Table of Contents

Amendment No. 1 to confidential draft submission

As submitted confidentially to the Securities and Exchange Commission on June 24, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AAC HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 8093 | 35-2496142 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

115 East Park Drive, Second Floor

Brentwood, TN 37027

(615) 732-1231

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Michael T. Cartwright

Chief Executive Officer and Chairman of the Board

AAC Holdings, Inc.

115 East Park Drive, Second Floor

Brentwood, TN 37027

(615) 732-1231

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Howard H. Lamar III, Esq. Laura R. Brothers, Esq. Bass, Berry & Sims PLC 150 3rd Avenue S., Suite 2800 Nashville, TN 37201 (615) 742-6200 |

Michael P. Heinz, Esq. Lindsey A. Smith, Esq. Sidley Austin LLP One South Dearborn Chicago, IL 60603 (312) 853-7000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one)

| Large Accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee | ||

| Common Stock, par value $0.001 per share |

||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. Includes the offering price of shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2014

PRELIMINARY PROSPECTUS

Shares

AAC Holdings, Inc.

Common Stock

This is the initial public offering of our common stock, and no public market currently exists for our stock. We currently expect the initial public offering price to be between $ and $ per share of common stock.

We have granted the underwriters a 30-day option to purchase up to additional shares of common stock to cover over-allotments, if any.

We intend to apply to list our common stock on the New York Stock Exchange under the symbol “AAC”.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our common stock involves risks. See “Risk Factors” beginning on page 15.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions1 |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

1 We refer you to “Underwriting” beginning on page 140 for additional information regarding underwriting compensation.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares on or about , 2014 through the book-entry facilities of The Depository Trust Company.

Joint Book-Running Managers

| William Blair | Wells Fargo Securities |

| Raymond James | Avondale Partners |

The date of this prospectus is , 2014

Table of Contents

| Page | ||||

| 1 | ||||

| 15 | ||||

| 33 | ||||

| 35 | ||||

| 35 | ||||

| 37 | ||||

| 39 | ||||

| 41 | ||||

| Selected Historical and Pro Forma Consolidated Financial and Operating Data |

52 | |||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

57 | |||

| 86 | ||||

| 107 | ||||

| 115 | ||||

| 122 | ||||

| 129 | ||||

| 131 | ||||

| 134 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders |

136 | |||

| 140 | ||||

| 146 | ||||

| 146 | ||||

| 146 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus to which we have referred you. No dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus. You must not rely on any unauthorized information or representations. This prospectus is an offer to sell only the shares of common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is accurate only as of the date of this prospectus or as of another date specified herein.

Trademarks, Trade Names and Service Marks

This prospectus includes our trademarks such as “American Addiction Centers,” “Desert Hope,” “FitRx,” “Forterus,” “Greenhouse,” “Singer Island,” “The Academy” and other company trade names and service marks that are protected under applicable intellectual property laws and constitute the property of AAC Holdings, Inc. or its subsidiaries. For convenience, we may not include the ® or ™ symbols, but such failure is not meant to indicate that we would not protect our intellectual property rights to the fullest extent allowed by law. Any other trademarks, trade names or service marks referred to in this registration statement are the property of their respective owners.

Industry and Market Data

Market data and other statistical information contained in this registration statement are based on independent industry publications, government publications, reports by market research firms and other published independent sources and reports. Some data is also based on our good faith estimates, which are derived from other relevant statistical information. Statements as to our market position are based on market data currently available to us and, primarily, on management estimates, as information regarding most of our major competitors is not publicly available. Our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” in this prospectus.

Table of Contents

This summary highlights the information contained elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that may be important to you. Before investing in our common stock, you should read this entire prospectus, including the information set forth under the heading “Risk Factors” and the financial statements and the notes thereto. In this prospectus, unless we indicate otherwise or the context requires, “we,” “our,” “us” and the “company” refer, prior to the Reorganization Transactions discussed below, to American Addiction Centers, Inc. and, after the Reorganization Transactions, to AAC Holdings, Inc., in each case together with its consolidated subsidiaries. The term “Holdings” refers to AAC Holdings, Inc. and the term “AAC” refers to American Addiction Centers, Inc. Unless otherwise noted, all information in this prospectus assumes (i) no exercise of the underwriters’ over-allotment option and (ii) the consummation of the Reorganization Transactions described under the caption “Reorganization Transactions.”

Our Business

We believe we are a leading provider of inpatient substance abuse treatment services for individuals with drug and alcohol addiction. As of March 31, 2014, we operated six substance abuse treatment facilities located throughout the United States, focused on delivering effective clinical care and treatment solutions across our 407 beds, which included 278 licensed detoxification beds. In addition, we have three facilities under development and an additional property under contract that we plan to develop into a new facility. The majority of our 679 employees are highly trained clinical staff who deploy evidence-based treatment programs with structured curricula for detoxification, residential treatment, partial hospitalization and intensive outpatient care. By applying a tailored treatment program based on the individual needs of each client, many of whom require treatment for a co-occurring mental health disorder, such as depression, bipolar disorder and schizophrenia, we believe we offer the level of quality care and service necessary for our clients to achieve and maintain sobriety. For the years ended December 31, 2013 and December 31, 2012, we had $115.7 million and $66.0 million in revenues, $11.6 million and $7.2 million in Adjusted EBITDA and $1.5 million and $1.1 million in net income, respectively. For the three months ended March 31, 2014 and 2013, we had $30.1 million and $29.4 million in revenues, $3.6 million and $5.0 million in Adjusted EBITDA and $0.8 million and $2.2 million in net income, respectively. See “Summary Historical and Pro Forma Consolidated Financial and Operating Data” for a discussion of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure.

We have made substantial investments in our treatment facilities with a specific focus on providing aesthetically pleasing properties and grounds, numerous amenities, healthy food and a courteous and attentive staff to distinguish us from our competitors. Our commitment to clinical excellence, premium facilities and customer service has allowed us to form relationships across a broad set of key referral sources, including hospitals, other treatment facilities, employers, alumni and employee assistance programs. In 2013 and the first quarter of 2014, approximately 90% and 91% of our revenues, respectively, were reimbursable by commercial payors, including amounts paid by such payors to clients, and the remaining portion was payable directly by our clients. We currently do not receive any revenues from government healthcare payment programs such as Medicare and Medicaid. Our platform is supported by a centralized infrastructure that includes a multi-faceted sales and marketing program, call center operations, a laboratory facility, billing and collection services and support functions. This infrastructure, in conjunction with our premium service offerings, has enabled us to develop a strong national brand. The substantial investments we have made at a corporate level contribute to our operational efficiencies and provide us flexibility to place clients at a variety of our facilities in order to optimize care that best fits both the clients’ clinical needs and their insurance benefits.

