UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended:

For the transition period from ____________ to _____________

Commission File No.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g)

of the Act:

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | ||

| Smaller reporting company | |||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether registrant is

a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

As of June 30, 2021 (the last business day of

the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s common shares

held by non-affiliates (based upon the closing price of such shares as reported on OTCQB Market) was approximately $

As of March 30, 2022, there were a total of

DOCUMENTS INCORPORATED BY REFERENCE

None.

1847 Holdings LLC

Annual Report on Form 10-K

Year Ended December 31, 2021

TABLE OF CONTENTS

i

INTRODUCTORY NOTES

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to “we,” “us,” “our” and “our company” are to 1847 Holdings LLC, a Delaware limited liability company, and its consolidated subsidiaries, and references to “our manager” are to 1847 Partners LLC, a Delaware limited liability company.

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to us. All statements other than statements of historical facts are forward-looking statements. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| ● | our ability to effectively integrate and operate the businesses that we acquire; |

| ● | our ability to successfully identify and acquire additional businesses; |

| ● | our organizational structure, which may limit our ability to meet our dividend and distribution policy; |

| ● | our ability to service and comply with the terms of indebtedness; |

| ● | our cash flow available for distribution and our ability to make distributions to our common shareholders; |

| ● | our ability to pay the management fee, profit allocation and put price to our manager when due; |

| ● | labor disputes, strikes or other employee disputes or grievances; |

| ● | the regulatory environment in which our businesses operate under; |

| ● | trends in the industries in which our businesses operate; |

| ● | the competitive environment in which our businesses operate; |

| ● | changes in general economic or business conditions or economic or demographic trends in the United States including changes in interest rates and inflation; |

| ● | our and our manager’s ability to retain or replace qualified employees of our businesses and our manager; |

| ● | casualties, condemnation or catastrophic failures with respect to any of our business’ facilities; |

| ● | costs and effects of legal and administrative proceedings, settlements, investigations and claims; and |

| ● | extraordinary or force majeure events affecting the business or operations of our businesses. |

In some cases, you can identify forward-looking statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under Item 1A “Risk Factors” and elsewhere in this report. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

The forward-looking statements made in this report relate only to events or information as of the date on which the statements are made in this report. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

ii

PART I

ITEM 1. BUSINESS.

OUR BUSINESS

Overview

We are an acquisition holding company focused on acquiring and managing a group of small businesses, which we characterize as those that have an enterprise value of less than $50 million, in a variety of different industries headquartered in North America. To date, we have completed six acquisitions and subsequently spun off two of the acquired companies.

On May 28, 2020, our subsidiary 1847 Asien Inc., or 1847 Asien, acquired Asien’s Appliance, Inc., a California corporation, or Asien’s. Asien’s has been in business since 1948 serving the North Bay area of Sonoma County, California. It provides a wide variety of appliance services, including sales, delivery/installation, in-home service and repair, extended warranties, and financing. Its main focus is delivering personal sales and exceptional service to its customers at competitive prices.

On September 30, 2020, our subsidiary 1847 Cabinet Inc., or 1847 Cabinet, acquired Kyle’s Custom Wood Shop, Inc., an Idaho corporation, or Kyle’s. Kyle’s is a leading custom cabinetry maker servicing contractors and homeowners since 1976 in Boise, Idaho and the surrounding area. Kyle’s focuses on designing, building, and installing custom cabinetry primarily for custom and semi-custom builders.

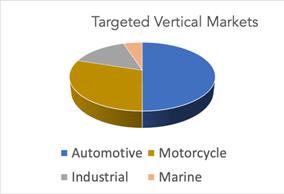

On March 30, 2021, our subsidiary 1847 Wolo Inc., or 1847 Wolo, acquired Wolo Mfg. Corp., a New York corporation, and Wolo Industrial Horn & Signal, Inc., a New York corporation (which we collectively refer to as Wolo). Headquartered in Deer Park, New York and founded in 1965, Wolo designs and sells horn and safety products (electric, air, truck, marine, motorcycle and industrial equipment), and offers vehicle emergency and safety warning lights for cars, trucks, industrial equipment and emergency vehicles.

On October 8, 2021, our subsidiary 1847 Cabinet acquired High Mountain Door & Trim Inc., a Nevada corporation, or High Mountain, and Sierra Homes, LLC d/b/a Innovative Cabinets & Design, a Nevada limited liability company, or Innovative Cabinets. Headquartered in Reno, Nevada and founded in 2014, High Mountain specializes in all aspects of finished carpentry products and services, including doors, door frames, base boards, crown molding, cabinetry, bathroom sinks and cabinets, bookcases, built-in closets, and fireplace mantles, among others, working primarily with large homebuilders of single-family homes and commercial and multi-family developers. Innovative Cabinets is headquartered in Reno, Nevada and was founded in 2008. It specializes in custom cabinetry and countertops for a client base consisting of single-family homeowners, builders of multi-family homes, as well as commercial clients.

Our first acquisition was on March 3, 2017, pursuant to which our subsidiary 1847 Neese Inc., or 1847 Neese, acquired Neese, Inc., or Neese, a business specializing in providing a wide range of land application services and selling equipment and parts in Grand Junction, Iowa. On April 19, 2021, we sold 1847 Neese back to the original owners.

On April 5, 2019, our subsidiary 1847 Goedeker Inc., or 1847 Goedeker, acquired substantially all of the assets of Goedeker Television Co., or Goedeker Television, a one-stop e-commerce destination for home furnishings, including appliances, furniture, home goods and related products. On October 23, 2020, we distributed all of the shares of 1847 Goedeker that we held to our shareholders, so we no longer own 1847 Goedeker.

Through our structure, we offer investors an opportunity to participate in the ownership and growth of a portfolio of businesses that traditionally have been owned and managed by private equity firms, private individuals or families, financial institutions or large conglomerates. We believe that our management and acquisition strategies will allow us to achieve our goals to grow regular distributions to our common shareholders and increasing common shareholder value over time.

We seek to acquire controlling interests in small businesses that we believe operate in industries with long-term macroeconomic growth opportunities, and that have positive and stable earnings and cash flows, face minimal threats of technological or competitive obsolescence and have strong management teams largely in place. We believe that private company operators and corporate parents looking to sell their businesses will consider us to be an attractive purchaser of their businesses. We make these businesses our majority-owned subsidiaries and actively manage and grow such businesses. We expect to improve our businesses over the long term through organic growth opportunities, add-on acquisitions and operational improvements.

1

Our Market Opportunity

We acquire and manage small businesses, which we characterize as those that have an enterprise value of less than $50 million. We believe that the merger and acquisition market for small businesses is highly fragmented and provides significant opportunities to purchase businesses at attractive prices. For example, according to GF Data, platform acquisitions with enterprise values greater than $50.0 million commanded valuation premiums 30% higher than platform acquisitions with enterprise values less than $50.0 million (8.2x trailing twelve month adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) versus 6.3x trailing twelve month adjusted EBITDA, respectively).

