the case of each of clauses (ii), (iii), (iv), (v) and (x) do not disproportionately affect the Company

and the Company Subsidiaries, taken as a whole, relative to other similarly situated participants in the commercial real estate

REIT industry in the United States, and in the case of clause (viii) do not disproportionately affect the Company and the

Company Subsidiaries, taken as a whole, relative to other participants in the commercial real estate REIT industry in the geographic

regions in which the Company and the Company Subsidiaries operate or own or lease properties.

“Company OP

Unit” shall mean a Company Partnership Unit designated by the Company Operating Partnership as an OP Unit under the Company

Partnership Agreement.

“Company Parties”

means the Company and the Company Operating Partnership.

“Company Partnership

Agreement” shall mean the Amended and Restated Agreement of Limited Partnership of the Company Operating Partnership,

dated August 10, 2015, as amended by the First Amendment, dated March 22, 2016, as further amended, modified or supplemented from

time to time.

“Company Partnership

Unit” shall have the same meaning as Partnership Unit as set forth in the Company Partnership Agreement.

“Company Related

Party” shall mean the Company and each of its affiliates and their and their respective affiliates’ stockholders,

partners, members, officers, directors, employees, controlling persons, agents and representatives.

“Company Restricted

Stock” shall mean any shares of Company Common Stock granted pursuant to the Company Restricted Stock Plan which are

subject to restrictions on transfer or forfeiture.

“Company Restricted

Stock Plan” shall mean the Company’s employee and director incentive restricted share plan.

“Company Special

Committee” shall mean the special committee of the independent directors of the Company.

“Company Stockholder

Meeting” shall mean the meeting of the holders of shares of Company Common Stock for the purpose of seeking the Company

Stockholder Approval, including any postponement or adjournment thereof.

“Company Subsidiary”

shall mean (a) any corporation of which more than fifty percent (50%) of the outstanding voting securities is, directly or

indirectly, owned by the Company, and (b) any partnership, limited liability company, joint venture or other entity of which

more than fifty percent (50%) of the total equity interest is, directly or indirectly, owned by the Company or of which the Company

or any Company Subsidiary is a general partner, manager, managing member or the equivalent, including the Company Operating Partnership.

“Confidentiality

Agreement” shall mean the Mutual Nondisclosure Agreement, dated February 4, 2016, as amended from time to time, between

the Company and Parent.

“control”

(including the terms “controlled by” and “under common control with”) shall mean the possession, directly

or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership

of voting securities, as trustee or executor, by contract or otherwise.

“Debt Financing”

shall have the meaning assigned thereto in the definition of “Financing Sources”.

“Delaware

Secretary” shall mean the Secretary of State of the State of Delaware.

“DRULPA”

shall mean the Delaware Revised Uniform Partnership Act, as amended.

“Environmental

Law” shall mean any Law (including common law) relating to the pollution or protection of the environment (including

air, surface water, groundwater, land surface or subsurface land), or human health or safety (as such matters relate to Hazardous

Substances), including Laws relating to the use, handling, presence, transportation, treatment, storage, disposal, release or discharge

of Hazardous Substances.

“Environmental

Permit” shall mean any permit, approval, license or other authorization required under any applicable Environmental Law.

“ERISA”

shall mean the Employee Retirement Income Security Act of 1974, as amended.

“ERISA Affiliate”

shall mean any entity, trade or business (whether or not incorporated) that, together with any other entity, trade or business

(whether or not incorporated), is required to be treated as a single employer under Section 414(b), (c), (m) or (o) of the Code.

“Exchange

Act” shall mean the Securities Exchange Act of 1934, as amended.

“Exchange

Ratio” shall mean 2.27.

“Expenses”

shall mean all expenses (including all fees and expenses of counsel, accountants, investment bankers, experts and consultants to

a party hereto and its affiliates) incurred by a party or on its behalf in connection with or related to the authorization, preparation,

negotiation, execution and performance of this Agreement, the preparation, printing, and filing of the Form S-4, the preparation,

printing, filing and mailing of the Joint Proxy Statement and all SEC and other regulatory filing fees incurred in connection with

the Form S-4 and the Joint Proxy Statement, the solicitation of stockholder approvals, engaging the services of the Exchange

Agent, obtaining third party consents, any other filings with the SEC and all other matters related to the closing of the Mergers

and the other transactions contemplated by this Agreement.

“Financing

Sources” shall mean the agents, arrangers, lenders and other entities that have committed to provide or arrange or otherwise

entered into agreements in connection with all or any part of the debt financing (“Debt Financing”) contemplated to

be obtained by Parent, including the parties to any joinder agreements, indentures or credit agreements entered into in connection

therewith, together with their respective affiliates and their and their respective affiliates’ officers, directors, employees,

partners, trustees, shareholders controlling persons, agents and representatives and their respective successors and assigns.

“GAAP”

shall mean the United States generally accepted accounting principles.

“Governmental

Authority” shall mean any United States (federal, state or local) or foreign government, arbitration panel, or any governmental

or quasi-governmental, regulatory, judicial or administrative authority, board, bureau, agency, commission or self-regulatory organization.

“Hazardous

Substances” shall mean (i) those substances listed in, defined in or regulated under any Environmental Law, including

the following federal statutes and their state counterparts, as each may be amended from time to time, and all regulations thereunder:

the Resource Conservation and Recovery Act, the Comprehensive Environmental Response, Compensation and Liability Act, the Toxic

Substances Control Act, the Clean Water Act, the Safe Drinking Water Act, the Atomic Energy Act and the Clean Air Act; (ii) petroleum

and petroleum products, including crude oil and any fractions thereof; and (iii) polychlorinated biphenyls, mold, methane,

asbestos, and radon.

