UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

—————

FORM 10-K

——————

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2019

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File Number 001-38355

NEMAURA MEDICAL INC.

(Exact name of registrant as specified in its charter)

| Nevada | 46-5027260 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Advanced Technology Innovation Centre,

Loughborough University Science and Enterprise Parks

5 Oakwood Drive,

Loughborough, Leicestershire

LE11 3QF

United Kingdom

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: + 44 1509 222912

Securities registered pursuant to Section 12(b) of the Act:

| ||||

| Title of Each Class | Name of each exchange on which registered | Trading Symbol | ||

| Common Stock, $0.0001 par value | NASDAQ Capital Market | NMRD | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☒ |

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒.

The aggregate market value of the registrant’s common stock held by non-affiliates computed based on the closing sales price of such stock on September 30, 2018 was $151,532,841.

The number of shares outstanding of the registrant's common stock, as of June 9, 2019 was 207,989,304.

| |

NEMAURA MEDICAL INC.

INDEX TO ANNUAL REPORT ON FORM 10-K

| Page | ||||||||

| PART I | ||||||||

| Item 1. | Business. | 3 | ||||||

| Item 1A. | Risk Factors. | 16 | ||||||

| Item 1B. | Unresolved Staff Comments. | 29 | ||||||

| Item 2. | Properties. | 29 | ||||||

| Item 3. | Legal Proceedings. | 29 | ||||||

| Item 4. | Mine Safety Disclosures | 29 | ||||||

| PART II | ||||||||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 30 | ||||||

| Item 6. | Selected Financial Data. | 31 | ||||||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | 31 | ||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 37 | ||||||

| Item 8. | Financial Statements and Supplementary Data. | 37 | ||||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 38 | ||||||

| Item 9A. | Controls and Procedures. | 38 | ||||||

| Item 9B. | Other Information. | 40 | ||||||

| PART III | ||||||||

| Item 10. | Directors, Executive Officers and Corporate Governance. | 40 | ||||||

| Item 11. | Executive Compensation. | 44 | ||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 45 | ||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 46 | ||||||

| Item 14. | Principal Accountant Fees and Services. | 46 | ||||||

| PART IV | ||||||||

| Item 15. | Exhibits, Financial Statement Schedules. | 47 | ||||||

| 1 |

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report that are not historical facts constitute forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, and are intended to be covered by the safe harbors created by that Act. Reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties, and other factors, which may cause actual results, performance, or achievements to differ materially from those expressed or implied. Any forward-looking statement speaks only as of the date made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which they are made.

The words "believe," "anticipate," "design," "estimate," "plan," "predict," "seek," "expect," "intend," "may," "could," "should," "potential," "likely," "projects," "continue," "will," and "would" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are not guarantees of the future as there are a number of meaningful factors that could cause Nemaura Medical Inc.’s (“Nemaura Medical”) actual results to vary materially from those indicated by such forward-looking statements. These statements are based on certain assumptions made based on experience, expected future developments and other factors Nemaura Medical believes are appropriate in the circumstances. Factors which could cause actual results to differ from expectations, many of which are beyond Nemaura Medical’s control, include, but are not limited to, obtaining regulatory approval for our sugarBEAT device, conducting successful clinical trials, executing agreements required to successfully advance the Company's objectives; retaining the management and scientific team to advance the product; overcoming adverse changes in market conditions and the regulatory environment; obtaining and enforcing intellectual property rights; obtaining adequate financing in the future through product licensing, public or private equity or debt financing or otherwise; dealing with general business conditions and competition; and other factors referenced herein in “Risk Factors.” Except as required by law, we do not assume any obligation to update any forward-looking statement. We disclaim any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

| 2 |

PART I

ITEM 1. BUSINESS.

Business Overview

We are a medical technology company developing sugarBEAT®, a non-invasive, affordable and flexible continuous glucose monitoring system for adjunctive use by persons with diabetes. SugarBEAT consists of a disposable adhesive skin-patch connected to a rechargeable wireless transmitter that displays glucose readings at regular five minute intervals via a mobile app. SugarBEAT works by extracting glucose from the skin into a chamber in the patch that is in direct contact with an electrode-based sensor. The transmitter sends the raw data to a mobile app where it is processed by an algorithm and displayed as a glucose reading, with the ability to track and trend the data over days, weeks and months. While sugarBEAT requires once per day calibration by the patient using a blood sample obtained by a finger stick, we believe sugarBEAT will be adopted by non-insulin dependent persons with diabetes alongside insulin-injecting persons with diabetes who all perform multiple daily finger sticks to manage their disease.

We announced on May 29, 2019 that we had been awarded CE approval to allow sugarBEAT to be legally sold in the European Union. CE approval is disclosed by the use of the CE Mark, a manufacturers' declaration that the product meets the requirements of the applicable European laws. The European clinical trial program for sugarBEAT evaluated 525 patient days across 75 Type 1 and Type 2 diabetic patients and was completed in December 2017. CE approval is the process to achieve a mandatory conformity marking for the sugarBEAT device to allow it to be legally sold in the European Union. It is a manufacturers' declaration that the product meets the requirements of the applicable European laws. We also completed studies required to support a US FDA submission for approval of sugarBEAT as a medical device, and are currently in the process of compiling the application for submission. We previously developed a wristwatch-based version of sugarBEAT for which we obtained CE approval in February 2016. Since then we have developed sugarBEAT using the underlying technology of the wristwatch.

We believe there are additional applications for sugarBEAT and the underlying BEAT technology platform, which may include:

| – | a web-server accessible by physicians and diabetes professionals to track the condition remotely, thereby reducing healthcare costs and managing the condition more effectively; |

| – | a complete virtual doctor that monitors a person's vital signs and transmits results via the web; and |

| – | other patches using the BEAT technology platform to measure alternative analytes, including lactate, uric acid, lithium and drugs. This would be a step-change in the monitoring of conditions, particularly in the hospital setting. Lactate monitoring is currently used to determine the relative fitness of professional athletes and we completed preliminary studies demonstrating the application of the BEAT technology for continuous lactate monitoring. |

Our Business Strategy

We intend to lead in the discovery, development and commercialization of innovative and targeted diagnostic medical devices that improve disease monitoring, management and overall patient care. Specifically, we intend to focus on the monitoring of molecules that can be drawn out through the skin non-invasively using our technology platform. In addition to glucose, such molecules may include lactic acid monitoring and the monitoring of prescription drugs and blood biomarkers that may help in the diagnosis, prevention or management of diseases, such as diabetes. We plan to take the following steps to implement our broad business strategy. Our key commercial strategies post-approval will first be implemented in Europe and then in parts of the Middle East and Asia, and then the U.S., as follows:

| – | Commercialize sugarBEAT in the United Kingdom and Republic of Ireland with Dallas Burston Pharma (Jersey) Limited, with whom we have an exclusive marketing rights agreement for these two countries. |

We have also signed a full commercial agreement with Dallas Burston Ethitronix (Europe) Limited in May 2018 for all other European territories as part of an equal joint venture agreement. The joint venture intends to seek sub-license rights opportunities to one or more leading companies in the diabetes monitoring space, to leverage their network, infrastructure and resources.

