dibs-202212310001600641false2022FY0.333300016006412022-01-012022-12-3100016006412022-06-30iso4217:USD00016006412023-02-16xbrli:shares00016006412022-12-3100016006412021-12-31iso4217:USDxbrli:shares00016006412021-01-012021-12-3100016006412020-01-012020-12-3100016006412019-12-310001600641us-gaap:CommonStockMember2019-12-310001600641us-gaap:AdditionalPaidInCapitalMember2019-12-310001600641us-gaap:RetainedEarningsMember2019-12-310001600641us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001600641us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001600641us-gaap:RetainedEarningsMember2020-01-012020-12-310001600641us-gaap:CommonStockMember2020-01-012020-12-310001600641us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-3100016006412020-12-310001600641us-gaap:CommonStockMember2020-12-310001600641us-gaap:AdditionalPaidInCapitalMember2020-12-310001600641us-gaap:RetainedEarningsMember2020-12-310001600641us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001600641us-gaap:CommonStockMember2021-01-012021-12-310001600641us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001600641us-gaap:RetainedEarningsMember2021-01-012021-12-310001600641us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001600641us-gaap:CommonStockMember2021-12-310001600641us-gaap:AdditionalPaidInCapitalMember2021-12-310001600641us-gaap:RetainedEarningsMember2021-12-310001600641us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001600641us-gaap:CommonStockMember2022-01-012022-12-310001600641us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001600641us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001600641us-gaap:RetainedEarningsMember2022-01-012022-12-310001600641us-gaap:CommonStockMember2022-12-310001600641us-gaap:AdditionalPaidInCapitalMember2022-12-310001600641us-gaap:RetainedEarningsMember2022-12-310001600641us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001600641us-gaap:IPOMember2021-06-142021-06-140001600641us-gaap:IPOMember2021-06-140001600641us-gaap:OverAllotmentOptionMember2021-06-142021-06-1400016006412021-06-142021-06-1400016006412021-06-14dibs:segment0001600641us-gaap:LetterOfCreditMember2022-12-310001600641dibs:DesignManagerMember2022-06-292022-06-290001600641us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001600641dibs:ComputerEquipmentAndSoftwareMember2022-01-012022-12-310001600641us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-01-012022-12-3100016006412022-06-012022-12-31dibs:reporting_unit00016006412022-01-012022-05-310001600641us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001600641us-gaap:TrademarksAndTradeNamesMembersrt:MinimumMember2022-01-012022-12-310001600641us-gaap:TrademarksAndTradeNamesMembersrt:MaximumMember2022-01-012022-12-310001600641us-gaap:TechnologyBasedIntangibleAssetsMember2022-01-012022-12-310001600641us-gaap:OtherIntangibleAssetsMember2022-01-012022-12-31xbrli:pure00016006412022-09-012022-09-300001600641us-gaap:CostOfSalesMember2022-01-012022-12-310001600641us-gaap:SellingAndMarketingExpenseMember2022-01-012022-12-310001600641us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001600641us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-3100016006412022-01-0100016006412021-05-252021-05-250001600641dibs:FranklinPotterAssociatesIncMember2019-05-020001600641dibs:FranklinPotterAssociatesIncMember2019-05-022019-05-020001600641dibs:DesignManagerMember2022-06-290001600641dibs:FranklinPotterAssociatesIncMember2022-01-012022-12-310001600641dibs:SellerMarketplaceServicesMember2022-01-012022-12-310001600641dibs:SellerMarketplaceServicesMember2021-01-012021-12-310001600641dibs:SellerMarketplaceServicesMember2020-01-012020-12-310001600641us-gaap:ServiceOtherMember2022-01-012022-12-310001600641us-gaap:ServiceOtherMember2021-01-012021-12-310001600641us-gaap:ServiceOtherMember2020-01-012020-12-310001600641us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-12-310001600641us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-12-310001600641us-gaap:LeaseholdImprovementsMember2022-12-310001600641us-gaap:LeaseholdImprovementsMember2021-12-310001600641us-gaap:FurnitureAndFixturesMember2022-12-310001600641us-gaap:FurnitureAndFixturesMember2021-12-310001600641dibs:ComputerEquipmentAndSoftwareMember2022-12-310001600641dibs:ComputerEquipmentAndSoftwareMember2021-12-310001600641us-gaap:ConstructionInProgressMember2022-12-310001600641us-gaap:ConstructionInProgressMember2021-12-310001600641us-gaap:CustomerRelationshipsMember2021-01-012021-12-310001600641us-gaap:CustomerRelationshipsMember2021-12-310001600641us-gaap:TechnologyBasedIntangibleAssetsMember2021-01-012021-12-310001600641us-gaap:TechnologyBasedIntangibleAssetsMember2021-12-310001600641us-gaap:TrademarksAndTradeNamesMember2021-01-012021-12-310001600641us-gaap:TrademarksAndTradeNamesMember2021-12-310001600641us-gaap:OtherIntangibleAssetsMember2021-12-310001600641dibs:ShareBasedPaymentArrangementOptionsOutstandingMember2022-12-310001600641dibs:ShareBasedPaymentArrangementOptionsOutstandingMember2021-12-310001600641us-gaap:RestrictedStockUnitsRSUMember2022-12-310001600641us-gaap:RestrictedStockUnitsRSUMember2021-12-310001600641dibs:ShareBasedPaymentArrangementOptionsReservedForFutureIssuanceMemberdibs:StockIncentivePlan2021Member2022-12-310001600641dibs:ShareBasedPaymentArrangementOptionsReservedForFutureIssuanceMemberdibs:StockIncentivePlan2021Member2021-12-310001600641dibs:ShareBasedPaymentArrangementEmployeeStockReservedForFutureIssuanceMember2022-12-310001600641dibs:ShareBasedPaymentArrangementEmployeeStockReservedForFutureIssuanceMember2021-12-310001600641dibs:ShareBasedPaymentArrangementOptionNewEmployeesMemberdibs:OptionPlan2011Member2022-01-012022-12-310001600641dibs:ShareBasedPaymentArrangementOptionNewEmployeesMemberdibs:OptionPlan2011Member2021-05-012021-05-310001600641dibs:ShareBasedPaymentArrangementOptionNewEmployeesMemberdibs:OptionPlan2011Memberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-05-012021-05-310001600641dibs:ShareBasedPaymentArrangementOptionNewEmployeesMemberdibs:OptionPlan2011Memberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2022-01-012022-12-310001600641dibs:ShareBasedPaymentArrangementOptionOthersMemberdibs:OptionPlan2011Member2022-01-012022-12-310001600641dibs:OptionPlan2011Member2021-02-012021-02-280001600641dibs:StockIncentivePlan2021Member2022-12-310001600641dibs:StockIncentivePlan2021Member2022-01-012022-12-310001600641dibs:ShareBasedPaymentArrangementOptionPerformanceBasedMember2021-01-012021-12-310001600641us-gaap:ShareBasedCompensationAwardTrancheOneMemberdibs:ShareBasedPaymentArrangementOptionPerformanceBasedMember2021-01-012021-12-310001600641us-gaap:ShareBasedCompensationAwardTrancheTwoMemberdibs:ShareBasedPaymentArrangementOptionPerformanceBasedMember2021-01-012021-12-310001600641us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001600641us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001600641us-gaap:EmployeeStockMember2022-12-310001600641us-gaap:EmployeeStockMember2022-01-012022-12-310001600641us-gaap:CostOfSalesMember2021-01-012021-12-310001600641us-gaap:CostOfSalesMember2020-01-012020-12-310001600641us-gaap:SellingAndMarketingExpenseMember2021-01-012021-12-310001600641us-gaap:SellingAndMarketingExpenseMember2020-01-012020-12-310001600641dibs:TechnologyDevelopmentExpenseMember2022-01-012022-12-310001600641dibs:TechnologyDevelopmentExpenseMember2021-01-012021-12-310001600641dibs:TechnologyDevelopmentExpenseMember2020-01-012020-12-310001600641us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310001600641us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-12-310001600641us-gaap:DomesticCountryMember2022-12-310001600641us-gaap:StateAndLocalJurisdictionMember2022-12-310001600641us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001600641us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001600641us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001600641us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001600641us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001600641us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001600641us-gaap:WarrantMember2022-01-012022-12-310001600641us-gaap:WarrantMember2021-01-012021-12-310001600641us-gaap:WarrantMember2020-01-012020-12-310001600641us-gaap:RedeemableConvertiblePreferredStockMember2022-01-012022-12-310001600641us-gaap:RedeemableConvertiblePreferredStockMember2021-01-012021-12-310001600641us-gaap:RedeemableConvertiblePreferredStockMember2020-01-012020-12-310001600641us-gaap:UnfavorableRegulatoryActionMember2022-12-310001600641us-gaap:UnfavorableRegulatoryActionMember2021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 333-256188

