Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-36325

NOW INC.

(Exact name of registrant as specified in its charter)

| Delaware | 46-4191184 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

7402 North Eldridge Parkway,

Houston, Texas 77041

(Address of principal executive offices)

(281) 823-4700

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of October 30, 2014 the registrant had 107,067,457 shares of common stock (excluding 1,062,871 unvested restricted shares), par value $0.01 per share, outstanding.

Table of Contents

NOW INC.

2

Table of Contents

NOW INC.

(In millions, except share data)

| September 30, | December 31, | |||||||

| 2014 | 2013 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 166 | $ | 101 | ||||

| Receivables, net |

906 | 661 | ||||||

| Inventories, net |

905 | 850 | ||||||

| Deferred income taxes |

20 | 21 | ||||||

| Prepaid and other current assets |

35 | 29 | ||||||

|

|

|

|

|

|||||

| Total current assets |

2,032 | 1,662 | ||||||

| Property, plant and equipment, net |

124 | 102 | ||||||

| Deferred income taxes |

9 | 15 | ||||||

| Goodwill |

328 | 333 | ||||||

| Intangibles, net |

65 | 68 | ||||||

| Other assets |

— | 3 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 2,558 | $ | 2,183 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 454 | $ | 264 | ||||

| Accrued liabilities |

120 | 99 | ||||||

| Accrued income taxes |

4 | — | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

578 | 363 | ||||||

| Deferred income taxes |

5 | 16 | ||||||

| Other liabilities |

2 | 2 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

585 | 381 | ||||||

| Commitments and contingencies |

||||||||

| Stockholders’ equity: |

||||||||

| Common stock—par value $0.01; 330 million shares authorized; 107,067,457 shares issued and outstanding |

1 | — | ||||||

| Preferred stock—par value $0.01; 20 million shares authorized; no shares issued and outstanding |

— | — | ||||||

| Additional paid-in capital |

1,951 | — | ||||||

| Retained earnings |

42 | — | ||||||

| National Oilwell Varco, Inc. (“NOV”) net investment |

— | 1,802 | ||||||

| Accumulated other comprehensive income (loss) |

(21 | ) | — | |||||

|

|

|

|

|

|||||

| Total stockholders’ equity |

1,973 | 1,802 | ||||||

|

|

|

|

|

|||||

| Total liabilities and stockholders’ equity |

$ | 2,558 | $ | 2,183 | ||||

|

|

|

|

|

|||||

See notes to unaudited consolidated financial statements.

3

Table of Contents

NOW INC.

CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(In millions, except per share data)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30 | September 30 | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Revenue |

$ | 1,070 | $ | 1,113 | $ | 3,099 | $ | 3,255 | ||||||||

| Operating expenses: |

||||||||||||||||

| Cost of products |

857 | 907 | 2,485 | 2,655 | ||||||||||||

| Operating and warehousing costs |

108 | 104 | 315 | 308 | ||||||||||||

| Selling, general and administrative |

55 | 39 | 144 | 118 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating profit |

50 | 63 | 155 | 174 | ||||||||||||

| Other income (expense) |

(1 | ) | (4 | ) | (1 | ) | — | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

49 | 59 | 154 | 174 | ||||||||||||

| Provision for income taxes |

17 | 20 | 54 | 61 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 32 | $ | 39 | $ | 100 | $ | 113 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings per share: |

||||||||||||||||

| Basic earnings per common share |

$ | 0.30 | $ | 0.37 | $ | 0.93 | $ | 1.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted earnings per common share |

$ | 0.30 | $ | 0.36 | $ | 0.93 | $ | 1.05 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average common shares outstanding, basic |

107 | 107 | 107 | 107 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted-average common shares outstanding, diluted |

108 | 107 | 108 | 107 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to unaudited consolidated financial statements.

4

Table of Contents

NOW INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(In millions)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30 | September 30 | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Net income |

$ | 32 | $ | 39 | $ | 100 | $ | 113 | ||||||||

| Other comprehensive income (loss): |

||||||||||||||||

| Currency translation adjustments |

(22 | ) | — | (21 | ) | (18 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Comprehensive income |

$ | 10 | $ | 39 | $ | 79 | $ | 95 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

See notes to unaudited consolidated financial statements.

5

Table of Contents

NOW INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

(In millions)

| Nine Months Ended | ||||||||

| September 30 | ||||||||

| 2014 | 2013 | |||||||

| Cash flows from operating activities: |

||||||||

| Net income |

$ | 100 | $ | 113 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

14 | 12 | ||||||

| Deferred income taxes |

— | 1 | ||||||

| Stock-Based compensation |

10 | 5 | ||||||

| Other, net |

(4 | ) | 10 | |||||

| Change in operating assets and liabilities: |

||||||||

| Receivables |

(244 | ) | (24 | ) | ||||

| Inventories |

(49 | ) | 80 | |||||

| Prepaid and other current assets |

(6 | ) | (19 | ) | ||||

| Accounts payable |

211 | 45 | ||||||

| Income taxes payable |

4 | (4 | ) | |||||

| Other assets / liabilities, net |

(6 | ) | (12 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

30 | 207 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchases of property, plant and equipment |

(32 | ) | (50 | ) | ||||

| Other, net |

8 | 1 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(24 | ) | (49 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Net contributions from (distributions to) NOV |

74 | (224 | ) | |||||

|

|

|

|

|

|||||

| Net cash provided by (used in) financing activities |

74 | (224 | ) | |||||

| Effect of exchange rates on cash and cash equivalents |

(15 | ) | (1 | ) | ||||

|

|

|

|

|

|||||

| Net change in cash and cash equivalents |

65 | (67 | ) | |||||

| Cash and cash equivalents, beginning of period |

101 | 138 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 166 | $ | 71 | ||||

|

|

|

|

|

|||||

| Supplemental disclosures of cash flow information: |

||||||||

| Income taxes paid |

$ | 50 | $ | 65 | ||||

| Non-cash investing and financing activities: |

||||||||

| Contributed property, plant and equipment, net |

$ | 4 | $ | — | ||||

| Accrued purchases of property, plant and equipment |

$ | 1 | $ | — | ||||

See notes to unaudited consolidated financial statements.

6

Table of Contents

NOW INC.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

(In millions, except share data)

| Common Stock | ||||||||||||||||||||||||

| Additional | NOV | Accum. Other | ||||||||||||||||||||||

| Par | Paid-In | Retained | Net | Comprehensive | ||||||||||||||||||||

| Value | Capital | Earnings | Investment | Income (Loss) | Total | |||||||||||||||||||

| January 1, 2014 |

$ | — | $ | — | $ | — | $ | 1,802 | $ | — | $ | 1,802 | ||||||||||||

| Net income |

— | — | — | 41 | — | 41 | ||||||||||||||||||

| Net contributions from NOV |

— | — | — | 78 | — | 78 | ||||||||||||||||||

| Other comprehensive loss |

— | — | — | — | (17 | ) | (17 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| March 31, 2014 |

