|

|

|

OMB APPROVAL | |

|

|

|

OMB Number: |

3235-0570 |

|

|

|

Expires: |

August 31, 2020 |

|

|

UNITED STATES |

Estimated average burden hours per response. . . . . . . . . . . . . . .20.6 | |

|

|

SECURITIES AND EXCHANGE COMMISSION |

| |

|

|

Washington, D.C. 20549 |

| |

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

Investment Company Act file number |

811-22955 | ||||||||

|

| |||||||||

|

Tekla Healthcare Opportunities Fund | |||||||||

|

(Exact name of registrant as specified in charter) | |||||||||

|

| |||||||||

|

100 Federal Street, 19th Floor, Boston, MA |

|

02110 | |||||||

|

(Address of principal executive offices) |

|

(Zip code) | |||||||

|

| |||||||||

|

Laura Woodward, Chief Compliance Officer and Vice President of Fund Administration | |||||||||

|

(Name and address of agent for service) | |||||||||

|

| |||||||||

|

Registrant’s telephone number, including area code: |

617-772-8500 |

| |||||||

|

| |||||||||

|

Date of fiscal year end: |

September 30 |

| |||||||

|

| |||||||||

|

Date of reporting period: |

October 1, 2018 to September 30, 2019 |

| |||||||

ITEM 1. REPORTS TO STOCKHOLDERS.

TEKLA HEALTHCARE

OPPORTUNITIES FUND

Annual Report

2 0 1 9

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund's website, teklacap.com., and you will be notified by mail each time a report is posted and provided with a website link to access the report.

Beginning on January 1, 2019, you may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call Computershare at 1-800-426-5523 to inform the Fund that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held in your account if you invest through your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

TEKLA HEALTHCARE

OPPORTUNITIES FUND

Distribution policy: The Fund has implemented a managed distribution policy (the Policy) that provides for monthly distributions at a rate set by the Board of Trustees. Under the current Policy, the Fund intends to make monthly distributions at a rate of $0.1125 per share to shareholders of record. The Policy would result in a return of capital to shareholders, if the amount of the distribution exceeds the Fund's net investment income and realized capital gains. A return of capital may occur, for example, when some or all of the money that you invested in the Fund is paid back to you. A return of capital distribution does not necessarily reflect the Fund's investment performance and should not be confused with "yield" or "income."

The amounts and sources of distributions reported in the Fund's notices pursuant to Section 19(a) of the Investment Company Act of 1940 are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund's investment experience during its fiscal year and may be subject to changes based on tax regulations. The Fund will send you a Form 1099-DIV for the calendar year that tells you how to report distributions for federal income tax purposes.

You should not draw any conclusions about the Fund's investment performance from the amount of distributions pursuant to the Policy or from the terms of the Policy. The Policy has been established by the Trustees and may be changed or terminated by them without shareholder approval. The Trustees regularly review the Policy and the frequency and rate of distributions considering the purpose and effect of the Policy, the financial market environment, and the Fund's income, capital gains and capital available to pay distributions. The suspension or termination of the Policy could have the effect of creating a trading discount or widening an existing trading discount. At this time there are no reasonably foreseeable circumstances that might cause the Trustees to terminate the Policy.

Consider these risks before investing: As with any investment company that invests in equity securities, the Fund is subject to market risk—the possibility that the prices of equity securities will decline over short or extended periods of time. As a result, the value of an investment in the Fund's shares will fluctuate with the market generally and market sectors in particular. You could lose money over short or long periods of time. Political and economic news can influence market-wide trends and can cause disruptions in the U.S. or world financial markets. Other factors may be ignored by the market as a whole but may cause movements in the price of one company's stock or the stock of companies in one or more industries. All of these factors may have a greater impact on initial public offerings and emerging company shares. Different types of equity securities tend to shift into and out of favor with investors, depending on market and economic conditions. The performance of funds that invest in equity securities of healthcare companies may at times be better or worse than the performance of funds that focus on other types of securities or that have a broader investment style.

TEKLA HEALTHCARE

OPPORTUNITIES FUND

Dear Shareholders,

Investing in healthcare companies continues to be an interesting and dynamic endeavor. As investors, our primary emphasis at Tekla has been to identify novel technologies and drugs being developed and/or commercialized by smart management teams and then invest in the associated companies at the right time and price. Over the last twenty years, we have seen and reported to you on remarkable progress in improving the quality and durability of patients' lives. Throughout this time there has been widespread agreement about the novelty and impact of these new drugs, products and related services, but there also has been legitimate concern about the associated dollar cost, particularly in the U.S., to both individuals and society. The result has been the promulgation of numerous proposals to dramatically change or even replace the current healthcare insurance/delivery system, at least in the United States. A popular U.S. theme reprised with vigor of late is to replace the current U.S. healthcare delivery system, which is largely employer based. The most common proposal is a centrally managed, single payer system which would presumably define benefits and premiums for recipients, as well as reimbursement/payments for providers, manufacturers and distributors. Given the current national conversation about this and the potential impact of such change in the U.S., the largest global pharma/biotech market, we have developed a view of the likely outcome and its impact on our investing approach.

We conclude that there may well be some near-term volatility in our sector rising from the recent proposals, particularly in the next year as the U.S. presidential election is resolved. However, beyond this period, we don't foresee dramatic change in how healthcare works in the U.S. While Americans see issues with healthcare cost, coverage and quality in general, a significant majority of U.S. adults rate both their own healthcare coverage (69%) and the care they personally receive (80%) as Good or Excellent (Source: Gallup). In addition, the rate at which healthcare spending is growing has declined in recent years (Source: American Medical Association). Furthermore, as we have previously noted, healthcare comprises almost 20% of the U.S. economy and a complete replacement would be tumultuous. The combination of these factors does not suggest to us any fundamental change in the near term. Rather than sweeping change, we expect that there will continue to be modest changes to address the specific issues. As a result, we do not conclude the need for a major change in our investing approach. We will incorporate market, sentiment and cost related factors, but our

1

fundamental approach to investing will continue to emphasize differentiated products and talented management.

Having said this, given the breadth of the healthcare sector, there will always be macro and micro factors that make us more or less confident in the short-term prospects of the healthcare sector or one of its subsectors. In recent months, for example, the sector has seen increased volatility relative to other times and has underperformed the broad S&P 500® Index* ("SPX"). This makes us a bit more cautious than usual. But as UBS Financial Services ("UBS") has recently noted, the healthcare sector, which often trades at a premium to the broad market, is now trading at a wider discount to the broad market than it has in quite some time. UBS also notes the long-term consistent quality of healthcare earnings history and points out that, unlike the broad SPX market, forward earnings estimates for the healthcare sector have not been negative in any of the last 20 years. They further conclude that we are entering into a "risk aversion" period in the current market cycle, based on the Purchasing Managers' Index® declining to less than 50. UBS' analysis indicates that healthcare has historically outperformed the broad market in such periods. As you might expect, these factors make us more positive toward the healthcare sector in the near and intermediate term.

With regard to micro factors, there are, as usual, both bearish and bullish factors. As an example, litigation involving opioid producing companies has been a negative of late, hurting individual company stocks and generally depressing sentiment and valuations in the specialty pharma and drug distributor subsectors. The hope is that a "global" settlement will lift valuations.

Novel approaches to product and service delivery hold both encouraging and cautionary possibilities. Retail giant Amazon, for example, continues to push deeper into healthcare. The Company remains a potential disruptor to traditional healthcare channel companies with a growing portfolio of medical supplies. The acquisition of PillPack gave Amazon mail order pharmacy capabilities which may well compete with traditional players. In addition, Amazon continues to advance its joint venture with Berkshire Hathaway and JP Morgan which aims to reduce healthcare costs for employees. While these developments are seen by many as threatening the status quo, we continue to see opportunity in the form of new entities that seek to change how various aspects of medical and related sector (e.g., consumer) products are delivered to consumers. Our view as always is that the market is evolving and that traditional players that can evolve with it will prosper and that those that don't won't. We endeavor to invest in the former and divest the latter.

2

In addition, the development and commercialization of biosimilar drug products continues to move forward, providing an opportunity to reduce the cost to payers and patients of biological products that have lost proprietary status. A new group of companies has been built for the purpose of competing with traditional pharma and biotech entities. Interestingly, a number of traditional pharma players have developed their own subsidiaries aimed at competing in the biosimilar market. We think these developments will drive both quality and cost effectiveness.

