DEF 14A0001606909falseiso4217:USD00016069092023-01-012023-12-3100016069092022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| | | | | |

| Filed by the Registrant | ý |

| Filed by a Party other than the Registrant | o |

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Under Rule 14a-12 |

PANGAEA LOGISTICS SOLUTIONS LTD.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ý | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

| | | | | |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

(1)Amount previously paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing Party:

(4)Date Filed:

PANGAEA LOGISTICS SOLUTIONS LTD.

109 Long Wharf

Newport, RI 02840

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 8, 2024

TO THE SHAREHOLDERS OF PANGAEA LOGISTICS SOLUTIONS LTD:

NOTICE IS HEREBY GIVEN that the annual meeting of shareholders of Pangaea Logistics Solutions Ltd., a Bermuda company, will be held at 2:00 pm, Eastern Time, on August 8, 2024, in the Company's Executive Office at 109 Long Wharf, Newport, RI 02840. You are cordially invited to attend the annual meeting, which will be held for the following purposes:

(1)To elect three directors to our Board of Directors as Class I directors serving until the annual meeting of shareholders to be held in August 2027;

(2)To approve the Pangaea Logistics Solutions Ltd. 2014 Share Incentive Plan, as amended and restated by the Board of Directors on May 7, 2024, referred to herein as the '2024 Plan';

(3)To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the Company’s fiscal year 2024;

(4)To approve, on an advisory, non-binding basis, the compensation of named executive officers;

(5)To recommend, on a non-binding basis, the frequency of future advisory votes on compensation of named executive officers; and

(6)to transact such other business as may properly come before the meeting or any adjournment thereof.

Shareholders of record at the close of business on June 17, 2024 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

All shareholders are cordially invited to attend the Annual Meeting. If you do not expect to be present at the Annual Meeting, you are requested to fill in, date and sign the enclosed proxy and mail it promptly in the enclosed envelope to make sure that your shares are represented at the Annual Meeting. Shareholders of record also have the option of voting via the Internet. Instructions for using the service is included on the proxy card. In the event you decide to attend the Annual Meeting in person, you may, if you desire, revoke your proxy and vote your shares in person in accordance with the procedures described in the accompanying proxy statement. If your shares are held in “street name” or are in a margin or similar account, you should contact your broker to ensure that votes related to the shares you beneficially own are properly counted.

Thank you for your participation. We look forward to your continued support.

By Order of the Board of Directors

/s/ Mark L. Filanowski

Mark L. Filanowski

Chief Executive Officer

Newport, Rhode Island

June 24, 2024

This notice and proxy statement is dated June 24, 2024, and is first being mailed to our shareholders on or about June 28, 2024.

PROXY STATEMENT

General

This proxy statement, which is being mailed to each person entitled to receive the accompanying Notice of Annual Meeting on or about June 28, 2024, is furnished in connection with the solicitation of proxies to be voted at the annual meeting of shareholders by the Board of Directors (the "Board") of Pangaea Logistics Solutions Ltd. ("Pangaea" or the "Company"), The meeting is to be held on August 8, 2024, at 2:00 pm. at the Company’s principal executive office, located at 109 Long Wharf, Newport, Rhode Island, and at any adjournments or postponements thereof.

Shareholders Who May Vote

All shareholders of record at the close of business on June 17, 2024 will be entitled to vote. As of June 17, 2024, Pangaea had outstanding 46,902,091 common shares, each of which is entitled to one vote with respect to each matter to be voted upon at the meeting. Proxies are solicited to give all shareholders who are entitled to vote on the matters that come before the meeting the opportunity to do so whether or not they attend the meeting in person.

Voting

If you are a holder of record of our common shares as of the record date, you may vote in person at the annual meeting or by submitting a proxy for the annual meeting. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage paid envelope. If you hold your shares in “street name,” which means your shares are held of record by a broker, bank or nominee, you should contact your broker, bank or nominee to ensure that votes related to the shares you beneficially own are properly counted. In this regard, you must provide the broker, bank or nominee with instructions on how to vote your shares or, if you wish to attend the meeting and vote in person, obtain a proxy from your broker, bank or nominee.

Changing or Revoking a Proxy

If you are a holder of record of our common shares as of the record date, you may change or revoke your proxy at any time before it is voted by submitting a new proxy with a later date, delivering a written notice of revocation to Pangaea's Secretary, or voting in person at the meeting. If your shares are held in the name of your broker or bank, you may change or revoke your voting instructions by contacting the bank or brokerage firm or other nominee holding the shares or by obtaining a legal proxy from such institution and voting in person at the annual meeting.

Required Vote

A quorum is required to conduct business at the meeting. A quorum requires the presence, in person or by proxy, of at least two shareholders representing the holders of at least thirty-three percent (33%) of the issued and outstanding shares entitled to vote at the meeting. Abstentions and broker “non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker non-vote occurs when you fail to provide voting instructions to your broker for shares owned by you but held in the name of your broker and your broker does not have authority to vote without instructions from you. Under those circumstances, your broker may be authorized to vote for you without your instructions on routine matters but is prohibited from voting without your instructions on non-routine matters. Non-routine matters include the election of directors for which your broker cannot vote and absent your instructions on how to vote, will result in broker non-votes.

Any question proposed for consideration at the meeting shall be decided on by a simple majority of votes cast.

Costs of Proxy Solicitation

Pangaea pays the cost of this solicitation of proxies. This solicitation is being made by mail but also may be made by telephone or in person. Our directors, officers and employees may also solicit proxies in person, by telephone or by other electronic means.

Pangaea will request that persons who hold shares for others, such as banks and brokers, solicit the owners of those shares and will reimburse them for their reasonable out-of-pocket expenses for those solicitations.

Attending the Meeting

If your shares are held in the name of your bank or broker and you plan to attend the meeting, please bring proof of ownership with you to the meeting. A bank or brokerage account statement showing that you owned voting shares of Pangaea on June 17, 2024 is acceptable proof to establish share ownership and obtain admittance to the meeting. If you are a shareholder of record, no proof of ownership is required. All shareholders or their proxies should be prepared to present government-issued photo identification upon request for proof of ownership and/or admission to the meeting.

TABLE OF CONTENTS

| | | | | |

| | |

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | |

| Members of Our Board | |

| Director Skills and Experience | |

| Director Independence | |

| Meetings and Committees of our Board of Directors | |

| Audit Committee Information | |

| Compensation Committee Information | |

Nominating and Environmental, Social and Governance Committee Information | |

| Board Leadership Structure and Role in Risk Oversight | |

| Related Person Policy | |

| Related Party Transactions | |

| EXECUTIVE OFFICERS | |

| HOW WE COMPENSATE OUR EXECUTIVES | |

| PROPOSAL 1 — ELECTION OF CLASS I DIRECTORS | |

| PROPOSAL 2 — TO APPROVE THE PANGAEA LOGISTICS SOLUTIONS LTD. 2014 SHARE INCENTIVE PLAN, AS AMENDED AND RESTATED BY THE BOARD OF DIRECTORS ON MAY 7, 2024, REFERRED TO HEREIN AS THE '2024 PLAN' | |

| PROPOSAL 3 — TO RATIFY THE APPOINTMENT OF GRANT THORNTON LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY’S FISCAL YEAR 2024 | |

| Principal Auditor Fees and Services | |

| Pre-Approval of Audit and Non-Audit Services | |

| PROPOSAL 4 — TO APPROVE, ON AN ADVISORY, NON-BINDING BASIS, THE COMPENSATION OF NAMED EXECUTIVE OFFICERS | |

| PROPOSAL 5 — TO RECOMMEND, ON A NON-BINDING BASIS, THE FREQUENCY OF FUTURE ADVISORY VOTES ON COMPENSATION OF NAMED EXECUTIVE OFFICERS | |

| OTHER INFORMATION | |

| AUDIT COMMITTEE REPORT | |

| SHARE OWNERSHIP | |

| Security Ownership of Certain Beneficial Owners and Management | |

| Section 16(a) Beneficial Ownership Reporting Compliance | |

| CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | |

| SHAREHOLDER PROPOSALS AND OTHER SHAREHOLDER COMMUNICATIONS | |

| DELIVERY OF DOCUMENTS TO SHAREHOLDERS | |

| OTHER BUSINESS | |

i

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Q. Why am I receiving this proxy statement?