“Indebtedness”

shall mean, with respect to any Person, (i) all indebtedness, notes payable, accrued interest payable or other obligations

for borrowed money, whether secured or unsecured, (ii) all obligations under conditional sale or other title retention agreements,

or incurred as financing, in either case with respect to property acquired by such Person, (iii) all obligations issued, undertaken

or assumed as the deferred purchase price for any property or assets, (iv) all obligations under capital leases, (v) all

obligations in respect of bankers acceptances or letters of credit, (vi) all obligations under interest rate cap, swap, collar

or similar transaction or currency hedging transactions, and (vii) any guarantee (other than customary non-recourse carve-out

or “badboy” guarantees) of any of the foregoing, whether or not evidenced by a note, mortgage, bond, indenture or similar

instrument.

“Indemnitee”

shall mean any individual who, on or prior to the Effective Time, was an officer, director, partner, member, trustee or agent of

the Company or served on behalf of the Company as an officer, director, partner, member or trustee of any of the Company Subsidiaries.

“Intellectual

Property” shall mean all United States and foreign (i) patents, patent applications, invention disclosures, and

all related continuations, continuations-in-part, divisionals, reissues, re-examinations, substitutions and extensions thereof,

(ii) trademarks, service marks, trade dress, logos, trade names, corporate names, Internet domain names, design rights and

other source identifiers, together with the goodwill symbolized by any of the foregoing, (iii) copyrightable works and copyrights,

(iv) confidential and proprietary information, including trade secrets, know-how, ideas, formulae, models and methodologies,

(v) all rights in the foregoing and in other similar intangible assets, and (vi) all applications and registrations for

the foregoing.

“Investment

Company Act” shall mean the Investment Company Act of 1940, as amended.

“IRS”

shall mean the United States Internal Revenue Service or any successor agency.

“knowledge”

shall mean the actual knowledge of the following officers and employees of the Company and Parent, as applicable, after inquiry

reasonable under the circumstances: (i) for the Company, each person identified as an executive officer of the Company in

the Company’s 2016 Proxy Statement; and (ii) for Parent, each person identified as an executive officer of Parent on

Parent’s 2016 Proxy Statement.

“Law”

shall mean any and all domestic (federal, state or local) or foreign laws, rules, regulations, orders, judgments or decrees promulgated

by any Governmental Authority.

“Lien”

shall mean with respect to any asset (including any security), any mortgage, deed of trust, claim, condition, covenant, lien, pledge,

charge, security interest, preferential arrangement, option or other third party right (including right of first refusal or first

offer), restriction, right of way, easement, or title defect or encumbrance of any kind in respect of such asset, including any

restriction on the use, voting, transfer, receipt of income or other exercise of any attributes of ownership.

“LTIP Unit”

shall mean a Parent Partnership Unit issued under the Parent OPP Agreement designated by the Parent Operating Partnership as an

LTIP Unit under the Partnership Agreement.

“MGCL”

shall mean the Maryland General Corporation Law.

“MLLCA”

shall mean the Maryland Limited Liability Company Act, as amended.

“NYSE”

shall mean the New York Stock Exchange.

“Order”

shall mean a judgment, order or decree of a Governmental Authority.

“Parent Advisor”

shall mean the Global Net Lease Advisors, LLC.

“Parent Advisory

Agreement” shall mean the Fourth Amended and Restated Advisory Agreement by and among Parent, the Parent Operating Partnership,

and the Parent Advisor.

“Parent Class

B Unit” shall mean a Parent Partnership Unit designated by the Parent Operating Partnership as a Class B Unit under the

Parent Partnership Agreement.

“Parent Intervening

Event” shall mean a material event, circumstance, change or development that was not known to the Parent Board prior

to the execution of this Agreement (or if known, the consequences of which were not known or reasonably foreseeable), which event

or circumstance, or any material consequence thereof, becomes known to the Parent Board prior to the Effective Time.

“Parent Lease”

shall mean each lease and sublease that was in effect as of June 1, 2016 and to which Parent, Merger Sub or the other Parent Subsidiaries

are parties as lessors or sublessors with respect to each of the applicable Parent Properties.

“Parent Material

Adverse Effect” shall mean any event, circumstance, change or effect (a) that is material and adverse to the business,

assets, properties, liabilities, financial condition or results of operations of Parent, Merger Sub and the other Parent Subsidiaries,

taken as a whole or (b) that will, or would reasonably be expected to, prevent or materially impair the ability of Parent

or Merger Sub to consummate the Mergers before the Outside Date; provided, however, that for purposes of clause (a)

“Parent Material Adverse Effect” shall not include any event, circumstance, change or effect to the extent arising

out of or resulting from (i) any failure of Parent to meet any projections or forecasts or any decrease in the market price

of the Parent Common Stock (it being understood and agreed that any event, circumstance, change or effect giving rise to such failure

or decrease shall be taken into account in determining whether there has been a Parent Material Adverse Effect), (ii) any

events, circumstances, changes or effects that affect the commercial real estate REIT industry generally, (iii) any changes

in the United States or global economy or capital, financial or securities markets generally, including changes in interest or

exchange rates, (iv) any changes in the legal or regulatory conditions, (v) the commencement, escalation or worsening

of a war or armed hostilities or the occurrence of acts of terrorism or sabotage, (vi) the negotiation, execution or announcement

of this Agreement, or the consummation or anticipation of the Mergers or other transactions contemplated hereby, (vii) the

taking of any action expressly required by, or the failure to take any action expressly prohibited by, this Agreement, or the taking

of any action at the written request or with the prior written consent of an executive officer of the Company, (viii) earthquakes,

hurricanes or other natural disasters, (ix) any damage or destruction of any Parent Property that is substantially covered

by insurance, or (x) changes in Law or GAAP, which in the case of each of clauses (ii), (iii), (iv), (v) and (x) do not

disproportionately affect Parent and the Parent Subsidiaries, taken as a whole, relative to other similarly situated participants

in the commercial real estate REIT industry in the United States, and in the case of clause (viii) do not disproportionately affect

Parent and the Parent Subsidiaries, taken as a whole, relative to other participants in the commercial real estate REIT industry

in the geographic regions in which Parent and the Parent Subsidiaries operate or own or lease properties.

“Parent OP

Unit” shall mean a Parent Partnership Unit designated by the Parent Operating Partnership as an OP Unit under the Parent

Partnership Agreement.

