wfrd-2023123100016039232023FYfalsehttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrentP1YP5D00016039232023-01-012023-12-3100016039232023-06-30iso4217:USD00016039232024-02-01xbrli:shares0001603923us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001603923us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001603923us-gaap:ServiceMember2023-01-012023-12-310001603923us-gaap:ServiceMember2022-01-012022-12-310001603923us-gaap:ServiceMember2021-01-012021-12-310001603923us-gaap:ProductMember2023-01-012023-12-310001603923us-gaap:ProductMember2022-01-012022-12-310001603923us-gaap:ProductMember2021-01-012021-12-3100016039232022-01-012022-12-3100016039232021-01-012021-12-310001603923us-gaap:RetainedEarningsMember2023-01-012023-12-31iso4217:USDxbrli:shares00016039232023-12-3100016039232022-12-310001603923us-gaap:CommonStockMember2020-12-310001603923us-gaap:AdditionalPaidInCapitalMember2020-12-310001603923us-gaap:RetainedEarningsMember2020-12-310001603923us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001603923us-gaap:NoncontrollingInterestMember2020-12-3100016039232020-12-310001603923us-gaap:RetainedEarningsMember2021-01-012021-12-310001603923us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001603923us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001603923us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001603923us-gaap:CommonStockMember2021-12-310001603923us-gaap:AdditionalPaidInCapitalMember2021-12-310001603923us-gaap:RetainedEarningsMember2021-12-310001603923us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001603923us-gaap:NoncontrollingInterestMember2021-12-3100016039232021-12-310001603923us-gaap:RetainedEarningsMember2022-01-012022-12-310001603923us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001603923us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001603923us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001603923us-gaap:CommonStockMember2022-12-310001603923us-gaap:AdditionalPaidInCapitalMember2022-12-310001603923us-gaap:RetainedEarningsMember2022-12-310001603923us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001603923us-gaap:NoncontrollingInterestMember2022-12-310001603923us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001603923us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001603923us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001603923us-gaap:CommonStockMember2023-12-310001603923us-gaap:AdditionalPaidInCapitalMember2023-12-310001603923us-gaap:RetainedEarningsMember2023-12-310001603923us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001603923us-gaap:NoncontrollingInterestMember2023-12-31wfrd:country0001603923us-gaap:GeographicConcentrationRiskMemberus-gaap:AccountsReceivableMembercountry:MX2023-01-012023-12-31xbrli:pure0001603923us-gaap:GeographicConcentrationRiskMemberus-gaap:AccountsReceivableMembercountry:MX2022-01-012022-12-310001603923us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMemberwfrd:MajorCustomerMember2023-01-012023-12-310001603923us-gaap:CustomerConcentrationRiskMemberus-gaap:AccountsReceivableMemberwfrd:MajorCustomerMember2022-01-012022-12-310001603923us-gaap:GeographicConcentrationRiskMembercountry:USus-gaap:AccountsReceivableMember2023-01-012023-12-310001603923us-gaap:GeographicConcentrationRiskMembercountry:USus-gaap:AccountsReceivableMember2022-01-012022-12-310001603923srt:MinimumMemberwfrd:BuildingsAndLeaseholdImprovementsMember2023-12-310001603923srt:MaximumMemberwfrd:BuildingsAndLeaseholdImprovementsMember2023-12-310001603923srt:MinimumMemberwfrd:RentalAndServiceEquipmentMember2023-12-310001603923srt:MaximumMemberwfrd:RentalAndServiceEquipmentMember2023-12-310001603923srt:MinimumMemberwfrd:MachineryAndOtherMember2023-12-310001603923srt:MaximumMemberwfrd:MachineryAndOtherMember2023-12-310001603923wfrd:DevelopedAndAcquiredTechnologyRightsMember2023-12-310001603923us-gaap:TradeNamesMember2023-12-31wfrd:reportable_segmentwfrd:unit0001603923us-gaap:OperatingSegmentsMemberwfrd:DrillingandEvaluationMember2023-01-012023-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:DrillingandEvaluationMember2022-01-012022-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:DrillingandEvaluationMember2021-01-012021-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:WellConstructionAndCompletionMember2023-01-012023-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:WellConstructionAndCompletionMember2022-01-012022-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:WellConstructionAndCompletionMember2021-01-012021-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:ProductionAndInterventionMember2023-01-012023-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:ProductionAndInterventionMember2022-01-012022-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:ProductionAndInterventionMember2021-01-012021-12-310001603923us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001603923us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001603923us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001603923us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001603923us-gaap:OperatingSegmentsMember2023-01-012023-12-310001603923us-gaap:OperatingSegmentsMember2022-01-012022-12-310001603923us-gaap:OperatingSegmentsMember2021-01-012021-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:DrillingandEvaluationMember2023-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:DrillingandEvaluationMember2022-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:WellConstructionAndCompletionMember2023-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:WellConstructionAndCompletionMember2022-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:ProductionAndInterventionMember2023-12-310001603923us-gaap:OperatingSegmentsMemberwfrd:ProductionAndInterventionMember2022-12-310001603923us-gaap:CorporateNonSegmentMember2023-12-310001603923us-gaap:CorporateNonSegmentMember2022-12-310001603923country:US2023-12-310001603923country:US2022-12-310001603923country:SA2023-12-310001603923srt:NorthAmericaMember2023-12-310001603923srt:NorthAmericaMember2022-12-310001603923srt:LatinAmericaMember2023-12-310001603923srt:LatinAmericaMember2022-12-310001603923wfrd:MiddleEastNorthAfricaAsiaMember2023-12-310001603923wfrd:MiddleEastNorthAfricaAsiaMember2022-12-310001603923wfrd:EuropeSubSaharaAfricaRussiaMember2023-12-310001603923wfrd:EuropeSubSaharaAfricaRussiaMember2022-12-310001603923us-gaap:GeographicConcentrationRiskMembercountry:MXus-gaap:SalesRevenueNetMember2023-01-012023-12-310001603923us-gaap:CustomerConcentrationRiskMemberwfrd:MajorCustomerMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001603923us-gaap:GeographicConcentrationRiskMembercountry:USus-gaap:SalesRevenueNetMember2023-01-012023-12-310001603923us-gaap:GeographicConcentrationRiskMembercountry:USus-gaap:SalesRevenueNetMember2022-01-012022-12-310001603923us-gaap:GeographicConcentrationRiskMembercountry:USus-gaap:SalesRevenueNetMember2021-01-012021-12-310001603923srt:NorthAmericaMember2023-01-012023-12-310001603923srt:NorthAmericaMember2022-01-012022-12-310001603923srt:NorthAmericaMember2021-01-012021-12-310001603923wfrd:InternationalExcludingNorthAmericaCountriesMember2023-01-012023-12-310001603923wfrd:InternationalExcludingNorthAmericaCountriesMember2022-01-012022-12-310001603923wfrd:InternationalExcludingNorthAmericaCountriesMember2021-01-012021-12-310001603923srt:LatinAmericaMember2023-01-012023-12-310001603923srt:LatinAmericaMember2022-01-012022-12-310001603923srt:LatinAmericaMember2021-01-012021-12-310001603923wfrd:EuropeSubSaharaAfricaRussiaMember2023-01-012023-12-310001603923wfrd:EuropeSubSaharaAfricaRussiaMember2022-01-012022-12-310001603923wfrd:EuropeSubSaharaAfricaRussiaMember2021-01-012021-12-310001603923wfrd:MiddleEastNorthAfricaAsiaMember2023-01-012023-12-310001603923wfrd:MiddleEastNorthAfricaAsiaMember2022-01-012022-12-310001603923wfrd:MiddleEastNorthAfricaAsiaMember2021-01-012021-12-310001603923us-gaap:ProductAndServiceOtherMember2023-12-310001603923us-gaap:ProductAndServiceOtherMember2022-12-310001603923wfrd:EquipmentRentalsMember2023-12-310001603923wfrd:EquipmentRentalsMember2022-12-310001603923us-gaap:CostOfSalesMember2023-01-012023-12-310001603923us-gaap:CostOfSalesMember2022-01-012022-12-310001603923us-gaap:CostOfSalesMember2021-01-012021-12-310001603923wfrd:ImpairmentsAndOtherChargesMember2023-01-012023-12-310001603923wfrd:ImpairmentsAndOtherChargesMember2022-01-012022-12-310001603923wfrd:ImpairmentsAndOtherChargesMember2021-01-012021-12-310001603923us-gaap:LandBuildingsAndImprovementsMember2023-12-310001603923us-gaap:LandBuildingsAndImprovementsMember2022-12-310001603923wfrd:RentalAndServiceEquipmentMember2023-12-310001603923wfrd:RentalAndServiceEquipmentMember2022-12-310001603923wfrd:MachineryAndOtherMember2023-12-310001603923wfrd:MachineryAndOtherMember2022-12-310001603923wfrd:DevelopedAndAcquiredTechnologyRightsMember2022-12-310001603923us-gaap:TradeNamesMember2022-12-310001603923wfrd:SeniorNotes65PercentDue2028Member2022-09-300001603923wfrd:SeniorNotes65PercentDue2028Memberus-gaap:SeniorNotesMember2023-12-310001603923wfrd:SeniorNotes65PercentDue2028Memberus-gaap:SeniorNotesMember2022-12-310001603923wfrd:ExitNotes11.00PercentDue2024Memberus-gaap:SeniorNotesMember2019-12-120001603923us-gaap:SeniorNotesMember2023-12-310001603923us-gaap:SeniorNotesMember2022-12-310001603923wfrd:SeniorNotes8625PercentDue2030Member2021-10-270001603923us-gaap:SeniorNotesMemberwfrd:SeniorNotes8625PercentDue2030Member2023-12-310001603923us-gaap:SeniorNotesMemberwfrd:SeniorNotes8625PercentDue2030Member2022-12-310001603923wfrd:ExitNotes11.00PercentDue2024Memberus-gaap:SeniorNotesMember2023-12-310001603923wfrd:ExitNotes11.00PercentDue2024Memberus-gaap:SeniorNotesMember2022-12-310001603923wfrd:ExitNotesMember2021-10-200001603923wfrd:ExitNotesMember2021-10-202021-10-2000016039232021-10-202021-10-200001603923wfrd:ExitNotesMember2022-12-310001603923wfrd:ExitNotes11.00PercentDue2024Memberus-gaap:SeniorNotesMember2022-01-012022-12-310001603923us-gaap:SeniorNotesMember2022-10-012022-12-310001603923wfrd:ExitNotesMember2023-12-310001603923wfrd:ExitNotes11.00PercentDue2024Memberus-gaap:SeniorNotesMember2023-01-012023-12-310001603923us-gaap:SeniorNotesMemberwfrd:SeniorNotes875PercentDue2024Member2020-08-280001603923wfrd:SeniorNotes875PercentDue2024Member2022-07-012022-09-300001603923wfrd:SeniorNotes65PercentDue2028Member2023-09-300001603923wfrd:SeniorNotes65PercentDue2028Member2023-01-012023-12-310001603923wfrd:SeniorNotes65PercentDue2028Member2022-07-012022-09-300001603923wfrd:SeniorNotes65PercentDue2028Member2022-01-012022-12-310001603923us-gaap:SecuredDebtMemberwfrd:SeniorNotes65PercentDue2028Member2023-12-310001603923us-gaap:SecuredDebtMemberwfrd:SeniorNotes65PercentDue2028Member2022-12-310001603923wfrd:SeniorNotes65PercentDue2028Memberus-gaap:SubsequentEventMember2024-01-012024-01-310001603923wfrd:SeniorNotes65PercentDue2028Memberus-gaap:SubsequentEventMember2024-01-310001603923wfrd:SeniorNotes8625PercentDue2030Member2022-12-310001603923us-gaap:LineOfCreditMemberwfrd:AmendedLCCreditAgreementMember2023-12-310001603923wfrd:AmendedLCCreditAgreementMember2023-12-310001603923us-gaap:RevolvingCreditFacilityMemberwfrd:ExitNotesMemberus-gaap:LineOfCreditMember2023-12-310001603923wfrd:AmendedLCCreditAgreementMember2023-03-240001603923us-gaap:RevolvingCreditFacilityMemberwfrd:ExitNotesMemberus-gaap:LineOfCreditMember2023-03-240001603923wfrd:AmendedLCCreditAgreementMember2019-12-120001603923wfrd:AmendedLCCreditAgreementMember2023-10-240001603923wfrd:PerformanceLettersOfCreditMemberwfrd:AmendedLCCreditAgreementMember2023-10-240001603923wfrd:PerformanceLettersOfCreditOrOtherBorrowingsMemberwfrd:AmendedLCCreditAgreementMember2023-10-2400016039232023-10-240001603923us-gaap:LineOfCreditMemberwfrd:AmendedLCCreditAgreementMember2023-10-240001603923wfrd:LCCreditAgreementLettersofCreditMember2023-12-310001603923wfrd:LCCreditAgreementLettersofCreditMember2023-12-310001603923wfrd:PerformanceLettersOfCreditMember2023-12-310001603923wfrd:PerformanceLettersOfCreditOrOtherBorrowingsMember2023-12-310001603923wfrd:UncommittedLettersofCreditMember2023-12-310001603923wfrd:LCCreditAgreementLettersofCreditMember2022-12-310001603923wfrd:UncommittedLettersofCreditMember2022-12-3100016039232022-10-170001603923us-gaap:RevolvingCreditFacilityMemberwfrd:ExitNotesMemberus-gaap:LineOfCreditMember2022-10-170001603923us-gaap:SecuredDebtMemberwfrd:ExitNotes11.00PercentDue2024Member2023-12-310001603923us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMemberwfrd:ExitNotes11.00PercentDue2024Memberus-gaap:FairValueInputsLevel2Member2023-12-310001603923us-gaap:SecuredDebtMemberwfrd:ExitNotes11.00PercentDue2024Member2022-12-310001603923us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SecuredDebtMemberwfrd:ExitNotes11.00PercentDue2024Memberus-gaap:FairValueInputsLevel2Member2022-12-310001603923us-gaap:EstimateOfFairValueFairValueDisclosureMemberwfrd:SeniorNotes65PercentDue2028Memberus-gaap:FairValueInputsLevel2Member2023-12-310001603923us-gaap:EstimateOfFairValueFairValueDisclosureMemberwfrd:SeniorNotes65PercentDue2028Memberus-gaap:FairValueInputsLevel2Member2022-12-310001603923us-gaap:EstimateOfFairValueFairValueDisclosureMemberwfrd:SeniorNotes8625PercentDue2030Memberus-gaap:FairValueInputsLevel2Member2023-12-310001603923us-gaap:EstimateOfFairValueFairValueDisclosureMemberwfrd:SeniorNotes8625PercentDue2030Memberus-gaap:FairValueInputsLevel2Member2022-12-310001603923us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001603923us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001603923us-gaap:ForeignExchangeContractMember2023-12-310001603923us-gaap:ForeignExchangeContractMember2022-12-310001603923wfrd:MajorCustomerMember2023-12-310001603923us-gaap:SubsequentEventMemberwfrd:MajorCustomerMember2024-01-310001603923us-gaap:CreditDefaultSwapMember2023-12-310001603923us-gaap:CreditDefaultSwapMember2023-01-012023-12-310001603923us-gaap:CreditDefaultSwapMembersrt:ScenarioForecastMember2024-12-310001603923us-gaap:CreditDefaultSwapMembersrt:ScenarioForecastMember2025-12-310001603923us-gaap:FairValueInputsLevel2Member2023-12-310001603923us-gaap:FairValueInputsLevel2Member2022-12-310001603923country:USsrt:MinimumMember2023-12-310001603923srt:MaximumMembercountry:US2023-12-310001603923country:USsrt:MinimumMember2022-12-310001603923srt:MaximumMembercountry:US2022-12-310001603923srt:MinimumMemberus-gaap:ForeignPlanMember2023-12-310001603923srt:MaximumMemberus-gaap:ForeignPlanMember2023-12-310001603923srt:MinimumMemberus-gaap:ForeignPlanMember2022-12-310001603923srt:MaximumMemberus-gaap:ForeignPlanMember2022-12-310001603923srt:MinimumMember2023-01-012023-12-310001603923srt:MaximumMember2023-01-012023-12-310001603923us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001603923us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001603923us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001603923srt:MinimumMemberus-gaap:PerformanceSharesMember2023-01-012023-12-310001603923srt:MaximumMemberus-gaap:PerformanceSharesMember2023-01-012023-12-310001603923us-gaap:PerformanceSharesMember2023-01-012023-12-310001603923us-gaap:PerformanceSharesMember2022-01-012022-12-310001603923us-gaap:PerformanceSharesMember2021-01-012021-12-310001603923us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-12-310001603923us-gaap:RestrictedStockUnitsRSUMember2022-12-310001603923us-gaap:PerformanceSharesMember2022-12-310001603923us-gaap:PhantomShareUnitsPSUsMember2022-12-310001603923us-gaap:PhantomShareUnitsPSUsMember2023-01-012023-12-310001603923us-gaap:RestrictedStockUnitsRSUMember2023-12-310001603923us-gaap:PerformanceSharesMember2023-12-310001603923us-gaap:PhantomShareUnitsPSUsMember2023-12-310001603923us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMember2023-12-310001603923us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:PerformanceSharesMember2023-12-3100016039232019-12-130001603923us-gaap:WarrantMember2019-12-130001603923us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001603923us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001603923us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001603923us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001603923us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001603923us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001603923us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001603923us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001603923us-gaap:WarrantMember2023-01-012023-12-310001603923us-gaap:WarrantMember2022-01-012022-12-310001603923us-gaap:WarrantMember2021-01-012021-12-310001603923us-gaap:StockCompensationPlanMember2023-01-012023-12-310001603923us-gaap:StockCompensationPlanMember2022-01-012022-12-310001603923us-gaap:StockCompensationPlanMember2021-01-012021-12-310001603923us-gaap:WarrantMember2019-12-130001603923wfrd:GainLossOnSaleOfDerivativesMember2023-01-012023-12-3100016039232019-01-012019-12-3100016039232020-01-012020-12-310001603923wfrd:InternalRestructuringMember2023-01-012023-12-310001603923us-gaap:EarliestTaxYearMembercountry:AR2023-01-012023-12-310001603923us-gaap:LatestTaxYearMembercountry:AR2023-01-012023-12-310001603923us-gaap:EarliestTaxYearMembercountry:CA2023-01-012023-12-310001603923us-gaap:LatestTaxYearMembercountry:CA2023-01-012023-12-310001603923us-gaap:EarliestTaxYearMembercountry:MX2023-01-012023-12-310001603923us-gaap:LatestTaxYearMembercountry:MX2023-01-012023-12-310001603923wfrd:RussiaDomainus-gaap:EarliestTaxYearMember2023-01-012023-12-310001603923us-gaap:LatestTaxYearMemberwfrd:RussiaDomain2023-01-012023-12-310001603923country:SAus-gaap:EarliestTaxYearMember2023-01-012023-12-310001603923us-gaap:LatestTaxYearMembercountry:SA2023-01-012023-12-310001603923country:CHus-gaap:EarliestTaxYearMember2023-01-012023-12-310001603923us-gaap:LatestTaxYearMembercountry:CH2023-01-012023-12-310001603923country:USus-gaap:EarliestTaxYearMember2023-01-012023-12-310001603923us-gaap:LatestTaxYearMembercountry:US2023-01-012023-12-310001603923wfrd:DRESegmentAcquisitionMemberus-gaap:SubsequentEventMember2024-02-012024-02-010001603923wfrd:DRESegmentAcquisitionMemberus-gaap:SubsequentEventMember2024-02-010001603923us-gaap:SubsequentEventMember2024-02-0100016039232023-10-012023-12-31

| | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| | | | | | | | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended | December 31, 2023 | |

| or | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from __________________________________to __________________________________ |

| Commission file number | 001-36504 | |

Weatherford International plc

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ireland | | 98-0606750 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 2000 St. James Place, | Houston, | Texas | | 77056 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 713.836.4000

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Ordinary shares, $0.001 par value per share | WFRD | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑Yes ☐ No

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☑ No ☐

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2023 was approximately $3.6 billion based upon the closing price on the Nasdaq Global Select Market as of such date. The registrant had 72,316,426 ordinary shares outstanding as of February 1, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required to be furnished pursuant to Part III of this Form 10-K will be set forth in, and will be incorporated by reference from, Weatherford’s definitive proxy statement for the 2024 Annual General Meeting of Shareholders to be filed by

Weatherford with the Securities and Exchange Commission (“SEC”) pursuant to Regulation 14A within 120 days after the registrant’s fiscal year ended December 31, 2023.

Weatherford International plc

Form 10-K for the Year Ended December 31, 2023

Table of Contents

| | | | | | | | |

| | PAGE |

| Item 1 | | |

| Item 1A | | |

| Item 1B | | |

Item 1C | | |

| Item 2 | | |

| Item 3 | | |

| Item 4 | | |

| | | |

| | |

| Item 5 | | |

| Item 6 | | |

| Item 7 | | |

| | |

| | |

| | |

| | |

| | |

| Item 7A | | |

| Item 8 | | |

| Item 9 | | |

| Item 9A | | |

| Item 9B | | |

| Item 9C | | |

| | | |

| | |

| Item 10 | | |

| Item 11 | | |

| Item 12 | | |

| Item 13 | | |

| Item 14 | | |

| | | |

| | |

| Item 15 | | |

| Item 16 | | |

| | |

Weatherford International plc – 2023 Form 10-K | 1

PART I

Item 1. Business.

Weatherford International plc, an Irish public limited company, together with its subsidiaries (“Weatherford,” the “Company,” “we,” “us” and “our”), is a leading global energy services company providing equipment and services used in the drilling, evaluation, well construction, completion, production, intervention, and responsible abandonment of wells in the oil and natural gas exploration and production industry as well as new energy platforms.

We conduct business in approximately 75 countries, answering the challenges of the energy industry with 335 operating locations including manufacturing, research and development, service, and training facilities. Our operational performance is reviewed and managed across the life cycle of the wellbore, and we report in three segments (1) Drilling and Evaluation, (2) Well Construction and Completions, and (3) Production and Intervention.

