Exhibit

Exhibit 99.1

TABLE OF CONTENTS

BASIS OF PRESENTATION

Unless otherwise stated, the information in this AIF is as of March 13, 2018.

In this AIF, unless stated otherwise or the context requires, all dollar amounts are expressed in U.S. dollars. All references to “$ or “US$” are to the lawful currency of the United States and all references to “CDN$” are to the lawful currency of Canada.

On March 13, 2018 the exchange rate for conversion of US dollars into Canadian dollars was US$1.00 = CDN$1.2912. based upon the Bank of Canada closing rate.

Market data and certain industry forecasts used in this AIF were obtained from market research, publicly available information and industry publications. We believe that these sources are generally reliable, but the accuracy and completeness of this information is not guaranteed. We have not independently verified such information, and we do not make any representation as to the accuracy of such information.

In this AIF, unless the context otherwise requires, references to “we”, “us”, “our” or similar terms, as well as references to “Aurinia” or the “Company”, refer to Aurinia Pharmaceuticals Inc., together with our subsidiaries.

This AIF describes the Company and its operations, its prospects, risks and other factors that affect its business.

Capitalized terms that are not otherwise defined in this AIF have the meanings attributed thereto in Schedule 3 to this AIF.

FORWARD-LOOKING STATEMENTS

A statement is forward-looking when it uses what we know and expect today to make a statement about the future. Forward-looking statements may include words such as “anticipate”, “believe”, “intend”, “expect”, “goal”, “may”, “outlook”, “plan”, “seek”, “project”, “should”, “strive”, “target”, “could”, “continue”, “potential” and “estimated”, or the negative of such terms or comparable terminology. You should not place undue reliance on the forward-looking statements, particularly those concerning anticipated events relating to the development, clinical trials, regulatory approval, and marketing of our product and the timing or magnitude of those events, as they are inherently risky and uncertain.

Securities laws encourage companies to disclose forward-looking information so that investors can get a better understanding our future prospects and make informed investment decisions. These forward-looking statements made in this AIF may include, without limitation:

| |

• | our belief that the AURA clinical trial had positive results; |

| |

• | our belief that we have sufficient cash resources to adequately fund operations through the AURORA clinical trial results and regulatory submission; |

| |

• | our belief that confirmatory data generated from the single AURORA clinical trial and the recently completed AURA clinical trial should support regulatory submissions in the United States, Europe and Japan and the timing of such including the NDA submission in the United States; |

| |

• | our belief that recently granted formulation patents regarding the delivery of voclosporin to the ocular surface for conditions such as dry eye have the potential to be of therapeutic value; |

| |

• | our plans and expectations and the timing of commencement, enrollment, completion and release of results of clinical trials; |

| |

• | our current forecast for the cost of the AURORA clinical trial and the continuation study; |

| |

• | our intention to seek regulatory approvals in the United States, Europe and Japan for voclosporin and anticipated timing of receiving approval; |

| |

• | our intention to demonstrate that voclosporin possesses pharmacologic properties with the potential to demonstrate best-in-class differentiation with first-in-class status for the treatment of LN outside of Japan; |

| |

• | our belief in voclosporin being potentially a best-in-class CNI with robust intellectual property exclusivity and the benefits over existing commercially available CNIs; |

| |

• | our belief that voclosporin has further potential to be effectively used across a range of therapeutic autoimmune areas including FSGS and DES; |

| |

• | our intention to initiate a Phase II clinical trial for voclosporin in FSGS patients and the timing for commencement and for data availability for the same; |

| |

• | our intention to commence a Phase IIa tolerability study of VOS and the timing for commencement and for data availability for the same; |

| |

• | statements concerning the anticipated commercial potential of voclosporin for the treatment of LN, FSGS and DES; |

| |

• | our belief that the expansion of the renal franchise could create significant value for shareholders; |

| |

• | our intention to use the net proceeds from financings for various purposes; |

| |

• | our belief that Aurinia’s current financial resources are sufficient to fund all existing programs, the new indication expansion and new product development work and supporting operations into 2020; |

| |

• | our plans to generate future revenues from products licensed to pharmaceutical and biotechnology companies; |

| |

• | statements concerning partnership activities and health regulatory discussions; |

| |

• | statements concerning the potential market for voclosporin; |

| |

• | our ability to take advantage of financing opportunities if and when needed; |

| |

• | our belief that VOS has the potential to compete in the multi-billion-dollar human prescription dry eye market; |

| |

• | our intention to seek additional corporate alliances and collaborative agreements to support the commercialization and development of our product; and |

| |

• | our belief that the annualized pricing for voclosporin could range between $45,000-$100,000 in the United States. |

Such statements reflect our current views with respect to future events and are subject to risks and uncertainties and are necessarily based on a number of estimates and assumptions that, while considered reasonable by management, as at the date of such statements, are inherently subject to significant business, economic, competitive, political, regulatory, legal, scientific and social uncertainties and contingencies, many of which, with respect to future events, are subject to change. The factors and assumptions used by management to develop such forward-looking statements include, but are not limited to:

| |

• | the assumption that we will be able to obtain approval from regulatory agencies on executable development programs with parameters that are satisfactory to us; |

| |

• | the assumption that recruitment to clinical trials will occur as projected; |

| |

• | the assumption that we will successfully complete our clinical programs on a timely basis, including conducting the required AURORA clinical trial and meet regulatory requirements for approval of marketing authorization applications and new drug approvals, as well as favourable product labeling; |

| |

• | the assumption that the planned studies will achieve positive results; |

| |

• | the assumptions regarding the costs and expenses associated with our clinical trials; |

| |

• | the assumption the regulatory requirements and commitments will be maintained; |

| |

• | the assumption that we will be able to meet GMP standards and manufacture and secure a sufficient supply of voclosporin on a timely basis to successfully complete the development and commercialization of voclosporin; |

| |

• | the assumptions on the market value for the LN program; |

| |

• | the assumption that our patent portfolio is sufficient and valid; |

| |

• | the assumption that we will be able to extend our patents on terms acceptable to us; |

| |

• | the assumptions on the market; |

| |

• | the assumption that there is a potential commercial value for other indications for voclosporin; |

| |

• | the assumption that market data and reports reviewed by us are accurate; |

| |

• | the assumption that another company will not create a substantial competitive product for Aurinia’s LN business without violating Aurinia’s intellectual property rights; |

| |

• | the assumptions on the burn rate of Aurinia’s cash for operations; |

| |

• | the assumption that our current good relationships with our suppliers, service providers and other third parties will be maintained; |

| |

• | the assumption that we will be able to attract and retain a sufficient amount of skilled staff; and/or |

| |

• | the assumptions relating to the capital required to fund operations through AURORA clinical trial results and regulatory submission. |

It is important to know that:

| |

• | actual results could be materially different from what we expect if known or unknown risks affect our business, or if our estimates or assumptions turn out to be inaccurate. As a result, we cannot guarantee that any forward-looking statement will materialize and, accordingly, you are cautioned not to place undue reliance on these forward-looking statements; |

| |

• | forward-looking statements do not take into account the effect that transactions or non-recurring or other special items announced or occurring after the statements are made may have on our business. For example, they do not include the effect of mergers, acquisitions, other business combinations or transactions, dispositions, sales of assets, asset write-downs or other charges announced or occurring after the forward-looking statements are made. The financial impact of such transactions and non-recurring and other special items can be complex and necessarily depends on the facts particular to each of them. Accordingly, the expected impact cannot be meaningfully described in the abstract or presented in the same manner as known risks affecting our business; |

| |

• | we disclaim any intention and assume no obligation to update any forward-looking statements even if new information becomes available, as a result of future events, new information, or for any other reason except as required by law. |

The factors discussed below and other considerations discussed in the “Risk Factors” section of this AIF could cause our actual results to differ significantly from those contained in any forward-looking statements.

