UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22967

Nuveen Minnesota Quality Municipal Income Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Gifford R. Zimmerman

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: May 31

Date of reporting period: November 30, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any

report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and

policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to

respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden

estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C.

ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on

the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports

right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund

dividends and statements from your

financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund

dividends and statements directly from

Nuveen.

NOT FDIC INSURED MAY LOSE

VALUE NO BANK GUARANTEE

right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund

dividends and statements from your

financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund

dividends and statements directly from

Nuveen.

NOT FDIC INSURED MAY LOSE

VALUE NO BANK GUARANTEE

3

Chair’s Letter

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Nuveen Funds’ Proxy Voting Information

CEO Certification Disclosure

Common Share Repurchases

Dear Shareholders,

Financial markets finished 2019 on a high note, despite the challenges of a weak start to the year, a slower global economy and heightened geopolitical risks. While global manufacturing languished, consumers remained

resilient amid tight labor markets, growing wages and tame inflation. Global business sentiment, however, was less optimistic due to trade frictions and weaker global demand, and across advanced economies, growth in corporate profits and earnings

was subdued in 2019. Nevertheless, the Federal Reserve’s (Fed) pivot to easing monetary conditions, along with liquidity provided by other central banks around the world, provided confidence that the economic cycle could be extended. Additionally,

the year ended with a reduction in trade tensions and Brexit uncertainty, although the direction of policy and sentiment from here remains difficult to predict.

While we continue to anticipate muted economic growth and increased market volatility, we note that recession fears appear to have receded. The U.S. economy held steady in the third quarter, and fourth quarter

economic indicators have provided upside surprises. Consumer confidence remains underpinned by low unemployment and modest wage growth. Looser financial conditions, in part driven by the Fed’s three interest rate cuts in 2019, have revived momentum

in the housing market and should continue to encourage borrowing by consumers and businesses. Outside the U.S., Germany avoided a recession in the second half of 2019 and other eurozone economic indicators are pointing to stabilization and

improving sentiment. Consumer spending in Europe and Japan, like in the U.S., has remained supported by jobs growth and rising wages.

At Nuveen, we still see investment opportunities in the maturing economic environment, but we are taking a selective approach. If you’re concerned about where the markets are headed from here, we encourage you to work

with your financial advisor to review your time horizon, risk tolerance and investment goals. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chair of the Board

January 21, 2020

Chair of the Board

January 21, 2020

4

Portfolio Managers’ Comments

Nuveen Georgia Quality Municipal Income Fund (NKG)

Nuveen Maryland Quality Municipal Income Fund (NMY)

Nuveen Massachusetts Quality Municipal Income Fund (NMT)

Nuveen Minnesota Quality Municipal Income Fund (NMS)

Nuveen Missouri Quality Municipal Income Fund (NOM)

Nuveen Virginia Quality Municipal Income Fund (NPV)

Nuveen Georgia Quality Municipal Income Fund (NKG)

Nuveen Maryland Quality Municipal Income Fund (NMY)

Nuveen Massachusetts Quality Municipal Income Fund (NMT)

Nuveen Minnesota Quality Municipal Income Fund (NMS)

Nuveen Missouri Quality Municipal Income Fund (NOM)

Nuveen Virginia Quality Municipal Income Fund (NPV)

These Funds feature portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen, LLC. Portfolio managers Daniel J. Close, CFA, Stephen J. Candido, CFA, Christopher L. Drahn,

CFA, and Michael S. Hamilton discuss key investment strategies and the six-month performance of these six Nuveen Funds. Dan has managed the Nuveen Georgia Fund since 2007. Steve assumed portfolio management responsibility for the Maryland and

Virginia Funds in 2016. Chris has managed the Missouri Fund since 2011 and assumed responsibility for the Minnesota Fund in 2016. Michael assumed portfolio management responsibility for the Massachusetts Fund in 2011.

What key strategies were used to manage the Funds during the six-month reporting period ended November 30, 2019?

Each Fund seeks to provide current income exempt from both regular federal and designated state income taxes by investing primarily in a portfolio of municipal obligations issued by state and local government

authorities within a single state or certain U.S. territories. Under normal market conditions, each Fund invests at least 80% of the sum of its net assets and the amount of any borrowings for investment purposes in municipal bonds that pay interest

that is exempt from regular federal personal income tax and a single state’s personal income tax. The Funds may invest up to 20% in municipal securities that are exempt from regular federal income tax, but not from that single state’s income tax

if, in the portfolio manager’s judgement, such purchases are expected to enhance the Fund’s after-tax total return potential. The Nuveen Minnesota Quality Municipal Income Fund (NMS) may invest only to a lesser extent in bonds not exempt from

Minnesota income tax, in order to conform to a requirement imposed by the State of Minnesota that a fund derive at least 95% of its exempt-interest dividends from bonds of issuers located in Minnesota in order for the fund’s dividends to be exempt

from those Minnesota income taxes. To the extent that the Fund invests in bonds of municipal issuers located in other states, the Fund’s dividends may not be exempt from state personal income tax.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The

forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements,

and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group (S&P), Moody’s Investors

Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment

grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial

success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments (continued)

Municipal bonds performed well during the six-month reporting period. Bond prices rose as interest rates fell, under pressure from concerns about a slower economic environment and the ongoing trade tensions between

the U.S. and China. With interest rates staying at low levels, investors continued to seek higher yield investments, including municipal bonds. The elevated demand and a moderate pace of supply, along with benign credit conditions, helped keep

municipal credit spreads stable to narrowing. Investors also tended to favor the incremental yield offered by longer duration and lower credit quality municipal bonds, which helped credits with these characteristics outperform the broad market.

