UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2017

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________

COMMISSION FILE NUMBER 333-194322

|

RECURSOS QUELIZ, INC. |

|

(Exact name of registrant as specified in its charter) |

|

NEVADA |

|

30-0818620 |

|

State or other jurisdiction of incorporation or organization |

|

(I.R.S. Employer Identification No.) |

|

Las Caobas, 4th St., No. 24, Puerto Plata, Dominican Republic |

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

| ||

|

Registrant's telephone number, including area code |

|

(809) 970-2353 |

|

Securities registered pursuant to Section 12(b) of the Act: |

|

NONE. |

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: |

|

Common Stock, $0.001 Par Value Per Share. |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

o |

|

Accelerated filer |

o |

|

Non-accelerated filer |

o |

(Do not check if a smaller reporting company) |

Smaller reporting company |

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $40,000 as of August 31, 2017, based on the registered resale of securities on Form S-1/A effective December 17, 2014 at a price of $0.002 per share.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of November 30, 2017, the Registrant had 90,000,000 shares of common stock outstanding.

RECURSOS QUELIZ, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED AUGUST 31, 2017

| 2 |

| Table of Contents |

This Form 10-K, particularly in the sections titled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” contains forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Form 10-K, including statements regarding our future financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “might,” “objective,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “predict,” “potential,” or the negative of these terms or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions described under the section titled “Risk Factors” and elsewhere in this Form 10-K, regarding, among other things:

|

● |

|

our attempts to explore La Mina claim in the Dominican Republic; |

|

| ||

|

● |

|

we have identified a mineral property in the Dominican Republic named La Mina which we will be exploring in the near future; |

|

| ||

|

● |

|

we may not be able to compete with other mining companies, either large or small, who operate in the Dominican Republic; and |

|

| ||

|

● |

|

there is no assurance we will be able to manage our future growth. |

These risks are not exhaustive. Other sections of this Form 10-K may include additional factors that could adversely impact our business and financial performance. These statements reflect our current views with respect to future events and are based on assumptions and subject to risk and uncertainties. Moreover, we operate in a very competitive and rapidly-changing environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of the forward-looking statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Form 10-K to conform these statements to actual results or to changes in our expectations.

As used in this Annual Report, the terms “we,” “us,” “our,” “Recursos Queliz” and the “Company” mean Recursos Queliz, Inc., unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

Overview of Our Business

We are an exploration mining company with our principal offices located at No. 24, 4th Street, Las Coabas, Peurto Plata, Dominican Republic. Our phone number is 809-970-2353. Our President, Secretary and Treasurer, Juan Alexi Payamps Dominiguez, incorporated El Caporal Management, SRL, our wholly owned subsidiary, in the Domincan Republic and the parent company in Nevada in order to seek out and acquire a mineral property in the Dominican Republic. With strong gold prices at that time he was interested in acquiring a property where gold might be discovered in sufficient quantities to warrant possible future production. We were incorporated in the State of Nevada on September 20, 2012 under the name “Recursos Queliz, Inc.”

| 3 |

| Table of Contents |

On September 18, 2012, we purchased a 100% interest of the Queliz Gold Concession (“Queliz Concession”) in San Jose de Ocoa, Dominican Republic. The Queliz Gold Concession consists of 5,200 mining hectares registered with the Ministry of Mines in the Dominican Republic. The Queliz Concession was acquired on September 18, 2012 by El Caporal Management, SRL. The Queliz Concession cost $13,000 to acquire it from the Department of Mines in the Dominican Republic.

On September 23, 2012, the subsidiary paid $25,800 for an exploration program on the Queliz Concession. The geologist carried out work in November 2012 and prepared a report with recommendations in February 2013. In August 2013, the Company paid for additional work on the concession in the amount of $19,778. Even with the Company undertaking two exploration programs on the Queliz concession, the Director of Mines for the Dominican Republic cancelled the Company’s rights to any mineralization on the claim.

As at August 31, 2017, we had $3,132 in cash with no other assets. From our inception on September 20, 2012 through August 31, 2017, we have raised $90,000 in capital in private placement (through the issuance of 90,000,000 shares of common stock at the price of $0.001 per share to our director). Queliz has raised no other funds since that time other than advances from its sole director and officer in January and February 2014 in the amount of $50,000 respectively and two other advances of $25,000 in August and November 2015 and $15,000 in January, $10,000 in on March and another $10,000 in April 2017 for a total amount of advances of $135,000. These advances are on a demand bases and bear no interest.

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of—

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A(a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

| 4 |

| Table of Contents |

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

Our Company is a start-up, exploration mining company formed to explore mineral properties in the Dominican Republic or elsewhere in the world.

The Company purchased, through its wholly-owned subsidiary, El Caporal Management, SRL (herein known as “El Caporal”) a 100% interest in the Queliz concession in the Dominican Republic. After having completed two exploration programs on the Queliz concession, the Director of Mines for the Dominican Republic cancelled the concession.

Our director has advanced $1,292 by way of paying on behalf of the Company certain expenses. In addition, he has advanced a further $135,000 for working capital purposes.

As at August 31, 2017, we had $3,132 in cash on hand and current liabilities of $170,880 resulting in a negative working capital position of $(167,748). Unless the Company is able to raise additional working capital in the future it might have to cease operations.

The Queliz concession, prior to its cancellation, had no production and hence was considered a grass roots property; since limited exploration work had occurred in the past. We have no other assets other than cash and therefore are considered a shell company.

We are a small reporting company as defined by Rule 12b-2 of the Securities Act of 1934 and are not required to provide information under this item.

The original property held by the Company was the Queliz concession located in the Dominican Republic. The Company undertook two exploration programs on this concession before the Director of Mining for the Dominican Republic cancelled our rights to the minerals on this concession. Therefore, the Company has no further interests in the minerals located on the Queliz concession. No real explanation was given for the cancellation of the concession.

We presently have the mineral rights to La Mira property.

