As filed with the U.S. Securities and Exchange Commission on December 22, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

under the Securities Act of 1933

SQL TECHNOLOGIES CORP.

(Exact name of registrant as specified in its charter)

| Florida | 3640 | 46-3645414 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

11030 Jones Bridge Road, Suite 206

Johns Creek, Georgia 30022

(770) 754-4711

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John Campi, Chief Executive Officer

11030 Jones Bridge Road, Suite 206

Johns Creek, Georgia 30022

(770) 754-4711

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Jurgita Ashley, Esq. Robin D. Powell, Esq. Thompson Hine LLP 3900 Key Center, 127 Public Square Cleveland, Ohio 44114 (216) 566-5500 |

Richard A. Friedman, Esq. Sheppard, Mullin, Richter & Hampton LLP 30 Rockefeller Plaza New York, New York 10112 (212) 653-8700 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer ☐ | Smaller Reporting Company ☒ | |

| Accelerated Filer ☐ | Emerging Growth Company ☐ | |

| Non-Accelerated Filer ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

Title of each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2) | Amount of Registration Fee(3) | ||||||

| Common Stock, no par value per share | $ | 23,000,000 | $ | 2,132.10 | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional securities that the underwriters have an option to purchase to cover over-allotments, if any. |

| (3) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed maximum aggregate offering price of the securities registered hereunder to be sold by the registrant. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED DECEMBER 22, 2021 |

Shares of Common Stock

SQL TECHNOLOGIES CORP.

(d/b/a Sky Technologies)

We are offering shares of our common stock. This is our initial public offering. Prior to the offering, there has been no established public market for our common stock. We expect the initial public offering price to be between $ and $ per share.

We have applied to list our common stock on The Nasdaq Stock Market LLC under the symbol “ ” upon our satisfaction of the exchange’s initial listing criteria. If our common stock is not approved for listing on The Nasdaq Stock Market LLC, we will not consummate this offering. No assurance can be given that our application will be approved.

For the purposes of this prospectus, we have assumed an initial public offering price of $ per share. The actual public offering price per share will be determined between us and the underwriters at the time of pricing. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

Investing in our common stock involves a high degree of risk. See the “Risk Factors” section beginning on page 20 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

| Per Share | Total | |||||||

| Public offering price | $ | $ | ||||||

| Underwriting discounts and commissions (1)(2) | $ | $ | ||||||

| Proceeds to us, before expenses | $ | $ | ||||||

| (1) | Excludes warrants to be issued to the underwriters upon the closing of this offering, which entitle them to purchase up to a total of 7.5% of the total number of shares of common stock sold in this offering (excluding the shares sold through the exercise of the over-allotment option) at an exercise price equal to 110% of the offering price of the common stock offered hereby. See “Underwriting” beginning on page 109 of this prospectus for additional information regarding the compensation payable to the underwriters. |

| (2) | See “Underwriting” for a description of all compensation payable to the underwriters. |

We have granted the underwriters an option to purchase up to additional shares of common stock from us at the public offering price less underwriting discounts and commissions to cover over-allotments, if any. The underwriters can exercise this option within 45 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters are offering the shares for sale on a firm commitment basis. The underwriters expect to deliver the shares of common stock to purchasers on or about , 2022.

The Benchmark Company

The date of this prospectus is , 2022

TABLE OF CONTENTS

We are responsible for the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with any other information other than in this prospectus, and we take no responsibility for, and the underwriters have not taken responsibility for, any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus outside of the United States.

This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

We obtained the statistical data, market data and other industry data and forecasts described in this prospectus from publicly available information, including industry publications. Industry publications generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy and completeness of the information. Similarly, while we believe that the statistical data, industry data and forecasts are reliable, we have not independently verified the data. We have not sought the consent of the sources to refer to their reports appearing or incorporated by reference in this prospectus. We did not commission any third party for collecting or providing data used in this prospectus.

Numerical figures included in this prospectus have been subject to rounding adjustments. Accordingly, numerical figures shown as totals in various tables may not be arithmetic aggregations of the figures that precede them.

| i |

This summary highlights certain information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider prior to investing in the securities offered hereby. After you read this summary, you should read and consider carefully the more detailed information and financial statements and related notes that we include in this prospectus, especially the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” If you invest in our securities, you are assuming a high degree of risk.

Unless we have indicated otherwise or the context otherwise requires, references in this prospectus to the “Company,” “we,” “us” and “our” or similar terms are to SQL Technologies Corp. (d/b/a Sky Technologies) and, where appropriate, our subsidiaries.

Our Mission

As electricity is a standard in every home and building, our mission is to make homes and buildings become safe-advanced and smart as the standard.

Overview

Sky Technologies has a series of highly disruptive advanced-safe-smart platform technologies, with over 60 U.S. and global patents and patent pending applications. Our technologies place an emphasis on high quality and ease of use, while significantly enhancing both safety and lifestyle in homes and buildings. We believe that our products are a necessity in every room in both homes and other buildings in the U.S. and globally.

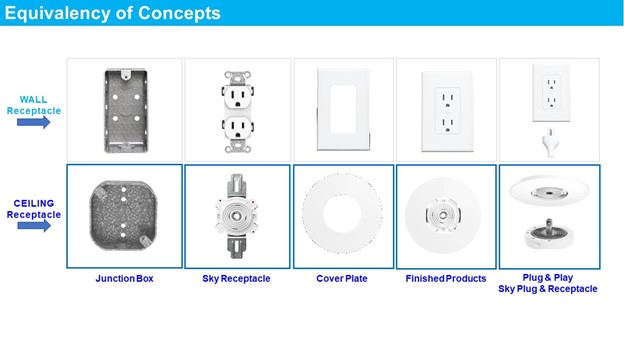

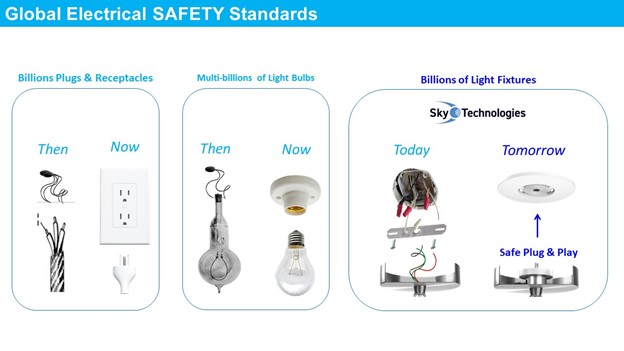

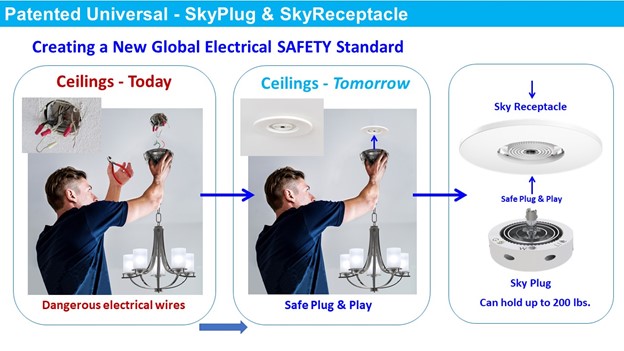

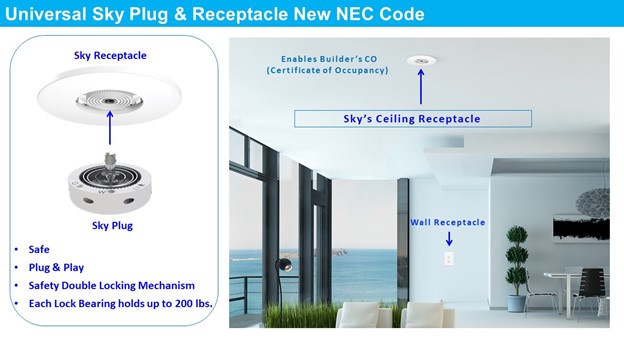

Our first-generation technologies enable light fixtures, ceiling fans and other electrically wired products to be installed safely and plugged-in, into a ceiling’s electrical outlet box within seconds, and without the need to touch hazardous wires. The plug and play technology method is a universal power-plug device that has a matching receptacle that is simply connected to the electrical outlet box on the ceiling, enabling a safe and quick plug and play installation of light fixtures and ceiling fans in just seconds. The plug and play power-plug technology, eliminates the need of touching hazardous electrical wires while installing light fixtures, ceiling fans and other hard wired electrical products. In recent years we have expanded the capabilities of our power-plug product, to include advanced safe and quick universal installation methods, as well as advanced smart capabilities. The smart features include control of light fixtures and ceiling fans by the SkyHome App, through WIFI, Bluetooth Low Energy (“BLE”) and voice control. It allows scheduling, energy savings eco mode, dimming, back-up emergency light, night light, light color changing and much more.