Such forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to differ materially from any assumptions, further results, performance or achievements expressed or implied by such forward-looking statements. Important factors that could cause such differences include, among other things, the following:

| |

• | the need for additional capital in the longer term to fund our development programs and the effect of capital market conditions and other factors on capital availability; |

| |

• | difficulties, delays, or failures we may experience in the conduct of and reporting of results of our clinical trials for voclosporin; |

| |

• | difficulties in meeting GMP standards and the manufacturing and securing of a sufficient supply of voclosporin on a timely basis to successfully complete the development and commercialization of voclosporin; |

| |

• | difficulties, delays or failures in obtaining regulatory approvals for the initiation of clinical trials; |

| |

• | difficulties in gaining alignment among the key regulatory jurisdictions, EMA, FDA and PMDA, which may require further clinical activities; |

| |

• | difficulties, delays or failures in obtaining regulatory approvals to market voclosporin; |

| |

• | not being able to extend our patent portfolio for voclosporin; |

| |

• | difficulties we may experience in completing the development and commercialization of voclosporin; |

| |

• | the market for the LN business may not be as we have estimated; |

| |

• | insufficient acceptance of and demand for voclosporin; |

| |

• | difficulties obtaining adequate reimbursements from third party payors; |

| |

• | difficulties obtaining formulary acceptance; |

| |

• | competitors may arise with similar products; |

| |

• | product liability, patent infringement and other civil litigation; |

| |

• | injunctions, court orders, regulatory and other enforcement actions; |

| |

• | we may have to pay unanticipated expenses, and/or estimated costs for clinical trials or operations may be underestimated, resulting in our having to make additional expenditures to achieve our current goals; |

| |

• | difficulties, restrictions, delays, or failures in obtaining appropriate reimbursement from payers for voclosporin; and/or |

| |

• | difficulties we may experience in identifying and successfully securing appropriate vendors to support the development and commercialization of our product. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. These forward-looking statements are made as of the date hereof.

For additional information on risks and uncertainties in respect of the Company and its business, please see the “Risks Factors” section of this AIF. Although we believe that the expectations reflected in such forward-looking statements and information are reasonable, undue reliance should not be placed on forward-looking statements or information because we can give no assurance that such expectations will prove to be correct.

OVERVIEW

Corporate structure

We are a clinical stage biopharmaceutical company with a head office at #1203-4464 Markham Street, Victoria, British Columbia V8Z 7X8. Our registered office is located at #201, 17904-105 Avenue, Edmonton, Alberta T5S 2H5 where the finance function is performed.

We are organized under the Business Corporations Act (Alberta). The Common Shares are currently listed and traded on the NASDAQ under the symbol “AUPH” and on the TSX under the symbol “AUP”. Our primary business is the development of a therapeutic drug to treat autoimmune diseases, in particular LN.

We have the following wholly-owned subsidiaries: Aurinia Pharma U.S., Inc. (Delaware incorporated) and Aurinia Pharma Limited (UK incorporated). Aurinia Pharma Corp. (British Columbia incorporated) was wound up into Aurinia Pharmaceuticals Inc. and dissolved on November 30, 2017.

Our By-Law No. 2 was amended at a shareholder’s meeting held on August 15, 2013 to include provisions requiring advance notice for any nominations of directors by shareholders, which are described further in our most recent information circular.

RECENT DEVELOPMENTS

Appointment of new board members

On February 7, 2018 we appointed Joseph P. “Jay” Hagan to our Board. Mr. Hagan is currently the President and Chief Executive Officer of Regulus Therapeutics Inc., having previously held the positions of Chief Operating Officer, Principal Financial Officer and Principal Accounting Officer.

On February 21, 2018 we appointed Michael Hayden, CM, OBC, MB, ChB, PhD, FRCP (C), FRSC to our Board. Dr. Hayden was most recently the President of Global R&D and Chief Scientific Officer at Teva Pharmaceutical Industries Ltd. Dr. Hayden is the co-founder of three biotechnology companies, including Aspreva, and currently sits on several boards. Dr. Hayden is a celebrated researcher, having focused his research primarily on genetic diseases.

Preliminary Base Shelf Prospectus

On January 4, 2018, in order to replace our prior expired base shelf prospectus and corresponding shelf registration statement, we filed a Preliminary Shelf Prospectus with the securities commissions in each of the provinces of Ontario, Alberta and British Columbia in Canada, and a corresponding shelf registration statement on Form F-10 with the SEC under the U.S./Canada Multijurisdictional Disclosure System.

The Preliminary Shelf Prospectus and corresponding shelf registration statement, when made final or effective, will allow Aurinia to offer up to US$250,000,000 of Common Shares, warrants, subscription receipts, debt securities or any combination thereof during the 25-month period that the shelf prospectus (once made final) is effective. We have no immediate intention to undertake an offering. However, the shelf prospectus (once made final) will enable Aurinia to potentially access new capital if and when needed. The amount and timing of any future offerings will be based on our financial requirements and market conditions at the time.

BUSINESS OF THE COMPANY

We are focused on the development of our novel therapeutic immunomodulating drug candidate, voclosporin, for the treatment of LN, FSGS and DES. Voclosporin is a next generation CNI which has clinical data in over 2,400 patients across multiple indications. It has also been previously studied in kidney rejection following transplantation, psoriasis and in various forms of uveitis (an ophthalmic disease).

Legacy CNIs have demonstrated efficacy for a number of conditions, including LN, transplant, DES and other autoimmune diseases; however, side effects exist which can limit their long-term use and tolerability. Some clinical complications of legacy CNIs include hypertension, hyperlipidemia, diabetes, and both acute and chronic nephrotoxicity.

Voclosporin is an immunosuppressant, with a synergistic and dual mechanism of action that has the potential to improve near- and long-term outcomes in LN when added to MMF, although not approved for such, the current standard of care for LN. By inhibiting calcineurin, voclosporin reduces cytokine activation and blocks interleukin IL-2 expression and T-cell mediated immune responses. Voclosporin also potentially stabilizes disease modifying podocytes, which protects against proteinuria. Voclosporin is made by a modification of a single amino acid of the cyclosporine molecule which has shown a more predictable pharmacokinetic and pharmacodynamic relationship, an increase in potency, an altered metabolic profile, and easier dosing without the need for therapeutic drug monitoring. Clinical doses of voclosporin studied to date range from 13 - 70 mg BID. The mechanism of action of voclosporin, a CNI, has been validated with certain first generation CNIs for the prevention of rejection in patients undergoing solid organ transplants and in several autoimmune indications, including dermatitis, keratoconjunctivitis sicca, psoriasis, rheumatoid arthritis, and for LN in Japan.

We believe that voclosporin possesses pharmacologic properties with the potential to demonstrate best-in-class differentiation with first-in-class regulatory approval status for the treatment of LN outside of Japan.

Based on published data, we believe the key potential benefits of voclosporin in the treatment of LN are as follows:

| |

• | increased potency compared to cyclosporine A, allowing lower dosing requirements and fewer off target effects; |

| |

• | limited inter and intra patient variability, allowing for easier dosing without the need for therapeutic drug monitoring; |

| |

• | less cholesterolemia and triglyceridemia than cyclosporine A; and |

| |

• | limited incidence of glucose intolerance and diabetes at therapeutic doses compared to tacrolimus. |

Strategy

Our business strategy is to optimize the clinical and commercial value of voclosporin and become a global biopharma company with a focused renal autoimmune franchise.

The key elements of our corporate strategy include:

| |

• | Advancing voclosporin through a robust LN Phase III clinical trial (AURORA) with anticipated completion of this trial in the fourth quarter of 2019; |

| |

• | Conduct a Phase II proof of concept trial for the additional renal indication of FSGS; |

| |

• | Evaluate other voclosporin indications while deploying the majority of our operational and financial resources to develop voclosporin for LN; |

| |

• | Conduct a Phase IIa tolerability study of VOS, and upon completion of this study look at all options to create value with our proprietary nanomicellar ocular formulation of voclosporin in the human health field including, but not limited to, further development, out-licensing or divestiture while remaining focused on our Nephrology efforts. |

OUR LN PROGRAM

AURORA clinical trial

We achieved a significant milestone in the second quarter of 2017 with the initiation of patient randomization for the AURORA clinical trial.

We currently have 201 clinical trial sites activated and able to enroll patients around the globe. We are actively recruiting the clinical trial and our clinical team is focused on initiating the remaining sites. An aggressive patient recruitment program for this trial is ongoing.

Based on an eighteen-month enrollment period, we believe AURORA is on track to complete enrollment in the fourth quarter of 2018. Topline data from AURORA is expected in late 2019. We believe the totality of data from both the AURORA and AURA clinical trials can potentially serve as the basis for a NDA submission following a successful completion of the AURORA clinical trial. Additionally, under voclosporin’s fast-track designation, we intend to utilize a rolling NDA process. We are actively putting together a NDA and intend to submit the first module (the non-clinical module) in the second half of 2018. We plan to submit the Chemistry, Manufacturing, and Controls module in the first half of 2019, and the clinical module in the first half of 2020.

The AURORA clinical trial is a global 52-week double-blind, placebo-controlled study of approximately 320 patients to evaluate whether voclosporin added to standard of care can increase overall renal response rates in the presence of low dose steroids.

