UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| [X] |

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2016

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from _______ to __________

Commission file number: 000-55205

Alpine 4 Technologies Ltd.

(Exact name of registrant as specified in its charter)

|

Delaware

|

46-5482689

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

| |

|

|

4742 N. 24th Street Suite 300

|

|

|

Phoenix, AZ

|

85016

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: 855-777-0077 ext 801

(Former name, former address and former fiscal year, if changed since last report)

Securities Registered pursuant to Section 12(b) of the Act: None

Securities Registered pursuant to Section 12(g) of the Act: Class A Common Stock, $0.0001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filings pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☒

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter. As of June 30, 2016, the aggregate market value of the voting and non-voting common equity held by non-affiliates, computed based on the average bid and asked price of the Class A common stock, was $0 because the Company's Class A Common Stock was not traded publicly as of that date.

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date: As of April 14, 2017, the issuer had 21,891,852 shares of its Class A common stock issued and outstanding and 1,600,000 shares of its Class B common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

FISCAL YEAR ENDED DECEMBER 31, 2016

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

|

PART I

|

|

Page

|

|

|

|

|

|

ITEM 1.

|

BUSINESS

|

3

|

|

|

|

|

|

ITEM 1A.

|

RISK FACTORS

|

10

|

|

|

|

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

15

|

|

|

|

|

|

ITEM 2.

|

PROPERTIES

|

16

|

|

|

|

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

16

|

|

|

|

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES

|

16

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

ITEM 5.

|

MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

21

|

|

|

|

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

21

|

|

|

|

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

21

|

|

|

|

|

|

ITEM 7A.

|

QUANTITATIVE AND QULAITATIVE DISCLOSURES ABOUT MARKET RISK

|

22

|

|

|

|

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

22

|

|

|

|

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

|

23

|

|

ITEM 9A.

|

CONTROLLS AND PROCEDURES

|

22

|

|

|

|

|

|

ITEM 9B.

|

OTHER INFORMATION

|

22

|

|

|

|

|

|

PART III

|

|

|

|

|

|

|

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

23

|

|

|

|

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

23

|

| |

|

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

23

|

| |

|

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

23

|

| |

|

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

23

|

| |

|

|

|

PART IV

|

|

|

| |

|

|

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

23

|

| |

|

|

| SIGNATURES |

|

24 |

PART I

Special Note Regarding Forward-Looking Statements

Information included or incorporated by reference in this Annual Report on Form 10-K contains forward-looking statements. All forward-looking statements are inherently uncertain as they are based on current expectations and assumptions concerning future events or future performance of the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which are only predictions and speak only as of the date hereof. Forward-looking statements may contain the words "believes," "project," "expects," "anticipates," "estimates," "forecasts," "intends," "strategy," "plan," "may," "will," "would," "will be," "will continue," "will likely result," and similar expressions, and are subject to numerous known and unknown risks and uncertainties. Additionally, statements relating to implementation of business strategy, future financial performance, acquisition strategies, capital raising transactions, performance of contractual obligations, and similar statements may contain forward-looking statements. In evaluating such statements, prospective investors and shareholders should carefully review various risks and uncertainties identified in this Report, including the matters set forth under the captions "Risk Factors" and in the Company's other SEC filings. These risks and uncertainties could cause the Company's actual results to differ materially from those indicated in the forward-looking statements. The Company disclaims any obligation to update or publicly announce revisions to any forward-looking statements to reflect future events or developments.

Although forward-looking statements in this Annual Report on Form 10-K reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by us. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, those specifically addressed under the heading "Risk Factors Related to Our Business" below, as well as those discussed elsewhere in this Annual Report on Form 10-K. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. We file reports with the Securities and Exchange Commission ("SEC"). You can read and copy any materials we file with the SEC at the SEC's Public Reference Room, 100 F. Street, NE, Washington, D.C. 20549. You can obtain additional information about the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. In addition, the SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, including us.

We disclaim any obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Annual Report on Form 10-K. Readers are urged to carefully review and consider the various disclosures made throughout the entirety of this Annual Report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects.

ITEM 1. BUSINESS.

