Exhibit 1.1

Execution Version

GasLog Partners LP

8.500% Series C Cumulative Redeemable Perpetual Fixed to Floating Rate Preference Units Representing Limited Partner Interests in the Partnership

Underwriting Agreement

November 7, 2018

UBS Securities LLC

1285 Avenue of the Americas

New York, New York 10019

Morgan Stanley & Co. LLC

1585 Broadway

New York, New York 10036

Stifel, Nicolaus & Company, Incorporated

787 7th Avenue, 11th Floor

New York, New York 10019

Citigroup Global Markets Inc.

388 Greenwich Street

New York, New York 10013

Credit Suisse Securities (USA) LLC

11 Madison Avenue

New York, New York 10010

As Representatives of the several Underwriters

named in Schedule I hereto,

Ladies and Gentlemen:

GasLog Partners LP, a limited partnership organized under the laws of the Republic of The Marshall Islands (the “Partnership”), has filed a registration statement with the Securities and Exchange Commission (the “Commission”) under which the Partnership may from time to time, issue and sell up to an aggregate of $750,000,000 of the Partnership’s common units representing limited partner interests in the Partnership (the “Common Units”), other classes of units representing limited partner interests in the Partnership (the “Other Units”), debt securities of the Partnership (the “Debt Securities”), warrants to purchase Common Units, 8.625% Series A Cumulative Redeemable Perpetual Fixed to Floating Rate Preference Units representing limited partner interests in the Partnership (the “Series A Preference Units”), Other Units or other rights (“Warrants”), rights to purchase Common Units and Other Units (the “Rights”), and any combination of Common Units, Other Units, Debt Securities, Series A Preference Units, Warrants and Rights.

The Partnership proposes, subject to the terms and conditions stated herein, to issue and sell an aggregate of 4,000,000 of the Partnership’s 8.500% Series C Cumulative Redeemable Perpetual Fixed to Floating Rate Preference Units (the “Offered Securities”), each representing limited partnership interests in the Partnership (the “Series C Preference Units”), to the underwriters named in Schedule I hereto (the “Underwriters”) for whom you are acting as representatives (the “Representatives”). At the election of the Underwriters, the Underwriters may purchase up to an additional 600,000 Series C Preference Units in the Partnership (the “Option Securities”, and together with the Offered Securities, the “Securities”).

GasLog Partners GP LLC, a limited liability company organized under the laws of the Republic of The Marshall Islands (the “General Partner”), serves as the sole general partner of the Partnership. GasLog Partners Holdings LLC, a limited liability company organized under the laws of the Republic of The Marshall Islands (the “Operating Company”), is a wholly owned direct subsidiary of the Partnership. The entities set forth under the caption “Owning Entity” on Schedule IV are direct subsidiaries of the Operating Company and are referred to herein collectively as the “Operating Subsidiaries”.

The agreements listed in Schedule VIII hereto are collectively referred to as the “Operative Agreements”.

The General Partner, the Partnership and the Operating Company are hereinafter referred to collectively as the “Partnership Parties” and, together with the Operating Subsidiaries, the “Partnership Entities”. GasLog Ltd. is hereinafter referred to as “GasLog”.

This is to confirm the agreement between the Partnership Parties and each of the Underwriters concerning the purchase of the Securities from the Partnership by the Underwriters.

1. The Partnership Parties represent and warrant to, and agree with each of the Underwriters that:

(a) A registration statement on Form F-3 (File No. 333-220736), including a prospectus (hereinafter referred to as the “Base Prospectus”) in respect of the Securities has been filed with the Commission not earlier than three years prior to the date hereof; the Base Prospectus and any post-effective amendment thereto, each in the form heretofore delivered to the Representatives, have been declared effective by the Commission in such form. Such registration statement, as amended, entered into in connection with a specific offering of the Securities and including any documents incorporated by reference therein, including exhibits (other than any Form T-1) and financial statements and any prospectus supplement relating to the Securities that is filed with the Commission pursuant to Rule 424(b) (“Rule 424(b)”) under the Act and deemed part of such registration statement pursuant to Rule 430B under the Act, is hereinafter referred to as the “Registration Statement”. The Partnership meets the requirements of the U.S. Securities Act of 1933, as amended, (the “Act”) for the use of the Form F-3. No stop order suspending the effectiveness of the Registration Statement, any part thereof or any post-effective amendment thereto, if any, has been issued and no proceeding for that purpose has been initiated or threatened by the Commission. The preliminary prospectus supplement which describes the Securities and the offering thereof and is used prior to filing the Final Prospectus (defined below) is hereinafter called a “Preliminary Prospectus”. The Preliminary Prospectus that was included

2

in the Registration Statement immediately prior to the Applicable Time (as defined in Section 1(c) hereof), together with the information set forth on Schedule II hereto, is hereinafter called the “Pricing Prospectus”. Such final prospectus, in the form first filed pursuant to Rule 424(b) under the Act in accordance with Section 5(a) hereof is hereinafter called the “Final Prospectus”. Any reference herein to the Base Prospectus, the Pricing Prospectus, any Preliminary Prospectus or the Final Prospectus shall be deemed to refer to and include the documents incorporated by reference therein pursuant to Item 6 of Form F-3 under the Act, as of the date of such prospectus; any reference to any amendment or supplement to the Base Prospectus, any Preliminary Prospectus or the Final Prospectus shall be deemed to refer to and include any post-effective amendment to the Registration Statement, any prospectus supplement relating to the Securities filed with the Commission pursuant to Rule 424(b) under the Act and any documents filed under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and incorporated therein, in each case after the date of the Base Prospectus, such Preliminary Prospectus, or the Final Prospectus, as the case may be; any reference to any amendment to the Registration Statement shall be deemed to refer to and include any annual report of the Company filed pursuant to Section 13(a) or 15(d) of the Exchange Act after the effective date of the Registration Statement that is incorporated by reference in the Registration Statement. Any “issuer free writing prospectus” as defined in Rule 433 under the Act relating to the Securities is hereinafter called an “Issuer Free Writing Prospectus”);

(b) No order preventing or suspending the use of any Preliminary Prospectus or any Issuer Free Writing Prospectus has been issued by the Commission, and each Preliminary Prospectus, at the time of filing thereof, conformed in all material respects to the requirements of the Act and the rules and regulations of the Commission thereunder, and did not contain an untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading; provided, however, that this representation and warranty shall not apply to any statements or omissions made in reliance upon and in conformity with information furnished in writing to the Partnership by an Underwriter through the Representatives expressly for use therein;

(c) For the purposes of this Agreement, the “Applicable Time” is 2:30 p.m. New York City time on the date of this Agreement. The Pricing Prospectus, as of the Applicable Time, did not include any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading; and each Issuer Free Writing Prospectus listed on Schedule III hereto does not conflict with the information contained in the Registration Statement, the Pricing Prospectus or the Final Prospectus, and each such Issuer Free Writing Prospectus, as supplemented by and taken together with the Pricing Prospectus as of the Applicable Time and as of any Time of Delivery, did not include any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading; provided, however, that this representation and warranty shall not apply to statements or omissions made in an Issuer Free Writing Prospectus in reliance upon and in conformity with information furnished in writing to the Partnership by an Underwriter through the Representatives expressly for use therein;

