UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANY

Investment Company Act file number: 811-22973

AMG PANTHEON FUND, LLC

(Exact name of registrant as specified in charter)

One Stamford Plaza, 263 Tresser Boulevard, Suite 949, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

One Stamford Plaza, 263 Tresser Boulevard, Suite 949, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: March 31st

Date of reporting period: April 1, 2020 – March 31, 2021

(Annual Shareholder Report)

| Item 1. | Reports to Shareholders |

|

ANNUAL REPORT |

| AMG Funds

March 31, 2021

AMG Pantheon Fund, LLC |

| www.amgfunds.com | 033121 AR080 |

AMG Funds

AMG Pantheon Fund, LLC

Annual Report—March 31, 2021

| TABLE OF CONTENTS | PAGE | |

|

|

3 | |

| FINANCIAL STATEMENTS |

||

| 6 | ||

| Balance sheet, net asset value (NAV) per Unit computations and cumulative undistributed amounts |

||

| 8 | ||

| Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year |

||

| 9 | ||

| Detail of changes in assets for the past two fiscal years |

||

| 10 | ||

| Detail of cash movements during the fiscal year |

||

| 11 | ||

| Historical net asset values per Unit, distributions, total returns, income and expense ratios, turnover ratios and net assets |

||

| 16 | ||

| Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks |

||

| 26 | ||

| 27 | ||

| 28 | ||

| Consolidated Financial Statements of AMG Pantheon Master Fund, LLC |

Appendix | |||

|

Portfolio Manager’s Comments (unaudited) |

|

|

Overview

For the year ended March 31, 2021, AMG Pantheon Fund’s (the “Fund”) Class 4 units returned 35.72% (net) while the MSCI World Index returned 54.03% on a 12-month trailing basis. As the Fund invests substantially all of its assets in AMG Pantheon Master Fund, LLC (the “Master Fund”), the following discussion reflects the investments held in the Master Fund.

Market Review and Outlook

The business and economic environment over the last year has been characterized by the ongoing global COVID-19 pandemic and associated business disruption due to the virus and associated prevention measures. Businesses experienced heightened disruption due to social distancing measures and mandated closures of all non-essential businesses for a period in 2020 throughout much of the world. A transition to remote working and learning also had a significant impact on business outcomes. This has been a headwind for certain businesses while providing a tailwind to other areas of the economy such as ecommerce and software.

Performance and Positioning

The Master Fund’s units returned 35.90% over the fiscal year versus a 54.03% return for the MSCI World Index. Much of the COVID-19 related volatility in the MSCI World Index preceded the start of this fiscal year and the last 12 months have been largely characterized by rising equity markets. Comparatively larger sector allocations in information technology and healthcare along with smaller exposures in businesses that derive revenue from physical locations helped the Fund avoid some headwinds relating to COVID-19 prevention measures. The Master Fund made 31 new investments over the last 12 months, resulting in approximately $102 million of new capital commitments. 24 of these investments were secondary investments and 7 were co-investments. We believe the Master Fund was able to execute on its mandate to provide a globally diversified portfolio to investors over the last year. Of the new deals that were completed over the last 12 months, 21 were in North America, 8 were in Europe, and 2 were in Asia. The Master Fund continues to seek opportunities on a global basis. As of March 31, 2021, the top four sector exposures in the Master Fund were as follows: Information Technology (33%), Healthcare (14%), Consumer Discretionary (16%), and Financials (15%). Information technology and healthcare remain two favored sectors with ample opportunity for investment. The Master Fund continues to deemphasize certain cyclical areas of the economy and sectors such as energy that are exposed to unpredictable commodity price risk.

This commentary reflects the viewpoints of Pantheon Ventures (US) LP as of March 31, 2021 and is not intended as a forecast or guarantee of future results

3

|

AMG Pantheon Fund, LLC Portfolio Manager’s Comments (continued) |

|

|

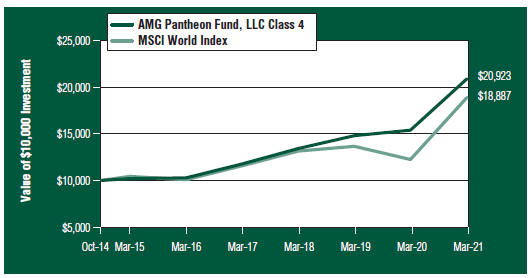

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Pantheon Fund, LLC’s cumulative total return is based on the monthly change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG Pantheon Fund, LLC’s Class 4 units on October 1, 2014 to a $10,000 investment made in the MSCI World Index for the same time period. The graph and table do not reflect the deduction of taxes that a unitholder would pay on a Fund distribution or redemption of units. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for AMG Pantheon Fund, LLC and MSCI World Index for the same time periods ended March 31, 2021.

| Average Annual Total Returns1 | One Year |

Five Years |

Since Inception |

Inception Date |

||||||||||||

| AMG Pantheon Fund, LLC2 |

||||||||||||||||

| AMG Pantheon Fund, LLC—Class 13 |

34.63 | % | 14.14 | % | 13.04 | % | 10/01/15 | |||||||||

| AMG Pantheon Fund, LLC—Class 2 |

35.12 | % | 14.67 | % | 13.56 | % | 10/01/15 | |||||||||

| AMG Pantheon Fund, LLC—Class 3 |

35.39 | % | 14.95 | % | 13.85 | % | 10/01/15 | |||||||||

| AMG Pantheon Fund, LLC—Class 4 |

35.72 | % | 15.23 | % | 12.04 | % | 10/01/14 | |||||||||

| AMG Pantheon Fund, LLC—Class 5 |

— | — | 26.73 | % | 07/31/20 | |||||||||||

| MSCI World Index4,5 |

54.03 | % | 13.36 | % | 10.28 | % | 10/01/14 | † | ||||||||

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s units, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per unit for the Fund and other information, please call 877.355.1566 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus unit price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by unitholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses. All returns are in U.S. dollars ($). |

| 2 | Effective July 31, 2020, Brokerage Class Units were renamed Class 1 Units, Advisory Class Units were renamed Class 2 Units, Institutional Class Units were renamed Class 3 Units, Institutional Plus Class Units were renamed Class 4 Units, and Class 5 Units were established. |

4

|

AMG Pantheon Fund, LLC Portfolio Manager’s Comments (continued) |

|

|

| 3 | The performance information for the Fund’s Class 1 units for periods prior to July 31, 2020 does not reflect the impact of the sales load that was in effect until July 31, 2020. |

| 4 | The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of 23 developed market country indices. Please go to msci.com for most current list of countries represented by the index. Unlike the Fund, MSCI World Index is unmanaged, is not available for investment and does not incur fees. |

| 5 | All MSCI data is provided “as is”. The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. |

5

Statement of Assets and Liabilities

March 31, 2021

| Assets: |

||||

| Investment in AMG Pantheon Master Fund, LLC, at value (cost $215,274,523; Units 15,000,770) |

$ 268,963,806 | |||

| Cash |

799,428 | |||

| Cash held in escrow |

36,493,500 | |||

| Capital stock receivable |

52,986 | |||

| Receivable from Investment Manager |

35,411 | |||

| Prepaid expenses and other assets |

48,442 | |||

|

|

|

|||

| Total Assets |

306,393,573 | |||

|

|

|

|||

| Liabilities: |

||||

| Subscriptions in advance |

36,493,500 | |||

| Payable for Fund Units tendered |

750,815 | |||

| Accrued expenses: |

||||

| Administrative fees |

10,809 | |||

| Distribution fees |

82,587 | |||

| Other |

72,044 | |||

|

|

|

|||

| Total Liabilities |

37,409,755 | |||

|

|

|

|||

|

|

|

|||

| Net Assets |

$ 268,983,818 | |||

|

|

|

|||

| Net Assets Represent: |

||||

| Paid-in capital |

$ 215,938,730 | |||

| Distributable earnings |

53,045,088 | |||

|

|

|

|||

| Net Assets |

$ 268,983,818 | |||

|

|

|

|||

The accompanying notes are an integral part of these financial statements.