We believe that due to safety, convenience, cost, and time that all hard-wired electrical products, such as light fixtures, ceiling fans and other products, should become plug and play and smart, as the standard, enabling consumers to plug their fixtures and control them through their smart phones at any time.

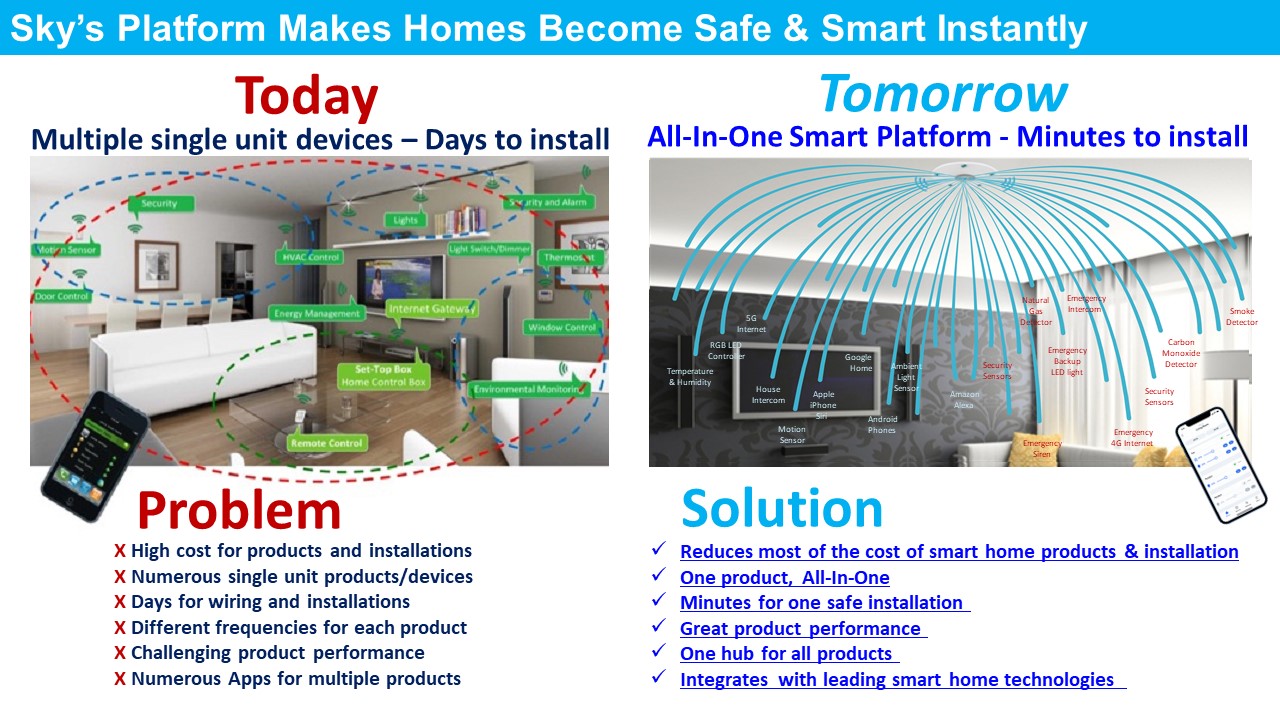

Our second-generation technology is an all-in-one safe and smart advanced platform (the “Smart Sky Platform”) that is designed to enhance all-around safety and lifestyle of homes and other buildings.

We believe that our patented advanced, safe and smart home platform technologies will make homes and buildings safer and smart as a standard, in a fraction of the time and cost, as compared to other market products.

We believe that our smart home products will enable builders to deliver smart homes as a standard, in the same way they deliver electricity and appliances as a standard.

As our advanced, safe and smart products can be easily implemented and installed in both existing and new homes and buildings in just minutes, it will save a major part of the cost and time associated with installation of smart home products. As many people spend the majority of time at their homes, we believe that they should have an affordable, easily installed, standard solution to make their homes safe, secured and smart. Similarly to how smartphones serve people as an all-in-one personal smart platform, we believe that our all-in-one Smart Sky Platform will enable every room in homes and other buildings to include a smart platform as a standard.

| 1 |

The all-in-one safe-smart-advanced platform technology is an open system that can integrate with both existing and new smart home features, devices, and systems. The advanced platform is designed and built in a way that it can accommodate additional smart home features, enabling the platform to serve as a gateway for safe and smart technologies into rooms/homes, buildings, and that it can act like a “Panama-Canal” that can accommodate other type of software systems, wireless systems, electronic chips and more.

Since 2015, we have generated over $29 million in sales from our standard products. We have decided to wind down the sales of our standard products by discontinuing production of light fixtures and ceiling fans that include the older version of our standard Sky Plug & Receptacle in favor of launching our new line of products, including our smart products and our advanced universal Sky Plug & Receptacle. We elected to do so since we believe that the market has great demand for smart advanced products, and that we will be able to generate significant sales from our new line of advanced and smart products from direct sales as well as from licensing.

Safety

We believe that safety is a necessity and the top priority in all aspects of life. Therefore, our technologies and products emphasize human safety, home, building and property safety and security, while combining safety features with high demand smart home features. We believe our products should contribute to the elimination of many cases of hazardous incidents, including ladder falls, electric shock/electrocutions, fires, carbon monoxide poisonings, injuries and deaths, as management believes that our products will result in easier installment processes and enhance the use of life saving products such as smoke detectors, carbon monoxide detectors, and emergency lights, among other products. The Smart Platforms incorporate “plug and play” technology, which eliminates the need to touch wires during the later plug-in install, replacement and maintenance, and cleaning and, accordingly, could result in reduced incidents of electrical shocks and fires resulting from faulty wiring. The installation of our Smart Platforms and retrofitting of electrical services does not require the services of a licensed electrician, but does not preclude the services of a licensed electrician. As more individuals engage in do-it-yourself (DIY) lighting projects, using our Smart Platforms rather than traditional lighting products could reduce incidents of incorrect wiring, shocks, injury and even death. In addition, we believe installing our Smart Platforms will allow installers to spend less time on a ladder during initial installation. Installers often wire light fixtures and fans while also holding such fixture or fan; with the Smart Platforms, the initial receptacle installation will be completed on the ladder and, afterwards, the fixture can simply be plugged into place, resulting in a faster and, we believe, much safer process, as installers can focus on wiring without also holding potentially heavy or breakable fixtures. Further, the Smart Platforms will incorporate a hard-wired smoke detector with battery back-up and a carbon monoxide monitor, which we believe could reduce injuries and deaths from fire and carbon monoxide poisoning.

Products

Our products are designed to improve all around home and building safety and lifestyle.

Our First Product: The Weight Bearing Power-Plug

Our first patented technology was the Power-Plug, a weight bearing power plug that acts as a safe and quick installation device, designed for “plug and play” installation of weight bearing electronics, such as light fixtures, ceiling fans and other electrical products, into ceiling electrical outlet boxes.