Patients are randomized 1:1 to either of 23.7 mg voclosporin BID and MMF or MMF and placebo, with both arms receiving a rapid oral corticosteroid taper. As in the AURA clinical trial, the study population in AURORA will be comprised of patients with biopsy proven active LN who will be evaluated on the primary efficacy endpoint of complete remission, or renal response, at 52 weeks, a composite which includes:

| |

• | normal, stable renal function (≥60 mL/min/1.73m2 or no confirmed decrease from baseline in eGFR of >20%); |

| |

• | presence of sustained, low dose steroids (≤10mg prednisone from week 16-24); and |

| |

• | no administration of rescue medications. |

Our current forecast is that the AURORA clinical trial will cost approximately $80 million, which includes costs of $27 million incurred to December 31, 2017.

Patients completing the AURORA trial will then have the option to roll-over into a 104-week blinded continuation study. The data from the continuation study will allow us to assess long-term outcomes in LN patients that will be valuable in a post-marketing setting in addition to future interactions with various regulatory authorities. The current estimate of the clinical cost of the continuation study is in the range of $20 million to $25 million .

In order to complete the clinical dossier, we will also commence a confirmatory drug-drug interaction study between voclosporin and MMF in 2018. In addition, we will conduct a pediatric study post-approval.

About LN

LN is an inflammation of the kidney caused by SLE and represents a serious manifestation of SLE. SLE is a chronic, complex and often disabling disorder. SLE is highly heterogeneous, affecting a wide range of organs and tissue systems. Unlike SLE, LN has straightforward disease measures (readily assessable and easily identified by specialty treaters) where an early response correlates with long-term outcomes, measured by proteinuria. In patients with LN, renal damage results in proteinuria and/or hematuria and a decrease in renal function as evidenced by reduced eGFR, and increased serum creatinine levels. eGFR is assessed through the Chronic Kidney Disease Epidemiology Collaboration equation. Rapid control and reduction of proteinuria in LN patients measured at 6 months shows a reduction in the need for dialysis at 10 years (Chen et al., Clin J. Am Soc Neph., 2008). LN can be debilitating and costly and if poorly controlled, can lead to permanent and irreversible tissue damage within the kidney. Recent literature suggests severe LN progresses to ESRD, within 15 years of diagnosis in 10%-30% of patients, thus making LN a serious and potentially life-threatening condition. SLE patients with renal damage have a 14-fold increased risk of premature death, while SLE patients with ESRD have a greater than 60-fold increased risk of premature death. Mean annual cost for patients (both direct and indirect) with SLE (with no nephritis) have been estimated to exceed $20,000 per patient, while the mean annual cost for patients (both direct and indirect) with LN who progress to intermittent ESRD have been estimated to exceed $60,000 per patient (Carls et al., JOEM., Volume 51, No. 1, January 2009).

LN Standard of Care

While at Aspreva, certain members of Aurinia’s management team executed the ALMS study which established CellCept® as the current standard of care for treating LN. The ALMS study was published in 2009 in the Journal of the American Society of Nephrology and in 2011 in the New England Journal of Medicine.

The American College of Rheumatology recommends that intravenous cyclophosphamide or MMF/CellCept® be used as first-line immunosuppressive therapy for LN. Despite their use, the ALMS study showed that the vast majority of patients failed to achieve CR, and almost half failed to have a renal response at 24 weeks for both of these therapeutics. Based upon the results of the ALMS study, we believe that a better solution is needed to improve renal response rates for LN.

Despite CellCept® being the current standard of care for the treatment of LN, it remains far from adequate with fewer than 20% of patients on therapy actually achieving disease remission after six months of therapy. Data suggests that a LN patient who does not achieve rapid disease remission upon treatment is more likely to experience renal failure or require dialysis at 10 years (Chen YE, Korbet SM, Katz RS, Schwartz MM, Lewis EJ; the Collaborative Study Group. Value of a complete or partial remission in severe lupus nephritis. Clin J Am Soc Nephrol. 2008;3:46-53.). Therefore, it is critically important to achieve disease remission as quickly and as effectively as possible.

Based on available data from the AURA clinical trial, we believe that voclosporin has the potential to address critical needs for LN by controlling active disease rapidly, lowering the overall steroid burden, impacting extra-renal disease and doing so with a convenient oral twice-daily treatment regimen. At the time of submission of this AIF, there are no drugs specifically approved by any regulatory agency as safe and effective for LN outside of Japan.

Market Potential and Commercial Considerations

Our target launch date for voclosporin as treatment for LN is late 2020 or early 2021.

The global immunology market which covers autoimmune conditions including SLE is set to rise from $57.7 billion in 2015 to $75.4 billion by 2022 according to GBI Research with the United States accounting for half of the market. The growth in the market is driven by continued increase in prevalence and incidence of autoimmune conditions in addition to new market entrants that are targeting better outcomes. There is significant unmet need for new therapies specifically in SLE and LN.

We have conducted market research including claims database reviews (where available) and physician-based research. Our physician research included approximately 900 rheumatologists and nephrologists across the United States, Europe and Japan to better define the potential market size, estimated pricing and treatment paradigms in those jurisdictions. Using the U.S. MarketScan® database (with approximately ~180,000,000 insured lives in the United States) there were 445,000 SLE patients in the database (between January 2006 and June 2016) based on specific

SLE diagnosis codes. The National Institute of Diabetes and Digestive and Kidney Diseases estimates that as many as 50% of people with SLE are diagnosed with LN. The Lupus Foundation of America estimates that 60% of people with lupus may develop kidney problems. Using claims database research and physician research, we believe the diagnosed range of LN patients to be approximately 125,000 to 200,000 in the United States and 150,000 to 215,000 for Europe and Japan combined. In the United States, Europe and Japan, one in five LN patients are thought to be undiagnosed due to referring physicians being inefficient and inaccurate in diagnosing the condition according to our research.

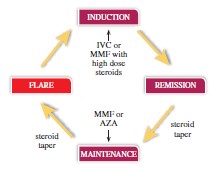

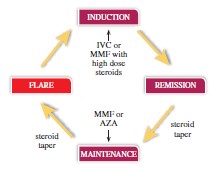

Similar to other autoimmune disorders, LN is a flaring and remitting disease. The destructive disease cycle people with LN go through is depicted below. The disease cycles from being in remission to being in flare, achieving partial remission and being back in remission. Treatment objectives between LN and other autoimmune diseases are remarkably similar. In other autoimmune conditions such as Multiple Sclerosis, Crohn’s, Rheumatoid Arthritis and SLE physician’s goals are to induce/maintain a remission of disease, decrease frequency of hospital or ambulatory care visits and limit long term disability. In LN specifically, physicians are trying to avoid further kidney damage, dialysis, renal transplantation, and death. According to a physician survey, the frequency of LN flares amongst treated patients was approximately every 14 months. The ability to get patients into remission quickly correlates with better long-term kidney outcomes as noted above.

The population of people with LN will be in different stages of their disease at any one time. Physicians currently use existing LN standard of care including immunosuppressants and high dose steroids to treat people with LN throughout the disease cycles including induction and maintenance phases. By studying voclosporin on top of an existing standard of care we are not seeking to displace current accepted treatment patterns. We feel that being additive to an existing standard of care in addition to the product being administered orally versus by an infusion or injection has the potential to support a more rapid market adoption once approved.

Current annualized pricing (based on published wholesale acquisition cost) for the treatments of other more prevalent autoimmune conditions such as Multiple Sclerosis, Crohn’s, Rheumatoid Arthritis and SLE ranges from $45,000-$100,000 in the United States. We have conducted pricing research that studied a similar pricing range with payers and physicians and believe that pricing in this range can be achievable for voclosporin in the United States. Pricing for other autoimmune conditions is lower in Europe and Japan than it is in the United States this is driven by the specific country pricing and reimbursement processes. We believe the US will provide the largest market opportunity followed by Europe and Japan.

New Voclosporin Indications

FSGS

FSGS is a lesion characterized by persistent scarring identified by biopsy and proteinuria. FSGS is a cause of NS and is characterized by high morbidity. NS is a collection of symptoms that indicate kidney damage, including: large amounts of protein in the urine; low levels of albumin and higher than normal fat and cholesterol levels in the blood, and edema. Similar to LN, early clinical response and reduction of proteinuria is thought to be critical to long-term kidney health and outcomes.

