Table of Contents

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

Table of Contents

| 1 | ||||

| PROXY STATEMENT |

||||

| 9 | ||||

| 13 | ||||

| 16 | ||||

| 20 | ||||

| 23 | ||||

| 31 | ||||

| Proposal No. 4 – Approval of the Compensation of our Named Executive Officers |

32 | |||

| 35 | ||||

| 45 | ||||

| 47 | ||||

| 49 | ||||

| 72 | ||||

| 76 | ||||

| 83 | ||||

| 84 | ||||

| 85 | ||||

| 88 | ||||

| 90 | ||||

| 90 | ||||

| 90 | ||||

APPENDIX A

DNOW INC. 2024 LONG-TERM INCENTIVE PLAN

Table of Contents

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

Wednesday, May 22, 2024

10:00 a.m. (Central Standard Time)

DNOW Inc.

7402 N. Eldridge Parkway

Houston, Texas 77041

The 2024 Annual Meeting of Stockholders of DNOW Inc. (“Annual Meeting”) will be held at the Company’s corporate headquarters located at 7402 N. Eldridge Parkway, Houston, Texas 77041 on Wednesday, May 22, 2024, at 10:00 a.m. local time, for the following purposes:

| ◾ | To elect eight directors to hold office for one-year terms (Proposal 1); |

| ◾ | To consider and act upon a proposal to approve the 2024 Long-Term Incentive Plan (Proposal 2); |

| ◾ | To consider and act upon a proposal to ratify the appointment of Ernst & Young LLP as independent auditors of the Company for 2024 (Proposal 3); |

| ◾ | To consider and act upon an advisory proposal to approve the compensation of our named executive officers (Proposal 4); and |

| ◾ | To consider and act upon any other matters that may properly come before the annual meeting or any postponement or adjournment thereof. |

The Board of Directors recommends that you vote “FOR” these four proposals.

The Board of Directors has set March 25, 2024 as the record date for the Annual Meeting. If you were a stockholder of record at the close of business on March 25, 2024, you are entitled to vote at the Annual Meeting. A complete list of these stockholders will be available for examination during ordinary business hours at our corporate headquarters for a period of ten days prior to the Annual Meeting.

On or about April 5, 2024, a Notice of Internet Availability of Proxy Materials containing instructions on how to access our 2024 Proxy Statement and 2023 Annual Report on Form 10-K and how to vote online will be made available. The Notice also provides instruction on how you can request a paper copy of these documents if you desire. If you received your 2024 annual meeting materials via e-mail, the e-mail contains voting instructions and links to the Proxy Statement and Form 10-K online.

You are cordially invited to join us at the Annual Meeting. However, to ensure your representation, we request that you return your signed proxy card or complete voting online at your earliest convenience, regardless of whether or not you plan to attend the Annual Meeting. You may revoke your proxy at any time if you wish to attend and vote in person.

By Order of the Board of Directors,

Raymond Chang

Vice President, General Counsel and Secretary

Houston, Texas

April 5, 2024

1

Table of Contents

Proxy Summary

This summary highlights information throughout our Proxy Statement. Please read this entire Proxy Statement carefully as this summary does not contain all information you should consider before voting.

| Annual Shareholders Meeting | ||||

| Date: May 22, 2024

Time: 10:00 a.m. Central Time

Meeting Agenda: The meeting will cover the four proposals listed in the Voting Matters and Vote Recommendations herein as well as any other business that may properly come before the meeting. |

Place: DNOW Inc. 7402 N. Eldridge Parkway Houston, TX 77041 |

|||

|

Record Date: March 25, 2024

Notice Date: This Proxy Statement was first mailed to shareholders on or about April 5, 2024. |

Voting: Shareholders as of the record date are entitled to vote. Each share of common stock of DNOW Inc. (“Company”) is entitled to one vote for each director nominee and one vote for each proposal. |

Despite a softer market with less momentum than originally expected in 2023, the Company had a very strong year. The Company continued to be debt-free and produced results that fueled an accumulation growth strategy by driving significant free cash flow while producing solid revenue growth. The Company’s commitment to growing through accretive organic growth and acquisitions remained a key priority, while also having the ability to repurchase shares opportunistically and a broadened capital allocation framework to generate attractive shareholder returns without deviating from a disciplined approach to balance sheet management. In the energy evolution landscape, the Company is helping its customers decarbonize by reducing or eliminating routine flaring as well as assisting in providing products geared towards the elimination of methane used. The Company’s focus is about finding where the solutions and the strengths it cultivates intersect with where its customers find value.

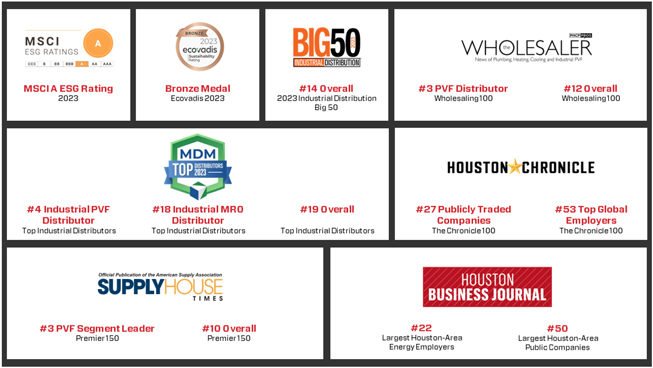

2023 External Recognitions

2

Table of Contents

Voting Matters and Vote Recommendations

| MANAGEMENT PROPOSALS |

Board Recommends | |

| Election of Eight Directors (Proposal 1) |

FOR | |

| To Consider and Act Upon a Proposal to Approve the 2024 Long-Term Incentive Plan (Proposal 2) |

FOR | |

| Ratification of the Selection of Ernst & Young LLP as our Independent Auditor for Fiscal Year 2024 (Proposal 3) |

FOR | |

| Advisory Vote to Approve Named Executive Officer Compensation (“Say-on-Pay Vote”) (Proposal 4) |

FOR |

Our Director Nominees

| Name Occupation |

Age | Director Since |

Independent | Other Public Boards |

AC | CC | ESGN | |||||||

| Richard Alario Former CEO, Key Energy Services, Inc. |

69 | 2014 | Yes | 1 | C | M | ||||||||

| Terry Bonno Former Senior Vice President of Industry and Community Relations, Transocean Ltd. |

66 | 2014 | Yes | 1 | M | M | ||||||||

| David Cherechinsky CEO, DNOW Inc. |

60 | 2020 | No | 0 | ||||||||||

| Galen Cobb Former Vice President Industry Relations, Halliburton |

70 | 2014 | Yes | 0 | M | |||||||||

| Paul Coppinger Former President of SPM Oil & Gas, a Caterpillar Company |

63 | 2017 | Yes | 0 | M | C | ||||||||

| Karen David-Green Former Chief Communications, Stakeholder, and Sustainability Officer, Expro Group |

55 | 2023 | Yes | 1 | M | |||||||||

| Rodney Eads Former Chief Operating Officer and Executive Vice President, Pride International Inc. |

73 | 2014 | Yes | 0 | C | |||||||||

| Sonya Reed Former Senior Vice President and Chief Human Resources |

50 | 2021 | Yes | 0 | M |

|

AC: Audit Committee CC: Compensation Committee ESGN: Environmental, Social, Governance and Nominating Committee |

