UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☑ QUARTERLY REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: September 30, 2017

or

☐ TRANSITION REPORT UNDER SECTION13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 333-194857

|

Nemaura Medical Inc.

|

|

(Exact name of small business issuer as specified in its charter)

|

| |

NEVADA

|

|

46-5027260

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Tax. I.D. No.)

|

|

|

|

|

Advanced Technology Innovation Centre,

Loughborough University Science and Enterprise Parks,

5 Oakwood Drive,

Loughborough, Leicestershire

LE11 3QF

United Kingdom

|

|

(Address of Principal Executive Offices)

|

|

|

|

+ 00 44 1509 222912

|

|

(Registrant’s Telephone Number, Including Area Code)

|

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☑

|

|

Non-accelerated filer ☐

(Do not check if a smaller reporting company)

|

|

Smaller reporting company ☐

|

|

Emerging growth company ☑

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The number of shares of common stock, par value $0.001 per share outstanding as of October 31, 2017 was 205,000,000.

NEMAURA MEDICAL INC.

| |

Page

|

|

PART I: FINANCIAL INFORMATION

|

3

|

|

ITEM 1

|

|

INTERIM FINANCIAL STATEMENTS

|

3

|

|

|

|

Condensed Consolidated Balance Sheets as of September 30, 2017 (unaudited) and March 31, 2017

|

3

|

|

|

|

Condensed Consolidated Statements of Comprehensive Loss for the Three and Six Months Ended September 30, 2017 and 2016 (unaudited)

|

4

|

|

|

|

Condensed Consolidated Statements of Cash Flows for the Six Months Ended September 30, 2017 and 2016 (unaudited)

|

5

|

|

|

|

Notes to Condensed Consolidated Financial Statements (unaudited)

|

6

|

|

ITEM 2

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

12

|

|

ITEM 3

|

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

15

|

|

ITEM 4

|

|

CONTROLS AND PROCEDURES

|

16

|

|

PART II: OTHER INFORMATION

|

18

|

|

ITEM 1

|

|

LEGAL PROCEEDINGS

|

18

|

|

ITEM 1A

|

|

RISK FACTORS

|

18

|

|

ITEM 2

|

|

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

|

18

|

|

ITEM 3

|

|

DEFAULTS UPON SENIOR SECURITIES

|

18

|

|

ITEM 4

|

|

MINE SAFETY DISCLOSURES

|

18

|

|

ITEM 5

|

|

OTHER INFORMATION

|

18

|

|

ITEM 6

|

|

EXHIBITS

|

18

|

|

SIGNATURES

|

19

|

PART I – FINANCIAL INFORMATION

ITEM 1. INTERIM FINANCIAL STATEMENTS

|

NEMAURA MEDICAL INC.

|

Condensed Consolidated Balance Sheets |

| |

|

As of September 30,

2017

($)

|

|

|

As of March 31,

2017

($)

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

Cash

|

|

|

597,539

|

|

|

|

911,359

|

|

|

Fixed rate cash account

|

|

|

1,350,738

|

|

|

|

1,867,950

|

|

|

Prepaid expenses and other receivables

|

|

|

71,844

|

|

|

|

51,086

|

|

|

Total Current Assets

|

|

|

2,020,121

|

|

|

|

2,830,395

|

|

| |

|

|

|

|

|

|

|

|

|

Other Assets:

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

7,683

|

|

|

|

9,161

|

|

|

Intangible assets, net of accumulated amortization

|

|

|

232,138

|

|

|

|

203,800

|

|

| |

|

|

239,821

|

|

|

|

212,961

|

|

| |

|

|

|

|

|

|

|

|

|

Long Term Assets:

|

|

|

|

|

|

|

|

|

|

Fixed rate cash account

|

|

|

4,735,241

|

|

|

|

4,358,550

|

|

| |

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

6,995,183

|

|

|

|

7,401,906

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

142,604

|

|

|

|

77,530

|

|

|

Liability due to related party

|

|

|

507,376

|

|

|

|

687,609

|

|

|

Other liabilities and accrued expenses

|

|

|

144,646

|

|

|

|

87,232

|

|

|

Total current liabilities

|

|

|

794,626

|

|

|

|

852,371

|

|

| |

|

|

|

|

|

|

|

|

|

Deferred revenue

|

|

|

1,272,811

|

|

|

|

1,183,035

|

|

| |

|

|

1,272,811

|

|

|

|

1,183,035

|

|

| |

|

|

,

|

|

|

|

|

|

|

Total liabilities

|

|

|

2,067,437

|

|

|

|

2,035,406

|

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies:

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ Equity:

|

|

|

|

|

|

|

|

|

Common stock, $0.001 par value, 420,000,000 shares authorized and 205,000,000

shares issued and outstanding

|

|

|

205,000

|

|

|

|

205,000

|

|

|

Additional paid in capital

|

|

|

12,919,672

|

|

|

|

12,919,672

|

|

|

Accumulated deficit

|

|

|

(7,953,451

|

)

|

|

|

(7,152,633

|

)

|

|

Accumulated other comprehensive loss

|

|

|

(243,475

|

)

|

|

|

(605,539

|

)

|

|

Total stockholders’ equity

|

|

|

4,927,746

|

|

|

|

5,366,500

|

|

|

Total liabilities and stockholders’ equity

|

|

|

6,995,183

|

|

|

|

7,401,906

|

|

See notes to the unaudited condensed consolidated financial statements

|

NEMAURA MEDICAL INC.