— | — | — | 1,921 | (17 | ) | 1,904 | |||||||||||||||||

| Net income earned through May 30, 2014 Separation |

— | — | — | 17 | — | 17 | ||||||||||||||||||

| Net contributions from NOV |

— | — | — | 6 | — | 6 | ||||||||||||||||||

| Other comprehensive income |

— | — | — | — | 18 | 18 | ||||||||||||||||||

| Stock-based compensation |

— | 2 | — | 1 | — | 3 | ||||||||||||||||||

| Reclassification of NOV net investment to additional paid in capital |

— | 1,945 | — | (1,945 | ) | — | — | |||||||||||||||||

| Issuance of common stock at Separation |

1 | (1 | ) | — | — | — | — | |||||||||||||||||

| Net income earned after May 30, 2014 Separation |

— | — | 10 | — | — | 10 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| June 30, 2014 |

1 | 1,946 | 10 | — | 1 | 1,958 | ||||||||||||||||||

| Net income |

— | — | 32 | — | — | 32 | ||||||||||||||||||

| Other comprehensive loss |

— | — | — | (22 | ) | (22 | ) | |||||||||||||||||

| Stock-based compensation |

— | 5 | — | — | — | 5 | ||||||||||||||||||

| Issuance of common stock |

— | — | — | — | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| September 30, 2014 |

$ | 1 | $ | 1,951 | $ | 42 | $ | — | $ | (21 | ) | $ | 1,973 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Shares of Common Stock | ||||

| (in thousands) | ||||

| January 1 and March 31, 2014 |

— | |||

| Issuance of common stock at the Separation |

107,053 | |||

| Issuance of common stock for exercise of options |

5 | |||

|

|

|

|||

| June 30, 2014 |

107,058 | |||

| Issuance of common stock for exercise of options |

9 | |||

|

|

|

|||

| September 30, 2014 |

107,067 | |||

|

|

|

|||

See notes to unaudited consolidated financial statements.

7

Table of Contents

NOW INC.

Notes to Unaudited Consolidated Financial Statements

1. Organization and Basis of Presentation

The Separation

On May 1, 2014, the National Oilwell Varco, Inc. (“NOV”) Board of Directors approved the spin-off (the “Spin-Off” or “Separation”) of its distribution business into an independent, publicly traded company named NOW Inc. (“NOW” or the “Company”). In accordance with a separation and distribution agreement, the two companies were separated by NOV distributing to its stockholders all 107,053,031 shares of common stock of the Company after the market closed on May 30, 2014. Each NOV stockholder received one share of NOW common stock for every four shares of NOV common stock held at the close of business on the record date of May 22, 2014 and not sold prior to close of business May 30, 2014. Fractional shares of NOW common stock were not distributed and any fractional shares of NOW common stock otherwise issuable to a NOV stockholder were sold in the open market on such stockholder’s behalf, and such stockholder received a cash payment with respect to that fractional share. In conjunction with the Separation, NOV received an opinion from its legal counsel to the effect that, based on certain facts, assumptions, representations and undertakings, for U.S. federal income tax purposes, the distribution of NOW common stock and certain related transactions generally was not taxable to NOV or U.S. holders of NOV common stock, except in respect to cash received in lieu of fractional shares, which generally will be taxable to such holders as a capital gain. Following the Separation, NOW is an independent, publicly traded company, and NOV has no ownership interest in NOW. Each company now has separate public ownership, boards of directors and management. A Registration Statement on Form 10, as amended, relating to the Spin-Off was filed by the Company with the U.S. Securities and Exchange Commission (“SEC”) and was declared effective on May 13, 2014. On June 2, 2014, NOW stock began trading the “regular-way” on the New York Stock Exchange under the symbol “DNOW”.

Basis of Presentation

All financial information presented before the Spin-Off represents the combined results of operations, financial position and cash flows for the Company and all financial information presented after the Spin-Off represents the consolidated results of operations, financial position and cash flows for the Company.

| • | The Company’s consolidated statement of income for the three months ended September 30, 2014 consist of the consolidated results of NOW for the period from July 1 through September 30, 2014. |

| • | The Company’s consolidated statement of income for the nine months ended September 30, 2014 consist of the consolidated results of NOW for the period from May 31 through September 30 and the combined results of NOW for the period from January 1, 2014 through May 30, 2014. |

| • | The Company’s consolidated balance sheet as at September 30, 2014 is presented on a consolidated basis, whereas the |

| • | Company’s consolidated balance sheet as at December 31, 2013 was prepared on a combined basis. |

| • | The Company’s consolidated statement of cash flows for the nine months ended September 30, 2014 consist of the consolidated cash flows of NOW for the period from May 31 through September 30 and the combined cash flows of NOW for the period from January 1, 2014 through May 30, 2014. |

The Company’s historical financial statements prior to May 31, 2014 were derived from the consolidated financial statements and accounting records of NOV and include assets, liabilities, revenues and expenses directly attributable to the Company’s operations. The assets and liabilities in the consolidated financial statements have been reflected on a historical cost basis, as immediately prior to the separation all of the assets and liabilities presented were wholly owned by NOV and were transferred within NOV. For the periods prior to the Separation, the consolidated financial statements include expense allocations for certain functions provided by NOV as well as other NOV employees not solely dedicated to NOW, including, but not limited to, general corporate expenses related to finance, legal, information technology, human resources, communications, ethics and compliance, shared services, employee benefits and incentives, and stock-based compensation. These expenses were allocated to NOW on the basis of direct usage when identifiable, with the remainder allocated on the basis of operating profit, headcount or other measures.

8

Table of Contents

Actual costs that would have been incurred if the Company had been a stand-alone public company would depend on multiple factors, including organizational structure and strategic decisions made in various areas, including information technology and infrastructure. The Company’s historical financial statements prior to May 31, 2014 do not reflect the debt or interest costs it might have incurred if it had been a stand-alone entity. In addition, the Company expects to incur other costs, not reflected in its historical financial statements prior to May 31, 2014, as a result of being a separate publicly traded company. As a result, the Company’s historical financial statements prior to May 31, 2014 do not necessarily reflect what its financial position or results of operations would have been if it had been operated as a stand-alone public entity during the periods covered prior to May 31, 2014, and may not be indicative of the Company’s future results of operations and financial position.

The consolidated financial statements include certain assets and liabilities that had historically been held by NOV but which are specifically identifiable or otherwise allocable to the Company. The cash and cash equivalents held by NOV were not specifically identifiable to NOW and therefore not allocated to it for any of the periods presented prior to the Separation. Cash and equivalents in the Company’s consolidated balance sheets primarily represent cash held locally by entities included in its consolidated financial statements. Transfers of cash prior to the Separation to and from NOV’s cash management system are reflected as a component of NOV net investment within equity on the consolidated balance sheets.

Prior to the Separation, all significant intercompany transactions between NOW and NOV were considered to be effectively settled for cash at the time the transaction was recorded. The total net effect of the settlement of these intercompany transactions is reflected in the consolidated statements of cash flow as a financing activity and in the consolidated balance sheet as NOV net investment within equity.

The unaudited consolidated financial information included in this report has been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and Article 10 of SEC Regulation S-X. The principles for interim financial information do not require the inclusion of all the information and footnotes required by generally accepted accounting principles for complete financial statements. Therefore, these financial statements should be read in conjunction with the financial statements included in the Company’s most recent Registration Statement on Form 10, as amended. In our opinion, the consolidated financial statements include all adjustments, all of which are of a normal recurring nature, necessary for a fair presentation of the results for the interim periods. The results of operations for the three and nine months ended September 30, 2014, are not necessarily indicative of the results to be expected for the full year.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect reported and contingent amounts of assets and liabilities as of the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments

The carrying amounts of cash and cash equivalents, receivables and payables approximated fair value because of the relatively short maturity of these instruments. Cash equivalents include only those investments having a maturity date of three months or less at the time of purchase. See Note 12 for the fair value of derivative financial instruments.