FSGS is likely the most common primary glomerulopathy and the most common primary glomerulopathy leading to ESRD. The incidence of FSGS and ESRD due to FSGS are increasing as time goes on. Precise estimates of incidence and prevalence are difficult to determine. According to NephCure Kidney International, more than 5400 patients are diagnosed with FSGS every year; however, this is considered an underestimate because a limited number of biopsies are performed. The number of FSGS cases are rising more than any other cause of NS and the incidence of FSGS is increasing through disease awareness and improved diagnosis. FSGS occurs more frequently in adults than in children and is most prevalent in adults 45 years or older. FSGS is most common in people of African American and Asian descent. It has been shown that the control of proteinuria is important for long-term dialysis-free survival of these patients. Currently, there are no approved therapies for FSGS in the United States and Europe.

Our clinical data in LN demonstrated that voclosporin decreased proteinuria, which is also an important disease marker for FSGS. Furthermore, voclosporin appears to demonstrate a more predictable pharmacology and an improved lipid and metabolic profile over legacy calcineurin inhibitors, which have shown efficacy in treating autoimmune disorders similar to those we are targeting. We plan to initiate a Phase II proof of concept clinical trial for voclosporin in FSGS in the second quarter of 2018. Interim data readouts will depend on the rate of trial recruitment and could begin in late 2018/first half of 2019.

DES

We plan to initiate a Phase IIa tolerability study of VOS versus the standard of care for the treatment of DES by the end of the second quarter of 2018, with data available in the second half of 2018. A CNI in the form of RESTASIS® (Cyclosporine Ophthalmic Emulsion, .05%) is a mainstay for the treatment for DES in the United States. The goal of this program is to prove that VOS has the potential to be a best-in-class CNI for the treatment of DES.

VOS is an aqueous, preservative free nanomicellar solution containing 0.2% voclosporin intended for use in the treatment of DES. It has shown evidence of efficacy in our partnered canine studies and in a small human Phase I study (n=35), this supports its development for the treatment of DES. Animal safety toxicology studies were previously completed in rabbit and dog models, and additional animal safety toxicology studies are planned. VOS has IP protection in the form of specific formulation patents until 2031.

DES, or keratoconjunctivitis sicca, is a chronic disease in which a lack of moisture and lubrication on the eye’s surface results in irritation and inflammation of the eye. DES is a multifactorial, heterogeneous disease estimated to affect greater than 20 million people in the United States (Market Scope, 2010 Comprehensive Report on The Global Dry Eye Products Market).

Voclosporin Background

Voclosporin mechanism of action

Voclosporin reversibly inhibits immunocompetent lymphocytes, particularly T-Lymphocytes in the G0 and G1 phase of the cell-cycle, and also reversibly inhibits the production and release of lymphokines. Through a number of processes voclosporin inhibits and prevents the activation of various transcription factors necessary for the induction of cytokine genes during T-cell activation. It is believed that the inhibition of activation of T-cells will have a positive modulatory effect in the treatment of LN. In addition to these immunologic impacts recent data suggests that CNIs have another subtle but important impact on the structural integrity of the podocytes (Faul C, et al. The actin cytoskeleton of kidney podocytes is a direct target of the antiproteinuric effect of cyclosporine A. Nat Med. 2008 Sep;14(9):931-8. doi: 10.1038/nm.1857). This data suggests that inhibition of calcineurin in patients with autoimmune kidney diseases helps stabilize the cellular actin-cytoskeleton of the podocytes thus having a structural impact on the podocyte and the subsequent leakage of protein into the urine, which is a key marker of patients suffering from LN.

Potential voclosporin clinical benefits

We believe that voclosporin has shown a number of key potential clinical benefits over the existing commercially available CNIs (tacrolimus & cyclosporine). Firstly, CNI assay results have indicated that voclosporin is approximately four times more potent than its parent molecule cyclosporine, which would indicate an ability to give less drug and produce fewer potentially harmful metabolites. Secondly, cyclosporine inhibits the enterohepatic recirculation of MPA, the active metabolite of MMF. The net effect of co-administration of CsA with MMF is reduced MPA systemic exposure by as much as 50% (D. Cattaneo et al. American Journal of Transplantation, 2005:12(5);2937-2944.). This drug interaction has not been observed with voclosporin and it is not expected that MPA blood exposure levels will be reduced with voclosporin co-administration. This is an important fact to consider as most patients being treated with voclosporin for LN will already be taking MMF. Furthermore, PK-PD analysis indicate lower PK-PD variability for voclosporin versus tacrolimus or cyclosporine, to the extent that we believe flat-dosing can be achieved for voclosporin. The currently available CNIs require extensive therapeutic drug monitoring which can often be costly, confusing and time consuming for treating physicians.

In a head-to-head study comparing voclosporin against cyclosporine in the treatment of psoriasis, cyclosporine was shown to cause significant increases in lipid levels as compared to voclosporin. The difference was statistically significant. This is important considering most lupus patients die of cardiovascular disease. In another study comparing voclosporin against tacrolimus in patients undergoing renal transplantation, the voclosporin group experienced a statistically significantly lower incidence of glucose intolerance and diabetes than tacrolimus treated patients. Additionally, in the Japanese tacrolimus study that led to the approval of this drug in Japan, almost 15% of tacrolimus patients experienced glucose intolerance (Miyasaka N, Kawai S, Hashimoto H. Efficacy and safety of tacrolimus for lupus nephritis: a placebo-controlled double-blind multicenter study. Mod Rheumatol. 2009;19(6):606-15. Epub 2009 Aug 18). This is a major limitation for physicians wanting to use this agent in lupus and is a well described side effect of tacrolimus.

We believe that voclosporin can be differentiated from the older CNIs and thus possess a unique position in the market as it relates to inducing remission in patients suffering from LN.

Scientific Rationale for Treatment of LN with voclosporin

While SLE is a highly heterogeneous autoimmune disease (often with multiple organ and immune system involvement), LN has straightforward disease outcomes. T-cell mediated immune response is an important feature of the pathogenesis of LN while the podocyte injury that occurs in conjunction with the ongoing immune insult in the kidney is an important factor in the clinical presentation of the disease. An early response in LN correlates with long-term outcomes and is clearly measured by proteinuria.

The use of voclosporin in combination with the current standard of care for the treatment of LN provides a novel approach to treating this disease (similar to the standard approach in preventing kidney transplant rejection). Voclosporin has shown to have potent effects on T-cell activation leading to its immunomodulatory effects. Additionally, recent evidence suggests that inhibition of calcineurin has direct physical impacts on the podocytes within the kidney. Inhibition of calcineurin within the podocytes can prevent the dephosphorylation of synaptopodin which in

turn inhibits the degradation of the actin cytoskeleton within the podocyte. This process is expected to have a direct impact on the levels of protein in the urine which is a key marker of LN disease activity.

Voclosporin Development History

More than 2,400 patients have been dosed with voclosporin in clinical trials including studies where voclosporin was compared to placebo or active control. The safety and tolerability profile of the drug therefore is well characterized. Phase II or later clinical studies that have been completed include studies in the following indications:

Psoriasis: To date, two Phase III clinical studies in patients with moderate to severe psoriasis have been completed. The primary efficacy endpoint in both studies was a reduction in Psoriasis Area and Severity Index, which is a common measure of psoriasis disease severity. The first study treatment with voclosporin resulted in statistically significantly greater success rates than treatment with placebo by the twelfth week. In a second study comparing voclosporin against cyclosporine, the drug was not shown to be statistically non-inferior to cyclosporine in terms of efficacy; however, voclosporin proved superior in terms of limiting elevations in hyperlipidemia. Due to the evolving psoriasis market dynamics and the changing standard of care for the treatment of this disease, we have decided not to pursue further Phase III development.

Renal Transplantation: A Phase 2b clinical trial in de novo renal transplant recipients was completed. Study ISA05-01, the PROMISE Study (Busque S, Cantarovich M, Mulgaonkar S, Gaston R, Gaber AO, Mayo PR, et al; PROMISE Investigators. The PROMISE study: a phase 2b multicenter study of voclosporin (ISA247) versus tacrolimus in de novo kidney transplantation. Am J Transplant. 2011 Dec;11(12):2675-84) was a six-month study with a six-month extension comparing voclosporin directly against tacrolimus on a background of MMF and corticosteroids. Voclosporin was shown to be equivalent in efficacy, but superior to tacrolimus with respect to the incidence of new onset diabetes after transplantation. In 2010, tacrolimus lost its exclusivity in most world markets and as a result, the competitive pricing environment for voclosporin for this indication has come into question. Additionally, the more expensive development timelines for this indication has made it a less attractive business proposition as compared to the LN indication, even when considering the fact that a special protocol assessment has been agreed to by the FDA for this indication.

