UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2020

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number 000-56035

GLOBAL WHOLEHEALTH PARTNERS CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada |

46-2316220 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

|

|

| |

| 2227 Avenida Oliva | ||

| San Clemente, California | 92673 | |

| (Address of principal executive offices) | (Zip Code) |

(714) 392-9752

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ | |

| Emerging growth company | ☐ |

| 1 |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in 12b-2 of the Exchange Act). Yes o No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 58,116,358 shares of common stock, par value $0.001, were outstanding on May 7, 2020.

| 2 |

GLOBAL WHOLEHEALTH PARTNERS CORPORATION

FORM 10-Q

For the Quarterly Period Ended March 31, 2020

Table of Contents

| PART I. | FINANCIAL INFORMATION | ||

| Item 1. | Financial Statements (Unaudited) | 4 | |

| Balance Sheets | 4 | ||

| Statements of Operations | 5 | ||

| Statements of Stockholders’ Equity | 6 | ||

| Statements of Cash Flows | 7 | ||

| Notes to Financial Statements | 8 | ||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 12 | |

| Item 4. | Controls and Procedures | 18 | |

| PART II. | OTHER INFORMATION | ||

| Item 1A. | Risk Factors | 19 | |

| Item 5. | Other Information | 19 | |

| Item 6. | Exhibits | 20 | |

|

|

Signatures | 21 | |

| 3 |

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

| GLOBAL WHOLEHEALTH PARTNERS CORPORATION | ||||||||

| CONSOLIDATED BALANCE SHEETS | ||||||||

| March 31, | June 30, | |||||||

| 2020 | 2019 | |||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 668 | $ | 19,918 | ||||

| Inventory | 23,372 | — | ||||||

| Total current assets | 24,040 | 19,918 | ||||||

| Total assets | $ | 24,040 | $ | 19,918 | ||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Current liabilities: | ||||||||

| Related party note | $ | 62,875 | $ | — | ||||

| Related party advances | 1,500 | — | ||||||

| Accounts payable and accrued liabilities | 1,372 | 100 | ||||||

| Total current liabilities | 65,747 | 100 | ||||||

| Total liabilities | 65,747 | 100 | ||||||

| Commitments and contingencies | ||||||||

| Stockholders' equity (deficit): | ||||||||

| Preferred stock; $0.001 par value, 10,000,000 shares authorized, no shares issued or outstanding at March 31, 2020 and June 30, 2019, respectively | — | — | ||||||

| Common stock; $0.001 par value, 400,000,000 shares authorized, 58,116,358 and 56,116,358 shares issued and outstanding at March 31, 2020 and June 30, 2019, respectively | 58,116 | 56,116 | ||||||

| Additional paid-in capital | 444,784 | 426,784 | ||||||

| Retained deficit | (544,607 | ) | (463,082 | ) | ||||

| Total stockholders' equity | (41,707 | ) | 19,818 | |||||

| Total liabilities and stockholders' equity | $ | 24,040 | $ | 19,918 | ||||

| (See accompanying notes to consolidated financial statements) | ||||||||

| 4 |

| GLOBAL WHOLEHEALTH PARTNERS CORPORATION | ||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED) FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2020 AND 2019 | ||||||||

Three Months Ended March 31, | Nine Months Ended March 31, | |||||||||||||||

| 2020 | 2019 | 2020 | 2019 | |||||||||||||

| Revenue | $ | — | $ | — | $ | — | $ | — | ||||||||

| Operating expense | ||||||||||||||||

| Professional fees | 9,000 | 6,738 | 44,900 | 6,738 | ||||||||||||

| Research and development | 443,750 | — | 443,750 | — | ||||||||||||

| Selling, general and administrative | 2,629 | 2,270 | 36,625 | 2,870 | ||||||||||||

| Total operating expense | 455,379 | 9,008 | 525,275 | 9,608 | ||||||||||||

| Loss from operations | (455,379 | ) | (9,008 | ) | (525,275 | ) | (9,608 | ) | ||||||||

| Other income | ||||||||||||||||

| Gain on forgiveness of liabilities | 443,750 | — | 443,750 | — | ||||||||||||

| Net loss | $ | (11,629 | ) | $ | (9,008 | ) | $ | (81,525 | ) | $ | (9,608 | ) | ||||

| Basic and Diluted Loss per Common Share | $ | (0.00 | ) | $ | (0.17 | ) | $ | (0.00 | ) | $ | (0.18 | ) | ||||

