Exhibit (c)(12)

Presentation to the Board of Directors Project William October 8, 2020

Executive Summary 2 Board began review of strategic alternatives in July 2020Review included broad

set of alternatives, including standalone strategy (including possible re-negotiation of agreements with key partners), run-off, and saleWhile strategic review was ongoing, Consortium led by Arthur with two private equity partners approached

Company with $25.00 bid on August 16, 2020Arthur a 12.6% holder of William common equity and has 2 board seats; Arthur's directors have recused themselves from all deliberations and votes regarding the Consortium's offerAfter multiple rounds of

negotiations, Arthur offered $31.00 per share on October 1, 2020 and subsequently bid $31.10 per share on October 2, 2020Penultimate bid was subject to 24-hour “fuse” and Board determined it incorporated a credible walkaway threatIn order to

expedite transaction timing, the two private equity partners will not be parties to the acquisition with WIlliamDuring the process, Edward also emerged as interested partySubsequent to public rumors of Arthur bid at $26, increased its stake

from 5.1% to 9.1% and filed updated 13-DAfter initial outreach, provided bid of $31.00 on September 30, 2020 which was publicly filed; diligence supporting the bid was entirely based on publicly available informationArthur indicated that they

would not be inclined to work cooperatively with Edward should Edward acquire WilliamSent follow-up letter on October 5 and filed updated 13-D with letterBoard ultimately elected to pursue Arthur bid at $31.10 on October 2 (Arthur bid on a

stand-alone basis, with possible sale of equity interest to other members of the Consortium post-closing)

Summary of Bid History August 16: Verbal offer from Consortium of $25 per shareAugust 26: Written

offer from Consortium of $25 per shareSeptember 3: Verbal offer from Consortium of $27 per shareSeptember 8: Public leak of Consortium interest at $26 per shareSeptember 9: Counteroffer of $32 with $30-34 collar based on performance of non-IG

portfolio, with equity rollover electionSeptember 15: Verbal offer from Consortium of $28.25 per shareSeptember 20: Counteroffer of $32 per share with walkaway and hedge structure based on performance of non-IG portfolio, with equity rollover

electionSeptember 22: Offer from Consortium of $30 per share with risk share structure with 20% walkaway based on performance of non-IG portfolioSeptember 24: Counterproposals at $31 – both fixed at 36% walkaway and with hedge at 10% walkaway,

with equity rollover electionSeptember 26: Offer from Consortium of $30 per share with walkaway at book value (down ~29% in BV)September 29: Counteroffer at $31 per share with walkaway at book valueSeptember 30: Edward offer of $31 per

shareBased solely on public information; indicated it would need 2-3 weeks to complete its diligenceIndicated willingness to assume existing contracts, but also a desire to enter into discussions with Arthur and Henry around potential contract

terminationFiled its offer letter with updated 13-D on October 1October 1: Arthur offers $31 per share with walkaway at book valueProvided William with 24 hours to accept proposal or Arthur would walk awayIndicated they could reach signed

transaction in 3-4 daysSuggested they are not willing to enter into bidding war with Edward, and were not going to facilitate Edward acquisition of WilliamOctober 2: Counteroffer of $32 per share with walkaway at book valueRejected by Arthur;

offered final price of $31.10 which was ultimately acceptedOctober 5: Edward follow-up letter receivedRequested ability to conduct due diligenceIndicated it may be able to offer a higher price following diligence 3 After initial bid of $25

per share, 6 revised proposals from Arthur, resulting in $31.10 per share proposal (+24% improvement)

Based on Draft Agreement Dated 10/8/2020 4 Summary of Terms Use the 2 columns Where is the

$42.28/share as at 8/30?VDR “Project William Supplement – July August Investment Income Update” has $42.45 as at 8/31 Parties to Proposal Arthur Fixed price of $31.10 per share Termination 12 month termination date with 3 month extension

for non-investment grade asset loss conditionArthur can terminate if Board changes its recommendationWilliam can terminate transaction if presented with a superior proposal; William to pay a termination fee of [•]% Acquiror Newly formed

Bermuda vehicle capitalized by Consortium Strategy Stabilize William’s ratings profile, eliminating risk of potential downgradeEliminate exposure to current investment portfolio’s volatilityPrivate ownership more suited for underwriting

strategy Conditions No MAEWilliam shareholder approvalHSR and insurance regulatory approvalsLosses on non-investment grade assets are less than $238MMOther customary conditions Financing Arthur to use available cashClosing would not be

contingent on financing Consideration 100% Cash Purchase Price

Transaction Metrics 5 Implied Transaction Metrics Source: Capital IQ (10/07/2020)Notes:Based on