1stdibs.com, Inc

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | | 94-3389618 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

51 Astor Place, 3rd Floor New York, New York |

| 10003 |

(Address of Principal Executive Offices) | | (Zip Code) |

(212) 627-3927

Registrant's telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | DIBS | The Nasdaq Stock Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

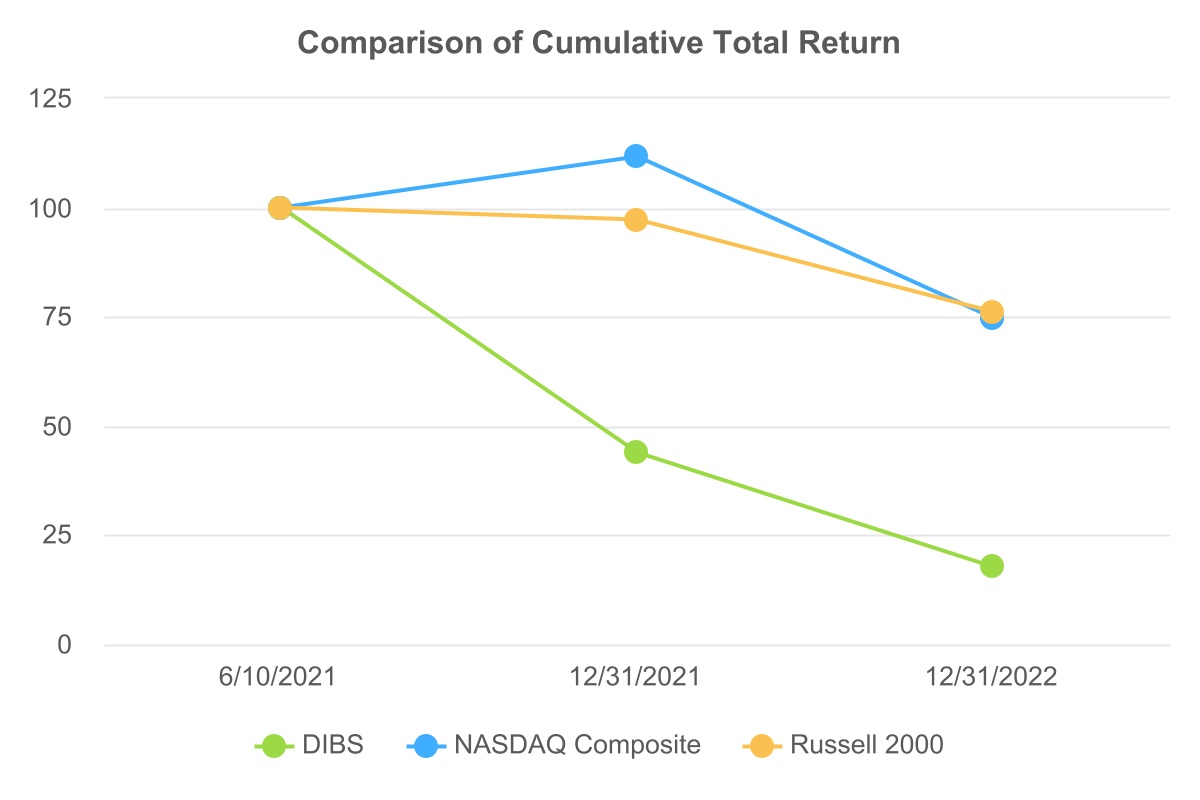

The aggregate market value of voting stock held by non-affiliates of the Registrant on June 30, 2022, based on the closing price of $5.69 for shares of the Registrant’s common stock as reported by the Nasdaq Stock Market, was approximately $131.6 million. Shares of common stock beneficially owned by each executive officer, director, and holder of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of February 16, 2023, the registrant had 39,268,171 shares of common stock, $0.01 par value per share outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement related to its 2023 Annual Stockholders' Meeting to be filed subsequently are incorporated by reference into Part III of this Form 10-K. Except as expressly incorporated by reference, the registrant's proxy statement shall not be deemed to be part of this report.

TABLE OF CONTENTS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements that involve substantial risks and uncertainties. Any statements contained in this Annual Report on Form 10-K that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “can,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “target,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” and “ongoing,” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the information expressed or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

•our future financial performance, including our expectations regarding our net revenue, cost of revenue, operating expenses, and our ability to achieve and maintain future profitability;

•our ability to effectively manage or sustain our growth and to effectively expand our operations, including internationally;

•our strategies, plans, objectives and goals;

•the market demand for the products offered on our online marketplace, including vintage, antique, and contemporary furniture, home décor, jewelry, watches, art, and fashion, new and authenticated luxury design products in general, and the online market for these products;

•our ability to compete with existing and new competitors in existing and new markets;

•our ability to attract and retain sellers and buyers;

•our ability to increase the supply of luxury design products offered through our online marketplace;

•our ability to timely and effectively scale our operations;

•our ability to enter international markets;

•our ability to successfully implement, launch, and achieve market acceptance of our non-fungible token (“NFT”) platform and to anticipate and manage the risks associated therewith;

•our ability to successfully implement, launch, and achieve market acceptance of our 1stDibs Auctions offering and to anticipate and manage the risks associated therewith

•our ability to develop and protect our brand;

•our ability to comply with laws and regulations;

•our expectations regarding outstanding litigation;

•our expectations and management of future growth;

•our expectations concerning relationships with third parties;

•economic and industry trends, projected growth, or trend analysis;

•our estimated market opportunity;

•our ability to add capacity, capabilities, and automation to our operations;

•the increased expenses associated with being a public company;

•the effect of the COVID-19 pandemic on our business and operations;

•our ability to maintain, protect, and enhance our intellectual property rights and successfully defend against claims of infringement, misappropriation, or other violations of third-party intellectual property;

•the availability of capital to grow our business;

•our ability to successfully defend any future litigation brought against us;

•our ability to implement, maintain, and improve effective internal controls;

•potential changes in laws and regulations applicable to us or our sellers, or our sellers’ ability to comply therewith; and

•the amount of time for which we expect our cash balances and other available financial resources to be sufficient to fund our operations.

These forward-looking statements reflect our management’s beliefs and views with respect to future events and are based on estimates and assumptions as of the date of this Annual Report on Form 10-K and are subject to risks and uncertainties. You should refer to the section titled “Risk Factors” included under Part I, Item 1A below and elsewhere in this Annual Report on Form 10-K, as well as in our other filings with the Securities and Exchange Commission (the “SEC”), for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report on Form 10-K will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified timeframe, or at all. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Annual Report on Form 10-K. While we believe that such information provides a reasonable basis for these statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on them.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance, or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. Such forward-looking statements relate only to events as of the date of this Annual Report on Form 10-K. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report on Form 10-K to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this Annual Report on Form 10-K and the documents that we reference and have filed as exhibits with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in this Annual Report on Form 10-K by these cautionary statements.

RISK FACTOR SUMMARY

The following risk factor summary should be read together with the more detailed discussion of risks and uncertainties set forth in the “Risk Factors” section of this report.