It is located in the Provinces Santigo and La Vega, municipality San Jose de las Matas and Jarabacoa, municipal district of Las Placetas and Manabao, sections Mata Grande, Jamamu and La Cienaga, and the Villages of Guacaritas, Rancho al Medio, Los Apostentos, El Valle, La Mina, Moshosa, Montellano, Jamamutico, Boca de los Rios and Los Tablones.

| 5 |

| Table of Contents |

Geology of the Region

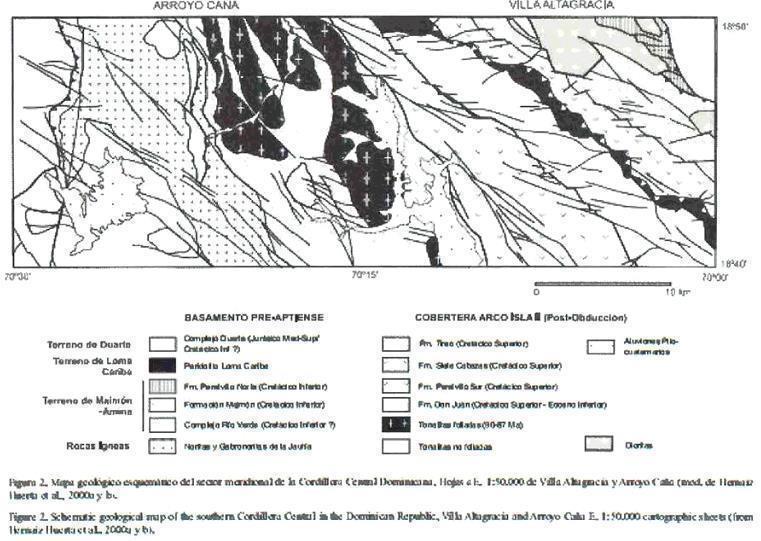

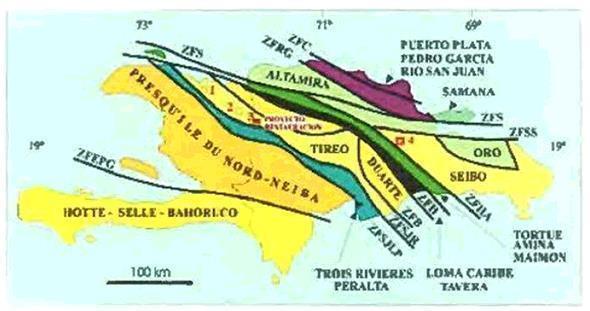

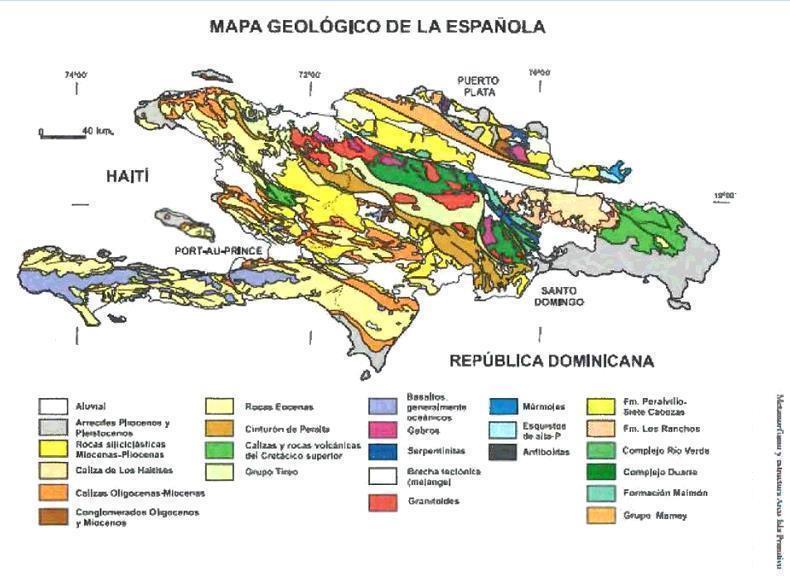

The mineralization of greater economic interest in the Dominican Republic correspond to massive sulphide ores of hydrothermal replacements and laterite concentrations. The massive sulphides are preferentially located in the Maimon Formation and formations Los Ranchos, Duarte, Tireo and Peralvillo. In the Maimon Formation have identified several Prospects Massive Sulphide mineralization such as: Cerro Maimon Loma Barbuito and Heavy.

The epithermal mineralization are preferably in the Formations Los Ranchos and Tireo, where you can highlight the tank sulphides Pueblo Viejo (Au, Ag, Zn) the deposit of Managua (Au, Ag) Deposits and Centenario (Au) and Candelones (Au).

The case of Pueblo Viejo is very particular, if the hypothesis that relates to Maar is true, the chances of a similar system there are very limited. If the situation in which the epithermal system associated with massive sulfide and acidic domes is correct, then there are more chances of finding similar systems.

The assessment of areas with mining potential of metallic minerals is related to geodynamic processes developed in Hispaniola, in origin related to plate tectonics. The evolution of the Caribbean Plate presents different episodes of continuous transformation, this evolution is also lithological with input from volcanic material and intrusion of plutons and subsequent metamorphic process. During these developmental periods affected include between Hispaniola island arc formation in the Upper Jurassic and Cretaceous to Eocene, although there is evidence of Quaternary volcanism without major contributions of metallic ores.

| 6 |

| Table of Contents |

The most representative tectonic events are associated with the contribution of volcanic rocks and large primary guidelines where this feature is in line with its geotectonic framework that is particularly favorable to the formation of various types of mineralization, many with great importance and economic significance. The global metallogenic analysis match the extraordinary fertility of the fields of island arc for the genesis of mineral deposits, especially regarding major types, such as hydrothermal volcanogenic massive sulfide (VHMS), epithermal, porphyry copper deposits including.

To obtain positive results in the exploration program, efforts will be directed to develop a mining project of exploitation of metallic minerals, to meet the current needs of the international market.

Exploration Program Proposed

In order to meet the principal conditions and logistical details, geological, petrological, chemical, mineralogical and assess the probable and exploitable reserves Rock of interest in targeted areas, besides establishing a fundamental principle of social conditions and environmental policies available for the project in question, referred the following activities.

Planning

In the management work, we will rely on the basic information, from technical research and / or scientific area or close to it and consulting thematic mapping of the area. The analysis of this information will allow us to establish a geological model of the reservoir, and thus determine the logistics to develop during the scanning process. This information is required to identify areas with mining potential, plus you may define areas that warrant further study in detail.

Geological Survey

To have a better understanding of project success, we will do a series of evaluation studies and collection of information in order to know all the geological, mineralogical and structural area of interest and surroundings were made, a geological survey of semi detailed will be made, aimed at identifying the main existing lithological units and make systematic sampling in order to differentiate varieties of rock lithology interest and to demarcated according to their physical characteristics and chemical composition, and develop a geological model that allows us to infer their behavior from the sub-soil, topography correlating with outcrops identified and grouping it by interest group, according to the demands and solutions satisfaction.

| 7 |

| Table of Contents |

Exploration

The exploration phase of the mining project will be in two stages, regional and detail. The first is the recognition of lithologic units in the area, determining its extent and thickness and fracturing associated with larger structures such as faults.

A regional sampling will be made in photogeological scale in the plan 1 / 20,000.00. Exploring in detail consist of a selective sampling of rocks and active sediments to determine their metallogenic characteristics, in the same manner, stratigraphic columns of geological formations will arise calicatas be planned, nets for soil sampling was conducted, and all this field information will be done with GPS.