C: Chair

M: Member | |||||||||||||

3

Table of Contents

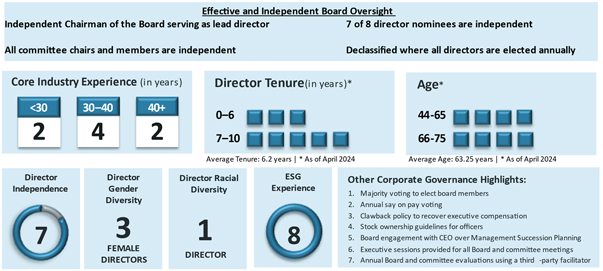

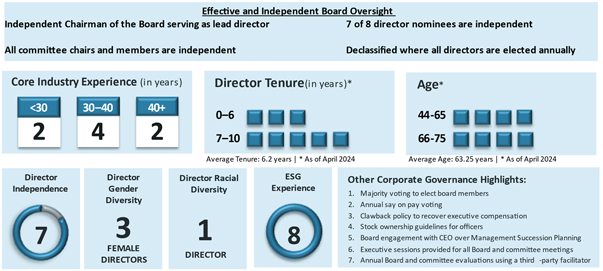

Governance and Board Best Practices

| We are committed to and recognize the importance of good corporate governance and high ethical standards. Our Board believes that having a diverse mix of directors with complementary qualifications, expertise, and attributes is essential to meeting its oversight responsibilities. |

| • Active Board and committees of the Board providing oversight of areas of risk to the Company • Independent Chairman of the Board serving as the lead director • 7 of 8 director nominees are independent • Independent committee chairs and members • Stock Ownership Guidelines for Executive Officers and Directors • Clawback policy to recover executive compensation • Annual Board and committee self-evaluations and assessments using a third-party facilitator to conduct the evaluations • Directors meet in executive sessions without management present |

• Fully Declassified Board where directors stand for annual election • All current Audit Committee members meet the NYSE standard of having accounting or related financial management expertise and each meet the SEC’s criteria of an Audit Committee Financial Expert • Directors are elected by majority vote in uncontested elections • Board engagement with Chief Executive Officer over Management Succession Planning for CEO and all executives • Minimum stock ownership guidelines for all directors | |

4

Table of Contents

DNOW INC.

7402 N. Eldridge Parkway

Houston, Texas 77041

PROXY STATEMENT

Except as otherwise specifically noted in this Proxy Statement, “DNOW”, the “Company,” “we,” “our,” “us,” and similar words in this Proxy Statement refer to DNOW Inc.

| ANNUAL MEETING: | Date: Wednesday, May 22, 2024 Time: 10:00 a.m. (Central Standard Time) Place: DNOW Corporate Headquarters 7402 N. Eldridge Parkway Houston, Texas 77041 | |

| AGENDA: | Proposal 1: To elect eight nominees as directors of the Company for one-year terms.

Proposal 2: To consider and act upon a proposal to approve the 2024 Long-Term Incentive Plan.

Proposal 3: To ratify the appointment of Ernst & Young LLP as independent auditors of the Company for 2024.

Proposal 4: To approve, on an advisory basis, the compensation of our named executive officers.

The Board of Directors recommends that you vote “FOR” the election of the eight nominees for director (Proposal 1), “FOR” the proposal to approve the 2024 Long-Term Incentive Plan (Proposal 2), “FOR” the proposal to ratify the appointment of Ernst & Young LLP as independent auditors of the Company for 2024 (Proposal 3), and “FOR” the approval of the compensation of our named executive officers (Proposal 4). | |

| RECORD DATE/ WHO CAN VOTE: |

All stockholders of record at the close of business on March 25, 2024 are entitled to vote. The only class of securities entitled to vote at the Annual Meeting is DNOW common stock. Holders of DNOW common stock are entitled to one vote per share at the Annual Meeting. | |

| PROXY NOTICE: | Proxy Materials will be available to stockholders on or about April 5, 2024. Our Annual Report on Form 10-K, including financial statements, for the fiscal year ended December 31, 2023, accompanies this Proxy Statement. The Annual Report on Form 10-K shall not be considered as a part of the proxy solicitation materials or as having been incorporated by reference. | |

| PROXIES SOLICITED: | Your vote and proxy is being solicited by the Board of Directors for use at the Annual Meeting. This Proxy Statement and enclosed proxy card is being sent on behalf of the Board of Directors to all stockholders beginning on or about April 5, 2024. By completing, signing and | |

5

Table of Contents

| returning your proxy card, you will authorize the persons named on the proxy card to vote your shares according to your instructions. | ||

| PROXIES: | If your proxy does not indicate how you wish to vote your common stock, the persons named on the proxy card will vote FOR election of the eight nominees for director (Proposal 1), FOR the proposal to approve the 2024 Long-Term Incentive Plan (Proposal 2), FOR the ratification of the appointment of Ernst & Young LLP as independent auditors (Proposal 3), and FOR the approval of the compensation of our named executive officers (Proposal 4). | |

| REVOKING YOUR PROXY: | You can revoke your proxy at any time prior to when the vote is taken at the meeting by: (i) filing a written notice revoking your proxy; (ii) filing another proxy bearing a later date; or (iii) casting your vote in person at the Annual Meeting. Your last vote will be the vote that is counted. | |

| QUORUM: | As of March 25, 2024, there were 108,894,127 shares of DNOW common stock issued and outstanding. The holders of these shares have the right to cast one vote for each share held by them. Shareholders, in person or by proxy, casting at least 54,447,064 votes constitutes a quorum for adopting the proposals at the Annual Meeting. Abstentions will be included in determining the number of shares present at the meeting for the purpose of determining a quorum, as will broker non-votes. A broker non-vote occurs when a broker is not permitted to vote on a matter without instructions from the beneficial owner of the shares and no instruction is given. If you have properly signed and returned your proxy card, you will be considered part of the quorum, and the persons named on the proxy card will vote your shares as instructed. | |

| VOTE REQUIRED FOR APPROVAL: |

For the proposal to elect the eight director nominees (Proposal 1), our bylaws require that each director nominee be elected by the majority of votes cast with respect to such nominee (i.e. the number of shares voted FOR a director nominee must exceed the number of shares voted AGAINST that nominee). For additional information regarding our majority voting policy, see page 9 of the proxy statement. You cannot abstain in the election of directors and broker non-votes are not counted. Brokers are not permitted to vote your shares on the election of directors in the absence of your specific instructions as to how to vote. Please provide your broker with voting instructions so that your vote can be counted.

Approval of the proposal to approve the 2024 Long-Term Incentive Plan (Proposal 2), the proposal to ratify the appointment of Ernst & Young LLP as independent auditors (Proposal 3) and the proposal to approve the compensation of our named executive officers (Proposal 4) will require the affirmative vote of a majority of the shares of our common stock entitled to vote in person or by proxy. An abstention will have the same effect as a vote AGAINST for each such proposal. With respect to Proposals 2 and 4, brokers are not permitted to vote your shares in the absence of your specific instructions as to how to vote. Please provide your broker with voting instructions so that your vote | |

6

Table of Contents

| can be counted. Broker non-votes will have no impact on the outcome of the proposals. | ||

| HOUSEHOLDING: | The U.S. Securities and Exchange Commission (“SEC”) has adopted rules that permit companies and intermediaries, such as brokers, to satisfy the delivery requirements for proxy statements with respect to two or more stockholders sharing the same address by delivering a copy of these materials, other than the Proxy Card, to those stockholders. This process, which is commonly referred to as “householding,” can mean extra convenience for stockholders and cost savings for the Company. Beneficial stockholders can request information about householding from their banks, brokers, or other holders of record. Through householding, stockholders of record who have the same address and last name will receive only one copy of our Proxy Statement and Annual Report, unless one or more of these stockholders notifies us that they wish to continue receiving individual copies. If an individual receives multiple proxy cards, this indicates that your shares are held in more than one account, such as two brokerage accounts, and are registered in different names. You should vote each of the proxy cards to ensure that all of your shares are voted.

Stockholders who participate in householding will continue to receive separate Proxy Cards. If, at any time, you no longer wish to participate in householding and would prefer to receive a separate Proxy Statement and Annual Report, please notify your broker if you are a beneficial stockholder. If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of Proxy Statements and Annual Reports, or if you hold stock in more than one account and wish to receive only a single copy of the Proxy Statement or Annual Report for your household, please contact Broadridge Householding Department, in writing, at 51 Mercedes Way, Edgewood, New York 11717, or by phone at (800) 542-1061. | |

| COST OF PROXY SOLICITATION: |

We have retained Okapi Partners LLC to solicit proxies from our stockholders at an estimated fee of $12,500, plus expenses. This fee does not include the costs of preparing, printing, assembling, and delivering the Proxy Statement. The Company will pay for the cost of soliciting proxies. Some of our directors, officers, and employees may also solicit proxies personally, without any additional compensation, by telephone or mail. Proxy materials also will be furnished without cost to brokers and other nominees to forward to the beneficial owners of shares held in their names. | |

7

Table of Contents

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be

Held on Wednesday, May 22, 2024. The Company’s 2024 Proxy Statement and the Annual Report

to Stockholders for the year ended 2023 are also available at:

http://www.proxyvote.com

For directions to the Annual Meeting, please contact Investor Relations at 281-823-4700.