•Our history of operating losses and ability to achieve or maintain profitability in the future, which could negatively impact our financial condition and our stock price;

•Fluctuations in our quarterly and annual net revenue and results of operations, which could cause our stock price to fluctuate and the value of your investment to decline;

•Our historical growth, which may not be indicative of our future growth;

•Our ability to generate a sufficient volume of listings of luxury design products on our online marketplace or to accurately vet the authenticity of these products, which could impact our business, brand, and reputation;

•Our ability to maintain the authenticity of the items listed and sold through our online marketplace, which could cause our business, brand, and reputation to suffer;

•Risks associated with claims that items listed on our online marketplace are counterfeit, infringing, hazardous, or illegal, or otherwise subject to regulation or cultural patrimony considerations;

•Risks associated with liability for fraudulent or unlawful activities of sellers who list items on our online marketplace, which could cause our business, brand, and reputation to suffer;

•Our ability to attract and maintain an active community of sellers and buyers, which could impact our growth;

•Our reliance, in part, on sellers to provide a positive experience to buyers;

•Our ability to compete effectively;

•Real or perceived inaccuracies in our metrics and market estimates used to evaluate our performance, which may harm our reputation and negatively affect our business;

•Our ability to successfully expand our business model to encompass additional categories of luxury design products in a timely and cost-effective manner;

•The COVID-19 pandemic, which has impacted, and may continue to impact, our business, key metrics, and results of operations in volatile and unpredictable ways;

•Risks associated with our recently launched NFT platform, including the regulatory, legal, reputational, commercial, technical, marketing, operational, and other risks related to successfully launching and profitably operating our NFT platform;

•Our ability to maintain and promote our brand and reputation, which could impact our business, market position, and future growth;

•Risks related to acquisitions, which may divert management’s attention and/or prove to be unsuccessful;

•Risks related to further expansion into markets outside of the United States;

•Our ability to successfully protect our intellectual property;

•Risks associated with the disclosure of sensitive information about our sellers and buyers or other third parties with whom we transact business, or cyber-attacks against us or our third-party providers, which could result in curtailed use of our online marketplace, exposure to liability, and reputational damage;

•Risks related to regulatory matters and litigation;

•Risks related to the impact of and focus on Environmental, Social, and Governance (“ESG”) matters

•Risks related to our operations as a public company;

•Risks related to our internal control over financial reporting and our disclosure controls and procedures; and

•Risks related to our common stock, including that an active trading market for our common stock may not develop or be sustained and that the price of our common stock may be volatile.

PART I

Item 1. Business

Company Overview

We are one of the world’s leading online marketplaces for connecting design lovers with many of the best sellers and makers of vintage, antique, and contemporary furniture, home décor, jewelry, watches, art, and fashion. We believe we are a leading online marketplace for these luxury design products based on the aggregate number of such listings on our online marketplace and our Gross Merchandise Value (“GMV”). Our thoroughly vetted seller base, in-depth marketing content, and custom-built technology platform create trust in our brand and facilitate high-consideration purchases of luxury design products online. By disrupting the way these items are bought and sold, we are both expanding access to, and growing the market for, luxury design products.

1stDibs began over two decades ago with the vision of bringing the magic of the Paris flea market online by creating a listings site for top vintage and antique furniture sellers. The quality of our initial seller base enabled us to build a reputation in the design industry as a trusted source for unique luxury design products. Since then, we have strengthened our brand and deepened our seller relationships. We launched our e-commerce platform in 2013 and transitioned to a full e-commerce marketplace model in 2016. As of December 31, 2022, we operate an e-commerce marketplace with approximately 7,300 seller accounts, compared to over 4,700 as of December 31, 2021. The increase in sellers reflects our launch of new seller pricing tiers in January 2022, including a subscription-free tier with higher commission rates. As of December 31, 2022, we had 5.5 million users compared to 4.3 million as of December 31, 2021 and approximately 1.5 million listings, compared to 1.3 million as of December 31, 2021. Users represent non-seller visitors who register on our website and include both buyers and prospective buyers. As of December 31, 2022, we had a seller stock value in excess of $16.0 billion compared to a seller stock value in excess of $14.0 billion as of December 31, 2021. Our seller stock value is the sum of the stock value of all available products listed on our online marketplace. An individual listing’s stock value is calculated as the item’s current price multiplied by its quantity available for sale.

We provide our sellers, the vast majority of which are small businesses, access to a global community of buyers and a platform to facilitate e-commerce at scale. Our sellers use our platform to manage their inventory, build their digital marketing presence, and communicate and negotiate orders directly with buyers. We provide our buyers a trusted purchase experience with our user-friendly interface, dedicated specialist support, and 1stDibs Promise, our comprehensive buyer protection program. We operate an asset-light business model which allows us to scale in a capital efficient manner. While we enable shipping and fulfillment logistics, we do not take physical possession of the items sold on our online marketplace.