“Parent OPP

Agreement” shall mean the Second Amended and Restated 2015 Advisor Multi-Year Outperformance Agreement, effective as

of February 25, 2016, among Parent, Parent Operating Partnership, and Parent Advisor.

“Parent Option

Plan” shall mean the American Realty Capital Global Daily Net Asset Value Trust, Inc. 2012 Stock Option Plan.

“Parent Parties”

means Parent, Merger Sub and the Parent Operating Partnership.

“Parent Partnership

Agreement” shall mean the Second Amended and Restated Agreement of Limited Partnership of Parent Operating Partnership,

dated as of June 2, 2015, as amended, modified or supplemented from time to time.

“Parent Partnership

Unit” shall have the same meaning as Partnership Unit as set forth in the Parent Partnership Agreement.

“Parent Restricted

Stock” shall mean any shares of Parent Common Stock granted pursuant to the Parent Restricted Stock Plan which are subject

to restrictions on transfer or forfeiture.

“Parent Restricted

Stock Plan” shall mean the Amended and Restated Incentive Restricted Share Plan of American Realty Capital Global Trust,

Inc.

“Parent Special

Committee” shall mean the special committee of the independent directors of Parent.

“Parent Stockholder

Meeting” shall mean the meeting of the holders of shares of Parent Common Stock for the purpose of seeking the Parent

Stockholder Approval, including any postponement or adjournment thereof.

“Parent Subsidiary”

shall mean (a) any corporation of which more than fifty percent (50%) of the outstanding voting securities is, directly or

indirectly, owned by Parent, and (b) any partnership, limited liability company or other entity of which more than fifty percent

(50%) of the total equity interest is, directly or indirectly, owned by Parent or of which Parent or any Parent Subsidiary is a

general partner, manager, managing member or the equivalent, including the Parent Operating Partnership.

“Parent Title

Insurance Policy” shall mean each policy of title insurance insuring Parent’s or the applicable Parent Subsidiary’s

(or the applicable predecessor’s) title to or leasehold interest in Parent Properties, subject to the matters and printed

exceptions set forth in the Parent Title Insurance Policies.

“Person”

shall mean an individual, corporation, partnership, limited partnership, limited liability company, person (including a “person”

as defined in Section 13(d)(3) of the Exchange Act), trust, association or other entity or a Governmental Authority or a political

subdivision, agency or instrumentality of a Governmental Authority.

“Representative”

shall mean, with respect to any Person, such Person’s directors, officers, employees, consultants, advisors (including attorneys,

accountants, consultants, investment bankers, and financial advisors), agents and other representatives.

“Sarbanes-Oxley

Act” shall mean the Sarbanes-Oxley Act of 2002, as amended.

“SEC”

shall mean the United States Securities and Exchange Commission (including the staff thereof).

“Securities

Act” shall mean the Securities Act of 1933, as amended.

“Service Provider”

shall mean Moor Park Capital Partners LLP.

“Special Limited

Partner” shall mean American Realty Capital Global II Special Limited Partner, LLC.

“Special Limited

Partner Interest” shall mean a Special Limited Partner Interest designated by the Company Operating Partnership as a

Special Limited Partner Interest under the Company Partnership Agreement.

“Tax”

or “Taxes” shall mean any and all federal, state, local or foreign or other taxes of any kind, together with

any interest, penalties and additions to tax, imposed by any Governmental Authority, including taxes on or with respect to income,

franchises, gross receipts, gross income, property, sales, use, transfer, capital stock, payroll, employment, unemployment, alternative

or add on minimum, estimated and net worth, and taxes in the nature of excise, withholding, backup withholding and value added

taxes, whether disputed or not and including any obligation to indemnify or otherwise assume or succeed to the tax liability of

any other Person.

“Tax Return”

shall mean any return, report or similar statement, together with any attached schedule, that is required to be provided to a Governmental

Authority with respect to Taxes, including information returns, refunds claims, amended returns and declarations of estimated Tax.

“Third Party”

shall mean any Person or group of Persons other than Parent, Merger Sub, the Company and their respective Affiliates.

(b) The

following terms shall have the respective meanings set forth in the Section set forth below opposite such term:

| Acceptable Confidentiality Agreement |

Section 1.1(a) |

| Acquisition Proposal |

Section 6.5(h)(i) |

| Action |

Section 1.1(a) |

| Advisory Agreement |

Section 1.1(a) |

| Affiliate |

Section 1.1(a) |

| Agreement |

Preamble |

| Articles of Merger |

Section 2.3(a)(i) |

| Benefit Plan |

Section 1.1(a) |

| Book-Entry Share |

Section 3.1(a)(ii) |

| Business Day |

Section 1.1(a) |

| Certificate |

Section 3.1(a)(ii) |

| Certificate of Merger |

Section 2.3(a)(ii) |

| Closing |

Section 2.2 |

| Closing Date |

Section 2.2 |

| Code |

Section 1.1(a) |

| Company |

Preamble |

| Company Advisor |

Section 1.1(a) |

| Company Board |

Section 4.4(a) |

| Company Bylaws |

Section 4.2(a) |

| Company Change in Recommendation |

Section 6.5(b)(v) |

| Company Change Notice |

Section 6.5(e)(ii)(C) |

| Company Charter |

Section 4.2(a) |

| Company Class B Unit |

Section 1.1(a) |

| Company Common Stock |

Recitals |

| Company Disclosure Letter |

Article IV |

| Company Distribution Rate |

Section 1.1(a) |

| Company GP Unit |

Section 1.1(a) |

| Company Insurance Policies |

Section 4.18 |

| Company Intervening Event |

Section 1.1(a) |

| Company Leases |

Section 4.16(i) |

| Company LP Unit |

Section 1.1(a) |

| Company Material Adverse Effect |

Section 1.1(a) |

| Company Material Contract |

Section 4.12(a) |

| Company OP Unit |

Section 1.1(a) |

| Company Operating Partnership |

Preamble |

| Company Parties |

Section 1.1(a) |

| Company Partnership Agreement |

Section 1.1(a) |

| Company Partnership Unit |

Section 1.1(a) |

| Company Permits |

Section 4.6(a) |

| Company Permitted Liens |

Section 4.16(b) |

| Company Preferred Stock |

Section 4.3(a) |

| Company Properties |

Section 4.16(a) |

| Company Property |

Section 4.16(a) |

| Company Recommendation |

Section 4.4(a) |

| Company REIT Representation Letter |

Section 6.1(b) |

| Company Reorganization Representation Letter |

Section 6.1(b) |

| Company Restricted Stock |

Section 1.1(a) |

| Company Restricted Stock Plan |

Section 1.1(a) |

| Company SEC Filings |

Section 4.7(a) |

| Company Special Committee |

Section 1.1(a) |

| Company Stockholder Approval |

Section 4.21 |

| Company Stockholder Meeting |

Section 1.1(a) |

| Company Subsidiary |

Section 1.1(a) |

| Company Subsidiary Partnership |

Section 4.17(h) |

| Company Tax Protection Agreements |

Section 4.17(h) |

| Company Title Insurance Policy |

Section 4.16(o) |

| Confidentiality Agreement |

Section 1.1(a) |

| control |

Section 1.1(a) |

| D&O Insurance |

Section 6.09(c) |

| Debt Commitment Letter |

Section 9.10 |

| Delaware Secretary |

Section 1.1(a) |

| DRULPA |

Section 1.1(a) |

| Effective Time |

Section 2.3(a) |

| Environmental Law |

Section 1.1(a) |

| Environmental Permit |

Section 1.1(a) |

| ERISA |

Section 1.1(a) |

| ERISA Affiliate |

Section 1.1(a) |

| Exchange Act |

Section 1.1(a) |

| Exchange Agent |

Section 3.2(a) |

| Exchange Fund |

Section 3.2(a) |

| Exchange Ratio |

Section 1.1(a) |

| Expenses |

Section 1.1(a) |

| Fee Recipient |

Section 8.3(f) |

| Form S-4 |

Section 4.5(b) |

| GAAP |

Section 1.1(a) |

| Governmental Authority |

Section 1.1(a) |

| Go Shop Bidder |

Section 6.5(a) |

| Go Shop Period End Time |

Section 6.5(a) |

| Go Shop Termination Fee |

Section 8.3(d)(i) |

| Hazardous Substances |

Section 1.1(a) |

| Indebtedness |

Section 1.1(a) |

| Indemnitee |

Section 1.1(a) |

| Intellectual Property |

Section 1.1(a) |

| Interim Period |

Section 6.1(a) |

| Investment Company Act |

Section 1.1(a) |

| IRS |

Section 1.1(a) |

| Joint Proxy Statement |

Section 4.5(b) |

| Knowledge |

Section 1.1(a) |

| Law |

Section 1.1(a) |

| Lien |

Section 1.1(a) |

| LTIP Unit |

Section 1.1(a) |

| Material Company Leases |

Section 4.16(i) |

| Material Parent Leases |

Section 5.16(h) |

| Merger |

Recitals |

| Merger Consideration |

Section 3.1(a)(ii) |

| Mergers |

Recitals |

| Merger Sub |

Preamble |

| Merger Sub Interests |

Section 3.1(c) |

| MGCL |

Section 1.1(a) |

| MLLCA |

Section 1.1(a) |

| NYSE |

Section 1.1(a) |

| Order |

Section 1.1(a) |

| Other Company Subsidiary |

Section 4.1(c) |

| Other Parent Subsidiary |

Section 5.1(d) |

| Outside Date |

Section 8.1(b)(i) |

| Parent |

Preamble |

| Parent Advisor |

Section 1.1(a) |

| Parent Advisory Agreement |

Section 1.1(a) |

| Parent Board |

Section 5.4(a) |

| Parent Bylaws |

Section 5.2(a) |

| Parent Change in Recommendation |

Section 6.6(a) |

| Parent Charge Notice |

Section 6.6(b) |

| Parent Charter |

Section 5.2(a) |

| Parent Class B Unit |

Section 1.1(a) |

| Parent Common Stock |

Section 3.1(a)(ii) |

| Parent Disclosure Letter |

Article V |

| Parent Insurance Policies |

Section 5.18 |

| Parent Intervening Event |

Section 1.1.(a) |

| Parent Lease |

Section 1.1(a) |

| Parent Material Adverse Effect |

Section 1.1(a) |

| Parent Material Contract |

Section 5.12(a) |

| Parent Operating Partnership |

Preamble |

| Parent OP Unit |

Section 1.1(a) |

| Parent OPP Agreement |

Section 1.1(a) |

| Parent Option Plan |

Section 1.1(a) |

| Parent Parties |

Section 1.1(a) |

| Parent Partnership Agreement |

Section 1.1(a) |

| Parent Partnership Unit |

Section 1.1(a) |

| Parent Permits |

Section 5.6(a) |

| Parent Permitted Liens |

Section 5.16(a) |

| Parent Preferred Stock |

Section 5.3(a) |

| Parent Properties |

Section 5.16(a) |

| Parent Property |

Section 5.16(a) |

| Parent Recommendation |

Section 5.4(a) |

| Parent REIT Representation Letter |

Section 6.2(b) |

| Parent Reorganization Representation Letter |

Section 6.2(b) |

| Parent Restricted Stock |

Section 1.1(a) |

| Parent Restricted Stock Plan |

Section 1.1(a) |

| Parent Recommendation |

Section 5.4(a) |

| Parent SEC Filings |

Section 5.7(a) |

| Parent Special Committee |

Section 1.1(a) |

| Parent Stockholder Approval |

Section 5.19 |

| Parent Stockholder Meeting |

Section 1.1(a) |

| Parent Subsidiary |

Section 1.1(a) |

| Parent Subsidiary Partnership |

Section 5.17(h) |

| Parent Tax Protection Agreements |

Section 5.17(h) |

| Parent Title Insurance Policy |

Section 1.1(a) |

| Partnership Certificate of Merger |

Section 2.3(b) |

| Partnership Merger |

Recitals |

| Partnership Merger Consideration |

Section 3.1(b) |

| Partnership Merger Effective Time |

Section 2.3(b) |

| Paying Party |

Section 8.3(f) |

| Person |

Section 1.1(a) |

| Qualified REIT Subsidiary |

Section 4.1(c) |

| Qualifying Income |

