UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2014

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-36325

NOW INC.

(Exact name of registrant as specified in its charter)

| Delaware | 46-4191184 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

7402 North Eldridge Parkway,

Houston, Texas 77041

(Address of principal executive offices)

(281) 823-4700

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x*

* The registrant became subject to such requirements on May 13, 2014, and it has filed all reports so required since that date.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The number of shares of the registrant’s common stock, par value $0.01, outstanding as of May 14, 2014 was 1,000, all of which were owned by National Oilwell Varco, Inc.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

NOW INC.

COMBINED BALANCE SHEETS

(In millions)

| March 31, 2014 |

December 31, 2013 |

|||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 175 | $ | 101 | ||||

| Receivables, net |

754 | 661 | ||||||

| Inventories, net |

839 | 850 | ||||||

| Deferred income taxes |

29 | 21 | ||||||

| Prepaid and other current assets |

29 | 29 | ||||||

|

|

|

|

|

|||||

| Total current assets |

1,826 | 1,662 | ||||||

| Property, plant and equipment, net |

104 | 102 | ||||||

| Deferred income taxes |

15 | 15 | ||||||

| Goodwill |

330 | 333 | ||||||

| Intangibles, net |

67 | 68 | ||||||

| Other assets |

1 | 3 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 2,343 | $ | 2,183 | ||||

|

|

|

|

|

|||||

| LIABILITIES AND NET PARENT COMPANY INVESTMENT | ||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 313 | $ | 264 | ||||

| Accrued liabilities |

100 | 99 | ||||||

| Accrued income taxes |

7 | — | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

420 | 363 | ||||||

| Deferred income taxes |

17 | 16 | ||||||

| Other liabilities |

2 | 2 | ||||||

|

|

|

|

|

|||||

| Total liabilities |

439 | 381 | ||||||

|

|

|

|

|

|||||

| Commitments and contingencies |

||||||||

| Net parent company investment: |

||||||||

| Net parent company investment |

1,921 | 1,802 | ||||||

| Accumulated other comprehensive income (loss) |

(17 | ) | — | |||||

|

|

|

|

|

|||||

| Total net parent company investment |

1,904 | 1,802 | ||||||

|

|

|

|

|

|||||

| Total liabilities and net parent company investment |

$ | 2,343 | $ | 2,183 | ||||

|

|

|

|

|

|||||

See notes to unaudited combined financial statements.

2

NOW INC.

COMBINED STATEMENTS OF INCOME (UNAUDITED)

(In millions)

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Revenue |

$ | 1,077 | $ | 1,072 | ||||

| Operating expenses: |

||||||||

| Cost of products |

869 | 874 | ||||||

| Operating and warehousing costs |

102 | 101 | ||||||

| Selling, general and administrative |

44 | 39 | ||||||

|

|

|

|

|

|||||

| Operating profit |

62 | 58 | ||||||

| Other income (expense), net |

— | 2 | ||||||

|

|

|

|

|

|||||

| Income before income taxes |

62 | 60 | ||||||

| Provision for income taxes |

21 | 19 | ||||||

|

|

|

|

|

|||||

| Net income |

$ | 41 | $ | 41 | ||||

|

|

|

|

|

|||||

See notes to unaudited combined financial statements.

3

NOW INC.

COMBINED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(In millions)

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Net income |

$ | 41 | $ | 41 | ||||

| Other comprehensive income (loss): |

||||||||

| Currency translation adjustments |

(17 | ) | (18 | ) | ||||

|

|

|

|

|

|||||

| Comprehensive income |

$ | 24 | $ | 23 | ||||

|

|

|

|

|

|||||

See notes to unaudited combined financial statements.

4

NOW INC.

COMBINED STATEMENTS OF CASH FLOWS (UNAUDITED)

(In millions)

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Cash flows from operating activities: |

||||||||

| Net income |

$ | 41 | $ | 41 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

4 | 4 | ||||||

| Deferred income taxes |

(7 | ) | — | |||||

| Other, net |

(3 | ) | 2 | |||||

| Change in operating assets and liabilities: |

||||||||

| Receivables |

(93 | ) | (22 | ) | ||||

| Inventories |

11 | 14 | ||||||

| Prepaid and other current assets |

— | (5 | ) | |||||

| Accounts payable |

49 | (5 | ) | |||||

| Income taxes payable |

7 | (6 | ) | |||||

| Other assets/liabilities, net |

(6 | ) | (3 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

3 | 20 | ||||||

|

|

|

|

|

|||||

| Cash flows from investing activities: |

||||||||

| Purchases of property, plant and equipment |

(6 | ) | (19 | ) | ||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(6 | ) | (19 | ) | ||||

|

|

|

|

|

|||||

| Cash flows from financing activities: |

||||||||

| Contributions from parent company |

78 | 8 | ||||||

|

|

|

|

|

|||||

| Net cash provided by financing activities |

78 | 8 | ||||||

| Effect of exchange rates on cash and cash equivalents |

(1 | ) | (1 | ) | ||||

|

|

|

|

|

|||||

| Increase in cash and cash equivalents |

74 | 8 | ||||||

| Cash and cash equivalents, beginning of period |

101 | 138 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents, end of period |

$ | 175 | $ | 146 | ||||

|

|

|

|

|

|||||

| Supplemental disclosures of cash flow information: |

||||||||

| Cash payments during the period for: |

||||||||

| Income taxes |

$ | 18 | $ | 19 | ||||

See notes to unaudited combined financial statements.

5

NOW INC.

Notes to Combined Financial Statements (Unaudited)

1. Organization and Basis of Presentation

The Spin-Off

On May 1, 2014, the National Oilwell Varco, Inc. (“NOV”) Board of Directors approved the spin-off of its distribution business (the “Spin-Off”) into an independent, publicly traded company named NOW Inc. (“NOW” or the “Company”). NOW will be headquartered in Houston, Texas. In accordance with a separation and distribution agreement, the spin-off will be completed by way of a pro rata distribution of all of the outstanding shares of NOW common stock to holders of NOV common stock. This distribution is expected to occur after market close on May 30, 2014 (the “Distribution Date”) to NOV stockholders of record as of the close of business on May 22, 2014 (the “Record Date”). On the Distribution Date, each NOV stockholder as of the Record Date will receive one share of NOW common stock for every four shares of NOV common stock held at the close of business on the Record Date. Fractional shares of NOW common stock will not be distributed and any fractional share of NOW common stock otherwise issuable to a NOV stockholder will be sold in the open market on such stockholder’s behalf, and such stockholder will receive a cash payment with respect to that fractional share. NOV expects to receive an opinion from its legal counsel to the effect that, based on certain facts, assumptions, representations and undertakings, for U.S. federal income tax purposes, the distribution of NOW common stock and certain related transactions generally will not be taxable to NOV or U.S. holders of NOV common stock, except in respect to cash received in lieu of fractional shares, which generally will be taxable to such holders as capital gain.