|

Condensed Consolidated Statements Of Comprehensive Loss |

|

(Unaudited)

|

| |

|

Three Months Ended September 30,

|

|

|

Six Months Ended September 30,

|

|

| |

|

2017

($)

|

|

|

2016

($)

|

|

|

2017

($)

|

|

|

2016

($)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue:

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

Total revenue

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

209,087

|

|

|

|

220,714

|

|

|

|

358,285

|

|

|

|

526,795

|

|

|

General and administrative

|

|

|

238,429

|

|

|

|

101,768

|

|

|

|

506,551

|

|

|

|

289,870

|

|

|

Total operating expenses

|

|

|

447,516

|

|

|

|

322,482

|

|

|

|

864,836

|

|

|

|

816,665

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(447,516

|

)

|

|

|

(322,482

|

)

|

|

|

(864,836

|

)

|

|

|

(816,665

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

54,485

|

|

|

|

-

|

|

|

|

64,018

|

|

|

|

-

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(393,031

|

)

|

|

|

(322,482

|

)

|

|

|

(800,818

|

)

|

|

|

(816,665

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment

|

|

|

159,309

|

|

|

|

140,312

|

|

|

|

362,064

|

|

|

|

(389,703

|

)

|

|

Comprehensive loss

|

|

|

(233,722

|

)

|

|

|

(182,170

|

)

|

|

|

(438,754

|

)

|

|

|

(1,206,368

|

)

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

|

*

|

|

|

Weighted average number of shares outstanding

|

|

|

205,000,000

|

|

|

|

205,000,000

|

|

|

|

205,000,000

|

|

|

|

205,000,000

|

|

* Per share amounts are less than $0.01

See notes to the unaudited condensed consolidated financial statements

|

NEMAURA MEDICAL INC.

|

Condensed Consolidated Statements of Cash Flows |

|

(Unaudited)

|

| |

|

Six Months Ended

September 30,

|

|

| |

|

2017

($)

|

|

|

2016

($)

|

|

| |

|

|

|

|

|

|

|

Cash Flows From Operating Activities:

|

|

|

|

|

|

|

|

Net loss

|

|

|

(800,818

|

)

|

|

|

(816,665

|

)

|

| |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

15,031

|

|

|

|

11,037

|

|

|

Changes in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Prepaid expenses and other receivables

|

|

|

(17,347

|

)

|

|

|

86,705

|

|

|

Accounts payable

|

|

|

72,401

|

|

|

|

(50,241

|

)

|

|

Liability due to related party

|

|

|

(221,735

|

)

|

|

|

-

|

|

|

Other liabilities and accrued expenses

|

|

|

39,147

|

|

|

|

-

|

|

|

Advances from related party

|

|

|

- |

|

|

|

270,210

|

|

|

Interest receivable

|

|

|

(54,295

|

)

|

|

|

-

|

|

|

Net cash used in operating activities

|

|

|

(967,616

|

)

|

|

|

(498,954

|

)

|

| |

|

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities:

|

|

|

|

|

|

|

|

|

|

Purchase of intangible assets

|

|

|

(25,245

|

)

|

|

|

(55,564

|

)

|

|

Purchase of property and equipment

|

|

|

-

|

|

|

|

(6,842

|

)

|

|

Fixed rate savings account

|

|

|

639,460

|

|

|

|

-

|

|

|

Net cash provided by (used in) investing activities

|

|

|

614,215

|

|

|

|

(62,406

|

)

|

| |

|

|

|

|

|

|

|

|

|

Net decrease in cash

|

|

|

(353,401

|

)

|

|

|

(561,360

|

)

|

|

Effect of exchange rate changes on cash

|

|

|

39,581

|

|

|

|

(524,323

|

)

|

|

Cash at beginning of period

|

|

|

911,359

|

|

|

|

9,403,965

|

|

|

Cash at end of period

|

|

|

597,539

|

|

|

|

8,318,282

|

|

See notes to the unaudited condensed consolidated financial statements

NEMAURA MEDICAL INC.

Notes to Condensed Consolidated Financial Statements

Three and Six Months Ended September 30, 2017 and 2016

(Unaudited)

INTERIM FINANCIAL STATEMENTS

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

Nemaura Medical Inc. ("Nemaura" or the "Company"), through its operating subsidiaries, performs medical device research of a continuous glucose monitoring system ("CGM"), named sugarBEAT. The sugarBEAT device is a non-invasive, wireless device for use by persons with Type I and Type II diabetes, and may also be used to screen pre-diabetic patients. The sugarBEAT device extracts analytes, such as glucose, to the surface of the skin in a non-invasive manner where it is measured using unique sensors and interpreted using a unique algorithm.