Uveitis: Multiple studies in various forms of non-infectious uveitis were completed by Lux, one of our former licensees, indicating mixed efficacy. In all but one of the studies, completed by the licensee, an impact on disease activity was shown in the voclosporin group. However, achievement of the primary end-points in multiple studies could not be shown. Uveitis is a notoriously difficult disease to study due to the heterogeneity of the patient population and the lack of validated clinical end-points. However, in all of the uveitis studies completed, the safety results were consistent, and the drug was well tolerated. We successfully terminated our licensing agreement with Lux on February 27, 2014. In conjunction with this termination we have retained a portfolio of additional patents that Lux had been prosecuting that are focused on delivering effective concentrations of voclosporin to various ocular tissues. We will continue to evaluate these patents and make strategic recommendations on how they fit into our ongoing strategic directives.

THREE YEAR HISTORY

Initiation of AURORA clinical trial

We achieved a significant milestone in the second quarter of 2017 with the initiation of our single, AURORA clinical trial with patients randomized on active treatment.

We believe the totality of data from both the AURORA and AURA clinical trials, if the AURORA results confirm the AURA data, can potentially serve as the basis for a NDA submission following a successful completion of the AURORA clinical trial. We are actively recruiting the clinical trial and expect an aggregate 18-month enrollment period.

AURA-LV 48-Week Results

On April 20, 2017, we presented in-depth 48-week results from our global AURA clinical trial in LN during the late-breaking session at National Kidney Foundation 2017 Spring Clinical Meetings in Orlando, Florida. These were updated results from the top-line remission rate results announced on March 1, 2017 and are summarized in the table below. In addition to the trial meeting its CR and PR endpoints at 48 weeks, all pre-specified secondary endpoints that had been analyzed to April 20, 2017 were also met at 48 weeks. These pre-specified endpoints included: time to CR and PR (speed of remission); reduction in SLEDAI score; and reduction in UPCR over the 48-week treatment period.

Each arm of the trial included the current standard of care of MMF as background therapy and a rapid steroid taper to 5mg/day by week 8 and 2.5mg by week 16. Both doses of voclosporin at 48 weeks demonstrated continued improvement over the control group across multiple dimensions. Notably, the voclosporin groups demonstrated statistically significantly improved speed and rates of CR and PR. Of the patients that achieved CR at 24 weeks, in the low-dose voclosporin group, 100% remained in CR at 48 weeks, which demonstrates durability of clinical response. Proteinuria levels and reduction in SLEDAI scores, which include non-renal measures of lupus activity, also continued to significantly separate over time versus the control group.

The 24 and 48-week efficacy results are summarized below:

|

| | | | | |

Endpoint | Treatment | 24 weeks | P-value* | 48 weeks | P-value* |

Complete Remission (CR) | 23.7mg VCS BID | 33% | p=.045 | 49% | p<.001 |

39.5mg VCS BID | 27% | p=.204 | 40% | p=.026 |

Control Arm | 19% | NA | 24% | NA |

Partial Remission (PR) | 23.7mg VCS BID | 70% | p=.007 | 68% | p=.007 |

39.5mg VCS BID | 66% | p=.024 | 72% | p=.002 |

Control Arm | 49% | NA | 48% | NA |

Time to CR (TTCR) [median] | 23.7mg VCS BID | 19.7 weeks | p<.001 | 19.7 weeks | p<.001 |

39.5mg VCS BID | 23.4 weeks | p=.001 | 23.4 weeks | p<.001 |

Control Arm | NA | NA | NA | NA |

Time to PR (TTPR) [median] | 23.7mg VCS BID | 4.1 weeks | p=.002 | 4.3 weeks | p=.005 |

39.5mg VCS BID | 4.4 weeks | P=.003 | 4.4 weeks | p=.002 |

Control Arm | 6.6 weeks | NA | 6.6 weeks | NA |

SLEDAI Reduction (non-renal lupus) | 23.7mg VCS BID | -6.3 | p=.003 | -7.9 | p<.001 |

39.5mg VCS BID | -7.1 | p=.003 | -8.3 | p<.001 |

Control Arm | -4.5 | NA | -5.3 | NA |

Reduction in UPCR | 23.7mg VCS BID | -3.769 mg/mg | p<.001 | -3.998 mg/mg | p<.001 |

39.5mg VCS BID | -2.792 mg/mg | p=.006 | -2.993 mg/mg | p=.008 |

Control Arm | -2.216 mg/mg | NA | -2.384 mg/mg | NA |

The results of the AURA clinical trial at 48 weeks demonstrate the highest complete remission rate of any global LN study of which we are aware, although we note that the criteria to measure remission differs among various studies. The below chart compares the results of the AURA clinical trial vs. the other global LN studies of which we are aware.

|

| | | | |

Name of Global Study | Number of weeks | Criteria to Measure Remission and Response Rate | Results |

Efficacy and Safety of Ocrelizumab in Active Proliferative Lupus Nephritis | 48 weeks | UP:CR(gm/gm) < .5 SCr ≤ 25% increase from baseline Steroid taper (not enforced) | Control = 34.7% LD OCR = 42.7% (NS) HD OCR = 32.5% (NS) |

Mycophenolate Mofetil versus Cyclophosphamide for Induction Treatment of Lupus Nephritis | 24 weeks | UP:CR(gm/gm) ≤ .5 Normal eGFR Normal Urinalysis Steroid taper (not enforced) | MMF = 8.6% (NS) IVC = 8.1% (NS) |

Efficacy and Safety of Abatacept in Lupus Nephritis | 52 weeks | UP:CR(gm/gm) ≤ .26 eGFR within 10% of screening/baseline Normal Urinalysis Criteria to be met on 2 successive visits No mandated steroid taper | Control = 8.0% LD ABT = 11.1% (NS) HD ABT = 9.1% (NS) |

AURA-LV: Aurinia Urine Protein Reduction in Active Lupus Nephritis Study | 24 and 48 weeks |

UP:CR(gm/gm) ≤ .5 No decrease in eGFR ≥ 20% No use of rescue medications Forced steroid taper | 24 weeks Control = 19.3% LD Voc=32.6% (p=.045) HD Voc = 27.3% (NS) | 48 weeks Control = 23.9% LD Voc = 49.4% (p<.001) HD Voc = 39.8% (p=.026) |

No new safety signals were observed with the use of voclosporin in LN patients, and voclosporin was well-tolerated over a 48-week period. The overall safety profile is consistent with the expectations for the class of drug, the patient population and concomitant therapies. Thirteen (13) deaths were reported during the AURA clinical trial, a pattern which is consistent with other global active LN studies. Eleven (11) of the thirteen (13) deaths occurred at sites with compromised access to standard of care, and patients who died had a statistically different clinical baseline picture, demonstrating a more severe form of LN, potential comorbid conditions, and poor nutrition. Furthermore, in the voclosporin arms, the renal function as measured by corrected eGFR was stable and not significantly different from the control arm after 48 weeks of treatment. Mean blood pressure was also similar between all treatment groups.

A summary of TEAEs, study withdrawals and drug discontinuations are below, which are consistent with other clinical trials evaluating immunosuppressive therapies.

|

| | | |

TEAEs, Drug Discontinuation & Study Withdrawals | Control N=88 n (%) | VCS 23.7 mg BID N=89 n (%) | VCS 39.5mg BID N=88 n (%) |

Any TEAE | 78 (88.6) | 82 (92.1) | 85 (96.6) |

Any Serious TEAE | 17 (19.3) | 25 (28.1) | 22 (25.0) |

Any TEAE with Outcome of Death1 | 4 (4.5) | 10 (11.2) | 2 (2.3) |

Any Treatment-Related TEAE | 15 (17.0) | 45 (50.6) | 55 (62.5) |

Any Serious Treatment-Related TEAE | 1 (1.1) | 4 (4.5) | 7 (8.0) |

Any adverse event (AE) leading to study drug discontinuation | 9 (10.2) | 16 (18.0) | 14 (15.9) |

Any AE leading to study drug discontinuation (excluding deaths) | 8 (9.1) | 11 (12.4) | 13 (14.8) |

Study Withdrawals | 18 (20) | 16 (18.0) | 8 (9.1) |

1. Data includes three placebo-randomized subjects that died post-study completion.

On June 4, 2017 and June 14, 2017, we presented additional data from the AURA trial in LN during ERA-EDTA 2017 and EULAR 2017.

As previously reported, treatment with low dose voclosporin showed statistically improved efficacy over the control arm at 24 and 48 weeks. The data presented at ERA-EDTA demonstrated this improved efficacy was attained while maintaining stable serum magnesium, potassium and blood pressure levels. Well-known side effects with other calcineurin inhibitors at their effective dose include hypomagnesemia and hyperkalemia, which are associated with renal impairment and require monitoring or intervention.