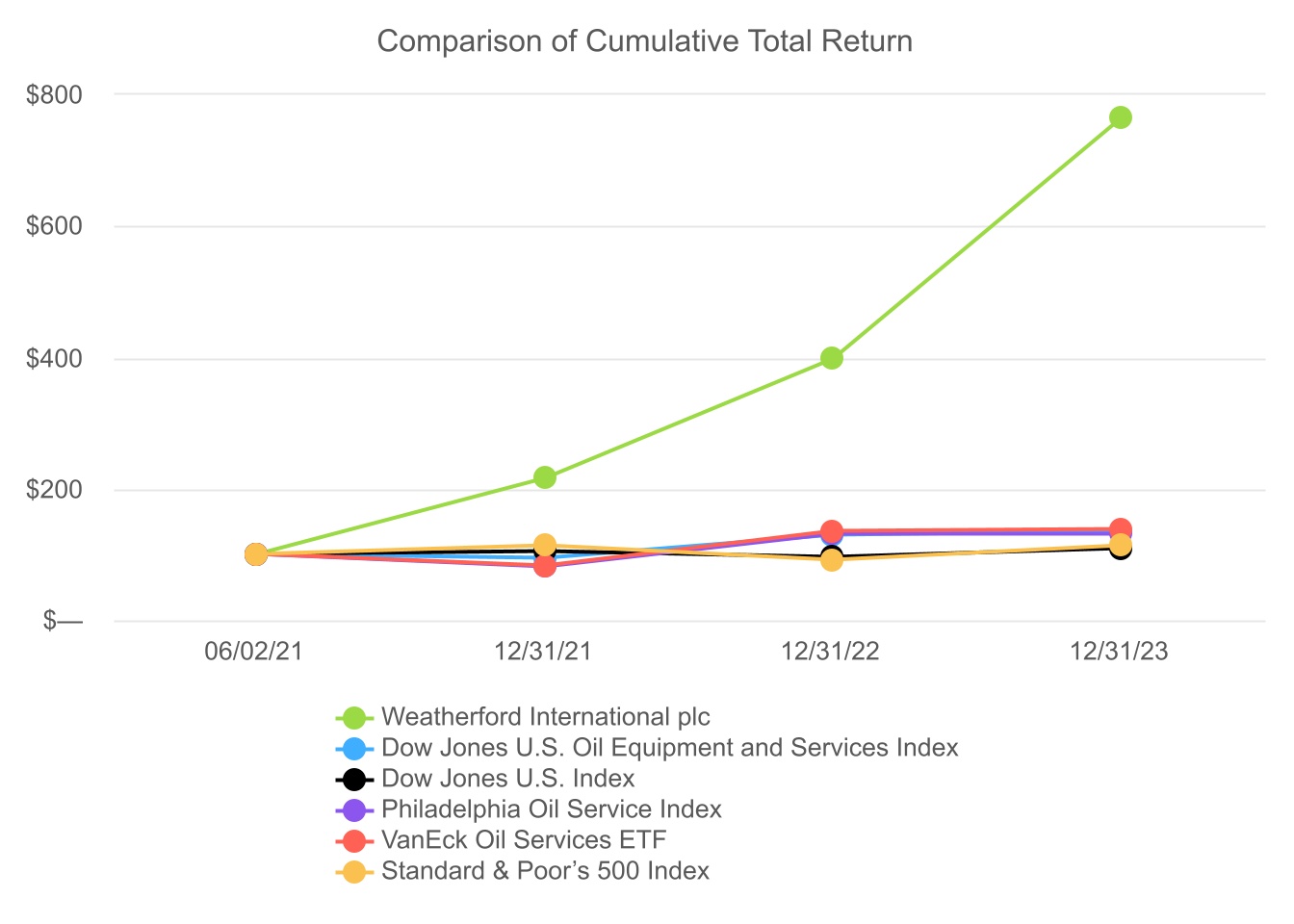

On June 1, 2021, NASDAQ approved our application for the listing of our ordinary shares. In connection with the listing, we became subject to the reporting requirements of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”). Our ordinary shares began trading on the Nasdaq Global Select Market on June 2, 2021, under the ticker symbol “WFRD”.

Our principal executive offices are located at 2000 St. James Place, Houston, Texas 77056, and our telephone number at that location is +1.713.836.4000. Our internet address is www.weatherford.com. General information about us, including our corporate governance policies, code of business conduct and charters for the committees of our Board of Directors, can be found on our website, and such information provided on our website, is not incorporated by reference into this Form 10-K. On our website we make available, free of charge, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments to those reports filed or furnished as soon as reasonably practicable after we electronically file or furnish them to the Securities and Exchange Commission (“SEC”). The SEC maintains a website that contains our reports, proxy and information statements, and our other SEC filings. The address of that site is www.sec.gov.

Strategy

Our goal is to create and deliver value for our shareholders throughout industry cycles by creating sustainable profitability that enables cash flow generation from our products and services regardless of market conditions. We accomplish this goal by disciplined use of capital, rigor around safety and operations, and a strong customer focus.

Our customers’ objectives are continually evolving and are currently focused on disciplined capital and operational expenditures, generating investor and shareholder returns, reducing emissions, participating in the energy transition, and enhancing safety. Weatherford has aligned our technology development and operations around these objectives and expanded our role as a market leading provider of solutions that assist our customers in addressing their key operational challenges not just in conventional reservoirs but also in mature fields, unconventionals, offshore, and in digitalization and automation.

Our focus is on accelerating the strategic deployment of our five strategic priorities of:

•Customer Experience enhancement;

•Creating the Future through innovation of our products, services and solutions;

•Organizational Vitality to hardness employee engagement, attract and retain talent, develop our people and

increase leadership effectiveness;

•Lean Operations to simplify and drive waste out of the business for increased productivity, quality, decreased

cycle-times and for improved service levels, and;

•Financial Performance and value throughout industry cycles with sustainable profitability and cash flow

generation.

We have driven this solution-based focus across our organization through a commitment to improving safety and service quality, embedding a returns-focused mindset in our organization, and developing and commercializing new technologies that add value to our customers’ operations.

Markets

Demand for our industry’s products and services is driven by many factors, including commodity prices, the number of oil and gas rigs and wells drilled, depth and drilling conditions of wells, number of well completions, age of existing wells, reservoir depletion, regulatory environments and the level of workover activity worldwide.

Weatherford International plc – 2023 Form 10-K | 2

Technology is critical to the energy services marketplace as a result of the maturity of the world’s oil and natural gas reservoirs, declining production rates and the nature of complex well designs, in both land and offshore markets. Customers continue to seek, test and use technologies that accelerate and optimize production at an increasing rate. We invest substantial resources into building our technology offerings, which enable our customers to evaluate, develop and produce from their oil and natural gas reservoirs more efficiently. Our products and services are designed to enable our customers to increase production rates while reducing their costs of drilling and production.

Reportable Segments

We offer our services and technologies in relation to the well life cycle and have three reportable segments: (1) Drilling and Evaluation (2) Well Construction and Completions, and (3) Production and Intervention. All of our segments are enabled by a suite of digital monitoring, control and optimization solutions using advanced analytics to provide safe, reliable and efficient solutions throughout the well life cycle, including responsible abandonment at the end of the well’s productive life.

Products and Services

Drilling and Evaluation (“DRE”) offers a suite of services including managed pressure drilling, drilling services, wireline and drilling fluids. DRE offerings range from early well planning to reservoir management through innovative tools and expert engineering to optimize reservoir access and productivity.

Managed Pressure Drilling helps to manage wellbore pressures to optimize drilling performance. We incorporate various technologies, including rotating control devices and advanced automated control systems, as well as several drilling techniques, such as closed-loop drilling, air drilling, managed-pressure drilling and underbalanced drilling.

Drilling Services includes directional drilling, logging while drilling, measurement while drilling and rotary-steerable systems. We provide a full range of downhole equipment, including high-temperature and high-pressure sensors, drilling reamers and circulation subs.

Wireline includes open-hole and cased-hole logging services that measure the geophysical properties of subsurface formations to determine production potential, locate resources and detect cement and casing integrity issues. We also execute well intervention and remediation operations by conveying equipment via cable into existing wells.

Drilling Fluids provides fluids and chemicals essential to the drilling process.

Well Construction and Completions (“WCC”) offers products and services for well integrity assurance across the full life cycle of the well. The primary offerings are tubular running services, cementation products, completions, liner hangers and well services. WCC deploys conventional to advanced technologies, providing safe and efficient services in any environment during the well construction phase.

Tubular Running Services provides equipment, tubular handling, tubular management and tubular connection services for the drilling, completions, and workover of various types of wells. We include conventional rig services, automated rig systems, real-time torque-monitoring, and remote viewing of the makeup and breakout verification process, all underscored by our technology and procedural protocols to provide casing and tubular running operations with superior efficiency, and reduced health, safety, and environmental risks.

Cementation Products enable operators to centralize the casing throughout the wellbore and control the displacement of cement and other fluids for proper zonal isolation. Specialized equipment includes plugs, float and stage equipment and torque-and-drag reduction technology. Our cementation engineers analyze customer requirements and provide software enabled design input from pre-job planning to installation.

Completions offer customers a comprehensive line of completion tools, such as safety valves, production packers, downhole reservoir monitoring, flow control, isolation packers, multistage fracturing systems and sand-control technologies that set the stage for maximum production with minimal cost per barrel.

Liner Hangers suspend a casing string within a previous casing string thereby eliminating the need to run casing to the surface. We offer a comprehensive liner-hanger portfolio, along with engineering and execution experience, for a wide range of applications that include high-temperature and high-pressure wells.

Weatherford International plc – 2023 Form 10-K | 3

Well Services provides through tubing products and services which ensure consistent delivery of well solutions that extend the economic life of our customer's assets.