A. Pangaea Logistics Solutions Ltd. is furnishing you this proxy statement to solicit proxies on behalf of its Board to be voted at the 2024 annual meeting of shareholders of Pangaea Logistics Solutions Ltd. The meeting will be held at the Company's Executive Office, 109 Long Wharf, Newport, RI 02840 on August 8, 2024, at 2:00 pm Eastern Time. The proxies also may be voted at any adjournments or postponements of the meeting. When used in this proxy statement, “Pangaea,” “Company,” “we,” “our,” “ours” and “us” refer to Pangaea Logistics Solutions Ltd. and its consolidated subsidiaries, except where the context otherwise requires or as otherwise indicated.

This proxy statement contains important information about the matters to be acted upon at the annual meeting. Shareholders should read it carefully.

Q. What is a proxy?

A. A proxy is your legal designation of another person to vote the shares you own on your behalf. That other person is referred to as a “proxy.” Our Board has designated Mark Filanowski and Gianni Del Signore as proxies for the annual meeting. By completing and returning the enclosed proxy card, you are giving Mr. Del Signore and Mr. Filanowski the authority to vote your shares in the manner you indicate on your proxy card.

Q. What do I need to do now?

A. We urge you to read carefully and consider the information contained in this proxy statement. The vote of our shareholders is important. Shareholders are then encouraged to vote as soon as possible in accordance with the instructions provided in this proxy statement and on the enclosed proxy card.

Q. Who is entitled to vote?

A. We have fixed the close of business on June 17, 2024, as the “record date” for determining shareholders entitled to notice of and to attend and vote at the annual meeting. As of the close of business on June 17, 2024, there were 46,902,091 common shares outstanding and entitled to vote. Each common share is entitled to one vote per share at the annual meeting.

Q. How do I vote?

A. If you are a stockholder of record, there are three ways to vote:

•by Internet at www.cstproxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on August 7, 2024 (have your Notice or proxy card in hand when you visit the website);

•by completing and mailing your proxy card with the pre-addressed postage paid envelope. (if you received printed proxy materials); or

•by written ballot at the Annual Meeting.

Even if you plan to attend the Annual Meeting in person, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend.

If you hold your shares in “street name,” which means your shares are held of record by a broker, bank or nominee, you should contact your broker, bank or nominee to ensure that votes related to the shares you beneficially own are properly counted. In this regard, you must provide the broker, bank or nominee with instructions on how to vote your shares or, if you wish to attend the meeting and vote in person, obtain a proxy from your broker, bank or nominee.

Q. What does it mean if I receive more than one proxy card?

A. It indicates that you may have multiple accounts with us, brokers, banks, trustees, or other holders of record. Sign and return all proxy cards to ensure that all of your shares are voted. We encourage you to register all your accounts in the same name and address.

Q. If my shares are held in “street name,” will my broker, bank or nominee automatically vote my shares for me?

A. No. Your broker, bank or nominee cannot vote your shares unless you provide instructions on how to vote in accordance with the information and procedures provided to you by your broker, bank or nominee.

Q. What are my voting choices when voting for director nominees, and what vote is needed to elect directors?

A. In voting on the election of two director nominees to serve until the 2026 annual meeting of shareholders. Shareholders may vote in one of the following ways:

•in favor of an individual nominee; or

•against an individual nominee; or

•withhold votes as to an individual nominee.

Each director will be elected by a simple majority of the votes of the common shares present or represented by proxy at the meeting.

Our Board recommends a vote “ FOR ” all nominees.

Q. What if a shareholder does not specify a choice for a matter when returning a proxy?

A. Shareholders should specify their choice for each matter on the enclosed form of proxy. If no instructions are given, proxies that are signed and returned will be voted “ FOR ” the election of the director nominees.

Q. What constitutes a quorum?

A. The presence, in person or by proxy, of at least two shareholders representing the holders of at least thirty-three percent (33%) of the outstanding common shares constitutes a quorum. We need a quorum of shareholders to hold a validly convened annual meeting. If you have signed and returned your proxy card, your shares will be counted toward the quorum. If a quorum is not present, the chairman may adjourn the meeting, without notice other than by announcement at the meeting, until the required quorum is present. As of the record date, 46,902,091 common shares were outstanding. Thus, the presence of the holders of common shares representing at least 15,634,030 shares will be required to establish a quorum.

Q. How are abstentions and broker non-votes counted?

A. Abstentions are counted for purposes of determining whether a quorum is present at the annual meeting. A properly executed proxy card marked “withhold” with respect to the election of the director will not be voted with respect to the director indicated, although it will be counted for purposes of determining whether there is a quorum.

Broker non-votes will have no effect on the outcome of the vote on any of the proposals.

Q. Will any other business be transacted at the meeting? If so, how will my proxy be voted?

A. We do not know of any business to be transacted at the annual meeting other than those matters described in this proxy statement. The period of time specified in our Bye-laws for submitting proposals to be considered at the meeting has expired and no proposals were submitted.

Q. May I change my vote after I have mailed my signed proxy card?

A. Yes. Send a later-dated, signed proxy card to our corporate secretary at the address set forth below so that it is received prior to the vote at the annual meeting or attend the annual meeting in person and vote. Shareholders also may revoke their proxy by sending a notice of revocation to our corporate secretary, which must be received by our corporate secretary prior to the vote at the annual meeting.

Q. Will I be able to view the proxy materials electronically?

A. Yes. To view this proxy statement and our 2023 Annual Report on Form 10-K ("Annual Report") electronically, visit http://www.cstproxy.com/pangaeals/2024.

Q. Where can I find the voting results of the annual meeting?

A. We intend to announce preliminary voting results at the annual meeting and will publish final results on a current report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) within four business days of the annual meeting.

Q. What is the deadline for submitting proposals to be considered for inclusion in the 2025 proxy statement and for submitting a nomination for director for consideration at the annual meeting of shareholders in 2025?

A. We expect to hold our 2025 annual meeting of shareholders on or about August 8, 2025. Shareholder proposals made in accordance with the relevant provisions of the Companies Act 1981 of Bermuda (i.e. the jurisdiction of incorporation of the Company) requested to be included in our 2025 proxy statement must be received no later than March 31, 2025. Proposals and nominations should be directed to Gianni Del Signore, Chief Financial Officer and Secretary, Pangaea Logistics Solutions Ltd., 109 Long Wharf, Newport, RI 02840.

Q. Who is paying the costs associated with soliciting proxies for the annual meeting?

A. We are soliciting proxies on behalf of our Board. This solicitation is being made by mail but also may be made by telephone or in person. Our directors, officers and employees may also solicit proxies in person, by telephone or by other electronic means. We will bear the cost of the solicitation.

We will ask banks, brokers and other institutions, nominees and fiduciaries to forward the proxy materials to their principals and to obtain their authority to execute proxies and voting instructions. We will reimburse them for their reasonable expenses.

Q. Who can help answer my questions?

A. If you have questions about the meeting or if you need additional copies of the proxy statement or the enclosed proxy card you should contact:

Gianni Del Signore

401.846.7790

gdelsignore@pangaeals.com

BOARD OF DIRECTORS

Members of Our Board

The following sets forth certain information concerning the persons who serve as the Company’s directors or are nominated for election:

| | | | | | | | | | | | | | |

| Name | | Age | | Position |

| Carl Claus Boggild | | 67 | | Lead Independent Director |

| Richard T. du Moulin | | 77 | | Director, Chair of the Board |

| Mark L. Filanowski | | 69 | | Chief Executive Officer and Director |

| Eric S. Rosenfeld | | 67 | | Director |

| David D. Sgro | | 48 | | Director |

| Anthony Laura | | 72 | | Director |

| Karen H. Beachy | | 53 | | Director |

Biographical information concerning the directors listed above is set forth below.