We believe that the following factors contribute to lower acquisition multiples for small businesses:

| ● | there are typically fewer potential acquirers for these businesses; | |

| ● | third-party financing generally is less available for these acquisitions; | |

| ● | sellers of these businesses may consider non-economic factors, such as continuing board membership or the effect of the sale on their employees; and | |

| ● | these businesses are generally less frequently sold pursuant to an auction process. |

We believe that our management team’s strong relationships with business brokers, investment and commercial bankers, accountants, attorneys and other potential sources of acquisition opportunities offers us substantial opportunities to purchase small businesses. See Item 10“Directors, Executive Officers and Corporate Governance” for more information about our management team.

We also believe that significant opportunities exist to improve the performance of the businesses upon their acquisition. In the past, our manager has acquired businesses that are often formerly owned by seasoned entrepreneurs or large corporate parents. In these cases, our manager has frequently found that there have been opportunities to further build upon the management teams of acquired businesses. In addition, our manager has frequently found that financial reporting and management information systems of acquired businesses may be improved, both of which can lead to substantial improvements in earnings and cash flow. Finally, because these businesses tend to be too small to have their own corporate development efforts, we believe opportunities exist to assist these businesses in meaningful ways as they pursue organic or external growth strategies that were often not pursued by their previous owners.

Our Strategy

Our long-term goals are to grow regular distributions to our common shareholders and to increase common shareholder value over the long-term. We plan to continue focusing on acquiring businesses. Therefore, we intend to continue to identify, perform due diligence on, negotiate and consummate platform acquisitions of small businesses in attractive industry sectors.

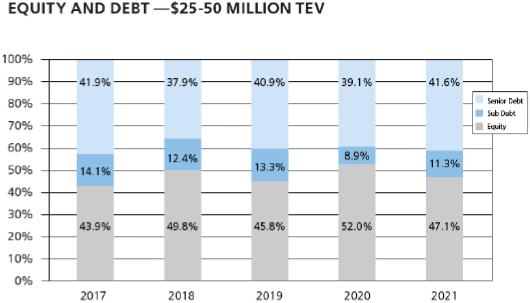

Unlike buyers of small businesses that rely on significant leverage to consummate acquisitions (as demonstrated by the data presented by total enterprise value, or TEV, below), we plan to limit the use of third-party (i.e., external) acquisition leverage so that our debt will not exceed the market value of the assets we acquire and so that our debt to EBITDA ratio will not exceed 1.25x to 1 for our operating subsidiaries. We believe that limiting leverage in this manner will avoid the imposition on stringent lender controls on our operations that would otherwise potentially hamper the growth of our operating subsidiaries and otherwise harm our business even during times when we have positive operating cash flows. Additionally, in our experience, leverage rarely leads to “break-out” returns and often creates negative return outcomes that are not correlated with the profitability of the business.

Source: GF Data ®

2

Source: GF Data ®

Management Strategy

Our management strategy involves the identification, performance of due diligence, negotiation and consummation of acquisitions. After acquiring businesses, we attempt to grow the businesses both organically and through add-on or bolt-on acquisitions. Add-on or bolt-on acquisitions are acquisitions by a company of other companies in the same industry. Following the acquisition of companies, we seek to grow the earnings and cash flow of acquired companies and, in turn, grow regular distributions to our common shareholders and to increase common shareholder value over time. We believe we can increase the cash flows of our businesses by applying our intellectual capital to improve and grow our businesses.

We seek to acquire and manage small businesses. We believe that the merger and acquisition market for small businesses is highly fragmented and provides opportunities to purchase businesses at attractive prices. We believe we will be able to acquire small businesses for multiples ranging from three to six times EBITDA. We also believe, and our manager has historically found, that significant opportunities exist to improve the performance of these businesses upon their acquisition.

In general, our manager oversees and supports the management team of our businesses by, among other things:

| ● | recruiting and retaining managers to operate our businesses by using structured incentive compensation programs, including minority equity ownership, tailored to each business; | |

| ● | regularly monitoring financial and operational performance, instilling consistent financial discipline, and supporting management in the development and implementation of information systems; |

3

| ● | assisting the management teams of our businesses in their analysis and pursuit of prudent organic growth strategies; | |

| ● | identifying and working with business management teams to execute on attractive external growth and acquisition opportunities; | |

| ● | identifying and executing operational improvements and integration opportunities that will lead to lower operating costs and operational optimization; | |

| ● | providing the management teams of our businesses the opportunity to leverage our experience and expertise to develop and implement business and operational strategies; and | |

| ● | forming strong subsidiary level boards of directors to supplement management teams in their development and implementation of strategic goals and objectives. |

We also believe that our long-term perspective provides us with certain additional advantages, including the ability to:

| ● | recruit and develop management teams for our businesses that are familiar with the industries in which our businesses operate; | |

| ● | focus on developing and implementing business and operational strategies to build and sustain shareholder value over the long term; | |

| ● | create sector-specific businesses enabling us to take advantage of vertical and horizontal acquisition opportunities within a given sector; | |

| ● | achieve exposure in certain industries in order to create opportunities for future acquisitions; and | |

| ● | develop and maintain long-term collaborative relationships with customers and suppliers. |

We intend to continually increase our intellectual capital as we operate our businesses and acquire new businesses and as our manager identifies and recruits qualified operating partners and managers for our businesses.

Acquisition Strategy

Our acquisition strategies involve the acquisition of small businesses in various industries that we expect will produce positive and stable earnings and cash flow, as well as achieve attractive returns on our invested capital. In this respect, we expect to make acquisitions in industries wherein we believe an acquisition presents an attractive opportunity from the perspective of both (i) return on assets or equity and (ii) an easily identifiable path for growing the acquired businesses. We believe that attractive opportunities will increasingly present themselves as private sector owners seek to monetize their interests in longstanding and privately held businesses and large corporate parents seek to dispose of their “non-core” operations.

We believe that the greatest opportunities for generating consistently positive annual returns and, ultimately, residual returns on capital invested in acquisitions will result from targeting capital light businesses operating in niche geographical markets with a clearly identifiable competitive advantage within the following industries: business services, consumer services, consumer products, consumable industrial products, industrial services, niche light manufacturing, distribution, alternative/specialty finance and in select cases, specialty retail. While we believe that the professional experience of our management team within the industries identified above will offer the greatest number of acquisition opportunities, we will not eschew opportunities if a business enjoys an inarguable moat around its products and services in an industry which our management team may have less familiarity.

From a financial perspective, we expect to make acquisitions of small businesses that are stable, have minimal bad debt, and strong accounts receivable. In addition, we expect to acquire companies that have been able to generate positive pro forma cash available for distribution for a minimum of three years prior to acquisition. Our previous acquisitions met these acquisition criteria.