Production and Intervention (“PRI”) offers production optimization technologies through the Company’s ability to design and deliver a complete production ecosystem ranging from boosting productivity to responsible well abandonment for our customers. The primary offerings are intervention services & drilling tools, artificial lift, digital solutions, sub-sea intervention and pressure pumping services in select markets. PRI utilizes a suite of reservoir stimulation designs, and engineering capabilities that isolate zones and unlock reserves in conventional and unconventional wells, deep water, and aging reservoirs.

Intervention Services & Drilling Tools provides re-entry, fishing and well abandonment services as well as patented bottom hole, tubular-handling equipment, pressure-control equipment and drill pipe and collars for various types of wells.

Artificial Lift provides pressure enabling methods to produce reservoir fluids from wells lacking sufficient reservoir pressure for natural flow. We provide most forms of lift, including reciprocating rod lift systems, progressing cavity pumping, gas-lift systems, hydraulic-lift systems, plunger-lift systems and hybrid lift systems for special applications. We also offer related automation and control systems.

Digital Solutions provides software, automation, and flow measurement solutions. For our customers’ drilling operations, the solutions deliver data aggregation, engineering, and optimization including performance analytics in real-time. For our customers’ production operations, the solutions provide flow measurement, surveillance, and control to deliver production optimization by integrating workflows and data for the well, surface facilities and the reservoir.

Sub-Sea Intervention provides electrical and hydraulic power transmission to subsea equipment in order to facilitate workovers and abandonment in deep and ultra-deep-water operations in select markets.

Pressure Pumping Services offers advanced chemistry-based solutions and associated pumping services for safe and effective production enhancements. In select international markets, we provide pressure pumping and reservoir stimulation services, including acidizing, fracturing, cementing, and coiled-tubing intervention.

Competition

We provide our products and services worldwide and compete with a number of global and regional competitors. Our principal competitors include SLB, Halliburton, Baker Hughes, National Oilwell Varco, ChampionX and Expro Group Holdings. We also compete with various other suppliers who provide products and services within a smaller cross section of our product line portfolio either locally, regionally, or globally. Competition is based on a number of factors, including performance, safety, quality, reliability, service, price, response time and, in some cases, depth and breadth of products. The energy services business is highly competitive, which may adversely affect our ability to succeed. Additionally, the consolidations of and acquisitions by our competitors are difficult to predict and may impact our business as a result.

Raw Materials

We purchase a wide variety of raw materials, as well as parts and components. We integrate products and components produced by other parties into the products and systems we sell. We continually evaluate and invest in our integrated supply chain in order to reduce materials constraints and impacts from inflationary pressures, while improving lead times and supporting our sustainability efforts.

Customers

Substantially all of our customers are engaged in the energy industry and include national oil companies, international and independent oil and natural gas companies as well as new energy companies.

Weatherford International plc – 2023 Form 10-K | 4

Research, Development and Patents

In addition to maintaining world-class technology and training centers throughout the world, we have research, development, and engineering teams focused on developing new technologies and improving existing products and services to meet customer demands for improved drilling performance, well integrity, and enhanced reservoir productivity, with emphasis on efficiency, reliability, safety and the environment. We also develop technologies for new energy markets, in addition to the existing oil and gas markets in which we traditionally operate. Weatherford has significant expertise, trade secrets, intellectual property and know-how with respect to the design, manufacturing, and use of our equipment and the provision of our services. As many areas of our business rely on proprietary technology, we seek to protect and defend our intellectual property through trade secrets and patent protection both inside and outside the U.S. for products and methods that we believe to have commercial significance. Although in the aggregate our patents are important to the manufacturing and marketing of many of our products and services, we do not believe that the expiration of any one of our patents would have a materially adverse effect on our business.

Seasonality

Weather and natural phenomena can temporarily affect the level of demand for our products and services; however, the widespread geographical locations of our operations serve to mitigate the overall impact on our business in any particular geographic region. Spring months in Canada, summer in the Southern hemisphere, and winter months in the North Sea and Russia typically have lower demand, driving a negative impact on operations. Additionally, heavy rains, hurricanes, unusual wildfires, extreme freezes or other unpredictable or unusually harsh natural phenomena could lengthen the periods of reduced activity and have a detrimental impact on our results of operations. In addition, customer spending patterns for our products and services may result in higher activity in the fourth quarter of each calendar year as our customers seek to fully utilize their annual budgets.

Russia Ukraine Conflict

On February 24, 2022, the military conflict between Russia and Ukraine (“Russia Ukraine Conflict”) began and in response we evaluated, and continue to evaluate, our operations, with the priority being centered on the safety and well-being of our employees in the impacted regions, as well as operating in full compliance with applicable international laws and sanctions.

Revenues in Russia were approximately 6% of our total revenue for the year ended December 31, 2023, and were approximately 7% of our total revenues for the years ended December 31, 2022 and 2021. As of December 31, 2023, our Russia operations included $62 million in cash, $94 million in other current assets, $76 million in property, plant and equipment and other non-current assets, and $62 million in liabilities. As of December 31, 2022, our Russia operations included $30 million in cash, $98 million in other current assets, $65 million in property, plant and equipment and other non-current assets, and $52 million in liabilities.

We continue to closely monitor and evaluate the developments in Russia as well as any changes in international laws and sanctions. We believe that operational complexity will increase over time and therefore continually evaluate these potential impacts on our business. As such, we continue to actively evaluate various options, strategies and contingencies with respect to our business in Russia, including, but not limited to:

•continuing the business in compliance with applicable laws and sanctions;

•evaluating the continued use or change in products, equipment and service offerings we currently provide in

Russia;

•curtailing or winding down our activities over time;

•potentially divesting some or all of our assets or businesses in Russia, which could include the option of re-entering the country if and when sanctions or applicable laws would allow for the same and;

•potential nationalization of the business.

Federal Regulation and Environmental Matters

Our operations are subject to federal, state and local laws and regulations in the U.S. and globally relating to the energy industry in general and the environment in particular. Our 2023 expenditures to comply with environmental laws and regulations were not material, and we currently do not expect the cost of compliance with environmental laws and regulations for 2024 to be material. We continuously monitor and strive to maintain compliance with changes in laws and regulations that impact our business.

Weatherford International plc – 2023 Form 10-K | 5

We have obligations and expect to incur capital, operating and maintenance, and remediation expenditures, as a result of compliance with environmental laws and regulations. Among those obligations, are the current requirements imposed by the Texas Commission on Environmental Quality (“TCEQ”) at a former facility in Midland, Texas where we are performing a TCEQ-approved Remedial Action Plan (“RAP”) to address contaminated ground water. The performance of the RAP and related expenses are scheduled to be performed over a twenty to thirty-year period and, may cost as much as $11 million, all of which were recorded as an undiscounted obligation on the Consolidated Balance Sheets as of December 31, 2022, and remains unchanged as of December 31, 2023.

Human Capital Management

Focus on People and Culture

At Weatherford, our global team is driven to further our mission – producing energy for today and tomorrow. Pivotal to our culture and ensuring we fulfill our mission and vision is our “One Weatherford” spirit – individually, we are impressive, and together, we are unstoppable. Our One Weatherford spirit motivates our global teams to collaborate for shared success and to seek out unique perspectives, fostering a culture where everyone can grow and contribute.

Our global team comprises experts in various disciplines, including engineering, oilfield services support, and multiple corporate functions. In addition to our commitment to operating sustainably with safety, quality, and integrity, we are also focused on recruiting, developing, and promoting an employee culture that revolves around the following Core Values:

•Passion: We are energized by our work and inspired to make a positive impact in our industry, for our customers, across our Company, and in our communities;

•Accountability: We operate with integrity, enable our people and teams to be successful, and aim to be true to our word;

•Innovation: We are driven to deliver advancements that propel our Company, industry, and customers forward; and

•Value Creation: We aspire to achieving long-term value for all our stakeholders by providing compelling and unique benefits through technology differentiation and operational excellence.