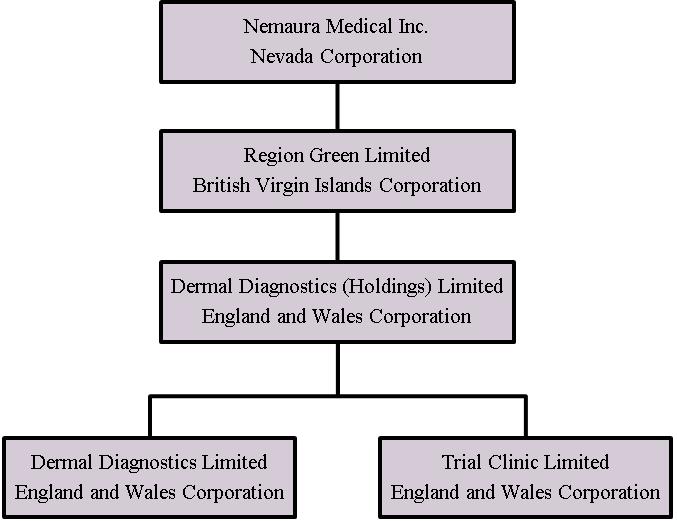

Nemaura is a Nevada holding company organized in 2013. Nemaura owns one hundred percent (100%) of Region Green Limited, a British Virgin Islands corporation formed ("RGL") on December 12, 2013. Region Green Limited owns one hundred percent (100%) of the stock in Dermal Diagnostic (Holdings) Limited, an England and Wales corporation ("DDHL") formed on December 11, 2013, which in turn owns one hundred percent (100%) of Dermal Diagnostics Limited, an England and Wales corporation formed on January 20, 2009 ("DDL"), and one hundred percent (100%) of Trial Clinic Limited, an England and Wales corporation formed on January 12, 2011 ("TCL").

DDL is a diagnostic medical device company headquartered in Loughborough, Leicestershire, England, and is engaged in the discovery, development and commercialization of diagnostic medical devices. The Company's initial focus has been on the development of the sugarBEAT device, which consists of a disposable patch containing a sensor, and a non-disposable miniature electronic watch with a re-chargeable power source, which is designed to enable trending or tracking of blood glucose levels. Except for a US cash account (approximately $48,000 at September 30, 2017), all of the Company’s operations and assets are located in England.

The following diagram illustrates our corporate and shareholder structure as of September 30, 2017:

NEMAURA MEDICAL INC.

Notes to Condensed Consolidated Financial Statements

Three and Six Months Ended September 30, 2017 and 2016

(Unaudited)

The Company has a limited operating history, recurring losses from operations and an accumulated deficit of $7,953,451 as of September 30, 2017. The Company expects to continue to incur losses from operations at least until clinical trials are completed later this calendar year and the product becomes available to be marketed. Management has evaluated its ability to continue as a going concern for the next twelve months from the issuance of these September 30, 2017 consolidated financial statements, and considered the expected expenses to be incurred along with its available cash, and has determined that there is not substantial doubt as to its ability to continue as a going concern for at least one year subsequent to the date of issuance of these financial statements. The Company has $597,539 of readily available cash on hand at September 30, 2017 and approximately $1.35 million will be available in December 2017, which is currently in a fixed rate deposit account. In addition, the Company has approximately $4.74 million of cash in a fixed rate deposit account which matures in December 2018.

Management's strategic plans include the following:

- continuing to advance commercialization of the Company's principal product, in the UK, European and other international markets;

- pursuing additional capital raising opportunities; and

- continuing to explore and execute prospective partnering or distribution opportunities.

NOTE 2 -- BASIS OF PRESENTATION

(a) Basis of presentation:

The accompanying condensed consolidated financial statements include the accounts of the Company and the Company’s subsidiaries, DDL, TCL, DDHL and RGL. The consolidated financial statements are prepared in accordance with the instructions to quarterly reports on Form 10-Q. In the opinion of management, all adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations and changes in financial position at September 30, 2017 and for all periods presented have been made. Certain information and footnote data necessary for fair presentation of financial position and results of operations in conformity with accounting principles generally accepted in the United States of America have been condensed or omitted. It is therefore suggested that these financial statements be read in conjunction with the summary of significant accounting policies and notes to financial statements included in the Company’s Annual Report on Form 10-K for the Year Ended March 31, 2017. The results of operations for the period ended September 30, 2017 are not necessarily an indication of operating results for the full year.

NOTE 3 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Cash includes cash equivalents, which the Company considers all highly liquid investments purchased with original maturities of three months or less to be cash equivalents. Cash and cash equivalents consist primarily of cash deposits maintained in the United Kingdom. From time to time, the Company's cash account balances exceed amounts covered by the Financial Services Compensation Scheme. The Company has never suffered a loss due to such excess balances.

| (b) |

Fixed rate cash accounts:

|

From time to time the Company invests funds in fixed rate cash savings accounts. These accounts, at the time of the initial investment, provide a higher interest rate than other bank accounts, and also require the Company to maintain the funds in the accounts for a period of time, $1,352,000 through December 2017 and $4,735,000 through December 2018. Early withdrawal may generally be made for liquidity needs.