Compared to the national municipal market, the Georgia, Maryland, Massachusetts and Virginia municipal markets underperformed and Missouri’s market outperformed, while Minnesota performed in line with the national

market. During this time, we continued to take a bottom-up approach to discovering sectors that appeared undervalued as well as individual credits that we believed had the potential to perform well over the long term.

Our trading activity continued to focus on pursuing the Funds’ investment objectives. We continued to seek bonds in areas of the market that we expected to perform well as the economy continued to improve. While the

supply available in each state varied, to the extent possible, the Funds’ overall positioning emphasized intermediate and longer maturities, lower rated credits and sectors offering higher yields.

In NKG, we were comfortable with the Fund’s positioning coming into the reporting period. We worked to reinvest the proceeds from called and maturing bonds to keep the Fund fully invested. We bought three in-state

credits: a prepaid gas bond issued for Main Street Natural Gas Inc., a hospital bond issued for Children’s Healthcare of Atlanta and a local general obligation (GO) bond for Valdosta and Lowndes County Hospital Authority. There were no notable

sales from NKG’s portfolio during the reporting period.

NMY found attractive opportunities to invest in higher grade bonds early in the reporting period as the interest rates rally began, including longer dated issues for Anne Arundel Health System and Washington Suburban

Sanitation District and higher grade housing bonds for the Maryland Community Development Administration. We also added to the Maryland Fund’s high yield exposure with purchases of Maryland Economic Development Corporation AFCO Cargo, a new cargo

leasing facility at Baltimore Washington International Airport, Puerto Rico sales tax revenue bonds known as COFINAs, Puerto Rico Aqueduct and Sewer Authority (PRASA) and Baltimore Harbor Point Project, a mixed use real estate development. All

additions in this reporting period were in-state bonds. To fund the new opportunities, we sold some shorter dated bonds and used call and maturity proceeds.

NMT continued to add to Puerto Rico COFINAs, particularly structures with longer (20- to 30-year) maturities. Other purchases included credits issued for a local school district, higher education, hospitals, housing

and charter schools. The proceeds from maturing bonds provided most of the cash to buy new bonds.

In Minnesota, state issuance increased substantially in the recent six-month reporting period (June 2019 to November 2019) compared to the prior six months (December 2018 to May 2019). A new issue for Minneapolis-St.

Paul Metropolitan Airport priced in August 2019, and we bought the bond for NMS in the secondary market after yields had moved somewhat higher in the fall. We added a lower investment grade rated credit for St. Paul Community of Peace Charter

School and two non-rated credits, Wayzata Folkstone Senior Living Community and Maple Plain Haven Homes Senior Housing. All four bonds bought in this reporting period offered incremental yield. Overall, NMS’s sector positions remained unchanged

during the reporting period, with overweight allocations to health care and higher education and underweight allocations to state GOs.

6

Trading activity in NOM was muted in this reporting period, as we had a relatively small amount of cash from called and maturing bonds to be put to work. Much of the activity occurred within the Fund’s Puerto Rico

exposure. COFINAs were the first major credit to exit Puerto Rico’s bankruptcy-like restructuring process and new bonds were issued with improved security features. NOM’s old COFINA bonds experienced calls and we bought some of the new replacement

bonds.

In NPV, we remained patient for opportunities to reinvest a modest level of proceeds from maturing bonds. We added to the Virginia Fund’s high yield exposure with COFINA and PRASA credits, both of which performed well

during the reporting period, and bonds for Fort Norfolk Retirement Community, Inc., a high end continuing care retirement community (CCRC). In the transportation sector, we bought Metropolitan Washington DC Airports Authority and Metropolitan

Washington DC Airports Dulles Toll Road. We also purchased an out of state hospital bond for CommonSpririt, a national Catholic hospital system, because it appeared to be a compelling opportunity even after the out of state tax differences. To buy

these bonds, we sold some shorter dated, lower embedded yield paper, for example Virginia Electric and Power, as well as used the proceeds from maturing bonds, such as Virginia Ports Authority.

As of November 30, 2019, NKG, NMY, NMT, NOM and NPV continued to use inverse floating rate securities. We employ inverse floaters for a variety of reasons, including duration management, income enhancement and total

return enhancement.

How did the Funds perform during the six-month reporting period ended November 30, 2019?

The tables in each Fund’s Performance Overview and Holding Summaries section of this report provide the Funds’ total returns for the six-month, one-year, five-year and ten-year periods ended November 30, 2019. Each

Fund’s total returns at common share net asset value (NAV) are compared with the performance of corresponding market indexes.

For the six-month reporting period ended November 30, 2019, the total return at common share NAV for all six Funds outperformed their respective state’s S&P Municipal Bond Index and the national S&P Municipal

Bond Index.