Class I Directors

Eric S. Rosenfeld. Mr. Rosenfeld serves as a director of the Company. Eric Rosenfeld of New York, New York, U.S.A., has been the President and Chief Executive Officer of Crescendo Partners, L.P., a New York based investment firm, since its formation in November 1998. Prior to forming Crescendo Partners, he held the position of Managing Director at CIBC Oppenheimer and its predecessor company Oppenheimer & Co., Inc. for 14 years. Mr. Rosenfeld currently serves on the board at Aecon Group, Inc., a construction company, and Algoma Steel, Inc., a fully integrated producer of hot and cold rolled steel products. Mr. Rosenfeld has also served as Chairman and CEO for Arpeggio Acquisition Corporation, Rhapsody Acquisition Corporation, Trio Merger Corp, Quartet Merger Corp and Harmony Merger Corp., all blank check corporations that later merged with Hill International, Primoris Services Corporation, SAExploration Holdings, Pangaea Logistics Solutions Ltd and NextDecade Corporation respectively. Mr. Rosenfeld has also served as the Chief SPAC Officer of Legato Merger Corp and Legato Merger Corp II., blank check corporations that later merged with Algoma Steel, Inc. and Southland Holdings, respectively. Mr. Rosenfeld is currently the Chief SPAC Officer of Legato Merger Corp. III, a blank check corporation. Mr. Rosenfeld is also currently the CEO of Allegro Merger Corp, a non-listed shell company. He was also a director of Primo Water Corp, a water delivery and filtration company, CPI Aero (Chairman Emeritus), a company engaged in the contract production of structural aircraft parts, Canaccord Genuity Group, a full-service financial services company, NextDecade Corporation, a development stage company building natural gas liquefaction plants, Absolute Software Corp., a leader in firmware-embedded endpoint security and management for computers and ultraportable devices, AD OPT Technologies, an airline crew planning service, Sierra Systems Group Inc., an information technology, management consulting and systems integration firm, Emergis Inc., an electronic commerce company, Hill International, a construction management firm, Matrikon Inc. a company that provides industrial intelligence solutions, DALSA Corp., a digital imaging and semiconductor firm, HIP Interactive, a video game company, GEAC Computer, a software company, Computer Horizons Corp. (Chairman), an IT services company, Pivotal Corp, a cloud software firm, Call-Net Enterprises, a telecommunication firm Primoris Services Corporation, a specialty construction company, and SAExploration Holdings, a seismic exploration company.

Mr. Rosenfeld is a regular guest lecturer at Columbia Business School and has served on numerous panels at Queen’s University Business Law School Symposia, McGill Law School, the World Presidents’ Organization, and the Value Investing Congress. He is a senior faculty member at the Director’s College. He is a guest lecturer at Tulane Law School. He has also been a regular guest host on CNBC. Mr. Rosenfeld received an A.B. in economics from Brown University and an M.B.A. from the Harvard Business School. The board nominated Mr. Rosenfeld to be a director because he has extensive experience serving on the boards of multinational public companies and in capital markets and mergers and acquisitions transactions. Mr. Rosenfeld also has valuable experience in the operation of a worldwide business faced with a myriad of international business issues. Mr. Rosenfeld’s leadership and consensus-building skills, together with his experience as senior independent director of all boards on which he currently serves, make him an effective board member.

Mark L. Filanowski. Mr. Filanowski was appointed to the position of Chief Executive Officer of the Company in December 2021. He served as Pangaea’s Chief Operating Officer from 2016 until his appointment as CEO, was a consultant to the Company from 2014 to 2016, and he has been a board member of the Company since 2014. Mr. Filanowski formed Intrepid Shipping LLC with another board member, Richard du Moulin, in 2002. From 1989 to 2002, he served as Chief Financial Officer and Senior Vice President at Marine Transport Corporation. Mr. Filanowski was Vice President and Controller at

Armtek Corporation from 1984 to 1988. Mr. Filanowski started his career at Ernst & Young and worked as a Certified Public Accountant at EY from 1976 to 1984. He has served as the Chairman of the Board at Arvak and at Shoreline Mutual (Bermuda) Ltd., both marine insurance companies. He earned a BS from the University of Connecticut and an MBA from New York University. Mr. Filanowski’s experience in many aspects of the shipping industry, his participation as a director on other independent company boards, and his financial background, qualifications, and experience, make him a valuable part of the Company’s board.

Anthony Laura. Mr. Laura is a founder of Pangaea and served as its Chief Financial Officer from the Company's inception until his retirement in April 2017. Prior to co-founding Bulk Partners Ltd., the predecessor to Pangaea, in 1996, Mr. Laura spent 10 years as CFO of Commodity Ocean Transport Corporation (COTCO). Mr. Laura also served as Chief Financial Officer at Navinvest Marine Services from 1986 to 2002. Mr. Laura is a graduate of Fordham University.

Class II Directors

Carl Claus Boggild. Mr. Boggild is a founder of Pangaea and served as its President (Brazil) from the Company's inception until his retirement in 2016. Prior to co-founding Bulk Partners Ltd., the predecessor company to Pangaea, in 1996, Mr. Boggild was Director of Chartering and Operations at the Korf Group of Germany. He also was a partner at Trasafra Ltd., a Brazilian agent for the largest independent grain parcel operator from Argentina and Brazil to Europe. He worked for Hudson Trading and Chartering where he was responsible for Brazilian related transportation services. As President of COTCO, he was responsible for the operations of its affiliate Handy Bulk Carriers Corporation. Prior to becoming President of COTCO, Mr. Boggild was an Executive Vice President and was responsible for its Latin American operations. Mr. Boggild holds a diploma in International Maritime Law. Mr. Boggild’s qualifications to sit on our board include his operational experience and deep knowledge of the shipping industry. Mr. Boggild serves as the Board's Lead Independent director.

David D. Sgro. Mr. Sgro serves as a director of the Company. Mr. Sgro served as Quartet’s chief financial officer, secretary, and a member of its Board of Directors. He has been the Head of Research of Jamarant Capital Mgmt. since its inception in 2015. From 2005 through 2021, Mr. Sgro was an employee of Crescendo Partners, where he completed his tenure as a Senior Managing Director of the firm. Mr. Sgro presently serves or has served on the board of directors of Legato Merger Corp. III, Algoma Steel, Inc., Legato Merger Corp. II, Legato Merger Corp., Allegro Merger Corp., Hill International, NextDecade Corporation, Trio, Primoris Services Corporation, Bridgewater Systems, Inc., SAExploration Holdings, Harmony Merger Corp., Imvescor Restaurant Group, BSM Technologies and COM DEV International Ltd. Mr. Sgro attended Columbia Business School and prior to that, Mr. Sgro worked as an analyst and then senior analyst at Management Planning, Inc., a firm engaged in the valuation of privately held companies. Simultaneously, Mr. Sgro worked as an associate with MPI Securities, Management Planning, Inc.’s boutique investment banking affiliate. Mr. Sgro received a B.S. in Finance from The College of New Jersey and an M.B.A. from Columbia Business School. In 2001, he became a Chartered Financial Analyst (CFA®) Charterholder. Mr. Sgro is an adjunct faculty member at the College of New Jersey and a regular guest lecturer at Columbia Business School.

Class III Directors

Richard T. du Moulin. Mr. du Moulin has a distinguished career in the shipping industry, with significant leadership roles spanning several decades. He spent 15 years at OMI Corporation (1974-1989), where he served as Executive Vice President, Chief Operating Officer, and Board Director. From 1989 to 1998, he was Chairman and CEO of Marine Transport Lines, followed by his tenure as Chairman and CEO of Marine Transport Corporation from 1998 to 2002. Currently, Mr. du Moulin is a Director of Teekay Tankers and an advisor to Hudson Structured Capital Management. He also serves as a Board Trustee for the Seamen's Church Institute of New York and New Jersey. He was Chairman of Intertanko, the leading trade organization for the tanker industry, from 1996 to 1999. In addition to his corporate roles, Mr. du Moulin has served in the US Navy and is a recipient of the US Coast Guard's Distinguished Service Medal. He holds a BA from Dartmouth College and an MBA from Harvard University. His extensive operational experience and profound knowledge of the shipping industry make him a valuable member of our board.

Karen H. Beachy. Ms. Beachy serves as a director of Oceaneering International (NYSE: OII), a global provider of engineered services and products for the offshore energy, defense, aerospace, and entertainment industries. In March 2022, Ms. Beachy was named to the board of Pangea Logistics Solutions (NASDQ: PANL), a Rhode Island based company that transports a wide variety of dry bulk cargoes and provides its customers with a comprehensive set of services and activities, including cargo loading, cargo discharge, vessel chartering, and voyage planning. Ms. Beachy founded her strategic consulting firm, Think B3 Consulting, in January 2021 and worked with The Alliance Risk Group, a consulting that helps energy leaders develop and enhance their integrated risk management and smart, clean resilient grid solutions. Prior to starting her consulting firm and

joining Oceaneering, Ms. Beachy served as the Senior Vice President of Growth and Strategy at Black Hills Corporation, an investor-owned electric and gas utility in the Midwest, where she was responsible for corporate planning, business development, process improvement, enterprise data and analytics, natural gas retail marketing, products and services, energy innovation and asset optimization. Ms. Beachy began her tenure at Black Hills in Rapid City, South Dakota in 2014 as the Director of Supply Chain and was promoted to Vice President of Supply Chain in 2016. She was responsible for sourcing, procurement, fleet, and materials management. Ms. Beachy worked at Vectren (now CenterPoint Energy) Corporation, an electric and gas utility in Indiana and Ohio, from 2010 to 2014 where Ms. Beachy led the gas operations division in Ohio and worked in supply chain. From 1995 to 2008, Ms. Beachy worked at Louisville Gas and Electric/Kentucky Utilities, an electric and gas utility in Kentucky and Western Virginia, where she held several positions in corporate development, products and services, electric operations, and supplier diversity. In 2007, Ms. Beachy completed an expatriate assignment in Germany with E.ON, a European electric utility, where she served as a project manager in the global liquified natural gas procurement group. Throughout her career, Ms. Beachy has served on several non-profit Boards with a focus on supporting and growing young people and entrepreneurs in the communities where she lived and worked. Ms. Beachy holds a bachelor’s degree in political science and a master’s degree in management from Purdue University.