NEMAURA MEDICAL INC.

Notes to Condensed Consolidated Financial Statements

Three and Six Months Ended September 30, 2017 and 2016

(Unaudited)

(c) Fair value of financial instruments

The Company's financial instruments primarily consist of cash, fixed rate cash accounts, and accounts payable. As of the balance sheet dates, the estimated fair values of non-related party financial instruments were not materially different from their carrying values as presented, due to their short maturities. The fair value of amounts payable to related parties are not practicable to estimate due to the related party nature of the underlying transactions.

(d) Property and equipment

Property and equipment is stated at cost and depreciated using the straight-line method over the estimated useful lives of the assets, generally four years for fixtures and fittings.

(e) Intangible assets

Intangible assets consist of licenses and patents associated with the sugarBEAT device and are amortized on a straight-line basis, generally over their legal lives of up to 20 years.

(f) Revenue recognition

Revenue is recognized when the four basic criteria of revenue recognition are met: (1) a contractual agreement exists; (2) transfer of rights has been completed; (3) the fee is fixed or determinable; and (4) collectability is reasonably assured.

The Company may enter into product development and other agreements and with collaborative partners. The terms of the agreements may include nonrefundable signing and licensing fees, milestone payments and royalties on any product sales derived from collaborations.

The Company recognizes up front license payments as revenue upon delivery of the license only if the license has stand alone value to the customer. However, where further performance criteria must be met, revenue is deferred and recognized on a straight line basis over the period the Company is expected to complete its performance obligations.

Royalty revenue will be recognized upon the sale of the related products provided the Company has no remaining performance obligations under the agreement.

(g) Research and development expenses

The Company charges research and development expenses to operations as incurred. Research and development expenses primarily consist of salaries and related expenses for personnel and outside contractor and consulting services. Other research and development expenses include the costs of materials and supplies used in research and development, prototype manufacturing, clinical studies, related information technology and an allocation of facilities costs.

(h) Income taxes

Income taxes are accounted for under the asset and liability method. Deferred income tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases, and operating loss carry forwards. Deferred income tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred income tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is provided to reduce the carrying amount of deferred income tax assets if it is considered more likely than not that some portion, or all, of the deferred income tax assets will not be realized.

NEMAURA MEDICAL INC.

Notes to Condensed Consolidated Financial Statements

Three and Six Months Ended September 30, 2017 and 2016

(Unaudited)

The Company recognizes the effect of income tax positions only if those positions are more likely than not of being sustained. Recognized income tax positions are measured at the largest amount that is greater than 50% likely of being realized. Changes in recognition or measurement are reflected in the period in which the change in judgment occurs. The Company has elected to classify interest and penalties related to unrecognized tax benefits as part of income tax expense in the consolidated statements of comprehensive loss. The Company does not have any accrued interest or penalties associated with any unrecognized tax benefits, nor was any interest expense related to unrecognized tax benefits recognized for the three months ended September 30, 2017 and 2016. The Company’s deferred tax asset consists primarily of net operating loss carried forwards, and are fully allowed for as realization of these assets is not considered to be more likely than not.

Basic earnings per share is computed by dividing income available to common stockholders by the weighted-average number of common shares outstanding during the period. There were no potentially dilutive securities as of September 30, 2017 and 2016. For the three month and six month periods ended September 30, 2017 and 2016, warrants to purchase 10 million shares of common stock were anti-dilutive and were excluded from the calculation of diluted loss per share.

(j) Use of estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the year. Actual results may differ from those estimates.

(k) Foreign currency translation

The functional currency of the Company is the Great Britain Pound Sterling ("GBP"). The reporting currency is the United States dollar (US$). Stockholders' equity is translated into United States dollars from GBP at historical exchange rates. Assets and liabilities are translated at the exchange rates as of balance sheet date. Income and expenditures are translated at the average exchange rates prevailing during the reporting period.

The translation rates are as follows:

| |

|

Six months ended

September 30,

2017

(unaudited)

|

|

|

Six months ended

September 30,

2016

(unaudited)

|

|

|

Three months ended

September 30,

2017

(unaudited)

|

|

|

Three months ended

September 30,

2016

(unaudited)

|

|

|

Twelve months ended

March 31,

2017

|

|

|

Period end GBP : US$ exchange rate

|

|

|

1.340

|

|

|

|

1.325

|

|

|

|

1.340

|

|

|

|

1.325

|

|

|

|

1.245

|

|

|

Average period/yearly GBP : US$ exchange rate

|

|

|

1.279

|

|

|

|

1.382

|

|

|

|

1.283

|

|

|

|

1.370

|

|

|

|

1.315

|

|

Adjustments resulting from translating the financial statements into the United States dollar are recorded as a separate component of accumulated other comprehensive loss in stockholders' equity.