6

AMG Pantheon Fund, LLC

Statement of Assets and Liabilities (continued)

March 31, 2021

| Class 1:# |

||||

| Net Assets |

$36,768,350 | |||

| Units outstanding |

2,037,926 | |||

| Net asset value, offering and redemption price per Unit |

$18.04 | |||

| Class 2:# |

||||

| Net Assets |

$73,555,483 | |||

| Units outstanding |

4,000,346 | |||

| Net asset value, offering and redemption price per Unit |

$18.39 | |||

| Class 3:# |

||||

| Net Assets |

$153,552,131 | |||

| Units outstanding |

8,241,191 | |||

| Net asset value and redemption price per Unit |

$18.63 | |||

| Class 4:# |

||||

| Net Assets |

$5,095,178 | |||

| Units outstanding |

269,802 | |||

| Net asset value, offering and redemption price per Unit |

$18.88 | |||

| Class 5:# |

||||

| Net Assets |

$12,676 | |||

| Units outstanding |

704 | |||

| Net asset value, offering and redemption price per Unit |

$18.01 | |||

| Maximum offering price per Unit |

$18.66 | |||

| # | Effective July 31, 2020, Brokerage Class Units were renamed Class 1 Units, Advisory Class Units were renamed Class 2 Units, Institutional Class Units were renamed Class 3 Units, Institutional Plus Class Units were renamed Class 4 Units, and Class 5 Units were established. (See Note 1 of the Notes to Financial Statements.) |

The accompanying notes are an integral part of these financial statements.

7

Statement of Operations

For the fiscal year ended March 31, 2021

| Expenses: |

||||

| Investment advisory and management fees |

$ 1,062,677 | |||

| Administrative fees |

92,482 | |||

| Distribution fees - Class 1# |

43,666 | |||

| Distribution fees - Class 2# |

237,922 | |||

| Distribution fees - Class 3# |

236,793 | |||

| Distribution fees - Class 5# |

73 | |||

| Professional fees |

271,094 | |||

| Transfer agent fees |

75,678 | |||

| Registration fees |

60,936 | |||

| Directors fees and expenses |

42,634 | |||

| Reports to Investors |

19,369 | |||

| Custody fees |

10,699 | |||

| Miscellaneous expenses |

21,018 | |||

|

|

|

|||

| Total expenses before offsets |

2,175,041 | |||

|

|

|

|||

| Expense reimbursements1 |

(501,105 | ) | ||

| Fee waiver |

(1,062,677 | ) | ||

|

|

|

|||

| Net expenses |

611,259 | |||

|

|

|

|||

| Net investment loss |

(611,259 | ) | ||

|

|

|

|||

| Net Realized and Unrealized Gain (Loss): |

||||

|

|

|

|||

| Capital gain distributions received |

1,839,968 | |||

| Net change in unrealized appreciation/depreciation of investments |

53,676,878 | |||

|

|

|

|||

| Net realized and unrealized gain |

55,516,846 | |||

|

|

|

|||

|

|

|

|||

| Net increase in net assets resulting from operations |

$ 54,905,587 | |||

|

|

|

|||

| # | Effective July 31, 2020, Brokerage Class Units were renamed Class 1 Units, Advisory Class Units were renamed Class 2 Units, Institutional Class Units were renamed Class 3 Units, and Class 5 Units were established. (See Note 1 of the Notes to Financial Statements.) |

| 1 | Includes $4,602 of recoupment of waived/reimbursed fees from prior periods. |

The accompanying notes are an integral part of these financial statements.

8

Statements of Changes in Net Assets

For the fiscal years ended March 31, 2021 and March 31, 2020

| For the fiscal year ended March 31, 2021 |

For the fiscal year ended March 31, 2020 |

|||||||

| Increase (Decrease) in Net Assets Resulting From Operations: |

||||||||

| Net investment loss |

$ (611,259) | $ (207,278) | ||||||

| Capital gain distributions received |

1,839,968 | 2,997,723 | ||||||

| Net change in unrealized appreciation/depreciation of investments |

53,676,878 | (1,061,396 | ) | |||||

|

|

|

|

|

|||||

| Net increase in net assets resulting from operations |

54,905,587 | 1,729,049 | ||||||

|

|

|

|

|

|||||

| Distributions to Investors: |

||||||||

| Class 1# |

(66,957 | ) | (977 | ) | ||||

| Class 2# |

(564,493 | ) | (1,719,441 | ) | ||||

| Class 3# |

(1,168,584 | ) | (3,195,402 | ) | ||||

| Class 4# |

(40,328 | ) | (202,816 | ) | ||||

| Class 5# |

(121 | ) | – | |||||

|

|

|

|

|

|||||

| Total distributions to Investors |

(1,840,483 | ) | (5,118,636 | ) | ||||

|

|

|

|

|

|||||

| Capital Unit Transactions:1 |

||||||||

| Net increase from capital Unit transactions |

120,801,857 | 65,546,555 | ||||||

|

|

|

|

|

|||||

| Total increase in net assets |

173,866,961 | 62,156,968 | ||||||

|

|

|

|

|

|||||

| Net Assets: |

||||||||

| Beginning of year |

95,116,857 | 32,959,889 | ||||||

|

|

|

|

|

|||||

| End of year |

$ 268,983,818 | $ 95,116,857 | ||||||

|

|

|

|

|

|||||

| # | Effective July 31, 2020, Brokerage Class Units were renamed Class 1 Units, Advisory Class Units were renamed Class 2 Units, Institutional Class Units were renamed Class 3 Units, Institutional Plus Class Units were renamed Class 4 Units, and Class 5 Units were established. (See Note 1 of the Notes to Financial Statements.) |

| 1 | See Note 1(g) of the Notes to Financial Statements. |

The accompanying notes are an integral part of these financial statements.

9

Statement of Cash Flows

For the fiscal year ended March 31, 2021

| Cash Flows from Operating Activities: |

||||

| Net increase in net assets resulting from operations |

$ 54,905,587 | |||

| Adjustments to reconcile net increase in net assets resulting from operations to net cash used in operating activities: |

||||

| Capital gain distributions received |

(1,839,968 | ) | ||

| Net change in unrealized appreciation/depreciation of investments |

(53,676,878 | ) | ||

| Decrease in receivable from Investment Manager |

105,155 | |||

| Increase in prepaid expenses and other assets |

(12,901 | ) | ||

| Increase in administrative fees payable |

3,525 | |||

| Increase in distribution fees payable |

55,946 | |||

| Decrease in other accrued expenses |

(33,396 | ) | ||

| Purchases of Master Fund |

(118,345,500 | ) | ||

|

|

|

| ||

| Net cash used in operating activities |

(118,838,430 | ) | ||

|

|

|

| ||

| Cash Flows from Financing Activities: |

||||

| Proceeds from capital Unit transactions (including increase in subscriptions in advance of $34,049,000 and increase in capital stock receivable of $52,986) |

156,656,299 | |||

| Disbursements from capital Unit transactions tendered (including change in payable for Fund Units tendered of $637,533) |

(2,864,830 | ) | ||

| Distributions paid in cash |

(196,548 | ) | ||

|

|

|

| ||

| Net cash provided by financing activities |

153,594,921 | |||

|

|

|

| ||

| Net increase in cash |

34,756,491 | |||

| Cash at beginning of year1 |

2,536,437 | |||

|

|

|

| ||

| Cash at end of year1 |

$ 37,292,928 | |||

|

|

|

| ||

| Supplemental Disclosure of Cash Flow Information |

||||

| Non-Cash Transactions: |

||||

| Reinvestment of distributions |

$ 1,643,935 | |||

| Capital gain distributions received and subsequent reinvestment into the Master Fund |

$ 1,839,968 | |||

| Units converted from Class 2 to Class 3# |

$ 7,143,656 | |||

| 1 | Includes cash and cash held in escrow on the statement of assets and liabilities. |

| # | Effective July 31, 2020, Advisory Class Units were renamed Class 2 Units and Institutional Class Units were renamed Class 3 Units. (See Note 1 of the Notes to Financial Statements.) |

The accompanying notes are an integral part of these financial statements.