Director Skills and Experience

The matrix below provides a summary of certain key skills and experience of our Directors. Our Directors, individually and as a group, possess numerous skills and experience that are highly relevant for an upstream shipping company like Pangaea. Our Directors are strategic thinkers with high expectations for the Company’s performance and are attuned to the demands of proper Board oversight and good governance practices.

| | | | | | | | | | | | | | | | | | | | | | | |

| Directors | Eric S. Rosenfeld | Mark L. Filanowski | Anthony Laura | Carl Claus Boggild | David D. Sgro | Richard T. du Moulin | Karen H. Beachy |

| Key Skills and Experience | | | | | | | |

| Public Board of Directors Experience | l | l | | | l | l | l |

| Shipping Industry Experience/Supply Chain Management | | l | l | l | | l | l |

CEO/Senior Executive | l | l | l | l | l | l | l |

| Strategic Planning/Investment and M&A | l | l | l | l | l | l | l |

| Human Capital Management | l | l | l | l | l | l | l |

| Finance/Capital Allocation | l | l | l | l | l | l | l |

| Financial Literacy/Accounting | l | l | l | l | l | l | l |

| Regulatory/Policy Matters | | l | | | l | l | l |

| Demographics | | | | | | | |

| Race/Ethnicity/Nationality | | | | | | | |

| African American | | | | | | | l |

| Asian/Pacific Islander | | | | | | | |

| White | l | l | l | l | l | l | |

| Hispanic/Latino | | | | | | | |

| Native American | | | | | | | |

| | | | | | | |

| Gender | | | | | | | |

| Female | | | | | | | l |

| Male | l | l | l | l | l | l | |

Director Independence

The Board of Directors affirmatively determined that the following Directors, including each Director serving on the Audit Committee, the Compensation Committee and the Nominating and ESG Committee (formerly known as the Nominating and Governance Committee), satisfy the independence requirements of Rule 5605(a)(2) of Nasdaq’s listing standards: Eric S. Rosenfeld, Anthony Laura, Carl Claus Boggild, David D. Sgro, Richard T. du Moulin and Karen H. Beachy. The Board of Directors also determined that all members of the Audit Committee, Compensation Committee and Nominating and ESG Committee are independent under applicable Nasdaq and SEC rules for committee members.

There is no family relationship between any of the Director nominees or executive officers of the Company.

Board Leadership Structure and Role in Risk Oversight

Senior management is responsible for assessing and managing the Company’s various exposures to risk on a day-to-day basis, including the creation of appropriate risk management programs and policies. The Company has developed a consistent, systemic and integrated approach to risk management to help determine how best to identify, manage and mitigate significant risks throughout the Company.

The Board of Directors is responsible for overseeing management in the execution of its responsibilities, including assessing the Company’s approach to risk management. The Board of Directors exercises these responsibilities periodically as part of its meetings and also through three of its committees, each of which examines various components of enterprise risk as part of its responsibilities. The Audit Committee has primary responsibility for addressing risks relating to financial matters, particularly financial reporting, accounting practices and policies, disclosure controls and procedures and internal control over financial reporting. The Compensation Committee has primary responsibility for risks and exposures associated with the Company’s compensation policies, plans and practices, regarding both executive compensation and the compensation structure generally, including whether it provides appropriate incentives that do not encourage excessive risk taking. The Nominating and Governance Committee oversees risks associated with the independence of the Board of Directors and succession planning.

An overall review of risk is inherent in the Board of Directors’ evaluation of the Company’s long-term strategies and other matters presented to the Board of Directors. The Board of Directors’ role in risk oversight of the Company is consistent with the Company’s leadership structure; the Chief Executive Officer and other members of senior management are responsible for assessing and managing the Company’s risk exposure, and the Board of Directors and its committees provide oversight in connection with those efforts.

Meetings and Committees of the Board of Directors

The Board of Directors has a standing Audit Committee, Compensation Committee and Nominating and Governance Committee, the respective members and functions of which are described below. Current charters describing the nature and scope of the responsibilities of each of the Audit Committee, Compensation Committee and Nominating and Governance Committee are posted on our website at www.pangaeals.com under the headings “Investors-board-committee-charters” and are available in print upon request to Pangaea Logistics Solutions Ltd., 109 Long Wharf, Newport, Rhode Island 02840.

A summary of the composition of the committees of the Board of Directors is as follows:

| | | | | | | | | | | | | | | | | | | | |

| Name | | Audit Committee | | Compensation Committee | | Nominating and ESG Committee |

| Carl Claus Boggild | | | | | | P |

| Richard T. du Moulin | | | | P | | P |

| Mark L. Filanowski | | | | | | |

| Eric S. Rosenfeld | | | | P | | P |

| David D. Sgro | | P | | P | | |

| Anthony Laura | | P | | | | |

| Karen H. Beachy | | P | | P | | |

| Meetings Held During 2023 | | Four | | Six | | Four |

Audit Committee Information

The Company’s Audit Committee is comprised of David Sgro, Anthony Laura and Karen H. Beachy, each of whom qualifies as independent under the applicable Nasdaq listing requirements and SEC rules.

The Board of Directors has determined that David Sgro is an audit committee “financial expert” as such term is defined in applicable SEC rules, and that he has the requisite financial management expertise within the meaning of Nasdaq rules and regulations. The Audit Committee is responsible for, among other duties, appointing and overseeing the work of, and

relationship with, the independent auditors, including reviewing their formal written statement describing the Company’s internal quality-control procedures and any material issues raised by the internal quality-control review or peer review of the Company or any inquiry or investigation by governmental or professional authorities and their formal written statement regarding auditor independence; reading and discussing with management and the independent auditors the annual audited financial statements and quarterly financial statements, and preparing annually a report to be included in the Company’s proxy statement; providing oversight of the Company’s accounting and financial reporting principles, policies, controls, procedures and practices; and discussing with management polices with respect to risk assessment and risk management. In addition, the Board of Directors has tasked the Audit Committee with reviewing transactions with related parties.

Compensation Committee Information and Compensation Committee Interlocks and Insider Participation

The Company’s Compensation Committee is comprised of independent directors Richard du Moulin, Eric Rosenfeld, David Sgro and Karen Beachy, each of whom qualifies as independent under the applicable Nasdaq listing requirements and SEC rules. The Compensation Committee reviews and approves compensation paid to the Company’s officers and directors and administers the Company’s incentive compensation plans, including authority to make and modify awards under such plans.

None of the members of the Compensation Committee was, or has ever been, an officer or employee of the Company or any of its subsidiaries. The Company had no compensation committee interlocks for the fiscal year ended December 31, 2023.

The Compensation Committee adopted the Company's Policy Regarding the Recovery of Erroneously Awarded Compensation ("Claw-Back Policy") in November 2023 to comply with Nasdaq listing standards and Section 10D and Rule 10D-1 of the Securities Exchange Act of 1934, as amended. Pursuant to the Claw-Back Policy, the Company is required to recover erroneously awarded compensation, including, but not limited to, bonuses and equity compensation, in the event of a financial restatement. The Compensation Committee has discretion under the Claw-Back Policy, which requires the financial restatement to be caused by misconduct of the executive. The Company's Claw-Back Policy was filed with our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Nominating and Environmental, Social and Governance Committee

The Company’s Nominating and ESG Committee (formerly known as the Nominating and Governance Committee) is comprised of Richard du Moulin, Eric Rosenfeld and Carl Claus Boggild, each of whom qualifies as independent under the applicable Nasdaq listing requirements and SEC rules.

The Nominating and ESG Committee, among other duties, assists the Board of Directors in identifying and evaluating qualified individuals to become members of the Board of Directors, and proposing nominees for election to the Board of Directors and to fill vacancies; considers nominees duly recommended by shareholders for election to the Board of Directors; and evaluates annually the independence of each member of the Board of Directors under applicable Nasdaq listing requirements and SEC rules.