Section 8.3(f) |

| REIT |

Section 4.17(b) |

| Relevant Company Partnership Interest |

Section 4.17(h) |

| Relevant Parent Partnership Interest |

Section 5.17(h) |

| Representative |

Section 1.1(a) |

| Sarbanes-Oxley Act |

Section 1.1(a) |

| SDAT |

Section 2.3(a) |

| SEC |

Section 1.1(a) |

| Securities Act |

Section 1.1(a) |

| Service Provider |

Section 1.1(a) |

| Special Limited Partner |

Section 1.1(a) |

| Special Limited Partner Interest |

Section 1.1(a) |

| Superior Proposal |

Section 6.5(h)(ii) |

| Surviving Entity |

Section 2.1(a) |

| Surviving Partnership |

Section 2.1(b) |

| Tax |

Section 1.1(a) |

| Tax Return |

Section 1.1(a) |

| Taxable REIT Subsidiary |

Section 4.1(c) |

| Taxes |

Section 1.1(a) |

| Termination Date |

Section 8.1 |

| Termination Fee |

Section 8.3(d)(ii) |

| Third Party |

Section 1.1(a) |

| Transfer Taxes |

Section 8.7 |

Article II

THE MERGERS

Section 2.1 The

Mergers.

(a) Upon

the terms and subject to the conditions of this Agreement, and in accordance with the MGCL and the MLLCA, at the Effective Time,

the Company shall be merged with and into Merger Sub, whereupon the separate existence of the Company shall cease, and Merger Sub

shall continue under the name “Mayflower Acquisition LLC” as the surviving entity in the Merger (the “Surviving

Entity”) and shall be governed by the laws of the State of Maryland. The Merger shall have the effects set forth in the

applicable provisions of the MGCL, the MLLCA and this Agreement. Without limiting the generality of the foregoing, and subject

thereto, from and after the Effective Time, the Surviving Entity shall possess all properties, rights, privileges, powers and franchises

of the Company and Merger Sub, and all of the claims, obligations, liabilities, debts and duties of the Company and Merger Sub

shall become the claims, obligations, liabilities, debts and duties of the Surviving Entity.

(b) Upon

the terms and subject to the conditions of this Agreement, and in accordance with the DRULPA, at the Partnership Merger Effective

Time, the Company Operating Partnership shall be merged with and into the Parent Operating Partnership, whereupon the separate

existence of the Company Operating Partnership shall cease, and the Parent Operating Partnership shall continue under the name

“Global Net Lease Operating Partnership, L.P.” as the surviving entity in the Partnership Merger (the “Surviving

Partnership”) and shall be governed by the laws of the State of Delaware. The Partnership Merger shall have the effects

set forth in the applicable provisions of the DRULPA and this Agreement. Without limiting the generality of the foregoing, and

subject thereto, from and after the Partnership Merger Effective Time, the Surviving Partnership shall possess all properties,

rights, privileges, powers and franchises of the Company Operating Partnership and the Parent Operating Partnership, and all of

the claims, obligations, liabilities, debts and duties of the Company Operating Partnership and the Parent Operating Partnership

shall become the claims, obligations, liabilities, debts and duties of the Surviving Partnership (including the obligations of

the Company Operating Partnership under the Company Partnership Agreement).

Section 2.2 Closing.

The closing of the Mergers (the “Closing”) shall occur at 10:00 a.m. (Eastern time), on the third (3rd) Business

Day after all of the conditions set forth in Article VII (other than those conditions that by their terms are required

to be satisfied or waived at the Closing, but subject to the satisfaction or waiver of such conditions) shall have been satisfied

or waived by the party entitled to the benefit of the same or at such other time and date as shall be agreed upon by the parties

hereto. The date on which the Closing occurs is referred to in this Agreement as the “Closing Date”. The Closing

shall take place at the offices of Proskauer Rose LLP, Eleven Times Square, New York, New York 10036-8299, or at such other place

as agreed to by the parties hereto.

Section 2.3 Effective

Time.

(a) Prior

to the Closing, Parent shall prepare and, on the Closing Date, the Company, Parent and Merger Sub shall (i) cause articles

of merger with respect to the Merger (the “Articles of Merger”) to be duly executed and filed with the State

Department of Assessments and Taxation of Maryland (the “SDAT”) as provided under the MGCL, and (ii) make

any other filings, recordings or publications required to be made by the Company or Merger Sub under the MGCL or MLLCA in connection

with the Merger. The Merger shall become effective at the later of the time the Articles of Merger are accepted for record by the

SDAT on the Closing Date or on such other date and time (not to exceed 30 days from the date the Articles of Merger are accepted

for record by the SDAT) as shall be agreed to by the Company and Parent and specified in the Articles of Merger (such date and

time the Merger becomes effective being the “Effective Time”), it being understood and agreed that the parties

hereto shall cause the Effective Time to occur on the Closing Date and prior to the Partnership Merger Effective Time.

(b) Prior

to the Closing, Parent shall prepare and, on the Closing Date, the Company Operating Partnership and the Parent Operating Partnership

shall (i) cause a certificate of merger with respect to the Partnership Merger (the “Partnership Certificate of Merger”)

to be duly executed and filed with the Delaware Secretary as provided under the DRULPA and (ii) make any other filings, recordings

or publications required to be made by the Company Operating Partnership or the Parent Operating Partnership under the DRULPA in

connection with the Partnership Merger. The Partnership Merger shall become effective at such time as the Partnership Certificate

of Merger shall have been duly filed with the Delaware Secretary on the Closing Date or on such other date and time (not to exceed

30 days from the date the Partnership Certificate of Merger is duly filed with the Delaware Secretary) as shall be agreed to by

the Company Operating Partnership and the Parent Operating Partnership and specified in the Partnership Certificate of Merger (such

date and time the Partnership Merger becomes effective being “Partnership Merger Effective Time”), it being

understood and agreed that the parties hereto shall cause the Partnership Merger Effective Time to occur on the Closing Date after

the Effective Time.