Our patented technology consists of a fixable socket and a revolving plug (the Power-Plug) for conducting electric power and supporting an electrical appliance attached to a wall or ceiling. The socket is comprised of a non-conductive body that houses conductive rings connectable to an electric power supply through terminals in its side exterior. The Power-Plug, which is comprised of a non-conductive body that houses corresponding conductive rings, attaches to the socket via a male post and can feed electric power to an appliance. The Power-Plug also includes a second structural element allowing it to revolve with a releasable latch that, when engaged, provides a retention force between the socket and the Power-Plug to prevent disengagement. The socket and Power-Plug can be detached by releasing the latch, disengaging the electric power from the Power-Plug. The socket is designed to replace the support bar incorporated in electric junction boxes, and the Power-Plug can be installed in light fixtures, ceiling fans, wall sconce fixtures and other electrical devices and products. Once installed, the socket can remain affixed to the junction box, enabling any electronic fixture installed with the Power-Plug to be connected and/or removed in seconds. The combined socket and Power-Plug technology are referred to throughout this prospectus as the “Sky Plug & Receptacle”.

Advanced Products

Sky – Universal Power-Plug & Receptacle: Our universal “plug and play” Sky Plug & Receptacle technology is comprised of two devices. The first device is a male Power-Plug Retrofit Kit, which can be easily embedded in the base of light fixtures and ceiling fans. The second device is a Ceiling Receptacle, which can be connected to a ceiling outlet box. After a one-time installation of the Ceiling Receptacle to a ceiling outlet box, a light fixture or ceiling fan that includes the Power-Plug Retrofit Kit can be plugged into the Ceiling Receptacle within seconds. The Universal Power-Plug & Receptacle should contribute to the elimination of hazardous incidents in homes and buildings including ladder falls, electric shock/electrocutions, fires, injuries, and deaths, etc. We expect to launch our new universal power plug in the first half of 2022.

Smart Products

SkyHome App: Our proprietary SkyHome Application works with both iPhones and Android phones. The SkyHome App controls products through WIFI and BLE, and is designed to control its products through additional communication methods as needed. The SkyHome App controls various products, features and specifications that include, scheduling, controlling, voice control, safety features, security features, lifestyle features, sound, lights, dimming, emergency back-up battery and much more. We expect to launch our SkyHome App in the first half of 2022.

| 2 |

Sky Smart - Universal Power-Plug & Receptacle: Our Sky Smart Plug & Receptacle system contains two devices. The male Power-Plug Device which includes a smart electronic board. The male Smart Power-Plug comes as a Retrofit Kit, that can be simply embedded to the base of light fixtures and ceiling fans, enabling them to become both Plug and Play and Smart. The second device is a Ceiling Receptacle that can be simply connected on to a ceiling outlet box. After a one-time simple installation of the Ceiling Receptacle to a ceiling outlet box, a light fixture or ceiling fan that includes the male Smart Plug Retrofit Kit can be plugged into the Ceiling Outlet Receptacle within seconds. Our Smart Power-Plug is controlled by our proprietary SkyHome App or through voice control, it is an open system that can integrate with other smart home devices and systems. Our Smart Power-Plug is connected through WIFI and BLE, includes numerous smart features, including scheduling, energy saving-eco mode, dimming, back-up emergency light, night light, light color changing and more. We believe that, due to safety, convenience, cost and time, all hard-wired electrical products, such as light fixtures and ceiling fans should become plug and play and smart, as the standard, enabling consumers to plug their fixture and control them through their smart phones at any time. The Smart Universal Power-Plug & Receptacle should contribute to the elimination of hazardous incidents in homes and buildings including ladder falls, electric shock/electrocutions, fires, injuries, and deaths, etc. We expect to launch our universal plug in the first half of 2022.

Sky - Smart Plug and Play Ceiling Fans: Our line of high-end smart plug and play ceiling fans can be installed to our matching ceiling receptacle within seconds. Our smart ceiling fans incorporate advanced technologies, have unique modern designs, and are controlled by our proprietary SkyHome App or through voice control, it is an open system that can integrate with other smart home devices and systems. Our Smart Power-Plug is connected through WIFI and BLE, includes numerous smart features, including scheduling, energy saving-eco mode, dimming, back-up emergency light, night light, light color changing and more. We believe that, due to safety, convenience, cost and time, all hard-wired electrical products, such as ceiling fans should become plug and play and smart, as the standard, enabling consumers to plug their fixture and control them through their smart phones at any time. The Smart Plug and Play Ceiling Fan should contribute to the elimination of hazardous incidents in homes and buildings including ladder falls, electric shock/electrocutions, fires, injuries, and deaths, etc. We expect to launch our universal plug in the first half of 2022.

Sky - Smart Plug and Play Lighting: Our line of high-end Smart Plug and Play light fixtures can be installed to our matching ceiling receptacle within seconds. Our smart light fixtures incorporate advanced technologies, have unique modern designs, and are controlled by our proprietary SkyHome App or through voice control, it is an open system that can integrate with other smart home devices and systems. Our Smart Power-Plug is connected through WIFI and BLE, includes numerous smart features, including scheduling, energy saving-eco mode, dimming, back-up emergency light, night light, light color changing and more. We believe that, due to safety, convenience, cost and time, all hard-wired electrical products, such as light fixtures should become plug and play and smart, as the standard, enabling consumers to plug their fixture and control them through their smart phones at any time. The Smart Plug and Play Lighting should contribute to the elimination of hazardous incidents in homes and buildings including ladder falls, electric shock/electrocutions, fires, injuries, and deaths, etc. We expect to launch our universal plug in the first half of 2022.

Sky – All-In-One Smart Platform: As most people spend a majority of time in their homes, we believe that they should have an easy solution to make their homes safe, secured, and smart in a simple way and as the standard. We believe that our patented advanced-safe-smart home platform technologies will make homes and buildings safe, have numerous technology features, and smart as a standard, instantly, in a fraction of time and cost, compared to other market products. Our all-in-one Advanced-Safe-Smart Platform is designed to enhance the all-around safety and lifestyle of homes and buildings and can be easily implemented and installed to the ceiling receptacle in both existing and new homes and buildings within minutes. Our smart platform includes distinctive advanced smart and safety technologies, have unique modern designs and are controlled by our proprietary Sky-Home App or through voice control. It is an open system that can integrate with other smart home devices and systems.

As smart phones serve people as an all-in-one personal smart platform, we believe that our all-in-one smart platform technology enables every room in homes and buildings to have a smart platform as a standard. Our smart platform is connected through WIFI and BLE, includes numerous of smart and safety features, including a smart smoke detector, a smart CO detector, time scheduling, temperature sensor, humidity sensor, WIFI extender, energy saving-eco mode, high quality speakers, back-up battery that can power back-up internet and an emergency light, as well as dimming, night light, light color changing and more. The platform’s electrical power and transformer combined with the size of our platform which represents vast electronic “Real-Estate” in terms of today’s technology driven by microchips, enables the platform to accommodate a significant amount of software as well as electronic microchips, while the unique ceiling location of the platform significantly enhances the performance of all platform’s features, including WIFI and BLE.

| 3 |

The Smart Platform is inconspicuous to the décor. It is designed to install over existing ceiling electrical outlet boxes while allowing any pre-existing fixture to reconnect to the same box utilizing our Retrofit Kits. This innovation gives us access to the best location for the gathering and distribution of electronic signals, virtually unlimited power for our low-voltage safety and smart features, and a vast amount of electronic real estate.

This open-system Smart Platform seamlessly integrates unrelated safe and smart products into a single, spatially designed unit whose functionality is controlled by an all-in-one app, the SkyHome App. The Smart Platform eliminates the need for installation of numerous stand-alone devices and their integration into a working unit.

The Smart Platform’s location on the ceiling significantly advances smart home products’ performance, including the speed and range of both Wi-Fi and Bluetooth, as well as the performance of sensors and alarms.

