0001601830FALSE2023FYP7D10010010043500016018302023-01-012023-12-3100016018302023-06-30iso4217:USD0001601830us-gaap:CommonClassAMember2024-01-31xbrli:shares0001601830us-gaap:CommonClassBMember2024-01-3100016018302023-12-3100016018302022-12-31iso4217:USDxbrli:shares0001601830us-gaap:CommonClassAMember2022-12-310001601830us-gaap:CommonClassAMember2023-12-310001601830us-gaap:CommonClassBMember2022-12-310001601830us-gaap:CommonClassBMember2023-12-310001601830rxrx:ExchangeableStockMember2023-12-310001601830rxrx:ExchangeableStockMember2022-12-310001601830us-gaap:LicenseAndServiceMember2023-01-012023-12-310001601830us-gaap:LicenseAndServiceMember2022-01-012022-12-310001601830us-gaap:LicenseAndServiceMember2021-01-012021-12-310001601830us-gaap:GrantMember2023-01-012023-12-310001601830us-gaap:GrantMember2022-01-012022-12-310001601830us-gaap:GrantMember2021-01-012021-12-3100016018302022-01-012022-12-3100016018302021-01-012021-12-3100016018302020-12-310001601830us-gaap:CommonStockMember2020-12-310001601830us-gaap:AdditionalPaidInCapitalMember2020-12-310001601830us-gaap:RetainedEarningsMember2020-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001601830us-gaap:RetainedEarningsMember2021-01-012021-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001601830us-gaap:CommonStockMember2021-01-012021-12-310001601830us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001601830us-gaap:ConvertiblePreferredStockMember2021-01-012021-12-310001601830us-gaap:CommonStockMemberrxrx:SeriesAAndSeriesBWarrantsMember2021-01-012021-12-310001601830us-gaap:AdditionalPaidInCapitalMemberrxrx:SeriesAAndSeriesBWarrantsMember2021-01-012021-12-310001601830rxrx:SeriesAAndSeriesBWarrantsMember2021-01-012021-12-3100016018302021-12-310001601830us-gaap:CommonStockMember2021-12-310001601830us-gaap:AdditionalPaidInCapitalMember2021-12-310001601830us-gaap:RetainedEarningsMember2021-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001601830us-gaap:RetainedEarningsMember2022-01-012022-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001601830us-gaap:CommonStockMember2022-01-012022-12-310001601830us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001601830us-gaap:CommonStockMember2022-12-310001601830us-gaap:AdditionalPaidInCapitalMember2022-12-310001601830us-gaap:RetainedEarningsMember2022-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001601830us-gaap:RetainedEarningsMember2023-01-012023-12-310001601830us-gaap:CommonStockMember2023-01-012023-12-310001601830us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001601830us-gaap:CommonStockMemberrxrx:TempusAgreementMember2023-01-012023-12-310001601830us-gaap:AdditionalPaidInCapitalMemberrxrx:TempusAgreementMember2023-01-012023-12-310001601830rxrx:TempusAgreementMember2023-01-012023-12-310001601830us-gaap:CommonStockMember2023-12-310001601830us-gaap:AdditionalPaidInCapitalMember2023-12-310001601830us-gaap:RetainedEarningsMember2023-12-310001601830us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001601830rxrx:TempusAgreementMember2022-01-012022-12-310001601830rxrx:TempusAgreementMember2021-01-012021-12-3100016018302021-04-012021-04-30xbrli:pure00016018302021-04-30rxrx:class0001601830us-gaap:CommonStockMember2021-04-012021-04-30rxrx:financial_institution0001601830us-gaap:OfficeEquipmentMember2023-12-310001601830rxrx:LaboratoryEquipmentMember2023-12-310001601830us-gaap:LeaseholdImprovementsMember2023-12-3100016018302022-01-010001601830rxrx:TempusLabsIncMember2023-11-012023-11-300001601830srt:MinimumMemberrxrx:TempusLabsIncMember2023-11-300001601830rxrx:TempusLabsIncMembersrt:MaximumMember2023-11-300001601830us-gaap:OtherCurrentAssetsMember2023-01-012023-12-310001601830rxrx:LaboratoryEquipmentMember2022-12-310001601830us-gaap:LeaseholdImprovementsMember2022-12-310001601830us-gaap:OfficeEquipmentMember2022-12-310001601830us-gaap:AssetUnderConstructionMember2023-12-310001601830us-gaap:AssetUnderConstructionMember2022-12-310001601830rxrx:BioHiveSupercomputerMember2023-01-012023-12-310001601830us-gaap:NotesPayableOtherPayablesMember2023-01-012023-01-310001601830us-gaap:NotesPayableOtherPayablesMember2023-01-310001601830us-gaap:NotesPayableOtherPayablesMember2023-12-310001601830us-gaap:NotesPayableOtherPayablesMemberrxrx:Station41LeaseMember2018-01-012018-12-310001601830us-gaap:NotesPayableOtherPayablesMemberrxrx:Station41LeaseMember2018-12-310001601830us-gaap:NotesPayableOtherPayablesMemberrxrx:Station41LeaseMember2023-12-310001601830rxrx:ValenceDiscoveryIncMemberus-gaap:CommonClassAMember2023-05-162023-05-160001601830rxrx:ValenceDiscoveryIncMemberrxrx:ExchangeableStockMember2023-05-162023-05-160001601830rxrx:ValenceDiscoveryIncMemberus-gaap:EmployeeStockOptionMember2023-05-162023-05-160001601830rxrx:ValenceDiscoveryIncMemberus-gaap:EmployeeStockMember2023-05-162023-05-160001601830rxrx:ValenceDiscoveryIncMember2023-05-162023-05-160001601830rxrx:ValenceDiscoveryIncMember2023-05-160001601830rxrx:ValenceDiscoveryIncMemberus-gaap:TechnologyBasedIntangibleAssetsMember2023-05-160001601830rxrx:ValenceDiscoveryIncMember2023-01-012023-12-310001601830rxrx:CyclicaIncMemberus-gaap:CommonClassAMember2023-05-252023-05-250001601830rxrx:CyclicaIncMemberus-gaap:EmployeeStockOptionMember2023-05-252023-05-250001601830rxrx:CyclicaIncMemberus-gaap:CommonClassAMember2023-12-312023-12-310001601830rxrx:CyclicaIncMember2023-05-252023-05-250001601830rxrx:CyclicaIncMemberus-gaap:EmployeeStockMember2023-05-252023-05-250001601830rxrx:CyclicaIncMember2023-05-250001601830us-gaap:TechnologyBasedIntangibleAssetsMemberrxrx:CyclicaIncMember2023-05-250001601830rxrx:CyclicaIncMember2023-01-012023-12-310001601830rxrx:RecursionValenceAndCyclicaMember2023-01-012023-12-310001601830rxrx:RecursionValenceAndCyclicaMember2022-01-012022-12-310001601830srt:MinimumMember2023-12-310001601830srt:MaximumMember2023-12-310001601830rxrx:TorontoLeaseMember2022-05-012022-05-31utr:sqft0001601830rxrx:TorontoLeaseMember2022-05-3100016018302023-10-27rxrx:claimrxrx:vote0001601830us-gaap:CommonClassAMemberrxrx:AtTheMarketOfferingProgramMember2023-08-082023-08-080001601830rxrx:NVDIAPrivatePlacementMemberus-gaap:CommonClassAMember2023-07-112023-07-110001601830us-gaap:CommonClassAMember2023-07-110001601830us-gaap:CommonClassAMember2023-07-112023-07-110001601830us-gaap:CommonClassAMember2023-05-160001601830rxrx:ExchangeableStockMember2023-01-012023-12-310001601830us-gaap:CommonClassAMemberrxrx:A2022PrivatePlacementMember2022-10-012022-10-310001601830us-gaap:CommonClassAMemberrxrx:A2022PrivatePlacementMember2022-10-310001601830rxrx:NVDIAPrivatePlacementMember2023-07-310001601830rxrx:NVDIAPrivatePlacementMembersrt:MaximumMember2023-07-310001601830rxrx:NVDIAPrivatePlacementMember2023-12-310001601830rxrx:ValenceDiscoveryIncMember2023-05-012023-05-3100016018302022-10-310001601830us-gaap:IPOMember2021-04-202021-04-200001601830us-gaap:IPOMember2021-04-200001601830rxrx:ChristopherGibsonAndAffiliatesMember2023-12-310001601830us-gaap:CollaborativeArrangementMemberrxrx:RocheAndGenentechMember2022-01-310001601830us-gaap:CollaborativeArrangementMemberrxrx:PhenomapsCreationMemberrxrx:RocheAndGenentechMember2022-01-012022-01-31rxrx:phenomap0001601830us-gaap:CollaborativeArrangementMemberrxrx:PhenomapsRawImagesMemberrxrx:RocheAndGenentechMember2022-01-012022-01-310001601830us-gaap:CollaborativeArrangementMemberrxrx:RocheAndGenentechMemberrxrx:DevelopedAndCommercializedProgramsMember2022-01-012022-01-31rxrx:program0001601830us-gaap:CollaborativeArrangementMemberrxrx:RocheAndGenentechMember2022-01-012022-01-31rxrx:performance_obligation0001601830us-gaap:CollaborativeArrangementMemberrxrx:RocheAndGenentechMemberrxrx:GastrointestinalCancerMember2022-01-012022-01-310001601830us-gaap:CollaborativeArrangementMemberrxrx:NeuroscienceMemberrxrx:RocheAndGenentechMember2022-01-012022-01-310001601830us-gaap:CollaborativeArrangementMemberrxrx:BayerAGMember2020-10-012020-10-310001601830us-gaap:CollaborativeArrangementMemberrxrx:BayerAGMember2020-10-310001601830us-gaap:CollaborativeArrangementMember2023-12-310001601830us-gaap:CollaborativeArrangementMemberrxrx:RocheAndGenentechMember2023-12-310001601830us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberrxrx:TwoCustomersMember2022-01-012022-12-310001601830us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberrxrx:TwoCustomersMember2023-01-012023-12-310001601830us-gaap:CustomerConcentrationRiskMemberrxrx:OneCustomerMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001601830rxrx:A2021EquityIncentivePlanMember2021-04-300001601830rxrx:A2021EquityIncentivePlanMember2023-12-310001601830us-gaap:CostOfSalesMember2023-01-012023-12-310001601830us-gaap:CostOfSalesMember2022-01-012022-12-310001601830us-gaap:CostOfSalesMember2021-01-012021-12-310001601830us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001601830us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001601830us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001601830us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001601830us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001601830us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001601830us-gaap:EmployeeStockMember2023-01-012023-12-310001601830us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001601830us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001601830us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001601830us-gaap:RestrictedStockUnitsRSUMember2021-04-012021-04-300001601830us-gaap:RestrictedStockMember2022-12-310001601830us-gaap:RestrictedStockMember2023-01-012023-12-310001601830us-gaap:RestrictedStockMember2023-12-310001601830us-gaap:DomesticCountryMember2023-12-310001601830us-gaap:DomesticCountryMember2022-12-310001601830us-gaap:StateAndLocalJurisdictionMember2023-12-310001601830us-gaap:StateAndLocalJurisdictionMember2022-12-310001601830us-gaap:ForeignCountryMember2023-12-310001601830us-gaap:DomesticCountryMemberus-gaap:ResearchMember2023-12-310001601830us-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMember2023-12-310001601830us-gaap:DomesticCountryMemberus-gaap:ResearchMember2022-12-310001601830us-gaap:StateAndLocalJurisdictionMemberus-gaap:ResearchMember2022-12-310001601830rxrx:OrphanDrugCreditCarryforwardMember2023-12-310001601830rxrx:OrphanDrugCreditCarryforwardMember2022-12-310001601830us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001601830us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001601830us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001601830rxrx:TempusAgreementMember2023-01-012023-12-310001601830rxrx:TempusAgreementMember2022-01-012022-12-310001601830rxrx:TempusAgreementMember2021-01-012021-12-310001601830us-gaap:ConvertiblePreferredStockMember2023-01-012023-12-310001601830us-gaap:ConvertiblePreferredStockMember2022-01-012022-12-310001601830us-gaap:ConvertiblePreferredStockMember2021-01-012021-12-310001601830us-gaap:WarrantMember2023-01-012023-12-310001601830us-gaap:WarrantMember2022-01-012022-12-310001601830us-gaap:WarrantMember2021-01-012021-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001601830us-gaap:FairValueMeasurementsRecurringMember2023-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2022-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001601830us-gaap:FairValueMeasurementsRecurringMember2022-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001601830us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001601830us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001601830us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2022-12-310001601830us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2023-12-310001601830us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:NotesPayableOtherPayablesMember2022-12-310001601830us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2023-12-310001601830us-gaap:PortionAtOtherThanFairValueFairValueDisclosureMember2022-12-310001601830us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001601830us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001601830rxrx:LondonLeaseMemberus-gaap:SubsequentEventMember2024-01-012024-01-310001601830rxrx:LondonLeaseMemberus-gaap:SubsequentEventMember2024-01-3100016018302023-10-012023-12-310001601830rxrx:ChristopherGibsonMember2023-01-012023-12-310001601830rxrx:ChristopherGibsonMember2023-10-012023-12-310001601830rxrx:ChristopherGibsonMember2023-12-31

| | |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549

FORM 10-K

(Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2023 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-40323

Recursion Pharmaceuticals, Inc. (Exact name of registrant as specified in its charter)

Delaware___________________________________________________ 46-4099738 (State or other jurisdiction of incorporation or organization)______________________ (I.R.S. Employer Identification No.)

41 S Rio Grande Street Salt Lake City, UT 84101 (Address of principal executive offices) (Zip code) (385) 269 - 0203 (Registrant’s telephone number, including area code) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, par value $0.00001 | RXRX | Nasdaq Global Select Market |

| | |

Securities registered pursuant to section 12(g) of the Act: None

_____________________________________________________________________________________________________ (Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

| | | | | | | | | | | | | | |

| Large accelerated filer | x | | Non-accelerated filer | ☐ |

| Accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the 124,546,642 shares of Class A common voting stock held by non-affiliates of the Registrant, computed by reference to the closing price as reported on the Nasdaq Stock Exchange, as of the last business day of the registrant’s most recently completed second fiscal quarter (June 30, 2023) was $930.4 million.

