united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

| Investment Company Act file number | 811-22976 |

| Cross Shore Discovery Fund |

| (Exact name of registrant as specified in charter) |

| Ultimus Asset Services, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH | 45246 |

| (Address of principal executive offices) | (Zip code) |

Neil Kuttner, President and Principal Executive Officer

Cross Shore Discovery Fund

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

(Name and address of agent for service)

| Registrant's telephone number, including area code: | 513-587-3400 |

| Date of fiscal year end: | 3/31 | |

| Date of reporting period: | 9/30/2019 |

Item 1. Reports to Stockholders.

Cross Shore Discovery Fund

Semi-Annual Report

September 30, 2019

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting the Fund at (844) 300-7828 or, if you own these shares through a financial intermediary, you may contact your financial intermediary.

You may elect to receive all future reports in paper free of charge. You can inform the Fund that you wish to continue receiving paper copies of your shareholder reports by contacting the Fund at (844) 300-7828. If you own shares through a financial intermediary, you may contact your financial intermediary or follow instructions included with this document to elect to continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds at your financial intermediary.

Cross Shore Capital Management, LLC

111 Great Neck Road

Suite 210

Great Neck, NY 11021

Investment Results (Unaudited)

Total Returns

(For the periods ended September 30, 2019)

Six Months |

One Year |

Since Inception(1) |

|

Cross Shore Discovery Fund |

(0.9)% |

(4.6)% |

4.9% |

S&P 500® Index(2) |

6.1% |

4.3% |

10.3% |

HFRX Equity Hedge Index(3) |

1.8% |

(1.4)% |

1.0% |

The returns shown do not reflect the deduction of taxes that a shareholder would pay on Cross Shore Discovery Fund (“Fund”) distributions or the redemption of Fund shares. |

|||

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. All performance figures are presented net of fees. Performance reflects any fee waivers during the applicable periods. If such fee waivers had not occurred, the quoted performance would have been lower.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained at www.crossshorefunds.com or by calling (844) 300-7828. The prospectus should be read carefully before investing. The Fund is distributed by Unified Financial Securities, LLC (Member FINRA).

|

(1) |

For the period from January 2, 2015 (inception date of the Fund) to September 30, 2019. Performance for more than one year is annualized. |

|

(2) |

The S&P 500® Index (“S&P 500”) is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. The index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. The S&P 500 returns assume reinvestment of all distributions and does not reflect the deduction of taxes and fees. Individuals cannot invest directly in the S&P 500. |

|

(3) |

The HFRX Equity Hedge Index (“HFRX”) is made up of hedge funds that have at least $50 million in assets under management, have been actively trading for at least 24 months, are open to new investment (in separately managed accounts), provide transparency, and satisfy Hedge Fund Research’s qualitative screening. The HFRX is a sub-index that focuses on Long/Short strategies and is an investable index. The index is rebalanced quarterly. |

1

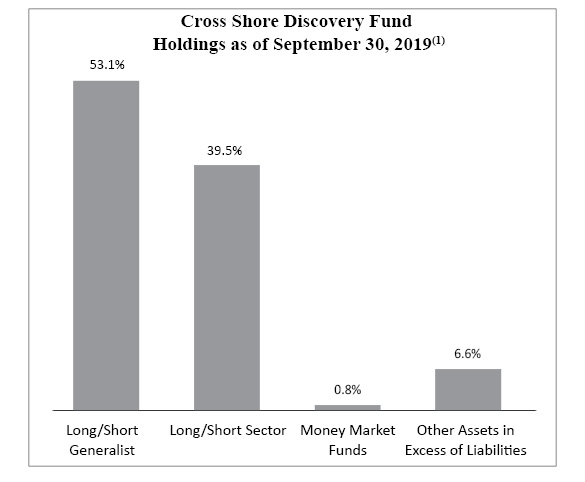

Fund Holdings (Unaudited)

|

1 |

As a percentage of net assets. |

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year within sixty days after the end of the period. The Fund’s portfolio holdings are available on the SEC’s website at http://www.sec.gov.

2

This page is intentionally left blank.

Cross Shore Discovery Fund

Schedule of Investments (Unaudited)

September 30, 2019

Portfolio Funds |

% of |

|||

Long/Short Generalist: |

||||

BBCM Offshore Fund, Ltd., Class A, Series 2019-02 |

4.5 | % | ||

BBCM Offshore Fund, Ltd., Class A, Series 2019-07 |

2.0 | % | ||

Total BBCM Offshore Fund, Ltd. |

6.5 | % | ||

Atika Offshore Fund, Ltd., Class A, Series 1 |

5.8 | % | ||

Atika Offshore Fund, Ltd., Class A, Series 2019-07 |

0.6 | % | ||

Total Atika Offshore Fund, Ltd. |

6.4 | % | ||

Hawk Ridge Partners Offshore, Ltd., Class A, Intial Series |

4.1 | % | ||

Hawk Ridge Partners Offshore, Ltd., Class A, Series 2019-02 |

0.5 | % | ||

Total Hawk Ridge Partners Offshore, Ltd. |

4.6 | % | ||

Vinik Offshore Fund II, Ltd., Class C, Series 2019-03 |

8.5 | % | ||

Rivulet Capital Offshore Fund, Ltd., Class A, Series 2014-05 |

5.4 | % | ||

Shellback Offshore Fund, Ltd., Class D, 2017-04 |

4.9 | % | ||

Bishop Rock Opportunity Offshore, Ltd., Class 2-NR, Series 17 |

4.6 | % | ||

Lomas Capital, Ltd., Class A, Series 15 |

4.3 | % | ||

Thames Absolute Return Offshore Fund, Ltd., Class B-2, Series 2 |

3.3 | % | ||

Marcato Encore International, Ltd., Class C-4, Initial Series |

0.7 | % | ||

Total Long/Short Generalist |

49.2 | % | ||

European Long/Short Generalist: |

||||

Elbe Investors, Ltd., Class A-F, Series 1 |

3.2 | % | ||

Elbe Investors, Ltd., Class A, Series 1 |

0.7 | % | ||

Total European Long/Short Generalist |

3.9 | % | ||

Long/Short Sector: |

||||

Healthcare, Biotechnology |

||||

Avoro Life Sciences Offshore Fund, Ltd., Class A, Series 2017-05 |

5.3 | % | ||

Biomedical Offshore Value Fund, Ltd., Class I, Series 200199-1 |

4.6 | % | ||

Total Healthcare, Biotechnology |

9.9 | % | ||

Healthcare, Consumer |

||||

Armistice Capital Offshore Fund, Ltd., Class A, Series 2019-04B |

0.0 | %(8) | ||

Armistice Capital Offshore Fund, Ltd., Class A2, Series 2015-09B |

0.0 | %(8) | ||

Armistice Capital Offshore Fund, Ltd., Class A2, Series 2013-08B |

0.0 | %(8) | ||

Total Armistice Capital Offshore Fund, Ltd. |

0.0 | %(8) | ||

Financial Services |

||||

Context BH Partners Cayman, LP, Class C |

4.4 | % | ||

Technology, Media and Telecommunications |

||||

Center Lake Capital, Ltd., Class A, Series 2019-05 |

3.6 | % | ||

Center Lake Capital, Ltd., Class A, Series 2019-07 |

0.8 | % | ||

Total Center Lake Capital, Ltd. |

4.4 | % | ||

Whale Rock Flagship Fund, Ltd., Class A-1, Series I00121834 |

6.4 | % | ||

Light Street Xenon, Ltd., Class A1, Series N |

5.7 | % | ||

Atreides Foundation Fund, Ltd., Founders Class, Series F-2 |

4.5 | % | ||

| 16.6 | % | |||

4 |

See accompanying notes which are an integral part of these financial statements. |