The adoption of the Smart Platform should contribute to the elimination of hazardous incidents in homes and buildings including ladder falls, electric shock/electrocutions, fires, carbon monoxide poisonings, injuries, and deaths, etc.

Installation takes only minutes and fixtures previously hung from that location can still be plugged into the Smart Platform.

We expect to launch our all-in-one Smart Platform in the third quarter of 2022.

| 4 |

| 5 |

| 6 |

Sustainability

We aim to provide safe and sustainable solutions to consumers, who increasingly consider sustainability and energy efficiency when purchasing products. We believe that creating sustainable products and streamlining our operations drives efficiency, innovation and, ultimately, long-term value-creation. In designing and improving our products, we consider and apply sustainability strategies, as appropriate. For example, our products’ features include an energy savings eco mode, which can help users reduce their energy consumption, and we generally use LED lighting in our ceiling fans and light fixtures, which is more energy-efficient than traditional lighting products.

Cyber Security

We have implemented measures and protocols in order to ensure that our users’ information is safe and fully protected. We use high level of cyber security measures and protocols to ensure that our software, technologies, servers, products, platform, and devices are all protected to prevent from any type unauthorized, or illegal access or interference to our software, technologies, servers, products, platforms, and devices.

Our products, platforms and devices communicate over MQTT and are encrypted over Transport Layer Security, with each individual product, platform and device having its own set of certificates, keys, and universally unique identifiers, which ensures that each device can only communicate with its own topic. This ensures that even in extreme cases of illegally gaining control over a specific device, it will not affect any other devices.

Each login to the platform generates the user a temporary token that grants access to the services for a limited amount of time, this ensures that there is no permanent access token that can be used by hackers for unauthorized access. Each token has permissions to access only the user’s resources.

Our solutions are designed in a way that the user will need to conduct a restricted set of permissions, thus minimizing the risk of unwanted users gaining control over other locations.

Sky Plug & Receptacle – NEC Code

The NEC (National Electrical Code) is the U.S. electrical safety building code, and is the benchmark for safe electrical design, installation, and inspection to protect people and property from electrical hazards. It has been adopted in some form in all 50 states in the United States and is intended to improve safety in U.S. homes and buildings.

| 7 |

Based on the safety aspects of the Sky Plug & Receptacle, it was voted into the NEC and is represented by 10 different segments in the NEC Code Book. The Company has provided data relating to safety aspects of its receptacle as to electrocutions, fires and ladder falls to NEC.

One of the key votes and segments relating to our technologies in the NEC Code Book was the change of the definition of “receptacle” in the Code Book, which we believe is one of the most significant additions to the NEC Code in the past 120 years. The NEC leads the United States and globally with respect to electrical safety standards; as such, we believe the reputable standards of the NEC can assist with the adoption of our technology in additional countries.

Pursuant to these new NEC provisions, the Sky Plug & Receptacle enables builders to expedite and obtain a Certificate of Occupancy without the need to install a light fixture to the ceiling.

Intellectual Property

Developing and maintaining a strong intellectual property position is one of the most important elements of our business. We rely on a combination of patents, copyright, trademarks and trade secret laws, as well as confidential procedures and contractual provisions, to protect our proprietary technology and our brands. We enter into confidentiality and proprietary rights agreements with our employees, consultants and other third parties. We have sought, and will continue to seek, patent protection for our technology and for improvements to our technology, as well as for any of our other technologies where we believe such protection will be advantageous.

We protect the Sky Technologies intellectual property through various aspects and strategies including broad and particular intellectual property claims. We have over 60 U.S. and global patents and patent applications, including 15 issued patents, including in China, India, major parts of Europe as well in other countries around the world. These patents and patent applications protect different aspects of our technologies. We sought intellectual property protection of the Sky Technology in China due to our current manufacturing operations and prospective sales in China’s market, and we sought protection in India in anticipation of future growth into India’s developing market, both with respect to the sales of the Sky Technology and our potential operations. As of December 21, 2021, in the U.S., we own seven issued patents, which expire from December 2036 to July 2038, and six pending or published but not yet issued patents. Outside of the U.S., we own eight issued patents, which expire from May 2026 to March 2039, and 46 pending or published but not yet issued patents. We intend to diligently maintain and vigorously defend the intellectual property of Sky Technologies, and to actively and continuously enhance our patent protections in the U.S. and globally.

The issued patents are directed to various aspects our platform technologies, including our smart and standard plug and play products, as well as our safety and smart platform technologies. As further innovations are developed, we intend to seek additional patent protection to enhance and maintain our competitive advantage. Additionally, we have submitted 10 trademark applications, seven of which have been issued and three of which are pending.

GE - General Electric Agreements

We have two U.S. and global agreements with General Electric (“GE”) related to our products.

| ● | The first agreement is a U.S. and Global Trademark Agreement dated June 15, 2011 (as later amended), which expires November 30, 2023 and is generally renewed for five-year periods. Pursuant to such agreement, the Company may use the GE brand logo on certain products, including Sky’s SQL standard and Smart devices as well as standard and smart ceiling fans. We have U.S. and global rights to market plug and play standard and smart products and smart ceiling fans under the GE brand. GE will assist us with manufacturing standards, audit of factories, audit of materials, and quality control under “Six Sigma” guidelines, as well as with public relations for products and more. |

| ● | The second agreement is a U.S. and Global Licensing and Master Service Agreement dated June 14, 2019, which expires June 14, 2024, and includes automatic renewal provisions. Pursuant to such agreement, GE’s Licensing team will license Sky’s Standard and Smart products in the U.S. and worldwide. GE’s licensing team will seek and for arrange licensees partners in the U.S. and globally, including negotiate agreement terms, manage contracts, collect payments, audit partners, assist with patent strategy and protection, assist in auditing product quality control under the “Six Sigma” guidelines. |

| 8 |

Leadership and Talent

Our management members include leading executive from various industries and have joined us as they believe in our vision, technology, and strategy. Many of our key personnel are employed pursuant to an employment agreement or a consulting agreement, pursuant to which many of them, including board members have invested in the Company and agreed to be compensated primarily in stock and stock options.

As of December 21, 2021, we had 31 total employees and consultants, 26 of which are full time. We also employ independent contractors to support our operations. We have never had a work stoppage, and none of our employees are represented by a labor union. We have not experienced any work stoppages and consider our relations with our employees to be good. We expect to continue to expand our staff and team of engineers to develop the Sky smart technologies.

Key Management Members

| ● | Rani R. Kohen, Executive Chairman. Rani R. Kohen has founded the Company and invented our technologies. Mr. Kohen is a businessman, entrepreneur, and inventor. He brings strategic acumen with over 30 years of experience in business, as well as in advanced smart home technologies, product design, lighting, and other related businesses. Since founding the Company, he has succeeded in attracting and engaging accomplished board members, talented management and leading executives from various industries. He has led every major milestone achieved by the Company to date, including securing substantial financing to support the Company’s growth. The board of directors believes that with Mr. Kohen’s leadership and qualifications, the continuity that he brings with his advanced business strategies, he will continue to move us forward towards achieving our goals. | |

| ● | Steven M. Schmidt, President. Steven M. Schmidt is the former Chief Executive Officer of ACNielsen Corporation and former President, International of Office Depot International, Inc. | |

| ● | John P. Campi, Chief Executive Officer (and Chief Financial Officer through December 31, 2021) . John P. Campi is the former Chief Procurement Officer and Executive Vice President of Chrysler, Senior Vice President of Procurement and Vendor Management for The Home Depot, Inc. and Chief Procurement Officer and Vice President of DuPont Global Sourcing and Logistics. | |

| ● | Marc-Andre Boisseau, Chief Financial Officer as of January 1, 2022. Marc-Andre Boisseau has served in finance roles for several public and private companies, including as Corporate Controller and Principal Accounting Officer of Citrix Systems, Inc. Mr. Boisseau will serve as the Company’s full-time Chief Financial Officer beginning January 1, 2022. | |