Recently Issued Accounting Standards

In April 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) No. 2014-08 Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, which is an update for Accounting Standards Codification Topic No. 205 “Presentation of Financial Statements” and Topic No. 360 “Property, Plant and Equipment’. This update changes the requirements of reporting discontinued operations. Under the amended guidance, a disposal of a component of an entity or a group of components of an entity is required to be reported in discontinued operations if the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results. The amendments in this update are effective for all disposals (or classifications as held for sale) of components of an entity that occur within annual periods beginning on or after December 15, 2014, and interim periods within those years, with early adoption permitted. The adoption of this update concerns presentation and disclosure only as it relates to the Company’s consolidated financial statements. The Company is currently assessing the impact of ASU No. 2014-08 on its financial position and results of operations. No material changes are expected upon adoption of this ASU.

9

Table of Contents

In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers: Topic 606. ASU 2014-09 affects any entity using GAAP that either enters into contracts with customers to transfer goods or services or enters into contracts for the transfer of nonfinancial assets unless those contracts are within the scope of other standards (e.g., insurance contracts or lease contracts). This ASU will supersede the revenue recognition requirements in Topic 605, Revenue Recognition, and most industry-specific guidance. In addition, the existing requirements for the recognition of a gain or loss on the transfer of nonfinancial assets that are not in a contract with a customer (e.g., assets within the scope of Topic 360, Property, Plant, and Equipment, and intangible assets within the scope of Topic 350, Intangibles—Goodwill and Other) are amended to be consistent with the guidance on recognition and measurement (including the constraint on revenue) in this ASU. The amendments in this ASU are effective for annual reporting periods beginning after December 15, 2016, including interim periods within that reporting period. Early application is not permitted. The ASU provides two transition methods: (i) retrospectively to each prior reporting period presented (ii) retrospectively with the cumulative effect of initially applying this ASU recognized at the date of initial application. The Company is currently assessing the impact of ASU No. 2014-09 on its financial position and results of operations.

10

Table of Contents

2. Property, Plant and Equipment

Property, plant and equipment consist of (in millions):

| September 30, 2014 |

December 31, 2013 |

|||||||

| Information technology equipment |

$ | 60 | $ | 27 | ||||

| Operating equipment |

53 | 57 | ||||||

| Land and buildings |

64 | 60 | ||||||

| Construction in progress |

11 | 19 | ||||||

|

|

|

|

|

|||||

| Total property, plant and equipment |

188 | 163 | ||||||

| Less: accumulated depreciation |

(64 | ) | (61 | ) | ||||

|

|

|

|

|

|||||

| Net property, plant and equipment |

$ | 124 | $ | 102 | ||||

|

|

|

|

|

|||||

3. Accrued Liabilities

Accrued liabilities consist of (in millions):

| September 30, 2014 |

December 31, 2013 |

|||||||

| Compensation and other related expenses |

$ | 30 | $ | 24 | ||||

| Customer prepayments |

25 | 18 | ||||||

| Taxes (non income) |

27 | 25 | ||||||

| Other |

38 | 32 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 120 | $ | 99 | ||||

|

|

|

|

|

|||||

11

Table of Contents

4. Debt

Credit Facility

On April 18, 2014, the Company entered into a five-year senior unsecured revolving credit facility with a syndicate of lenders, including Wells Fargo Bank, National Association, as administrative agent. The credit facility became available to the Company on June 2, 2014 as a result of the satisfaction of customary conditions, including the consummation of the Separation. The credit facility is for an aggregate principal amount of up to $750 million with sub-facilities for standby letters of credit and swingline loans, each with a sublimit of $150 million and $50 million, respectively. The Company has the right, subject to certain conditions, to increase the aggregate principal amount of commitments under the credit facility by $250 million. Borrowings under the credit facility will bear interest at a base rate (as defined in the credit agreement) plus an applicable interest margin based on our capitalization ratio. The base rate is calculated as the highest of (a) the Federal Funds Rate, as published by the Federal Reserve Bank of New York, plus 1/2 of 1%, (b) the prime commercial lending rate of the administrative agent, as established from time to time at its principal U.S. office, and (c) the Daily One-Month LIBOR (as defined in the credit agreement) plus 1%. The Company also has the option for our borrowings under the credit facility to bear interest based on LIBOR (as defined in the credit agreement). The credit facility is unsecured and guaranteed by our domestic subsidiaries. The credit agreement also provides for customary fees, including administrative agent fees, commitment fees, fees in respect of letters of credit and other fees. The annual commitment fee ranges from 25 to 35 basis points of the unused portion of the credit facility. The line of credit expires in April 2019, unless extended.

The credit facility contains usual and customary affirmative and negative covenants for credit facilities of this type including financial covenants consisting of (a) a maximum capitalization ratio (as defined in the credit agreement) of 50% and (b) a minimum interest coverage ratio (as defined in the credit agreement) of no less than 3:1. As of September 30, 2014, the Company was in compliance with all covenants.

At September 30, 2014, the Company had no borrowings against its revolving credit facility and a $2 million letter of credit was issued under its revolving credit facility. The letter of credit was issued in conjunction with casualty insurance expiring May 30, 2015.

5. Accumulated Other Comprehensive Income (Loss)

The components of accumulated other comprehensive income (loss) are as follows (in millions):

| Currency Translation Adjustments |

||||

| Balance at December 31, 2013 |

$ | — | ||

| Accumulated other comprehensive income (loss) before reclassifications |

(21 | ) | ||

| Amounts reclassified from accumulated other comprehensive income (loss) |

— | |||

|

|

|

|||

| Balance at September 30, 2014 |

$ | (21 | ) | |

|

|

|

|||

The Company’s reporting currency is the U.S. dollar. A majority of the Company’s international entities in which there is a substantial investment have the local currency as their functional currency. As a result, currency translation adjustments resulting from the process of translating the entities’ financial statements into the reporting currency are reported in Other Comprehensive Income or Loss in accordance with ASC Topic 830 “Foreign Currency Matters” (“ASC Topic 830”).

12

Table of Contents

6. Business Segments

Operating results by reportable segment are as follows (in millions):

| Three Months Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Revenue: |

||||||||||||||||

| United States |

$ | 748 | $ | 732 | $ | 2,114 | $ | 2,187 | ||||||||

| Canada |

173 | 191 | 489 | 578 | ||||||||||||

| International |

149 | 190 | 496 | 490 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

$ | 1,070 | $ | 1,113 | $ | 3,099 | $ | 3,255 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating profit: |

||||||||||||||||

| United States |

$ | 28 | $ | 36 | $ | 86 | $ | 109 | ||||||||

| Canada |

14 | 13 | 33 | 35 | ||||||||||||

| International |

8 | 14 | 36 | 30 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating profit |

$ | 50 | $ | 63 | $ | 155 | $ | 174 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating profit %: |

||||||||||||||||

| United States |

3.7 | % | 4.9 | % | 4.1 | % | 5.0 | % | ||||||||

| Canada |

8.1 | % | 6.8 | % | 6.7 | % | 6.1 | % | ||||||||

| International |

5.4 | % | 7.4 | % | 7.3 | % | 6.1 | % | ||||||||

| Total operating profit % |

4.7 | % | 5.7 | % | 5.0 | % | 5.3 | % | ||||||||

13

Table of Contents

7. Income Tax

In connection with the Separation, the Company and NOV entered into a Tax Matters Agreement, dated as of May 29, 2014 (the “Tax Matters Agreement”), which governs the Company’s and NOV’s respective rights, responsibilities and obligations. The Tax Matters Agreement sets forth the Company and NOV’s rights and obligations related to the allocation of federal, state, local and foreign taxes for periods before and after the Spin-Off, as well as taxes attributable to the Spin-Off, and related matters such as the filing of tax returns and the conduct of IRS and other audits. Pursuant to the Tax Matters Agreement, NOV will prepare and file the consolidated federal income tax return, and any other tax returns that include both NOV and the Company for all taxable periods ending on or prior to May 30, 2014. NOV will indemnify and hold harmless the Company for any income tax liability for periods before the Separation date. The Company will prepare and file all tax returns that include solely the Company for all taxable periods ending after that date. Settlements of tax payments between NOV and the Company were generally treated as contributions from or distributions to NOV in periods prior to the Separation date.

