Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Rule 14a-12 |

| [ ] | Confidential, for the Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

Vectrus, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

Fee paid previously with preliminary materials.

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

Table of Contents

March 31, 2015

Vectrus, Inc.

655 Space Center Drive

Colorado Springs, CO 80915

Dear Fellow Shareholders:

Enclosed are the Notice of Annual Meeting and Proxy Statement for the Vectrus, Inc. 2015 Annual Meeting of Shareholders. This year’s meeting is intended to address only the business included on the agenda. Details of the business to be conducted at the Annual Meeting are given in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement which provides information required by applicable laws and regulations.

Your vote is important and we encourage you to vote whether you are a registered owner or a beneficial owner. In accordance with U.S. Securities and Exchange Commission rules, we are using the Internet as our primary means of furnishing proxy materials to shareholders. Because we are using the Internet, most shareholders will not receive paper copies of our proxy materials. We will instead send these shareholders a notice with instructions for accessing the proxy materials and voting via the Internet. This notice also provides information on how shareholders may obtain paper copies of our proxy materials if they so choose. We believe use of the Internet makes the proxy distribution process more efficient, less costly and helps in conserving natural resources.

If you are the registered owner of Vectrus common stock, you may vote your shares by making a toll-free telephone call or using the Internet. Details of these voting options are explained in the Proxy Statement. If you choose to receive paper copies of our proxy materials, you can vote by completing and returning the enclosed proxy card by mail as soon as possible.

If you are a beneficial owner and someone else, such as your bank, broker or trustee is the owner of record, the owner of record will communicate with you about how to vote your shares.

Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. If you are a registered owner of Vectrus common stock and do not plan to vote in person at the Annual Meeting, you may vote via the Internet, by telephone or, if you receive a paper proxy card in the mail, by mailing the completed proxy card. Voting by any of these methods will ensure your representation at the Annual Meeting of Shareholders.

Sincerely,

Kenneth W. Hunzeker

Chief Executive Officer and President

Louis J. Giuliano

Non-Executive Chairman of the Board of Directors

Table of Contents

March 31, 2015

| Notice of 2015 Annual Meeting of Shareholders | ||||

| Time: | 8:00 a.m. Mountain Time, on Friday, May 15, 2015 | |||

| Place: | Cheyenne Mountain Resort, 3225 Broadmoor Valley Road, Colorado Springs, CO 80906 | |||

| Items of Business: | 1. | To elect three Class I Directors as members of the Board of Directors for a three-year term, each as named in the attached Proxy Statement. | ||

| 2. | To ratify the appointment of Deloitte & Touche LLP as the Vectrus, Inc. Independent Registered Public Accounting Firm for 2015. | |||

| 3. | To approve, on an advisory basis, the compensation paid to our named executive officers, as described herein. | |||

| 4. | To determine, on an advisory basis, whether a shareholder vote to approve the compensation of our named executive officers should occur every one, two or three years. | |||

| 5. | To transact such other business as may properly come before the meeting. | |||

| Who May Vote: | You can vote if you were a shareholder at the close of business on March 18, 2015, the record date. | |||

| Annual Report to Shareholders and Annual Report on Form 10-K: | Copies of our Annual Report to Shareholders and 2014 Annual Report on Form 10-K are provided to shareholders. | |||

| Mailing or Availability Date: | Beginning on or about March 31, 2015, this Notice of Annual Meeting of Shareholders and the 2015 Proxy Statement are being mailed or made available, as the case may be, to shareholders of record on March 18, 2015. | |||

| About Proxy Voting: | Your vote is important. Proxy voting permits shareholders unable to attend the Annual Meeting of Shareholders to vote their shares through a proxy. By appointing a proxy, your shares will be represented and voted in accordance with your instructions. If you do not provide instructions on how to vote, the proxies will vote as recommended by the Board of Directors. Most shareholders will not receive paper copies of our proxy materials and can vote their shares by following the Internet voting instructions provided on the Notice of Internet Availability of Proxy Materials. If you are a registered owner and requested a paper copy of the proxy materials, you can vote your shares by completing and returning your proxy card or by following the Internet or telephone voting instructions provided on the proxy card. Beneficial owners who received or requested a paper copy of the proxy materials may vote their shares by completing and returning their voting instruction form or by following the Internet or telephone voting instructions provided on the voting instruction form. You can change your voting instructions or revoke your proxy at any time prior to the Annual Meeting of Shareholders by following the instructions on page 6 of this proxy statement and on the proxy card. | |||

Table of Contents

| This communication presents only an overview of the more complete proxy materials that are available to you on the Internet. We encourage you to access and review all of the important information contained in the proxy materials before voting. | ||||

| Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to be held on Friday, May 15, 2015 at 8:00 a.m. Mountain Time at the Cheyenne Mountain Resort, 3225 Broadmoor Valley Road, Colorado Springs, CO 80906. The Company’s 2015 Proxy Statement, 2014 Annual Report on Form 10-K and Annual Report to Shareholders are available online at www.proxyvote.com. | ||||

| If you want to receive a paper or email copy of these documents, you must request a copy. There is no charge to you for requesting a copy. Please make your request for a copy as instructed in this proxy statement on or before April 30, 2015 to facilitate timely delivery. | ||||

| By order of the Board of Directors, |

|

| Michele L. Tyler |

| Senior Vice President, |

| Chief Legal Officer and Corporate Secretary |

Table of Contents

i

Table of Contents

ii

Table of Contents

| Annual Meeting of Shareholders Information | ||

| Date: | May 15, 2015 | |

| Time: | 8:00 a.m. Mountain Time | |

| Location: | Cheyenne Mountain Resort, 3225 Broadmoor Valley Road, Colorado Springs, CO 80906 | |

| Record Date: | March 18, 2015 | |

| Transfer Agent: | Computershare | |

| Corporate Headquarters: | 655 Space Center Drive, Colorado Springs, CO 80915 | |

| Corporate Website: | www.vectrus.com | |

| Investor Relations Website: | http://investors.vectrus.com/phoenix.zhtml?c=253463&p=irol-irhome | |

| Annual Report on Form 10-K: | http://services.corporate- ir.net/SEC.Enhanced/SecCapsule.aspx?c=253463&fid=9998474 | |

| Annual Report to Shareholders: | http://investors.vectrus.com/phoenix.zhtml?c=253463&p=irol-reportsannual | |

| Code of Conduct: |

http://media.corporate- 20Book%20Final%2024%20Jul%2014.pdf | |

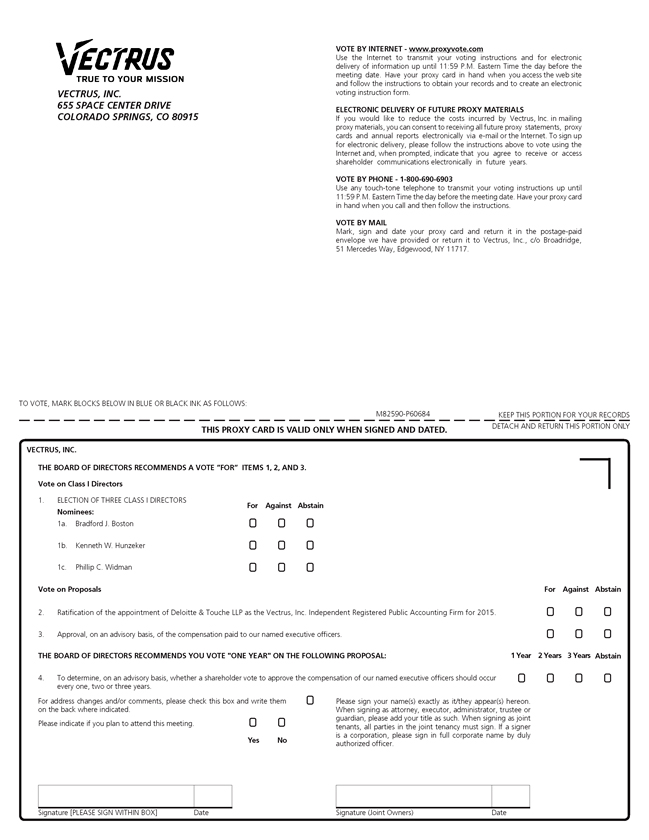

| Annual Meeting of Shareholders Agenda Items to be Voted On | ||||

| Management Recommendation | ||||

|

1. |

To elect Class I Directors: • Bradford J. Boston • Kenneth W. Hunzeker • Phillip C. Widman |

