spke-20231231false2023FY0001606268P1YP3Yhttp://fasb.org/us-gaap/2023#OtherAssetsCurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLongTermDebtNoncurrenthttp://fasb.org/us-gaap/2023#OtherLongTermDebtNoncurrent0.20.20.50.50.50P1Y00016062682023-01-012023-12-310001606268us-gaap:CommonClassAMember2023-01-012023-12-310001606268us-gaap:SeriesAPreferredStockMember2023-01-012023-12-3100016062682023-06-30iso4217:USD0001606268us-gaap:CommonClassAMember2024-02-27xbrli:shares0001606268us-gaap:CommonClassBMember2024-02-270001606268us-gaap:SeriesAPreferredStockMember2024-02-2700016062682023-12-3100016062682022-12-310001606268us-gaap:TradeAccountsReceivableMember2023-12-310001606268us-gaap:TradeAccountsReceivableMember2022-12-310001606268us-gaap:NonrelatedPartyMember2023-12-310001606268us-gaap:NonrelatedPartyMember2022-12-310001606268us-gaap:RelatedPartyMember2023-12-310001606268us-gaap:RelatedPartyMember2022-12-31iso4217:USDxbrli:shares0001606268us-gaap:CommonClassAMember2022-12-310001606268us-gaap:CommonClassAMember2023-12-310001606268us-gaap:CommonClassBMember2023-12-310001606268us-gaap:CommonClassBMember2022-12-310001606268us-gaap:RetailMember2023-01-012023-12-310001606268us-gaap:RetailMember2022-01-012022-12-310001606268us-gaap:RetailMember2021-01-012021-12-3100016062682022-01-012022-12-3100016062682021-01-012021-12-310001606268us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001606268us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001606268us-gaap:ProductAndServiceOtherMember2021-01-012021-12-310001606268us-gaap:CommonStockMemberus-gaap:CommonClassAMember2020-12-310001606268us-gaap:CommonClassBMemberus-gaap:CommonStockMember2020-12-310001606268us-gaap:TreasuryStockCommonMember2020-12-310001606268us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001606268us-gaap:AdditionalPaidInCapitalMember2020-12-310001606268us-gaap:RetainedEarningsMember2020-12-310001606268us-gaap:ParentMember2020-12-310001606268us-gaap:NoncontrollingInterestMember2020-12-3100016062682020-12-310001606268us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001606268us-gaap:ParentMember2021-01-012021-12-310001606268us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-01-012021-12-310001606268us-gaap:RetainedEarningsMember2021-01-012021-12-310001606268us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001606268us-gaap:CommonClassAMember2021-01-012021-12-310001606268us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-01-012021-12-310001606268us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001606268us-gaap:CommonClassBMemberus-gaap:CommonStockMember2021-12-310001606268us-gaap:TreasuryStockCommonMember2021-12-310001606268us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001606268us-gaap:AdditionalPaidInCapitalMember2021-12-310001606268us-gaap:RetainedEarningsMember2021-12-310001606268us-gaap:ParentMember2021-12-310001606268us-gaap:NoncontrollingInterestMember2021-12-3100016062682021-12-310001606268us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001606268us-gaap:ParentMember2022-01-012022-12-310001606268us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001606268us-gaap:RetainedEarningsMember2022-01-012022-12-310001606268us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001606268us-gaap:CommonClassAMember2022-01-012022-12-310001606268us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001606268us-gaap:CommonClassBMemberus-gaap:CommonStockMember2022-12-310001606268us-gaap:TreasuryStockCommonMember2022-12-310001606268us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001606268us-gaap:AdditionalPaidInCapitalMember2022-12-310001606268us-gaap:RetainedEarningsMember2022-12-310001606268us-gaap:ParentMember2022-12-310001606268us-gaap:NoncontrollingInterestMember2022-12-310001606268us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001606268us-gaap:ParentMember2023-01-012023-12-310001606268us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001606268us-gaap:RetainedEarningsMember2023-01-012023-12-310001606268us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001606268us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001606268us-gaap:CommonClassBMemberus-gaap:CommonStockMember2023-12-310001606268us-gaap:TreasuryStockCommonMember2023-12-310001606268us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001606268us-gaap:AdditionalPaidInCapitalMember2023-12-310001606268us-gaap:RetainedEarningsMember2023-12-310001606268us-gaap:ParentMember2023-12-310001606268us-gaap:NoncontrollingInterestMember2023-12-310001606268spke:MergerAgreementWithRetailcoMember2023-12-290001606268spke:ResidentialCustomerEquivalentMember2022-12-310001606268spke:WirelessDeviceMember2023-12-310001606268srt:MinimumMember2023-12-310001606268srt:MaximumMember2023-12-310001606268us-gaap:CustomerRelationshipsMember2023-01-012023-12-310001606268us-gaap:CustomerRelationshipsMember2021-01-012021-12-310001606268us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001606268spke:CustomerRelationshipsOtherMembersrt:MaximumMember2022-12-310001606268srt:MaximumMemberus-gaap:CustomerRelationshipsMember2023-12-310001606268spke:CustomerRelationshipsOtherMembersrt:MinimumMember2022-12-310001606268spke:CustomerRelationshipsOtherMember2022-01-012022-12-310001606268us-gaap:TrademarksMembersrt:MinimumMember2023-12-310001606268us-gaap:TrademarksMembersrt:MaximumMember2023-12-310001606268us-gaap:TrademarksMember2023-12-310001606268us-gaap:TrademarksMember2022-12-310001606268us-gaap:TrademarksMember2023-01-012023-12-310001606268us-gaap:TrademarksMember2022-01-012022-12-310001606268us-gaap:TrademarksMember2021-01-012021-12-310001606268us-gaap:OtherCurrentAssetsMember2023-12-310001606268us-gaap:OtherCurrentAssetsMember2022-12-310001606268us-gaap:OtherCurrentLiabilitiesMember2023-12-310001606268us-gaap:OtherCurrentLiabilitiesMember2022-12-310001606268spke:NewEnglandMemberus-gaap:RetailMemberspke:RetailElectricityMember2023-01-012023-12-310001606268spke:NewEnglandMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:NewEnglandMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:NewEnglandMemberus-gaap:RetailMemberspke:RetailElectricityMember2022-01-012022-12-310001606268spke:NewEnglandMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:NewEnglandMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:NewEnglandMemberus-gaap:RetailMemberspke:RetailElectricityMember2021-01-012021-12-310001606268spke:NewEnglandMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:NewEnglandMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:MidAtlanticMemberus-gaap:RetailMemberspke:RetailElectricityMember2023-01-012023-12-310001606268spke:MidAtlanticMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:MidAtlanticMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:MidAtlanticMemberus-gaap:RetailMemberspke:RetailElectricityMember2022-01-012022-12-310001606268spke:MidAtlanticMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:MidAtlanticMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:MidAtlanticMemberus-gaap:RetailMemberspke:RetailElectricityMember2021-01-012021-12-310001606268spke:MidAtlanticMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:MidAtlanticMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:MidwestMemberus-gaap:RetailMemberspke:RetailElectricityMember2023-01-012023-12-310001606268spke:RetailNaturalGasMemberspke:MidwestMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:MidwestMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:MidwestMemberus-gaap:RetailMemberspke:RetailElectricityMember2022-01-012022-12-310001606268spke:RetailNaturalGasMemberspke:MidwestMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:MidwestMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:MidwestMemberus-gaap:RetailMemberspke:RetailElectricityMember2021-01-012021-12-310001606268spke:RetailNaturalGasMemberspke:MidwestMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:MidwestMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:SouthwestMemberus-gaap:RetailMemberspke:RetailElectricityMember2023-01-012023-12-310001606268spke:SouthwestMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:SouthwestMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:SouthwestMemberus-gaap:RetailMemberspke:RetailElectricityMember2022-01-012022-12-310001606268spke:SouthwestMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:SouthwestMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:SouthwestMemberus-gaap:RetailMemberspke:RetailElectricityMember2021-01-012021-12-310001606268spke:SouthwestMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:SouthwestMemberus-gaap:RetailMember2021-01-012021-12-310001606268us-gaap:RetailMemberspke:RetailElectricityMember2023-01-012023-12-310001606268spke:RetailNaturalGasMemberus-gaap:RetailMember2023-01-012023-12-310001606268us-gaap:RetailMemberspke:RetailElectricityMember2022-01-012022-12-310001606268spke:RetailNaturalGasMemberus-gaap:RetailMember2022-01-012022-12-310001606268us-gaap:RetailMemberspke:RetailElectricityMember2021-01-012021-12-310001606268spke:RetailNaturalGasMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:CommercialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMemberspke:RetailElectricityMember2023-01-012023-12-310001606268spke:CommercialMemberspke:RetailNaturalGasMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2023-01-012023-12-310001606268spke:CommercialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2023-01-012023-12-310001606268spke:CommercialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMemberspke:RetailElectricityMember2022-01-012022-12-310001606268spke:CommercialMemberspke:RetailNaturalGasMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2022-01-012022-12-310001606268spke:CommercialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2022-01-012022-12-310001606268spke:CommercialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMemberspke:RetailElectricityMember2021-01-012021-12-310001606268spke:CommercialMemberspke:RetailNaturalGasMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2021-01-012021-12-310001606268spke:CommercialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2021-01-012021-12-310001606268spke:ResidentialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMemberspke:RetailElectricityMember2023-01-012023-12-310001606268spke:RetailNaturalGasMemberspke:ResidentialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2023-01-012023-12-310001606268spke:ResidentialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2023-01-012023-12-310001606268spke:ResidentialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMemberspke:RetailElectricityMember2022-01-012022-12-310001606268spke:RetailNaturalGasMemberspke:ResidentialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2022-01-012022-12-310001606268spke:ResidentialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2022-01-012022-12-310001606268spke:ResidentialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMemberspke:RetailElectricityMember2021-01-012021-12-310001606268spke:RetailNaturalGasMemberspke:ResidentialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2021-01-012021-12-310001606268spke:ResidentialMemberus-gaap:RetailMemberus-gaap:BilledRevenuesMember2021-01-012021-12-310001606268us-gaap:UnbilledRevenuesMemberus-gaap:RetailMemberspke:RetailElectricityMember2023-01-012023-12-310001606268us-gaap:UnbilledRevenuesMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2023-01-012023-12-310001606268us-gaap:UnbilledRevenuesMemberus-gaap:RetailMember2023-01-012023-12-310001606268us-gaap:UnbilledRevenuesMemberus-gaap:RetailMemberspke:RetailElectricityMember2022-01-012022-12-310001606268us-gaap:UnbilledRevenuesMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2022-01-012022-12-310001606268us-gaap:UnbilledRevenuesMemberus-gaap:RetailMember2022-01-012022-12-310001606268us-gaap:UnbilledRevenuesMemberus-gaap:RetailMemberspke:RetailElectricityMember2021-01-012021-12-310001606268us-gaap:UnbilledRevenuesMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2021-01-012021-12-310001606268us-gaap:UnbilledRevenuesMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:PurchaseofAccountsReceivableMarketMemberus-gaap:RetailMemberspke:RetailElectricityMember2023-01-012023-12-310001606268spke:PurchaseofAccountsReceivableMarketMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:PurchaseofAccountsReceivableMarketMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:PurchaseofAccountsReceivableMarketMemberus-gaap:RetailMemberspke:RetailElectricityMember2022-01-012022-12-310001606268spke:PurchaseofAccountsReceivableMarketMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:PurchaseofAccountsReceivableMarketMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:PurchaseofAccountsReceivableMarketMemberus-gaap:RetailMemberspke:RetailElectricityMember2021-01-012021-12-310001606268spke:PurchaseofAccountsReceivableMarketMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:PurchaseofAccountsReceivableMarketMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:NonPurchaseofAccountsReceivableMarketMemberus-gaap:RetailMemberspke:RetailElectricityMember2023-01-012023-12-310001606268spke:NonPurchaseofAccountsReceivableMarketMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:NonPurchaseofAccountsReceivableMarketMemberus-gaap:RetailMember2023-01-012023-12-310001606268spke:NonPurchaseofAccountsReceivableMarketMemberus-gaap:RetailMemberspke:RetailElectricityMember2022-01-012022-12-310001606268spke:NonPurchaseofAccountsReceivableMarketMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:NonPurchaseofAccountsReceivableMarketMemberus-gaap:RetailMember2022-01-012022-12-310001606268spke:NonPurchaseofAccountsReceivableMarketMemberus-gaap:RetailMemberspke:RetailElectricityMember2021-01-012021-12-310001606268spke:NonPurchaseofAccountsReceivableMarketMemberspke:RetailNaturalGasMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:NonPurchaseofAccountsReceivableMarketMemberus-gaap:RetailMember2021-01-012021-12-310001606268spke:ElectricandGasRevenueMember2023-01-012023-12-310001606268spke:ElectricandGasRevenueMember2022-01-012022-12-310001606268spke:ElectricandGasRevenueMember2021-01-012021-12-310001606268spke:CostofServicesEnergyServicesMember2023-01-012023-12-310001606268spke:CostofServicesEnergyServicesMember2022-01-012022-12-310001606268spke:CostofServicesEnergyServicesMember2021-01-012021-12-310001606268us-gaap:TradeAccountsReceivableMember2023-01-012023-12-310001606268spke:SparkHoldCoMember2023-01-012023-12-31xbrli:pure0001606268spke:NuDevcoRetailandRetailcoLLCMemberspke:SparkHoldCoMember2023-01-012023-12-310001606268spke:SparkHoldCoMember2022-01-012022-12-310001606268spke:NuDevcoRetailandRetailcoLLCMemberspke:SparkHoldCoMember2022-01-012022-12-310001606268us-gaap:CommonClassAMember2023-03-200001606268us-gaap:CommonClassBMember2023-03-200001606268us-gaap:CommonClassBMember2021-07-012021-07-3100016062682021-07-310001606268srt:AffiliatedEntityMember2023-01-012023-12-310001606268spke:RestrictedUnitsandLiabilityAwardsMember2023-01-012023-12-310001606268spke:RestrictedUnitsandLiabilityAwardsMember2022-01-012022-12-310001606268spke:RestrictedUnitsandLiabilityAwardsMember2021-01-012021-12-310001606268us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001606268us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001606268us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001606268us-gaap:CommonClassBMember2023-01-012023-12-310001606268us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001606268us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310001606268us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310001606268us-gaap