We believe that ensuring we have the right talent in place is essential to delivering positive results for the business. We remain focused on developing our talent through training, competency, and mentoring, as well as attracting diverse and qualified individuals who will bring fresh perspectives and skill sets to the team. Through role-specific competency-based training and leadership development programs, we seek to expand our employees’ skill sets and regularly reinforce important topics that align with our core values and strategic priorities.

Focus on Safety

Weatherford is committed to the health, safety, and well-being of our employees, customers, and the communities in which we operate. We strive to be a company that is incident free, delivers on our promises, and leaves the environments and communities in which we operate better than we found them. Our company values are built on the foundation of safety, and we realize that a safe operation is indeed an efficient operation. Our commitment to safety and service quality is embedded into every level of our organization. Our Operational Excellence and Performance System (“OEPS”) is our integrated quality, health, safety, security, and environmental management system. OEPS meets or exceeds criteria outlined by international management system standards such as ISO 45001, supports our employees in the field, and enables us to deliver on our customer commitments without sacrificing quality, health, safety, security, or environmental performance. In addition, we have safety programs that are designed to educate employees and our Stop Work Authority program empowers them to intervene when they see or anticipate unsafe behaviors or conditions.

Compensation

We believe in aligning our employees’ compensation with the positive performance of our Company and returns realized for our shareholders. The goal of our compensation programs is to provide competitive compensation opportunities to each of our employees that are well-balanced between our current and long-term strategic priorities, that discourage excessive or unnecessary risk taking, and that reward our employees appropriately for their efforts. We are committed to maintaining and fostering a culture grounded in the principles inherent in pay-for-performance over the short and long-term for our employees eligible to receive a bonus. Through this culture, we strive to attract, motivate, retain, and reward our employees for their work that contributes to building our brand and to sustaining our success in the marketplace. We believe our culture of aligning our compensation programs with our strategic priorities supports a cohesive drive towards value creation for all our stakeholders.

Weatherford International plc – 2023 Form 10-K | 6

Diversity, Equity and Inclusion

We understand the importance of operating collaboratively and inclusively across all levels of our organization, embracing the full spectrum of diversity among our employees, and recognizing the strength and competitive advantages our differences afford us as a Company. Our Diversity, Equity, and Inclusion (“DE&I”) Program is a core element of our One Weatherford culture. Our DE&I efforts aim to provide learning, engagement, and philanthropic opportunities to help our people and communities flourish. The executive team and frontline employees champion our commitment to embedding our DE&I Program into our organization.

In 2023, we continued to advance our program and awareness throughout the organization, including creating DE&I strategies for each region and conducting celebrations across the Company that foster collaboration and meaningful conversations regarding DE&I. We trained our employees on unconscious bias and continued our focus on NextGen, our field engineering graduate program designed to accelerate the development of defined competencies and skillsets to prepare participants for future leadership positions, as well as our Localization programs for select customers to develop local talent. In addition, we expanded participation in the Women of Weatherford (“WOW”), an employee resource group that seeks to engage, support, empower, and inspire women to foster professional growth and advancement across our regions and employee levels.

Community Impact and Volunteering

In addition to investing in our employees, we are committed to making a positive impact in the communities in which we live and work. Across the globe, our employees give back to organizations who need support in terms of donated items, volunteered time, and financial giving. For example, our team in Canada participates in an annual radiothon to support a local hospital, and our offices across the Latin America and Europe and Africa regions donate time and resources to orphanages, hospitals, and schools to support children and their families. In the United States, we continue to raise funds and awareness to find a cure for Multiple Sclerosis (“MS”) through the MS Society and through our annual Weatherford Walks event, we raised approximately $500,000 benefiting a number of local not-for-profit organizations.

Employee Statistics

As of December 31, 2023, Weatherford had approximately 18,500 employees globally. Some of our operations are subject to union contracts and these contracts cover approximately 17% of our employees.

Weatherford International plc – 2023 Form 10-K | 7

Executive Officers of Weatherford

The following table sets forth, as of February 7, 2024, the names and ages of the executive officers of Weatherford, including all offices and positions held by each for at least the past five years. There are no family relationships between the executive officers of the Company or between any director and any executive officer of the Company.

| | | | | | | | |

| Name | Age | Current Position and Five-Year Business Experience |

| Girishchandra K. Saligram | 52 | President and Chief Executive Officer of Weatherford International plc, since October 2020 |

| | Senior Vice President and Chief Operating Officer of Exterran Corporation from August 2018 to September 2020 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Arunava Mitra | 51 | Executive Vice President and Chief Financial Officer of Weatherford International plc, since January 2023 |

| | Executive Vice President and Chief Financial Officer of Mitsubishi Power Americas Inc. from October 2021 to December 2022 |

| | Executive Vice President and Chief Financial Officer of Mitsubishi Hitachi Power Systems of Americas Inc. from October 2014 to October 2021 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Scott C. Weatherholt (a) | 46 | Executive Vice President, General Counsel, and Chief Compliance Officer of Weatherford International plc, since July 2020 |

| | Senior Vice President and General Counsel of Arena Energy, L.P., from September 2019 to July 2020 |

| | Executive Vice President, General Counsel, and Corporate Secretary at Midstates Petroleum Company, Inc., from February 2015 to August 2019 |

| | |

| | |

| | |

| | |

| | |

Richard D. Ward | 55 | Executive Vice President, Global Field Operations of Weatherford International plc, since January 2024 |

| | Senior Vice President, Subsea Production Systems of Baker Hughes Co, from May 2021 to December 2022 |

| | Senior Vice President, Strategic Planning & Solutions of Baker Hughes Co, from October 2019 to May 2021 |

| | Vice President, Marketing, Strategy & Solutions of Baker Hughes Co, from August 2017 to October 2019 |

David J. Reed | 50 | Executive Vice President and Chief Commercial Officer of Weatherford International plc, since January 2024 |

| | Senior Vice President and Chief Commercial Officer of Weatherford International plc, from August 2021 to December 2023 |

| | Vice President of Sales, Tenaris, from July 2015 to January 2021 |

Depinder Sandhu | 48 | Executive Vice President, Global Product Lines of Weatherford International plc, since January 2024 |

| | Senior Vice President, Global Product Lines of Weatherford International plc, from December 2021 to December 2023 |

| | Senior Director, Corporate Strategy of Weatherford International plc, from April 2021 to November 2021 |

| | Vice President, Business Development & Strategy of Weatherford International plc, from July 2020 to March 2021 |

| | Director, Service Delivery of Weatherford International plc, from November 2017 to May 2020 |

| Desmond J. Mills | 51 | Senior Vice President and Chief Accounting Officer of Weatherford International plc, since November 2021 (Interim Chief Financial Officer August 2022 to January 2023) |

| | |

| | Vice President and Chief Accounting Officer of Weatherford International plc, from March 2021 to November 2021 |

| | Segment Compliance Manager, Construction Industries Segment, Caterpillar Inc., from July 2020 to March 2021 |

| | Division Chief Financial Officer, Integrated Components and Solutions Division, Caterpillar Inc., from September 2018 to July 2020 |

| | |

Weatherford International plc – 2023 Form 10-K | 8

(a)Prior to joining Weatherford, Mr. Weatherholt was the General Counsel at Midstates Petroleum Company, Inc. when the company filed for bankruptcy protection on May 1, 2016 in the Federal Bankruptcy Court for the Southern District of Texas (Houston Division) and served the company before, during and after its bankruptcy. In addition, he was the Senior Vice President & General Counsel of Arena Energy, LP, which filed for bankruptcy protection on August 20, 2020, in the Federal Bankruptcy Court for the Southern District of Texas (Houston Division) approximately 4 weeks after his departure from the company.

Item 1A. Risk Factors.

An investment in our securities involves various risks. You should consider carefully all the risk factors described below, the matters discussed herein under “Forward-Looking Statements” and other information included and incorporated by reference in this Form 10-K, as well as in other reports and materials that we file with the SEC. If any of the risks described below, or elsewhere in this Form 10-K, were to materialize, our business, financial condition, results of operations, cash flows and or prospects could be materially adversely affected. In such case, the trading price of our ordinary shares could decline, and investors could lose part or all of their investment. Additional risks and uncertainties not currently known to us or that we currently deem immaterial may also materially adversely affect our financial condition, results of operations and cash flows.