(c) If

the consummation of the Merger prior to the consummation of the Partnership Merger (and, therefore, the Effective Time occurring

prior to the Partnership Merger Effective Time), as is contemplated by this Agreement, would cause any of the parties to incur

a materially greater amount of Transfer Taxes than would be incurred if the Merger were consummated following the consummation

of the Partnership Merger (and, therefore, if the Effective Time were to occur following the Partnership Merger Effective Time),

then, notwithstanding anything in this Agreement to the contrary, and with the written consent of Parent and the Company (which

consent shall not be unreasonably withheld, conditioned or delayed), the timing of the consummation of the Merger and Partnership

Merger shall be re-ordered so that the Merger shall occur and be consummated following the consummation of the Partnership Merger

(and, therefore, the Effective Time will occur following the Partnership Merger Effective Time).

Section 2.4 Organizational

Documents. Subject to Section 6.10, at the Effective Time, the articles of organization and limited liability

company agreement of Merger Sub, as in effect immediately prior to the Effective Time, shall be the articles of organization and

limited liability company agreement of the Surviving Entity, until thereafter amended in accordance with applicable Law and the

applicable provisions of such articles of organization and limited liability company agreement. At the Partnership Merger Effective

Time, the certificate of limited partnership of the Parent Operating Partnership and the Parent Partnership Agreement, each as

in effect immediately prior to the Partnership Merger Effective Time shall be the certificate of limited partnership and limited

partnership agreement of the Surviving Partnership, until thereafter amended in accordance with applicable Law and the applicable

provisions of such certificate of limited partnership and partnership agreement.

Section 2.5 Tax

Consequences. It is intended that, for U.S. federal income tax purposes, the Merger shall qualify as a reorganization within

the meaning of Section 368(a) of the Code, and that this Agreement be, and is hereby adopted as, a plan of reorganization purposes

of Sections 354 and 361 of the Code. It is further intended for U.S. federal income tax purposes that (i) the Partnership Merger

shall qualify as and constitute an “asset-over” form of merger under Treasury Regulations Section 1.708-1(c)(3)(i)

with the Surviving Partnership as the continuation of the Parent Operating Partnership and the termination of the Company Operating

Partnership and (ii) the issuance of Parent Common Stock pursuant to the transactions contemplated by this Agreement to each Person

identified on Section 2.5 of the Company Disclosure Letter be treated as the direct purchase by Parent Operating Partnership,

immediately prior to the Partnership Merger, of each Person’s Company LP Units in exchange for the shares of Parent Common

Stock set forth on Section 2.5 of the Company Disclosure Letter; provided, that each such Person consent to such treatment

at or prior to the Partnership Merger Effective Time and Parent Operating Partnership agrees to report such issuance of Parent

Common Stock consistent with this clause (ii) of Section 2.5, all pursuant to Treasury Regulations Section 1.708-1(c)(4).

Section 2.6 Subsequent

Actions.

(a) If

at any time after the Effective Time the Surviving Entity shall determine, in its sole and absolute discretion, that any actions

are necessary or desirable to vest, perfect or confirm of record or otherwise in the Surviving Entity its right, title or interest

in, to or under any of the rights or properties of the Company acquired or to be acquired by the Surviving Entity as a result of,

or in connection with, the Merger or otherwise to carry out this Agreement, then the members, officers and managers of the Surviving

Entity shall be authorized to take all such actions as may be necessary or desirable to vest all right, title or interest in, to

or under such rights or properties in the Surviving Entity or otherwise to carry out this Agreement.

(b) If

at any time after the Partnership Merger Effective Time the Surviving Partnership shall determine, in its sole and absolute discretion,

that any actions are necessary or desirable to vest, perfect or confirm of record or otherwise in the Surviving Partnership its

right, title or interest in, to or under any of the rights or properties of the Company Operating Partnership acquired or to be

acquired by the Surviving Partnership as a result of, or in connection with, the Partnership Merger or otherwise to carry out this

Agreement, then the general partner(s) of the Surviving Partnership shall be authorized to take all such actions as may be necessary

or desirable to vest all right, title or interest in, to or under such rights or properties in the Surviving Partnership or otherwise

to carry out this Agreement.

Article III

EFFECT OF THE MERGERS

Section 3.1 Effect

of the Mergers.

(a) The

Merger. At the Effective Time, by virtue of the Merger and without any action on the part of the parties hereto or any holder

of any capital stock of the Company:

(i) Each

share of Company Common Stock issued and outstanding immediately prior to the Effective Time that is held by any wholly owned Company

Subsidiary, Parent or any Parent Subsidiary shall no longer be outstanding and shall automatically be cancelled and retired and

shall cease to exist, and no payment shall be made with respect thereto.

(ii) Subject

to Section 3.1(d), Section 3.7 and Section 3.8 each share of Company Common Stock (including each share of

Company Restricted Stock) issued and outstanding immediately prior to the Effective Time (other than shares cancelled pursuant

to Section 3.1(a)(i)) shall be cancelled and automatically converted into the right to receive that number of validly issued,

fully paid and nonassessable shares of common stock, par value $0.01 per share, of Parent (“Parent Common Stock”)

equal to the Exchange Ratio (the “Merger Consideration”). All shares of Company Common Stock (including all

shares of Company Restricted Stock), when so converted pursuant to this Section 3.1(a)(ii), shall no longer be outstanding

and shall automatically be cancelled and retired and shall cease to exist, and each holder of a certificate (a “Certificate”)

or book-entry share registered in the transfer books of the Company (a “Book-Entry Share”) that immediately

prior to the Effective Time represented shares of Company Common Stock shall cease to have any rights with respect to such Company

Common Stock other than the right to receive the Merger Consideration in accordance with Section 3.2, including the

right, if any, to receive, pursuant to Section 3.11, cash in lieu of fractional shares of Parent Common Stock into which

such shares of Company Common Stock have been converted pursuant to Section 3.1(a)(ii), together with the amounts, if any,

payable pursuant to Section 3.4.