Guidelines for Selecting Director Nominees

The guidelines for selecting nominees, which are specified in our Nominating Committee Charter, generally provide that persons to be nominated:

•should have demonstrated notable or significant achievements in business, education or public service;

•should possess the requisite intelligence, education and experience to make a significant contribution to the Board of Directors and bring a range of skills, diverse perspectives and backgrounds to its deliberations; and

•should have the highest ethical standards, a strong sense of professionalism and intense dedication to serving the interests of our shareholders.

Our Nominating and ESG Committee considers many factors when determining the eligibility of candidates for nomination to the Board. In the event of a vacancy, the Committee’s goal is to nominate candidates from a broad range of experiences and backgrounds who can contribute to the Board’s overall effectiveness in meeting its mission. In considering and evaluating the suitability of candidates, the Board of Directors and the Nominating and ESG Committee take into account many factors, including the nominee’s judgment, experience, independence, character, business acumen and such other factors as the Nominating and ESG Committee concludes are pertinent in light of the current needs of the Board of Directors. The Board of Directors believes that an important factor in its composition is diversity with respect to viewpoint, including such that is held by candidates of different gender, race, ethnicity, background, age, thought and tenure on our board (in connection with the consideration of the renomination of an existing director). To reflect this determination, the Nominating and ESG Committee seeks to include diverse candidates in all director searches, taking into account the foregoing diversity considerations, including by affirmatively instructing any search firm retained to assist the Nominating and ESG Committee in identifying director candidates to seek to include diverse candidates from traditional and nontraditional candidate groups. The Nominating and ESG Committee also takes into account, as an important factor, considerations of diversity in connection with each potential director nominee, as well as on a periodic basis in connection with its periodic review of the composition of the board and the size of the board as a whole. Additionally, directors should be persons of good character and thus should generally have the personal characteristics of integrity, accountability, judgment, responsibility, high performance standards, commitment, enthusiasm, and courage to express his or her views. The Nominating and ESG Committee examines a candidate’s specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and the Company.

In addition to using search firms, the Nominating and ESG Committee may identify potential candidates by asking current Directors and executive officers to notify the Nominating and ESG Committee if they become aware of persons meeting the criteria described above, who might have an interest in serving as a Director.

There have been no material changes to the procedures by which security holders may recommend nominees to our board of directors. The Nominating and Corporate Committee Charter is available on the Company's website at www.pangaeals.com/investors/board-committee-charters.

Related Person Policy

Our Code of Ethics requires us to avoid, wherever possible, all related party transactions that could result in actual or potential conflicts of interests, except under guidelines approved by the Board or the Audit Committee. Related-party transactions are defined as transactions in which (1) the aggregate amount involved will or may be expected to exceed $120,000 in any calendar year, (2) we or any of our subsidiaries is a participant, and (3) any (a) executive officer, director or nominee for election as a director, (b) greater than 5% beneficial owner of our common shares, or (c) immediate family member, of the persons referred

to in clauses (a) and (b), has or will have a direct or indirect material interest (other than solely as a result of being a director or a less than 10% beneficial owner of another entity). A conflict of interest situation can arise when a person takes actions or has interests that may make it difficult to perform his or her work objectively and effectively. Conflicts of interest may also arise if a person, or a member of his or her family, receives improper personal benefits as a result of his or her position.

We also require each of our directors and executive officers to complete a directors’ and officers’ questionnaire that elicits information about related party transactions.

These procedures are intended to determine whether any such related party transaction impairs the independence of a director or presents a conflict of interest on the part of a director, employee or officer.

Related Party Transactions

Amounts and notes payable to related parties consist of the following:

| | | | | | | | | | | | | | | | | |

| December 31, 2023 | | Activity | | March 31, 2024 |

| | | | | | (unaudited) |

| Included in accounts payable, accrued expenses and other current liabilities on the consolidated balance sheets: | | | | | |

| | | | | |

Commissions payable (trade payables) (i) | $ | — | | | $ | 35,468 | | | $ | 35,468 | |

i. Phoenix Bulk Carriers (Brasil) Intermediacoes Maritimas Ltda. - a wholly-owned Company of a member of the Board of Directors.

EXECUTIVE OFFICERS

Executive officers are elected by and serve at the discretion of the Board of Directors and shall be a President (or Chief Executive Officer), a Secretary and a Treasurer (or Chief Financial Officer). Set forth below is biographical information regarding our current executive officers (not including any executive officer who is also a nominee for election as a Director, for whom information is set forth under the heading “Board of Directors” above).

Mark L. Filanowski Refer to the "BOARD OF DIRECTORS" for biographical information.

Gianni Del Signore Mr. Del Signore is the Chief Financial Officer at Pangaea, responsible for the Company's finance, accounting, reporting functions, strategies, and information technology. Prior to his appointment as CFO, he served as the Controller of the Company from 2010 to 2017. Before joining Pangaea, he worked in the Assurance Service practice at Ernst & Young from 2005 to 2010. Mr. Del Signore holds an MBA from Bryant University and a BS in Accountancy from Providence College. He is a Certified Public Accountant (inactive).

Mads Rosenberg Boye Petersen Mr. Petersen is the Chief Operating Officer of the Company, responsible for overseeing all chartering and operational functions. Before assuming the role of COO, he served as Managing Director of Nordic Bulk Carriers, a wholly owned subsidiary, since 2009. Prior to that, Mr. Petersen gained extensive experience in various operational and management positions within the dry bulk industry. He holds an Executive MBA in Shipping and Logistics from Copenhagen Business School.

HOW WE COMPENSATE OUR EXECUTIVES

This section provides information regarding Pangaea's compensation program for 2023 for individuals who served as executive officers and who are listed in the Summary Compensation Table (collectively, the “Named Executive Officers” or “NEOs”). Our NEOs for 2023 are:

| | | | | | | | |

| Name | | Position |

| Mark L. Filanowski | | Chief Executive Officer and Director |

| Gianni Del Signore | | Chief Financial Officer |

| Mads Rosenberg Boye Petersen | | Chief Operations Officer |

As noted elsewhere in this Proxy Statement, Pangaea qualifies as a “Smaller Reporting Company,” or “SRC,” under SEC rules. As a Smaller Reporting Company, we are permitted to provide reduced disclosures in this Proxy Statement, including those relating to executive compensation. Among other things, we are not required to have a Compensation Discussion and Analysis. Nevertheless, we are providing the following information to be transparent to our stockholders on how we compensate our executives. This section describes our compensation philosophy, the objectives of our executive compensation program and policies, the elements of the compensation program and how each element fits into our overall compensation philosophy and strategy.

Overview of Our Executive Compensation Program

The Compensation Committee of Pangaea’s Board of Directors is responsible for the Company’s Executive Compensation Programs, including the review and approval of the compensation of the Chief Executive Officer and other executive officers. In fulfillment of its responsibilities, the Committee, among other things:

•identifies, reviews, and approves corporate goals and objectives relevant to the CEO and to each executive officer’s compensation;

•evaluates, at least annually, the CEO’s and each executive officer’s performance in light of such goals and objectives and determines the CEO’s and each executive officer’s cash compensation based on such evaluation, including such other factors as the Compensation Committee deems appropriate and in the best interests of the Company;

•determines any long-term incentive component of the CEO’s and each executive officer’s compensation.

The objectives of our Compensation Programs are to attract and retain highly qualified and motivated people to perform the responsibilities delegated to them and to successfully manage and guide the Company by achieving strategic objectives as outlined by our Board of Directors. The Committee believes the Company’s Compensation Program should be somewhat

flexible and discretionary and should include a high proportion of long term incentives, considering the highly volatile industry in which the Company operates.

Our Executive Compensation Program consists of the following primary components:

•A fixed base salary for each executive which reflects their assumed responsibilities and is competitive with a peer group of companies that operate ocean going fleets of similar size as Pangaea;

•A discretionary annual cash bonus that reflects the Company’s and the executive’s performance in financial and non-financial measurements, including:

◦Safety and environmental performance, as measured by the number of incidents and vessel crew injuries

◦Revenue, as measured by TCE performance compared to peers and market averages

◦Cash flow generation, as measured by Earnings Before Interest, Taxes, Depreciation, and Amortization ("EBITDA") and operating cash flow

◦Cost control, as measured by vessel operating costs and general and administrative expenses

◦Governance, assessed by considering management's communication with the Board regarding significant issues the Company faces, including risk evaluation

◦Individual performance, as measured by accomplishment against individual and company-wide goals and objectives

•Discretionary awards under the Company’s Long Term Incentive Plan, consisting exclusively of grants of Restricted Shares of Common Stock of Pangaea which have, to date,usually historically included vesting in years three, four and five after the grants are were made; however, the most recent grants made include 25% vesting in each of years one through four after the grants were made; and

•Health benefits, 401(k) contributions and other benefits that are substantially equivalent to those offered to all of Pangaea’s full-time employees.