| Weighted average number of common shares outstanding - basic and diluted | 58,116,358 | 52,358 | 57,343,755 | 52,358 | ||||||||||||

| (See accompanying notes to consolidated financial statements) | ||||||||||||||||

| 5 |

| GLOBAL WHOLEHEALTH PARTNERS CORPORATION | ||||||||||||||||||||

| CONSOLIDATED STATEMENTS OF STOCKHOLDERS' DEFICIT (UNAUDITED) | ||||||||||||||||||||

| FOR THE NINE MONTHS ENDED MARCH 31, 2020 | ||||||||||||||||||||

| Common Stock | Additional Paid-in | Retained | Total Stockholders’ | |||||||||||||||||

| Shares | Amount | Capital | Deficit | Deficit | ||||||||||||||||

| BALANCE JULY 1, 2019 | 56,116,358 | $ | 56,116 | $ | 426,784 | $ | (463,082 | ) | $ | 19,818 | ||||||||||

| Net loss for the three months ended September 30, 2019 | — | — | — | (18,798 | ) | (18,798 | ) | |||||||||||||

| Balance, September 30, 2019 | 56,116,358 | 56,116 | 426,784 | (481,880 | ) | 1,020 | ||||||||||||||

| Common stock issued to related party for cash at $0.01 per share | 2,000,000 | 2,000 | 18,000 | — | 20,000 | |||||||||||||||

| Net loss for the three months ended December 31, 2019 | — | — | — | (51,098 | ) | (51,098 | ) | |||||||||||||

| Balance, December 31, 2019 | 58,116,358 | 58,116 | 444,784 | (532,978 | ) | (30,078 | ) | |||||||||||||

| Net loss for the three months ended March 31, 2020 | — | — | — | (11,629 | ) | (11,629 | ) | |||||||||||||

| Balance, March 31, 2020 | 58,116,358 | $ | 58,116 | $ | 444,784 | $ | (544,607 | ) | $ | (41,707 | ) | |||||||||

| FOR THE NINE MONTHS ENDED MARCH 31, 2019 | ||||||||||||||||||||

| BALANCE JULY 1, 2018 | 52,358 | $ | 52 | $ | 430,748 | $ | (432,215 | ) | $ | (1,415 | ) | |||||||||

| Net loss for the three months ended September 30, 2018 | — | — | — | (300 | ) | (300 | ) | |||||||||||||

| Balance, September 30, 2018 | 52,358 | 52 | 430,748 | (432,515 | ) | (1,715 | ) | |||||||||||||

| Net loss for the three months ended December 31, 2018 | — | — | — | (300 | ) | (300 | ) | |||||||||||||

| Balance, December 31, 2018 | 52,358 | 52 | 430,748 | (432,815 | ) | (2,015 | ) | |||||||||||||

| Net loss for the three months ended March 31, 2019 | — | — | — | (9,008 | ) | (9,008 | ) | |||||||||||||

| Balance, March 31, 2019 | 52,358 | $ | 52 | $ | 430,748 | $ | (441,823 | ) | $ | (11,023 | ) | |||||||||

| (See accompanying notes to consolidated financial statements) | ||||||||||||||||||||

| 6 |

GLOBAL WHOLEHEALTH PARTNERS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) | ||||||||

| FOR THE NINE MONTHS ENDED MARCH 31, 2020 AND 2019 | ||||||||

| Nine Months Ended March 31, | ||||||||

| 2020 | 2019 | |||||||

| Cash flows from operating activities | ||||||||

| Net loss | $ | (81,525 | ) | $ | (9,608 | ) | ||

| Adjustments to reconcile net loss to net cash flows used in operating activities: | ||||||||

| Common stock issued for services | — | — | ||||||

| Common stock issued for debt settlement | — | — | ||||||

| Changes in operating assets and liabilities: | ||||||||

| (Increase) decrease in inventory | (23,372 | ) | — | |||||

| Increase (decrease) in related party advances | 1,500 | 10,923 | ||||||

| Increase (decrease) in accounts payable and accrued expenses | 1,272 | (1,315 | ) | |||||

| Net cash flows from operating activities | (102,125 | ) | — | |||||

| Cash flows from financing activities | ||||||||

| Cash for common shares of stock | 20,000 | |||||||

| Proceeds from related party note, net | 62,875 | |||||||

| Net cash flows from financing activities | 82,875 | — | ||||||

| Change in cash | (19,250 | ) | — | |||||

| Cash at beginning of period | 19,918 | — | ||||||

| Cash at end of period | $ | 668 | $ | — | ||||

| Supplemental disclosure of cash flow information: | ||||||||

| Interest paid in cash | $ | — | $ | — | ||||

| Income taxes paid in cash | $ | — | $ | — | ||||

| (See accompanying notes to consolidated financial statements) | ||||||||

| 7 |

GLOBAL WHOLEHEALTH PARTNERS CORPORATION

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND NINE MONTHS ENDED MARCH 31, 2020 AND 2019