The data presented at EULAR 2017 demonstrated that over the course of the 48-week trial, patients on voclosporin stayed in remission approximately twice the amount of time as those in the control group.

The analysis of additional data after April 20, 2017 identified that two non-key secondary endpoints: urine sediment, which describes analysis of active urinary sediment at each visit; and comparison of C3 and C4 levels between study arms, did not demonstrate statistical significance between arms. The urine sediment endpoint was not statistically different as there was too few data to demonstrate a difference. C3 and C4 levels are non-specific markers of general lupus disease activity. Rises in C3 and C4 were seen in all arms indicating disease improvement though no significant difference was observed between treatment arms.

To summarize, in addition to the trial meeting its CR and PR endpoints at 48 weeks, all key pre-specified secondary endpoints were also met at 48 weeks.

AURORA to serve as basis for regulatory submissions in major markets-US, Europe, and Japan

On April 6, 2017, we announced the outcome of discussions with both the EMA and the PMDA in Japan regarding the development of voclosporin for the treatment of active LN. Pursuant to these discussions, we believe that the confirmatory data that can be generated from the AURORA clinical trial and the recently completed AURA clinical trial should support regulatory submissions in the US, Europe and Japan.

48-week data from open-label AURION clinical trial

On March 27, 2017, we presented the 48-week results from the open-label AURION clinical trial at the 12th International Congress on Systemic Lupus Erythematosus and the 7th Asian Congress on Autoimmunity jointly in Melbourne, Australia.

The trial successfully achieved its primary objective by demonstrating that early biomarker response in active LN patients can be a significant predictor of renal response at 24 and 48 weeks. In the per protocol analysis at 48 weeks, 71% of subjects (n=5/7) on treatment remain in complete remission as measured by a UPCR of ≤ 0.5mg/mg, eGFR within 20% of baseline and concomitant steroid dose of <5mg/day. A 25% reduction in UPCR at week eight was found to be highly predictive of achieving renal response at 24 and 48 weeks. Conversely, if C3 and C4 do not normalize by week 8, then a renal response at week 24 and 48 is highly unlikely. Anti-dsDNA was not found to be a useful biomarker in predicting long-term response in LN patients.

No new safety signals were observed with the use of voclosporin in LN patients; voclosporin was well-tolerated, and the safety profile was consistent with other immunomodulators. A total of three subjects were discontinued prior to 48 weeks due to lupus related complications or investigator discretion.

Results from AURION demonstrated that an early UPCR reduction of 25% is the best predictor of renal response at 24 and 48 weeks. In addition, the use of C3 or C4 improves the precision of predicting if a patient will achieve a clinical response. This exploratory study is supportive of the successful AURA clinical trial.

Each arm of the trial included the current standard of care of MMF as background therapy and a forced steroid taper to 5mg/day by week 8 and 2.5mg by week 16.

Results from Japanese Phase I Ethnobridging Study for Voclosporin

On February 14, 2017, we announced the results of a supportive Phase I safety PK-PD study in healthy Japanese patients which supports further development of voclosporin in this patient population. Based on evaluations comparing the Japanese ethno-bridging data vs. previous PK and PD studies in non-Japanese patients, voclosporin demonstrated no statistically significant differences in exposure with respect to Area Under the Curve measurements. Furthermore, the PK parameters in Japanese patients were generally consistent with previously evaluated PK parameters in non-Japanese volunteers. There were no unusual or unexpected safety signals in the study.

CORPORATE AND OPERATIONAL DEVELOPMENTS IN 2017

March 20, 2017 Offering

On March 20, 2017, we completed an underwritten public offering of 25.64 million Common Shares, which included 3.35 million Common Shares issued pursuant to the full exercise of the underwriters’ overallotment option to purchase additional Common Shares (the “March Offering”). The Common Shares were sold at a public offering price of $6.75 per share. The gross proceeds from the March Offering were $173.10 million before deducting the 6% underwriting commission and other offering expenses which totaled $10.78 million. Leerink Partners LLC and Cantor Fitzgerald & Co. acted as joint book-running managers for the March Offering. The Offering was made pursuant to a U.S. registration statement on Form F-10, declared effective by the United States Securities and Exchange Commission (the “SEC”) on November 5, 2015 (the “Registration Statement”), and the Company’s existing Canadian short form base shelf prospectus (the “Base Shelf Prospectus”) dated October 16, 2015. The prospectus supplements relating to the Offering (together with the Base Shelf Prospectus and the Registration Statement, the “Offering Documents”) were filed with the securities commissions in the provinces of British Columbia, Alberta and Ontario in Canada, and with the SEC in the United States.

We intend to use the net proceeds of the March Offering for research and development activities, including the AURORA clinical trial activities, commercialization activities and working capital purposes.

Changes to Board and Management

On February 6, 2017, we appointed Dr. Richard M. Glickman LLD (Hon), our founder and Chairman of the Board, as our Chairman and Chief Executive Officer. The Board accepted the resignation of Charles Rowland as Chief Executive Officer and an executive member of the Board.

On May 9, 2017, we appointed George M. Milne Jr., PhD to the Board. Prior to his retirement, Dr. Milne served as Executive Vice President of Global Research and Development and President of Worldwide Strategic and Operations Management at Pfizer. Dr. Milne serves on multiple corporate boards including Charles River Laboratories where he is the lead director and Amylyx Pharmaceuticals and is a Venture Partner at Radius Ventures. On May 8, 2017, Dr. Gregory Ayers resigned from the Board.

On April 17, 2017, we hired Simrat Randhawa MD, MBA, as Head of Medical Affairs. Simrat brings over 20 years of experience to Aurinia across clinical practice, medical affairs and business development. For the past 10 years, he has held a number of senior leadership roles in commercial and medical affairs within large and small pharmaceutical companies. During this time, Simrat served as the medical lead for Novartis' Multiple Sclerosis (MS) franchise, where he played an integral role in establishing Gilenya® as the first oral therapy for the treatment of Relapsing MS. Most recently he was the global medical affairs lead at BioMarin Pharmaceuticals for MPS, Duchenne Muscular Dystrophy and Hemophilia

On July 3, 2017, we hired Erik Eglite, DPM, JD, MBA as Senior Vice President, General Counsel & Chief Corporate Compliance Officer. Prior to joining Aurinia, Erik was Vice President, Chief Compliance Officer and Corporate Counsel for Marathon Pharmaceuticals and Vice President, Chief Compliance Officer and Corporate Counsel for Lundbeck Pharmaceuticals. Prior to that, he was Vice President, Chief Compliance Officer and Corporate Counsel for Ovation Pharmaceuticals and Global Chief Compliance Officer, Corporate Counsel for Aspreva Pharmaceuticals. Erik has been involved with the clinical development, launch and commercialization of 12 drugs and drug programs. He is also a licensed podiatric physician and surgeon.

Termination of Paladin Agreements

Effective December 28, 2017, we terminated the License Agreement dated June 18, 2009 between Paladin and the Company (as amended). Concurrent with the termination of the License Agreement, under the terms of the R&D Agreement dated June 18, 2009, between Paladin and the Company (as amended), the R&D Agreement also terminated effective December 28, 2017.

CORPORATE DEVELOPMENTS IN 2016

FDA End of Phase 2 Meeting and Plans for Single LN Phase 3 Clinical Trial

On November 2, 2016, we announced the FDA’s preference for a single LN Phase III clinical trial for voclosporin in the treatment of LN and our plans and expectations for the AURORA clinical trial. A further description of the AURORA clinical trial is set out under the headings “Phase III AURORA clinical trial” and “Initiation of Phase III AURORA clinical trial”.

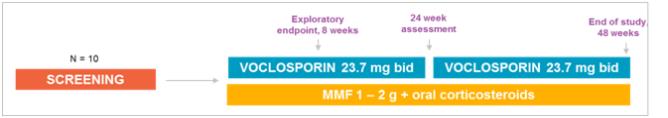

AURION Clinical Trial Update

The AURION trial was a single-arm, twin center, exploratory study assessing the predictive value of an early reduction in proteinuria in subjects receiving 23.7 mg of voclosporin BID with the current standard of care in patients with active LN. The primary objective of the AURION clinical trial was to examine biomarkers of disease activity at eight weeks and their ability to predict response at 24 and 48 weeks.

Study Design:

The primary analysis is the number of patients achieving each of the following biomarkers and the number of these patients who go on to achieve week 24 or week 48 remission.