PLEASE VOTE – YOUR VOTE IS IMPORTANT

8

Table of Contents

ELECTION OF DIRECTORS

PROPOSAL NO. 1 ON THE PROXY CARD

At the Company’s inception in 2014, the Board of Directors of DNOW Inc. (the “Board”) was divided into three classes with each class serving a term of three years. In 2020, stockholders approved the declassification of the Board over a three-year period which culminated in 2023. All directors now stand for election for one-year terms if elected at the upcoming annual meeting of stockholders.

Richard Alario, Terry Bonno, David Cherechinsky, Galen Cobb, Paul Coppinger, Karen David-Green, Rodney Eads, and Sonya Reed are nominees for directors, each for a one-year term expiring at the Annual Meeting in 2025, or when their successors are elected and qualified. We believe each of the nominees will be able to serve if elected. However, if any nominee is unable to serve, the remaining members of the Board have the authority to nominate another person, elect a substitute, or reduce the size of the Board. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Vote Required for Approval

DNOW’s Bylaws require that each director be elected by the majority of votes cast with respect to such director in uncontested elections (the number of shares voted FOR a director nominee must exceed the number of votes cast AGAINST that nominee). In a contested election (a situation in which the number of nominees exceeds the number of directors to be elected), the standard for election of directors would be a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors. Whether an election is contested or not contested is determined 14 days in advance of when we file our definitive proxy statement with the SEC. This year’s election was determined to be an uncontested election and the majority vote standard will apply. If a nominee who is serving as a director is not elected at the annual meeting, Delaware law provides that the director would continue to serve on the Board as a “holdover director.” However, under our Bylaws and Corporate Governance Guidelines, each director must submit an advance, contingent, irrevocable resignation that the Board may accept if the director fails to be elected through a majority vote. In that situation, our Environmental, Social, Governance, and Nominating Committee would make a recommendation to the Board about whether to accept or reject the resignation or whether to take other action. The Board will act on the Environmental, Social, Governance, and Nominating Committee’s recommendation and publicly disclose its decision and the rationale behind it within 90 days from the date the election results are certified. If a nominee who was not already serving as a director fails to receive a majority of votes cast at the annual meeting, Delaware law provides that the nominee does not serve on the Board as a “holdover director.” In 2024, all director nominees are currently serving on the Board.

Brokers are not permitted to vote your shares on the election of directors in the absence of your specific instructions as to how to vote. Please provide your broker with voting instructions so that your vote can be counted.

9

Table of Contents

Information Regarding Nominees for Director for Terms Expiring in 2024:

| Name | Biography | |

| Richard Alario (69)

First Became a Director in 2014 |

Mr. Alario has been a director of the Company since May 2014 and has served as the Company’s Chairman of the Board since April 2021. Mr. Alario served as Interim Chief Executive Officer of the Company from November 2019 until June 2020, and as Executive Vice Chairman on an interim, short-term basis from June 2020 until October 2020. Mr. Alario served as Chief Executive Officer and director of Key Energy Services, Inc., a provider of oilfield services, from 2004 until his retirement in March 2016. Prior to joining Key Energy Services, Mr. Alario was employed by BJ Services Company, an oilfield services company, where he served as Vice President from 2002 after OSCA, Inc. was acquired by BJ Services. Prior to joining BJ Services, Mr. Alario had over 21 years of service in various capacities with OSCA, an oilfield services company, most recently having served as its Executive Vice President. He is also a director of Kirby Corporation, serving as its lead director and chairman of its Environmental, Social, Governance and Nominating Committee, and effective starting April 26, 2024, will serve as their Chairman of the Board. He formerly served as Chairman of the National Ocean Industries Association. | |

| Terry Bonno (66)

First Became a Director in 2014 |

Ms. Bonno has been a director of the Company since May 2014. Ms. Bonno provides advisory and consulting services to numerous private companies utilizing her professional expertise in Global business development, commercial and contractual due diligence, Sustainability and Enterprise Risk Management. She has served as a Director of Kodiak Gas Services, a publicly held gas compression company, where she serves as the Chair of the Personnel and Compensation Committee and as a member of the Nominating, Governance, and Sustainability Committee. From 2017 to the successful divestiture to 3i in 2019, Ms. Bonno served as a Director of Tampnet, the largest offshore high-capacity communication network in the world. She also served as a director on energy industry and charity boards. In 2017, she was accepted as an industry expert to serve in an advisory capacity on the National Offshore Safety and Advisory Committee (NOSAC) for a three-year term ending 2020. Ms. Bonno served as Senior Vice President of Industry and Community Relations for Transocean Ltd. from 2017 until her retirement in September 2018. Her responsibilities included leadership in industry forums, community affairs and driving sustainability in the organization. Ms. Bonno previously served as Senior Vice President of Marketing for Transocean Ltd. from 2011 and Vice President Marketing from 2008 with oversight of Transocean’s marketing in 14 countries. Prior to this role, she served in various director and management roles at Transocean Ltd. leading the marketing and contracts efforts for West Africa and the Americas from 2001 until 2008. She served in a Director Marketing and Contracts role for Turnkey Drilling with RBFalcon and Global Marine (a wholly owned subsidiary of Applied Drilling Technology Inc. (ADTI)) from 1993 until 2001, who later became acquired by Transocean Ltd. During her time with Global Marine from 1982 to 1999, she served in various Accounting Management roles. She is also a Certified Public Accountant. | |

| David Cherechinsky (60)

First Became a Director in 2020 |

Mr. Cherechinsky has served as President and Chief Executive Officer and been a director of the Company since June 2020. Prior to serving as President and Chief Executive Officer, Mr. Cherechinsky served as the Company’s Senior Vice President and Chief Financial Officer from February 2018 until June 2020. Mr. Cherechinsky previously served as Vice President, Corporate Controller and Chief Accounting Officer from February 2014 until February 2018. Mr. Cherechinsky served as Vice President—Finance for NOV’s distribution business group from 2003, and as Vice President—Finance for NOV’s Distribution & Transmission business segment from 2011, until the Company’s spin-off in May 2014. He previously served NOV starting in 1989 in various corporate roles, including internal auditor, credit management and business analyst, and is a CPA. | |

| Galen Cobb (70)

First Became a Director in 2014 |

Mr. Cobb has been a director of the Company since May 2014. Mr. Cobb recently served as Vice President Industry Relations for Halliburton since 2002 until his retirement in 2022 where he was responsible for Halliburton’s industry relations global activities, energy trade policy issues, executive client relations, and trade organization oversight. He worked for Halliburton for over forty years serving in various executive management positions in operations, marketing, sales and business development. From 1991 to 1994, he was Director CIS and China with oversight in establishing Halliburton’s presence and operations in these emerging markets. Later, he was named Director Executive Sales and Business Development with expanded responsibilities for the worldwide development and promotion of Halliburton’s services and products. |

10

Table of Contents

| Name | ||

| Paul Coppinger (63)

First Became a Director in 2017 |

Mr. Coppinger has been a director of the Company since December 2017. Mr. Coppinger was the President of SPM Oil & Gas, a Caterpillar Company (formerly the Oil & Gas Division of the Weir Group PLC which was acquired by Caterpillar in February 2021) from 2014 until his retirement in 2022. From 2012 to 2014, Mr. Coppinger served as President, Pressure Pumping, for the Weir Group, and from 2011 to 2012 as President of Weir SPM. Prior to that, Mr. Coppinger was Group President of the Energy Segment of CIRCOR International, Inc. from 2001 to 2011. Mr. Coppinger is Chairman Emeritus of the Energy Workforce & Technology Council (formerly the Petroleum Equipment & Services Association) and served on its Board of Directors from 2007 to 2019. | |

| Karen David-Green (55)