Dallas Burston (Jersey) Limited was founded by Dr. Dallas Burston, MBBS, an entrepreneur who has founded and sold several companies specializing in marketing pharmaceuticals. For example, in 1999, he sold 49% of Ashbourne Pharmaceuticals to HSBC Private Equity for £32 million and Bartholomew-Rhodes to Galen Ltd. for £19.8 million. More recently, in 2015, he sold DB Ashbourne Limited, a provider of off-patent branded pharmaceuticals for the UK market, to Ethypharm. At the time of the sale, DB Ashbourne Limited was estimated to have revenue of approximately £90 million.

| 3 |

| – | Establish licensing or joint venture agreements with other parties to market sugarBEAT in other geographies. We are in detailed discussions and negotiations with several other parties worldwide for licensing or joint venture agreements for the sale of the sugarBEAT device and have signed commercial agreements with TP MENA for the GCC (Gulf Region), and Al-Danah Medical for Qatar. |

| – | Submit FDA application for approval of sugarBEAT. The application is currently in progress and expected to be submitted in Q2 2019. |

| – | Expand the indications for which the sugarBEAT device may be used. We believe that the sugarBEAT device may offer significant benefits as compared to those found in the non-acute setting for the monitoring of other diseases. This includes monitoring of lactic acid for performance athletics, and the monitoring of drugs. We have completed initial proof of concept for Lactate monitoring and now plan to explore the route to commercialization for well-being applications in athletic performance training, and plan to undertake further clinical programs to support clinical use of the device for lactate monitoring, |

| – | Expand our product pipeline through our proprietary platform technologies, acquisitions and strategic licensing arrangements. We intend to leverage our proprietary platform technologies to grow our portfolio of product candidates for the diagnosis of diabetes and other diseases. In addition, we intend to license our product and acquire products and technologies that are consistent with our research and development and business focus and strategies. This may include drug delivery products for the improved management of diabetes, for example improved insulin injector systems, and/or combination drug products for diabetes related drugs. |

Product Development

Management has extensive experience in regulatory and clinical development of diagnostic medical devices. We intend to take advantage of this experience in the field of diagnostic medical devices in an attempt to increase the probability of product approval. The overall regulatory process for diagnostic medical devices for diabetes is currently similar to those governing other diagnostic devices. The timelines are shorter than, for example, when new drugs or completely invasive diagnostic devices are trialed in clinics. We have successfully tested and evaluated the device for its clinical output, in this case the accuracy and safety with which it can trend blood glucose levels, based on which CE approval was granted by the Notified body BSI, and we are currently in the process of preparing a submission to the US FDA. As we continue to raise funds for marketing the device in some European Union territories, we also intend to seek collaborations with future licensees and marketing partners to achieve our product development and meet our projected milestones.

The table below provides our current estimate of our timeline:

Product Development Timelines

| Milestone | Target Start Date | Target Completion Date |

| Completion of clinical studies in Type 1 and Type 2 diabetic subjects to define final device claims and for submission for CE Mark approval with final device claims. | July 2017 | Completed |

Scale up of commercial sensor/patch manufacturing (Scale up means we have started looking at larger scales - sufficient for product launch in the UK. It refers to the manufacturing process for sensors.) |

January 2017 | Completed |

| Scale up of device (transmitter) manufacturing | January 2017 | Ongoing |

| CE Mark for body worn transmitter device | August 2018 | Completed |

| Commercial launch in the UK, followed by major territories in Europe | Q3 2019 | Staggered launch |

| US FDA Submission | Q2 2019 | Q2 2019 |

Market Opportunity for the Company's Products

According to the International Diabetes Federation Atlas (the "IDF"), there are approximately 425 million people in the world who had diabetes as of December 2017. The IDF is predicting that by 2035 this will rise to 592 million people. The number of people with Type 2 diabetes is increasing in every country and currently eighty percent (80%) of people with diabetes live in low- and middle-income countries. The greatest number of people with diabetes is between 40 and 59 years of age.

| 4 |

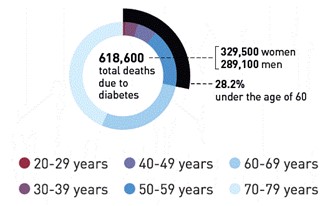

Statistics published by the IDF report that diabetes is a huge and growing problem, and the costs to society are high and escalating. In addition, Europe has the highest prevalence of children with Type 1 diabetes.

Statistical Data for Diabetes in Europe

| 2013 | 2035 | |

Adult population (20-79 years, millions) |

659 | 669 |

| Diabetes (20 – 79 years) | ||

| Regional prevalence (%) | 8.5 | 10.3 |

| Comparative prevalence (%) | 6.8 | 7.1 |

Number of people with diabetes (millions) |

56.3 | 68.9 |

| Impaired Glucose Tolerance (20 – 79 years) | ||

| Regional prevalence (%) | 9.2 | 11.0 |

| Comparative prevalence (%) | 8.1 | 8.9 |

| Number of people with IGT (millions) | 60.6 | 73.7 |

| Type 1 diabetes (0 – 14 years) | ||

Number of children with Type 1 diabetes (thousands) |

129.4 | - |

| Number of newly diagnosed cases per year (thousands) | 20.0 | - |

Each year approximately 600,000 people die from diabetes in Europe.

Deaths From Diabetes

Europe has the highest incidence of children with Type 1 diabetes according to data supplied from IDF.org. The top five countries for the number of people afflicted with diabetes in Europe are listed in the table below.

Top 5 Countries In Europe For People Afflicted With Diabetes 20-79 Years (2013)

| Countries/Territories | Millions |

| Russian Federation | 10.9 |

| Germany | 7.6 |

| Turkey | 7.0 |

| Spain | 3.8 |

| Italy | 3.6 |

Type 1 diabetes, once known as juvenile diabetes or insulin-dependent diabetes, is a chronic condition in which the pancreas produces little or no insulin, a hormone needed to allow sugar (glucose) to enter cells to produce energy. The far more common Type 2 diabetes occurs when the body becomes resistant to the effects of insulin or doesn't make enough insulin.

Various factors may contribute to Type 1 diabetes including genetics and exposure to certain viruses. Although Type 1 diabetes typically appears during childhood or adolescence, it also can develop in adults.

Despite active research, Type 1 diabetes has no cure, although it can be managed. With proper treatment, people who have Type 1 diabetes can expect to live longer, healthier lives than they did in the past. Type 1 diabetes includes autoimmune Type 1 diabetes (Type 1a) which is characterized by having positive autoantibodies, as well as idiopathic Type 1 diabetes (Type 1b) where autoantibodies are negative and c-peptide is low. Patients with Type 1 diabetes (insulin dependent) require long term treatment with exogenous insulin and these patients perform self-monitoring of blood glucose (SMBG) to calculate the appropriate dose of insulin. SMBG is done by using blood samples obtained by finger sticks but frequent SMBG does not detect all the significant deviations in blood glucose, specifically in patients who have rapidly fluctuating glucose levels.

| 5 |

Type 2 diabetes, once known as adult-onset or non-insulin-dependent diabetes, is a chronic condition that affects the way your body metabolizes sugar (glucose), your body's main source of fuel. With Type 2 diabetes, your body either resists the effects of insulin, a hormone that regulates the movement of sugar into your cells, or doesn't produce enough insulin to maintain a normal glucose level. Untreated, Type 2 diabetes can be life-threatening.

More common in adults, Type 2 diabetes increasingly affects children as childhood obesity increases. There's no cure for Type 2 diabetes, but it can be managed by eating well, exercising and maintaining a healthy weight. If diet and exercise don't control the blood sugar, diabetes medications or insulin therapy may be required.

Each year, millions of patients undergo diabetes testing in the European Union and in the U.S. The main reason for this testing is to detect and evaluate diabetes in patients with symptoms of diabetes. These studies provide clinical benefit in the initial evaluation of patients with suspected but unproven diabetes, and in those patients in whom a diagnosis of diabetes has been established and information on prognosis or risk is required.