4

We benefit from our manager’s ability to identify diverse acquisition opportunities in a variety of industries. In addition, we rely upon our management teams’ experience and expertise in researching and valuing prospective target businesses, as well as negotiating the ultimate acquisition of such target businesses. In particular, because there may be a lack of information available about these target businesses, which may make it more difficult to understand or appropriately value such target businesses, our manager will:

| ● | engage in a substantial level of internal and third-party due diligence; |

| ● | critically evaluate the management team; | |

| ● | identify and assess any financial and operational strengths and weaknesses of any target business; | |

| ● | analyze comparable businesses to assess financial and operational performances relative to industry competitors; | |

| ● | actively research and evaluate information on the relevant industry; and | |

| ● | thoroughly negotiate appropriate terms and conditions of any acquisition. |

The process of acquiring new businesses is time-consuming and complex. Our manager has historically taken from 2 to 24 months to perform due diligence on, negotiate and close acquisitions. Although we expect our manager to be at various stages of evaluating several transactions at any given time, there may be significant periods of time during which it does not recommend any new acquisitions to us.

Upon an acquisition of a new business, we rely on our manager’s experience and expertise to work efficiently and effectively with the management of the new business to jointly develop and execute a business plan.

While primarily seek to acquire controlling interests in a business, we may also acquire non-control or minority equity positions in businesses where we believe it is consistent with our long-term strategy.

As discussed in more detail below, we intend to raise capital for additional acquisitions primarily through debt financing, primarily at our operating company level, additional equity offerings by our company, the sale of all or a part of our businesses or by undertaking a combination of any of the above.

Our primary corporate purpose is to own, operate and grow our operating businesses. However, in addition to acquiring businesses, we expect to sell businesses that we own from time to time. Our decision to sell a business will be based upon financial, operating and other considerations rather than a plan to complete a sale of a business within any specific time frame. We may also decide to own and operate some or all of our businesses in perpetuity if our board believes that it makes sense to do so. Upon the sale of a business, we may use the resulting proceeds to retire debt or retain proceeds for future acquisitions or general corporate purposes. Generally, we do not expect to make special distributions at the time of a sale of one of our businesses; instead, we expect that we will seek to gradually increase regular common shareholder distributions over time.

There are several risks associated with our acquisition strategy, including the following risks, which are described more fully in Item 1A “Risk Factors—Risks Related to Our Business and Structure”:

| ● | we may not be able to successfully fund future acquisitions of new businesses due to the unavailability of debt or equity financing on acceptable terms, which could impede the implementation of our acquisition strategy; |

| ● | we may experience difficulty as we evaluate, acquire and integrate businesses that we may acquire, which could result in drains on our resources, including the attention of our management, and disruptions of our on-going business; |

| ● | we face competition for businesses that fit our acquisition strategy and, therefore, we may have to acquire targets at sub-optimal prices or, alternatively, forego certain acquisition opportunities; and |

| ● | we may change our management and acquisition strategies without the consent of our shareholders, which may result in a determination by us to pursue riskier business activities. |

Strategic Advantages

Based on the experience of our manager and its ability to identify and negotiate acquisitions, we believe that we are strongly positioned to acquire additional businesses. Our manager has strong relationships with business brokers, investment and commercial bankers, accountants, attorneys and other potential sources of acquisition opportunities. In negotiating these acquisitions, we believe our manager will be able to successfully navigate complex situations surrounding acquisitions, including corporate spin-offs, transitions of family-owned businesses, management buy-outs and reorganizations.

5

We believe that the flexibility, creativity, experience and expertise of our manager in structuring transactions provides us with strategic advantages by allowing us to consider non-traditional and complex transactions tailored to fit a specific acquisition target.

Our manager also has a large network of deal intermediaries who expose us to potential acquisitions. Through this network, we have a substantial pipeline of potential acquisition targets. Our manager also has a well-established network of contacts, including professional managers, attorneys, accountants and other third-party consultants and advisors, who may be available to assist us in the performance of due diligence and the negotiation of acquisitions, as well as the management and operation of our businesses once acquired.

Valuation and Due Diligence

When evaluating businesses or assets for acquisition, we perform a rigorous due diligence and financial evaluation process. In doing so, we seek to evaluate the operations of the target business as well as the outlook for the industry in which the target business operates. While valuation of a business is, by definition, a subjective process, we define valuations under a variety of analyses, including:

| ● | discounted cash flow analyses; |

| ● | evaluation of trading values of comparable companies; |

| ● | expected value matrices; |

| ● | assessment of competitor, supplier and customer environments; and |

| ● | examination of recent/precedent transactions. |

One outcome of this process is an effort to project the expected cash flows from the target business as accurately as possible. A further outcome is an understanding of the types and levels of risk associated with those projections. While future performance and projections are always uncertain, we believe that our detailed due diligence review process allows us to more accurately estimate future cash flows and more effectively evaluate the prospects for operating the business in the future. To assist us in identifying material risks and validating key assumptions in our financial and operational analysis, in addition to our own analysis, we engage third-party experts to review key risk areas, including legal, tax, regulatory, accounting, insurance and environmental. We may also engage technical, operational or industry consultants, as necessary.

A further critical component of the evaluation of potential target businesses is the assessment of the capability of the existing management team, including recent performance, expertise, experience, culture and incentives to perform. Where necessary, and consistent with our management strategy, we actively seek to augment, supplement or replace existing members of management who we believe are not likely to execute the business plan for the target business. Similarly, we analyze and evaluate the financial and operational information systems of target businesses and, where necessary, we actively seek to enhance and improve those existing systems that are deemed to be inadequate or insufficient to support our business plan for the target business.

Financing

We finance acquisitions primarily through additional equity and debt financings. We believe that having the ability to finance most, if not all, acquisitions with the general capital resources raised by our company, rather than financing relating to the acquisition of individual businesses, provides us with an advantage in acquiring attractive businesses by minimizing delay and closing conditions that are often related to acquisition-specific financings. In this respect, we believe that, at some point in the future, we may need to pursue additional debt or equity financings, or offer equity in our company or target businesses to the sellers of such target businesses, in order to fund acquisitions.

Our Competitive Advantages

We believe that our manager’s collective investment experience and approach to executing our investment strategy provide us with several competitive advantages. These competitive advantages, certain of which are discussed below, have enabled our management to generate very attractive risk- adjusted returns for investors in their predecessor firms.

6

Robust Network. Through their activities with their predecessor firms and their comprehensive marketing capabilities, we believe that the management team of our manager has established a “top of mind” position among investment bankers and business brokers targeting small businesses. By employing an institutionalized, multi-platform marketing strategy, we believe our manager has established a robust national network of personal relationships with intermediaries, seasoned operating executives, entrepreneurs and managers, thereby firmly establishing our presence and credibility in the small business market. In contrast to many other buyers of and investors in small businesses, we believe that we can buy businesses at value-oriented multiples and through our asset management activities with a group of professional, experienced and talented operating partners, create appreciable value. We believe our experience, track record and consistent execution of our marketing and investment activities will allow us to maintain a leadership position as the preferred partner for today’s small business market.

