|

Delaware

|

| |

2834

|

| |

11-3430072

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

| |

(Primary Standard Industrial

Classification Code Number)

|

| |

(I.R.S. Employer

Identification Number)

|

|

Kenneth L. Guernsey

Brett D. White

Anitha Anne

Cooley LLP

Three Embarcadero Center,

20th Floor

San Francisco, CA 94111

(650) 843-5000

|

| |

Jennifer J. Rhodes

General Counsel

Angion Biomedica Corp.

7-57 Wells Avenue

Newton, Massachusetts 02459

(857) 336-4001

|

| |

Kristen Ferris

Goulston & Storrs PC

400 Atlantic Ave

Boston, MA 02110

(617) 482-1776

|

| |

William C. Hicks

Daniel A. Bagliebter

Mintz Levin Cohn Ferris

Glovsky & Popeo, P.C.

One Financial Center

Boston, MA 02111

(617) 542-6000

|

|

Large accelerated filer

|

| |

☐

|

| |

Accelerated filer

|

| |

☐

|

|

Non-accelerated filer

|

| |

☒

|

| |

Smaller reporting company

|

| |

☒

|

|

|

| |

|

| |

Emerging growth company

|

| |

☒

|

|

Jay R. Venkatesan, M.D.

President and Chief Executive Officer

Angion Biomedica Corp.

|

| |

Robert Connelly

Chief Executive Officer

Elicio Therapeutics, Inc.

|

|

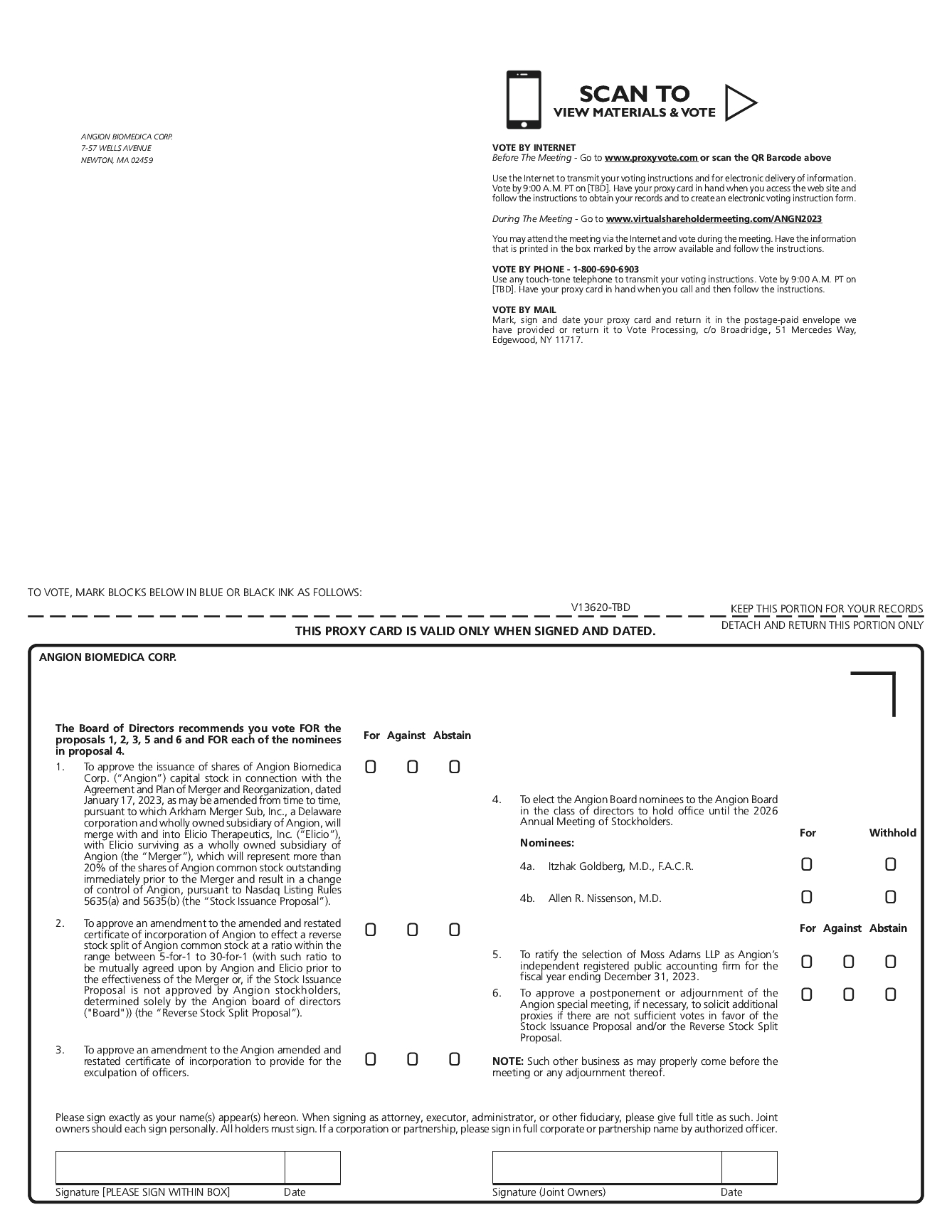

1.

|

Approve the issuance of shares of Angion capital stock pursuant to the Merger, which will represent more than 20% of the

shares of Angion common stock outstanding immediately prior to the Merger and result in a change of control of Angion, pursuant to Nasdaq Listing Rules 5635(a) and 5635(b), referred to as the Stock Issuance Proposal;

|

|

2.

|

Approve an amendment to the amended and restated certificate of incorporation of Angion to effect a reverse stock split of

Angion common stock at a ratio within the range between 5-for-1 to 30-for-1 (with such ratio to be mutually agreed upon by Angion and Elicio prior to the effectiveness of the Merger or, if the Stock Issuance Proposal is not approved by

Angion stockholders, determined solely by the Angion Board), referred to as the Reverse Stock Split Proposal;

|

|

3.

|

Approve an amendment to the Angion amended and restated certificate of incorporation to provide for the exculpation of

officers, referred to as the Exculpation Proposal;

|

|

4.

|

Elect the Angion Board nominees, Itzhak Goldberg, M.D., F.A.C.R. and Allen R. Nissenson, M.D., to the Angion Board in the

class of directors to hold office until the 2026 Annual Meeting of Stockholders, referred to as the Director Election Proposal;

|

|

5.

|

Ratify the selection of Moss Adams LLP as Angion’s independent registered public accounting firm for the fiscal year ending

December 31, 2023, referred to as the Accounting Firm Proposal; and

|

|

6.

|

Approve a postponement or adjournment of the Angion special meeting, if necessary, to solicit additional proxies if there are

not sufficient votes in favor of the Stock Issuance Proposal and/or the Reverse Stock Split Proposal, referred to as the Adjournment Proposal.

|

|

|

| |

Page

|

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

|

|

| |

Page

|

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

|

|

| |

Page

|

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | | ||

| | |

|

Q:

|

What is the Merger?

|

|

A:

|

Angion, Merger Sub, and Elicio entered into the Merger Agreement on

January 17, 2023. The Merger Agreement, as it may be further amended from time to time, contains the terms and conditions of the proposed merger transaction among Angion, Merger Sub and Elicio. Under the Merger Agreement, Merger Sub

will merge with and into Elicio, with Elicio surviving as a wholly owned subsidiary of Angion. This transaction is referred to as the Merger.

|

|

Q:

|

When will the Exchange Ratio be final?

|

|

A:

|

Angion and Elicio will agree to an anticipated closing date at least 15

calendar days prior to the Angion special meeting of stockholders (the Anticipated Closing Date). At least ten calendar days prior to the Angion special meeting of stockholders, Angion will deliver to Elicio a schedule (Net Cash

Schedule) setting forth the estimated calculation of Angion Net Cash as of the Anticipated Closing Date. For further details, see the section titled “The Merger

Agreement—Calculation of Angion Net Cash” beginning on page 142 of this proxy statement/prospectus/information statement.

|

|

Q:

|

What will happen to Angion if, for any reason, the Merger does not close?

|

|

A:

|

If, for any reason, the Merger does not close, the board of directors

of Angion (Angion Board) may elect to, among other things, continue the business of Angion, attempt to continue to sell or otherwise dispose of the various assets of Angion, dissolve and liquidate its assets or commence bankruptcy

proceedings. Under certain circumstances, Angion may be obligated to pay Elicio a termination fee of either $1 million or $2 million and reimburse certain expenses of Elicio up to $500,000, as more fully described in the section

titled “The Merger Agreement—Termination and Termination Fees” beginning on page 151 of this proxy

statement/prospectus/information statement. If Angion decides to dissolve and liquidate its assets, Angion would be required to pay all of its debts and contractual obligations, and to set aside certain reserves for potential future

claims. There can be no assurances as to the amount or timing of available cash left to distribute to stockholders after paying the debts and other obligations of Angion and setting aside funds for reserves.

|

|

Q:

|

Why are the two companies proposing to merge?