Following the distribution of NOW common stock, NOW will be an independent, publicly traded company, and NOV will retain no ownership interest in NOW. NOW has received approval for the listing of its common stock on the New York Stock Exchange under the symbol “DNOW”. A registration statement on Form 10 relating to the spin-off was filed by the Company with the U.S. Securities and Exchange Commission (“SEC”) and was declared effective on May 13, 2014. NOW expects a “when-issued” public trading market for NOW common stock to commence on or about May 20, 2014 under the symbol “DNOW WI” and will continue through the Distribution Date. NOW also anticipates that “regular way” trading of NOW common stock will begin on the first trading day following the Distribution Date.

Basis of Presentation

The combined financial statements in this 10-Q were derived from the consolidated financial statements and accounting records of National Oilwell Varco. These statements reflect the combined historical results of operations, financial position and cash flows of NOW Inc. operations and an allocable portion of corporate costs.

These financial statements are presented as if such businesses had been combined for all periods presented. All intercompany transactions and accounts within NOW have been eliminated. The assets and liabilities in the combined financial statements have been reflected on a historical cost basis, as immediately prior to the separation all of the assets and liabilities presented are wholly owned by NOV and are being transferred within NOV. The combined statement of income also includes expense allocations for certain corporate functions historically performed by NOV and not allocated to its operating segments, including allocations of general corporate expenses related to executive oversight, accounting, treasury, tax, legal, procurement and information technology. These allocations are based primarily on specific identification of time and/or activities associated with NOW, employee headcount or capital expenditures. Management believes the assumptions underlying the combined financial statements, including the assumptions regarding allocating general corporate expenses from NOV, are reasonable. Nevertheless, the combined financial statements may not include all of the actual expenses that would have been incurred had we been a stand-alone public company during the periods presented and may not reflect our combined results of operations, financial position and cash flows had we been a stand-alone public company during the periods presented. Actual costs that would have been incurred if we had been a stand-alone public company would depend on multiple factors, including organizational structure and strategic decisions made in various areas, including information technology and infrastructure.

The preparation of financial statements in conformity with generally accepted accounting principles (“GAAP”) in the United States requires management to make estimates and assumptions that affect reported and contingent amounts of assets and liabilities as of the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

The accompanying unaudited combined financial statements of the Company present information in accordance with GAAP in the United States for interim financial information and the instructions to Form 10-Q and applicable rules of Regulation S-X. They do not include all information or footnotes required by GAAP in the United States for complete combined financial statements and should be read in conjunction with our most recent Information Statement on Form 10.

In our opinion, the combined financial statements include all adjustments, all of which are of a normal recurring nature, necessary for a fair presentation of the results for the interim periods. The results of operations for the three months ended March 31, 2014 are not necessarily indicative of the results to be expected for the full year.

Cash and Cash Equivalents

Cash equivalents include only those investments having a maturity date of three months or less at the time of purchase.

6

2. Property, Plant and Equipment, net

Property, plant and equipment consist of (in millions):

| Estimated Useful Lives |

March 31, 2014 |

December 31, 2013 |

||||||||

| Information technology equipment |

1-7 Years | $ | 48 | $ | 44 | |||||

| Operating equipment |

3-15 Years | 57 | 57 | |||||||

| Land and buildings |

5-35 Years | 60 | 62 | |||||||

|

|

|

|

|

|||||||

| 165 | 163 | |||||||||

| Less: accumulated depreciation |

(61 | ) | (61 | ) | ||||||

|

|

|

|

|

|||||||

| Total |

$ | 104 | $ | 102 | ||||||

|

|

|

|

|

|||||||

3. Accrued Liabilities

Accrued liabilities consist of (in millions):

| March 31, 2014 |

December 31, 2013 |

|||||||

| Compensation and other related expenses |

$ | 21 | $ | 24 | ||||

| Customer prepayments |

17 | 18 | ||||||

| Taxes (non income) |

21 | 25 | ||||||

| Other |

41 | 32 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 100 | $ | 99 | ||||

|

|

|

|

|

|||||

4. Accumulated Other Comprehensive Income (Loss)

The components of accumulated other comprehensive income (loss) are as follows (in millions):

| Currency Translation Adjustments |

||||

| Balance at December 31, 2013 |

$ | — | ||

| Accumulated other comprehensive income (loss) before reclassifications |

(17 | ) | ||

| Amounts reclassified from accumulated other comprehensive income (loss) |

— | |||

|

|

|

|||

| Balance at March 31, 2014 |

$ | (17 | ) | |

|

|

|

|||

The Company’s reporting currency is the U.S. dollar. A majority of the Company’s international entities in which there is a substantial investment have the local currency as their functional currency. As a result, currency translation adjustments resulting from the process of translating the entities’ financial statements into the reporting currency are reported in Other Comprehensive Income or Loss in accordance with ASC Topic 830 “Foreign Currency Matters” (“ASC Topic 830”). For the three months ended March 31, 2014 the majority of these local currencies weakened against the U.S. dollar resulting in net Other Comprehensive Loss of $17 million upon the translation from local currencies to the U.S. dollar.