Disciplined Deal Sourcing. We employ an institutionalized, multi-platform approach to sourcing new acquisition opportunities. Our deal sourcing efforts include leveraging relationships with more than 3,000 qualified deal sources through regular calling, mail and e-mail campaigns, assignment of regional marketing responsibilities, in-person visits and high-profile sponsorship of important conferences and industry events. We supplement these activities by retaining selected intermediary firms to conduct targeted searches for opportunities in specific categories on an opportunistic basis. As a result of the significant time and effort spent on these activities, we believe we established close relationships and unique “top of mind” awareness with many of the most productive intermediary sources for small business acquisition opportunities in the United States. While reinforcing our market leadership, this capability enables us to generate a large number of attractive acquisition opportunities.

Differentiated Acquisition Capabilities in the Small Business Market. We deploy a differentiated approach to acquiring businesses in the small business market. Our management concentrates their efforts on mature companies with sustainable value propositions, which can be supported by our resources and institutional expertise. Our evaluation of acquisition opportunities typically involves significant input from a seasoned operating partner with relevant experience, which we believe enhances both our diligence and ongoing monitoring capabilities. In addition, we approach every acquisition opportunity with creative structures, which we believe enables us to engineer mutually attractive scenarios for sellers, whereas competing buyers may be limited by their rigid structural requirements. We believe our commitment to conservative capital structures and valuation will enhance each acquired operating subsidiary’s ability to deliver consistent levels of cash available for distribution, while additionally supporting reinvestment for growth.

Value Proposition for Business Owners. We employ a creative, flexible approach by tailoring each acquisition structure to meet the specific liquidity needs and certain qualitative objectives of the target’s owners and management team. In addition to serving as an exit pathway for sellers, we seek to align our interests with the sellers by enabling them to retain and/or earn (through incentive compensation) a substantial economic interest in their businesses following the acquisition and by typically allowing the incumbent management team to retain operating control of the acquired operating subsidiary on a day-to-day basis. We believe that our company is an appealing buyer for small business owners and managers due to our track record of capitalizing portfolio companies conservatively, enhancing our ability to execute on its strategic initiatives and adding equity value. As a result, we believe business owners and managers will find our company to be a dynamic, value-added buyer that brings considerable resources to achieve their strategic, capital and operating needs, resulting in substantial value creation for the operating subsidiary.

Operating Partner. Our manager has consistently worked with a strong network of seasoned operating partners - former entrepreneurs and executives with extensive experience building, managing and optimizing successful small businesses across a range of industries. We believe that our operating partner model will enable us to make a significant improvement in the operating subsidiary, as compared to other buyers, such as traditional private equity firms, which rely principally upon investment professionals to make acquisition/investment and monitoring decisions regarding not only the business, financial and legal due diligence aspects of a business but also the more operational aspects including industry dynamics, management strength and strategic growth initiatives. We typically engage an operating partner soon after identifying a target business for acquisition, enhancing our acquisition judgment and building the acquisition team’s relationship with the subsidiary’s management team. Operating partners usually serve as a member of the board of directors of an operating subsidiary and spend two to four days per month working with the subsidiary’s management team. We leverage the operating partner’s extensive experience to build the management team, improve operations and assist with strategic growth initiatives, resulting in value creation.

Small Business Market Experience. We believe the history and experience of our manager’s partnering with companies in the small business market allows us to identify highly attractive acquisition opportunities and add significant value to our operating subsidiaries. Our manager’s investment experience in the small business market prior to forming our company has further contributed to our institutional expertise in the acquisition, strategic and operational decisions critical to the long-term success of small businesses. Since 2000, the management team of our manager has collectively been presented with several thousand investment opportunities and actively worked with more than 30 small businesses on all facets of their strategy, development and operations, which we have successfully translated into unique, institutionalized capabilities directed towards creating value in small businesses.

Intellectual Property

Our manager owns certain intellectual property relating to the term “1847.” Our manager has granted our company a license to use the term “1847” in its business.

Employees

As of December 31, 2021, our company had three full-time employees (excluding our operating subsidiaries described below).

7

OUR CORPORATE STRUCTURE AND HISTORY

Our company is a Delaware limited liability company that was formed on January 22, 2013. Your rights as a holder of common shares, and the fiduciary duties of our board of directors and executive officers, and any limitations relating thereto, are set forth in the operating agreement governing our company and differ from those applying to a Delaware corporation. However, subject to certain exceptions, the documents governing our company specify that the duties of our directors and officers will be generally consistent with the duties of directors and officers of a Delaware corporation.

Our company is classified as a partnership for U.S. federal income tax purposes. Under the partnership income tax provisions, our company is not expected to incur any U.S. federal income tax liability; rather, each of our shareholders will be required to take into account his or her allocable share of company income, gain, loss, deduction and credit. As a holder of our shares, you may not receive cash distributions sufficient in amount to cover taxes in respect of your allocable share of our net taxable income. We will file a partnership return with the IRS and will issue you with tax information, including a Schedule K-1, setting forth your allocable share of our income, gain, loss, deduction, credit and other items. The U.S. federal income tax rules that apply to partnerships are complex, and complying with the reporting requirements may require significant time and expense. See “Material U.S. Federal Income Tax Considerations” included in our amended registration statement on Form S-1 filed with the Securities and Exchange Commission, or the SEC, on January 31, 2022, for more information.

We currently have four classes of limited liability company interests - the common shares, the series A senior convertible preferred shares, the series B senior convertible preferred shares and the allocation shares. All of our allocation shares have been and will continue to be held by our manager.

On March 3, 2017, our newly formed wholly-owned subsidiary 1847 Neese acquired all of the issued and outstanding capital stock of Neese for an aggregate purchase price of $6,655,000, consisting of: (i) $2,225,000 in cash; (ii) 450 shares of the common stock of 1847 Neese, valued by the parties at $1,530,000, constituting 45% of its capital stock; (iii) the issuance of a vesting promissory note in the principal amount of $1,875,000 (which was determined to have a fair value of $395,634) due June 30, 2020; and (iv) the issuance of a short-term promissory note in the principal amount of $1,025,000 due March 3, 2018. On April 19, 2021, we entered into a stock purchase agreement with the original owners of Neese, pursuant to which they purchased our 55% ownership interest in 1847 Neese for a purchase price of $325,000 in cash. As a result of this transaction, 1847 Neese is no longer a subsidiary of our company.

On April 5, 2019, our newly formed indirect wholly-owned subsidiary 1847 Goedeker acquired substantially all of the assets of Goedeker Television for an aggregate purchase price of $6,200,000 consisting of: (i) $1,500,000 in cash; (ii) the issuance of a promissory note in the principal amount of $4,100,000; and (iii) up to $600,000 in earn out payments. As additional consideration, our newly formed wholly-owned subsidiary 1847 Goedeker Holdco Inc., or 1847 Holdco, issued to each of the stockholders of Goedeker Television a number of shares of its common stock equal to a 11.25% non-dilutable interest in all of the issued and outstanding stock of 1847 Holdco as of the closing date. On August 4, 2020, 1847 Holdco distributed all of its shares of 1847 Goedeker to its stockholders in accordance with their pro rata ownership in 1847 Holdco, after which time 1847 Holdco was dissolved. On October 23, 2020, we distributed all of the shares of 1847 Goedeker that we held to our shareholders. As a result of this distribution, 1847 Goedeker is no longer a subsidiary of our company.