The exploration phase will conclude with geological-mining information, where the reservoir model is presented, and the geophysical and / or drilling campaigns are designed, the volume of potential reserves are determined, the overburden will be estimated and economic viability of the mining project will be assessed.

It also includes the set of activities that allow access to (the) site (s) and the establishment of basic infrastructure for the mining project, this includes the acquisition of mineral rights and environmental permits to start mining, detailed design and construction of supports, as well as machinery, budgeting, and economic viability.

After performing all basic studies to detailed engineering we will begin with preliminary work in the area where the fronts to undermine and its facilities are located. Among the highlights infrastructure access roads, networks of power and drinking water, the ground for the installation of the processing plant, the area of collection of raw materials and waste dumps for recovery of mined fronts.

Exploration Program

In order to achieve the main logistics, geological and mining details, we have scheduled a plan of geological and mining work to be done in the area of the Concession Exploration for Minerals and Precious Metal (Gold, Silver, Copper, Zinc and Lead), called "LA MINA", in addition to assessing the socio-economic and environmental conditions that currently exist in the area of the mining project.

General Recognition

The purpose of this phase is to delineate areas of interest that must be priority targets for a detailed study. This stage include the definition of regional geological environment and mining, using as point maps and existing items obtained from the previous compilation phase. The purpose is to understand the high-grade mineralization.

It is planned to map scale 1 / 20,000.00 of geological formations, structures, alterations and occurrences of mineralization to locate all representative outcrops in the area, while conducting geochemical sampling of mineralized outcrops and altered. These activities will be supported by the database collected during the compilation, including satellite imagery and aerial photographs. The photographs will be used alongside the available topographic maps, GPS receivers and polygon drawn with compasses and tapes countryside location.

The fieldwork will be conducted by geologists, prospectors assisted by technicians and local labor, forming brigades of field, to which they are assigned specific areas. These teams will be structured based on logistical convenience, and as it progresses the proposed program, will be gathering information in a database to be closing anomalies discovered.

| 8 |

| Table of Contents |

Rocks and Sediment Sampling Assets

During this phase, a detailed sampling of rocks and sediments assets to complement previous work in the area program will be implemented. River sediments will be collected both permanent and seasonal streams. Initially, a pilot study, in each sampling one sifted sample and a concentrated punt will collect and examine which exists among the best signal geochemical anomalies. We anticipate at this stage to collect approximately one sample per stream or ravine, which could mean an approximate sampling to 5 samples per square kilometer, or requiring the area.

Samples shaped rock chips will be taken from any or altered mineralized outcrop is located. These samples will be taken at the discretion of the leading field geologist to obtain a representative specimen of mineralization and / or alteration. Rock samples will be taken along gutters, cut through the mineralized outcrops and / or altered.

Rock samples and sediments will be stored in plastic bags, labeled for identification, packaged and sent for chemical analysis through a chain of custody to a laboratory accreditation and international solvency, we can ensure data consistent and reliable exploration, and allow us track progress in real-time results to be closing or expanding areas of anomalies.

Samples will be analyzed by atomic absorption or induced multiple elements plasma, among which include Au, Ag, Ba, Bi, Cd, Co, Cu, Fe, Ga, Hg, In, Pb, Sb, Sn, Te, W, Zn, and other indicators of mineralization associated with the type of deposit explored.

The results of the analysis are plotted together to geology, in detailed maps of anomalies and limits of these anomalies will be determined mediantes geostatistical analysis of the samples.

| 9 |

| Table of Contents |

Cutting Lines and Soil Sampling

During this phase of mapping it is planned to establish one or more meshes soil sampling due to the efficiency of this method of exploration to define areas of hidden mineralization, covered by soil or weathering. The grid or mesh will be established with topography and surveying using precision equipment such as traffic type total station and / or differential GPS. The sampling interval to be used, typically in the order of 50-200 meters apart lines and from 25-100 meters between samples.

Soil samples will be taken into wells dug by hand with pick and shovel or hand holes using Auger type, from a depth of about 50 Cms., Or enough to sample the horizon "B" of the soil profile. Like rock samples and sediments, soil samples will be sent on the same basis for analysis to an accredited laboratory with recognized international standards of quality.

| 10 |

| Table of Contents |

Detailed Geological Mapping

During this phase, we will develop detailed maps at 1: 10,000 or of larger outcrops and cuts along roads, drainage, firm and so on. Will be taken detailed structural measures, including stratifications, faults and joints, folds, foliations and addresses of veins. Simultaneously a systematic geochemical sampling along continuous gutters or chip on outcrops are performed.

As a basis for this detailed mapping will be used aerial photos, GPS receivers and detailed topographic maps as well as a network of local control surveying points along a grid or mesh established specially for this purpose.

Throughout the exploration program a vast precaution is taken to ensure quality control in the collection and analysis of samples, especially rocks, by including verification testing with known standards and random repetition of a number of samples for ensuring the accuracy of the analytical methods.

The results of chemical analyzes will be plotted in a digital format previously designed to complement previous work, and using computer programs specially designed for this purpose.

The results will be statistically analyzed to extract the three-dimensional anomalies of interest to them. Similarly, the results will be periodically checked by routine checkups in separate laboratories.

Pits and trenches

Digging pits and / or trenches on areas where it is necessary to expose rocks covered by soil and vegetation will be considered. The excavations will be carried out using a hydraulic backhoe or manually. This motor is compact and does not require access preparation. We will cut loose soil to 2.80 m (9'2''feet) deep to learn more about soil and subsoil, considering that there is no pattern yet to define where the first ends and begins the second.

The outcrops and areas of mineralization and / or discovered alterations during this activity will be mapped in detail and extensively sampled. The samples will be processed and analyzed in a similar way to the gutters and / or rock chip collected in the program of detailed mapping and geochemistry.

For this activity, while the works are in progress we will implement security measures such as fencing work areas and mark them properly, in order to restrict access to the work area to authorized personnel only. Once we have completed the work of excavation, mapping and sampling of the trenches and / or pits, a program of claim impacted areas will be conducted. This will include filling the trenches and / or pits used for the same purposes extracted material, restoring soil and topsoil removed and replanted with grass, shrubs and / or endemic plants.

Geophysics

Induced polarization (IP) by the time domain technique that provides power to the ground with a pulse of alternating square wave upon shall be determined by current injection apparent resistivity bulk soil to identify metal mineralization related ground and calculated from the input current and voltage primary measures mineralized zones and ensure other studies such as drilling, which will allow us to confirm, across the mineralization identified at depths and model them with surface results their similarities with relatively strong anomalies. Also will be identified and confirmed the structures or failure and abnormal concentrations for the Exploration Concesion (Gold, Silver, Copper, Zinc and Lead), called LA MINA.

| 11 |

| Table of Contents |

Drilling

A first phase of exploratory drilling include at least about 4200.00 meters of diamond drilling on priority areas. It is not possible without a priori knowledge of the geology of the area and the proposed program of geophysics, determine the specific parameters of each probe, which will be distributed according to the anomalous areas and disturbed mineralization identified, but one would expect that most of these exceeding 150 meters. The polls will in diameter NTW (2,205 Sch. (5.61 Cms.)) Method that guarantees a 38.00% increase in the diameter of the resulting core NQ model, since it is characterized as a cut thin wall, increasing the cutting efficiency and recovery.