First Became a Director in 2023 |

Ms. David-Green has been a director of the company since 2023. Ms. David-Green has over 30 years of experience in senior leadership positions on Wall Street and as a corporate executive for multinational companies. Her skillset encompasses capital market transactions, demand generation, risk/reputation management, data analytics, business and cultural transformation, scaling businesses in a highly cyclical environment, cybersecurity, go-to-market strategies and energy transition and sustainability. She previously held key positions in the Executive Leadership Team at Expro Group N.V. and Weatherford International plc where she served as the former Chief Marketing, Stakeholder, Investor Relations, Communications and Sustainability Officer. During her tenure at Weatherford from 2010-2020, Ms. David-Green played instrumental roles as Chief Marketing Officer, Sr. Vice President of Stakeholder Engagement, President of the Weatherford Foundation, Inc., Chair of the Sustainability Leadership Council, and Executive Member of the Disclosure and Global Business Continuity and Planning Committees. She is also a former Senior Wall Street equity research analyst. Notably, she previously led the energy service equity research franchise at Oppenheimer & Co. Inc. and Crédit Agricole where she was responsible for providing financial forecasts to clients globally. Ms. David-Green is an Independent Director for PHX Energy Services Inc. where she serves on the Audit and Compensation and Human Resources Committees. She is Directorship Certified by the National Association of Corporate Directors (NACD) and NACD Certified in Cybersecurity Oversight. | |

| Rodney Eads (73)

First Became a Director in 2014 |

Mr. Eads has been a director and Chair of the Audit Committee of the Company (commencing this position May 2014). Mr. Eads has served as President of Eads Holdings, LLC, a wholly owned private investment firm (commencing 2009) and is an active investor in early-stage companies. Mr. Eads has provided advisory and due diligence services for numerous private equity entities, with deep expertise in Enterprise Risk Management and Crisis Management. He has provided Expert Witness services for several international arbitration cases in the $150M-$250M claim range. He is a NACD Certified Director, and since 2019 has served on the NACD TriCities Board (Houston, Austin, San Antonio). During the last 5 years he has been an active participant in the Southwest Audit Committee Network. Mr. Eads served as a director from 2010 to 2015 for private equity owned Nautronix UK Limited. Mr. Eads previously served as Chief Operating Officer and Executive Vice President of Pride International Inc. (NYSE) from 2006 until 2009, where he was responsible for safety, environmental, and regulatory compliance for offshore operations and South American and eastern hemisphere land assets operating in 15 countries. He also managed a public company spin-off in 2009 of Seahawk Drilling Company. He served as Senior Vice President of Worldwide Operations for Diamond Offshore Drilling Inc. (NYSE) from 1997 until 2006, with responsibility for safety, environmental, and regulatory compliance in 12 countries. From 1977 to 1997, he served in several executive and operations management positions with Exxon Corporation, primarily in international assignments spanning 11 countries, providing engineering, business planning and project analysis, and compliance for safety, environmental, and regulatory requirements. Mr. Eads has managed global workforces as large as 14,000 employees, managed operating budgets of $1B per year, and capital projects exceeding $3B. | |

| Sonya Reed (50)

First Became a Director in 2021 |

Ms. Reed has been a director of the Company since August 2021. Ms. Reed is a former executive officer of Phillips 66 where she served as the Senior Vice President and Chief Human Resources Officer from 2015 until 2023. In this capacity she also had accountability for corporate communications, including internal and external messaging, branding, social media and philanthropy. From 2011 to 2015, Ms. Reed was with General Cable, where she last served as Executive Vice President, Chief Human Resources Officer. Ms. Reed began her career at Zurich Financial Services, where she held several positions of increasing responsibility, the last of which was Vice President of Human Resources of their Latin American business. Throughout her career Ms. Reed both lived and worked domestically and internationally, had accountability across multiple countries and administered her role in both English and Spanish (of which she is fluent). Her skillset encompasses executive compensation, succession |

11

Table of Contents

| management, leadership development, cultural transformation, organizational design, communications, and brand and reputation management in large, global organizations. |

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE IN FAVOR OF THE ELECTION OF THE EIGHT NOMINEES FOR DIRECTOR.

12

Table of Contents

COMMITTEES AND MEETINGS OF THE BOARD

Committees

The Board of Directors appoints committees to help carry out its duties with the following current standing committees: Audit, Compensation, and Environmental, Social, Governance, and Nominating. Last year, the Board of Directors met five times and the committees met a total of twelve times. The following table sets forth the committees of the Board of Directors and their members as of the date of this proxy statement, as well as the number of meetings each committee held during 2023:

| Director | Audit Committee | Compensation Committee |

Environmental, Social, Governance, and Nominating Committee | |||

| David Cherechinsky (1) |

||||||

| Richard Alario |

+ | • | ||||

| Terry Bonno |

• | • | ||||

| Galen Cobb |

• | |||||

| Paul Coppinger |

• | + | ||||

| Karen David-Green |

• | |||||

| Rodney Eads |

+ | |||||

| Sonya Reed |

• | |||||

| Number of Meetings Held in 2023 |

8 | 2 | 2 |

| (+) | Denotes Chair |

| (1) | As Mr. Cherechinsky is an employee of the Company serving as President and Chief Executive Officer, he does not serve as a member of any board committees. |

Attendance at Meetings

Each incumbent director attended at least 75% of the meetings of the Board and committees of which that director was a member in 2023.

Audit Committee

Messrs. Eads (Chairman), Cobb, Ms. Bonno, and David-Green are the current members of the Audit Committee. All members of this committee are independent within the meaning of the rules governing audit committees by the New York Stock Exchange.

The Audit Committee is appointed to assist the Board in fulfilling its oversight responsibilities. The Committee’s primary duties and responsibilities are to:

| • | monitor the integrity of the Company’s financial statements, financial reporting processes, systems of internal controls regarding finance, and disclosure controls and procedures; |

| • | select and appoint the Company’s independent auditors, pre-approve all audit and non-audit services to be provided, consistent with requirements of the SEC and PCAOB regarding auditor independence, to the Company by the Company’s independent auditors, and establish the fees and other compensation to be paid to the independent auditors; |

| • | monitor the independence and performance of the Company’s independent auditors and internal audit function; |

| • | establish procedures for the receipt, retention, response to and treatment of complaints, including confidential, anonymous submissions by the Company’s employees, regarding accounting, internal controls, disclosure or auditing matters, and provide an avenue of communication among the independent auditors, management, the internal audit function and the Board of Directors; |

13

Table of Contents

| • | prepare an audit committee report as required by the SEC to be included in the Company’s Annual Proxy Statement; |

| • | review, on a quarterly basis, reports from the Company’s enterprise risk management system, cybersecurity monitoring system, and ESG monitoring system and reports to the full Board on these matters; and |

| • | monitor the Company’s compliance with legal and regulatory requirements. |

A copy of the Audit Committee Charter is available on the Company’s website under the Investor Relations/Corporate Governance section at https://ir.dnow.com/corporate-governance/documents.

Audit Committee Financial Expert

The Board of Directors has determined that all members of the Audit Committee meet the NYSE standard of having accounting or related financial management expertise and each meet the SEC’s criteria of an Audit Committee Financial Expert.

Compensation Committee

Messrs. Alario (Chairman), Coppinger, and Ms. Reed are the current members of the Compensation Committee. All members of the Compensation Committee are independent as defined by the applicable NYSE listing standards.

The Compensation Committee is appointed by the Board of Directors to assist in fulfilling its oversight responsibilities. The Committee’s primary duties and responsibilities are to:

| • | discharge the Board’s responsibilities relating to compensation of the Company’s directors and executive officers; |

| • | approve and evaluate all compensation of directors and executive officers, including salaries, bonuses, and compensation plans, policies, and programs of the Company; and |

| • | administer all plans of the Company under which shares of common stock may be acquired by directors or executive officers of the Company. |

A copy of the Compensation Committee Charter is available on the Company’s website under the Investor Relations/Corporate Governance section at https://ir.dnow.com/corporate-governance/documents.