(l) Recent accounting pronouncements

The Company continually assesses any new accounting pronouncements to determine their applicability. When it is determined that a new accounting pronouncement affects the Company's financial reporting, the Company undertakes a study to determine the consequences of the change to its consolidated financial statements and assures that there are proper controls in place to ascertain that the Company's consolidated financial statements properly reflect the change.

In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Updates ("ASU") No. 2014-09, Revenue from Contracts with Customers. ASU 2014-09 has been modified multiple times since its initial release. This ASU outlines a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and will replace most existing revenue recognition guidance in U.S. GAAP when it becomes effective. ASU 2014-09, as amended, becomes effective for annual reporting periods beginning after December 15, 2017. Early adoption is permitted. The Company is currently evaluating the impact that this standard will have on its financial statements and related disclosures. The impact is expected to be insignificant until the Company begins to generate revenue, except as to the possible impact related to the deferred revenue recorded in connection with the licensing agreement described in Note 4 which the Company is currently evaluating. The standard permits the use of either the retrospective or cumulative effect transition method. The Company has not yet selected a transition method.

NEMAURA MEDICAL INC.

Notes to Condensed Consolidated Financial Statements

Three and Six Months Ended September 30, 2017 and 2016

(Unaudited)

In March 2016, the FASB issued ASU No. 2016-02, Leases. The main difference between the provisions of ASU No. 2016-02 and previous U.S. GAAP is the recognition of right-of-use assets and lease liabilities by lessees for those leases classified as operating leases under previous U.S. GAAP. ASU No. 2016- 02 retains a distinction between finance leases and operating leases, and the recognition, measurement, and presentation of expenses and cash flows arising from a lease by a lessee have not significantly changed from previous U.S. GAAP. For leases with a term of 12 months or less, a lessee is permitted to make an accounting policy election by class of underlying asset not to recognize right-of-use assets and lease liabilities. The accounting applied by a lessor is largely unchanged from that applied under previous U.S. GAAP. In transition, lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. This ASU is effective for public business entities in fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Early adoption is permitted as of the beginning of any interim or annual reporting period. The Company has not yet determined the effect of the standard on its ongoing reporting.

In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows - Classification of Certain Cash Receipts and Cash Payments. ASU No. 2016-15 is intended to reduce diversity in how certain cash receipts and cash payments are presented in the statement of cash flows. The new guidance clarifies the classification of cash activity related to debt prepayment or debt extinguishment costs, settlement of zero-coupon debt instruments, contingent consideration payments made after a business combination, proceeds from the settlement of insurance claims, proceeds from the settlement of corporate and bank-owned life insurance policies, distributions received from equity-method investments, and beneficial interests in securitization transactions. The guidance also describes a predominance principle pursuant to which cash flows with aspects of more than one class that cannot be separated should be classified based on the activity that is likely to be the predominant source or use of cash flow. This ASU is effective for public entities for annual and interim periods beginning after December 15, 2017. Early adoption is permitted as of the beginning of any interim or annual reporting period. The Company is currently evaluating the impact this standard will have on its financial statements and related disclosures, but does not expect it to have a material effect on the Company's consolidated financial statements and related disclosures.

In November 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows - Restricted Cash. ASU 2016-18 requires entities to show the changes in the total of cash, cash equivalents, restricted cash and restricted cash equivalents in the statement of cash flows. When cash, cash equivalents, restricted cash and restricted cash equivalents are presented in more than one line item on the balance sheet, a reconciliation of the totals in the statement of cash flows to the related captions in the balance sheet is required. This ASU is effective for public entities for annual and interim periods beginning after December 15, 2017. Early adoption is permitted as of the beginning of any interim or annual reporting period. The Company is currently evaluating the impact this standard will have on its financial statements and related disclosures.

(m) Risks and uncertainties

The Company is in the development stage of one primary product that it expects to introduce to the UK market after completion of clinical trials and CE mark approval (European Union approval of the product). The Company has entered into sales and marketing agreements for the product, but has not yet entered into manufacturing agreements. These matters raise uncertainties as regulatory acceptance of the Company’s primary product development efforts and if acceptance is attained, the cost structure to produce the product.

(n) Subsequent events

In October 2017, the Company’s board of directors designated 200,000 shares of Series A Convertible Preferred Stock, as authorized by its articles of incorporation. The par value of the preferred stock is $0.001 per share. Each share of preferred stock is convertible into 1,000 shares of the Company’s common stock, automatically upon the occurrence of certain triggering events, as set forth in the certificate of designation, or voluntarily by the holder after February 1, 2019, if these triggering events have not occurred. Each holder of issued and outstanding preferred stock is entitled to a number of votes equal to the number of shares of common stock into which the preferred stock is convertible. Holders of preferred are entitled to vote on any and all matters presented to stockholders of the Company, except as provided by law. The preferred stock has preference to the common stock as to dividends or distributions of assets upon liquidation or winding up of the Company. Currently, no shares of preferred stock have been issued.

NEMAURA MEDICAL INC.