NOTE 1 – Basis of Presentation, Organization and Going Concern

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements of Global WholeHealth Partners Corporation and Subsidiary (the “Company”) as of March 31, 2020, and for the three and nine months ended March 31, 2020 and 2019, include the accounts of the Company and its wholly-owned and controlled subsidiary, Global WholeHealth Partners Corp, a private Wyoming corporation, and have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”), for interim financial information and with the instructions to Form 10-Q and Article 8 of Regulation S-X. Certain information or footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted.

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements, and the reported amounts of expenses during the reporting periods. Actual results may differ from those estimates. The interim financial statements should be read in conjunction with the audited financial statements and notes thereto included in the Company’s Annual Report on Form 10 for the year ended June 30, 2019.In the opinion of management, the accompanying unaudited interim condensed consolidated financial statements have been prepared on the same basis as the audited financial statements and include all adjustments (including normal recurring adjustments) necessary for the fair presentation of the Company’s financial position as of December 31, 2019, results of operations for the three and nine months ended March 31, 2020 and 2019, and stockholders’ equity and cash flows for the three and nine months ended March 31, 2020 and 2019. The Company did not record an income tax provision during the periods presented due to net taxable losses. The results of operations for any interim period are not necessarily indicative of the results of operations for the entire year.

Organization

Global WholeHealth Partners Corporation was incorporated on March 7, 2013 in the State of Nevada under the name Texas Jack Oil and Gas Corp. On May 9, 2019, the Company amended its Articles of Incorporation to effect a change of name to Global WholeHealth Partners Corporation to align the company name with its focus on health care related development and products. The Company’s ticker symbol changed to GWHP.

The Company was originally organized for the purpose of exploration of Oil and Gas. However, the Company was unable to establish an oil and gas concern and was abandoned in 2016. On February 27, 2019, the Clark County District Court of Nevada appointed Barbara Bauman as custodian to the Company. The custodian reestablished the Company in good standing.

On May 9, 2019, the Board reverse split (1-for-500) the outstanding Common Shares of 58,172,000 to 116,358 shares.

May 23, 2019, the Company and LionsGate Funding Group LLC (“LionsGate”), owner of a majority of the Company’s outstanding common stock as of May 23, 2019, entered into a Stock Sale and Purchase Agreement (the “SPA”) which closed on June 27, 2019. Pursuant the SPA, the Company issued 56,000,000 shares of common stock to LionsGate in exchange for 100% of their interests in Global WholeHealth Partners Corp., a private Wyoming corporation incorporated on April 9, 2019 (“Global Private”). Global Private has contacts with suppliers and contract manufacturers in the In vitro diagnostic industry, with rights to sell rapid diagnostic tests, such as the following 6 minute rapid whole blood Ebola Test, 6 minute whole blood Zika test, 8 minute whole blood rapid TB test and 75 plus other tests more than 40 which are FDA approved. Due to the common control of the Company and Global Private, pursuant to ASC 805-50-25, “Transactions Between Entities Under Common Control”, the SPA was accounted for as a transfer of the carrying amounts of assets and liabilities under the predecessor value method of accounting. Financial statement presentation under the predecessor values method of accounting as a result of a business combination between entities under common control requires the receiving entity (i.e., the Company) to report the results of operations as if both entities had been combined as of the beginning of the periods presented. The consolidated financial statements include both entities’ full results since the inception of Global Private.

| 8 |

Going Concern

The Company’s consolidated financial statements are prepared using generally accepted accounting principles in the United States of America applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs to allow it to continue as a going concern. As of March 31, 2020, the Company had an accumulated deficit of $544,607. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations.