The effective tax rate for the Company was 34.7% and 35.3% for the three and nine months ended September 30, 2014, respectively, and 33.9% and 35.0% for the same periods of the prior year, respectively. Compared to the U.S. statutory rate, the effective tax rate is increased in the periods by the effect of state income taxes and certain non-deductible expenses that is offset by the effect of lower tax rates on income earned in foreign jurisdictions which are permanently reinvested. The provision for income taxes for periods prior to the Separation has been computed as if NOW were a stand-alone company.

The difference between the effective tax rate reflected in the provision for income taxes and the U.S. federal statutory rate of 35% was as follows (in millions):

| Three Months Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Federal income tax at the U.S. federal statutory rate |

$ | 17 | $ | 21 | $ | 54 | $ | 61 | ||||||||

| Foreign income tax rate differential |

(1 | ) | (2 | ) | (3 | ) | (4 | ) | ||||||||

| State income tax, net of federal benefit |

1 | 1 | 2 | 2 | ||||||||||||

| Nondeductible expenses/foreign inclusions |

1 | 1 | 3 | 5 | ||||||||||||

| Foreign tax credit |

(1 | ) | (1 | ) | (3 | ) | (4 | ) | ||||||||

| Other |

— | — | 1 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Provision for income taxes |

$ | 17 | $ | 20 | $ | 54 | $ | 61 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The Company is subject to taxation in the United States, various states and foreign jurisdictions. The Company has significant operations in the United States and Canada and to a lesser extent in various other international jurisdictions including the United Kingdom, Indonesia and Norway. Tax years that remain subject to examination by major tax jurisdictions vary by legal entity, but are generally open in the U.S. for the tax years ending after 2009 and outside the U.S. for the tax years ending after 2006. The Company is indemnified for any income tax expense exposures related to periods prior to the Separation.

To the extent penalties and interest would be assessed on any underpayment of income tax, such accrued amounts will continue to be classified as a component of income tax expense in the financial statements.

14

Table of Contents

8. Stock-based Compensation and Outstanding Awards

Prior to the Separation, the Company participated in NOV’s stock-based compensation plan known as the National Oilwell Varco, Inc. Long-Term Incentive Plan (the “NOV Plan”) and the Company’s employees were issued NOV equity awards. Under the NOV Plan, our employees were granted stock options, restricted stock units (RSUs), performance share awards (PSAs) and/or restricted stock awards (RSAs).

In connection with the Separation, the Company established the NOW Inc. Long-Term Incentive Plan (the “Plan”). The Plan was adopted by the Company’s board of directors and approved by NOV, as the Company’s sole stockholder, on May 1, 2014. In connection with the Separation, stock-based compensation awards granted under the NOV Plan and held by Company employees as of May 30, 2014, were adjusted or substituted as follows. These adjustments were intended to preserve the intrinsic value of the awards on May 30, 2014.

| • | Stock option awards held by Company employees were replaced with substitute awards to purchase NOW common stock. |

| • | Unvested RSAs and RSUs under the NOV plan were replaced with adjusted, substitute awards for NOW RSAs or RSUs, as applicable. |

| • | PSAs received were replaced entirely with substitute NOW RSAs. |

Stock based compensation expense recognized in the three month periods ended September 30, 2014 and 2013 totaled $5 million and $2 million, respectively. Stock based compensation expense recognized in the nine month periods ended September 30, 2014 and 2013 totaled $10 million and $5 million, respectively. Adjustment and substitution of the awards did not result in additional compensation expense.

Awards granted under the Plan as a result of the adjustment and substitution of the NOV Plan awards in connection with the Separation and a summary of stock option, RSU and RSA activity for the period from May 30, 2014, to September 30, 2014, are presented in the following table:

| Stock Options | RSUs / RSAs | |||||||

| Awards | Awards | |||||||

| Outstanding as of May 30, 2014 |

3,599,654 | 1,034,055 | ||||||

| Granted |

— | — | ||||||

| Forfeited |

— | — | ||||||

| Exercised or settled |

(4,667 | ) | — | |||||

| Expired or canceled |

— | — | ||||||

|

|

|

|

|

|||||

| Outstanding as of June 30, 2014 |

3,594,987 | 1,034,055 | ||||||

| Granted |

— | 169,014 | ||||||

| Forfeited |

(28,805 | ) | (6,194 | ) | ||||

| Exercised or settled |

(9,613 | ) | — | |||||

| Expired or canceled |

— | — | ||||||

|

|

|

|

|

|||||

| Outstanding as of September 30, 2014 |

3,556,569 | 1,196,875 | ||||||

|

|

|

|

|

|||||

All Stock Options, RSUs, and RSAs presented in this table are for NOW stock only.

Awards granted in connection with the adjustment and substitution of awards originally issued under the NOV Plan were deducted from the number of NOW shares of common stock available for grant under the Plan. As of September 30, 2014, unrecognized compensation cost related to stock option awards was $15 million, which is expected to be recognized over a weighted average period of 1.9 years. Unrecognized compensation cost related to RSU and RSA awards was $26 million, which is expected to be recognized over a weighted average period of 2.7 years. The calculations of unamortized expense and weighted-average periods include awards that were based on both NOW and NOV stock held by NOW employees.

15

Table of Contents

9. Earnings Per Share

In conjunction with the Separation, NOV distributed to its stockholders all 107,053,031 shares of common stock of NOW Inc. after the market closed on May 30, 2014. Each NOV stockholder received one share of NOW common stock for every four shares of NOV common stock held at the close of business on the record date of May 22, 2014 and not sold prior to close of business May 30, 2014. On June 2, 2014, NOW Inc. stock began trading the “regular-way” on the New York Stock Exchange under the symbol “DNOW”.

Basic earnings per share is based on net income attributable to the Company’s earnings and is calculated based upon the daily weighted-average number of common shares outstanding during the periods presented. Also, this calculation includes fully vested stock and unit awards that have not yet been issued as common stock. Diluted EPS includes the above, plus unvested stock, unit or option awards granted and vested unexercised stock options, but only to the extent these instruments dilute earnings per share.

For comparative purposes, and to provide a more meaningful calculation of weighted-average shares outstanding, the Company has assumed the 107,053,031 shares of common stock of NOW Inc. that was distributed on May 30, 2014 to be outstanding as of the beginning of each period prior to the separation presented in the calculation of weighted-average shares. In addition, the Company has assumed the dilutive securities outstanding at May 30, 2014, were also outstanding for each of the periods prior to the Separation presented.