(b) The

Partnership Merger. Immediately prior to the Partnership Merger Effective Time, the Parent shall contribute to the Parent Operating

Partnership a number of issued, fully paid and nonassessable shares of Parent Common Stock equal to the number of issued and outstanding

Company LP Units times the Exchange Ratio. At the Partnership Merger Effective Time, by virtue of the Partnership Merger and without

any action on the part of the parties hereto or any holder of any equity interests of the Company Operating Partnership, (i) each

Company LP Unit issued and outstanding immediately prior to the Partnership Merger Effective Time shall automatically be exchanged

for a number of validly issued, fully paid and nonassessable shares of Parent Common Stock equal to the Exchange Ratio and (ii)

each Company Partnership Unit other than the Company LP Units shall automatically be converted into a number of Parent OP Units

equal to the Exchange Ratio (collectively, the “Partnership Merger Consideration”). The general partnership

interest of the Parent Operating Partnership shall remain outstanding and constitute the only general partnership interest in the

Surviving Partnership, and the Parent OP Units issued and outstanding immediately prior to the Partnership Merger Effective Time

shall remain outstanding. All Company Partnership Units, when so exchanged or converted pursuant to this Section 3.1(b),

shall no longer be outstanding and shall automatically be cancelled and retired and shall cease to exist, and each former holder

of Company Partnership Units shall cease to have any rights with respect to such Company Partnership Unit other than the right

to receive the Partnership Merger Consideration in accordance with Section 3.2.

(c) Treatment

of Merger Sub Membership Interests. All membership interests of Merger Sub (the “Merger Sub Interests”),

issued and outstanding immediately prior to the Effective Time shall remain as the only membership interests of the Surviving Entity.

(d) Adjustments.

Without limiting the other provisions of this Agreement and subject to Section 6.1(c)(ii) and Section 6.1(c)(iii),

if at any time during the period between the date of this Agreement and the Effective Time, the Company or the Company Operating

Partnership should split, combine or otherwise reclassify the Company Common Stock or Company Partnership Units, or make a dividend

or other distribution in shares of Company Common Stock or Company Partnership Units (including any dividend or other distribution

of securities convertible into Company Common Stock or Company Partnership Units), or engage in a reclassification, reorganization,

recapitalization or exchange or other like change, then (without limiting any other rights of the Parent Parties hereunder), the

Merger Consideration or Partnership Merger Consideration, as applicable, shall be ratably adjusted to reflect fully the effect

of any such change. Without limiting the other provisions of this Agreement and subject to Section 6.2(c)(ii) and Section 6.2(c)(iii),

if at any time during the period between the date of this Agreement and the Effective Time, Parent or the Parent Operating Partnership

should split, combine or otherwise reclassify the Parent Common Stock or Parent Partnership Units, or make a distribution in shares

of Parent Common Stock or Parent Partnership Units (including any dividend or other distribution of securities convertible into

Parent Common Stock or Parent Partnership Units), or engage in a reclassification, reorganization, recapitalization or exchange

or other like change, then the Merger Consideration or Partnership Merger Consideration, as applicable, shall be ratably adjusted

to reflect any such change.

Section 3.2 Exchange

Fund; Exchange Agent; Payment Procedures.

(a) Prior

to the Effective Time, Parent shall appoint a bank or trust company reasonably satisfactory to the Company to act as exchange agent

(the “Exchange Agent”) for the payment and delivery of the Merger Consideration and Partnership Merger Consideration.

On or before the Effective Time, Parent shall deposit, or cause to be deposited, with the Exchange Agent (i) evidence of Parent

Common Stock in book-entry form issuable pursuant to Section 3.1(a)(ii) equal to the Merger Consideration and (ii) cash

in immediately available funds in an amount equal to any cash payable in lieu of the fractional shares pursuant to Section 3.11

(collectively, the “Exchange Fund”). Any interest or other income earned on cash deposited in the Exchange Fund

shall be the sole and exclusive property of Parent and the Surviving Entity and shall be paid to Parent or the Surviving Entity.

(b) As

soon as reasonably practicable after the Effective Time and in any event not later than the fifth Business Day following the Effective

Time, the Exchange Agent shall mail to each holder of record of a Certificate or Book-Entry Share immediately prior to the Effective

Time a form of letter of transmittal (which shall specify that delivery shall be effected, and risk of loss and title to the Certificates

or Book-Entry Shares shall pass, only upon delivery of the Certificates or Book-Entry Shares to the Exchange Agent) and instructions

for use in effecting the surrender of the Certificates or Book-Entry Shares in exchange for the Merger Consideration. Upon proper

surrender of a Certificate or Book-Entry Share for exchange and cancellation to the Exchange Agent, together with a letter of transmittal,

duly completed and validly executed in accordance with the instructions thereto, and such other documents as may be required pursuant

to such instructions, the holder of such Certificate or Book-Entry Share shall be entitled to receive in exchange therefor the

Merger Consideration in respect of the shares of Company Common Stock formerly represented by such Certificate or Book-Entry Share.

No interest will be paid or accrued for the benefit of holders of the Certificates or Book-Entry Shares on the Merger Consideration

payable upon the surrender of the Certificates or Book-Entry Shares.

Section 3.3 Share

Transfer Books. At the Effective Time, the share transfer books of the Company shall be closed, and thereafter there shall

be no further registration of transfers of shares of Company Common Stock. From and after the Effective Time, Persons who held

shares of Company Common Stock immediately prior to the Effective Time shall cease to have rights with respect to such shares,

except as otherwise provided for herein. On or after the Effective Time, any Certificates or Book-Entry Shares presented to the

Exchange Agent or the Surviving Entity for any reason shall be cancelled and exchanged for the Merger Consideration with respect

to the shares of Company Common Stock formerly represented thereby.