3

(d) The Registration Statement conforms, and the Final Prospectus and any further amendments or supplements to the Registration Statement and the Final Prospectus will conform, in all material respects to the requirements of the Act and the rules and regulations of the Commission thereunder and do not and will not, as of the applicable effective date as to each part of the Registration Statement, as of the applicable filing date as to the Final Prospectus and any amendment or supplement thereto and as of any Time of Delivery, contain an untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading; provided, however, that this representation and warranty shall not apply to any statements or omissions made in reliance upon and in conformity with information furnished in writing to the Partnership by an Underwriter through the Representatives expressly for use therein;

(e) Each of the Partnership Parties (i) has not alone engaged in any Testing the Waters Communication and (ii) has not authorized anyone to engage in Testing the Waters Communications. None of the Partnership Parties have distributed or approved for distribution any Written Testing the Waters Communications. “Testing the Waters Communication” shall mean any oral or written communication with potential investors undertaken in reliance on Section 5(d) of the Act. “Written Testing the Waters Communication” means any Testing the Waters Communication that is a written communication within the meaning of rule 405 under the Act;

(f) None of the Partnership Entities has sustained, since the date of the latest audited financial statements included or incorporated by reference in the Pricing Prospectus, any material loss or interference with its business from fire, explosion, flood, piracy, terrorism or other calamity, whether or not covered by insurance, or from any labor dispute or court or governmental action, order or decree, otherwise than as set forth or contemplated in the Pricing Prospectus; and, since the respective dates as of which information is given in the Registration Statement and the Pricing Prospectus, there has not been any material adverse change, or any development that would reasonably be expected to involve a prospective material adverse change, in or affecting the general affairs, management, financial position, shareholders’ equity or results of operations of the Partnership Entities, taken as a whole (a “Material Adverse Effect”), or any change in the share capital or long-term debt of the Partnership Entities, otherwise than as set forth or contemplated in the Pricing Prospectus;

(g) None of the Partnership Entities owns an interest in any material real property. Each of them has good and marketable title to all personal property owned by them which is material to the business of the Partnership Entities, including the vessels listed on Schedule IV hereto (collectively, the “Vessels”), in each case free and clear of all liens, encumbrances and defects except such as are described in the Pricing Prospectus, including those arising under credit facilities, or such as do not materially affect the value of such property and do not materially interfere with the use made and proposed to be made of such property taken as a whole by the Partnership Entities; and any real property and buildings occupied by the Partnership Entities are occupied by them under valid, subsisting and enforceable contractual arrangements with such exceptions as are not material and do not interfere with the use made and proposed to be made of such property and buildings by the Partnership Entities, otherwise than as set forth or contemplated in the Pricing Prospectus;

4

(h) Each of the Partnership Entities has been duly formed or incorporated and is validly existing as a limited partnership, limited liability company, corporation or other entity, as applicable, in good standing under the laws of its respective jurisdiction of formation or incorporation, with all limited partnership, limited liability company, corporate or other entity power and authority, as applicable, to enter into and perform its obligations under the Operative Agreements to which it is a party, to own or lease and to operate its properties currently owned or leased or to be owned or leased at the First Time of Delivery and any other Time of Delivery (as such terms are defined herein) and to conduct its business as currently conducted or as to be conducted at the First Time of Delivery and any other Time of Delivery, in each case as described in the Pricing Prospectus, except where the failure to be so qualified or in good standing and to have such power or authority would not, individually or in the aggregate, result in a Material Adverse Effect. Each of the Partnership Entities is, and at the First Time of Delivery and any other Time of Delivery will be (i) duly qualified to do business as a foreign limited partnership, limited liability company, corporation or other entity, as applicable, and (ii) is in good standing under the laws of each jurisdictions that requires, and at the First Time of Delivery and any other Time of Delivery will require, such qualification or registration except to the extent that a lack of such qualification would not, individually or in the aggregate, have a Material Adverse Effect or would subject the limited partners of the Partnership to any material liability or disability;

(i) The General Partner has, and at the First Time of Delivery and any other Time of Delivery thereafter will have, full limited liability company power and authority to act as the general partner of the Partnership in all material respects as described in the Pricing Prospectus;

(j) As of the date hereof, GasLog owns, and at the First Time of Delivery will own, the number of Common Units as set forth in the Pricing Prospectus (the “Sponsor Units”). The Sponsor Units, and the limited partner interests represented thereby, have been duly authorized for issuance and sale and are validly issued in accordance with the limited partnership agreement of the Partnership (as the same may be amended and restated at or prior to the First Time of Delivery, the “Partnership Agreement”) and are fully paid (to the extent required under the Partnership Agreement) and nonassessable (except as such nonassessability may be affected by Sections 30, 41, 51 and 60 of The Republic of The Marshall Islands Limited Partnership Act (the “Marshall Islands LP Act”)); and GasLog owns the Sponsor Units free and clear of all liens, encumbrances, security interests, charges, equities or other claims (“Liens”);

(k) As of the date hereof GasLog owns, and at the First Time of Delivery will own, 100% of the incentive distribution rights of the Partnership (the “Incentive Distribution Rights”); the Incentive Distribution Rights have been duly authorized for issuance and sale, are validly issued in accordance with the Partnership Agreement and are fully paid (to the extent required under the Partnership Agreement) and nonassessable (except as such nonassessability may be affected by Sections 30, 41, 51 and 60 of the Marshall Islands LP Act); and GasLog owns the Incentive Distribution Rights free and clear of all Liens;

(l) As of the date hereof the General Partner owns, and at the First Time of Delivery will own, the general partner units, representing a 2% general partner interest in the Partnership (the “General Partner Interest”). The General Partner Interest has been duly authorized for issuance and sale, is validly issued in accordance with the Partnership Agreement and is fully paid (to the

5

extent required under the Partnership Agreement) and nonassessable (except as such nonassessability may be affected by Sections 30, 41, 51 and 60 of the Marshall Islands LP Act); and the General Partner owns the General Partner Interest free and clear of all Liens;

(m) As of the date hereof GasLog directly owns, and at the First Time of Delivery will own, 100% of the limited liability company interest in the General Partner, such limited liability company interest has been duly authorized and validly issued in accordance with the limited liability company agreement of the General Partner (as the same may be amended and restated at or prior to the First Time of Delivery, the “General Partner LLC Agreement”) and is fully paid (to the extent required by the General Partner LLC Agreement) and nonassessable (except as such nonassessability may be affected by Sections 20, 31, 40 and 49 of The Republic of The Marshall Islands Limited Liability Company Act of 1996 (the “Marshall Islands LLC Act”)); and GasLog owns such limited liability company interest free and clear of all Liens;

(n) As of the date hereof the Partnership directly owns, and at the First Time of Delivery will directly own, 100% of the limited liability company interest in the Operating Company; such limited liability company interest has been duly authorized and validly issued in accordance with the limited liability company agreement of the Operating Company (as the same may be amended and restated at or prior to the First Time of Delivery, the “Operating Company LLC Agreement”) and is fully paid (to the extent required under the Operating Company LLC Agreement) and nonassessable (except as such nonassessability may be affected by Sections 20, 31, 40 and 49 of the Marshall Islands LLC Act); and the Partnership owns such limited liability company interest free and clear of all Liens;

(o) As of the date hereof the Operating Company owns, and at the First Time of Delivery will directly own, 100% of the equity interests in each of the Operating Subsidiaries listed on Schedule IV hereto; such equity interests have been duly authorized and validly issued in accordance with the respective bye-laws of each Operating Subsidiary (as the same may be amended or restated at or prior to the First Time of Delivery, the “Operating Subsidiaries Organizational Documents” and together with the Partnership Agreement, the General Partner LLC Agreement and the Operating Company LLC Agreement, the “Partnership Entities Organizational Agreements”) and are fully paid (to the extent required under the Operating Subsidiaries Organizational Documents) and non-assessable (except as such nonassessability may be affected by the applicable statutes of the jurisdiction of formation of the applicable Operating Subsidiary and the Operating Subsidiaries Organizational Documents); and the Operating Company owns each of such equity interests free and clear of all Liens;