Energy Services Industry Risks

Our business is dependent on capital spending by our customers which is greatly affected by fluctuations in oil and natural gas prices and the availability and cost of capital; reductions in capital spending by our customers has had, and could continue to have, an adverse effect on our business, financial condition and results of operations.

Demand for our products and services is tied to the level of exploration, development and production activity and the corresponding capital and operating spending by oil and natural gas exploration and production companies, including national oil companies. The level of exploration, development and production activity is directly affected by fluctuations in oil and natural gas prices, which historically have been volatile and are likely to continue to be volatile in the future, especially given current geopolitical and economic conditions. Low oil and natural gas prices and decline in global demand for oil and natural gas, including reduced demand as a result of a pandemic, have previously led to our customers, including national oil companies and large oil and natural gas exploration and production companies, to greatly reduce planned future capital expenditures. Factors affecting the prices of oil and natural gas include, but are not limited to:

•the level of supply and demand for oil and natural gas;

•the ability or willingness of the Organization of Petroleum Exporting Countries (“OPEC”) and the expanded alliance (“OPEC+”) and other high oil exporting non-OPEC+ nations to set and maintain oil production levels;

•the level of oil and natural gas production in the U.S. and by other non-OPEC+ countries;

•oil refining capacity;

•shifts in end-customer preferences toward sustainable energy sources, fuel efficiency and the use of natural gas;

•the cost of, and constraints associated with, producing and delivering oil and natural gas;

•governmental regulations, including the policies of governments regarding the exploration for and production and

development of their oil and natural gas reserves;

•weather conditions, unusual wildfires, natural disasters, and health or similar issues, such as pandemics or epidemics;

•worldwide political, military, and economic conditions (including impacts from the Russia Ukraine Conflict); and

•increased demand for alternative energy and electric vehicles, including government initiatives to promote the use of

sustainable, renewable energy sources and public sentiment around alternatives to oil and natural gas.

Reductions in capital spending or reductions in the prices we receive for our products and services provided to our customers could have a material adverse effect on our business, financial condition and results of operations. Spending by exploration and production companies can also be impacted by conditions in the capital markets, which may be volatile at times. Limitations on the availability of capital or higher costs of capital may cause exploration and production companies to make additional reductions to their capital budgets even if oil and natural gas prices increase from current levels. In addition, the transition of the global energy sector from primarily a fossil fuel-based system to renewable energy sources could affect our customers' levels of expenditures. Any such reductions in spending could curtail drilling programs, as well as discretionary spending on well services, which may result in a reduction in the demand for certain of our products and services, the rates we can charge for and the utilization of our assets, any or all of which could have a material adverse effect on our business, financial condition and results of operations.

Weatherford International plc – 2023 Form 10-K | 9

Our fulfillment system relies on a global network of external suppliers and service providers, which may be impacted by macroeconomic conditions and geopolitical conflict and instability. Shortages, supplier capacity constraints, supplier production disruptions, supplier quality and sourcing issues or price increases could have a material adverse effect on our business, financial condition and results of operations.

We purchase a variety of raw materials, as well as parts and components made by other manufacturers and suppliers for use in our manufacturing facilities. Our global supply chain is also subject to macroeconomic conditions and political risks. Adverse macroeconomic conditions, including inflation, slower growth or recession and higher interest rates could create disruptions in our supply chain. Similarly, geopolitical risks, including instability resulting from civil unrest, political demonstrations, strikes and armed conflict or other crises in the oil and gas producing regions, such as the Russia Ukraine Conflict and the resulting sanctions, could change the global supply chain dynamics and demand. A disruption in deliveries to or from suppliers or decreased availability of materials could have an adverse effect on our ability to meet our commitments to customers or increase our operating costs. Also, certain parts and equipment that we use in our operations may be available only from a small number of suppliers, manufacturers or service providers, or in some cases may be sourced through a single supplier, manufacturer or service provider. A disruption in the deliveries from such third‑party suppliers, manufacturers or service providers, capacity constraints, production disruptions, price increases, quality control issues, recalls or other decreased availability of parts and equipment could adversely affect our ability to meet our commitments to customers and have a material adverse effect on our business, financial condition and results of operations.

Climate change, environmental, social and governance (“ESG”) and other sustainability initiatives may result in regulatory or structural industry changes that could require significant operational changes and expenditures, reduce demand for our products and services and adversely affect our business, financial condition, results of operations, stock price or access to capital markets.

Sustainability initiatives are a growing global movement. Continuing political and social attention to these issues has resulted in both existing and pending international agreements and national, regional and local legislation, regulatory measures, reporting obligations and policy changes. Also, there is increasing societal pressure in some of the areas where we operate, to limit greenhouse gas emissions as well as other global initiatives. These agreements and measures, including the Paris Climate Accord, may require, or could result in future legislation, regulatory measures or policy changes that would require, significant equipment modifications, operational changes, taxes, or purchases of emission credits to reduce emission of greenhouse gases from our operations or those of our customers, which may result in substantial capital expenditures and compliance, operating, maintenance and remediation costs. As a result of heightened public awareness and attention to these issues as well as continued political and regulatory initiatives to reduce the reliance upon oil and natural gas, demand for hydrocarbons may be reduced, which could have an adverse effect on our business, financial condition, and results of operations. The imposition and enforcement of stringent greenhouse gas emissions reduction requirements could severely and adversely impact the oil and natural gas industry and therefore significantly reduce the value of our business.

Certain financial institutions, institutional investors and other sources of capital have begun to limit or eliminate their investment in financing of conventional energy-related activities due to concerns about climate change, which could make it more difficult for our customers and for us to finance our respective businesses. Increasing attention to climate change, ESG and sustainability has resulted in governmental investigations, and public and private litigation, which could increase our costs or otherwise adversely affect our business or results of operations.

In addition, organizations that provide information to investors on corporate governance and related matters have developed ratings processes for evaluating companies on their approach to ESG matters. Such ratings are used by some investors to inform their investment and voting decisions. Unfavorable ESG ratings may lead to increased negative investor sentiment toward us and our industry and to the diversion of investment to other companies or industries, which could have a negative impact on the price of our securities and our access to and costs of capital.

Any or all of these ESG and sustainability initiatives may result in significant operational changes and expenditures, reduced demand for our products and services, and could materially adversely affect our business, financial condition, results of operations, stock price or access to capital markets.

Weatherford International plc – 2023 Form 10-K | 10

Failure to effectively and timely address the need to operate more sustainably and with a lower carbon footprint and impact could adversely affect our business, results of operations and cash flows.

Our long-term success may depend on our ability to effectively lower the carbon impact of how we deliver our products and services to our customers as well as adapting our technology portfolio for potentially changing government requirements and customer preferences towards more sustainable competitors. We may also consider engaging with our customers to develop solutions to decarbonize our customers’ oil and natural gas operations. We could potentially lose engagement with customers, investors and/or certain financial institutions if we fail or are perceived to fail at effectively and timely addressing the need to conduct our operations and provision of services to our customers more sustainably and with a lower carbon footprint which could materially adversely affect our business, financial condition and results of operations.

Failure to effectively and timely address the energy transition could materially adversely affect our business, financial condition and results of operations.

Our long-term success depends on our ability to effectively participate in the energy transition, which will require adapting our technology portfolio to potentially changing market demand for products and services and to support the production of energy from sources other than hydrocarbons (e.g., geothermal, carbon capture, responsible abandonment, wind, solar and hydrogen). If the energy transition landscape changes faster than anticipated or in a manner that we do not anticipate, demand for our products and services could be adversely affected. Furthermore, if we fail or are perceived to not effectively implement an energy transition strategy, or if investors or financial institutions shift funding away from companies focused primarily or solely in fossil fuel-related industries, it could materially adversely affect our business, financial condition, results of reparations and our access to capital or the market for our securities.

Severe weather, including extreme weather conditions and unusual wildfires, has in the past, and could in the future, adversely affect our business and results of operations.