Clinical trial successes and failures continue to both excite and disappoint the market. Among recent successes, we have seen cardiovascular benefit demonstrated by two new products. Amarin Corporation plc's Vascepa has demonstrated a mortality benefit and The Medicine Co.'s gene therapy product has demonstrated a differentiated way to reduce cholesterol. Furthermore, and surprisingly to many, after an apparent failure earlier this year that hit the biotech sector hard, it may well be that an anti-amyloid antibody developed by Biogen, Inc. can have a beneficial impact on Alzheimer's disease. Balancing these positive developments there have been, as always a few results that have disappointed us in recent months. These include Gilead Sciences, Inc.'s recent NASH trial, Novavax, Inc.'s RSV trial and Allergan plc's recent trial in major depressive disorder.

Probably the most encouraging development in recent quarters has been an apparent increase in the rate of successful merger and acquisition activity. After some initial uncertainty, it now looks like the megamerger of Bristol-Myers Squibb and Co. and Celgene Corp. will be completed. We are also encouraged by the expected acquisition of Allergan by AbbVie, Inc. and the merger of Mylan N.V. with Pfizer, Inc.'s generic drug unit.

As always, we thank you for your consideration of the Tekla Funds. Please call our distribution partner Destra Capital Advisors LLC or us if you have any questions.

Be well,

|

|

||||||

Daniel R. Omstead

President and Portfolio Manager

3

TEKLA HEALTHCARE

OPPORTUNITIES FUND

Fund Essentials

Objective of the Fund

The Fund's investment objective is to seek current income and long-term capital appreciation.

Description of the Fund

Tekla Healthcare Opportunities Fund ("THQ") is a non-diversified closed-end healthcare fund traded on the New York Stock Exchange under the ticker THQ. THQ employs a versatile growth and income investment strategy investing across all healthcare sub-sectors and across a company's full capital structure.

Investment Philosophy

Tekla Capital Management LLC, the Investment Adviser to the Fund, believes that:

• Aging demographics and adoption of new medical products and services may provide long-term tailwinds for healthcare companies

• Late stage biotechnology product pipeline could lead to significant increases in biotechnology sales

• Investment opportunity spans 11 sub-sectors including biotechnology, healthcare technology, managed care and healthcare REITs

• Robust M&A activity in healthcare may create additional investment opportunities

Fund Overview and Characteristics as of 9/30/19

|

Market Price1 |

$ |

17.46 |

|||||

|

NAV2 |

$ |

18.80 |

|||||

|

Premium/(Discount) |

-7.13 |

% |

|||||

|

Average 30 Day Volume |

95,990 | ||||||

|

Net Assets |

$ |

779,686,117 |

|||||

|

Managed Assets |

$ |

1,004,686,117 |

|||||

|

Leverage Outstanding |

$ |

225,000,000 |

|||||

|

Total Leverage Ratio3 |

22.40 |

% |

|||||

|

Ticker |

THQ |

||||||

|

NAV Ticker |

XTHQX |

||||||

|

Commencement of Operations Date |

7/31/14 |

||||||

|

Fiscal Year to Date Distributions per Share |

$ |

1.35 |

|||||

1 The closing price at which the Fund's shares were traded on the exchange.

2 Per-share dollar value of the Fund, calculated by dividing the total value of all the securities in its portfolio, plus any other assets and less liabilities, by the number of Fund shares outstanding.

3 As a percentage of managed assets

Holdings of the Fund (Data is based on net assets)

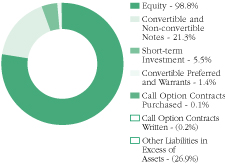

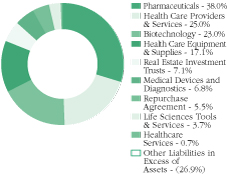

Asset Allocation as of 9/30/19

Sector Diversification as of 9/30/19

This data is subject to change on a daily basis.

4

TEKLA HEALTHCARE

OPPORTUNITIES FUND

Largest Holdings by Issuer

(Excludes Short-Term Investments)

As of September 30, 2019

| Issuer – Sector |

% of Net Assets |

||||||

| Merck & Co., Inc. – Pharmaceuticals |

8.8 |

% |

|||||

| Johnson & Johnson – Pharmaceuticals |

8.3 |

% |

|||||

| Pfizer, Inc. – Pharmaceuticals |

7.0 |

% |

|||||

| UnitedHealth Group, Inc. – Health Care Providers & Services |

6.9 |

% |

|||||

| Amgen, Inc. – Biotechnology |

4.7 |

% |

|||||

| Anthem, Inc. – Health Care Providers & Services |

4.3 |

% |

|||||

| AbbVie, Inc. – Biotechnology |

4.2 |

% |

|||||

| Bristol-Myers Squibb Co. – Pharmaceuticals |

4.2 |

% |

|||||

| CVS Health Corp. – Health Care Providers & Services |

4.1 |

% |

|||||

| Gilead Sciences, Inc. – Biotechnology |

3.9 |

% |

|||||

| Medtronic plc – Health Care Equipment & Supplies |

3.2 |

% |

|||||

| Abbott Laboratories – Health Care Equipment & Supplies |

2.7 |

% |

|||||

| Celgene Corp. – Biotechnology |

2.6 |

% |

|||||

| Stryker Corp. – Health Care Equipment & Supplies |

2.3 |

% |

|||||

| Intuitive Surgical, Inc. – Medical Devices and Diagnostics |

2.3 |

% |

|||||

| Thermo Fisher Scientific, Inc. – Life Sciences Tools & Services |

2.1 |

% |

|||||

| Allergan plc – Pharmaceuticals |

2.0 |

% |

|||||

| Zoetis, Inc. – Pharmaceuticals |

1.8 |

% |

|||||

| Becton, Dickinson and Co. – Health Care Equipment & Supplies |

1.7 |

% |

|||||

| Zimmer Biomet Holdings, Inc. – Health Care Equipment & Supplies |

1.7 |

% |

|||||

Portfolio Highlights as of September 30, 2019

Among other investments, Tekla Healthcare Opportunities Fund's performance benefitted in the past year by the following:

Galapagos NV (GLPG) is a Belgian/Dutch large-cap company with a predominantly inflammatory focus that is on the cusp of transitioning to a commercial stage company on the basis of their Gilead-partnered asset, filgotinib. We expect regulatory filing for rheumatoid arthritis by the end of the year, with approval and launch coming in mid-'20. Although likely preclusive of a near term acquisition, we view the close collaboration with Gilead as a long-term asset for the Company that should accelerate their earlier stage clinical compounds.

DENTSPLY Sirona, Inc. (XRAY) is a global distributor and manufacturer of dental products that is in the midst of a successful turnaround.

5

In late 2018 the stock lost over half its value when the Company was forced to lower financial outlook guidance due to pricing pressures and problems with its distributor relationships. As a result, Dentsply enacted a corporate restructuring process and streamlined its sales and manufacturing divisions. These initiatives have begun to bear fruit as the stock has posted solid earnings the last two quarters and we believe remains poised for significant upside.

The Medicines Co. (MDCO) has a lead asset, the RNA-modulator Inclisiran, in multiple dyslipidemia phase III studies for which the company will report results in the coming months. Assuming success, this agent will represent a new modality in the treatment of dyslipidemia with an annual vaccine-like dosing regimen that should prove attractive to the medical community. The stock has appreciated significantly since the beginning of the year, helping the Fund's performance.

Among other examples, Tekla Healthcare Opportunities Fund's performance was negatively impacted by the following investments:

Teva Pharmaceutical Industries Ltd. (TEVA) is one of the largest manufacturers of generic pharmaceuticals. The U.S. generic drug industry has faced significant headwinds over the past several years due to increased competition, fewer blockbuster drugs rolling off patent, consolidation among large buying consortiums, and uncertainty around opioid drug litigation. Overall, this has led to persistent generic price deflation and a challenging operating environment. Following a management change in late 2017, turnaround efforts have included the rationalization of unprofitable products and significant cost cutting efforts. Overall, TEVA's restructuring efforts and stabilization of generic deflation helps position the company to deleverage its balance sheet and return to growth, but opioid litigation uncertainty continues to weigh on TEVA. We have decreased our ownership of this stock over the past year, but Fund performance was negatively affected in the reporting period.

Diplomat Pharmacy, Inc. (DPLO) is the largest independent provider of specialty pharmacy services in the U.S., positioning it well to capitalize on the rapidly growing specialty drug market. The Company acquired two small middle market Pharmacy Benefit Managers ("PBM") to diversify its business, but integration did not proceed as hoped and DPLO saw significant PBM customer losses which has weighed on the Company's growth and share price. The Company's specialty pharmacy and infusion businesses remain attractive assets, and management is currently exploring strategic alternatives. There is a reasonable likelihood that the Company is ultimately acquired by a strategic buyer.