10

Financial Highlights

For a Unit outstanding throughout each fiscal year

| For the fiscal years ended March 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Class 1 Units* |

||||||||||||||||||||

| Net Asset Value, Beginning of Year |

$13.55 | $14.06 | $13.12 | $11.60 | $10.25 | |||||||||||||||

| Income (Loss) from Investment Operations: |

||||||||||||||||||||

| Net investment loss1,2 |

(0.16 | ) | (0.14 | ) | (0.14 | ) | (0.12 | ) | (0.10 | ) | ||||||||||

| Net realized and unrealized gain from investments |

4.82 | 0.60 | 1.30 | 1.65 | 1.45 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Total from investment operations |

4.66 | 0.46 | 1.16 | 1.53 | 1.35 | |||||||||||||||

| Less Distributions to Investors from: |

||||||||||||||||||||

| Net investment income |

– | – | (0.17 | ) | – | – | ||||||||||||||

| Net realized gain on investments |

(0.17 | ) | (0.97 | ) | (0.05 | ) | (0.01 | ) | – | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Net Asset Value, End of Year |

$18.04 | $13.55 | $14.06 | $13.12 | $11.60 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Total Return1 |

34.63 | % | 3.10 | % | 8.97 | % | 13.18 | % | 13.17 | % | ||||||||||

| Ratio/Supplemental Data: |

||||||||||||||||||||

| Ratio of net expenses to average net assets |

0.92 | %3 | 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||

| Ratio of gross expenses to average net assets4 |

1.82 | %3 | 2.61 | % | 4.66 | % | 10.07 | % | 23.89 | % | ||||||||||

| Ratio of net investment loss to average net assets1 |

(0.92 | %) | (1.00 | %) | (1.00 | %) | (1.00 | %) | (1.00 | %) | ||||||||||

| Portfolio turnover rate (Master Fund) |

0% | 0% | 59% | 0%5 | 0%5 | |||||||||||||||

| Net assets, end of year (in thousands) |

$36,768 | $15 | $14 | $13 | $11 | |||||||||||||||

| * | Effective July 31, 2020, Brokerage Class Units were renamed Class 1 Units. |

| 1 | Total return and net investment income would have been lower had certain expenses not been offset. |

| 2 | Per Unit numbers have been calculated using average Units. |

| 3 | Such ratio includes recoupment of waived/reimbursed fees from prior periods amounting to 0.01% for the fiscal year ended March 31, 2021. |

| 4 | Excludes the impact of expense reimbursements or fee waivers and expense reductions, but includes expense recoupments and non-reimbursable expenses, if any, such as interest and taxes. |

| 5 | Less than 0.5%. |

11

AMG Pantheon Fund, LLC

Financial Highlights (continued)

For a Unit outstanding throughout each fiscal year

| For the fiscal years ended March 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Class 2 Units* |

||||||||||||||||||||

| Net Asset Value, Beginning of Year |

$13.76 | $14.19 | $13.27 | $11.68 | $10.27 | |||||||||||||||

| Income (Loss) from Investment Operations: |

||||||||||||||||||||

| Net investment loss1,2 |

(0.09 | ) | (0.07 | ) | (0.07 | ) | (0.06 | ) | (0.05 | ) | ||||||||||

| Net realized and unrealized gain from investments |

4.89 | 0.61 | 1.31 | 1.66 | 1.46 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total from investment operations |

4.80 | 0.54 | 1.24 | 1.60 | 1.41 | |||||||||||||||

| Less Distributions to Investors from: |

||||||||||||||||||||

| Net investment income |

– | – | (0.27 | ) | – | – | ||||||||||||||

| Net realized gain on investments |

(0.17 | ) | (0.97 | ) | (0.05 | ) | (0.01 | ) | – | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Asset Value, End of Year |

$18.39 | $13.76 | $14.19 | $13.27 | $11.68 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Return1 |

35.12 | % | 3.64 | % | 9.53 | % | 13.69 | % | 13.73 | % | ||||||||||

| Ratio/Supplemental Data: |

||||||||||||||||||||

| Ratio of net expenses to average net assets |

0.56 | %3 | 0.50 | % | 0.50 | % | 0.50 | % | 0.50 | % | ||||||||||

| Ratio of gross expenses to average net assets4 |

1.57 | %3 | 2.11 | % | 4.16 | % | 9.57 | % | 23.40 | % | ||||||||||

| Ratio of net investment loss to average net assets1 |

(0.56 | %) | (0.50 | %) | (0.50 | %) | (0.50 | %) | (0.50 | %) | ||||||||||

| Portfolio turnover rate (Master Fund) |

0% | 0% | 59% | 0%5 | 0%5 | |||||||||||||||

| Net assets, end of year (in thousands) |

$73,555 | $33,062 | $11,955 | $1,430 | $202 | |||||||||||||||

| * | Effective July 31, 2020, Advisory Class Units were renamed Class 2 Units. |

| 1 | Total return and net investment income would have been lower had certain expenses not been offset. |

| 2 | Per Unit numbers have been calculated using average Units. |

| 3 | Such ratio includes recoupment of waived/reimbursed fees from prior periods amounting to less than 0.005% for the fiscal year ended March 31, 2021. |

| 4 | Excludes the impact of expense reimbursements or fee waivers and expense reductions, but includes expense recoupments and non-reimbursable expenses, if any, such as interest and taxes. |

| 5 | Less than 0.5%. |

12

AMG Pantheon Fund, LLC

Financial Highlights (continued)

For a Unit outstanding throughout each fiscal year

| For the fiscal years ended March 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Class 3 Units* |

||||||||||||||||||||

| Net Asset Value, Beginning of Year |

$13.91 | $14.30 | $13.37 | $11.73 | $10.29 | |||||||||||||||

| Income (Loss) from Investment Operations: |

||||||||||||||||||||

| Net investment loss1,2 |

(0.05 | ) | (0.04 | ) | (0.03 | ) | (0.03 | ) | (0.03 | ) | ||||||||||

| Net realized and unrealized gain from investments |

4.94 | 0.62 | 1.30 | 1.68 | 1.47 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Total from investment operations |

4.89 | 0.58 | 1.27 | 1.65 | 1.44 | |||||||||||||||

| Less Distributions to Investors from: |

||||||||||||||||||||

| Net investment income |

– | – | (0.29 | ) | – | – | ||||||||||||||

| Net realized gain on investments |

(0.17 | ) | (0.97 | ) | (0.05 | ) | (0.01 | ) | |

– |

| |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Net Asset Value, End of Year |

$18.63 | $13.91 | $14.30 | $13.37 | $11.73 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Total Return1 |

35.39 | % | 3.89 | % | 9.70 | % | 14.06 | % | 13.99 | % | ||||||||||

| Ratio/Supplemental Data: |

||||||||||||||||||||

| Ratio of net expenses to average net assets |

0.30 | %3 | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | ||||||||||

| Ratio of gross expenses to average net assets4 |

1.32 | %3 | 1.86 | % | 3.91 | % | 9.32 | % | 23.15 | % | ||||||||||

| Ratio of net investment loss to average net assets1 |

(0.30 | %) | (0.25 | %) | (0.25 | %) | (0.25 | %) | (0.25 | %) | ||||||||||

| Portfolio turnover rate (Master Fund) |

0% | 0% | 59% | 0%5 | 0%5 | |||||||||||||||

| Net assets, end of year (in thousands) |

$153,552 | $58,897 | $17,122 | $1,672 | $1,149 | |||||||||||||||

| * | Effective July 31, 2020, Institutional Class Units were renamed Class 3 Units. |

| 1 | Total return and net investment income would have been lower had certain expenses not been offset. |

| 2 | Per Unit numbers have been calculated using average Units. |

| 3 | Such ratio includes recoupment of waived/reimbursed fees from prior periods amounting to less than 0.005% for the fiscal year ended March 31, 2021. |

| 4 | Excludes the impact of expense reimbursements or fee waivers and expense reductions, but includes expense recoupments and non-reimbursable expenses, if any, such as interest and taxes. |

| 5 | Less than 0.5%. |

13

AMG Pantheon Fund, LLC

Financial Highlights (continued)

For a Unit outstanding throughout each fiscal year

| For the fiscal years ended March 31, | ||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | ||||||||||||||||

| Class 4 Units* |

||||||||||||||||||||

| Net Asset Value, Beginning of Year |

$14.06 | $14.41 | $13.44 | $11.77 | $10.30 | |||||||||||||||

| Income (Loss) from Investment Operations: |

||||||||||||||||||||

| Net investment income (loss)1,2 |

(0.01 | ) | (0.00 | )3 | (0.00 | )3 | (0.00 | )3 | 0.00 | |||||||||||

| Net realized and unrealized gain from investments |

5.00 | 0.62 | 1.33 | 1.68 | 1.47 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Total from investment operations |