We believe that our market opportunity is a direct function of the number of persons tested, diagnosed and treated for either Type 1 or Type 2 diabetes. The IDF indicates that the total world market opportunity for a continuous glucose monitoring device is in the billions of dollars and is projected to grow annually through the year 2035.

We do not believe it is possible to estimate the number of diabetes patients that undergo finger pricks or other types of invasive glucose monitoring. However, we are unaware of any product currently on the market that may allow for non-invasive continuous glucose monitoring. We believe the sugarBEAT device may be readily adopted by the medical community for the assessment of a patient continuously.

We believe our non-invasive sugarBEAT device possesses many significant advantages and may represent an ideal device for the detection of discordances in an individual's blood sugar levels. If approved for commercialization, we believe the sugarBEAT device may represent a best in class non-invasive continuous glucose monitoring device to reach those afflicted with diabetes. While we cannot estimate the market share that our sugarBEAT device may capture, we believe that the sugarBEAT device will capture a significant share of the non-invasive continuous glucose monitoring market, in-particular the market that has been established by the Abbott Freestyle Libre device for glucose trending, as well as be adopted by non-insulin dependent diabetics who have not historically used continuous glucose monitoring devices due to their invasiveness.

Commercialization Plan

We intend to develop our products through the completion of FDA approvals, to verify the claims that the device may be used as an adjunct to a finger-stick measurement, and/or a glucose trending device such as those claims made by the Abbott Freestyle Libre device. We will seek to partner with organizations that may facilitate the further development and distribution of our products at all stages of development. We also intend to seek strategic partners early in the research and development cycle for programs that may fall outside of our core competencies.

Competitive Landscape

We expect to compete with several medical device manufacturing companies including Dexcom, Abbott, and Senseonics. Our competitors may:

| – | develop and market products that are less expensive or more effective than our future product; |

| – | commercialize competing products before we or our partners can launch any products developed by us; |

| – | operate larger research and development programs or have substantially greater financial resources than we do; |

| – | initiate or withstand substantial price competition more successfully than we can; |

| – | have greater success in recruiting skilled technical and scientific workers from the limited pool of available talent; |

| – | more effectively negotiate third-party licenses and strategic relationships; and |

| – | take advantage of acquisition or other opportunities more readily than we can. |

We will compete for market share against large pharmaceutical and biotechnology companies, smaller companies that are collaborating with larger pharmaceutical companies, new companies, academic institutions, government agencies and other public and private research organizations. Many of these competitors, either alone or together with their partners, may develop new products that will compete with ours, and these competitors may, and in certain cases do, operate larger research and development programs or have substantially greater financial resources than we do.

We anticipate that we will have competition from specific companies. Although it is difficult to analyze our major competitors since currently there are no non-invasive diagnostic medical devices to continuously monitor blood glucose levels, we anticipate that specific companies may compete with us in the future.

| 6 |

Information relating to our competitors is listed in the table below.

| FreeStyle Libre™(1) | Platinum G6®(2) | Platinum G5®(3) | Eversense™(4) | SugarBEAT® | |

| Manufacturer | Abbott | Dexcom | Dexcom | Senseonics | Nemaura Medical |

| Technology | Inserted Sensor | Inserted Sensor | Inserted Sensor | Implanted Sensor | Non-invasive Sensor |

| Reliability (Overall MARD) | 11.4% | 9.8% | 9.0% | 11.4% | <12%* |

| Reliability (Clarke Error Grid A+B zone) | 99% | Not available | 97.0% | 99.1% | >95.0% |

| Patients Studied | 72 | 324 | 97 | 44 | >75 |

| Patient Days Studies | 14 | 10 | 9 | 90 | 1 to 4 |

| Warm-up Time | 1 hour | 2 hours | 2 hours | NA | 30-60 min |

| Daily Calibration | None | None | 2x | 2x | 1x |

| Glucose Display Frequency | On manual activation of sensor | Every 5 min | Every 5 min | Every 5 min | Every 5 min |

| Patch/Senor Life | 14 days | 10 days | 7 days | 90 days | 1 day |

| Regulatory Approvals | EU | US | Worldwide | EU | EU |

| Basis for reimbursement | Finger stick | Not available | CGM | CGM | Finger stick |

| Daily Avg. Reimbursement Cost | $2.50 (Germany) | Not available | $9 (US) | Not available | $2.50** |

| Daily Retail Cost UK (exc. VAT) | £3.50 (Patch) £50 (Reader) |

Not available | £7.30 (Patch) £475 (Hardware) |

Not available | £2** (Daily Patch) £30** (Transmitter) |

Sources: (1) Diabetes Technology & Therapeutics, Timothy Bailey, MD, et al., Nov. 2015; (2) Dexcom’s press release, Mar. 2018; Dexcom G6 user’s guide (3) Dexcom’s press release, Aug. 2015; Dexcom G5 user’s guide; (4) SenseonicsHoldings’ 8-K, Dec. 2015. * based on summary data released in August 2018; **Estimated

Regulatory Requirements

Our device has been electrically safety tested, and all biocompatibility conformance also demonstrated, against the relevant European Medical Device Directives. When new materials are introduced, these undergo a biocompatibility risk assessment, and further testing where necessary. Batches of the device and patches were manufactured for human clinical studies that took place between November 2014 and December 2015. This was a functional watch device with a wire connection to a skin adhered sensor and electrode. Subsequent to studies conducted in India the device received a CE mark approval in February 2016. The device has since been upgraded to include wireless communication from a body worn/adhered transmitter and also to reduce the device size, and with an enhanced sensor system. This miniaturised wireless device achieved CE approval in May 2019, and FDA submission is planned in Q2 2019. An application for CE mark approval requires the Company to have a ISO13485 Quality Management System, covering the design, development and manufacture of a medical device. Nemaura Medical does not have this accreditation, and instead under the terms of a service contract dated 4th April 2018 with Nemaura Pharma Limited, Nemaura Medical has outsourced the CE approval registration process to Nemaura Pharma. Under the terms of the service contract Nemaura Pharma has undertaken all required activities to register the product for CE approval under a fee for service arrangement, whilst Nemaura Medical will retain full title and beneficial ownership of the CE mark, and all related intellectual property without any further payments or royalties becoming due other than the fee for service.

Prior to launching commercial sales of our product, we must complete key material points:

| – | Prepare the body worn transmitter, and sensor-electrode system for manufacturing for commercial sales, i.e., in large volumes. The patches (containing the sensors) and the device have been manufactured in small batches sufficient for clinical studies and laboratory testing. The scale up of the processes have commenced and are being conducted in stages to reflect the market demand based on a staggered launch. This is a continuous process of development, to mass-produce the sensors and patches and the devices in a scale that allows large volume batches to be produced cost effectively. This is necessary to ensure that the manufacturing costs of our products are minimized in order to effectively meet market demands. |

Intellectual Property

We believe that clear and extensive intellectual property relating to our technologies is central to long-term success and we intend to invest accordingly. This applies to both domestic and international patent coverage, and trade secrets, and trademarks.

The SugarBEAT technology is protected by our portfolio of intellectual property comprised of issued and pending patents and trade secrets covering a range of claims, including the methods and apparatus for measuring glucose extracted from human skin in a non-invasive manner, the formula for the cumulative measurement of an analyte, and the formulation and process for preparation of the enzyme solution used in the sensor.

| 7 |

On May 8, 2014, NDM Technologies Limited, a related company, assigned the UK patent application 1208950.4 and International (PCT) patent application PCT/GB2013/051322 entitled "Cumulative Measurement of an Analyte" to Dermal Diagnostics Limited (“DDL”) for a nominal consideration.