6

Exelixis, Inc. (EXEL) is a mid-cap biotech company focused on the development of small molecule TKIs for oncology. Its lead product, Cabometyx, is approved in kidney cancer, where it appears likely to remain the mainstay of treatment in the second-line setting. However, prospects for use in front-line patients may be limited given emerging competition from other immuno-oncology combinations. Cabometyx is also approved for second-line liver cancer, but we see limited uptake in this tumor type.

Fund Performance

THQ is a closed-end fund which invests predominantly in healthcare companies. Subject to regular consideration, the Trustees of THQ have instituted a policy of making monthly distributions to shareholders.

The Fund invests in equity and debt of healthcare companies. The Fund seeks to benefit from the earnings growth of the healthcare industry while capturing income. Income is derived from multiple sources including equity dividends, fixed income coupons, real estate investment trust distributions, convertible securities coupons and selective equity covered call writing premiums. In order to accomplish its objectives, THQ often holds a majority of its assets in equities. Allocation of assets to various healthcare sectors can vary significantly as can the percentage of the portfolio which is overwritten.

The Fund may invest up to 20 percent of managed assets, measured at the time of investment, in the debt of healthcare companies. It may also invest up to 25 percent of managed assets in healthcare REITs. The Fund may also hold up to 30 percent of managed assets in convertible securities and may invest a portion of its assets in restricted securities. In order to generate additional "current" income, THQ often sells (or writes) calls against a material portion of its equity assets. The portion of equity assets overwritten can vary, but usually represents less than 20 percent of managed assets. At times, the overwritten portion of assets is materially less than 20 percent of managed assets. The use of covered calls is intended to produce "current" income, but may limit upside in bullish markets. The Fund may also use leverage to enhance yield. The Fund may incur leverage up to 20 percent of managed assets at the time of borrowing. "Managed Assets" means the total assets of the Fund (including any assets attributable to borrowings for investment purposes) minus the sum of the Fund's accrued liabilities (other than liabilities representing borrowings for investment purposes).

The Fund considers investments in companies of all sizes and in all healthcare subsectors, including but not limited to, biotechnology,

7

pharmaceuticals, healthcare equipment, healthcare supplies, life science tools and services, healthcare distributors, managed healthcare, healthcare technology, and healthcare facilities. The Fund emphasizes innovation, investing both in public and pre-public venture companies. The Fund considers its pre-public and other restricted investments to be a differentiating characteristic. Among the various healthcare subsectors, THQ has considered the biotechnology subsector, including both pre-public and public companies, to be a key contributor to the healthcare sector. The Fund holds biotech assets, including both public and pre-public, often representing 15-30% of net assets.

There is no commonly published index which matches the investment strategy of THQ. With respect to the Fund's equity investments, THQ often holds 15-30% of its assets in biotechnology. This compares with the S&P Composite 1500® Health Care Index* ("S15HLTH") that consists of more than 170 companies representing most or all of the healthcare subsectors in which THQ typically invests; biotechnology often represents 15-20% of this index. By contrast, the NASDAQ Biotechnology Index®* ("NBI"), which contains approximately 220 constituents, is much more narrowly constructed. The vast majority of this index is comprised of biotechnology, pharmaceutical and life science tools companies. In recent years, biotechnology has often represented 72-82% of the NBI. Neither the S15HLTH nor NBI indices contain any material amount of pre-public company assets.

The S&P 500® Health Care Corporate Bond Index* ("SP5HCBIT") measures the performance of U.S. corporate debt issued by constituents in the healthcare sector of the SPX. This index is generally reflective of the debt assets in which THQ invests though the Fund invests in the SPX debt components as well as those of smaller capitalization companies.

The FTSE NAREIT Health Care Property Sector Index®* ("FNHEA") is comprised of U.S. publicly traded REITs in the healthcare sector. This index is generally reflective of the REITs in which THQ invests.

Given the circumstances, we present both NAV and stock returns for the Fund in comparison to several commonly published indices. We note that THQ is a dynamically configured multi-asset class healthcare growth and income fund. There is no readily available index comprised of similar characteristics to THQ and to which THQ can directly be compared. Therefore, we provide returns for a number of indices representing the major components of THQ's assets. Having said this, we note that there are no readily available indices representing the covered call strategy employed by THQ or the restricted security components of THQ. We

8

also note that unlike any of the various indicies we describe, the Fund makes a regular cash distribution to shareholders.

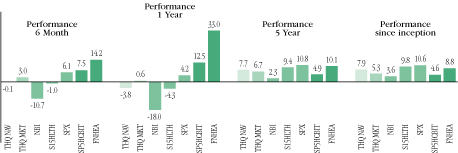

Fund Performance as of September 30, 2019

|

Period |

THQ NAV |

THQ MKT |

NBI |

S15HLTH |

SPX |

SP5HCBIT |

FNHEA |

||||||||||||||||||||||||

| 6 month |

-0.11 |

3.03 |

-10.68 |

-0.99 |

6.08 |

7.52 |

14.16 |

||||||||||||||||||||||||

| 1 year |

-3.81 |

0.63 |

-17.99 |

-4.33 |

4.25 |

12.53 |

32.99 |

||||||||||||||||||||||||

| 5 year |

7.70 |

6.65 |

2.27 |

9.43 |

10.83 |

4.93 |

10.08 |

||||||||||||||||||||||||

|

inception |

7.85 |

5.28 |

3.60 |

9.78 |

10.55 |

4.65 |

8.79 |

||||||||||||||||||||||||

Inception date July 29, 2014

All performance over one-year has been annualized.

Performance data quoted represents past performance, which is no guarantee of future results, and current performance may be lower or higher than the figures shown. The NAV total return takes into account the Fund's total annual expenses and does not reflect transaction charges. If transaction charges were reflected, NAV total return would be reduced. All distributions are assumed to be reinvested either in accordance with the dividend reinvestment plan (DRIP) for market price returns or NAV for NAV returns. Until the DRIP price is available from the Plan Agent, the market price returns reflect the reinvestment at the closing market price on the last business day of the month. Once the DRIP is available around mid-month, the market price returns are updated to reflect reinvestment at the DRIP price.

**The trademarks NASDAQ Biotechnology Index®, S&P Composite 1500® Health Care Index, S&P 500® Index, S&P 500® Health Care Corporate Bond Index and FTSE NAREIT Health Care Property Sector Index® referenced in this report are the property of their respective owners. These trademarks are not owned by or associated with the Fund or its service providers, including Tekla Capital Management LLC.

9

TEKLA HEALTHCARE

OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019

|

SHARES |

CONVERTIBLE PREFERRED AND WARRANTS (Restricted) (a) (b) - 1.4% of Net Assets |

VALUE |

|||||||||

|

Biotechnology - 1.3% |

|||||||||||

|

911,124 |

Decipher Biosciences, Inc. Series II, 8.00% |

$ |

1,272,840 |

||||||||

|

905,797 |

Decipher Biosciences, Inc. Series III, 8.00% |

1,967,391 |

|||||||||

|

1,106,444 |

Galera Therapeutics, Inc. Series C, 6.00% |

2,449,999 |

|||||||||

|

264,833 |

Oculis SA, Series B2 (c) |

2,209,308 |

|||||||||

|

2,538,462 |

Rainier Therapeutics, Inc. Series A, 6.00% |

1,302,739 |

|||||||||

|

1,470,588 |

Rainier Therapeutics, Inc. Series B, 6.00% |

1,100,000 |

|||||||||

|

10,302,277 |

|||||||||||

|

Health Care Equipment & Supplies - 0.1% |

|||||||||||

|

407,078 |

IlluminOss Medical, Inc. Series AA, 8.00% |

339,300 |

|||||||||

|

383,470 |

IlluminOss Medical, Inc. Junior Preferred, 8.00% |

38 |

|||||||||

| 21,885 |

IlluminOss Medical, Inc. Warrants (expiration 01/11/27, exercise price $1.00) |

0 |

|||||||||

| 21,885 |

IlluminOss Medical, Inc. Warrants (expiration 02/06/27, exercise price $1.00) |

0 |

|||||||||

|

32,792 |

IlluminOss Medical, Inc. Warrants (expiration 03/31/27, exercise price $1.00) |

0 |

|||||||||

|

27,356 |

IlluminOss Medical, Inc. Warrants (expiration 09/06/27, exercise price $1.00) |

0 |

|||||||||

|

10,942 |

IlluminOss Medical, Inc. Warrants (expiration 11/20/27, exercise price $1.00) |

0 |

|||||||||

| 21,388 |

IlluminOss Medical, Inc. Warrants (expiration 01/29/29, exercise price $1.00) |

0 |

|||||||||

|

5,968 |

IlluminOss Medical, Inc. Warrants (expiration 04/29/29, exercise price $1.00) |

0 |

|||||||||

|

9,423 |

IlluminOss Medical, Inc. Warrants (expiration 05/13/29, exercise price $1.00) |

0 |

|||||||||

|

13,003 |

IlluminOss Medical, Inc. Warrants (expiration 07/02/29, exercise price $1.00) |

0 |

|||||||||

|

4,250 |

IlluminOss Medical, Inc. Warrants (expiration 08/29/29, exercise price $1.00) |

0 |

|||||||||

|

24,668 |

IlluminOss Medical, Inc. Warrants (expiration 09/27/29, exercise price $1.00) |

0 |

|||||||||

|

339,338 |

|||||||||||

|

TOTAL CONVERTIBLE PREFERRED AND WARRANTS (Cost $13,022,152) |

10,641,615 |

||||||||||

The accompanying notes are an integral part of these financial statements.