(p) Except as described in Sections 1(l), 1(n) and 1(o) herein, none of the Partnership Entities owns, or, at the First Time of Delivery or any other Time of Delivery, will own, directly or indirectly, any equity or long-term debt securities of any corporation, partnership, limited liability company, joint venture, association or other entity;

(q) At the First Time of Delivery, assuming no exercise of the option provided in Section 2, the issued and outstanding limited partner interests of the Partnership will consist of the number of Common Units, Series A Preference Units, 8.200% Series B Cumulative Redeemable Perpetual Fixed to Floating Rate Preference Units representing limited partner interests in the

6

Partnership and the Incentive Distribution Rights as set forth under the caption “Cash and Capitalization” in the Pricing Prospectus;

(r) The Securities to be sold by the Partnership pursuant to this Agreement, and the limited partner interests represented thereby, have been duly authorized for issuance and sale to the Underwriters in accordance with this Agreement and the Partnership Agreement, and when issued and delivered by the Partnership pursuant to this Agreement against payment of the consideration set forth herein, will be validly issued, fully paid (to the extent required under the Partnership Agreement) and nonassessable (except as such nonassessability may be affected by matters described in Sections 30, 41, 51 and 60 of the Marshall Islands LP Act), will conform in all material respects to the information in the Pricing Prospectus and to the description of such Securities contained in the Final Prospectus; the unitholders of the Partnership do not and will not have preemptive rights with respect to the Series C Preference Units; and none of the outstanding Series C Preference Units of the Partnership have been issued in violation of any preemptive or similar rights of any security holder;

(s) The issue and sale of the Securities and the execution, delivery and performance of the terms of the Operative Agreements by the Partnership Entities party thereto, and the consummation of the transactions by the Partnership Entities, as applicable, set forth herein (i) will not conflict with or result in a breach or violation of any of the terms or provisions of, or require the consent of any person, or constitute a default or Debt Repayment Triggering Event (as defined below), or result in the imposition of any lien, charge or encumbrance on any property of the Partnership Entities, under any indenture, mortgage, deed of trust, loan agreement or other agreement or instrument, including the instruments listed on Schedule IX (the “Specified Agreements”), or give any person the right to terminate any agreement or contract to which any Partnership Entity is a party or by which any Partnership Entity is bound or to which any of the property or assets of the Partnership Entities is subject; and (ii) will not result in any violation of (A) any of the Partnership Entities Organizational Agreements or (B) any statute or any order, rule or regulation of any court or governmental agency or body having jurisdiction over the Partnership Entities or any of their properties or assets, except in the case of clause (i), for any conflict, breach, or violation that would not result in a Material Adverse Effect or have a material adverse effect on the consummation of the transactions contemplated hereby; and no consent, approval, authorization, order, registration or qualification of or with any such court or governmental agency or body is required for the issue and sale of the Securities or the consummation by the Partnership Entities of the transactions contemplated by this Agreement, except the registration under the Act of the Securities and such consents, approvals, authorizations, registrations or qualifications as may be required under state securities or Blue Sky laws in connection with the purchase and distribution of the Securities by the Underwriters, and such other consents, approvals, authorizations, orders, registrations or qualifications that have already been obtained. A “Debt Repayment Triggering Event” means any event or condition that gives, or with the giving of notice or lapse of time would give, the holder of any loan, note, debenture or other evidence of indebtedness (or any person acting on such holder’s behalf) the right to accelerate the due date of any payment of, or to require the repurchase, redemption or repayment of all or a portion of such indebtedness by the Partnership Entities (for the avoidance of doubt, Debt Repayment Triggering Event excludes any put right that is not triggered by the occurrence of an extraordinary event);

7

(t) At the First Time of Delivery, each of the Operative Agreements, the Partnership Entities Organizational Agreements and the other instruments listed on Schedule VII (the “Covered Agreements”) hereto, as applicable, has been duly authorized, executed and delivered by the Partnership Entities party thereto, and each such agreement is a valid and legally binding agreement of each such Partnership Entity, enforceable against such party in accordance with its terms; provided, that, with respect to each such agreement, the enforceability thereof may be limited by (A) applicable bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws relating to or affecting creditors’ rights and remedies generally and by general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law) and (B) public policy, applicable law relating to fiduciary duties and indemnification and an implied covenant of good faith and fair dealing. The Operative Agreements, the Partnership Entities Organizational Agreements and the Covered Agreements referenced above are herein collectively referred to as the “Operative Documents”;

(u) [Reserved].

(v) None of the Partnership Entities is (i) in violation of its respective organizational or governing documents, (ii) in violation of any applicable statute, law, rule, regulation, judgment, order or decree of any competent court, regulatory body, administrative agency, governmental body, arbitrator or other authority or (iii) in default (or with the giving of notice or lapse of time would be in default) under any existing obligation, agreement, covenant or condition contained in any indenture, mortgage, deed of trust, loan agreement, lease or other agreement or instrument to which any of them is a party or by which any of them is bound or to which any of the properties of any of them is subject, except in each case covered by clauses (ii) and (iii) such as would not result in a Material Adverse Effect or have a material adverse effect on the consummation of the transactions contemplated hereby;

(w) None of the Partnership Entities is currently prohibited, directly or indirectly, from paying any cash distributions to any other Partnership Entity, from making any other distribution on such entity’s equity securities, or from transferring any of such entity’s property or assets to any other Partnership Entity, except as described in the Pricing Prospectus;

(x) There are no contracts, agreements or understandings between the Partnership Parties and any person that would give rise to a valid claim against the Partnership or any Underwriter for a brokerage commission, finder’s fee or other like payment in connection with the issuance and sale of the Securities;

(y) The statements set forth or incorporated by reference in the Pricing Prospectus and Final Prospectus under the captions “Description of the Series C Preference Units”, “Summary of Our Partnership Agreement”, “Material U.S. Federal Income Tax Considerations”, and “Non-United States Tax Considerations”, insofar as such statements purport to summarize legal matters, agreements, documents or proceedings discussed therein, are accurate and fair summaries of such legal matters, agreements, documents or proceedings and present the information required to be shown;

(z) There are no business relationships or related-party transactions involving the Partnership Entities or any other person required to be described in the Registration Statement,

8

Pricing Prospectus and Final Prospectus which have not been described as required or through incorporation by reference therein;

(aa) Any statistical and market-related data included in the Pricing Prospectus and Final Prospectus are based on or derived from sources that the Partnership Parties reasonably believe to be reliable and accurate, and the Partnership Parties have obtained the written consent for the use of such data from such sources to the extent required;

(bb) No forward-looking statement (within the meaning of Section 27A of the Act and Section 21E of the Exchange Act) contained in the Pricing Prospectus has been made or reaffirmed without a reasonable basis or has been disclosed other than in good faith;

(cc) There are no legal or governmental proceedings pending to which any of the Partnership Entities is a party or of which any property of the Partnership Entities is the subject or, to the Partnership Parties’ knowledge, after due inquiry, to which any of the Partnership Entities’ directors or executive officers is a party, which, if determined adversely to any such entity, would individually or in the aggregate have a Material Adverse Effect; and, to the Partnership Parties’ knowledge, no such proceedings are threatened or contemplated by governmental authorities or threatened by others;