7

5. Business Segments

Operating results by segment are as follows (in millions):

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Revenue: |

||||||||

| United States |

$ | 704 | $ | 712 | ||||

| Canada |

191 | 215 | ||||||

| International |

182 | 145 | ||||||

|

|

|

|

|

|||||

| Total Revenue |

$ | 1,077 | $ | 1,072 | ||||

|

|

|

|

|

|||||

| Operating Profit: |

||||||||

| United States |

$ | 30 | $ | 33 | ||||

| Canada |

16 | 17 | ||||||

| International |

16 | 8 | ||||||

|

|

|

|

|

|||||

| Total Operating Profit |

$ | 62 | $ | 58 | ||||

|

|

|

|

|

|||||

| Operating Profit %: |

||||||||

| United States |

4.3 | % | 4.6 | % | ||||

| Canada |

8.4 | % | 7.9 | % | ||||

| International |

8.8 | % | 5.5 | % | ||||

| Total Operating Profit % |

5.8 | % | 5.4 | % | ||||

Primary End-Market:

The following table presents combined revenues by primary end-market (in millions):

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Energy Branches |

$ | 899 | $ | 890 | ||||

| Supply Chain |

178 | 182 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 1,077 | $ | 1,072 | ||||

|

|

|

|

|

|||||

Our Energy Branches are the legacy brick and mortar supply store operations that provide products to multiple upstream and midstream customers from a single location. These branches serve repeat customers across a variety of pricing models. Our Supply Chain group targets a broader customer sector to include downstream, upstream, industrial and manufacturing, in which our customers are generally contractually committed to source from us under a single business model that includes a fixed pricing structure. We are typically integrated into our customers’ facilities; have on-site NOW branches and inventory committed to a specific customer; perform duties otherwise managed by our customers; manage third party materials on behalf of our customers; employ vending machines and/or tool cribs to store and dispense materials on-demand; and have a much greater component of technology to enable e-commerce and key performance indicators to be measured and reported specifically to each customer. While Energy Branches and Supply Chain serve different markets, in some cases customers require the similar products resulting in some overlap of products carried and sold.

8

The following table presents a comparison of the approximate sales mix in the principal product categories (in millions):

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Product Category |

||||||||

| Drilling and production |

$ | 248 | $ | 245 | ||||

| Valves |

222 | 194 | ||||||

| Pipe |

202 | 220 | ||||||

| Fittings and flanges |

186 | 191 | ||||||

| Mill tool, MRO, safety and other |

219 | 222 | ||||||

|

|

|

|

|

|||||

| Total |

$ | 1,077 | $ | 1,072 | ||||

|

|

|

|

|

|||||

6. Income Tax

The effective tax rate for the three months ended March 31, 2014 was 33.8%, compared to 31.7% for the same period in 2013. Compared to the U.S. statutory rate, the effective tax rate was favorably impacted in the periods by the effect of lower tax rates on income earned in foreign jurisdictions which are permanently reinvested.

The difference between the effective tax rate reflected in the provision for income taxes and the U.S. federal statutory rate of 35% was as follows (in millions):

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Federal income tax at U.S. federal statutory rate |

$ | 22 | $ | 21 | ||||

| Foreign income tax rate differential |

(2 | ) | (2 | ) | ||||

| State income tax, net of federal benefit |

1 | 1 | ||||||

| Other |

— | (1 | ) | |||||

|

|

|

|

|

|||||

| Provision for income taxes |

$ | 21 | $ | 19 | ||||

|

|

|

|

|

|||||

The Company is subject to taxation in the United States, various states and foreign jurisdictions. The Company has significant operations in the United States, Canada, the United Kingdom, Indonesia, and Norway. Tax years that remain subject to examination by major tax jurisdictions vary by legal entity, but are generally open in the U.S. for the tax years ending after 2007 and outside the U.S. for the tax years ending after 2006.

To the extent penalties and interest would be assessed on any underpayment of income tax, such accrued amounts have been classified as a component of income tax expense in the financial statements.

9

7. Stock-Based Compensation

NOV has a stock-based compensation plan known as the National Oilwell Varco, Inc. Long-Term Incentive Plan (the “Plan”). The Plan provides for the granting of stock options, performance-based share awards, restricted stock, phantom shares, stock payments and stock appreciation rights. Total stock-based compensation for all stock-based compensation arrangements for NOW employees under the Plan was $2 million and $1 million for the three months ended March 31, 2014 and 2013, respectively. The total income tax benefit recognized in the Combined Statements of Income for all stock-based compensation arrangements for employees of NOW under the Plan was $1 million and less than $1 million for the three months ended March 31, 2014 and 2013, respectively.

During the three months ended March 31, 2014, employees of NOW were granted 204,952 stock options with a fair value of $25.60 per share and 30,008 shares of restricted stock and restricted stock units with a fair value of $74.83 per share. In addition, certain members of senior management of NOW were granted performance share awards on February 25, 2014, with potential payouts varying from zero to 22,472 shares. The stock options were granted February 25, 2014 with an exercise price of $74.83. These options generally vest over a three-year period from the grant date. The restricted stock and restricted stock units were granted February 25, 2014 and vest on the third anniversary of the date of grant. The performance share awards can be earned based on performance against established goals over a three-year performance period. The performance share awards are divided into two equal, independent parts that are subject to two separate performance metrics: 50% with a TSR (total shareholder return) goal (the “TSR Award”) and 50% with an internal ROC (return on capital) goal (the “ROC Award”).

After the Spin-Off, pursuant to the terms of the agreements entered into between NOW and NOV in connection with the Spin-Off, outstanding equity awards under the Plan held by NOV employees who will become NOW employees will be converted to similar awards under NOW’s Long-Term Incentive Plan, provided, that performance conditions attached to the performance share awards for the members of senior management of NOV that joined NOW will be removed and the vesting of such awards will only be subject to continued employment by such employees with NOW through the original performance period.

8. Commitments and Contingencies

We are involved in various claims, regulatory agency audits and pending or threatened legal actions involving a variety of matters. We record accruals for estimated losses from these matters when available information indicates that a loss is probable and the loss can be reasonably estimated. We also assess the potential for additional losses above the amounts accrued as well as potential losses for matters that are not probable but are reasonably possible. The total potential loss on these pending matters cannot be determined; however, in our opinion, any ultimate liability, to the extent not otherwise recorded or accrued for, will not materially affect our financial position, cash flow or results of operations. These estimated liabilities are based on the Company’s assessment of the nature of these matters, their progress toward resolution, the advice of legal counsel and outside experts as well as management’s intention and experience.

Our business is affected both directly and indirectly by governmental laws and regulations relating to the oilfield service industry in general, as well as by environmental and safety regulations that specifically apply to our business. Although we have not incurred material costs in connection with our compliance with such laws, there can be no assurance that other developments, such as new environmental laws, regulations and enforcement policies hereunder may not result in additional, presently unquantifiable, costs or liabilities to us.