The Funds’ performance was affected by duration and yield curve positioning, credit ratings allocations, sector allocations and credit selection. In addition, the use of regulatory leverage was a factor affecting

performance of the Funds. Leverage is discussed in more detail later in the Fund Leverage section of this report.

Duration and yield curve positioning was beneficial to all six Funds in this reporting period, as the Funds maintained longer duration profiles than their benchmark indexes, which enabled the Funds to benefit more in

the falling interest rate environment, and emphasized longer maturities, which outperformed shorter maturity bonds. NKG was most helped by an overweight to 8- to 10-year duration bonds and an underweight to 0- to 2-year duration bonds. For NMY,

overweight allocations to longer duration bonds in general were advantageous but especially strong was the overweight to 8- to 10-year durations and an underweight to the shortest durations. NMT’s overweight allocations to 6-year and longer

duration bonds and underweight allocations across the 2- to 6-year duration categories were positive contributors, as longer duration bonds outperformed intermediate duration bonds. For NMS, the overweight allocation to the longest durations was

the main contributor. NOM’s duration and yield curve positioning was modestly positive as the Fund’s overall duration profile was longer than its benchmark but by less so than other Funds. We have continued to hold bonds with higher embedded yields

to support NOM’s dividend, even as their durations naturally drifted lower as the bonds

7

Portfolio Managers’ Comments (continued)

approach their maturity date. As a result, NOM’s duration positioning has tended to be a smaller contributor than it is for the other Funds. In NPV, the largest contribution came from durations of 8 years and longer,

followed by an underweight to the 2- to 6-year segment.

Credit ratings allocations had a positive impact on the Funds’ performance in this reporting period. The Funds were generally positioned with heavier weightings among lower rated bonds, which outperformed, and less

emphasis on high grade bonds, which lagged. In NKG, the overweight to BBB rated bonds was the strongest contributor, offsetting a small detraction from the overweight to AA rated credits, which underperformed. NMY’s overweight allocations to BBB

and below investment grade bonds (including Puerto Rico, tobacco settlement, real estate project and CCRC bonds) were the largest positive contributors, and a sizeable underweight to AAA and AA rated paper also helped. NMT’s overweight allocation

to BBB and lower rated credits, including non-rated bonds, and the underweight allocation to the highest grade (AAA and AA rated) paper were the most beneficial. For NMS, overweight allocations to single A, BBB and non-rated bonds added value.

NOM’s credit quality positioning contributed marginally to performance, driven by overweight allocations to BBB and BB rated bonds. In NPV, overweights to BBB and non-rated bonds and an underweight to AAA rated credits helped. However, NPV’s

underweight allocation to single A rated credits was a slight detractor as the single A segment outperformed the benchmark index.

Sector allocations were favorable for most of the Funds during this reporting period. NKG’s performance was negatively impacted from its allocation to Georgia state GOs but was helped by an overweight to the higher

education sector. For NMY, the overweight to health care sector (including hospitals, life care and nursing homes) was the top contributor. NMY’s out of state tobacco settlement bonds (Maryland does not offer tobacco bonds) helped as higher

yielding, lower rated credits outperformed. The Maryland Fund’s underweight to the tax supported sector was also beneficial. Within the tax supported sector, NMY has maintained a meaningful underweight to state GOs, which look less opportunistic to

us given the size of the state’s pension funding shortfall. NMT’s allocation to the tax supported sector aided performance, particularly the Fund’s position in dedicated tax bonds such as COFINAs. However, the health care sector was a slight

detractor from the Massachusetts Fund due to the underperformance of some life care credits that were older portfolio positions and had shorter durations rather than credit or sector related. For NMS and NOM, sector positioning was not a material

factor driving performance in this reporting period. In NPV, the large overweight to the transportation sector was a large positive contributor, as was the overweight to tobacco settlement bonds. Also advantageous was the Virginia Fund’s overweight

to the aggregated health care sector (including hospitals, CCRCs, life care and nursing homes). We note that although we have deemphasized CCRCs, where default rates have been relatively higher, NPV owns selected lower rated, higher yielding CCRC

names that have performed well as spreads contracted. Additionally, NPV’s sizeable underweight to the tax supported sector helped performance.

8

Among individual credits, the best performers in this reporting period were holdings with longer durations and offering higher yields, while shorter dated, high quality bonds such as pre-refunded bonds lagged. NKG

benefited from strong security selection, especially among single A and BBB rated credits and among its tender option bond (TOB) holdings due to their longer durations. For NMY, the top performers included zero coupon bonds (especially zero coupon

tobacco settlement bonds), longer dated health care credits (MedStar Health, Trinity Health and Peninsula Regional Medical Center), high yield names (St. Mary’s University, COFINAs and Vantage House, a CCRC in Howard County). NMT’s positions in

COFINA bonds led performance, with additional contributions from several lower rated health care bonds (CareGroup, Lowell General Hospital and Dana-Farber Cancer Institute), U.S. territory bonds issued for Guam Waterworks Authority and a non-call

bond issued for WGBH Educational Foundation. Non-callable structures maintain long duration profiles over the life of the bond, which was beneficial in this reporting period when long duration bonds outperformed. For NMS, long duration holdings

also did well. Tightening credit spreads in St. Paul Port Authority Gerdau Steel Mill Project bonds and in health care names such as Fairview Hospital and Essentia Health helped these bonds perform well. A long duration Western Minnesota Municipal

Power Agency bond which was advance refunded was another strong performer. For NOM, in addition to longer duration holdings, some of the better performers included senior living holdings such as Lutheran Senior Services bonds, as Missouri senior

living issuance subsided and credit spreads tightened in the secondary market, and an A.T. Still University bond which was advance refunded. NPV’s top contributors included Metropolitan Washington DC Airports Dulles Toll Road zero coupon bonds,

I-66 toll road, Chesapeake Bay Bridge and Tunnel, TOBs, tobacco settlement bonds, Peninsula Town Center, Hampton Road Sanitation District (which saw strong price appreciation due to its advance refunding) and COFINAs.

