ORGANIZATION AND PRINCIPAL ACTIVITIES |

3 Months Ended | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Jun. 30, 2022 | ||||||||||||||||

| Accounting Policies [Abstract] | ||||||||||||||||

| ORGANIZATION AND PRINCIPAL ACTIVITIES | NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

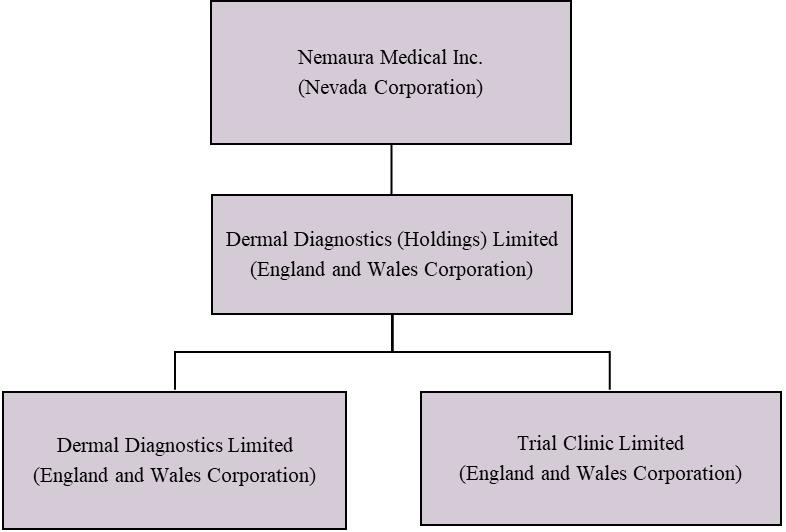

Nemaura Medical Inc. (“Nemaura” or the “Company”), through its operating subsidiaries, performs medical device research and manufacturing of a continuous glucose monitoring system (“CGM”), named sugarBEAT®. The sugarBEAT® device is a non-invasive, wireless device for use by persons with Type I and Type II diabetes and may also be used to screen pre-diabetic patients. The sugarBEAT® device extracts analytes, such as glucose, to the surface of the skin in a non-invasive manner where it is measured using unique sensors and interpreted using a unique algorithm. Nemaura is a Nevada holding company organized in 2013. Nemaura owns 100% of the stock in Dermal Diagnostic (Holdings) Limited, an England and Wales corporation (“DDHL”) formed on December 11, 2013, which in turn owns 100% of Dermal Diagnostics Limited, an England and Wales corporation formed on January 20, 2009 (“DDL”), and 100% of Trial Clinic Limited, an England and Wales corporation formed on January 12, 2011 (“TCL”). DDL is a diagnostic medical device company headquartered in Loughborough, Leicestershire, England, and is engaged in the discovery, development, and commercialization of diagnostic medical devices. The Company’s initial focus has been on the development of the sugarBEAT® device, which consists of a disposable patch containing a sensor, and a non-disposable miniature wireless transmitter with a re-chargeable power source, which is designed to enable trending or tracking of blood glucose levels. All of the Company’s operations and assets are located in England. During the fiscal year ended March 31, 2021, the Board of Directors assessed the adequacy of the group’s organizational structure and concluded that the intermediate holding company that sat below Nemaura Medical Inc., Region Green Limited (a British Virgin Islands corporation), was no longer required as the entity had been effectively dormant since inception and no longer represented a requirement to be maintained. It was therefore determined that Region Green Limited should be unwound, with the intention that the assets held by Region Green Limited be transferred up to Nemaura Medical Inc. following which Region Green Limited would be dissolved. The transfer of assets took place on March 5, 2021 and Region Green Limited was formally dissolved as of April 23, 2021.

The following diagram illustrates Nemaura’s corporate structure as of June 30, 2022:

The Company was incorporated in 2013 and has reported recurring losses from operations to date and an accumulated deficit of $41,710,773 as of June 30, 2022. These operations have resulted in the successful completion of clinical programs to support a CE mark (European Union approval of the product) approval, as well as a De Novo 510(k) medical device application to the U.S. Food and Drug Administration (“FDA”) submission.

The Company expects to continue to incur losses from operations until revenues are generated through licensing fees or product sales. However, given the completion of the requisite clinical programs, these losses are expected to decrease over time. Management has entered into licensing, supply, or collaboration agreements with unrelated third parties relating to the United Kingdom (“UK”), Europe, Qatar, and all countries in the Gulf Cooperation Council.

Going Concern As identified under Item 1A, Management is aware of the need to raise additional funds in order to finance the ongoing commercialization of sugarBEAT®. The Company had $14,751,833 of cash at June 30, 2022, however the terms of the existing debt held on balance sheet will fall due for repayment as of February 2023, which will trigger a requirement to either restructure the debt or obtain additional, new, funding. In evaluating the going concern position of the Company, Management has considered the ability of the Company to raise additional funding in combination with one or more of the different funding options available to it at this time. Based on current and ongoing engagement with potential funding providers, management believes that there is a reasonable expectation that funding could be provided by one, or more, of the following options: Equity funding – the Company has immediate access to funds through the ATM facility that is currently in place; in addition to this, there are various alternative mechanisms available to the Company similar to those used previously e.g. direct sale of shares to interested third parties, similar to the stake sold to Tiger Trading Partners L.L.C. in February 2022, as well as other mechanisms to sell common stock via an underwritten agreement or the further exercise of warrants by the current warrant holders etc.

Alternative funding as used in the past such as the sale of licenses. As product development is now at a significant more advanced stage then it was, it is Management’s belief that the sufficient funding could be provided through the sale of licenses in a similar way to the UK license agreement sale that help provided early-stage development funding. However, as a consequence of this funding requirement being triggered without the funding bridge having been put in place by the filing date of these unaudited condensed consolidated financial statements, ASC 205-40 requires that Management recognize and disclose this point as an event which creates a substantial doubt as to the Company’s ability to continue as a going concern for at least one year from the date of filing of these unaudited condensed consolidated financial statements. Following the receipt of the CE mark approval in the EU, and in support of our plans for similar certification with the FDA in the U.S., our plan is to utilize the cash on hand to continue establishing commercial manufacturing operations for the commercial supply of the sugarBEAT® device and sensor patches in our target markets. Management's strategic plans include the following:

|