On May 28, 2020, our newly formed wholly-owned subsidiary 1847 Asien acquired all of the issued and outstanding capital stock of Asien’s for an aggregate purchase price of $1,918,000 consisting of: (i) $233,000 in cash; (ii) the issuance of an amortizing promissory note in the principal amount of $200,000; (iii) the issuance of a demand promissory note in the principal amount of $655,000; and (iv) 415,000 common shares of our company, having a mutually agreed upon value of $830,000 and a fair value of $1,037,500, which could be repurchased by 1847 Asien for a period of one year following the closing at a purchase price of $2.50 per share. The shares were repurchased by 1847 Asien on July 29, 2020. As a result of this transaction, we own 95% of 1847 Asien, with the remaining 5% held by Leonite Capital LLC, or Leonite, and 1847 Asien owns 100% of Asien’s. 1847 Asien was formed in the State of Delaware on March 24, 2020 and Asien’s was formed in the State of California on February 6, 2004.

8

On September 30, 2020, our newly formed wholly-owned subsidiary 1847 Cabinet acquired all of the issued and outstanding capital stock of Kyle’s for an aggregate purchase price of up to $6,839,792, consisting of (i) $4,389,792 in cash, (ii) an 8% contingent subordinated note in the aggregate principal amount of up to $1,050,000, and (iii) 700,000 common shares of our company, having a mutually agreed upon value of $1,400,000 and a fair value of $3,675,000. As a result of this transaction, we own 92.5% of 1847 Cabinet, with the remaining 7.5% held by Leonite, and 1847 Cabinet owns 100% of Kyle’s. 1847 Cabinet was formed in the State of Delaware on August 21, 2020 and Kyle’s was formed in the State of Idaho on May 7, 1991.

On March 30, 2021, our newly formed wholly-owned subsidiary 1847 Wolo acquired all of the issued and outstanding capital stock of Wolo for an aggregate purchase price of $8,344,055, consisting of (i) $6,550,000 in cash, (ii) a 6% secured promissory note in the aggregate principal amount of $850,000 and (iii) cash paid to seller, net of working capital adjustment, of $944,055. As a result of this transaction, we own 92.5% of 1847 Wolo, with the remaining 7.5% held by Leonite, and 1847 Wolo owns 100% of Wolo Mfg. Corp and Wolo Industrial Horn & Signal, Inc. 1847 Wolo was formed in the State of Delaware on December 3, 2020. Wolo Mfg. Corp. was formed in the State of New York on August 6, 1965 and Wolo Industrial Horn & Signal, Inc. was formed in the State of New York on January 28, 1999.

On October 8, 2021, 1847 Cabinet acquired all of the issued and outstanding capital stock or other equity securities of High Mountain and Innovative Cabinets for an aggregate purchase price of $16,567,845 (subject to adjustment), consisting of (i) $10,687,500 in cash (subject to adjustment) and (ii) the issuance by 1847 Cabinet of 6% subordinated convertible promissory notes in the aggregate principal amount of $5,880,345.

The purchase price is subject to a post-closing working capital adjustment provision. Under this provision, the sellers delivered to 1847 Cabinet at the closing an unaudited balance sheet of High Mountain and Innovative Cabinets and a calculation of estimated net working capital of High Mountain and Innovative Cabinets as of that date. On or before the 75th day following the closing, 1847 Cabinet must deliver to the sellers an unaudited balance sheet of High Mountain and Innovative Cabinets and its calculation of the final net working capital of High Mountain and Innovative Cabinets as of the closing date. If such final net working capital exceeds the estimated net working capital, 1847 Cabinet must, within seven days, pay to the sellers an amount of cash that is equal to such excess. If the estimated net working capital exceeds the final net working capital, the sellers must, within seven days, pay to 1847 Cabinet an amount in cash equal to such excess. As of the date of this report, the post-closing working capital adjustment has not been completed notwithstanding the fact that the date of this report is past the 75th day following closing. 1847 Cabinet has agreed with the sellers to finalize the post-working capital adjustment.

As a result of this transaction, 1847 Cabinet owns 92.5% of High Mountain and Innovative Cabinets, with the remaining 7.5% held by Leonite. High Mountain was formed in the State of Nevada on April 4, 2014 and Innovative Cabinets was formed in the State of Nevada on June 17, 2008.

On May 14, 2021, we formed 1847 HQ Inc. as a wholly-owned subsidiary in the State of Delaware to manage our benefit plans.

9

The following chart depicts our current organizational structure:

See “—Our Manager” for more details regarding the ownership of our manager.

OUR MANAGER

Overview of Our Manager

Our manager, 1847 Partners LLC, is a Delaware limited liability company. It has two classes of limited liability interests known as Class A interests and Class B interests. The Class A interests, which give the holder the right to the profit allocation received by our manager as a result of holding our allocation shares, are owned in their entirety by 1847 Partners Class A Member LLC; and the Class B interests, which give the holder the right to all other profits or losses of our manager, including the management fee payable to our manager by us, are owned in their entirety by 1847 Partners Class B Member LLC. 1847 Partners Class A Member LLC is owned 52% by Ellery W. Roberts, our Chief Executive Officer, 38% by 1847 Founders Capital LLC, which is owned by Edward J. Tobin, and approximately 9% by Louis A. Bevilacqua, the managing member of Bevilacqua PLLC, our outside counsel, with the balance being owned by a former contractor to such law firm. 1847 Partners Class B Member LLC is owned 54% by Ellery W. Roberts, 36% by 1847 Founders Capital LLC and 10% by Louis A. Bevilacqua. Mr. Roberts is also the sole manager of both entities. In the future, Mr. Roberts may cause 1847 Partners Class A Member LLC or 1847 Partners Class B Member LLC to issue units to employees of our manager to incentivize those employees by providing them with the ability to participate in our manager’s incentive allocation and management fee.

Key Personnel of Our Manager

The key personnel of our manager are Ellery W. Roberts, our Chief Executive Officer, and Edward J. Tobin. Each of these individuals will be compensated entirely by our manager from the management fees it receives. As employees of our manager, these individuals devote a substantial majority of their time to the affairs of our company.

Collectively, the management team of our manager has more than 60 years of combined experience in acquiring and managing small businesses and has overseen the acquisitions and financing of over 50 businesses.

10

Acquisition and Disposition Opportunities

Our manager has exclusive responsibility for reviewing and making recommendations to our board of directors with respect to acquisition and disposition opportunities. If our manager does not originate an opportunity, our board of directors will seek a recommendation from our manager prior to making a decision concerning such opportunity. In the case of any acquisition or disposition opportunity that involves an affiliate of our manager or us, our nominating and corporate governance committee, or, if we do not have such a committee, the independent members of our board of directors, will be required to authorize and approve such transaction.