Cross Shore Discovery Fund

Schedule of Investments (Unaudited) (continued)

September 30, 2019

Cost(1) |

Fair Value |

Initial |

Redemption |

Next Available |

|||||||||||||||

| $ | 1,700,000 | $ | 1,833,174 | 2/1/2019 | Quarterly | 12/31/2019(3)(4) | |||||||||||||

| 800,000 | 809,089 | 7/1/2019 | Quarterly | 12/31/2019(3)(4) | |||||||||||||||

| 2,500,000 | 2,642,263 | ||||||||||||||||||

| 1,190,187 | 2,353,544 | 1/2/2015 | Quarterly | 12/31/2019 | |||||||||||||||

| 250,000 | 231,443 | 7/1/2019 | Quarterly | 12/31/2019(5) | |||||||||||||||

| 1,440,187 | 2,584,987 | ||||||||||||||||||

| 1,400,000 | 1,659,887 | 2/1/2018 | Quarterly | 12/31/2019 | |||||||||||||||

| 200,000 | 213,459 | 2/1/2019 | Quarterly | 12/31/2019(5) | |||||||||||||||

| 1,600,000 | 1,873,346 | ||||||||||||||||||

| 3,250,000 | 3,459,280 | 3/1/2019 | Quarterly | 12/31/2019(5) | |||||||||||||||

| 1,550,000 | 2,197,819 | 6/1/2015 | Quarterly | 12/31/2019(6) | |||||||||||||||

| 1,509,607 | 1,991,204 | 1/2/2015 | Quarterly | 12/31/2019 | |||||||||||||||

| 1,750,000 | 1,869,063 | 3/1/2019 | Quarterly | 12/31/2019(7) | |||||||||||||||

| 1,445,219 | 1,765,323 | 1/2/2015 | Quarterly | 12/31/2019 | |||||||||||||||

| 1,300,000 | 1,340,159 | 11/1/2017 | Quarterly | 12/31/2019 | |||||||||||||||

| 312,500 | 302,416 | 7/1/2015 | Quarterly | 12/31/2019(6) | |||||||||||||||

| 16,657,513 | 20,025,860 | ||||||||||||||||||

| 1,250,000 | 1,290,242 | 6/1/2017 | Monthly | 10/31/2019 | |||||||||||||||

| 250,000 | 274,148 | 2/1/2019 | Monthly | 10/31/2019 | |||||||||||||||

| 1,500,000 | 1,564,390 | ||||||||||||||||||

| 1,200,000 | 2,169,088 | 5/1/2017 | Quarterly | 12/31/2019 | |||||||||||||||

| 1,600,000 | 1,855,610 | 1/1/2019 | Quarterly | 12/31/2019(7) | |||||||||||||||

| 2,800,000 | 4,024,698 | ||||||||||||||||||

| 17,040 | 16,644 | 4/1/2019 | N/A | (9) | |||||||||||||||

| 4,503 | 6,805 | 9/1/2015 | N/A | (9) | |||||||||||||||

| 3,109 | 5,153 | 1/2/2015 | N/A | (9) | |||||||||||||||

| 24,652 | 28,602 | ||||||||||||||||||

| 1,750,000 | 1,808,345 | 5/1/2018 | Quarterly | 12/31/2019 | |||||||||||||||

| 1,500,000 | 1,444,744 | 5/1/2019 | Semi-Annual | 12/31/2019(7) | |||||||||||||||

| 350,000 | 305,737 | 7/1/2019 | Semi-Annual | 12/31/2019(7) | |||||||||||||||

| 1,850,000 | 1,750,481 | ||||||||||||||||||

| 1,595,147 | 2,619,171 | 4/1/2015 | Quarterly | 12/31/2019 | |||||||||||||||

| 1,541,962 | 2,309,702 | 1/2/2015 | Quarterly | 12/31/2019 | |||||||||||||||

| 1,850,000 | 1,812,281 | 5/15/2019 | Quarterly | 12/31/2019(6)(10) | |||||||||||||||

| 4,987,109 | 6,741,154 | ||||||||||||||||||

See accompanying notes which are an integral part of these financial statements. |

5 |

Cross Shore Discovery Fund

Schedule of Investments (Unaudited) (continued)

September 30, 2019

Portfolio Funds (continued) |

% of |

|||

Long/Short Sector: (continued) |

||||

Utilities |

||||

Electron Global Fund, Ltd., Class A, Series 37 |

3.7 | % | ||

Electron Global Fund, Ltd., Class A, Series 40 |

0.5 | % | ||

Total Electron Global Fund, Ltd. |

4.2 | % | ||

Total Long/Short Sector |

39.5 | % | ||

Total Investments In Portfolio Funds |

92.6 | % | ||

Money Market Funds |

% of |

|||

Fidelity Institutional Money Market Government Portfolio, |

||||

Institutional Class, 1.90%(12) |

0.8 | % | ||

Total Investments |

93.4 | % | ||

Other Assets in Excess of Liabilities |

6.6 | % | ||

Net Assets |

100.0 | % | ||

|

(1) |

There were no unfunded capital commitments as of September 30, 2019. |

|

(2) |

Certain redemptions may be subject to various restrictions and limitations such as redemption penalties on investments liquidated within a certain period subsequent to investment (e.g., a soft lock-up), investor-level gates and/or Portfolio Fund-level gates. Redemption notice periods range from 30 to 120 days. |

|

(3) |

Subject to 6% soft lock during the first year of investment. |

|

(4) |

Subject to 50% investor level quarterly gate. |

|

(5) |

Subject to 3% soft lock during first year of investment. |

|

(6) |

Subject to 25% investor level quarterly gate. |

|

(7) |

Subject to 5% soft lock during the first year of investment. |

|

(8) |

Amount is less than 0.05%. |

|

(9) |

Redemptions are not permitted until the underlying special investments are sold/liquidated. |

|

(10) |

Subject to 5% soft lock during first two years of investment. |

|

(11) |

Subject to 2.5% soft lock during the first year of investment. |

|

(12) |

Rate disclosed is the seven day effective yield as of September 30, 2019. |

6 |

See accompanying notes which are an integral part of these financial statements. |

Cross Shore Discovery Fund

Schedule of Investments (Unaudited) (continued)