As of January 31, 2024, there were 227,143,401 and 7,509,871 shares of the registrant’s Class A and B common stock, respectively, par value $0.00001 per share outstanding, respectively. |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for use in connection with the registrant’s 2024 Annual Meeting of Stockholders to be filed hereafter are incorporated by reference into Part III of this report. |

| | | | | | | | |

| | |

A Letter from Our Co-Founder and CEO Dear current or prospective shareholder, Recursion celebrated its tenth anniversary in 2023, and as I reflect back on the past decade of building and look forward to the next decade, it feels increasingly clear that we are in the midst of a tremendous technology and AI-driven transition in our society. Knowledge workers are on the precipice of a massive transformation in their work; much of the toil embedded into the processes, systems and delivery today will give way to higher efficiency, more creativity and smart risk-taking with new tools that will enable rapid and deep experimentation and fast failure. For many, embracing this evolving landscape of work will be tumultuous, but for those who are open to the possibilities technology brings, an exciting new future awaits. Like all major past shifts in society, we will face many new challenges and obstacles as we come to terms with the risks and opportunities of the new tools that are becoming increasingly available at our fingertips. The broad transformations in society will be mirrored in the life sciences with the evolution of BioTech into TechBio over the coming decade. The digitization of biology and chemistry will enable us to predict ways to map and navigate it, allowing us to design rather than discover better medicines faster with less failure. Advancements in laboratory automation, biological tools and quantified human health will allow for the emergence of massive datasets of human health and disease that will feed the AI-driven insights transforming life sciences. Of course, the idea that an AI ‘black-box’ will pop out new cures at scale in the coming 12-24 months is a fallacy and we have to be careful not to be caught up in that sort of hype. Drug discovery is too complex, has too many steps and has too long of a feedback loop for that sort of ‘overnight’ shift. But looking back at how far we have come and the compounding improvements we see today, I believe that our industry will shift more in the coming decade than it ever has before. |

| | |

| | |

| | A common argument from skeptics is that biology is too complex and healthcare too complicated for such a disruptive technological transformation to be possible. But like in prior industrial revolutions, a new technology (or technologies) has set in motion a current that will fundamentally reshape the forces and assumptions that drive various fields, including our own. Here are a few facts that signal this transformation is happening right now: Data & Compute: •The world has generated more data in the past 24 months than in all of human history before that •The world has consumed more computational cycles in the last 12 months than in all of human history before that Biological Tools: •CRISPR-based gene editing has, in just the last five years, enabled for the first time arrayed genome-wide genetic screens •Innovations in induced pluripotent stem cells allow us to generate high-quality, differentiated human cells at massive scale Automation and Reagents: •Robotic laboratory systems and software enable highly standardized and quality-controlled high-throughput screening to generate relatable data at scale |

| |

| |

THE WORLD HAS GENERATED MORE DATA IN THE PAST 24 MONTHS than in all of human history before that | |

| |

| |

| | | | | | | | |

| | |

| | |

| | What’s more, the signs of AI-enabled point-solutions are already plentiful across our industry: •Protein folding •Scaled protein-ligand interaction prediction •Generative AI for chemistry for tractable targets •The FDA is already discussing the use of LLMs for program review •Major pharma companies are drafting regulatory filings like INDs by LLMs These facts lay out a clear future where efficiencies and improvements across the many current AI-enabled point-solutions will begin to combine into integrated ‘tech-stacks’ and workflows that will result in compounding improvements in our ability to drug historically undruggable targets, understand the underlying networks of biology with increasing fidelity, fast-follow newly validated biology, characterize disease in increasingly robust ways and ultimately deliver more, better medicines to patients to alleviate suffering at scale. The question is no longer whether this sort of future is before us, but when and who will lead it. Looking Back at 2023 and Before Reflecting back on late 2013 when Recursion was founded and how far we have come, it is simultaneously incredible and unsurprising to see where we are today. Recursion was then a Utah-based startup founded by two graduate students and a professor. Our first office was a conference room in the nearby University Research Park and our first laboratory was a converted storage room. Today, Recursion is a multinational, clinical-stage company leading the transition of BioTech into TechBio. We have over 500 employees, five clinical stage programs, one of the world’s largest biological and chemical datasets and two of the largest discovery collaborations in the industry with Roche/Genentech and Bayer. And in 2023, the opportunity ahead feels so much greater than it did in 2013, that in some ways it still feels like we are just getting started. In fact, from an internal perspective, 2023 felt like one of the best years in our history. In 2023 we achieved a lot of important milestones, and a lot of things we’ve been working to build, in some cases for years, really seemed to start hitting their stride, including: Pipeline •Five phase 2 clinical-stage programs with multiple upcoming data readouts expected, including REC-994 in cerebral cavernous malformation (CCM) in Q3 2024, REC-2282 in neurofibromatosis type 2 (NF2) in Q4 2024, REC-4881 in familial adenomatous polyposis (FAP) in H1 2025, and REC-4881 in AXIN1 or APC mutant solid tumors in H1 2025 •Completed a Phase 1 study for REC-3964 in healthy volunteers for the potential treatment of Clostridioides difficile (C. difficile) infection with a favorable safety and tolerability profile •Advanced our RBM39 program in homologous recombination proficient ovarian cancer and other solid tumors to IND-enabling studies •In-licensed a program (Target Epsilon) that emerged from our fibrosis collaboration with Bayer that represents a novel approach to treating fibrotic diseases with compelling early data |

| |

| |

| |

| |

FIVE PHASE 2 CLINICAL-STAGE PROGRAMS with multiple upcoming data readouts expected | |

| |

| |

| | | | | | | | |

| | |

| | |

| Our Collaborators | | Partnership •Made significant progress against both the gastrointestinal-oncology and neuroscience portions of our collaboration with Roche and Genentech, including Roche exercising its Small Molecule Validated Hit Option to further advance our first partnership program in GI-oncology •Updated our collaboration with Bayer to focus on challenging oncology indications with high unmet need, commensurate with higher per program milestone payments •Entered into a collaboration with NVIDIA to accelerate the construction, optimization and deployment of foundation models for biology and chemistry as well as host Recursion-built computational and data tools on BioNeMo (NVIDIA’s drug discovery platform) – additionally, NVIDIA invested $50 million in Recursion via a private placement •Entered into a collaboration with Tempus giving Recursion access to over 20 petabytes of proprietary de-identified, multimodal patient oncology data for the purpose of training causal AI models for the discovery of novel therapeutic hypotheses, biomarker strategies and patient cohort selection •Entered into a partnership with Enamine to generate enriched screening libraries with insights from Recursion’s protein-ligand interaction predictions spanning across Enamine’s massive library of approximately 36 billion compounds Recursion OS •Built, scaled and industrialized multiple tools and technologies to heavily automate workflows across the drug discovery process, creating one of the most complete full-stack TechBio solutions •Created LOWE (Large Language Model-Orchestrated Workflow Engine) connecting wet-lab and dry-lab components of the Recursion OS using a natural language interface to streamline complex drug discovery tasks •Deployed large language models (LLMs) to map scientific literature in conjunction with our internally derived proprietary maps for the purpose of autonomously identifying novel opportunities in areas of unmet need •Deployed Phenom-1, a vision transformer utilizing hundreds of millions of parameters trained on billions of biological images from our proprietary data, which we believe to be the world’s largest phenomics foundation model at this time •Deployed new digital chemistry tools to predict the ligand-protein interactions for approximately 36 billion compounds in the Enamine REAL Space, reported to be the largest synthesizable chemical library •Produced over 1 trillion human induced pluripotent stem cell (hiPSC)-derived neuronal cells since 2022, likely making Recursion one of the world’s largest producers of neuronal cells •Began training causal AI models leveraging over 20 petabytes of multi-modal precision oncology patient data from Tempus to support the discovery of potential biomarker-enriched therapeutics at scale |

| |

| |

Roche and Genentech Bayer NVIDIA Tempus Enamine | |

| |

| |

LOWE (LARGE LANGUAGE MODEL-ORCHESTRATED WORKFLOW ENGINE) is connecting wet-lab and dry-lab components of the Recursion OS using a natural language interface to streamline complex drug discovery tasks | |

| |

| |

| |

| |

| |

>1 Trillion HUMAN INDUCED PLURIPOTENT STEM CELL (hiPSC)-derived neuronal cells produced since 2022 | |

| |

| |

| | | | | | | | |

| | |

| | |

ACQUIRED CYCLICA AND VALENCE DISCOVERY TO BOLSTER digital chemistry and generative AI capabilities | | Company Building •Acquired Cyclica and Valence Discovery to bolster digital chemistry and generative AI capabilities •Expanded our operations in Salt Lake City and Montréal and opened our Canadian headquarters in Toronto with a focus on growing our machine learning and digital chemistry teams •Committed to quadrupling the capacity of our supercomputer, BioHive-1, to support our pipeline, partnerships and the construction of foundation models across the multiple modalities of biology, chemistry and patient-centric data – we believe that this expansion should make our supercomputer a top 50 supercomputer across any industry according to the TOP500 list As one of the leading TechBio companies, Recursion has played a critical role in driving the pace and scale of adoption of new TechBio tools across the industry. And while I am very proud of how our team delivered in 2023, the most important shift for our business happened outside our walls this year. We finally found the ideas embedded in TechBio, and in particular the belief in the utility of AI in our industry, finding mainstream support among some of the larger and more traditional companies in the space. While there is no doubt there will be massive short-term volatility in the space, there is an increasing consensus among leaders in BioPharma that ML and AI are going to play a very important role over the coming decade. While we have incredible work before us, it feels as if we are no longer sailing into the wind, but now the wind is starting to shift to our backs. And I believe that there is no team in the world better prepared to sail fast in this new environment and continue to put deep blue water between us and many of our competitors as we look out over the coming years. Looking Out at 2024 and Beyond You could almost taste the shift in sentiment around TechBio at the J.P. Morgan Healthcare Conference at the beginning of this year when compared to years prior. While some skepticism still prevails, it no longer carries the room in most places as a shift towards cautious optimism permeates the executive teams and boards of the most powerful companies in our space. Following the announcement of our partnership with NVIDIA in 2023, we co-hosted an event with them at the JP Morgan conference. We brought together members of the executive teams and boards of many of the largest biopharma companies in the world, many of the CEOs of leading TechBio companies, executives of leading tech companies, and investors and analysts who either already invest in or cover this convergence or are tempted to do so. That evening, attendees heard from life science luminaries like Scott Gottlieb, Aviv Regev and Amy Abernethy as well as Jensen Huang, the CEO of NVIDIA. They heard conviction from those leaders about how clearly the trend of ML and AI will impact our industry going forward. What I found most interesting was how fluent the tech leaders among the group were in speaking the language of biopharma. Far more fluent, I would argue, than the leaders of biopharma are in speaking ‘tech.’ And that presents a risk for biopharma and an opportunity for companies like Recursion that are positioned as leaders in TechBio. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | |

| | |

| | |

| | But despite all the excitement around our space, we are part of an industry with a mission to alleviate suffering by bringing new, better medicines to patients. That is how we ultimately measure our impact. And as I look ahead to the next 18 months, Recursion will take meaningful steps toward that goal as we read out our first four phase 2 studies. This is incredibly exciting as it represents the first opportunity for us to demonstrate utility for the patients we aim to serve. But it is also important to come into these initial readouts with a focus on how they can help us learn and tune our platform. The trials that will read out this year are from the earliest iterations of our Recursion OS. They represent repurposing opportunities in rare genetic diseases we modeled using challenging tools like siRNA. New generations of our operating system using more and more powerful biology tools, chemistry tools and AI tools are leading us to identify and advance more exciting programs with some even already moving to the clinic. The industry average success rate for Phase 2 readouts is approximately 20-30%. This suggests that if even one of our upcoming four readouts demonstrates a useful signal, we are on the right track to developing meaningful potential treatments for patients. And while we hope to do better than that, for the good of all the patients we seek to treat, we are in this for the long-run and we will use every piece of data, positive or negative, to learn and feedback into the Recursion OS so that we can maximize our long term impact. It is important to understand that we are not a company who built a platform to deliver a handful of medicines; we are a company who is building a platform to deliver many medicines over time. And if our thesis holds, our system should improve over time with decreasing rates of late-stage failures. We believe we have built an operating system capable of discovering and developing many medicines, both within our own pipeline and via partnerships with others in the industry. And beyond the excitement we all have for all we will learn from our first generation of programs reading out in the near term, we are also tremendously excited to be helping the rest of the industry adopt tools and technologies that can help them put the power of our operating system at their fingertips. We announced LOWE (Large Language Model Orchestrated Workflow Engine) at JP Morgan via a live software demonstration at the conference. Together with the audience we started a mock oncology program, from leveraging Recursion’s proprietary data to identify a target of interest in oncology, to designing and ordering potential small molecule modulators of the target, to scheduling follow-up experiments on our platform to evaluate the molecules in a first cycle of SAR. You can view a version of this demonstration and our software tool LOWE here: https://www.youtube.com/watch?v=Hf1bb9rPQtE While this was a fun and exciting way to engage with the audience at JPM, we are actively discussing making LOWE available to various potential partners for deployment within their own R&D engine. While we don’t know exactly what the future holds for LOWE, this represents an exciting new opportunity for Recursion to help accelerate the industry and the broader adoption of TechBio by integrating portions of our RecursionOS into the engine of other companies in the space. |

| |

| |

| |

| "We are a company building a platform to deliver many medicines over time." | |

| |

| | | | | | | | |

| | |

| | |

| “From our perspective there are two key drivers that will determine the winners in this race: data and execution.” | | The Differentiator Will Be Data and Execution Extending our view out beyond the near term and over the next decade, it feels possible, and even probable, that there will be a small number of very powerful companies in TechBio who may supplant much of what we call BioTech today. Who will these companies be and how will they win? While compute is supply-constrained right now, it has also never been anywhere near as abundant as it is today. Table-stakes in this race over the next few years will be access to dedicated compute and robust ML/AI and software engineering teams. That is why Recursion has continued investing in BioHive-1, our on-premise supercomputer. We announced in late 2023 an expansion of the computer with our partners at NVIDIA that is likely to make it the fastest supercomputer wholly owned and operated by any biopharma company on Earth, including all the big ones. We also have an incredible, talented and growing team of ML researchers and engineers working to leverage this compute to advance the OS. We’ve grown both organically on these teams and by acquisition when needed. But as I said, these are table stakes. From our perspective there are two key drivers that will determine the winners in this race: data and execution. There is a divergence of opinions on what sort of data to use. There are those who believe that much of the data needed to solve the biggest problems in drug discovery and development exist today, either publicly or in the hands of large pharmaceutical companies. There is some evidence to support this idea; for example, the incredible progress in protein folding has been driven by sophisticated compute applied to the Protein Data Bank (PDB), a publicly available dataset. But there are few other examples in our field of data as robustly and carefully annotated as in the PDB. In fact, it is well-understood that the majority of data in the published literature cannot be recapitulated by other laboratories. Turning to large pharmaceutical companies, who obviously have large quantities of data from their longstanding operations in drug discovery and development, we find more headwinds. First, few if any of these large datasets were built for the purpose of machine-learning. And while that doesn’t mean machine learning and AI cannot be a useful tool, the unimodal nature of the data in these sources and the lack of inter-experiment controls, especially from preclinical and clinical sides, will make it challenging to extract enough value. Further, the success of large language models trained across the internet and the subsequent lawsuits we are beginning to see from content purveyors whose data was used to train these models (e.g., https://www.nytimes.com/2023/12/27/business/media/new-york-times-open-ai-microsoft-lawsuit.html) should be making it clear to large pharma companies that they must be cautious about sharing these data. For all of the reasons above, at Recursion we have always believed that generating and aggregating large-scale, iterative many-modal data will be the fastest path to achieving our mission to decode biology. We have now done more than 200 million experiments across multiple -omics modalities. We have also signed our first data aggregation partnership with Tempus, where we now have access to the DNA and RNA-sequencing data of over 100K oncology patients on which we can train causal-AI models. And while each layer of our data is powerful, the true magic is found when we combine them together to train more general models of biology spanning massive cellular -omics data, animal omics data and human patient omics data. We believe this deeply enough that you can expect us to continue investing deeply in building data across new layers and partnering to aggregate the proprietary datasets we believe are key to our long-term ambition. |