(dd) Other than as set forth in the Pricing Prospectus, (A)(i) to the Partnership Parties’ knowledge, after due inquiry, none of the Partnership Entities is in violation of any applicable United States federal, state, local or non-U.S. statute, law, rule, regulation, ordinance, code, other requirement or rule of law (including common law), or decision or order of any competent domestic or foreign governmental agency, governmental body or court applicable to them, relating to pollution, to the use, handling, transportation, treatment, storage, discharge, disposal or release of Hazardous Substances (as defined below), to the protection or restoration of the environment or natural resources (including biota), to health and safety as such relates to exposure to Hazardous Substances, and to natural resource damages (collectively, “Environmental Laws”), (ii) none of the Partnership Entities owns, operates or leases any real property contaminated with Hazardous Substances, (iii) none of the Partnership Entities is conducting or funding any investigation, remediation, remedial action or monitoring of actual or suspected Hazardous Substances in the environment, (iv) none of the Partnership Entities is liable or allegedly liable for any release or threatened release of Hazardous Substances, including at any off-site treatment, storage or disposal site, (v) none of the Partnership Entities is a party to any claim by any governmental agency or governmental body or person relating to Environmental Laws or Hazardous Substances, and (vi) the Partnership Entities have received and are in compliance with all, and have no liability under any, permits, licenses, authorizations, identification numbers or other approvals required under applicable Environmental Laws to conduct their respective businesses, except in each case covered by clauses (i) — (vi) such as would not individually or in the aggregate have a Material Adverse Effect; (B) to the Partnership Parties’ knowledge, there are no facts or circumstances that would reasonably be expected to result in a violation of, liability under, or claim against the Partnership Entities pursuant to any Environmental Law that would have a Material Adverse Effect; and (C) to the Partnership Parties’ knowledge, there are no requirements proposed for adoption or implementation under any Environmental Law that would reasonably be expected to have a Material Adverse Effect. For purposes of this subsection, “Hazardous Substances” means (x) petroleum and petroleum

9

products, by-products or breakdown products, radioactive materials, asbestos-containing materials, polychlorinated biphenyls and mold and (y) any other chemical, material or substance defined or regulated as toxic or hazardous or as a pollutant, contaminant or waste under Environmental Laws;

(ee) Other than as set forth in the Pricing Prospectus, the Partnership Parties have reasonably concluded that none of the Partnership Entities has incurred any costs or liabilities associated with Environmental Laws (including, without limitation, any capital or operating expenditures required for clean-up, closure of properties or compliance with Environmental Laws or any permit, license or approval, any related constraints on operating activities and any potential liabilities to third parties) which would, individually or in the aggregate, have a Material Adverse Effect;

(ff) Other than as set forth in the Pricing Prospectus, the Partnership Entities possess all certificates, authorizations and permits issued by the appropriate federal, state or foreign regulatory authorities as necessary for the Partnership Entities to conduct their respective businesses as currently conducted, except as would not individually or in the aggregate have a Material Adverse Effect; and none of the Partnership Entities has received any notice of proceedings relating to the revocation or modification of any such certificate, authorization or permit which, individually or in the aggregate, if the subject of an unfavorable decision, ruling or finding, would have a Material Adverse Effect;

(gg) The Partnership Entities own or possess, or hold a right or license to use, or can acquire on reasonable terms, all material patents, patent rights, licenses, inventions, copyrights, know-how (including trade secrets and other unpatented and/or unpatentable proprietary or confidential information, systems or procedures), trademarks, service marks and trade names currently employed by them in connection with the business now operated by them, and none of the Partnership Entities has received any notice of infringement of or conflict with asserted rights of others with respect to any of the foregoing, which if the subject of an unfavorable decision, ruling or finding, would have a Material Adverse Effect;

(hh) No material labor dispute, work stoppage, slow down or other conflict with the employees of the Partnership Parties exists or, to the Partnership Parties’ knowledge, is threatened or contemplated;

(ii) The Partnership Entities and the Vessels are insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as are prudent and customary in the businesses in which they are engaged; none of the Partnership Entities has been refused any insurance coverage sought or applied for; and none of the Partnership Entities has any reason to believe that it will not be able to renew its existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business at a cost that would not have a Material Adverse Effect;

(jj) None of the Partnership Entities has any off-balance sheet arrangements, except as described in the Registration Statement, the Pricing Prospectus and the Final Prospectus;

10

(kk) (A) None of the Partnership Entities or, to the Partnership Parties’ knowledge, any of their respective directors, executive officers, affiliates, employees or agents or other persons associated with or acting on behalf of the Partnership Entities: (i) knowingly does any business with or involving the government of, or any person or project located in, any country targeted by any of the economic sanctions promulgated by any Executive Order issued by the President of the United States or administered by the United States Treasury Department’s Office of Foreign Assets Control (the “OFAC”) (collectively, “Sanctions”); or (ii) knowingly supports or facilitates any such business or project, in each case other than as permitted under such economic sanctions; (B) none of the Partnership Parties is controlled (within the meaning of the Executive Orders or regulations promulgating such economic sanctions or the laws authorizing such promulgation) by any such government or person; (C) the proceeds from the offering of the Securities contemplated hereby will not be used to fund any operations in, to finance any investments, projects or activities in, or to make any payments to, any country, or to make any payments to, or finance any activities with, any person targeted by any of such economic sanctions; and (D) the Partnership Parties maintain and have implemented adequate internal controls and procedures to monitor and audit transactions that are reasonably designed to detect and prevent any use of the proceeds from the offering of the Securities contemplated hereby that is inconsistent with any of the representations and obligations under clause (C) of this paragraph or in the Registration Statement, Pricing Prospectus or Final Prospectus;

(ll) None of the Partnership Entities or, to the Partnership Parties’ knowledge, any of their respective directors, executive officers, affiliates, employees or agents or other persons associated with or acting on behalf of the Partnership Entities, has taken any action in furtherance of an offer, payment, promise to pay, or authorization or approval of the payment or giving of money, property, gifts or anything else of value, directly or indirectly, to any “government official” (including any officer or employee of a government or government-owned or controlled entity or of a public international organization, or any person acting in an official capacity for or on behalf of any of the foregoing, or any political party or party official or candidate for political office) to influence official action or secure an improper advantage in violation of any applicable law; and the Partnership Entities and, to the knowledge of the Partnership Parties, their respective affiliates have conducted their businesses in compliance with applicable anti-corruption laws and have instituted and maintain and will continue to maintain policies and procedures designed to promote and achieve compliance with such laws and with the representation and warranty contained herein;

(mm) The operations of the Partnership Entities, are and have been conducted at all times in compliance with applicable financial recordkeeping and reporting requirements, including to the extent applicable those of the Currency and Foreign Transactions Reporting Act of 1970, as amended, the Bank Secrecy Act, as amended by Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT Act), the money laundering statutes of all jurisdictions, the rules and regulations thereunder and any related or similar rules, regulations or guidelines, issued, administered or enforced by any governmental agency (collectively, the “Money Laundering Laws”); and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator or non-governmental authority involving the Partnership Entities with respect to the Money Laundering Laws is pending or, to the Partnership Parties’ knowledge, threatened;

11

(nn) As of the effective date of the Registration Statement, the Partnership and, to the knowledge of the Partnership Parties, the officers and directors of the Partnership, in their capacities as such, were, and at the First Time of Delivery will be, in compliance in all material respects with all applicable provisions of the Sarbanes-Oxley Act of 2002 and the rules and regulations promulgated in connection therewith that are then in effect and with which any of them is required to comply, including Section 402 related to loans;