10

TEKLA HEALTHCARE

OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019

(continued)

|

PRINCIPAL AMOUNT |

CONVERTIBLE AND NON-CONVERTIBLE NOTES - 21.3% of Net Assets |

VALUE |

|||||||||

|

Convertible Notes (Restricted) (a) - 0.3% |

|||||||||||

|

Biotechnology - 0.2% |

|||||||||||

|

$ |

1,315,551 |

Rainier Therapeutics, Inc. Promissory Notes, 8.00% due 03/31/20 |

$ |

1,315,551 |

|||||||

|

Health Care Equipment & Supplies - 0.1% |

|||||||||||

|

774,246 |

IlluminOss Medical, Inc. Promissory Notes, 8.00% due 12/31/21 |

774,246 |

|||||||||

|

Total Convertible Notes |

2,089,797 |

||||||||||

|

Non-Convertible Notes - 21.0% |

|||||||||||

|

Biotechnology - 4.2% |

|||||||||||

|

5,303,000 |

AbbVie, Inc., 4.25% due 11/14/28 |

5,753,953 |

|||||||||

|

3,245,000 |

AbbVie, Inc., 3.20% due 05/14/26 |

3,304,262 |

|||||||||

|

2,200,000 |

Amgen, Inc., 3.20% due 11/02/27 |

2,300,038 |

|||||||||

|

10,000,000 |

Amgen, Inc., 3.63% due 05/15/22 |

10,345,272 |

|||||||||

|

840,000 |

Biogen, Inc., 3.63% due 09/15/22 |

873,367 |

|||||||||

|

10,000,000 |

Gilead Sciences, Inc., 2.95% due 03/01/27 |

10,311,119 |

|||||||||

|

32,888,011 |

|||||||||||

|

Health Care Equipment & Supplies - 2.2% |

|||||||||||

|

2,100,000 |

Abbott Laboratories, 3.40% due 11/30/23 |

2,202,394 |

|||||||||

|

2,413,000 |

Becton, Dickinson and Co., 3.70% due 06/06/27 |

2,561,591 |

|||||||||

|

2,225,000 |

Medtronic, Inc., 3.50% due 03/15/25 |

2,388,299 |

|||||||||

|

3,500,000 |

Stryker Corp., 3.65% due 03/07/28 |

3,791,894 |

|||||||||

|

6,000,000 |

Zimmer Biomet Holdings, Inc., 4.25% due 08/15/35 |

6,069,293 |

|||||||||

|

17,013,471 |

|||||||||||

|

Health Care Providers & Services - 9.0% |

|||||||||||

|

6,393,000 |

Acadia Healthcare Co., Inc., 5.13% due 07/01/22 |

6,440,947 |

|||||||||

|

2,975,000 |

Anthem, Inc., 4.10% due 03/01/28 |

3,213,189 |

|||||||||

|

10,500,000 |

Anthem, Inc., 3.50% due 08/15/24 |

11,004,599 |

|||||||||

|

2,325,000 |

Anthem, Inc., 4.65% due 08/15/44 |

2,592,612 |

|||||||||

|

1,504,000 |

Cigna Corp, 4.38% due 10/15/28 |

1,643,385 |

|||||||||

|

3,600,000 |

CVS Health Corp., 4.30% due 03/25/28 |

3,892,807 |

|||||||||

|

3,700,000 |

CVS Health Corp., 5.05% due 03/25/48 |

4,199,236 |

|||||||||

|

2,100,000 |

CVS Health Corp., 3.70% due 03/09/23 |

2,185,970 |

|||||||||

|

2,100,000 |

CVS Health Corp., 4.78% due 03/25/38 |

2,299,885 |

|||||||||

|

3,125,000 |

Encompass Health Corp., 5.75% due 11/01/24 |

3,157,656 |

|||||||||

The accompanying notes are an integral part of these financial statements.

11

TEKLA HEALTHCARE

OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019

(continued)

| PRINCIPAL AMOUNT |

Health Care Providers & Services - continued |

VALUE |

|||||||||

|

$ |

8,250,000 |

Express Scripts Holding Co., 6.13% due 11/15/41 |

$ |

10,464,430 |

|||||||

|

2,100,000 |

Express Scripts Holding Co., 3.50% due 06/15/24 |

2,192,969 |

|||||||||

|

4,850,000 |

HCA Healthcare, Inc., 6.25% due 02/15/21 |

5,078,435 |

|||||||||

|

2,750,000 |

Tenet Healthcare Corp., 4.63% due 07/15/24 |

2,826,257 |

|||||||||

|

1,460,000 |

UnitedHealth Group, Inc., 3.85% due 06/15/28 |

1,598,334 |

|||||||||

|

2,100,000 |

UnitedHealth Group, Inc., 2.88% due 12/15/21 |

2,140,177 |

|||||||||

|

4,970,000 |

UnitedHealth Group, Inc., 3.88% due 12/15/28 |

5,471,921 |

|||||||||

|

70,402,809 |

|||||||||||

|

Healthcare Services - 0.3% |

|||||||||||

|

2,100,000 |

Laboratory Corporation of America Holdings, 3.60% due 02/01/25 |

2,201,889 |

|||||||||

|

Life Sciences Tools & Services - 0.3% |

|||||||||||

|

2,100,000 |

Thermo Fisher Scientific, Inc., 3.20% due 08/15/27 |

2,195,302 |

|||||||||

|

Pharmaceuticals - 5.0% |

|||||||||||

|

4,750,000 |

AstraZeneca plc, 6.45% due 09/15/37 (c) |

6,702,911 |

|||||||||

|

7,500,000 |

Bristol-Myers Squibb Co., 3.20% due 06/15/2 (d) |

7,868,363 |

|||||||||

|

2,100,000 |

Bristol-Myers Squibb Co., 3.40% due 07/26/29 (d) |

2,243,055 |

|||||||||

|

2,200,000 |

Johnson & Johnson, 2.90% due 01/15/28 |

2,313,848 |

|||||||||

|

4,200,000 |

Merck & Co., Inc., 2.80% due 05/18/23 |

4,324,231 |

|||||||||

|

2,100,000 |

Merck & Co., Inc., 2.75% due 02/10/25 |

2,174,671 |

|||||||||

|

4,000,000 |

Merck & Co., Inc., 3.40% due 03/07/29 |

4,339,036 |

|||||||||

|

8,100,000 |

Pfizer, Inc., 3.45% due 03/15/29 |

8,770,038 |

|||||||||

|

38,736,153 |

|||||||||||

| Total Non-Convertible Notes |

163,437,635 |

||||||||||

|

TOTAL CONVERTIBLE AND NON-CONVERTIBLE NOTES (Cost $ 159,687,152) |

165,527,432 |

||||||||||

|

SHARES |

COMMON STOCKS AND WARRANTS - 98.8% of Net Assets |

|

|||||||||

|

Biotechnology - 17.3% |

|||||||||||

|

315,686 |

AbbVie, Inc. (e) |

23,903,744 |

|||||||||

|

50,716 |

Alexion Pharmaceuticals, Inc. (b) |

4,967,125 |

|||||||||

|

125,117 |

Amgen, Inc. (e) |

24,211,391 |

|||||||||

|

58,535 |

Atreca, Inc. (b) |

716,468 |

|||||||||

|

125,178 |

Atreca, Inc.(Restricted) (a) (b) |

1,378,961 |

|||||||||

The accompanying notes are an integral part of these financial statements.