FOR EACH CLASS I DIRECTOR | ||

| 2. |

To ratify the appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for 2015. | FOR | ||

| 3. |

To approve, on an advisory basis, the compensation of our named executive officers, as described in the 2015 Proxy Statement. | FOR | ||

| 4. |

To determine, on an advisory basis, whether a shareholder vote to approve the compensation of our named executive officers should occur every one, two or three years. | ONE YEAR | ||

| Directors Standing for Election | ||||

| Independent | Committee Assignment | |||

| Bradford J. Boston | yes | Compensation and Personnel Committee, Chair | ||

| Kenneth W. Hunzeker | no | none | ||

| Phillip C. Widman | yes | Audit Committee, Audit Committee Financial Expert; Compensation and Personnel Committee | ||

1

Table of Contents

| Board and Committee Information | ||||

| Board Meetings in 2014 | 3 | |||

| Committee Meetings in 2014 | ||||

| Compensation and Personnel Committee Meetings in 2014 | 4 | |||

| Nominating and Governance Committee Meetings in 2014 | 3 | |||

| Audit Committee Meetings in 2014 | 3 | |||

| Independent Non-Executive Chair |

| Louis J. Giuliano |

| Director Compensation Information | ||

| Director Share Ownership Guidelines | 5X the Annual Retainer Amount | |

| Annual Director Compensation | ||

| Cash Retainer | $75,000 | |

| Restricted Stock Units | $75,000 | |

| Audit Committee Chair – Incremental Compensation | $15,000 Cash Retainer | |

| Compensation and Personnel Committee Chair – Incremental Compensation | $10,000 Cash Retainer | |

| Nominating and Governance Committee Chair – Incremental Compensation | $10,000 Cash Retainer | |

| Non-Executive Chair – Incremental Compensation | $50,000 Cash Retainer and $50,000 in Restricted Stock Units |

| Board Size following the 2015 Annual Meeting of Shareholders | ||

| 9 Directors | ||

| Key Governance Principles |

|

• Independent Chairman of the Board |

|

• Committees 100% Independent |

|

¡ Audit ¡ Compensation and Personnel ¡ Nominating and Governance |

|

• Majority Vote Standard in Uncontested Elections |

|

• Limited Perquisites |

|

• No tax gross-ups in change of control |

|

• Policy Against Hedging, Pledging or Speculating in Company Stock |

|

• Share Ownership Guidelines for Directors and Officers |

|

• Clawback Policy |

|

• Compensation Tied to Performance |

2

Table of Contents

| We do: |

|

• Use an independent compensation consultant. |

|

• Pay for performance. |

|

• Have share ownership guidelines. |

|

• Recommend that we have an annual Say-on-Pay vote. |

|

• Mitigate compensation risk through oversight, controls and appropriate incentives in our balanced compensation programs. |

|

• Have change of control provisions that only trigger upon consummation of the change in control transaction. |

|

• Provide for annual vesting over a three-year period for our restricted stock unit and stock option awards. |

|

• For 2015, the Company implemented a relative total shareholder return component that represents 50% of the long term incentives. The awards are subject to a three-year performance period. |

| We do not: |

|

• Reprice stock options. |

|

• Provide tax gross-ups for any perquisites or in connection with payments made in the event of change of control. |

|

• Have Directors or executive officers who have pledged shares. |

|

• Guarantee minimum bonus payments. |

3

Table of Contents

2015 Proxy Statement

Introduction

Your vote is very important. For this reason, the Board of Directors of Vectrus, Inc. (“Vectrus” or the “Company”) is requesting that you allow your common stock to be represented at the Annual Meeting of Shareholders by the proxies named on the proxy card. This statement is being sent or made available to you in connection with this request and has been prepared for the Board of Directors by our management team.

Separation from Exelis Inc.

Vectrus is composed of Exelis’ former military and government services business provider of infrastructure management, logistics and supply chain management, and information technology and network communication services worldwide. On September 27, 2014 (the “Distribution Date”), Vectrus, Inc. became an independent, publicly traded company (the “Separation” or “Spin-Off”) as a result of Exelis Inc.‘s (“Exelis”) distribution of its shares of Vectrus to Exelis shareholders and its stock began trading “regular way” under the ticker symbol “VEC” on the New York Stock Exchange (“NYSE”) on September 29, 2014. The Vectrus 2015 Proxy Statement provides information related to Vectrus’ partial year as an independent, publicly traded company. References to Exelis are included only as needed to explain necessary historical information.

Why did I receive these proxy materials?

Beginning on or about March 31, 2015, this Proxy Statement is being mailed or made available, as the case may be, to shareholders who were Vectrus shareholders as of the March 18, 2015 record date (the “Record Date”), as part of the Board of Directors’ solicitation of proxies for the Vectrus 2015 Annual Meeting of Shareholders and any postponements or adjournments thereof. This Proxy Statement, the CEO Annual Report Letter, and the 2014 Annual Report on Form 10-K (which have been furnished to shareholders eligible to vote at the 2015 Annual Meeting of Shareholders) contain information that the Board of Directors believes offers an informed view of Vectrus and meets the regulations of the U.S. Securities and Exchange Commission (the “SEC”) for proxy solicitations.

Who is entitled to vote?

You can vote if you owned shares of the Company’s common stock as of the close of business on March 18, 2015, the record date.

What items of business will I be voting on?

You are voting on the following items of business:

| 1. | To elect three Class I Directors as members of the Board of Directors for a three-year term, each as named in this Proxy Statement. |

| 2. | To ratify the appointment of Deloitte & Touche LLP (“Deloitte”) as the Company’s Independent Registered Public Accounting Firm for 2015. |

4

Table of Contents

| 3. | To approve, on an advisory basis, the compensation paid to our named executive officers, as described herein. |

| 4. | To determine, on an advisory basis, whether a shareholder vote to approve the compensation of our named executive officers should occur every one, two or three years. |

| 5. | To transact such other business as may properly come before the meeting. |

How do I vote?

If you are a registered owner, you can either vote in person at the Annual Meeting of Shareholders or by proxy, whether or not you attend the Annual Meeting of Shareholders. If you are a beneficial owner, you may vote by submitting voting instructions to your bank, broker, trustee or other nominee. If you are a beneficial owner and your shares are held in a bank or brokerage account, you will need to obtain a proxy, executed in your favor, from your bank or broker to be able to vote in person at the Annual Meeting of Shareholders. If you hold shares through the Vectrus 401(k) Plan, your shares held in the Vectrus 401(k) Plan will be voted by Evercore Trust Company, N.A., an independent fiduciary appointed for purposes of voting such shares. As an independent fiduciary, Evercore will act solely in the interest of the plan and the plan’s participants and beneficiaries.

What are the proxy voting procedures?

If you vote by proxy, you can vote by following the voting procedures on the proxy card. You may vote:

| • | By the Internet, |

| • | By Telephone, if calling from the United States, or |

| • | By Mail. |

Why does the Board solicit proxies from shareholders?

Since it is impractical for all shareholders to attend the Annual Meeting of Shareholders and vote in person, the Board of Directors recommends that you appoint the two people named on the accompanying proxy card to act as your proxies at the 2015 Annual Meeting of Shareholders.

How do the proxies vote?

The proxies vote your shares in accordance with your voting instructions. If you appoint the proxies but do not provide voting instructions, they will vote as recommended by the Board of Directors, except as discussed below under “What is a broker non-vote?” If any other matters not described in this Proxy Statement are properly brought before the meeting for a vote, the proxies will use their discretion in deciding how to vote on those matters.

How many votes do I have?

You have one vote for every share of Vectrus common stock that you owned on the Record Date.

How does the Board of Directors recommend that I vote on the proposals?