None of our executives presently have an employment contract agreement with the Company.

During the year ended December 31, 2023, the Committee determined:

•Safety records: The Company's fleet had exemplary safety records, performing at or above the industry average;

•Vessel performance: Pangaea has consistently demonstrated outstanding performance in the independent VesselIndex ratings,finishing with the second highest average out performance of 28 public dry bulk companies over the six year period ending in December 2023, the period of time the VesselIndex has been published;

•Adjusted EBITDA performance: The Company earned adjusted EBITDA of $79.9 million;

•Operating costs: Vessel operating costs reflected inflationary pressures, while general and administrative costs based on the number of ship days were lower than the peer group average;

•Governance: The Compensation Committee considered governance to be a highlight of management's performance during the year, especially reporting on risk management tools, market volatility, and other corporate matters;

•Cash bonus awards: Individual performance, measured against goals and objectives set by the Committee, was reflected in the cash bonus awards granted; and

•Long-term incentive awards: The executive team's successful efforts to increase share liquidity and share performance in the stock market over the last two years were recognized through long-term incentive awards.

The following table sets forth the total compensation for the fiscal years ended December 31, 2023 and 2022:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary and Compensation (1) | | Cash Bonus | | Stock Awards (2) | | All Other Compensation(3) | | Total |

| Mark L. Filanowski | | 2023 | | $ | 450,000 | | | $ | 600,000 | | | $ | 399,994 | | | $ | 34,273 | | | $ | 1,484,267 | |

| Chief Executive Officer | | 2022 | | $ | 250,000 | | | $ | 1,350,000 | | | $ | 439,838 | | | $ | 35,014 | | | $ | 2,074,852 | |

| (Principal Executive Officer) | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Gianni Del Signore | | 2023 | | $ | 300,000 | | | $ | 275,000 | | | $ | 199,997 | | | $ | 27,080 | | | $ | 802,077 | |

| Chief Financial Officer | | 2022 | | $ | 200,000 | | | $ | 450,000 | | | $ | 274,898 | | | $ | 21,428 | | | $ | 924,898 | |

| (Principal Financial Officer) | | | | | | | | | | | | |

| | | | | | | | | | | | |

Mads Rosenberg Boye Petersen (4) | | 2023 | | $ | 350,000 | | | $ | 375,000 | | | $ | 224,999 | | | $ | 7,587 | | | $ | 957,586 | |

| Chief Operating Officer | | 2022 | | $ | 223,770 | | | $ | 600,000 | | | $ | 329,880 | | | $ | 1,399 | | | $ | 1,155,049 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1) Base salary amounts shown above represented actual salary earned during the year, reported as gross earnings (i.e., gross amounts before taxes and applicable payroll deductions).

(2) The grant date fair value of the restricted stock awards is based on the closing price of the Company’s common stock on the date of grant in accordance with FASB ASC 718 (“ASC 718”).

(3) This amount represents: (i) the Company’s matching contributions under the Company’s 401(k) plan and (ii) health insurance premiums paid by the Company.

(4) On February 22, 2022, Mads Rosenberg Boye Petersen was appointed as Chief Operating Officer, effective on April 1, 2022.

The information in above table represents the period from January 1, 2022 to December 31, 2023.

Outstanding Equity Awards at Fiscal Year End

As of December 31, 2023, the Company’s named executive officers held the following outstanding equity or equity-based awards, all of which are earned:

| | | | | | | | | | | | | | | | | | | | |

| | Stock Award Grant Date | | Number of Shares or Units of Stock That Have Not Vested | | Market Value of Shares or Units of Stock That Have

Not Vested |

| Mark Filanowski | | 03/19/24 | | 57,388 | | | $ | 399,994 | |

| Chief Executive Officer | | 01/02/23 | | 81,301 | | | $ | 669,920 | |

| | 01/02/22 | | 35,000 | | | $ | 288,400 | |

| | 12/28/20 | | 33,334 | | | $ | 274,672 | |

| | 12/31/19 | | 16,667 | | | $ | 137,336 | |

| | 01/02/19 | | 15,000 | | | $ | 123,600 | |

| | | | 238,690 | | | 1,893,923 | |

| | | | | | |

| Gianni Del Signore | | 03/19/24 | | 28,694 | | | $ | 199,997 | |

| Chief Financial Officer | | 01/02/23 | | 50,813 | | | $ | 418,699 | |

| | 01/02/22 | | 30,000 | | | $ | 247,200 | |

| | 12/28/20 | | 36,667 | | | $ | 302,136 | |

| | 12/31/19 | | 18,334 | | | $ | 151,072 | |

| | 01/02/19 | | 16,667 | | | $ | 137,336 | |

| | | | 181,175 | | | 1,456,441 | |

| | | | | | |

| Mads Rosenberg Boye Petersen | | 03/19/24 | | 32,281 | | | $ | 224,999 | |

| Chief Operating Officer | | 01/02/23 | | 60,976 | | | $ | 502,442 | |

| | 01/02/22 | | 30,000 | | | $ | 247,200 | |

| | 12/15/20 | | 20,000 | | | $ | 164,800 | |

| | 12/15/19 | | 10,000 | | | $ | 82,400 | |

| | 01/02/19 | | 6,667 | | | 54,936 | |

| | | | 159,924 | | | 1,276,777 | |

Retirement Benefits, Termination, Severance and Change in Control Payments

As of December 31, 2023, none of the Company’s officers, including its named executive officers, have any retirement benefits (other than their right to participate in the Company’s 401(k) retirement plan, as described above) or have any contractual rights to severance payments.

Pay Versus Performance

As required by the Dodd-Frank Wall Street Reform and Consumer Protection Act and SEC rules, we are providing the following information about the relationship of executive compensation actually paid (“Compensation Actually Paid”) and certain financial performance of our company. The following table shows the total compensation for our Named Executive Officers ("NEOs") NEOs for the past two fiscal years as set forth in the Summary Compensation Table, the Compensation Actually Paid to our CEO (also referred to as the principal executive officer or “PEO”) and our other non-PEO NEO, our total shareholder return on a $100 hypothetical investment in our common stock and our net income.

The compensation actually paid ("CAP") for the PEO and the average non-PEO NEOs is calculated by taking the Summary Compensation Table values: a) less the grant value of equity granted during the year; b) plus the year-end fair value of unvested equity awards granted during the year; c) plus, for awards granted in prior years that are outstanding and unvested at the end of the year, the difference between the year-end fair value and the immediately prior year-end fair value; d) plus, for awards granted in prior years that vested during the year, the difference between the fair value as of the vesting date and the immediately prior year-end fair value; The tables below illustrate the CAP for the PEO and average non-PEO NEO's.

Pay Versus Performance Table

| | | | | | | | | | | | | | | | | | | | |

| Year | Summary compensation table total for PEO (1) | Compensation actually paid to PEO (1) | Average summary compensation table total for non-PEO NEOs (2) | Average compensation actually paid to non-PEO NEOs (2) | Total shareholder return (3) | Net income (in thousands) |

| 2023 | $ | 1,484,267 | | $ | 2,073,120 | | $ | 879,832 | | $ | 1,398,907 | | $ | 221 | | $ | 26,323 | |

| 2022 | $ | 2,074,852 | | $ | 1,996,552 | | $ | 1,039,974 | | $ | 1,036,608 | | $ | 142 | | $ | 79,491 | |

(1) The Principal Executive Officer ("PEO") in 2023 was CEO, Mr. Filanowski.

(2) The non-PEO NEOs in 2023 were Mr. Del Signore and Mr. Petersen.

(3) The values disclosed in this column represent a hypothetical investment of $100 in our stock on December 31, 2021, and as of December 31, 2022 and December 31, 2023, based upon the Company's TSR for the years then ended.