|

|

A:

|

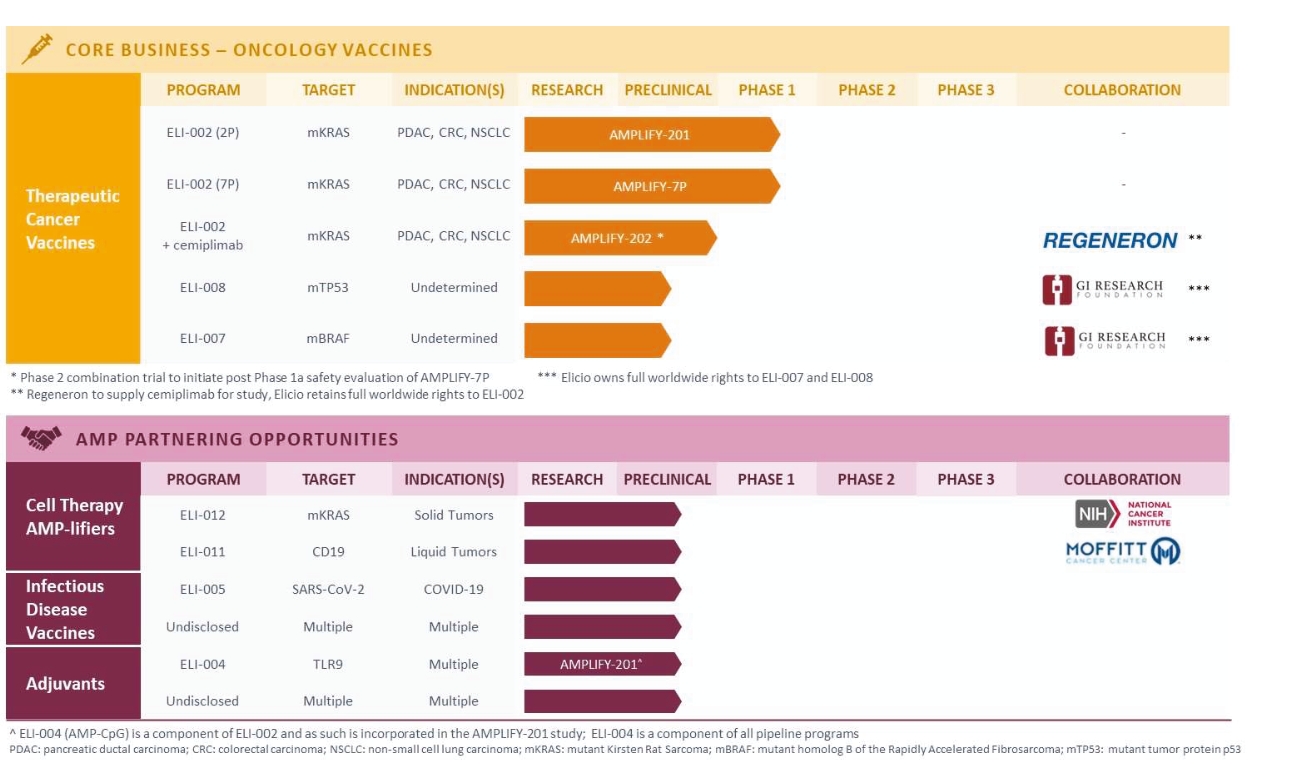

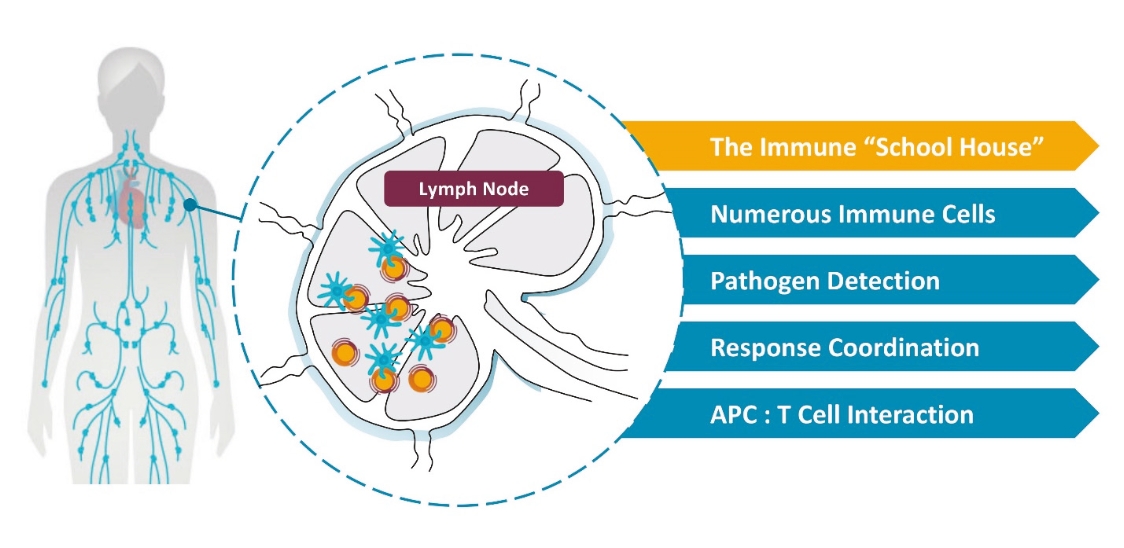

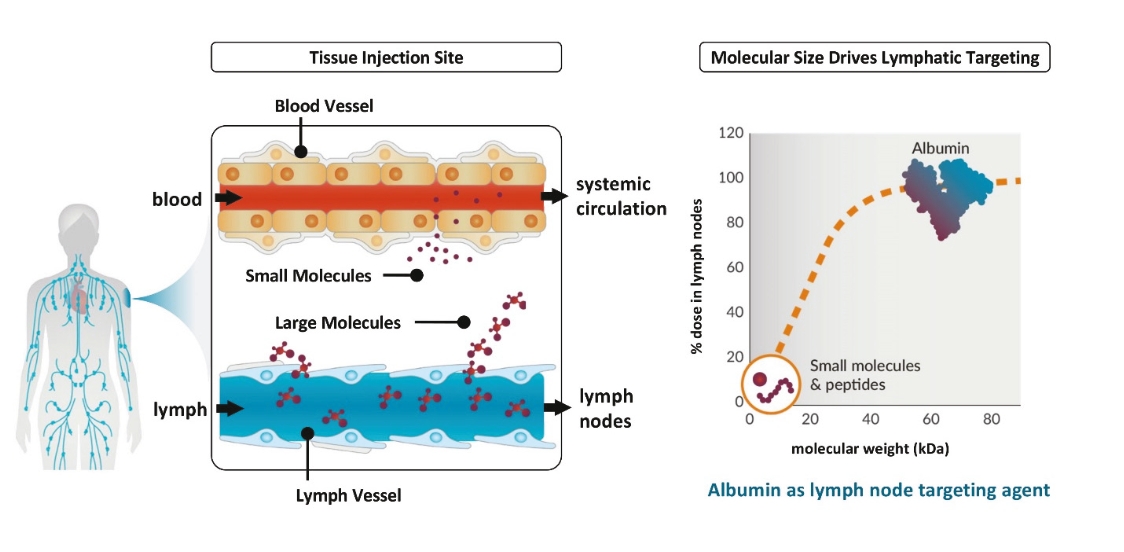

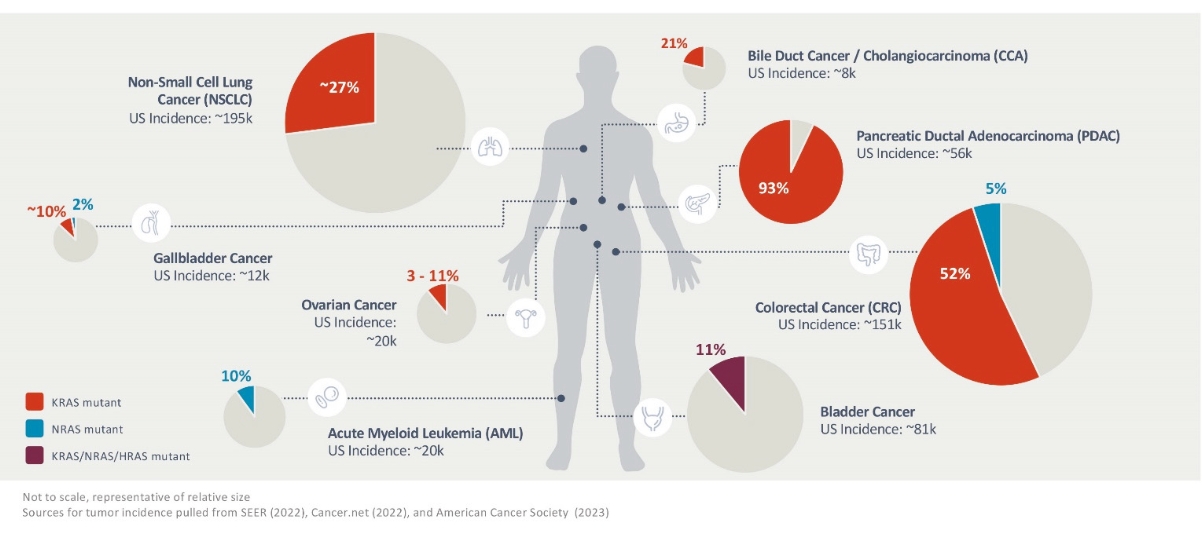

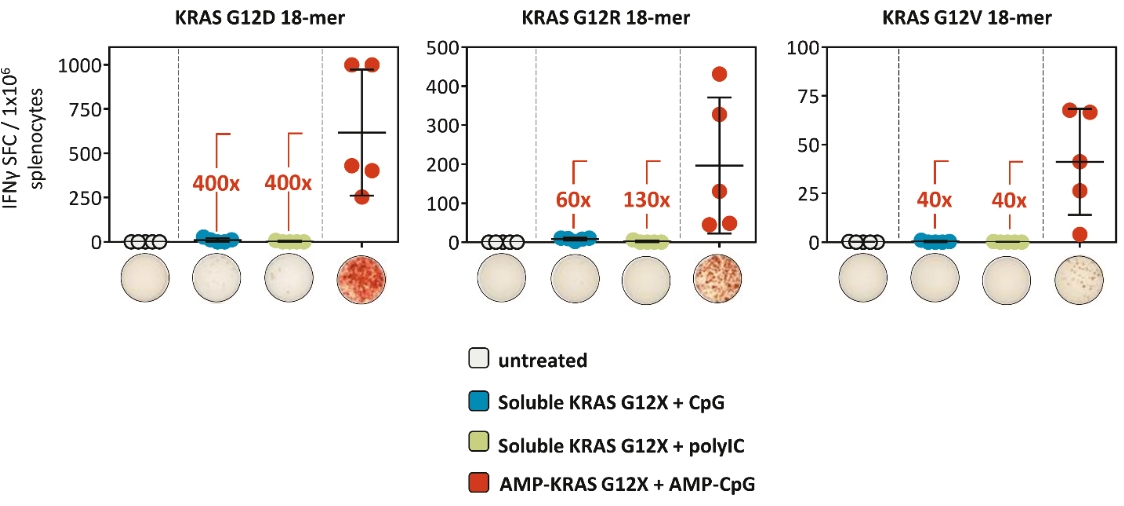

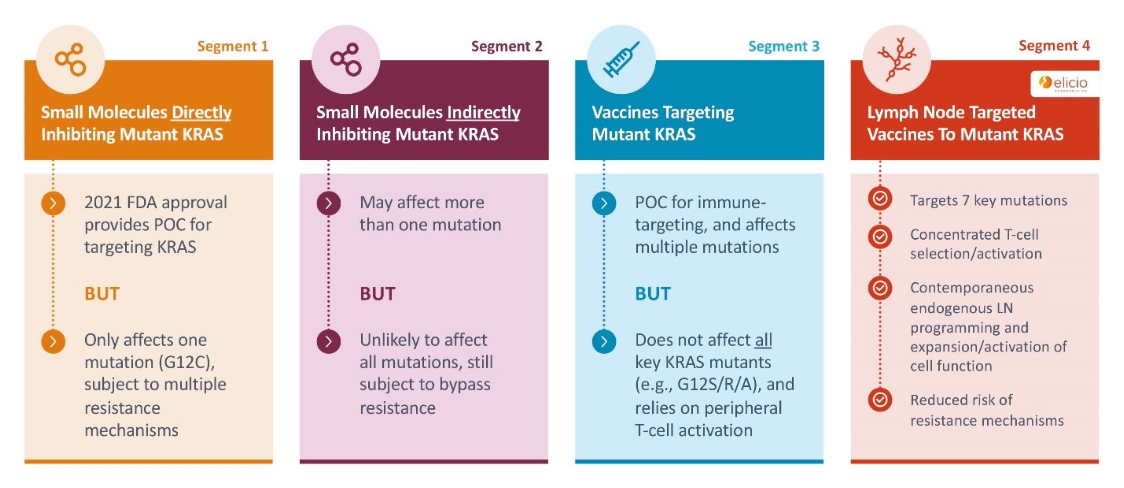

The Merger will result in a clinical-stage biopharmaceutical company

advancing Elicio’s proprietary lymph node-targeting Amphiphile (AMP) technology to develop immunotherapies, with a focus on ELI-002, a therapeutic cancer vaccine targeting mKRAS-driven tumors. For a discussion of Angion’s and Elicio’s

reasons for the Merger, please see the section titled “The Merger—Angion Reasons for the Merger” beginning on page 108 of this proxy statement/prospectus/information statement and “The Merger—Elicio Reasons for the Merger”

beginning on page 111 of this proxy statement/prospectus/information statement.

|

|

Q:

|

Why am I receiving this proxy statement/prospectus/information statement?

|

|

A:

|

You are receiving this proxy statement/prospectus/information statement

because you have been identified as a holder of Angion common stock as of the record date, or a stockholder of Elicio eligible to execute the Elicio written consent. If you are a common stockholder of Angion, you are entitled to vote

at the Angion special meeting, which has been called for the purpose of approving the following proposals:

|

|

1.

|

Proposal 1 - the issuance of shares of Angion capital stock pursuant to the Merger,

which will represent more than 20% of the shares of Angion common stock outstanding immediately prior to the Merger and result in a change of control of Angion, pursuant to Nasdaq Listing Rules 5635(a) and 5635(b), referred to as the

Stock Issuance Proposal;

|

|

2.

|

Proposal 2 - the amendment to the amended and restated certificate of incorporation

of Angion to effect a reverse stock split of Angion common stock at a ratio within the range between 5-for-1 to 30-for-1 (with such ratio to be mutually agreed upon by Angion and Elicio prior to the effectiveness of the Merger or, if

the Stock Issuance Proposal is not approved by Angion stockholders, at a ratio as determined solely by the Angion Board), referred to as the Reverse Stock Split Proposal;

|

|

3.

|

Proposal 3 - the amendment to the amended and restated certificate of incorporation

of Angion to provide for the exculpation of officers, referred to as the Exculpation Proposal;

|

|

4.

|

Proposal 4 - the election of the Angion Board’s nominees, Itzhak Goldberg, M.D.,