:CommonClassBMembersrt:MinimumMember2023-03-202023-03-200001606268srt:MinimumMemberus-gaap:CommonClassAMember2023-03-202023-03-200001606268us-gaap:CommonClassBMembersrt:MaximumMember2023-03-202023-03-200001606268srt:MaximumMemberus-gaap:CommonClassAMember2023-03-202023-03-200001606268us-gaap:SeriesAPreferredStockMember2022-04-142022-04-140001606268us-gaap:SeriesAPreferredStockMember2022-04-152022-04-150001606268us-gaap:SeriesAPreferredStockMember2022-04-150001606268us-gaap:SeriesAPreferredStockMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001606268us-gaap:SeriesAPreferredStockMember2023-12-310001606268us-gaap:SeriesAPreferredStockMember2022-01-012022-12-310001606268us-gaap:SeriesAPreferredStockMember2022-12-310001606268us-gaap:SeriesAPreferredStockMemberus-gaap:SubsequentEventMember2024-01-172024-01-170001606268srt:NaturalGasReservesMemberus-gaap:LongMemberspke:NontradingMember2023-01-012023-12-31utr:MMBTU0001606268srt:NaturalGasReservesMemberus-gaap:LongMemberspke:NontradingMember2022-01-012022-12-310001606268us-gaap:LongMemberus-gaap:ElectricityMemberspke:NontradingMember2023-01-012023-12-31utr:MWh0001606268us-gaap:LongMemberus-gaap:ElectricityMemberspke:NontradingMember2022-01-012022-12-310001606268srt:NaturalGasReservesMemberus-gaap:LongMemberspke:DesignatedasTradingMember2023-01-012023-12-310001606268srt:NaturalGasReservesMemberus-gaap:LongMemberspke:DesignatedasTradingMember2022-01-012022-12-310001606268spke:NontradingMember2023-01-012023-12-310001606268spke:NontradingMemberspke:NoncashFlowHedgingMember2022-01-012022-12-310001606268spke:NontradingMemberspke:NoncashFlowHedgingMember2021-01-012021-12-310001606268spke:NoncashFlowHedgingMemberspke:DesignatedasTradingMember2023-01-012023-12-310001606268spke:NoncashFlowHedgingMemberspke:DesignatedasTradingMember2022-01-012022-12-310001606268spke:NoncashFlowHedgingMemberspke:DesignatedasTradingMember2021-01-012021-12-310001606268us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMemberspke:DesignatedasTradingMember2022-01-012022-12-310001606268spke:NontradingCommodityContractCurrentMember2023-12-310001606268spke:TradingCommodityContractCurrentMember2023-12-310001606268spke:CommodityContractCurrentMember2023-12-310001606268spke:NontradingCommodityContractNoncurrentMember2023-12-310001606268spke:TradingCommodityContractNoncurrentMember2023-12-310001606268spke:CommodityContractNoncurrentMember2023-12-310001606268us-gaap:CommodityContractMember2023-12-310001606268spke:NontradingCommodityContractCurrentMember2022-12-310001606268spke:TradingCommodityContractCurrentMember2022-12-310001606268spke:CommodityContractCurrentMember2022-12-310001606268spke:NontradingCommodityContractNoncurrentMember2022-12-310001606268spke:TradingCommodityContractNoncurrentMember2022-12-310001606268spke:CommodityContractNoncurrentMember2022-12-310001606268us-gaap:CommodityContractMember2022-12-310001606268srt:MinimumMemberus-gaap:SoftwareDevelopmentMember2023-12-310001606268srt:MaximumMemberus-gaap:SoftwareDevelopmentMember2023-12-310001606268us-gaap:SoftwareDevelopmentMember2023-12-310001606268us-gaap:SoftwareDevelopmentMember2022-12-310001606268srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001606268srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001606268us-gaap:FurnitureAndFixturesMember2023-12-310001606268us-gaap:FurnitureAndFixturesMember2022-12-310001606268us-gaap:CustomerRelationshipsMember2023-12-310001606268us-gaap:CustomerRelationshipsMember2022-12-310001606268spke:CustomerRelationshipsOtherMember2023-12-310001606268spke:CustomerRelationshipsOtherMember2022-12-310001606268spke:CustomerRelationshipsandNoncompeteAgreementsMember2020-12-310001606268spke:CustomerRelationshipsOtherMember2020-12-310001606268us-gaap:TrademarksMember2020-12-310001606268spke:CustomerRelationshipsandNoncompeteAgreementsMember2021-01-012021-12-310001606268spke:CustomerRelationshipsOtherMember2021-01-012021-12-310001606268spke:CustomerRelationshipsandNoncompeteAgreementsMember2021-12-310001606268spke:CustomerRelationshipsOtherMember2021-12-310001606268us-gaap:TrademarksMember2021-12-310001606268spke:CustomerRelationshipsandNoncompeteAgreementsMember2022-01-012022-12-310001606268spke:CustomerRelationshipsandNoncompeteAgreementsMember2022-12-310001606268spke:CustomerRelationshipsandNoncompeteAgreementsMember2023-01-012023-12-310001606268spke:CustomerRelationshipsOtherMember2023-01-012023-12-310001606268spke:CustomerRelationshipsandNoncompeteAgreementsMember2023-12-310001606268us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-12-310001606268us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001606268us-gaap:SubordinatedDebtMember2023-12-310001606268us-gaap:SubordinatedDebtMember2022-12-310001606268us-gaap:LineOfCreditMember2023-01-012023-12-310001606268us-gaap:LineOfCreditMember2022-01-012022-12-310001606268us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001606268us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-01-012022-12-310001606268us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2021-01-012021-12-310001606268spke:OtherLongTermDebtMember2023-01-012023-12-310001606268spke:OtherLongTermDebtMember2022-01-012022-12-310001606268spke:OtherLongTermDebtMember2021-01-012021-12-310001606268spke:PriorSeniorCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2017-05-190001606268us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-06-300001606268us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001606268srt:MinimumMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001606268srt:MaximumMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001606268srt:MinimumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001606268srt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001606268srt:MinimumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001606268srt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001606268spke:SeniorSecuredRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-01-012023-12-310001606268spke:ViaRenewablesMemberspke:WKeithMaxwellIIIMember2023-12-310001606268spke:AmendedAndRestatedSubordinatedPromissoryNoteMemberus-gaap:SubordinatedDebtMember2021-10-310001606268spke:AmendedAndRestatedSubordinatedPromissoryNoteMembersrt:MinimumMemberus-gaap:SubordinatedDebtMember2021-10-310001606268srt:MaximumMemberspke:AmendedAndRestatedSubordinatedPromissoryNoteMemberus-gaap:SubordinatedDebtMember2021-10-310001606268spke:AmendedAndRestatedSubordinatedPromissoryNoteMemberus-gaap:PrimeRateMemberus-gaap:SubordinatedDebtMember2021-10-312021-10-310001606268spke:AmendedAndRestatedSubordinatedPromissoryNoteMemberus-gaap:SubordinatedDebtMember2023-12-310001606268spke:AmendedAndRestatedSubordinatedPromissoryNoteMemberus-gaap:SubordinatedDebtMember2022-12-310001606268spke:FederalFundsRateMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001606268us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberspke:NontradingCommodityContractMember2023-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:NontradingCommodityContractMemberus-gaap:FairValueInputsLevel2Member2023-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:NontradingCommodityContractMemberus-gaap:FairValueInputsLevel3Member2023-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:NontradingCommodityContractMember2023-12-310001606268us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberspke:TradingCommodityContractMember2023-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:TradingCommodityContractMemberus-gaap:FairValueInputsLevel2Member2023-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:TradingCommodityContractMemberus-gaap:FairValueInputsLevel3Member2023-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:TradingCommodityContractMember2023-12-310001606268us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001606268us-gaap:FairValueMeasurementsRecurringMember2023-12-310001606268us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberspke:NontradingCommodityContractMember2022-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:NontradingCommodityContractMemberus-gaap:FairValueInputsLevel2Member2022-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:NontradingCommodityContractMemberus-gaap:FairValueInputsLevel3Member2022-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:NontradingCommodityContractMember2022-12-310001606268us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberspke:TradingCommodityContractMember2022-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:TradingCommodityContractMemberus-gaap:FairValueInputsLevel2Member2022-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:TradingCommodityContractMemberus-gaap:FairValueInputsLevel3Member2022-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberspke:TradingCommodityContractMember2022-12-310001606268us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001606268us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001606268us-gaap:FairValueMeasurementsRecurringMember2022-12-310001606268spke:RestrictedStockUnitsLiabilityAwardsMemberspke:NonEmployeeDirectorMember2023-01-012023-12-310001606268us-gaap:ShareBasedCompensationAwardTrancheOneMemberspke:OfficerEmployeeandEmployeeofAffiliatesMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001606268us-gaap:ShareBasedCompensationAwardTrancheTwoMemberspke:OfficerEmployeeandEmployeeofAffiliatesMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001606268us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001606268us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001606268us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001606268us-gaap:RestrictedStockUnitsRSUMember2022-12-310001606268us-gaap:RestrictedStockUnitsRSUMember2023-12-310001606268us-gaap:CommonClassAMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001606268spke:ChangeInControlRestrictedStockUnitsRSUMember2023-01-012023-12-310001606268spke:RestrictedStockUnitsLiabilityAwardsMemberus-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001606268spke:RestrictedStockUnitsLiabilityAwardsMemberus-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001606268spke:RestrictedStockUnitsLiabilityAwardsMemberus-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001606268spke:RestrictedStockUnitsLiabilityAwardsMember2023-12-310001606268spke:RestrictedStockUnitsLiabilityAwardsMember2022-12-310001606268spke:RestrictedStockUnitsLiabilityAwardsMember2023-01-012023-12-310001606268spke:RestrictedStockUnitsLiabilityAwardsMemberus-gaap:CommonClassAMember2023-01-012023-12-310001606268spke:LitigationAndRegulatoryMattersMember2023-12-310001606268spke:LitigationAndRegulatoryMattersMember2022-12-310001606268spke:IndirectTaxAuditsMember2023-12-310001606268spke:IndirectTaxAuditsMember2022-12-310001606268srt:AffiliatedEntityMember2023-12-310001606268srt:AffiliatedEntityMember2022-12-310001606268srt:AffiliatedEntityMember2022-01-012022-12-310001606268srt:AffiliatedEntityMember2021-01-012021-12-310001606268spke:AllocatedOverheadCostsMembersrt:AffiliatedEntityMember2023-01-012023-12-310001606268spke:AllocatedOverheadCostsMembersrt:AffiliatedEntityMember2022-01-012022-12-310001606268spke:AllocatedOverheadCostsMembersrt:AffiliatedEntityMember2021-01-012021-12-310001606268spke:PaymentofIncomeTaxesIncurredbytheCompanyMembersrt:AffiliatedEntityMember2023-01-012023-12-310001606268spke:PaymentofIncomeTaxesIncurredbytheCompanyMembersrt:AffiliatedEntityMember2022-01-012022-12-310001606268spke:PaymentofIncomeTaxesIncurredbytheCompanyMembersrt:AffiliatedEntityMember2021-01-012021-12-310001606268spke:NontradingMember2022-01-012022-12-310001606268spke:NontradingMember2021-01-012021-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailElectricityMember2023-01-012023-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailNaturalGasMember2023-01-012023-12-310001606268us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001606268srt:ConsolidationEliminationsMember2023-01-012023-12-310001606268us-gaap:OperatingSegmentsMemberspke:NontradingMemberspke:RetailElectricityMember2023-01-012023-12-310001606268us-gaap:OperatingSegmentsMemberspke:NontradingMemberspke:RetailNaturalGasMember2023-01-012023-12-310001606268us-gaap:CorporateNonSegmentMemberspke:NontradingMember2023-01-012023-12-310001606268srt:ConsolidationEliminationsMemberspke:NontradingMember2023-01-012023-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailElectricityMember2023-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailNaturalGasMember2023-12-310001606268us-gaap:CorporateNonSegmentMember2023-12-310001606268srt:ConsolidationEliminationsMember2023-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailElectricityMember2022-01-012022-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailNaturalGasMember2022-01-012022-12-310001606268us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001606268srt:ConsolidationEliminationsMember2022-01-012022-12-310001606268us-gaap:OperatingSegmentsMemberspke:NontradingMemberspke:RetailElectricityMember2022-01-012022-12-310001606268us-gaap:OperatingSegmentsMemberspke:NontradingMemberspke:RetailNaturalGasMember2022-01-012022-12-310001606268us-gaap:CorporateNonSegmentMemberspke:NontradingMember2022-01-012022-12-310001606268srt:ConsolidationEliminationsMemberspke:NontradingMember2022-01-012022-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailElectricityMember2022-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailNaturalGasMember2022-12-310001606268us-gaap:CorporateNonSegmentMember2022-12-310001606268srt:ConsolidationEliminationsMember2022-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailElectricityMember2021-01-012021-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailNaturalGasMember2021-01-012021-12-310001606268us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001606268srt:ConsolidationEliminationsMember2021-01-012021-12-310001606268us-gaap:OperatingSegmentsMemberspke:NontradingMemberspke:RetailElectricityMember2021-01-012021-12-310001606268us-gaap:OperatingSegmentsMemberspke:NontradingMemberspke:RetailNaturalGasMember2021-01-012021-12-310001606268us-gaap:CorporateNonSegmentMemberspke:NontradingMember2021-01-012021-12-310001606268srt:ConsolidationEliminationsMemberspke:NontradingMember2021-01-012021-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailElectricityMember2021-12-310001606268us-gaap:OperatingSegmentsMemberspke:RetailNaturalGasMember2021-12-310001606268us-gaap:CorporateNonSegmentMember2021-12-310001606268srt:ConsolidationEliminationsMember2021-12-310001606268us-gaap:CostOfGoodsTotalMember2023-01-012023-12-31spke:supplier0001606268us-gaap:CostOfGoodsTotalMember2022-01-012022-12-310001606268us-gaap:CostOfGoodsTotalMember2021-01-012021-12-310001606268us-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMemberspke:TwoLargestSuppliersMember2023-01-012023-12-310001606268us-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMemberspke:ThreeLargestSuppliersMember2022-01-012022-12-310001606268us-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMemberspke:TwoLargestSuppliersMember2021-01-012021-12-310001606268spke:ResidentialCustomerEquivalentMember2021-05-012021-05-31utr:kWh0001606268spke:ResidentialCustomerEquivalentMember2022-01-012022-12-310001606268spke:CustomerContractMember2022-01-012022-12-310001606268spke:ResidentialCustomerEquivalentMember2023-12-310001606268spke:ResidentialCustomerEquivalentMember2021-07-012021-07-310001606268spke:ResidentialCustomerEquivalentMember2022-08-012022-08-310001606268spke:BrokerContractsMember2022-01-012022-01-31spke:customer0001606268spke:RightsToBrokerContractsMember2022-01-012022-01-310001606268spke:RightsToBrokerContractsMember2022-06-012022-06-30

| | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36559

Via Renewables, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | | 46-5453215 |

(State or other jurisdiction of

incorporation or organization) | | | | (I.R.S. Employer

Identification No.) |

12140 Wickchester Ln, Suite 100

Houston, Texas 77079

(Address of principal executive offices)

(713) 600-2600

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | |

Title of each class | | Trading Symbols | | Name of exchange on which registered |

Class A common stock, par value $0.01 per share | | VIA | | The NASDAQ Global Select Market |

8.75% Series A Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Stock, par value $0.01 per share | | VIASP | | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐

Non-accelerated filer ☒ Smaller reporting company ☐

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements

of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

The aggregate market value of common stock held by non-affiliates of the registrant on June 30, 2023, the last business day of the registrant's most recently completed second fiscal quarter, based on the closing price on that date of $6.96, was approximately $17 million. The registrant, solely for the purpose of this required presentation, deemed its Board of Directors and Executive Officers to be affiliates, and deducted their stockholdings in determining the aggregate market value.

There were 3,232,701 shares of Class A common stock, 4,000,000 shares of Class B common stock and 3,567,543 shares of Series A Preferred Stock outstanding as of February 27, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of this Annual Report on Form 10-K will be disclosed in a Form 10-K/A or in a definitive Proxy Statement for an Annual Meeting of Shareholders (the “Proxy Statement”) no later than 120 days after December 31, 2023.

Table of Contents

| | | | | | | | | | | | | | |

| | | | Page No. |

| | PART I | | |

| Items 1 & 2. | | Business and Properties | | |

| Item 1A. | | Risk Factors | | |

| Item 1B. | | Unresolved Staff Comments | | |

| Item 1C. | | Cybersecurity | | |

| Item 3. | | Legal Proceedings | | |

| Item 4. | | Mine Safety Disclosures | | |

| | PART II | | |

| Item 5. | | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | |

| | Stock Performance Graph | | |

| Item 6. | | Reserved | | |

| Item 7. | | Management’s Discussion and Analysis of Financial Condition and Results of Operations | | |

| | Overview | | |

| | Drivers of Our Business | | |

| | Non-GAAP Performance Measures | | |

| | Consolidated Results of Operations | | |

| | Operating Segment Results | | |

| | Liquidity and Capital Resources | | |

| | Cash Flows | | |

| | Summary of Contractual Obligations | | |

| | Off-Balance Sheet Arrangements | | |

| | Related Party Transactions | | |

| | Critical Accounting Policies and Estimates | | |

| | Contingencies | | |

| Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | |

| Item 8. | | Financial Statements and Supplementary Data | | |

| | Index to Consolidated Financial Statements | | |

| Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | |

| Item 9A. | | Controls and Procedures | | |

| Item 9B. | | Other Information | | |

| Item 9 C. | | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | | |

| | PART III | | |

| Item 10. | | Directors, Executive Officers and Corporate Governance | | |

| Item 11. | | Executive Compensation | | |

| Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | |

| Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | |

| Item 14. | | Principal Accounting Fees and Services | | |

| | PART IV | | |

| Item 15. | | Exhibits, Financial Statement Schedules | | |

| Item 16. | | Form 10-K Summary | | |

| | SIGNATURES | | |

| | | | |

Cautionary Note Regarding Forward Looking Statements

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. These forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) can be identified by the use of forward-looking terminology including “may,” “should,” “likely,” “will,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “plan,” “intend,” “project,” or other similar words. Forward-looking statements appear in a number of places in this Annual Report. All statements, other than statements of historical fact included in this Annual Report are forward-looking statements. The forward-looking statements include statements, regarding the impacts of the 2021 severe weather event, cash flow generation and liquidity, business strategy, prospects for growth and acquisitions, outcomes of legal proceedings, ability to pay and amount of cash dividends and distributions on our Class A Common Stock and Series A Preferred Stock, future operations, financial position, estimated revenues and losses, projected costs, prospects, plans, objectives, beliefs of management, availability of and terms of capital, competition and government regulation and general economic conditions. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot give any assurance that such expectations will prove correct.

The forward-looking statements in this Annual Report are subject to risks and uncertainties. Important factors that could cause actual results to materially differ from those projected in the forward-looking statements include, but are not limited to:

•the ultimate impact of the 2021 severe weather event, including future benefits or costs related to ERCOT market Securitization efforts, and any corrective action by the State of Texas, ERCOT, the Railroad Commission of Texas, or the Public Utility Commission of Texas;

•changes in commodity prices, the margins we achieve, and interest rates;

•the sufficiency of risk management and hedging policies and practices;

•the impact of extreme and unpredictable weather conditions, including hurricanes and other natural disasters;

•federal, state and local regulations, including the industry's ability to address or adapt to potentially restrictive new regulations that may be enacted by public utility commissions;

•our ability to borrow funds and access credit markets;

•restrictions and covenants in our debt agreements and collateral requirements;

•credit risk with respect to suppliers and customers;

•our ability to acquire customers and actual attrition rates;

•changes in costs to acquire customers;

•accuracy of billing systems;

•our ability to successfully identify, complete, and efficiently integrate acquisitions into our operations;

•significant changes in, or new changes by, the independent system operators (“ISOs”) in the regions we operate;

•competition;

•our ability to successfully obtain the requisite shareholder approval of and to consummate the merger and transactions contemplated by the Merger Agreement (as defined below) and other risks related thereto, including but not limited to, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, the failure to satisfy other conditions to completion of the proposed merger, the failure of the proposed merger to close for any other reason, the outcome of any legal proceedings, regulatory proceedings or enforcement matters that may be instituted against us and others relating to the Merger Agreement or otherwise, the amount of the costs, fees, expenses and charges related to the proposed merger, the effect of the announcement of the proposed merger on our relationships with our contractual counterparties, operating results and business generally, the risk that the pendency of the proposed merger disrupts current plans and operations and the potential difficulties in employee retention as a result of the pendency of the proposed merger, risks related to disruption of management’s attention from our ongoing business operations due to the merger and transactions contemplated by the Merger Agreement; and

•the “risk factors” described in "Item 1A— Risk Factors" of this Annual Report.

You should review the risk factors and other factors noted throughout or incorporated by reference in this Annual Report that could cause our actual results to differ materially from those contained in any forward-looking statement. All forward-looking statements speak only as of the date of this Annual Report. Unless required by law, we disclaim any obligation to publicly update or revise these statements whether as a result of new information, future events or otherwise. It is not possible for us to predict all risks, nor can we assess the impact of all factors on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Risk Factor Summary

Our business, financial condition, cash flows, results of operations and ability to pay dividends on our Class A common stock and Series A Preferred Stock could be materially and adversely affected by, and the price of our Class A common stock and Series A Preferred Stock could decline due to a number of factors, whether currently known or unknown, including but not limited to those summarized below. You should carefully consider the risk factors summarized below and described in more detail in Item 1A. — Risk Factors, together with the other information contained in this Annual Report.

Risks Related to Our Business and Our Industry

•We are subject to commodity price risk.

•Our financial results may be adversely impacted by weather conditions and changes in consumer demand.

•Our risk management policies and hedging procedures may not mitigate risk as planned, and we may fail to fully or effectively hedge our commodity supply and price risk.

•ESCOs face risks due to increased and rapidly changing regulations and increasing monetary fines by the state regulatory agencies.

•The retail energy business is subject to a high level of federal, state and local regulations, which are subject to change.

•Liability under the TCPA has increased significantly in recent years, and we face risks if we fail to comply.

•We are, and in the future may become, involved in legal and regulatory proceedings and, as a result, may incur substantial costs.

•Our business is dependent on retaining licenses in the markets in which we operate.

•We may be subject to risks in connection with acquisitions, which could cause us to fail to realize many of the anticipated benefits of such acquisitions.

•We have historically distributed a significant portion of our cash through regular quarterly dividends, and our ability to grow and make acquisitions with cash on hand could be limited.

•We may not be able to manage our growth successfully.

•Our financial results fluctuate on a seasonal, quarterly and annual basis.

•We may have difficulty retaining our existing customers or obtaining a sufficient number of new customers, due to competition and for other reasons.

•Increased collateral requirements in connection with our supply activities may restrict our liquidity.

•We face risks related to health epidemics, pandemics and other outbreaks.

•We are subject to direct credit risk for certain customers who may fail to pay their bills as they become due.

•We depend on the accuracy of data in our information management systems, which subjects us to risks.

•Cyberattacks and data security breaches could adversely affect our business.

•Our success depends on key members of our management, the loss of whom could disrupt our business operations.

•We rely on third party vendors for our customer acquisition verification, billing and transactions platform that exposes us to third party performance risk and other risk.

•A large portion of our current customers are concentrated in a limited number of states, making us vulnerable to customer concentration risks.