Our Business

Company Background and History

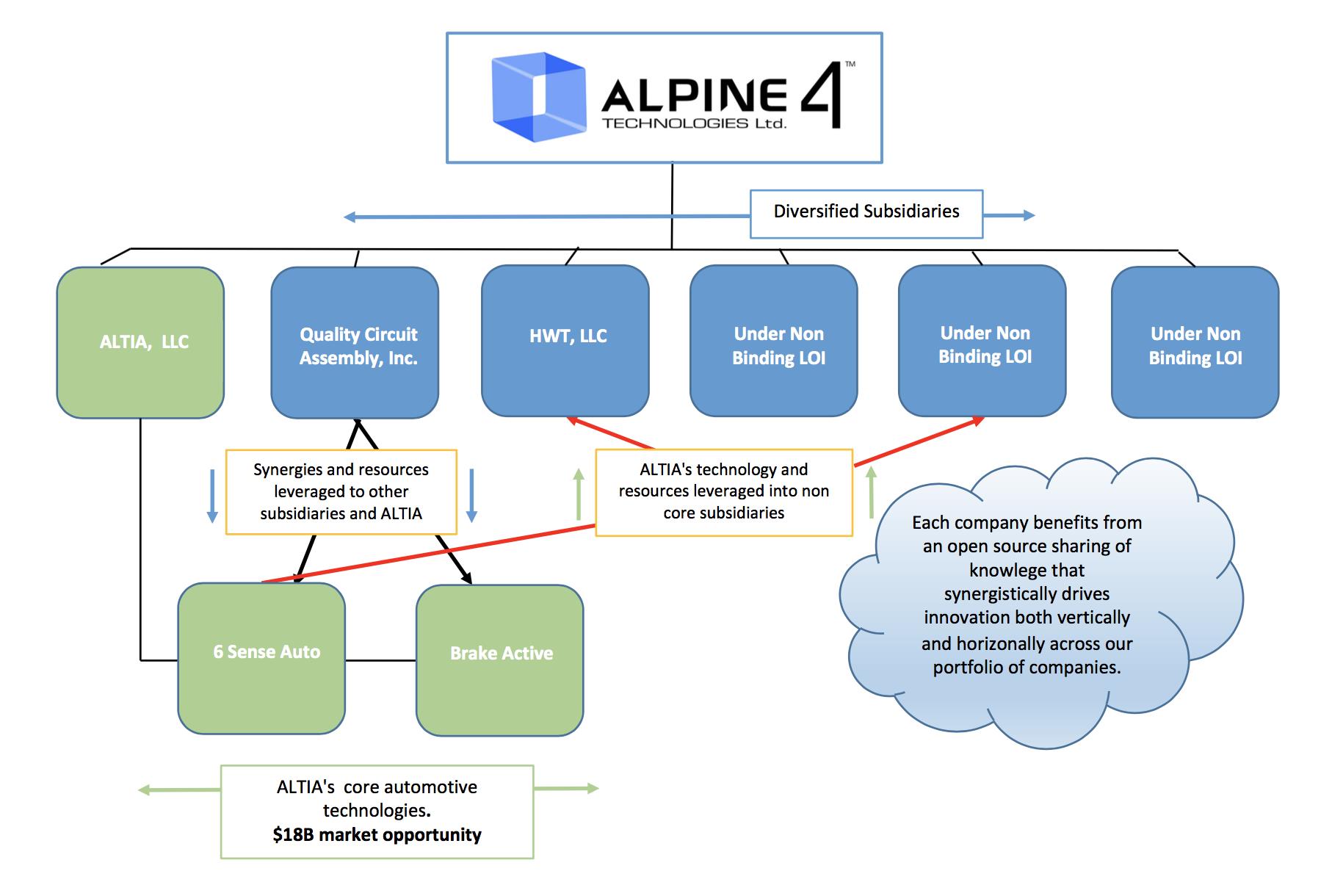

Alpine 4 Technologies Ltd. (the "Company") was incorporated under the laws of the State of Delaware on April 22, 2014. The Company was formed to serve as a vehicle to effect an asset acquisition, merger, exchange of capital stock, or other business combination with a domestic or foreign business. As of the date of this Report, the Company is a technology holding company owning three companies (ALTIA, LLC, Quality Circuit Assembly, Inc., and Horizon Well Testing, LLC.)

Alpine 4 is a publicly held enterprise with four principles at the core of its business: Synergy, Innovation, Drive, and Excellence (S.I.D.E.). At Alpine 4, we believe synergistic innovation drives excellence. By anchoring these words to our combined experience and capabilities, we are able to aggressively pursue opportunities within and across vertical markets. We deliver solutions that not only drive industry standards, but also increase value for our shareholders.

At Alpine 4, we understand the nature of how technology and innovation can accentuate a business. We strive to develop strategic synergies between our holdings to create value and operational excellence within a unique long-term perspective.

Our Strategy

Alpine 4's strategy is to provide Fortune 500-level execution strategies in its subsidiary companies and market segments to businesses and companies that have the most to benefit from this access.

Alpine 4 feels this opportunity exists in smaller middle market operating companies with revenues between $5 to $150 million. In this target rich environment, businesses generally sell at more reasonable multiples, presenting greater opportunities for operational and strategic improvements and have greater potential for growth. Implementation of our strategy within our holdings is accomplished by the offering of strategic and tactical MBA-level training and development, delivered via the following modules:

|

-

|

Alpine 4 Mini MBA program; and

|

| |

|

|

-

|

An Alpine 4 developed ERP (Enterprise Resource Planning system) and collaboration system called SPECTRUMebos. SPECTRUMebos is what we are defining as an Enterprise Business Operating System (ebos). This system will combine the key technology software components of Accounting and Financial Reporting, an Enterprise Resource Planning System (ERP), a Document Management System (DMS), a Business Intelligence (BI) platform and a Customer Resource Management (CRM) hub which will be tethered to management reporting and collaboration toolsets. Management believes that these tools will help drive real-time information in two directions: first, to the front lines by empowering customer-facing stakeholders; and second, back to management for planning, problem solving, and integration. Management believes that SPECTRUMebos will be the technology "secret sauce" in managing our portfolio of companies and, in time, will be an offering to external customers.

|

All great strategies must have trades offs. Therefore, Alpine 4 avoids companies that have unionized employees, businesses that have more than $150 million in revenue and companies that reside in highly regulated business industries.

Diversification

It is our goal to help drive Alpine 4 into a leading multi-faceted holding company with diverse products and services that not only benefit from one another as whole but also have the benefit of independence. This type of corporate structure is about having our subsidiaries prosper through strong onsite leadership, while working synergistically with other Alpine 4 holdings. Alpine 4 has been set up with a holding company model, with Presidents who will run each business, and Managers with specific industry related experience who, along with Kent Wilson, the CEO of Alpine 4, will help guide our portfolio of companies as needed. Alpine 4 will work with our Presidents and Managers to ensure that our motto of S.I.D.E (Synergistic, Innovation, Drives, Excellence) is utilized. Further, we plan to work with our subsidiaries and capital partners to provide the proper capital allocation and, to work to make sure each business is executing at high levels.

In 2016, we saw the beginning of our plan for diversification take hold with the acquisition of Quality Circuit Assembly, Inc. ("QCA") when Alpine 4 acquired 100% of QCA's stock effective April 1, 2016. Additional information relating to our acquisition of QCA can be found in our Current Report on Form 8-K, filed with the SEC on March 15, 2016.

In October of 2016, Alpine 4 formed a new Limited Liability Company called ALTIA (Automotive Logic & Technology In Action) to create an independent subsidiary for Alpine 4's 6th Sense Auto product and its BrakeActive product.

Effective, January 1, 2017, Alpine 4 acquired 100% of Horizon Well Testing, LLC ("Horizon"). Additional information about the acquisition of Horizon can be found in our Current Reports on Form 8-K filed with the SEC on December 8, 2016, and January 13, 2017.

Finally, we have entered into two additional LOI's to acquire two different companies, and will provide additional disclosures relating to those transactions as they progress.

Recent Developments

Acquisition of Horizon Well Testing

On November 30, 2016, Alpine 4 entered into a Stock Purchase Agreement (the "HWT SPA") with Horizon Well Testing, L.L.C., an Oklahoma company ("HWT") and its sole shareholder, Alan Martin ("HWT Seller"). Effective as of January 1, 2017, Alpine 4 acquired and took full control of HWT.

Since 2010, HWT has been providing services to the Oil and Gas industry. This acquisition is another step in Alpine 4's strategy of diversification through acquisitions.

Pursuant to the HWT SPA, Alpine 4, HWT and HWT Seller agreed on the terms pursuant to which Alpine 4 would purchase from HWT Seller all of the outstanding shares of common stock of HWT (the "HWT Stock"). The purchase price paid by Alpine 4 for the HWT Stock consisted of cash, a note, a convertible note, and securities consideration. The "Cash Consideration" paid was $2,200,000. The "Note" consisted of a secured note in the amount of $300,000, secured by a subordinated security interest in the assets of HWT. The Note bears interest at 1% and will be payable in full by April 30, 2017. The "Convertible Note" consisted of a secured convertible note in the amount of $1,500,000, secured by a subordinated security interest in the assets of HWT. The HWT Seller has the opportunity to convert the Convertible Note into shares of Alpine 4's Class A common stock at a conversion price of $8.50 after a restricted period according to securities laws. The Convertible Note bears interest at 5% and is payable in full with a balloon payment on the 18-month anniversary of the closing date of the transaction with no monthly payments. The "Securities" consisted of two components, an aggregate of 379,403 shares of alpine 4s Class A common stock issued to the Seller, and a warrant to purchase an additional 75,000 shares of Class A common stock.