| ● | Patricia Barron, Chief Operations Officer and Code Team Senior Member. Patricia Barron was previously President and owner of LTG Services, Inc., an electrical safety consulting company. LTG managed technical review of lighting and ceiling fan projects for Underwriters Laboratories (“UL”) and managed UL safety testing for world fans. | |

| ● | Mark Earley, President of the Code Team. Mark Earley joined the Company, as President of the Code Team. Mr. Earley is a world leading electrical engineer and former head of the NEC (National Electrical Code) and Chief Electrical Engineer. After leading the NEC for 35 years, he retired in 2019 and joined Sky to lead its U.S. and Global code team. Mr. Earley is still a leading member of the IEC (International Electrical Commission), the Canadian Electrical Code, the UL Electrical Council and the U.S. National Committee. | |

| ● | Chuck Mello, SVP of the Code Team. Chuck Mello joined the Company in 2019 as SVP of the Code Team. Mr. Mello is the former International President of the IAEI (International Association of Electrical Inspectors), where he is still an instructor and author. He was formerly with UL as a Global Field Evaluation Program Manager. | |

| ● | Amy Cronin, Executive Director Codes & Standards. Ms. Cronin is a former NFPA (NEC) Executive Leader, managing the Department of Codes and Standards, and she was responsible for more than 300 code decisions including the NEC (National Electrical Codes). | |

| ● | Mark Wells, President of Lighting. Mark Wells, former General Manager of Consumer Lighting for GE, joined the Company in August 2016 and currently serves as our President of Lighting. |

| 9 |

| ● | John Poole, Vice President of Sales. John Poole joined the Company in 2017 as Vice President of Sales. He formerly served in a variety of sales management roles at GE, including as General Manager of Business Development for European Retail and General Manager for GE Lighting’s Target and Home Depot accounts. | |

| ● | Steve Briggs, Senior Advisor and President of Product Development. Steve Briggs joined the Company is 2017 as Senior Advisor and President of Product Development. He previously served in a variety of roles for GE Lighting, including as General Manager of Global Product Lighting. | |

| ● | Eliran Ben-Zikri, Chief Technology Officer and GM of Sky’s Israeli Office. Eliran Ben-Zikri joined the Company in 2019 as Chief Technology Officer and GM of Sky’s Israeli Office. He served in one of the most elite computer units of the Israeli Defense Force and has over 10 years of experience in the technology and cloud technology industry, previously holding senior positions in leading Israeli tech companies, including eToro and SimilarWeb. He has a vast experience in the Internet of Things, data collection, data processing, analytics, security, cloud, and production. | |

| ● | Michael Perrillo, Vice President Global Sales. Michael Perrillo is the former Chief Executive Officer of Design Solutions International. He joined the Company as a full-time consultant to enhance and expand our sales objectives, particularly toward construction/home builders, hotels and other sales channels that we are targeting. | |

| ● | Jonathan Globerson, Vice President Design & Marketing. In 2016, Jonathan Globerson, Vice President Design & Marketing, joined the Company. He served in the most elite counter terrorism unit in the Israeli Defense Force (Sayeret Matkal) as head of the technology department, is an international award-winning product developer, former lead product designer of augmented reality and virtual reality for the 5G team for Verizon and founder of GloberDesign, a global product design and engineering firm. | |

| ● | David Usha, General Manager China. David Usha has over 25 years of experience managing production operations in China, Poland, West Africa, Russia and Taipei, including as General Manager of Omegaplast Polska, a Polish plastic devices company, and General Manager of L’Oréal (Tel Aviv). | |

| ● | Julio Plutt, CPA, Controller. Julio Plutt, CPA, a consultant and business strategist with OneTHinc, serves as our Controller and is a former auditor with KPMG. |

Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our current and future employees. We encourage and support the growth and development of our employees. Continual learning and career development is advanced through ongoing performance and development conversations with employees, and reimbursement is available to employees for seminars, conferences, formal education and other training events employees attend in connection with their job duties.

Our core values of accountability, openness and integrity underscore everything we do and drive our day-to-day interactions. The safety, health and wellness of our employees is a top priority. The COVID-19 pandemic has presented a unique challenge with regard to maintaining employee safety while continuing successful operations. Through teamwork and the adaptability of our management and staff, we were able to transition, over a short period of time, a majority of our corporate office employees to effectively working from remote locations on a full-time basis, with others working both remotely and in the office on a hybrid basis, and also to ensure a safely-distanced working environment for employees who remain in our facilities.

Business Strategy

Our business strategy is to enhance all around safety and advance smart living lifestyle in homes and other buildings.

Following our product launch, we plan to educate retail and commercial consumers about our products through a coordinated public relation campaign that will cover the safety aspects of our products and all the related hazardous incidents and property damage that our products can prevent, including ladder falls, electric shock/electrocutions, fires, carbon monoxide poisonings, injuries, deaths and more.

| 10 |

We will also educate on all our advanced smart technology features.

Lead and Seed Strategy: We expect to lead by selling our highly disruptive line of products through a variety of channels as well as seed our products through licensing to various industries.

| ● | Lead Through Direct Sales : We expect to sell our products through various representatives to online customers, builders, rental properties, hotels, big box retail, OEM customers and more. We expect to sell our products to personal consumers primarily through direct sales via our website, to large retailers, distributors and dealers, and through warehouse programs. We plan to rely primarily on product distribution arrangements with third parties and expect that our multi-channel sales strategy will evolve and expand in the future. We expect our primary customers to be retail consumers, retail showrooms, builders residential/commercial, hotels, OEM and licensing. | |

| ● | Seed Through Licensing : After our public relation campaign and our official product launch, we expect to license a variety of our standard and smart products to companies in various industries, including electrical companies, lighting and ceiling fan companies, as well as smart home companies. |

We intend to expand our sales and marketing operations and activities and intend to build strong customer relationships and expand our brand awareness. We can provide no assurance that we will be able to successfully expand our operations or activities, gain market awareness or acceptance of our products, or achieve our expectations described above.

Product Usage

Our products and technologies can be used in new and existing homes and buildings, including by builders, rental properties, hotels, cruise ships, elder living facilities, schools, hospitals, offices, commercial, and retail. We provide a one-year full performance warranty on all of our products, as well as part replacements. We intend to provide extended warranty coverage plans in the future.

Our Opportunity

Based on the significance of the safety aspects and lifestyle features of our products, we believe that our products are a necessity in most rooms, homes, and other buildings, both in the U.S. and globally, and that they can help prevent most of related hazardous incidents in homes and buildings, including ladder falls, electric shock/electrocutions, fires, carbon monoxide poisonings, injuries, and deaths. Therefore, we believe our product is a necessity in rooms, homes and other buildings.