| |

| |

| |

| |

| |

| | | | | | | | |

| | |

| | |

| | Finally, while it seems obvious to state that execution will be a differentiator in our space, the type of execution and the perspective from which decisions are made matters deeply here. The scale of the opportunity before us is so great that we are making decisions at Recursion which we believe are most likely to increase the probability of success that we are the first company to build a general utility AI model of biology. That is, to achieve our mission by decoding biology such that we can predict or simulate how any perturbation might affect not only a human cell, but a human patient. And while realization of that mission may take another decade or two, if a company were to achieve it well-ahead of other companies in the space or alongside a small set of other companies, there could be an opportunity to aggregate much of the multi-trillion dollar value of biopharma across one or a handful of companies, as opposed to the broad distribution of valuable companies we see in biopharma today (e.g. there are about a dozen public biopharma companies with market caps solidly above $100B as of writing this note). As such, we will make decisions that we believe increase the probability we will be one of a handful of big winners in this space versus decisions that increase the probability we achieve intermediate successes. The next decade is going to be absolutely incredible for biopharma, where the pace of change will be much higher than at any point in our past. While there is much more work to do to best take advantage of the creative destruction that is ahead, I cannot imagine many other teams who are more ready to take this on and prepared to win. Thank you, Chris Gibson, Ph.D. Co-Founder and Chief Executive Officer |

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item IC. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7 | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| Item 15. | Exhibits and Financial Statement Schedules | |

| Item 16. | | |

| | |

PART I

RISK FACTOR SUMMARY

Below is a summary of the principal factors that make an investment in the common stock of Recursion Pharmaceuticals, Inc. (Recursion, the Company, we, us, or our) risky or speculative. This summary does not address all of the risks we face. Additional discussion of the risks summarized below, and other risks that we face, can be found in the section titled “Item 1A. Risk Factors” in this Annual Report on Form 10-K.

Risks Related to Our Limited Operating History, Financial Position, and Need for Additional Capital

◦We are a clinical-stage biotechnology company with a limited operating history and no products approved by regulators for commercial sale, which may make it difficult to evaluate our current and future business prospects

◦We have incurred significant operating losses since our inception and anticipate that we will incur continued losses for the foreseeable future.

◦We will need to raise substantial additional funding. If we are unable to raise capital when needed, we would be forced to delay, reduce, or eliminate at least some of our product development programs, business development plans, strategic investments, and potential commercialization efforts, and to possibly cease operations.

◦Raising additional capital and issuing additional securities may cause dilution to our stockholders, restrict our operations, require us to relinquish rights to our technologies or drug candidates, and divert management’s attention from our core business.

◦We are engaged in strategic collaborations and we intend to seek to establish additional collaborations, including for the clinical development or commercialization of our drug candidates. If we are unable to establish collaborations on commercially reasonable terms or at all, or if current and future collaborations are not successful, we may have to alter our development and commercialization plans.

◦We have no products approved for commercial sale and have not generated any revenue from product sales. We or our current and future collaborators may never successfully develop and commercialize our drug candidates, which would negatively affect our results of operation and our ability to continue our business operations.

◦If we engage in future acquisitions or strategic partnerships, this may increase our capital requirements, dilute our stockholders’ equity, cause us to incur debt or assume contingent liabilities, and subject us to other risks.

Risks Related to the Discovery and Development of Drug Candidates

◦Our approach to drug discovery is unique and may not lead to successful drug products for various reasons, including, but not limited to, challenges identifying mechanisms of action for our candidates.

◦Our drug candidates are in preclinical or clinical development, which are lengthy and expensive processes with uncertain outcomes and the potential for substantial delays.

◦If we experience delays or difficulties in the enrollment of patients in clinical trials, our receipt of necessary regulatory approvals could be delayed or prevented.

◦Our planned clinical trials, or those of our current and potential future collaborators, may not be successful or may reveal significant adverse events not seen in our preclinical or nonclinical studies, which may result in a safety profile that could inhibit regulatory approval or market acceptance of any of our drug candidates.

◦We conduct clinical trials for our drug candidates outside the United States, and the FDA and similar foreign regulatory authorities may not accept data from such trials.

◦It is difficult to establish with precision the incidence and prevalence for target patient populations of our drug candidates. If the market opportunities for our drug candidates are smaller than we estimate, or if any approval that we obtain is based on a narrower definition of the patient population, our revenue and ability to achieve profitability will be adversely affected, possibly materially.

◦We may never realize a return on our investment of resources and cash in our drug discovery collaborations.

◦We face substantial competition, which may result in others discovering, developing, or commercializing products before, or more successfully than, we do.

◦Because we have multiple programs and drug candidates in our development pipeline and are pursuing a variety of target indications and treatment modalities, we may expend our limited resources to pursue a particular drug candidate and fail to capitalize on development opportunities or drug candidates that may be more profitable or for which there is a greater likelihood of success.

Risks Related to Our Platform and Data

◦We have invested, and expect to continue to invest, in research and development efforts to further enhance our drug discovery platform, which is central to our mission. If the return on these investments is lower or develops more slowly than we expect, our business and operating results may suffer.

◦Our information technology systems and infrastructure may fail or experience security breaches and incidents that could adversely impact our business and operations and subject us to liability.

◦Interruptions in the availability of server systems or communications with internet or cloud-based services, or failure to maintain the security, confidentiality, accessibility, or integrity of data stored on such systems, could harm our business.

◦Our solutions utilize third-party open source software (OSS), which presents risks that could adversely affect our business and subject us to possible litigation.

◦Issues relating to the use of artificial intelligence and machine learning in our offerings could adversely affect our business and operating results.

Risks Related to Our Operations/Commercialization

◦Even if any drug candidates we develop receive marketing approval, they may fail to achieve the degree of market acceptance by physicians, patients, healthcare payors, and others in the medical community necessary for commercial success.

◦If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to sell and market any drug candidates we may develop, we may not be successful in commercializing those drug candidates, if and when they are approved.

◦We are subject to regulatory and operational risks associated with the physical and digital infrastructure at both our internal facilities and those of our external service providers.

Risks Related to Our Intellectual Property

◦Our success significantly depends on our ability to obtain and maintain patents of adequate scope covering our proprietary technology and drug candidate products. Obtaining and maintaining patent assets is inherently challenging, and our pending and future patent applications may not issue with the scope we need, if at all.

◦Our current proprietary position for certain drug product candidates depends upon our owned or in-licensed patent filings covering components of such drug product candidates, manufacturing-related methods, formulations, and/or methods of use, which may not adequately prevent a competitor or other third party from using the same drug candidate for the same or a different use.

◦We may not be able to protect our intellectual property and proprietary rights throughout the world.

◦If we do not obtain patent term extension and data exclusivity for any drug product candidates we may develop, our business may be materially harmed.

◦We may need to license certain intellectual property from third parties, and such licenses may not be available or may not be available on commercially reasonable terms.

◦Changes in U.S. patent law could diminish the value of patents in general, thereby impairing our ability to protect our products.

◦Issued patents covering our drug product candidates and proprietary technology that we have developed or may develop in the future could be found invalid or unenforceable if challenged in court or before administrative bodies in the United States or abroad.

Risks Related to Government Regulation

◦Even if we receive FDA or other regulatory approval for any of our drug candidates, we will be subject to ongoing regulatory obligations and other conditions that may result in significant additional expense, as well as the potential recall or market withdrawal of an approved product if unanticipated safety issues are discovered.

◦Though we have been granted orphan drug designation for certain of our drug candidates, we may be unsuccessful or unable to maintain the benefits associated with such a designation, including the potential for market exclusivity.

◦We are subject to U.S. and foreign laws regarding privacy, data protection, and data security that could entail substantial compliance costs, while the failure to comply could subject us to significant liability.

◦Regulatory and legislative developments related to the use of AI could adversely affect our use of such technologies in our products, services, and business.

Other Risks

◦Third parties that perform some of our research and preclinical testing or conduct our clinical trials may not perform satisfactorily or their agreements may be terminated.

◦Third parties that manufacture our drug candidates for preclinical development, clinical testing, and future commercialization may not provide sufficient quantities of our drug candidates or products at an acceptable cost, which could delay, impair, or prevent our development or commercialization efforts.

◦We may not realize all of the anticipated outcomes and benefits of our Acquisitions.

◦Our future success depends on our ability to retain key executives and experienced scientists, and to attract, retain, and motivate qualified personnel.

◦We have identified a material weakness in our internal control over financial reporting.

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains “forward-looking statements” about us and our industry within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “would,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions. Forward-looking statements contained in this report may include without limitation those regarding:

•our research and development programs;

•the initiation, timing, progress, results, and cost of our current and future preclinical and clinical studies, including statements regarding the design of, and the timing of initiation and completion of, studies and related preparatory work, as well as the period during which the results of the studies will become available;

•the ability of our clinical trials to demonstrate the safety and efficacy of our drug candidates, and other positive results;

•the ability and willingness of our collaborators to continue research and development activities relating to our development candidates and investigational medicines;

•future agreements with third parties in connection with the commercialization of our investigational medicines and any other approved product;

•the timing, scope, and likelihood of regulatory filings and approvals, including the timing of Investigational New Drug applications and final approval by the U.S. Food and Drug Administration, or FDA, of our current drug candidates and any other future drug candidates, as well as our ability to maintain any such approvals;

•the timing, scope, or likelihood of foreign regulatory filings and approvals, including our ability to maintain any such approvals;

•the size of the potential market opportunity for TechBio companies;

•the size of the potential market opportunity for our drug candidates, including our estimates of the number of patients who suffer from the diseases we are targeting;

•our ability to identify viable new drug candidates for clinical development and the rate at which we expect to identify such candidates, whether through an inferential approach or otherwise;

•our expectation that the assets that will drive the most value for us are those that we will identify in the future using our datasets and tools;

•our ability to develop and advance our current drug candidates and programs into, and successfully complete, clinical studies;

•our ability to reduce the time or cost or increase the likelihood of success of our research and development relative to the traditional drug discovery paradigm;

•our ability to improve, and the rate of improvement in, our infrastructure, datasets, biology, technology tools, and drug discovery platform, and our ability to realize benefits from such improvements;

•our ability to effectively use machine learning and artificial intelligence in our drug development process;

•our ability to use the assets acquired in recent acquisitions to expand our technology-enabled drug discovery process and accelerate our digital chemistry capabilities;

•our ability to leverage our collaborations and partnerships to develop our products and grow our business;

•our expectations related to the performance and benefits of our BioHive-1 supercomputer, Recursion OS, and our digital chemistry platform;

•our ability to realize a return on our investment of resources and cash in our drug discovery collaborations;

•our ability to sell or license assets and re-invest proceeds into funding our long-term strategy;

•our ability to scale like a technology company and to add more programs to our pipeline each year;

•our ability to successfully compete in a highly competitive market;

•our manufacturing, commercialization, and marketing capabilities and strategies;

•our plans relating to commercializing our drug candidates, if approved, including the geographic areas of focus and sales strategy;

•our expectations regarding the approval and use of our drug candidates in combination with other drugs;

•the rate and degree of market acceptance and clinical utility of our current drug candidates, if approved, and other drug candidates we may develop;

•our competitive position and the success of competing approaches that are or may become available;

•our estimates of the number of patients that we will enroll in our clinical trials and the timing of their enrollment;

•the beneficial characteristics, safety, efficacy, and therapeutic effects of our drug candidates;

•our plans for further development of our drug candidates, including additional indications we may pursue;

•our ability to adequately protect and enforce our intellectual property and proprietary technology, including the scope of protection we are able to establish and maintain for intellectual property rights covering our current drug candidates and other drug candidates we may develop, receipt of patent protection, the extensions of existing patent terms where available, the validity of intellectual property rights held by third parties, the protection of our trade secrets, and our ability not to infringe, misappropriate or otherwise violate any third-party intellectual property rights;

•the impact of any intellectual property disputes and our ability to defend against claims of infringement, misappropriation, or other violations of intellectual property rights;

•our ability to keep pace with new technological developments;

•our ability to utilize third-party open source software and cloud-based infrastructure, on which we are dependent;

•the adequacy of our insurance policies and the scope of their coverage;

•the potential impact of a pandemic, epidemic, or outbreak of an infectious disease, such as COVID-19, or natural disaster, global political instability, or warfare, and the effect of such outbreak or natural disaster, global political instability, or warfare on our business and financial results;

•our ability to achieve net-zero greenhouse gas emissions across our operations;

•our ability to maintain our technical operations infrastructure to avoid errors, delays, or cybersecurity breaches;

•our continued reliance on third parties to conduct additional clinical trials of our drug candidates, and for the manufacture of our drug candidates for preclinical studies and clinical trials;

•our ability to obtain, and negotiate favorable terms of, any collaboration, licensing or other arrangements that may be necessary or desirable to research, develop, manufacture, or commercialize our platform and drug candidates;

•the pricing and reimbursement of our current drug candidates and other drug candidates we may develop, if approved;

•our estimates regarding expenses, future revenue, capital requirements, and need for additional financing;

•our financial performance;

•the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and capital expenditure requirements;

•our ability to raise substantial additional funding;

•the impact of current and future laws and regulations, and our ability to comply with all regulations that we are, or may become, subject to;

•the need to hire additional personnel and our ability to attract and retain such personnel;

•the impact of any current or future litigation, which may arise during the ordinary course of business and be costly to defend;

•our expectations regarding the period during which we will qualify as an emerging growth company under the JOBS Act;

•our ability to maintain effective internal control over financial reporting and disclosure controls and procedures, including our ability to remediate the material weakness in internal control over financial reporting;

•our anticipated use of our existing resources and the net proceeds from our initial public offering; and

•other risks and uncertainties, including those listed in the section titled “Risk Factors.”