For the three and nine months ended September 30, 2014, 1,233,385 and 2,083,908, respectively, of stock options, RSAs and RSUs were excluded from the computation of diluted earnings per share due to their antidilutive effect.

| Three Months Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

| (In millions, except share data) |

2014 | 2013 | 2014 | 2013 | ||||||||||||

| Numerator for basic and diluted net income per share attributable to the Company’s stockholders: |

||||||||||||||||

| Net income attributable to the Company |

$ | 32 | $ | 39 | $ | 100 | $ | 113 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator for basic earnings per share attributable to the Company’s stockholders: |

||||||||||||||||

| Weighted average common shares outstanding |

107,061,639 | 107,053,031 | 107,055,932 | 107,053,031 | ||||||||||||

| Effect of dilutive securities: |

||||||||||||||||

| Dilutive effect of stock based compensation |

563,604 | 415,837 | 492,235 | 415,837 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Denominator for diluted earnings per share attributable to the Company’s stockholders: |

107,625,243 | 107,468,868 | 107,548,167 | 107,468,868 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings per share attributable to the Company’s stockholders: |

||||||||||||||||

| Basic |

$ | 0.30 | $ | 0.37 | $ | 0.93 | $ | 1.06 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | 0.30 | $ | 0.36 | $ | 0.93 | $ | 1.05 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

16

Table of Contents

10. Commitments and Contingencies

The Company is involved in various claims, regulatory agency audits and pending or threatened legal actions involving a variety of matters. The Company records accruals for estimated losses from these matters when available information indicates that a loss is probable and the loss can be reasonably estimated. The Company also assesses the potential for additional losses above the amounts accrued as well as potential losses for matters that are not probable but are reasonably possible. The total potential loss on these pending matters cannot be determined; however, in our opinion, any ultimate liability, to the extent not otherwise recorded or accrued for, will not materially affect our financial position, cash flow or results of operations. These estimated liabilities are based on the Company’s assessment of the nature of these matters, their progress toward resolution, the advice of legal counsel and outside experts as well as management’s intention and experience.

Our business is affected both directly and indirectly by governmental laws and regulations relating to the oilfield service industry in general, as well as by environmental and safety regulations that specifically apply to our business. Although the Company has not incurred material costs in connection with our compliance with such laws, there can be no assurance that other developments, such as new environmental laws, regulations and enforcement policies hereunder may not result in additional, presently unquantifiable, costs or liabilities to the Company.

The Company has entered into various agreements with NOV as a result of the Spin-Off, including a Separation and Distribution Agreement (See Note 11), Tax Matters Agreement (See Note 7) and Employee Matters Agreement (See Note 11), which govern various terms of the separation of the Company’s business from NOV’s other businesses.

17

Table of Contents

11. Related Party Transactions

Related Party Transactions

In connection with the Separation, the Company and NOV entered into a Separation and Distribution Agreement, Tax Matters Agreement, Employee Matters Agreement, and Transition Service Agreement each dated May 29, 2014.

The Separation and Distribution Agreement contains the key provisions related to the separation from NOV and the distribution of our common stock to NOV shareholders. The Separation and Distribution Agreement separated the assets related to the Company’s business from NOV, along with liabilities related to such assets, which now reside with the Company. In general, the Company agrees to indemnify NOV from liabilities arising from the Company’s business and assets, and NOV agrees to indemnify the Company from liabilities arising from NOV’s business and assets (that remained with NOV), except as otherwise provided in such agreement.

The Tax Matters Agreement (See Note 7) governs the respective rights, responsibilities and obligations of each party with respect to taxes and tax benefits, the filing of tax returns, the control of audits, restrictions to preserve the tax-free status of the Spin-Off and other tax matters.

The Employee Matters Agreement governs the Company and NOV’s compensation and employee benefit obligations with respect to current and former employees of each company, and generally allocates liabilities and responsibilities relating to employee compensation and benefit plans and programs. Such agreement also provides the adjustment mechanisms to be applied as a result of the Spin-Off to convert outstanding NOV equity awards held by Company employees to Company awards.

The Transition Service Agreement provides for transitional services in the areas of information technology, tax, accounting, finance and employee benefits and are initially short-term in nature. The charges under these transition service agreements will be at cost-based rates. For the period from May 31 through September 30, 2014, the net amount of less than $1 million incurred by the Company under this agreement was recognized in selling, general and administrative in the consolidated statements of income. No amounts were reflected in the consolidated statements of income prior to May 31, 2014, as the Transition Service Agreement was not effective prior to the Separation.

Additionally, the Company and NOV entered into a Master Distributor Agreement and a Master Service Agreement, effective as of May 29, 2014. Under the Master Distributor Agreement, the Company will act as a distributor of certain NOV products. Under the Master Service Agreement, the Company will supply products and provide solutions, including supply chain management solutions, to NOV.

Allocation of General Corporate Expenses

For the periods prior to the Separation, the consolidated financial statements include expense allocations for certain functions provided by NOV as well as other NOV employees not solely dedicated to NOW, including, but not limited to, general corporate expenses related to finance, legal, information technology, human resources, communications, ethics and compliance, shared services, employee benefits and incentives, and stock-based compensation. These expenses were allocated to NOW on the basis of direct usage when identifiable, with the remainder allocated on the basis of operating profit, headcount or other measures. During the three months ended September 30, 2014 and 2013, NOW was allocated $0 million and $3 million, respectively, which is included within selling, general and administrative expenses in the accompanying consolidated statements of income. During the nine months ended September 30, 2014 and 2013, NOW was allocated $6 million and $7 million, respectively, of expenses incurred by NOV which is included within selling, general and administrative expenses in the accompanying consolidated statements of income. Allocations from NOV discontinued as of May 30, 2014.

The expense allocations were determined on a basis that was considered to be a reasonable reflection of the utilization of services provided or the benefit received by the Company during the periods presented. The allocations may not reflect the expense the Company would have incurred as an independent, publicly traded company for the periods presented. Actual costs that may have been incurred if the Company had been a stand-alone public company would depend on a number of factors, including the chosen organizational structure, what functions were outsourced or performed by employees and strategic decisions made in areas such as information technology and infrastructure.

18

Table of Contents

NOV Net Investment

Prior to the Separation, net contributions from (distributions to) NOV invested equity were included within NOV net investment on the Consolidated Balance Sheets and Statements of Cash Flows. The components of the change in NOV net investment for the nine months ended September 30, 2014 and 2013 are as follows (in millions):

| Nine Months Ended September 30 |

||||||||

| 2014 | 2013 | |||||||

| Net contribution from (distributions to) NOV per the consolidated statements of changes in equity |

$ | 143 | $ | (111 | ) | |||

| Non-cash adjustments: |

||||||||

| Stock-based compensation |

(3 | ) | — | |||||

| Net transfer of assets and liabilities from NOV |

(8 | ) | — | |||||

| Less: Net income attributable to NOV net investment prior to the Separation |

(58 | ) | (113 | ) | ||||

|

|

|

|

|

|||||

| Net contribution from (distributions to) NOV per the consolidated statements of cash flows |

$ | 74 | $ | (224 | ) | |||

|

|

|

|

|

|||||

12. Derivative Financial Instruments

The Company is exposed to certain risks relating to its ongoing business operations. The primary risk managed by using derivative instruments is foreign currency exchange rate risk. Forward contracts against foreign currencies may be entered into to manage (i) foreign currency exchange rate risk on forecasted revenues and expenses denominated in currencies other than the functional currency of the operating unit, (ii) foreign currency exchange rate risk on recognized nonfunctional currency monetary accounts, or (iii) foreign-currency exchange rate risk on unrecognized firm commitments.