•Increases in state renewable portfolio standards or an increase in the cost of renewable energy credit and carbon offsets may adversely impact the price, availability and marketability of our products.

•Our access to marketing channels may be contingent upon the viability of our telemarketing and door-to-door agreements with our vendors.

•Our vendors may expose us to risks.

Risks Related to Our Capital Structure and Capital Stock

•Our indebtedness could adversely affect our ability to raise additional capital to fund our operations or pay dividends. It could also expose us to the risk of increased interest rates and limit our ability to react to changes in the economy or our industry as well as impact our cash available for distribution.

•Our ability to pay dividends depends on many factors, including the performance of our business, cash flows, RCE counts and the margins we receive, as well as restrictions under our Senior Credit Facility.

•We are a holding company. Our sole material asset is our equity interest in Spark HoldCo, LLC ("Spark HoldCo") and we are accordingly dependent upon distributions from Spark HoldCo to pay dividends on the Class A common stock and Series A Preferred Stock.

•The Class A common stock and Series A Preferred Stock are subordinated to our existing and future debt obligations.

•Numerous factors may affect the trading price of the Class A common stock and Series A Preferred Stock.

•There may not be an active trading market for the Class A common stock or Series A Preferred Stock, which may in turn reduce the market value and your ability to transfer or sell your shares of Class A common stock or Series A Preferred Stock.

•Mr. Maxwell holds a substantial majority of the voting power of our common stock.

•Holders of Series A Preferred Stock have extremely limited voting rights.

•We have engaged in transactions with our affiliates in the past and expect to do so in the future. The terms of such transactions and the resolution of any conflicts that may arise may not always be in our or our stockholders’ best interests.

•Our amended and restated certificate of incorporation and amended and restated bylaws, as well as Delaware law, contain provisions that could discourage acquisition bids or merger proposals, which may adversely affect the market price of our Class A common stock.

•Our amended and restated certificate of incorporation designates the Court of Chancery of the State of Delaware as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, employees or agents.

•Future sales of our Class A common stock and Series A Preferred Stock in the public market could reduce the price of the Class A common stock and Series A Preferred Stock, and may dilute your ownership in us.

•We have issued preferred stock and may continue to do so, and the terms of such preferred stock could adversely affect the voting power or value of our Class A common stock.

•Our amended and restated certificate of incorporation limits the fiduciary duties of one of our directors and certain of our affiliates and restricts the remedies available to our stockholders for actions taken by Mr. Maxwell or certain of our affiliates that might otherwise constitute breaches of fiduciary duty.

•The Series A Preferred Stock represent perpetual equity interests in us, and investors should not expect us to redeem the Series A Preferred Stock on the date the Series A Preferred Stock becomes redeemable by us or on any particular date afterwards.

•The Series A Preferred Stock is not rated.

•The Change of Control Conversion Right may make it more difficult for a party to acquire us or discourage a party from acquiring us.

•Changes in the method of determining the Three-Month CME Term SOFR, or the replacement of Three-Month CME Term SOFR with an alternative reference rate, may adversely affect the floating dividend rate of our Series A Preferred Stock.

•A substantial increase in the Three-Month CME Term SOFR Rate or an alternative rate could negatively impact our ability to pay dividends on the Series A Preferred Stock and Class A common stock.

•We may not have sufficient earnings and profits in order for dividends on the Series A Preferred Stock to be treated as dividends for U.S. federal income tax purposes.

•You may be subject to tax if we make or fail to make certain adjustments to the conversion rate of the Series A Preferred Stock even though you do not receive a corresponding cash distribution.

•We are a “controlled company” under NASDAQ Global Select Market rules, and as such we are entitled to an exemption from certain corporate governance standards of the NASDAQ Global Select Market, and you may not have the same protections afforded to shareholders of companies that are subject to all of the NASDAQ Global Market corporate governance requirements.

PART I.

Items 1 & 2. Business and Properties

General

We are an independent retail energy services company founded in 1999 and are organized as a Delaware corporation that provides residential and commercial customers in competitive markets across the United States with an alternative choice for their natural gas and electricity. We purchase our electricity and natural gas supply from a variety of wholesale providers and bill our customers monthly for the delivery of electricity and natural gas based on their consumption at either a fixed or variable price. Electricity and natural gas are then distributed to our customers by local regulated utility companies through their existing infrastructure.

Our business consists of two operating segments:

•Retail Electricity Segment. In this segment, we purchase electricity supply through physical and financial transactions with market counterparties and ISOs and supply electricity to residential and commercial consumers pursuant to fixed-price and variable-price contracts.

•Retail Natural Gas Segment. In this segment, we purchase natural gas supply through physical and financial transactions with market counterparties and supply natural gas to residential and commercial consumers pursuant to fixed-price and variable-price contracts.

Our Operations

As of December 31, 2023, we operated in 104 utility service territories across 20 states and the District of Columbia and had approximately 335,000 residential customer equivalents (“RCEs”). An RCE is an industry standard measure of natural gas or electricity usage with each RCE representing annual consumption of 100 MMBtu of natural gas or 10 MWh of electricity. We serve natural gas customers in sixteen states (Arizona, California, Colorado, Connecticut, Florida, Illinois, Indiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, Ohio, Pennsylvania and Virginia) and electricity customers in twelve states (Connecticut, Delaware, Illinois, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Ohio, Pennsylvania and Texas) and the District of Columbia using seven brands (Electricity Maine, Electricity N.H., Major Energy, Provider Power Mass, Respond Power, Spark Energy, and Verde Energy).

Customer Contracts and Product Offerings

Fixed and variable-price contracts

We offer a variety of fixed-price and variable-price service options to our natural gas and electricity customers. Under our fixed-price service options, our customers purchase natural gas and electricity at a fixed price over the life of the customer contract, which provides our customers with protection against increases in natural gas and electricity prices. Our fixed-price contracts typically have a term of one to two years for residential customers and up to four years for commercial customers, and most provide for an early termination fee in the event that the customer terminates service prior to the expiration of the contract term. In a typical market, we offer fixed-price electricity plans for 6, 12 and 24 months and fixed-price natural gas plans from 12 to 24 months, which may or may not provide for a monthly service fee and/or a termination fee, depending on the market and customer type. Our variable-price service options carry a month-to-month term and are priced based on our forecasts of underlying commodity prices and other market and business factors, including the competitive landscape in the market and the regulatory environment, and may also include a monthly service fee depending on the market and customer type. Our variable plans may or may not provide for a termination fee, depending on the market and customer type.

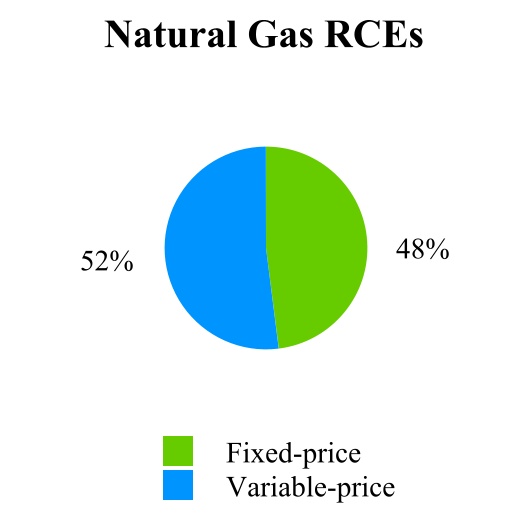

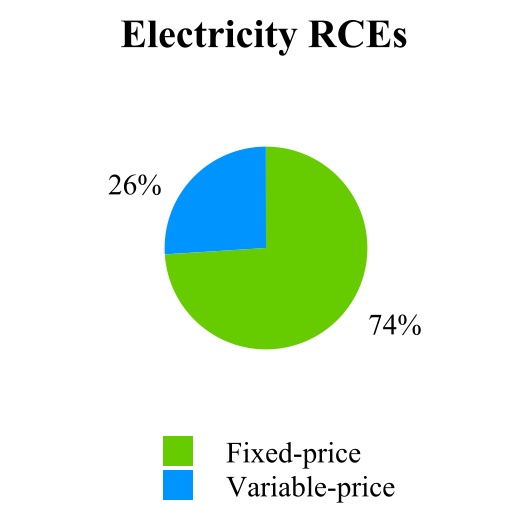

The fixed/variable splits of our RCEs were as follows as of December 31, 2023:

Green products and renewable energy credits

The reduction of carbon emission has become a major focus around the world. We offer renewable and carbon neutral (“green”) products in several markets. Green energy products are a growing market opportunity and typically provide increased unit margins as a result of improved customer satisfaction. Renewable electricity products allow customers to choose electricity sourced from wind, solar, hydroelectric and biofuel sources, through the purchase of renewable energy credits (“RECs”). A REC is a market-based instrument that represents the realized renewable attributes of renewable-based power generation. When we procure RECs on behalf of our customers, we are claiming their share of renewable generation that was delivered to the electric grid, directly supporting renewable generators.

Carbon neutral natural gas products give customers the option to reduce or eliminate the carbon footprint associated with their energy usage through the purchase of carbon offset credits. These products typically provide for fixed or variable prices and generally follow the same terms as our other products with the added benefit of carbon reduction and reduced environmental impact.

We utilize RECs to offset customer volumes related to customers enrolled in renewable energy plans. As of December 31, 2023, approximately 25% of our customers utilized green products. Also, as a key element of our corporate rebranding and our commitment to sustainability, we began offsetting 100% of customer volume beginning in the second quarter of 2021, by procuring RECs on behalf of our customers.

In addition to the RECs we purchase to satisfy our voluntary requirements under the terms of our green contracts with our customers and to support our corporate sustainability initiatives, we must also purchase a specified number of RECs based on the amount of electricity we sell in a state in a year pursuant to individual state renewable portfolio standards. We forecast the price for the required RECs and incorporate this cost component into our customer pricing models.

Customer Acquisition and Retention

Our customer acquisition strategy consists of customer growth obtained through traditional sales channels complemented by customer portfolio and business acquisitions. We make decisions on how best to deploy capital based on a variety of factors, including cost to acquire customers, availability of opportunities and our view of commodity pricing in particular regions.

We strive to maintain a disciplined approach to recovery of our customer acquisition costs within a 12-month period. We capitalize and amortize our customer acquisition costs over a one to two-year period, which is based on our estimate of the expected average length of a customer relationship. We factor in the recovery of customer acquisition costs in determining which markets we enter and the pricing of our products in those markets. Accordingly, our results are significantly influenced by our customer acquisition costs.

As a result of the COVID-19 pandemic, certain public utility commissions, regulatory agencies, and other governmental authorities in all of our markets had issued orders that impacted the way we historically acquired customers, such as door to door marketing. Our reduced marketing resulted in significantly reduced customer acquisition costs during 2021 compared to historical amounts. As these orders expired in 2022, our customer acquisition costs with respect to door to door marketing increased during 2022 and 2023. We are unable to predict our future customer acquisition costs at this time. Please see “Item 1A—Risk Factors” in this “Annual Report.”

We are currently focused on growing through organic sales channels; however, we continue to evaluate opportunities to acquire customers through acquisitions and pursue such acquisitions when it makes sense economically or strategically.

Organic Growth

We use organic sales strategies to both maintain and grow our customer base by offering products providing options for term flexibility, price certainty, variable rates and/or green product offerings. We manage growth on a market-by-market basis by developing price curves in each of the markets we serve and create product offerings in which our targeted customer segments find value. The attractiveness of a product from a consumer’s standpoint is based on a variety of factors, including overall pricing, price stability, contract term, sources of generation and environmental impact and whether or not the contract provides for termination and other fees. Product pricing is also based on several other factors, including the cost to acquire customers in the market, the competitive landscape and supply issues that may affect pricing.

Once a product has been created for a particular market, we then develop a marketing campaign. We identify and acquire customers through a variety of sales channels, including our inbound customer care call center, outbound calling, online marketing, opt-in web-based leads, email, direct mail, door-to-door sales, affinity programs, direct sales, brokers and consultants. For residential customers, we have historically used indirect sales brokers, web based solicitation, door-to-door sales, outbound calling, and other methods. For 2023, the largest channels were direct sales, telemarketing and web-based sales. We typically use brokers or direct marketing to obtain C&I customers, which are typically larger and have greater natural gas and electricity requirements. At December 31, 2023, our customer base was 68% residential and 32% C&I customers. In our sales practices, we typically employ multiple vendors under short-term contracts and have not entered into any exclusive marketing arrangements with sales vendors. Our marketing team continuously evaluates the effectiveness of each customer acquisition channel and makes adjustments in order to achieve targeted growth and manage customer acquisition costs. We strive to maintain a disciplined approach to recovery of our customer acquisition costs within defined periods.

Acquisitions

We actively monitor acquisition opportunities that may arise in the domestic acquisition market, and seek to acquire portfolios of customers and broker book acquisitions, as well as retail energy companies utilizing some combination of cash and borrowings under our senior secured borrowing base credit facility ("Senior Credit Facility), the issuance of common or preferred stock, or other financing arrangements. Historically, our customer acquisition strategy has been executed using both third parties and through affiliated relationships. See “—Relationship with our Founder, Majority Shareholder and Chief Executive Officer” for a discussion of affiliate relationships.

The following table provides a summary of our acquisitions over the past five years:

| | | | | | | | | | | | | | |

| Company / Portfolio | Date Completed | RCEs | Segment | Acquisition Source |

|

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Customer Portfolio | May 2019 | 60,000 | Natural Gas

Electricity | Third Party |

| Customer Portfolio | May 2021 | 45,000 | Electricity | Third Party |

| Customer Portfolio | July 2021 | 33,000 | Natural Gas | Third Party |

Customer Portfolio (1) | January 2022 | 69,000 | Natural Gas

Electricity | Third Party |

| Customer Portfolio | August 2022 | 18,700 | Natural Gas | Third Party |

(1) These RCEs are related to broker contracts we acquired as part of asset purchase agreements and are not included in our Retail RCEs.

Please see “Item 1A — Risk Factors” in this Annual Report for a discussion of risks related to our acquisition strategy and ability to finance such transactions.

Retaining customers and maximizing customer lifetime value

Following the acquisition of a customer, we devote significant attention to customer retention. We have developed a disciplined renewal communication process, which is designed to effectively reach our customers prior to the end of the contract term, and employ a team dedicated to managing this renewal communications process. Customers are contacted in each utility prior to the expiration of the customer's contract. We may contact the customer through additional channels such as outbound calls or email. We also apply a proprietary evaluation and segmentation process to optimize value to both us and the customer. We analyze historical usage, attrition rates and consumer behaviors to specifically tailor competitive products that aim to maximize the total expected return from energy sales to a specific customer, which we refer to as customer lifetime value.

We actively monitor unit margins from energy sales. We use this information to assess the results of products and to guide business decisions, including whether to engage in pro-active non-renewal of lower margin customers.

Commodity Supply

We hedge and procure our energy requirements from various wholesale energy markets, including both physical and financial markets, through short- and long-term contracts. Our in-house energy supply team is responsible for managing our commodity positions (including energy procurement, capacity, transmission, renewable energy, and resource adequacy requirements) within our risk management policies. We procure our natural gas and electricity requirements at various trading hubs, city-gates and load zones. When we procure commodities at trading hubs, we are responsible for delivery to the applicable local regulated utility for distribution.