September 30, 2019

Cost(1) |

Fair Value |

Initial |

Redemption |

Next Available |

|||||||||||||||

| $ | 1,500,000 | $ | 1,523,963 | 8/1/2018 | Monthly | 10/31/2019 | |||||||||||||

| 200,000 | 203,023 | 2/1/2019 | Monthly | 10/31/2019(11) | |||||||||||||||

| 1,700,000 | 1,726,986 | ||||||||||||||||||

| $ | 13,111,761 | $ | 16,080,266 | ||||||||||||||||

| $ | 31,269,274 | $ | 37,670,516 | ||||||||||||||||

Cost |

Fair Value |

Shares |

|||||||||

| $ | 316,809 | $ | 316,809 | 316,809 | |||||||

| $ | 31,586,083 | $ | 37,987,325 | ||||||||

| $ | 2,666,028 | ||||||||||

| $ | 40,653,353 | ||||||||||

See accompanying notes which are an integral part of these financial statements. |

7 |

Cross Shore Discovery Fund

Statement of Assets and Liabilities

September 30, 2019 (Unaudited)

Assets |

||||

Investments in Portfolio Funds and Money Market Funds, at fair value (cost $31,586,083) |

$ | 37,987,325 | ||

Cash |

2,151,653 | |||

Receivable for Portfolio Funds sold |

618,159 | |||

Total assets |

40,757,137 | |||

Liabilities |

||||

Payable to Adviser |

46,813 | |||

Payable for audit fees |

27,000 | |||

Payable for Chief Compliance Officer (“CCO”) fees |

2,583 | |||

Payable for administration fees |

3,125 | |||

Payable for fund accounting fees |

6,250 | |||

Payable for custody fees |

2,014 | |||

Other accrued expenses |

15,999 | |||

Total liabilities |

103,784 | |||

Net Assets |

$ | 40,653,353 | ||

Net Assets Consist Of |

||||

Paid-in capital |

$ | 40,125,086 | ||

Accumulated earnings |

528,267 | |||

Net Assets |

$ | 40,653,353 | ||

Net Asset Value Per Share |

||||

Institutional Shares (based on 398,574 shares outstanding; 442,805 additional shares registered) |

$ | 102.00 | ||

8 |

See accompanying notes which are an integral part of these financial statements. |

Cross Shore Discovery Fund

Statement of Operations

For the six months ended September 30, 2019 (Unaudited)

Investment Income |

||||

Dividend income |

$ | 7,553 | ||

Expenses |

||||

Investment Adviser |

260,561 | |||

Audit and tax preparation fees |

27,000 | |||

Administration |

18,750 | |||

Legal |

16,250 | |||

Chief Compliance Officer |

15,500 | |||

Fund accounting |

12,500 | |||

Trustee |

11,263 | |||

Custodian |

10,093 | |||

Transfer agent |

10,000 | |||

Miscellaneous |

7,046 | |||

Printing |

6,092 | |||

Registration |

5,601 | |||

Insurance |

4,637 | |||

Total expenses |

405,293 | |||

Recoupment of prior expenses waived/reimbursed by Adviser |

11,605 | |||

Net expenses |

416,898 | |||

Net investment loss |

(409,345 | ) | ||

Realized and Change in Unrealized Gain from Investments in Portfolio Funds |

||||

Net realized gain on sale of investments in Portfolio Funds |

50,820 | |||

Net change in unrealized appreciation/(depreciation) from investments in Portfolio Funds |

(41,723 | ) | ||

Net realized and change in unrealized gain from investments in Portfolio Funds |

9,097 | |||

Net decrease in net assets resulting from operations |

$ | (400,248 | ) | |

See accompanying notes which are an integral part of these financial statements. |

9 |

Cross Shore Discovery Fund

Statements of Changes in Net Assets

For The Six |

For The |

|||||||

Increase/(Decrease) In Net Assets Resulting From Operations |

||||||||

Net investment loss |

$ | (409,345 | ) | $ | (719,963 | ) | ||

Net realized gain on sale of investments in Portfolio Funds |

50,820 | 3,368,673 | ||||||

Net change in unrealized appreciation/(depreciation) from investments in Portfolio Funds |

(41,723 | ) | (1,324,839 | ) | ||||

Net increase/(decrease) in net assets resulting from operations |

(400,248 | ) | 1,323,871 | |||||

Distributions To Shareholders From Earnings |

||||||||

Institutional Shares |

— | (1,373,500 | ) | |||||

Capital Share Transactions - Institutional Shares |

||||||||

Proceeds from issuance of shares |

729,928 | 6,371,136 | ||||||

Reinvestment of distributions |

— | 737,906 | ||||||

Payments for redemption of shares |

(67,958 | ) | (77,239 | ) | ||||

Net increase in net assets resulting from capital share transactions |

661,970 | 7,031,803 | ||||||

Net increase in net assets |

261,722 | 6,982,174 | ||||||

Net assets at beginning of period |

40,391,631 | 33,409,457 | ||||||

Net assets at end of period |

$ | 40,653,353 | $ | 40,391,631 | ||||

Share Transactions - Institutional Shares |

||||||||

Shares issued |

6,913 | 62,286 | ||||||

Reinvestment of distributions |

— | 7,961 | ||||||

Shares redeemed |

(637 | ) | (750 | ) | ||||

Net increase in share transactions |

6,276 | 69,497 | ||||||

10 |

See accompanying notes which are an integral part of these financial statements. |

Cross Shore Discovery Fund

Financial Highlights - Institutional Shares

For The |

For the Year Ended: |

For The |

||||||||||||||||||||||

September |

March 31, |

March 31, |

March 31, |

March 31, |

2015 to |

|||||||||||||||||||

Per Share Operating Performance |

||||||||||||||||||||||||

Net asset value, beginning of period |

$ | 102.96 | $ | 103.50 | $ | 105.77 | $ | 93.21 | $ | 103.50 | $ | 98.99 | ||||||||||||

Investment operations: |

||||||||||||||||||||||||

Net investment loss |

(1.03 | )(2) | (2.09 | )(2) | (2.47 | )(2) | (2.97 | ) | (1.93 | ) | (0.38 | )(2) | ||||||||||||

Net realized and unrealized gains/(losses) from investments in Portfolio Funds |

0.07 | 5.51 | 15.55 | 16.42 | (6.63 | ) | 4.89 | |||||||||||||||||

Net change in net assets resulting from operations |

(0.96 | ) | 3.42 | 13.08 | 13.45 | (8.56 | ) | 4.51 | ||||||||||||||||

Distributions from: |

||||||||||||||||||||||||

Net investment income |

— | (3.96 | ) | (15.35 | ) | (0.89 | ) | (1.73 | ) | — | ||||||||||||||

Net asset value, end of period |

$ | 102.00 | $ | 102.96 | $ | 103.50 | $ | 105.77 | $ | 93.21 | $ | 103.50 | ||||||||||||