20.0MM fully diluted shares outstanding as of 06/30/2020, per Company ManagementUnaffected date of 09/08/2020; reflects 52-week trading range prior to unaffected dateIncludes July and August estimated income per Company Management

Summary of Valuation Analysis Notes:Based on 20.0MM fully diluted shares outstanding as of 6/30/2020,

per Company Management; values rounded to nearest $0.25Reflects 52-week trading range prior to unaffected date (09/08/2020)2021E earnings projections based on street consensus as of 10/07/2020Based on Company Management projectionsBased on

Company Management projections; terminal multiple range reflects P/BV range of precedent run-off transactions 6 Unaffected Price(09/08/2020):$17.87 Offer Price:$31.10

Stock Price Performance since Listing Stock Price ($), Volume (MM Shares) Source: Capital IQ, SNL

Financial (10/07/2020) Notes:1. Period ending 02/19/2020 7 5/14/2020: All-Time Low of $10.86 $30.27 ~140k sharesPre-COVID Average Daily Volume ~65k sharesPost-COVID Average Daily Volume $25.76Listing-to-COVID VWAP $31.10Offer

Price 9/9/2020 (Leak): $22.309/8/2020 (Unaffected): $17.87 10/29/2019: All-Time High of $28.90 2/19/2020 (COVID): $24.42 Post-Leak ~384k sharesPost-Leak

William Stock Price Performance vs. Peers Since William Listing 8 Stock Price Performance since

William Listing 03/28/2019 – 10/07/2020 (%) Source: Capital IQ (10/07/2020)Notes:Total Return Reinsurance Peers include GLRE and TPRETraditional Reinsurance Peers include ACGL, AXS, RE, RNR and Y +12.1% (7.9%) (33.4%) William Total

Return Re. Peers (1) Trad’l Rein. Peers (2) Post-Leak 2/19/2020 (COVID): (10%) Listing To Date 9/9/2020 (Leak)Stock price down ~34% pre-leak

Trading Multiples: P / BV 01/01/2015 – 10/07/2020 (x) Source: SNL Financial (10/07/2020)Notes:Total

Return Reinsurance Peers include GLRE and TPRETraditional Reinsurance Peers include ACGL, AXS, RE, RNR and Y 9 William Total Return Re. Peers (1) Trad’l Rein. Peers (2) Post-Leak 0.78x 0.91x 0.55x 9/9/2020 (Leak)P/BV (pre-leak):

0.46x William initial listing on 3/28/2019

Peer Trading Comparables Source: SNL Financial, Capital IQ (10/07/2020), Company FilingsNotes:Reflects

median annual combined ratio over the last 10 fiscal years, or since inception as appropriateReflects standard deviation of annual combined ratios over the last 10 fiscal years, or since inception as appropriate Reflects median annual BVPS

growth, including dividends, over the last 10 fiscal years, or since inception as appropriateReflects standard deviation of annual BVPS growth, including dividends, over the last 10 fiscal years, or since inception as

appropriate 10 (1) (2) (3) (4)

Source: Source: Source: Source: 11 Historical & Projected Financial Highlights Forecasted

Financials Per Management Projections Premiums Written($MM) ($MM) Combined Ratio (%) Net Investment Assets and Average Yield($MM) ($MM / %) Net Income and ROAE($MM) ($MM / %) (0.3%) 6.0% 2.3% 4.3% 4.1% 4.1% Net

Yield: (5.7%) 5.1% 2.1% 9.1% 11.6% 11.0% ROAE: 10.3% 4.1% 14.3% (0.9%) Key Assumptions reflected in Management Projections, per Company Management:Dependent on favorable resolution of potential downgrade from AM BestDependent on

Arthur to achieve growth in 2020 business plan and achieve improved combined ratios (although Arthur has expressed concerns about achievability of plan given potential ratings downgrade)Further assumes ongoing market hardening and dependent on

no further worsening of macro environment from COVID-19 impactsNo changes to existing agreements with Arthur, based on Arthur declining to amend agreements Source: Company Management

Standalone Dividend Discount Model Summary Based on Company Management Projections Valuation as of

12/31/2020Includes market value gains through 8/31/2020 per Company ManagementBase case financial projections as provided by Company Management Capital target set at 30% BCAR ratioDiscount rate of 10% based on cost of equity

analysis(1) Notes:Cost of equity calculated using beta as of unaffected date of 09/08/2020 and current risk-free rate as of 10/07/2020Includes loss reserve equity, senior notes, contingent redeemable preferred shares less intangible

assets 12 (2)