The Board of Directors recommends a vote “FOR” the election of each of the Class I Director nominees of the Board of Directors (Item 1), “FOR” the ratification of the appointment of Deloitte as the

5

Table of Contents

Vectrus Independent Registered Public Accounting Firm for 2015 (Item 2), “FOR” the advisory approval of the compensation of our named executive officers (Item 3) and “ONE YEAR” with respect to how frequently an advisory vote to approve the compensation of our named executive officers should occur (Item 4).

What if I change my mind?

You can revoke your proxy at any time before it is exercised by mailing a new proxy card with a later date or casting a new vote via the Internet or by telephone, as applicable. You can also send a written revocation to the Corporate Secretary at the Vectrus Corporate Headquarters, 655 Space Center Drive, Colorado Springs, CO 80915. If you come to the Annual Meeting of Shareholders, you can ask that the proxy you submitted earlier not be used.

What is a “broker-non vote”?

The NYSE has rules that govern brokers who have record ownership of listed company stock held in brokerage accounts for their clients who beneficially own the shares. Under these rules, brokers who do not receive voting instructions from their clients have the discretion to vote uninstructed shares on certain matters (“discretionary matters”) but do not have discretion to vote uninstructed shares as to certain other matters (“non-discretionary matters”). A broker may cast a vote on behalf of a beneficial owner from whom the broker has not received instructions with regard to discretionary matters but not non-discretionary matters. The broker’s inability to vote with respect to the non-discretionary matters to which the broker has not received instructions from the beneficial owner is referred to as a “broker non-vote.” Under current NYSE interpretations, agenda Item 2, the ratification of Deloitte as the Company’s Independent Registered Public Accounting Firm, is considered a discretionary item. Your broker does not have discretion to vote your shares held in street name on Items 1, 3 or 4, each of which is considered a non-discretionary item.

Under Indiana law, the law of the state where the Company is incorporated, broker non-votes and abstentions are counted to determine whether there is a quorum present but an abstention or broker non-vote will have no effect on the outcome of the proposals. There are four formal items scheduled to be voted upon at the Annual Meeting of Shareholders as described in this Proxy Statement. As of the date of this Proxy Statement, the Board of Directors is not aware of any business other than as described in this Proxy Statement that will be presented for a vote at the 2015 Annual Meeting of Shareholders.

How many votes are required to elect Directors or approve a proposal? How many votes are required for an agenda item to pass?

The Amended and Restated Articles of Incorporation and By-Laws provide that in uncontested elections, Directors shall be elected by a majority of the votes cast (that is, the number of votes cast “for” a Director nominee must exceed the number of votes cast “against” that nominee). The By-Laws provide that in uncontested elections, any Director nominee who fails to be elected by a majority, but who also is a Director at the time, shall promptly provide a written resignation, as a holdover Director, to the Chairman of the Board or the Corporate Secretary. The Nominating and Governance Committee (or the equivalent committee then in existence) shall promptly consider the resignation and all relevant facts and circumstances concerning any vote and the best interests of the Company and its shareholders. The Board will act on the Nominating and Governance Committee’s recommendation no later than its next regularly scheduled Board meeting or within 90 days after certification of the shareholder vote, whichever is earlier, and the Board will promptly publicly disclose its decision and the reasons for its decision. Cumulative voting in the election of directors is not permitted.

6

Table of Contents

Items 2, 3 and 4 are advisory in nature and are non-binding. Item 2 and Item 3 of the proposed agenda items will be considered to have passed if the votes cast in favor of the proposal exceed the votes cast against the proposal. Item 4 will be determined by which of the options (i.e. every year, every two years, every three years) receives a majority of the votes cast.

How many shares of Vectrus stock are outstanding?

As of the Record Date, 10,528,031 shares of Vectrus common stock were outstanding and entitled to vote at the Annual Meeting of Shareholders.

How many holders of Vectrus outstanding shares must be present to hold the Annual Meeting of Shareholders?

In order to conduct business at the Annual Meeting of Shareholders it is necessary to have a quorum. The presence in person or by proxy of holders of a majority of the outstanding shares of common stock entitled to vote will constitute a quorum for the transaction of business at the Annual Meeting of Shareholders. In the event of abstentions or broker non-votes, the shares represented will be considered present for quorum purposes.

What is the difference between a beneficial owner and a registered owner?

If shares you own are held in the Vectrus 401(k) Plan, a stock brokerage account, bank or by another holder of record, you are considered the “beneficial owner” because someone else holds the shares on your behalf. If the shares you own are registered in your name directly with Computershare, our transfer agent, you are the registered owner and the “shareholder of record.”

Can I vote shares I hold in the Vectrus 401(k) Plan?

No. Your shares held in the Vectrus 401(k) Plan will be voted by Evercore Trust Company, N.A., an independent fiduciary appointed for purposes of voting such shares. As an independent fiduciary, Evercore Trust will act solely in the interest of the plan and the plan’s participants and beneficiaries. Evercore Trust does not have any role in connection with the vote of any shares you may hold outside of the Vectrus 401(k) Plan.

How many shares are held by participants in the Vectrus 401(k) Plan?

As of the Record Date, Prudential, as the trustee for the Vectrus 401(k) Plan, held 1,917 shares of Vectrus common stock for the Vectrus 401(k) Plan (approximately 0.018%).

Who counts the votes? Is my vote confidential?

A representative from Broadridge counts the votes. A representative of Broadridge will act as an Inspector of Election for the 2015 Annual Meeting of Shareholders. The Inspector of Election monitors the voting and certifies whether the votes of shareholders are kept in confidence in compliance with the Vectrus confidential voting policy.

Who pays for the proxy solicitation cost?

Vectrus pays the full cost of soliciting proxies from registered owners, and has appointed Okapi Partners LLC to help with the solicitation effort. Vectrus will pay Okapi Partners LLC a fee of $7,500

7

Table of Contents

plus reimbursement of expenses, to assist with the solicitation and reimburse brokers, nominees, custodians and other fiduciaries for their costs in sending proxy materials to beneficial owners.

Who solicits proxies?

Directors, officers or other regular employees of Vectrus may solicit proxies from shareholders in person or by telephone, facsimile transmission or other electronic communication.

How can I submit a proposal for the 2016 Annual Meeting of Shareholders?

Rule 14a-8 of the Securities Exchange Act of 1934, or the “Exchange Act,” establishes the eligibility requirements and the procedures that must be followed for a shareholder proposal to be included in a public company’s proxy materials. If you want us to consider including a shareholder proposal in next year’s proxy statement, you must deliver such proposal, in writing, to Michele L. Tyler, our Chief Legal Officer and Corporate Secretary, at our principal executive offices on or before December 2, 2015 and comply with applicable eligibility requirements and procedures. Any other matters proposed to be submitted for consideration at next year’s Annual Meeting of Shareholders (other than a shareholder proposal included in our proxy materials pursuant to Rule 14a-8 of the rules promulgated under the Securities Exchange Act of 1934, as amended) must be given in writing to our Corporate Secretary and received at our principal executive offices not less than 90 days nor more than 120 days prior to the first anniversary of the date we first sent or made these proxy materials available to shareholders.

Therefore, to be presented at our 2016 Annual Meeting of Shareholders, such a proposal must be received on or after December 2, 2015 but not later than January 2, 2016. Although the 90 day mark is technically January 1, 2016, the Company will honor any requests for proposals received on January 2, 2016 as January 1 is a federally recognized holiday on which mail will not be delivered. The proposal must contain specific information required by our By-Laws, which are on file with the Securities and Exchange Commission and may be obtained from our Corporate Secretary upon written request. If a shareholder proposal is received before or after the range of dates specified above, our proxy materials for the next Annual Meeting of Shareholders may confer discretionary authority to vote on such matter without any discussion of the matter in the proxy materials.

Can a shareholder nominate Director Candidates?