9

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through their issuance of preferred shares and/or investments in inverse

floating rate securities, which represent leveraged investments in underlying bonds. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income. The opportunity arises when

short-term rates that the Fund pays on its leveraging instruments are lower than the interest the Fund earns on its portfolio of long-term bonds that it has bought with the proceeds of that leverage. This has been particularly true in the recent

market environment where short-term rates have been low by historical standards.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund’s common shares will experience a greater increase in their net asset value if the municipal

bonds acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the bonds acquired through leverage decline in value, which will make the shares’ net asset value

more volatile, and total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. In recent

quarters, fund leverage expenses have generally tracked the overall movement of short-term tax-exempt interest rates. While fund leverage expenses are somewhat higher than their all-time lows after the 2007-2009 financial crisis, which has

contributed to a reduction in common share net income and long-term total return potential, leverage nevertheless continues to provide the opportunity for incremental common share income. Management believes that the potential benefits from

leverage continue to outweigh the associated increase in risk and volatility previously described.

Leverage from issuance of preferred shares had a positive impact on the total return performance of all six Funds over the reporting period. The use of leverage through inverse floating rate securities had a

negligible impact on the total return performance of the Funds over the reporting period.

As of November 30, 2019, the Funds’ percentages of leverage are as shown in the accompanying table.

|

|

NKG

|

NMY

|

NMT

|

NMS

|

NOM

|

NPV

|

|

Effective Leverage*

|

34.78%

|

37.63%

|

36.89%

|

37.17%

|

36.24%

|

35.70%

|

|

Regulatory Leverage*

|

28.54%

|

34.29%

|

34.72%

|

37.17%

|

35.48%

|

32.39%

|

|

*

|

Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

10

THE FUNDS’ REGULATORY LEVERAGE

As of November 30, 2019, the Funds have issued and outstanding preferred shares as shown in the accompanying table.

|

|

Variable Rate

|

|||||||||||

|

|

Variable Rate

|

Remarketed

|

||||||||||

|

|

Preferred*

|

Preferred**

|

||||||||||

|

|

Shares Issued at

|

Shares Issued at

|

||||||||||

|

|

Liquidation Preference

|

Liquidation Preference

|

Total

|

|||||||||

|

NKG

|

$

|

58,500,000

|

$

|

—

|

$

|

58,500,000

|

||||||

|

NMY

|

$

|

182,000,000

|

$

|

—

|

$

|

182,000,000

|

||||||

|

NMT

|

$

|

74,000,000

|

$

|

—

|

$

|

74,000,000

|

||||||

|

NMS

|

$

|

52,800,000

|

$

|

—

|

$

|

52,800,000

|

||||||

|

NOM

|

$

|

18,000,000

|

$

|

—

|

$

|

18,000,000

|

||||||

|

NPV

|

$

|

128,000,000

|

$

|

—

|

$

|

128,000,000

|

||||||

|

*

|

Preferred shares of the Fund featuring a floating rate dividend based on a predetermined formula or spread to an index rate. Includes the following preferred shares AMTP, iMTP, MFP-VRM and VRDP in Special Rate Mode, where applicable. See

Notes to Financial Statements, Note 5 – Fund Shares, Preferred Shares for further details.

|

|

**

|

Preferred shares of the Fund featuring floating rate dividends set by a remarketing agent via a regular remarketing. Includes the following preferred shares VRDP not in Special Rate Mode, MFP-VRRM and MFP-VRDM, where applicable. See

Notes to Financial Statements, Note 5 – Fund Shares, Preferred Shares for further details.

|

Refer to Notes to Financial Statements, Note 5 – Fund Shares, Preferred Shares for further details on preferred shares and each Fund’s respective transactions.

11

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of November 30, 2019. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investments

value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

|

|

Per Common Share Amounts

|

|||||||||||||||||||||||

|

Monthly Distribution (Ex-Dividend Date)