Compensation Committee Interlocks and Insider Participation

Messrs. Alario (Chairman), Coppinger, and Ms. Reed are the current members of the Compensation Committee. Mr. Alario, who had previously served as Chair of the Compensation Committee prior to his appointment as interim Chief Executive Officer and as Executive Vice Chairman on an interim, short-term basis from November 2019 until October 2020, reassumed his role as Chair of the Compensation Committee in February 2021. Except as disclosed herein, none of these members is a former or current officer or employee of the Company or any of its subsidiaries, is involved in a relationship requiring disclosure as an interlocking executive officer/director, or had any relationship requiring disclosure under Item 404 of Regulation S-K.

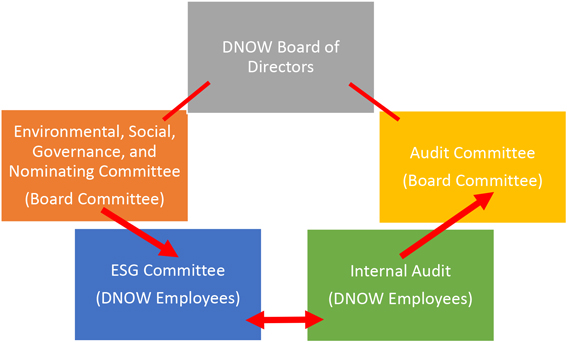

Environmental, Social, Governance, and Nominating Committee

The Environmental, Social, Governance, and Nominating Committee is appointed to assist the Board in fulfilling its oversight responsibilities. Messrs. Coppinger (Chairman), Alario, and Ms. Bonno are the current members of the Environmental, Social, Governance, and Nominating Committee. All members of

14

Table of Contents

the Environmental, Social, Governance, and Nominating Committee are independent as defined by the applicable NYSE listing standards.

The Environmental, Social, Governance, and Nominating Committee gives oversight at the board level to the Company’s ESG initiatives by working with management on ESG risk assessment. The Environmental, Social, Governance, and Nominating Committee’s oversight includes controlling and mitigating these risks, including risks related to climate change and other ESG related matters, as well as working with management to determine areas of opportunities, goal setting, and expansion in its ESG initiatives. The Committee’s primary duties and responsibilities are to:

| • | ensure that the Board and its committees are appropriately constituted so that the Board and directors may effectively meet their fiduciary obligations to stockholders and the Company; |

| • | identify individuals qualified to become Board members and recommend to the Board director nominees for each annual meeting of stockholders and candidates to fill vacancies on the Board; |

| • | recommend to the Board annually the directors to be appointed to Board committees; |

| • | monitor, review, and recommend, when necessary, any changes to the Corporate Governance Guidelines; |

| • | monitor and evaluate annually the effectiveness of the Board and management of the Company, including their effectiveness in implementing the policies and principles of the Corporate Governance Guidelines; |

| • | oversee the Company’s efforts on environmental, social, and governance (ESG) matters including the publication of the Company’s annual sustainability report; and |

| • | oversee the Company’s efforts on Diversity, Equity and Inclusion (DEI) and management succession planning including the CEO and his direct reports. |

A copy of the Environmental, Social, Governance, and Nominating Committee Charter is available on the Company’s website under the Investor Relations/Corporate Governance section at https://ir.dnow.com/corporate-governance/documents.

15

Table of Contents

BOARD OF DIRECTORS

Director Nomination Process and Diversity Considerations

The Environmental, Social, Governance, and Nominating Committee has the responsibility of identifying candidates for election as directors, reviewing background information relating to those candidates, and recommending nominees to the Board of Directors to be submitted to stockholders for election. It is the policy of the Committee to consider director candidates recommended by stockholders. Nominees are selected by the Committee from candidates recommended by multiple sources, including other directors, management, stockholders, and by independent search firms (which firms may be paid by the Company for their services), all of whom will be evaluated based on the same criteria. As of March 25, 2024, we had not received any formal recommendations from stockholders for potential director candidates that were approved as a nominee for director by the Environmental, Social, Governance, and Nominating Committee for submission to stockholders for election. All of the current nominees for director are standing members of the Board that are proposed by the entire Board for re-election. Written suggestions for nominees should be sent to the Secretary of the Company at the address listed herein.

The Board of Directors believes that nominees should reflect the following characteristics:

| • | have a reputation for integrity, honesty, candor, fairness, and discretion; |

| • | be knowledgeable, or willing to become so quickly, in the critical aspects of the Company’s businesses and operations; and |

| • | have a range of talent, skill, and expertise sufficient to provide sound and prudent guidance with respect to the full scope of the Company’s operations and interests. |

The Environmental, Social, Governance, and Nominating Committee reviews Board composition annually to ensure that the Board reflects the knowledge, experience, skills, expertise, and diversity required for the Board to fulfill its duties. There are currently no directorship vacancies to be filled on the Board.

We are committed to and recognize the importance of good corporate governance and high ethical standards.

Our Board believes that having a diverse mix of directors with complementary qualifications, expertise, and

attributes is essential to meeting its oversight responsibilities.

16

Table of Contents

Board Diversity

The Board considers diversity in identifying nominees for director. The Board seeks to achieve a mix of directors that represent a diversity of background and experience, including with respect to gender and race. The Board considers diversity in a variety of different ways and in a fairly expansive manner. The Board not only considers diversity concepts such as race and gender, but also diversity in the sense of differences in viewpoint, professional experience, education, skill, and other qualities and attributes that contribute to board heterogeneity. Also considered as part of the diversity analysis is whether the individual has work experience in the Company’s industry or in the broader energy or industrial markets. The Company believes the Board can benefit from different viewpoints and experiences by having a mix of members of the Board who have worked in its industry and those who may not have such experience.

Although we do not have a formal diversity policy in place for the director nomination process, the Board recognizes that diverse candidates with appropriate and relevant skills and experience contribute to the depth and diversity of perspective in the boardroom. An important factor in our Environmental, Social, Governance, and Nominating Committee’s consideration and assessment of a director candidate is the diversity of background, viewpoints, professional experience, education, gender, age, and culture – including nationality, race or ethnic background.

To show these goals and efforts by the Board, over the last three years, the Board has added two new directors, Ms. Karen David-Green and Ms. Sonya Reed, who provide additional diversity in gender, ethnicity and experience to the Board.

If and when the need arises for the Company to add an additional new director to the Board, the Environmental, Social, Governance, and Nominating Committee will reasonable efforts to ensure that diverse candidates (including, without limitation, women and minority candidates) are in the pool which nominees are chosen from and strive to obtain diverse candidates by searching in traditional corporate environments, as well as government, academia, and non-profit organizations. Accordingly, the Environmental, Social, Governance, and Nominating Committee may include candidates reflecting ethnic and gender diversity as part of the candidate search criteria.

Furthermore, the Company acknowledges that the current policies of several of its key stakeholders require a minimum number of female board members on a board. The Company will take such policies into strong consideration when considering any future director appointments. To the extent SEC regulations come out in the future with minimum diversity requirements, the Company will comply with these requirements to the extent applicable.

Director Qualifications

The Company believes that each member of its Board of Directors possesses the basic attributes of being a director of the Company, namely having a reputation for integrity, honesty, candor, fairness, and discretion. Each director has also become knowledgeable in major aspects of the Company’s business and operations, which has allowed the Board to provide better oversight functions to the Company. In addition to the experience, qualifications, and skills of each director set forth in their biographies, the Company also considered the following factors in determining that the board member should serve on the Board:

Mr. Alario served as the interim Chief Executive Officer of the Company from November 2019 until June 2020, as Executive Vice Chairman on an interim, short-term basis from June 2020 until October 2020, and previously served as the chief executive officer and as the chairman of another publicly traded company for 12 years. Mr. Alario has extensive experience in the oil service business, having worked in that industry for over 30 years. Mr. Alario has gained valuable board experience from his tenure as a director of Kirby Corporation, including from his service as its lead director and chairman of its Environmental, Social,

17

Table of Contents

Governance, and Nominating Committee as well as on its audit committee. Through service in these roles, Mr. Alario has gained extensive experience in assessing the risks associated with various energy industry cycles.