F.A.C.R. and Allen R. Nissenson, M.D., to the Angion Board in the class of directors to hold office until the 2026 Annual Meeting of Stockholders, referred to as the Director Election Proposal;

|

|

5.

|

Proposal 5 - the ratification of the selection of Moss Adams LLP as Angion’s

independent registered public accounting firm for the fiscal year ending December 31, 2023, referred to as the Accounting Firm Proposal; and

|

|

6.

|

Proposal 6 - the postponement or adjournment of the Angion special meeting, if

necessary, to solicit additional proxies if there are not sufficient votes in favor of the Stock Issuance Proposal and/or the Reverse Stock Split Proposal, referred to as the Adjournment Proposal.

|

|

Q:

|

What is required to consummate the Merger?

|

|

A:

|

To consummate the Merger, Angion’s common stockholders must approve the

Required Angion Closing Stockholder Matters (Proposal Nos. 1 and 2 above) and Elicio’s stockholders must approve the Elicio Stockholder Matters.

|

|

Q:

|

What will Elicio’s stockholders, option holders and warrant holders receive in the Merger?

|

|

A:

|

Each share of Elicio capital stock outstanding will be converted into

the right to receive a number of shares of Angion common stock calculated using the Exchange Ratio. Angion will assume outstanding and unexercised options to purchase shares of Elicio capital stock, and in connection with the Merger

such options will be converted into options

|

|

Q:

|

What will Angion’s stockholders and option holders receive in the Merger?

|

|

A:

|

At the Effective Time, Angion’s stockholders will continue to own and

hold their existing shares or options to purchase shares of Angion common stock.

|

|

Q:

|

Who will be the directors of Angion following the Merger?

|

|

A:

|

At the Effective Time, the combined company is expected to initially

have a nine-member board of directors, comprising (a) Robert Connelly, Julian Adams, Ph.D., Carol Ashe, Yekaterina (Katie) Chudnovsky, Daphne Karydas, and Assaf Segal, each as an Elicio designee and (b) Jay Venkatesan, M.D., MBA,

Karen J. Wilson, and Allen R. Nissenson, M.D., each as an Angion designee, until their respective successors are duly elected or appointed and qualified or their earlier death, resignation or removal. The aforementioned board of

directors will have an audit committee, a compensation committee and a nominating and corporate governance committee, in accordance with the rules of Nasdaq. All of Angion’s current directors other than Dr. Venkatesan, Karen J.