1

Table of Contents

Our Industry

Addiction is a chronic disease that affects brain function and behavior. Substance abuse, specifically the abuse of drugs and alcohol, is one of the most common and serious forms of addiction. If left untreated, substance abuse can lead to a variety of destructive social conditions such as problems at home or work, violence, crime and even death. According to the National Institute on Drug Abuse, or NIDA, the total societal cost of substance abuse in the United States is estimated to be over $600 billion annually. The 2012 National Survey on Drug Use and Health estimates that approximately 23.1 million people aged 12 or older needed treatment for a drug or alcohol use problem in the United States in 2012, of which only 2.5 million, or 10.8% of those needing treatment, received treatment at a specialty facility. The mental health and substance abuse treatment industry is expected to continue to expand as a result of a combination of factors, including increased awareness and de-stigmatization of substance abuse treatment and recent healthcare reform improving access to care, particularly for young adults now able to access their parents’ insurance. According to a 2008 report by the Substance Abuse and Mental Health Services Administration, or SAMHSA, annual spending on treatment for substance abuse in the United States is expected to grow to $35 billion in 2014.

The National Comorbidity Survey reports that up to 65% of adults with substance abuse addiction also have a co-occurring mental health disorder, defined by SAMHSA as at least one major mental health disorder, such as depression, bipolar disorder and schizophrenia, occurring concurrently with substance abuse. According to the Disease Management and Health Outcomes Journal, integrating treatment for both substance abuse and a co-occurring mental health disorder is believed to result in significantly better outcomes.

In addition to strong industry growth dynamics, the substance abuse treatment sector has several favorable attributes that differentiate it from other healthcare services sectors. Of particular note, as a result of the nature of substance abuse treatment, clients have more control in deciding when to seek treatment and who to select as their treatment provider. Also, clients are typically not limited to their local geographic area in selecting a treatment facility. As a result, providers are able to market and advertise directly to potential clients and their families on a national level.

Our Competitive Strengths

We believe the following strengths differentiate us from our competitors and will allow us to successfully operate and grow our business:

| • | Leading substance abuse treatment platform. We believe we are a leading provider of substance abuse treatment services based on the scale and nationwide reach of our platform, quality of our facilities and breadth of our treatment capabilities. We believe we offer one of the largest for-profit fully licensed programs to treat drug and alcohol addiction regardless of stage or severity. In addition, we believe our commitment to quality and customer service, as well as our dedication to clinical excellence, results in improved client retention, an important factor in ensuring clients receive the care they need. |

| • | Comprehensive addiction treatment programs with co-occurring mental health disorder treatment capabilities. Our clinical staff is trained to deploy an evidence-based treatment program with a structured curriculum, particularly focused on identifying and addressing the needs of clients with co-occurring mental health disorders. Given that up to 65% of adults with substance abuse addiction are estimated to also have at least one co-occurring mental health disorder, we believe our medical and clinical staff’s ability to identify and treat both disorders is critical in helping clients achieve sobriety. We believe our ability to address these complex conditions enhances our reputation with clients, their families and other referral sources. |

2

Table of Contents

| • | Proven ability to develop de novo treatment facilities. We have a successful track record of identifying suitable de novo sites, securing properties, overseeing the licensing and development of facilities and integrating de novo centers into our broader platform. We have successfully transformed acquired properties, such as a luxury spa and an assisted living facility, into substance abuse treatment facilities. We believe our skill and experience in executing our de novo development strategy provides us with a competitive advantage in quickly and cost-effectively developing substance abuse treatment facilities and enrolling clients. |

| • | Multi-faceted sales and marketing program. Our national sales and marketing program provides a competitive advantage compared to treatment facilities that primarily target local geographic areas and use fewer marketing channels to attract clients. Our national team of 36 professional sales representatives develops and maintains relationships with key referral sources such as hospitals, other treatment facilities, employers, alumni and employee assistance programs. In addition, our team of over 60 centralized, trained call center treatment consultants provides coverage and support 24 hours a day, seven days a week. Our coordinated approach across multiple channels and our ability to serve clients from our varied facilities across the United States allows us to reach a broad audience of potential clients and build a nationally recognized brand. |

| • | Attractive payor mix and diversified client base. We have generated revenues solely from commercial payors and our clients with no reimbursement from government healthcare payment programs such as Medicare and Medicaid, which are typically subject to lower reimbursement rates. The relationships we have developed with our referral sources enhance our interactions with payors and help us achieve our attractive reimbursement profile. For the year ended December 31, 2013 and the three months ended March 31, 2014, approximately 90% and 91% of our revenues, respectively, were reimbursable by commercial payors, including amounts paid by such payors to clients, with the remaining portion of our revenues payable directly by our clients. No single payor in 2013 or the first quarter of 2014 accounted for more than 12.3% and 16.1% of our revenue reimbursements, respectively. |

| • | Strong financial performance and attractive returns on invested capital. We have achieved strong financial performance in terms of recent growth and profitability. Our revenues for the year ended December 31, 2013 were $115.7 million, representing a 75.3% increase over $66.0 million in 2012. Our revenues for the three months ended March 31, 2014 were $30.1 million, representing a 2.2% increase over $29.4 million for the same period in 2013. We have demonstrated the ability to generate attractive returns on investment with our de novo development strategy. Each of our two de novo developments, Greenhouse and Desert Hope, which added 218 total beds on a combined basis, was profitable within its first year of operation. |

| • | Experienced management team with track record of success. Our senior management team, with an average of over 15 years of experience in the healthcare industry, has significant experience developing, operating and growing a variety of behavioral health treatment facilities. We believe the combination of our management team’s skills and experiences provides us with an advantage in developing high quality de novo treatment facilities and quickly integrating them into our broader platform. |

Our Growth Strategy

We have developed our company and the American Addiction Centers national brand through substantial investment in our facilities, our clinical expertise, our professional staff and our national sales and marketing program. We seek to extend our position as a leading provider of treatment for drug and alcohol addiction by executing the following growth strategies:

| • | Improve census at existing facilities by increasing our client leads through our multi-faceted sales and marketing program. |

3

Table of Contents

| • | Expand capacity at existing residential facilities by selectively increasing our number of residential beds, expanding our clinical facility space and hiring additional clinical staff to enable us to provide services to additional clients. |

| • | Pursue de novo development of residential facilities built on the success of two full-service residential treatment facilities that we developed in the past two years: Greenhouse, a former luxury spa in Dallas, Texas, and Desert Hope, a former assisted living facility in Las Vegas, Nevada. |

| • | Opportunistically pursue treatment facility acquisitions to expand and diversify our geographic presence and service offerings. |

| • | Expand outpatient operations to complement our broader network of residential treatment facilities and further enhance our brand and our ability to provide a more comprehensive suite of services across the spectrum of care. |

| • | Target complementary growth opportunities, including providing pharmacy and laboratory services, expanding licensure of existing facilities, treating other mental health and wellness disorders and expanding other ancillary services. |