In the HWT SPA, Mr. Martin acknowledged and agreed that his entry into consulting agreements with Alpine 4 was an integral part of the transaction contemplated by the HWT SPA. As such, Mr. Martin agreed to enter into consulting agreements with Alpine 4 and HWT, and continue to work with HWT for a period of time agreed upon by Alpine 4 and Mr. Martin.

Change in Capital Structure

Effective November 1, 2016, pursuant to the approved amendment for a reverse split, Alpine 4 issued one (1) new share for each ten (10) old share of the Company's commons stock. The reverse split only reduced the number of outstanding shares of class A and Class B common stock and did not correspondingly reduce the number of Class a and Class B commons shares authorized for issuance, which remained at 500,000,000 and 100,000,000 respectively.

Common Stock

Voting Rights

Holders of our Class A and Class B common stock have identical rights, except that holders of our Class A common stock are entitled to one vote per share and holders of our Class B common stock are entitled to ten votes per share. Holders of shares of Class A common stock and Class B common stock will vote together as a single class on all matters (including the election of directors) submitted to a vote of stockholders, unless otherwise required by law. We have not provided for cumulative voting for the election of directors in our certificate of incorporation.

Dividends

Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of Class A common stock and Class B common stock shall be entitled to share equally in any dividends that our board of directors may determine to issue from time to time. In the event a dividend is paid in the form of shares of common stock or rights to acquire shares of common stock, the holders of Class A common stock shall receive Class A common stock, or rights to acquire Class A common stock, as the case may be, and the holders of Class B common stock shall receive Class B common stock, or rights to acquire Class B common stock, as the case may be.

Liquidation Rights

Upon our liquidation, dissolution or winding-up, the holders of Class A common stock and Class B common stock shall be entitled to share equally all assets remaining after the payment of any liabilities and the liquidation preferences on any outstanding preferred stock.

Conversion

Our Class A common stock is not convertible into any other shares of our capital stock.

Each share of Class B common stock is convertible at any time at the option of the holder into one share of Class A common stock. In addition, each share of Class B common stock shall convert automatically into one share of Class A common stock upon any transfer, whether or not for value, except for certain transfers described in our certificate of incorporation.

Once transferred and converted into Class A common stock, the Class B common stock shall not be reissued. No class of common stock may be subdivided or combined unless the other class of common stock concurrently is subdivided or combined in the same proportion and in the same manner.

The foregoing description of the Second Amended and Restated Certificate of Incorporation is qualified in its entirety by reference to the text of the Amendment attached as Exhibit 3.1 to the Current Report on Form 8-K filed with the SEC on August 27, 2015, and incorporated therein by reference.

Employees

As of the date of this Report, we had 63 full-time and 5 part-time employees. We believe our relationships with our employees is good. Other than as disclosed in this Report, we have no employment agreements with our employees.

ITEM 1A. RISK FACTORS

Because of the following factors, as well as other factors affecting the Company's financial condition and operating results, past financial performance should not be considered to be a reliable indicator of future performance, and investors should not use historical trends to anticipate results or trends in future periods.

RISKS ASSOCIATED WITH ALPINE 4:

Alpine 4 is an "emerging growth company," and the reduced disclosure requirements applicable to "emerging growth companies" could make our common stock less attractive to investors.

Alpine 4 is an "emerging growth company," as defined in the JOBS Act. For as long as we are an emerging growth company, we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding advisory "say-on-pay" votes on executive compensation and shareholder advisory votes on golden parachute compensation. We will remain an "emerging growth company" until the earliest of (i) the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more; (ii) the last date of the fiscal year following the fifth anniversary of the date of the first sale of common stock under the Company's first filed registration statement; (iii) the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; and (iv) the date on which we are deemed to be a "large accelerated filer" under the Exchange Act. We will be deemed a large accelerated filer on the first day of the fiscal year after the market value of our common equity held by non-affiliates exceeds $700 million, measured on October 31.

We cannot predict if investors will find our common stock less attractive to the extent we rely on the exemptions available to emerging growth companies. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. An emerging growth company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

A Company that elects to be treated as an emerging growth company shall continue to be deemed an emerging growth company until the earliest of (i) the last day of the fiscal year during which it had total annual gross revenues of $1,000,000,000 (as indexed for inflation), (ii) the last day of the fiscal year following the fifth anniversary of the date of the first sale of common stock under the Company's first filed registration statement; (iii) the date on which it has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (iv) the date on which is deemed to be a 'large accelerated filer' as defined by the SEC, which would generally occur upon it attaining a public float of at least $700 million.

However, we are choosing to "opt out" of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern.

Alpine 4 has incurred net losses of $17,436,455 since inception through December 31, 2016. This net loss was primarily driven in 2015 by stock issuance to employees. Because we have yet to attain profitable operations, in their report on our financial statements for the period ended December 31, 2016, our independent auditors included an explanatory paragraph regarding their substantial doubt about our ability to continue as a going concern. While we believe we will have net operating gains beginning in the second quarter of 2017, there can be no guarantee that we will be able to achieve these net operating gains. Our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing sales or obtaining loan from various financial institutions where possible. Our net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful. Our financial statements contain additional note disclosures describing the management's assessment of our ability to continue as a going concern.

Management of Alpine 4 cannot guarantee that Alpine 4 will continue to generate revenues which could result in a total loss of the value of your investment if it is unsuccessful in its business plans.

Alpine 4 has generated only limited revenues during its history. Additionally, there can be no assurance that Alpine 4 will be able to continue to generate revenues or that revenues will be sufficient to maintain its business. As a result, investors or shareholders could lose all of their investment if Alpine 4 is not successful in its proposed business plans.

Alpine 4's needs could exceed the amount of time or level of experience its officers and directors may have. Alpine 4 will be dependent on key executives, and the loss of the services of the current officers and directors could severely impact Alpine 4's business operations.

Alpine 4's business plan does not provide for the hiring of any additional employees other than outlined in its plan of operations until sales will support the expense. Until that time, the responsibility of developing Alpine 4's business and fulfilling the reporting requirements of a public company will fall upon the officers and the directors. In the event they are unable to fulfill any aspect of their duties to Alpine 4, it may experience a shortfall or complete lack of sales resulting in little or no profits and eventual closure of our business.

Additionally, the management of future growth will require, among other things, continued development of Alpine 4's financial and management controls and management information systems, stringent control of costs, increased marketing activities, and the ability to attract and retain qualified management, research, and marketing personnel. The loss of key executives or the failure to hire qualified replacement personnel would compromise Alpine 4's ability to generate revenues or otherwise have a material adverse effect on Alpine 4. There can be no assurance that Alpine 4 will be able to successfully attract and retain skilled and experienced personnel.

Significant time and management resources are required to ensure compliance with public company reporting and other obligations. Taking steps to comply with these requirements will increase our costs and require additional management resources, and does not ensure that we will be able to satisfy them.