In accordance with procedures and requirements set forth in our By-Laws, shareholders may propose nominees for election to the Board of Directors only after providing timely written notice, as set forth in the preceding section. To be timely, notice of Director nomination or any other business for consideration at the shareholders’ meeting must be received by our Corporate Secretary at our principal executive offices no less than 90 days nor more than 120 days prior to the date we released our Proxy Statement to shareholders in connection with last years’ Annual Meeting of Shareholders. Therefore, to be presented at our 2016 Annual Meeting of Shareholders, such a proposal must be received on or after December 2, 2015 but not later than January 2, 2016. The nomination and notice must meet all other qualifications and requirements of the Company’s Corporate Governance Principles, By-Laws and Regulation 14A of the Exchange Act. The nominee will be evaluated by the Nominating and Governance Committee of the Board using the same standards as it uses for all Director nominees.

These standards are discussed in further detail below under “Information about the Board of Directors-Director Selection, Composition, and Diversity.” No one may be nominated for election as a Director after he or she has reached 72 years of age unless the Board of Directors waives the age requirement. You can request a copy of the nomination requirements from the Corporate Secretary of Vectrus.

8

Table of Contents

Where can I find the voting results of the Annual Meeting of Shareholders?

We will announce preliminary voting results at the 2015 Annual Meeting of Shareholders and will publish final results in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the 2015 Annual Meeting of Shareholders. If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the 2015 Annual Meeting of Shareholders, we intend to file a Form 8-K to disclose preliminary voting results and, within four business days after the final results are known, we will file an additional Form 8-K with the SEC to disclose the final voting results.

Householding of Proxy Materials

SEC rules permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements and notices with respect to two or more shareholders sharing the same address by delivering a single proxy statement or a single notice addressed to those shareholders. This process, which is commonly referred to as “householding,” provides cost savings for companies. Some brokers household proxy materials, delivering a single proxy statement or notice to multiple shareholders sharing an address unless contrary instructions have been received from the affected shareholders. Once you have received notice from your broker that they will be sending householding materials to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate proxy statement or notice, please notify your broker. You can request prompt delivery of a copy of the proxy materials by writing to: Corporate Secretary, Vectrus, Inc., 655 Space Center Drive, Colorado Springs, CO 80915 or by calling 719-591-3600.

We make available, free of charge on our website, all of our filings that are made electronically with the SEC, including Forms 10-K, 10-Q, and 8-K. To access these filings, go to our website (www.vectrus.com) and click on “SEC Filings” under the “Investors” heading. Copies of our Annual Report on Form 10-K for the year ended December 31, 2014, including financial statements and schedules thereto, filed with the SEC, are also available without charge to shareholders upon written request addressed to: Corporate Secretary, Vectrus, Inc., 655 Space Center Drive, Colorado Springs, CO 80915.

Internet Availability of Proxy Materials

In accordance with SEC rules, we are using the Internet as our primary means of furnishing proxy materials to shareholders. Because we are using the Internet, most shareholders will not receive paper copies of our proxy materials. We will instead send these shareholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement, Annual Report to Shareholders and 2014 Annual Report on Form 10-K, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information on how shareholders may obtain paper copies of our proxy materials if they so choose.

Historically The Exelis Board of Directors’ share ownership guidelines provided for share ownership levels at five times the annual cash retainer amount for Non-Management Directors. Guidelines for the corporate officers were set as follows: for the chief executive officer at five times annual base salary; chief financial officer at three times annual base salary; executive vice presidents at three times annual base salary; senior vice presidents at two times annual base salary; and all other corporate vice presidents at one times annual base salary.

9

Table of Contents

Following the Distribution The Vectrus Board of Directors established similar share ownership guidelines, as set forth below, for our Non-Management Directors and corporate officers that are consistent with general market practices. Share ownership guidelines for Non-Management Directors and corporate officers were first approved by the Vectrus Board of Directors in December 2014. The share ownership guidelines provide for share ownership levels at five times the annual cash retainer amount for the Non-Management Directors of the Company. Non-Management Directors receive a portion of their retainer, and the Non-Executive Chairman of the Board receives a portion of his Chairman fee, in restricted stock units (also referred to as “RSUs”), which are paid in shares when the restricted stock units vest. Non-Management Directors are encouraged to hold such shares until their total share ownership meets or exceeds the ownership guidelines.

The approved guidelines require share ownership, expressed as a multiple of base salary, for all senior corporate officers. The guidelines specify the desired levels of Company stock ownership and encourage a set of behaviors for each corporate officer to reach the guideline levels. Specifically the guidelines apply as follows: chief executive officer at five times annual base salary; chief financial officer at three times annual base salary; executive vice presidents at three times annual base salary; senior vice presidents at two times annual base salary; and corporate vice presidents at one times annual base salary. In achieving these ownership levels, shares owned outright, Vectrus restricted stock and restricted stock units and shares held in the Vectrus 401(k) Plan are considered.

With respect to corporate officers, to attain the ownership levels set forth in the guidelines, it is expected that any restricted shares or restricted stocks units paid in shares when the restricted stock units vest will be held, and that all shares acquired through the exercise of stock options will be held, except, in all cases, to the extent necessary to meet tax obligations. Compliance with the guidelines is monitored periodically. Non-Management Directors and corporate officers are afforded five years to meet the guidelines. The Company has taken individual tenure, the recent Spin-Off transaction resulting in Vectrus’ listing as a new publicly traded company, and Non-Management Directors and corporate officer share ownership levels into account in determining compliance with the guidelines. As of February 9, 2015, our Non-Management Directors and corporate officers have attained levels that will permit attainment of share ownership at the guideline levels within five years.

Share Ownership Guidelines Summary

| Non-Management Directors | 5 X Annual Cash Retainer Amount | |

| CEO | 5 X Annual Base Salary | |

| CFO | 3 X Annual Base Salary | |

| Executive Vice Presidents | 3 X Annual Base Salary | |

| Senior Vice Presidents | 2 X Annual Base Salary | |

| Corporate Vice Presidents | 1 X Annual Base Salary |

The following table shows, as of February 9, 2015, the beneficial ownership of Vectrus common stock and options exercisable within 60 days of that date by each Director, by each of the executive officers named in the Summary Compensation Table on page 59, and by all Directors and executive officers as a group, as well as each person known to us to beneficially own more than 5% of our outstanding common stock. In addition, we have provided information about ownership of options and restricted stock units that provide economic linkage to Vectrus common stock but do not represent actual beneficial ownership of shares.

The number of shares beneficially owned by each Non-Management Director or executive officer has been determined under the rules of the SEC, which provide that beneficial ownership includes any

10

Table of Contents

shares as to which a person has the right to acquire beneficial ownership within 60 days through the exercise of any option or other right. Unless otherwise indicated, each Non-Management Director or executive officer has sole voting and dispositive power or shares those powers with his or her spouse.

The information regarding persons owning more than 5% of our outstanding common stock is based solely on the most recent Schedule 13D or 13G filings with the SEC on behalf of such person. Each person or entity has reported sole voting and investment power with respect to the shares beneficially owned by that person or entity, except as otherwise indicated. This information does not include holdings by the trustee with respect to individual participants in the Vectrus 401(k) Plan. The percentages below for the beneficial owners holding more than 5% are based on the number of shares of our common stock issued and outstanding as of December 31, 2014.

There were 10,484,974 shares of Vectrus common stock outstanding on February 9, 2015.