Our Substance Abuse Treatment Facilities

The following table presents information, as of March 31, 2014, about our network of substance abuse treatment facilities, including current facilities, facilities under development and properties under contract:

| Facility Name(1) |

Location |

Capacity (beds) |

First Clients Served |

Treatment |

Real Property Leased / Owned | |||||||

| Desert Hope |

Las Vegas, NV | 148 | 2013 | DTX, RTC, PHP, IOP | Owned | |||||||

| Greenhouse |

Grand Prairie, TX (Dallas area) |

130 | (3) | 2012 | DTX, RTC, PHP, IOP | Owned | ||||||

| Forterus |

Temecula, CA | 76 | 2004 | DTX, RTC, PHP, IOP | Leased | |||||||

| Singer Island |

West Palm Beach, FL | 65 | 2012 | PHP, IOP | Leased | |||||||

| San Diego Addiction Treatment Center |

San Diego, CA | 36 | 2010 | DTX, RTC, PHP, IOP | Leased | |||||||

| The Academy |

West Palm Beach, FL | 12 | 2012 | PHP, IOP | Leased | |||||||

| TBD |

Riverview, FL (Tampa area) |

164 | (4) | Under Development(4) |

DTX, RTC, PHP, IOP(4) | Owned | ||||||

| TBD |

Arlington, TX (Dallas area) |

n/a | Under Development(5) |

PHP, IOP(5) | Owned | |||||||

| TBD |

Las Vegas, NV | n/a | Under Development(6) |

PHP, IOP(6) | Owned | |||||||

| TBD |

Ringwood, NJ (New York City area) | 150 | (7) | Under Contract(7) |

DTX, RTC, PHP, IOP(7) | n/a | ||||||

(1) Excluded from this table is our non-substance abuse treatment facility, FitRx, which is a 20-bed leased facility located in Brentwood, Tennessee that provides outpatient treatment services for men and women who struggle with obesity-related behavioral disorders.

(2) DTX: Detoxification; RTC: Residential Treatment; PHP: Partial Hospitalization; IOP: Intensive Outpatient.

(3) This figure includes 60 additional beds anticipated as a result of the ongoing Greenhouse expansion, which we anticipate to be completed in the second half of 2014.

(4) Reflects our current expectations with respect to this facility, which we anticipate will begin construction in the second half of 2014 and open in the first half of 2015.

4

Table of Contents

(5) In March 2014, we acquired an approximately 20,000 square foot property in Arlington, Texas. We intend to begin construction of an outpatient treatment facility at this location in the third quarter of 2014, and we are targeting opening this facility in the second half of 2014. The facility will provide treatment services and additional programming space for our Greenhouse facility. Treatment certifications reflect our expectations.

(6) In May 2014, we acquired an approximately 20,000 square foot property in Las Vegas, Nevada. We intend to begin construction of an outpatient treatment facility at this location in the third quarter of 2014, and we are targeting opening this facility by the end of 2014. The facility will provide treatment services and additional programming space for our Desert Hope facility. Treatment certifications reflect our expectations.

(7) We entered into a purchase agreement to acquire a 96 acre property located fewer than 50 miles from New York City, subject to the satisfaction of certain closing conditions and the arrangement of financing. We anticipate beginning construction of a residential treatment facility at this location by early 2015, and we are targeting opening this facility in 2016 with approximately 150 beds. Treatment certifications reflect our expectations.

Risks Related to Our Business

Our business is subject to a number of risks that you should understand before making an investment decision. These risks, which are discussed more fully in “Risk Factors” following this prospectus summary, include the following:

| • | We currently operate a limited number of treatment facilities. Our revenues, profitability and cash flows could be materially adversely affected if we are unable to operate certain key treatment facilities or our corporate office. |

| • | We rely on our multi-faceted sales and marketing program to continuously attract and enroll clients to our network of facilities. Any disruption in our national sales and marketing program would have a material adverse effect on our business, financial condition and results of operations. |

| • | We derive a significant portion of our revenues from providing services to clients covered by third-party payors who could reduce their reimbursement rates or otherwise restrain our ability to obtain, or provide services to, clients. This risk is heightened because we are generally an “out-of-network” provider. |

| • | An increase in uninsured and underinsured clients or the deterioration in the collectability of the accounts of such clients could have a material adverse effect on our business, financial condition and results of operations. |

| • | If we overestimate the reimbursement amounts that payors will pay us for services performed, it would increase our revenue adjustments, which could have a material adverse effect on our revenues, profitability and cash flows. |

| • | Our business may face significant risks with respect to future de novo expansion, including the time and costs of identifying new geographic markets, the ability to obtain necessary licensure and other zoning or regulatory approvals and significant start-up costs including advertising, marketing and the costs of providing equipment, furnishings, supplies and other capital resources. |

| • | Our acquisition strategy exposes us to a variety of operational and financial risks, which may have a material adverse effect on our business, financial condition and results of operations. |

| • | Our ability to maintain census and the average length of stay of our clients is dependent on a number of factors outside of our control, and if we are unable to maintain census, or if we experience a significant decrease in average length of stay, our business, results of operations and cash flows could be materially adversely affected. |

| • | We will need additional financing to execute our business plan and fund operations, which additional financing may not be available on reasonable terms or at all. |

5

Table of Contents

| • | If we fail to comply with the extensive laws and government regulations impacting our industry, we could suffer penalties, be the subject of federal and state investigations and potential claims and legal actions by clients, employees and others or be required to make significant changes to our operations, which may reduce our revenues, increase our costs and have a material adverse effect on our business, financial condition and results of operations. |

| • | Our directors, executive officers and principal stockholders and their respective affiliates will continue to have substantial control over the company after this offering and could delay or prevent a change in corporate control. |

Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenues of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates was $700.0 million or more as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that may otherwise be applicable to public companies. These provisions include:

| • | only two years of audited consolidated financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| • | reduced disclosure about our executive compensation arrangements; |

| • | no requirement that we hold non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting. |

We have taken advantage of some of these reduced requirements and may continue to do so for so long as we remain an emerging growth company, and thus the information we provide stockholders may be less than what you might receive from other public companies in which you hold shares.

Reorganization Transactions

AAC Holdings, Inc. was incorporated as a Nevada corporation on February 12, 2014 for the purpose of acquiring all of the common stock of American Addiction Centers, Inc. and to engage in certain reorganization transactions, as described below. In April 2014, Holdings completed the following transactions:

| • | a voluntary private share exchange with certain stockholders of AAC, whereby holders representing 93.6% of the outstanding shares of common stock of AAC exchanged their shares on a one-for-one basis for shares of Holdings common stock, which we refer to as the Private Share Exchange; |