12

TEKLA HEALTHCARE

OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019

(continued)

|

SHARES |

Biotechnology - continued |

VALUE |

|||||||||

|

35,596 |

Biogen, Inc. (b) |

$ |

8,287,461 |

||||||||

|

204,109 |

Celgene Corp. (b) |

20,268,024 |

|||||||||

|

47,991 |

Esperion Therapeutics, Inc. (b) |

1,759,350 |

|||||||||

|

116,040 |

Exelixis, Inc. (b) |

2,052,167 |

|||||||||

|

317,890 |

Gilead Sciences, Inc. (e) |

20,147,868 |

|||||||||

|

54,000 |

Incyte, Corp. (b) (e) |

4,008,420 |

|||||||||

|

11,459 |

Ligand Pharmaceuticals, Inc. (b) (e) |

1,140,629 |

|||||||||

|

40,093 |

Nektar Therapeutics (b) |

730,294 |

|||||||||

|

336 |

Neurocrine Biosciences, Inc. (b) |

30,277 |

|||||||||

|

226,241 |

Pieris Pharmaceuticals, Inc. (b) |

771,482 |

|||||||||

|

40,496 |

Pieris Pharmaceuticals, Inc., Series A Warrants (expiration 06/08/21, exercise price $3.00) (a) (b) |

72,488 |

|||||||||

|

20,248 |

Pieris Pharmaceuticals, Inc., Series B Warrants (expiration 06/08/21, exercise price $2.00) (a) (b) |

46,773 |

|||||||||

|

12,196 |

Puma Biotechnology, Inc. (b) |

131,290 |

|||||||||

|

23,521 |

Regeneron Pharmaceuticals, Inc. (b) (e) |

6,524,725 |

|||||||||

|

41,951 |

REGENXBIO, Inc. (b) (e) |

1,493,456 |

|||||||||

|

68,859 |

Vertex Pharmaceuticals, Inc. (b) (e) |

11,666,092 |

|||||||||

|

27,479 |

Xencor, Inc. (b) |

926,867 |

|||||||||

|

135,235,352 |

|||||||||||

|

Health Care Equipment & Supplies - 14.8% |

|||||||||||

|

222,429 |

Abbott Laboratories |

18,610,634 |

|||||||||

|

16,384 |

ABIOMED, Inc. (b) (e) |

2,914,550 |

|||||||||

|

107,126 |

Baxter International, Inc. (e) |

9,370,311 |

|||||||||

|

42,835 |

Becton, Dickinson and Co. (e) |

10,835,542 |

|||||||||

|

87,621 |

DENTSPLY Sirona, Inc. (e) |

4,671,076 |

|||||||||

|

40,800 |

Edwards Lifesciences Corp. (b) (e) |

8,972,328 |

|||||||||

|

17,402 |

Hologic, Inc. (b) |

878,627 |

|||||||||

|

25,306 |

IDEXX Laboratories, Inc. (b) (e) |

6,881,461 |

|||||||||

|

34,888 |

Inogen, Inc. (b) |

1,671,484 |

|||||||||

|

14,585 |

Masimo Corp. (b) (e) |

2,170,102 |

|||||||||

|

205,126 |

Medtronic plc (e) |

22,280,786 |

|||||||||

|

4,660 |

STERIS plc |

673,323 |

|||||||||

|

65,638 |

Stryker Corp. (e) |

14,197,499 |

|||||||||

|

6,379 |

Teleflex Inc. |

2,167,265 |

|||||||||

|

82,221 |

Wright Medical Group N.V. (b) |

1,696,219 |

|||||||||

|

53,363 |

Zimmer Biomet Holdings, Inc. |

7,325,139 |

|||||||||

|

115,316,346 |

|||||||||||

The accompanying notes are an integral part of these financial statements.

13

TEKLA HEALTHCARE

OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019

(continued)

|

SHARES |

Health Care Providers & Services - 16.0% |

VALUE |

|||||||||

|

49,650 |

Acadia Healthcare Co., Inc. (b) |

$ |

1,543,122 |

||||||||

|

70,598 |

Anthem, Inc. (e) |

16,950,580 |

|||||||||

|

42,387 |

Cardinal Health, Inc. (c) (e) |

2,000,243 |

|||||||||

|

21,540 |

Charles River Laboratories International, Inc. (b) (e) |

2,851,250 |

|||||||||

|

82,890 |

Cigna Corp. (b) (e) |

12,581,873 |

|||||||||

|

109,035 |

Community Health Systems, Inc. (b) |

392,526 |

|||||||||

|

306,016 |

CVS Health Corp. (e) |

19,300,429 |

|||||||||

|

127,901 |

Diplomat Pharmacy, Inc. (b) |

626,715 |

|||||||||

|

50,780 |

HCA Healthcare, Inc. (e) |

6,114,928 |

|||||||||

|

31,810 |

HealthEquity, Inc. (b) (e) |

1,817,782 |

|||||||||

|

51,105 |

Humana, Inc. (e) |

13,066,015 |

|||||||||

|

141,136 |

Tenet Healthcare Corp. (b) |

3,121,928 |

|||||||||

|

205,388 |

UnitedHealth Group, Inc. (e) |

44,634,920 |

|||||||||

|

125,002,311 |

|||||||||||

|

Healthcare Services - 0.4% |

|||||||||||

|

17,903 |

Laboratory Corporation of America Holdings (b) |

3,007,704 |

|||||||||

|

Life Sciences Tools & Services - 3.4% |

|||||||||||

|

34,025 |

Agilent Technologies, Inc. |

2,607,336 |

|||||||||

|

23,856 |

Illumina, Inc. (b) (e) |

7,257,472 |

|||||||||

|

12,456 |

PerkinElmer, Inc. |

1,060,878 |

|||||||||

|

19,700 |

PRA Health Sciences, Inc. (b) |

1,954,831 |

|||||||||

|

48,561 |

Thermo Fisher Scientific, Inc. (e) |

14,144,362 |

|||||||||

|

27,024,879 |

|||||||||||

|

Medical Devices and Diagnostics - 6.8% |

|||||||||||

|

19,377 |

Align Technology, Inc. (b) (e) |

3,505,687 |

|||||||||

|

323,903 |

Boston Scientific Corp. (b) (e) |

13,179,613 |

|||||||||

|

86,056 |

Danaher Corp. |

12,429,068 |

|||||||||

|

32,983 |

Intuitive Surgical, Inc. (b) (e) |

17,808,511 |

|||||||||

|

19,824 |

Quest Diagnostics, Inc. |

2,121,763 |

|||||||||

|

27,547 |

ResMed, Inc. |

3,721,875 |

|||||||||

|

52,766,517 |

|||||||||||

|

Pharmaceuticals - 33.0% |

|||||||||||

|

91,959 |

Allergan plc (c) |

15,475,780 |

|||||||||

|

109,765 |

AmerisourceBergen Corp. (e) |

9,036,952 |

|||||||||

|

427,584 |

Bristol-Myers Squibb Co. (e) |

21,682,785 |

|||||||||

|

114,082 |

Eli Lilly & Co. (e) |

12,757,790 |

|||||||||

|

25,696 |

IQVIA Holdings, Inc. (b) |

3,838,468 |

|||||||||

|

480,865 |

Johnson & Johnson (e) |

62,214,314 |

|||||||||

|

65,556 |

McKesson Corp. (e) |

8,958,883 |

|||||||||

|

14,381 |

Medicines Co. (The) (b) |

719,050 |

|||||||||

|

687,999 |

Merck & Co., Inc. (e) |

57,915,756 |

|||||||||

The accompanying notes are an integral part of these financial statements.