Total return(3) |

(0.93 | %)(4) | 3.73 | % | 12.57 | % | 14.49 | % | (8.37 | %) | 4.56 | %(4) | ||||||||||||

Net assets, end of period |

$ | 40,653,353 | $ | 40,391,631 | $ | 33,409,457 | $ | 32,389,358 | $ | 32,097,221 | $ | 16,293,591 | ||||||||||||

Ratios To Average Net Assets |

||||||||||||||||||||||||

Expenses after waiver and reimbursement or recoupment(5) |

2.00 | %(6) | 2.08 | % | 2.25 | % | 2.25 | % | 2.25 | % | 2.25 | %(6) | ||||||||||||

Expenses before waiver and reimbursement or recoupment(5) |

1.95 | %(6) | 2.18 | % | 2.57 | % | 2.72 | % | 2.97 | % | 5.11 | %(6) | ||||||||||||

Net investment loss after waiver and reimbursement or recoupment(5) |

(1.96 | %)(6) | (2.00 | %) | (2.25 | %) | (2.25 | %) | (2.25 | %) | (2.25 | %)(6) | ||||||||||||

Net investment loss before waiver and reimbursement or recoupment(5) |

(1.91 | %)(6) | (2.10 | %) | (2.57 | %) | (2.72 | %) | (2.97 | %) | (5.11 | %)(6) | ||||||||||||

Portfolio turnover rate |

11.32 | %(4) | 32.77 | % | 15.61 | % | 15.01 | % | 2.00 | % | 0.00 | %(4) | ||||||||||||

|

(1) |

The period of the financial highlights is from the date of effectiveness of the Fund’s registration statement under the Investment Company Act of 1940, as amended, and the Securities Act of 1933, as amended, through March 31, 2015. |

|

(2) |

Calculated based on the average shares outstanding during the period. |

|

(3) |

Total return represents the rate an investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions, if any. |

|

(4) |

Not annualized. |

|

(5) |

The ratios do not reflect the Fund’s proportionate share of income, expenses and incentive allocations of the underlying Portfolio Funds. |

|

(6) |

Annualized. |

See accompanying notes which are an integral part of these financial statements. |

11 |

Cross Shore Discovery Fund

Notes to the Financial Statements

September 30, 2019

1. Organization

Cross Shore Discovery Fund (the “Fund”) was organized on May 21, 2014 as a Delaware statutory trust. The Fund commenced operations on January 2, 2015. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a non-diversified closed-end management investment company and offers interests (“Shares”) registered under the 1940 Act and the Securities Act of 1933, as amended. The Fund’s initial registration under the 1940 Act and the Securities Act of 1933 became effective on January 30, 2015. The Fund operates as a “fund of hedge funds”. The Fund provides investors access to a variety of professionally managed private investment funds (“hedge funds”) that predominately employ equity long/short strategies (each a “Portfolio Fund”). The Portfolio Funds are not registered under the 1940 Act and are generally organized outside of the United States (“U.S.”). The Fund currently offers one class of shares (“Institutional Shares”).

Under the Fund’s organizational documents, its officers and Board of Trustees (“Board”) are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts with vendors and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies”. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets, liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates.

A. Portfolio Fund Transactions and Income Recognition

Investments in Portfolio Funds are recorded on a subscription effective date basis, which is generally the first day of the calendar month in which the investment is effective. Realized gains and losses are calculated on a specific identification method when redemptions are accepted by a Portfolio Fund, which is generally on the last day of the calendar month. Interest income, if any, and expense are accrued each month. Dividends, less foreign tax withholding (if any), are recorded on the ex-dividend date.

12

Cross Shore Discovery Fund

Notes to the Financial Statements (continued)

September 30, 2019

A Portfolio Fund previously held by the Fund was liquidated as of December 31, 2018. As of September 30, 2019, proceeds from the liquidation, which have been estimated by management, have not been received. These proceeds are included in the receivable for Portfolio Funds sold on the Statement of Assets and Liabilities.

B. Investment Valuation and Risks

The Fund will calculate the net asset value per share (“NAV”) of the Institutional Shares as of the close of business on the last business day of each calendar month and at such other times as the Board may determine, including in connection with the repurchase of Institutional Shares.

Because the Fund invests all or substantially all of its assets in Portfolio Funds, the NAV of the Institutional Shares will depend on the value of the Portfolio Funds. The NAVs of Portfolio Funds are generally not available from pricing vendors, nor are they calculable independently by the Fund or by Cross Shore Capital Management, LLC, the Fund’s investment adviser (the “Adviser”).

Accordingly, the Board has approved procedures (the “Valuation Procedures”) pursuant to which the Fund will value its investments in the Portfolio Funds at fair value. Under the Valuation Procedures, the Adviser is responsible for determining the fair value of each Portfolio Fund as of each date upon which the NAV of the Institutional Shares is calculated (the “NAV Date”). The Valuation Procedures require the Adviser to consider all relevant information when assessing and determining the fair value of the Fund’s interest in each Portfolio Fund and to make all fair value determinations in good faith. All fair value determinations made by the Adviser are subject to the review and supervision of the Board through its Valuation Committee. The Board’s Valuation Committee will be responsible for ensuring that the valuation process utilized by the Adviser is fair to the Fund and consistent with applicable regulatory guidelines.

As a general matter, the fair value of the Fund’s interest in a Portfolio Fund will be the amount that the Fund could reasonably expect to receive from the Portfolio Fund if the Fund’s interest in the Portfolio Fund was redeemed as of the NAV Date. In accordance with the Valuation Procedures, the fair value of the Fund’s interest in a Portfolio Fund as of a NAV Date will ordinarily be the most recent NAV reported by a Portfolio Fund’s Investment Manager or third party administrator (“Portfolio Fund Management”). In the event that the last reported NAV of a Portfolio Fund is not as of the NAV Date, the Adviser may use other information that it believes should be taken into consideration in determining the Portfolio Fund’s fair value as of the NAV Date, including benchmark or other triggers to determine any significant market movement that has occurred between the effective date of the most recent NAV reported by the Portfolio Fund and the NAV Date.

Because Portfolio Funds are not registered under the 1940 Act and their governing documents typically do not impose significant investment restrictions, a Portfolio Fund may without limitation or prior notice to the Adviser, invest and trade in a broad range of securities, derivatives and other financial instruments (collectively, “Assets”). While, generally, each Portfolio Fund carries its investments at fair value, these investments may be associated with a varying degree of off-balance sheet risks, including both market and credit risks. Market risk is the risk of potential adverse changes to the value of the Assets because of the changes in market conditions such as interest

13

Cross Shore Discovery Fund

Notes to the Financial Statements (continued)

September 30, 2019

and currency rate movements and volatility of Asset values. Credit risk is the risk of the potential inability of counterparties to perform the terms of the contracts, which may be in excess of the amounts recorded in the Portfolio Funds’ respective balance sheets. In addition, the Portfolio Funds will engage in the short sale of securities. A short sale of a security not owned by a Portfolio Fund involves the sale of a security that is borrowed from a counterparty to complete the sale. The sale of a borrowed security may result in a loss if the price of the borrowed security increases after the sale. Purchasing securities to close out the short position can itself cause their market price to rise further, increasing losses. Furthermore, a short seller may be prematurely forced to close out a short position if a counterparty demands the return of borrowed securities. Losses on short sales are theoretically unlimited, although losses to the Fund are limited to its investment in a particular Portfolio Fund.