Security Ownership of Certain Beneficial Owners and Management

| Amount and Nature of Beneficial Ownership | Additional Economic Linkage Information |

|||||||||||||||||||||||||

| Name and Address of Beneficial Owner |

Shares Owned (1) |

Right to Acquire (2) |

Total Shares Beneficially Owned |

Percent Beneficially Owned |

Total RSUs | Total Options | ||||||||||||||||||||

| 5% Stockholders |

|

|||||||||||||||||||||||||

| BlackRock, Inc. (3) |

669,131 | — | 669,131 | 6.4 | % | — | — | |||||||||||||||||||

|

First Trust Portfolios, L.P. (4) First Trust Advisors, L.P. The Charger Corporation |

659,814 | — | 659,814 | 6.3 | % | — | — | |||||||||||||||||||

| Grantham, Mayo, Van Otterloo & Co. LLC (5) |

599,321 | — | 599,321 | 5.7 | % | — | — | |||||||||||||||||||

| Directors and Named Executive Officers (6) |

|

|||||||||||||||||||||||||

| Louis J. Giuliano |

— | — | — | * | 4,049 | — | ||||||||||||||||||||

|

Bradford J. Boston |

— | — | — | * | 2,425 | — | ||||||||||||||||||||

| Mary L. Howell |

— | — | — | * | 2,425 | — | ||||||||||||||||||||

|

William F. Murdy |

— | — | — | * | 2,425 | — | ||||||||||||||||||||

| Melvin F. Parker |

— | — | — | * | 2,425 | — | ||||||||||||||||||||

|

Eric M. Pillmore |

— | — | — | * | 2,425 | — | ||||||||||||||||||||

| Stephen L. Waechter |

5,000 | — | 5,000 | * | 2,425 | — | ||||||||||||||||||||

|

Phillip C. Widman |

— | — | — | * | 2,425 | — | ||||||||||||||||||||

| Kenneth W. Hunzeker |

11,342 | 109,692 | 121,034 | * | 71,381 | 218,502 | ||||||||||||||||||||

|

Theodore R. Wright |

— | 7,649 | 7,649 | * | 41,928 | 30,684 | ||||||||||||||||||||

| Matthew M. Klein |

22 | 18,391 | 18,413 | * | 35,933 | 41,343 | ||||||||||||||||||||

|

Janet L. Oliver |

— | 24,084 | 24,084 | * | 24,639 | 39,337 | ||||||||||||||||||||

| Kelvin R. Coppock |

— | 17,297 | 17,297 | * | 22,087 | 32,045 | ||||||||||||||||||||

|

All current executive officers and Directors as a group (16 persons) |

16,739 | 214,080 | 230,819 | 2.2 | % | 284,586 | 424,965 | |||||||||||||||||||

* Less than 1% of the outstanding shares of common stock.

| (1) | Includes shares for which the named person has sole voting and investment power or shared voting and investment power with a spouse. Excludes shares that may be acquired through stock option exercises. |

| (2) | Shares of common stock subject to options currently exercisable or exercisable within 60 days of February 9, 2015 and restricted stock units that will become vested within 60 days of February 9, 2015 are deemed outstanding and beneficially owned by the person holding such options or restricted stock units for purposes of computing the number of shares and |

11

Table of Contents

| percentage beneficially owned by such person, but are not deemed outstanding for purposes of computing the percentage beneficially owned by any other person. |

| (3) | As reported on a Schedule 13G filed on February 2, 2015, BlackRock, Inc. has sole voting power with respect to 563,704 shares, shared voting power with respect to 0 shares of common stock, shared dispositive power with respect to 0 shares of common stock and sole dispositive power with respect to 669,131 shares of common stock. The address for BlackRock, Inc. is 55 East 52nd Street, New York, NY 10022. |

| (4) | As reported on a Schedule 13G filed on January 20, 2015: First Trust Portfolios, L.P. has sole voting and dispositive power with respect to 0 shares of common stock, shared voting power with respect to 0 shares of common stock and shared dispositive power with respect to 194,093 shares of common stock; First Trust Advisors, L.P. has sole voting and dispositive power with respect to 0 shares of common stock, shared voting power with respect to 465,721 shares of common stock and shared dispositive power with respect to 659,814 shares of common stock; The Charger Corporation has sole voting and dispositive power with respect to 0 shares of common stock, shared voting power with respect to 465,721 shares of common stock and shared dispositive power with respect to 659,814 shares of common stock. The address for First Trust Portfolios, L.P., First Trust Advisors, L.P. and The Charger Corporation is 120 East Liberty Drive, Suite 400, Wheaton, IL 60187. |

| (5) | As reported on a Schedule 13G filed on January 27, 2015, Grantham, Mayo, Van Otterloo & Co. LLC has sole voting and dispositive power with respect to 599,321 shares of common stock and shared voting and dispositive power with respect to 0 shares of common stock. The address for Grantham, Mayo, Van Otterloo & Co. LLC is 40 Rowes Wharf, Boston, MA 02110. |

| (6) | The address of each of the Directors and NEOs listed is c/o Vectrus, Inc., 655 Space Center Drive, Colorado Springs, CO 80915. |

Section 16(a) of the Exchange Act requires that the Company’s executive officers and Directors, and any persons beneficially owning more than 10% of a registered class of the Company’s equity securities, file reports of ownership and changes in ownership with the SEC within specified time periods. To the Company’s knowledge, based upon a review of the copies of the reports furnished to the Company and written representations that no other reports were required, all filing requirements were satisfied in a timely manner for the year ended December 31, 2014.

Election of Directors

Our Amended and Restated Articles of Incorporation provides for a classified Board of Directors divided into three classes designated Class I, Class II and Class III, each serving staggered three-year terms. The terms of the Class I Directors expire at the 2015 Annual Meeting of Shareholders. The terms of the Class II and Class III Directors will expire at the 2016 and 2017 Annual Meeting of Shareholders, respectively. Directors elected by the shareholders at an Annual Meeting of Shareholders to succeed those Directors whose terms expire at such meeting are of the same class as the Directors they succeed and are elected for a term to expire at the third Annual Meeting of Shareholders after their election and until their successors are duly elected and qualified.

The election of Directors requires the affirmative vote of a majority of the votes cast at the Annual Meeting of Shareholders. Accordingly, abstentions and broker non-votes will not have any effect on the election of a Director.

12

Table of Contents

The full Board of Directors has considered and nominated three Class I nominees for election as Directors at the 2015 Annual Meeting of Shareholders, to serve for a three-year term. The qualifications and attributes considered by the Board when selecting each of these directors for nomination are described under the heading “Additional Qualifications” in the respective director’s biography below. Each of the Class I nominees is currently serving as a Director of Vectrus and has agreed to continue to serve if elected until the earlier of his or her retirement, resignation or death. If unforeseen circumstances arise before the 2015 Annual Meeting of Shareholders and a nominee becomes unable to serve, the Board of Directors could reduce the size of the Board or nominate another candidate for election.

If the Board of Directors nominates another candidate, the proxies could use their discretion to vote for that nominee.

PROPOSAL 1

The following information describes the biographical information, offices held, other business directorships, additional director experience, qualifications, attributes and skills and the class and term of each nominee. Beneficial ownership of equity securities of the nominees is described in the discussion of “Security Ownership of Certain Beneficial Owners and Management.”

Class I - Directors Standing for Election Whose Terms Expire in 2015

|

Bradford J. Boston | ||

Mr. Boston serves as a Director. Mr. Boston is currently the President and Chief Executive Officer of NetNumber Inc., a provider of next-generation centralized addressing, routing and database solutions to the global communications industry. He was Senior Vice President of Global Government Solutions & Corporate Security Programs Office of Cisco Systems, Inc. from 2006 to 2012, where he was responsible for engineering, business development and advanced services groups in support of defense customers in the United States, NATO and elsewhere and led all Cybersecurity coordination efforts with various governments around the world. Before that, he was Chief Information Officer of Cisco Systems, Inc. from 2001 to 2006. He also held senior positions at Corio, Inc., Sabre Holdings Corporation, American Express Company and Visa International from 1993 to 2001. Mr. Boston currently serves on the Board of Directors of NetNumber Inc. and is Chairman of the Board of Directors of Aap3 Inc. He is also Chairman of the Compensation Committee and a member of the Audit Committee of Aap3 Inc. Mr. Boston received a Bachelor’s degree from the University of Illinois.

| Age: |

61 | |

| Director Since: |

2014 | |

| Committee Assignments: |

Compensation and Personnel Committee, Chair | |

| Additional Qualifications: |

Mr. Boston has extensive leadership and management experience in delivery technology solutions, including to defense industry customers. He has also served in various senior management positions at both public and private companies. | |

13

Table of Contents

Class I - Directors Standing for Election Whose Terms Expire in 2015 (cont.)