Adjustments from Total Compensation to Compensation Actually Paid

The following tables present the requisite adjustments from total compensation, as reported in the Summary Compensation Table, to calculate Compensation Actually Paid to our CEO and other NEO for the fiscal years ended December 31, 2023 and 2022.

| | | | | | | | | | | | | | |

| Summary Compensation Table to Compensation Actually Paid to our PEO | 2023 | | 2022 |

| Summary Compensation Table - Total Compensation | $ | 1,484,267 | | | $ | 2,074,852 | |

| — | | Grant Date Fair Value of Equity Awards Granted in Fiscal Year | (399,994) | | | (439,838) | |

| + | Fair Value at Fiscal Year-End of Outstanding and Unvested Equity Awards Granted in Fiscal Year | 439,838 | | | 134,750 | |

| + | Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Fiscal Years | 549,009 | | | 226,788 | |

| Compensation Actually Paid | $ | 2,073,120 | | | $ | 1,996,552 | |

| | | | | | | | | | | | | | |

| Summary Compensation Table to Compensation Actually Paid to non-PEO NEO | 2023 | | 2022 |

| Summary Compensation Table - Total Compensation | $ | 879,832 | | | $ | 1,039,974 | |

| — | | Grant Date Fair Value of Equity Awards Granted in Fiscal Year | (212,498) | | | (302,389) | |

| + | Fair Value at Fiscal Year-End of Outstanding and Unvested Equity Awards Granted in Fiscal Year | 302,389 | | | 115,500 | |

| + | Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Fiscal Years | 429,184 | | | 183,523 | |

| Compensation Actually Paid | $ | 1,398,907 | | | $ | 1,036,608 | |

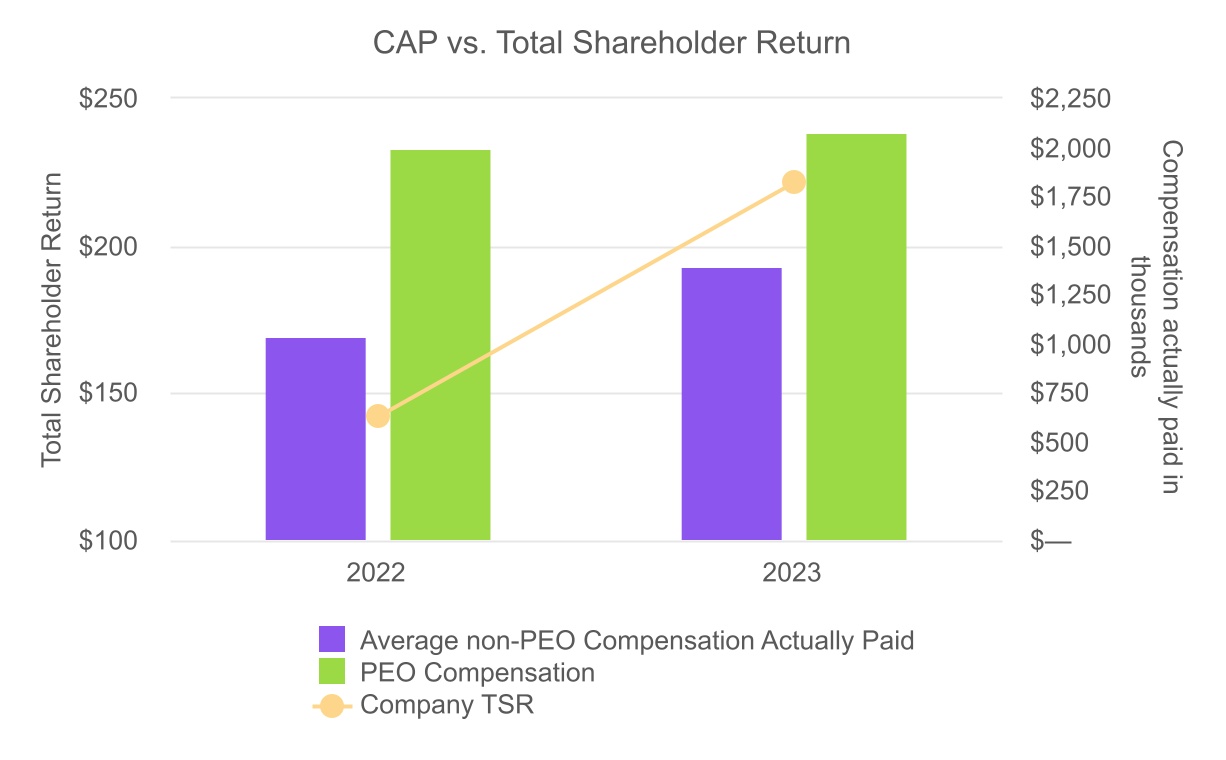

Relationship between CAP and TSR

The following graph displays the PEO and average non-PEO NEO CAP amounts are aligned with the Company’s TSR (assuming an initial investment of $100 made on December 31, 2021) for the fiscal years ended December 31, 2022 and 2023. The CAP dollar amounts in the graph are shown in thousands of dollars.

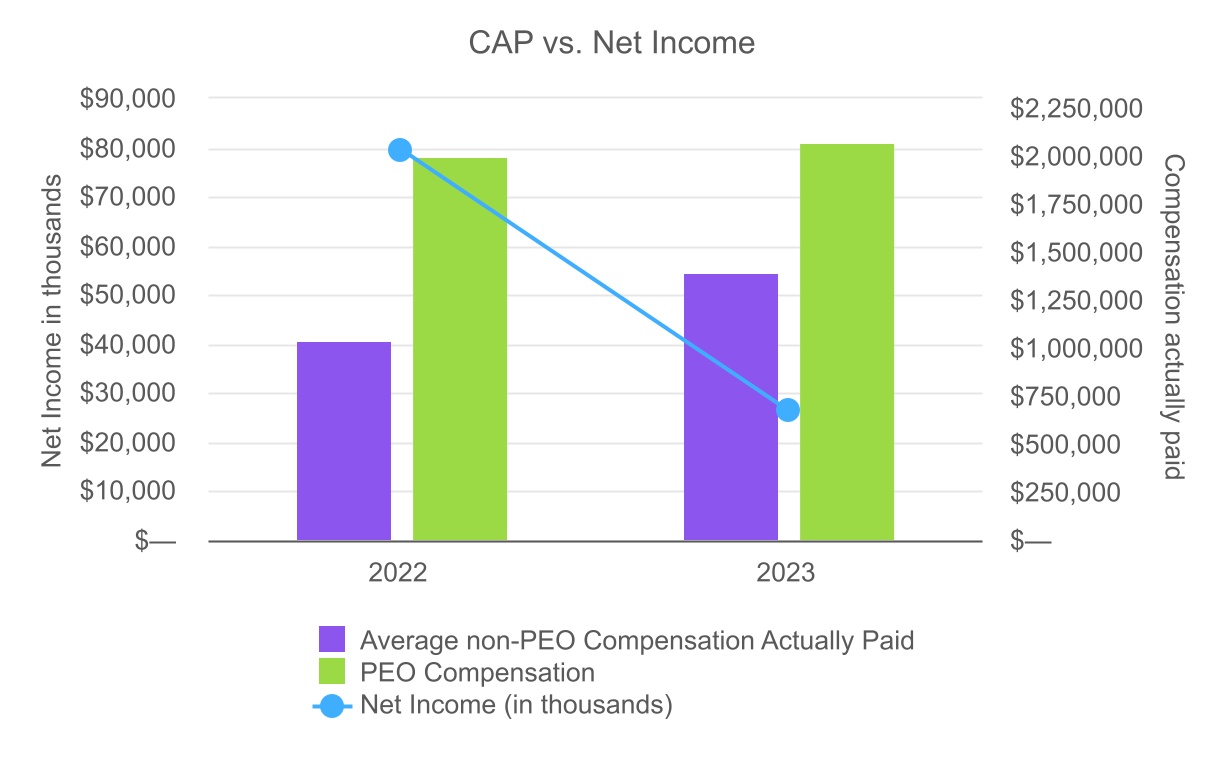

Relationship between CAP and Net Income

The graph below reflects the relationship between PEO and average Non-PEO NEO CAP amounts and the Company’s net income for the fiscal years ending December 31, 2022 and 2023. The Net Income dollar amounts in the graph are shown in thousands of dollars.

PROPOSAL 1 - ELECTION OF CLASS II DIRECTORS

To elect the following three nominees to our Board of Directors as Class I directors serving until the annual meeting of shareholders to be held in 2027:

•Eric S. Rosenfeld

•Mark L. Filanowski

•Anthony Laura

Our Board unanimously recommends that shareholders vote “FOR" the election of two Class I director, Eric S. Rosenfeld, Mark L. Filanowski and Anthony Laura.

Our Board of Directors consists of seven members divided into three classes. If approved at the 2024 meeting, our Board of Directors will consist of the following:

•in Class II, to stand for reelection in 2025: Carl Claus Boggild and David D. Sgro;

•in Class III, to stand for reelection in 2026: Richard du Moulin and Karen H. Beachy; and

•in Class I, to stand for reelection in 2027: Eric S. Rosenfeld, Mark L. Filanowski and Anthony Laura.

Votes to withhold authority and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business, but will not affect the election outcome.

Nominee Information

Our Board believes that the nominees possess the qualities and experience that it believes our directors should possess, as described in detail below. The nominees for election to the Board, and our other continuing directors, together with their biographical information and the Board’s reasons for nominating them to serve as directors, are set forth in the section of this proxy statement titled “BOARD OF DIRECTORS”. No family relationship exists between of the directors or the executive officers listed in the “Executive Officers and Executive Compensation” portion of this proxy statement.