9. Related Party Transactions and Net Parent Company Investment

Allocation of General Corporate Expenses

The combined financial statements include expense allocations for certain functions provided by NOV as well as other NOV employees not solely dedicated to NOW, including, but not limited to, general corporate expenses related to finance, legal, information technology, human resources, communications, ethics and compliance, shared services, employee benefits and incentives, and stock-based compensation. These expenses have been allocated to NOW on the basis of direct usage when identifiable, with the remainder allocated on the basis of operating profit, headcount or other measures. During the three months ended March 31, 2014 and 2013, NOW was allocated $3 million and $2 million, respectively, of general corporate expenses incurred by NOV which is included within selling, general and administrative expenses in the accompanying combined statements of income.

10

The expense allocations have been determined on a basis that is considered to be a reasonable reflection of the utilization of services provided or the benefit received by the Company during the periods presented. The allocations may not reflect the expense the Company would have incurred as an independent, publicly traded company for the periods presented. Actual costs that may have been incurred if the Company had been a stand-alone public company would depend on a number of factors, including the chosen organizational structure, what functions were outsourced or performed by employees and strategic decisions made in areas such as information technology and infrastructure.

Net Parent Company Investment

Net contributions from (distributions to) net parent company investment are included within net parent company investment on the Combined Balance Sheets and Statements of Cash Flows. The components of the net transfers to and from parent as of March 31, 2014 and 2013 are as follows (in millions):

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Net contributions from parent company per the combined changes in net parent company investment |

$ | 119 | $ | 49 | ||||

| Less: Net income |

(41 | ) | (41 | ) | ||||

|

|

|

|

|

|||||

| Contributions from parent company per the combined statements of cash flows |

$ | 78 | $ | 8 | ||||

|

|

|

|

|

|||||

The combined financial statements include certain assets and liabilities that have historically been held at the parent company corporate level but which are specifically identifiable or otherwise allocable to the Company. The cash and cash equivalents held by the parent company at the corporate level are not specifically identifiable to NOW and therefore were not allocated to it for any of the periods presented. Cash and equivalents in the Company’s combined balance sheets primarily represent cash held locally by entities included in its combined financial statements. Transfers of cash to and from the parent company’s cash management system are reflected as a component of net parent company investment on the combined balance sheets.

All significant intercompany transactions between NOW and the parent company have been included in these combined financial statements and are considered to be effectively settled for cash in the combined financial statements at the time the transaction is recorded when the underlying transaction is to be settled in cash by the parent company. The total net effect of the settlement of these intercompany transactions is reflected in the combined statements of cash flow as a financing activity and in the combined balance sheets as parent company investment.

10. Recently Issued Accounting Standards

In April 2014, the Financial Accounting Standards Board issued Accounting Standard Update No. 2014-08 “Reporting Discontinued Operations and Disclosures of Disposals of Components of and Entity” (ASU No. 2014-08), which is an update for Accounting Standards Codification Topic No. 205 “Presentation of Financial Statements” and Topic No. 360 “Property, Plant and Equipment’. This update changes the requirements of reporting discontinued operations. Under the amended guidance, a disposal of a component of an entity or a group of components of an entity is required to be reported in discontinued operations if the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results. The amendments in this update are effective for all disposals (or classifications as held for sale) of components of an entity that occur within annual periods beginning on or after December 15, 2014, and interim periods within those years, with early adoption permitted. The adoption of this update concerns presentation and disclosure only as it relates to our consolidated financial statements. The Company is currently assessing the impact of ASU No. 2014-08 on its combined financial position and results of operations. No material changes are expected upon adoption of this ASU.

11. Subsequent Event

On April 18, 2014, we entered into a five-year senior unsecured credit facility with a syndicate of lenders, including Wells Fargo Bank, National Association, as administrative agent. The credit facility will become available to us upon the satisfaction of customary conditions, including the consummation of the separation.

The credit facility will be for an aggregate principal amount of up to $750 million with sub-facilities for standby letters of credit and swingline loans, each with a sublimit of $150 million and $50 million, respectively. We have the right, subject to certain conditions, to increase the aggregate principal amount of commitments under the credit facility by $250 million.

The credit facility will be unsecured and guaranteed by our domestic subsidiaries. In the event that we or any subsidiary incurs long-term debt which is secured (other than certain excluded obligations), then we are required to secure the credit facility on equal terms with the security granted to such future debt.

The credit agreement related to the credit facility contains usual and customary affirmative and negative covenants for credit facilities of this type including financial covenants consisting of (a) a maximum capitalization ratio (as defined in the credit agreement) of 50% and (b) a minimum interest coverage ratio (as defined in the credit agreement) of no less than 3.00x. Borrowings under the credit facility will bear interest at a base rate (as defined in the credit agreement) plus an applicable interest margin based on our capitalization ratio. The base rate is calculated as the highest of (a) the Federal Funds Rate, as published by the Federal Reserve Bank of New York, plus 1/2 of 1%, (b) the prime commercial lending rate of the administrative agent, as established from time to time at its principal U.S. office, and (c) the Daily One-Month LIBOR (as defined in the credit agreement) plus 1%. We also have the option for our borrowings under the credit facility to bear interest based on LIBOR (as defined in the credit agreement). The credit agreement also provides for customary fees, including administrative agent fees, commitment fees, fees in respect of letters of credit and other fees.

11

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Introduction

We are a distributor to the upstream, midstream, downstream and industrial markets with an operating legacy of over one-hundred and fifty years. We provide pipe, valves and valve automation, fittings, mill and industrial supplies, tools, safety products, and artificial lift systems. We also offer value-added services, including supply chain management, project management and e-commerce solutions. Our employees have extensive knowledge, broad experience, and a thorough understanding of our customers’ processes and business drivers. We operate primarily under the DistributionNOW and Wilson Export brands. Our operations consist of three reportable segments: United States, Canada and International.

United States

We have more than 200 locations in the U.S., which are geographically positioned to best serve the upstream, midstream and downstream energy and industrial markets. Our U.S. branch network was significantly expanded with the locations added through the Wilson acquisition in 2012, which has enabled us to broaden our customer base, leverage our inventory and purchasing power and enhance our position in the midstream and downstream energy and industrial markets.

Approximately 75% of our U.S. locations are Energy Branches. Our Energy Branches primarily serve the upstream and midstream sectors of the oil and gas industry with locations in every major land and offshore area of the country. Within our branch network, we have a team of sales and operations professionals trained in the products, applications and customer service required to support our customers as they drill, explore, produce and transport oil and gas products. Our locations offer a comprehensive line of products, including line pipe, valves, fittings and flanges, original equipment manufacturer (“OEM”) spare parts, mill supplies, tools, safety supplies, personal protective equipment and miscellaneous expendable items. We also have a team of technical professionals who provide expertise in applied products, and applications, such as artificial lift systems, coatings, electrical products, gas meter runs and valve actuation.