14

TEKLA HEALTHCARE

OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019

(continued)

|

SHARES |

Pharmaceuticals - continued |

VALUE |

|||||||||

|

112,651 |

Mylan N.V. (b) |

$ |

2,228,237 |

||||||||

|

1,278,548 |

Pfizer, Inc. (e) |

45,938,230 |

|||||||||

|

352,804 |

Teva Pharmaceutical Industries Ltd. (b) (f) |

2,427,292 |

|||||||||

|

109,700 |

Zoetis, Inc. (e) |

13,667,523 |

|||||||||

|

656,921 |

Zyla Life Sciences (a) (b) (g) |

712,759 |

|||||||||

|

257,573,819 |

|||||||||||

|

Real Estate Investment Trusts - 7.1% |

|||||||||||

|

126,122 |

LTC Properties, Inc. |

6,459,969 |

|||||||||

|

119,109 |

Medical Properties Trust, Inc. |

2,329,772 |

|||||||||

|

105,543 |

New Senior Investment Group Inc. |

705,027 |

|||||||||

|

223,295 |

Omega Healthcare Investors, Inc. |

9,331,498 |

|||||||||

|

248,608 |

Physicians Realty Trust |

4,412,792 |

|||||||||

|

395,119 |

Sabra Health Care REIT, Inc. |

9,071,932 |

|||||||||

|

293,879 |

Senior Housing Properties Trust |

2,719,850 |

|||||||||

|

118,869 |

Ventas, Inc. |

8,681,003 |

|||||||||

|

127,462 |

Welltower, Inc. |

11,554,430 |

|||||||||

|

55,266,273 |

|||||||||||

|

TOTAL COMMON STOCKS AND WARRANTS (Cost $ 785,461,663) |

771,193,201 |

||||||||||

|

PRINCIPAL AMOUNT |

SHORT-TERM INVESTMENT - 5.5% of Net Assets |

||||||||||

|

$ |

42,691,000 |

Repurchase Agreement, Fixed Income Clearing Corp., repurchase value $42,691,000, 0.25%, dated 09/30/19, due 10/01/19 (collateralized by U.S. Treasury Notes 1.88%, due 09/30/22, market value $43,549,427) |

42,691,000 |

||||||||

|

TOTAL SHORT-TERM INVESTMENT (Cost $42,691,000) |

42,691,000 |

||||||||||

The accompanying notes are an integral part of these financial statements.

15

TEKLA HEALTHCARE

OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019

(continued)

|

NUMBER OF |

CALL OPTION CONTRACTS PURCHASED - 0.1% |

|

|||||||||

|

65/2,340,000 |

Biogen, Inc. Jun20 360 Call |

$ |

16,413 |

||||||||

|

2,500/12,500,000 |

Bristol-Myers Squibb Co. Jan20 50 Call |

697,500 |

|||||||||

|

TOTAL CALL OPTION CONTRACTS PURCHASED (Premium paid $1,445,488) |

713,913 |

||||||||||

|

OPTION CONTRACTS WRITTEN - (0.2)% |

|||||||||||

|

Call Option Contracts Written - (0.2)% |

|||||||||||

|

600/(4,440,000) |

AbbVie, Inc. Oct19 74 Call |

(139,200 |

) |

||||||||

|

78/(1,560,000) |

ABIOMED, Inc. Oct19 200 Call |

(5,460 |

) |

||||||||

|

59/(1,121,000) |

Align Technology, Inc. Oct19 190 Call |

(15,930 |

) |

||||||||

|

103/(875,500) |

AmerisourceBergen Corp. Oct19 85 Call |

(11,845 |

) |

||||||||

|

118/(2,419,000) |

Amgen, Inc. Oct19 205 Call |

(5,074 |

) |

||||||||

|

66/(1,716,000) |

Anthem, Inc. Oct19 260 Call |

(4,224 |

) |

||||||||

|

52/(1,404,000) |

Anthem, Inc. Oct19 270 Call |

(884 |

) |

||||||||

|

101/(883,750) |

Baxter International, Inc. Oct19 87.5 Call |

(15,150 |

) |

||||||||

|

40/(1,040,000) |

Becton, Dickinson and Co. Oct19 260 Call |

(6,000 |

) |

||||||||

|

386/(1,698,400) |

Boston Scientific Corp. Oct19 44 Call |

(3,088 |

) |

||||||||

|

2,500/(15,000,000) |

Bristol-Myers Squibb Co. Jan20 60 Call |

(60,000 |

) |

||||||||

|

212/(1,017,600) |

Cardinal Health, Inc. Oct19 48 Call |

(20,140 |

) |

||||||||

|

51/(714,000) |

Charles River Laboratories International, |

(3,443 |

) |

||||||||

|

477/(7,870,500) |

Cigna Corp. Oct19 165 Call |

(19,557 |

) |

||||||||

|

83/(1,411,000) |

Cigna Corp. Oct19 170 Call |

(1,411 |

) |

||||||||

|

262/(1,689,900) |

CVS Health Corp. Oct19 64.5 Call |

(19,126 |

) |

||||||||

|

290/(1,885,000) |

CVS Health Corp. Oct19 65 Call |

(14,500 |

) |

||||||||

|

163/(896,500) |

DENTSPLY Sirona, Inc. Oct19 55 Call |

(8,150 |

) |

||||||||

|

38/(855,000) |

Edwards Lifesciences Corp. Oct19 225 Call |

(9,690 |

) |

||||||||

|

108/(1,242,000) |

Eli Lilly & Co. Oct19 115 Call |

(10,800 |

) |

||||||||

|

624/(4,118,400) |

Gilead Sciences, Inc. Oct19 66 Call |

(24,960 |

) |

||||||||

|

48/(585,600) |

HCA Healthcare, Inc. Oct19 122 Call |

(9,120 |

) |

||||||||

|

69/(414,000) |

Healthequity, Inc. Oct19 60 Call |

(9,315 |

) |

||||||||

|

89/(2,558,750) |

Humana, Inc. Oct19 287.5 Call |

(3,560 |

) |

||||||||

The accompanying notes are an integral part of these financial statements.

16

TEKLA HEALTHCARE

OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019

(continued)

|

NUMBER OF |

Call Option Contracts Written - continued |

VALUE |

|||||||||

|

24/(672,000) |

IDEXX Laboratories, Inc. Oct19 280 Call |

$ |

(7,440 |

) |

|||||||

|

238/(7,437,500) |

Illumina, Inc. Oct19 312.5 Call |

(130,424 |

) |

||||||||

|

66/(577,500) |

Incyte, Corp. Oct19 87.5 Call |

(1,155 |

) |

||||||||

|

60/(3,270,000) |

Intuitive Surgical, Inc. Oct19 545 Call |

(79,800 |

) |

||||||||

|

548/(7,233,600) |

Johnson & Johnson Oct19 132 Call |

(67,952 |

) |

||||||||

|

700/(9,660,000) |

Johnson & Johnson Oct19 135 Call |

(30,100 |

) |

||||||||

|

31/(325,500) |

Ligand Pharmaceuticals, Inc. |

(6,200 |

) |

||||||||

|

55/(880,000) |

Masimo Corp. Oct19 160 Call |

(3,025 |

) |

||||||||

|

108/(1,620,000) |

McKesson Corp. Oct19 150 Call |

(5,076 |

) |

||||||||

|

915/(8,006,250) |

Merck & Co., Inc. Oct19 87.5 Call |

(29,280 |

) |

||||||||

|

2,450/(9,065,000) |

Pfizer, Inc. Oct19 37 Call |

(58,800 |

) |

||||||||

|

22/(682,000) |

Regeneron Pharmaceuticals, Inc. |

(1,716 |

) |

||||||||

|

355/(1,420,000) |

REGENXBIO, Inc. Oct19 40 Call |

(47,925 |

) |

||||||||

|

340/(10,200,000) |

Thermo Fisher Scientific, Inc. |

(91,800 |

) |

||||||||

|

193/(4,390,750) |

UnitedHealth Group, Inc. Oct19 227.5 Call |

(43,425 |

) |

||||||||

|

57/(1,368,000) |

UnitedHealth Group, Inc. Oct19 240 Call |

(2,508 |

) |

||||||||

|

64/(1,136,000) |

Vertex Pharmaceuticals, Inc. |

(10,112 |

) |

||||||||

|

103/(1,297,800) |

Zoetis, Inc. Oct19 126 Call |

(14,935 |

) |

||||||||

|

Total Call Option Contracts Written (Premiums received $2,080,589) |

(1,052,300 |

) |

|||||||||

The accompanying notes are an integral part of these financial statements.

17

TEKLA HEALTHCARE

OPPORTUNITIES FUND

SCHEDULE OF INVESTMENTS

SEPTEMBER 30, 2019

(continued)

|

NUMBER OF |

Put Option Contracts Written - 0.0% |

VALUE |

|||||||||

|

2,500/(10,000,000) |

Bristol-Myers Squibb Co. Jan20 40 Put |

$ |

(60,000 |

) |

|||||||

|

470/(4,700,000) |

Medtronic plc Oct19 100 Put |

(6,580 |

) |

||||||||

|

117/(2,340,000) |

Stryker Corp. Oct19 200 Put |

(6,143 |

) |

||||||||

|

Total Put Option Contracts Written (Premiums received $704,326) |

(72,723 |

) |

|||||||||

|

TOTAL OPTION CONTRACTS WRITTEN (Premiums received $2,784,915) |

(1,125,023 |

) |

|||||||||

|

TOTAL INVESTMENTS - 126.9% (Cost $999,522,540) |

989,642,138 |

||||||||||

|

OTHER LIABILITIES IN EXCESS |

(209,956,021 |

) |

|||||||||

|

NET ASSETS - 100% |

$ |

779,686,117 |

|||||||||

(a) Security fair valued using significant unobservable inputs. See Investment Valuation and Fair Value Measurements.