The orientation of these will be determined by the geological conditions of the explored areas and the results of the geophysical program.

The reason for choosing this drilling system is the versatility with which you can move this drill to remote or inaccessible places, without having to develop or build access roads, equipment can also be disassembled and built by hand, and space required, which shall never exceed 25.00 Mts2 addition to this equipment requires approximately 20.00% of tork, resulting in a significant drop in fuel consumption.

Because the perforations require water for circulation and cooling of the drill, it will be obtained from local surface sources. This water will be pumped up to drilling platforms, which will enter into a semi-closed circuit. Water will enter the circuit only when the poll and not re-circulate to the surface, but it infiltrates into the well. Fluid within the circuit is usually added drilling additives based on biodegradable polymers and bentonite clays. Cement may be used to control cavities and collapse of the probes to how to stabilize the direction of drilling or prevent leakage of water therefrom. These products are non-toxic and rapidly degradable, however will be treated with extreme caution and will be used in the minimum quantities required and the time when circumstances so require.

The drilling program will be carried out under the constant supervision of geologists to ensure the quality of work and compliance by the contractor with the standards of environmental protection and safety set by the developer of the award.

The exploration will be mapped to locate progress and depth deviation. After completion of the wells will be jacketed with PVC plastic, a way to ensure that no occurrence of future accidents and ensure, if required, test some method of three-dimensional geophysical or any other study.

Evaluation of Results

Once the exploration program completed, all information generated by the laboratory analysis will be compiled into a specialized computer system. Vertical sections and plan be developed and a three-dimensional model of the mineralization. Similarly the economic potential of any found reservoir is modeled using geostatistical methods.

Possible extensions of mineralization and the occurrence of other previously unrecognized mineralized zones were considered. Based on these interpretations the next phase of the program will be designed, if the results obtained to date warrant will be a reserve evaluation using reverse circulation drilling. To complement this program drilling with diamond cutting and retrieval purposes witnesses detailing the geological knowledge of the area will continue.

If the drilling results continue to provide positive information, they will not stop until both are not managed through the mineralized zone, and the next step, once you have located a significant mineral resource is to conduct a preliminary feasibility study and consider all possible scenarios for an eventual mining operation.

Calculation of Mineral Reserves

From the geological information obtained and the contributions obtained from the test pits and boreholes in the area, we will select the áreas with greater potential and delimit deposits most relevant sites.

| 12 |

| Table of Contents |

Thus determine the probable reserve of the Concesion Exploration for Basic and Precious Metals and Minerals (Gold, Silver, Copper, Zinc and Lead), called "LA MINA" to define lifetime, compared to operating model predefined would last the reserve of (the) site (s), determining all relevant investments at short, medium and long term.

Making Bi-annual and Annual Reports

To comply with the provisions of Article 72 of the Mining Law No. 146, dated 4 June 1971 and Regulation No. 207-98, we will submit to the Directorate General of Mines, Three (03) Semiannual Reports with the progress of major exploration activities during the three (03) years of this application. These reports will supply any additional information on progress related to development in the present application where Mining Concession is located.

The Interim Report will present the progress of exploratory work which will include the sequence of activities and expenditures.

The Annual Reports, will inform the results obtained during the period, including sampling, surveying and geological correlations, screening methods employed for localization and definition of deposits of mineral substances.

It is anticipated that during the first three years of exploration we will have enough information to decide whether waiving the requested area or an exploitation concession is requested.

Socio-Economic Environmental Study

In order to know in details all the features of the area to evaluate, we will make a general recognition of it, where we will measure:

Flora and Fauna

First you must know the vegetation of the area, what are the endemic plants of the region and where the main aquifer runoff are, for the purpose of making an inventory of the flora and fauna and in the future have defined the remediation plan it would be implemented at project completion.

Population

Population of major communities and their modus vivendis, main sources of income, profits or scope of communities regarding the possession of services such as electricity, drinking water supplies and other benefits, is a fundamental part of the study to be performed.

Ways of Communication

Major roads, be it roads and highways and conditions, will be essential for the advancement of the exploratory work guidance, as these allow us to have a major advance, allowing us to penetrate different areas, which will be the starting point for areas.

| 13 |

| Table of Contents |

Economic Feasibility Study Project

With all aspects of both geological, mining, technological, environmental, logistical and social acquaintances, field studies will be prepare in orderto establish the economic feasibility for implementation of the project.

In this context, we will prepare a study of the market or the products and sub-products derived from the operations at local, regional and international levels to quantify all the costs associated with the production, the level of investment required for the development will be defined and implementation, and in the same way, parameters to measure the level of desirability or feasibility of using the investment needed in implementing the project evaluated and the return of the capital invested will be calculated.

Exploration Budget – Phase II

|

Item Units |

|

Number and Cost |

|

|

Total Cost USD |

| |

|

|

|

|

|

|

| ||

|

Salaries |

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Supervising Geologist |

|

22 days @ $600/day |

|

|

|

13,200 |

|

|

Geological Assistant |

|

22 days @ $200/day |

|

|

|

4,400 |

|

|

|

|

|

|

|

|

|

|

|

Transportation |

|

1,500 km @ $0.75/km |

|

|

|

1,125 |

|

|

Camp costs/lodging |

|

22 days @ 100/day |

|

|

|

2,200 |

|

|

|

|

|

|

|

|

|

|

|

Compiliation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Data and digitizing |

|

15 day @ $150/day |

|

|

|

2,250 |

|

|

Drill hole interp & modeling |

|

11 days @$600/day |

|

|

|

6,600 |

|

|

Structural consultant |

|

17 days @ $200/day |

|

|

|

3,400 |

|

|

|

|

|

|

|

|

|

|

|

Soil Geochemistry |

|

|

|

|

|

12,500 |

|

|

Diamond drilling (initial test holes) |

|

150 m @ $60/m |

|

|

|

9,000 |

|

|

Assay of Drill core |

|

150 samps @ $34/sample |

|

|

|

5,100 |

|

|

|

|

|

|

|

|

|

|

|

SUBTOTAL |

|

|

|

|

|

59,775 |

|

|

Contingency |

|

10% |

|

|

5,978 |

| |

|

|

|

|

|

|

|

|

|

|

TOTAL USD |

|

|

|

|

|

65,753 |

|

Exploitation Concession Application

Geological explorations in the requested área called "LA MINA" has positive results, ie one or more anomalies and / or damage to metallic minerals with a law that allows a rational exploitation locate the area and the economic evaluation studies would evidence that these resources can be developed in an economically viable project, then all information obtained will be collected, and this compendium proceed to make the corresponding file to request the Dominican Government, through the Directorate General of mining, a mining concession area delimiting the deposit or deposits evaluated, following the requirements and standards set out in the Mining Act in force and the provisions of the Implementing Regulations of this Law and the governing body of the official mining sector.