The balance of our U.S. locations are Supply Chain locations, which serve the upstream and downstream energy and industrial end markets and our customer on-site locations. Through our network of upstream and downstream and industrial facilities staffed by skilled personnel, we provide products primarily to refineries, chemical companies, utilities, manufacturers and engineering and construction companies in the areas of the country where these markets are situated. Our primary product offering for the upstream and downstream and industrial markets includes all grades of pipe, valves, fittings, mill supplies, tools and safety supplies. Additionally, our upstream and downstream and industrial branches offer safety equipment, repair and maintenance, and also provide planning, sourcing and expediting of orders throughout the lifecycle of large capital projects. Our Supply Chain locations serve many oil and gas operators and drilling contractors. Supply Chain customers outsource procurement functions to us, which brings our sizeable vendor network to their doorstep and enables them to benefit from on-site management of their warehouses, inventory, materials, projects, logistics and manufacturing tool cribs. Customers engage our Supply Chain operations to improve their bottom lines and accelerate their time to market through the identification and implementation of measurable operational efficiencies. To achieve this, we partner with our customers to review their current operations, allowing us to make informed recommendations regarding the restructuring of processes and inventories. Our Supply Chain operations result in long term partnerships because they are customized to each customer’s requirements, guided by a strategic framework, and are not easily replicated.

We also have extensive one-stop shop specialty operations in the U.S. that provide our customers a unique way to purchase artificial lift, valves and valve actuation, measurement and controls, fluid transfer and flow optimization, which enables them to better focus on their core business. In these businesses, we provide additional value to our customers through the design, assembly, fabrication and optimization of products and equipment essential to the safe and efficient production of oil and gas.

Canada

We have a network of over 70 branches in the Canadian oilfield, predominantly in the oil rich provinces of Alberta and Saskatchewan in Western Canada. Our Canada segment primarily serves the energy exploration, production and drilling business, offering customers the same products and value-added solutions that we perform in the U.S. In Canada, we also provide training and supervise the installation of fiberglass pipe, supported by substantial inventory on the ground to serve our customers.

International

We operate in over 20 countries and serve the needs of our international customers from more than 30 locations outside of the U.S. and Canada, all of which are strategically located in major oil and gas development areas. Our approach in these markets is similar to our approach in the U.S., as our customers look to us to provide inventory and support closer to their drilling and exploration activities. Our long legacy of operating in many international regions, combined with significant recent expansion into several new key markets, provides a significant competitive advantage as few of our competitors have a presence in all of these markets.

12

Critical Accounting Policies and Estimates

In our Information Statement on Form 10, we identified our most critical accounting policies and estimates. In preparing the financial statements, we make assumptions, estimates and judgments that affect the amounts reported. We periodically evaluate our estimates and judgments that are most critical in nature which are related to allowance for doubtful accounts; inventory reserves; goodwill; purchase price allocation of acquisitions; vendor consideration; and income taxes. Our estimates are based on historical experience and on our future expectations that we believe are reasonable. The combination of these factors forms the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from our current estimates and those differences may be material.

13

Operating Environment Overview

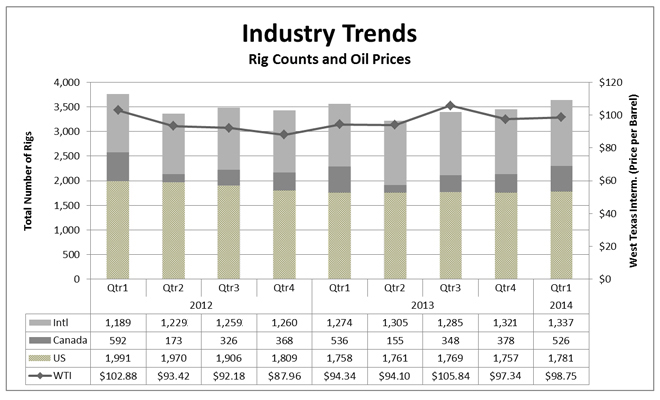

The Company’s results are dependent on, among other things, the level of worldwide oil and gas drilling, well remediation activity, the prices of crude oil and natural gas, capital spending by other oilfield service companies and drilling contractors, and worldwide oil and gas inventory levels. Key industry indicators for the first quarter of 2014 and 2013 and the fourth quarter of 2013 include the following:

| 1Q14* | 1Q13* | % 1Q14 v 1Q13 |

4Q13* | % 1Q14 v 4Q13 |

||||||||||||||||

| Active Drilling Rigs: |

||||||||||||||||||||

| U.S. |

1,781 | 1,758 | 1.3 | % | 1,757 | 1.4 | % | |||||||||||||

| Canada |

526 | 536 | (1.9 | )% | 378 | 39.2 | % | |||||||||||||

| International |

1,337 | 1,274 | 4.9 | % | 1,321 | 1.2 | % | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Worldwide |

3,644 | 3,568 | 2.1 | % | 3,456 | 5.4 | % | |||||||||||||

| West Texas Intermediate Crude Prices (per barrel) |

$ | 98.75 | $ | 94.34 | 4.7 | % | $ | 97.34 | 1.4 | % | ||||||||||

| Natural Gas Prices ($/mmbtu) |

$ | 5.18 | $ | 3.49 | 48.4 | % | $ | 3.84 | 34.9 | % | ||||||||||

| Hot-Rolled Coil Prices (steel) ($/short ton) |

$ | 651.79 | $ | 624.15 | 4.4 | % | $ | 663.46 | (1.8 | )% | ||||||||||

| * | Averages for the quarters indicated. See sources below. |

The following table details the U.S., Canadian and international rig activity and West Texas Intermediate Oil prices for the past nine quarters ended March 31, 2014, on a quarterly basis:

Source: Rig count: Baker Hughes, Inc. (www.bakerhughes.com); West Texas Intermediate Crude and Natural Gas Prices: Department of Energy, Energy Information Administration (www.eia.doe.gov).