We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate, and financial trends that we believe may affect our business, financial condition, results of operations, and prospects. These forward-looking statements are not guarantees of future performance or development. These statements speak only as of the date of this report and are subject to a number of risks, uncertainties and assumptions described in the section titled “Risk Factors” and elsewhere in this report. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, we undertake no obligation to update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this report. While we believe such information forms a reasonable basis for such statements, the information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all

potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon them.

Item 1. Business.

Business Overview

Recursion is a leading clinical stage TechBio company decoding biology to industrialize drug discovery. Central to our mission is the Recursion Operating System (OS), a platform built across diverse technologies that enables us to map and navigate trillions of biological, chemical, and patient-centric relationships across over 50 petabytes of proprietary data. We frame this integration of the physical and digital components as iterative loops, where scaled ‘wet-lab’ biology, chemistry, and patient-centric experimental data are organized by ‘dry-lab’ computational tools in order to identify, validate, and translate therapeutic insights. We believe Recursion’s unbiased, data-driven approach to understanding biology will bring more, new, and better medicines at higher scale and lower cost to patients.

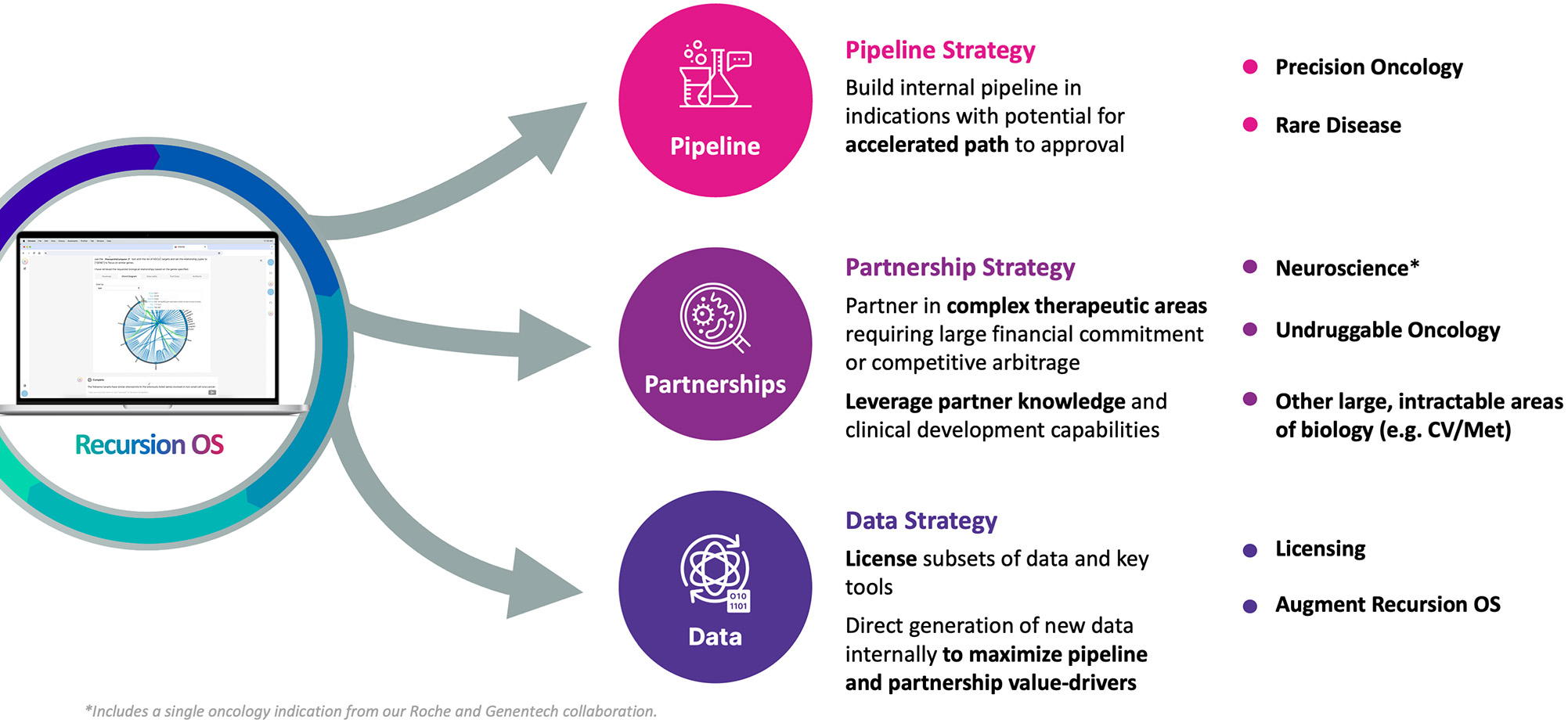

There are three key value-drivers at Recursion:

•An expansive pipeline of internally developed clinical and preclinical programs focused on precision oncology and genetically driven rare diseases with significant unmet need and market opportunities that could potentially exceed $1 billion in annual sales in some cases

•Transformational partnerships with leading biopharma and technology companies to map and navigate intractable areas of biology, identify novel targets, and develop potential new medicines by using advanced computational and data resources

•An industry-leading dataset intentionally designed to capitalize on computational tools and accelerate value created through our pipeline, partnerships and technology products

Key Achievements in 2023

Pipeline

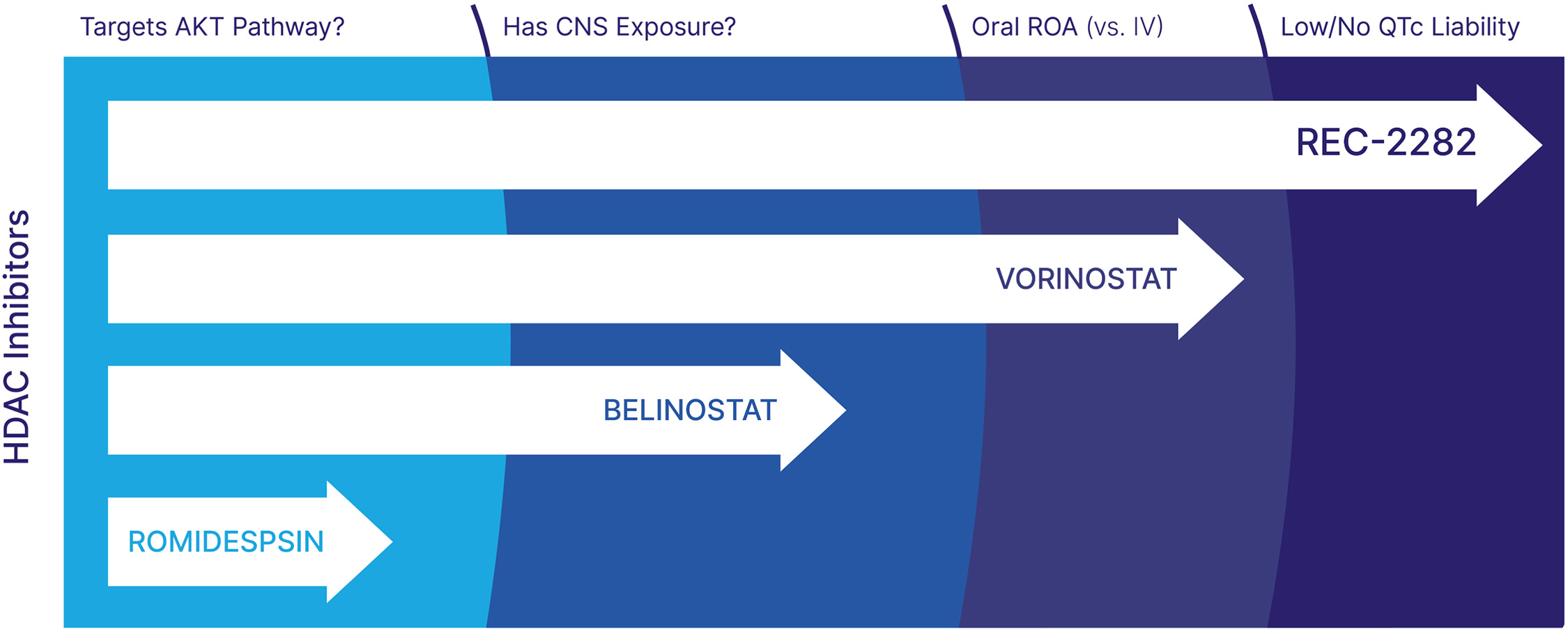

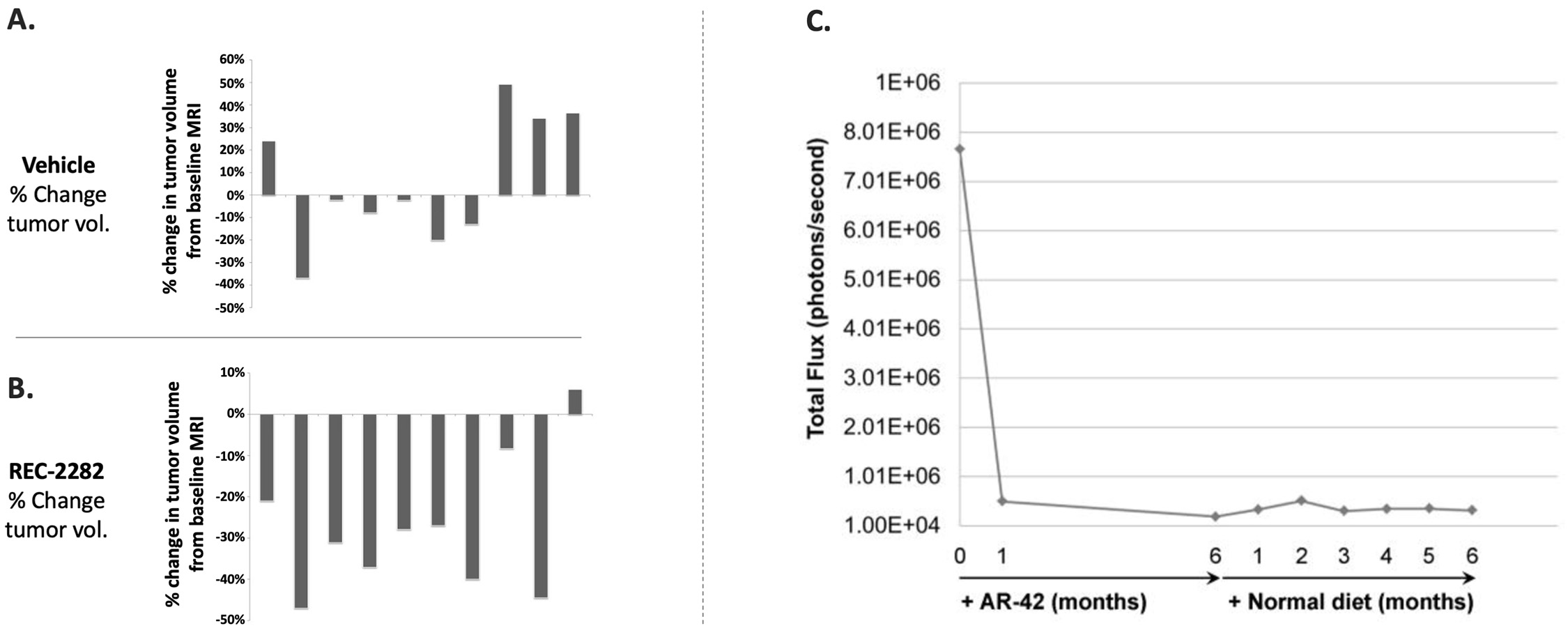

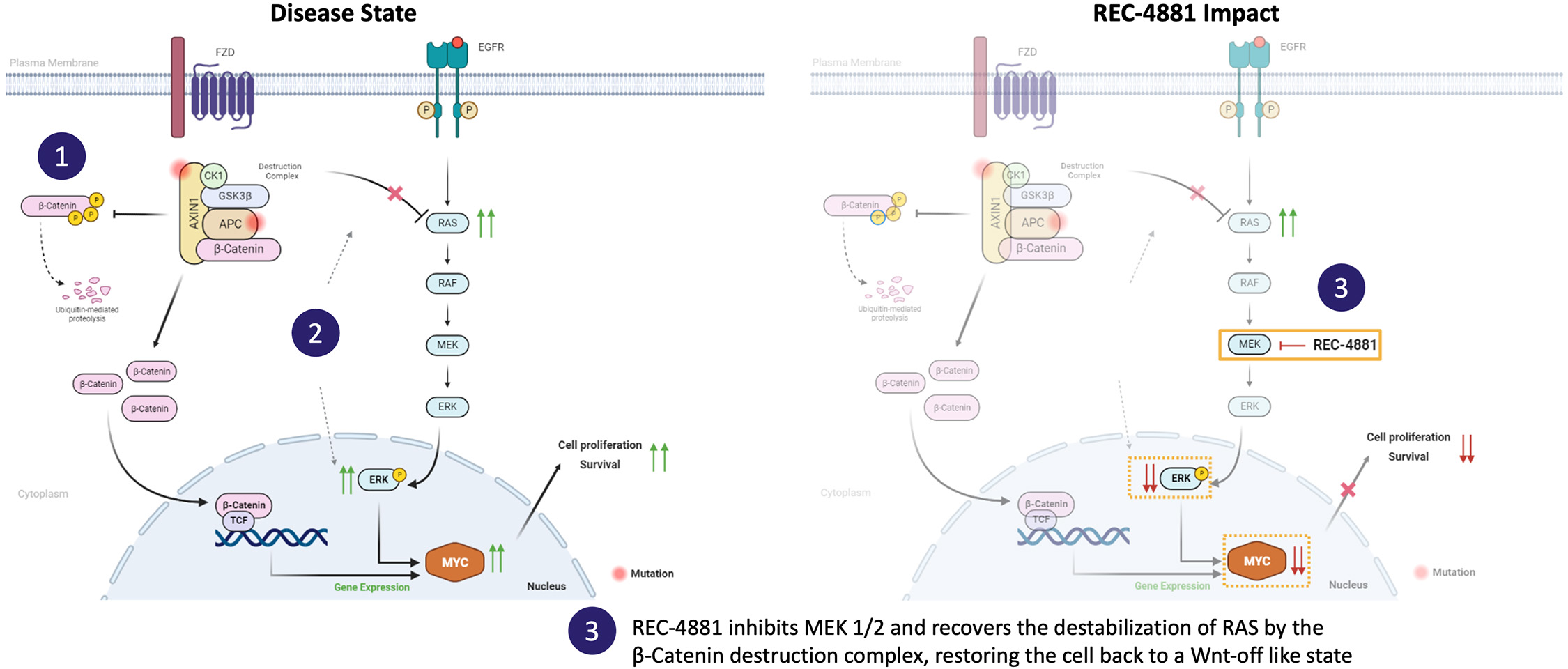

•Five phase 2 clinical-stage programs with multiple upcoming data readouts expected, including REC-994 in cerebral cavernous malformation (CCM) in Q3 2024, REC-2282 in neurofibromatosis type 2 (NF2) in Q4 2024, REC-4881 in familial adenomatous polyposis (FAP) in H1 2025, and REC-4881 in AXIN1 or APC mutant solid tumors in H1 2025