Portfolio Fund Investment Managers (the “Investment Managers”), who operate Portfolio Funds in which the Fund invests, receive fees for their services. The fees include management and incentive fees or allocations based upon the net asset value of the Fund’s investment. These fees are deducted directly from each Portfolio Fund’s assets in accordance with the governing documents of the Portfolio Fund. During the six months ended September 30, 2019, the fees for these services ranged from 0.75% to 2.00% per annum for management fees and up to 20% of the Portfolio Funds’ net profits for incentive fees or allocations. In certain cases, the incentive fees or allocations may be subject to a hurdle rate. The impact of these fees are reflected in the Fund’s performance, but are not operational expenses of the Fund.

Based on the information the Adviser typically receives from the Portfolio Funds, the Fund is unable to determine on a look-through basis if any investments, on an aggregate basis, held by the Portfolio Funds represent greater than 5% of the Fund’s net assets.

The Fund’s interests in Portfolio Funds are also illiquid and subject to substantial restrictions on transferability. The Fund may not be able to acquire initial or additional interests in a Portfolio Fund or withdraw all or a portion of its investment from a Portfolio Fund promptly after it has made a decision to do so because of limitations set forth in that Portfolio Fund’s governing documents.

Generally, the fair value of the Fund’s investments in a Portfolio Fund represents the Fund’s proportionate share of that Portfolio Fund’s net assets as reported by applicable Portfolio Fund Management. All valuations as of September 30, 2019, were determined by the Adviser to be consistent with the Fund’s Valuation Procedures and are net of management and incentive fees pursuant to the Portfolio Funds’ applicable agreements. The fair value represents the amount the Fund expects to receive, gross of redemption fees or penalties, at September 30, 2019, if it were to liquidate its investments in the Portfolio Funds. Because of the inherent uncertainly of valuation, the value of investments in the Portfolio Funds held by the Fund may differ significantly from the values that would have been used had a ready market existed, and differences could be material.

Pursuant to the Valuation Procedures, the Adviser may conclude in certain circumstances that, after considering information reasonably available at the time the valuation is made and that the Adviser believes to be reliable, the balance provided by the Portfolio Fund Management does not represent the fair value of the Fund’s interest in the Portfolio Fund. In addition, in the absence of specific transaction activity in the interests of a particular Portfolio Fund, the Adviser could consider whether it was appropriate, in light of all relevant circumstances, to value such a position

14

Cross Shore Discovery Fund

Notes to the Financial Statements (continued)

September 30, 2019

at the Portfolio Fund’s net assets as reported at the time of valuation, or whether to adjust such value to reflect a premium or discount to the reported net assets and would be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used. Any such decision is made in good faith and is subject to the review and supervision of the Board.

In determining fair values as of September 30, 2019, the Adviser has, as a practical expedient, estimated the fair value of each Portfolio Fund using the NAV (or its equivalent) provided by the Portfolio Fund Management of each Portfolio Fund as of that date.

The valuation techniques described maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Fund’s investments are summarized in the three broad levels listed below:

|

● |

Level 1 – Unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date. |

|

● |

Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly. |

|

● |

Level 3 – Inputs, broadly referred to as the assumptions that market participants use to make valuation decisions, are unobservable and reflect the Adviser’s best estimate of what market participants would use in pricing the financial instrument at the measurement date. |

Investments in money market mutual funds are generally priced at the ending NAV provided by the service agent of the funds. Accordingly, money market mutual funds with a fair value of $316,809 have been categorized as Level 1 in the fair value hierarchy. All investments for which fair value is measured using the NAV per share as a practical expedient are not required to be categorized within the fair value hierarchy. Accordingly, Portfolio Funds with a fair value of $37,670,516 have not been categorized in the fair value hierarchy.

3. Investment Strategies

The Fund seeks to invest at least 80% of its total assets in Portfolio Funds that predominately employ equity long/short strategies. Generally, the equity long/short strategies employed by the Portfolio Funds involve taking long and short positions in the equity securities (or the equivalent thereof) of U.S. and foreign issuers. These long and short positions are created by purchasing and selling short specific equity securities or groups of equity securities.

Investment Managers may utilize a variety of investment approaches and techniques to implement their long/short equity strategies. Investment Managers, for example, may construct long and short portions based upon: (1) a mispricing of equity securities relative to each other or relative to historic norms (Relative Value Approach); (2) the effect of events on different equity securities (Event Driven Approach); (3) perceived valuations of equity securities (e.g., whether an issuer is overvalued or undervalued) (Fundamental Long/Short Approach); and/or (4) the effect of economic and political changes on the prices of equity securities (Directional Trading Approach) (collectively, “Long/Short Equity Techniques”). The Investment Managers may utilize a variety of investment

15

Cross Shore Discovery Fund

Notes to the Financial Statements (continued)

September 30, 2019

styles (e.g., growth/value, small cap/large cap) and focus on specific sectors, regions (e.g., U.S., emerging markets, global) and asset classes (e.g., common stocks, preferred stocks and convertible securities) to implement their long/short equity strategies.

While it is anticipated that the Portfolio Funds will primarily invest in publicly traded U.S. and foreign common stocks, Portfolio Funds may also use other equity securities such as preferred stock, convertible securities and warrants to implement their equity long/short strategies. A Portfolio Fund may also invest in fixed income securities such as corporate debt obligations, government securities, municipal securities, financial institution obligations, mortgage-related securities, asset-backed securities and zero-coupon securities issued by U.S. issuers and similar securities issued by foreign issuers (collectively, “Fixed Income Securities”) on an opportunistic basis. For example, a Portfolio Fund may take a long or short position in the Fixed Income Securities of one or more specific issuers or groups of Fixed Income Securities to the extent that the Investment Manager believes that such securities constitute a better investment opportunity than corresponding equity securities over a given period of time. A Portfolio Fund may also take long or short positions in Fixed Income Securities as a hedge against the equity or fixed income exposure in its portfolio. It is expected that an Investment Manager may apply techniques similar to the Long/Short Equity Techniques to implement long/short positions in Fixed Income Securities.

While a Portfolio Fund generally implements its long/short strategies by investing directly or selling short Equity and Fixed Income Securities, a Portfolio Fund may use derivatives, typically, options on Equity or Fixed Income indices (each an “Index”), futures on Indices and total return swaps involving one or a basket of Equity or Fixed Income Securities, to create synthetic exposure to these Indices/securities for the purposes of increasing portfolio profitability or for hedging against certain long/short strategy risks.