Notes to Condensed Consolidated Financial Statements

Three and Six Months Ended September 30, 2017 and 2016

(Unaudited)

NOTE 4 – LICENSING AGREEMENT

In March 2014, the Company entered into an Exclusive Marketing Rights Agreement with an unrelated third party, that granted to the third party the exclusive right to market and promote the sugarBEAT device and related patches under its own brand in the United Kingdom and the Republic of Ireland, the Channel Islands and the Isle of Man. The Company received a non-refundable, up front cash payment of GBP 1,000,000 (approximately $1.340 million and $1.245 million as of September 30, 2017 and March 31, 2017 respectively) which is wholly non-refundable, upon signing the agreement.

As the Company has continuing performance obligations under the agreement, the up front fees received from this agreement have been deferred and will be recorded as income over the term of the commercial licensing agreement beginning from the date of clinical evaluation approval. As the Company expects commercialization of the sugarBEAT device to occur in the year ending March 31, 2019, approximately $67,000 of the deferred revenue has been classified as a current liability.

In April 2014, a Letter of Intent was signed with the third party which specified a 10 year term and in November 2015, a Licence, Supply and Distribution agreement with an initial 5 year term was executed. The Company grants the exclusive right to market and promote its product in the United Kingdom, and purchase the product at specified prices.

NOTE 5 – RELATED PARTY TRANSACTIONS

Nemaura Pharma Limited (Pharma) and NDM Technologies Limited (NDM) are entities controlled by the Company’s majority shareholder, Dewan F.H. Chowdhury.

In accordance with the United States Securities and Exchange Commission (SEC) Staff Accounting Bulletin 55, these financial statements are intended to reflect all costs associated with the operations of DDL and TCL. Pharma has invoiced DDL and TCL for research and development services. In addition, certain operating expenses of DDL and TCL were incurred and paid by Pharma and NDM which have been invoiced to the Company. Certain costs incurred by Pharma and NDM are directly attributable to DDL and TCL and such costs were billed to the Company. Prior to the year ended March 31, 2016, other costs were shared between the organizations. In situations where the costs were shared, expense has been allocated between Pharma and NDM and DDL and TCL using a fixed percentage allocation and were billed to the Company. Management believes the allocation methodologies used are reasonable. DDL and TCL advanced Pharma certain amounts to cover a portion of the costs.

Following is a summary of activity between the Company and Pharma and NDM for the six months ended September 30, 2017 and 2016. These amounts are unsecured, interest free, and payable on demand.

| |

|

Six Months Ended

September 30, 2017

(unaudited)

($)

|

|

|

Six Months Ended

September 30, 2016

(unaudited)

($)

|

|

|

Balance due from (to) Pharma and NDM at beginning of period

|

|

|

(687,609

|

)

|

|

|

(494,145

|

)

|

|

Amounts invoiced by Pharma to DDL and TCL (1)

|

|

|

(239,758

|

)

|

|

|

(286,096

|

)

|

|

Amounts invoiced by DDL to Pharma

|

|

|

-

|

|

|

|

15,886

|

|

|

Amounts repaid by DDL to Pharma

|

|

|

440,266

|

|

|

|

-

|

|

|

Amounts paid by DDL on behalf of Pharma

|

|

|

19,889

|

|

|

|

-

|

|

|

Foreign exchange differences

|

|

|

(40,164

|

)

|

|

|

46,420

|

|

|

Balance due to Pharma and NDM at end of the period

|

|

|

(507,376

|

)

|

|

|

(717,935

|

)

|

(1) These amounts are included primarily in research and development expenses charged to the Company by Pharma and NDM.

ITEM 2: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview:

The Company has experienced recurring losses and negative cash flows from operations. At September 30, 2017, the Company had approximate cash and fixed rate cash account balances of $6,683,000, working capital of $1,225,000, total stockholders' equity of $4,928,000 and an accumulated deficit of $7,953,000. To date, the Company has in large part relied on equity financing to fund its operations. Additional funding has come from related party contributions. The Company expects to continue to incur losses from operations for the near-term and these losses could be significant as product development, regulatory activities, clinical trials and other commercial and product development related expenses are incurred.

Management's strategic assessment includes the following potential options:

• obtaining regulatory approval for the sugarBEAT device

• pursuing additional capital raising opportunities;

• exploring licensing opportunities; and

• developing the sugarBEAT device for commercialization.

Results of Operations

Comparative Results for the Six Months Ended September 30, 2017 and 2016

Revenue

There was no revenue recognized in the six months ended September 30, 2017 and 2016. In 2014, we received an upfront non-refundable cash payment of approximately $1.67 million in connection with an Exclusive Marketing Rights Agreement with an unrelated third party that provides the third party the exclusive right to market and promote the sugarBEAT device and related patch under its own brand in the United Kingdom and the Republic of Ireland. We have deferred this licensing revenue until we complete our continuing performance obligations, which include securing successful CE marking of the sugarBEAT patch, and we expect to record the revenue in income over an approximately 10 year term from the date CE marking approval is obtained. Although the revenue is deferred at September 30, 2017, the cash payment became immediately available and was being used to fund our operations, including research and development costs associated with obtaining the CE marking approval.