4.99 | 0.62 | 1.33 | 1.68 | 1.47 | |||||||||||||||

| Less Distributions to Investors from: |

||||||||||||||||||||

| Net investment income |

– | – | (0.31 | ) | – | – | ||||||||||||||

| Net realized gain on investments |

(0.17 | ) | (0.97 | ) | (0.05 | ) | (0.01 | ) | – | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Net Asset Value, End of Year |

$18.88 | $14.06 | $14.41 | $13.44 | $11.77 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

| Total Return1 |

35.72 | % | 4.15 | % | 10.11 | % | 14.26 | % | 14.27 | % | ||||||||||

| Ratio/Supplemental Data: |

||||||||||||||||||||

| Ratio of net expenses to average net assets |

0.05 | %4 | 0.00 | %5 | 0.00 | %5 | 0.00 | %5 | 0.00 | % | ||||||||||

| Ratio of gross expenses to average net assets6 |

1.07 | %4 | 1.61 | % | 3.66 | % | 9.07 | % | 22.90 | % | ||||||||||

| Ratio of net investment income (loss) to average net assets1 |

(0.05 | %) | (0.00 | %)5 | (0.00 | %)5 | (0.00 | %)5 | 0.00 | % | ||||||||||

| Portfolio turnover rate (Master Fund) |

0% | 0% | 59% | 0%7 | 0%7 | |||||||||||||||

| Net assets, end of year (in thousands) |

$5,095 | $3,144 | $3,868 | $3,680 | $2,794 | |||||||||||||||

| * | Effective July 31, 2020, Institutional Plus Class Units were renamed Class 4 Units. |

| 1 | Total return and net investment income would have been lower had certain expenses not been offset. |

| 2 | Per Unit numbers have been calculated using average Units. |

| 3 | Less than (0.005). |

| 4 | Such ratio includes recoupment of waived/reimbursed fees from prior periods amounting to less than 0.005% for the fiscal year ended March 31, 2021. |

| 5 | Less than 0.005% or (0.005%). |

| 6 | Excludes the impact of expense reimbursements or fee waivers and expense reductions, but includes expense recoupments and non-reimbursable expenses, if any, such as interest and taxes. |

| 7 | Less than 0.5%. |

14

AMG Pantheon Fund, LLC

Financial Highlights (continued)

For a Unit outstanding throughout each fiscal year

| For the fiscal period ended March 31, 2021* | ||||

| Class 5 Units |

||||

| Net Asset Value, Beginning of Period |

$14.37 | |||

| Income (Loss) from Investment Operations: |

||||

| Net investment loss 1,2 |

(0.11 | ) | ||

| Net realized and unrealized gain from investments |

3.92 | |||

|

|

|

| ||

| Total from investment operations |

3.81 | |||

| Less Distributions to Investors from: |

||||

| Net realized gain on investments |

(0.17 | ) | ||

|

|

|

| ||

| Net Asset Value, End of Period |

$18.01 | |||

|

|

|

| ||

| Total Return1 |

26.73 | %3 | ||

| Ratio/Supplemental Data: |

||||

| Ratio of net expenses to average net assets |

1.05 | %4,5 | ||

| Ratio of gross expenses to average net assets6 |

2.07 | %4,5 | ||

| Ratio of net investment loss to average net assets1 |

(1.05 | %)4 | ||

| Portfolio turnover rate (Master Fund) |

0%3 | |||

| Net assets, end of period (in thousands) |

$13 | |||

| * | Class commenced operations on July 31, 2020. |

| 1 | Total return and net investment income would have been lower had certain expenses not been offset. |

| 2 | Per Unit numbers have been calculated using average Units. |

| 3 | Not annualized. |

| 4 | Annualized. |

| 5 | Such ratio includes recoupment of waived/reimbursed fees from prior periods amounting to less than 0.005% for the fiscal year ended March 31, 2021. |

| 6 | Excludes the impact of expense reimbursements or fee waivers and expense reductions, but includes expense recoupments and non-reimbursable expenses, if any, such as interest and taxes. |

15

Notes to Financial Statements

March 31, 2021

| 1. | ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

AMG Pantheon Fund, LLC (the “Fund”) is organized as a Delaware limited liability company and is registered under the Investment Company Act of 1940, as amended (the “1940 Act”) as a closed-end, non-diversified management investment company. The Fund’s term is perpetual unless the Fund is otherwise terminated under the terms of the Fund’s organizational documents. The Fund’s investment objective is to seek long-term capital appreciation. In pursuing its investment objective, the Fund invests substantially all of its assets in AMG Pantheon Master Fund, LLC, an affiliate of the Fund, which has the same investment objective and investment policies as those of the Fund. AMG Pantheon Master Fund, LLC makes investments directly and through its wholly owned subsidiary, AMG Pantheon Subsidiary Fund, LLC (the “Subsidiary Fund” and together with AMG Pantheon Master Fund, LLC, the “Master Fund”). As of March 31, 2021, the Fund owned 66.1% of the Units in the Master Fund. The performance of the Fund is directly affected by the performance of the Master Fund. The consolidated financial statements of the Master Fund, including the Consolidated Schedule of Investments, are included elsewhere in this report and should be read in conjunction with the Fund’s financial statements.

The Fund offers five classes of Units (each a “Unit” and collectively, “Units”). On July 31, 2020, Brokerage Class was renamed Class 1, Advisory Class was renamed Class 2, Institutional Class was renamed Class 3, Institutional Plus was renamed Class 4, and the Fund began offering Class 5 Units. Each Unit is offered to “accredited investors” (as defined in Regulation D under the Securities Act of 1933, as amended (the “Securities Act”)) and may be purchased on a continuous basis as of the first business day of each month at the class’s net asset value (“NAV”) per Unit. The Units of Class 1, Class 2, Class 3, Class 4, and Class 5 generally have identical voting rights, but each Unit class may vote separately when required by law. Different Unit classes will pay different distribution amounts to the extent the NAV per Unit and/or the expenses of such Unit classes differ. Each Unit class has its own expense structure. Sales of Units of Class 5 will incur a sales load up to 3.50%. Effective July 31, 2020, the sales load of up to 3.50% applicable to the Fund’s Class 1 Units was eliminated. The Fund has registered $500,000,000 in Units for sale under the Securities Act and offers Units of Class 1, Class 2, Class 3, Class 4, and Class 5 to the public under the Securities Act.

To provide liquidity to unitholders of the Fund (“Investors”), the Fund may, from time to time, offer to repurchase Units pursuant to written tenders by Investors. Repurchases will be made at such times, in such amounts and on such terms as may be determined by the Fund’s Board of Directors (the “Board” or the “Directors”).

The Fund’s financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), including accounting and reporting guidance pursuant to Accounting Standards Codification Topic 946 applicable to investment companies. U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and

16

AMG Pantheon Fund, LLC

Notes to Financial Statements (continued)

expenses during the reporting period. Actual results could differ from those estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements:

| a. | VALUATION OF INVESTMENTS: The Fund records its investment in the Master Fund at a value based on the NAV per Unit of the Master Fund. Valuation policies for securities held by the Master Fund are discussed in Note 1(a) of the Master Fund’s Notes to Consolidated Financial Statements. |

| b. | SECURITY TRANSACTIONS: For financial reporting purposes, contributions to and withdrawals from the Master Fund are accounted for on a trade date basis. Security transactions are accounted for as of trade date. Realized gains and losses on withdrawals from the Master Fund and on securities sold are determined on the basis of identified cost. For the fiscal year ended March 31, 2021, the Fund purchased $118,345,500 of the Master Fund and did not redeem any Units of the Master Fund. |

The Master Fund may, from time to time, offer to repurchase Units pursuant to written tenders by the Master Fund’s investors. Repurchases will be made at such times, in such amounts and on such terms as may be determined by the Master Fund’s Board of Directors.