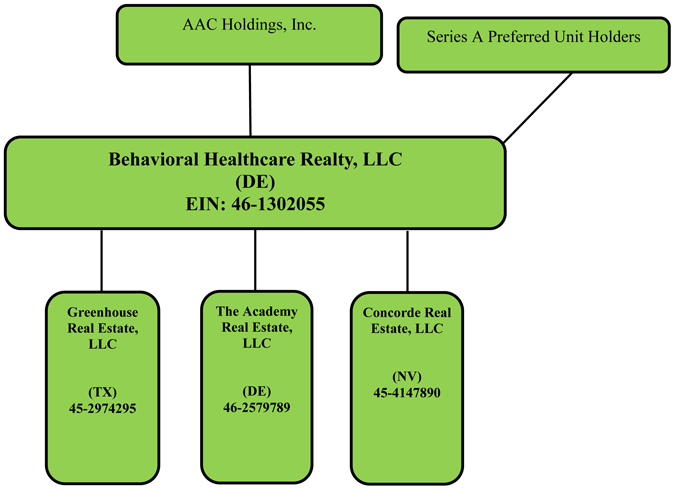

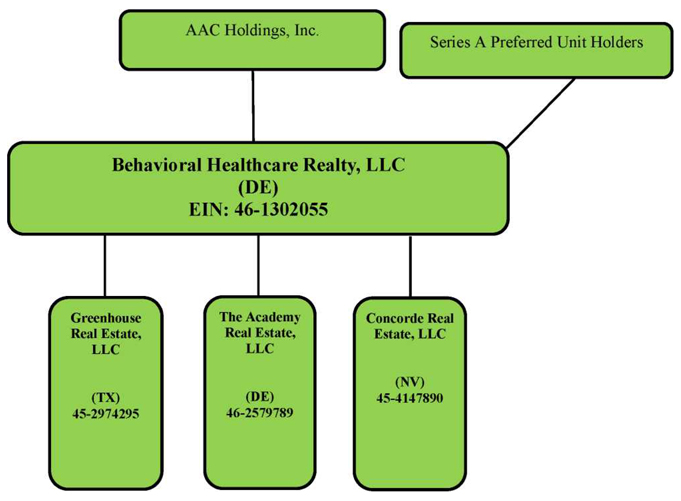

| • | substantially concurrent with the Private Share Exchange, the acquisition of all of the outstanding common membership interests of Behavioral Healthcare Realty, LLC, or BHR, an entity controlled by related parties, which owns all the outstanding equity interests of Concorde Real Estate, LLC, Greenhouse Real Estate, LLC and The Academy Real Estate, LLC, which entities own the Desert Hope, |

6

Table of Contents

| Greenhouse and Riverview, Florida properties, respectively, in exchange for $3.0 million in cash, the assumption of a $1.8 million term loan and 521,999 shares of Holdings common stock, representing 5.2% of our outstanding common stock immediately prior to this offering, which we refer to as the BHR Acquisition; and |

| • | substantially concurrent with the Private Share Exchange and BHR Acquisition, the acquisition of all of the outstanding membership interests of Clinical Revenue Management Services, LLC, or CRMS, an entity controlled by related parties, which provides client billing and collection services for AAC, in exchange for $0.5 million in cash and 149,144 shares of Holdings common stock, representing 1.5% of our outstanding common stock immediately prior to this offering, which we refer to as the CRMS Acquisition. |

As a result of the foregoing transactions, which are collectively referred to as the “Reorganization Transactions,” Holdings now owns (i) 93.6% of the outstanding common stock of AAC, (ii) 100% of the outstanding common membership interests in BHR, which represents 100% of the voting rights in BHR, and (iii) 100% of the outstanding membership interests in CRMS. To help fund or facilitate the Reorganization Transactions, the following additional financing transactions were undertaken in 2014 prior to or in connection with the Reorganization Transactions: (i) AAC sold 471,843 shares of its common stock in a private placement to certain accredited investors from February 2014 through April 2014, with net proceeds of $6.0 million, (ii) BHR sold 8.5 Series A Preferred Units in a private placement to certain accredited investors in January and February 2014 with net proceeds of $0.4 million, (iii) BHR redeemed all of the outstanding 36.5 Series A Preferred Units from certain accredited investors in April 2014 and (iv) BHR sold 160 new Series A Preferred Units in a private placement to an accredited investor in April 2014 with net proceeds of $7.7 million. For additional information related to the Reorganization Transactions, see “Unaudited Pro Forma Consolidated Financial Statements,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 18 to our audited financial statements included elsewhere in this prospectus.

Subsequent to this offering, we expect to conduct a subsidiary short-form merger with AAC whereby the legacy holders who did not participate in the Private Share Exchange, representing 6.4% of the outstanding common stock of AAC, would be entitled to receive Holdings shares on a one-for-one basis. Upon the completion of the short-form merger, Holdings would own 100% of AAC. No assurance can be given that the subsequent short-form merger will occur in a timely manner or at all.

Corporate Information

AAC Holdings, Inc. is a Nevada corporation. Our principal executive offices are located at 115 East Park Drive, Second Floor, Brentwood, Tennessee 37027, and our telephone number is (615) 732-1231. Our website address is www.americanaddictioncenters.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus. Investors should not rely on any such information in deciding whether to purchase our common stock. We have included our website address in this prospectus solely as an inactive textual reference.

7

Table of Contents

The Offering

| Common stock offered by us |

shares |

| Common stock to be outstanding immediately after this offering |

shares |

| Option to purchase additional shares |

We have granted the underwriters a 30-day option to purchase up to an additional shares of our common stock to cover over-allotments, if any. |

| Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ million assuming a public offering price of $ per share (the midpoint of the range set forth on the cover page of this prospectus). We intend to use the net proceeds to repay approximately $ million of outstanding indebtedness and the remaining net proceeds for working capital and other general corporate purposes. In addition, we may use a portion of the net proceeds of this offering to finance future potential acquisitions and de novo facility developments. We may allocate funds from other sources to fund some or all of these activities. See “Use of Proceeds.” |

| Dividend policy |

We do not anticipate paying dividends on our common stock for the foreseeable future. See “Dividend Policy.” |

| Risk factors |

For a discussion of certain factors you should consider before making an investment, see “Risk Factors.” |

| Conflict of interest |

An affiliate of Wells Fargo Securities, LLC, an underwriter in this offering, is the lender under our amended and restated credit facility and may receive more than 5% of the net proceeds from this offering. Accordingly, Wells Fargo Securities, LLC may be deemed to have a “conflict of interest” with us within the meaning of Rule 5121 of the Conduct Rules of the Financial Industry Regulatory Authority, Inc., or FINRA. William Blair & Company, L.L.C. has agreed to serve as a “qualified independent underwriter” as defined by FINRA and performed due diligence investigations and reviewed and participated in the preparation of the registration statement of which this prospectus forms a part. See “Underwriting—Conflict of Interest.” |

| Proposed New York Stock Exchange symbol |

“AAC” |

| Directed share program |

At our request, the underwriters have reserved up to 5% of the common stock being offered by this prospectus for sale at the initial public offering price to our directors, officers and certain of our employees. See “Underwriting.” |

8

Table of Contents

The number of shares of common stock to be outstanding immediately after this offering is based on the number of shares outstanding as of , 2014, plus the issuance of shares of common stock in this offering and excludes (i) 1,000,000 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan, or the 2014 Plan, which we have adopted in connection with this offering, and (ii) 630,886 shares of common stock, which we plan to issue in connection with the subsidiary short-form merger with AAC subsequent to this offering.

Except as otherwise noted, all information in this prospectus:

| • | assumes no exercise of the underwriters’ over-allotment option; and |

| • | gives effect to a -for-1 stock split effected on , 2014. |

9

Table of Contents

SUMMARY HISTORICAL AND PRO FORMA CONSOLIDATED FINANCIAL AND OPERATING DATA

The following tables present AAC’s summary historical and pro forma consolidated financial and operating data as of the dates and for the periods indicated. Holdings was formed as a Nevada corporation on February 12, 2014, and acquired 93.6% of the outstanding shares of common stock of AAC prior to the consummation of this offering in connection with the Reorganization Transactions, and Holdings therefore controls AAC. Holdings has not engaged in any business or other activities except in connection with its formation and the Reorganization Transactions. Accordingly, all financial and other information herein relating to periods prior to the completion of the Reorganization Transactions is that of AAC and its consolidated subsidiaries.