Two further patents were filed in 2018, that will not be published in the public domain for some months, relating to the sensor and device application, providing further strength to the intellectual property position. Further patents are intended to be filed in the coming months relating to the device and sensor, providing new intellectual property protection, some of which will supersede previous intellectual property.

Additionally, we retain substantial trade secrets relating to the sensor formulation, which have taken over five years to develop, and will prove very difficult to reverse engineer as it consists of formulation components in addition to processing methods in complex combinations that are unique to the final functional sensor. Patents will not be filed on this aspect of the technology to avoid any public dissemination of the know-how.

These patents and know-how cover aspects of the technology platform. Furthermore the trademark BEAT and sugarBEAT has been registered in all major territories globally. Accordingly, all intellectual property essential to the sugarBEAT product is owned by us, and not subject to royalty payments. We intend to take the lead in the preservation and/or prosecution of these patents and patent applications going forward as required. We intend to file additional patents as the development progresses, where deemed to be of value to protecting the technology platform and future modifications and improvements. Where patents cannot be secured, the intellectual property will be limited to know-how and trade secrets, and these will be diligently guarded.

Trade Secrets, Trademarks, and Patents Filed, Granted and Pending

| IP: Patent (Core Claim), Know-how, Trademark | Expiration Date | Jurisdictions in which Granted/ Issued | Jurisdictions

in which Pending |

Ongoing Royalty or Milestone Payments | ||

| Patent: Cumulative Measurement of an Analyte*. | May 20, 2032 | Australia, France, Germany, Italy, Poland, Spain, Netherlands, UK | Brazil, Canada, China, India, Japan, Qatar, United Arab Emirates, U.S. | None | ||

Patent: Patches for Reverse Iontophoresis**

|

July 1, 2029

|

Australia, Germany, France, UK, Italy, Netherlands, Switzerland, China, Hong Kong, Japan. | None | None | ||

| Know-how: Sensor Formulation | N/A | Trade Secret | N/A | N/A | ||

| Two Patents: Sensor and device application. | Filed 2018 | First filed in UK | All | None | ||

| Trademark: BEAT | Renewal due in 2026 | UK, China, EU, India, Japan | Canada | None | ||

| Trademark: sugarBEAT | Renewal due in 2025 | UK, Australia, Switzerland, China, Egypt, EU, Israel, India, Iran, Japan, North Korea, Morocco, Mexico, Norway, New Zealand, Russia, Singapore, Tunisia, Turkey, USA | Canada | None |

* This patent provides a formula for calculating the amount of glucose extracted over a defined period of time by deducting the difference between two readings to allow rapid sensing without needing to deplete the analyte being measured.

** This patent provides a reverse iontophoresis patch with means for releasing a conductive medium onto the skin during use and means for transporting analyte to a separate location for analysis.

| 8 |

Clinical Trials

Our clinical testing is conducted by contract clinical research organizations in various centers around the world to cover a wide demographic – including Asia and Europe – and is managed by our in-house management team.

We have had 2 pre-submission meetings with the FDA in June 2016, to define the clinical roadmap. As a result, a detailed clinical plan was developed and approved internally and a clinical site in Europe was been selected and audited and approved for commencement of clinical studies using the body worn transmitter device version of the sugarBEAT. The study was completed and the FDA submission is in preparation.

In August 2017, we commenced a European three-stage 75 patient clinical study, consisting of 80% Type 1 and 20% Type 2 diabetics. The study was designed as a single center open-label, single arm, within-subject comparison of sugarBEAT, with blood samples drawn from a venous catheter at corresponding time points, with glucose concentration measured using a laboratory blood glucose analyser, ARCHITECT C8000. The European clinical trial program consisted of a total of 525 patient days, with each patient continuously wearing sugarBEAT for 14 hours on seven consecutive days in a combination of home and clinic settings. Three of the seven days were in-clinic where venous blood samples were taken at 15 minute intervals over a continuous 12 hour period. The clinical study was completed in December 2017. An interim analysis of the data has thus far indicated a precision of 1.07 and accuracy as determined by the Mean Absolute Relative Deviation (MARD) of less than 14%, with no serious or major adverse events. The precision and accuracy of sugarBEAT observed in the study was similar to other CE Mark approved continuous glucose monitors. Data from the clinical study was published on the Nemaura Medical Website, Publications section, in August 2018.

Research and development

We spent $2,296,668 and $993,833 during the years ended March 31, 2019 and 2018, respectively, on research and development. We anticipate that for the year ending March 2020, research and development expenditures will increase to further develop the device for commercial launch in the UK and Europe.

Development and clinical test costs in support of our current product, as well as costs to file patents and revise and update previous filings on our technologies, will continue to be substantial as we assess the next steps to advance the product.

Manufacturing

The manufacture and sale of CE certified medical devices are controlled and governed by guidelines stipulated in the International Organization for Standardization (ISO), more specifically ISO13485; sugarBEAT will be manufactured and marketed according to ISO13485 quality standards.

In preparation for our anticipated commercial launch of sugarBEAT in the UK during the second half of 2019 we worked with our manufacturing partner Nemaura Pharma, to initiate scale-up manufacturing of the various sugarBEAT components alongside facilities for final assembly and packaging. As part of this process, we are expanding our manufacturing and assembly capabilities by occupying additional space within our existing headquarters site at Loughborough Science Park in the UK.

Manufacturers of key components required for our device are:

| – | Sensors - Parlex (a division of Johnson Electrics), based in the Isle of White, UK |

| – | Patches - Polarseal Limited, located in Surrey, UK |

| – | Electronics- Datalink Limited located in Loughborough, UK |

We expect to enter into the following types of agreements during 2019:

| – | Manufacturing agreements for the sensor manufacture |

| – | Manufacturing agreements for the patch manufacture |

| – | Manufacturing agreements for the CGM watch device and transmitter device manufacture |

| 9 |

Sales and Marketing

An Exclusive Marketing Rights agreement for the UK and Republic of Ireland was signed on March 31, 2014 with Dallas Burston Pharma, a Jersey (Channel Island) based company (“DB Pharma”) who has pharmaceutical product marketing operations in the UK and has demonstrated a very successful model for the marketing of prescription medical products directly to general practitioners. We received a non-refundable upfront payment of $1.67 million in return for providing DB Pharma with the exclusive right to sell the sugarBEAT device in the UK and Republic of Ireland, both direct to consumer and through prescriptions by general practitioners. Subsequently, on April 4, 2014, a Letter of Intent was entered into outlining the basic terms of the cost at which the patches and watch will be supplied and minimum order quantities in the first two (2) years. The key terms of the Exclusive Marketing Rights Agreement were concluded in a Commercial Agreement signed in August 2015.

In addition, a joint venture agreement was entered into with Dallas Burston Ethitronix (Europe) in May 2018, whereby we will share equally the costs and net profits of the sales of our sugarBEAT system in all territories in Europe, with the exception of the United Kingdom, which is the subject of a separate agreement with DB Pharma. Commercial agreements were signed in 2018 with TPMENA and Al-Danah Medical, for the Gulf Region (GCC) and Qatar respectively.