|

NKG

|

NMY

|

NMT

|

NMS

|

NOM

|

NPV

|

||||||||||||||||||

|

June 2019

|

$

|

0.0370

|

$

|

0.0440

|

$

|

0.0410

|

$

|

0.0490

|

$

|

0.0430

|

$

|

0.0435

|

||||||||||||

|

July

|

0.0370

|

0.0440

|

0.0410

|

0.0490

|

0.0430

|

0.0435

|

||||||||||||||||||

|

August

|

0.0370

|

0.0440

|

0.0410

|

0.0490

|

0.0430

|

0.0435

|

||||||||||||||||||

|

September

|

0.0370

|

0.0440

|

0.0410

|

0.0490

|

0.0430

|

0.0435

|

||||||||||||||||||

|

October

|

0.0370

|

0.0440

|

0.0410

|

0.0490

|

0.0430

|

0.0435

|

||||||||||||||||||

|

November 2019

|

0.0370

|

0.0440

|

0.0410

|

0.0490

|

0.0430

|

0.0435

|

||||||||||||||||||

|

Total Distributions from Net Investment Income

|

$

|

0.2220

|

$

|

0.2640

|

$

|

0.2460

|

$

|

0.2940

|

$

|

0.2580

|

$

|

0.2610

|

||||||||||||

|

Yields

|

||||||||||||||||||||||||

|

Market Yield*

|

3.56

|

%

|

3.93

|

%

|

3.50

|

%

|

4.22

|

%

|

3.57

|

%

|

3.62

|

%

|

||||||||||||

|

Taxable-Equivalent Yield*

|

6.66

|

%

|

7.31

|

%

|

6.48

|

%

|

8.57

|

%

|

6.61

|

%

|

6.77

|

%

|

||||||||||||

|

*

|

Market Yield is based on the Fund’s current annualized monthly dividend divided by the Fund’s current market price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully

taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 46.6%, 46.6%, 45.9%, 50.7%, 46.2% and 46.6% for NKG, NMY, NMT, NMS, NOM and NPV, respectively.

Your actual combined federal and state income tax rate may differ from the assumed rate. The Taxable- Equivalent Yield also takes into account the percentage of the Fund’s income generated and paid by the Fund (based on payments made during

the previous calendar year) that was either exempt from federal income tax but not from state income tax (e.g., income from an out-of-state municipal bond), or was exempt from neither federal nor state income tax. Separately, if the

comparison were instead to investments that generate qualified dividend income, which is taxable at a rate lower than an individual’s ordinary graduated tax rate, the fund’s Taxable-Equivalent Yield would be lower.

|

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend,

the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to common shareholders are determined on a tax basis, which may differ from amounts recorded in

the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information

regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by each Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net

investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in

this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

CHANGE IN METHOD OF PUBLISHING NUVEEN CLOSED-END FUND DISTRIBUTION AMOUNTS

During November 2019, the Nuveen Closed-End Funds discontinued the practice of announcing Fund distribution amounts and timing via press release. Instead, information about the Nuveen Closed-End Funds’ monthly and

quarterly periodic distributions to shareholders are posted and can be found on Nuveen’s enhanced closed-end fund resource page, which is at www.nuveen.com/closed-end-fund-distributions, along with other Nuveen closed-end fund product updates.

Shareholders can

12

expect regular distribution information to be posted on www.nuveen.com on the first business day of each month. To ensure that our shareholders have timely access to the latest information, a subscribe function can be

activated at this link here, or at this web page (www.nuveen.com/en-us/people/about-nuveen/for-the-media).

COMMON SHARE REPURCHASES

During August 2019, the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of November 30, 2019, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding common shares as shown in the accompanying table.

|

|

NKG

|

NMY

|

NMT

|

NMS

|

NOM

|

NPV

|

|

Common shares cumulatively repurchased and retired

|

149,500

|

1,005,000

|

26,148

|

10,000

|

—

|

55,000

|

|

Common shares authorized for repurchase

|

1,040,000

|

2,310,000

|

930,000

|

580,000

|

235,000

|

1,790,000

|

During the current reporting period, the Funds did not repurchase any of their outstanding common shares.

OTHER COMMON SHARE INFORMATION

As of November 30, 2019, and during the current reporting period, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs as shown in the accompanying table.

|

|

NKG

|

NMY

|

NMT

|

NMS

|

NOM

|

NPV

|

||||||||||||||||||

|

Common share NAV

|

$

|

14.08

|

$

|

15.10

|

$

|

14.93

|

$

|

15.44

|

$

|

13.96

|

$

|

14.95

|

||||||||||||

|

Common share price

|

$

|

12.47

|

$

|

13.42

|

$

|

14.04

|

$

|

13.92

|

$

|

14.45

|

$

|

14.41

|

||||||||||||

|

Premium/(Discount) to NAV

|

(11.43

|

)%

|

(11.13

|

)%

|

(5.96

|

)%

|

(9.84

|

)%

|

3.51

|

%

|

(3.61

|

)%

|

||||||||||||

|

6-month average premium/(discount) to NAV

|

(11.59

|

)%

|

(12.17

|

)%

|

(8.15

|

)%

|

(9.13

|

)%

|

0.15

|

%

|

(8.99

|

)%

|

||||||||||||

13

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Georgia Quality Municipal Income Fund (NKG)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to

their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As

interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. State concentration makes the Fund more susceptible to local adverse economic, political, or regulatory changes affecting municipal bond issuers. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NKG.

Nuveen Maryland Quality Municipal Income Fund (NMY)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to

their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk,

interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks;

there is no guarantee a fund’s leverage strategy will be successful. State concentration makes the Fund more susceptible to local adverse economic, political, or regulatory changes affecting municipal bond

issuers. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NMY.

Nuveen Massachusetts Quality Municipal Income Fund (NMT)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to

their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As

interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. State concentration makes the Fund more susceptible to local adverse economic, political, or regulatory changes affecting municipal bond issuers. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NMT.