We are a publicly reporting company. As a public company, we are required to comply with applicable provisions of the Sarbanes-Oxley Act of 2002, as well as other federal securities laws, and rules and regulations promulgated by the SEC and the various exchanges and trading facilities where our common stock may trade, which result in significant legal, accounting, administrative and other costs and expenses. These rules and requirements impose certain corporate governance requirements relating to director independence, distributing annual and interim reports, stockholder meetings, approvals and voting, soliciting proxies, conflicts of interest, and codes of conduct, depending on where our shares trade. Our management and other personnel will need to devote a substantial amount of time to ensure that we comply with all applicable requirements.

As we review our internal controls and procedures, we may determine that they are ineffective or have material weaknesses, which could impact the market's acceptance of our filings and financial statements.

In connection with the preparation of this Annual Report, we conducted a review of our internal control over financial reporting for the purpose of providing the management report required by these rules. During the course of our review and testing, we have identified deficiencies and have been unable to remediate them before we were required to provide the required reports. Furthermore, because we have material weaknesses in our internal control over financial reporting, we may not detect errors on a timely basis and our financial statements may be materially misstated. Even if we are able to remediate the material weaknesses, we may not be able to conclude on an ongoing basis that we have effective internal controls over financial reporting, which could harm our operating results, cause investors to lose confidence in our reported financial information and cause the trading price of our stock to fall. In addition, as a public company we are required to file in a timely manner accurate quarterly and annual reports with the SEC under the Securities Exchange Act of 1934 (the "Exchange Act"), as amended. Any failure to report our financial results on an accurate and timely basis could result in sanctions, lawsuits, delisting of our shares from the market or trading facility where our shares may trade, or other adverse consequences that would materially harm our business.

Because Alpine 4 has shown a net loss since inception, ownership of Alpine 4 shares is highly risky and could result in a complete loss of the value of your investment if Alpine 4 is unsuccessful in its business plans.

Based upon current plans, Alpine 4 expects to incur operating losses in future periods as it incurs significant expenses associated with the growth of its business. Further, there is no guarantee that it will be successful in realizing future revenues or in achieving or sustaining positive cash flow at any time in the future. Any such failure could result in the possible closure of its business or force Alpine 4 to seek additional capital through loans or additional sales of its equity securities to continue business operations, which would dilute the value of any shares you receive in connection with the Share Exchange.

Growth and development of operations will depend on the acceptance of Alpine 4's proposed businesses. If Alpine 4's products are not deemed desirable and suitable for purchase and it cannot establish a customer base, it may not be able to generate future revenues, which would result in a failure of the business and a loss of the value of your investment.

The acceptance of Alpine 4's automotive products, and specifically the LotWatch and ServiceWatch products (now called 6th Sense Auto) purchased from AutoTek, is critically important to our success. Alpine 4 cannot be certain that the services that it will be offering will be appealing and as a result there may not be any demand for these products and its sales could be limited and it may never realize any revenues. In addition, there are no assurances that if we alter or change the products we offer in the future that the demand for these new products will develop and this could adversely affect our business and any possible revenues.

If demand for the products Alpine 4 plans to offer slows, then its business would be materially affected, which could result in the loss of your entire investment.

Demand for products which we intend to sell depends on many factors, including:

|

-

|

the number of customers Alpine 4 is able to attract and retain over time;

|

| |

|

|

-

|

the economy, and in periods of rapidly declining economic conditions, customers may defer purchases of new vehicles, which will impact the sales and deployment of products such as ours;

|

| |

|

|

-

|

the competitive environment in the automotive aftermarket product market may force us to reduce prices below our desired pricing level or increase promotional spending; and

|

| |

|

|

-

|

the ability to anticipate changes in consumer preferences and to meet customers' needs in a timely cost effective manner.

|

For the long term, demand for the products we plan to offer may be affected by:

|

-

|

the ability to establish, maintain and eventually grow market share in a competitive environment.

|

| |

|

|

-

|

delivery of its information globally, geopolitical changes, changes in liquor regulations, currency fluctuations, natural disasters, pandemics and other factors beyond our control may increase the cost of items it purchases, create communication issues or render product delivery difficult which could have a material adverse effect on its sales and profitability.

|

All of these factors could result in immediate and longer term declines in the demand for the products we plan to offer, which could adversely affect our sales, cash flows and overall financial condition. Holders of Alpine 4 Common Stock could lose their entire investment as a result.

Alpine 4 has limited management resources, and will be dependent on key executives. The loss of the services of the current officers and directors could severely impact Alpine 4's business operations and future development, which could result in a loss of revenues and adversely impact the ability to ever sell any Exchange Shares received through participation in the Share Exchange.

Alpine 4 is relying on a small number of key individuals to implement its business and operations and, in particular, the professional expertise and services of Kent B. Wilson, our President, Chief Executive Officer, and Secretary, David Schmitt, our Chief Financial Officer, and Charles Winters, our Chairman of the Board of Directors. Mr. Wilson intends to serve full time in his capacities with Alpine 4 to work to develop and grow the Company. Nevertheless, Alpine 4 may not have sufficient managerial resources to successfully manage the increased business activity envisioned by its business strategy. In addition, Alpine 4's future success depends in large part on the continued service of Mr. Wilson and Mr. Schmitt. If they choose not to serve as officers or if they are unable to perform their duties, this could have an adverse effect on Company business operations, financial condition and operating results if we are unable to replace Mr. Wilson, Mr. Schmitt or Mr. Winters with other individuals qualified to develop and market our business. The loss of their services could result in a loss of revenues, which could result in a reduction of the value of any ownership of Alpine 4.

Competition that Alpine 4 faces is varied and strong.

Alpine 4's subsidiaries' products and industries as a whole are subject to competition. There is no guarantee that we can sustain our market position or expand our business.

We compete with a number of entities in providing products to our customers. Such competitor entities include a variety of large nationwide corporations, including but not limited to public entities and companies that have established loyal customer bases over several decades.

Many of our current and potential competitors are well established and have significantly greater financial and operational resources, and name recognition than we have. As a result, these competitors may have greater credibility with both existing and potential customers. They also may be able to offer more competitive products and services and more aggressively promote and sell their products. Our competitors may also be able to support more aggressive pricing than we will be able to, which could adversely affect sales, cause us to decrease our prices to remain competitive, or otherwise reduce the overall gross profit earned on our products.

Our success in business and operations will depend on general economic conditions.

The success of Alpine 4 and its subsidiaries depends, to a large extent, on certain economic factors that are beyond its control. Factors such as general economic conditions, levels of unemployment, interest rates, tax rates at all levels of government, competition and other factors beyond Alpine 4's control may have an adverse effect on the ability of our subsidiaries to sell its products, to operate, and to collect sums due and owing to them.

Alpine 4 may not be able to successfully implement its business strategy, which could adversely affect its business, financial condition, results of operations and cash flows. If Alpine 4 cannot successfully implement its business strategy, it could result in the loss of the value of your investment.