|

Kenneth W. Hunzeker | ||

Lieutenant General (Ret.) Kenneth W. Hunzeker serves as our Chief Executive Officer and President, and Director. Mr. Hunzeker previously served as Executive Vice President, Exelis and President of the Mission Systems business. Prior to his position with Exelis, he was the President and General Manager of ITT Mission Systems, ITT Corporation. Mr. Hunzeker joined ITT Corporation in September 2010 as Vice President, Government Relations for ITT Defense and Information Solutions after 35 years of distinguished service in the U.S. Army, most recently serving as Deputy Commander, United States Forces - Iraq. He was appointed President of the Mission Systems business in April 2011. Mr. Hunzeker is responsible for the management and overall operation of all facilities and projects of the Mission Systems business. Mr. Hunzeker has more than 20 years of defense community experience in program management, strategy development and finance and has worked with key decision makers within the Army, Department of Defense, Office of Management and Budget, and Congress. Mr. Hunzeker holds a Bachelor’s degree from the U.S. Military Academy at West Point and two Master’s degrees.

| Age: |

62 | |

| Director Since: |

2014 | |

| Committee Assignments: |

None | |

| Additional Qualifications: |

Mr. Hunzeker brings his perspective and experience as Chief Executive Officer and President of the Company. He has significant management and operational experience as a Lieutenant General with the U.S. Army, and has an extensive background and leadership in the government services sector. | |

14

Table of Contents

Class I - Directors Standing for Election Whose Terms Expire in 2015 (cont.)

|

Phillip C. Widman | ||

Mr. Widman serves as a Director. From 2002 to his retirement in 2013, Mr. Widman was Senior Vice President and Chief Financial Officer of Terex Corporation, a global manufacturer delivering customer-driven solutions for a wide range of commercial applications, including the construction, infrastructure, quarrying, mining, manufacturing, transportation, energy and utility industries. From 2001 to 2002, he was an independent consultant, and from 1998 to 2001, he served as Executive Vice President and Chief Financial Officer of Philip Services Corporation, an integrated environmental and industrial service corporation. Prior to joining Philip Services Corporation, Mr. Widman spent 11 years at Asea Brown Boveri Ltd. and 12 years at UNISYS Corporation in various financial and operational capacities. Mr. Widman currently serves as a director of Sturm, Ruger & Co., Inc., where he is the Chairman of the Audit Committee and a member of the Risk Oversight Committee, and as a director of Harsco Corporation, where he is a member of the Audit Committee. He was a director of Lubrizol Corporation from November 2008 until its acquisition by Berkshire Hathaway in September 2011, where he served as a member of the Nominating and Governance Committee and Chairman of the Audit Committee. Mr. Widman received a BBA from the University of Michigan and an MBA from Eastern Michigan University.

| Age: |

60 | |

| Director Since: |

2014 | |

| Committee Assignments: |

Audit Committee, Financial Expert; Compensation and Personnel Committee, Member | |

| Additional Qualifications: |

Mr. Widman has an extensive financial and management background and has experience serving as a Chief Financial Officer and senior executive of several companies. Mr. Widman has also served as a Director of other public companies, including service as member and Chair of several audit committees. | |

The Board of Directors recommends you vote “FOR” the election of each of the proposed three Class I nominees listed above to the Vectrus Board of Directors.

15

Table of Contents

Continuing Members of the Board of Directors

The following information describes the offices held, biographical information, other business directorships, additional director experience, qualifications, attributes and skills, and the class and term of each director whose term continues beyond the 2015 Annual Meeting of Shareholders and who is not subject to election this year. Beneficial ownership of equity securities of continuing members of the Board of Directors is described in the discussion of “Security Ownership of Certain Beneficial Officers and Management.”

Class II - Directors Whose Terms Expire in 2016

| Louis J. Giuliano |

Mr. Giuliano serves as our Non-Executive Chairman. He currently serves as a senior advisor to The Carlyle Group. Mr. Giuliano retired as Chairman, CEO, and President of ITT Corporation in December 2004. Mr. Giuliano joined ITT Corporation in 1988 as vice president of Defense Operations and became president of ITT Defense and Electronics in 1991. Before joining ITT Corporation, Mr. Giuliano spent 20 years with Allied-Signal where he held numerous positions within the Aerospace Group. He is on the Board of Accudyne Industries, and is the Chairman of the Board of Meadowkirk Retreat Center. He is an active member of the CEO Forum and the Advisory Board for the Princeton University Faith and Work Initiative, and a founder of Workforce Ministries. Mr. Giuliano was named a governor of the U.S. Postal Service by President George W. Bush in November 2004. He was confirmed by the Senate in June 2005, for a term that expires in December 2015. He served as vice chairman of United States Post Office Board of Governors from February 2009 to January 2010, and as chairman of the United States Post Office Board of Governors from January 2010 until December 2011. Prior Board positions include Engelhard Corp., ServiceMaster, and JMC Steel Group. He is a graduate of Syracuse University with a Bachelor of Arts degree in chemistry and a Master’s of Business Administration.

| Age: |

68 | |

| Director Since: |

2014 | |

| Committee Assignments: |

None | |

| Additional Qualifications: |

Mr. Giuliano has an extensive background in management and finance, as well as experience as the former Chairman, CEO and President of ITT Corporation, a global diversified manufacturing company and former parent of Exelis. | |

16

Table of Contents

Class II - Directors Whose Terms Expire in 2016 (cont.)

| Mary L. Howell | ||

Ms. Howell serves as a Director. Ms. Howell is currently the Chief Executive Officer of Howell Strategy Group, an international consulting firm. Previously, Ms. Howell served as Executive Vice President of Textron Inc. from 1995 until her retirement in 2009. She served as an officer of Textron Inc. for 24 years, serving on the Textron Management Committee for over 15 years. Ms. Howell currently serves on the Board of Directors of Esterline Corporation and serves on the Audit Committee and Strategy and Technology Committee and chairs the Regulatory Compliance Sub-committee. She also serves on the executive committee of the Board of the Atlantic Council as well as serving on the Board of The Phillips Collection and chairing its Development Committee. In 2008, Ms. Howell received the Charles Ruch Semper Fidelis Award and in 2010 became an Honorary Marine. Ms. Howell received a Bachelor’s degree from the University of Massachusetts at Amherst.

| Age: |

62 | |

| Director Since: |

2014 | |

| Committee Assignments: |

Audit Committee, Member; Compensation and Personnel Committee, Member | |

| Additional Qualifications: |

Ms. Howell has extensive management experience in the aerospace and defense industry. She has served as a Director of another public company that also serves government and defense customers. | |

| Eric M. Pillmore | ||

Mr. Pillmore serves as a Director. From 2010 to July 2014, Mr. Pillmore served as senior advisor to the Center for Corporate Governance of Deloitte LLP, which provides board governance services to global clients. Mr. Pillmore was Senior Vice President of Corporate Governance of Tyco International Corporation from 2002 to 2007. Mr. Pillmore also held CFO positions at Multilink Technology Corporation, McData Corporation and General Instrument Corporation from 1996 to 2002. Before that, he spent 17 years with General Electric Company and four years as a naval officer. Mr. Pillmore is currently a Board member of Cardone Industries, Friends of Tenwek and Focus on the Family. He received a Bachelor’s degree from the University of New Mexico and an Executive Masters of Business Administration degree from Villanova University.

| Age: |

61 | |

| Director Since: |

2014 | |

| Committee Assignments: |

Nominating and Governance Committee, Chair | |

| Additional Qualifications: |

Mr. Pillmore has extensive corporate governance and financial experience, which includes advising boards of private and public companies on corporate governance and serving as Chief Financial Officer of several companies. | |