In most markets, we hedge our electricity exposure with financial products and then purchase the physical power directly from the ISO for delivery. Alternatively, we may use physical products to hedge our electricity exposure rather than buying physical electricity in the day-ahead market from the ISO. During the year ended December 31, 2023, we transacted physical and financial settlements of electricity with approximately ten suppliers.

We are assessed monthly for ancillary charges such as reserves and capacity in the electricity sector by the ISOs. For example, the ISOs will charge all retail electricity providers for monthly reserves that the ISO determines are necessary to protect the integrity of the grid. Many of the utilities we serve also allocate natural gas transportation and storage assets to us as a part of their competitive choice program. We are required to fill our allocated storage capacity with natural gas, which creates commodity supply and price risk. Sometimes we cannot hedge the volumes associated with these assets because they are too small compared to the much larger bulk transaction volumes required for trades in the wholesale market or it is not economically feasible to do so.

We periodically adjust our portfolio of purchase/sale contracts in the wholesale natural gas market based upon analysis of our forecasted load requirements. Natural gas is then delivered to the local regulated utility city-gate or other specified delivery point where the local regulated utility takes control of the natural gas and delivers it to individual customer locations. Additionally, we hedge our natural gas price exposure with financial products. During the year ended December 31, 2023, we transacted physical and financial settlements of natural gas with approximately 81 wholesale counterparties.

We also enter into back-to-back wholesale transactions to optimize our credit lines with third-party energy suppliers. With each of our third-party energy suppliers, we have certain contracted credit lines, which allow us to purchase energy supply from these counterparties. If we desire to purchase supply beyond these credit limits, we are required to post collateral in the form of either cash or letters of credit. As we begin to approach the limits of our credit line with one supplier, we may purchase energy supply from another supplier and sell that supply to the original counterparty in order to reduce our net position with that counterparty and open up additional credit to procure supply in the future. Our sales of gas pursuant to these activities also enable us to optimize our credit lines with third-party energy suppliers by decreasing our net buy position with those suppliers.

Asset Optimization

Part of our business includes asset optimization activities in which we identify opportunities in the wholesale natural gas markets in conjunction with our retail procurement and hedging activities. Many of the competitive pipeline choice programs in which we participate require us and other retail energy suppliers to take assignment of and manage natural gas transportation and storage assets upstream of their respective city-gate delivery points. In our allocated storage assets, we are obligated to buy and inject gas in the summer season (April through October) and sell and withdraw gas during the winter season (November through March). These injection and purchase obligations require us to take a seasonal long position in natural gas. Our asset optimization group determines whether market conditions justify hedging these long positions through additional derivative transactions. We also contract with third parties for transportation and storage capacity in the wholesale market and are responsible for reservation and demand charges attributable to both our allocated and third-party contracted transportation and storage assets. Our asset optimization group utilizes these allocated and third-party transportation and storage assets in a variety of ways to either improve profitability or optimize supply-side counterparty credit lines.

We frequently enter into spot market transactions in which we purchase and sell natural gas at the same point or we purchase natural gas at one location and ship it using our pipeline capacity for sale at another location, if we are able to capture a margin. We view these spot market transactions as low risk because we enter into the buy and sell transactions on a back-to-back basis. We also act as an intermediary for market participants who need assistance with short-term procurement requirements. Consumers and suppliers contact us with a need for a certain quantity of natural gas to be bought or sold at a specific location. When this occurs, we are able to use our contacts in the wholesale market to source the requested supply and capture a margin in these transactions.

Our risk policies require that optimization activities be limited to back-to-back purchase and sale transactions, or open positions subject to aggregate net open position limits, which are not held for a period longer than two months. Furthermore, all additional capacity procured outside of a utility allocation of retail assets must be approved by a risk committee. Hedges of our firm transportation obligations are limited to two years or less and hedging of interruptible capacity is prohibited.

Risk Management

We operate under a set of corporate risk policies and procedures relating to the purchase and sale of electricity and natural gas, general risk management and credit and collections functions. Our in-house energy supply team is responsible for managing our commodity positions (including energy, capacity, transmission, renewable energy, and resource adequacy requirements) within our risk management policies. We attempt to increase the predictability of cash flows by following our hedging strategies.

Our risk committee has control and authority over all of our risk management activities. The risk committee establishes and oversees the execution of our credit risk management policy and our commodity risk policy. The risk management policies are reviewed at least annually by the risk management committee and such committee typically meets quarterly to assure that we have followed these policies. The risk committee also seeks to ensure the application of our risk management policies to new products that we may offer. The risk committee is comprised of our Chief Executive Officer and our Chief Financial Officer, who meet on a regular basis to review the status of the risk management activities and positions. Our risk team reports directly to our Chief Financial Officer and their compensation is unrelated to trading activity. Commodity positions are typically reviewed and updated daily based on information from our customer databases and pricing information sources. The risk policy sets volumetric limits on intra-day and end of day long and short positions in natural gas and electricity. With respect to specific hedges, we have established and approved a formal delegation of authority policy specifying each trader's authorized volumetric limits based on instrument type, lead time (time to trade flow), fixed price volume, index price volume and tenor (trade flow) for individual transactions. The risk team reports to the risk committee any hedging transactions that exceed these delegated transaction limits. The various risks we face in our risk management activities are discussed below.

Commodity Price and Volumetric Risk

Because our contracts require that we deliver full natural gas or electricity requirements to our customers and because our customers’ usage can be impacted by factors such as weather, we may periodically purchase more or less commodity than our aggregate customer volumetric needs. In buying or selling excess volumes, we may be exposed to commodity price volatility. In order to address the potential volumetric variability of our monthly deliveries for fixed-price customers, we implement various hedging strategies to attempt to mitigate our exposure.

Our commodity risk management strategy is designed to hedge substantially all of our forecasted volumes on our fixed-price customer contracts, as well as a portion of the near-term volumes on our variable-price customer contracts. We use both physical and financial products to hedge our fixed-price exposure. The efficacy of our risk management program may be adversely impacted by unanticipated events and costs that we are not able to effectively hedge, including abnormal customer attrition and consumption, certain variable costs associated with electricity grid reliability, pricing differences in the local markets for local delivery of commodities, unanticipated events that impact supply and demand, such as extreme weather, and abrupt changes in the markets for, or availability or cost of, financial instruments that help to hedge commodity price.

Variability in customer demand is primarily impacted by weather. We use utility-provided historical and/or forward projected customer volumes as a basis for our forecasted volumes and mitigate the risk of seasonal volume fluctuation for some customers by purchasing excess fixed-price hedges within our volumetric tolerances. Should seasonal demand exceed our weather-normalized projections, we may experience a negative impact on our financial results.

From time to time, we also take further measures to reduce price risk and optimize our returns by: (i) maximizing the use of natural gas storage in our daily balancing market areas in order to give us the flexibility to offset volumetric variability arising from changes in winter demand; (ii) entering into daily swing contracts in our daily balancing markets over the winter months to enable us to increase or decrease daily volumes if demand increases or decreases; and (iii) purchasing out-of-the-money call options for contract periods with the highest seasonal volumetric risk to protect against steeply rising prices if our customer demands exceed our forecast. Being geographically diversified in our delivery areas also permits us, from time to time, to employ assets not being used in one area to other areas, thereby mitigating potential increased costs for natural gas that we otherwise may have had to acquire at higher prices to meet increased demand.

We utilize New York Mercantile Exchange (“NYMEX”) settled financial instruments to offset price risk associated with volume commitments under fixed-price contracts. The valuation for these financial instruments is calculated daily based on the NYMEX Exchange published closing price, and they are settled using the NYMEX Exchange’s published settlement price at their maturity.

Basis Risk