Regulatory matters

Government Regulation

Our business is subject to extensive federal, state, local and foreign laws and regulations, including those relating to the protection of the environment, health and safety. Some of the pertinent laws have not been definitively interpreted by the regulatory authorities or the courts, and their provisions are open to a variety of subjective interpretations. In addition, these laws and their interpretations are subject to change, or new laws may be enacted.

Both federal and state governmental agencies continue to subject the healthcare industry to intense regulatory scrutiny, including heightened civil and criminal enforcement efforts. We believe that we have structured our business operations to comply with all applicable legal requirements. However, it is possible that governmental entities or other third parties could interpret these laws differently and assert otherwise. We discuss below the statutes and regulations that are most relevant to our business.

United Kingdom and Wales and the European Union regulations

Government authorities in the United Kingdom and Wales and the European Union as well as other foreign countries extensively regulate, among other things, the research, development, testing, manufacture, labelling, promotion, advertising, distribution, sampling, marketing and import and export of medical devices, including patches and other pharmaceutical products. Our body worn transmitter devices in the United Kingdom and Wales will be subject to strict regulation and require regulatory approval prior to commercial distribution. The process of obtaining governmental approvals and complying with ongoing regulatory requirements requires the expenditure of substantial time and financial resources. In addition, statutes, rules, regulations and policies may change and new legislation or regulations may be issued that could delay such approvals. If we fail to comply with applicable regulatory requirements at any time during the product development process, approval process, or after approval, we may become subject to administrative or judicial sanctions. These sanctions could include the authority's refusal to approve pending applications, withdrawals of approvals, clinical holds, warning letters, product recalls, product seizures, total or partial suspension of our operations, injunctions, fines, civil penalties or criminal prosecution. Any agency enforcement action could have a material adverse effect on us.

The European Commission on Public Health (the "ECPH") provides the regulation for the development and commercialization of new medical diagnostic devices. Any medical device placed on the European market must comply with the relevant legislation, notably with Directive 93/42/EEC, with the active implantable devices Directive 90/385/EEC or with the in vitro devices Directive 98/79/EC. We must first determine whether the device we intend to manufacture or import falls under any of these directives. All medical devices must fulfil the essential requirements set out in the above-mentioned directives. Where available, relevant standards may be used to demonstrate compliance with the essential requirements defined in the devices Directives.

| 10 |

Manufacturers also need to determine the appropriate conformity assessment route. For devices falling under Directive 93/42/EEC, other than custom-made devices and devices intended for clinical investigation, the conformity assessment route depends on the class of the device, to be determined in accordance with certain rules set forth in the directives. Once the applicable class or list has been determined, manufacturers need to follow the appropriate conformity assessment procedure. Subject to the type of the device, this may require manufacturers to have their quality systems and technical documentation reviewed by a Notified Body before they can place their products on the market. A Notified Body is a third-party body that can carry out a conformity assessment recognized by the European Union. The Notified Body will need to assure itself that relevant requirements have been met before issuing relevant certification. Manufacturers can then place the CE marking on their products to demonstrate compliance with the requirements.

The CE approval is the process of achieving a mandatory conformity marking for the sugarBEAT device to allow it to be legally sold in the European Union. It is a manufacturers' declaration that the product meets the requirements of the applicable European laws. The process for the sugarBEAT device CE submission and approval involved the following:

1. The device is classified depending on certain categories described by the European Directive with Class I products being low risk (e.g. band aid plasters), through Class III devices being the highest risk. The classes are Class I, IIa, IIb and III. Risk is based upon the potential harm to the patient should a problem arise with a product or its use. The sugarBEAT device is classified as a IIb device.

2. A 'technical file' containing all of the information required to demonstrate that the product meets the essential requirements of the European directive will be prepared. This includes information relating to performance and safety of the device such as product specifications, labelling, instructions for use, risk analysis and specific test information/clinical evidence relating to the product that support the claims being made for the product.

3. Clinical evidence included in the technical file is expected to demonstrate that the device is safe and meets defined performance requirements. This clinical evidence can be in the form of literature data where substantial published data exists that utilizes the same technique for glucose extraction and measurement (albeit in a different device format), or data from actual clinical studies performed using the sugarBEAT device. The first CE mark submission was based on literature evaluation of 3rd party published clinical data available in the public domain. The final CE mark submission has claims based on the clinical performance of the device, based on clinical studies described earlier herein. The clinical data showed that the sugarBEAT device can trend blood glucose levels in a human subject by taking measurements every 5 minutes. The clinical trial data demonstrates the sugarBEAT device blood glucose trend can be used to supplement normal finger prick measurements.

4. The technical file has been assessed by an independent inspector (the Notified Body), regulated by the competent authority, (Medicines and Healthcare products Regulatory Agency, MHRA in the United Kingdom). The Notified Body (an organization in the European Union that has been accredited by a member state to determine whether a medical device complies with the European medical device directives), will then notify The European Commission on Public Health (the "ECPH") of the approval and a certificate will be issued to the Company by the notified body and we will then be able to apply the CE mark to the device, and legally offer the product for sale in the European Economic Area (EEA). The CE mark has been issued as of May 2019 and the company is now able to offer the device for commercial sale in the EU.

5. The review of the technical file commenced in August 2018, and the final review and sign off was received in May 2019.

U.S. Food and Drug Administration regulation of medical devices.

The FDCA and FDA regulations establish a comprehensive system for the regulation of medical devices intended for human use. sugarBeat is a medical device that is subject to these, as well as other federal, state, local and foreign, laws and regulations. The FDA is responsible for enforcing the laws and regulations governing medical devices in the United States.

The FDA classifies medical devices into one of three classes (Class I, Class II, or Class III) depending on their level of risk and the types of controls that are necessary to ensure device safety and effectiveness. The class assignment is a factor in determining the type of premarketing submission or application, if any, that will be required before marketing in the United States. SugarBeat falls under Class III.

| – | Class I devices present a low risk and are not life-sustaining or life-supporting. The majority of Class I devices are subject only to "general controls" (e.g., prohibition against adulteration and misbranding, registration and listing, good manufacturing practices, labeling, and adverse event reporting. General controls are baseline requirements that apply to all classes of medical devices.) |

| 11 |

| – | Class II devices present a moderate risk and are devices for which general controls alone are not sufficient to provide a reasonable assurance of safety and effectiveness. Devices in Class II are subject to both general controls and "special controls" (e.g., special labeling, compliance with performance standards, and post market surveillance. Unless exempted, Class II devices typically require FDA clearance before marketing, through the premarket notification (510(k)) process.) |

| – | Class III devices present the highest risk. These devices generally are life-sustaining, life-supporting, or for a use that is of substantial importance in preventing impairment of human health, or present a potential unreasonable risk of illness or injury. Class III devices are devices for which general controls, by themselves, are insufficient and for which there is insufficient information to determine that application of special controls would provide a reasonable assurance of safety and effectiveness. Class III devices are subject to general controls and typically require FDA approval of a premarket approval ("PMA") application before marketing. |

Unless it is exempt from premarket review requirements, a medical device must receive marketing authorization from the FDA prior to being commercially marketed, distributed or sold in the United States. The most common pathways for obtaining marketing authorization are 510(k) clearance and PMA. After preliminary discussions with the FDA in June 2016 as part of a pre-submission meeting it was determined that the pathway for sugarBeat would be a PMA approval.

Premarket approval pathway

The PMA approval process requires an independent demonstration of the safety and effectiveness of a device. PMA is the most stringent type of device marketing application required by the FDA. PMA approval is based on a determination by the FDA that the PMA contains sufficient valid scientific evidence to ensure that the device is safe and effective for its intended use(s). A PMA application generally includes extensive information about the device including the results of clinical testing conducted on the device and a detailed description of the manufacturing process.