17

Table of Contents

Class III - Directors Whose Terms Expire in 2017

| William F. Murdy |

Mr. Murdy serves as a Director. Mr. Murdy has served as Chairman of the Thayer Hotel since April 2009 and as Chairman of the Thayer Leader Development Group since May 2010. Mr. Murdy retired as the Chairman of Comfort Systems USA, a provider of heating, ventilation, air conditioning installation and services in the commercial/industrial/institutional sector, in May 2014. From 2000 to 2011, Mr. Murdy was Chairman and Chief Executive Officer of Comfort Systems USA. Prior to that, he was President and Chief Executive Officer of Club Quarters, a membership hotel chain. From 1997 to 1999, he was Chairman, President, Chief Executive Officer and Co-Founder of LandCare USA, Inc., a leading commercial landscape and tree services company, which later merged with ServiceMaster. Mr. Murdy also held management positions in the investment sector, including as Managing General Partner of the Morgan Stanley Venture Capital Fund and President of its associated management company from 1981 to 1989. From 1974 to 1981 he served in a number of positions including Chief Operating Officer of Pacific Resources. He served in the United States Army from 1964 to 1974. Currently, Mr. Murdy serves on the Board of Directors, Audit Committee and is Chair of the Compensation Committee of UIL Holdings; the Board of Directors, Governance Committee and is Chair of the Compensation Committee of Kaiser Aluminum; the Board of Directors, the Compensation Committee and the Strategic Committee of LSB Industries, Inc.; and is a civilian aide to the Secretary of the Army. He received a Bachelor’s degree from the U.S. Military Academy at West Point and a Master’s degree from Harvard Business School.

| Age: |

73 | |

| Director Since: |

2014 | |

| Committee Assignments: |

Audit Committee, Member; Nominating and Governance Committee, Member | |

| Additional Qualifications: |

Mr. Murdy has strong industry background and extensive management and leadership experience as Chairman and Chief Executive Officer of several public companies. Mr. Murdy has also served as a Director of other public companies providing additional relevant experience. | |

18

Table of Contents

Class III - Directors Whose Terms Expire in 2017 (cont.)

| Melvin F. Parker | ||

Mr. Parker serves as a Director. From 2012 to December 2014, Mr. Parker served as President of North America for the Brink’s Company, a major provider of armored transportation services in North America. Before joining Brink’s in 2012, Mr. Parker served as Vice President and General Manager of the North America Consumer and Small Business Division at Dell, Inc. from 2010 to 2012 and as Executive Director and General Manager of US Small Business - Small and Medium Business - Americas at Dell, Inc. from 2009 to 2010. From 1994 until 2009, he held numerous senior leadership roles at multiple Fortune 500 Companies, including PepsiCo., Corporate Express (Staples) and Newell Rubbermaid. Mr. Parker is a decorated combat veteran and graduate of the U.S. Army Ranger and Airborne School. He served with distinction in the 82nd Airborne Division at Fort Bragg, N.C. He currently serves as a director on the Board of the National Black MBA Association. He is also a member of the Executive Leadership Council and was named to the Savoy Top 100 Most Influential Blacks in Corporate America for 2012 and 2014. Mr. Parker received a Bachelor’s degree from the U.S. Military Academy at West Point.

| Age: |

47 | |

| Director Since: |

2014 | |

| Committee Assignments: |

Compensation and Personnel Committee, Member; Nominating and Governance Committee, Member | |

| Additional Qualifications: |

Mr. Parker has extensive management and leadership experience as a senior executive for a number of public companies. | |

19

Table of Contents

Class III - Directors Whose Terms Expire in 2017 (cont.)

| Stephen L. Waechter | ||

Mr. Waechter serves as a Director. From 2008 to 2014, Mr. Waechter was Vice President of Business Operations and Chief Financial Officer of ARINC Incorporated, a provider of communications, engineering and integration solutions for commercial, defense and government customers worldwide. From 1999 to 2007, he was Executive Vice President and Chief Financial Officer of CACI International, Inc., one of the largest government information technology contractors. Before joining CACI, Mr. Waechter served as Chief Financial Officer for a number of high-technology companies including Government Technology Services, Inc., Vincam Human Resources, Inc. and Applied Bioscience International. Mr. Waechter’s early career includes 19 years at GE, most recently as Vice President, Finance for GE Information Services. Mr. Waechter currently serves as Chair of the Audit Committee of Social & Scientific Systems, Inc., and is Chair of the Audit Committee and a member of the Executive Committee, Strategic Planning Committee and Nominating Committee of CareFirst, Inc. He is also a member of the Board of Trustees of Christian Brothers University and former Chair of the Finance Committee of Choral Arts Society of Washington, D.C. Mr. Waechter received a Bachelor’s degree from Christian Brothers College and a Master’s degree in Business Administration from Xavier University.

| Age: |

64 | |

| Director Since: |

2014 | |

| Committee Assignments: |

Audit Committee, Chair | |

| Additional Qualifications: |

Mr. Waechter has extensive financial and leadership experience as Chief Financial Officer of several government contractors. Mr. Waechter has also served as a director and as audit committee member of several private companies. | |

PROPOSAL 2

The Audit Committee has appointed Deloitte as the Vectrus independent registered public accounting firm for 2015. Shareholder ratification is not required for making such appointment for the fiscal year ending December 31, 2015 because the Audit Committee has responsibility for the appointment of our independent registered public accounting firm. The appointment is being submitted to shareholders for ratification with a view toward soliciting the opinion of shareholders, which opinion will be taken into consideration in future deliberations. No determination has been made as to what action the Board of Directors or the Audit Committee would take if shareholders do not ratify the appointment. Even if the appointment is ratified, the Audit Committee retains discretion to appoint a new independent registered public accounting firm at any time if the Audit Committee concludes such a change would be in the best interests of Vectrus and its shareholders. We expect that representatives of Deloitte will be present at the Annual Meeting of Shareholders and will have an opportunity to make a statement if they desire to do so and to respond to appropriate questions. Deloitte is a registered public accounting firm as provided by the Public Company Accounting Oversight Board (“PCAOB”). Representatives of Deloitte attended all regularly scheduled meetings of the Audit Committee during 2014. The Audit Committee annually reviews and considers Deloitte’s performance of the Company’s audit.

20

Table of Contents

Performance factors reviewed include Deloitte’s:

| • Independence |

• Financial strength |

• Peer review program | ||

| • Experience |

• Industry insight |

• Commitment to quality report | ||

| • Technical capabilities |

• Leadership |

• Appropriateness of fees charged | ||

| • Client service assessment |

• Non-audit services |

• Compliance and ethics programs | ||

| • Responsiveness |

• Management structure |

The Audit Committee also reviewed the terms and conditions of Deloitte’s engagement letter. The Audit Committee discussed these considerations as well as Deloitte’s fees and services with Deloitte and Company management. The Audit Committee also determined that the Company did not incur additional costs for any non-audit services (services other than those described in the annual audit services engagement letter) provided by Deloitte in fiscal year 2014. The Committee determined that future non-audit services will be evaluated to confirm that the services were permitted under the rules and regulations concerning auditor independence promulgated by the SEC and rules promulgated by the PCAOB in Rule 3526.

Independent Registered Public Accounting Firm Fees

For the year ended December 31, 2014, following the Spin-Off on September 27, 2014, we paid Deloitte fees totaling $1,056,920, which are categorized below. Prior to the Spin-Off, Exelis paid any audit, audit-related, tax and other fees of Deloitte. As a result, the amounts reported below are not necessarily representative of the fees we expect to pay Deloitte in future years. Aggregate fees billed to Vectrus represent fees billed by the member firms of Deloitte Touche Tohmatsu and their respective affiliates.

| Fiscal Year Ended | ||||||||

| 2014 ($) | 2013($)(1) | |||||||

| Audit Fees(2) |

1,056,920 | N/A | ||||||

| Audit-Related Fees(3) |

- | N/A | ||||||

| Tax Fees(4) |

- | N/A | ||||||

| All Other Fees(5) |

- | N/A | ||||||

| Total |

1,056,920 | N/A | ||||||

| (1) | Exelis paid any audit, audit-related, tax and other fees of Deloitte prior to the Spin-Off. |

| (2) | Fees for audit services billed in 2014 consisted of: |

| • | Audit of the Company’s annual consolidated financial statements; |

| • | Reviews of the Company’s quarterly financial statements; and |

| • | Consents and other services related to SEC matters. |

| (3) | Fees for audit related services billed in 2014: |

| • | Deloitte performed no audit-related services in 2014 for Vectrus. |

| (4) | Fees for tax services, including tax compliance and tax planning, billed in 2014: |

| • | Deloitte performed no tax services in 2014 for Vectrus. |

| (5) | All Other Fees: |

| • | No other fees were billed to Vectrus for services performed in 2014. |

Pre-Approval of Audit and Non-Audit Services

The Audit Committee pre-approves audit and permitted non-audit services provided by Deloitte. The Audit Committee has also adopted a policy on pre-approval of permitted audit related and non-audit services provided by Deloitte and permitted certain non-audit services provided by outside internal audit service providers. The purpose of the policy is to identify thresholds for services, project amounts and circumstances where Deloitte and any outside internal audit service providers may perform permitted non-audit services. A second level of review and approval by the Audit Committee is required when such permitted non-audit services, project amounts, or circumstances exceed specified amounts.