The Company records all derivative financial instruments at their fair value in its Consolidated Balance Sheets. None of the derivative financial instruments that the Company holds are designated as either a fair value hedge or cash flow hedge. For derivative instruments that are non-designated, the gain or loss on the derivative instrument subject to the economically-hedged risk (i.e. unrecognized firm commitments) is recognized in other income in current earnings.

The Company has entered into forward exchange contracts which have terms of less than a year to economically hedge foreign currency exchange rate risk on recognized nonfunctional currency monetary accounts denominated in pounds sterling and foreign-currency exchange rate risk on unrecognized firm commitments denominated in U.S. Dollars. The purpose of the Company’s foreign currency economic hedging activities are to economically-hedge the Company’s risk from (i) forecasted cash flows associated with nonfunctional currency monetary accounts and (ii) changes in the fair value of a non-functional currency denominated unrecognized firm commitment attributable to changes in the rates between the non-functional currency and the functional currency.

The Company has determined that the fair value of its derivative financial instruments are determined using level 2 inputs (inputs other than quoted prices in active markets for identical assets and liabilities that are observable either directly or indirectly for substantially the full term of the asset or liability) in the fair value hierarchy as the fair value is based on publicly available foreign exchange rates at each financial reporting date. At September 30, 2014, the net fair value of the Company’s foreign currency forward contracts totaled a net asset of less than $1 million and is included in prepaid and other current assets in the accompanying Consolidated Balance Sheets.

At September 30, 2014, the Company’s financial instruments do not contain any credit-risk-related or other contingent features that could cause accelerated payments when the Company’s financial instruments are in net liability positions. The Company does not use derivative financial instruments for trading or speculative purposes.

19

Table of Contents

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

Some of the information in this document contains, or has incorporated by reference, forward-looking statements within the meaning of section 27A of the securities act of 1933, as amended, and section 21E of the securities exchange act of 1934, as amended. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements typically are identified by use of terms such as “may,” “believe,” “anticipate,” “expect,” “plan,” “predict,” “estimate,” “will be” or other similar words and phrases, although some forward-looking statements are expressed differently. You should be aware that our actual results could differ materially from results anticipated in the forward-looking statements due to a number of factors, including, but not limited to, changes in oil and gas prices, changes in the energy markets, customer demand for our products, significant changes in the size of our customers, difficulties encountered in integrating mergers and acquisitions, general volatility in the capital markets, changes in applicable government regulations, the inability to realize the benefits of the Spin-Off, increased borrowing costs, competition between us and our former parent company, NOV, unfavorable reactions from our employees, the triggering of rights and obligations by the transaction or any litigation arising out of or related to the separation, impairments in goodwill or other intangible assets and worldwide economic activity. You should also consider carefully the statements under “risk factors,” as disclosed in our Registration Statement on Form 10, as amended, which address additional factors that could cause our actual results to differ from those set forth in the forward-looking statements. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward-looking statements. We undertake no obligation to update any such factors or forward-looking statements to reflect future events or developments.

Company Overview

We are a global distributor to the upstream, midstream, downstream and industrial markets with an operating legacy of over one hundred and fifty years. We operate primarily under the DistributionNOW and Wilson Export brands in over 20 countries from more than 300 locations worldwide.

We offer a comprehensive line of products and solutions for the upstream, midstream and downstream energy and industrial sectors. Our locations provide products and solutions to exploration and production companies, energy transportation companies, refineries, chemical companies, utilities, manufacturers and engineering and construction companies.

Products we distribute include pipe and tubing, manual and actuated valves, fittings, flanges, gaskets, fasteners, instrumentation, power transmission products, mill and janitorial supplies, hand and power tools, machine cutting tools, safety products, personal protective equipment (“PPE”), electrical products, artificial lift equipment, pumps, drilling and production products and industrial paint and coatings. We also provide artificial lift services, export services, industrial vending, innovation and technology solutions, project management, RigPAC, RigStore, safety solutions, tubing reclamation and warehouse and inventory management.

We operate under three reportable segments: United States, Canada and International.

United States

We have more than 200 locations in the U.S., which are geographically positioned to best serve the upstream, midstream and downstream energy and industrial sectors.

Canada

We have a network of approximately 70 branches in the Canadian oilfield, predominantly in the oil rich provinces of Alberta and Saskatchewan in Western Canada. Our Canada segment primarily serves the energy exploration, production and drilling business.

International

We operate in over 20 countries and serve the needs of our international customers from more than 30 locations outside of the U.S. and Canada, all of which are strategically located in major oil and gas development areas. Our International segment primarily serves the energy exploration, production and drilling business.

20

Table of Contents

The Separation

On May 1, 2014, the NOV Board of Directors approved the Spin-Off of its distribution business into an independent, publicly traded company named NOW Inc. In accordance with a separation and distribution agreement, the two companies were separated by NOV distributing to its stockholders all 107,053,031 shares of common stock of NOW Inc. after the market closed on May 30, 2014. Each NOV stockholder received one share of NOW common stock for every four shares of NOV common stock held at the close of business on the record date of May 22, 2014 and not sold prior to close of business May 30, 2014. Fractional shares of NOW common stock were not distributed and any fractional shares of NOW common stock otherwise issuable to a NOV stockholder were sold in the open market on such stockholder’s behalf, and such stockholder received a cash payment with respect to that fractional share. In conjunction with the separation, NOV received an opinion from its legal counsel to the effect that, based on certain facts, assumptions, representations and undertakings, for U.S. federal income tax purposes, the distribution of NOW common stock and certain related transactions generally was not taxable to NOV or U.S. holders of NOV common stock, except in respect to cash received in lieu of fractional shares, which generally will be taxable to such holders as capital gain. Following the separation, NOW is an independent, publicly traded company, and NOV has no ownership interest in NOW. Each company now has separate public ownership, boards of directors and management. A Registration Statement on Form 10, as amended, relating to the Spin-Off was filed by the Company with the SEC and was declared effective on May 13, 2014. On June 2, 2014, NOW Inc. stock began trading the “regular-way” on the New York Stock Exchange under the symbol “DNOW”.

Basis of Presentation

The financial statements are presented as if the Company’s businesses had been consolidated for all periods presented. The Company’s historical financial statements prior to May 31, 2014 were derived from the consolidated financial statements and accounting records of NOV and include assets, liabilities, revenues and expenses directly attributable to the Company’s operations. The assets and liabilities in the combined financial statements have been reflected on a historical cost basis, as immediately prior to the separation all of the assets and liabilities presented were wholly owned by NOV and were transferred within NOV. All intercompany transactions and accounts were eliminated. The Company’s historical financial statements prior to May 31, 2014 reflect allocations of certain corporate costs from NOV for certain corporate functions historically performed by NOV, including allocations of general corporate costs related to executive oversight, accounting, treasury, tax, legal, procurement and information technology. These costs have been allocated to the Company on a basis that it considers to reflect fairly and reasonably the utilization of the services provided to or the benefit obtained by the Company’s businesses. Actual costs that would have been incurred if we had been a stand-alone public company would depend on multiple factors, including organizational structure and strategic decisions made in various areas, including information technology and infrastructure. The Company’s historical financial statements prior to May 31, 2014 do not reflect the debt and interest costs it might have incurred if it had been a stand-alone entity. In addition, the Company expects to incur other costs, not reflected in its historical financial statements prior to May 31, 2014, as a result of being a separate publicly traded company. As a result, the Company’s historical financial statements prior to May 31, 2014 do not necessarily reflect what its financial position or results of operations would have been if it had been operated as a stand-alone public entity during the periods covered prior to May 31, 2014, and may not be indicative of the Company’s future results of operations and financial position.