Wilson, and Allen R. Nissenson, M.D. are expected to resign from their positions as directors of Angion, effective upon the Effective Time.

|

|

Q:

|

Who will be the executive officers of Angion following the Merger?

|

|

A:

|

Immediately following the Merger, the executive management team of the

combined company is expected to comprise the following individuals with such additional officers as may be added by Elicio or the combined company:

|

|

Name

|

| |

Position with the Combined Company

|

| |

Current Position at Elicio

|

|

Robert Connelly

|

| |

Chief Executive Officer, President and Director

|

| |

Chief Executive Officer

|

|

|

| |

|

| |

|

|

Daniel Geffken

|

| |

Interim Chief Financial Officer

|

| |

Interim Chief Financial Officer

|

|

|

| |

|

| |

|

|

Christopher Haqq, M.D., Ph.D.

|

| |

Executive Vice President, Head of Research and Development and Chief Medical

Officer

|

| |

Executive Vice President, Head of Research and Development and Chief Medical

Officer

|

|

|

| |

|

| |

|

|

Annette Matthies, Ph.D.

|

| |

Chief Business Officer

|

| |

Chief Business Officer

|

|

|

| |

|

| |

|

|

Peter DeMuth, Ph.D.

|

| |

Chief Scientific Officer

|

| |

Chief Scientific Officer

|

|

Q:

|

As a stockholder of Angion, how does the Angion Board recommend that I vote?

|

|

A:

|

After careful consideration, the Angion Board unanimously recommends

that the holders of Angion common stock vote:

|

|

•

|

“FOR” Proposal 1 - the Stock Issuance Proposal;

|

|

•

|

“FOR” Proposal 2 - the Reverse Stock Split Proposal;

|

|

•

|

“FOR” Proposal 3 - the Exculpation Proposal.

|

|

•

|

“FOR” Proposal 4 - the election of the Angion Board’s nominees in the Director Election

Proposal;

|

|

•

|

“FOR” Proposal 5 - the Accounting Firm Proposal; and

|

|

•

|

“FOR” Proposal 6 - the Adjournment Proposal.

|

|

Q:

|

How many votes are needed to approve each proposal?

|

|

A:

|

Approval of each of the Stock Issuance Proposal, the Accounting Firm

Proposal, and the Adjournment Proposal requires the affirmative vote of the holders of a majority of the voting power of the shares outstanding on the record date for the Angion special meeting present in person, by remote

communication, or represented by proxy at the meeting and voting affirmatively or negatively (excluding abstentions and broker non-votes) on this matter.

|

|

Q:

|

As a stockholder of Elicio, how does the board of directors of Elicio recommend that I vote?

|

|

A:

|

After careful consideration, the Elicio Board unanimously recommends

that the Elicio stockholders execute the written consent indicating their vote in favor of the Elicio Stockholder Matters.

|

|

Q:

|

What risks should I consider in deciding whether to vote in favor of the Angion Proposals or to execute and

return the written consent, as applicable?

|

|

A:

|

You should carefully review the section of the proxy

statement/prospectus/information statement titled “Risk Factors,” which sets forth certain risks and uncertainties related to the

Merger, risks and uncertainties to which the combined company’s business will be subject, and risks and uncertainties to which each of Angion and Elicio, as an independent company, is subject.

|

|

Q:

|

When do you expect the Merger to be consummated?

|

|

A:

|

We anticipate that the Merger will be consummated during the second

quarter of 2023, soon after the Angion special meeting to be held on May 31, 2023 but we cannot predict the exact timing. For more information, please see the section titled “The Merger Agreement—Conditions to the Completion of the Merger” beginning on page 139 of

this proxy statement/prospectus/information statement.

|

|

Q:

|

What are the material U.S. federal income tax consequences of the Merger to U.S. holders of Elicio shares?

|

|

A:

|

Angion and Elicio intend the Merger to qualify as a reorganization

within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (Code), as described in the section titled “The Merger—Material U.S. Federal Income

Tax Consequences of the Merger” beginning on page 128 of this proxy statement/prospectus/information statement. If the Merger so qualifies, Elicio stockholders who are

U.S. holders (as defined in the section titled “The Merger—Material U.S. Federal Income Tax Consequences of the Merger” beginning

on page 128 of this proxy statement/prospectus/information statement) generally will not recognize gain or loss for U.S. federal income tax purposes on the receipt of shares of Angion common stock issued in

connection with the Merger. Each Elicio stockholder who is a U.S. holder who receives cash in lieu of a fractional share of Angion common stock generally will recognize capital gain or loss in an amount equal to the difference between

the amount of cash received in lieu of such fractional share and such Elicio stockholder’s tax basis allocable to such fractional share.

|

|

Q:

|

What are the material U.S. federal income tax consequences of the Reverse Stock Split to U.S. holders of

Angion shares?

|

|

A:

|

Angion intends to treat the Reverse Stock Split as a “recapitalization”

for U.S. federal income tax purposes. If it so qualifies, an Angion stockholder who is a U.S. holder (as defined in the section titled “Matters Being Submitted to a Vote of

Angion’s Stockholders—Proposal No. 2: Approval of an Amendment to the Amended and Restated Certificate of Incorporation of Angion

Effecting the Reverse Stock Split—Material U.S. Federal Income Tax Consequences of the Reverse Stock Split” beginning on page 167 of this proxy

statement/prospectus/information statement) should not recognize gain or loss upon the Reverse Stock Split (other than in respect of cash received in lieu of fractional shares). A U.S. holder’s aggregate tax basis in the shares of

Angion common stock received pursuant to the Reverse Stock Split should equal the aggregate tax basis of the shares of Angion common stock surrendered (excluding any portion of such basis that is allocated to any fractional share of

Angion common stock), and such U.S. holder’s holding period in the shares of Angion common stock received should include the holding period in the shares of Angion common stock surrendered. Treasury Regulations provide detailed rules

for allocating the tax basis and holding period of the shares of Angion common stock surrendered to the shares of Angion common stock received in a “recapitalization”. U.S. holders of shares of Angion common stock acquired on

different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

|

|

Q:

|

What do I need to do now?

|

|

A:

|

Angion and Elicio urge you to read this proxy

statement/prospectus/information statement carefully, including its annexes and information incorporated herein, and to consider how the Merger affects you.

|

|

Q:

|

When and where is the Angion special meeting? What must I do to attend the Angion special meeting?

|

|

A:

|

The Angion special meeting will be held exclusively online via live

audio-only webcast on May 31, 2023 at 9:00 a.m. Pacific Time. Online check-in will begin at 8:45 a.m. Pacific Time, and Angion encourages you to allow ample time for the online check-in procedures.

Please note that you will not be able to attend the Angion special meeting in person.

|

|

Q:

|

How are votes counted?

|

|

A:

|

Votes will be counted by the inspector of elections appointed for the

meeting, who will separately count votes “FOR” and “AGAINST,” abstentions and, if applicable, broker non-votes.

|

|

Q:

|

What are “broker non-votes”?

|

|

A:

|

Brokers who hold shares in street name for customers have the authority

to vote on “routine” proposals when they have not received instructions from beneficial owners. However, brokers are precluded from exercising their voting discretion with respect to approval of non-routine matters, and, as a result,

absent specific instructions from the beneficial owner of such shares, brokers are not empowered to vote those shares, referred to generally as “broker non-votes.” Broker non-votes, if any, will be treated as shares that are present

at the Angion special meeting for purposes of determining whether a quorum exists but will not have any effect for the purpose of voting on Proposal No. 1 (Stock Issuance Proposal), Proposal No. 4 (Director Election Proposal),

Proposal No. 5 (Accounting Firm Proposal) and Proposal No. 6 (Adjournment Proposal). Broker non-votes, if any, will have the same effect as “AGAINST” votes for Proposal No. 2 (Reverse Stock

Split Proposal) and Proposal No. 3 (Exculpation Proposal).

|

|

Q:

|

What will happen if I return my proxy form without indicating how to vote?

|

|

A:

|

If you submit your proxy form without indicating how to vote your

shares on any particular proposal, the common stock represented by your proxy will be voted as recommended by the Angion Board with respect to that proposal.

|

|

Q:

|

May I change my vote after I have submitted a proxy or voting instruction form?

|

|

A:

|

Angion’s common stockholders of record, other than those Angion

stockholders who are parties to voting agreements, may change their vote at any time before their proxy is voted at the Angion special meeting in one of following ways:

|

|

•

|

By sending a written notice to the Secretary of Angion stating that it would like to revoke its proxy.

|

|

•

|

By duly executing a subsequently dated proxy relating to the same shares of common stock and return it in the postage-paid

envelope provided or similar means, which subsequent proxy is received before the prior proxy is exercised at the Angion special meeting;

|

|

•

|

Duly submitting a subsequently dated proxy relating to the same shares of common stock by telephone or via the Internet

(i.e., your most recent duly submitted voting instructions will be followed) before 11:59 p.m. Eastern Time on May 30, 2023; and

|

|

•

|

By attending the Angion special meeting and voting such shares during the Angion special meeting.

|

|

Q:

|

Who is paying for this proxy solicitation?

|

|

A:

|

Angion will pay for the cost of printing and filing of this proxy

statement/prospectus/information statement and the proxy card. Arrangements will also be made with brokerage firms and other custodians, nominees and fiduciaries who are record holders of Angion common stock for the forwarding of

solicitation materials to the beneficial owners of Angion common stock. Angion will reimburse these brokers, custodians, nominees and fiduciaries for the reasonable out-of-pocket expenses they incur in connection with the forwarding

of solicitation materials. In addition, Angion has engaged Mackenzie Partners, Inc., a proxy solicitation firm, to solicit proxies from Angion’s stockholders for a fee of up to $9,500 plus certain additional costs associated with

solicitation campaigns. Fees paid to the SEC in connection with filing the statement/prospectus/information statement, and any amendments and supplements thereto, with the SEC will be paid by Angion.