In view of these conditions, the ability of the Company to continue as a going concern is in doubt and dependent upon achieving a profitable level of operations and on the ability of the Company to obtain necessary financing to fund ongoing operations. Historically, the Company has relied upon internally generated funds, and funds from the sale of stock, issuance of promissory notes and loans from its shareholders and private investors to finance its operations and growth. Management is planning to raise necessary additional funds for working capital through loans and/or additional sales of its common stock. However, there is no assurance that the Company will be successful in raising additional capital or that such additional funds will be available on acceptable terms, if at all. Should the Company be unable to raise this amount of capital its operating plans will be limited to the amount of capital that it can access. These consolidated financial statements do not give effect to any adjustments which will be necessary should the Company be unable to continue as a going concern and therefore be required to realize its assets and discharge its liabilities in other than the normal course of business and at amounts different from those reflected in the accompanying consolidated financial statements.

NOTE 2 – Summary of Significant Accounting Policies

Principles of Consolidation

Global WholeHealth Partners Corp, a private Wyoming corporation was incorporated on April 9, 2019 to receive private investor funds and aggregate certain in vitro diagnostic assets.

These consolidated financial statements presented are those of Global WholeHealth Partners Corporation and its wholly owned subsidiary, Global Private. All significant intercompany balances and transactions have been eliminated.

Accounting estimates

The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting principles (“GAAP”) requires Management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ significantly from those estimates.

Cash and cash equivalents

The Company considers all highly liquid instruments purchased with an original maturity of three months or less and money market accounts to be cash equivalents.

| 9 |

Income Taxes

The Company accounts for income taxes using the asset and liability method. Under the asset and liability method, deferred tax assets and liabilities are recognized for the future tax consequences attributed to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and tax credits and loss carry-forwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences and carry-forwards are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is established when necessary to reduce deferred tax assets to amounts expected to be realized. The Company reports a liability for unrecognized tax benefits resulting from uncertain income tax positions, if any, taken or expected to be taken in an income tax return. Estimated interest and penalties are recorded as a component of interest expense or other expense, respectively.

Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Company utilizes a three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the lowest priority to unobservable inputs (level 3 measurements). These tiers include:

Level 1, defined as observable inputs such as quoted prices for identical instruments in active markets;

Level 2, defined as inputs other than quoted prices in active markets that are either directly or indirectly observable such as quoted prices for similar instruments in active markets or quoted prices for identical or similar instruments in markets that are not active; and

Level 3, defined as unobservable inputs in which little or no market data exists, therefore requiring an entity to develop its own assumptions, such as valuations derived from valuation techniques in which one or more significant inputs or significant value drivers are unobservable.

During the periods covered by this report, the Company did not have any assets or liabilities that were required to be measured at fair value on a recurring basis or on a non-recurring basis.

Fair Value of Financial Instruments

The Company’s financial instruments consist of cash, accounts payable and accrued expenses. The carrying amounts of the Company’s financial instruments approximate fair value because of the short term maturity of these items. These fair value estimates are subjective in nature and involve uncertainties and matters of significant judgment and, therefore, cannot be determined with precision. Changes in assumptions could significantly affect those estimates. We do not hold or issue financial instruments for trading purposes, nor do we utilize derivative instruments.

Net Income (Loss) Per Share

The computation of basic earnings per share (“EPS”) is based on the weighted average number of shares that were outstanding during the period, including shares of common stock that are issuable at the end of the reporting period. The computation of diluted EPS is based on the number of basic weighted-average shares outstanding plus the number of common shares that would be issued assuming the exercise of all potentially dilutive common shares outstanding using the treasury stock method. The Company had no potentially dilutive securities as of December 31, 2019.

New Accounting Pronouncements

Any reference in these notes to applicable accounting guidance is meant to refer to the authoritative non-governmental US GAAP as found in the Financial Accounting Standards Board's Accounting Standards Codification.

We review new accounting standards as issued. Although some of these accounting standards issued or effective after the end of our previous fiscal year may be applicable to us, we have not identified any standards that we believe merit discussion. We believe that none of the new standards will have a significant impact on our consolidated financial statements.

| 10 |

NOTE 3 – Stockholder’s Equity

Preferred Stock

The Company has Preferred stock: $0.001 par value; 10,000,000 shares authorized with no shares issued and outstanding.

Common Stock

The Company has 400,000,000 shares of Common Stock authorized of which 58,116,358 and 56,116,358 shares were issued and outstanding as of March 31, 2020 and June 30, 2019, respectively. During the nine months ended March 31, 2020, the number of shares increased by 2,000,000 as a result of the Company selling 2,000,000 shares at $0.01 per share to LionsGate in exchange for cash of $20,000.

NOTE 4 – Related Party Transactions

During the nine months ended March 31, 2020, the Company received $20,000 upon the sale of 2,000,000 shares of common stock to LionsGate for $0.01 per share.