4. Investment Advisory Fee and Other Transactions with Affiliates

A. Investment Advisory Fees

The Adviser serves as the Fund’s investment adviser. The Adviser receives an annual fee of 1.25% payable monthly based on the Fund’s monthly net assets.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses to the extent necessary to ensure that the total annual Fund operating expenses attributable to the Institutional Shares will not exceed an annual rate of 2.00% (after fee waivers and/or expense reimbursements, and exclusive of taxes, interest, portfolio transaction expenses, acquired fund fees and expenses, dividend expenses on short sales and extraordinary expenses not incurred in the ordinary course of the Fund’s business) of the Fund’s average net assets for the fiscal year. The arrangement will continue until at least July 31, 2020 and can only be terminated prior to that day with approval from the Board. The Adviser may recoup fees waived and expenses reimbursed within three years of the date in which such waivers and reimbursements were made if such recoupment does not cause current expenses within the fiscal year to exceed the expense limit in effect at the

16

Cross Shore Discovery Fund

Notes to the Financial Statements (continued)

September 30, 2019

time the expense was paid/waived or any expense limit in effect at the time of repayment. As of September 30, 2019, the Adviser may seek repayment of investment advisory fee waivers and expense reimbursements by the following dates:

March 31, 2020 |

$ | 72,480 | ||

March 31, 2021 |

110,417 | |||

March 31, 2022 |

52,404 | |||

| $ | 235,301 |

For the six months ended September 30, 2019, the Adviser recouped $11,605 in prior advisory fees waived and expenses reimbursed.

B. Administration, Accounting, Compliance Services and Transfer Agent Fees

Pursuant to an agreement between the Fund and Ultimus Fund Solutions, LLC (“Administrator” or “Ultimus”), the Administrator provides administration, transfer agency and compliance services to the Fund and supplies certain officers to the Fund including a Principal Financial Officer, a Chief Compliance Officer, and an Anti-Money Laundering Officer. The Fund pays the Administrator a basis point fee, subject to fee minimums, for administrative services, a base annual fee plus an annual fee per open shareholder account for transfer agency and a fixed fee for compliance services and certain out of pocket expenses. Pursuant to an agreement between the Fund and Citco Fund Services (USA), Inc. (“Fund Accountant” or “Citco”), the Fund Accountant provides fund accounting services to the Fund. The Fund pays Citco, a basis point fee, subject to fee minimums, for fund accounting services and certain out of pocket expenses.

C. Distribution

Unified Financial Securities, LLC (the “Distributor”) acts as principal underwriter and distributor of the Fund’s shares of beneficial interest on a best effort basis, subject to various conditions. The Distributor may retain additional broker-dealers and other financial intermediaries (each a “Selling Agent”) to assist in the distribution of shares and shares are available for purchase through these Selling Agents or directly through the Distributor. Generally, shares are only offered to investors that are U.S. persons for U.S. federal income tax purposes.

D. Custodian Fees

The Huntington National Bank, N.A. (the “Custodian”) is custodian of the Fund’s investments and may maintain Fund assets with U.S. and foreign sub custodians, subject to policies and procedures approved by the Board. The Fund and the Custodian have entered into an agreement with Citco Bank (Canada) (“Citco Bank”) to perform certain sub-custodian services to the Fund. Fees and expenses of the Custodian and Citco Bank are paid by the Fund.

17

Cross Shore Discovery Fund

Notes to the Financial Statements (continued)

September 30, 2019

E. General

Certain officers of the Fund are officers, directors and/or trustees of the above companies. Independent trustees are paid a $2,500 for each regularly scheduled Board meeting and $1,250 for each special Board meeting attended, for their services to the Fund. Interested trustees and officers of the Trust are not paid for services directly by the Fund.

5. Capital Share Transactions

Shares of the Fund will be traded for purchase only through the Distributor, or a Selling Agent as of the first business day of each month. To provide a limited degree of liquidity to shareholders, the Fund may from time to time offer to repurchase shares pursuant to written repurchase offers, but is not obligated to do so.

Repurchase offers will be made at such times and on such terms as may be determined by the Board in its sole discretion and generally will be offers to repurchase an aggregate specified dollar amount of outstanding shares or a specific number of shares. Any such offer will be made only on terms that the Board determines to be fair to the Fund and to all shareholders or persons holdings shares acquired from shareholders. When the Board determines that the Fund will repurchase shares or portions thereof, notice will be provided to each shareholder describing the terms thereof, and containing information a shareholder should consider in deciding whether and how to participate in such repurchase opportunity. The Board convenes quarterly to consider whether or not to authorize a tender offer. The Board expects that repurchase offers, if authorized, will be made no more frequently than on a quarterly basis and will typically have a valuation date as of March 31, June 30, September 30 or December 31 (or, if any such date is not a Business Day, on the last Business Day of such calendar quarter).

6. Purchases and Sales of Portfolio Funds

Aggregate purchases and proceeds from sales of Portfolio Funds, other than short-term investments, for the six months ended September 30, 2019 amounted to $8,207,226 and $4,228,194, respectively. There were no purchases or sales of U.S. government obligations for the six months ended September 30, 2019.

7. Distributions

The Fund declares and pays dividends on investment income, if any, annually. The Fund also makes distributions of net capital gains, if any, annually.

8. Federal Income Taxes

It is the policy of the Fund to qualify or continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes.

18

Cross Shore Discovery Fund

Notes to the Financial Statements (continued)

September 30, 2019

The following information is provided on a tax basis as of September 30, 2019:

Gross Unrealized Appreciation |

$ | — | ||

Gross Unrealized Depreciation |

(257,106 | ) | ||

Net Unrealized Appreciation/(Depreciation) |

$ | (257,106 | ) |

As of September 30, 2019, the aggregate cost of investment entities for federal tax purposes was $38,244,431. The difference between the book-basis unrealized appreciation/(depreciation) is attributable primarily to the realization for tax purposes of unrealized gain/(losses) on investments in passive foreign investment companies.

As of March 31, 2019, the Fund’s most recent fiscal year end, the components of accumulated earnings (deficit) on a tax basis were as follows:

Undistributed ordinary income |

$ | 1,564,397 | ||

Accumulated capital and other losses |

(415,869 | ) | ||

Unrealized appreciation/ (depreciation) |

(220,013 | ) | ||

Total |

$ | 928,515 |

The tax character of distributions for the fiscal year ended March 31, 2019 was as follows:

Distributions paid from: |

||||

Ordinary income |

$ | 1,373,500 | ||

Total distributions paid |

$ | 1,373,500 |

As of March 31, 2019, for federal income tax purposes and the treatment of distributions payable, the Fund had $199,701 of short-term and $216,168 of long-term capital loss carryforwards available to offset future gains, if any, that may be carried forward indefinitely, to the extent provided by the Treasury regulations.

Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (ie, all open tax periods since inception). Management believes there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

9. Control Persons

A control person is a shareholder who owns beneficially, or through controlled companies, more than 25% of the voting securities of a company or acknowledges the existence of control. Shareholders owning voting securities in excess of 25% may determine the outcome of any matter affecting and voted on by shareholders of the Fund. As of September 30, 2019, Cross Shore QP Partners, LP owned 39% of the outstanding shares of the Fund.