|

|

Q:

|

What is the quorum requirement?

|

|

A:

|

A quorum of stockholders is necessary to hold a valid meeting. The

presence at the Angion special meeting, virtually or represented by proxy, of the holders of a majority of the voting power of the stock issued, outstanding and entitled to vote thereat, as of the record date, will constitute a quorum

for the transaction of business at the Angion special meeting.

|

|

Q:

|

Should Angion’s and Elicio’s stockholders send in their stock certificates now, to the extent they have any?

|

|

A:

|

No. After the Merger is consummated, Elicio’s stockholders will receive

written instructions from the exchange agent for exchanging their certificates representing shares of Elicio capital stock for certificates representing shares of Angion common stock. Each Elicio stockholder who otherwise would be

entitled to receive a fractional share of Angion common stock will be entitled to receive an amount in cash, without interest, determined by multiplying such fraction by the volume-weighted average closing trading price of a share of

Angion common stock on Nasdaq for the five consecutive trading days ending five trading days immediately prior to the date upon which the Merger becomes effective.

|

|

Q:

|

Who can help answer my questions?

|

|

A:

|

If you are a stockholder of Angion and would like additional copies,

without charge, of this proxy statement/prospectus/information statement or if you have questions about the Merger, including the procedures for voting your shares, you should contact Mackenzie Partners, Inc., Angion’s proxy

solicitor, by telephone, toll-free, at 1-800-322-2885 (toll-free), 212-929-5500 (call collect) or by email at Angion@mackenziepartners.com.

|

|

Name

|

| |

Position with the Combined Company

|

| |

Current Position at Elicio

|

|

Robert Connelly

|

| |

Chief Executive Officer, President and Director

|

| |

Chief Executive Officer

|

|

Daniel Geffken

|

| |

Interim Chief Financial Officer

|

| |

Interim Chief Financial Officer

|

|

Christopher Haqq, M.D., Ph.D.

|

| |

Executive Vice President, Head of Research and Development and Chief Medical

Officer

|

| |

Executive Vice President, Head of Research and Development and Chief Medical

Officer

|

|

Annette Matthies, Ph.D.

|

| |

Chief Business Officer

|

| |

Chief Business Officer

|

|

Peter DeMuth, Ph.D.

|

| |

Chief Scientific Officer

|

| |

Chief Scientific Officer

|

|

•

|

The Exchange Ratio is not adjustable based on the market price of Angion common stock so the consideration at the closing

of the Merger may have a greater or lesser value than at the time the Merger Agreement was signed;

|

|

•

|

Angion’s net cash may be less than $26.5 million at the Closing, which would result in Angion’s stockholders owning a

smaller percentage of the combined organization and, if Angion’s net cash is less than $25.0 million as of the End Date (as defined below), could even result in the termination of the Merger Agreement;

|

|

•

|

Failure to complete the Merger may result in Angion or Elicio paying a termination fee to the other party and could harm

the common stock price of Angion and future business and operations of each company;

|

|

•

|

If the conditions to the closing of the Merger are not met, the Merger may not occur;

|

|

•

|

Lawsuits have been filed, and additional lawsuits may be filed, relating to the Merger. An adverse ruling in any such

lawsuit may prevent the Merger from being consummated;

|

|

•

|

The Merger may be completed even though material adverse changes may result from the announcement of the Merger,

industry-wide changes and/or other causes;

|

|

•

|

Some executive officers and directors of Angion and Elicio have interests in the Merger that are different from the

respective stockholders of Angion and Elicio and that may influence them to support or approve the Merger without regard to the interests of the respective stockholders of Angion and Elicio;

|

|

•

|

The market price of Angion common stock following the Merger may decline as a result of the Merger;

|

|

•

|

Angion and Elicio securityholders will have a reduced ownership and voting interest in, and will exercise less influence

over the management of, the combined company following the closing of the Merger as compared to their current ownership and voting interest in the respective companies;

|

|

•

|

During the pendency of the Merger, Angion and Elicio may not be able to enter into a business combination with another

party at a favorable price because of restrictions in the Merger Agreement, which could adversely affect their respective businesses;

|

|

•

|

Certain provisions of the Merger Agreement may discourage third parties from submitting competing proposals, including

proposals that may be superior to the arrangements contemplated by the Merger Agreement;

|

|

•

|

Because the lack of a public market for Elicio capital stock makes it difficult to evaluate the fairness of the Merger, the

shareholders of Elicio may receive consideration in the Merger that is less than the fair market value of Elicio capital stock and/or Angion may pay more than the fair market value of Elicio’s capital stock;

|

|

•

|

The opinion delivered by Oppenheimer to the Angion Board prior to the entry into the Merger Agreement does not reflect

changes in circumstances that may have occurred since the date of the opinion;

|

|

•

|

The Financial Projections included in the section titled “The Merger—Certain Unaudited

Financial Projections,” which were considered by the Angion Board in evaluating the Merger and used by Oppenheimer in rendering its opinion and performing its related financial analyses, reflect numerous variables, estimates

and assumptions and are inherently uncertain. If any of these variables, estimates and assumptions prove to be wrong, such as the assumptions relating to the approval of Elicio’s product candidates, the actual results for Elicio’s

business may be materially different from the results reflected in the Financial Projections;

|

|

•

|

The Merger may fail to qualify as a reorganization for U.S. federal income tax purposes, resulting in recognition of

taxable gain or loss by Elicio stockholders who are U.S. Holders in respect of their Elicio capital stock;

|

|

•

|

The combined organization may become involved in securities class action litigation that could divert management’s

attention and harm the combined organization’s business and insurance coverage may not be sufficient to cover all costs and damages; and

|

|

•

|

If any of the events described in under the section titled “Risk Factors—Risks Related to

the Merger” occur, those events could cause the potential benefits of the Merger not to be realized.

|

|

•

|

Angion’s recent organizational changes and cost cutting measures may not be successful;

|

|

•

|

Angion may not be able to comply with Nasdaq’s continued listing standards;

|

|

•

|

Angion has temporarily suspended its clinical programs and has no products approved for sale, which makes it difficult to

assess its future viability;

|

|

•

|

To achieve Angion’s goals it will require substantial additional funding, which capital may not be available to Angion on

acceptable terms, or at all, and, if not so available, may require Angion to delay, limit, reduce or cease operations and

|

|

•

|

Adverse developments affecting the financial services industry, such as actual events or concerns involving liquidity,

defaults or non-performance by financial institutions could adversely affect Angion’ current financial condition and projected business operations.

|

|

•

|

Elicio has a history of operating losses that are expected to continue for the foreseeable future, and it is unable to

predict the extent of future losses, or whether it will generate significant revenues or achieve or sustain profitability;

|

|

•

|

Elicio will require substantial additional capital to finance its operations, and a failure to obtain this necessary

capital when needed on acceptable terms, or at all, could force it to delay, limit, reduce or terminate its research and development programs, commercialization efforts or cease operations;

|

|

•

|

Elicio has never generated revenue from product sales and may never become profitable;

|

|

•

|

Elicio’s product candidates are at an early stage of development and may not be successfully developed or commercialized;

|

|

•

|

The FDA regulatory approval process is lengthy, time-consuming, and inherently unpredictable, and Elicio may experience

significant delays in the clinical development and regulatory approval, if any, of its product candidates;

|

|

•

|

If any product candidate that Elicio successfully develops does not achieve broad market acceptance among physicians,

patients, health care payors and the medical community, the revenues that it generates from their sales will be limited; and

|

|

•

|

Elicio’s success will depend upon intellectual property and proprietary technologies, and it may be unable to protect its

intellectual property.

|

|

•

|

The combined company will need to raise additional financing in the future to fund its operations, which may not be

available to it on favorable terms or at all;

|

|

•

|

The market price of the combined company’s common stock is expected to be volatile, and the market price of the common

stock may drop following the Merger;

|

|

•

|

The combined company will incur costs and demands upon management as a result of complying with the laws, rules and

regulations affecting public companies; and

|

|

•

|

Anti-takeover provisions in the combined company’s charter documents and under Delaware law could make an acquisition of

the combined company more difficult and may prevent attempts by the combined company stockholders to replace or remove the combined company management.

|

|

•

|

upon termination of the Merger Agreement, Angion may be required to pay Elicio a termination fee of $2.0 million or

$1.0 million, under certain circumstances, and/or up to $500,000 in expense reimbursements; or Elicio may be required to pay Angion a termination fee of $1.0 million, under certain circumstances, and/or up to $500,000 in expense

reimbursements;

|

|

•

|

the parties will have incurred significant expenses related to the Merger, such as legal and accounting fees, which must be

paid even if the Merger is not completed;

|

|

•

|

the price of Angion’s common stock may decline and remain volatile; and

|

|

•

|

Angion may be forced to cease its operations, dissolve and liquidate its assets.