We believe that our series of highly disruptive advanced-safe-smart platform technologies are a necessity as they are expected to disrupt and positively influence various industries, both in the U.S. and globally.

| ● | Lighting Industry: We believe that due to ease of the installation, time savings, cost savings on installations and the safety aspect of our product, our product provides a competitive advantage within the light fixture, ceiling fan and smart home industries. | |

| We believe that all light fixtures should become plug and play, smart and controlled by an app as a standard, and that light fixtures should be installed to the ceiling within seconds, safely and without the need to touch dangerous electrical wires. Our product is intended to help prevent most of related ladder falls, electric shock/electrocutions, fires, carbon monoxide poisonings, injuries, and deaths. | ||

| ● | Ceiling Fan Industry: We believe that due to the ease of installation, time savings, cost savings on installations and the safety aspect of our product, our product is a necessity for the ceiling fan industry. | |

| We believe that all ceiling fans should become plug and play, smart and controlled by an app as a standard, and that ceiling fans should be installed to the ceiling within seconds, safely and without the need to touch dangerous electrical wires. Our product is intended to help prevent most of related ladder falls, electric shock/electrocutions, fires, carbon monoxide poisonings, injuries, and deaths. | ||

| ● | Smart Home Industry: We believe that due to ease of the installation, time savings, cost savings on installations and the safety aspect of our product, our product is a necessity for the smart home industry. | |

| We believe that homes and buildings should become safe and smart as a standard. Our Advanced All-In-One Safe-Smart Platform enables rooms, homes, and buildings to become safe and smart instantly. | ||

| Our Advanced Smart Platform significantly enhances smart home products’ performance, including the speed and range of both Wi-Fi and Bluetooth, as well as the performance of sensors and alarms. We believe that widespread adoption of the Smart Platform should contribute to the elimination of most related hazardous incidents in homes and buildings including ladder falls, electric shock/electrocutions, fires, carbon monoxide poisonings, injuries, and deaths. Therefore, we believe our product is a necessity in rooms, homes, and buildings. | ||

| Our Advanced All-In-One Safe-Smart Platform can be used in existing homes and buildings, by builders, rental properties, hotels, cruise ships, elder living facilities, schools, hospitals, offices, commercial, retail and other. |

| 11 |

We intend to launch our new universal power plug, our SkyHome App, and our smart universal plug in the first half of 2022 and our all-in-one Smart Platform in the third quarter of 2022. Bringing our products to market will require us to take certain steps, including, but not limited to, the following:

| ● | Manufacturing: While we have manufactured and sold our prior products, and intend to continue to use the third-party manufacturers with which we have an ongoing relationship, we have not yet begun manufacturing our new products. We expect it may take approximately 90 days to complete manufacturing of our new universal power plug and/or our smart universal plug after we place an order. However, it may take longer than expected due to, among other things, difficulties finding suppliers, shipping delays resulting in late deliveries of necessary supplies and materials, and chip shortages. | |

| ● | Marketing and Public Relations: We will need to gain brand awareness and attract customers. In connection with our product launch, we plan to educate retail and commercial consumers about our products through a coordinated public relation campaign that will cover the safety aspects of our products and all the related hazardous incidents and property damage that our products can contribute to preventing, as well as our advanced smart technology features. We currently rely, and plan to rely primarily, on product distribution arrangements with third parties. We expect to enter into additional sales, distribution and/or licensing agreements in the future, and we may not be able to enter into these agreements on terms that are favorable to us, if at all. We may also need to hire additional sales personnel. | |

| ● | Government Approval: While we have received a variety of final electrical code approvals, including UL, United Laboratories for Canada (cUL) and Conformité Européenne (CE), and 2017 and 2020 inclusion in the NEC Code Book, we may need or desire to obtain additional UL, cUL or CE certifications for new product configurations, which may increase the time and costs to complete our product launches. In addition, we may be unable to obtain new certifications within a reasonable time, or at all. |

Expected Revenue Stream

We believe our products will enable us to access a global market with multiple revenue streams, including:

| ● | Global market with numerous potential product applications |

| ● | Product sales |

| ● | Royalties/Licensing |

| ● | Subscription model |

| ● | Monitoring services |

| ● | Sale of product and licensing rights to additional countries |

Royalties from the Sky Plug & Receptacle. Management has agreed to license products in the U.S. and globally through the efforts of its GE licensing and trademark agreements. We anticipate we will also license our smart technologies products currently in development.

Selling/Licensing Country Rights. Management is considering selling and licensing marketing rights to certain countries in exchange for payment and on-going royalties.

Product Sales. We currently generate revenue from our product sales, and management will strive to achieve strong market penetration worldwide for our current products and products in development. We have previously sold our standard products in the United States, Canada and Mexico, and expect to begin selling our new smart products in these markets in 2022. We intend to expand our sales footprint in certain countries in Latin America, Europe and Asia. We may be unable to gain market acceptance in such markets and cannot provide any assurance that we will be successful in our efforts to expand our market reach.

Subscription & Monitoring Services. Our future plans include offering subscription services as part of our Smart Sky Platform, including, among other services, communications, fire alarms, home intrusion alerts, emergency response services and monitoring services. Our smart platform will include, among other features, a smart smoke detector, a smart carbon monoxide detector, and a WIFI extender. We intend to expand our operations to enable us to provide services relating to these functions, including high-speed internet services, monitoring systems designed to sense movement, smoke, fire, carbon monoxide, temperature, and other environmental conditions and hazards, monitor home access and visitors and address personal emergencies such as injuries and other medical emergencies. We intend to market such services to homeowners and other types of facilities, including rental properties, hotels, cruise ships, elder living facilities, schools, hospitals, offices, commercial, and retail. Our ability to provide such services will depend on a variety of factors, including, but not limited to, subscriber interest and financial resources, any applicable licensing and regulatory compliance, our ability to manage our anticipated expansion and to hire, train and retain personnel, and general economic conditions. We may partner with other businesses to provide such services. We expect to begin providing such services in 2023, but cannot provide any assurance that we will be able to do so.

Our History

We began as Safety Quick Light LLC in 2004 and started developing the Sky Plug & Receptacle technology in 2007 for installation of light fixtures and ceiling fans during manufacturing and as a Retrofit Kit for installing the Sky Technology in existing light fixtures and ceiling fans. Historically, we have sold over hundreds of thousands of units of the Sky Plug & Receptacle technology through original equipment manufacturing and through other channels to lighting manufacturers and retailers who installed the Sky Plug & Receptacle technology into their lighting fixtures for sale at retail stores. We also sold, directly to retailers, approximately hundreds of thousands of Sky Plugs & Receptacles embedded with ceiling fans.

Since our inception, we have sold hundreds of thousands of units of our standard Sky Plug & Receptacle. Since 2015 we generated over $29 million in sales. We have wound down our standard product sales by discontinuing production of light fixtures and ceiling fans that include the older version of our standard Sky Plug & Receptacle, in favor of licensing our product and developing our Smart Power-Plug and Smart Sky Platform technologies.

| 12 |

We hold over 60 U.S. and global patents and patent applications and have received a variety of final electrical code approvals, including UL, United Laboratories for Canada (cUL) and Conformité Européenne (CE), and 2017 and 2020 inclusion in the NEC Code Book.

Third-Party Manufacturing and Suppliers

Our business model entails the use of third-party manufacturers to produce the Sky Technology product. The manufacturers currently used by us are located in China and, with respect to products that bear the GE logo, as required by the Licensing Agreement with GE, such manufacturers must be approved by GE to ensure certain quality standards are met. To further ensure that quality specifications are maintained, we maintain an office in the Guangdong province in China that is staffed with GE trained auditors who regularly inspect the products that are being produced by third-party manufacturers.

Raw materials used in our products include copper, aluminum, zinc, steel, acrylonitrile butadiene styrene (ABS) plastic and wood. We also purchase integrated circuit chip sets or other electronic components from third-party suppliers or rely on third-party independent contractors, some of which are customized or custom made for us. While we have experienced shortages in obtaining necessary materials, including zinc, copper and steel, as well as integrated circuit chips to be used in our products, we have been able to make other arrangements and find additional suppliers as necessary. With respect to circuit chips, we believe we have obtained a sufficient number to manufacture our products by the anticipated launch date. Going forward, we believe we can obtain more chips and other materials as needed within a reasonable time period and may be able to replace difficult to acquire components with different products or modify our design if necessary

Our principal suppliers are Mei Pin Metal & Electrical Co., Ltd (Guangdong, China), Siterwell Electronics Co., Ltd (Zhejiang, China), Zhongshan Paragon Source Lighting Co., Ltd. (Noble) (Zhongshan, Guangdong, China), Artisan Industrial Co., Ltd. (Jiangmen, Guangdong, China) and Youngo Limited (Aircool) (Huizhou City, Guangdong, China).