Ms. Bonno provides valuable service and experience to the Board due to her current roles as Chair of the Personnel & Compensation Committee and as a member of the Nominating, Governance, and Sustainability Committee of Kodiak Gas Services as well as her past experience on Kodiak’s Audit Committee as well as serving on the financial committee, enterprise risk management committee, and disclosure committee at Transocean Ltd. Ms. Bonno has extensive experience in the oil service industry of 37 years and a background in accounting with approximately 34 years of being a certified public accountant and experience overseeing the Sox Compliance of the Global Marketing function. Ms. Bonno’s extensive professional experience in international business development, commercial and contractual acumen, Sustainability and Enterprise Risk Management has provided her the knowledge to deal with all facets of potential risk areas and opportunities for a global energy company, and she brings that experience and perspective to the Board.

Mr. Cherechinsky has been an officer of a publicly traded company since 2014. Mr. Cherechinsky’s 34-year career with the Company includes positions of increasing importance, from business analyst, to Vice President—Corporate Controller, to Chief Financial Officer, to Chief Executive Officer. Mr. Cherechinsky has extensive experience with the Company and the oil service industry. Mr. Cherechinsky’s experience in the Company’s business and the industry, his extensive financial background, and his unparalleled knowledge of the Company make him uniquely and well qualified to serve as a director of the Company.

Mr. Cobb provides valuable service and experience to the Audit Committee, due to his over 40 years of serving in various management positions for Halliburton. Mr. Cobb has developed experience and expertise in warehouse management and distribution, international operations, especially in emerging markets, as well as marketing and business development in a large corporate environment. As a result of this extensive experience, Mr. Cobb is very familiar with the strategic and project planning processes that impact the Company’s business and continued development for growth.

Mr. Coppinger has over 35 years of experience in the petroleum equipment and service, process equipment and flow control businesses, as well as experience in the industrial markets and manufacturing, and has held various positions of increasing responsibility, including managing domestic and international operations. Mr. Coppinger has extensive operational and strategic planning experience from his long career in manufacturing and distribution. Mr. Coppinger also has extensive mergers and acquisitions experience of over 20 years on a global basis. Mr. Coppinger has dealt with all facets of potential risk areas for a global energy service company and brings that experience to the Company.

Ms. David-Green has over 30 years of experience in senior leadership positions on Wall Street and as a C-Suite Executive and Corporate Officer for multinational companies with a global manufacturing and service footprint. Her experience in finance, corporate communications, sustainability efforts, cybersecurity, and marketing for a publicly traded company provide the Company valuable knowledge at a board level. Further, she is Directorship Certified by the National Association of Corporate Directors (NACD) and NACD Certified in Cybersecurity Oversight. Her work on other company boards, external councils, and networks give the Company insight into how peers see current market conditions and strategies which the Company can use to their future benefit. Ms. David-Green’s extensive financial background, prior board experience, and detailed work in cybersecurity, sustainability, and shareholder engagement efforts make her highly qualified to be a board member.

Mr. Eads provides valuable service and experience to the Audit Committee, due to his MBA degree and 40 years of experience in the energy industry and in his previous roles in senior executive management where he worked to identify and mitigate risk. Mr. Eads has also been an active member of the National Association of Corporate Directors (NACD) since 2010, achieving the NACD’s Governance Fellow

18

Table of Contents

recognition, the highest standard of credentialing for directors and governance professionals, and recently achieved the NACD Directorship Certification. He currently serves on the Board for the Tri-Cities Chapter NACD. Mr. Eads established the board cybersecurity reporting system for the Company, which includes quarterly cybersecurity metrics reported to the Audit Committee. He has been involved in two early-stage cybersecurity companies, one as a lead investor. He has completed the AICPA Cybersecurity Certificate Program. Mr. Eads’ significant international experience and deep expertise in health and safety/environmental/regulatory compliance; risk assessment; supply chain management; and large construction projects, together with his 12 years of experience as an executive officer of two public companies, which included SEC reporting, mergers and acquisitions evaluations and integration, pay/performance programs, and asset rationalization efforts including a public company spin-off, and private equity sales, makes him well qualified to serve as a director of the Company.

Ms. Reed has over 30 years of experience in domestic, international and global organizations across multiple industries. She most recently served as a chief human resources officer of two public companies for over ten years. Her expertise in executive compensation, succession planning and talent management, and diversity, equity, and inclusion provide the board with significant insight on these key risk areas. Ms. Reed has depth of expertise in corporate communications including internal and external messaging, brand and reputation management, media relations and philanthropy in a large corporate environment. She has led the human capital component of major organizational transformations focusing on operating model design, organizational structures and building the critical skills necessary for the new environment. As a result of her broad experience, Ms. Reed has had extensive board exposure and uses that background and knowledge to help provide a perspective on these evolving risk areas.

The following are some of the key qualifications and skills of our Board.

| Alario | Bonno | Cherechinsky | Cobb | Coppinger | David- Green |

Eads | Reed | |||||||||

| CEO/Former CEO |

• | • | ||||||||||||||

| Financial Acumen/Expert |

• | • | • | • | • | • | • | |||||||||

| Operations Leadership |

• | • | • | • | • | |||||||||||

| ESG Experience |

• | • | • | • | • | • | • | • | ||||||||

| International Exposure/Experience |

• | • | • | • | • | • | • | • | ||||||||

| Oil & Gas Industry |

• | • | • | • | • | • | • | • | ||||||||

| Technology Systems |

• | • | • | • | ||||||||||||

| Cybersecurity Experience |

• | • | • | • | • | • | • | • | ||||||||

| Diversity |

• | • | • | |||||||||||||

| Strategic Planning |

• | • | • | • | • | • | • | • | ||||||||

| Background |

||||||||||||||||

| Age |

69 | 66 | 60 | 70 | 63 | 55 | 73 | 50 | ||||||||

| Gender |

Male | Female | Male | Male | Male | Female | Male | Female | ||||||||

| Ethnicity |

White | White | White | White | White | White | White | Hispanic | ||||||||

| Year Joined Board |

2014 | 2014 | 2020 | 2014 | 2017 | 2023 | 2014 | 2021 | ||||||||

| Other Boards |

1 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | ||||||||

| Independent |

• | • | • | • | • | • | • |

19

Table of Contents

AUDIT COMMITTEE REPORT

Composition

The Audit Committee is currently comprised of four members: Rodney Eads, Committee Chairman, Terry Bonno, Galen Cobb, and Karen David-Green. The Board of Directors has determined that all of the members of the Audit Committee are independent based on the guidelines set forth by the NYSE and SEC rules for the independence of Audit Committee members. The Board of Directors has also determined that all members of the Audit Committee meet the NYSE standard of having accounting or related financial management expertise and each member meets the SEC’s criteria of an Audit Committee Financial Expert.

Oversight Responsibilities

Under the Audit Committee Charter, which is available for review on the Company’s website under the Investor Relations/Corporate Governance section, the Audit Committee’s primary objective is to assist the Board of Directors in fulfilling its oversight responsibilities. The Audit Committee’s primary purposes and functions are:

(1) monitoring the integrity of the Company’s financial statements, financial reporting processes, systems of internal controls regarding finance, and disclosure controls and procedures;

(2) selecting and appointing the Company’s independent auditors, pre-approving all audit and non-audit services to be provided, consistent with all applicable laws and regulations, to the Company by the Company’s independent auditors, and establishing the fees and other compensation to be paid to the independent auditors;

(3) monitoring the independence and performance of the Company’s independent auditors and internal audit function;

(4) establishing procedures for the receipt, retention, response to and treatment of complaints, including confidential and/or anonymous submissions by the Company’s employees, regarding accounting, internal controls, disclosure or auditing matters, and providing an avenue of communication among the independent auditors, management, the internal audit function, and the Board; and

(5) monitoring the Company’s compliance with legal and regulatory requirements.

With respect to the oversight of accounting, internal controls, and disclosure matters as well as the Company’s compliance with various legal and regulatory requirements, the Audit Committee, as appropriate, but at least on a quarterly basis, reviews all reports generated by the Company’s independently administered employee hotline and other corporate governance hotline systems. The Audit Committee also reviews, on a quarterly basis, reports from the Company’s enterprise risk management system, cybersecurity monitoring system, and ESG monitoring system, and reports to the full Board on these matters.