Our manager will review each acquisition or disposition opportunity presented to our manager to determine if such opportunity satisfies the acquisition and disposition criteria established by our board of directors. The acquisition and disposition criteria provide that our manager will review each acquisition opportunity presented to it to determine if such opportunity satisfies our acquisition and disposition criteria, and if it is determined, in our manager’s sole discretion, that an opportunity satisfies the criteria, our manager will refer the opportunity to our board of directors for its authorization and approval prior to the consummation of any such opportunity.

Our investment criteria include the following:

| ● | Revenue of at least $5.0 million |

| ● | Current year EBITDA/Pre-tax Income of at least $1.5 million with a history of positive cash flow |

| ● | Clearly identifiable “blueprint” for growth with the potential for break-out returns |

| ● | Well-positioned companies within our core industry categories (consumer-driven, business-to-business, light manufacturing and specialty finance) with strong returns on capital |

| ● | Opportunities wherein building management team, infrastructure and access to capital are the primary drivers of creating value |

| ● | Headquartered in North America |

We believe we will be able to acquire small businesses for multiples ranging from three to six times EBITDA. With respect to investment opportunities that do not fall within the criteria set forth above, our manager must first present such opportunities to our board of directors. Our board of directors and our manager will review these criteria from time to time and our board of directors may make changes and modifications to such criteria as we make additional acquisitions and dispositions.

If an acquisition opportunity is referred to our board of directors by our manager and our board of directors determines not to timely pursue such opportunity in whole or in part, any part of such opportunity that we do not promptly pursue may be pursued by our manager or may be referred by our manager to any person, including affiliates of our manager. In this case, our manager is likely to devote a portion of its time to the oversight of this opportunity, including the management of a business that we do not own.

If there is a disposition, our manager must use its commercially reasonable efforts to manage a process through which the value of such disposition can be maximized, taking into consideration non-financial factors such as those relating to competition, strategic partnerships, potential favorable or adverse effects on us, our businesses, or our investments or any similar factors that may reasonably perceived as having a short- or long-term impact on our business, results of operations and financial condition.

Management Services Agreement

The management services agreement sets forth the services performed by our manager. Our manager performs such services subject to the oversight and supervision of our board of directors.

In general, our manager performs those services for us that would be typically performed by the executive officers of a company. Specifically, our manager performs the following services, which we refer to as the management services, pursuant to the management services agreement:

| ● | manage our day-to-day business and operations, including our liquidity and capital resources and compliance with applicable law; |

11

| ● | identify, evaluate, manage, perform due diligence on, negotiate and oversee acquisitions of target businesses and any other investments; |

| ● | evaluate and oversee the financial and operational performance of our businesses, including monitoring the business and operations of such businesses, and the financial performance of any other investments that we make; |

| ● | provide, on our behalf, managerial assistance to our businesses; |

| ● | evaluate, manage, negotiate and oversee dispositions of all or any part of any of our property, assets or investments, including disposition of all or any part of our businesses; |

| ● | provide or second, as necessary, employees of our manager to serve as our executive officers or other employees or as members of our board of directors; and |

| ● | perform any other services that would be customarily performed by executive officers and employees of a publicly listed or quoted company. |

We and our manager have the right at any time during the term of the management services agreement to change the services provided by our manager. In performing management services, our manager has all necessary power and authority to perform, or cause to be performed, such services on our behalf, and, in this respect, our manager is the only provider of management services to us. Nonetheless, our manager is required to obtain authorization and approval of our board of directors in all circumstances where executive officers of a corporation typically would be required to obtain authorization and approval of a corporation’s board of directors, including, for example, with respect to the consummation of an acquisition of a target business, the issuance of securities or the entry into credit arrangements.

While our Chief Executive Officer, Mr. Ellery W. Roberts, intends to devote substantially all of his time to the affairs of our company, neither Mr. Roberts, nor our manager, is expressly prohibited from investing in or managing other entities. In this regard, the management services agreement does not require our manager and its affiliates to provide management services to us exclusively.

Secondment of Our Executive Officers

In accordance with the terms of the management services agreement, our manager may second to us our executive officers, which means that these individuals will be assigned by our manager to work for us during the term of the management services agreement. Our board of directors has appointed Mr. Roberts as an executive officer of our company. Although Mr. Roberts is an employee of our manager, he will report directly, and be subject, to our board of directors. In this respect, our board of directors may, after due consultation with our manager, at any time request that our manager replace any individual seconded to us and our manager will, as promptly as practicable, replace any such individual; however, our Chief Executive Officer, Mr. Roberts, controls our manager, which may make it difficult for our board of directors to completely sever ties with Mr. Roberts. Our manager and our board of directors may agree from time to time that our manager will second to us one or more additional individuals to serve on our behalf, upon such terms as our manager and our board of directors may mutually agree.

Indemnification by our Company

We have agreed to indemnify and hold harmless our manager and its employees and representatives, including any individuals seconded to us, from and against all losses, claims and liabilities incurred by our manager in connection with, relating to or arising out of the performance of any management services. However, we will not be obligated to indemnify or hold harmless our manager for any losses, claims and liabilities incurred by our manager in connection with, relating to or arising out of (i) a breach by our manager or its employees or its representatives of the management services agreement, (ii) the gross negligence, willful misconduct, bad faith or reckless disregard of our manager or its employees or representatives in the performance of any of its obligations under the management services agreement, or (iii) fraudulent or dishonest acts of our manager or its employees or representatives with respect to our company or any of its businesses.

Termination of Management Services Agreement

Our board of directors may terminate the management services agreement and our manager’s appointment if, at any time:

| ● | a majority of our board of directors vote to terminate the management services agreement, and the holders of at least a majority of the outstanding shares (other than shares beneficially owned by our manager) then entitled to vote also vote to terminate the management services agreement; |

12

| ● | neither Mr. Roberts nor his designated successor controls our manager, which change of control occurs without the prior written consent of our board of directors; |

| ● | there is a finding by a court of competent jurisdiction in a final, non-appealable order that (i) our manager materially breached the terms of the management services agreement and such breach continued unremedied for 60 days after our manager receives written notice from us setting forth the terms of such breach, or (ii) our manager (x) acted with gross negligence, willful misconduct, bad faith or reckless disregard in performing its duties and obligations under the management services agreement, or (y) engaged in fraudulent or dishonest acts in connection with our business or operations; |

| ● | our manager has been convicted of a felony under federal or state law, our board of directors finds that our manager is demonstrably and materially incapable of performing its duties and obligations under the management services agreement, and the holders of at least 66 2/3% of the then outstanding shares, other than shares beneficially owned by our manager, vote to terminate the management services agreement; or |

| ● | there is a finding by a court of competent jurisdiction that our manager has (i) engaged in fraudulent or dishonest acts in connection with our business or operations or (ii) acted with gross negligence, willful misconduct, bad faith or reckless disregard in performing its duties and obligations under the management services agreement, and the holders of at least 66 2/3% of the then outstanding shares (other than shares beneficially owned by our manager) vote to terminate the management services agreement. |

In addition, our manager may resign and terminate the management services agreement at any time upon 120 days prior written notice to us, and this right is not contingent upon the finding of a replacement manager. However, if our manager resigns, until the date on which the resignation becomes effective, it will, upon request of our board of directors, use reasonable efforts to assist our board of directors to find a replacement manager at no cost and expense to us.