|

|

•

|

general business or economic conditions generally affecting the industry in which Elicio or Angion operate;

|

|

•

|

acts of war, the outbreak or escalation of armed hostilities, acts of terrorism, earthquakes, wildfires, hurricanes or other

natural disasters, health emergencies, including pandemics (including COVID-19 and any evolutions or mutations thereof) and related or associated epidemics, disease outbreaks or quarantine restrictions;

|

|

•

|

changes in financial, banking or securities markets;

|

|

•

|

any change in the stock price or trading volume of Angion common stock;

|

|

•

|

any failure by Angion to meet internal or analysts’ expectations or projections or the results of operations of Angion;

|

|

•

|

any change in or affecting clinical trial programs or studies conducted by or on behalf of Angion or its subsidiaries;

|

|

•

|

any change from continued losses from operations or decreases in cash balances of Elicio or any of its subsidiaries or on a

consolidated basis among Elicio and its subsidiaries;

|

|

•

|

any change in, or any compliance with or action taken for the purpose of complying with, any law or GAAP (or interpretations

of any law or GAAP); or

|

|

•

|

any change resulting from the announcement of the Merger Agreement or the pendency of the Contemplated Transactions;

|

|

•

|

the taking of any action required to be taken by the Merger Agreement; or

|

|

•

|

any reduction in the Angion’s cash and cash equivalents as a result of winding down its activities associated with the

termination of its research and development activities.

|

|

•

|

investors react negatively to the prospects of the combined company’s business and prospects following the closing of the

Merger;

|

|

•

|

the effect of the Merger on the combined company’s business and prospects following the closing of the Merger is not

consistent with the expectations of financial or industry analysts; or

|

|

•

|

the combined company does not achieve the perceived benefits of the Merger as rapidly or to the extent anticipated by

stockholders or financial or industry analysts.

|

|

•

|

a limited availability of market quotations for its securities;

|

|

•

|

reduced liquidity for its securities;

|

|

•

|

a determination that the combined company’s common stock is a “penny stock” which will require brokers trading in the

combined company’s common stock to adhere to more stringent rules and possibly result in a reduced level of trading activity in the secondary trading market for our securities;

|

|

•

|

a limited amount of news and analyst coverage; and

|

|

•

|

a decreased ability to issue additional securities or obtain additional financing in the future.

|

|

•

|

to maintain, expand and defend the scope of its intellectual property portfolio, including the amount and timing of any

payments Angion may be required to make, or Angion may receive, in connection with the licensing, filing, prosecution, defense and enforcement of any patents or other intellectual property rights, and

|

|

•

|

the costs associated with being a public company, including Angion’s need to implement additional internal systems and

infrastructure, including financial and reporting systems.

|

|

•

|

delays or difficulties in enrolling patients in clinical trials;

|

|

•

|

delays or difficulties in clinical site initiation, including difficulties in recruiting clinical site investigators and

clinical site staff;

|

|

•

|

diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as

Angion’s clinical trial sites and hospital staff supporting the conduct of its clinical trials;

|

|

•

|

interruption of key clinical trial activities, such as clinical trial site monitoring, due to limitations on travel imposed

or recommended by federal or state governments, employers and others or interruption of clinical trial subject visits and study procedures, the occurrence of which could affect the integrity of clinical trial data;

|

|

•

|

the risk that participants enrolled in Angion’s clinical trials will acquire COVID-19 while the clinical trial is ongoing,

which could impact the results of the clinical trial, including by increasing the number of observed adverse events;

|

|

•

|

limitations in employee resources that would otherwise be focused on the conduct of Angion’s clinical trials, including

because of sickness of employees or their families or the desire of employees to avoid contact with large groups of people;

|

|

•

|

delays in receiving authorizations from local regulatory authorities to initiate Angion’s planned clinical trials;

|

|

•

|

delays in clinical sites receiving the supplies and materials needed to conduct Angion’s clinical trials;

|

|

•

|

interruption in global shipping that may affect the transport of clinical trial materials, such as investigational drug

product used in Angion’s clinical trials;

|

|

•

|

changes in local regulations as part of a response to the COVID-19 pandemic which may require Angion to change the ways in

which Angion’s clinical trials are conducted, which may result in unexpected costs, or to discontinue the clinical trials altogether;

|

|

•

|

interruptions or delays in preclinical studies due to restricted or limited operations at Angion’s research and development

laboratory facilities or at its third-party clinical research organizations;

|

|

•

|

delays in necessary interactions with local regulators, ethics committees and other important agencies and contractors due to

limitations in employee resources or forced furlough of government employees; and

|

|

•

|

refusal of the FDA to accept data from clinical trials in affected geographies outside the United States.

|

|

•

|

a classified board of directors with three-year staggered terms, which may delay the ability of stockholders to change the

membership of a majority of the Angion Board;

|

|

•

|

no cumulative voting in the election of directors, which limits the ability of minority stockholders to elect director

candidates;

|

|

•

|

the exclusive right of the Angion Board to elect a director to fill a vacancy created by the expansion of the Angion Board or

the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on the Angion Board;

|

|

•

|

the ability of the Angion Board to authorize the issuance of shares of preferred stock and to determine the price and other

terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquiror;

|

|

•

|

the ability of the Angion Board to alter Angion’s amended and restated bylaws without obtaining stockholder approval;

|

|

•

|

the required approval of at least 66 2/3% of the shares entitled to vote at an election of directors to adopt, amend or

repeal Angion’s amended and restated bylaws or repeal the provisions of Angion’s amended and restated certificate of incorporation regarding the election and removal of directors;

|

|

•

|

a prohibition on stockholder action by written consent, which forces stockholder action to be taken at an annual or special

meeting of Angion’s stockholders;

|

|

•

|

the requirement that a special meeting of stockholders may be called only by Angion’s chief executive officer or president or

chairperson of the Angion Board or by the Angion Board directors, which may delay the ability of Angion’s stockholders to force consideration of a proposal or to take action, including the removal of directors; and

|

|

•

|

advance notice procedures stockholders must comply with in order to nominate candidates to the Angion Board or to propose

matters to be acted upon at a stockholders' meeting, which may discourage or deter a potential acquiror from conducting a solicitation of proxies to elect the acquiror's own slate of directors or otherwise attempting to obtain control

of Angion.

|

|

•

|

continuing to undertake preclinical and clinical development;

|

|

•

|

engaging in the development of product candidate formulations and manufacturing processes;

|

|

•

|

interacting with the applicable regulatory authorities and pursuing other required steps for regulatory approval;

|

|

•

|

engaging with payors and other pricing and reimbursement authorities;

|

|

•

|

submitting marketing applications to and receiving approval from the applicable regulatory authorities; and

|

|

•

|

manufacturing the applicable products and product candidates in accordance with regulatory requirements and, if ultimately

approved, conducting sales and marketing activities in accordance with health care, FDA and similar foreign regulatory authority laws and regulations.

|

|

•

|

Elicio’s ability to obtain additional funding to develop its product candidates;

|

|

•

|

Elicio’s ability to conduct and complete nonclinical studies and clinical trials,

|

|

•

|

delays in the commencement, enrollment and timing of clinical trials;

|

|

•

|

the success of Elicio’s nonclinical studies and clinical trials through all phases of development;

|

|

•

|

any delays in regulatory review and approval of product candidates in clinical development;

|

|

•

|

Elicio’s ability to obtain and maintain regulatory approval for its product candidates in the United States and foreign

jurisdictions;

|

|

•

|

potential toxicity and/or side effects of Elicio’s product candidates that could delay or prevent commercialization, limit

the indications for any approved products, require the establishment of risk evaluation and mitigation strategies, or cause an approved drug to be taken off the market;

|

|

•

|

Elicio’s ability to establish or maintain partnerships, collaborations, licensing or other arrangements;

|

|

•

|

market acceptance of Elicio’s product candidates, if approved;

|

|

•

|

competition from existing products, new products or new therapeutic approaches that may emerge;

|

|

•

|

the ability of patients or health care providers to obtain coverage of or sufficient reimbursement for Elicio’s products;

|

|

•

|

Elicio’s ability to leverage its proprietary AMP technology platform to discover and develop additional product candidates;

|

|

•

|

Elicio’s ability and its licensors’ abilities to successfully obtain, maintain, defend and enforce intellectual property

rights important to its business; and

|

|

•

|

potential product liability claims.