The summary consolidated financial data as of and for the years ended December 31, 2012 and 2013 are derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated financial data for the year ended December 31, 2011 are derived from our audited consolidated financial statements not included in this prospectus. The summary consolidated financial data as of March 31, 2014 and for the three months ended March 31, 2013 and 2014 are derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus. The results for the three months ended March 31, 2013 and the three months ended March 31, 2014 are not necessarily indicative of the results that may be expected for the entire year. The following summary consolidated financial data should be read together with our audited consolidated financial statements, unaudited condensed consolidated financial statements and accompanying notes and information under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

The summary unaudited pro forma financial and other data for the year ended December 31, 2013 and as of and for the three months ended March 31, 2014 have been adjusted to give effect to this offering and our intended use of proceeds from this offering and certain other transactions as described in the section titled “Unaudited Pro Forma Consolidated Financial Statements” included elsewhere in this prospectus. Specifically, the “Pro Forma as Adjusted” columns in the summary unaudited pro forma financial and other data give effect to the Reorganization Transactions, the related financing transactions and this offering and our intended use of proceeds therefrom as described in “Use of Proceeds,” in each case for the year ended December 31, 2013 and as of and for the three months ended March 31, 2014. This data is subject and gives effect to the assumptions and adjustments described in the notes accompanying the unaudited pro forma consolidated financial statements included elsewhere in this prospectus. The summary unaudited pro forma financial data is presented for informational purposes only and should not be considered indicative of actual results of operations that would have been achieved had the transactions and this offering been consummated on the dates indicated and does not purport to be indicative of financial condition data or results of operations as of any future date or for any future period.

The “Pro Forma as Adjusted” columns do not include the effects of the CRMS Acquisition, as CRMS’s only revenue stream is payments from us, and CRMS no longer has revenues subsequent to the completion of the CRMS Acquisition. Accordingly, CRMS does not meet the definition of a business under Regulation S-X Rule 11-01(d), and this transaction is not permitted to be included in the unaudited pro forma consolidated financial statements included elsewhere in this prospectus. However, for the purposes of the following table we have included an additional column to reflect the pro forma effects of the CRMS Acquisition because it provides investors with information from which to analyze our financial results in a manner that is consistent with the way management reviews and analyzes our results of operations as a combined company following the consummation of the Reorganization Transactions and the related financing transactions. In addition, we believe the “Pro Forma as Adjusted including CRMS Acquisition” income statement data provide investors with the most meaningful comparison between our financial results for prior and future periods.

10

Table of Contents

| Year Ended December 31, 2013 |

Three Months Ended March 31, 2014 |

|||||||||||||||||||||||||||||||||||

| Year Ended December 31, |

Pro Forma as Adjusted |

Pro Forma as Adjusted including CRMS Acquisition(1) |

Three Months Ended March 31, 2013 Actual (unaudited) |

Actual (unaudited) |

Pro Forma as Adjusted |

Pro Forma as Adjusted including CRMS Acquisition(1) |

||||||||||||||||||||||||||||||

| 2011 | 2012 | Actual | ||||||||||||||||||||||||||||||||||

| (in thousands, except for share and per share amounts) | ||||||||||||||||||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||||||||||||||||||

| Revenues |

$ | 28,275 | $ | 66,035 | $ | 115,741 | $ | $ | $ | 29,438 | $ | 30,083 | $ | $ | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||||||||||||

| Salaries, wages and benefits |

9,171 | 25,680 | 46,856 | 10,911 | 11,544 | |||||||||||||||||||||||||||||||

| Advertising and marketing |

4,915 | 8,667 | 13,493 | 3,148 | 3,290 | |||||||||||||||||||||||||||||||

| Professional fees |

1,636 | 5,430 | 10,277 | 2,055 | 2,497 | |||||||||||||||||||||||||||||||

| Client related services |

5,791 | 8,389 | 7,986 | 1,897 | 2,457 | |||||||||||||||||||||||||||||||

| Other operating expenses |

2,448 | 6,384 | 11,615 | 2,806 | 2,723 | |||||||||||||||||||||||||||||||

| Rents and leases |

1,196 | 3,614 | 4,634 | 1,335 | 470 | |||||||||||||||||||||||||||||||

| Provision for doubtful accounts |

1,063 | 3,344 | 10,950 | 2,640 | 4,173 | |||||||||||||||||||||||||||||||

| Litigation settlement(2) |

— | — | 2,588 | — | — | |||||||||||||||||||||||||||||||

| Restructuring(3) |

— | — | 806 | — | — | |||||||||||||||||||||||||||||||

| Depreciation and amortization |

195 | 1,288 | 3,003 | 683 | 1,077 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total operating expenses |

26,415 | 62,796 | 112,208 | 25,475 | 28,231 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income from operations |

1,860 | 3,239 | 3,533 | 3,963 | 1,852 | |||||||||||||||||||||||||||||||

| Interest expense |

337 | 980 | 1,390 | 410 | 354 | |||||||||||||||||||||||||||||||

| Other expense, net |

— | 12 | 36 | (38 | ) | 42 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income before income tax expense |

1,523 | 2,247 | 2,107 | 3,591 | 1,456 | |||||||||||||||||||||||||||||||

| Income tax expense |

652 | 1,148 | 615 | 1,352 | 615 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income |

871 | 1,099 | 1,492 | 2,239 | 841 | |||||||||||||||||||||||||||||||

| Less: net loss (income) attributable to noncontrolling interest(4) |

— | 405 | (706 | ) | (146 | ) | 178 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income attributable to American Addiction Centers, Inc. |

871 | 1,504 | 1,786 | 2,093 | 1,019 | |||||||||||||||||||||||||||||||

| Deemed contribution – redemption of Series B Preferred |

— | — | 1,000 | 1,000 | — | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income available to American Addiction Centers, Inc. common stockholders |

$ | 871 | $ | 1,504 | $ | 1,786 | $ | $ | $ | 3,093 | $ | 1,019 | $ | $ | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Earnings per share attributable to common stockholders(5): |

||||||||||||||||||||||||||||||||||||

| Basic |

$ | 0.20 | $ | 0.19 | $ | 0.20 | $ | $ | $ | 0.36 | $ | 0.11 | $ | $ | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Diluted |

$ | 0.20 | $ | 0.19 | $ | 0.20 | $ | $ | $ | 0.36 | $ | 0.11 | $ | $ | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Weighted-average shares outstanding(5): |

||||||||||||||||||||||||||||||||||||

| Basic |

4,287,131 | 7,770,359 | 8,819,062 | 8,503,928 | 9,175,580 | |||||||||||||||||||||||||||||||

| Diluted |

4,314,051 | 7,869,017 | 9,096,660 | 8,566,920 | 9,225,073 | |||||||||||||||||||||||||||||||

| Other Financial Information: |

||||||||||||||||||||||||||||||||||||

| Adjusted EBITDA(6) |

$ | 2,055 | $ | 7,168 | $ | 11,558 | $ | $ | $ | 5,002 | $ | 3,592 | $ | $ | ||||||||||||||||||||||