21

Table of Contents

Operating Environment Overview

The Company’s results are dependent on, among other things, the level of worldwide oil and gas drilling, well remediation activity, price of crude oil and natural gas, capital spending by oilfield service companies and drilling contractors, and worldwide oil and gas inventory levels. Key industry indicators for the third quarter of 2014 and 2013 and the second quarter of 2014 include the following:

| 3Q14* | 3Q13* | % 3Q14 v 3Q13 |

2Q14* | % 3Q14 v 2Q14 |

||||||||||||||||

| Active Drilling Rigs: |

||||||||||||||||||||

| U.S. |

1,903 | 1,769 | 7.6 | % | 1,852 | 2.8 | % | |||||||||||||

| Canada |

385 | 348 | 10.6 | % | 202 | 90.6 | % | |||||||||||||

| International |

1,348 | 1,285 | 4.9 | % | 1,348 | 0.0 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Worldwide |

3,636 | 3,402 | 6.9 | % | 3,402 | 6.9 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| West Texas Intermediate Crude Prices (per barrel) |

$ | 97.87 | $ | 105.84 | (7.5 | %) | $ | 103.35 | (5.3 | %) | ||||||||||

| Natural Gas Prices ($/MMBtu) |

$ | 3.96 | $ | 3.55 | 11.5 | % | $ | 4.61 | (14.1 | %) | ||||||||||

| Hot-Rolled Coil Prices (steel) ($/short ton) |

$ | 673.76 | $ | 642.60 | 4.8 | % | $ | 678.17 | (0.7 | %) | ||||||||||

| * | Averages for the quarters indicated. See sources below. |

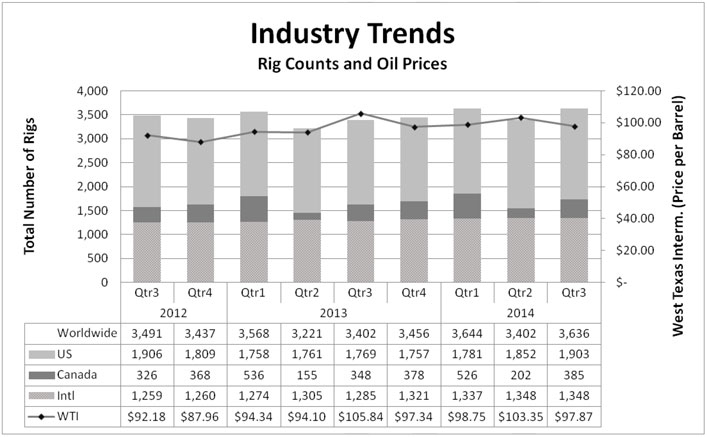

The following table details the U.S., Canadian and international rig activity and West Texas Intermediate Oil prices for the past nine quarters ended September 30, 2014, on a quarterly basis:

Sources: Rig count: Baker Hughes, Inc. (www.bakerhughes.com); West Texas Intermediate Crude and Natural Gas Prices: Department of Energy, Energy Information Administration (www.eia.doe.gov); Hot-Rolled Coil Prices: American Metal Market (www.amm.com).

22

Table of Contents

The worldwide quarterly average rig count increased 6.9% (from 3,402 to 3,636) and the U.S. increased 2.8% (from 1,852 to 1,903), in the third quarter of 2014 compared to the second quarter of 2014. The average price per barrel of West Texas Intermediate Crude decreased 5.3% (from $103.35 per barrel to $97.87 per barrel) and natural gas prices decreased 14.1% (from $4.61 per MMBtu to $3.96 per MMBtu) in the third quarter of 2014 compared to the second quarter of 2014. The average price per short ton of Hot-Rolled Coil decreased 0.7% (from $678.17 per short ton to $673.76 per short ton) in the third quarter of 2014 compared to the second quarter of 2014.

U.S. rig count at October 24, 2014 was 1,927 rigs an increase of 1.3% compared to the third quarter average of 1,903 rigs. The price for West Texas Intermediate Crude was $82.76 per barrel at October 20, 2014, a decrease of 15.4% from the third quarter average. The price for natural gas was $3.69 per MMBtu at October 20, 2014, a decrease of 6.8% from the third quarter average. The price for Hot-Rolled Coil was $654.09 per short ton at October 24, 2014, a decrease of 2.9% from the third quarter average.

Executive Summary

For the three and nine months ended September 30, 2014, the Company generated $32 million and $100 million in net income, respectively, on $1,070 million and $3,099 million in revenue, respectively. Revenue decreased for the three and nine months ended September 30, 2014, $43 million or 3.9% and $156 million or 4.8%, respectively, when compared to the corresponding periods of 2013. Net income decreased for the three and nine months ended September 30, 2014, $7 million or 17.9% and $13 million or 11.5%, respectively, when compared to the corresponding periods of 2013.

For the three and nine months ended September 30, 2014, operating profit was $50 million or 4.7% of revenue and $155 million or 5.0% of revenue, respectively, compared to $63 million or 5.7% of revenue and $174 million or 5.3% of revenue, respectively, for the corresponding periods of 2013.

Outlook

We believe we are an organization with a strong financial position, and the Spin-Off creates new opportunities for us to grow market share, expand product lines, markets and geographies and reinvest in our business in ways that could only be accomplished as a pure play, supply chain provider and distributor to the energy and industrial markets.

We believe we are well positioned and should benefit from our global infrastructure, broad product offering, diverse customer base, strong balance sheet, capitalization and access to credit. In the event of a market downturn, we also believe that our long history of cost control and downsizing in response to slowing market conditions, and of executing strategic acquisitions will enable us to capitalize on new opportunities to effect new organic growth and acquisition initiatives.

In the second quarter of 2014, we migrated substantially all of our business onto one Enterprise Resource Planning (“ERP”) platform. We experienced short term effects related to its implementation, and our results were impacted by this implementation into the third quarter, although to a lesser extent than what we experienced in the second quarter. We believe the standardization improves supply chain visibility, enables global inventory redeployment and expedites the movement of goods through the system while maximizing value to our customers.

Our outlook for the Company remains closely tied to the rig count, particularly in North America. Average U.S. rig count during the third quarter of 2014 saw gains of 7.6% compared to the third quarter of 2013. The third quarter of 2014 saw average Canadian rig count increase by 10.6% year-over-year. The ERP implementation issues and Spin-Off related activities temporarily affected the correlation between our results and active rig count. Additionally, recent economic weakness is causing pressure on oil prices, which could lead to further activity declines, particularly among North American operators which may rely on cash flows from gas production and/or external financing to fund their drilling operations.