(b) Non-income producing security.

(c) Foreign security.

(d) Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers.

(e) A portion of security is pledged as collateral for call options written.

(f) American Depository Receipt

(g) Affiliated issuers in which the Fund holds 5% or more of the voting securities (total market value of $712,759).

The accompanying notes are an integral part of these financial statements.

18

TEKLA HEALTHCARE OPPORTUNITIES FUND

STATEMENT OF ASSETS AND LIABILITIES

SEPTEMBER 30, 2019

|

ASSETS: |

|||||||

|

Investments in unaffiliated issuers, at value (cost $995,321,894) |

$ |

990,054,401 |

|||||

|

Investments in affiliated issuers, at value (cost $6,985,561) |

712,759 |

||||||

|

Total investments |

990,767,160 |

||||||

|

Cash and restricted cash |

17,040,486 |

||||||

|

Dividends and interest receivable |

2,212,991 |

||||||

|

Prepaid expenses |

76,624 |

||||||

|

Total assets |

1,010,097,261 |

||||||

|

LIABILITIES: |

|||||||

|

Payable for investments purchased |

1,989,998 |

||||||

|

Accrued advisory fee |

857,184 |

||||||

|

Accrued investor support service fees |

42,859 |

||||||

|

Accrued shareholder reporting fees |

38,612 |

||||||

|

Accrued trustee fees |

1,409 |

||||||

|

Loan payable |

225,000,000 |

||||||

|

Options written, at value (premium received $2,784,915) |

1,125,023 |

||||||

|

Income distribution payable |

103,873 |

||||||

|

Interest payable |

1,125,881 |

||||||

|

Accrued other |

126,305 |

||||||

|

Total liabilities |

230,411,144 |

||||||

|

Commitments and Contingencies (see Notes 1 and 5) |

|||||||

|

NET ASSETS |

$ |

779,686,117 |

|||||

|

SOURCES OF NET ASSETS: |

|||||||

|

Shares of beneficial interest, par value $.01 per share, unlimited number of shares authorized, amount paid in on 41,462,660 shares issued and outstanding |

$ |

794,031,680 |

|||||

|

Total distributable earnings (loss) |

(14,345,563 |

) |

|||||

|

Total net assets (equivalent to $18.80 per share based on 41,462,660 shares outstanding) |

$ |

779,686,117 |

|||||

The accompanying notes are an integral part of these financial statements.

19

TEKLA HEALTHCARE OPPORTUNITIES FUND

STATEMENT OF OPERATIONS

YEAR ENDED SEPTEMBER 30, 2019

|

INVESTMENT INCOME: |

|||||||

|

Dividend income |

$ |

16,725,426 |

|||||

|

Interest and other income |

5,696,805 |

||||||

|

Total investment income |

22,422,231 |

||||||

|

EXPENSES: |

|||||||

|

Advisory fees |

10,276,793 |

||||||

|

Interest expense |

7,340,262 |

||||||

|

Investor support service fees |

513,840 |

||||||

|

Administration fees |

194,602 |

||||||

|

Custodian fees |

165,464 |

||||||

|

Auditing fees |

69,484 |

||||||

|

Shareholder reporting |

141,342 |

||||||

|

Trustees' fees and expenses |

126,269 |

||||||

|

Legal fees |

110,968 |

||||||

|

Transfer agent fees |

28,061 |

||||||

|

Other (see Note 2) |

369,113 |

||||||

|

Total expenses |

19,336,198 |

||||||

|

Net investment income |

3,086,033 |

||||||

|

REALIZED AND UNREALIZED GAIN (LOSS): |

|||||||

|

Net realized gain (loss) on: |

|||||||

|

Investments in affiliated issuers |

6,985,561 |

||||||

|

Investments in unaffiliated issuers |

32,912,243 |

||||||

|

Closed or expired option contracts written |

5,304,158 |

||||||

|

Foreign currency transactions |

7,669 |

||||||

|

Net realized gain |

45,209,631 |

||||||

|

Change in unrealized appreciation (depreciation) on: |

|||||||

|

Investments in affiliated issuers |

12,760 |

||||||

|

Investments in unaffiliated issuers |

(91,084,809 |

) |

|||||

|

Option contracts purchased |

(731,575 |

) |

|||||

|

Option contracts written |

1,650,226 |

||||||

|

Change in unrealized appreciation (depreciation) |

(90,153,398 |

) |

|||||

|

Net realized and unrealized gain (loss) |

(44,943,767 |

) |

|||||

|

Net decrease in net assets resulting from operations |

($ |

41,857,734 |

) |

||||

The accompanying notes are an integral part of these financial statements.

20

TEKLA HEALTHCARE OPPORTUNITIES FUND

STATEMENTS OF CHANGES IN NET ASSETS

|

Year ended September 30, 2019 |

Year ended September 30, 2018 |

||||||||||

|

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS: |

|||||||||||

|

Net investment income |

$ |

3,086,033 |

$ |

5,716,320 |

|||||||

|

Net realized gain |

45,209,631 |

51,428,217 |

|||||||||

|

Change in net unrealized appreciation (depreciation) |

(90,153,398 |

) |

38,720,068 |

||||||||

|

Net increase (decrease) in net assets resulting from operations |

(41,857,734 |

) |

95,864,605 |

||||||||

|

DISTRIBUTIONS TO SHAREHOLDERS FROM (See Note 1): |

|||||||||||

|

Distributions |

(56,059,707 |

) |

(57,856,225 |

) |

|||||||

|

Total distributions |

(56,059,707 |

) |

(57,856,225 |

) |

|||||||

|

CAPITAL SHARE TRANSACTIONS: |

|||||||||||

|

Fund shares repurchased (610,415 and 1,443,016 shares, respectively) (see Note 1) |

(10,638,148 |

) |

(25,422,774 |

) |

|||||||

|

Total capital share transactions |

(10,638,148 |

) |

(25,422,774 |

) |

|||||||

|

Net increase (decrease) in net assets |

(108,555,589 |

) |

12,585,606 |

||||||||

|

NET ASSETS: |

|||||||||||

|

Beginning of year |

888,241,706 |

875,656,100 |

|||||||||

|

End of year |

$ |

779,686,117 |

$ |

888,241,706 |

|||||||

The accompanying notes are an integral part of these financial statements.

21

TEKLA HEALTHCARE OPPORTUNITIES FUND

STATEMENT OF CASH FLOWS

YEAR ENDED SEPTEMBER 30, 2019

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|||||||

|

Purchases of portfolio securities |

($ |

567,976,948 |

) |

||||

|

Purchases to close option contracts written |

(2,038,581 |

) |

|||||

|

Net maturities of short-term investments |

(22,289,000 |

) |

|||||

|

Sales of portfolio securities |

635,959,650 |

||||||

|

Proceeds from option contracts written |

10,497,860 |

||||||

|

Interest income received |

5,755,084 |

||||||

|

Dividend income received |

16,751,585 |

||||||

|

Other operating receipts (expenses paid) |

(18,386,721 |

) |

|||||

|

Net cash provided from operating activities |

58,272,929 |

||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|||||||

|

Cash distributions paid |

(56,132,696 |

) |

|||||

|

Fund shares repurchased |

(10,638,148 |

) |

|||||

|

Net cash used for financing activities |

(66,770,544 |

) |

|||||

|

NET DECREASE IN CASH AND RESTRICTED CASH |

(8,497,915 |

) |

|||||

|

CASH AND RESTRICTED CASH AT BEGINNING OF YEAR |

25,538,401 |

||||||

|

CASH AND RESTRICTED CASH AT END OF YEAR |

$ |

17,040,486 |

* |

||||

|

RECONCILIATION OF NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS TO NET CASH PROVIDED FROM OPERATING ACTIVITIES: |

|||||||

|

Net decrease in net assets resulting from operations |

($ |

41,857,734 |

) |

||||

|

Purchases of portfolio securities |

(567,976,948 |

) |

|||||

|

Purchases to close option contracts written |

(2,038,581 |

) |

|||||

|

Net maturities of short-term investments |

(22,289,000 |

) |

|||||

|

Sales of portfolio securities |

635,959,650 |

||||||

|

Proceeds from option contracts written |

10,497,860 |

||||||

|

Accretion of discount |

295,090 |

||||||

|

Net realized (gain) loss on investments, options and foreign currencies |

(45,209,631 |

) |

|||||

|

Decrease in net unrealized (appreciation) depreciation on investments and options |

90,153,398 |

||||||

|

Increase in dividends and interest receivable |

(210,652 |

) |

|||||

|

Decrease in accrued expenses |

(158,410 |

) |

|||||

|

Increase in prepaid expenses and interest payable |

1,107,887 |

||||||

|

Net cash provided from operating activities |

$ |

58,272,929 |

|||||

|

Cash paid for interest |

$ |

6,214,381 |

|||||

* Includes $486 of cash and $17,040,000 of restricted cash.