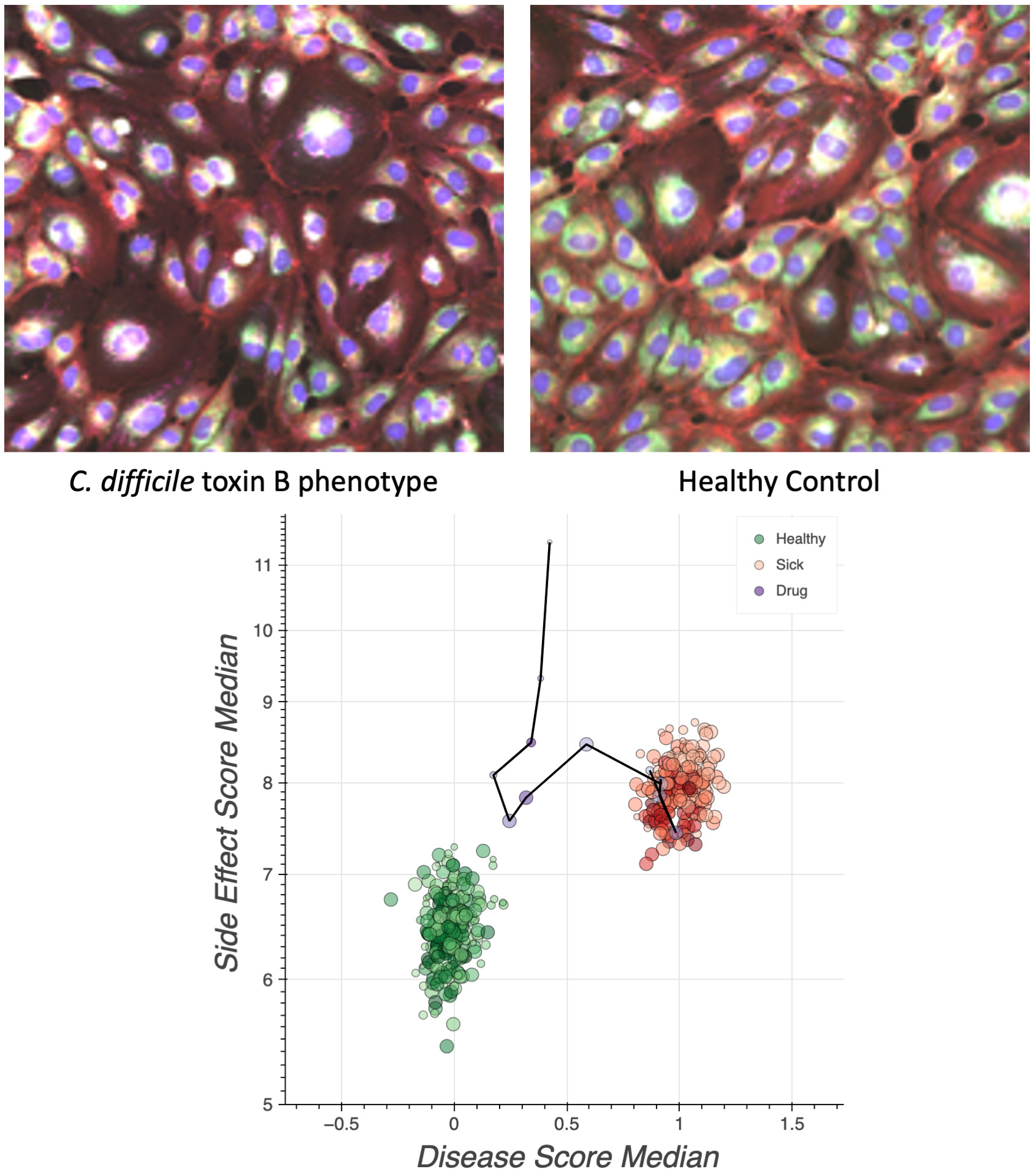

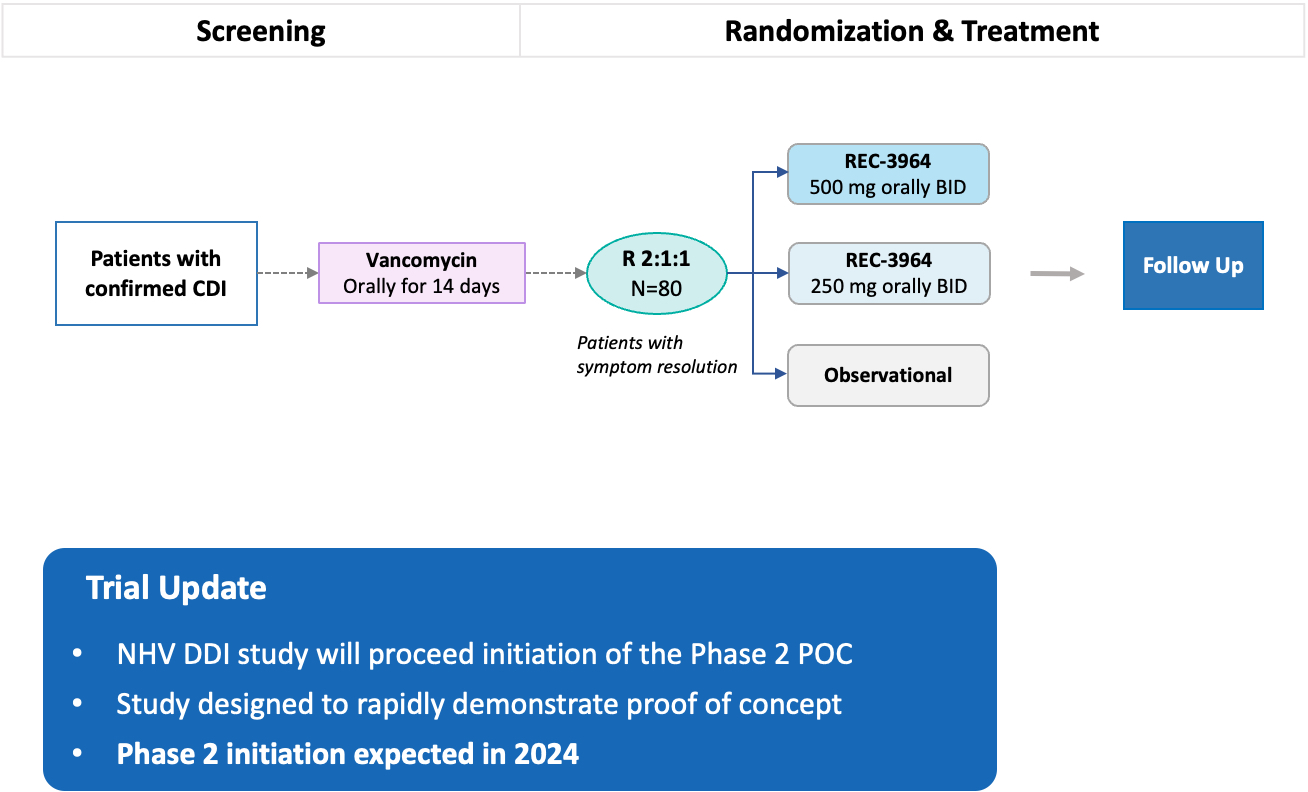

•Completed a Phase 1 study for REC-3964 in healthy volunteers for the potential treatment of Clostridioides difficile (C. difficile) infection with a favorable safety and tolerability profile

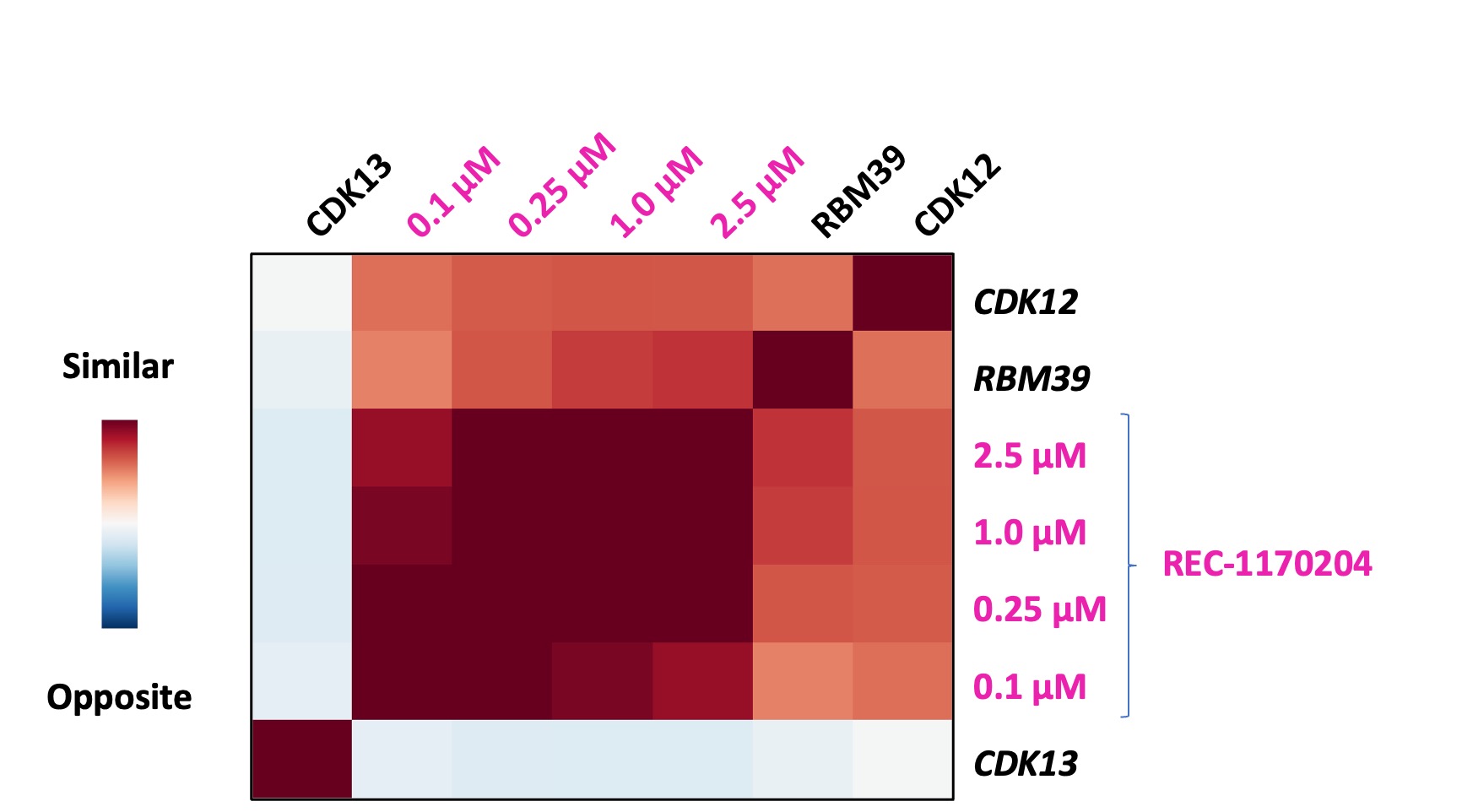

•Advanced our RBM39 program in homologous recombination proficient ovarian cancer and other solid tumors to IND-enabling studies

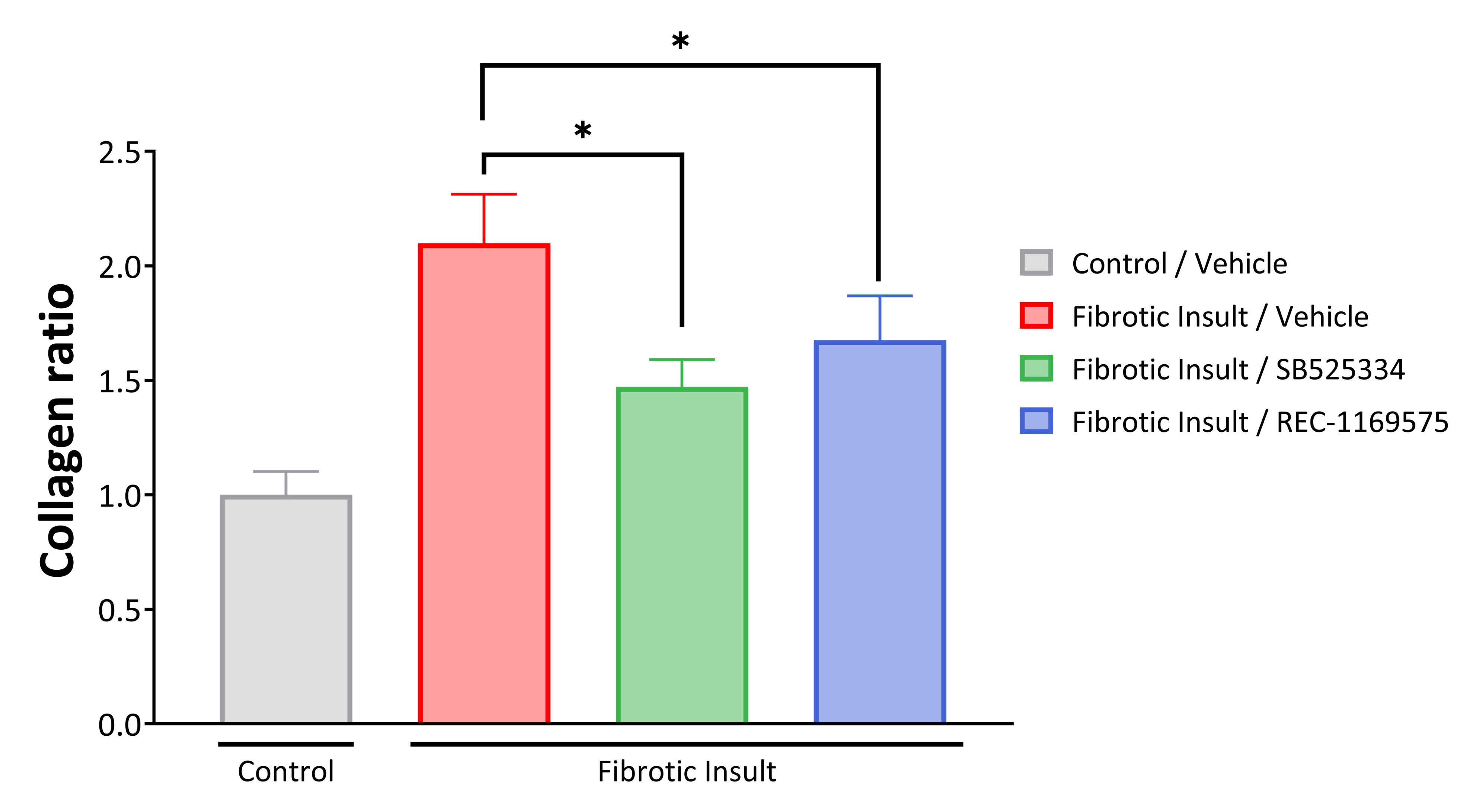

•In-licensed a program (Target Epsilon) that emerged from our fibrosis collaboration with Bayer that represents a novel approach to treating fibrotic diseases with compelling early data

Partnership

•Made significant progress against both the gastrointestinal-oncology and neuroscience portions of our collaboration with Roche and Genentech, including Roche exercising its Small Molecule Validated Hit Option to further advance our first partnership program in GI-oncology

•Updated our collaboration with Bayer to focus on challenging oncology indications with high unmet need, commensurate with higher per program milestone payments

•Entered into a collaboration with NVIDIA to accelerate the construction, optimization and deployment of foundation models for biology and chemistry as well as host Recursion-built computational and data tools on BioNeMo (NVIDIA’s drug discovery platform) – additionally, NVIDIA invested $50 million in Recursion via a private placement

•Entered into a collaboration with Tempus giving Recursion access to over 20 petabytes of proprietary deidentified, multimodal patient oncology data for the purpose of training causal AI models for the discovery of novel therapeutic hypotheses, biomarker strategies and patient cohort selection

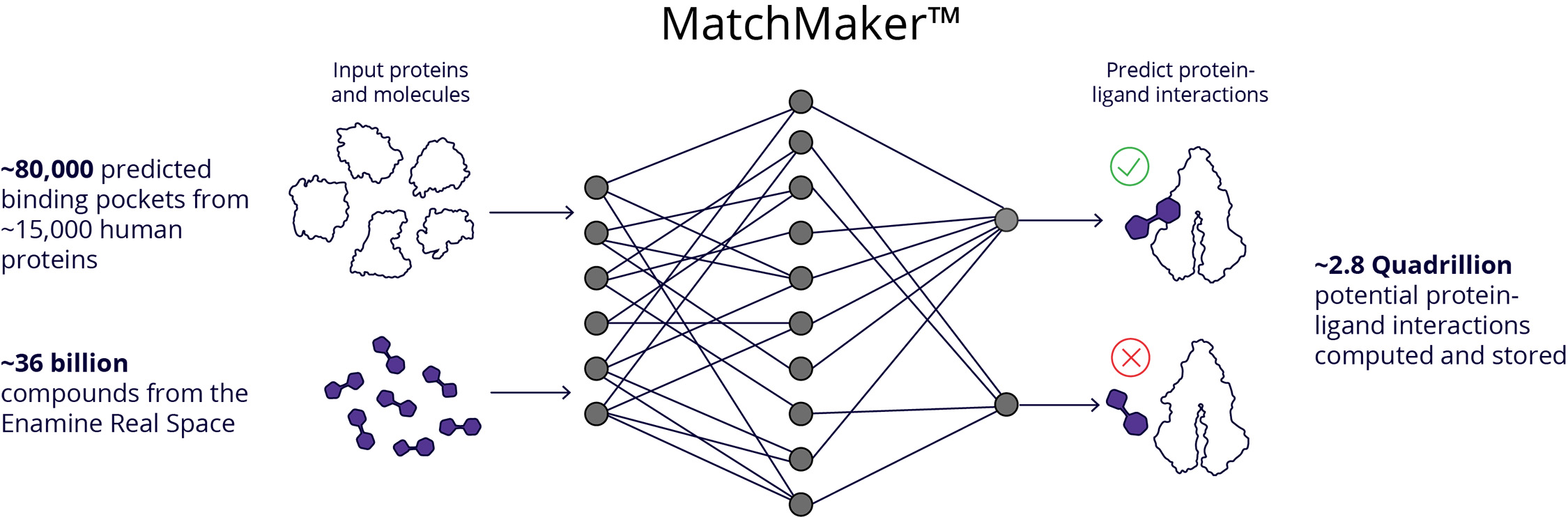

•Entered into a partnership with Enamine to generate enriched screening libraries with insights from Recursion’s protein-ligand interaction predictions spanning across Enamine’s massive library of approximately 36 billion compounds

Recursion OS

•Built, scaled and industrialized multiple tools and technologies to heavily automate workflows across the drug discovery process, creating one of the most complete full-stack TechBio solutions

•Created LOWE (Large Language Model-Orchestrated Workflow Engine) connecting wet-lab and dry-lab components of the Recursion OS using a natural language interface to streamline complex drug discovery tasks

•Deployed large language models (LLMs) to map scientific literature in conjunction with our internally derived proprietary maps for the purpose of autonomously identifying novel opportunities in areas of unmet need

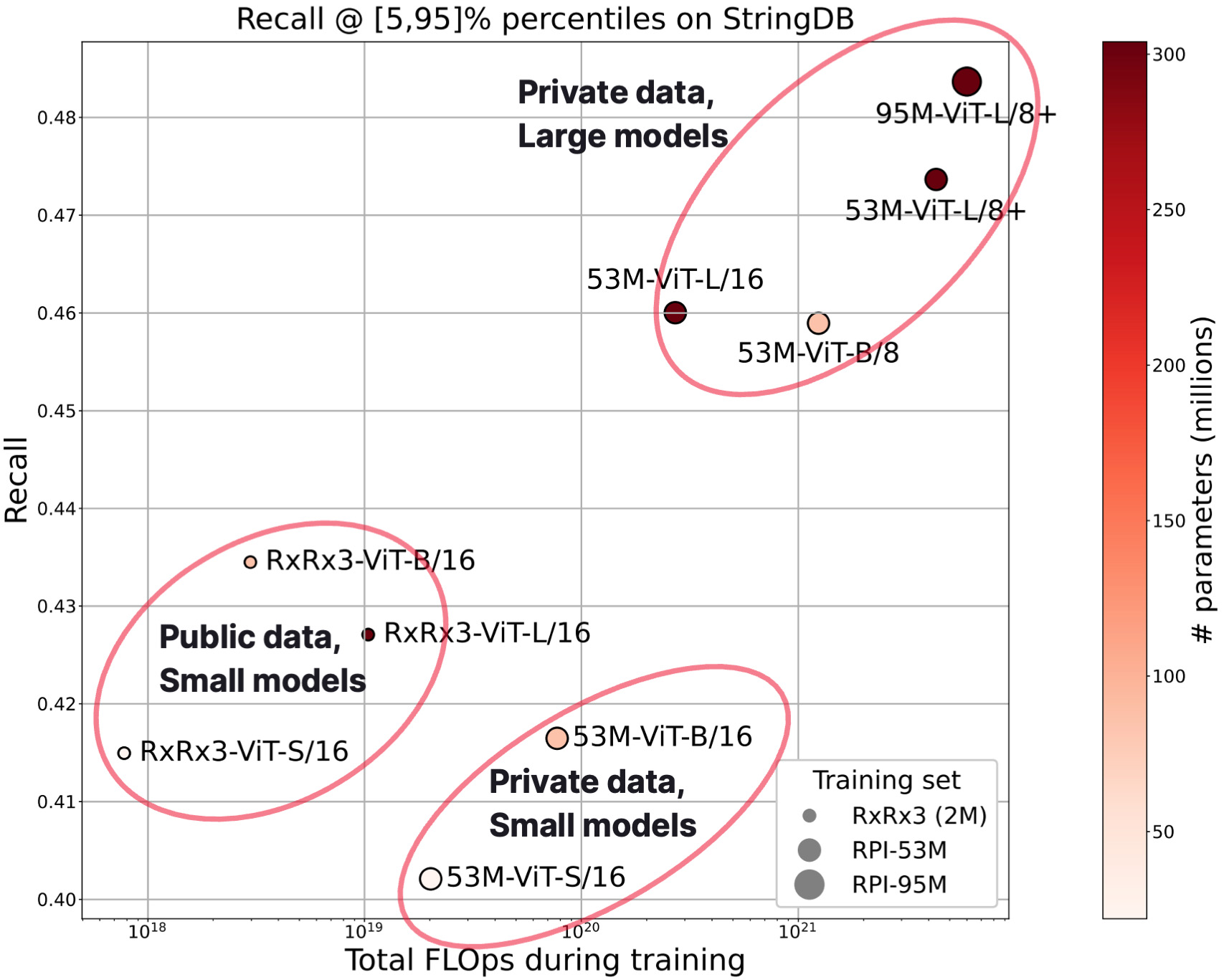

•Deployed Phenom-1, a vision transformer utilizing hundreds of millions of parameters trained on billions of biological images from our proprietary data, which we believe to be the world’s largest phenomics foundation model at this time

•Deployed new digital chemistry tools to predict the ligand-protein interactions for approximately 36 billion compounds in the Enamine REAL Space, reported to be the largest synthesizable chemical library

•Produced over 1 trillion human induced pluripotent stem cell (hiPSC)-derived neuronal cells since 2022, likely making Recursion one of the world’s largest producers of neuronal cells

•Began training causal AI models leveraging over 20 petabytes of multimodal precision oncology patient data from Tempus to support the discovery of potential biomarker-enriched therapeutics at scale

Company Building

•Acquired Cyclica and Valence Discovery to bolster digital chemistry and generative AI capabilities

•Expanded our operations in Salt Lake City and Montréal and opened our Canadian headquarters in Toronto with a focus on growing our machine learning and digital chemistry teams

•Committed to quadrupling the capacity of our supercomputer, BioHive-1, to support our pipeline, partnerships and the construction of foundation models across the multiple modalities of biology, chemistry and patient-centric data – we believe that this expansion should make our supercomputer a top 50 supercomputer across any industry according to the TOP500 list

Vision, Mission, People and Culture

Human biology is an incredibly complex system for which human intelligence alone is insufficient to fully comprehend it. Our world is transiting its next industrial revolution based on extraordinary progress in automation, computation, machine learning (ML), and artificial intelligence (AI). This progress is apparent through the rapid rise of LLMs, generative AI, and accessible applications like ChatGPT. Undoubtedly, remarkable shifts in perception occurred in 2023 amongst technology and biopharma companies as well as among regulators and policymakers, who highlight the utility of AI/ML for broad drug discovery and development from novel target discovery through next-generation manufacturing.

However, a key lesson from numerous other industries is that computational sophistication alone is rarely sufficient to create disruptive change. It is when computational sophistication is paired with the right data, typically in an iterative process of ongoing learning, prediction, and refinement, that outsized change is created.

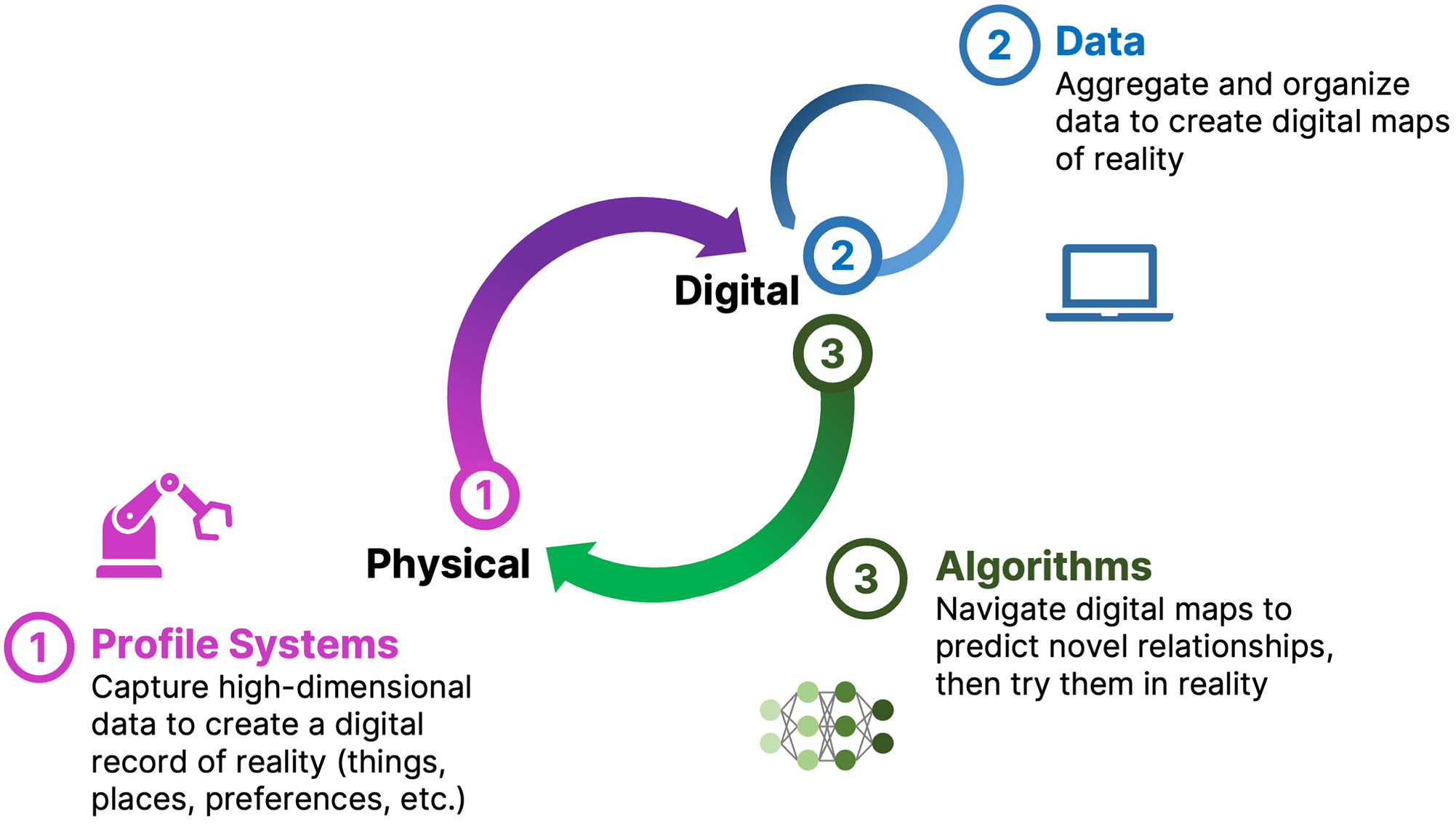

Figure 1. A simple formula is used across technology industries to map and navigate complex systems. First, high-dimensional data is generated, aggregated and organized to create digital representations. Then, AI/ML algorithms make predictions about that system that can be tested in reality. The result is a virtuous cycle of learning and iteration.