11

Table of Contents

| As of December 31, | As of March 31, 2014 | |||||||||||||||||||

| Actual (unaudited) |

Pro Forma | AAC Holdings, Inc. Pro Forma as Adjusted(7) |

||||||||||||||||||

| 2012 | 2013 | |||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 740 | $ | 2,012 | $ | 4,340 | $ | 9,077 | $ | |||||||||||

| Working capital |

3,190 | 1,220 | 3,733 | 8,143 | ||||||||||||||||

| Total assets |

53,598 | 81,638 | 89,557 | 94,308 | ||||||||||||||||

| Total debt, including current portion |

25,222 | 43,075 | 45,015 | 46,774 | ||||||||||||||||

| Total mezzanine equity (including noncontrolling interest)(8) |

11,613 | 11,842 | 12,267 | 7,739 | ||||||||||||||||

| Total stockholders’ equity (including noncontrolling interest)(9) |

4,678 | 11,883 | 16,519 | 24,089 | ||||||||||||||||

| Year Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||

| 2012 | 2013 | 2013 | 2014 | |||||||||||||

| Operating Metrics: (unaudited): |

||||||||||||||||

| Average daily census(10) |

238 | 339 | 368 | 371 | ||||||||||||

| Average daily revenue(11) |

$ | 759 | $ | 935 | $ | 889 | $ | 901 | ||||||||

| Average net daily revenue(12) |

$ | 722 | $ | 847 | $ | 809 | $ | 776 | ||||||||

| New admissions(13) |

2,934 | 4,027 | 1,085 | 1,065 | ||||||||||||

| Bed count at end of period(14) |

338 | 431 | 486 | 427 | ||||||||||||

(1) CRMS’s only revenue stream is payments from us, and CRMS no longer has revenues upon completion of the CRMS Acquisition. Accordingly, CRMS does not meet the definition of a business under Regulation S-X Rule 11-01(d), and this transaction is not permitted to be included in the unaudited pro forma consolidated financial statements included elsewhere in this prospectus. The 2013 column includes the historical results of CRMS for the year ended December 31, 2013 that consist of revenues of $3.4 million, salaries, wages and benefits of $2.0 million, professional fees of $0.1 million, other operating expenses of $0.5 million, rentals and leases of $0.2 million and depreciation and amortization of $0.1 million. These historical financial results are as adjusted for (i) the elimination of CRMS’s revenues of $3.4 million and the elimination of the corresponding $3.4 million of professional fees we paid to CRMS, (ii) the reduction of $0.3 million in salary expense for an executive officer whose employment ended effective upon the consummation of the CRMS Acquisition and (iii) recording a tax provision of $0.3 million on the historical income of CRMS and the pro forma adjustments at a tax rate of 36.0%. The first quarter 2014 column includes the historical financial results of CRMS for the three months ended March 31, 2014 that consist of revenues of $1.1 million, salaries, wages and benefits of $1.1 million, professional fees of $6,000, other operating expense of $0.1 million and rents and leases of $0.1 million. These historical results are adjusted for (i) the elimination of CRMS’s revenues of $1.1 million and the elimination of the corresponding $1.1 million of professional fees we paid to CRMS, (ii) the reduction of $0.1 million in salary expense for an executive officer whose employment ended effective upon the consummation of the CRMS Acquisition and (iii) recording a tax provision of $19,000 on the historical income of CRMS and the pro forma adjustments at a tax rate of 36.0%.

(2) We recorded a $2.6 million reserve in the second quarter of 2013 in connection with a consolidated wage and hour class action claim. We made a payment of $2.6 million in the second quarter of 2014 to settle the matter. For additional discussion of this litigation settlement, see Note 16 to our audited financial statements included elsewhere in this prospectus.

(3) During the first half of 2013, management adopted restructuring plans to centralize our call centers and to close the Leading Edge facility. As a result, aggregate restructuring and exit charges of $0.8 million were recognized in 2013. We did not recognize any restructuring expenses during 2012 as expenses related to the corporate relocation were not significant.

(4) Represents the net loss (income) attributable to the noncontrolling interest in BHR (for 2012, 2013 and first quarter 2014) and the Professional Groups (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Consolidation of VIEs”) (for 2013 and first quarter 2014) and the net loss (income) in the Pro Forma columns, the Pro Forma as Adjusted columns and the Pro Forma as Adjusted including CRMS Acquisition columns of (i) the Professional Groups and (ii) the net income attributable to the stockholders of AAC that did not exchange their shares for Holdings common stock.

12

Table of Contents

(5) After giving effect to the subsidiary short-form merger with AAC that we expect to complete subsequent to this offering, pro forma basic and diluted earnings per share attributable to common stockholders would be and , respectively, based on pro forma basic and diluted weighted-average shares outstanding of and , respectively.

(6) Adjusted EBITDA is a “non-GAAP financial measure” as defined under the rules and regulations promulgated by the U.S. Securities and Exchange Commission or SEC. We define Adjusted EBITDA as net income adjusted for interest expense, depreciation and amortization expense, income tax expense, stock-based compensation and related tax reimbursements, litigation settlement and restructuring charges and acquisition related de novo startup expenses, which includes professional services for accounting, legal and valuation services related to the acquisitions and legal and licensing expenses related to de novo projects. Adjusted EBITDA, as presented in this prospectus, is considered a supplemental measure of our performance and is not required by, or presented in accordance with, generally accepted accounting principles in the United States or GAAP. Adjusted EBITDA is not a measure of our financial performance under GAAP and should not be considered as an alternative to net income or any other performance measures derived in accordance with GAAP. We have included information concerning Adjusted EBITDA in this prospectus because we believe that such information is used by certain investors as a measure of a company’s historical performance. We believe this measure is frequently used by securities analysts, investors and other interested parties in the evaluation of issuers of equity securities, many of which present EBITDA and Adjusted EBITDA when reporting their results. Because Adjusted EBITDA is not determined in accordance with GAAP, it is subject to varying calculations and may not be comparable to the Adjusted EBITDA (or similarly titled measures) of other companies. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or nonrecurring items. The following table presents a reconciliation of Adjusted EBITDA to net income, the most comparable GAAP measure, for each of the periods indicated:

| Year Ended December 31, 2013 | Three Months Ended March 31, 2013 Actual (unaudited) |

Three Months Ended March 31, 2014 | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, |