| 14 |

| Table of Contents |

Design Method of Operation

Knowing the geological and logistical conditions of the area and the distribution and amount of exploitable reserves, in the event that these justify their exploitation, and knowing the demand for raw materials of the project, the main characteristics or mining methods to be defined that they allow an optimal and rational use of useful resources, minimizing negative environmental effects, allowing us to maintain harmony among neighbors, as active principal, and adjust to a program of corporate social responsibility, to be efficient and the transfer of technology and modern mining techniques that were needed by.

As a structural study, defining the directions and dips, the geometry of the reservoir, we would identify the technology to be used, equipment, machinery, staff make rational exploitation of any mineral deposit, also determining demand and possible sources of supply for the project of water and energy resources.

Environmental Impact Assessment Project

Parallel to the request for granting exploitation of resources assessed and known technical features in the areas of geology, mining, calculation of reserves and others, and economic conditions of the project we intend to make in the requested area shall be dealing with the Ministry of Environment and Natural Resources Terms of Reference for the EIA will be required to complete the permits for obtaining prior to the start of any mining operations Environmental License.

Following the specifications of the Terms of References cited and with the multidisciplinary team needed, the Environmental Impact Study and design of the Management Plan and Environmental Adjustment that must be implemented operations will take place before, during and after the conclusion.

As access for exploratory work mapping, sampling and drilling will be used the same roads used by villagers (farmers), so that logging or tree or shrub is not necessary, nor removal will be necessary topsoil throughout the exploration program (soil and rock geochemistry, geophysics and drilling).

So we would be betting on developing a mining based on a commitment to socio-environmental responsibility, maintaining a close relationship with the economic socio-physical-biotic and scenarios in different existing ecosystems, allowing participation of different social actors and designing instruments for the recovery and conservation of the environment and renewable natural resources, while sustainable development of mining and neighboring communities would be promoted as the established processes of environmental management model base environmental planning is created and renewable natural resources management plans through which they can achieve the goals of recovery, conservation and sustainable development to ensure that management involves environmental education and citizen participation, knowledge, conservation and sustainable use of biodiversity, pollution control, management, use and control of renewable natural resources.

Competitive Factors

We are a small exploration company with limited personnel and funds. There are many other exploration companies who have more personnel and funds at their disposal to carry out exploration and extraction on their concessions. Further, they will be able to attract expertise and workers better with higher salaries. This is a huge disadvantage for us.

Recursos Queliz’s Main Product

Recursos Queliz’s main product will be the sale, if a mineral ore reserve is identified on La Mina mineral property, of gold or other minerals that can be extracted from it once the claim has been explored.

| 15 |

| Table of Contents |

Exploration Facilities

The Company has no plans to construct a mill or smelter on La Mina and the likely hood of an ore body being discovered is slight. While in the exploration stage, the crew of workers will be housed in tent located on La Mina or in is a town nearby and then the facilities in the town will be used. This will initially avoid building any structures either permanent or removable on La Mina.

We have no plant or significant equipment, nor are we going to buy any plant or significant equipment during the next twelve months. We will not buy any equipment until we have both located a body of ore on the mineral claim to be identified and have determined the economical feasibility of its extraction.

Employees

Besides the director, no other employees exist within the Company. For any future exploration program on La Mina, we will likely retain the services of the geologist. He will be responsible for hiring addition personnel to assist in the exploration as he sees fit. Once the exploration work is complete, the geologist and any other personnel he has hired will be terminated to reduce our on-going expenditures. Others may be hired on short-term bases as needed. Nevertheless, we are hoping to be able to hire full time employees once we have proven ore reserves on La Mina claim.

Consulting Fees

Other than the fees spent to prepare the effective registration statement and for identifying a market maker for the Company, the Company is not expecting to hire any other consultants in the near future. This does not take into consideration consulting work relating to future geological reports on La Mina. Such consulting fees cannot be determined at this time.

Contractual Obligations

We currently have no contractual obligations. We have not entered into any contracts with the director, contracting geologist or other individuals or companies. There are no contracts for equipment or with mineral processing and refining facilities. There are also no contracts with potential purchaser or joint-venture partners.

Research and Development Expenditures

Recursos Queliz has not expended any money on research and development since its inception.

Patents and Trademarks

Recursos Queliz does not have any patents or trademarks.

We are not a party to any pending litigation and none is contemplated or threatened.

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

| 16 |

| Table of Contents |

No Public Market for Common Stock

There is no public market for our common shares due to not being either quoted or listed on a recognized stock exchange. Recursos Queliz will make an application to FINRA for a quotation on the OTCBB now that its registration statement has become effective. There is no guarantee that the Company’s shares will ever be quoted on the OTCBB.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) monthly account statements showing the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a suitably written statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject to these penny stock rules. Therefore, if our common stock becomes subject to the penny stock rules, stockholders may have difficulty selling those securities.

Common Shares

At this time the outstanding number of common shares is 90,000,000. Only 20,000,000 of these common shares were registered under our effective registration statement and have been sold by our director to various third parties. All our outstanding common shares are fully paid and non-assessable.

Our shareholders are entitled to one vote for each share owned on any and all matters brought forth at a shareholders’ meeting. There are no cumulative voting rights, which mean that the shareholder or shareholders owning 50% of the issued and outstanding shares in our capital stock can elect the entire Board of Directors. Therefore, any shareholder or shareholders, cumulatively, with less than 50% cannot elect any director to the Board of Directors on their own. Pursuant to the provisions of Section 78.320 of the Nevada Revised Statutes (the “NRS”) and Section 8 of our Bylaws, at least one percent of the outstanding shares of stock entitled to vote must be present, in person or by proxy, at any meeting of stockholders in order to constitute a valid quorum for the transaction of business. Actions taken by stockholders at a meeting in which a valid quorum is present are approved if the number of votes cast at the meeting in favour of the action exceeds the number of votes cast in opposition to the action, provided, however, that directors are elected by a plurality of the votes of the shares present at the meeting and entitled to vote. Certain fundamental corporate changes such as the liquidation of all our assets, mergers or amendments to our Articles of Incorporation require the approval of holders of a majority of the outstanding shares entitled to vote.

| 17 |

| Table of Contents |

Holders of our common stock have no pre-emptive rights, no conversion rights and no subscription rights. There are no redemption or sinking fund provisions applicable to the common stock.