PROPOSAL 2 - TO APPROVE THE AMENDMENT OF THE PANGAEA LOGISTICS SOLUTIONS LTD. 2014 SHARE INCENTIVE PLAN, AS AMENDED AND RESTATED BY THE BOARD OF DIRECTORS ON MAY 7, 2024, REFERRED AS THE '2024 PLAN'

At the Annual General Meeting, our shareholders will be asked to approve the Pangaea Logistics Solutions Ltd. 2024 Share Incentive Plan (the "2024 Plan"), which replaces in its entirety the Company’s 2014 Equity Incentive Plan (the “2014 Plan”). The Board of Directors adopted the 2024 Plan on May 7, 2024, subject to shareholder approval at the Annual Meeting. If approved by our shareholders, the 2024 Plan will effect the following substantive changes to the 2024 Plan:

•Increase the share reserved under the 2014 Plan by an additional 2,000,000 shares; and

•Establish an expiration date of the tenth (10th) anniversary of the effective date of the 2024 Plan, which will be the date of the 2024 annual meeting of shareholders.

Rationale for Approval

The 2014 Plan was originally adopted by our Board of Directors in April 2014. On August 12, 2019, our shareholders approved an amendment and restatement of the 2014 Plan as adopted by our Board of Directors on May 14, 2019. The purpose of the 2024 Plan is to provide officers, directors, employees and consultants of the Company and its subsidiaries whose initiative and efforts are deemed important to the successful conduct of the Company’s business with incentives to enter into and remain in the service of the Company and its subsidiaries, to acquire a proprietary interest in the success of the Company, to maximize their performance and to enhance the long-term performance of the Company.

The Board of Directors believes that the effective use of stock-based, long-term incentive compensation has been integral to the Company’s success in the past and is vital to its ability to achieve strong performance in the future. The 2014 Plan is the only plan pursuant to which we can grant such equity awards, and the limited number of shares remaining available under the 2014 Plan restricts our ability to continue to grant future equity awards. As of June 23, 2024, approximately 926,531 shares remained available for future awards under the renewed 2014 Plan. Our average annual shares issued for the past five years is approximately 493,612 shares. Our Board of Directors does not believe that the number of shares of our common stock remaining available for issuance under the 2014 Plan is sufficient to accomplish the aforementioned purposes of our long-term

incentive compensation. The 2024 Plan will add 2,000,000 shares to the 2014 Plan share reserve, increasing the maximum number of shares available for issuance from 1,362,000 as of December 31, 2023, to 2,926,531 as of August 8, 2024, pending shareholder approval of the proposal. A total of 5,273,469 have been granted to non-employee directors and employees since inception of the plan.

Summary of the 2024 Plan

The following is a summary of the material terms of the 2024. This summary is qualified in its entirety by the full text of the 2024 Plan. A copy of the 2024 Plan Equity Incentive Plan is attached to this proxy statement as Appendix A and is incorporated herein by reference. Shareholders are encouraged to review the 2024 Equity Incentive Plan.

The 2024 Plan will become effective only if it is approved by the Company’s shareholders. If this amendment and restatement is not approved, the 2014 Plan will expire on September 29, 2024 and we will no longer be able to grant equity-based compensation awards after that date.

Plan Administration. The 2024 Plan is administered by the Board or such other committee consisting of two or more individuals appointed by the Board to administer the 2024 Plan (the “Committee”). The Committee has the authority, among other things, to select participants, determine types of awards and terms and conditions of awards for participants, prescribe rules and regulations for the administration of the 2024 Plan and make all decisions and determinations as deemed necessary or advisable for the administration of the 2024 Plan. The Committee may delegate certain of its authority as it deems appropriate, pursuant to the terms of the 2024 Plan, to officers or employees of the Company or its affiliates. The Committee’s actions will be final, conclusive and binding.

Authorized Shares. A total of 6,200,000 common shares are reserved and available for delivery under the 2024 Plan. The number of common shares reserved and available for delivery under the 2024 Plan is subject to adjustment, as described below. The maximum number of common shares reserved and available for delivery under the 2024 Plan may be issued in respect of incentive stock options. Common shares issued under the 2024 Plan may consist of authorized but unissued common shares or previously issued common shares. Common shares underlying awards that are settled in cash, canceled, forfeited, or otherwise terminated without delivery to a participant will again be available for issuance under the 2024 Plan. Common shares withheld or surrendered in connection with the payment of an exercise price of an award or to satisfy tax withholding will again become available for issuance under the 2024 Plan.

Individual Limits. The maximum value of awards that may be granted to any non-employee directors of the Company in any one calendar year will not exceed $150,000 (calculating the value of any award based in shares on the grant date fair value of such awards for financial reporting purposes and excluding, for this purpose, the value of any dividend equivalent payment paid pursuant to any award granted in a previous year. Previously, the limitation was 10,000 shares.

During any time that the Company is subject to Section 162(m) of the Code, the maximum number of shares of common stock subject to options, share appreciation rights or performance awards, in each case, that may be granted to any individual in any one calendar year may not exceed 200,000 common shares. Similarly, the maximum value of a performance award that is valued in dollars and that is intended to qualify as performance-based compensation under Section 162(m) of the Code that may be granted to any individual in any one year may not exceed $1,000,000.

Types of Awards. The types of awards that may be available under the 2024 Plan are described below. All of the awards described below will be subject to the terms and conditions determined by the Committee in its sole discretion, subject to certain limitations provided in the 2024 Plan. Each award granted under the 2024 Plan will be evidenced by an award agreement, which will govern that award’s terms and conditions.

Non-qualified Stock Options. A non-qualified stock option is an option that is not intended to meet the qualifications of an incentive stock option, as described below. An award of a non-qualified stock option grants a participant the right to purchase a certain number of our common shares during a specified term in the future, or upon the achievement of performance or other conditions, at an exercise price set by the Committee on the grant date. The term of a non-qualified stock option will be set by the Committee but may not exceed 10 years from the grant date. The exercise price may be paid using cash, or by certified or bank cashier’s check, and if approved by the Committee (i) by delivery of common shares previously owned by the participant, (ii) by a broker-assisted, cashless exercise in accordance with procedures approved by the Committee, or (iii) by any other means approved by the Committee.

Incentive Stock Options. An incentive stock option is an option that meets the requirements of Section 422 of the Code. Incentive stock options may be granted only to our employees or employees of certain of our subsidiaries and must have an exercise price of no less than 100% of the fair market value (or 110% with respect to a ten-percent shareholder) of a common share on the grant date and a term of no more than 10 years (or 5 years with respect to a ten-percent shareholder).

Share Appreciation Rights. A share appreciation right entitles the participant to receive an amount equal to the difference between the fair market value of our common shares on the exercise date and the base price of the share appreciation right that is set by the Committee on the grant date, multiplied by the number of shares subject to the share appreciation right. The term of a share appreciation right will be set by the Committee but may not exceed 10 years from the grant date. Payment to a participant upon the exercise of a share appreciation right may be either in cash, common shares, or specified property as determined by the Committee.

Restricted Shares. A restricted share award is an award of restricted common shares that does not vest until a specified period of time has elapsed, and/or upon the achievement of performance or other conditions determined by the Committee, and which will be forfeited if the conditions to vesting are not met. During the period that any restrictions apply, transfer of the restricted common shares is generally prohibited. Unless otherwise specified in their award agreement, participants generally have all of the rights of a shareholder as to the restricted common shares, including the right to vote such shares, provided, that any cash or share dividends with respect to the restricted common shares will be withheld by the Company and will be subject to forfeiture to the same degree as the restricted common shares to which such dividends relate.

Restricted Share Units. A restricted share unit is an unfunded and unsecured obligation to issue a common share (or an equivalent cash amount) to the participant in the future. Restricted share units become payable on terms and conditions determined by the Committee and will vest and be settled at such times in cash, common shares, or other specified property, as determined by the Committee.

Other Share-Based or Cash-Based Awards. Under the 2024 Plan, the Committee may grant other types of equity-based or cash-based awards subject to such terms and conditions that the Committee may determine. Such awards may include the grant of dividend equivalents, which generally entitle the participant to receive amounts equal to the dividends that are paid on the shares underlying the award. The Committee may also grant common shares as a bonus, and may grant other awards in lieu of obligations of the Company or its affiliates to pay cash or deliver other property under the 2024 Plan or under other plans or compensatory arrangements, subject to such terms and conditions as the Committee may determine.