Successful implementation of our business strategy depends on our being able to acquire additional businesses and grow our existing subsidiaries, as well as on factors specific to the industries in which our subsidiaries operate, and the state of the financial industry and numerous other factors that may be beyond our control. Adverse changes in the following factors could undermine our business strategy and have a material adverse effect on our business, our financial condition, and results of operations and cash flow:

|

o

|

The competitive environment in the industries in which our subsidiaries operate that may force us to reduce prices below the optimal pricing level or increase promotional spending;

|

| |

|

|

o

|

Our ability to anticipate changes in consumer preferences and to meet customers' needs for our products in a timely cost effective manner; and

|

| |

|

|

o

|

Our ability to establish, maintain and eventually grow market share in these competitive environments.

|

Our revenue growth rate depends primarily on our ability to satisfy relevant channels and end-customer demands, identify suppliers of our necessary ingredients and to coordinate those suppliers, all subject to many unpredictable factors.

We may not be able to identify and maintain the necessary relationships with suppliers of product and services as planned. Delays or failures in deliveries could materially and adversely affect our growth strategy and expected results. As we supply more customers, our rate of expansion relative to the size of such customer base will decline. In addition, one of our biggest challenges is securing an adequate supply of suitable product. Competition for product is intense, and commodities costs subject to price volatility.

Our ability to execute our business plan also depends on other factors, including:

|

o

|

ability to keep satisfied vendor relationships

|

| |

|

|

o

|

hiring and training qualified personnel in local markets;

|

| |

|

|

o

|

managing marketing and development costs at affordable levels;

|

| |

|

|

o

|

cost and availability of labor;

|

| |

|

|

o

|

the availability of, and our ability to obtain, adequate supplies of ingredients that meet our quality standards; and

|

| |

|

|

o

|

securing required governmental approvals in a timely manner when necessary.

|

Risks Related to Our Common Stock

Alpine 4 stockholders, and others who choose to purchase shares of Alpine 4 common stock if and when offered, may have difficulty in reselling their shares due to the limited public market or state Blue Sky laws.

Our common stock is currently quoted on the OTC market. Current Alpine 4 stockholders and persons who desire to purchase them in any trading market should be aware that there might be additional significant state law restrictions upon the ability of investors to resell our shares. Accordingly, investors should consider any secondary market for our securities to be a limited one.

Sales of our common stock under Rule 144 could reduce the price of our stock.

Under Rule 144 affiliates of Alpine 4 may not sell more than one percent of the total issued and outstanding shares in any 90-day period and must resell the shares in an unsolicited brokerage transaction at the market price. If substantial amounts of our common stock become available for resale under Rule 144 once a market has developed for our common stock, the then-prevailing market prices for our common stock may be reduced.

We may, in the future, issue additional securities, which would reduce our stockholders' percent of ownership and may dilute our share value.

Our Certificate of Incorporation, as amended to date, authorizes us to issue 500,000,000 shares of Class A common stock, and 100,000,000 shares of Class B common stock. As of the date of this Annual Report, we had 21,891,852 shares of Class A common stock outstanding, and 1,600,000 shares of Class B common stock outstanding. Accordingly, we may issue up to an additional 478,108,148 shares of Class A common stock, and an additional 98,400,000 shares of Class B common stock. The future issuance of additional shares of Class A common stock may result in additional dilution in the percentage of our Class A common stock held by our then existing stockholders. We may value any Class A common stock issued in the future on an arbitrary basis including for services or acquisitions or other corporate actions that may have the effect of diluting the value of the shares held by our stockholders, and might have an adverse effect on any trading market for our Class A common stock. Additionally, our board of directors may designate the rights terms and preferences of one or more series of preferred stock at its discretion including conversion and voting preferences without prior notice to our stockholders. Any of these events could have a dilutive effect on the ownership of our shareholders, and the value of shares owned.

Raising additional capital or purchasing businesses through the issuance of common stock will cause dilution to our existing stockholders.

We may seek additional capital through a combination of private and public equity offerings, debt financings, collaborations, and strategic and licensing arrangements, as well as issuing stock to make additional business or asset acquisitions. To the extent that we raise additional capital through the sale of common stock or securities convertible or exchangeable into common stock or through the issuance of equity for purchases of businesses or assets, your ownership interest in Alpine 4 will be diluted.

Raising additional capital may restrict our operations or require us to relinquish rights.

We may seek additional capital through a combination of private and public equity offerings, debt financings, collaborations, and strategic and licensing arrangements. To the extent that we raise additional capital through the sale of common stock or securities convertible or exchangeable into common stock, the terms of any such securities may include liquidation or other preferences that materially adversely affect your rights as a stockholder. Debt financing, if available, would increase our fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaboration, strategic partnerships and licensing arrangements with third parties, we may have to relinquish valuable rights to our intellectual property, future revenue streams or grant licenses on terms that are not favorable to us.

Market volatility may affect our stock price and the value of your shares.

The market price for our common stock is likely to be volatile, in part because the volume of trades of our common stock. In addition, the market price of our common stock may fluctuate significantly in response to a number of factors, most of which we cannot control, including, among others:

|

·

|

announcements of new products, brands, commercial relationships, acquisitions or other events by us or our competitors;

|

| |

|

|

·

|

regulatory or legal developments in the United States and other countries;

|

| |

|

|

·

|

fluctuations in stock market prices and trading volumes of similar companies;

|

| |

|

|

·

|

general market conditions and overall fluctuations in U.S. equity markets;

|

| |

|

|

·

|

variations in our quarterly operating results;

|

| |

|

|

·

|

changes in our financial guidance or securities analysts' estimates of our financial performance;

|

| |

|

|

·

|

changes in accounting principles;

|

| |

|

|

·

|

our ability to raise additional capital and the terms on which we can raise it;

|

| |

|

|

·

|

sales of large blocks of our common stock, including sales by our executive officers, directors and significant stockholders;

|

| |

|

|

·

|

additions or departures of key personnel;

|

| |

|

|

·

|

discussion of us or our stock price by the press and by online investor communities; and

|

| |

|

|

·

|

other risks and uncertainties described in these risk factors.

|

If securities or industry analysts do not publish or cease publishing research or reports or publish misleading, inaccurate or unfavorable research about us, our business or our market, our stock price and trading volume could decline.

The trading market for our common stock will be influenced by the research and reports that securities or industry analysts may publish about us, our business, our market or our competitors. We currently have limited coverage and may never obtain increased research coverage by securities and industry analysts. If no or few securities or industry analysts cover our company, the trading price and volume of our stock would likely be negatively impacted. If we obtain securities or industry analyst coverage and if one or more of the analysts who covers us downgrades our stock or publishes inaccurate or unfavorable research about our business, or provides more favorable relative recommendations about our competitors, our stock price would likely decline. If one or more of these analysts ceases coverage of us or fails to publish reports on us regularly, demand for our stock could decrease, which could cause our stock price or trading volume to decline.

Future sales of our common stock may cause our stock price to decline.

Sales of a substantial number of shares of our common stock in the public market or the perception that these sales might occur could significantly reduce the market price of our common stock and impair our ability to raise adequate capital through the sale of additional equity securities.