After a PMA application is accepted for review, the FDA begins an in-depth review of the submitted information. FDA regulations provide 180 days to review the PMA and make a determination; however, in reality, the review time is normally longer (e.g., 1-3 years). During this review period, the FDA may request additional information or clarification of information already provided. Also during the review period, an advisory panel of experts from outside the FDA may be convened to review and evaluate the data supporting the application and provide recommendations to the FDA as to whether the data provide a reasonable assurance that the device is safe and effective for its intended use. In addition, the FDA generally will conduct a preapproval inspection of the manufacturing facility to ensure compliance with Quality System Regulation, which imposes comprehensive development, testing, control, documentation and other quality assurance requirements for the design and manufacturing of a medical device.

Based on its review, the FDA may (i) issue an order approving the PMA, (ii) issue a letter stating the PMA is "approvable" (e.g., minor additional information is needed), (iii) issue a letter stating the PMA is "not approvable," or (iv) issue an order denying PMA. A company may not market a device subject to PMA review until the FDA issues an order approving the PMA. As part of a PMA approval, the FDA may impose post-approval conditions intended to ensure the continued safety and effectiveness of the device including, among other things, restrictions on labeling, promotion, sale and distribution, and requiring the collection of additional clinical data. Failure to comply with the conditions of approval can result in materially adverse enforcement action, including withdrawal of the approval.

Most modifications to a PMA approved device, including changes to the design, labeling, or manufacturing process, require prior approval before being implemented. Prior approval is obtained through submission of a PMA supplement. The type of information required to support a PMA supplement and the FDA's time for review of a PMA supplement vary depending on the nature of the modification.

The recent De-Novo and subsequent 510(k) by Dexcom provide evidence that current FDA thinking on invasive CGM devices for non-adjunctive use are suitable for Class II classification. The non-invasive nature of sugarBEAT®, as an adjunctive CGM, provides a low level of risk as compared to invasive CGMs. Moreover, the risks to health are understood, and appropriate general and special controls have been applied through the ISO 13485:2016 design controls to provide evidence of assurance of safety and effectiveness. Nemaura is exploring the possibility of submission of a De-Novo application in place of a PMA.

| 12 |

Clinical trials

Clinical trials of medical devices in the United States are governed by the FDA's Investigational Device Exemption ("IDE") regulation. This regulation places significant responsibility on the sponsor of the clinical study including, but not limited to, choosing qualified investigators, monitoring the trial, submitting required reports, maintaining required records, and assuring investigators obtain informed consent, comply with the study protocol, control the disposition of the investigational device, submit required reports, etc.

Clinical trials of significant risk devices (e.g., implants, devices used in supporting or sustaining human life, devices of substantial importance in diagnosing, curing, mitigating or treating disease or otherwise preventing impairment of human health) require FDA and Institutional Review Board ("IRB") approval prior to starting the trial. FDA approval is obtained through submission of an IDE application. Clinical trials of non-significant risk ("NSR"), devices (i.e., devices that do not meet the regulatory definition of a significant risk device) only require IRB approval before starting. The clinical trial sponsor is responsible for making the initial determination of whether a clinical study is significant risk or NSR; however, a reviewing IRB and/or FDA may review this decision and disagree with the determination.

An IDE application must be supported by appropriate data, such as performance data, animal and laboratory testing results, showing that it is safe to evaluate the device in humans and that the clinical study protocol is scientifically sound. There is no assurance that submission of an IDE will result in the ability to commence clinical trials. Additionally, after a trial begins, the FDA may place it on hold or terminate it if, among other reasons, it concludes that the clinical subjects are exposed to an unacceptable health risk.

As noted above, the FDA may require a company to collect clinical data on a device in the post-market setting.

The collection of such data may be required as a condition of PMA approval. The FDA also has the authority to order, via a letter, a post-market surveillance study for certain devices at any time after they have been cleared or approved.

Pervasive and continuing FDA regulation

After a device is placed on the market, regardless of its classification or premarket pathway, numerous additional FDA requirements generally apply. These include, but are not limited to:

| – | Establishment registration and device listing requirements; |

| – | Quality System Regulation ("QSR"), which governs the methods used in, and the facilities and controls used for, the design, manufacture, packaging, labelling, storage, installation, and servicing of finished devices; |

| – | Labelling requirements, which mandate the inclusion of certain content in device labels and labelling, and generally require the label and package of medical devices to include a unique device identifier ("UDI"), and which also prohibit the promotion of products for uncleared or unapproved, i.e., "off-label," uses; |

| – | Medical Device Reporting ("MDR") regulation, which requires that manufacturers and importers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if it were to recur; and |

| – | Reports of Corrections and Removals regulation, which requires that manufacturers and importers report to the FDA recalls (i.e., corrections or removals) if undertaken to reduce a risk to health posed by the device or to remedy a violation of the Federal Food, Drug and Cosmetic Act that may present a risk to health; manufacturers and importers must keep records of recalls that they determine to be not reportable. |

The FDA enforces these requirements by inspection and market surveillance. Failure to comply with applicable regulatory requirements can result in enforcement action by the FDA, which may include, but is not limited to, the following sanctions:

| – | Untitled letters or warning letters; |

| – | Fines, injunctions and civil penalties; |

| – | Recall or seizure of our products; |

| – | Operating restrictions, partial suspension or total shutdown of production; |

| – | Refusing our request for 510(k) clearance or premarket approval of new products; |

| – | Withdrawing 510(k) clearance or premarket approvals that are already granted; and |

| – | Criminal prosecution. |

We would be subject to unannounced device inspections by the FDA, as well as other regulatory agencies overseeing the implementation of and compliance with applicable state public health regulations. These inspections may include our suppliers' facilities.

| 13 |

Other Regulation in the United Kingdom and Wales and the EU

Healthcare Reimbursement

Government and private sector initiatives to limit the growth of healthcare costs, including price regulation, competitive pricing, coverage and payment policies, and managed-care arrangements, are continuing in many countries where we do business, including the United Kingdom and Wales. These changes are causing the marketplace to put increased emphasis on the delivery of more cost-effective medical products. Government programs, private healthcare insurance and managed-care plans have attempted to control costs by limiting the amount of reimbursement they will pay for particular procedures or treatments. This has created an increasing level of price sensitivity among customers for products. Some third-party payers must also approve coverage for new or innovative devices or therapies before they will reimburse healthcare providers who use the medical devices or therapies. Even though a new medical product may have been cleared for commercial distribution, we may find limited demand for the product until reimbursement approval has been obtained from governmental and private third-party payers.

Environmental Regulation

We are also subject to various environmental laws and regulations both within and outside the United Kingdom and Wales. Like many other medical device companies, our operations involve the use of substances, including hazardous wastes, which are regulated under environmental laws, primarily manufacturing and sterilization processes. We do not expect that compliance with environmental protection laws will have a material impact on our consolidated results of operations, financial position or cash flow. These laws and regulations are all subject to change, however, and we cannot predict what impact, if any, such changes might have on our business, financial condition or results of operations.

Foreign Regulation

Whether or not we obtain regulatory approval for a product, we must obtain approval from the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of the product in those countries. The approval process varies from country to country, and the time may be longer or shorter than that required for EC approval. The requirements governing the conduct of clinical trials, product licensing, pricing and reimbursement also vary greatly from country to country.