| c. | INVESTMENT INCOME AND EXPENSES: Dividend income, including distributions from the Master Fund, is recorded on the ex-dividend date. Expenses are recorded on an accrual basis. Legal fees are apportioned between the Fund and the Master Fund based on level of service. The Fund indirectly bears its proportional share of the Master Fund’s expenses, which is reflected in the NAV of the Master Fund’s Units. During the fiscal year ended March 31, 2021, the Fund’s proportional share of the Master Fund’s expenses and deferred tax expense was $2,365,257 and $740,842, respectively, which represents 1.56% and 0.48%, respectively, of the Fund’s average investment balance in the Master Fund. |

Investment income, realized and unrealized gains and losses, the common expenses of the Fund, and certain Fund level expense reductions, if any, are allocated on a pro-rata basis to each class based on the relative net assets of each class to the total net assets of the Fund.

| d. | DIVIDENDS AND DISTRIBUTIONS: Fund distributions resulting from either net investment income or realized net capital gains, if any, will normally be declared and paid at least annually as described in the Fund’s prospectus. Distributions to Investors are recorded on the ex-dividend date. Distributions are determined in accordance with federal income tax regulations, which may differ from net investment income and net realized capital gains for financial statement purposes (U.S. GAAP). Differences may be permanent or temporary. Permanent differences, including book tax differences relating to Investors’ distributions, are reclassified among capital accounts in the financial |

17

AMG Pantheon Fund, LLC

Notes to Financial Statements (continued)

| statements to reflect their tax character. Temporary differences arise when certain items of income, expense and gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some time in the future. As of September 30, 2020, the Fund had permanent differences relating to the write-off of net operating losses. The Fund had temporary differences relating to qualified late year ordinary loss deferral. |

The tax character of distributions paid during the tax years ended September 30, 2020 and September 30, 2019 was as follows:

| Distributions paid from: | 2020 | 2019 | ||||||

| Ordinary income |

$ - | $ 379,254 | ||||||

| Long-term capital gains |

5,118,636 | 250,666 | ||||||

|

|

|

|

|

|||||

| Total |

$ 5,118,636 | $ 629,920 | ||||||

|

|

|

|

|

|||||

As of September 30, 2020, the components of accumulated earnings on a tax basis were as follows:

| Undistributed net investment income |

$ - | |||

| Undistributed long-term capital gains |

$ - | |||

| Late year loss deferral |

$ (217,630) | |||

Based on the cost of investments of $123,635,555 for federal income tax purposes at September 30, 2020, the Fund’s aggregate gross unrealized appreciation and depreciation were $15,213,030 and $0, respectively, resulting in net unrealized appreciation of $15,213,030.

| e. | FEDERAL TAXES: The Fund qualifies as an investment company and intends to comply with the requirements under Subchapter M of the Internal Revenue Code of 1986, as amended (the “IRC”), and to distribute substantially all of its taxable income and gains to its Investors and to meet certain diversification and income requirements with respect to investment companies. Therefore, no provision for federal income or excise tax is included in the accompanying financial statements. If the Fund and/or the Master Fund were to fail to meet the requirements of Subchapter M of the IRC to qualify as a regulated investment company, and if the Fund and/or the Master Fund were ineligible to or otherwise were not to cure such failure, the Fund would be subject to tax on its taxable income at corporate rates, whether or not distributed to its Investors, and all distributions out of income and profits would be taxable to Investors as ordinary income. In addition, the Fund could be required to recognize unrealized gains, pay substantial taxes and interest and make substantial distributions before requalifying as a regulated investment company that is accorded special tax treatment under Subchapter M of the IRC. |

18

AMG Pantheon Fund, LLC

Notes to Financial Statements (continued)

The Fund’s tax year end is September 30. Management has analyzed the Fund’s tax positions as of March 31, 2021, and for all open tax years (generally, the three prior taxable years), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. Additionally, the Fund is not aware of any tax position for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

| f. | CAPITAL LOSS CARRYOVERS AND DEFERRALS: As of September 30, 2020, the Fund had no capital loss carryovers for federal income tax purposes. Should the Fund incur net capital losses for the tax year ended September 30, 2021, such amounts may be used to offset future realized capital gains for an unlimited time period and retain their character as short-term and/or long-term. |

| g. | CAPITAL STOCK: The Fund’s Limited Liability Company Agreement authorizes an issuance of an unlimited number of Units, without par value. The Fund records sales and repurchases of its capital stock on the trade date. Additionally, a 2.00% early repurchase fee will be charged by the Fund with respect to any repurchase of Units at any time prior to the day immediately preceding the one-year anniversary of the Investor’s purchase of the Units. For the fiscal years ended March 31, 2021 and March 31, 2020, there were no early repurchase fees. |

For the fiscal years ended March 31, 2021 and March 31, 2020, the Fund’s capital Unit transactions by class were as follows:

| March 31, 2021 | March 31, 2020 | |||||||||||||||

| Units | Amount | Units | Amount | |||||||||||||

| Class 1:1 |

||||||||||||||||

| Proceeds from sale of Units |

2,033,874 | $ 33,082,500 | – | – | ||||||||||||

| Reinvestment of dividends |

4,052 | 63,083 | 71 | $ 977 | ||||||||||||

| Cost of Units tendered |

(1,076 | ) | (16,748 | ) | – | – | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Net increase |

2,036,850 | $ 33,128,835 | 71 | $ 977 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Class 2:1 |

||||||||||||||||

| Proceeds from sale of Units |

2,120,045 | $ 32,363,315 | 1,627,505 | $ 23,215,450 | ||||||||||||

| Reinvestment of dividends |

28,157 | 446,563 | 96,180 | 1,358,057 | ||||||||||||

| Cost of Units tendered |

(52,474 | ) | (830,059 | ) | (10,646 | ) | (147,765 | ) | ||||||||

| Unit Conversion |

(497,492 | ) | (7,143,656 | ) | (153,398 | ) | (2,220,129 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| Net increase |

1,598,236 | $ 24,836,163 | 1,559,641 | $ 22,205,613 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

19

AMG Pantheon Fund, LLC

Notes to Financial Statements (continued)

| March 31, 2021 | March 31, 2020 | |||||||||||||||

| Units | Amount | Units | Amount | |||||||||||||

| Class 3:1 |

||||||||||||||||

| Proceeds from sale of Units |

3,598,811 | $ | 56,274,261 | 2,669,544 | $ | 38,730,943 | ||||||||||

| Reinvestment of dividends |

68,229 | 1,095,751 | 214,551 | 3,061,639 | ||||||||||||

| Cost of Units tendered |

(151,518) | (2,477,165) | – | – | ||||||||||||

| Unit Conversion |

491,846 | 7,143,656 | 152,092 | 2,220,129 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase |

4,007,368 | $ | 62,036,503 | 3,036,187 | $ | 44,012,711 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Class 4:1 |

||||||||||||||||

| Proceeds from sale of Units |

54,831 | $ | 930,209 | 10,831 | $ | 152,358 | ||||||||||

| Reinvestment of dividends |

2,361 | 38,417 | 14,075 | 202,816 | ||||||||||||

| Cost of Units tendered |

(10,964) | (178,391) | (69,834) | (1,027,920) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase (decrease) |

46,228 | $ | 790,235 | (44,928) | $ | (672,746) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Class 5:2 |

||||||||||||||||

| Proceeds from sale of Units |

696 | $ | 10,000 | – | – | |||||||||||

| Reinvestment of dividends |

8 | 121 | – | – | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net increase |

704 | $ | 10,121 | – | – | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1 | Effective July 31, 2020, Brokerage Class Units were renamed Class 1 Units, Advisory Class Units were renamed Class 2 Units, Institutional Class Units were renamed Class 3 Units, and Institutional Plus Class Units were renamed Class 4 Units. |

| 2 | Commencement of operations was July 31, 2020. |

At March 31, 2021, seven affiliated Investors, including Officers/Directors/Trustees of the Fund and/or Pantheon Ventures (US) LP (the “Investment Manager” or “Pantheon”), owned 0.63% of the net assets of the Fund.

| h. | CASH AND CASH HELD IN ESCROW: Cash consists of monies held at The Bank of New York Mellon (the “Custodian” or “BNYM”). Such cash, at times, may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts. There are no restrictions on the cash held by the Fund’s Custodian. Cash held in escrow represents monies received in advance of the effective date of an Investor’s subscription. The monies are deposited with the Fund’s transfer agent, and will be released from escrow on the effective date of the subscription. |

20

AMG Pantheon Fund, LLC

Notes to Financial Statements (continued)

| 2. | AGREEMENTS AND TRANSACTIONS WITH AFFILIATES |

The Fund has entered into an investment management agreement with Pantheon, a limited partnership organized under the laws of the State of Delaware and registered as an investment adviser under the Investment Advisers Act of 1940, as amended. Affiliated Managers Group, Inc. (“AMG”) indirectly owns a majority of the interests of the Investment Manager. Investment management fees are paid directly by the Fund to the Investment Manager at the annual rate of 0.70% of the net assets of the Fund as of the end of each month, determined before giving effect to the accrual of the investment management fee being calculated or to any purchases or repurchases of interests of the Fund or any distributions by the Fund. The Investment Manager has agreed to waive its investment management fee paid by the Fund with respect to any period during which the only investment security held by the Fund is that of another investment company registered under the 1940 Act. Investment management fees waived under this investment management fee waiver may not be recouped by the Investment Manager in subsequent periods. During the fiscal year ended March 31, 2021, the Investment Manager waived all investment management fees payable by the Fund in the amount of $1,062,677.