23

Table of Contents

Operating results by segment are as follows (in millions):

| Three Months Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Revenue: |

||||||||||||||||

| United States |

$ | 748 | $ | 732 | $ | 2,114 | $ | 2,187 | ||||||||

| Canada |

173 | 191 | 489 | 578 | ||||||||||||

| International |

149 | 190 | 496 | 490 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

$ | 1,070 | $ | 1,113 | $ | 3,099 | $ | 3,255 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating profit: |

||||||||||||||||

| United States |

$ | 28 | $ | 36 | $ | 86 | $ | 109 | ||||||||

| Canada |

14 | 13 | 33 | 35 | ||||||||||||

| International |

8 | 14 | 36 | 30 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total operating profit |

$ | 50 | $ | 63 | $ | 155 | $ | 174 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating profit %: |

||||||||||||||||

| United States |

3.7 | % | 4.9 | % | 4.1 | % | 5.0 | % | ||||||||

| Canada |

8.1 | % | 6.8 | % | 6.7 | % | 6.1 | % | ||||||||

| International |

5.4 | % | 7.4 | % | 7.3 | % | 6.1 | % | ||||||||

| Total operating profit % |

4.7 | % | 5.7 | % | 5.0 | % | 5.3 | % | ||||||||

United States

For the three and nine months ended September 30, 2014, revenue was $748 million and $2,114 million, respectively, an increase of $16 million or 2.2% and a decrease of $73 million or 3.3%, respectively, when compared to the corresponding periods of 2013. The increase for the three months ended September 30, 2014 was due to increased activity in the supply chain business offset by reduced pipe revenue. The decrease for the nine months ended September 30, 2014, is attributable to the ERP implementation that occurred in the second quarter of 2014 and the relocation of our central U.S. pipe yard.

For the three and nine months ended September 30, 2014, operating profit was $28 million and $86 million, a decrease of $8 million or 22.2% and $23 million or 21.1%, respectively, when compared to the corresponding periods of 2013. For the three and nine months ended September 30, 2014, operating profit percentage was 3.7% and 4.1%, respectively. Decreased operating profit is primarily attributable to the incremental costs incurred in connection with operating as an independent publicly traded company.

24

Table of Contents

Canada

For the three and nine months ended September 30, 2014, revenue was $173 million and $489 million, respectively, a decrease of $18 million or 9.4% and $89 million or 15.4%, respectively, when compared to the corresponding periods of 2013. The decrease for the three and nine months ended September 30, 2014 is attributable to the ERP implementation, most notably creating a disruption at the Edmonton central distribution center and its warehouse management software. For the same periods, the strengthening of the U.S. dollar accounted for more than one third of the revenue decline.

For the three and nine months ended September 30, 2014, operating profit was $14 million and $33 million, an increase of $1 million or 7.7% and a decrease of $2 million or 5.7%, respectively, when compared to the corresponding periods of 2013. For the three and nine months ended September 30, 2014, operating profit percentage was 8.1% and 6.7%, respectively. For the three months ended September 30, 2014, operating profit increased due to a change in product mix and lower operating costs which included receivable recoveries and reduced inventory obsolescence. For the nine months ended September 30, 2014, decreased operating profit is primarily related to lower sales volumes experienced in the second quarter.

International

For the three and nine months ended September 30, 2014, revenue was $149 million and $496 million, respectively, a decrease of $41 million or 21.6% and an increase of $6 million or 1.2%, respectively, when compared to the corresponding periods of 2013. The decrease for the third quarter is primarily due to large non-recurring export and valve projects in the third quarter of 2013. For the nine months, revenue growth was primarily due to strong activity in Asia, offset by declines cited above.

For the three and nine months ended September 30, 2014, operating profit was $8 million and $36 million, a decrease of $6 million or 42.9% and an increase of $6 million or 20.0%, respectively, when compared to the corresponding periods of 2013. For the three and nine months ended September 30, 2014, operating profit percentage was 5.4% and 7.3%, respectively. For the three months ended September 30, 2014, the operating profit decrease is attributable to fewer project sales discussed above. Year to date, the increase in operating profit is mainly attributable to growth in higher margin business, coupled with the increase in revenue.

Cost of products

For the three and nine months ended September 30, 2014, cost of products was $857 million and $2,485 million, respectively, compared to $907 million and $2,655 million for the corresponding periods of 2013, a decrease of $50 million and $170 million, respectively, or 5.5% and 6.4%, respectively in line with changes in revenue. Cost of products includes the cost of inventory sold and related items, such as vendor consideration, inventory allowances and inbound and outbound freight.

Operating and warehousing costs

For the three and nine months ended September 30, 2014, operating and warehousing costs were $108 million and $315 million, respectively, compared to $104 million and $308 million for the corresponding periods of 2013. Operating and warehousing costs include branch location and distribution center expenses (including costs such as compensation, benefits and rent).

Selling, general and administrative

For the three and nine months ended September 30, 2014, selling, general and administrative expenses were $55 million and $144 million, respectively, compared to $39 million and $118 million for the corresponding periods of 2013. The increase is primarily related to the incremental costs incurred in connection with operating as an independent publicly traded company and spin activities.

Other

For the three and nine months ended September 30, 2014, other expense was less than $1 million for both periods, compared to $4 million and less than a million for the corresponding periods of 2013, an increase of less than a million and $4 million, respectively. These differences were primarily due to exchange rate changes.

Provision for income taxes

The effective tax rate for the Company was 34.7% and 35.3% for the three and nine months ended September 30, 2014, respectively, and 33.9% and 35.0% for the same periods of the prior year, respectively. Compared to the U.S. statutory rate, the effective tax rate is increased by the effect of state income taxes and certain non-deductible expenses that is partially offset by the effect of lower tax rates on income earned in foreign jurisdictions which are permanently reinvested.

25

Table of Contents

Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”)

We believe EBITDA helps investors compare our operating performance with the performance of other companies who have different financing and capital structures or tax rates. We believe that net income is the financial measure calculated and presented in accordance with U.S. generally accepted accounting principles that is most directly comparable to EBITDA. The following is a reconciliation of our net income to EBITDA for the three and nine months ended September 30, 2014 and 2013 (in millions):

| Three Months Ended September 30 |

Nine Months Ended September 30 |

|||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Net income |

$ | 32 | $ | 39 | $ | 100 | $ | 113 | ||||||||

| Interest |

— | — | — | — | ||||||||||||

| Tax provision |

17 | 20 | 54 | 61 | ||||||||||||

| Depreciation and amortization |

4 | 5 | 14 | 12 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| EBITDA (1) |

$ | 53 | $ | 64 | $ | 168 | $ | 186 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| EBITDA % (2) |

5.0 | % | 5.8 | % | 5.4 | % | 5.7 | % | ||||||||

| (1) | Because EBITDA is a non-U.S. GAAP financial measure, as defined by the SEC, we included a reconciliation of EBITDA to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP. |

| (2) | EBITDA % is defined as EBITDA divided by Revenue. |

Liquidity and Capital Resources

We assess liquidity in terms of our ability to generate cash to fund operating, investing and financing activities. We expect to remain in a strong financial position, with resources expected to be available to reinvest in existing businesses, strategic acquisitions and capital expenditures to meet short- and long-term objectives. We believe that cash on hand, cash generated from expected results of operations and amounts available under our revolving credit facility will be sufficient to fund operations, anticipated working capital needs and other cash requirements, including capital expenditures.