Under European Union regulatory systems, we may submit marketing authorization applications under a decentralized procedure. The decentralized procedure provides for mutual recognition of national approval decisions. Under this procedure, the holder of a national marketing authorization may submit an application to the remaining member states. Within 90 days of receiving the applications and assessment report, each member state must decide whether to recognize approval. This procedure is referred to as the mutual recognition procedure, or called the MRP.

In addition, regulatory approval of prices is required in most countries other than the United States. We face the risk that the prices which result from the regulatory approval process would be insufficient to generate an acceptable return to us or our collaborators.

EU General Data Protection Regulation

The EU General Data Protection Regulation (the “GDPR”) came into force in all EU Member States from May 25, 2018 and replaced previous EU data privacy laws. Although a number of basic existing principles will remain the same, the GDPR introduces new obligations on data controllers and rights for data subjects, including, among others:

| – | accountability and transparency requirements, which will require data controllers to demonstrate and record compliance with the GDPR and to provide more detailed information to data subjects regarding processing; |

| – | enhanced data consent requirements, which includes “explicit” consent in relation to the processing of sensitive data; |

| 14 |

| – | obligations to consider data privacy as any new products or services are developed and limit the amount of information collected, processed, stored and its accessibility; |

| – | constraints on using data to profile data subjects; |

| – | providing data subjects with personal data in a useable format on request and erasing personal data in certain circumstances; and |

| – | reporting of breaches without undue delay (72 hours where feasible). |

The GDPR also introduces new fines and penalties for a breach of requirements, including fines for serious breaches of up to the higher of 4% of annual worldwide revenue or €20m and fines of up to the higher of 2% of annual worldwide revenue or €10m (whichever is highest) for other specified infringements. The GDPR identifies a list of points to consider when imposing fines (including the nature, gravity and duration of the infringement).

The Company has assessed the implications of the GDPR on all personal data it holds and has implemented measures to ensure that personal data shall be:

| - | Processed lawfully, fairly and in a transparent manner in relation to the data subject. |

| - | Collected for a specified, explicit and legitimate purpose and not further processed in a manner that is incompatible with those purposes. |

| - | Adequate, relevant and limited to what is necessary in relation to the purposes for which they are processed. |

| - | Kept in a form which permits identification of data subjects for no longer than is necessary for the purposes for which the personal data are processed. |

| - | Processed in a manner that ensures appropriate security of the personal data, including protection against unauthorised or unlawful processing and against accidental loss, destruction or damage, using appropriate technical or organisational measures. |

| - | Maintained accurately and up to date and that every reasonable step is taken to ensure that personal data that are inaccurate, having regard to the purposes for which they are processed, are erased or rectified without delay. |

At the current stage of the Company’s development and, with being pre-revenue at this stage, the scope of data held, and consequently the impact of GDPR, is limited. Increased application of GDPR will be assessed and implemented prior to further Company developments that warrant additional GDPR measures. As the Company progresses with product commercialization, the extent to which GDPR will affect the Company will increase, which will require additional changes to the Company’s procedures and policies which could adversely impact operational and compliance costs. Further, there is a risk that the measures will not be implemented correctly or that individuals within the business will not be fully compliant with the new procedures. If there are breaches of these measures, the Company could face significant administrative and monetary sanctions as well as reputational damage which may have a material adverse effect on its operations, financial condition and prospects.

Corporate Information

Our principal executive offices are located at The Advanced Technology Centre, Oakwood Drive, Loughborough, Leicestershire, LE11 3QF, UK. Our website is located at www.nemauramedical.com and our telephone number is +44 1509 222912. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this Annual Report, and you should not consider it part of the Annual Report.

Employees

We currently employ 8 personnel. We believe our relationships with our employees and contractors are good.

| 15 |

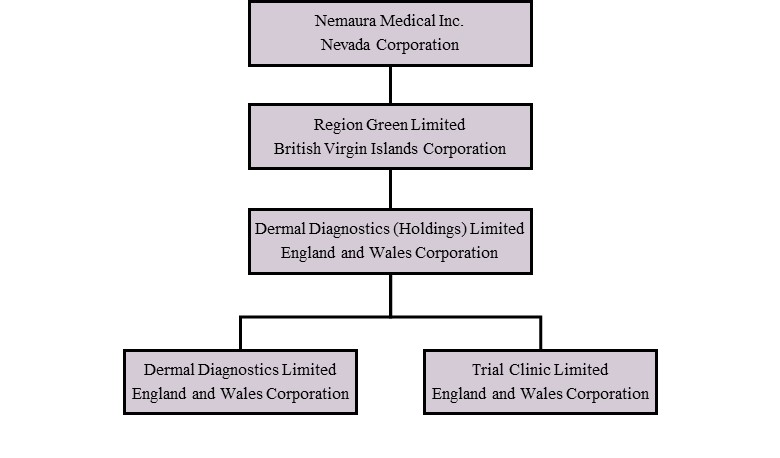

Corporate History and Restructuring

We are a holding corporation that owns one hundred percent (100%) of a diagnostic medical device company specializing in discovering, developing and commercializing specialty medical devices. We were organized on December 24, 2013 under the laws of the State of Nevada. We own one hundred percent (100%) of Region Green Limited, a British Virgin Islands corporation formed on December 12, 2013. Region Green Limited owns one hundred percent (100%) of the stock in Dermal Diagnostic (Holdings) Limited, an England and Wales corporation formed on December 11, 2013. Dermal Diagnostics (Holdings) Limited owns one hundred percent (100%) of the stock in Dermal Diagnostics Limited, an England and Wales corporation formed on January 20, 2009, and one hundred percent (100%) of the stock in Trial Clinic Limited, an England and Wales corporation formed on January 12, 2011.

In December 2013, we restructured the Company and re-domiciled as a domestic corporation in the United States. The corporate re-organization was accomplished to preserve the tax advantages under the laws of the England and Wales tax laws for the benefit of the shareholders of both Dermal Diagnostics Limited (“DDL”) and Trial Clinic Limited (“TCL”).

DDL is a diagnostic medical device company headquartered in Loughborough, Leicestershire, England. DDL was founded on January 20, 2009 to engage in the discovery, development and commercialization of diagnostic medical devices. The Company’s initial focus has been on the development of a novel continuous glucose monitoring (CGM) device.

RECENT DEVELOPMENT

On March 27, 2019, we filed a new Registration Statement on Form S-3 (Reg. No. 333-230535), registering up to $250,000,000 of our common stock, preferred stock, warrants, debt securities and units (the “Form S-3”). The Form S-3 was declared effective by the Securities and Exchange Commission on April 8, 2019. We may offer and sell up to $250,000,000 in the aggregate of the securities identified from time to time in one or more offerings. The securities may be sold directly by us, through dealers, or agents, designated from time to time, to or through underwriters, or through a combination of these methods as set forth in the “Plan of Distribution” included therein. Each time we offer securities under the prospectus that is part of the Form S-3, we will provide the specific terms of the securities being offered, including the offering price in a prospectus supplement.

CE Approval

On May 29, 2019 Nemaura Medical announced it had received confirmation of approval of the European Conformity for sugarBEAT which now allows Nemaura to commence commercialization of the product in to the European Union. The EU currently has in excess of 58 million1 diabetics which represents an enormous market opportunity that has yet to be fully exploited by other CGM’s due primarily to the cost of competitor products whereby a single sensor costs $10’s of dollars as each sensor has to be applied continuously for up to 14 days, whereas with sugarBEAT the sensor is a daily disposable, and therefore the cost of use is limited to a daily cost, and gives the user flexibility over how many days of the month they wear the CGM, to extract very powerful glucose trending data that finger prick testing quite simply cannot provide.