|

|

•

|

complete research and obtain favorable results from nonclinical and clinical development of Elicio’s current and future

product candidates, including addressing any clinical holds that may be placed on its development activities by regulatory authorities;

|

|

•

|

seek and obtain regulatory and marketing approvals for any of Elicio’s product candidates for which it completes clinical

trials, as well as their manufacturing facilities;

|

|

•

|

launch and commercialize any of Elicio’s product candidates for which it obtains regulatory and marketing approval by

establishing a sales force, marketing, and distribution infrastructure or, alternatively, collaborating with a commercialization partner;

|

|

•

|

qualify for coverage and establish adequate reimbursement by government and third-party payors for any of Elicio’s product

candidates for which it obtains regulatory and marketing approval;

|

|

•

|

develop, maintain, and enhance a sustainable, scalable, reproducible, and transferable manufacturing process for the product

candidates Elicio may develop;

|

|

•

|

establish and maintain supply and manufacturing capabilities or capacities internally or with third parties that can provide

adequate, in both amount and quality, products, and services to support clinical development and the market demand for any of Elicio’s product candidates for which it obtains regulatory and marketing approval;

|

|

•

|

obtain market acceptance of current or any future product candidates as viable treatment options and effectively compete with

other therapies to establish market share;

|

|

•

|

maintain a continued acceptable safety and efficacy profile of Elicio’s product candidates following launch;

|

|

•

|

address competing technological and market developments;

|

|

•

|

implement internal systems and infrastructure, as needed;

|

|

•

|

negotiate favorable terms in any collaboration, licensing, or other arrangements into which Elicio may enter and perform its

obligations in such collaborations;

|

|

•

|

maintain, protect, enforce, defend, and expand Elicio’s portfolio of intellectual property rights, including patents, trade

secrets, and know-how;

|

|

•

|

avoid and defend against third-party interference, infringement, and other intellectual property claims; and

|

|

•

|

attract, hire, and retain qualified personnel.

|

|

•

|

Elicio may be unable to generate sufficient nonclinical, toxicology, or other in vivo or in vitro data to support the

initiation of clinical trials;

|

|

•

|

regulators or IRBs or Independent Ethics Committees (IECs) may not authorize Elicio or its investigators to commence or

continue a clinical trial, conduct a clinical trial at a prospective trial site, or amend trial protocols, or may require that it modifies or amends its clinical trial protocols;

|

|

•

|

Elicio, regulators, independent data safety monitoring committees, IRBs or IECs, or its data monitoring committee(s) may

recommend or require the suspension or termination of clinical research for various reasons, including non-compliance with regulatory requirements or a finding that participants are being exposed to unacceptable health risks,

undesirable side effects, or a failure of the product candidate to demonstrate any benefit to subjects, or other unexpected characteristics (alone or in combination with other products) of the product candidate, or due to findings of

undesirable effects caused by a chemically or mechanistically similar therapeutic or therapeutic candidate;

|

|

•

|

new information may emerge regarding Elicio’s product candidates or technology platform that result in continued development

of some or all of its product candidates being deemed undesirable;

|

|

•

|

Elicio may have delays identifying, recruiting and training suitable clinical investigators or investigators may withdraw

from its studies;

|

|

•

|

Elicio may experience delays in reaching, or failing to reach, agreement on acceptable clinical trial contracts or clinical

trial protocols with prospective trial sites or contract research organizations (CROs). Contractual terms can be subject to extensive negotiation, may be subject to modification from time to time and may vary significantly among

different CROs and trial sites;

|

|

•

|

Elicio may have delays in adding new investigators or clinical trial sites, or it may experience a withdrawal of clinical

trial sites;

|

|

•

|

the number of patients required for clinical trials of Elicio’s product candidates may be larger than it anticipates,

enrollment in these clinical trials may be slower than it anticipates, or participants may drop out of these clinical trials or be lost to follow-up at a higher rate than it anticipates for a number of reasons, such as adverse events,

an inadequate treatment response, fatigue with the clinical trial process or personal issues;

|

|

•

|

patients who enroll in Elicio’s studies may misrepresent their eligibility or may otherwise not comply with clinical trial

protocols, resulting in the need to drop those patients from those studies, increase the needed enrollment size for those studies, or extend the duration of those studies;

|

|

•

|

there may be flaws in Elicio’s study design, which may not become apparent until a study is well advanced;

|

|

•

|

Elicio’s contractors may fail to comply with regulatory requirements or clinical trial protocols, or meet their contractual

obligations to it in a timely manner, or at all, or it may be required to engage in additional clinical trial site monitoring;

|

|

•

|

regulatory authorities or IRBs/IECs may disagree with the design, including endpoints, scope, or implementation of Elicio’s

clinical trials, or regulatory authorities may disagree with its intended indications;

|

|

•

|

regulatory authorities may disagree with the formulation for Elicio’s product candidates, or its product candidate dose or

dosing schedule;

|

|

•

|

Elicio may be unable to demonstrate to the satisfaction of regulatory authorities that a product candidate is safe, pure, and

potent for any indication;

|

|

•

|

regulatory authorities may not accept, or Elicio or its clinical trials may not meet the criteria required to submit,

clinical data from trials which are conducted outside of their jurisdictions;

|

|

•

|

the results of clinical trials may be negative or inconclusive, may not meet the level of statistical significance required

for, or may not otherwise be sufficient to support marketing approval, and Elicio may decide, or regulatory authorities may require it, to conduct additional clinical trials, analyses, reports, data, or nonclinical studies, or abandon

product development programs;

|

|

•

|

Elicio’s product candidates may have undesirable or unintended side effects, toxicities, or other characteristics that

preclude marketing approval or prevent or limit commercial use;

|

|

•

|

Elicio may be unable to demonstrate that a product candidate’s clinical and other benefits outweigh its safety risks or

otherwise provide an advantage over current standard of care (SOC) or current or future competitive therapies in development;

|

|

•

|

the standard of care for the indications Elicio is investigating may change, which changes could impact the meaningfulness of

its resulting study data or which may necessitate changes to its studies;

|

|

•

|

regulatory authorities may disagree with Elicio’s scope, design, including endpoints, implementation, or its interpretation

of data from nonclinical studies or clinical trials;

|

|

•

|

regulatory authorities may require Elicio to amend its studies, perform additional or unanticipated clinical trials or

nonclinical studies or manufacturing development work to obtain approval or initiate clinical trials, or it may decide to do so or abandon product development programs;

|

|

•

|

regulatory authorities may find that Elicio or its third-party manufacturers do not satisfy regulatory requirements and

standards for the facilities and operations used in the manufacture of its product candidates;

|

|

•

|

the cost of clinical trials of Elicio’s product candidates may be greater than it anticipates, or it may have insufficient

funds for a clinical trial or to pay the substantial user fees required by the FDA or other regulatory authorities upon the filing of a marketing application;

|

|

•

|

the supply or quality of Elicio’s product candidates or other materials necessary to conduct clinical trials of its product

candidates may be insufficient or inadequate;

|

|

•

|

regulatory authorities may take longer than Elicio anticipates to make a decision on its product candidates; or

|

|

•

|

changes in or the enactment of the approval policies, statutes, or regulations of the applicable regulatory authorities may

significantly change in a manner rendering Elicio’s nonclinical or clinical data insufficient for approval.

|

|

•

|

the FDA or comparable foreign regulatory authorities may disagree with the design or implementation of Elicio’s clinical

trials;

|

|

•

|

the population studied in the clinical program may not be sufficiently broad or representative to assure safety in the full

population for which Elicio seeks approval;

|

|

•

|

Elicio may be unable to demonstrate that its product candidates’ risk-benefit ratios for their proposed indications are

acceptable;

|

|

•

|

the results of clinical trials may not meet the level of statistical significance required by the FDA or comparable foreign

regulatory authorities for approval;

|

|

•

|

Elicio may be unable to demonstrate that the clinical and other benefits of its product candidates outweigh their safety

risks;

|

|

•

|

the FDA or comparable foreign regulatory authorities may disagree with Elicio’s interpretation of data from nonclinical

studies or clinical trials;

|

|

•

|

the data collected from clinical trials of Elicio’s product candidates may not be sufficient to the satisfaction of the FDA

or comparable foreign regulatory authorities to support the submission of a BLA or other comparable submission in foreign jurisdictions or to obtain regulatory approval in the United States or elsewhere;

|

|

•

|

the FDA or comparable foreign regulatory authorities may fail to approve the manufacturing processes, Elicio’s own

manufacturing facilities, or a third-party manufacturer’s facilities with which it contracts for clinical and commercial supplies; and

|

|

•

|

the approval policies or regulations of the FDA or comparable foreign regulatory authorities may significantly change in a

manner rendering Elicio’s clinical data insufficient for approval.

|

|

•

|

Elicio’s platform may not be successful in identifying additional product candidates;

|

|

•

|

Elicio may not be able or willing to assemble sufficient resources to acquire or discover additional product candidates;

|

|

•

|

Elicio’s product candidates may not succeed in nonclinical or clinical testing;

|

|

•

|

a product candidate may upon further study demonstrate harmful side effects or other characteristics that indicate it is

unlikely to be effective or otherwise does not meet applicable regulatory criteria;

|

|

•

|

competitors may develop alternatives that render Elicio’s product candidates obsolete or less attractive;

|

|

•

|

product candidates Elicio develops may nevertheless be covered by third parties’ patents or other exclusive rights;

|

|

•

|

the market for a product candidate may change during Elicio’s program so that the continued development of that product

candidate is no longer reasonable;

|

|

•

|

a product candidate may not be capable of being produced in commercial quantities at an acceptable cost, or at all; and

|

|

•

|

a product candidate may not be accepted as safe and effective by patients, the medical community or third-party payors, if

applicable.