The Investment Manager has entered into an Expense Limitation and Reimbursement Agreement with the Fund and the Master Fund to waive the investment management fees payable by the Master Fund and pay or reimburse the Fund’s expenses (whether borne directly or indirectly through and in proportion to the Fund’s interest in the Master Fund) such that the Fund’s total annual operating expenses (exclusive of certain “Excluded Expenses” listed below) do not exceed 1.45% per annum of the Fund’s net assets as of the end of each calendar month (the “Expense Cap”). “Excluded Expenses” is defined to include (i) the Fund’s proportional share of (a) fees, expenses, allocations, carried interests, etc. of the private equity investment funds and co-investments in portfolio companies in which the Master Fund invests (including all acquired fund fees and expenses); (b) transaction costs, including legal costs and brokerage commissions, of the Master Fund associated with the acquisition and disposition of primary interests, secondary interests, co-investments, ETF investments, and other investments; (c) interest payments incurred by the Master Fund; (d) fees and expenses incurred in connection with any credit facilities obtained by the Master Fund; (e) taxes of the Master Fund; (f) extraordinary expenses of the Master Fund (as determined in the sole discretion of the Investment Manager), which may include non-recurring expenses such as, for example, litigation expenses and shareholder meeting expenses; (g) fees and expenses billed directly to the Subsidiary Fund by any accounting firm for auditing, tax and other professional services provided to the Subsidiary Fund; and (h) fees and expenses paid by the Subsidiary Fund for custody and fund administration services provided to the Subsidiary Fund; and (ii) (a) any investment management fee paid by the Fund; (b) acquired fund fees and expenses of the Fund; (c) transaction costs, including legal costs and brokerage commissions, of the Fund; (d) interest payments incurred by the Fund; (e) fees and expenses incurred in connection with any credit facilities obtained by the Fund; (f) the distribution and/or service fee paid by the Fund; (g) taxes of the Fund; and (h) extraordinary expenses of the Fund (as determined in the sole discretion of the Investment Manager), which may include non-recurring expenses such as, for example, litigation expenses and shareholder meeting expenses. Expenses that are subject to

21

AMG Pantheon Fund, LLC

Notes to Financial Statements (continued)

the Expense Limitation and Reimbursement Agreement include, but are not limited to, the Master Fund’s investment management fee, the Fund’s administration, custody, transfer agency, record keeping, fund accounting and investor services fees, the Fund’s professional fees (outside of professional fees related to transactions), the Fund’s organizational costs and fees and expenses of Fund Directors.

To the extent that the Fund’s total annual operating expenses for any month exceed the Expense Cap, the Investment Manager will pay or reimburse the Fund for expenses and/or waive the management fee payable by the Master Fund to the extent necessary to eliminate such excess. The Fund, or, with respect to the waived management fee, the Master Fund, will be obligated to pay the Investment Manager all such amounts paid, waived, or reimbursed by the Investment Manager pursuant to the Expense Cap, provided that (a) the amount of such additional payment in any year, together with all expenses of the Fund (whether borne directly or indirectly through and in proportion to the Fund’s interest in the Master Fund), in the aggregate, would not cause the Fund’s total annual operating expenses, whether borne directly or indirectly through and in proportion to the Fund’s interest in the Master Fund, exclusive of Excluded Expenses, in any such year to exceed the lesser of any expense limitation in place at the time of payment or the expense limitation in place at the time of waiver or reimbursement, (b) the amount of such additional payment shall be borne pro rata by all Fund Investors or Master Fund unitholders, as applicable, and (c) no such additional payments by the Fund, or, with respect to the waived management fee, the Master Fund, will be made with respect to amounts paid, waived, or reimbursed by the Investment Manager more than thirty-six (36) months after the date such amounts are paid, waived, or reimbursed by the Investment Manager. The Expense Limitation Agreement shall continue until such time that the Investment Manager ceases to be the investment manager of the Fund or upon mutual agreement between the Investment Manager and the Fund’s Board.

For the fiscal year ended March 31, 2021, the Fund’s expiration of recoupment is as follows:

| Expiration Period | ||||

| Less than 1 year |

$ | 545,847 | ||

| Within 2 years |

563,801 | |||

| Within 3 years |

505,707 | |||

|

|

|

|||

| Total Amount Subject to Recoupment |

$ | 1,615,355 | ||

|

|

|

|||

The Fund has entered into an Administration Agreement under which AMG Funds LLC, a subsidiary and the U.S. retail distribution arm of AMG, serves as the Fund’s administrator (the “Administrator”) and is responsible for all non-portfolio management aspects of managing the Fund’s operations, including administration and Investor services to the Fund, its Investors, and certain institutions, such as broker-dealers and registered investment advisers, that advise or act as an intermediary with the Fund’s Investors. The Fund pays a fee to the Administrator at

22

AMG Pantheon Fund, LLC

Notes to Financial Statements (continued)

the rate of 0.05% per annum of the Fund’s average monthly net assets, with a minimum annual fee of $86,000 for these services.

The Fund is distributed by AMG Distributors, Inc. (the “Distributor”), a wholly-owned subsidiary of the Administrator. The Distributor serves as the distributor and underwriter for the Fund and is a registered broker-dealer and member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). Units of the Fund will be continuously offered and will be sold directly to prospective accredited investors and through brokers, dealers or other financial intermediaries who have executed selling agreements with the Distributor. Generally the Distributor bears all or a portion of the expenses of providing services pursuant to the distribution agreement, including the payment of the expenses relating to the distribution of registration statements for sales purposes and any advertising or sales literature. The Distributor has appointed Pantheon Securities, LLC, an affiliate of the Investment Manager, as a sub distributor of the Fund (the “Sub Distributor”) in which the Sub Distributor may carry out certain responsibilities of the Distributor.

The Fund adopted a distribution and service plan (the “Plan”) with respect to Class 1, Class 2, Class 3, and Class 5, in accordance with the requirements of Rule 12b-1 under the 1940 Act and the requirements of the applicable rules of FINRA regarding asset based sales charges. Pursuant to the Plan, the Fund may make payments to the Distributor for its expenditures in financing any activity primarily intended to result in the sale of the Fund’s Class 1, Class 2, Class 3, and Class 5 Units and for maintenance and personal service provided to existing Investors of those classes. The Plan authorizes payments to the Distributor of 0.75%, 0.50%, 0.25%, and 1.00% annually of the average monthly net assets attributable to Class 1, Class 2, Class 3, and Class 5, respectively. Effective July 31, 2020, the annual rate of distribution and service fees payable by Class 1 Units was lowered from 1.00% to 0.75%. The Plan further provides for periodic payments by the Fund to brokers, dealers and other financial intermediaries for providing shareholder services and for promotional and other sales related costs. The portion of payments made under the Plan by Class 1, Class 2, Class 3, and Class 5 for shareholder servicing may not exceed an annual rate of 0.25% of the average daily NAV of the Fund’s Units of that class owned by clients of such broker, dealer or financial intermediary.