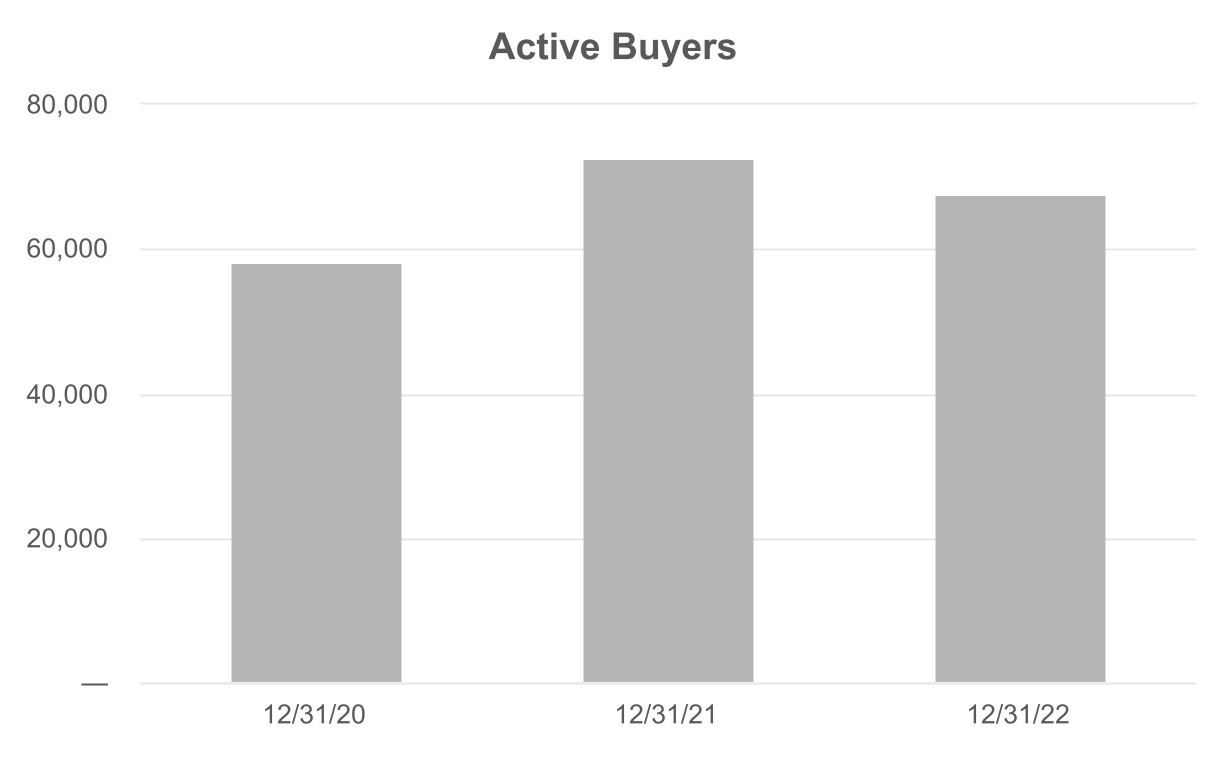

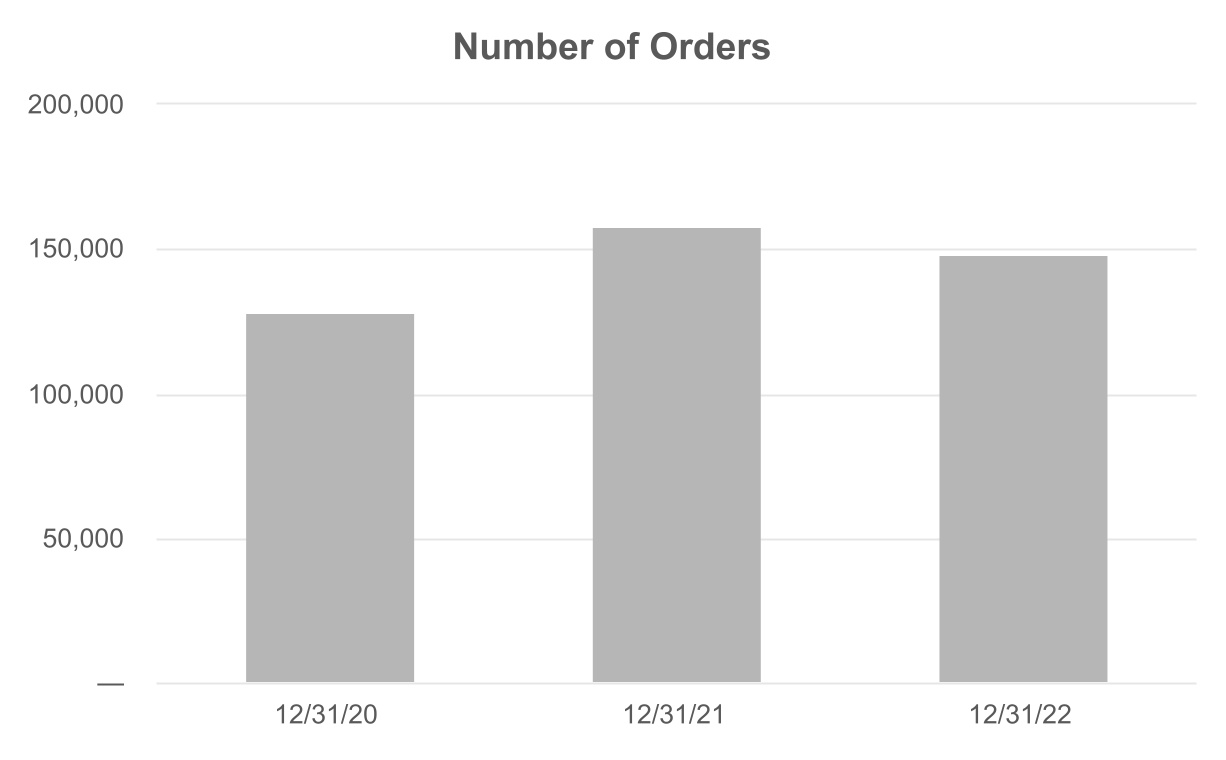

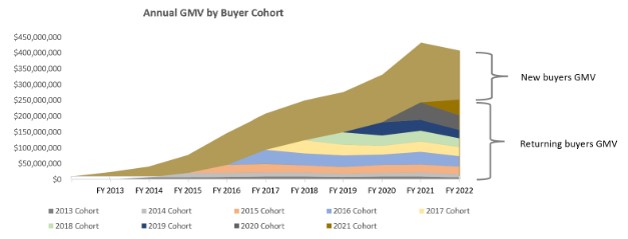

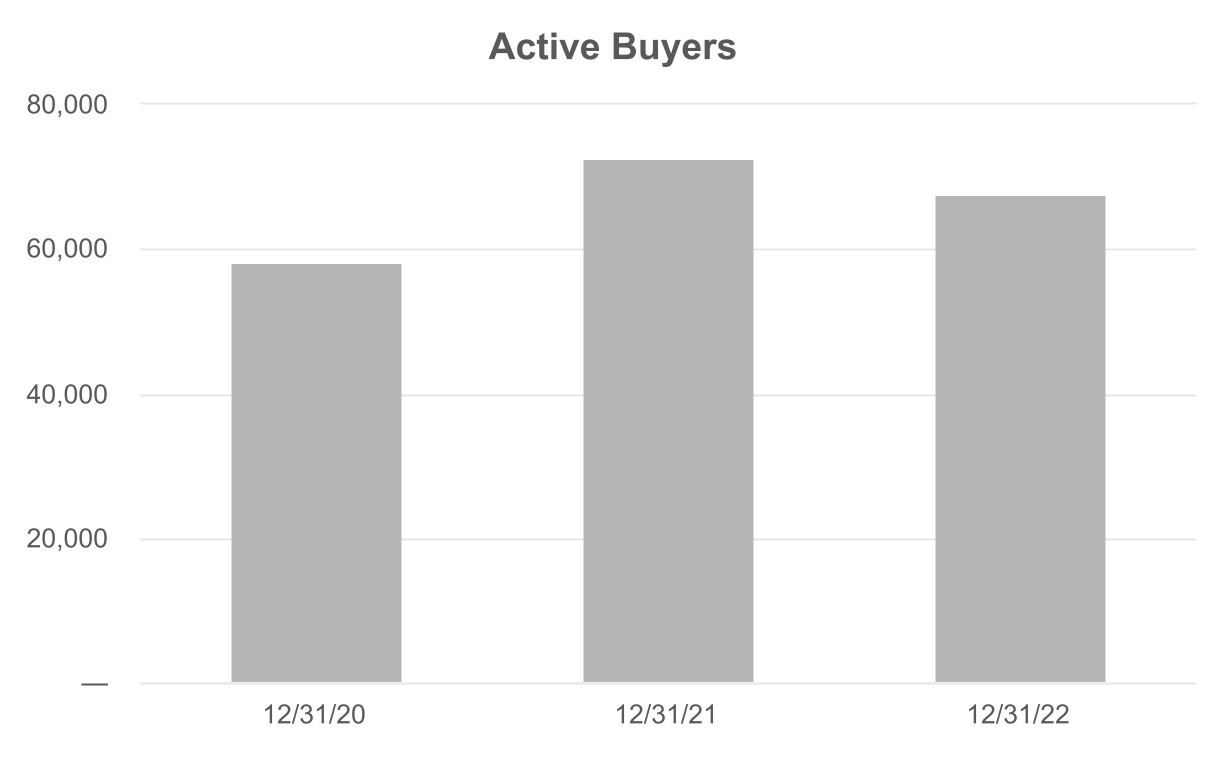

The uniqueness, diversity, and high quality of the products on our online marketplace, together with an active marketing effort, have produced a large, global, and growing base of design-loving buyers. Our user-friendly interface, dedicated specialist support, and 1stDibs Promise enable a trusted purchase experience. Despite the growth on the seller and user side, we experienced year-over-year decreases in GMV, net revenue, and certain key buyer metrics as they have been negatively impacted, both directly and indirectly, by macroeconomic factors, including significant capital market volatility, the prolonged COVID-19 pandemic and the changing consumer behaviors as a result, significant housing market volatility, raising interest rates, global economic and geopolitical developments, and inflation; however, these impacts are difficult to isolate and quantify. During the year ended December 31, 2022, we had approximately 68,000 Active Buyers, compared to approximately 72,000 in the year ended December 31, 2021. We define Active Buyers as buyers who have made at least one purchase through our online marketplace during the 12 months ended on the last day of the period presented, net of cancellations. We plan to continue to invest in our strategic initiatives, including those discussed below, in order to continue to drive growth on the seller side and be prepared for if and when macroeconomic conditions improve.

In each of the years ended December 31, 2022 and 2021, we had an on-platform average order value (“AOV”) of above $2,700 and a median order value (“MOV”) of approximately $1,300. We do not focus on AOV or MOV as key metrics in evaluating our business given our priority to make unique, high-end design items across various price points available through our online marketplace. The percentage of Active Buyers who make more than one purchase in any given year has been generally consistent from year to year and comprised of approximately 30% of total Active Buyers in each of the years ended December 31, 2022 and 2021. Highly experienced interior designers, whom we refer to as Trade Buyers, are frequent, repeat purchasers on our online marketplace and accounted for 32% and 29% of our on-platform GMV in the years ended December 31, 2022 and 2021, respectively. Through our Trade 1st program, we offer these Trade Buyers, who comprise a subset of our buyers, additional benefits such as trade-only personalized support, exclusive trade pricing, and buyer incentives. Our Trade 1st program is a buyer-only program and members do not pay any fees to participate in this program.

As our online marketplace has scaled, we have created powerful network effects, with better supply attracting more buyers and more buyers encouraging high-quality sellers to join and remain on our platform. Once in motion, the flywheel effect of this network enhances both seller and buyer quality, which we believe drives a competitive advantage.

We are driving consumer demand for luxury design products online by providing global access to a traditionally fragmented, local, and offline market. As sellers and buyers of luxury design products gain experience transacting online, we believe our combination of technology, service, and brand positions us to enable and grow this market by providing sellers and buyers the tools and access they need.

Our proprietary technology platform enables a purchase funnel that is more robust and interactive than the conventional e-commerce experience. The discovery and transaction process in our industry is more complex than in most e-commerce categories. Specifically, transacting in unique luxury design products requires the ability for sellers and buyers to exchange messages, negotiate prices, arrange customized shipping support, and pay swiftly and securely through various payment methods. Our platform turns this complex order flow into an easy-to-use process and converts the valuable data we collect from buyers’ browsing and purchase activity into actionable insights for both sellers and buyers. We empower buyers to engage directly with sellers on our platform throughout all stages of a transaction. Our technology and data represent the cumulative experience of 20 years of business activity, and we believe are extremely difficult to replicate.