Notwithstanding the foregoing, it is not the Audit Committee’s duty to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles (“GAAP”) or to conduct audits. In carrying out its duties, the Audit Committee relies on the Company’s senior management, specifically senior financial management, who are responsible for establishing a system of internal controls, assessing such controls, and for preparing the consolidated financial statements in accordance with GAAP. Management is also responsible for assuring compliance

20

Table of Contents

with laws and regulations and the Company’s corporate policies. The Company’s independent registered public accountants are responsible for auditing the consolidated financial statements and the effectiveness of our internal control over financial reporting in accordance with standards of the Public Company Accounting Oversight Board (the “PCAOB”) and issuing their reports based on those audits. During each regularly scheduled quarterly meeting in 2023, the Audit Committee met separately in executive session with both the internal audit director and the independent audit partner without Company’s senior management being present.

Oversight of Independent Auditor

The Audit Committee reviews in advance and pre-approves audit and non-audit services provided to the Company by the independent auditors. The Audit Committee is also directly responsible for reviewing with the independent registered public accountants the plans and scope of the audit engagement, and providing an open venue of communication among management, the internal audit function, the independent registered public accountants, and the Board.

In connection with the selection and appointment of the independent auditors each year, the Audit Committee reviews and evaluates the qualifications, performance, and independence of the independent auditors and lead partner including taking into account the opinions of management and the Company’s internal auditor. In doing so, the Audit Committee considers a number of factors including, but not limited to: quality of services provided; technical expertise and knowledge of the industry; effective communication; objectivity; independence; costs of services considering scope of services as compared to independent auditor costs of similar size public companies in same industry sector; and the potential impact of changing independent auditors. Based on this evaluation, the Audit Committee has retained Ernst & Young LLP (“EY”) as the Company’s independent auditors for 2024. EY has been the Company’s independent auditors since 2013 and the Company’s current new lead partner has been engaged since February 2024 (as the Company’s prior lead partner from EY, who had served in such capacity since 2019 for five years, was required to roll off pursuant to current applicable rules upon the completion of the Company’s 2023 audit in February 2024).

The Audit Committee and Board of Directors believe that it is in the best interests of the Company and its stockholders to continue retention of EY to serve as its independent auditors. Although the Audit Committee has the sole authority to appoint the independent auditors, the Audit Committee will continue to recommend that the Board of Directors request the stockholders at the Annual Meeting to ratify the appointment of the independent auditors.

2023 Audited Financial Statements

The Audit Committee reviewed and discussed with senior management the audited financial statements included in the Company’s Annual Report on Form 10-K. Management has confirmed to the Audit Committee that such financial statements have been prepared with integrity and objectivity and in conformity with GAAP. Non-GAAP measures reported by management are reviewed by the Audit Committee to ensure transparency and consistency.

The Audit Committee discussed with EY, the Company’s independent auditors, the matters required to be discussed by the applicable requirements of the PCAOB, which included the identification of Critical Audit Matters.

The Audit Committee has received the written disclosures and the letter from EY required by applicable requirements of the PCAOB regarding EY’s communication with the Audit Committee concerning independence and has discussed with the independent auditors any relationships that may impact their objectivity and independence.

21

Table of Contents

Based on the foregoing, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s 2023 Annual Report on Form 10-K.

Members of the Audit Committee

Rodney Eads, Committee Chairman

Terry Bonno

Galen Cobb

Karen David-Green

22

Table of Contents

APPROVAL OF THE DNOW INC.

2024 LONG-TERM INCENTIVE PLAN

PROPOSAL NO. 2 ON THE PROXY CARD

The growth and future success of our Company depends upon the efforts of our officers, directors, and key employees. We believe that the proposed DNOW Inc. 2024 Long-Term Incentive Plan (the “2024 LTIP”) combines an effective means of attracting and retaining qualified key personnel with a long-term focus on maximizing stockholder value. Upon the recommendation of our Compensation Committee, our Board has adopted the 2024 LTIP, subject to the approval of our stockholders at the 2024 Annual Meeting. The 2024 LTIP will become effective as of the date it is approved by our stockholders.

In 2014, the stockholders approved the NOW Long-Term Incentive Plan (the “2014 Equity Incentive Plan”). The 2014 Equity Incentive Plan when adopted had a ten (10) year term, where it would expire in May 2024. Given that our existing long-term incentive plan is expiring in May 2024 and will no longer be available to the Company for future equity grants, the Company is seeking approval for the 2024 LTIP. With a new long-term incentive plan to replace the Company’s existing, expiring long-term incentive plan, we would also be able to roll over the remaining shares available for grant under the 2014 Equity Incentive Plan into the new 2024 LTIP.

As of March 25, 2024, approximately 4,729,338 shares are available for grant under the 2014 Equity Incentive Plan. As of March 25, 2024, there were 4,537,037 outstanding stock awards under the 2014 Equity Incentive Plan. The Compensation Committee and the Board consider this number to be inadequate to achieve the stated purpose of the 2014 Equity Incentive Plan in the future; namely, to promote the long-term financial interests of the Company by: (i) enhancing the ability of the Company to attract and retain directors, officers and key employees of outstanding ability; (ii) providing directors, officers and key employees with an interest in the Company aligned with that of the Company’s stockholders; and (iii) encouraging directors, officers and employees of the Company to acquire a meaningful ownership position in the Company. Furthermore, additional awards are not permitted to be made under the 2014 Equity Incentive Plan after May 12, 2024. As a result, the Company has decided to adopt the new DNOW Inc. 2024 LTIP. The new 2024 LTIP will permit awards to be granted until 2034 (the tenth anniversary of its effective date), and includes modernized terms and provisions that reflect current market practice. The 2024 LTIP is provided as Appendix A to this proxy statement.

Overhang and Dilution

The following aggregated information regarding potential overhand and dilution is as of March 25, 2024. As of March 25, 2024, there were 108,894,127 shares of the Company’s common stock issued and outstanding. The Company only has one outstanding stock plan, the 2014 Equity Incentive Plan. The only outstanding awards the Company currently has are all under the 2014 Equity Incentive Plan, as provided below.

As of March 25, 2024, there are 4,537,037 shares subject to outstanding awards under the 2014 Equity Incentive Plan (equal to approximately 4.2% of the Company’s outstanding shares), comprised of:

| • | Outstanding unvested “full value” awards, including performance shares (at target performance level): 3,152,342 shares |

| • | Outstanding stock options: 1,384,695 shares, where the Company’s outstanding stock options have a weighted average exercise price of $10.75 and a weighted average remaining term of 2.5 years |

As of March 25, 2024, approximately 4,729,338 shares are available for grant under the 2014 Equity Incentive Plan.

23

Table of Contents

If the 2024 LTIP is approved by the stockholders, then the 6,702,338 shares of our common stock that could be issued under the 2024 LTIP (comprised of the 4,729,338 shares to be rolled over from the 2014 Equity Incentive Plan and an additional 1,973,000 shares allowed under the new 2024 LTIP) would represent approximately 6.2% of the total number of shares of our common stock outstanding on a fully diluted basis as of March 25, 2024.

Existing awards under the 2014 Equity Incentive Plan will remain in full force and effect in accordance with the plan’s terms. Any awards of shares made under the 2014 Equity Incentive Plan after March 25, 2024 through May 22, 2024 shall reduce, on a one-for-one basis, the aggregate number of shares issuable under the 2024 LTIP. No new awards will be made under the 2014 Equity Incentive Plan after approval of the 2024 LTIP by stockholders.

Reasons for Seeking Shareholder Approval

The 2024 LTIP provides for long-term compensation and incentive opportunities for directors, executives and key employees of the Company and its subsidiaries. The Board believes that the future success of the Company is dependent upon the quality and continuity of management, and that compensation programs such as restricted stock grants are important in attracting and retaining individuals of superior ability and in motivating their efforts on behalf of the Company.