14

The worldwide quarterly average rig count increased 5.4% (from 3,456 to 3,644) and the U.S. increased 1.4% (from 1,757 to 1,781), in the first quarter of 2014 compared to the fourth quarter of 2013. The average price per barrel of West Texas Intermediate Crude increased 1.4% (from $97.34 per barrel to $98.75 per barrel) and natural gas prices increased 34.9% (from $3.84 per mmbtu to $5.18 per mmbtu) in the first quarter of 2014 compared to the fourth quarter of 2013. The average price per short ton of Hot-Rolled Coil decreased 1.8% (from $663.46 per short ton to $651.79 per short ton) in the first quarter of 2014 compared to the fourth quarter of 2013.

U.S. rig count at April 25, 2014 was 1,861 rigs an increase of 4.5% compared to the first quarter average of 1,781 rigs. The price for West Texas Intermediate Crude was $100.60 per barrel at April 25, 2014, an increase of 1.9% from the first quarter average. The price for natural gas was $4.65 per mmbtu at April 25, 2014, a decrease of 10.2% from the first quarter average. The price for Hot-Rolled Coil was $679.48 per short ton at April 25, 2014, an increase of 4.2% from the first quarter average.

Executive Summary

For its first quarter ended March 31, 2014, the Company generated $41 million in net income, on $1.1 billion in revenue. Compared to the first quarter of 2013, revenue increased $5 million or 0.5%, and net income stayed the same year over year.

Operating profit was $62 million or 5.8% of revenue in the first quarter of 2014, compared to 5.4% of revenue in the first quarter of 2013.

Outlook

We are an organization with a strong financial position and we believe the spin-off creates new opportunities for us to grow market share, expand product lines, markets and geographies and reinvest in our business in ways that could only be accomplished as a pure play, supply chain provider to the energy and industrial markets.

We believe we are well positioned and should benefit from our global infrastructure, broad product offering, diverse customer base, strong balance sheet and capitalization and access to credit. In the event of a market downturn, we also believe that our long history of cost control and downsizing in response to slowing market conditions, and of executing strategic acquisitions will enable us to capitalize on new opportunities to effect new organic growth and acquisition initiatives. To dramatically enhance operational and back-office performance, we are migrating substantially all of our business onto one Enterprise Resource Planning (“ERP”) platform in 2014. Our ERP standardization improves supply chain visibility, enables global inventory redeployment and expedites the movement of goods through the system while maximizing value to our customers. The recovery of the world economy continues to move forward slowly and with a great deal of uncertainty amid regional economic worries. If such global economic uncertainties develop adversely, world oil and gas prices could be impacted which in turn could negatively impact the worldwide rig count and our future financial results.

Our outlook for the Company remains closely tied to the rig count, particularly in North America. Average U.S. rig count during the first quarter of 2014 saw modest gains of 1% compared to the first quarter of 2013. The first quarter of 2014 saw average Canadian rig count remain relatively flat year-over-year. For both the U.S. and Canada, pricing and volumes remain stressed as companies reduce operating and capital expenditures. Additionally, economic weakness may pressure oil prices, which could lead to further activity declines, particularly among North American operators which may rely on cash flows from gas production and/or external financing to fund their drilling operations. In contrast, activity generally seems to be continuing to increase in most international markets outside North America.

15

Results of Operations

Operating results by segment are as follows (in millions):

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Revenue: |

||||||||

| United States |

$ | 704 | $ | 712 | ||||

| Canada |

191 | 215 | ||||||

| International |

182 | 145 | ||||||

|

|

|

|

|

|||||

| Total Revenue |

$ | 1,077 | $ | 1,072 | ||||

|

|

|

|

|

|||||

| Operating Profit: |

||||||||

| United States |

$ | 30 | $ | 33 | ||||

| Canada |

16 | 17 | ||||||

| International |

16 | 8 | ||||||

|

|

|

|

|

|||||

| Total Operating Profit |

$ | 62 | $ | 58 | ||||

|

|

|

|

|

|||||

| Operating Profit %: |

||||||||

| United States |

4.3 | % | 4.6 | % | ||||

| Canada |

8.4 | % | 7.9 | % | ||||

| International |

8.8 | % | 5.5 | % | ||||

| Total Operating Profit % |

5.8 | % | 5.4 | % | ||||

| EBITDA |

$ | 66 | $ | 64 | ||||

| EBITDA % |

6.1 | % | 6.0 | % | ||||

United States

Three Months Ended March 31, 2014 and 2013. Revenue was $704 million for the three months ended March 31, 2014, a decrease of $8 million (1.1%) compared to the three months ended March 31, 2013. This decrease was primarily attributable to $12 million less pipe revenue driven by lower projects in the first quarter of 2014. Excluding this change, the United States experienced a $4 million increase in revenue in line with rig count gains.

Operating profit was $30 million for the three months ended March 31, 2014, a decrease of $3 million (9.1%) compared to $33 million for the three months ended March 31, 2013. Operating profit percentage decreased to 4.3%, from 4.6% in the first quarter of 2013. This decrease was attributable to the net incremental costs incurred in connection with spin-off activities and organizational preparation to operate as an independent publicly traded company.

Canada

Three Months Ended March 31, 2014 and 2013. Revenue was $191 million for the three months ended March 31, 2014, a decrease of $24 million (11.2%) compared to the three months ended March 31, 2013. This decrease was primarily attributable to the decline in the Canadian dollar.

Operating profit was $16 million for the three months ended March 31, 2014, compared to $17 million for the three months ended March 31, 2013. Operating profit percentage increased to 8.4% from 7.9% in the first quarter of 2013. Synergies realized by facility consolidations drove operating profit percentage gains.

16

International

Three Months Ended March 31, 2014 and 2013. Revenue was $182 million for the three months ended March 31, 2014, an increase of $37 million (25.5%) compared to the three months ended March 31, 2013. The increase is primarily due to strong growth in Asia and valve projects elsewhere.

Operating profit was $16 million for the three months ended March 31, 2014, an increase of $8 million (100.0%) compared to $8 million for the three months ended March 31, 2013. Operating profit percentage increased to 8.8% from 5.5% in the first quarter of 2013. The dollar increase primarily resulted from the volume gains discussed above with minimal additional operating costs.

Cost of products

Cost of products was $869 million for the three months ended March 31, 2014 compared to $874 million for the three months ended March 31, 2013, a decrease of $5 million, or less than one percent primarily associated with a change in product mix. Cost of products includes the cost of inventory sold and related items, such as vendor consideration, inventory allowances and inbound and outbound freight.