(oo) There are no restrictions on subsequent transfers of the Securities under the laws of the Republic of The Marshall Islands;

(pp) Except as disclosed in the Pricing Prospectus, there are no contracts, agreements or understandings between the Partnership Parties and any person granting such person the right to require any of the Partnership Parties to file a registration statement under the Act with respect to any securities of the Partnership Entities or to require the Partnership Parties to include such securities with the securities registered pursuant to the Registration Statement;

(qq) The Partnership shall use commercially reasonable efforts to effect the admission, listing and trading of the Series C Preference Units on the New York Stock Exchange (the “Exchange”), within 30 days of the of the First Time of Delivery;

(rr) The Partnership Parties have taken all necessary actions to comply with all applicable corporate governance requirements of the Exchange that are, or will be, applicable to the Partnership, except for such requirements that have been waived and disclosed in the Pricing Prospectus;

(ss) Except as described in the Pricing Prospectus, the Partnership has not sold, issued or distributed any Securities during the six-month period preceding the date hereof, including any sales pursuant to Rule 144A or Regulation D or S under the Act, other than Common Units issued pursuant to employee benefit plans, qualified option plans or other employee compensation plans or pursuant to outstanding options, rights or warrants;

(tt) None of the Partnership Entities has taken, directly or indirectly, any action which was designed to or which has constituted or which might reasonably be expected to cause or result in stabilization or manipulation of the price of any security of the Partnership to facilitate the sale or resale of the Securities;

(uu) Subsequent to the execution and delivery of this Agreement, there shall not have occurred any downgrading in the rating of any debt securities of the Partnership Parties by any “nationally recognized statistical rating organization” (as defined in Section 3(a)(62) of the Exchange Act), or any public announcement that any such organization has under surveillance or review its rating of any debt securities of the Partnership Parties;

(vv) The Partnership is not and, after giving effect to the offering and sale of the Securities and the application of the proceeds thereof, will not be required to register as an “investment company”, as such term is defined in the Investment Company Act of 1940, as amended;

12

(ww) At the time of filing the Registration Statement and as of the Applicable Time, the Partnership was not and is not an “ineligible issuer”, as defined under Rule 405 under the Act;

(xx) As described in the Registration Statement and subject to the limitations and restrictions described therein, the Partnership Parties believe that the Partnership should not be a “passive foreign investment company” as defined in the Internal Revenue Code of 1986, as amended;

(yy) The Partnership is a “foreign private issuer” as defined in Rule 405 under the Act;

(zz) Except as described in the Pricing Prospectus, there are no affiliations or associations between any member of the Financial Industry Regulatory Authority (“FINRA”) and the Partnership Entities and, to the Partnership Parties’ knowledge, there are no affiliations or associations between (a) any member of FINRA and (b) any member of the Partnership’s officers, directors or 5% or greater security holders or any beneficial owner of the Partnership’s unregistered equity securities that were acquired at any time on or after the 180th day immediately preceding the date the Registration Statement was initially submitted to the Commission;

(aaa) Deloitte LLP, who have certified certain financial statements included or incorporated by reference in the Registration Statement, Pricing Prospectus and Final Prospectus, are independent public accountants with respect to the Partnership Entities as required by the Act and the rules and regulations of the Commission thereunder;

(bbb) The Partnership maintains a system of internal control over financial reporting (as such term is defined in Rule 13a-15(f) under the Exchange Act) sufficient to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with international financial reporting standards as adopted by the International Accounting Standards Board (“IFRS”) and such system will comply in all material respects with the requirements of the Exchange Act when so required. Except as set forth in the Pricing Prospectus, the Partnership’s internal control over financial reporting is effective, and the Partnership is not aware of any material weaknesses in its internal control over financial reporting;

(ccc) Since the date of the latest audited financial statements included or incorporated by reference in the Pricing Prospectus, there has been no change in the Partnership’s internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, the Partnership’s internal control over financial reporting (each an “Internal Control Event”);

(ddd) The Partnership maintains disclosure controls and procedures (as such term is defined in Rule 13a-15(e) under the Exchange Act) that comply with the requirements of the Exchange Act; such disclosure controls and procedures have been designed to ensure that material information relating to the Partnership and its subsidiaries is made known to the Partnership’s principal executive officer and principal financial officer by others within those entities; and such disclosure controls and procedures are effective;

(eee) The financial statements of the Partnership included or incorporated by reference in the Pricing Prospectus, together with the related notes thereto, present fairly in all material

13

respects the combined financial position of the Partnership as of the date shown, and such financial statements have been prepared in conformity with IFRS, applied on a consistent basis throughout the periods involved; and the schedules included in the Pricing Prospectus, if any, present fairly the information required to be stated therein. The selected financial data and the summary financial information included or incorporated by reference in the Pricing Prospectus present fairly the information shown therein and have been compiled on a basis consistent with that of the audited and unaudited financial statements included in the Pricing Prospectus. Any pro forma financial information included or incorporated by reference in the Pricing Prospectus comply as to form with the applicable accounting requirements of Regulation S-X under the Act and includes assumptions that provide a reasonable basis for presenting the significant effects directly attributable to the transactions and events described therein, the related pro forma adjustments give appropriate effect to those assumptions, and the pro forma adjustments reflect the proper application of those adjustments to the historical financial statement amounts in the pro forma balance sheet included in the Pricing Prospectus. All disclosures contained in the Preliminary Prospectus, Pricing Prospectus and Final Prospectus, or incorporated by reference therein, regarding “non-GAAP financial measures” (as such term is defined by the rules and regulations of the Commission) comply with Regulation G of the 1934 Act and Item 10 of Regulation S-K of the 1933 Act, to the extent applicable;

(fff) Neither the Partnership’s independent auditors nor any internal auditor has recommended that the Partnership’s board of directors review or investigate, (i) adding to, deleting, changing the application of, or changing the Partnership’s disclosure with respect to, any of the Partnership’s material accounting policies; (ii) any matter which could result in a restatement of the Partnership’s audited balance sheet included in the Registration Statement; or (iii) any Internal Control Event;

(ggg) The Vessels are owned directly by the respective Operating Subsidiary listed on Schedule IV hereto; each of the Vessels has been duly registered as a vessel under the laws and regulations and flag of the jurisdiction set forth opposite its name on Schedule IV in the sole ownership of the subsidiary set forth opposite its name on Schedule IV, and no other action is necessary to establish and perfect such entity’s title to and interest in such Vessel as against any charterer or other third party; each such subsidiary has good title to the applicable Vessel, free and clear of all mortgages, pledges, liens, security interests and claims and all defects of the title of record except for those mortgages, pledges, liens, security interests and claims arising under credit facilities, each as disclosed in the Registration Statement, the Pricing Prospectus and the Final Prospectus, and any other encumbrances which would not, in the aggregate, result in a Material Adverse Effect; and each such Vessel is in good standing with respect to the payment of past and current taxes, fees and other amounts payable under the laws of the jurisdiction where it is registered as would affect its registry with the ship registry of such jurisdiction except for failures to be in good standing which would not, in the aggregate, result in a Material Adverse Effect;

(hhh) Each Vessel is operated in compliance in all material respects with the rules, codes of practice, conventions, protocols, guidelines or similar requirements or restrictions imposed, published or promulgated by any governmental authority, classification society or insurer applicable to the respective vessel (collectively, “Maritime Guidelines”) and all applicable international, national, state and local conventions, laws, regulations, orders, governmental