|

|

•

|

the development of ELI-002 may be delayed because it may be difficult to identify patients for enrollment in Elicio’s

clinical trials in a timely manner;

|

|

•

|

ELI-002 may not receive marketing approval if its safe and effective use depends on a companion diagnostic and none is

commercially available; and

|

|

•

|

Elicio may not realize the full commercial potential of ELI-002 if it receives marketing approval if, among other reasons, it

is unable to appropriately identify patients or types of tumors with the specific genetic alterations targeted by these product candidates.

|

|

•

|

the number of clinical trials for other product candidates in the same therapeutic area that are currently in clinical

development, and Elicio’s ability to compete with such trials for subjects and clinical trial sites;

|

|

•

|

the severity of the disease under investigation and the existence of current treatments;

|

|

•

|

the perceived risks and benefits of the product candidate, including the potential advantages or disadvantages of the product

candidate being studied in relation to other available therapies;

|

|

•

|

the subject eligibility criteria defined in the protocol, as well as Elicio’s ability to compensate subjects for their time

and effort;

|

|

•

|

the size and nature of the patient population;

|

|

•

|

the proximity and availability of clinical trial sites for prospective subjects;

|

|

•

|

the design of the trial, including factors such as frequency of required assessments, length of the study and ongoing

monitoring requirements;

|

|

•

|

subjects’ and investigators’ ability to comply with the specific instructions related to the trial protocol, proper

documentation, and use of the product candidate;

|

|

•

|

Elicio’s ability to recruit clinical trial investigators with the appropriate competencies and experience;

|

|

•

|

patient referral practices of physicians and the effectiveness of publicity created by clinical trials sites regarding the

trial;

|

|

•

|

the ability to adequately monitor subjects during and after treatment and compensate them for their time and effort;

|

|

•

|

the ability of Elicio’s clinical study sites, CROs, and other applicable third parties to facilitate timely enrollment;

|

|

•

|

the ability of clinical trial sites to enroll subjects that meet all inclusion criteria and any patient exclusion due to

erroneous enrollment;

|

|

•

|

Elicio’s ability to obtain and maintain subject informed consents; and

|

|

•

|

the risk that subjects enrolled in clinical trials will drop out of the trials before completion of the study or not return

for post-study follow-up, especially subjects in control groups.

|

|

•

|

regulatory authorities may withdraw or limit their approvals of such products;

|

|

•

|

regulatory authorities may require the addition of labeling statements, specific warnings or contraindications;

|

|

•

|

Elicio may be required to create a REMS plan, which could include a medication guide outlining the risks of such side effects

for distribution to patients, a communication plan for health care providers, and/or other elements to assure safe use;

|

|

•

|

Elicio may be required to change the way such products are distributed or administered, or change the labeling of the

products;

|

|

•

|

the FDA or a comparable foreign regulatory authority may require Elicio to conduct additional clinical trials or costly

post-marketing testing and surveillance to monitor the safety and efficacy of the products;

|

|

•

|

Elicio may decide to recall such products from the marketplace after they are approved;

|

|

•

|

Elicio could be sued and held liable for harm caused to individuals exposed to or taking its products; and

|

|

•

|

Elicio’s reputation may suffer.

|

|

•

|

loss of revenue from decreased demand for Elicio’s products and/or product candidates;

|

|

•

|

impairment of Elicio’s business reputation or financial stability;

|

|

•

|

incurred costs and time of related litigation;

|

|

•

|

substantial monetary awards to patients or other claimants, and loss of revenue;

|

|

•

|

diversion of management attention;

|

|

•

|

withdrawal of clinical trial participants and potential termination of clinical trial sites or entire clinical programs;

|

|

•

|

the inability to commercialize Elicio’s product candidates;

|

|

•

|

significant negative media attention;

|

|

•

|

decrease in Elicio’s stock price;

|

|

•

|

initiation of investigations, and enforcement actions by regulators; and/or

|

|

•

|

product recalls, withdrawals, revocation of approvals, or labeling, marketing or promotional restrictions.

|

|

•

|

the efficacy of Elicio’s products and the prevalence and severity of any adverse events;

|

|

•

|

any potential advantages or disadvantages when compared to alternative treatments;

|

|

•

|

interactions of Elicio’s products with other medicines patients are taking and any restrictions on the use of its products

together with other medications;

|

|

•

|

the clinical indications for which the products are approved and the approved claims that Elicio may make for the products;

|

|

•

|

limitations or warnings contained in the product’s FDA-approved labeling, including potential limitations or warnings for

such products that may be more restrictive than other competitive products;

|

|

•

|

changes in the standard of care for the targeted indications for such product candidates, which could reduce the marketing

impact of any claims that Elicio could make following approval, if obtained;

|

|

•

|

the safety, efficacy, and other potential advantages over alternative treatments, such as relative convenience and ease of

administration of such products, and the availability of alternative treatments already used or that may later be approved;

|

|

•

|

cost of treatment versus economic and clinical benefit in relation to alternative treatments or therapies;

|

|

•

|

the availability of formulary coverage and adequate coverage or reimbursement by third parties, such as insurance companies

and other health care payors, and by U.S. and international government health care programs, including Medicaid and Medicare;

|

|

•

|

the price concessions required by third-party payors and government health care programs to obtain coverage and payment;

|

|

•

|

the extent and strength of Elicio’s marketing and distribution of such products;

|

|

•

|

distribution and use restrictions imposed by the FDA and equivalent foreign regulatory authorities with respect to such

products or to which Elicio agrees, for instance, as part of a REMS or voluntary risk management plan;

|

|

•

|

the timing of market introduction of such products, as well as competitive products;

|

|

•

|

Elicio’s ability to offer such products for sale at competitive prices;

|

|

•

|

Elicio’s ability to offer programs to facilitate market acceptance and insurance coverage from public and private insurance

companies, provide patient assistance, and transition patient coverage;

|

|

•

|

the willingness of the target patient population to try new therapies and of physicians to prescribe these therapies;

|

|

•

|

the extent and strength of Elicio’s third-party manufacturer and supplier support;

|

|

•

|

the approval of other new products, including biosimilar products that may be priced at a substantially lower price than

Elicio expects to offer its product candidates for, if approved;

|

|

•

|

adverse publicity about the product or favorable publicity about competitive products;

|

|

•

|

the success of any efforts to educate the medical community and third-party payors regarding Elicio’s products, which efforts

may require significant resources and may not be successful; and

|

|

•

|

potential product liability claims.

|

|

•

|

Elicio’s inability to recruit and retain adequate numbers of effective sales, marketing, reimbursement, customer service,

medical affairs, and other support personnel;

|

|

•

|

the inability of sales personnel to obtain access to physicians to discuss Elicio’s products;

|

|

•

|

the inability of reimbursement professionals to negotiate arrangements for formulary access, reimbursement, and other

acceptance by payors, and to secure adequate coverage;

|

|

•

|

reduced realization on government sales from mandatory discounts, rebates and fees, and from price concessions to private

health plans and pharmacy benefit managers necessitated by competition for access to managed formularies;

|

|

•

|

the clinical indications for which the products are approved and the claims that Elicio may make for the products, as well as

any limitations on use or warnings;

|

|

•

|

the costs associated with training sales and marketing personnel on legal and regulatory compliance matters and monitoring

their actions, and any liability for sales or marketing personnel who fail to comply with the applicable legal and regulatory requirements;

|

|

•

|

restricted or closed distribution channels that make it difficult to distribute Elicio’s products to different segments of

the patient population;

|

|

•

|

the lack of complementary medicines to be offered by sales personnel, which may put Elicio at a competitive disadvantage

relative to companies with more extensive product lines; and

|

|

•

|

unforeseen costs and expenses associated with creating an independent commercialization organization.

|

|

•

|

they are incident to a physician’s services;

|

|

•

|

they are reasonable and necessary for the diagnosis or treatment of the illness or injury for which they are administered

according to accepted standards of medical practice; and

|

|

•

|

they have been approved by the FDA and meet other requirements of the statute.

|

|

•

|

pending patent applications may not result in any patents being issued;

|

|

•

|

patents that may be issued or in-licensed may be challenged, invalidated, modified, revoked, circumvented, found to be

unenforceable, or otherwise may not provide barriers to entry or any competitive advantage;

|

|

•

|

because of the extensive time required for development, testing and regulatory review of a potential product, it is possible

that before a potential product can be commercialized, any related patent may expire, or remain in existence for only a short period following commercialization, reducing or eliminating any advantage of the patent;

|

|

•

|

Elicio’s competitors, many of which have substantially greater resources than it or its partners do, and many of which have

made significant investments in competing technologies, may seek, or may already have sought or obtained, patents that will limit, interfere with, or eliminate Elicio’s ability to make, use, and sell its potential products;

|

|

•

|

there may be significant pressure on the U.S. government and other international governmental bodies to limit the scope of

patent protection both inside and outside the United States for disease treatments that prove successful as a matter of public policy regarding worldwide health concerns;

|

|

•

|

countries other than the United States may have patent laws less favorable to patentees than those upheld by United States