Run-Off Analysis - Dividend Discount Model Summary Based on Company Management Projections Valuation as

of 12/31/2020Includes market value gains through 8/31/2020 per Company ManagementDiscount rate of 10% based on cost of equity analysis(1)Exit multiple of 0.80x BVPS based on precedent run-off deals(2) Notes:Cost of equity calculated using beta

as of unaffected date of 09/08/2020 and current risk-free rate as of 10/07/2020Based on 50% of net reservesTerminal multiple range reflects P/BV range of precedent run-off transactions; 0.80x reflects midpoint of range 13 (2) (2) (3)

Precedent Transactions Run-Off Transactions – P&C Source: Capital IQ, SNL Financial, Company

Filings and Materials 14 Notes:Deal value and multiples based on the combined value and book value of Downlands Liability Management and Hartford Financial Products International Limited (1)

Premiums Paid for U.S. Public Targets (1)(2) Transactions of $100MM or More All Cash

Consideration 25-Year Avg: 38.3% S&P 500 (3) Source: Source: 15 Notes:Includes announced bids for control of U.S. public targets with an aggregate value of $100MM or more; excludes terminated transactions, ESOPs, self-tenders,

spin-offs, share repurchases, minority interest transactions, exchange offers, recapitalizations, and restructurings. Includes transactions announced on or before 06/30/2020Annual amounts based on mean of percentage premiums paid over

unaffected stock price which is defined as stock price four weeks prior to the earliest of the deal announcement; announcement of a competing bid; and market rumorsS&P 500 indexed to closing price on the last trading day of 1996 Source:

Refinitiv (06/30/2020)

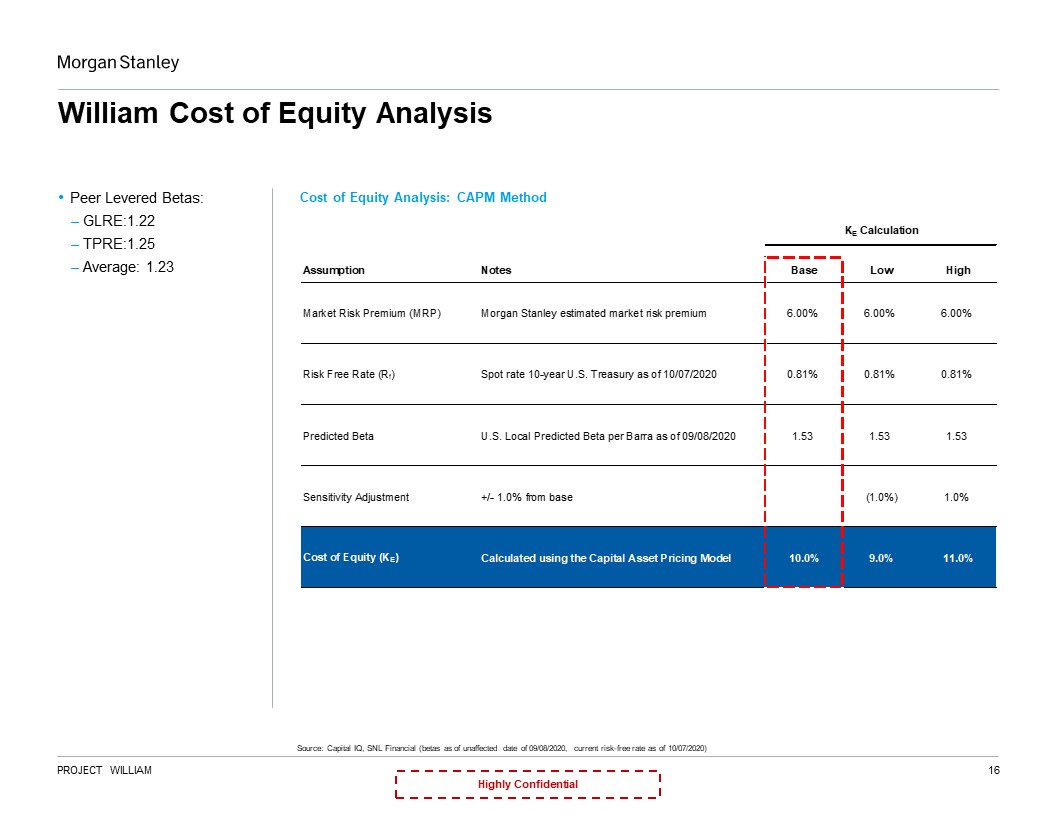

16 Cost of Equity Analysis: CAPM Method William Cost of Equity Analysis Source: Capital IQ, SNL

Financial (betas as of unaffected date of 09/08/2020, current risk-free rate as of 10/07/2020) Peer Levered Betas:GLRE:1.22TPRE:1.25Average: 1.23