14

licenses and other requirements (including, without limitation, all Environmental Laws) in the jurisdictions in which the Partnership and its subsidiaries operate or where such vessel is operated, in each case as in effect on the date hereof, except where such failure to be in compliance would not have, individually or in the aggregate, a Material Adverse Effect. The Partnership Entities are qualified to own or lease, as the case may be, and operate such vessels under all applicable international, national, state and local conventions, laws, regulations, orders, governmental licenses and other requirements (including, without limitation, all Environmental Laws) and Maritime Guidelines, including the laws, regulations and orders of each such vessel’s flag state, in each case as in effect on the date hereof, except where such failure to be so qualified would not have, individually or in the aggregate, a Material Adverse Effect;

(iii) None of the Partnership Parties is entitled to any immunity, whether characterized as sovereign immunity or otherwise, from any legal proceedings in respect of themselves or their respective properties under the laws of the United States or their jurisdiction of formation or incorporation; and

(jjj) The Partnership Entities have filed all United States federal, state and local and non-U.S. tax returns that are required to be filed or have requested extensions thereof (except in any case in which the failure so to file would not, individually or in the aggregate, have a Material Adverse Effect); except as set forth in the Pricing Prospectus, the Partnership Entities have paid all taxes (including any assessments, fines or penalties that are currently owed and due) required to be paid by them and that are currently owed and due, except for any such taxes, assessments, fines or penalties currently being contested in good faith or as would not, individually or in the aggregate, have a Material Adverse Effect; and no capital gains, income, withholding or other taxes or stamp or other issuance or transfer taxes or duties or similar fees or charges are payable by or on behalf of the Underwriters in connection with the sale and delivery by the Partnership of the Securities to or for the accounts of the Underwriters or the sale and delivery by the Underwriters of the Securities to the initial purchasers thereof.

2. Subject to the terms and conditions herein set forth, (a) the Partnership agrees to issue and sell to each of the Underwriters, and each of the Underwriters agree, severally and not jointly, to purchase from the Partnership, the number of Offered Securities set forth opposite the name of such Underwriters on Schedule I hereto at the applicable purchase price set forth on Schedule II and (b) in the event and to the extent that the Underwriters shall exercise the election to purchase Option Securities as provided below, the Partnership agrees, to issue and sell to each of the Underwriters, and each of the Underwriters agrees to purchase from the Partnership, at the purchase price per Series C Preference Unit set forth in clause (a) of this Section 2, that portion of the number of Option Securities as to which such election shall have been exercised (to be adjusted by the Representatives so as to eliminate fractional Series C Preference Units) determined by multiplying such number of Option Securities by a fraction, the numerator of which is the maximum number of Option Securities which such Underwriter is entitled to purchase as set forth opposite the name of such Underwriter in Schedule I hereto and the denominator of which is the maximum number of Option Securities that all of the Underwriters are entitled to purchase hereunder.

The Partnership, as and to the extent indicated in Schedule I hereto, hereby grants severally and not jointly to the Underwriters the right to purchase at their election up to 600,000

15

Option Securities, at the purchase price per Series C Preference Unit set forth in the paragraph above; provided, that the purchase price per Option Security shall be reduced by an amount per Option Security equal to any dividends or distributions declared by the Partnership and payable on the Offered Securities but not payable on the Option Securities. Any such election to purchase Option Securities may be exercised only by written notice from the Representatives to the Partnership, given within a period of 30 calendar days after the date of this Agreement, setting forth the aggregate number of Option Securities to be purchased and the business day on which such Option Securities are to be delivered, as determined by the Representatives but in no event earlier than the First Time of Delivery or, unless the Representatives and the Partnership otherwise agree in writing, earlier than two or later than ten business days after the date of such notice.

3. [Reserved.]

4. (a) The Securities to be purchased by each Underwriter hereunder, in definitive form, and in such authorized denominations and registered in such names as the Representatives may request upon at least forty-eight hours’ prior notice to the Partnership shall be delivered by or on behalf of the Partnership to the Representatives through the facilities of the Depository Trust Company (“DTC”), for the account of such Underwriter against payment by or on behalf of such Underwriter of the purchase price therefor by wire transfer of Federal (same-day) funds to the account specified by the Partnership to the Representatives at least forty-eight hours in advance. The time and date of such delivery and payment shall be, with respect to the Offered Securities, 9:00 a.m., New York City time, on November 15, 2018 or such other time and date as the Representatives and the Partnership may agree upon in writing, and with respect to the Option Securities, on the date specified by the Representatives in the written notice given by the Representatives’ election to purchase such Option Securities, or such other time and date as the Representatives and the Partnership may agree upon in writing. Such time and date for delivery of the Offered Securities is herein called the “First Time of Delivery”, such time and date for delivery of the Option Securities, if not the First Time of Delivery, is herein called the “Second Time of Delivery”, and each such time and date for delivery is herein called a “Time of Delivery”.

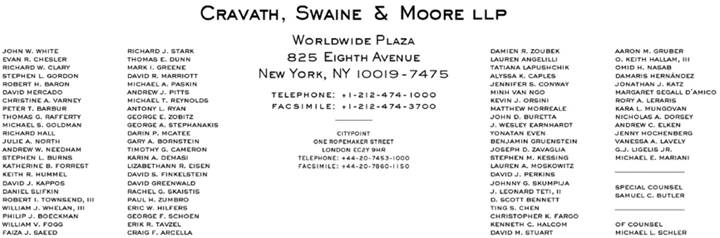

(b) The documents to be delivered at each Time of Delivery by or on behalf of the parties hereto pursuant to Section 8 hereof, including the cross receipt for the Securities and any additional documents requested by the Underwriters pursuant to Section 8(n) hereof, will be delivered at the offices of Cravath, Swaine & Moore LLP, Worldwide Plaza, 825 Eighth Avenue, New York, New York 10019 (the “Closing Location”). A meeting will be held at the Closing Location at 5:00 p.m., New York City time, on the New York Business Day next preceding such Time of Delivery, at which meeting the final drafts of the documents to be delivered pursuant to the preceding sentence will be available for review by the parties hereto. For the purposes of this Section 4, “New York Business Day” shall mean each Monday, Tuesday, Wednesday, Thursday and Friday which is not a day on which banking institutions in New York City are generally authorized or obligated by law or executive order to close.

5. The Partnership Parties agree with each of the Underwriters:

16

(a) To prepare the Final Prospectus in a form approved by the Representatives and to file such Final Prospectus pursuant to Rule 424(b) under the Act not later than the Commission’s close of business on the second business day following the execution and delivery of this Agreement; to make no further amendment or any supplement to the Registration Statement or the Final Prospectus prior to the last Time of Delivery, which shall be disapproved by the Representatives promptly after reasonable notice thereof; to advise the Representatives, promptly after it receives notice thereof, of the time when any amendment to the Registration Statement has been filed or becomes effective or any amendment or supplement to the Final Prospectus has been filed and to furnish the Representatives with copies thereof; to file promptly all material required to be filed by the Partnership with the Commission pursuant to Rule 433(d) under the Act; to file promptly all reports and any definitive proxy or information statements required to be filed by the Partnership with the Commission pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of the Prospectus and for so long as the delivery of a prospectus (or in lieu thereof, the notice referred to in Rule 173(a) under the Act) is required in connection with the offering or sale of the Securities; to advise the Representatives, promptly after it receives notice thereof, of the issuance by the Commission of any stop order or of any order preventing or suspending the use of any Preliminary Prospectus or other prospectus in respect of the Securities, of the suspension of the qualification of the Securities for offering or sale in any jurisdiction, of the initiation or threatening of any proceeding for any such purpose, or of any request by the Commission for the amending or supplementing of the Registration Statement, any Preliminary Prospectus, the Final Prospectus or Issuer Free Writing Prospectus or for additional information; and, in the event of the issuance of any stop order or of any order preventing or suspending the use of any Preliminary Prospectus or other prospectus or suspending any such qualification, to promptly use its best efforts to obtain the withdrawal of such order;