Recursion was founded in 2013 with a vision to capitalize on the convergence of advancements in computation and machine learning to address the decreasing efficiency of drug discovery and development. We believe that this opportunity represents one of the most positively impactful applications of ML and AI. Our vision is to leverage technology to map and navigate biology, chemistry, and patient-centric outcomes in order to increasingly transition the process of developing medicines from discovery to design. We believe that neither advanced computational approaches, massive datasets, nor human intelligence alone can fundamentally shift the efficiency curve of drug discovery and development; instead, we believe that those companies that augment their teams with sophisticated computational tools and focus deeply on generating and aggregating the right datasets will have a significant advantage. Our success and the success of the burgeoning TechBio sector has the promise to drive more, new, and better medicines to patients at higher scale and lower prices in the coming decades. We are working to not only lead this space but define it.

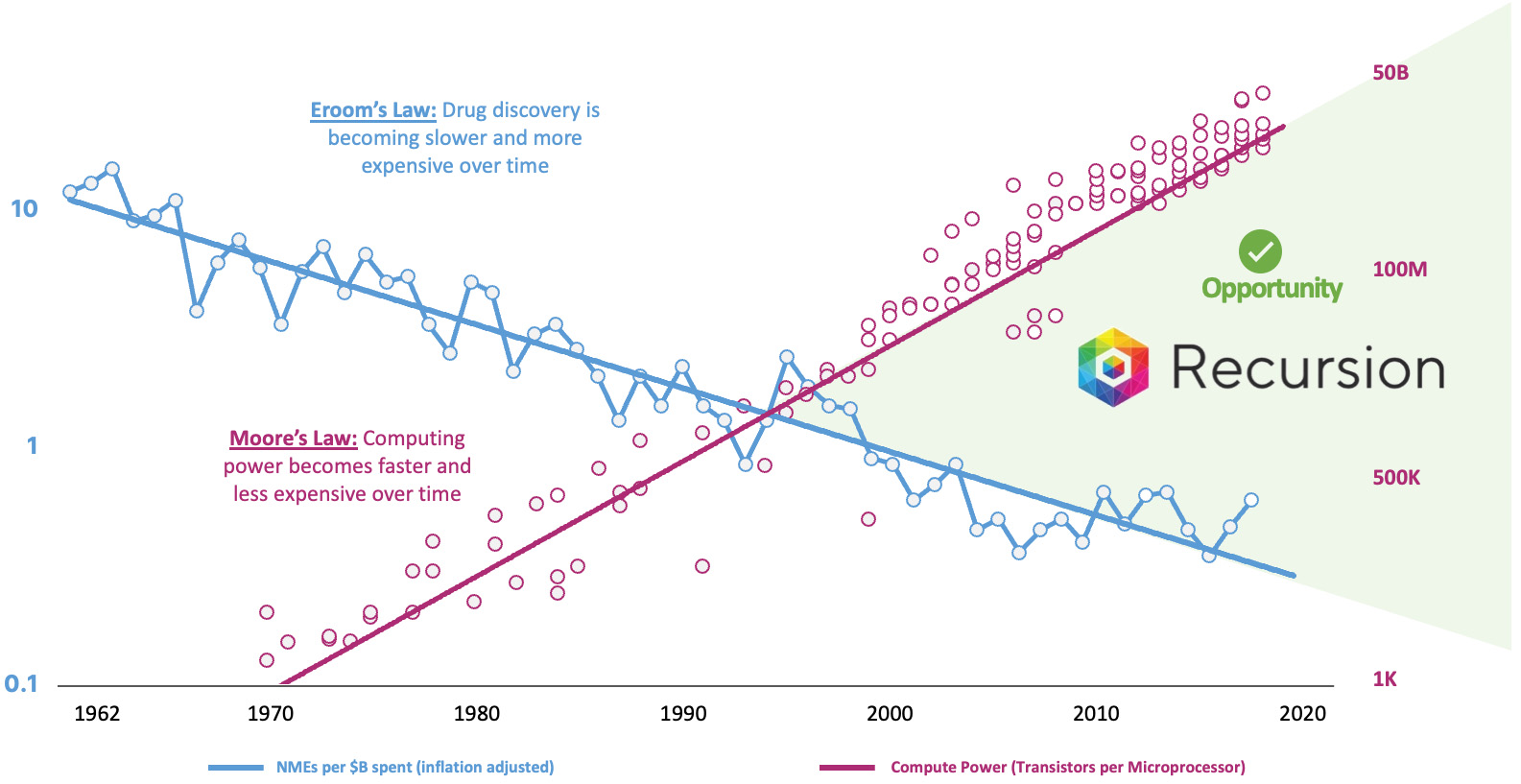

Figure 2. Eroom’s Law observes that while technology advancements have made many processes faster and less expensive over the years, drug discovery is becoming slower and more expensive.1,2 Recursion was created to take advantage of the discontinuity between these fields and harness the power of accelerating technological innovations to improve the efficiency of drug discovery and development.

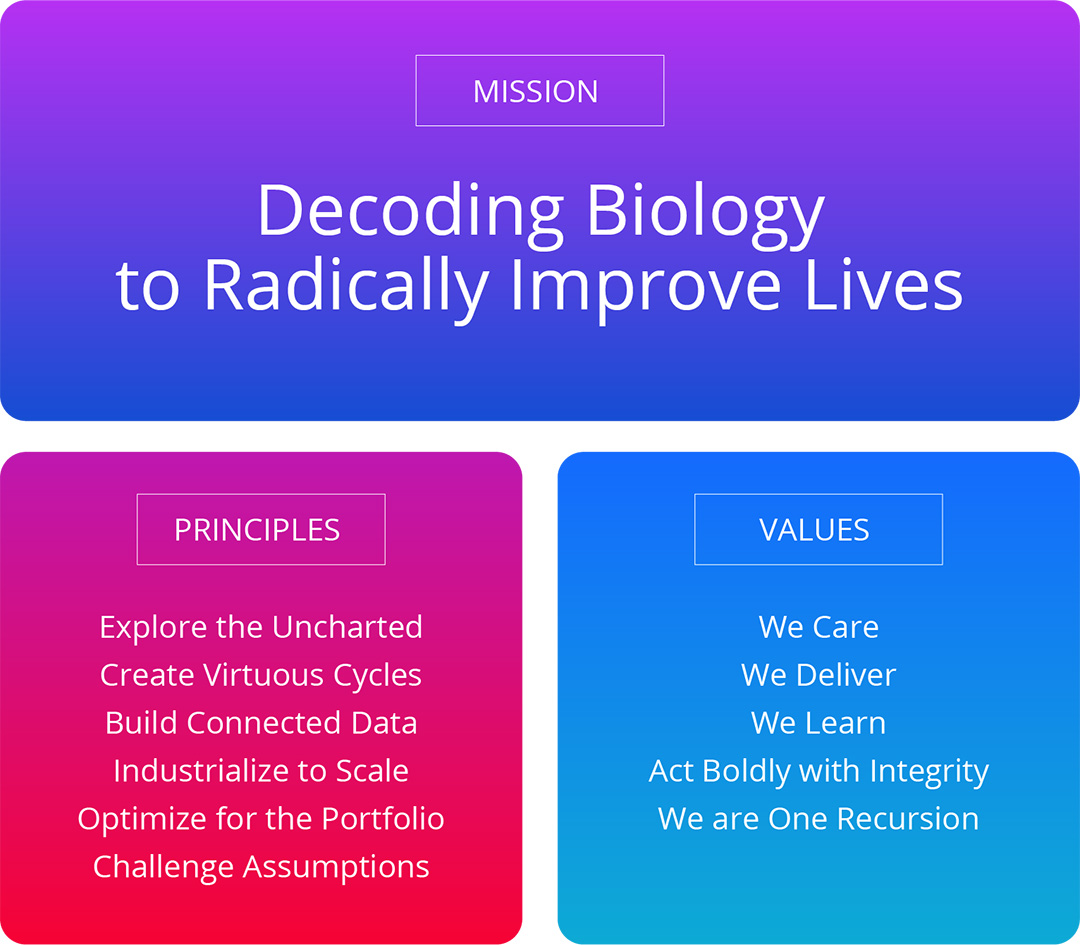

Our mission at Recursion, Decoding Biology to Radically Improve Lives, flows naturally from our vision. We interpret our mission expansively and believe it to be a durable direction and source of inspiration for our team. We started pioneering, scaling, and industrializing phenomics (data based on images of cellular structures) over a decade ago, but we recognize that drug discovery is made up of many steps, and a point solution targeting one or two steps is insufficient to generate efficiencies across the entire process. To decode biology, we must construct a full-stack technology platform capable of integrating and industrializing many complex workflows. Success in decoding biology implies our ability to predict ways to navigate it. The ability to predictably navigate biology may enable us to build an expansive pipeline of medicines, either by ourselves, with partners, or both. As part of that work, we seek not only to radically improve the lives of patients who could benefit from the medicines we help to deliver, but the lives of those who care for those patients, the lives of our employees and their families, as well as the communities in which we operate our company.

1 Adapted from Scannell, J et al (2012). Diagnosing the decline in pharmaceutical R&D efficiency. Nat Rev Drug Discov, 11, 191-200.