The holders of our common stock are entitled to receive dividends on a pro rata based on the number of shares held, when and if declared by our Board of Directors, from funds legally available for that purpose. Section 78.288 of Chapter 78 of the NRS prohibits us from declaring dividends where, after giving effect to the distribution of the dividend we would not be able to pay our debts as they become due in the normal course of business; or except as may be allowed by our Articles of Incorporation, our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of stockholders who may have preferential rights and whose preferential rights are superior to those receiving the distribution. We do not, however, intend to pay any dividends in the foreseeable future and currently intend to retain all future earnings to finance our business.

Preferred Stock

At present, we have no plans to issues any preferred stock. If and when it is done, this would be under the authority of our Board of Directors, which would then determine the rights, privileges and restrictions thereof.

Rule 144 Share Restrictions

Under Rule 144, an individual who is not an affiliate of our Company and has not been an affiliates at any time during the three months preceding a sale and has been the beneficial owner of our shares for at least six months would be entitled to sell them without restriction. This is subject to the continued availability of current public information about us for the first year that can be eliminated after a one-year hold.

Whereas an individual who is deemed to be an affiliate and has beneficially owned shares in our Company for at least six months can sell their shares in a given three month period as follows:

|

|

1. | One percent of the number of shares of our Company's common stock then outstanding, which the case of our current director and officer, will equal approximately 700,000 shares as of the date of this Form 10-K; or |

|

|

|

|

|

|

2. | The average weekly trading volume of our Company's common stock during the four calendar weeks preceding the filing of a notice on form 144 with respect to the sale. |

As of the date of this Form 10-K, we are a company that has either no or nominal operations and no or nominal assets (a “shell company”). In particular, Rule 144 is not available for securities initially issued by a shell company, whether reporting or non-reporting, or a company that was at any time previously a shell company, unless the company:

|

|

● | has ceased to be a shell company; |

|

|

|

|

|

|

● | is subject to the Exchange Act reporting obligations; |

|

|

|

|

|

|

● | has filed all required Exchange Act reports during the preceding twelve months; and |

|

|

|

|

|

|

● | at least one year has elapsed from the time the company filed with the SEC current Form 10 type information reflecting its status as an entity that is not a shell company. |

| 18 |

| Table of Contents |

As a result, our sole director and officer, being an affiliate, and any other person initially issued shares of our common stock, excluding those shares registered in our effective registration statement, may not be entitled to sell such shares until the above conditions have been satisfied. Upon satisfaction of these conditions, such sales by our director would be limited by the manner of sale provisions and notice requirements and to the availability of current public information about us as set forth above.

HOLDERS OF OUR COMMON STOCK

As of November 30, 2017, there were 41 shareholders holding 90,000,000 common shares of which our sole director and officer hold 70,000,000 common shares.

DIVIDENDS

Recursos Queliz’s Articles of Incorporation or Bylaws do not restrict it from declaring dividends. Nevertheless, the Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| 1. | We would not be able to pay our debts as they become due in the usual course of business; or |

|

|

|

| 2. | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution. |

Recursos Queliz has not declared any dividends since its inception and does not conceive that it will be declaring any dividends in the near future. Management wants to retain any excess funds in the Company for working capital and for further exploration on its La Mina mineral claim.

The holders of our common stock are entitled to receive dividends as may be declared by our Board of Directors; are entitled to share ratably in all of our assets available for distribution upon winding up of the affairs our Company; and are entitled to one non-cumulative vote per share on all matters on which shareholders may vote at all meetings of the shareholders.

The shareholders are not entitled to preference as to dividends or interest; preemptive rights to purchase in new issues of shares; preference upon liquidation; or any other special rights or preferences.

There are no restrictions on dividends under any loan or other financing arrangements.

Outstanding Stock Opinion, Purchase Warrants and Convertible Securities

Recursos Queliz has not issued any stock options to its sole director nor has it attached share purchase warrants to the shares issued and outstanding. There are no convertible securities as of the date of this Form 10-K. Queliz has not registered any shares for sale by security holders under the Securities Act other than as disclosed in our effective registration statement.

Our authorized capital consists of 400,000,000 shares of common stock, par value $0.001 per share, of which 90,000,000 shares are presently issued.

Non-Cumulative Voting.

The holders of our shares of common stock do not have cumulative voting rights, which means that the holders of more than 50% of such outstanding shares, voting for the election of Directors, can elect all of the Directors to be elected, if they so choose. In such event, the holders of the remaining shares will not be able to elect any of our Directors.

| 19 |

| Table of Contents |

Employment Agreements

We have no employment agreement with our executive officer nor any other individual.

Equity Compensation Plans, Stock Options, Bonus Plans

No such plans or options exist. None have been approved or are anticipated. No Compensation Committee exists either.

Pension Benefits

We do not maintain any defined benefit pension plans.

Nonqualified Deferred Compensation

We do not maintain any nonqualified deferred compensation plans.

Change in Control of Our Company

We do not know of any arrangements that might result in a change in control.

Registered Agent

We are required by Section 78.090 of the Nevada Revised Statutes (the “NRS”) to maintain a registered agent in the State of Nevada. Our registered agent for this purpose is American Corporate Enterprises, 123 W Nye Lane, Suite 129, Carson City, NV 89703. All legal process and any demand or notice authorized by law to be served upon us may be served upon our registered agent in the State of Nevada in the manner provided in NRS 14.020(2).

Transfer Agent

We have engaged the service of Action Stock Transfer Corp., Suite 214 – 2469 E. Fort Union Blvd, Salt Lake City, Utah, 84121, to act as transfer and registrar.

Debt Securities and Other Securities

There are no debt securities outstanding or other securities.

| 20 |

| Table of Contents |

RECENT SALES OF UNREGISTERED SECURITIES

None.

We filed with the SEC a registration statement on Form S-1 under the Securities Act of 1933, as amended, with respect to the offering of our common stock. For further information, with respect to us and our common stock offered under our effective registration statement, we refer you to the registration statement, including the exhibits and the financial statements and notes filed as a part of the registration statement. Statements contained in this Form 10-K as to the contents of any contract or any other document referred to are not necessarily complete, and in each instance, we refer you to the copy of the contract or other document filed as an exhibit to the effective registration statement. Each of these statements is qualified in all respects by this reference.

The exhibits to the effective registration statement should be referenced for the complete contents of these contracts and documents. You may obtain copies of this information by mail from the Public Reference Section of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549, at prescribed rates. You may obtain information on the operation of the public reference rooms by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports, proxy statements and other information about issuers, like us, that file electronically with the SEC. The address of that website is www.sec.gov.