(b) Promptly from time to time to take such action as the Representatives may reasonably request to qualify the Securities for offering and sale under the securities laws of such jurisdictions as the Representatives may request and to comply with such laws so as to permit the continuance of sales and dealings therein in such jurisdictions for as long as may be necessary to complete the distribution of the Securities, provided that in connection therewith the Partnership shall not be required to qualify as a foreign corporation or to file a general consent to service of process or to subject itself to taxation for doing business in any jurisdiction if it is not otherwise so subject;

(c) Prior to 10:00 a.m., New York City time, on the New York Business Day next succeeding the date of this Agreement and from time to time, to furnish the Representatives with written and electronic copies of the Final Prospectus in New York City in such quantities as the Representatives may reasonably request, and, if the delivery of a prospectus (or in lieu thereof, the notice referred to in Rule 173(a) under the Act) is required, at any time prior to the expiration of nine months after the time of issue of the Final Prospectus in connection with the offering or sale of the Securities and if at such time any event shall have occurred as a result of which the Final Prospectus as then amended or supplemented would include an untrue statement of a material fact or omit to state any material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made when such Final Prospectus (or in lieu thereof, the notice referred to in Rule 173(a) under the Act) is delivered, not misleading, or, if for any other reason it shall be necessary during such same period to amend or supplement the

17

Final Prospectus or to file under the Exchange Act any document incorporated by reference in the Final Prospectus in order to comply with the Act or the Exchange Act, to notify the Representatives and upon the request of the Representatives to file such document or to prepare and furnish without charge to each Underwriter and to any dealer in securities as many written and electronic copies as the Representatives may from time to time reasonably request of an amended Final Prospectus or a supplement to the Final Prospectus which will correct such statement or omission or effect such compliance; and in case each Underwriter is required to deliver a prospectus (or in lieu thereof, the notice referred to in Rule 173(a) under the Act) in connection with sales of any of the Securities at any time nine months or more after the time of issue of the Final Prospectus, upon the request of the Representatives but at the expense of such Underwriter, to prepare and deliver to such Underwriter as many written and electronic copies as the Representatives may request of an amended or supplemented Final Prospectus complying with Section 10(a)(3) of the Act;

(d) To make generally available to its securityholders as soon as practicable, but in any event not later than sixteen months after the effective date of the Registration Statement (as defined in Rule 158(c) under the Act), an earnings statement of the Partnership and its subsidiaries (which need not be audited) complying with Section 11(a) of the Act and the rules and regulations of the Commission thereunder (including, at the option of the Partnership, Rule 158);

(e) During the period beginning from the date hereof and continuing to and including the date 30 days after the date of the Final Prospectus (the “Lock-Up Period”), not to (i) offer, sell, contract to sell, pledge, grant any option to purchase, make any short sale or otherwise transfer or dispose of, directly or indirectly, or file with the Commission a registration statement under the Act relating to, any securities of the Partnership that are substantially similar to the Securities (excluding, for avoidance of doubt, Common Units) including but not limited to any options to purchase any Securities or publicly disclose the intention to make any offer, sale, pledge, disposition or filing or (ii) enter into any swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership of the Securities or any such other securities, whether any such transaction described in clause (i) or (ii) above is to be settled by delivery of the Securities or such other securities, in cash or otherwise (other than (x) the Securities to be sold hereunder, (y) securities offered or sold pursuant to employee stock option or other incentive compensation plans or employment arrangements existing on the date hereof as described in the Pricing Prospectus, or, provided such securities do not vest or become exercisable until after the Lock-Up Period, pursuant to incentive compensation plans or employment arrangements entered into in the ordinary course, or (z) the establishment of a trading plan pursuant to Rule 10b5-1 under the Act, for the transfer of Series C Preference Units, provided that such plan does not provide for the transfer of Series C Preference Units during the Lock-Up Period), without the prior written consent of the Representatives;

(f) During the first 12 months following the last Time of Delivery, to furnish to its unitholders as soon as practicable after the end of each fiscal year an annual report (including a balance sheet and statements of income, unitholders’ equity and cash flows of the Partnership and its consolidated subsidiaries certified by an independent registered public accounting firm) and, as soon as practicable after the end of each of the first three quarters of each fiscal year (beginning with the fiscal quarter ending after the effective date of the Registration Statement),

18

to make available to its unitholders consolidated summary financial information of the Partnership and its subsidiaries for such quarter in reasonable detail reviewed in accordance with SAS 100 by an independent registered public accounting firm; provided, however, that the Partnership may satisfy the requirements of this subsection by making any such reports, communications or information available on its website or by filing or furnishing such information with the Commission via EDGAR;

(g) During a period of three years from the date hereof, to furnish to the Representatives copies of all reports or other communications (financial or other) furnished to its unitholders, and to deliver to the Representatives as soon as they are available, copies of any reports and financial statements furnished to or filed with the Commission or any national securities exchange on which any class of securities of the Partnership is listed; provided, however, that the Partnership may satisfy the requirements of this subsection by making any such reports, communications or information available on its web site or by filing or furnishing such information with the Commission via EDGAR;

(h) To use the net proceeds received by the Partnership from the sale of the Securities pursuant to this Agreement in the manner specified in the Pricing Prospectus under the caption “Use of Proceeds”;

(i) To use its reasonable best efforts to list, subject to notice of issuance, the Securities on the Exchange;

(j) To file with the Commission such information on Form 20-F as may be required by Rule 463 under the Act;

(k) If the Partnership elects to rely upon Rule 462(b), the Partnership shall file a Rule 462(b) Registration Statement with the Commission in compliance with Rule 462(b) by 10:00 p.m., New York time, on the date of this Agreement, and the Partnership shall at the time of filing either pay to the Commission the filing fee for the Rule 462(b) Registration Statement or give irrevocable instructions for the payment of such fee pursuant to Rule 111(b) under the Act; and

(l) Upon request of any Underwriter, to furnish, or cause to be furnished, to such Underwriter an electronic version of the Partnership’s trademarks, servicemarks and corporate logo for use on the website, if any, operated by such Underwriter for the purpose of facilitating the on-line offering of the Securities (the “License”); provided, however, that the License shall be used solely for the purpose described above, is granted without any fee and may not be assigned or transferred.

6. (a) The Partnership represents and agrees that, without the prior consent of the Representatives, it has not made and will not make any offer relating to the Securities that would constitute a “free writing prospectus” as defined in Rule 405 under the Act; each Underwriter represents and agrees that, without the prior consent of the Partnership and the Representatives, it has not made and will not make any offer relating to the Securities that would constitute a free writing prospectus required to be filed with the Commission; any such free writing prospectus

19

the use of which has been consented to by the Partnership and the Representatives is listed on Schedule III hereto.

(b) The Partnership has complied and will comply with the requirements of Rule 433 under the Act applicable to any Issuer Free Writing Prospectus, including timely filing with the Commission or retention where required and legending.