Biomarkers:

| |

• | 25% reduction in UPCR at eight weeks; |

| |

• | C3 complement normalization at 8 weeks; |

| |

• | C4 complement normalization at 8 weeks; and |

| |

• | Anti-dsDNA normalization at eight weeks. |

The secondary analysis includes the 24 and 48-week outcomes, markers of SLE and PK-PD of voclosporin.

On October 6, 2016, we announced 24-week data in all 10 patients from the AURION clinical trial, an open-label exploratory study to assess the short-term predictors of response using voclosporin (23.7 mg BID) in combination with MMF and oral corticosteroids in patients with active LN. The data was presented by Robert Huizinga, Vice President of Clinical Affairs at Aurinia Pharmaceuticals at the 10th Annual European Lupus Meeting in Venice, Italy.

The primary objective of the trial is to examine biomarkers of disease activity at eight weeks and their ability to predict response at 24 and 48 weeks.

In this trial, 70% (7/10) of patients achieved CR at 24 weeks as measured by a UPCR of 0.5mg/mg, eGFR within 20% of baseline and concomitant steroid dose of <5 mg/day. Of the 10 patients that achieved a reduction of UPCR of 25% at 8 weeks, 80% were responders (50% reduction in UPCR over baseline) at 24 weeks and 70% were in CR at 24 weeks, proteinuria levels decreased by a mean of 61% from baseline through the first 24 weeks of the study. In addition, inflammatory markers such as C3, C4 and Anti-dsDNA all continued to normalize to 24 weeks. Voclosporin was well-tolerated with no unexpected safety signals observed. Renal function, as measured by eGFR, also remained stable over the 24 weeks. We believe that the results of the AURION clinical trial supports the use of the 23.7 mg twice daily dose in further studies.

Details of the results are below:

|

| | | | | | | | | |

Patient# | Attained ≥25% reduction in UPCR at 8 weeks | | Attained PR* at 8 weeks | | Attained PR* at 24 weeks | | Attained CR at 8 weeks | | Attained CR at 24 weeks |

1 | Y | | Y | | Y | | Y | | Y |

2 | Y | | Y | | Y | | Y | | Y |

3 | Y | | Y | | Y | | N | | N |

4 | Y | | N | | N | | N | | N |

5 | Y | | Y | | Y | | Y | | Y |

6 | Y | | Y | | Y | | Y | | Y |

7 | Y | | N | | N | | N | | N |

8 | Y | | Y | | Y | | Y | | Y |

9 | Y | | N | | Y | | N | | Y |

10 | Y | | Y | | Y | | N | | Y |

TOTALS: | 100% (10/10) | | 70% (7/10) | | 80% (8/10) | | 50% (5/10) | | 70% (7/10) |

| |

* | Retrospectively defined by ≥50% reduction in UPCR |

AURA - Positive Top-Line Results For 24 Week Data

On August 15, 2016, we announced positive top-line results from the AURA clinical trial in patients with active LN. The trial achieved its primary endpoint, demonstrating statistically significantly greater CR at 24 weeks (and confirmed at 26 weeks) in patients treated with 23.7 mg of voclosporin twice daily (p=0.045). This was the first global study of LN to meet its primary end point. Both treatment arms, 23.7 mg and 39.5 mg twice daily also showed a statistically significant improvement in the rate of achieving PR at 24 weeks (p=0.007; p=0.024). Each arm of the trial included the current standard of care of MMF as background therapy, and a forced steroid taper.

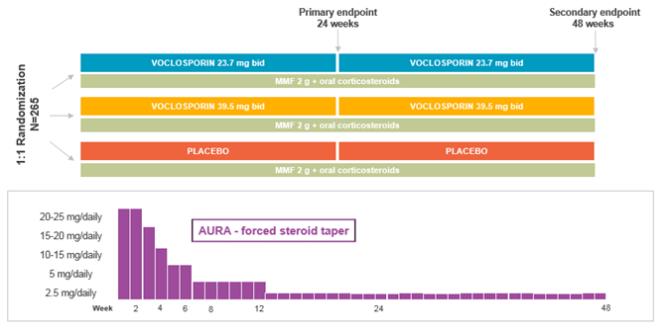

AURA Trial Design

The AURA clinical trial compared the efficacy of voclosporin added to current standard of care of MMF, also known as CellCept®, against standard of care with placebo in achieving CR in patients with active LN. It enrolled 265 patients at centers in 20 countries worldwide. On entry to the trial, patients were required to have a diagnosis of LN according to established diagnostic criteria (American College of Rheumatology) and clinical and biopsy features indicative of active LN.

Patients were randomized to one of two dosage groups of voclosporin (23.7 mg BID and 39.5 mg BID) or placebo, with all patients also receiving MMF and oral corticosteroids as background therapy. All patients had an initial IV dose of steroids (500-1000 mg) and then were started on 20-25 mg/daily, which was tapered down to a low dose of 5 mg daily by week 8 and 2.5 mg daily by week 16.

The primary endpoint was a measure of the number of patients who achieved CR at 24 weeks which had to be confirmed at 26 weeks. CR required the following four elements:

| |

• | protein/creatinine ratio of 0.5 mg/mg; |

| |

• | normal stable renal function (eGFR 60 mL/min/1.73m2 or no confirmed decrease from baseline in eGFR of 20%); |

| |

• | Presence of sustained, low dose steroids (10mg/day of prednisone from week 16 - 24); and |

| |

• | No administration of rescue medications throughout the treatment period. |

Summary of Results

The groups were generally well-balanced for age, gender and race, however, when considered together, the proteinuria and eGFR data suggest that disease severity was greater for the low-dose voclosporin group.

Efficacy

| |

• | The primary endpoint of CR was met for the low-dose voclosporin group in the ITT analysis (p=0.045). 32.6% of patients on low dose achieved CR, compared to 27.3% on high dose and 19.3% in the control arm. |

| |

• | The odds ratio indicates that patients were twice as likely to achieve CR at 24 weeks compared to the control arm (OR=2.03). |

| |

• | The primary endpoint was re-analyzed using the 24-hour urine data in place of First Morning Void collections, confirming the finding that patients were twice as likely to achieve CR at 24 weeks compared to the control arm (p=0.047; OR=2.12). |

| |

• | Both voclosporin groups had a significantly faster time to CR (UPCR 0.5 mg/mg) than the control arm. Results of time to CR for co-variate analyses were broadly consistent with overall efficacy rates in those sub-groups. |

| |

• | The secondary endpoint of PR (50% reduction in UPCR over baseline with no administration of rescue medication throughout the treatment period) was met for both voclosporin groups in the ITT analysis with 69.7% of patients on low dose achieving PR (p=0.007) and 65.9% in the high dose group (p=0.024). 49.4% of patients in the control arm achieved PR. |

| |

• | Time to PR was similar (4 weeks) in the two voclosporin groups and was shorter than what was observed in the control group (6.6 weeks). |

Safety

| |

• | The overall rate of AEs was similar across all groups. |

| |

• | The overall rate of SAEs was higher in both voclosporin groups but the nature of SAEs is consistent with highly active LN. |

| |

• | The overall pattern of AEs and SAEs was consistent with that observed in other LN studies. |

| |

• | There were 13 deaths across the trial: two in the high-dose voclosporin arm; 10 in the low-dose voclosporin arm; and one in the control arm, with the majority of overall deaths (11/13) occurring in Asia. All deaths were assessed by the study investigator as being unrelated to study treatment. |

On September 29, 2016, we announced that in addition to voclosporin (23.7 mg BID) achieving its primary endpoint of CR at 24 weeks, both doses of voclosporin when added to the current standard of care of MMF and a forced oral corticosteroid taper have met all 24-week pre-specified secondary endpoints vs the control group. These pre-specified endpoints include: PR, which is measured by a 50% reduction in UPCR with no concomitant use of rescue medication; time to CR and PR; reduction in SLEDAI score; and reduction in UPCR over the 24-week treatment period.

|

| | | | | |

Pre-specified Secondary Endpoint | Control | | Low Dose VCS (23.7mg BID) | | High Dose VCS (39.5mg BID) |

Time to CR [median] | Not achieved | | 19.7 weeks p<.001 | | 23.4 weeks p=.001 |

PR (as measured by UPCR reduction of ≥ 50% from baseline) | 49% | | 70% p=.007 | | 66% p=.024 |

Time to PR [median] | 6.6 weeks | | 4.1 weeks p=.002 | | 4.4 weeks p=.003 |

SLEDAI Reduction | -4.5 | | -6.3 p=.003 | | -7.1 p=.003 |

Reduction in UPCR | -2.216 mg/mg | | -3.769 mg/mg p<.001 | | -2.792 mg/mg p=.006 |

| | | All p-values are vs control |

On September 30, 2016, we presented detailed results on the AURA clinical trial. These included a number of pre-specified subset and co-variate analyses and post-hoc analyses on the data, which show rapid proteinuria reduction and early remission. Based on recent literature suggesting that using a UPCR of .7mg/mg has better predictive power regarding long-term renal outcomes in LN patients, we performed a post hoc analysis applying this measure. In doing so, we saw both a greater treatment difference between the 23.7 mg BID voclosporin arm and the control arm, and better statistical power, which improves from a p-value of .045 to less than .01.