Our compliance with the Sarbanes-Oxley Act and SEC rules concerning internal controls may be time consuming, difficult and costly.

Alpine 4's executive officers do not have experience being officers of a public company. It may be time consuming, difficult and costly for us to develop and implement the internal controls and reporting procedures required by Sarbanes-Oxley. We may need to hire additional financial reporting, internal controls and other finance staff in order to develop and implement appropriate internal controls and reporting procedures. If we are unable to comply with Sarbanes-Oxley's internal controls requirements, we may not be able to obtain the independent accountant certifications that Sarbanes-Oxley Act requires publicly-traded companies to obtain.

Alpine 4 may issue Preferred Stock with voting and conversion rights that could adversely affect the voting power of the holders of Common Stock.

Alpine 4's Board of Directors may issue Preferred Stock with voting and conversion rights that could adversely affect the voting power of the holders of Common Stock. Any such provision may be deemed to have a potential anti-takeover effect, and the issuance of Preferred Stock in accordance with such provision may delay or prevent a change of control of Alpine 4. The Board of Directors also may declare a dividend on any outstanding shares of Preferred Stock. All outstanding shares of Preferred Stock are fully paid and non-assessable.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable to Smaller Reporting Companies.

ITEM 2. PROPERTIES.

Alpine 4 maintains our corporate office in rented offices at 4742 N. 24th Street, Suite 300, Phoenix, AZ 85016. The monthly rent obligation is approximately $3,600 per month.

QCA rents a location at 1709 Junction Court #380 San Jose, CA 95112. The monthly rent obligation is approximately $27,500 per month.

HWT owns properties at 3635 E Hwy #270 McAlester, OK 74502 and 27274 CR 460 Alva, OK 73717. They also rent a location at 510 ½ W Second Street Watonga, OK 73772. The monthly rent obligation is approximately $1,500 per month.

ITEM 3. LEGAL PROCEEDINGS.

None.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

MARKET PRICES AND DIVIDEND DATA

Stock Prices

As of the date of this Report, our Class A Common Stock is listed on the OTC QB Market under the symbol ALPP. As of the date of this Report, the share price was $1.05/share with limited volume. Alpine 4 plans to work with a market maker and other professionals to drive trading volume and interest in the stock.

Shareholders

As of the date of this Report, Alpine 4 had 402 shareholders of record.

Dividends

Alpine 4 has not declared any cash dividends on its common stock since inception. Any decisions as to future payments of dividends will depend on Alpine 4's earnings and financial position and such other facts, as the Board of Directors deems relevant.

Director Independence

Alpine 4 is not required by any outside organization (such as a stock exchange or trading facility) to have independent directors.

Securities Authorized for Issuance under Equity Compensation Plans

Adoption of 2016 Stock Option and Stock Award Plan

On November 10, 2016, the Company's Board of Directors adopted the Company's 2016 Stock Option and Stock Award Plan (the "Plan"). Pursuant to the Plan, the Company may issue stock options, including incentive stock options and non-qualifying stock options, and stock grants to employees and consultants of the Company, as set forth in the Plan, a copy of which was filed as an exhibit to the Company's Quarterly Report on Form 10-Q for the period ended September 30, 2016.

The Company has reserved 2,000,000 shares of the Company's Class A common stock for issuance under the Plan.

Recent Sales of Unregistered Securities

Private Offerings of Shares

During the quarter ended December 31, 2016 (Successor), the Company had no sales of the Company's Class A common stock.

Issuance of Equity Securities in Horizon Transaction

In connection with the acquisition of Horizon Well Testing, L.L.C. ("HWT"), described in more detail above under "Recent Developments," Alpine 4 purchased all of the outstanding stock of HWT (the "HWT Stock") from Alan Martin (the "Seller"). The purchase price paid by Alpine 4 for the HWT Stock consisted of cash, a note, a convertible note, and securities consideration. The "Cash Consideration" paid was $2,200,000. The "Note" consisted of a secured note in the amount of $300,000, secured by a subordinated security interest in the assets of HWT. The Note bears interest at 1% and will be payable in full by April 30, 2017. The "Convertible Note" consisted of a secured convertible note in the amount of $1,500,000, secured by a subordinated security interest in the assets of HWT. The HWT Seller has the opportunity to convert the Convertible Note into shares of Alpine 4's Class A common stock at a conversion price of $8.50 after a restricted period according to securities laws. The Convertible Note bears interest at 5% and is payable in full with a balloon payment on the 18-month anniversary of the closing date of the transaction with no monthly payments. The "Securities" consisted of two components, an aggregate of 379,403 shares of alpine 4s Class A common stock issued to the Seller, and a warrant to purchase an additional 75,000 shares of Class A common stock.

The Note, the Convertible Note, and the Securities was issued to the Seller pursuant to a share exchange agreement with the Seller, in which the Seller made certain representations and warranties, including that he was an accredited investor, that he was acquiring the securities for his own account and not for the account of another, that he was acquiring the securities for investment purposes and not with a view to distribute the securities acquired, and that he had sufficient knowledge and experience in financial and business matters to evaluate the merits and risks of an investment in the Company. As such, the securities were issued to the Seller without registration under the 1933 Act in reliance on Section 4(a)(2) of the 1933 Act and the rules and regulations promulgated thereunder. The Horizon transaction did not involve a public offering.

Stock Options to Employees and Consultants

On April 7, 2017, the Company issued 741,500 options to purchase shares of the Company's Class A common stock to 34 employees and consultants of the Company. The options were issued pursuant to the Company's 2016 Stock Option and Stock Award Plan (the "Plan"). The options granted vest over the next four years and the exercise price of the options granted was $0.90, which was the last closing bid price of the Company's common stock as traded on the OTC QB Market.

The Company provided to each of the recipients of the Options copies of the Company's public filings including the financial information and other disclosures about the Company. The options were issued to the recipients without registration under the 1933 Act in reliance on Section 4(a)(2) of the 1933 Act and rules and regulations promulgated thereunder. The issuance of the options did not involve a public offering of the Company's securities.

ITEM 6. SELECTED FINANCIAL DATA.

Not required for Smaller Reporting Companies.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

There are statements in this Report that are not historical facts. These "forward-looking statements" can be identified by use of terminology such as "believe," "hope," "may," "anticipate," "should," "intend," "plan," "will," "expect," "estimate," "project," "positioned," "strategy" and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. For a discussion of these risks, you should read this entire Report carefully, especially the risks discussed under "Risk Factors." Although management believes that the assumptions underlying the forward looking statements included in this Report are reasonable, they do not guarantee our future performance, and actual results could differ from those contemplated by these forward looking statements. The assumptions used for purposes of the forward-looking statements specified in the following information represent estimates of future events and are subject to uncertainty as to possible changes in economic, legislative, industry, and other circumstances. As a result, the identification and interpretation of data and other information and their use in developing and selecting assumptions from and among reasonable alternatives require the exercise of judgment. To the extent that the assumed events do not occur, the outcome may vary substantially from anticipated or projected results, and, accordingly, no opinion is expressed on the achievability of those forward-looking statements. In the light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this Report will in fact transpire. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. We expressly disclaim any obligation to update or revise any forward-looking statements.