Our Market Opportunity

We connect sellers and buyers in what has historically been a fragmented and highly localized global market for unique luxury design products. This market has generally operated offline, functioning mostly through independent galleries, boutiques, and auction houses, thereby restricting a seller’s potential buyer audience and limiting a buyer’s product selection. These offline operations create barriers to both new supply and new demand, limiting the market’s overall growth potential.

We created a single online marketplace that consolidates previously fragmented sellers and buyers on a global scale. We believe our online marketplace, powered by our technology platform, has transformed almost all dimensions of the luxury design buying experience by increasing accessibility and enhancing selection and convenience.

Global Luxury Market

Our core market, including high-quality design furniture and homewares, fine art, and watches and jewelry, was estimated to be approximately $178 billion in 2022, according to Bain & Company. Our platform is built on a scalable infrastructure that allows us to enter adjacent luxury markets and expand our addressable market with minimal additional investment. The personal luxury goods market, as defined by Bain & Company, excluding watches and jewelry, was estimated to total approximately $260 billion in 2022 and includes adjacent categories, such as footwear, leather goods, apparel, and beauty.

Combining our core market of high-quality design furniture and homewares, fine art, and watches and jewelry with the personal luxury goods market (excluding watches and jewelry), results in an estimated total addressable market size of $438 billion as of 2022.

Expanding the Luxury Goods Market

While the global luxury design market is already large, we believe that as a digital disruptor we have the potential to further expand the overall size of our market. We believe we are growing the market by: (1) increasing the number of digital global luxury design sellers by enabling them to transact on a global online marketplace that materially expands their potential customer base; and (2) growing the luxury design buyer base by introducing our online audience to unique products previously only accessible via in-person galleries, boutiques, and auction houses. In the year ended December 31, 2022, we launched new seller pricing tiers, including a subscription-free tier with higher commission rates which increased our seller count to approximately 7,300 from over 4,700 as of December 31, 2021, as well as launched localized sites in Germany and France. Additionally, in November 2021 we introduced 1stDibs Auctions, and for the year ended December 31, 2022 auction orders comprised approximately 5% of total orders. We were able to grow these metrics in the year ended December 31, 2022, despite the macroeconomic issues effecting GMV and net revenue.

As we reinvent how buyers discover and engage with luxury design products, we have found that we are attracting a new and broader audience to our market. We have sold items on our online marketplace ranging from less than $100 to over $1 million, demonstrating that high-end luxury design products are attainable and within reach of the expanding buyer audience we are attracting to the market.

Increasing Online Penetration

One of the most significant trends driving online penetration in the luxury goods market is an increasingly digitally native customer base. Bain & Company estimates that online personal luxury goods purchases will continue to grow, reaching up to 30% of total sales by 2025. According to Bain & Company, Gen-Y and Gen-Z, born during 1981-1995 and 1996-2015, respectively, are expected to account for 65-70% of luxury spend by 2025. Spending by Gen-Z and Gen-Alpha, born during 1996-2015 and kids born after 2016, respectively, will grow three times faster than previous generations, making up one third of purchases in the luxury goods market by 2030. These generations are leading the shift from offline to online commerce and will soon dominate the luxury goods market’s customer base.

During the year ended December 31, 2022, traffic on our website grew 16% from the year ended December 31, 2021. Additionally, the number of seller accounts grew to approximately 7,300 from over 4,700 as of December 31, 2021. We believe these metrics are proof of the increasing online penetration in the luxury goods market, despite the macroeconomic issues effecting GMV and net revenue.

The 1stDibs Marketplace

Trust

Trust is at the core of the online marketplace that we have built in over two decades of operating history. Trust in our online marketplace is critical to facilitating online transactions of highly considered purchases with high price points. During each of the years ended December 31, 2022 and 2021, over 20% of our on-platform GMV was generated from orders with an item value above $15,000 and approximately 4% and 3% for orders with an item value of $100,000 or more for the years ended December 31, 2022 and 2021, respectively. Our thorough seller vetting process inspires buyer confidence in our sellers and in the quality of the luxury design products sold on 1stDibs. Extensive fraud protection and secure payment solutions further establish the trust sellers and buyers have in our online marketplace. The ability for buyers to interact and negotiate prices directly with sellers increases both on-platform conversion and buyer retention rate. Our 1stDibs Promise gives our buyers peace of mind with every purchase by providing the following features and commitments:

•A community of thoroughly vetted sellers from around the world to ensure high-quality products;

•Confidence at checkout with multiple secure payment options and a comprehensive fraud protection and prevention program;

•Customer service support from dedicated specialists to answer questions, assist with orders, and stand ready to resolve any transaction or technical issues throughout the buying process;

•Worry-free cancellations within 24 hours;

•The ability to work with both parties in the event a buyer receives an item that is different than described or has been damaged in transit to resolve the issue;

•A price-match guarantee to ensure that if a buyer finds a 1stDibs seller that has the same item for a lower price elsewhere, 1stDibs will match it; and

•Enablement of a seamless and transparent global end-to-end shipping, logistics and delivery experience focused on security and a high level of care.

Value Proposition to Sellers

•Demand Generation: As of December 31, 2022, we provided sellers access to a global base of approximately 5.5 million users in over 150 countries, who would otherwise largely be inaccessible in an offline market. We built 1stDibs to empower and inspire confidence in our sellers by using our proprietary technology to digitize and transform their businesses. We believe that creating a digital presence and enabling access to buyers across the globe allows us to expand the addressable market for luxury sellers. Expanding a seller’s ability to share its story across various forms of media, including text, photographs, and videos, significantly increases buyer engagement and conversion. Once sellers are added to our online catalog, we help build sellers’ online presence through editorial and social placements, including our online magazine Introspective, which offers sellers additional avenues through which to advertise online. Our integration with Apple News also allows a broader audience of users to discover 1stDibs.

•Online Presence: We help sellers establish an online presence on our online marketplace. Sellers can customize their listings on 1stDibs by uploading biographies, item descriptions, photos, videos, and content to distinguish themselves. This allows sellers to provide nuanced details about each piece, show scale and curate their inventory to feature specific items. Sellers can make changes at their discretion at any time. This information provides more context about our sellers’ listings and builds trust with our buyer community. As sellers increase sales they are potentially more able to tap into our platform benefits, such as partner managers, elevated listing visibility, and paid media coverage.

•Data Analytics: Our platform provides us with rich data throughout the entire user journey. This data allows sellers to offer more relevant products and optimize their pricing strategies, which enables them to efficiently scale their businesses. We provide sellers with a comprehensive suite of seller tools, education, and analytics,

including reporting, tracking, and inside perspectives on pricing based on the historical sales of similar items. Sellers also benefit from our proprietary algorithms and targeting technologies to connect with both consumers and Trade Buyers.

•Listing & Pricing: We empower sellers with tools useful for them to control item pricing and item visibility on our online marketplace. Sellers can leverage our proprietary classification methodologies and structured data to create listings tailored to their inventory. We have created a pricing index, “1stDibs Insider,” which provides pricing guidance to our sellers based on historical pricing trends. By providing historical pricing data for similar items that have recently sold, we believe this help sellers price items more competitively. On our platform, sellers can set item pricing based on user type (Consumer vs. Trade) or a specific user (Private Listing). We also provide sellers purchase format flexibility beyond the standard list price model. Sellers can choose to list items without price using the “Price Upon Request” purchasing format, or allow buyers to bid on their favorite items with 1stDibs Auctions. Furthermore, sellers can review, accept, or counter-offer negotiation requests, or create “Private Offers” for prospective buyers and “Automated Private Offers” (preset and triggered by buyer behavior).

•Operational Efficiency: Our sellers can efficiently scale their businesses without the friction associated with in-person sales and multiple third-party platforms. The ability to offer a convenient, seamless transaction experience, including on-platform communications and a wide range of payment solutions, such as credit card, PayPal, ACH, wire, Apple Pay, and Klarna further drives buyer conversion. We maximize search engine optimization to help buyers find items and connect with our sellers, allowing them to purchase products tailored to their tastes and preferences with ease. We have assembled a robust network of logistics providers to help sellers fulfill orders at a lower cost, giving them an advantage relative to conventional offline sales and allowing them to focus more time on what they do best: curating and selling unique luxury design items. Sellers have the ability to request custom quotes, offer free or partial shipping, opt into shipping services that we help enable, and access tracking details via the platform. Using our platform, sellers can also select to subsidize the shipping cost and pass on savings to buyers.