Nuveen Minnesota Quality Municipal Income Fund (NMS)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to

their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As

interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return

14

and its risks; there is no guarantee a fund’s leverage strategy will be successful. State concentration makes the Fund more susceptible to local adverse economic, political, or

regulatory changes affecting municipal bond issuers. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the

Fund’s web page at www.nuveen.com/NMS.

Nuveen Missouri Quality Municipal Income Fund (NOM)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to

their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As

interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. State concentration makes the Fund more susceptible to local adverse economic, political, or regulatory changes affecting municipal bond issuers. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NOM.

Nuveen Virginia Quality Municipal Income Fund (NPV)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to

their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As

interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. State concentration makes the Fund more susceptible to local adverse economic, political or regulatory changes affecting municipal bond issuers. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NPV.

Investment Policy Updates

Change in Investment Policy

Each of the Funds has recently adopted the following policy regarding limits to investments in illiquid securities:

While there are no such limits imposed by applicable regulations, certain Nuveen Closed-End Funds formerly had investment policies that placed limits on a Fund’s ability to invest in illiquid securities. All

exchange-listed Nuveen Closed-End Funds now have no formal limit on their ability to invest in such illiquid securities, but each Fund’s portfolio management team will monitor such investments in the regular, overall management of the Fund’s

portfolio securities.

New Temporary Investment Policy

Each of the Funds has adopted the following policy regarding its temporary investments:

Each Fund may temporarily depart from its normal investment policies and strategies – for instance, by allocating up to 100% of its assets to cash equivalents, short-term investments, or municipal bonds that do not

comply with a Fund’s Name Policy – in response to adverse or unusual market, economic, political or other conditions. Such conditions could include a temporary decline in the availability of municipal bonds that comply with a Fund’s Name Policy.

During these periods, the weighted average maturity of a Fund’s investment portfolio may fall below the defined range described in the respective Fund Summary under “Principal Investment Strategies”, and a Fund may not achieve its investment

objective of current income that is exempt from regular federal and state personal income tax.

15

|

Nuveen Georgia Quality Municipal

|

|

|

|

Income Fund

|

|

|

Performance Overview and Holding Summaries as of

|

|

|

November 30, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

Average Annual Total Returns as of November 30, 2019

|

||||

|

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NKG at Common Share NAV

|

3.20%

|

11.79%

|

3.99%

|

4.57%

|

|

NKG at Common Share Price

|

1.87%

|

18.50%

|

4.17%

|

4.53%

|

|

S&P Municipal Bond Georgia Index

|

2.13%

|

7.45%

|

3.13%

|

4.02%

|

|

S&P Municipal Bond Index

|

2.31%

|

8.13%

|

3.55%

|

4.44%

|

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund

distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for

direct investment.

Common Share Price Performance — Weekly Closing Price

16

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself.

Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This

treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are

below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

150.8%

|

|

Short-Term Municipal Bonds

|

0.2%

|

|

Other Assets Less Liabilities

|

2.3%

|

|

Net Assets Plus Floating Rate Obligations

|

|

|

& AMTP Shares, net of deferred

|

|

|

offering costs

|

153.3%

|

|

Floating Rate Obligations

|

(13.4)%

|

|

AMTP Shares, net of deferred

|

|

|

offering costs

|

(39.9)%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

Georgia

|

90.4%

|

|

Florida

|

2.5%

|

|

West Virginia

|

1.8%

|

|

Colorado

|

1.5%

|

|

Illinois

|

1.2%

|

|

Nevada

|

1.0%

|

|

Puerto Rico

|

0.9%

|

|

Washington

|

0.7%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Tax Obligation/General

|

21.3%

|

|

Tax Obligation/Limited

|

16.8%

|

|

Water and Sewer

|

15.0%

|

|

Health Care

|

11.5%

|

|

Utilities

|

11.4%

|

|

Education and Civic Organizations

|

10.6%

|

|

Transportation

|

7.2%

|

|

U.S. Guaranteed

|

5.6%

|

|

Other

|

0.6%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

5.7%

|

|

AAA

|

6.8%

|

|

AA

|

59.8%

|

|

A

|

17.5%

|

|

BBB

|

7.8%

|

|

N/R (not rated)

|

2.4%

|

|

Total

|

100%

|

17

|

NMY

|

Nuveen Maryland Quality Municipal

|

|

|

Income Fund

|

|

|

Performance Overview and Holding Summaries as of

|

|

|

November 30, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

Average Annual Total Returns as of November 30, 2019

|

||||

|

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NMY at Common Share NAV

|

3.75%

|

12.59%

|

4.78%

|

5.15%

|

|

NMY at Common Share Price

|

7.02%

|

19.51%

|

6.16%

|

4.80%

|

|

S&P Municipal Bond Maryland Index

|

2.01%

|

7.11%

|

2.99%

|

3.67%

|

|

S&P Municipal Bond Index

|

2.31%

|

8.13%

|

3.55%

|

4.44%

|

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund

distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for

direct investment.

Common Share Price Performance — Weekly Closing Price

18

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself.

Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This

treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are

below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

158.4%

|

|

Other Assets Less Liabilities

|

1.8%

|

|

Net Assets Plus Floating Rate Obligations

|

|

|

& AMTP Shares, net of deferred

|

|

|

offering costs

|

160.2%

|

|

Floating Rate Obligations

|

(8.1)%

|

|

AMTP Shares, net of deferred

|

|

|

offering costs

|

(52.1)%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

Maryland

|

82.1%

|

|

Guam

|

4.6%

|

|

Puerto Rico

|

3.7%

|

|

California

|

2.8%

|

|

Virgin Islands

|

1.9%

|

|

District of Columbia

|

1.9%

|

|

New York

|

1.6%

|

|

New Jersey

|

0.5%

|

|

Pennsylvania

|

0.4%

|

|

Texas

|

0.4%

|

|

Ohio

|

0.1%

|

|

Alaska

|

0.0%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Health Care

|

23.4%

|

|

Tax Obligation/Limited

|

21.2%

|

|

Transportation

|

8.0%

|

|

Tax Obligation/General

|

7.3%

|

|

Education and Civic Organizations

|

6.0%

|

|

U.S. Guaranteed

|

6.0%

|

|

Long-Term Care

|

5.5%

|

|

Water and Sewer

|

5.4%

|

|

Housing/Multifamily

|

5.4%

|

|

Other

|

11.8%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

6.0%

|

|

AAA

|

5.6%

|

|

AA

|

29.7%

|

|

A

|

22.9%

|

|

BBB

|

18.5%

|

|

BB or Lower

|

6.6%

|

|

N/R (not rated)

|

10.7%

|

|

Total

|

100%

|

19

|

NMT

|

Nuveen Massachusetts Quality Municipal

|

|

|

Income Fund

|

|

|

Performance Overview and Holding Summaries as of

|

|

|

November 30, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

Average Annual Total Returns as of November 30, 2019

|

||||

|

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NMT at Common Share NAV

|

3.04%

|

11.48%

|

4.43%

|

5.36%

|

|

NMT at Common Share Price

|

11.30%

|

19.96%

|

6.09%

|

5.36%

|

|

S&P Municipal Bond Massachusetts Index

|

2.18%

|

8.01%

|

3.26%

|

3.99%

|

|

S&P Municipal Bond Index

|

2.31%

|

8.13%

|

3.55%

|

4.44%

|

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund

distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for

direct investment.

Common Share Price Performance — Weekly Closing Price

20

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself.

Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This

treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below

investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

151.1%

|

|

Other Assets Less Liabilities

|

1.9%

|

|

Net Assets Plus VRDP Shares,

|

|

|

net of deferred offering costs

|

153.0%

|

|

VRDP Shares, net of deferred

|

|

|

offering costs

|

(53.0)%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

Massachusetts

|

92.4%

|

|

Guam

|

4.9%

|

|

Puerto Rico

|

1.9%

|

|

Virgin Islands

|

0.8%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Education and Civic Organizations

|

29.2%

|

|

Health Care

|

21.1%

|

|

Tax Obligation/Limited

|

13.3%

|

|

Tax Obligation/General

|

11.3%

|

|

U.S. Guaranteed

|

10.3%

|

|

Transportation

|

6.3%

|

|

Water and Sewer

|

5.1%

|

|

Other

|

3.4%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

9.5%

|

|

AAA

|

3.7%

|

|

AA

|

51.1%

|

|

A

|

21.2%

|

|

BBB

|

8.4%

|

|

BB or Lower

|

4.2%

|

|

N/R (not rated)

|

1.9%

|

|

Total

|

100%

|

21

|

NMS

|

Nuveen Minnesota Quality Municipal

|

|

|

Income Fund

|

|

|

Performance Overview and Holding Summaries as of

|

|

|

November 30, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

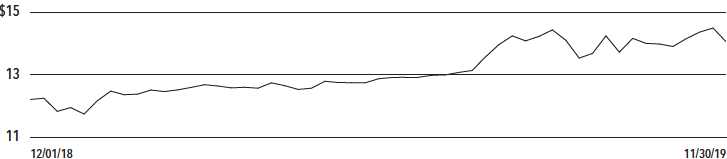

Average Annual Total Returns as of November 30, 2019

|

||||

|

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NMS at Common Share NAV

|

3.60%

|

12.94%

|

4.66%

|

6.50%

|

|

NMS at Common Share Price

|

3.26%

|

19.39%

|

3.73%

|

4.91%

|

|

S&P Municipal Bond Minnesota Index

|

2.31%

|

8.04%

|

3.23%

|

4.03%

|

|

S&P Municipal Bond Index

|

2.31%

|

8.13%

|

3.55%

|

4.44%

|

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund

distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for

direct investment.

Common Share Price Performance — Weekly Closing Price

22

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself.

Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This

treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are

below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

155.9%

|

|

Short-Term Municipal Bonds

|

2.4%

|

|

Other Assets Less Liabilities

|

0.7%

|

|

Net Assets Plus AMTP Shares,

|

|

|

net of deferred offering costs

|

159.0%

|

|

AMTP Shares, net of deferred

|

|

|

offering costs

|

(59.0)%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

Minnesota

|

99.7%

|

|

Guam

|

0.3%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Health Care

|

22.0%

|

|

Education and Civic Organizations

|

19.5%

|

|

Tax Obligation/General

|

17.0%

|

|

Tax Obligation/Limited

|

9.6%

|

|

Long-Term Care

|

9.4%

|

|

Utilities

|

8.5%

|

|

Other

|

14.0%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

4.4%

|

|

AAA

|

15.5%

|

|

AA

|

20.0%

|

|

A

|

25.8%

|

|

BBB

|

11.1%

|

|

BB or Lower

|

7.5%

|

|

N/R (not rated)

|

15.7%

|

|

Total

|

100%

|

23

|

NOM

|

Nuveen Missouri Quality Municipal

|

|

|

Income Fund

|

|

|

Performance Overview and Holding Summaries as of

|

|

|

November 30, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

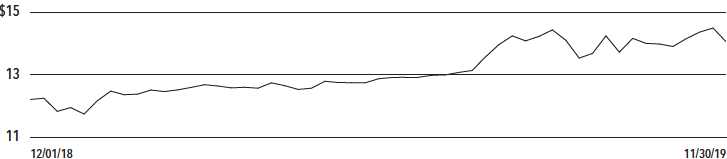

Average Annual Total Returns as of November 30, 2019

|

||||

|

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NOM at Common Share NAV

|

2.74%

|

10.13%

|

4.37%

|

5.74%

|

|

NOM at Common Share Price

|

5.36%

|

26.47%

|

3.67%

|

5.30%

|

|

S&P Municipal Bond Missouri Index

|

2.36%

|

7.97%

|

3.57%

|

4.54%

|

|

S&P Municipal Bond Index

|

2.31%

|

8.13%

|

3.55%

|

4.44%

|

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund

distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for

direct investment.

Common Share Price Performance — Weekly Closing Price

24

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself.

Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This

treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are

below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

155.0%

|

|

Other Assets Less Liabilities

|

1.1%

|

|

Net Assets Plus Floating Rate Obligations

|

|

|

& MFP Shares, net of deferred

|

|

|

offering costs

|

156.1%

|

|

Floating Rate Obligations

|

(1.8)%

|

|

MFP Shares, net of deferred

|

|

|

offering costs

|

(54.3)%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

Missouri

|

96.9%

|

|

Guam

|

1.7%

|

|

Puerto Rico

|

1.4%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Health Care

|

23.6%

|

|

Tax Obligation/Limited

|

16.1%

|

|

Tax Obligation/General

|

15.9%

|

|

U.S. Guaranteed

|

12.9%

|

|

Education and Civic Organizations

|

10.9%

|

|

Long-Term Care

|

7.6%

|

|

Water and Sewer

|

6.2%

|

|

Other

|

6.8%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

8.5%

|

|

AAA

|

5.7%

|

|

AA

|

42.9%

|

|

A

|

20.2%

|

|

BBB

|

9.9%

|

|

BB or Lower

|

4.5%

|

|

N/R (not rated)

|

8.3%

|

|

Total

|

100%

|

25

|

NPV

|

Nuveen Virginia Quality Municipal

|

|

|

Income Fund

|

|

|

Performance Overview and Holding Summaries as of

|

|

|

November 30, 2019

|

|

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

|

||||

|

Average Annual Total Returns as of November 30, 2019

|

||||

|

|

||||

|

|

Cumulative

|

Average Annual

|

||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

|

NPV at Common Share NAV

|

3.70%

|

12.85%

|

4.64%

|

5.23%

|

|

NPV at Common Share Price

|

13.66%

|

29.28%

|

6.14%

|

4.97%

|

|

S&P Municipal Bond Virginia Index

|

2.16%

|

7.62%

|

3.33%

|

3.93%

|

|

S&P Municipal Bond Index

|

2.31%

|

8.13%

|

3.55%

|

4.44%

|

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund

distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for

direct investment.

Common Share Price Performance — Weekly Closing Price

26

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself.

Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This

treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are

below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

153.7%

|

|

Other Assets Less Liabilities

|

1.7%

|

|

Net Assets Plus Floating Rate Obligations

|

|

|

& VRDP Shares, net of deferred

|

|

|

offering costs

|

155.4%

|

|

Floating Rate Obligations

|

(7.6)%

|

|

VRDP Shares, net of deferred

|

|

|

offering costs

|

(47.8)%

|

|

Net Assets

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

Virginia

|

78.0%

|

|

District of Columbia

|

8.5%

|

|

Puerto Rico

|

4.7%

|

|

Guam

|

3.3%

|

|

Virgin Islands

|

2.5%

|

|

Colorado

|

0.9%

|

|

Washington

|

0.7%

|

|

Pennsylvania

|

0.5%

|

|

Tennessee

|

0.5%

|

|

Wisconsin

|

0.2%

|

|

New York

|

0.2%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Transportation

|

28.8%

|

|

Tax Obligation/Limited

|

21.3%

|

|

Health Care

|

13.0%

|

|

U.S. Guaranteed

|

10.5%

|

|

Education and Civic Organizations

|

8.1%

|

|

Other

|

18.3%

|

|

Total

|

100%

|

|

Portfolio Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

U.S. Guaranteed

|

9.5%

|

|

AAA

|

6.1%

|

|

AA

|

40.5%

|

|

A

|

12.1%

|

|

BBB

|

14.9%

|

|

BB or Lower

|

9.0%

|

|

N/R (not rated)

|

7.9%

|

|

Total

|

100%

|

27