Research and Development Expenses

Research and development expenses were $358,285 and $526,795 for the six months ended September 30, 2017 and 2016, respectively. This amount consisted primarily of expenditure on sub-contractor activities, consultancy fees and wages and demonstrated continuing expenditure for improvements made to the sugarBEAT device. The decrease of $168,510 is due to decreases in these costs as the sugarBEAT product is nearing completion.

General and Administrative Expenses

General and administrative expenses were $506,551 and $289,870 for the six months ended September 30, 2017 and 2016, respectively. These consisted of fees for legal, professional, audit services, charitable donations and wages. The increase of $216,681 was due to increases in professional fees as the CGM device enters clinical trials and legal fees incurred as the company prepares for future product launch, plus £123,000 in charitable donations. We expect general and administrative expenses to remain at similar levels going forward in the long term, as there will continue to be professional, consultancy and legal fees associated with planned fundraising.

Other Comprehensive Loss

For the six months ended September 30, 2017 and 2016, other comprehensive income (loss) was $362,064 and ($389,703) respectively, arising from foreign currency translation adjustments.

Comparative Results for the Three Months Ended September 30, 2017 and 2016

Revenue

There was no revenue recognized in the three months ended September 30, 2017 and 2016. In 2014, we received an upfront non-refundable cash payment of £1,000,000 in connection with an Exclusive Marketing Rights Agreement with an unrelated third party that provides the third party the exclusive right to market and promote the sugarBEAT device and related patch under its own brand in the United Kingdom and the Republic of Ireland. We have deferred this licensing revenue until we complete our continuing performance obligations, which include securing successful CE marking of the sugarBEAT patch, and we expect to record the revenue in income over an approximately 10 year term from the date CE marking approval is obtained. Although the revenue is deferred at September 30, 2017, the cash payment became immediately available and was being used to fund our operations, including research and development costs associated with obtaining the CE marking approval.

Research and Development Expenses

Research and development expenses were $209,087 and $220,714 for the three months ended September 30, 2017 and 2016, respectively. This amount consisted primarily of expenditure on sub-contractor activities, consultancy fees and wages and demonstrated continuing expenditure for improvements made to the sugarBEAT device. The decrease of $11,627 is due to decreases in these costs as the sugarBEAT product is nearing completion.

General and Administrative Expenses

General and administrative expenses were $238,429 and $101,768 for the three months ended September 30, 2017 and 2016, respectively. These consisted of fees for legal, professional, audit services, charitable donations and wages. The increase of $136,661 was due to increases in professional fees as the CGM device enters clinical trials and legal fees incurred as the company prepares for future product launch. We expect general and administrative expenses to remain at similar levels going forward in the long term, as there will continue to be professional, consultancy and legal fees associated with planned fundraising.

Other Comprehensive Loss

For the three months ended September 30, 2017 and 2016, other comprehensive income was $159,309 and $140,312 respectively, arising from foreign currency translation adjustments.

Liquidity and Capital Resources

We have experienced net losses and negative cash flows from operations since our inception. We have sustained cumulative losses of $7,953,451 through September 30, 2017. We have historically financed our operations through the issuances of equity and contributions of services from related entities.

At September 30, 2017, the Company had net working capital of $1,225,495 which included cash and short-term fixed rate cash account balances of $1,948,277. The Company reported a net loss of $800,818 for the six months ended September 30, 2017.

While our current cash level (including fixed rate cash accounts) is sufficient for the completion of the clinical studies and the initial scale up of our manufacturing, our long term business plan is contingent upon our ability to raise additional funds. This may include a combination of debt, equity and licensing fees. If we are not successful in raising the funds needed in the specified timelines, the target dates for the achievement of the milestones will be extended.

ITEM 4. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Mr. Dewan F.H. Chowdhury, who is our Chief Executive Officer and Mr. Iain S. Anderson, who is our Principal Financial and Accounting Officer, have evaluated the effectiveness of our disclosure controls and procedures as of the end of the period covered by this Quarterly Report on Form 10-Q. The term "disclosure controls and procedures," as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), means controls and other procedures of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is accumulated and communicated to the company's management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure. Management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives and management necessarily applies its judgment in evaluating the cost benefit relationship of possible controls and procedures. Based on this evaluation, management concluded that our disclosure controls and procedures were not effective as of September 30, 2017, at the reasonable assurance level due to a material weakness in our internal control over financial reporting, which is described below.

Changes in Internal Control over Financial Reporting

As of September 30, 2017, our management, with the participation of our Principal Executive Officer and Principal Financial Officer, evaluated our internal control over financial reporting. Based on that evaluation, our Principal Executive Officer and Principal Financial Officer concluded that no changes in our internal control over financial reporting occurred during the quarter ended September 30, 2017 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

As described in our Annual Report on Form 10-K for the year ended March 31, 2017, management assessed the effectiveness of our internal control over financial reporting as of March 31, 2017. In making this assessment we used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control – Integrated Framework (2013). As a result of its assessment, management identified material weaknesses in our internal control over financial reporting. Based on the material weaknesses as described below, management concluded that our internal control over financial reporting was not effective as of March 31, 2017. Accordingly, our internal control over financial reporting is not effective as of September 30, 2017 because of the material weaknesses identified and described below.