The Board provides supervision of the affairs of the Fund, the Master Fund, and other trusts within the AMG Funds family of mutual funds. The Directors of the Fund who are not affiliated with the Investment Manager receive an annual retainer and per meeting fees for regular, special and telephonic meetings, and they are reimbursed for out-of-pocket expenses incurred while carrying out their duties as Board members. The Chairperson of the Board and the Audit Committee Chair receive additional annual retainers. The Directors’ fees and expenses are split evenly between the Master Fund and the Fund. Certain Directors and Officers of the Fund are Officers and/or Directors of the Investment Manager, the Administrator, AMG and/or the Distributor.

23

AMG Pantheon Fund, LLC

Notes to Financial Statements (continued)

| 3. | COMMITMENTS AND CONTINGENCIES |

Under the Fund’s organizational documents, its Directors and Officers are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts and agreements that contain a variety of representations and warranties, which may provide general indemnifications. The maximum exposure to the Fund under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred.

| 4. | FINANCIAL AND OTHER RISK FACTORS |

The Fund invests a substantial portion of its assets in the Master Fund and the Master Fund intends to invest a substantial portion of its available capital in private equity securities including investments in private equity, infrastructure, and other private asset funds. These investments are generally restricted securities that are subject to substantial holding periods and are not traded in public markets so that the Master Fund may not be able to resell some of its holdings for extended periods, which may be several years. No guarantee or representation is made that the Fund’s investment objective will be met.

Units in the Fund provide limited liquidity because repurchases of Units are subject to approval of the Fund’s Board.

A discussion of the risks associated with the Fund’s investment in the Master Fund is provided in Note 9 of the Master Fund’s Notes to Consolidated Financial Statements and the Fund’s prospectus.

| 5. | SUBSEQUENT EVENTS |

Subsequent events after March 31, 2021 have been evaluated through the date at which the financial statements were issued. In conjunction with the June 30, 2021 tender offer, the Fund will repurchase 45,500 Units from Investors with an approximate value of $826,280.

| 6. | CHANGE IN INDEPENDENT ACCOUNTANT (unaudited) |

On February 18, 2021, PricewaterhouseCoopers LLP (“PwC”) resigned as the independent registered public accountants of the Fund. On February 18, 2021, the Audit Committee of the Board of the Fund accepted and recommended that the Board accept the resignation of PwC and approved and recommended that the Board approve the appointment of KPMG LLP as the independent registered public accountants for the Fund for the fiscal year ending March 31, 2021. On February 19, 2021, PwC provided a letter confirming that the client-auditor relationship between the Fund and PwC had ceased.

24

AMG Pantheon Fund, LLC

Notes to Financial Statements (continued)

For the fiscal years ended March 31, 2019 and March 31, 2020, PwC’s audit reports contained no adverse opinion or disclaimer of opinion; nor were its reports qualified or modified as to uncertainty, audit scope, or accounting principles.

Further, in connection with its audits for the fiscal years ended March 31, 2019 and March 31, 2020, and the subsequent interim period through February 18, 2021: (i) there were no “disagreements” with PwC of the kind described in paragraph (a)(1)(iv) of Item 304 of Regulation S-K, and (ii) there were no “reportable events” of the kind described in paragraph (a)(1)(v) of such Item 304.

The Fund provided PwC with a copy of the disclosure contained in this N-CSR and requested that PwC furnish the Fund with a letter addressed to the Securities & Exchange Commission (SEC) stating whether it agrees with the above statements and, if not, stating the respects in which it does not agree. A copy of PwC’s letter dated June 4, 2021 will be filed as Exhibit (a)(4) to the Fund’s N-CSR.

During the Fund’s two most recent fiscal years ended March 31, 2019 and March 31, 2020, and the subsequent interim period through February 18, 2021, neither the Fund nor anyone on its behalf consulted KPMG LLP regarding either: (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Fund’s financial statements, and neither a written report was provided to the Fund or oral advice was provided to the Fund that KPMG LLP concluded was an important factor considered by the Fund in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement or reportable event as defined in Regulation S-K, Item 304(a)(1)(iv) and Item 304(a)(1)(v), respectively.

25

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Unitholders of AMG Pantheon Fund, LLC:

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of AMG Pantheon Fund, LLC (the Fund) as of March 31, 2021, the related statement of operations and cash flows for the year then ended, the statement of changes in net assets for the year then ended, and the related notes (collectively, the financial statements) and the financial highlights for the year then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Fund as of March 31, 2021, the results of its operations and its cash flows for the year then ended, the changes in its net assets for the year then ended, and the financial highlights for the year then ended, in conformity with U.S. generally accepted accounting principles. The statement of changes in net assets for the year ended March 31, 2020, and the financial highlights for each of the years in the four year period ended March 31, 2020, were audited by other auditors. Those auditors expressed an unqualified opinion on the statement of changes in net assets and those financial highlights in their report dated June 26, 2020.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audit included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of investments owned as of March 31, 2021, by correspondence with the transfer agent. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audit provide a reasonable basis for our opinion.

/s/KPMG LLP

We have served as the auditor of one or more AMG Funds investment companies since 2021.

New York, New York

June 4, 2021

26

Other Tax Information (unaudited)

AMG Pantheon Fund, LLC hereby designates the maximum amount allowable of its net taxable income as qualified dividends as provided in the Jobs and Growth Tax Relief Reconciliation Act of 2003. The 2019/2020 Form 1099-DIV you received for the Fund showed the tax status of all distributions paid to you during the year.

Pursuant to section 852 of the Internal Revenue Code, AMG Pantheon Fund, LLC hereby designates $5,118,636 as a capital gain distribution with respect to the taxable fiscal year ended September 30, 2020, or if subsequently determined to be different, the net capital gains of such year.

27

Directors and Officers (unaudited)

The Directors and Officers, their business addresses, principal occupations for the past five years and ages are listed below. The Directors provide broad supervision over the affairs of the Fund. The Directors are experienced executives who meet periodically throughout the year to oversee the Fund’s activities, review contractual arrangements with companies that provide services to the Fund, and review the Fund’s performance. Unless otherwise noted, the address of each Director or Officer is the address of the Fund: One Stamford Plaza, 263 Tresser Boulevard, Suite 949, Stamford, Connecticut 06901. There is no stated term of office for Directors. Directors serve until their resignation, retirement or removal in accordance with the Fund’s organizational documents and policies adopted by the Board from time to time. The President, Treasurer and Secretary of the Fund are elected by the Directors annually. The Officers hold office at the pleasure of the Directors.

Independent Directors

The following Directors are not “interested persons” of the Fund within the meaning of the 1940 Act:

| Number of Funds Overseen in Fund Complex |

Name, Age, Principal Occupation(s) During Past 5 Years and Other Directorships Held by Director | |

|

● Director since 2014 ● Oversees 46 Funds in Fund Complex |

Kurt A. Keilhacker, 57 Managing Partner, TechFund Europe (2000-Present); Managing Partner, TechFund Capital (1997-Present); Managing Partner, Elementum Ventures (2013-Present); Director, MetricStory, Inc. (2017-Present); Trustee, Wheaton College (2018-Present); Trustee, Gordon College (2001- 2016); Board Member, 6wind SA (2002-2019). | |

|

● Independent Chairman ● Director since 2014 ● Oversees 46 Funds in Fund Complex |