Nemaura has initiated plans to launch the product into the UK market in Q3 of 2019, followed by Germany and other markets. In the UK, Nemaura is working with its licensee DBP (Jersey) Ltd., to launch the product in the UK, and is in discussions with major distributors in Germany through its Joint venture with DB Ethitronix to commence registration and commercial launch into the German market which represents the single largest market in Europe.

The Company ordered 12,500 sugarBEAT devices in July 2018 in anticipation of CE approval, and these devices are currently being assembled and programmed with the updated software for the planned launch in Germany and the UK, and they are in discussions with their UK licensee with regards to taking orders for additional quantities to support product launch for the next 12 months.

Nemaura also plans to commence activities with respect to registering the CGM product based on the CE Mark in the GCC countries with their respective licensees in that region, Al-Danah Medical and TPMena in the coming weeks.

| 1. | https://www.idf.org/aboutdiabetes/what-is-diabetes/facts-figures.html |

| 16 |

Management Team Hire

Nemaura plans to further strengthen its operational and management team with the hire of Chris Avery, Vice President Business Operations. Chris has an impeccable track record of over 32 years in the diabetes industry including 9 years at Hypoguard, 5 years at Lifescan and 15 years at Nipro Diagnostics where he served as the UK Managing Director from 2010-14, and most recently was Senior VP Global Business Development at DB Ethitronix., where over a period of 2 years he was appointed to oversee the development of sugarBEAT and its commercialization strategy. Chris is expected to oversee the global operational management, handle investor updates on the technical and commercial development, as well as help broaden the global market reach of the product through the implementation of novel strategies based on the opportunities sugarBEAT presents that no other CGM is currently able to offer to date, due to its flexible wear time of sugarBEAT.

Advisory Board

Nemaura plans to further strengthen its advisory board through the appointment of Jafar Hamid who is a Private banking professional with over 25 years in the Investment Banking Industry, including with UBS, Credit Suisse and Citibank, and most recently J P Morgan. His expertise includes advising ultra High Net Worth individuals and family offices in the Healthcare and Pharmaceuticals areas. Mr. Hamid is expected to act as an adviser to the board.

ITEM 1A. — RISK FACTORS

If any of the following risks actually occur, they could materially adversely affect our business, financial condition or operating results. In that case, the trading price of our common stock could decline.

Risks Related to Our Product Candidate and Operation

We are largely dependent on the success of our sole product candidate, the sugarBEAT device, and we may not be able to successfully commercialize this potential product.

We have incurred and will continue to incur significant costs relating to the development and marketing of our sole product candidate, the sugarBEAT device. We have obtained approval to market this product in the EU, but it is not guaranteed that we will achieve this in any jurisdiction and we may never be able to obtain approval or, if approvals are obtained, to commercialize this product successfully in other territories.

If we fail to successfully commercialize our product(s) in multiple territories, we may be unable to generate sufficient revenue to sustain and grow our business, and our business, financial condition and results of operations will be adversely affected

If we fail to obtain regulatory approval of the sugarBEAT device or any of our other future products, we will be unable to commercialize these potential products.

The development, testing, manufacturing and marketing of our product is subject to extensive regulation by governmental authorities in Great Britain and the European Union. In particular, the process of obtaining CE approval by a Notified Body, a third party that can carry out a conformity assessment recognized by the European Union, is costly and time consuming, and the time required for such approval is uncertain. Our product must undergo rigorous preclinical and clinical testing and an extensive regulatory approval process mandated for the CE. Such regulatory review includes the determination of manufacturing capability and product performance. We have received CE approval on sugarBEAT wireless body worn device in May 2019.

There can be no assurance that all necessary approvals will be granted for future products or that CE review or actions will not involve delays caused by requests for additional information or testing that could adversely affect the time to market for and sale of our product. Further failure to comply with applicable regulatory requirements can, among other things; result in the suspension of regulatory approval as well as possible civil and criminal sanctions.

| 17 |

Failure to enroll patients in our clinical trials may cause delays in developing the sugarBEAT device or any of our future products.

We may encounter delays in the development and commercialization, or fail to obtain marketing approval, of the sugarBEAT device or any other future products if we are unable to enroll enough patients to complete clinical trials. Our ability to enroll sufficient numbers of patients in our clinical trials depends on many factors, including the severity of illness of the population, the size of the patient population, the nature of the clinical protocol, the proximity of patients to clinical sites, and the eligibility criteria for the trial and competing clinical trials. Delays in any possible future patient enrolment, based on request by local regulatory agencies to conduct studies in their territory, may result in increased costs and harm our ability to complete our clinical trials and obtain regulatory approval.

Delays in clinical testing could result in increased costs to us and delay our ability to generate revenue.

Significant delays in clinical testing could materially adversely impact our product development costs. We do not know whether planned clinical trials will begin on time, will need to be restructured or will be completed on schedule, if at all. Clinical trials can be delayed for a variety of reasons, including delays in obtaining regulatory approval to commence and continue a study, delays in reaching agreement on acceptable clinical study terms with prospective sites, delays in obtaining institutional review board approval to conduct a study at a prospective site and delays in recruiting patients to participate in a study.

Significant delays in testing or regulatory approvals for any of our current or future products, including the sugarBEAT device, could prevent or cause delays in the commercialization of such product candidates, reduce potential revenues from the sale of such product candidates and cause our costs to increase.

Our clinical trials for any of our current or future products may produce negative or inconclusive results and we may decide, or regulators may require us, to conduct additional clinical and/or preclinical testing for these products or cease our trials.

We will only receive regulatory approval to commercialize a product candidate if we can demonstrate to the satisfaction of the applicable regulatory agency that the product is safe and effective. We do not know whether our future clinical trials will demonstrate safety and efficacy sufficiently to result in marketable products. Because our clinical trials for the sugarBEAT device may produce negative or inconclusive results, we may decide, or regulators may require us, to conduct additional clinical and/or preclinical testing for this product or cease our clinical trials. If this occurs, we may not be able to obtain approval for this product or our anticipated time to market for this product may be substantially delayed and we may also experience significant additional development costs. We may also be required to undertake additional clinical testing if we change or expand the indications for our product.

If approved, the commercialization of our product, the sugarBEAT device, may not be profitable due to the need to develop sales, marketing and distribution capabilities, or make arrangements with a third party to perform these functions.

In order for the commercialization of our potential product to be profitable, our product must be cost-effective and economical to manufacture on a commercial scale. Subject to regulatory approval, we expect to incur significant sales, marketing, distribution, and to the extent we do not outsource manufacturing, manufacturing expenses in connection with the commercialization of the sugarBEAT device and our other potential products. We do not currently have a dedicated sales force or manufacturing capability, and we have no experience in the sales, marketing and distribution of medical diagnostic device products. In order to commercialize the sugarBEAT device or any of our other potential products that we may develop, we must develop sales, marketing and distribution capabilities or make arrangements with a third party to perform these functions. Developing a sales force is expensive and time-consuming, and we may not be able to develop this capacity. If we are unable to establish adequate sales, marketing and distribution capabilities, independently or with others, we may not be able to generate significant revenue and may not become profitable. Our future profitability will depend on many factors, including, but not limited to:

| – | the costs and timing of developing a commercial scale manufacturing facility or the costs of outsourcing the manufacturing of the sugarBEAT device; |

| – | receipt of regulatory approval of the sugarBEAT device; |