Our business has been, and in the future will likely be, affected by severe weather and unusual wildfires in areas where we operate, which could materially adversely affect our operations. In addition, the frequency and severity of these events may also materially affect our operations and financial results. Any such events could have a material adverse effect on our business, financial condition and results of operations.

Liability claims resulting from catastrophic incidents could have a material adverse effect on our business, financial condition and results of operations.

Drilling for and producing hydrocarbons, and the associated products and services that we provide, include inherent dangers that may lead to property damage, personal injury, death or the discharge of hazardous materials into the environment. Many of these events are outside our control. Typically, we provide products and services at a well site where our personnel and equipment are located together with personnel and equipment of our customer and third parties, such as other service providers. At many sites, we depend on other companies and personnel to conduct drilling and other operations in accordance with appropriate safety standards. From time to time, personnel are injured, or equipment or property is damaged or destroyed, as a result of accidents, equipment failures, faulty products or services, failure of safety measures, uncontained formation pressures or other dangers inherent in drilling for or producing oil and natural gas. Any of these events can be the result of human error. With increasing frequency, our products and services are deployed on more challenging prospects both onshore and offshore, where the occurrence of the types of events mentioned above can have an even more catastrophic impact on people, equipment or the environment. Such events may expose us to significant potential losses which could have a material adverse effect on our business, financial condition and results of operations.

Business and Operational Risks

A significant portion of our revenue is derived from our operations outside the U.S., which exposes us to risks inherent in doing business in each of the approximately 75 countries in which we operate.

The U.S. accounted for 16%, 20% and 19% of revenues in 2023, 2022 and 2021, respectively. The rest of our revenues were from non-U.S. operations. Operations in countries other than the U.S. are subject to various risks, including:

•global political, economic and market conditions, political disturbances, war, terrorist attacks, changes in global trade policies, weak local economic conditions and international currency fluctuations (including the Russia Ukraine Conflict);

Weatherford International plc – 2023 Form 10-K | 11

•general global economic repercussions related to U.S. and global inflationary pressures and potential recessionary concerns;

•failure to ensure on-going compliance with current and future laws and government regulations, including but not limited to those related to the Russia Ukraine Conflict, and environmental and tax and accounting laws, rules and regulations;

•changes in, and the administration of, treaties, laws, and regulations, including in response to issues related to the Russia Ukraine Conflict and the potential for such issues to exacerbate other risks we face;

•exposure to expropriation of our assets, deprivation of contract rights or other governmental actions;

•social unrest, acts of terrorism, war or other armed conflict;

•fraud and political corruption;

•varying international laws and regulations;

•adequate responses to a pandemic and related restrictions;

•confiscatory taxation or other adverse tax policies;

•trade and economic sanctions or other restrictions imposed by the European Union, the United Kingdom, the U.S. or other countries, including in response to the Russia Ukraine Conflict;

•exposure under the U.S. Foreign Corrupt Practices Act or similar governmental legislation in other countries; and

•restrictions on the repatriation of income or capital.

A concentration of our accounts receivables and revenues were related to one customer and significant changes to the demand or health of the customer could adversely impact our consolidated results of operations, financial condition and statements of cashflows.

Approximately 10% of our 2023 revenue and approximately 22% of our December 31, 2023 accounts receivables were related to our largest customer in Mexico. Additionally, during the fourth quarter of 2023, we entered into a credit default swap (“CDS”) with a third-party financial institution as described in “Note 10 – Derivative Financial Instruments” related to a secured loan between that third-party financial institution and our largest customer in Mexico. The secured loan was utilized by this customer to pay certain of our outstanding receivables. We expect the concentration risk to continue into 2024.

Business slowdowns or other items impacting the financial health of the customer could potentially have an adverse impact on our results of operations.

Our business could be negatively affected by cybersecurity incidents and other technology disruptions.

We rely heavily on information systems and other digital technology to conduct and protect our business. These information systems and other digital technology are subject to the risk of increasingly sophisticated cybersecurity attacks, incursions or other incidents such as unauthorized access to data and systems, loss or destruction of data (including confidential customer, supplier and employee information), computer viruses, or other malicious code, phishing and cyberattacks, and other similar events. These incidents could arise from numerous sources, including those outside our control, including fraud or malice on the part of third parties, governmental actors, accidental technological failure, electrical or telecommunication outages, failures of computer servers or other damage to our property or assets, human error, complications encountered as existing systems are maintained, repaired, replaced, or upgraded or outbreaks of hostilities or terrorist acts.

Given the rapidly evolving nature of cybersecurity incidents, there can be no assurance that the controls we have designed and implemented to prevent or limit the effects of cybersecurity incidents or attacks will be sufficient in preventing or limiting the effects of all such incidents or attacks or be able to avoid a material impact to our systems should such incidents or attacks occur. Recent widespread cybersecurity incidents and attacks in the U.S. and elsewhere have affected many companies. To date, none of these have had a material impact on us. Cybersecurity incidents can result in the disclosure of confidential or proprietary customer, supplier or employee information; theft or loss of intellectual property; impairment in our ability to operate or conduct our business; damage to our reputation with our customers, suppliers, employees and the market; failure to meet customer requirements or result in customer dissatisfaction; legal and regulatory exposure, including fines or legal proceedings (including as a result of our failure to make adequate or timely disclosures to the public, government agencies or affected individuals); damage to equipment (which could cause environmental or safety issues) and other financial costs and losses, including as a result of any remediation efforts. While Weatherford imposes controls on third-party system connectivity to our systems, the risks from an attack via a third-party remain.

The occurrence of a cybersecurity incident can go unnoticed for a period of time despite efforts to detect and respond in a timely manner. Any investigation of a cybersecurity incident is inherently unpredictable, and it takes time before the completion of any investigation and before there is availability of full and reliable information. Even when an attack has been detected, it is not always immediately apparent what the full nature and scope of any potential harm may be, or how best to remediate it, and

Weatherford International plc – 2023 Form 10-K | 12

certain errors or actions could be repeated or compounded before they are discovered and remediated, all or any of which further increase the risks, costs and consequences of a cybersecurity event or other technology disruption. As cybersecurity incidents and attacks continue to evolve, we may be required to expend significant additional resources and incur significant expenses to continue to modify or enhance our protective measures or to investigate, respond to or remediate any information security vulnerabilities.

Depending on the nature and scope of the cybersecurity incident, it could have a material adverse effect on our business, reputation, financial condition and results of operations.

A pandemic significantly weakened demand for our products and services and had a substantial negative impact on our business, financial condition, results of operations and cash flows. A future pandemic may result in similar impacts.

The effects of the COVID-19 pandemic in 2020 and 2021, including actions taken by businesses and governments to contain the spread of the virus, resulted in a significant reduction in international and U.S. economic activity and severely impacted our business and our industry. The effects included adverse revenue and net income impacts; disruptions to our operations; customer shutdowns of oil and natural gas exploration and production; employee impacts from illness, school closures and other community response measures; and temporary closures of our facilities or the facilities of our customers and suppliers.

The COVID-19 pandemic, and the volatile regional and global economic conditions stemming from the pandemic, exacerbated the potential negative impact from many of the other risks we face. We believe that a future pandemic may result in similar impacts and could also include, but not limited to:

•Structural shift in the global economy and its demand for oil and natural gas as a result of changes in the way people work, travel and interact, or in connection with a global or regional recession or depression;

•Reduction of our global workforce to adjust to market conditions, including severance payments, retention issues, and an inability to hire employees when market conditions improve;

•Infections and quarantining of our employees and the personnel of our customers, suppliers and other third parties in areas in which we operate;

•Our insurance policies may not cover losses associated with pandemics or similar global health threats;

•Litigation risk and possible loss contingencies related to a pandemic and its impact, including with respect to commercial contracts, employment matters, personal injury and insurance arrangements; and

•Cybersecurity incidents, as our reliance on digital technologies increases, those digital technologies may become more vulnerable and experience a higher rate of cybersecurity attacks, intrusions or incidents in the current environment of remote connectivity, as well as increased geopolitical conflicts and tensions.

Weatherford International plc – 2023 Form 10-K | 13