Operating and warehousing costs

Operating and warehousing costs were $102 million for the three months ended March 31, 2014 compared to $101 million for the three months ended March 31, 2013, an increase of $1 million or less than one percent. Operating and warehousing costs include branch location and distribution center expenses (including costs such as compensation, benefits and rent).

Selling, general and administrative expenses

Selling, general and administrative expenses were $44 million for the three months ended March 31, 2014 compared to $39 million for the three months ended March 31, 2013, an increase of $5 million. The increase is related to the net incremental costs incurred in connection with spin activities and organizational preparation to operate as an independent publicly traded company.

Other income (expense), net

Other income (expense), net was nil for the three months ended March 31, 2014 compared to $2 million for the three months ended March 31, 2013. This decrease was primarily due to lower foreign exchange losses compared to March 31, 2013.

Provision for income taxes

The effective tax rate for the three months ended March 31, 2014 was 33.8%, compared to 31.7% for same period in 2013. Compared to the U.S. statutory rate, the effective tax rate was positively impacted in the periods by the effect of lower tax rates on income earned in foreign jurisdictions which are permanently reinvested.

Earnings Before Interest, Taxes, Depreciation and Amortization ("EBITDA")

We believe EBITDA helps investors compare our operating performance with the performance of other companies who have different financing and capital structures or tax rates. We believe that net income is the financial measure calculated and presented in accordance with U.S. generally accepted accounting principles that is most directly comparable to EBITDA. The following is a reconciliation of our net income to EBITDA for the three months ended March 31, 2014 and March 31, 2013 (in millions):

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Net income |

41 | 41 | ||||||

| Tax provision |

21 | 19 | ||||||

| Depreciation and amortization |

4 | 4 | ||||||

|

|

|

|

|

|||||

| EBITDA (1) |

66 | 64 | ||||||

| EBITDA % (2) |

6.1 | % | 6.0 | % | ||||

| (1) | Because EBITDA is a non-U.S. GAAP financial measure, as defined by the SEC, we included a reconciliation of EBITDA to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP. |

| (2) | EBITDA % is defined as EBITDA divided by Revenue. |

17

Liquidity and Capital Resources

We assess liquidity in terms of our ability to generate cash to fund operating, investing and financing activities. We expect to remain in a strong financial position, with resources expected to be available to reinvest in existing businesses, strategic acquisitions and capital expenditures to meet short- and long-term objectives. We believe that cash on hand, cash generated from expected results of operations and amounts available under our revolving credit facility will be sufficient to fund operations, anticipated working capital needs and other cash requirements such as capital expenditures.

As of March 31, 2014 and December 31, 2013, we had cash and cash equivalents of $175 million and $101 million, respectively. As of March 31, 2014, approximately $120 million of our cash and cash equivalents was maintained in the accounts of our various foreign subsidiaries and, if such amounts were transferred among countries or repatriated to the U.S., such amounts may be subject to additional tax liabilities, which would be recognized in our financial statements in the period during which such decision was made. We currently have the intent and ability to permanently reinvest the cash held by our foreign subsidiaries and there are currently no plans for the repatriation of such amounts.

The following table summarizes our net cash flows provided by operating activities, net cash used in investing activities and net cash provided by financing activities for the periods presented (in millions):

| Three Months Ended March 31, |

||||||||

| 2014 | 2013 | |||||||

| Net cash provided by operating activities |

$ | 3 | $ | 20 | ||||

| Net cash used in investing activities |

(6 | ) | (19 | ) | ||||

| Net cash provided by financing activities |

78 | 8 | ||||||

Operating Activities

For the first three months of 2014, cash provided by operating activities was $3 million compared to cash provided by operating activities of $20 million in the same period of 2013. Net cash provided by operating activities was positively impacted by an increase in accounts payable and income tax payables by $49 million and $7 million, respectively, offset by an increase in accounts receivable of $93 million. The shifts in accounts payable and accounts receivables are primarily attributable to a legal entity conversion and the ERP system implementation which were underway during the period.

Investing Activities

For the first three months of 2014, net cash used in investing activities was $6 million compared to net cash used in investing activities of $19 million for the same period of 2013. Capital expenditures in the first three months of 2014 were lower than the first three months of 2013 when the Company was consolidating ERP systems and facilities subsequent to the Wilson and CE Franklin acquisitions.

Financing Activities

For the first three months of 2014, net cash provided by financing activities was $78 million compared to cash provided by financing activities of $8 million for the same period of 2013. The increase was primarily related to the changes in net parent company investment.

The effect of the change in exchange rates on cash flows was a negative $1 million for each of the first three months of 2014 and 2013.

We intend to pursue additional acquisition candidates, but the timing, size or success of any acquisition effort and the related potential capital commitments cannot be predicted. We continue to expect to fund future acquisitions primarily with cash

18

flows from operations and borrowings, including the unborrowed portion of the credit facility or new debt issuances, but may also issue additional equity either directly or in connection with acquisitions. There can be no assurance that additional financing for acquisitions will be available at terms acceptable to us.

Recently Issued Accounting Standards

In April 2014, the Financial Accounting Standards Board issued Accounting Standard Update No. 2014-08 “Reporting Discontinued Operations and Disclosures of Disposals of Components of and Entity” (ASU No. 2014-08), which is an update for Accounting Standards Codification Topic No. 205 “Presentation of Financial Statements” and Topic No. 360 “Property, Plant and Equipment’. This update changes the requirements of reporting discontinued operations. Under the amended guidance, a disposal of a component of an entity or a group of components of an entity is required to be reported in discontinued operations if the disposal represents a strategic shift that has (or will have) a major effect on an entity’s operations and financial results. The amendments in this update are effective for all disposals (or classifications as held for sale) of components of an entity that occur within annual periods beginning on or after December 15, 2014, and interim periods within those years, with early adoption permitted. The adoption of this update concerns presentation and disclosure only as it relates to our consolidated financial statements. The Company is currently assessing the impact of ASU No. 2014-08 on its combined financial position and results of operations.