19

Cross Shore Discovery Fund

Notes to the Financial Statements (concluded)

September 30, 2019

10. Recent Accounting Pronouncements

In August 2018, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2018-13, which changes the fair value measurement disclosure requirements of FASB Accounting Standards Codification Topic 820, Fair Value Measurement. The update to Topic 820 includes new, eliminated, and modified disclosure requirements. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019, including interim periods, although early adoption is permitted. Management has evaluated the implications of certain provisions of ASU 2018-13 and has determined to early adopt all aspects related to the removal and modification of certain fair value measurement disclosures under the ASU effective immediately.

11. Subsequent Events

The Fund announced that the Board had approved a tender offer to purchase up to 20% of the net asset value of the Fund’s Institutional Shares to be calculated at a price equal to the Fund’s Institutional Shares net asset value as of September 30, 2019. The Fund commenced its tender offer on July 1, 2019 and the expiration of the tender offer was on July 31, 2019.

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date these financial statements were issued. Based upon this evaluation, management has determined there were no additional items requiring adjustment of the financial statements or additional disclosure.

20

Investment Advisory Agreement Approval (Unaudited)

The Board of Trustees (the “Board”), including the Trustees who are not “interested persons” (as that terms is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended) (the “Independent Trustees”) voting separately, reviewed and approved the Investment Advisory Agreement (the “Advisory Agreement”) between Cross Shore Capital Management, LLC (the “Adviser”) and Cross Shore Discovery Fund, a Delaware statutory trust and registered closed-end fund under the Investment Company Act of 1940, as amended (the “Trust”), on behalf of its sole series of the same name (the “Fund”). The approval took place at meeting held on May 22, 2019 at which all of the Independent Trustees and the Interested Trustee were present in person.

Prior to the meeting, the Board requested from, and received and reviewed a substantial amount of information provided by the Adviser (the “Support Materials”). The Support Materials included, among other things, information regarding: (1) the Adviser’s organizational structure, management, personnel and proposed services to the Fund; (2) the fees to be paid by the Fund to the Adviser for services rendered under the Advisory Agreement, (3) the Adviser’s projected profitability on services to be rendered to the Fund and related economies of scale; (4) the financial stability of the Adviser; and (5) the Adviser’s compliance program, including the Adviser’s Code of Ethics.

The Board also received a memorandum from counsel to the Fund and the Independent Trustees (“Counsel”) outlining the Board’s duties and legal standards applicable to the consideration and approval of advisory agreements. Counsel discussed with the Trustees the types of information and factors that should be considered by the Board in order to make an informed decision regarding the approval of the Advisory Agreement, including the following material factors: (i) the nature, extent, and quality of the services to be provided by the Adviser under the Advisory Agreement; (ii) the investment performance of the Adviser; (iii) the costs of the services to be provided and anticipated profits to be realized by the Adviser from the relationship with the Fund; (iv) the extent to which economies of scale would be realized if the Fund grows; (v) whether advisory fee levels reflect those economies of scale for the benefit of the Fund’s investors; and (vi) other potential benefits to the Adviser from its relationship with the Fund (collectively, the “Factors”).

During the meeting and prior to approving the Advisory Agreement, the Independent Trustees received a presentation from Mr. Neil Kuttner, a Managing Member of the Adviser and Trustee of the Trust, and he discussed the services to be rendered by the Adviser to the Fund. The Independent Trustees also convened with Counsel in executive session to discuss their obligations with respect to the approval of the Advisory Agreement and the Factors and the information provided by the Adviser applicable thereto.

In considering the Advisory Agreement and reaching its conclusion to approve the Advisory Agreement, the Board reviewed and analyzed the Factors as set forth below. The Trustees did not identify any particular Factor or information that was most relevant to their consideration to approve the Advisory Agreement and each Trustee may have afforded different weight to the various Factors.

Nature, Extent and Quality of Services. The Trustees reviewed the services being provided by the Adviser to the Fund as set forth in the Advisory Agreement, including the indication by Mr. Kuttner that Adviser employees spend the majority of their time working on matters related to the Fund. The Trustees also noticed the Adviser’s success in growing the Fund’s assets in the last year, in part, by adding the Fund as an investment option on a large registered investment adviser’s platform. The Trustees also noted that during the past year, the Adviser had not experienced any issues under

21

Investment Advisory Agreement Approval (Unaudited)(continued)

its compliance program, and that the Adviser has not experienced any problems or litigation. The Trustees also considered the experience of the Adviser’s personnel servicing the Fund, the Adviser’s compliance environment as well as the Fund’s performance. The Trustees concluded that they were satisfied with the quality, extent, and nature of the services provided by the Adviser.

Performance of the Fund. The Trustees compared the performance of the Fund with the performance of its benchmark index, the HFRX Equity Hedge Index. The Trustees considered that since its August 1, 2012 inception (including the performance of its predecessor fund, Cross Shore Discovery Fund, Ltd.) through March 31, 2019, and in calendar years 2013 through 2018, the Fund has outperformed its benchmark index. The Trustees further considered that the Adviser reported that the Fund has consistently outperformed other competitive indices since its inception while underperforming the S&P 500 Index. The Board concluded that they were satisfied with the Fund’s performance.

Cost of Advisory Services and Profitability. The Trustees considered the financial condition of the Adviser based on its balance sheet as of December 31, 2018 and other related data including assets under management. The Trustees considered that the fee arrangement of the Fund with the Adviser currently involves an advisory fee of 1.25%, which was reduced from 1.75% in August 2018. The Trustees considered the advisory fees paid to Adviser during a twelve month period and the Adviser’s expenses incurred over that period, as well as, an estimation of the Adviser’s operational overhead allocable to the services provided to the Fund. The Trustees also reviewed the Adviser’s assets under management and insurance arrangements. The Trustees concluded that the Adviser’s profitability was reasonable and that the Adviser’s assets, coupled with its insurance coverage, were sufficient to cover potential liabilities incurred under the Advisory Agreement.

Comparative Fee and Expense Data; Economies of Scale. The Trustees compared the fees and expenses of the Fund (including the Fund’s advisory fee) to those of a peer group of ten similarly managed, closed-end funds identified by the Adviser (the “Peer Group”), noting that the Fund’s advisory fee is higher than the average fee of the funds in the Peer Group, but lower than two of the funds in the Peer Group and the same as two other funds. The Trustees also considered that the Adviser viewed the fee as appropriate based on the Fund’s total assets. The Trustees also noted that the Fund’s advisory fee was lower than the fees charged to other non-registered fund of funds managed by the Adviser on a pro forma annual basis through April 30, 2019 when the other funds incentive fees are also taken into consideration. The Trustees considered the Fund’s fee arrangements with the Adviser and noted that the advisory fee would stay the same as asset levels increased, noting, however, that the shareholders of the Fund would benefit from the cap on Fund expenses. The Trustees noted the Adviser’s lowering of the advisory fee from 1.75% to 1.25% in August 2018. Taking into account the Fund’s superior performance and the fact that it is a small fund with no profit for the Adviser, the Trustees determined that the Fund’s fee arrangements with the Adviser were fair and reasonable.