Since our registration statement has become effective, we are subject to the information reporting requirements of the Securities Act and we will file reports, proxy statements and other information with the SEC. These reports, proxy statements and other information will be available for inspection and copying at the public reference room and website of the SEC referred to above. We do not at this time have our own website.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS.

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our consolidated financial statements and their corresponding notes included elsewhere in this Form 10-K. The following discussion and analysis contains forward-looking statements that reflect our plans, estimates and beliefs. These forward-looking statements involve risks and uncertainties. Our actual results could differ materially from those discussed in the forward-looking statements. You should review “Risk Factors” for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by these forward looking statements.

Overview

Recursos Queliz is a start-up company. We were incorporated in the State of Nevada on September 20, 2012. Previously we held the rights to the mineral rights to the Queliz Concession before it was cancelled by the Director of Mines for the Dominican Republic. The Company incorporated a wholly-owned subsidiary in the Dominican Republic on September 28, 2012 named El Caporal Management, SRL. which originally held the mineral rights to the Queliz concession and now to La Mina claim.

We previously have undertaken two surface exploration programs on the Queliz Concession. The first in September 2012 and the second in August 2013. Both these exploration programs comprised obtaining soil, sediment and rock samples from various areas of the Queliz Concession. Unfortunately, the Director of Mines in the Dominican Republic decided to cancel our rights to the minerals on the Queliz concession and hence we have no further rights to such minerals. During the current period the Company obtained the rights to the minerals on La Misa mineral claim located in the Dominican Republic.

We have a limited operating history and have not yet generated or realized any revenues from our activities. We are in the early stages of exploration, and there is a reasonable likelihood no revenue will ever be derived from any mineral concession we obtain in the futue. Even if exploration were successful, comprehensive economic and legal studies would also have to demonstrate the feasibility of production.

| 21 |

| Table of Contents |

Our financial statements contained in this Form 10-K have been prepared on a going concern basis, which assumes that we will be able to realize our assets and discharge our obligations in the normal course of business. No adjustments have been included in the financial statements; these adjustments would be necessary if we could no longer continue as a going concern.

Our auditors have issued a going concern opinion. In other words, there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional financing. This is because we have not generated any revenues and no revenues are anticipated until we, if ever, locate a source of valuable minerals, extract them and sell them. Thus, we incurred a net loss from September 20, 2012 (inception) to August 31, of 2017 of $257,748. To continue, we must raise cash from other sources.

PLAN OF OPERATIONS

Our financial information deals primarily with our current liquidity as a result of being still in the exploration stage. As of August 31, 2017 we had negative working capital of $167,748 and is expected to increase still further during the next few months, Our director is not committed to advancing us funds although he did do so in January and February 2014 in the amount totaling $50,000 and a two further advances of $25,000 in August and November 2015 and three advances in 2017 totalling $35,000. If we do not raise additional funds, we will increase our working capital deficiency by the end of the next twelve months. Our future financial success is dependent on the successful finding and exploring La Misa mineral claim in the Dominican Republic. Such exploration may take many years and hefty financial investment to complete. Our success doing this is impossible to predict at this time. The value of any mineral reserve we might find would also be dependent on factors beyond our control such as currency exchange rates, fluctuating metal prices and mining regulations in the various jurisdictions we obtain mineral claims.

Funds Required over the Next Twelve Months.

We are committed to the following expenditures over the next twelve months which must be met if we are going to remain a going concern. Presently, we have limited available funds to meet these obligations unless our sole director is willing to advance us further funds. The following expenditures are estimates made by management based on what he feels will be the final amount due and payable. All amounts herein are expressed in United States dollars.

|

Estimated Expenditures for the twelve months |

|

|

|

|

Total |

| ||

|

|

|

|

|

|

|

| ||

|

Independent accountant performing bookkeeping services (i) |

|

$ | 7,140 |

|

|

|

| |

|

Auditor (i) |

|

|

11,000 |

|

|

$ | 18,140 |

|

|

Filing fees including edgar charges (ii) |

|

|

|

|

|

|

3,000 |

|

|

Office – courier, photocopying and faxing |

|

|

|

|

|

|

400 |

|

|

Transfer agent – Annual Report filed with the Secretary of State for Nevada and the issuance of share certificates to shareholders |

|

|

|

|

|

|

1,700 |

|

|

Subtotal |

|

|

|

|

|

|

23,240 |

|

|

Accounts payable to independent third parties – as at August 31, 2017 |

|

|

|

|

|

|

34,588 |

|

|

|

|

|

|

|

|

|

57,828 |

|

|

Less: Cash on hand as of August 31, 2017 |

|

|

|

|

|

|

(3,132 | ) |

|

|

|

|

|

|

|

|

|

|

|

Additional funds required for the next twelve months |

|

|

|

|

|

$ | 54,696 |

|

(i) Represents fees for the next twelve months.

(ii) Future charges for edgarizing the Form 10-K and 10-Qs for the next twelve months.

| 22 |

| Table of Contents |

It is estimated from the above cash analysis that the present cash position will not be sufficient for twelve months.

The sources available to the Company are as follows:

• Further advances from our sole director and officer;

• Seeking institutional lending with a personal guarantee from our sole officer and director; or

• Once the Company has obtained a quotation on the OTCBB, if it ever does, to enter into an underwriting in order to seek funds from the investing public.

At the present time management has not considered any of these options.

RESULTS OF OPERATIONS

Expenses Incurred in Operations to Date.

The following are the expenses incurred in operation from the date of incorporation, being September 20, 2012, to August 31, 2017 as shown in the books of Recursos Queliz, Inc and El Caporal Management SRL;

|

|

|

Recursos Queliz, Inc. |

|

|

El Caporal Management |

|

|

Consolidated Total |

| |||

|

|

|

|

|

|

|

|

|

|

| |||

|

Independent bookkeeper and auditors |

|

$ | 66,985 |

|

|

$ | - |

|

|

$ | 66,985 |

|

|

Exploration – two programs of surface exploration |

|

|

- |

|

|

|

92,060 |

|

|

|

92,060 |

|

|

Consulting fees |

|

|

27,725 |

|

|

|

- |

|

|

|

27,725 |

|

|

Edgarizing services |

|

|

11,175 |

|

|

|

- |

|

|

|

11,175 |

|

|

Filing fees – Interim Report on Officers, Directors |

|

|

595 |

|

|

|

- |

|

|

|

595 |

|

|

Filing fees – filing of Dominican Tax return and other |

|

|

- |

|

|

|

5,040 |

|

|

|

5,040 |

|

|

Incorporation of companies |

|

|

689 |

|

|

|

3,000 |

|

|

|

3,689 |

|

|

Legal - fees charged to opinion letter on tradability of shock |

|

|

1,525 |

|

|

- |

|

|

|

1,525 |

| |

|

Legal – fees charged by Dominican attorney |

|

|

- |

|

|

|

23,397 |

|

|

|

23,397 |

|

|

Office – photocopying charges |

|

|

1,513 |

|

|

|

- |

|

|

|

1,513 |

|

|

Office – membership to National Geological Association |

|

|

- |

|

|

|

885 |

|

|

|

885 |

|

|

Transfer agent – Initial List of Officers and preparation of incorporation documents, annual report |