We have prepared this document solely for informational purposes. You should not definitively rely upon

it or use it to form the definitive basis for any decision, contract, commitment or action whatsoever, with respect to any proposed transaction or otherwise. You and your directors, officers, employees, agents and affiliates must hold this

document and any oral information provided in connection with this document in strict confidence and may not communicate, reproduce, distribute or disclose it to any other person, or refer to it publicly, in whole or in part at any time except

with our prior written consent. If you are not the intended recipient of this document, please delete and destroy all copies immediately.We have prepared this document and the analyses contained in it based, in part, on certain assumptions and

information obtained by us from the recipient, its directors, officers, employees, agents, affiliates and/or from other sources. Our use of such assumptions and information does not imply that we have independently verified or necessarily agree

with any of such assumptions or information, and we have assumed and relied upon the accuracy and completeness of such assumptions and information for purposes of this document. Neither we nor any of our affiliates, or our or their respective

officers, employees or agents, make any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any

data it generates and accept no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information. We and our affiliates and our and their respective officers, employees

and agents expressly disclaim any and all liability which may be based on this document and any errors therein or omissions therefrom. Neither we nor any of our affiliates, or our or their respective officers, employees or agents, make any

representation or warranty, express or implied, that any transaction has been or may be effected on the terms or in the manner stated in this document, or as to the achievement or reasonableness of future projections, management targets,

estimates, prospects or returns, if any. Any views or terms contained herein are based on financial, economic, market and other conditions prevailing as of the date of this document and are therefore subject to change. We undertake no

obligation or responsibility to update any of the information contained in this document. Past performance does not guarantee or predict future performance.We have (i) assumed that any forecasted financial information contained herein reflects

the best available estimates of future financial performance, and (ii) not made any independent valuation or appraisal of the assets or liabilities of any company involved in any proposed transaction, nor have we been furnished with any such

valuations or appraisals. The purpose of this document is to provide the recipient with an explanation of the basis upon which Morgan Stanley is issuing a financial opinion letter in relation to the proposed transaction. This document should be

read in conjunction with and is subject to the terms of such financial opinion. This document supersedes any previous documents or presentations delivered by Morgan Stanley to the recipient in connection with the proposed transaction.This

document and the information contained herein do not constitute an offer to sell or the solicitation of an offer to buy any security, commodity or instrument or related derivative, nor do they constitute an offer or commitment to lend,

syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and do not constitute legal,

regulatory, accounting or tax advice to the recipient. We recommend that the recipient seek independent third party legal, regulatory, accounting and tax advice regarding the contents of this document. This document is not a research report and

was not prepared by the research department of Morgan Stanley or any of its affiliates.Notwithstanding anything herein to the contrary, each recipient hereof (and their employees, representatives, and other agents) may disclose to any and all

persons, without limitation of any kind from the commencement of discussions, the U.S. federal and state income tax treatment and tax structure of the proposed transaction and all materials of any kind (including opinions or other tax analyses)

that are provided relating to the tax treatment and tax structure. For this purpose, "tax structure" is limited to facts relevant to the U.S. federal and state income tax treatment of the proposed transaction and does not include information

relating to the identity of the parties, their affiliates, agents or advisors.This document is provided by Morgan Stanley & Co. LLC and/or certain of its affiliates, which may include Morgan Stanley Realty Incorporated, Morgan Stanley

Senior Funding, Inc., Morgan Stanley Bank, N.A., Morgan Stanley & Co. International plc, Morgan Stanley & Co. Limited, Morgan Stanley Bank International (Milan Branch), Morgan Stanley Saudi Arabia, Morgan Stanley South Africa (PTY)

Limited, Morgan Stanley Securities Limited, Morgan Stanley Bank AG, Morgan Stanley MUFG Securities Co., Ltd, Mitsubishi UFJ Morgan Stanley Securities Co., Ltd, Morgan Stanley India Company Private Limited, Morgan Stanley Asia Limited, Morgan

Stanley Australia Limited, Morgan Stanley Asia (Singapore) Pte., Morgan Stanley Services Limited, Morgan Stanley & Co. International plc, Seoul Branch, Morgan Stanley Canada Limited, Banco Morgan Stanley S.A. and/or Morgan Stanley, SV, SAU.

Unless governing law permits otherwise, you must contact an authorized Morgan Stanley entity in your jurisdiction regarding this document or any of the information contained herein. 17