Value Proposition to Buyers

We provide buyers with tools to communicate directly with sellers, receive quick responses, negotiate prices, and access multiple payment methods for a convenient checkout experience. We curate our buyers’ experience to target their specific tastes and preferences and provide them with design inspiration through our expertly merchandised collections and our online editorial publications. Our platform calculates a “salability” score for items using machine learning and gives items with a higher likelihood of selling increased priority in buyers’ search and browse sort order. Additionally, our platform offers pricing insights to show buyers historical pricing data for similar items that have recently sold which can help buyers negotiate, increase confidence, and help in decision-making. Our customized Private Client and Trade Service teams provide high-touch human support for consumer and Trade Buyers. Our buyer services include:

•Buyer-Seller Communication: Given the unique inventory available on our online marketplace and the relatively high price points, buyers are likely to have questions regarding origin and item attributes. We have developed tools to facilitate communication between sellers and buyers and have added incentives for sellers to respond quickly. The majority of our sellers respond to inquiries in less than two hours. Negotiation is a common purchase format in our verticals; Buyers can negotiate via the “Make Offer” experience, and also receive a personalized “Private Offer” after initiating a conversation with a seller or “favoriting” an item. Additionally, buyers have the option to bid on items listed with 1stDibs Auctions.

•Mobile: During the year ended December 31, 2022, the majority of user sessions came to our online marketplace via a mobile device, either by browsing our mobile site or by using our highly rated mobile app. The bulk of our users are browsing via our mobile site. Our mobile app users take advantage of app-specific features, including local shopping, personalized notifications, and the ability to “see” items in their homes via our augmented reality feature. While mobile app sessions only make up approximately 5% of total sessions during the year ended December 31, 2022, they accounted for approximately 16% of total order volume.

•Personalization: We collect rich data around our users’ preferences, site engagement, item and seller attributes, buyers’ browsing patterns and purchase behaviors. As a result, we are able to curate our buyers’ experience to target their specific tastes and preferences. We use this data to personalize our marketing efforts and listing suggestions. These include alerts when new items from followed creators are listed, item recommendations, discovery feeds, and highly contextual emails. This personalization improves user engagement. We provide high-touch human support for Consumer and Trade Buyers through our customized Private Client and Trade teams, which further enhances the buying process.

•Curated Assortment: We are a highly sought after destination for unique, high-quality luxury design products. Thoroughly vetting all sellers on our online marketplace supports our buyers’ desire for quality and curation, thereby reducing their search time and purchase risk. We provide buyers with design inspiration through our expertly merchandised collections and our online editorial publication Introspective.

•Quality of Experience: Unlike conventional offline alternatives, we offer our buyers convenient 24/7 access to approximately 1.5 million luxury design products. Multiple possible payment methods offer our buyers a convenient checkout experience compared to traditional offline retail channels by removing complexity and introducing transparency to the purchasing process. We allow buyers to transact securely from their homes, bypassing the complicated and time-intensive process, and often opaque pricing associated with traditional offline channels. Our valuable buyer base also appreciates the privacy and anonymity associated with purchasing products online through our marketplace. Our Price-Match Guarantee further increases purchasing confidence, as buyers are assured they will always transact at the lowest price. In addition, we provide additional benefits to Trade Buyers, including trade exclusive pricing, buyer incentives, priority support, sourcing expertise, and enhanced buyer protection, among others through our Trade 1st program. Our client service associates help ensure the satisfaction of sellers and buyers by addressing and assisting in the resolution of questions relating to orders, deliveries, returns, and disputes. For certain individual Consumers or Trade Buyer, respectively, we provide support at the individual level through our Private Client and Trade Services to provide a seamless buying process.

Our Competitive Strengths

Largest Selection of Unique Luxury Design Products

We offer one of the largest online selection of luxury design products from leading sellers and makers of vintage, antique, and contemporary furniture, home décor, jewelry, watches, art, and fashion. We believe our growing collection of approximately 1.5 million luxury design products is unmatched and makes us the premier destination for design lovers and enthusiasts. Luxury design products tend to retain value over time as a result of their scarcity and durability. We aggregate supply from a large number of globally distributed sellers, offering buyers an online destination to access a variety of luxury products across the globe. As of December 31, 2022 and December 31, 2021, we had approximately 41% and 40% of our listings located outside the United States, respectively. The percentage of our seller accounts based outside of the United States was 51% and 47% as of December 31, 2022 and December 31, 2021, respectively.

Brand History Built on Trust and Authenticity

We have built a digitally native brand that is synonymous with luxury design by earning credibility with sellers and building buyer trust and loyalty in our brand and online marketplace. This trust is built through a seamless buying and selling experience, backed by years of excellence and an industry-leading vetting process. Our vetting specialists complete an evaluation of each seller prior to being accepted by 1stDibs. These specialists are highly trained, experienced experts in art, design, jewelry, among other areas, and conduct due diligence on each seller. This vetting process helps to ensure that our buyers can continue to purchase items on our online marketplace with confidence as we grow.

Highly Engaged Buyer Community

Our online marketplace appeals to a broad range of design lovers across multiple income groups, geographies, and age groups. Our diverse group of buyers appreciate the value of high-quality luxury products and want a convenient and secure way to complete these highly considered product purchases. Our Active Buyers had 81 and 80 sessions and viewed 289 and 237 product pages, on average, during the years ended December 31, 2022 and December 31, 2021, respectively. Our marketing content, combined with our expert curation and merchandising, helps buyers navigate through approximately 1.5 million luxury design products.

Seamless Purchasing Experience

We deliver a seamless luxury experience in a digital environment. We pioneered a two-sided communication functionality that allows sellers and buyers to negotiate directly through our platform’s message center. Our buyers also have access to dedicated sales and client service teams to ensure a smooth, convenient, and personalized buying experience. As ambassadors of 1stDibs, our sales team interacts with high potential trade accounts and Private Clients to identify sales opportunities and to educate them on our service offerings. Buyers enjoy the flexibility of accessing our platform across devices and choosing among a wide range of payment options and purchase formats, such as Negotiation, Auction, or Private Offer. Additionally, we have assembled a global network of logistics providers to allow our sellers to ship products virtually anywhere in the world.

Powerful Network Effects

We created powerful network effects by leveraging our proprietary data and technology with better supply attracting more buyers and more buyers encouraging high-quality sellers to join and remain on our online marketplace. Once in motion, the

flywheel of this network enhances both seller and buyer quality and drives a competitive advantage. Having more buyers on our marketplace increases the sale potential for our sellers, causing them to list more inventory and focus more time on 1stDibs buyers. This value cycle serves as a barrier to entry against potential competition. This network effect has driven tremendous value to all parties and made 1stDibs one of the largest luxury design online marketplaces in the world with increasing returns to scale.

Fully Scalable Marketplace Model

We are an online marketplace operating a scaled, asset-light business that offers an extensive catalog of luxury design products across our specific verticals. We enable fulfillment and shipping, but do not own or manage inventory, further supporting favorable working capital dynamics as we grow. Our scalable technology platform enables us to efficiently drive expansion into new geographies and verticals while supporting the creation and development of new applications. For example in November 2021, we introduced 1stDibs Auctions as a new purchase format. Also, in April and May 2022, we launched localized sites in Germany and France, respectively. These sites enable local buyers to browse and receive customer support in their local language.

Powerful Data and Analytics

We use proprietary data and algorithms to drive operational insights that continuously enhance our seller and buyer experiences. We leverage this data, including user behaviors, sales trends, and seller behaviors, to improve the effectiveness of our buyer targeting and conversion efforts, and increase supply growth from existing and prospective sellers. As our online marketplace grows, our data becomes increasingly valuable. This data advantage allows us to develop business processes to optimize our operations, including marketplace supply, merchandising, authentication, pricing, marketing, and servicing. We collect and share data from across the platform to improve seller tactics and help them make informed decisions about sourcing, pricing, and selling products on our online marketplace. We use internal and external data to target, acquire, and retain qualified buyers through performance-based, data-driven marketing campaigns.

Innovative and Proprietary Technology

Our highly sophisticated, purpose-built technology stack facilitates complex, multi-step online transactions and is extremely difficult to replicate. We created an extensive digital catalog in luxury design with associated metadata that is used to simplify the buyer experience in an ordinarily complex purchase process. Technology powers all aspects of our business, including our complex single-SKU and multi-SKU order management system. We leverage automation and tools to improve efficiency and deliver a positive customer experience.