Forward-Looking Statements

Some of the information in this document contains, or has incorporated by reference, forward-looking statements. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements typically are identified by use of terms such as “may,” “expect,” “anticipate,” “estimate,” and similar words, although some forward-looking statements are expressed differently. All statements herein regarding expected merger synergies are forward-looking statements. You should be aware that our actual results could differ materially from results anticipated in the forward-looking statements due to a number of factors, including but not limited to changes in oil and gas prices, customer demand for our products, difficulties encountered in integrating mergers and acquisitions, and worldwide economic activity. You should also consider carefully the statements under “Risk Factors,” as disclosed in our Information Statement on Form 10, which address additional factors that could cause our actual results to differ from those set forth in the forward-looking statements. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward-looking statements. We undertake no obligation to update any such factors or forward-looking statements to reflect future events or developments.

19

Item 3. Quantitative and Qualitative Disclosures About Market Risk

We are exposed to changes in commodity prices and foreign currency exchange rates. Additional information concerning these matters follows:

Commodity Price Risk

The Company’s business is sensitive to steel tubular prices, which can impact our product pricing. While we cannot predict steel prices, we manage this risk by managing our inventory levels, including maintaining sufficient quantity on hand to meet demand, while reducing the risk of overstocking.

Foreign Currency Risk

The Company has operations in foreign countries. The net assets and liabilities of these operations are exposed to changes in foreign currency exchange rates, although such fluctuations generally do not affect income since their functional currency is typically the local currency. However, these operations also have net assets and liabilities not denominated in the functional currency, which exposes the Company to changes in foreign currency exchange rates that impact income. During the three months ended March 31, 2014 and 2013, the Company recognized foreign currency gains of nil and $2 million, respectively. Gains and losses are primarily due to exchange rate fluctuations related to monetary asset balances denominated in currencies other than the functional currency. Strengthening of currencies against the U.S. dollar may create losses in future periods to the extent the Company maintains net assets and liabilities not denominated in the functional currency of the countries using the local currency as its functional currency.

Some of the Company’s revenues in foreign countries are denominated in U.S. dollars, and therefore, changes in foreign currency exchange rates impact earnings to the extent that costs associated with those U.S. dollar revenues are denominated in the local currency. Similarly some of the Company’s revenues are denominated in foreign currencies, but have associated U.S. dollar costs, which also give rise to foreign currency exchange rate exposure.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and with the participation of the Company’s management, including the Company’s Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of the Company’s disclosure controls and procedures. The Company’s disclosure controls and procedures are designed to provide reasonable assurance that the information required to be disclosed by the Company in the reports it files under the Exchange Act is accumulated and communicated to the Company’s management, including the Company’s Chief Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required disclosures and is recorded, processed, summarized and reported within the time period specified in the rules and forms of the Securities and Exchange Commission. Based upon that evaluation, the Company’s Chief Executive Officer and Chief Financial Officer concluded that the Company’s disclosure controls and procedures are effective as of the end of the period covered by this report at a reasonable assurance level.

Changes in Internal Control Over Financial Reporting

The Securities and Exchange Commission has adopted rules that generally require every company that files reports with the Commission to evaluate its effectiveness of internal controls over financial reporting. Our management, with the participation of our principal executive and principal financial officers, will not be required to evaluate the effectiveness of our internal controls over financial reporting until the filing of our 2015 Annual Report on Form 10-K, due to a transition period established by Commission rules applicable to new public companies.

There have been no changes in internal control over financial reporting that occurred in the quarterly period covered by this report that materially affected, or are reasonable likely to materially affect, our internal control over financial reporting.

20

PART II - OTHER INFORMATION

Item 6. Exhibits

Reference is hereby made to the Index to Exhibits commencing on page 22.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Date: May 14, 2014 | By: | /s/ Daniel L. Molinaro | ||||

| Daniel L. Molinaro | ||||||

| Senior Vice President and Chief Financial Officer (Duly Authorized Officer, Principal Financial and Accounting Officer) |

21

INDEX TO EXHIBITS

(a) Exhibits

| Exhibit No. |

Exhibit Description | |

| 2.1 | Form of Separation and Distribution Agreement between National Oilwell Varco, Inc. and NOW Inc. (1) | |

| 3.1 | Form of NOW Inc. Amended and Restated Certificate of Incorporation (1) | |

| 3.2 | Form of NOW Inc. Amended and Restated Bylaws (1) | |

| 10.1 | Form of Transition Services Agreement between National Oilwell Varco, Inc. and NOW Inc. (1) | |

| 10.2 | Form of Tax Matters Agreement between National Oilwell Varco, Inc. and NOW Inc. (1) | |

| 10.3 | Form of Employee Matters Agreement between National Oilwell Varco, Inc. and NOW Inc. (1) | |

| 10.4 | Form of Master Distributor Agreement between National Oilwell Varco, L.P. and DNOW L.P. (1) | |

| 10.5 | Form of Master Services Agreement between National Oilwell Varco, L.P. and DNOW L.P. (1) | |

| 10.6 | Form of NOW Inc. 2014 Incentive Compensation Plan (1) | |

| 10.7 | Credit Agreement among NOW Inc., Wells Fargo Bank, National Association, as Administrative Agent, and the lenders and other financial institutions named therein, dated as of April 18, 2014 (2) | |

| 31.1 | Certification pursuant to Rule 13a-14a and Rule 15d-14(a) of the Securities and Exchange Act, as amended | |

| 31.2 | Certification pursuant to Rule 13a-14a and Rule 15d-14(a) of the Securities and Exchange Act, as amended | |

| 32.1 | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| 32.2 | Certification pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 | |

| 101 | The following materials from our Quarterly Report on Form 10-Q for the period ended March 31, 2014 formatted in eXtensible Business Reporting Language (XBRL): (i) Combined Balance Sheets, (ii) Combined Statements of Income, (iii) Combined Statements of Comprehensive Income, (iv) Combined Statements of Cash Flows, and (v) Notes to Combined Financial Statements, tagged as block text. (3) | |

| (1) | Filed as an Exhibit to our Amendment No. 1 to Form 10 Registration Statement filed on April 8, 2014 |

| (2) | Filed as an Exhibit to our Amendment No. 2 to Form 10 Registration Statement filed on April 23, 2014 |

| (3) | As provided in Rule 406T of Regulation S-T, this information is furnished and not filed for purposes of Sections 11 and 12 of the Securities Act of 1933 and Section 18 of the Securities Exchange Act of 1934. |

We hereby undertake, pursuant to Regulation S-K, Item 601(b), paragraph (4) (iii), to furnish to the U.S. Securities and Exchange Commission, upon request, all constituent instruments defining the rights of holders of our long-term debt not filed herewith.

22