Shareholder approval of the 2024 LTIP is required under the rules of the New York Stock Exchange applicable to the Company. If the 2024 LTIP is not approved, it will not go into effect. If that occurs, awards may continue to be made under the 2014 Equity Incentive Plan in accordance with its terms through May 12, 2024 or until the shares remaining for awards under the 2014 Equity Incentive Plan are exhausted. As the ability to grant new awards under the 2014 Equity Incentive Plan expires on May 12, 2024, failure to approve the 2024 LTIP will severely restrict the Company’s ability to attract, retain and incentivize directors, officers and key employees. The Company is also asking the stockholders to approve the 2024 LTIP for purposes of Section 421 of the Internal Revenue Code of 1986, as amended (the “Code”).

As of March 25, 2024, the closing market price per share of the Company’s common stock as reported on the New York Stock Exchange was $15.13.

Vote Required for Approval

Approval of the proposal FOR the adoption of the 2024 LTIP will require the affirmative vote of the majority of the votes cast on the proposal. An abstention will have the same effect as a vote AGAINST such proposal. Your shares will be voted as you specify on your proxy. If your properly executed proxy does not specify how you want your shares voted, they will be voted for the adoption of the 2024 LTIP.

Description of the Plan

The following summary describes briefly the principal features of the proposed 2024 LTIP which is provided as Appendix A to this Proxy Statement.

General Terms

The purpose of the 2024 LTIP is to promote the long-term financial interests of the Company, including its growth and performance, by encouraging directors, officers and employees of the Company and its affiliates to acquire a meaningful ownership position in the Company, by enhancing the ability of the Company to attract and retain directors, officers and key employees of outstanding ability, and by providing directors,

24

Table of Contents

officers and key employees with an interest in the Company aligned with that of the Company’s stockholders.

Administration

Generally, the 2024 LTIP will be administered by the Compensation Committee, which is and will be composed of independent directors of the Company. The Board will administer the 2024 LTIP as to awards to members of the Board. In addition, the Compensation Committee has the authority to delegate to one or more members of the Board or one or more officers of the Company the power to administer the plan as to employees, other than persons subject to Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Compensation Committee will have full authority, subject to the terms of the 2024 LTIP, to establish rules and regulations for the proper administration of the 2024 LTIP, to select the employees and directors to whom awards are granted, and to set the date of grant, the type of award that shall be made and the other terms of the awards.

Eligibility

All employees and directors of the Company are eligible to participate in the 2024 LTIP. The selection of those employees and directors who will receive awards is within the discretion of the Compensation Committee and the Chief Executive Officer. As of February 15, 2024, there were approximately 2,475 worldwide employees working for the Company who were eligible to participate in the plan. It is not possible at this time to determine the benefits or amounts that will be received by or allocated to eligible participants under the 2024 LTIP.

Shares Subject to the Plan

The 2024 LTIP provides that the administrator is authorized to deliver with respect to awards granted under the 2024 LTIP an aggregate of 1,973,000 shares of common stock, plus 4,729,338 shares of common stock that are available under the 2014 Equity Incentive Plan, on the date that the 2024 LTIP is approved by stockholders. The maximum number of shares for which incentive stock options may be granted under the 2024 Plan is 6,702,338, and the maximum number of shares of common stock granted during a single fiscal year to any non-employee director, taken together with any cash fees paid to such non-employee director during the fiscal year in respect of such non-employee director’s service on the Board, will not exceed $750,000 in total value. Except as otherwise provided in the 2024 LTIP, in the event any award is forfeited, cancelled, settled or otherwise terminated without a distribution of shares to a participant, the undelivered shares may be granted again under the 2024 LTIP.

Any awards of shares made under the 2014 Equity Incentive Plan after March 25, 2024 through May 22, 2024 shall reduce, on a one-for-one basis, the aggregate number of shares issuable under the 2024 LTIP.

Change in Control

In the event of a “change in control” (as defined in the 2024 LTIP) of the Company, awards will vest on an accelerated basis upon the participant’s termination of employment or service in connection with a change in control or upon the occurrence of any other event that the administrator may set forth in an applicable award agreement. If the Company is a party to an agreement that is reasonably likely to result in a change in control, such agreement may provide for: (i) the continuation of any award by the Company, if the Company is the surviving corporation; (ii) the assumption of any award by the surviving corporation or its parent or subsidiary; (iii) the substitution by the surviving corporation or its parent or subsidiary of equivalent awards for any award, provided, however, that any such substitution with respect to options and

25

Table of Contents

stock appreciation rights will occur in accordance with the requirements of Code Section 409A; or (iv) settlement of any award for the change in control price (less, to the extent applicable, the per share exercise or grant price), or, if the per share exercise or grant price equals or exceeds the change in control price or if the administrator determines that award cannot reasonably become vested pursuant to its terms, such award shall terminate and be canceled without consideration. To the extent that restricted shares, restricted stock units or other awards settle in shares in accordance with their terms upon a change in control, such shares will be entitled to receive as a result of the change in control transaction the same consideration as the shares held by stockholders of the Company as a result of the change in control transaction.

Clawback/Forfeiture

All awards and payments under the 2024 LTIP will be subject to reduction, cancellation, forfeiture or recoupment to the extent necessary to comply with any clawback, forfeiture, or other similar policy adopted by the Company, and applicable law (including, without limitation, the applicable rules and regulations of the SEC and the New York Stock Exchange or any other securities exchange or inter-dealer quotation system on which the Company’s common stock is listed or quoted).

Term of the Plan

If approved, the 2024 LTIP will terminate on May 22, 2034, after which time no additional awards may be made or granted under the 2024 LTIP.

Types of Awards

The 2024 LTIP permits the granting of any or all of the following types of awards (“Awards”): (1) Options, (2) Stock Appreciation Rights, (3) Restricted Shares, (4) Restricted Stock Units, (5) Other Share Based Awards, and (6) Other Cash-Based Awards.

The term of each Award will be as specified by the Compensation Committee at the date of grant (but not more than ten years). The effect of the termination of a participant’s employment or membership on the Board will be specified in the award agreement that evidences each grant. These awards will be subject to certain terms, conditions or restrictions, including vesting terms that may be linked to performance criteria or other specified criteria including passage of time. The Compensation Committee may, in its sole discretion, waive any restrictions on any outstanding award as of a date determined by the Compensation Committee.

Options - The administrator, may, in its sole discretion, grant options to participants. Solely with respect to participants who are employees, the administrator may grant incentive stock options, nonqualified stock options or a combination of both. The exercise price of shares purchasable under an option shall be determined by the administrator in its sole discretion at the time of grant; provided, however, that (i) in no event shall the exercise price of an option be less than one hundred percent (100%) of the fair market value of a share on the date of grant, and (ii) no incentive stock option granted to a ten percent (10%) stockholder of the Company (within the meaning of Code Section 422(b)(6)) shall have an exercise price per share less than one-hundred ten percent (110%) of the fair market value of a share on such date. The maximum term of each option shall be fixed by the administrator, but in no event shall (i) an option be exercisable more than ten (10) years after the date such option is granted, and (ii) an incentive stock option granted to a ten percent (10%) stockholder of the Company (within the meaning of Code Section 422(b)(6)) be exercisable more than five (5) years after the date such option is granted. Each option’s term is subject to earlier expiration pursuant to the applicable provisions in the 2024 LTIP and an applicable award agreement.

26

Table of Contents

Stock Appreciation Rights - Stock appreciation rights may be granted either alone (“Free Standing Rights”) or in conjunction with all or part of any option granted under the 2024 LTIP (“Related Rights”). Any Related Right that relates to a nonqualified stock option may be granted at the same time the option is granted or at any time thereafter, but before the exercise or expiration of the option. Any Related Right that relates to an incentive stock option must be granted at the same time the incentive stock option is granted. The administrator shall determine the eligible recipients to whom, and the time or times at which, grants of stock appreciation rights shall be made, the number of shares to be awarded, the price per share, and all other conditions of stock appreciation rights. Notwithstanding the foregoing, no Related Right may be granted for more shares than are subject to the option to which it relates and any stock appreciation right must be granted with an exercise price not less than the fair market value of a share on the date of grant. The term of each Free Standing Right shall be fixed by the administrator, but no Free Standing Right shall be exercisable more than ten (10) years after the date such right is granted. The term of each Related Right shall be the term of the option to which it relates, but no Related Right shall be exercisable more than ten (10) years after the date such right is granted.