Pro Forma as Adjusted |

Pro Forma as Adjusted including CRMS Acquisition |

Actual (unaudited) |

Pro Forma as Adjusted |

Pro Forma as Adjusted including CRMS Acquisition |

|||||||||||||||||||||||||||||||

| 2011 | 2012 | Actual | ||||||||||||||||||||||||||||||||||

| Net Income |

$ | 871 | $ | 1,099 | $ | 1,492 | $ | $ | $ | 2,239 | $ | 841 | $ | $ | ||||||||||||||||||||||

| Non-GAAP Adjustments: |

||||||||||||||||||||||||||||||||||||

| Interest expense |

337 | 980 | 1,390 | 410 | 354 | |||||||||||||||||||||||||||||||

| Depreciation and amortization |

195 | 1,288 | 3,003 | 683 | 1,077 | |||||||||||||||||||||||||||||||

| Income tax expense |

652 | 1,148 | 615 | 1,352 | 615 | |||||||||||||||||||||||||||||||

| Stock-based compensation and related tax reimbursements |

— | 2,408 | 1,649 | 303 | 705 | |||||||||||||||||||||||||||||||

| Litigation settlement |

— | — | 2,588 | — | — | |||||||||||||||||||||||||||||||

| Restructuring |

— | — | 806 | — | — | |||||||||||||||||||||||||||||||

| Acquisition related and de novo start-up expenses |

— | 245 | 15 | 15 | — | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Adjusted EBITDA |

$ | 2,055 | $ | 7,168 | $ | 11,558 | $ | $ | $ | 5,002 | $ | 3,592 | $ | $ | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

(7) Reflects the issuance of shares of Holdings common stock at the initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus) and the estimated net proceeds of $ and a use of a portion of the proceeds to repay approximately $ million of outstanding indebtedness. Each $1.00 increase or decrease in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase or decrease, as applicable, our cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $ million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

(8) For additional discussion of mezzanine equity and noncontrolling interest, see Note 11 to our audited financial statements included elsewhere in this prospectus.

(9) Noncontrolling interest represents the equity of BHR and the Professional Groups (as defined in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Consolidation of VIEs”) that we do not own as well as the outstanding shares of AAC common stock that were not exchanged for shares of Holdings common stock.

(10) Includes client census at all of our owned or leased inpatient facilities, including FitRx, as well as beds obtained through contractual arrangements to meet demand exceeding capacity. For additional information about contracted beds, see “Revenues” under Note 3 to our audited financial statements included elsewhere in this prospectus.

(11) Average daily revenue is calculated as total revenues during the period divided by the product of the number of days in the period multiplied by average daily census.

13

Table of Contents

(12) Average net daily revenue is calculated as total revenues less provision for doubtful accounts during the period dividend by the product of the number of days in the period multiplied by average daily census.

(13) Includes total client admissions for the period presented.

(14) Bed count at end of period includes all beds at owned and leased inpatient facilities, including FitRx, but excludes contracted beds as of December 31, 2012. We did not have any contracted beds as of any other period presented. Bed count at the end of the 2012 period and the March 31, 2013 period includes 70 beds at our former Leading Edge facility, which was closed in the second quarter of 2013. For additional information regarding the closure of the Leading Edge facility, see Note 13 to our audited financial statements included elsewhere in this prospectus. In the first quarter of 2014, we added two beds at the FitRx facility to accommodate increased client census and eliminated six beds at The Academy facility as a result of an expired housing lease.

14

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risk factors discussed below, as well as the other information presented in this prospectus, in evaluating us, our business and an investment in our common stock. If any of the matters highlighted by the following risks actually occur, our business, financial condition, results of operations, cash flows and prospects could be materially and adversely affected. As a result, the trading price of our common stock could decline and you could lose all or part of your investment in our common stock. See “Special Note Regarding Forward-Looking Statements.”

Risks Related to Our Business

Our revenues, profitability and cash flows could be materially adversely affected if we are unable to operate certain key treatment facilities or our corporate office.

We derive a significant portion of our revenues from three treatment facilities located in California, Nevada and Texas. These treatment facilities accounted for 76.5% of our total revenues in 2013 and 83.8% for the three months ended March 31, 2014. It is likely that a small number of facilities will continue to contribute a significant portion of our total revenues in any given year for the foreseeable future. Additionally, we have a centralized corporate office that houses our accounting, billing and collections, information technology, marketing and call center departments. If any event occurs that would result in a complete or partial shutdown of any of these facilities or our centralized corporate office, including, without limitation, any material changes in legislative, regulatory, economic, environmental or competitive conditions in these states or natural disasters such as hurricanes, earthquakes, tornadoes or floods or prolonged airline disruptions for any reason, such event could lead to decreased revenues and/or higher operating costs, which could have a material adverse effect on our revenues, profitability and cash flows.

We rely on our multi-faceted sales and marketing program to continuously attract and enroll clients to our network of facilities. Any disruption in our national sales and marketing program would have a material adverse effect on our business, financial condition and results of operations.

We believe our national sales and marketing program provides us with a competitive advantage compared to treatment facilities that primarily target local geographic areas and use fewer marketing channels to attract clients. If any disruption occurs in our national sales and marketing program for any reason or if we are unable to effectively attract and enroll new clients to our network of facilities, our ability to maintain census could be adversely affected, which would have a material adverse effect on our business, financial condition and results of operations.

In addition, our ability to grow or even to maintain our existing level of business depends significantly on our ability to establish and maintain close working and referral relationships with hospitals, other treatment facilities, employers, alumni, employee assistance programs and other referral sources. We have no binding commitments with any of these referral sources. We may not be able to maintain our existing referral relationships or develop and maintain new relationships in existing or new markets. If we lose existing relationships with our referral sources, the number of people to whom we provide services may decline, which may adversely affect our revenues. Also, if we fail to develop new referral relationships, our growth may be restrained.

We derive a significant portion of our revenues from providing services to clients covered by third-party payors who could reduce their reimbursement rates or otherwise restrain our ability to obtain, or provide services to, clients. This risk is heightened because we are generally an “out-of-network” provider.

Managed care organizations and other third-party payors pay for the services that we provide to many of our clients. For 2013 and the three months ended March 31, 2014, approximately 90% and 91% of our revenues, respectively, were reimbursable by third-party payors, including amounts paid by such payors to clients, with the

15

Table of Contents

remaining portion payable directly by our clients. If any of these third-party payors reduce their reimbursement rates or elect not to cover some or all of our services, our business, financial condition and results of operations may decline.

In addition to limiting the amounts payors will pay for the services we provide to their members, controls imposed by third-party payors designed to reduce admissions and the length of stay for clients, commonly referred to as “utilization review,” have affected and are expected to continue to affect our facilities. Utilization review entails the review of the admission and course of treatment of a client by third-party payors. Inpatient utilization, average lengths of stay and occupancy rates continue to be negatively affected by payor-required preadmission authorization and utilization review and by payor pressure to maximize outpatient and alternative healthcare delivery services for less acutely ill clients. Efforts to impose more stringent cost controls are expected to continue. Although we are unable to predict the effect these controls and changes will have on our operations, significant limits on the scope of services reimbursed and on reimbursement rates and fees could have a material adverse effect on our business, financial condition and results of operations.

We are considered an “out-of-network” provider with respect to the vast majority of third-party payors, and, therefore, we bill our full charges for services covered by such third-party payors. Third-party payors will generally attempt to limit use of out-of-network providers by requiring clients to pay higher copayment and/or deductible amounts for out-of-network care. Additionally, third-party payors have become increasingly aggressive in attempting to minimize the use of out-of-network providers by disregarding the assignment of payment from clients to out-of-network providers (i.e., sending payments to clients instead of out-of-network providers), capping out-of-network benefits payable to clients, waiving out-of-pocket payment amounts and initiating litigation against out-of-network providers for interference with contractual relationships, insurance fraud and violation of state licensing and consumer protection laws. If third-party payors impose further restrictions on out-of-network providers, our revenues could be threatened, forcing our facilities to participate with third-party payors and accept lower reimbursement rates compared to our historic reimbursement rates.