Competition

We believe our technologies are highly disruptive and with an edge compared to other market technologies. Our competitors vary based on our products, market, and industry.

| ● | Our main competitors for our Universal Power Plug and Play, Sky Plug & Receptacle product are: To the best of our knowledge we do not have direct competition at this point to Universal Power Plug and Play, Sky Plug & Receptacle product, although all lighting and ceiling fan manufacturers are potential competitors. |

| ● | Our main competitors for our Smart Universal Power Plug and Play Sky Plug & Receptacle product are: To the best of our knowledge we do not have direct competition at this point to Smart Universal Power Plug and Play Sky Plug & Receptacle product, although all lighting and ceiling fan manufacturers are potential competitors. |

| ● | Our main competitors for our Smart Plug and Play Light Fixture products are: To the best of our knowledge we do not have direct competition at this point to our Smart Plug and Play Light Fixtures, although there are lighting manufacturers that have smart lights that are controlled through smart wall switches/app or other, including companies such as Casainc, Global Electric, Designers, Minca, Fountain, Enbrgiten, Nbg, Minka, Hampton Bay and other. To the best of our knowledge there are no other light fixtures that have an all-in-one combination of light fixtures that have both plug and play and smart. |

| ● | Our main competitors for our Smart Plug and Play Ceiling Fan Products: To the best of our knowledge we do not have direct competition at this point to our Smart Plug and Play Ceiling Fan products, although there are ceiling fan manufacturers that have smart fans that are controlled through smart wall switches/app or other, including companies such as Hunter, Minka, Home Decorators, Fanomation, Modern Homes, Hampton Bay and others. |

| ● | Our main competitors for our Plug and Play All-In-One Safe-Smart Platform product: To the best of our knowledge we do not have direct competition at this point to our Plug and Play All-In-One Safe-Smart Platform product, although there are many smart home companies than can be our competitors, including companies such as, Control 4, Vivent, Apple, Google, Microsoft, Amazon, Adt, Blue, Cove and many others and many other smart home companies that have a variety of smart home products. As to the best of our knowledge there are no other Plug and Play All-In-One Safe-Smart Platform products. |

| 13 |

Risks Associated with our Business

Our ability to implement our business strategy is subject to numerous risks that you should be aware of before making an investment decision. Below is a summary of material factors that make an investment in our common stock speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below in the section entitled “Risk Factors” and should be carefully considered, together with other information included in this prospectus.

| ● | We have a history of operating losses, will likely incur losses in the future and may be unable to generate sufficient revenue to support our operations. |

| ● | If we are unable to successfully launch our smart products and technologies, integrate them with third-party products and technologies, further develop them to include new features and to respond to customer demands, or otherwise are unable to realize our product strategy or compete in our industry, our business, results of operations and financial condition would be adversely affected. |

| ● | Our success depends on our ability to develop, expand and manage our operations and effectively and timely develop and implement our strategic business initiatives, which may include engaging in strategic transactions, including acquisitions, which involves substantial risks. |

| ● | We may need to raise additional financing to support our operations, and any inability to do so may adversely affect or terminate our operations. We also face risks related to our current debt financing. |

| ● | Our business has been, and could continue to be, negatively impacted by the COVID-19 pandemic. |

| ● | We depend on a limited number of third-party manufacturers and suppliers. |

| ● | The loss of any significant customers, or the loss of our License Agreement with GE, could materially adversely affect us. |

| ● | We face substantial risks relating to our intellectual property, including any inability to protect our intellectual property, potential litigation and the expiration or loss of patent protection and licenses. |

| ● | We could face significant liabilities or may be subject to legal claims that could adversely affect our business and financial condition. |

| ● | We have limited product distribution experience and expect to rely on third parties, who may not successfully sell our products. |

| ● | We will incur increased costs as a result of operating as a public company. |

| ● | Our future success depends on our ability to retain key executives and qualified personnel. |

| ● | Any failure to maintain effective internal control over financial reporting or disclosure controls and procedures could negatively impact us. |

| ● | Unstable market and economic conditions, as well as natural disasters, geopolitical events and other highly disruptive events, such as the COVID-19 pandemic, could materially adversely affect us. |

| ● | Unauthorized breaches or failures in cybersecurity measures adopted by us or third parties on which we rely and/or are included in our products and technologies, or any disruption to our cloud-based infrastructure, could have a material adverse effect on our business. |

| 14 |

| ● | There is currently no established public trading market for our common stock, and we cannot provide any assurance that an active, liquid market for our common stock will develop or be sustained. |

| ● | If our stock price fluctuates after the offering, you could lose a significant part of your investment. |

| ● | If you purchase our common stock in this offering, you will incur immediate and substantial dilution in the book value of your shares. In addition, the conversion of outstanding convertible notes and warrants into shares of common stock could materially dilute our stockholders. |

| ● | Our executive officers, directors, principal stockholders and their affiliates will continue to exercise significant influence after this offering. |

| ● | We have broad discretion in how we use the proceeds of this offering and may not use these proceeds effectively. |

| ● | We are a smaller reporting company, and we cannot be certain whether the reduced reporting requirements applicable to smaller reporting companies will make our common stock less attractive to investors. |

| ● | Anti-takeover provisions in our charter documents and under Florida law could discourage, delay or prevent a change in control of us and may affect the trading price of our common stock. |

Corporate Information

We were originally organized in May 2004 as a Florida limited liability company under the name of Safety Quick Light, LLC. We converted to a Florida corporation on November 6, 2012 and, effective August 12, 2016, we changed our name from “Safety Quick Lighting & Fans Corp.” to “SQL Technologies Corp.” We currently do business as “Sky Technologies.” Our principal executive offices are located at 11030 Jones Bridge Road, Suite 206, Johns Creek, Georgia 30022, and our telephone number is (770) 754-4711. Our website can be found at www.skyplug.com. The information contained in or accessible from our website is not incorporated into this prospectus, and you should not consider it part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

Recent Developments

In late December 2021, the Company received gross proceeds of approximately $8.3 million from the sale of 692,667 shares of common stock at $12.00 per share to several investors, in a private placement.

| 15 |

The Offering

The summary below describes the principal terms of this offering. The “Description of Capital Stock” section of this prospectus contains a more detailed description of our common stock.

| Common stock offered by us | shares of our common stock (or shares if the underwriters exercise their option in full) | |

| Initial public offering price | $ per share | |

| Underwriters’ over-allotment option | We have granted the underwriters an option for a period of 45 days from the date of this prospectus to purchase up to an additional shares of our common stock from us at the initial public offering price less underwriting discounts and commissions to cover over-allotments, if any. | |

| Common stock to be outstanding immediately after this offering | shares (or shares if the underwriters’ option to purchase additional shares of our common stock from us is exercised in full)(1) | |

| Use of proceeds | We estimate that the net proceeds from the sale of shares of our common stock in this offering will be approximately $ million (or approximately $ million if the underwriters’ option to purchase additional shares of our common stock from us is exercised in full), based on the assumed initial public offering price of $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. | |

| We intend to use the net proceeds of this offering for general corporate purposes. See “Use of Proceeds.” | ||

| Dividend policy | We have never declared or paid any cash dividends on our common stock. Holders of our Series A Preferred Stock (as defined below) receive interest payments quarterly, at a rate of 6% per year, and rank senior with respect to interest on junior securities, dividends, distributions or liquidation preference. We anticipate that we will retain any earnings to support operations and to finance the growth and development of our business. Accordingly, we do not expect to pay cash dividends on our common stock in the foreseeable future. | |

| Risk factors | Investing in our common stock involves a high degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. | |

| Proposed listing | We have applied to list our common stock for trading on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “ .” We cannot assure you that our application will be approved. | |

| Proposed trading symbol | “ ” | |

| (1) | In this prospectus, except as otherwise indicated, the number of shares of our common stock that will be outstanding immediately after this offering and the other information based thereon is based on shares of our common stock outstanding as of September 30, 2021 (after giving effect to the Preferred Stock Conversion (as defined below) and the Subsequent Issuances (as defined below)), and: |