Section 3.4 Dividends

with Respect to Parent Common Stock. No dividends or other distributions with respect to Parent Common Stock with a

record date after the Effective Time shall be paid to the holder of any unsurrendered Certificate or Book-Entry Shares with

respect to the shares of Parent Common Stock issuable hereunder, and all such dividends and other distributions shall be paid

by Parent to the Exchange Agent and shall be included in the Exchange Fund, in each case until the surrender of such

Certificate (or affidavit of loss in lieu thereof) or Book-Entry Shares in accordance with this Agreement. Subject to

applicable Laws, following surrender of any such Certificate (or affidavit of loss in lieu thereof) or Book-Entry Shares

there shall be paid to the holder thereof, without interest, (i) the amount of dividends or other distributions with a

record date after the Effective Time theretofore paid with respect to such shares of Parent Common Stock to which such holder

is entitled pursuant to this Agreement and (ii) at the appropriate payment date, the amount of dividends or other

distributions with a record date after the Effective Time but prior to such surrender and with a payment date subsequent to

such surrender payable with respect to such shares of Parent Common Stock.

Section 3.5 Termination

of Exchange Fund. Any portion of the Exchange Fund (including any interest and other income received with respect thereto)

which remains undistributed to the former holders of shares of Company Common Stock on the first anniversary of the Effective

Time shall be delivered to Parent, upon demand, and any former holders of shares of Company Common Stock who have not theretofore

received any Merger Consideration (including any cash in lieu of fractional shares and any applicable dividends or other distributions

with respect to Parent Common Stock) to which they are entitled under this Agreement shall thereafter look only to Parent and

the Surviving Entity for payment of their claims with respect thereto.

Section 3.6 No

Liability. None of Parent, Merger Sub, the Company, the Parent Operating Partnership, the Company Operating Partnership, the

Surviving Entity, the Surviving Partnership or the Exchange Agent, or any employee, officer, director, agent or Affiliate of any

of them, shall be liable to any holder of shares of Company Common Stock in respect of any cash that would have otherwise been

payable in respect of any Certificate or Book-Entry Share from the Exchange Fund delivered to a public official pursuant to any

applicable abandoned property, escheat or similar Law. Any amounts remaining unclaimed by holders of any such shares immediately

prior to the time at which such amounts would otherwise escheat to, or become property of, any Governmental Authority shall, to

the extent permitted by applicable Law, become the property of the Surviving Entity, free and clear of any claims or interest

of any such holders or their successors, assigns or personal representatives previously entitled thereto.

Section 3.7 Company

Restricted Stock. Immediately prior to the Effective Time, any then-outstanding shares of Company Restricted Stock shall become

fully vested and the Company shall be entitled to deduct and withhold such number of shares of Company Common Stock otherwise

deliverable upon such acceleration to satisfy any applicable income and employment withholding Taxes (assuming a fair market value

of a share of Company Common Stock equal to the Exchange Ratio multiplied by the per share closing price of the Parent Common

Stock on the last completed trading day immediately prior to the Closing on the NYSE, as reported in The Wall Street Journal).

All shares of Company Common Stock then-outstanding as a result of the full vesting of the shares of Company Restricted Stock

and the satisfaction of any applicable income and employment withholding Taxes shall have the right to receive the Merger Consideration

in accordance with the terms and conditions of this Agreement. Notwithstanding anything to the contrary contained herein, prior

to the Effective Time, the Company shall take all actions necessary to effectuate the provisions of this Section 3.7.

Section 3.8 Withholding

Rights. Each and any Parent Party, Company Party, the Surviving Entity, the Surviving Partnership or the Exchange Agent,

as applicable, shall be entitled to deduct and withhold from the Merger Consideration, the Partnership Merger Consideration

and/or, otherwise, any other amounts or property otherwise payable or distributable to any Person pursuant to this Agreement

such amounts or property (or portions thereof) as such Parent Party, Company Party, the Surviving Entity, the Surviving

Partnership or the Exchange Agent is required to deduct and withhold with respect to the making of such payment or

distribution under the Code, and the rules and regulations promulgated thereunder, or any provision of applicable Tax Law. To

the extent that amounts are so deducted or withheld and paid over to the appropriate Governmental Authority by a Parent

Party, a Company Party, the Surviving Entity, the Surviving Partnership or the Exchange Agent, as applicable, such withheld

amounts shall be treated for all purposes of this Agreement as having been paid to the Person in respect of which such

deduction and withholding was made by the Parent Party, the Company Party, the Surviving Entity, the Surviving Partnership or

the Exchange Agent, as applicable.

Section 3.9 Lost

Certificates. If any Certificate shall have been lost, stolen or destroyed, then upon the making of an affidavit of that fact

by the Person claiming such Certificate to be lost, stolen or destroyed and, if required by the Surviving Entity, the posting

by such Person of a bond in such reasonable and customary amount as the Surviving Entity may direct, as indemnity against any

claim that may be made against it with respect to such Certificate, the Exchange Agent will issue in exchange for such lost, stolen

or destroyed Certificate, the Merger Consideration to which the holder thereof is entitled pursuant to this Article III.

Section 3.10 Dissenters’

Rights. No dissenters’ or appraisal rights (or rights of an objecting stockholder) shall be available with respect to

the Mergers or the other transactions contemplated by this Agreement.

Section 3.11 Fractional

Shares. No certificate or scrip representing fractional shares of Parent Common Stock shall be issued upon the surrender for

exchange of Certificates or with respect to Book-Entry Shares, and such fractional share interests shall not entitle the owner

thereof to vote or to any other rights of a stockholder of Parent. Notwithstanding any other provision of this Agreement, each

holder of shares of Company Common Stock or Company Partnership Units exchanged or converted pursuant to the Merger who would

otherwise have been entitled to receive a fraction of a share of Parent Common Stock shall receive (aggregating for this purpose

all the shares of Parent Common Stock such holder is entitled to receive hereunder), in lieu thereof, cash, without interest,

in an amount equal to the product of (a) such fractional part of a share of Parent Common Stock, multiplied by (b) the per share