Upon the termination of the management services agreement, seconded officers, employees, representatives and delegates of our manager and its affiliates who are performing the services that are the subject of the management services agreement will resign their respective position with us and cease to work at the date of such termination or at any other time as determined by our manager. Any director appointed by our manager may continue serving on our board of directors, subject to the terms of the operating agreement.

If we terminate the management services agreement, we have agreed to cease using the term “1847”, including any trademarks based on the name of our company that may be licensed to them by our manager, under the licensing provisions of the management services agreement, entirely in our business and operations within 180 days of such termination. Such licensing provisions of the management services agreement would require our company and its businesses to change their names to remove any reference to the term “1847” or any reference to trademarks licensed to them by our manager. In this respect, our right to use the term “1847” and related intellectual property is subject to licensing provisions between our manager, on the one hand, and our company, on the other hand.

Except with respect to the termination fee payable to our manager due to a termination of the management services agreement based solely on a vote of our board of directors and our shareholders, no other termination fee is payable upon termination of the management services agreement for any other reason. See “—Our Manager as a Service Provider—Termination Fee” for more information about the termination fee payable upon termination of the management services agreement.

While termination of the management services agreement will not affect any terms and conditions, including those relating to any payment obligations, that exist under any offsetting management services agreements or transaction services agreements, such agreements will be terminable by our businesses upon 60 days prior written notice and there will be no termination or other similar fees due upon such termination. Notwithstanding termination of the management services agreement, our manager will maintain its rights with respect to the allocation shares it then owns, including its rights under the supplemental put provision of our operating agreement. See “—Our Manager as an Equity Holder—Supplemental Put Provision” for more information on our manager’s put right with respect to the allocation shares.

13

Our Relationship with Our Manager, Manager Fees and Manager Profit Allocation

Our relationship with our manager is based on our manager having two distinct roles: first, as a service provider to us and, second, as an equity holder of the allocation shares.

As a service provider, our manager performs a variety of services for us, which entitles it to receive a management fee. As holder of our allocation shares, our manager has the right to a preferred distribution in the form of a profit allocation upon the occurrence of certain events. Our manager paid $1,000 for the allocation shares. In addition, our manager will have the right to cause us to purchase the allocation shares then owned by our manager upon termination of the management services agreement.

These relationships with our manager are governed principally by the following agreements:

| ● | the management services agreements relating to the services our manager performs for us and our businesses; and |

| ● | our operating agreement relating to our manager’s rights with respect to the allocation shares it owns and which contains the supplemental put provision relating to our manager’s right to cause us to purchase the allocation shares it owns. |

We also expect that our manager will enter into offsetting management services agreements and transaction services agreements with our businesses directly. These agreements, and some of the material terms relating thereto, are discussed in more detail below. The management fee, profit allocation and put price under the supplemental put provision will be our payment obligations and, as a result, will be paid, along with other company obligations, prior to the payment of distributions to common shareholders.

The following table provides a simplified description of the fees and profit allocation rights held by our manager. Further detail is provided in the following subsections.

| Description | Fee Calculation | Payment Term | ||

| Management Fees | ||||

| Determined by management services agreement | 0.5% of adjusted net assets (2.0% annually) | Quarterly | ||

| Determined by offsetting management services agreement | Payment of fees by our subsidiary businesses that result in a dollar for dollar reduction of manager fees paid by us to our manager such that our manager cannot receive duplicate fees from both us and our subsidiary | Quarterly | ||

| Termination fee – determined by management services agreement | Accumulated management fee paid in the preceding 4 fiscal quarters multiplied by 2. Paid only upon termination by our board and a majority in interest of our shareholders | |||

| Determined by management services agreement | Reimbursement of manager’s costs and expenses in providing services to us, but not including: (1) costs of overhead; (2) due diligence and other costs for potential acquisitions our board of directors does not approve pursuing or that are required by acquisition target to be reimbursed under a transaction services agreement; and (3) certain seconded officers and employees | Ongoing | ||

| Transaction Services Fees | ||||

| Acquisition services of target businesses or disposition of subsidiaries – fees determined by transaction services agreements | 2.0% of aggregate purchase price up to $50 million; plus 1.5% of aggregate purchase price in excess of $50 million and up to and equal to $100 million; plus 1.0% of aggregate purchase price in excess of $100 million | Per transaction | ||

| Manager profit allocation determined by our operating agreement |

20% of certain profits and gains on a sale of subsidiary after clearance of the 8% annual hurdle rate 8% hurdle rate determined for any subsidiary by multiplying the subsidiary’s average quarterly share of our assets by an 8% annualized rate

|

Sale of a material amount of capital stock or assets of one of our businesses or subsidiaries.

Holding event: at the option of our manager, for the 30 day period following the 5th anniversary of an acquired business (but only based on historical profits of the business) |

14

Our Manager as a Service Provider

Management Fee

We will pay our manager a quarterly management fee equal to 0.5% (2.0% annualized) of its adjusted net assets, as discussed in more detail below (which we refer to as the parent management fee).

Subject to any adjustments discussed below, for performing management services under the management services agreement during any fiscal quarter, we will pay our manager a management fee with respect to such fiscal quarter. The management fee to be paid with respect to any fiscal quarter will be calculated as of the last day of such fiscal quarter, which we refer to as the calculation date. The management fee will be calculated by an administrator, which will be our manager so long as the management services agreement is in effect. The amount of any management fee payable by us as of any calculation date with respect to any fiscal quarter will be (i) reduced by the aggregate amount of any offsetting management fees, if any, received by our manager from any of our businesses with respect to such fiscal quarter, (ii) reduced (or increased) by the amount of any over-paid (or under-paid) management fees received by (or owed to) our manager as of such calculation date, and (iii) increased by the amount of any outstanding accrued and unpaid management fees.

The management fee will be paid prior to the payment of distributions to our common shareholders. If we do not have sufficient liquid assets to pay the management fee when due, we may be required to liquidate assets or incur debt in order to pay the management fee.

Offsetting Management Services Agreements

Pursuant to the management services agreement, we have agreed that our manager may, at any time, enter into offsetting management services agreements with our businesses pursuant to which our manager may perform services that may or may not be similar to management services. Any fees to be paid by one of our businesses pursuant to such agreements are referred to as offsetting management fees and will offset, on a dollar-for-dollar basis, the management fee otherwise due and payable by us under the management services agreement with respect to a fiscal quarter. The management services agreement provides that the aggregate amount of offsetting management fees to be paid to our manager with respect to any fiscal quarter shall not exceed the management fee to be paid to our manager with respect to such fiscal quarter.