Our Environmental, Social, and Governance (“ESG”) Efforts

Our business creates a positive environmental and economic impact, balancing the needs of our buyers, sellers, partners, employees, investors and the environment. We are committed to extending the lifecycle of luxury goods by promoting their recirculation. As of December 31, 2022, approximately 64% of the listings on our marketplace are secondary. Buying an item on our marketplace offsets the need to manufacture a new item, this opportunity to shop sustainably creates a positive economic impact for all parties.

We have built a talented, experienced management team led by our CEO, David Rosenblatt, who joined 1stDibs in November 2011 with a vision to transform the online luxury experience. Members of our management team have helped create and grow leading luxury, design, and technology businesses globally such as Amazon, Care.com, Christie’s, DoubleClick, Farfetch, Google, PayPal, Refinery29 and Shutterstock, and have retained a strong entrepreneurial spirit and a wide array of knowledge. We believe in the importance of fostering a diverse, inclusive, and safe workplace; diversity is both a priority and strength of our company. We strive to continue to improve representation throughout the organization. Below is a breakdown of how our U.S.-based team self-identifies as of December 31, 2022.

| | | | | | | | | | | | | | | | | | | | |

| Asian | Black or African American | Hispanic or Latino | White | Two or more races | Female |

| All Employees | 17 | % | 8 | % | 8 | % | 64 | % | 3 | % | 56 | % |

Management(1) | — | % | 13 | % | — | % | 87 | % | — | % | 50 | % |

(1) - Management is defined as our Executive Leadership Team.

The composition of our Board of Directors also reflects our commitment to diversity. Three of our six directors, including each chairperson of our Audit, Compensation, and Nomination and Corporate Governance committees, are female or a member of the LGBTQ+ community.

We are committed to building a diverse team and an inclusive workplace that respects and meets the needs of our diverse community of sellers, creators, and customers. To that end, we are leading a number of initiatives to further broaden the spectrum of our workforce and to create a culture of diversity, equity, and inclusion. Our goal is to ensure that all people feel welcome and are ultimately celebrated for their uniqueness.

Our efforts are focused on establishing business norms that promote Diversity, Equity, Inclusion, and Belonging (“DEIB”) both within the company and across the broader design community. During the year ended December 31, 2022, our internal approach included educational, recruiting, and corporate social responsibility programs. We established six employee resource groups for the purpose of connecting employees with shared identities, backgrounds, and interests to help foster the company’s culture of inclusion, and engage employees in our DEIB efforts. Externally, we continued to provide financial support to organizations through our employee giving and charitable donations program.

Our Growth Strategies

Expand Our Buyer Base

We are focused on continuing to grow our buyer base and believe we are still in the early stages of introducing a unique and growing supply of luxury design products to a much broader audience. Of our 5.5 million users as of December 31, 2022, we estimate that approximately 67% are U.S.-based and 33% are international, which represents less than 1% penetration of the population of both markets. As of December 31, 2021, of out 4.3 million users, we estimated that approximately 69% were U.S.-based and 31% were international. Users represent non-seller visitors who register on our website and are identified by a unique email address, and include both buyers and prospective buyers. As of December 31, 2022, 18% of buyers are located internationally, which is unchanged from December 31, 2021. To date, we have primarily grown our current buyer base organically through word-of-mouth, mentions in the press, and earned media. In addition to continued organic growth, we believe we can significantly increase our buyer base by utilizing targeted, data-driven marketing efforts that generate meaningful returns. We believe we can continue to expand our buyer audience across a wide swath of buyer demographics including income, geography, and age, as well as level of design experience and design preference.

Grow Our Marketplace Supply

We intend to further increase the supply on our online marketplace while maintaining our thorough seller vetting process, by offering a captivating value proposition and enhanced item listing tools, adding new inventory from existing sellers, and growing the range of sellers from whom we source. We continue to enhance our value proposition for sellers by providing broad and growing access to a global base of design-minded buyers and a platform with a comprehensive suite of tools that help our sellers successfully transact and scale their business. This value proposition drives sellers to our online marketplace, deepens the breadth of our inventory, and helps attract new buyers.

Consistent with our strategy to grow our online marketplace supply, we launched new seller pricing tiers in January 2022, which allow new sellers to choose the plan that best fits their business, including choices of a higher monthly subscription fee and lower commission rates, as well as a subscription-free tier with higher commission rates. As of December 31, 2022, the number of seller accounts grew to approximately 7,300 from over 4,700 as of December 31, 2021, and our seller stock value was in excess of $16.0 billion as of December 31, 2022 compared to a seller stock value in excess of $14.0 billion as of December 31, 2021.

We may also choose to expand our network of sellers inorganically, either through acquisitions of, or partnerships with, companies or design brands.

Pursue New Product Verticals and Diversification Opportunities

We have demonstrated our ability to successfully grow and diversify beyond our original offering of vintage furniture, as exemplified by our proven track record of expanding both across verticals, such as art, jewelry, and fashion, and within verticals, such as the expansion from vintage and antique furniture to include new and custom furniture. Adding verticals has several benefits, including increasing our addressable market, the number of sellers and buyers, and purchasing frequency, and offering our buyers a wider supply of inventory while strengthening our brand as a preeminent online destination for luxury design products. We believe there are also opportunities to diversify our business model by expanding into additional sales formats, including, for example, an auction format which launched in November 2021 and has traditionally been the primary sales format in our industry. For the year ended December 31, 2022 auction orders comprised approximately 5% of total orders. We intend to continue to evaluate such diversification opportunities as part of our overall growth strategy. Our platform infrastructure is designed to scale with growth and diversification in mind.

Expand Internationally

During the year ended December 31, 2022, the vast majority of our buyers were located in the United States and other English-speaking countries. As of December 31, 2022, 41% of the supply on our online marketplace comes from outside the

United States, while only 18% of buyers are located internationally. We believe that this presents a large international expansion opportunity. Our website traffic also indicates strong international presence and opportunities for conversion, with approximately 38% of current traffic coming from outside the United States. In continuing to expand internationally, we plan to focus initially on organic search and later on performance-driven paid marketing and email campaigns. We may also expand internationally through acquisitions.

Our Technology and Data

Technology powers all aspects of our business. Our proprietary services-based architecture is the foundation of our platform. It is designed to connect sellers and buyers worldwide, enabling online transactions of unique products by removing purchase friction. We leverage appropriate technologies to ensure security, performance, and scalability. Key features of our technology platform include:

•Services-based Architecture: Allows us to scale individual parts of the platform independently from others, increasing engineering efficiency. It also facilitates using different programming languages appropriate for specific tasks, including python for machine learning, java for big data jobs, and node for front end integrations.

•Proprietary Database: Includes taxonomies, structured metadata, an expansive catalog of luxury brands and designers, and an extensive library of luxury design products, product attributes, and pricing data.

•Big Data: Leverages browsing history on our platform, followed searches, “favorited” items, and previous purchases to generate personalized emails and on-site recommendations. Provides the ability to predict the relative likelihood of an item selling, as compared with other items, based upon price point and the quality of the listing, images, and shipping quotes.

•Scalable Page Creation: Utilizes unstructured on-platform search query data to create new indexable pages automatically to increase our long-tail organic search traffic and enable broader Search Engine Optimization (“SEO”) and Search Engine Marketing (“SEM”) coverage.

•System Security and Business Continuity: Infrastructure has been designed to adhere to industry best practices for secure storage and management of all sensitive data, including encryption (for data at rest as well as in transit), access logging, and internal change controls. Physical and logical access controls are in place, and personally identifiable information is obfuscated. Utilize third-party servers across multiple availability zones with data securely backed up in real time across multiple regions, with ability to rapidly migrate to alternative data centers.

Marketing

We acquire new buyers and drive traffic to our online marketplace through a mix of direct response marketing channels, with an emphasis on digital and a focus is on efficient growth. We derive a relatively low percentage of our traffic and orders from paid media. During the year ended December 31, 2022, we estimate that approximately 71% of new user sessions came from non-paid channels, including organic search, direct web, direct app, organic social, email, and referral compared to 68% during the year ended December 31, 2021.

We utilize user data and rigorous A/B testing to improve the user experience, and continuously optimize the performance of our marketing campaigns and channels. We use highly targeted promotional incentives, where appropriate, to profitably acquire and retain buyers. We focus on engaging and retaining our users with personalized experiences and elevated storytelling. We understand user preferences from their discovery and purchase history, and use that data to recommend products that are most likely to drive engagement, conversion, and repeat purchasing. We offer Private Client services to our most engaged consumers and cultivate interior designer engagement and retention through the Trade 1st program. We communicate with our buyers primarily through email, site, text, mobile push notifications, print catalogs, and organic social.