2 Adapted from Roser, M et al. (2013). Technological Change. OurWorldInData.org.

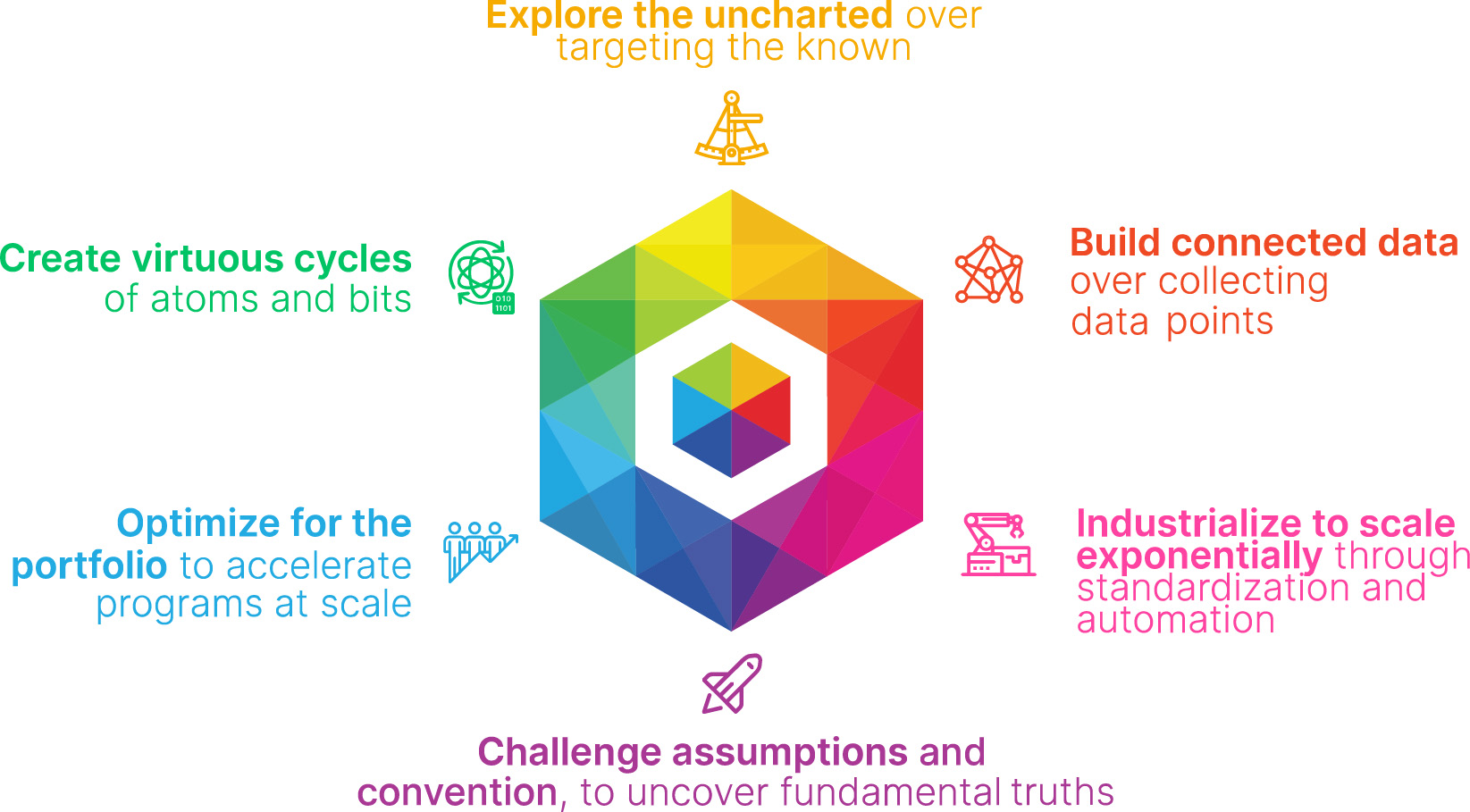

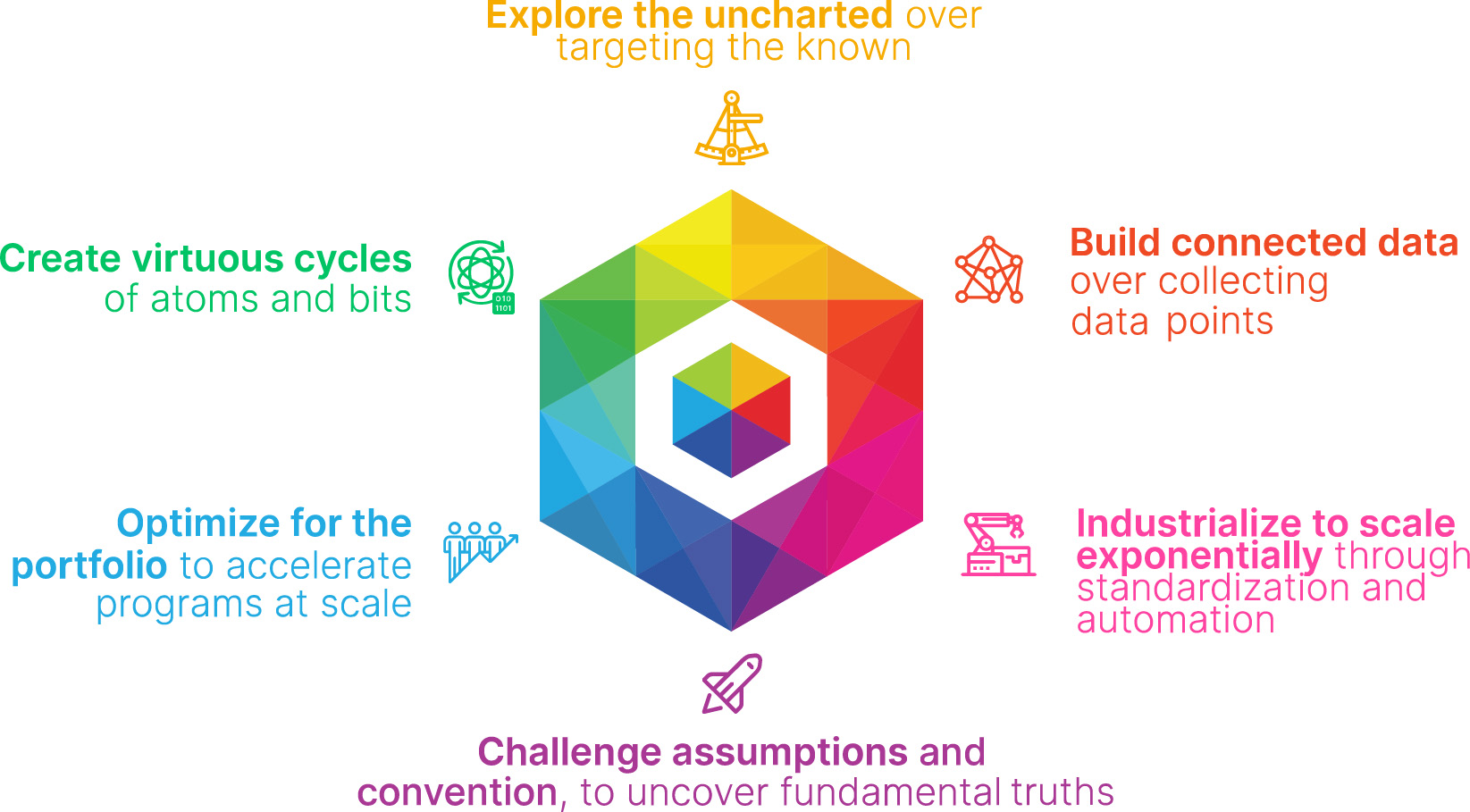

Figure 3: Recursion’s Founding Principles and Values support our ambitious mission. Together, these elements shape Recursion’s culture by guiding our people to high-impact decision-making and behaviors.

Our culture at Recursion is intentionally designed to fuel our mission. We believe culture drives delivery. Essential to decoding biology in our context is the Recursion Mindset, a deep commitment to achieving impact at unprecedented scale through pioneering new industrialized approaches. To decode biology, we intentionally source talent from an incredible breadth of fields from multiple industries. For all of our employees, Recursion is a new kind of company. The guideposts for teaching our people to successfully transition to TechBio and deliver our mission are our Founding Principles and Values. They are the essential shape of our culture. Our Founding Principles direct us in making scientific and technical decisions that further our mission. Our Values define the day-to-day behaviors that further our mission.

Figure 4. Recursion’s team requires operating at the interface of many diverse fields. Building a TechBio company requires fluency in operating at the interface of many disciplines and fields not previously attuned to working as closely in traditional biopharma.

How Recursion is Industrializing the Drug Discovery Process

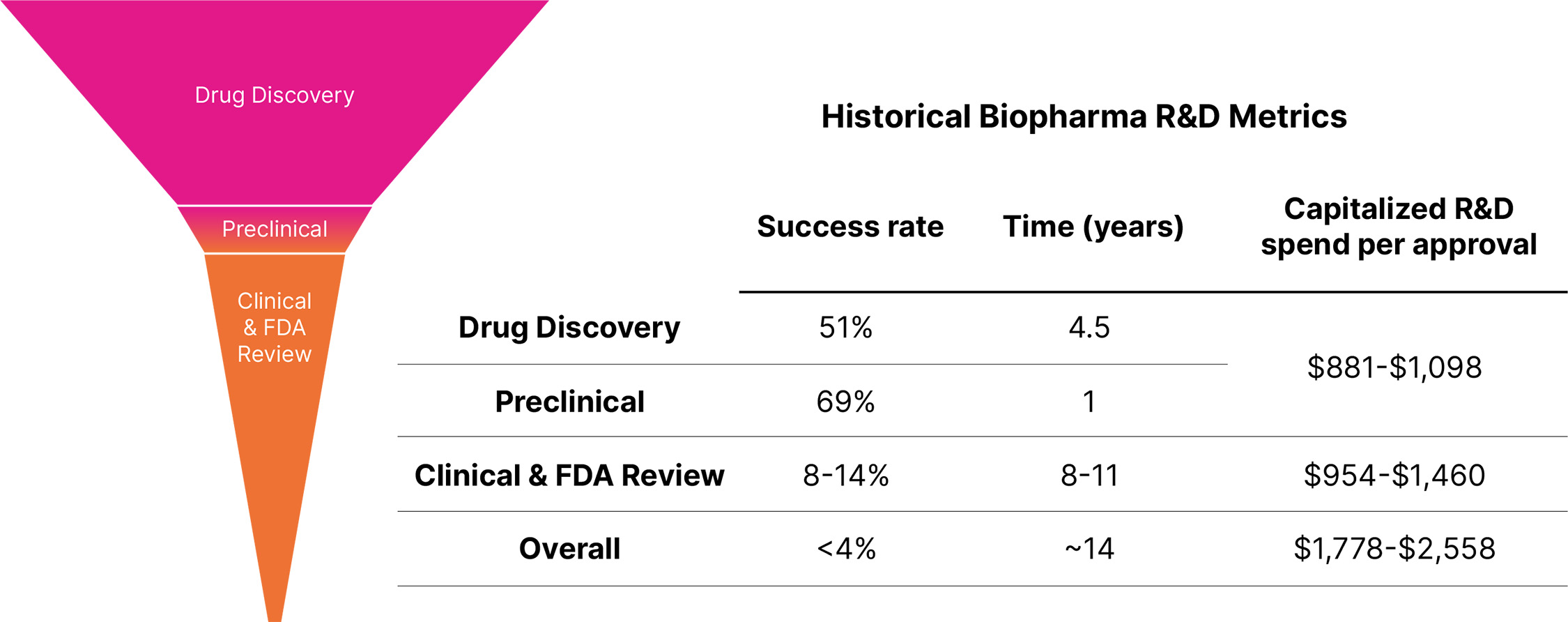

The traditional drug discovery and development process is characterized by substantial financial risks, with increasing and long-term capital outlays for development programs that often fail to reach patients as marketed products. Historically, it has taken over ten years and an average capitalized R&D cost of approximately $2 billion per approved medicine to move a drug discovery project from early discovery to an approved therapeutic. Such productivity outcomes have culminated in a rapidly declining internal rate of return for the biopharma industry.

Figure 5. Historical biopharma industry R&D metrics. The primary driver of the cost to discover and develop a new medicine is clinical failure. Less than 4% of drug discovery programs that are initiated result in an approved therapeutic, resulting in a risk-adjusted cost of approximately $1.8 to $2.6 billion per new drug launched.3,4,5,6,7

Despite significant investment and brilliant scientists, these metrics point to the need to evolve a more efficient drug discovery process and explore new tools. Traditional drug discovery relies on basic research discoveries from the scientific community to elucidate disease-relevant pathways and targets to interrogate. Coupled with biology’s incredible complexity, this approach has forced the industry to rely on reductionist hypotheses of the critical drivers of complex diseases, which can create a ‘herd mentality’ as multiple parties chase a limited number of therapeutic targets. The situation has been exacerbated by human bias (e.g., confirmation bias and sunk-cost fallacy). Accentuating this problem, the sequential nature of current drug discovery activities and the challenges with aggregation and relatability of data across projects, teams and departments lead to frequent replication of work and long timelines to discharge the scientific risk of such hypotheses. Despite decades of accumulated knowledge, the result is that drug discovery has unintentionally created hurdles for innovation.

Simultaneously, exponential improvements in computational speed and reductions in data storage costs driven by the technology industry, coupled with the rapid rise of large language models, generative AI and other ML tools, have transformed complex industries from media to transportation to e-commerce. Historically, the biopharma sector has been slow to embrace such innovations. Within the past 18 months, there have been remarkable shifts in perception among technology and biopharma companies as well as among regulators and policymakers, who highlight the utility of AI/ML for broad drug discovery and development from novel target discovery through next-generation manufacturing. We believe this rapid acceleration and adoption of these technologies demonstrates the growing consensus that AI/ML is a catalyst for substantial leaps in drug discovery.

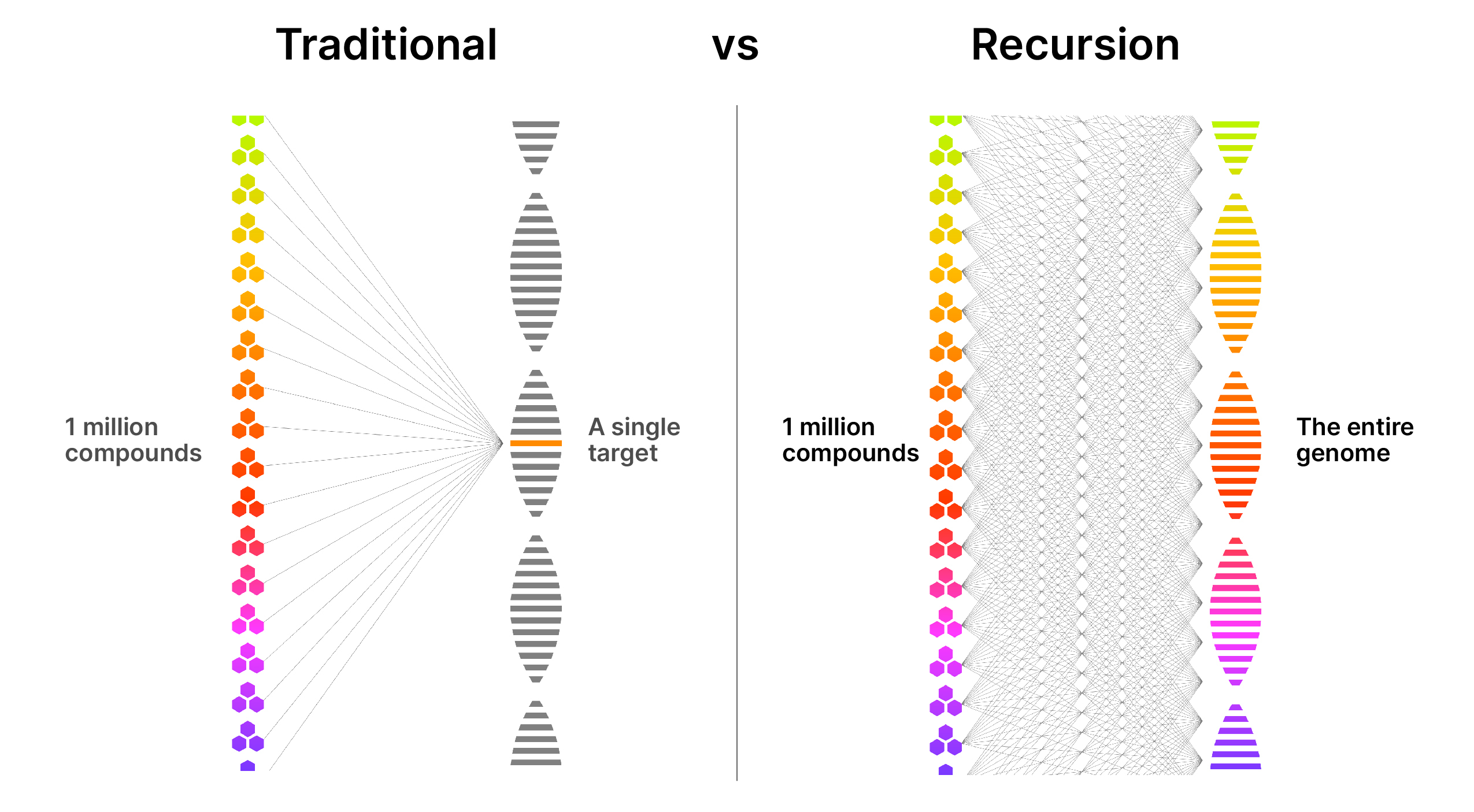

At Recursion, we are pioneering the integration of innovations across biology, chemistry, automation, data science and engineering to industrialize drug discovery in a full-stack solution across dozens of key workflows and processes critical in discovering and developing a drug. For example, by combining advances in high content microscopy with arrayed CRISPR genome editing techniques, we can rigorously profile massive, high-dimensional biological and chemical perturbation libraries in multiple human cellular contexts to create digital ‘maps’ of human biology. Leveraging advances in scaled computation, we can conduct massive virtual screens to predict the protein targets for billions of chemical compounds. Similarly, data generated from our automated DMPK module and InVivomics platform enables us to predict ADME properties and identify toxicity signals, respectively, significantly faster than traditional methods. We believe that by harnessing advances in technology to industrialize drug discovery, we can derive novel biological insights not previously described by scientific researchers, reduce the effects of human bias inherent in discovery biology and reduce translational risk at the program outset.

3 Zhou, S. and Johnson, R. (2018). Pharmaceutical Probability of Success. Alacrita Consulting, 1-42

4 Steedman M, and Taylor K. (2020). Ten years on: Measuring the return from pharmaceutical innovation. Deloitte. 1-44.

5 DiMasi et al. (2016). Innovation in the pharmaceutical industry: New estimates of R&D costs. Journal of Health Economics. 47, 20-33.

6 Paul, et al. (2010). How to improve R&D productivity: the pharmaceutical industry’s grand challenge. Nature Reviews Drug Discovery. 9,203-214

7 Martin et al. (2017). Clinical trial cycle times continue to increase despite industry efforts. Nature Reviews Drug Discovery. 16, 157

Figure 6. Recursion’s approach to drug discovery. We utilize our Founding Principles on the right to build datasets which are scalable, reliable and relatable in order to elucidate novel biological and chemical insights and industrialize the drug discovery process.