Third-party payors also are entering into sole source contracts with some healthcare providers, which could effectively limit our pool of potential clients. Moreover, third-party payors are beginning to carve out specific services, including substance abuse treatment services, and establish small, specialized networks of providers for such services at fixed reimbursement rates. Continued growth in the use of carve-out arrangements could materially adversely affect our business to the extent we are not selected to participate in such smaller specialized networks or if the reimbursement rate is not adequate to cover the cost of providing the service.

An increase in uninsured and underinsured clients or the deterioration in the collectability of the accounts of such clients could have a material adverse effect on our business, financial condition and results of operations.

Collection of receivables from third-party payors and clients is critical to our operating performance. Our primary collection risks are (i) the risk of overestimating our net revenues at the time of billing that may result in us receiving less than the recorded receivable, (ii) the risk of non-payment as a result of commercial insurance companies denying claims, (iii) the risk that clients will fail to remit insurance payments to us when the commercial insurance company pays out-of-network claims directly to the client, (iv) resource and capacity constraints that may prevent us from handling the volume of billing and collection issues in a timely manner, (v) the risk that clients do not pay us for their self-pay balance (including co-pays, deductibles and any portion of the claim not covered by insurance) and (vi) the risk of non-payment from uninsured clients. Additionally, our ability to hire and retain experienced personnel also affects our ability to bill and collect accounts in a timely manner. We establish our provision for doubtful accounts based on the aging of the receivables and taking into consideration historical collection experience by facilities, services provided and respective payors’ historical reimbursements. At December 31, 2013 and March 31, 2014, our allowance for doubtful accounts represented approximately 35.2% and 38.5%, respectively, of our accounts receivable balance as of such date, with three commercial payors each representing in excess of 10% of the accounts receivable balance as of December 31,

16

Table of Contents

2013 and March 31, 2014. We routinely review accounts receivable balances in conjunction with these factors and other economic conditions that might ultimately affect the collectability of the client accounts and make adjustments to our allowances as warranted. Significant changes in business office operations, payor mix or economic conditions, including changes resulting from implementation of the Affordable Care Act, could affect our collection of accounts receivable, cash flows and results of operations. In addition, increased client concentration in states that permit commercial insurance companies to pay out-of-network claims directly to the client instead of us, such as California and Nevada, will adversely affect our collection of receivables. If we experience unexpected increases in the growth of uninsured and underinsured clients or in our provision for doubtful accounts or unexpected changes in reimbursement rates by third-party payors, it could have a material adverse effect on our business, financial condition and results of operations.

If we overestimate the reimbursement amounts that payors will pay us for services performed, it would increase our revenue adjustments, which could have a material adverse effect on our revenues, profitability and cash flows.

We recognize revenues from commercial payors at the time services are provided based on our estimate of the amount that payors will pay us for the services performed. We estimate the net realizable value of revenues by adjusting gross client charges using our expected realization and applying this discount to gross client charges. Through December 31, 2013, our expected realization was determined by management after taking into account historical collections received from the commercial payors since our inception compared to the gross client charges billed. Beginning in January 2014, we enhanced the methodology related to our net realizable value to more quickly react to potential changes in reimbursements by facility, by type of service and by payor. As a result, management adjusted the expected realization to reflect a twelve-month historical analysis of reimbursement data by facility in addition to considering the type of services provided, the payors and the gross client charge rates. This adjustment resulted in a decrease in our expected realization for the first quarter of 2014. Although we are unable to quantify the future effects of this change in methodology, we currently anticipate this adjustment will decrease our expected realization and net realizable value of revenues over the remainder of 2014.

During the three months ended March 31, 2014, we experienced a decline in our collection rates as expressed as a percentage of gross client charges. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations—Comparison of Three Months ended March 31, 2014 to Three Months ended March 31, 2013—Revenues.” A significant or sustained decrease in our collection rates could have a material adverse effect on our operating results. There is no assurance that we will be able to maintain or improve historical collection rates in future reporting periods.

Estimates of net realizable value are subject to significant judgment and approximation by management. It is possible that actual results could differ from the historical estimates management has used to help determine the net realizable value of revenues. If our actual collections either exceed or are less than the net realizable value estimates, we will record a revenue adjustment, either positive or negative, for the difference between our estimate of the receivable and the amount actually collected in the reporting period in which the collection occurred. A significant negative revenue adjustment could have a material adverse effect on our revenues, profitability and cash flows.

Certain third-party payors account for a significant portion of our revenues, and the reduction of reimbursement rates by any such payor could have a material adverse effect on our revenues, profitability and cash flows.

For the year ended December 31, 2013, approximately 12.3% of our revenue reimbursements came from Blue Cross Blue Shield of California, 12.1% came from Aetna, and 10.3% came from United Behavioral Health. No other payor accounted for more than 10% of our revenue reimbursements for the year ended December 31, 2013. For the three months ended March 31, 2014, approximately 16.1% of our revenue reimbursements came from Anthem Blue Cross Blue Shield of Colorado, 13.6% came from Blue Cross Blue Shield of California and 12.4% came from Aetna. No other payor accounted for more than 10% of our revenue

17

Table of Contents

reimbursements for the three months ended March 31, 2014. If any of these or other third-party payors reduce their reimbursement rates for the services we provide, our revenues, profitability and cash flows could be materially adversely affected.

Our business may face significant risks with respect to future de novo expansion, including the time and costs of identifying new geographic markets, the ability to obtain necessary licensure and other zoning or regulatory approvals and significant start-up costs including advertising, marketing and the costs of providing equipment, furnishings, supplies and other capital resources.

As part of our growth strategy, we intend to develop new substance abuse treatment facilities in existing and new markets, either by building a new facility from the ground up or acquiring an existing facility with an alternative use and repurposing it as a substance abuse treatment facility. Such de novo expansion involves significant risks, including, but not limited to, the following:

| • | identifying locations in suitable geographic markets can be a lengthy and costly process; |

| • | a change in existing comprehensive zoning plans or zoning regulations that imposes additional restrictions on use or requirements could impact our expansion into otherwise suitable geographic markets; |

| • | the de novo facility may require significant advertising and marketing expenditures to attract clients; |

| • | we will need to provide each de novo facility with the appropriate equipment, furnishings, materials, supplies and other capital resources; |

| • | our ability to obtain licensure, obtain accreditation, establish relationships with healthcare providers in the community and delays or difficulty in installing our operating and information systems; |

| • | the time and costs of evaluating new markets, hiring experienced local physicians, management and staff and opening new facilities, and the time lags between these activities and the generation of sufficient revenues to support the costs of the expansion; and |

| • | our ability to finance de novo expansion and possible dilution to our existing stockholders if our common stock is used as consideration. |

As a result of these risks, there can be no assurance that a de novo treatment facility will become profitable.

Our acquisition strategy exposes us to a variety of operational and financial risks, which may have a material adverse effect on our business, financial condition and results of operations.