We acquire new sellers through a combination of inbound applicants who primarily find us by word of mouth from other sellers, as well as focused lead sourcing from fairs, association, and industry groups. We review all applications from these efforts, tier them according to desirability based on their inventory quality and “salability” onsite, and then invite the approved sellers to join our online marketplace.

Services and Logistics

We are committed to offering exceptional service as an integral part of a digital luxury experience. Our 1stDibs Promise, includes a price-match guarantee, comprehensive buyer protection, global delivery and more. Our Marketplace Trust team oversees anti-money laundering, fraud protection, and seller performance. In addition, we may offer certain Private Clients and Trade Buyers with a dedicated sales specialist and exclusive benefits. We provide additional benefits to Trade Buyers, including trade exclusive pricing, buyer incentives, priority support, sourcing expertise, and enhanced buyer protection, among others. Our client service team helps ensure the satisfaction of sellers and buyers by addressing and assisting in the resolution of questions relating to orders, deliveries, returns, and disputes, including our buyer protection program. Our logistics team works

closely with leading global logistics providers to enable seamless delivery from the sellers’ locations directly to buyers, both within the United States and internationally.

Our Employees, Culture, Values and Human Capital Resources

As of December 31, 2022, we had 310 full-time employees, including 80 in technology development, 110 in sales and marketing, 36 in general and administrative, and 84 in operations.

Our human capital resources objective is to ensure that we have the best possible team to reach our business goals, and that the team we have has a positive employee experience. We do this through attracting and hiring the best team, ensuring our policies and practices create an inclusive culture, and developing our team in ways that contribute to personal and business growth. We regularly receive input from our team members through employees surveys, focus groups, and events to gauge employee engagement and identify areas of focus.

Segment and Geographic Information

We have one operating and reportable segment. See Note 2 “Summary of Significant Accounting Policies” to our consolidated financial statements for further discussion of our operating and reportable segment.

Data Security and Protection

We are committed to the security of the sellers and buyers who transact business on our online marketplace. We collect and store certain personally identifiable information provided by our sellers and buyers and other third parties with whom we transact business, such as names, email addresses, and the details of transactions. We do not directly collect, transmit, and store personal financial information such as credit card data and other payment information and rely on third-party payment processors who provide these services on our behalf. The collection, transmission, and storage of such information is subject to stringent legal and regulatory obligations. Some of our third-party service providers, such as identity verification and payment processing providers, also regularly have access to seller and buyer data. We undertake administrative and technical measures to protect our systems and the consumer data those systems process and store. We have developed policies and procedures designed to manage data security risks, including employment of technical security defenses and continual monitoring of servers and systems. Further, as part of our efforts to protect sensitive information, we rely on a variety of security measures, including encryption and authentication technology licensed from third parties. We also use third parties to assist in our security practices and prevent and detect fraud. We intend to continue to invest in efforts associated with the detection and prevention of security breaches and any security-related incidents.

Regulatory

Our business is subject to foreign and domestic laws and regulations applicable to companies conducting business on the Internet and in the resale market. These include laws governing areas such as personal privacy and data security, consumer protection, payment processing, sales and other taxes, and unfair and deceptive trade practices, among other areas. Related laws may govern the manner in which we store or transfer sensitive information, or impose obligations on us in the event of a security breach or inadvertent disclosure of such information. International jurisdictions impose different, and sometimes more stringent, consumer and privacy protections.

We list luxury design products from numerous sellers located throughout the United States and from over 85 countries, and the items we list from our sellers may contain materials that are subject to regulation by international, federal, state, and local governments and other regulatory authorities. In addition, numerous U.S. states and municipalities have regulations regarding the handling of antique and vintage items and licensing requirements of antique and vintage dealers. Our business activities are also subject to various restrictions under U.S. export and similar laws and regulations, as well as various economic and trade sanctions administered by the U.S. Treasury Department’s Office of Foreign Assets Control. Further, various countries regulate the import of certain technology and have enacted or could enact laws that could limit our ability to provide sellers and buyers access to our platform or could limit our sellers’ and buyers’ ability to access or use our services in those countries.

We are also subject to various domestic and international anti-corruption laws, such as the U.S. Foreign Corrupt Practices Act and the U.K. Bribery Act, as well as other similar anti-bribery and anti-kickback laws and regulations. These laws and regulations generally prohibit companies, their employees, and their intermediaries from authorizing, offering, providing, and/or accepting improper payments or other benefits for improper purposes. Although we take precautions to prevent violations of these laws, our exposure for violating these laws increases as our international presence expands and as we increase sales and operations in foreign jurisdictions.

New legislation or regulation or changes thereof due to federal elections, the application of laws from jurisdictions whose laws do not currently apply to our business, or the application of existing laws and regulations to the Internet and e-commerce generally could result in significant additional compliance costs and responsibilities for our business.

Competition

We compete with a broad range of sellers of new and pre-owned luxury design products, including traditional brick-and-mortar entities, such as department stores, branded luxury goods stores, and specialty retailers, and entities providing access to more unique luxury goods, such as galleries, boutiques, and auction houses. We also compete with the online offerings of these traditional retail entities, as well as online marketplaces that may offer the same or similar goods and services that we offer.

We believe that we compete effectively based on the volume, quality, and assortment of unique luxury design products available on our online marketplace, our brand awareness and history built on trust and authenticity, the experience and value proposition we offer to sellers and buyers, and the scale of our online marketplace.

Intellectual Property

We rely on a combination of intellectual property rights, contractual protections, and other practices to protect our brand, proprietary information, technologies and processes. We primarily rely on copyright and trade secret laws to protect our proprietary technologies, and processes, including the algorithms we use throughout our business. Our principal trademark assets include the registered trademark “1stDibs” and our logos and taglines. Our trademarks are valuable assets that support our brand and consumers’ perception of our services and merchandise. We also hold the rights to the “1stDibs.com” Internet domain name and various related domain names, which are subject to Internet regulatory bodies and trademark and other related laws of each applicable jurisdiction. Although we do not currently have any issued patents, we may pursue patent protection for aspects of our technology in the future. We seek to protect our proprietary information, in part, by entering into confidentiality and proprietary rights agreements with our employees and independent contractors. Our employees are also subject to invention assignment agreements. See “Risk Factors—Risks Relating to Intellectual Property.”

Website Access to Company’s Reports

Our website address is www.1stdibs.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are available free of charge through our website as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC.

Disclosure Information

In compliance with disclosure obligations under Regulation FD, 1stDibs announces material information to the public through a variety of means, including filings with the SEC, press releases, public conference calls, and webcasts, as well as the investor relations website.

Item 1A. Risk Factors

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Annual Report on Form 10-K., including our audited consolidated financial statements and related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” before investing in our common stock. If any of the following risks are realized, in whole or in part, our business, financial condition, results of operations, and prospects could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business, financial condition, results of operations, and prospects.

Risks Related to Our Business and Industry

We have a history of operating losses, and we may not achieve or maintain profitability in the future, which in turn could negatively impact our financial condition and our stock price.

We incurred net losses of $22.5 million, $21.0 million, and $12.5 million during the fiscal years ended December 31, 2022, 2021, and 2020, respectively. We had an accumulated deficit of $291.0 million as of December 31, 2022. We expect to incur significant losses in the future. We will need to generate and sustain increased revenue levels or reduce operating costs materially in future periods to achieve profitability, and even if we achieve profitability, we may not be able to maintain or increase our level of profitability. We expect that our operating expenses will increase substantially for the foreseeable future as we hire additional employees, invest in expanding our seller and buyer base and deepening our existing seller and buyer relationships, expand across and within product verticals, increase our marketing efforts and brand awareness, and invest in expanding our international operations. In addition, as a public company, we will incur significant legal, accounting, and other expenses that we did not incur as a private company. These expenditures will make it more difficult for us to achieve and maintain profitability. Our efforts to grow our business may be more costly than we expect, and we may not be able to increase our revenue enough to offset our higher operating expenses. If we were to reduce our expenses, it could negatively impact our growth and growth strategy. As a result, we can provide no assurance as to whether or when we will achieve profitability. If we are not able to achieve and maintain profitability, the value of our company and our common stock could decline significantly, and you could lose some or all of your investment.

Our annual and quarterly results of operations have fluctuated from period to period and may do so in the future, which could cause our stock price to fluctuate and the value of your investment to decline.