| ● | assumes an initial public offering price of $ per share of common stock, which is the midpoint of the estimated public offering price range set forth on the cover page of this prospectus; |

| 16 |

| ● | assumes the conversion of our Series A Convertible Preferred Stock, no par value (“Series A Preferred Stock”), into shares of common stock in connection with the closing of this offering (the “Preferred Stock Conversion”); | |

| ● | includes the issuance of shares of common stock after September 30, 2021 (the “Subsequent Issuances”); |

| ● | assumes no exercise by the underwriters of their option to purchase up to an additional shares of our common stock from us in this offering to cover over-allotments, if any; | |

| ● | gives effect to the filing and effectiveness of the certificate of amendment to the articles of incorporation (as amended, the “articles of incorporation”) in Florida, which will be filed prior to effectiveness of the registration statement of which this prospectus forms a part, and the effectiveness of our amended and restated bylaws (the “bylaws”), which will become effective immediately prior to the effectiveness of the registration statement of which this prospectus forms a part; | |

| ● | assumes no exercise of the outstanding options or warrants, or conversion of the outstanding convertible notes, as described below; |

| ● | assumes no exercise of the underwriters’ warrant to be issued in connection with this offering; and |

| ● | excludes: |

| ○ | 1,834,039 shares of common stock issuable upon the exercise of warrants to purchase common stock that were exercisable and outstanding as of September 30, 2021 at a weighted average exercise price of $4.34 per share (without giving effect to any of the anti-dilution adjustment provisions thereof); | |

| ○ | shares of common stock issuable upon the exercise of exercisable and outstanding warrants to purchase common stock issued after September 30, 2021 at an exercise price of $12.00 per share; | |

| ○ | 86,668 shares of common stock issuable upon the conversion of $1,300,000 of convertible notes outstanding as of September 30, 2021 that convert at $15.00 per share (which does not include shares that would be issuable if holders elect to receive interest payments on the notes in shares of common stock); | |

| ○ | shares of common stock to be issued to stockholders who purchased common stock in private placement transactions during 2021, based on an assumed initial public offering price of $ per share, which is the midpoint of the estimated public offering price range set forth on the cover page of this prospectus, as a result of anti-dilution provisions (the “Anti-Dilution Shares”); | |

| ○ | shares of common stock issuable to Newbridge Securities Corporation in connection with the consummation of this offering, based on an assumed initial public offering price of $ per share, which is the midpoint of the estimated public offering price range set forth on the cover page of this prospectus, pursuant to an investment banking engagement agreement, entered into in May 2021, as payment of a $500,000 corporate advisory fee, payable in restricted common stock upon listing of our common stock on a national securities exchange (the “Newbridge Advisory Shares”) (see “Certain Relationships and Related Party Transactions – Newbridge Securities Corporation” for additional information); | |

| ○ | 10,437,182 shares of common stock issuable upon the exercise of stock options outstanding as of September 30, 2021 under our 2015 Stock Incentive Plan (the “2015 Plan”) and the 2018 Stock Incentive Plan, as amended and restated (the “2018 Plan”), at a weighted average exercise price of $3.65 per share; | |

| ○ | shares of common stock issuable upon the exercise of outstanding stock options granted after September 30, 2021, with an exercise price of $12.00 per share, pursuant to our 2018 Plan; | |

| ○ | 4,372,818 shares of common stock reserved for future issuance as of September 30, 2021 (including the additional shares reserved for issuance pursuant to the November 2021 amendment and restatement) under the 2018 Plan, which will cease to be available for issuance at the time that our 2021 Stock Incentive Plan (the “2021 Plan” and, collectively with the 2015 Plan and the 2018 Plan, the “Incentive Plans”) becomes effective; | |

| ○ | 20,000,000 shares of common stock that will become available for future issuance under the 2021 Plan, which will become effective immediately prior to, and subject to, the effectiveness of the registration statement of which this prospectus forms a part; and | |

| ○ | 3,315,000 shares of common stock issuable upon exercise of stock options outstanding as of September 30, 2021 issued outside of the Incentive Plans, at a weighted average exercise price of $4.06 per share. |

| 17 |

You should read the following summary financial data together with our financial statements and the related notes appearing elsewhere in this prospectus and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of this prospectus. We have derived the statement of operations data for the years ended December 31, 2020 and 2019 from our audited financial statements appearing elsewhere in this prospectus. We have derived the condensed statement of operations data for the nine months ended September 30, 2021 and 2020 and the condensed balance sheet data as of September 30, 2021 from our unaudited condensed interim financial statements appearing elsewhere in this prospectus. The unaudited interim condensed financial statements have been prepared on the same basis as our audited financial statements and reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for a fair statement of the financial information included in those unaudited interim condensed financial statements. Our historical results are not necessarily indicative of the results that may be expected the future, and our results for any interim period are not necessarily indicative of results that may be expected for any full year.

| (unaudited) | ||||||||||||||||

| Year Ended December 31, | Nine Months Ended September 30, | |||||||||||||||

| Consolidated Statements of Operations Data | 2020 | 2019 | 2021 | 2020 | ||||||||||||

| Revenue | $ | 258,376 | $ | 3,809,752 | $ | 106,577 | $ | 249,175 | ||||||||

| Cost of Sales | (503,033 | ) | (3,549,030 | ) | (130,599 | ) | (490,538 | ) | ||||||||

| Gross Profit (Loss) | (244,657 | ) | 260,722 | (24,022 | ) | (241,363 | ) | |||||||||

| Selling, general and administrative expenses | 8,635,011 | 16,483,480 | 3,153,897 | 4,726,224 | ||||||||||||

| Depreciation and amortization | 106,309 | 107,241 | 63,325 | 69,772 | ||||||||||||

| Total operating expenses | 8,741,320 | 16,590,721 | 3,217,222 | 4,795,996 | ||||||||||||

| Loss from Operations | (8,985,977 | ) | (16,329,999 | ) | (3,241,244 | ) | (5,037,359 | ) | ||||||||

| Other Income / (Expense) | ||||||||||||||||

| Interest expense | (515,515 | ) | (490,626 | ) | (425,323 | ) | (370,524 | ) | ||||||||

| Other income, SBA Loan forgiveness | 257,468 | — | 10,000 | — | ||||||||||||

| Gain (loss) on exchange | 408 | 726 | 7,886 | (542 | ) | |||||||||||

| Gain on debt forgiveness (license) | — | 49,706 | — | — | ||||||||||||

| Interest income | 1,511 | 17,494 | 36 | 1,433 | ||||||||||||

| Total other income (expense), net | (256,128 | ) | (422,700 | ) | (407,401 | ) | (369,633 | ) | ||||||||

| Net income (loss) including noncontrolling interest | (9,242,105 | ) | (16,752,699 | ) | (3,648,645 | ) | (5,406,992 | ) | ||||||||

| Less net loss attributable to noncontrolling interest | — | — | — | — | ||||||||||||

| Preferred dividends | 130,206 | 130,206 | 97,655 | 97,655 | ||||||||||||

| Net income (loss) attributed to common shareholders | $ | (9,372,311 | ) | $ | (16,882,905 | ) | $ | (3,746,300 | ) | $ | (5,504,647 | ) | ||||

| Net Income (Loss) per share - basic and diluted | $ | (0.14 | ) | $ | (0.29 | ) | $ | (0.05 | ) | $ | (0.08 | ) | ||||

| Weighted average number of common shares outstanding during the year – basic and diluted | 62,880,875 | 57,964,073 | 64,810,157 | 62,808,921 | ||||||||||||

(unaudited) As of September 30, 2021 | ||||||||||||

| Consolidated Balance Sheet Data | Actual | Pro Forma(2) | Pro Forma As Adjusted(3)(4) | |||||||||

| Cash | $ | 2,234,653 | $ | $ | ||||||||

| Working capital(1) | (89,506 | ) | ||||||||||

| Total assets | 3,747,858 | |||||||||||