A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that, there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. As a result of our assessment, management identified the following material weaknesses in internal control over financial reporting as of March 31, 2017:

· Our size has prevented us from being able to employ sufficient resources to enable us to have an adequate level of supervision and segregation of duties within our internal control system. This has resulted in a number of internal control deficiencies. Specifically,

· there is a lack of segregation of duties in the processing of financial transactions which could result in inappropriate initiation, processing and review of transactions and the financial reporting of such transactions whether due to errors or fraud;

· there is a lack of review and approval of journal entries which could result in the improper initiation and reporting of transactions; and

· there is a lack of access controls and documentation over the Company’s IT applications which could result in the improper initiation and reporting of significant transactions.

· Management has identified that there is a lack of adequate financial expertise related to the assessment of complex transactions and a lack of adequate resources to review out of the ordinary transactions and arrangements of the Company. This could result in the improper reporting of significant transactions or arrangements.

· Related party transactions. Specifically, there are limited policies and procedures to ensure that financial statement disclosures reconcile fully to the underlying accounting records and that Board approval of these transactions is not documented.

Notwithstanding the identified material weaknesses, management believes the consolidated financial statements included in this Quarterly Report on Form 10-Q fairly represent in all material respects our financial condition, results of operations and cash flows at and for the periods presented in accordance with U.S. GAAP.

Remediation of Material Weaknesses

We are in the process of implementing improvements and remedial measures in response to the material weaknesses, including:

· Assembling a team from our finance department to be responsible for the preparation of financial statements under U.S. Securities laws, including hiring additional qualified personnel such as a CFO with US listed company experience.

· In assembling this team, the Company will put in place controls to segregate duties in the processing of key transactions, controls to ensure the review and approval of journal entries and controls to ensure that access to IT systems is limited to authorized users and adequately documented based on the applications and their functions within the organization.

· Engaging a third party consulting firm to assist in assessing, designing, implementing, and monitoring controls related to financial statement preparation, IT general controls, journal entries, and significant operating processes.

· Organizing regular training sessions on US GAAP for our finance department in the form of workshops, seminars and newsletters as well as requiring our finance personnel to participate in annual in-house or public US GAAP training courses; and

· Implementing stronger internal controls and processes over related party transactions including segregating reviews and approvals, as well as continuing efforts to reduce the amount and volume of related party transactions; and

· Establishing an audit committee with an "audit committee financial expert" within the definition of the applicable Securities and Exchange Commission. The committee will be helped by an outsourced internal audit department to review our internal control processes, policies and procedures to ensure compliance with the Sarbanes-Oxley Act.

Further information regarding our remediation plans is contained in our Annual Report on Form 10-K for the year ended March 31, 2017. We are continuing to address these issues and to date have:

· On December 12, 2016, appointed Mr. Iain Anderson to serve as the Chief Financial Officer.

· Engaged a third party consulting firm to help us assess our current internal control over financial reporting against COSO 2013, as well as identifying a gap analysis, suggest improvements in controls, and assist us in testing our control systems. These items have been completed for certain of our controls, including purchasing processes, payment processes, and month end closing procedures.

· During the quarter ended September 30, 2017, the board of directors appointed three independent directors to serve on our board of directors, each of whom meet the definition of “independent” as set forth under The Nasdaq Stock Market rules. The Board has established an audit committee with each of the independent directors serving as members of the audit committee. The Board has also designated one of the independent directors to serve as Chair of the audit committee who meets the definition of an “audit committee financial expert.”.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

None.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

ITEM 5. OTHER INFORMATION

None.

The exhibits listed on the Exhibit Index below are provided as part of this report.

|

Exhibit No.

|

|

Document Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

101

|

|

Interactive Data Files (1)

|

(1) Pursuant to Rule 406T of Regulation S-T, the XBRL related information in Exhibit 101 to this Quarterly Report on Form 10-Q shall not be deemed to be filed by the Company for purposes of Section 18 or any other provision of the Exchange Act of 1934, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

NEMAURA MEDICAL INC.

|

|

|

|

|

Dated: October 31, 2017

|

/s/ Dewan F H Chowdhury

|

| |

Dewan F H Chowdhury

|

| |

Chief Executive Officer (Principal Executive Officer)

|

|

Dated: October 31, 2017

|

/s/ Iain S Anderson

|

| |

Iain S Anderson

|

| |

Chief Financial Officer (Principal Financial Officer)

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Document Description

|

|

31.1

|

|

Certification of the Principal Executive Officer pursuant to Rule 13A-14(A)/15D-14(A) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

31.2

|

|

Certification of the Principal Financial Officer pursuant to Rule 13A-14(A)/15D-14(A) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

32.1

|

|

Certification of the Principal Executive Officer pursuant to Rule 13A-14(A)/15D-14(A) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

32.2

|

|

Certification of the Principal Financial Officer pursuant to Rule 13A-14(A)/15D-14(A) of the Securities Exchange Act of 1934, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|