Eric Rakowski, 62 Professor of Law, University of California at Berkeley School of Law (1990-Present); Tax Attorney at Davis Polk & Wardwell and clerked for Judge Harry T. Edwards of the U.S. Court of Appeals for the District of Columbia Circuit and for Justice William J. Brennan Jr. of the U.S. Supreme Court; Director of Harding, Loevner Funds, Inc. (10 portfolios); Trustee of Third Avenue Trust (3 portfolios) (2002-2019); Trustee of Third Avenue Variable Trust (1 portfolio) (2002-2019). | |

| ● Director since 2014 ● Oversees 46 Funds in Fund Complex |

Victoria L. Sassine, 55 Adjunct Professor, Babson College (2007-Present); Director, Board of Directors, PRG Group (2017-Present); CEO, Founder, Scale Smarter Partners, LLC (2018-Present); Adviser, EVOFEM Biosciences (2019-Present); Chairperson, Board of Directors, Business Management Associates (2018-2019). | |

| Interested Directors |

||

| Number of Funds Overseen in Fund Complex | Name, Age, Principal Occupation(s) During Past 5 Years and Other Directorships Held by Director | |

|

● Director since 2014 ● Oversees 46 Funds in Fund Complex |

Christine C. Carsman, 69 Senior Policy Advisor, Affiliated Managers Group, Inc. (2019-Present); Chair of the Board of Directors, AMG Funds plc (2015-2018); Director, AMG Funds plc (2010-2018); Executive Vice President, Deputy General Counsel and Chief Regulatory Counsel, Affiliated Managers Group, Inc. (2017-2018); Senior Vice President and Deputy General Counsel, Affiliated Managers Group, Inc. (2011-2016); Senior Vice President and Chief Regulatory Counsel, Affiliated Managers Group, Inc. (2007-2011); Vice President and Chief Regulatory Counsel, Affiliated Managers Group, Inc. (2004-2007); Secretary and Chief Legal Officer, AMG Funds, AMG Funds I, AMG Funds II and AMG Funds III (2004-2011); Senior Counsel, Vice President and Director of Operational Risk Management and Compliance, Wellington Management Company, LLP; Director Emeritus of Harding, Loevner Funds, Inc. (0 portfolios) (2021-Present); Director of Harding, Loevner Funds, Inc. (9 portfolios) (2017-2020). | |

28

AMG Pantheon Fund, LLC

Directors and Officers (continued)

| Officers |

||

| Position(s) Held with Fund and Length of Time Served | Name, Age, Principal Occupation(s) During Past 5 Years | |

|

● President since 2018 ● Principal Executive Officer since 2018 ● Chief Executive Officer since 2018 ● Chief Operating Officer since 2014 |

Keitha L. Kinne, 63 Chief Operating Officer, AMG Funds LLC (2007-Present); Chief Investment Officer, AMG Funds LLC (2008-Present); President and Principal, AMG Distributors, Inc. (2018-Present); Chief Operating Officer, AMG Distributors, Inc. (2007-Present); President, Chief Executive Officer and Principal Executive Officer, AMG Funds, AMG Funds I, AMG Funds II, AMG Funds III and AMG Funds IV (2018-Present); Chief Operating Officer, AMG Funds, AMG Funds I, AMG Funds II, and AMG Funds III (2007-Present); Chief Operating Officer, AMG Funds IV (2016-Present); Chief Operating Officer and Chief Investment Officer, Aston Asset Management, LLC (2016); President and Principal Executive Officer, AMG Funds, AMG Funds I, AMG Funds II and AMG Funds III (2012-2014); Managing Partner, AMG Funds LLC (2007-2014); President and Principal, AMG Distributors, Inc. (2012-2014); Managing Director, Legg Mason & Co., LLC (2006-2007); Managing Director, Citigroup Asset Management (2004-2006). | |

|

● Secretary and Chief Legal Officer since 2015 |

Mark J. Duggan, 56 Managing Director and Senior Counsel, AMG Funds LLC (2021-Present); Senior Vice President and Senior Counsel, AMG Funds LLC (2015-2021); Secretary and Chief Legal Officer, AMG Funds, AMG Funds I, AMG Funds II, AMG Funds III and AMG Funds IV (2015-Present); Attorney, K&L Gates, LLP (2009-2015). | |

|

● Chief Financial Officer since 2017 ● Treasurer since 2017 ● Principal Financial Officer since 2017 ● Principal Accounting Officer since 2017 |

Thomas G. Disbrow, 55 Vice President, Mutual Fund Treasurer & CFO, AMG Funds, AMG Funds LLC (2017-Present); Chief Financial Officer, Principal Financial Officer, Treasurer and Principal Accounting Officer, AMG Funds, AMG Funds I, AMG Funds II, AMG Funds III and AMG Funds IV (2017-Present); Managing Director - Global Head of Traditional Funds Product Control, UBS Asset Management (Americas), Inc. (2015-2017); Managing Director - Head of North American Funds Treasury, UBS Asset Management (Americas), Inc. (2011-2015). | |

|

● Deputy Treasurer since 2017 |

John A. Starace, 50 Vice President, Mutual Fund Accounting, AMG Funds LLC (2021-Present); Director, Mutual Fund Accounting, AMG Funds LLC (2017-2021); Vice President, Deputy Treasurer of Mutual Funds Services, AMG Funds LLC (2014-2017); Deputy Treasurer, AMG Funds, AMG Funds I, AMG Funds II, AMG Funds III and AMG Funds IV (2017-Present); Vice President, Citi Hedge Fund Services (2010-2014); Audit Senior Manager (2005-2010) and Audit Manager (2001- 2005), Deloitte & Touche LLP. | |

|

● Chief Compliance Officer and Sarbanes-Oxley Code of Ethics Compliance Officer since 2019 |

Patrick J. Spellman, 47 Vice President, Chief Compliance Officer, AMG Funds LLC (2017-Present); Chief Compliance Officer and Sarbanes-Oxley Code of Ethics Compliance Officer, AMG Funds, AMG Funds I, AMG Funds II, AMG Funds III and AMG Funds IV (2019-Present); Chief Compliance Officer, AMG Distributors, Inc., (2010-Present); Senior Vice President, Chief Compliance Officer, AMG Funds LLC (2011-2017); Anti-Money Laundering Compliance Officer, AMG Funds, AMG Funds I, AMG Funds II, and AMG Funds III (2014-2019); Anti-Money Laundering Officer, AMG Funds IV, (2016-2019); Compliance Manager, Legal and Compliance, Affiliated Managers Group, Inc. (2005-2011). | |

|

● Anti-Money Laundering Compliance Officer since 2019 |

Hector D. Roman, 43 Director, Legal and Compliance, AMG Funds LLC (2020-Present); Manager, Legal and Compliance, AMG Funds LLC (2017-2019); Anti-Money Laundering Compliance Officer, AMG Funds, AMG Funds I, AMG Funds II, AMG Funds III and AMG Funds IV (2019-Present); Director of Compliance, Morgan Stanley Investment Management (2015-2017); Senior Advisory, PricewaterhouseCoopers LLP (2014-2015); Risk Manager, Barclays Investment Bank (2008- 2014). | |

|

● Executive Vice President since 2021 |

Susan Long McAndrews, 54 Partner of U.S. Investment and Global Business Development, Pantheon Ventures (US) LP (2002-Present); Chief Executive Officer, Pantheon Securities, LLC (2002-Present); Principal, Capital Z Partners (1998-2001); Director, Private Equity Group, Russell Investments (1995- 1998). | |

29

|

ANNUAL REPORT |

| AMG Funds

March 31, 2021

AMG Pantheon Master Fund, LLC |

| www.amgfunds.com | 033121 AR081 |

AMG Funds

AMG Pantheon Master Fund, LLC

Annual Report—March 31, 2021

| TABLE OF CONTENTS | PAGE | |||

| 3 | ||||

| CONSOLIDATED FINANCIAL STATEMENTS |

||||

| 5 | ||||

| 13 | ||||

| Balance sheet, net asset value (NAV) per Unit computation and cumulative undistributed amounts |

||||

| 14 | ||||

| Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year |

||||

| 15 | ||||

| Detail of changes in assets for the past two fiscal years |

||||

| 16 | ||||

| Detail of cash movements during the fiscal year |

||||

| 17 | ||||

| Historical net asset values per Unit, distributions, total returns, income and expense ratios, turnover ratios and net assets |

||||

| 18 | ||||

| Accounting and distribution policies, details of agreements and transactions with Master Fund management and affiliates, and descriptions of certain investment risks |

||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 38 | ||||

| 46 | ||||

|

Portfolio Manager’s Commnets (unaudited) |

|

|

Overview

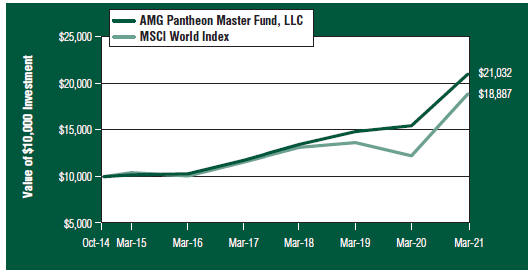

For the year ended March 31, 2021, AMG Pantheon Master Fund, LLC (the “Master Fund”) returned 35.90%, while the MSCI World Index returned 54.03% on a 12-month trailing basis.

Market Review and Outlook