Based on these data we believe:

| |

• | voclosporin has shown statistically significant efficacy in multiple dimensions; |

| |

• | pre-specified and post-hoc analyses have provided valuable insight; |

| |

• | the LN Phase 3 clinical trial will be de-risked based upon the AURA results; and |

| |

• | biomarker data suggest significant effect on the underlying immunologic process of the disease. |

We also released detailed safety data for the trial including an in-depth mortality assessment. The safety and tolerability of voclosporin has been well-documented in numerous studies. In previous studies, over 2,000 patients have been treated with voclosporin across multiple indications with no unexpected SAEs. Clinical doses of voclosporin studies to date range from 13-70 mg BID.

In comparing four global LN trials, AURA, ALMS, Ocrelizumab and Abatacept, it is evident that the AURA clinical trial enrolled the most severe patients, as measured by proteinuria at baseline. The difference in UPCR and the eGFR in the low dose voclosporin arm at baseline indicates patients had more severe disease.

No new safety signals were observed with the use of voclosporin in LN patients and voclosporin was well- tolerated. The overall safety profile of voclosporin is consistent with other immunomodulators. The summary of AEs by SOC across arms in the trial is as follows:

|

| | | |

| Control | Voclosporin 23.7mg BID | Voclosporin 39.5 mg BID |

SOC | N=88 | N=89 | N=88 |

Any AE | 74 (84.1) | 81 (91.0) | 84 (95.5) |

Thirteen deaths have been reported in the AURA clinical trial which is a pattern that is consistent with other global active LN studies. Eleven of thirteen deaths occurred at sites with compromised access to standard of care; and patients who died in the trial had a statistically different clinical baseline picture, indicating a more severe form of LN, potential comorbid conditions and poor nutrition. The last death in the trial occurred in February 2016. Both the FDA and Data Safety Monitoring Board have reviewed in detail each death that occurred in the trial.

On November 15, 2016, at the American College of Rheumatology annual meeting, we presented speed of remission data from the AURA trial in a late-breaking abstract titled “Speed of Remission with the Use of Voclosporin, MMF and Low Dose Steroids: Results of a Global Lupus Nephritis Study.” The data presented are a post-hoc responder analysis (median time to CR for those who achieve CR), demonstrating 7.3 weeks to CR for voclosporin 23.7mg BID vs the control arm of 12 weeks.

On November 21, 2016, at the American Society of Nephrology Kidney Week 2016, we presented renal function data for the AURA trial in a late breaking session titled “High Impact Clinical Trials”. These data showed that in the voclosporin treatment arms, the renal function as measured by eGFR was stable and not significantly different from the control arm during the course of the trial. Mean blood pressure was slightly reduced and was similar between all treatment groups.

Financings

June 2016 Private Placement

On June 22, 2016, we completed a private placement of 3,000,000 units at US$2.36 per unit for aggregate gross proceeds of US$7,080,000. Each unit consisted of one Common Share and a 0.35 of one Common Share purchase warrant exercisable for a period of two years from the date of issuance at an exercise price of US$2.77.

July 2016 At-the-Market Facility

On July 22, 2016, we entered into a controlled equity offering sales agreement with Cantor Fitzgerald & Co. pursuant to which the Company was authorized to sell, from time to time, through at-the-market offerings (the “July ATM”) with Cantor Fitzgerald & Co. acting as sales agent, such Common Shares as would have an aggregate offer price of up to US$10,000,000. We also filed a prospectus supplement with securities regulatory authorities in Canada in the provinces of British Columbia, Alberta and Ontario, and with the United States Securities and Exchange Commission, which supplemented our short form base shelf prospectus dated October 16, 2015, and our shelf registration statement on Form F-10 dated October 16, 2015, declared effective on November 5, 2015 (the “Shelf Prospectus”). Sales in the July ATM were only conducted in the United States through NASDAQ at market prices. No sales were conducted in Canada or through the Toronto Stock Exchange.

As of October 3, 2016, sales pursuant to the July ATM were concluded. We issued 3,306,085 Common Shares, receiving gross proceeds in the aggregate of US$8,000,000 ($6,142,000 in the third quarter of 2016 and $1,858,000 subsequent to the quarter end), being the maximum value permissible in accordance with Canadian securities laws.

November 9, 2016 At-the-Market Facility

We entered into a Controlled Equity OfferingSM Sales Agreement (the “Sales Agreement”) with Cantor Fitzgerald & Co. dated November 9, 2016 relating to the sale of our Common Shares having an aggregate offering price of up to $8.0 million (the “November ATM”). We also filed a prospectus supplement on November 9, 2016 with securities regulatory authorities in Canada in the provinces of British Columbia, Alberta and Ontario, and with the United States Securities and Exchange Commission, which supplemented our shelf prospectus. The prospectus supplement was amended, and an amended and restated prospectus supplement was filed on February 24, 2017 to update changes to certain information.

The sales under the November ATM were only conducted in the United States through NASDAQ at market prices. No sales were conducted in Canada or through the Toronto Stock Exchange.

As a result of completion of the March Offering, we determined that the November ATM facility was no longer required and as a result the Sales Agreement was terminated effective May 8, 2017.

As at December 31, 2016, we had issued 138,986 Common Shares and received gross proceeds of $396,000. There were no sales under the November ATM in 2017.

December 2016 Public Offering

On December 28, 2016, we closed our US$28.75 million financing (including US$3.75 million pursuant to an exercise of the underwriters’ over-allotment option), for the sale of 12,777,775 units at a price of US$2.25 per unit. Each unit consisted of one Common Share and one half of one Common Share purchase warrant (each whole warrant, a “December 2016 Warrant”). Each December 2016 Warrant entitles the holder to purchase one common share at the exercise price of US$3.00 per common share for a period of five years after the closing of the offering. H.C. Wainwright & Co., LLC acted as sole book-running manager, and Cormark Securities Inc., acted as co-manager. The underwriters received a fee of 7.0% of the gross proceeds of the offering.

CORPORATE DEVELOPMENTS IN 2015

Filing of Base Shelf Prospectus - October 19, 2015

We received a final receipt from the British Columbia Securities Commission on October 19, 2015 for the Shelf Prospectus.

The Shelf Prospectus and corresponding shelf registration statement allowed Aurinia to offer Common Shares of Aurinia, warrants to purchase Common Shares of Aurinia and subscription receipts that entitle the holder to receive upon satisfaction of certain release conditions, and for no additional consideration, Common Shares of Aurinia or any combination thereof during the 25-month period that the Shelf Prospectus is effective, with a total offering price, in the aggregate, of up to US$250 million. The Shelf Prospectus was intended to give Aurinia the capability to access new capital from time to time. The amount and timing of any future offerings will be based on our financial requirements and market conditions at the time. The Shelf Prospectus expired November 19, 2017.

REGULATORY AND BUSINESS MATTERS

REGULATORY REQUIREMENTS

The development, manufacturing and marketing of voclosporin is subject to regulations relating to the demonstration of safety and efficacy of the products as established by the government (or regulatory) authorities in those jurisdictions where this product is to be marketed. We would require regulatory approval in the United States, Europe and Japan where activities would be conducted by us or on our behalf. Depending upon the circumstances surrounding the clinical evaluation of the product candidate, the Company itself may undertake clinical trials, contract clinical trial activities to contract research organizations, or rely upon corporate partners for such development. We believe this approach will allow us to make cost effective developmental decisions in a timely fashion. We cannot predict or give any assurances as to whether regulatory approvals will be received or how long the process of seeking regulatory approvals will take.

Although only the jurisdictions of the United States, Europe and Japan are discussed in this section, we also intend to seek regulatory approval in other jurisdictions in the future and will initiate clinical studies where appropriate.

United States

In the United States, all drugs are regulated under the Code of Federal Regulations and are enforced by the FDA. The regulations require that non-clinical and clinical studies be conducted to demonstrate the safety and effectiveness of products before marketing, and that the manufacturing be conducted according to certain GMP standards provided by the FDA.