Overview and Highlights

Company Background

Alpine 4 Technologies Ltd. (the "Company") was incorporated under the laws of the State of Delaware on April 22, 2014. The Company was formed to serve as a vehicle to affect an asset acquisition, merger, exchange of capital stock, or other business combination with a domestic or foreign business. As of the date of this Report, the Company is a technology holding company owning three companies (ALTIA, LLC; Quality Circuit Assembly, Inc. ("QCA"); and Horizon Well Testing, LLC). For 2016, QCA made up most of the revenue for the consolidated financial statements. Horizon Well Testing was not acquired until January 1, 2017, so it is not combined in our 2016 or 2015 financial statements.

The Company owns no real estate or personal property. The Company selected December 31 as its fiscal year end.

Business Strategy

Alpine 4's strategy is to provide Fortune 500-level execution strategies in its subsidiary companies and market segments to businesses and companies that have the most to benefit from this access.

Alpine 4 feels this opportunity exists in smaller middle market operating companies with revenues between $5 to $150 million. In this target rich environment, businesses generally sell at more reasonable multiples, presenting greater opportunities for operational and strategic improvements and have greater potential for growth. Implementation of our strategy within our holdings is accomplished by the offering of strategic and tactical MBA-level training and development, delivered via the following modules:

|

-

|

Alpine 4 Mini MBA program; and

|

| |

|

|

-

|

An Alpine 4 developed ERP (Enterprise Resource Planning system) and collaboration system called SPECTRUMebos. SPECTRUMebos is what we are defining as an Enterprise Business Operating System (ebos). This system will combine the key technology software components of Accounting and Financial Reporting, an Enterprise Resource Planning System (ERP), a Document Management System (DMS), a Business Intelligence (BI) platform and a Customer Resource Management (CRM) hub which will be tethered to management reporting and collaboration toolsets. Management believes that these tools will help drive real-time information in two directions: first, to the front lines by empowering customer-facing stakeholders; and second, back to management for planning, problem solving, and integration. Management believes that SPECTRUMebos will be the technology "secret sauce" in managing our portfolio of companies and, in time, will be an offering to external customers.

|

All great strategies must have trades offs. Therefore, Alpine 4 avoids companies that have unionized employees, businesses that have more than $150 million in revenue and companies that reside in highly regulated business industries.

Business Seasonality and Product Introductions

Following the acquisition of the Quality Circuit Assembly, Inc. and Horizon Well Testing, LLC and with the newly acquired dealership pilot and contract for ALTIA, LLC, the Company expects to experience higher net sales in its second and third quarters compared to other quarters in its fiscal year. Each company has varying seasonality to their sales and will be reflected in the financial statements.

Going Concern

The accompanying financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred losses since inception and had accumulated a deficit of $17,436,455 as of December 31, 2016. The Company requires capital for its contemplated operational and marketing activities. The Company's ability to raise additional capital through the future issuances of common stock is unknown. The obtainment of additional financing, the successful development of the Company's contemplated plan of operations, and its transition, ultimately, to the attainment of profitable operations are necessary for the Company to continue operations. The ability to successfully resolve these factors rai

se substantial doubt about the Company's ability to continue as a going concern. The financial statements of the Company do not include any adjustments that may result f

rom the outcome of these aforementioned uncertainties. However, management believes we will have net operating gains beginning in the second quarter of 2017 and our ability to continue as a going concern is subject to our ability to generate a profit and/or obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities, increasing sales or obtaining loan from various financial institutions where possible. Our net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful. Our financial statements contain additional note disclosures describing the management's assessment of our ability to continue as a going concern.

In order to mitigate the risk related with this uncertainty, the Company plans to issue additional shares of common stock for cash and services during the next 12 months.

Results of Operations

Explanatory Note

The consolidated financial statements included in this Annual Report are presented under predecessor entity reporting and because the Company, as the acquiring entity in the QCA Transaction, had nominal operations as compared with the acquired company, QCA, prior historical information of the acquirer is not presented.

This new basis of accounting was created on April 1, 2016, the effective date for financial reporting purposes of the stock purchase agreement. In the following discussion, the results of the operations and cash flows for the periods ended on or prior to March 31, 2016, and the financial position of QCA as of balance sheet date on or prior to March 31, 2016 are referred to as "Predecessor" financial information, and the results of operations and cash flows of the Company for periods beginning April 1, 2016 and the financial position of the Company as of April 1, 2016 and subsequent balance sheet dates are referred to herein as "Successor" consolidated financial information.

Financial statements and information are presented for the twelve months ended December 31, 2015 (Predecessor), and the nine months ended December 31, 2016 (Successor). Due to this there is some lack of comparability.

Revenue

Our revenues for the year ended December 31, 2015 (Predecessor) and for the nine months ended December 31, 2016 (Successor), were $7,513,844 and $6,072,384, respectively. We expect our revenue to grow significantly over the next 12 months. Management's expectations of growth in revenues is based on multiple areas. First, management believes that its contacts within the automobile dealership industry, and the anticipated increase in interest in Alpine 4's products and services as Alpine 4 increases its advertising and brand and product/service awareness campaigns will produce increased revenues as the Company engages more dealerships with the Alpine 4 products. Second, management anticipates continued growth of QCA through new customers and internal growth. Third, management plans to continue the Company's focus on finding and acquiring companies.

Cost of Revenue

Our cost of revenues for the year ended December 31, 2015 (Predecessor), and for the nine months ended December 31, 2016 (Successor), were $5,736,354 and $4,239,850, respectively. We expect our cost of revenue to increase over the next 12 months as our revenue increases.

General and administrative expenses

Our general and administrative expenses for the year ended December 31, 2015 (Predecessor), and for the nine months ended December 31, 2016 (Successor), were $1,404,526 and $3,847,876, respectively. For the year ended December 31, 2015 (Predecessor), and for the nine months ended December 31, 2016 (Successor), $0 and $1,866,039 of our general and administrative expenses were non-cash expenses related to the issuance of our common stock for services, of which $1,275,000 was for employees. The significant increase in general and administrative expenses is due to the issuance of common stock for services and the expansion of our business in 2016. We expect that our general and administrative expenses will increase significantly over the next 12 months as we ramp up our operations. As we increase our advertising and brand and product/service awareness campaigns and as we hire additional personnel as needed and as operations permit, management anticipates that such actions will result in significantly increased expenses to the Company. The addition of more dealerships also will increase expenses relating to installations, customer management, and operational costs.