|

|

4,201 |

|

|

- |

|

|

|

4,201 |

| |

|

Travel – trips by attorney to Santa Domingo for meeting with Ministry of Mines and Energy |

|

- |

|

|

|

5,958 |

|

|

|

5,958 |

| |

|

Write-off of cost of Queliz Concession |

|

|

- |

|

|

|

13,000 |

|

|

|

13,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total expenses to August 31, 2017 |

|

$ | 114,408 |

|

|

$ | 143,340 |

|

|

$ | 257,748 |

|

| 23 |

| Table of Contents |

Recursos Queliz pays all the expenses on behalf of El Caporal Management SRL thereby controlling the disbursements of funds.

Fiscal Year Ended August 31, 2017 compared to the period from August 31, 2016

|

Account |

|

August 31, 2017 |

|

|

August 31, 2016 |

| ||

|

|

|

|

|

|

|

| ||

|

Accounting and audit |

|

$ | 17,140 |

|

|

$ | 17,140 |

|

|

Consulting |

|

|

8,000 |

|

|

|

15,000 |

|

|

Edgarizing |

|

|

3,000 |

|

|

|

3,223 |

|

|

Exploration |

|

|

12,980 |

|

|

|

12,980 |

|

|

Filing fees |

|

|

- |

|

|

|

650 |

|

|

Legal |

|

|

5,000 |

|

|

|

2,800 |

|

|

Office |

|

|

127 |

|

|

|

625 |

|

|

Transfer agent fees |

|

|

1,108 |

|

|

|

1,001 |

|

|

Travel |

|

|

- |

|

|

|

1,596 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

$ | 47,355 |

|

|

$ | 55,015 |

|

The expenses in the current year decreased by $7,660 due the a decrease in consulting fees relating to the consultant in the year ended August 31, 2016 charges a fee of $15,000 to identify a market maker for the Company. Unfortunately, the market maker choosen no longer wanted to file Form 15c-211. During the current year another consultant was engaged to identify a market maker but the Company has not yet proceeded with submitting the documents to this market maker. Legal expenses increased at of August 31, 2017 by $2,200 due to the attorney in the Dominican Republic having to completer certain filing with the Ministry of Mines for the Dominican Republic. No travel expenses were incurred during the current year compared to $1,596 in the previous year.

Liquidity and Capital Resources

As of August 31, 2017, we had $3,132 in cash which is not sufficient to meet our outstanding obligation of $170,880 of which $136,292 is owed to our sole director and officer. But as mentioned above, this is not sufficient cash to meet our obligations over the next twelve months. Our accounts payable as of August 31, 2017 comprise the fees charged by our bookkeeper for preparation of the financial statements for the period from August 31, 2014 to May 31, 2016 in the amount of $34,336, the balance owed for photocopying services in the amount of $252.

The only funds we have received since our incorporation are from the sale of shares in the amount of $90,000 and from advances from our director in January and February 2014 in the amount of $50,000 respectively and further advances in August and November 2015 of $50,000 as well as three advances in 2017 totalling $35,000. None of the funds from the sale of the 20,000,000 common shares sold under our effective registration statement accrued to the benefit of the Company. The funds advanced by our director are non-interest bearing and on a demand basis. The Company has not entered into an agreement with the director relating to these funds and for the foreseeable future does not expect to do so.

| 24 |

| Table of Contents |

At this time we have not made a decision as to where we will obtain additional funding to assist in the development of our Company including the exploration of La Mina claim. Certain avenues available to us are inducing our director to advance further funds to our Company, complete a private placement or undertake a public offering of our shares from Treasury.

Off-Balance Sheet Arrangements

None.

Trends

From Recursos Queliz’s date of inception it has been an exploration company which has produced no revenue and maybe will not be able to produce revenue. To the knowledge of its management, Recursos Queliz is unaware of any trends or past and future events which will have a material effect upon it, its income and business, both in the long and short term. Please refer to Recursos Queliz’s assessment of Risk Factors as noted on page 6.

Critical Accounting Policies and Estimates

In accordance with the U.S. generally accepted accounting principles, or GAAP, we are required to make estimates and assumptions on our financial statements that affect the reported amounts of assets, liabilities, revenues, costs and expenses and related disclosures. Some of the estimates and assumptions we are required to make relate to matters that are inherently uncertain as they pertain to future events. We base these estimates and assumptions on historical experience or on various other factors that we believe to be reasonable and appropriate under the circumstances. On an on-going basis, we reconsider and evaluate our estimates and assumptions. Actual results may differ significantly from these estimates. We believe that the critical accounting policies listed below involve our more significant judgments, assumptions and estimates and, therefore, could have the greatest potential impact on our financial statements. In addition, we believe that a discussion of these policies is necessary to understand and evaluate the financial statements contained in this Form 10-K.

Estimates and Assumptions

Management uses estimates and assumptions in preparing financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect the reported amounts of the assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were assumed in preparing these financial statements.

Recent Accounting Pronouncements

No material impact should arise from the adoption of any recent accounting pronouncements.

Income taxes

The income tax on net income for companies in the United States and Dominican Republic is 28%. As we have incurred substantial losses, we will not need to pay income tax. Any deferred losses may result in a tax benefit in the future.

| 25 |

| Table of Contents |

Research and Development Expenditures

To date, and in the immediate future, we do not expect to incur any costs relating to research and development.

Patents and Trademarks

There are no patents or trademarks in our Company.

Royalties

There are currently no situations where we are paying any royalty based upon production and sales since we do not have any production.

ITEM 8 FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Audited financial statements for the years ended August 31, 2017 and 2016 are attached as follows:

| 26 |

| Table of Contents |

PLS CPA, A PROFESSIONAL CORPORATION

u 4725 MERCURY STREET #210 u SAN DIEGO u CALIFORNIA 92111 u

u TELEPHONE (858)722-5953 u FAX (858) 761-0341 u FAX (858) 764-5480

u E-MAIL changgpark@gmail.com u

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Recursos Queliz, Inc.

We have audited the accompanying consolidated balance sheets of Recursos Queliz, Inc. and its subsidiary the “Company”) as of August 31, 2017 and 2016 and the related consolidated financial statements of operations, changes in shareholder’s equity and cash flows for the years ended August 31, 2017 and 2016. These consolidated financial statements are the responsibility of the Company’s management.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.