21

Table of Contents

The Audit Committee has determined that, where practical, all permitted non-audit services shall first be placed for competitive bid prior to selection of a service provider. Management may select the party deemed best suited for the particular engagement, which may or may not be Deloitte. Providers other than Deloitte shall be preferred in the selection process for permitted non-audit service-related work. The policy and its implementation are reviewed and reaffirmed on a regular basis to assure conformance with applicable rules.

The Audit Committee has approved specific categories of audit, audit-related and tax services incremental to the normal auditing function, which Deloitte may provide without further Audit Committee pre-approval. These categories include among others, the following:

| 1. | Professional services rendered for the audits of the consolidated and combined financial statements, statutory audits, reviews of the quarterly consolidated financial statements and assistance with review of documents filed with the SEC. Due diligence, closing balance sheet audit services, purchase price dispute support and other services related to mergers, acquisitions and divestitures; |

| 2. | Employee benefit plan independent audits and preparation of tax returns for the Company’s defined contribution, defined benefit and health and welfare benefit plans, and preparation of the associated tax returns; |

| 3. | Tax compliance and certain tax planning; and |

| 4. | Accounting consultations and support related to new or existing accounting standards. |

The Audit Committee has also approved specific categories of audit-related services, including the assessment and review of internal controls and the effectiveness of those controls, which outside internal audit service providers may provide without further approval.

If fees for any pre-approved non-audit services provided by either Deloitte or any outside internal audit service provider exceed a pre-determined threshold during any calendar year, any additional proposed non-audit services provided by that service provider must be submitted for second-level approval by the Audit Committee. Other audit, audit-related and tax services which have not been pre-approved are subject to specific prior approval. The Audit Committee reviews the fees paid or committed to Deloitte on at least a quarterly basis.

The Company may not engage Deloitte to provide the services described below:

| 1. | Bookkeeping or other services related to the accounting records or financial statements of the Company; |

| 2. | Financial information systems design and implementation; |

| 3. | Appraisal or valuation services, fairness opinions, or contribution-in-kind reports; |

| 4. | Actuarial services; |

| 5. | Internal audit outsourcing services; |

| 6. | Management functions or human resources services; |

| 7. | Broker-dealer, investment adviser or investment banking services; or |

| 8. | Legal services and other expert services unrelated to the audit. |

Employees of Deloitte who are senior manager level or above, including lead or concurring partners or other significant audit partners and who have been involved with the Company in the independent audit, shall not be employed by the Company in any capacity for a period of five years after the termination of their activities on the Company account.

The Board of Directors recommends you vote “FOR” the ratification of appointment of the Company’s Independent Registered Public Accounting Firm for 2015.

22

Table of Contents

PROPOSAL 3

In accordance with the requirements of Section 14A of the Exchange Act (which was added by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”)) and the related rules of the SEC, we are including in these proxy materials a separate resolution subject to shareholder vote to approve, in a non-binding vote, the compensation of our named executive officers as disclosed pursuant to Item 402 of Regulations S-K. The text of the resolution in respect of Proposal No. 3 is as follows:

“RESOLVED, that the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables, and any related narrative discussion, is hereby APPROVED.”

In considering their vote, shareholders may wish to review with care the information on the Company’s compensation policies and decisions regarding the named executive officers presented in the Compensation Discussion and Analysis.

In particular, shareholders should note that the Company’s Compensation and Personnel Committee (the “Compensation Committee”) bases its executive compensation decisions on the following key objectives:

| • | align executive and shareholder interests by providing incentives linked to operating income, revenue, operating cash flow, and return on invested capital; |

| • | achieve long-term shareholder value creation without undue business risk; |

| • | create a link between an executive’s compensation and his or her individual contribution and performance; |

| • | attract and retain the most creative and talented industry leaders, recognizing the extremely competitive nature of the industries in which we operate; and |

| • | maintain compensation programs and practices that are competitive with and comparable to the compensation programs and practices of peer companies in the industries in which we operate and other comparable companies. |

While the results of the vote not binding on the Board of Directors but are only advisory in nature, the Board of Directors intends to carefully consider the results of the vote.

The Board of Directors recommends that you vote “FOR” the approval of the compensation of our named executive officers.

PROPOSAL 4

Non-Binding Advisory Vote on whether a Shareholder Vote to Approve the Compensation of our Named Executive Officers should occur every one, two or three years.

In accordance with the requirements of Section 14A of the Exchange Act (which was added by the Dodd-Frank Act) and the related rules of the SEC, we are including in these proxy materials a separate resolution subject to shareholder vote to recommend, in a non-binding advisory vote, whether a non-binding advisory shareholder vote to approve the compensation of our named executive officers should occur every one, two or three years.

23

Table of Contents

The text of the resolution in respect of Proposal No. 4 is as follows:

“RESOLVED, that the shareholders recommend, on an advisory basis, whether the preferred frequency of an advisory vote on the executive compensation of the Company’s named executives as set forth in the Company’s proxy statement should be every one year, every two years, or every three years.”

In considering their vote, shareholders may wish to review with care the information presented in connection with Proposal No. 3, as well as the information on the Company’s compensation policies and decisions regarding the named executive officers presented in the Compensation Discussion and Analysis.

Our Board of Directors has determined that a non-binding advisory shareholder vote on executive compensation that occurs every year is the most appropriate frequency for Vectrus at this time. In formulating its recommendation, our Board of Directors recognized that the Company’s executive compensation programs are designed to promote a long-term connection between pay and performance. However, because executive compensation disclosures are made annually, the Board of Directors considered that an annual advisory vote on executive compensation will allow shareholders to provide us with their direct input on our compensation philosophy, policies and practices as disclosed in the proxy statement every year. Additionally, an annual advisory vote on executive compensation is consistent with our policy of seeking input from, and engaging in discussions with, our shareholders on corporate governance matters and our executive compensation philosophy, policies and practices.

If the non-binding advisory vote on executive compensation will occur every year, a resolution subject to a non-binding shareholder vote to approve the compensation of our named executive officers will be presented in the proxy materials for the 2016 Annual Meeting of Shareholders.

For the reasons stated above, the Board of Directors is recommending a vote for a one-year frequency for the non-binding advisory shareholder vote to approve the compensation of our named executive officers. Note that shareholders are not voting to approve or disapprove the recommendation of the Board of Directors with respect to this proposal. Instead, each proxy card provides for four choices with respect to this proposal: a one, two or three year frequency or shareholders may abstain from voting on the proposal.

Your vote on this proposal will be non-binding on us and the Board of Directors, and it will not be construed as overruling a decision by us or the Board of Directors. Your vote will not create or imply any change to our fiduciary duties or create or imply any additional fiduciary duties for us or the Board of Directors. However, the Board of Directors values the opinions that our shareholders express in their votes and will consider the outcome of the vote when making future decisions on the inclusion of such proposals in the proxy materials as it deems appropriate.

The Board of Directors recommends that you vote for the option of “ONE YEAR” as the preferred frequency for advisory votes on the compensation of our named executive officers.

24

Table of Contents

The following table sets forth information concerning the shares of common stock that may be issued under equity compensation plans as of December 31, 2014.

| Plan Category | (a) Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants & Rights (Millions) |

(b) Weighted-Average Exercise Price Of Outstanding Options, Warrants And Rights ($) |