(c) The Partnership agrees that if at any time following issuance of an Issuer Free Writing Prospectus any event occurred or occurs as a result of which such Issuer Free Writing Prospectus would conflict with the information in the Registration Statement, the Pricing Prospectus or the Final Prospectus or would include an untrue statement of a material fact or omit to state any material fact necessary in order to make the statements therein, in the light of the circumstances then prevailing, not misleading, the Partnership will give prompt notice thereof to the Representatives and, if requested by the Representatives, will prepare and furnish without charge to each Underwriter an Issuer Free Writing Prospectus or other document which will correct such conflict, statement or omission; provided, however, that this representation and warranty shall not apply to any statements or omissions in an Issuer Free Writing Prospectus made in reliance upon and in conformity with information furnished in writing to the Partnership by an Underwriter through the Representatives expressly for use therein.

7. The Partnership covenants and agrees with the several Underwriters that the Partnership will pay or cause to be paid the following: (i) the reasonable fees, disbursements and expenses of the Partnership’s counsel and accountants in connection with the registration of the Securities under the Act and all other expenses in connection with the preparation, printing, reproduction and filing of the Registration Statement, any Preliminary Prospectus, any Issuer Free Writing Prospectus and the Final Prospectus and amendments and supplements thereto and the mailing and delivering of copies thereof to the Underwriters and dealers; (ii) the cost of printing or producing any agreement among the Underwriters, this Agreement, any Blue Sky memorandum, closing documents (including any compilations thereof) and any other documents in connection with the offering, purchase, sale and delivery of the Securities; (iii) all expenses in connection with the qualification of the Securities for offering and sale under state securities laws as provided in Section 5(b) hereof, including the fees and disbursements of counsel for the Underwriters in connection with such qualification and in connection with the Blue Sky survey; (iv) all fees and expenses in connection with listing the Securities on the Exchange; (v) the cost of preparing certificates, as applicable; (vi) the cost and charges of any transfer agent or registrar; and (vii) all other costs and expenses incident to the performance of its obligations hereunder which are not otherwise specifically provided for in this Section 7. It is understood, however, that the Underwriters will pay, except as provided in this Section 7, and Sections 9 and 13 hereof, all of their own costs and expenses, including the fees and disbursements of their counsel, transfer taxes on resale of any of the Securities by them, and any advertising expenses connected with any offers they may make.

8. The obligations of the Underwriters hereunder, as to the Securities to be delivered at each Time of Delivery, shall be subject, in their discretion, to the condition that all representations and warranties and other statements of the Partnership Parties herein are, at and as of such Time of Delivery, true and correct, the condition that the Partnership Parties shall have

20

performed all of their obligations hereunder theretofore to be performed, and the following additional conditions:

(a) The Final Prospectus shall have been filed with the Commission pursuant to Rule 424(b) under the Act within the applicable time period prescribed for such filing by the rules and regulations under the Act and in accordance with Section 5(a) hereof; all material required to be filed by the Partnership pursuant to Rule 433(d) under the Act shall have been filed with the Commission within the applicable time period prescribed for such filing by Rule 433; if the Partnership has elected to rely upon Rule 462(b) under the Act, the Rule 462(b) Registration Statement shall have become effective by 10:00 p.m., New York time, on the date of this Agreement; no stop order suspending the effectiveness of the Registration Statement or any part thereof shall have been issued and no proceeding for that purpose shall have been initiated or threatened by the Commission; no stop order suspending or preventing the use of the Final Prospectus or any Issuer Free Writing Prospectus shall have been initiated or threatened by the Commission; and all requests for additional information on the part of the Commission shall have been complied with to the reasonable satisfaction of the Representatives;

(b) Latham & Watkins LLP, counsel for the Underwriters, shall have furnished to the Representatives such written opinion or opinions, dated such Time of Delivery, in form and substance reasonably satisfactory to the Representatives, and such counsel shall have received such papers and information as they may reasonably request to enable them to pass upon such matters;

(c) Cravath, Swaine & Moore LLP, U.S. counsel for the Partnership Parties, shall have furnished to the Representatives their written opinion, dated such Time of Delivery, in form and substance satisfactory to the Representatives, to the effect set forth in Annex I;

(d) Cozen O’Connor, special counsel on matters of Marshall Islands law for the Partnership Parties, shall have furnished to the Representatives their written opinion, dated such Time of Delivery, in form and substance satisfactory to the Representatives, to the effect set forth in Annex II;

(e) Conyers Dill & Pearman Limited, special Bermuda counsel for the Partnership Parties, shall have furnished to the Representatives their written opinion, dated such Time of Delivery, in form and substance satisfactory to the Representatives, to the effect set forth in Annex III;

(f) CMS Cameron McKenna Nabarro Olswang LLP, special English counsel for the Partnership Parties, shall have furnished to the Representatives their written opinion, dated such Time of Delivery, in form and substance satisfactory to the Representatives, to the effect set forth in Annex IV;

(g) On the date hereof and at each Time of Delivery, Deloitte LLP shall have furnished to the Representatives a letter or letters, dated the respective dates of delivery thereof, containing statements and information of the type ordinarily included in accountants’ “comfort letters” to underwriters with respect to the financial statements and certain financial information contained

21

in the Registration Statement, Pricing Prospectus and Final Prospectus, in form and substance satisfactory to the Representatives;

(h) (i) None of the Partnership Entities shall have sustained since the date of the latest audited financial statements included or incorporated by reference in the Pricing Prospectus any loss or interference with its business from fire, explosion, flood, piracy, terrorism or other calamity, whether or not covered by insurance, or from any labor dispute or court or governmental action, order or decree, otherwise than as set forth or contemplated in the Pricing Prospectus and (ii) since the respective dates as of which information is given in the Pricing Prospectus there shall not have been any change in the capital or long-term debt of the Partnership Entities or any change, or any development involving a prospective change, in or affecting the general affairs, management, financial position, unitholders’ or shareholders’ equity, as applicable, or results of operations of the Partnership Entities, otherwise than as set forth or contemplated in the Pricing Prospectus, the effect of which, in any such case described in clause (i) or (ii), is in the judgment of the Representatives so material and adverse as to make it impracticable or inadvisable to proceed with the public offering or the delivery of the Securities being delivered at such Time of Delivery on the terms and in the manner contemplated in the Final Prospectus;

(i) On or after the Applicable Time (i) no downgrading shall have occurred in the rating accorded the Partnership Parties’ debt securities or preferred stock by any “nationally recognized statistical rating organization”, as such term is defined in Section 3(a)(62) of the Exchange Act and (ii) no such organization shall have publicly announced that it has under surveillance or review, with possible negative implications, its rating of any of the Partnership Parties’ debt securities or preferred stock;

(j) On or after the Applicable Time there shall not have occurred any of the following: (i) a suspension or material limitation in trading in securities generally on the Exchange or the NASDAQ Global Select Stock Market; (ii) a suspension or material limitation in trading in the Partnership Parties’ securities on the Exchange; (iii) a general moratorium on commercial banking activities declared by either Federal or New York State authorities or a material disruption in commercial banking or securities settlement or clearance services in the United States; (iv) the outbreak or escalation of hostilities involving the United States or the Republic of The Marshall Islands or the declaration by the United States of a national emergency or war; or (v) the occurrence of any other calamity or crisis or any change in financial, political or economic conditions in the United States or elsewhere, if the effect of any such event specified in clause (iv) or (v) in the judgment of the Representatives makes it impracticable or inadvisable to proceed with the public offering or the delivery of the Securities being delivered at such Time of Delivery on the terms and in the manner contemplated in the Final Prospectus;

(k) The Securities to be sold by the Partnership at such Time of Delivery shall have been authorized for listing, subject to notice of issuance, on the Exchange;