The accompanying notes are an integral part of these financial statements.

22

TEKLA HEALTHCARE OPPORTUNITIES FUND

FINANCIAL HIGHLIGHTS

|

For the years ended September 30, |

|||||||||||||||||||||||

|

2019 |

2018 |

2017 |

2016 |

2015 |

|||||||||||||||||||

|

OPERATING PERFORMANCE FOR A SHARE OUTSTANDING THROUGHOUT EACH YEAR |

|||||||||||||||||||||||

|

Net asset value per share, beginning of year |

$ |

21.11 |

$ |

20.12 |

$ |

19.14 |

$ |

18.77 |

$ |

19.33 |

|||||||||||||

|

Net investment income (1) |

0.07 |

0.13 |

0.16 |

0.18 |

0.11 |

||||||||||||||||||

|

Net realized and unrealized gain (loss) |

(1.06 |

) |

2.15 |

2.16 |

1.78 |

0.68 |

|||||||||||||||||

|

Total increase (decrease) from investment operations |

(0.99 |

) |

2.28 |

2.32 |

1.96 |

0.79 |

|||||||||||||||||

|

Distributions to shareholders from: |

|||||||||||||||||||||||

|

Income |

(0.15 |

) |

(0.58 |

) |

(1.03 |

) |

(1.37 |

)(2) |

(1.35 |

) |

|||||||||||||

|

Net realized capital gains |

(1.20 |

) |

(0.77 |

) |

(0.32 |

) |

(0.28 |

)(2) |

— |

||||||||||||||

|

Total distributions |

(1.35 |

) |

(1.35 |

) |

(1.35 |

) |

(1.65 |

) |

(1.35 |

) |

|||||||||||||

|

Increase resulting from shares repurchased (1) |

0.03 |

0.06 |

0.01 |

0.06 |

— |

||||||||||||||||||

|

Net asset value per share, end of year |

$ |

18.80 |

$ |

21.11 |

$ |

20.12 |

$ |

19.14 |

$ |

18.77 |

|||||||||||||

|

Per share market value, end of year |

$ |

17.46 |

$ |

18.74 |

$ |

18.57 |

$ |

17.48 |

$ |

16.30 |

|||||||||||||

|

Total investment return at market value |

0.63 |

% |

9.00 |

% |

14.85 |

% |

18.25 |

% |

(7.37 |

%) |

|||||||||||||

|

Total investment return at net asset value |

(3.81 |

%) |

13.32 |

% |

13.64 |

% |

12.44 |

% |

4.02 |

% |

|||||||||||||

|

RATIOS |

|||||||||||||||||||||||

|

Expenses to average net assets |

2.42 |

% |

2.21 |

% |

2.03 |

% |

1.88 |

% |

1.60 |

% |

|||||||||||||

|

Expenses, excluding interest expense, to average net assets |

1.50 |

% |

1.49 |

% |

1.51 |

% |

1.50 |

% |

1.44 |

% |

|||||||||||||

|

Net investment income to average net assets |

0.39 |

% |

0.69 |

% |

0.86 |

% |

0.96 |

% |

0.50 |

% |

|||||||||||||

|

SUPPLEMENTAL DATA |

|||||||||||||||||||||||

|

Net assets at end of year (in millions) |

$ |

780 |

$ |

888 |

$ |

876 |

$ |

837 |

$ |

824 |

|||||||||||||

|

Portfolio turnover rate |

55.92 |

% |

39.59 |

% |

36.22 |

% |

48.24 |

% |

92.61 |

% |

|||||||||||||

(1) Computed using average shares outstanding.

(2) Amount previously presented incorrectly as solely distributions from income has been revised to reflect the proper classification.

The accompanying notes are an integral part of these financial statements.

23

TEKLA HEALTHCARE OPPORTUNITIES FUND

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(1) Organization and Significant Accounting Policies

Tekla Healthcare Opportunities Fund (the Fund) is a Massachusetts business trust formed on April 2, 2014 and registered under the Investment Company Act of 1940 as a non-diversified closed-end management investment company. The Fund commenced operations on July 31, 2014. The Fund's investment objective is to seek current income and long-term capital appreciation through investments in U.S. and non-U.S. companies in the healthcare industry (including equity securities, debt securities and pooled investment vehicles). The Fund invests primarily in securities of public and private companies believed by the Fund's Investment Adviser, Tekla Capital Management LLC (the Adviser), to have significant potential for above-average growth. The Fund may invest in private companies and other restricted securities, including private investments in public equity and venture capital investments, if these securities would currently comprise 10% or less of Managed Assets.

The preparation of these financial statements requires the use of certain estimates by management in determining the Fund's assets, liabilities, revenues and expenses. Actual results could differ from these estimates and such differences could be material. The following is a summary of significant accounting policies followed by the Fund, which are in conformity with accounting principles generally accepted in the United States of America (GAAP). The Fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board Accounting Standards Codification 946. Events or transactions occurring after September 30, 2019, through the date that the financial statements were issued, have been evaluated in the preparation of these financial statements.

Clarification in Foreign Security Investment Definition

Effective January 31, 2019, the Fund will not invest more than 20% of its Managed Assets as measured at the time of investment in non-U.S. securities, which may include securities denominated in the U.S. dollars or in non-U.S. currencies or multinational currency units. The Fund may invest in non-U.S. securities of so-called emerging market issuers. For purposes of the Fund, the Adviser determines, in its discretion, whether a company is a non-U.S. company using an independent analysis of one or more classifications assigned by third parties. These classifications are generally based on a number of criteria, including a company's country of domicile, the primary stock exchange on which a company's securities trade, the location from which the majority of a company's revenue is derived, and a company's reporting currency. Non-U.S. securities markets generally are not as developed or efficient as those in the United States. Securities of some non-U.S. issuers are less liquid and more volatile than securities of comparable U.S. issuers. Similarly, volume and liquidity in most non-U.S. securities markets are less than in the United States and, at times, price volatility can be greater than in the United States.

Change in Debt Investment Strategy

The Board approved on March 21, 2019, an increase in the Fund's limit on debt security investments from 15% of Managed Assets to 20% of Managed Assets. This change was effective on March 29, 2019.

Investment Valuation

Shares of publicly traded companies listed on national securities exchanges or trading in the over-the-counter market are typically valued at the last sale price, as of the close of trading, generally 4 p.m., Eastern time. The Board of Trustees of the Fund (the Trustees) has established

24

TEKLA HEALTHCARE OPPORTUNITIES FUND

NOTES TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2019

(continued)

and approved fair valuation policies and procedures with respect to securities for which quoted prices may not be available or which do not reflect fair value. Convertible, corporate and government bonds are valued using a third-party pricing service. Convertible bonds are valued using this pricing service only on days when there is no sale reported. Puts and calls generally are valued at the close of regular trading on the securities or commodities exchange on which they are primarily traded. Options on securities generally are valued at their last bid price in the case of exchange traded options or, in the case of OTC-traded options, the average of the last bid price as obtained from two or more dealers unless there is only one dealer, in which case that dealer's price is used. Forward foreign currency contracts are valued on the basis of the value of the underlying currencies at the prevailing currency exchange rate. Restricted securities of companies that are publicly traded are typically valued based on the closing market quote on the valuation date adjusted for the impact of the restriction as determined in good faith by the Adviser also using fair valuation policies and procedures approved by the Trustees described below. Non-exchange traded warrants of publicly traded companies are generally valued using the Black-Scholes model, which incorporates both observable and unobservable inputs. Short-term investments with a maturity of 60 days or less are generally valued at amortized cost, which approximates fair value.

Convertible preferred shares, warrants or convertible note interests in private companies and other restricted securities, as well as shares of publicly traded companies for which market quotations are not readily available, such as stocks for which trading has been halted or for which there are no current day sales, or which do not reflect fair value, are typically valued in good faith, based upon the recommendations made by the Adviser pursuant to fair valuation policies and procedures approved by the Trustees.