Our manager entered into offsetting management services agreements with 1847 Neese, 1847 Goedeker, 1847 Asien, 1847 Cabinet and 1847 Wolo. See Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Management Fees” for a description of these agreements. Our manager may also enter into offsetting management services agreements with our future subsidiaries, which agreements would be in the form prescribed by our management services agreement. The offsetting management fee paid to our manager for providing management services to a future subsidiary will vary.

The services that our manager provides under the offsetting management services agreements include: conducting general and administrative supervision and oversight of the subsidiary’s day-to-day business and operations, including, but not limited to, recruiting and hiring of personnel, administration of personnel and personnel benefits, development of administrative policies and procedures, establishment and management of banking services, managing and arranging for the maintaining of liability insurance, arranging for equipment rental, maintenance of all necessary permits and licenses, acquisition of any additional licenses and permits that become necessary, participation in risk management policies and procedures; and overseeing and consulting with respect to our business and operational strategies, the implementation of such strategies and the evaluation of such strategies, including, but not limited to, strategies with respect to capital expenditure and expansion programs, acquisitions or dispositions and product or service lines. If our manager and the subsidiary do not enter into an offsetting management services agreement, our manager will provide these services for our subsidiaries under our management services agreement.

15

Example of Calculation of Management Fee with Adjustment for Offsetting Management Fees

In order to better understand how the management fee is calculated, we are providing the following example:

| Quarterly management fee: | (in thousands) | ||||

| 1 | Consolidated total assets | $ | 100,000 | ||

| 2 | Consolidated accumulation amortization of intangibles | 5,000 | |||

| 3 | Total cash and cash equivalents | 5,000 | |||

| 4 | Adjusted total liabilities | (10,000 | ) | ||

| 5 | Adjusted net assets (Line 1 + Line 2 – Line 3 – Line 4) | 90,000 | |||

| 6 | Multiplied by quarterly rate | 0.5 | % | ||

| 7 | Quarterly management fee | $ | 450 | ||

| Offsetting management fees: | |||||

| 8 | Acquired company A offsetting management fees | $ | (100 | ) | |

| 9 | Acquired company B offsetting management fees | (100 | ) | ||

| 10 | Acquired company C offsetting management fees | (100 | ) | ||

| 11 | Acquired company D offsetting management fees | (100 | ) | ||

| 12 | Total offsetting management fees (Line 8 + Line 9 – Line 10 – Line 11) | (400 | ) | ||

| 13 | Quarterly management fee payable by Company (Line 7 + Line 12) | $ | 50 | ||

The foregoing example provides hypothetical information only and does not intend to reflect actual or expected management fee amounts.

For purposes of the calculation of the management fee:

| ● | “Adjusted net assets” will be equal to, as of any calculation date, the sum of (i) our consolidated total assets (as determined in accordance with U.S. generally accepted accounting principles, or GAAP) as of such calculation date, plus (ii) the absolute amount of our consolidated accumulated amortization of intangibles (as determined in accordance with GAAP) as of such calculation date, minus (iii) total cash and cash equivalents, minus (iv) the absolute amount of our adjusted total liabilities as of such calculation date. |

| ● | “Adjusted total liabilities” will be equal to, as of any calculation date, our consolidated total liabilities (as determined in accordance with GAAP) as of such calculation date after excluding the effect of any outstanding third-party indebtedness. |

| ● | “Quarterly management fee” will be equal to, as of any calculation date, the product of (i) 0.5%, multiplied by (ii) our adjusted net assets as of such calculation date; provided, however, that with respect to any fiscal quarter in which the management services agreement is terminated, we will pay our manager a management fee with respect to such fiscal quarter equal to the product of (i)(x) 0.5%, multiplied by (y) our adjusted net assets as of such calculation date, multiplied by (ii) a fraction, the numerator of which is the number of days from and including the first day of such fiscal quarter to but excluding the date upon which the management services agreement is terminated and the denominator of which is the number of days in such fiscal quarter. |

| ● | “Total offsetting management fees” will be equal to, as of any calculation date, fees paid to our manager by the businesses that we acquire in the future under separate offsetting management services agreements. |

16

Transaction Services Agreements

Pursuant to the management services agreement, we have agreed that our manager may, at any time, enter into transaction services agreements with any of our businesses relating to the performance by our manager of certain transaction-related services in connection with the acquisitions of target businesses by us or dispositions of our property or assets. These services may include those customarily performed by a third-party investment banking firm or similar financial advisor, which may or may not be similar to management services, in connection with the acquisition of target businesses by us or our subsidiaries or disposition of subsidiaries or any of our property or assets or those of our subsidiaries. In connection with providing transaction services, our manager will generally receive a fee equal to the sum of (i) 2.0% of the aggregate purchase price of the target business up to and equal to $50 million, plus (ii) 1.5% of the aggregate purchase price of the target business in excess of $50 million and up to and equal to $100 million, plus (iii) 1.0% of the aggregate purchase price over $100 million, subject to annual review by our board of directors. The purchase price of a target business shall be defined as the aggregate amount of consideration, including cash and the value of any shares issued by us on the date of acquisition, paid for the equity interests of such target business plus the aggregate principal amount of any debt assumed by us of the target business on the date of acquisition or any similar formulation. The other terms and conditions relating to the performance of transaction services will be established in accordance with market practice.

Our manager may enter into transaction services agreements with our subsidiaries and future subsidiaries, which agreements would be in the form prescribed by our management services agreement.

The services that our manager will provide to our subsidiaries and future subsidiaries under the transaction services agreements will include the following services that would be provided in connection with a specific transaction identified at the time that the transaction services agreement is entered into: reviewing, evaluating and otherwise familiarizing itself and its affiliates with the business, operations, properties, financial condition and prospects of the future subsidiary and its target acquisition and preparing documentation describing the future subsidiary’s operations, management, historical financial results, projected financial results and any other relevant matters and presenting such documentation and making recommendations with respect thereto to certain of our manager’s affiliates.

Any fees received by our manager pursuant to such a transaction services agreement will be in addition to the management fee payable by us pursuant to the management services agreement and will not offset the payment of such management fee. A transaction services agreement with any of our businesses may provide for the reimbursement of costs and expenses incurred by our manager in connection with the acquisition of such businesses.

Transaction services agreements will be reviewed, authorized and approved by our board of directors on an annual basis.

Reimbursement of Expenses

We are responsible for paying costs and expenses relating to its business and operations. We agreed to reimburse our manager during the term of the management services agreement for all costs and expenses that are incurred by our manager or its affiliates on our behalf of, including any out-of-pocket costs and expenses incurred in connection with the performance of services under the management services agreement, and all costs and expenses the reimbursement of which are specifically approved by our board of directors.