Liquidity and Capital Resources

We have financed our operations since inception from the sale of common stock, capital contributions from stockholders and from the issuance of notes payable and convertible notes payable. We expect to continue to finance our operations by selling shares of our common stock and by generating income from the sale of our products. As noted above, management's expectations of growth in revenues is based on management's contacts within the automobile dealership industry, and the anticipated increase in interest in Alpine 4's products and services as Alpine 4 increases its advertising and brand and product/service awareness campaigns. Additionally, management anticipates that the new campaigns will result in the Company's adding new dealerships in 2017.

Management expects to have sufficient working capital for continuing operations from either the sale of its products or through the raising of additional capital through private offerings of our securities. Additionally, as of the date of this Report, the Company was in negotiations to acquire additional businesses, which management believes will provide additional operating revenues to the Company. There can be no guarantee that the planned acquisitions will close or that they will produce the anticipated revenues on the schedule anticipated by management, or at all.

The Company also may elect to seek bank financing or to engage in debt financing through a placement agent. If the Company is unable to raise sufficient capital from operations or through sales of its securities or other means, we may need to delay implementation of our business plans.

Contractual Obligations

Our significant contractual obligations as of December 31, 2016, were as follows:

|

|

|

Payments due by Period

|

|

|

|

|

Less than

One Year

|

|

|

One to

Three Years

|

|

|

Three to

Five Years

|

|

|

More Than

Five Years

|

|

|

Total

|

|

|

Notes payable, related parties

|

|

$

|

205,000

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

-

|

|

|

$

|

205,000

|

|

|

Notes payable, non-related parties

|

|

|

1,332,031

|

|

|

|

107,270

|

|

|

|

39,809

|

|

|

|

|

|

|

|

1,479,110

|

|

|

Convertible notes payable

|

|

|

254,780

|

|

|

|

1,760,198

|

|

|

|

|

|

|

|

|

|

|

|

2,014,978

|

|

|

Interest on notes

|

|

|

19,262

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19,262

|

|

|

Total

|

|

$

|

1,811,073

|

|

|

$

|

1,867,468

|

|

|

$

|

39,809

|

|

|

$

|

-

|

|

|

$

|

3,718,350

|

|

Off-Balance Sheet Arrangements

The Company has not entered into any transactions with unconsolidated entities whereby the Company has financial guarantees, subordinated retained interests, derivative instruments, or other contingent arrangements that expose the Company to material continuing risks, contingent liabilities, or any other obligation under a variable interest in an unconsolidated entity that provides financing, liquidity, market risk, or credit risk support to the Company.

Critical Accounting Policies and Estimates

The preparation of financial statements and related disclosures in conformity with U.S. generally accepted accounting principles ("U.S. GAAP") and the Company's discussion and analysis of its financial condition and operating results require the Company's management to make judgments, assumptions, and estimates that affect the amounts reported in its condensed consolidated financial statements and accompanying notes. Note 2, "Summary of Significant Accounting Policies," of this Form 10-K describes the significant accounting policies and methods used in the preparation of the Company's condensed consolidated financial statements. Management bases its estimates on historical experience and on various other assumptions it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Actual results may differ from these estimates and such differences may be material.

Management believes the Company's critical accounting policies and estimates are those related to revenue recognition and inventory valuation. Management considers these policies critical because they are both important to the portrayal of the Company's financial condition and operating results, and they require management to make judgments and estimates about inherently uncertain matters.

ALTIA

The Company accounts for its revenue per the guidance in Accounting Standards Codification ("ASC") 605-25-25 by allocating the total contract amount between the product and service elements. When a vehicle is sold to the driving consumer who purchases the 6th Sense Auto service, the cost of the service is added to the price of the car and the amount collected by the dealership for this service is remitted to the Company. At the time of the vehicle is purchased, the Company recognizes the service portion of the contract over the service period of generally 12 to 36 months.

Quality Circuit Assembly

The Company accounts for its revenue per the guidance in ASC 605-25-25 by allocating the total contract amount between the product and service elements. Revenue is recognized when either the product has completely been built and shipped or the service has been completed. If a deposit for product or service is received prior to completion the payment is recorded to deferred revenue until such point the product or services meets our revenue recognition policy. There is an implied warranty on all our services and production. If a customer is unsatisfied with our work then we will redo the work until the customer is satisfied. Any returns are credited to the customer until the rework is completed and then reinvoiced to the customer. Management assess the materiality and likelihood of warranty work and records reserves as needed. For all periods presented the warrant reserve assessment was immaterial.

Principles of consolidation

The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries as of December 31, 2016 (Successor), and December 31, 2015 (Predecessor). Significant intercompany balances and transactions have been eliminated.

Basis of presentation

The accompanying financial statements present the balance sheets, statements of operations, stockholders' deficit and cash flows of the Company. The financial statements have been prepared in accordance with U.S. GAAP.

Use of estimates

The preparation of financial statements in conformity with U.S. GAAP requires the Company to make estimates and judgments that affect the reported amounts of assets and liabilities, revenues and expenses, and related disclosures of contingent assets and liabilities. These estimates and judgments are based on historical information, information that is currently available to the Company and on various other assumptions that the Company believes to be reasonable under the circumstances. Actual results could differ from those estimates.

Advertising

Advertising costs are expensed when incurred. All advertising takes place at the time of expense. We have no long-term contracts for advertising. Advertising expense for all periods presented were under $10,000.

Cash

Cash and cash equivalents consist of cash and short-term investments with original maturities of less than 90 days. Cash equivalents are placed with high credit quality financial institutions and are primarily in money market funds. The carrying value of those investments approximates fair value. As of December 31, 2016 (Successor) and 2015 (Predecessor), the Company had no cash equivalents.

Major Customers

For all periods presented the Company had two customers that made up approximately 50% of total revenues. All other customers were less than 10% each of total revenues in each period.

For all periods presented the Company had two customers that made up approximately 50% of outstanding accounts receivable. All other customers were less than 10% each of total accounts receivable for each period presented.

Accounts Receivable

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. Reserves are recorded primarily on a specific identification basis. As of December 31, 2016 and 2015, we had no allowance for bad debt.

Inventory

Inventory is valued at the lower of the inventory's cost (weighted average basis) or the current market price of the inventory. Management compares the cost of inventory with its market value and an allowance is made to write down inventory to market value, if lower. Inventory is segregated into four areas, raw materials, WIP, finished goods, and In-Transit. Below is a breakdown of how much inventory is in each area as of December 31, 2016 (Successor), and December 31, 2015 (Predecessor).

| |

|

Dec 31, 2016 (Successor)

|

|

|

Dec 31, 2015 (Predecessor)

|

|

| |

|

|

|

|

|

|

|

|

|

Raw materials

|

|

|

527,599

|

|

|

|

391,845

|

|

|

WIP

|

|

|

193,525

|

|

|

|

351,697

|

|

|

Finished goods

|

|

|

195,990

|

|

|

|

192,820

|

|

|

In Transit

|

|

|

13,000

|

|

|

|

13,000

|

|

|

|

|

$

|

930,114

|

|

|

$

|

949,362

|

|

Property and Equipment