Other Benefits. The Board noted that the Adviser benefits from its relationship with the Fund as the firm may gain introductions to fund managers through its work for the Fund that might fit the investment criteria of the Adviser’s other managed funds. Similarly, in marketing the Fund, the Adviser may discover opportunities which benefit the Adviser. The Trustees concluded that the benefits realized by the Adviser from managing the Fund were acceptable.

22

Investment Advisory Agreement Approval (Unaudited)(concluded)

Conclusion

After full consideration of the above Factors as well as other factors, the Trustees concluded that the overall arrangements between the Fund and the Adviser as set forth in the Advisory Agreement are fair and reasonable in light of the services performed, fees paid and such other matters as the Trustees considered relevant in the exercise of their reasonable judgment and the Trustees unanimously concluded that approval of the renewal of the Advisory Agreement was in the best interests of the Fund and its shareholders.

23

Privacy Notice

FACTS |

WHAT DOES CROSS SHORE DISCOVERY FUND DO WITH YOUR PERSONAL INFORMATION? |

||

Why? |

Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

||

What? |

The types of personal information we collect and share depend on the product or service you have with us. This information can include:

■ Social Security number ■ Assets ■ Retirement Assets ■ Transaction History ■ Checking Account Information ■ Purchase History ■ Account Balances ■ Account Transactions ■ Wire Transfer Instructions When you are no longer our customer, we continue to share your information as described in this notice. |

||

How? |

All financial companies need to share your personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons Cross Shore Discovery Fund chooses to share; and whether you can limit this sharing. |

||

Reasons we can share your personal information |

Does Cross Shore Discovery Fund share? |

Can you limit this sharing? |

|

For our everyday business purposes — |

Yes |

No |

|

For our marketing purposes — |

No |

We don’t share |

|

For joint marketing with other financial companies |

No |

We don’t share |

|

For our affiliates’ everyday business purposes – |

No |

We don’t share |

|

24

Privacy Notice (continued)

For our affiliates’ everyday business purposes – |

No |

We don’t share |

|

For nonaffiliates to market to you |

No |

We don’t share |

|

Questions? |

Call (844) 300-7828 |

||

Who we are |

|

Who is providing this notice? |

Cross Shore Discovery Fund |

What we do |

|

How does Cross Shore Discovery Fund protect my personal information? |

To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings.

Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

How does Cross Shore Discovery Fund collect my personal information? |

We collect your personal information, for example, when you

■ Open an account ■ Provide account information ■ Give us your contact information ■ Make deposits or withdrawals from your account ■ Make a wire transfer ■ Tell us where to send the money ■ Tell us who receives the money ■ Show your government-issued ID ■ Show your driver’s license We also collect your personal information from other companies. |

Why can’t I limit all sharing? |

Federal law gives you the right to limit only

■ Sharing for affiliates’ everyday business purposes — information about your creditworthiness ■ Affiliates from using your information to market to you ■ Sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

25

Privacy Notice (concluded)

Definitions |

|

Affiliates |

Companies related by common ownership or control. They can be financial and nonfinancial companies.

■ Cross Shore Capital Management, LLC, the investment adviser to Cross Shore Discovery Fund, could be deemed to be an affiliate. |

Nonaffiliates |

Companies not related by common ownership or control. They can be financial and nonfinancial companies.

■ Cross Shore Discovery Fund does not share with nonaffiliates so they can market to you. |

Joint marketing |

A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

■ Cross Shore Discovery Fund does not jointly market. |

26

This page is intentionally left blank.

This page is intentionally left blank.

This page is intentionally left blank.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30 are available (1) without charge upon request by calling the Fund at (844) 300-7828 and (2) in Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

Neil Kuttner, Chairman

David J. Gruber

Thomas E. Niehaus

OFFICERS

Neil Kuttner, Chief Executive Officer and President

Gregory Knoth, Principal Financial Officer and Treasurer

Simon Berry, Secretary

Martin R. Dean, Chief Compliance Officer

INVESTMENT ADVISER

Cross Shore Capital Management, LLC

111 Great Neck Road, Suite 210

Great Neck, NY 11021

DISTRIBUTOR

Unified Financial Securities, LLC

9465 Counselors Row, Suite 200

Indianapolis, IN 46240

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

LEGAL COUNSEL

Bernstein Shur

100 Middle Street

Portland, ME 04104

CUSTODIAN

Huntington National Bank

41 South High Street

Columbus, OH 43215

FUND ACCOUNTANT

Citco Fund Services (USA), Inc.

3 Second Street, Harborside Plaza 10

Jersey City, NJ 07311

ADMINISTRATOR AND TRANSFER AGENT

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, LLC

Member FINRA/SIPC

Item 2. Code of Ethics.

NOT APPLICABLE- disclosed with annual report

Item 3. Audit Committee Financial Expert.

NOT APPLICABLE- disclosed with annual report

Item 4. Principal Accountant Fees and Services.

NOT APPLICABLE- disclosed with annual report than the principal accountant's full-time, permanent employees.

Item 5. Audit Committee of Listed Companies.

NOT APPLICABLE – applies to listed companies only

Item 6. Schedule of Investments. Schedules filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

NOT APPLICABLE- disclosed with annual report

Item 8. Portfolio Managers of Closed-End Investment Companies.

| (a) | NOT APPLICABLE- disclosed with annual report |

| (b) | As of this reporting period end there have been no changes to any of the Portfolio Managers since the registrant’s previous form N-CSR filing. |

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

NOT APPLICABLE

Item 10. Submission of Matters to a Vote of Security Holders.

The guidelines applicable to shareholders desiring to submit recommendations for nominees to the Registrant's board of trustees are contained in the statement of additional information of the Fund with respect to the Fund(s) for which this Form N-CSR is being filed.

Item 11. Controls and Procedures.

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “Act”)) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

NOT APPLICABLE

Item 13. Exhibits.

| (a) | (1) | NOT APPLICABLE- disclosed with annual report. |

| (2) | Certifications by the registrant’s principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes- Oxley Act of 2002 and required by Rule 30a-2 under the Investment Company Act of 1940 are filed herewith. | |

| (3) | Not Applicable | |

| (b) | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is filed herewith. |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | Cross Shore Discovery Fund | |

| By: | /s/ Neil Kuttner | |

| Neil Kuttner, President and Chief Executive Officer | ||

| Date: | December 4, 2019 | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated. | ||

| By: | /s/ Neil Kuttner | |

| Neil Kuttner, President and Chief Executive Officer | ||

| Date: | December 4, 2019 | |

| By: | /s/ Gregory Knoth | |

| Gregory Knoth, Treasurer and Principal Officer | ||

| Date: | December 4, 2019 | |