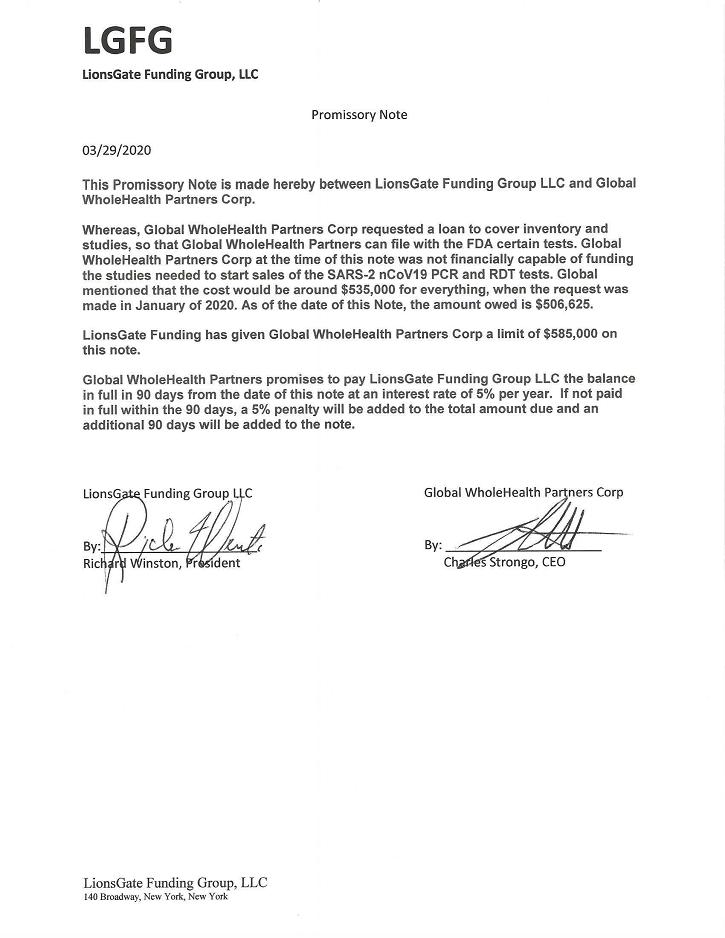

From time-to-time the Company receives shareholder advances to cover operating costs which are reflected on the balance sheet as related party advances. During the three months ended March 31, 2020, LionsGate provided advances totaling $455,950 which was used to pay professional fees of $11,100, research studies for the development of its CoVid-19 tests of $443,750 and general costs of $1,100. During the nine months ended March 31, 2020, LionsGate provided advances totaling $506,625 which was used to pay professional fees of $46,000, research studies for the development of CoVid-19 tests of $443,750 and general costs of $16,875.

During the three months ended March 31, 2020, the Company paid $431,250 to Pan Probe Biotech to perform studies in validation of the Company’s CoVid-19 tests. Dr. Shujie Cui is the Company’s Chief Science Officer and 100% owner of Pan Probe.

NOTE 5 – Promissory Note

On March 29, 2020, the Company issued a Promissory Note (the “Note”) to LionsGate in the amount of $506,625 which was equivalent to the advances made to the Company up to March 29, 2020. On March 30, 2020, LG decided it would be in the best interests of the Company to forgive the portion of the Note related to testing costs which totaled $443,750. As a result, the Company recognized $443,750 of other income for the three and six months ended March 31, 2020 leaving a Note balance of $62,875. The terms of the Note provide total funding of up to $585,000 or an additional $78,375. The Note bears interest at the rate of 5% per annum and the principal and interest is due and payable in full in 90 days on June 30, 2020. If not paid within the 90 days a 5% penalty will be added to the Note and the term will extend for an additional 90 days.

The Note was issued by the Company under the exemption from registration afforded by Section 4(a)(2) of the Securities Act, as amended and/or Regulation D promulgated thereunder, as the securities were issued to accredited investors, without a view to distribution, and were not issued through any general solicitation or advertisement.

NOTE 6 – Subsequent Events

Management has reviewed material events subsequent of the period ended March 31, 2020 and prior to the filing of our consolidated financial statements in accordance with FASB ASC 855 “Subsequent Events”.

The recent outbreak of the novel coronavirus CoVid-19, which was declared a pandemic by the World Health Organization on March 11, 2020, has led to adverse impacts on the U.S. and global economies and created uncertainty regarding potential impacts to the Company’s employees and R&D activities. The CoVid-19 pandemic has impacted and could further impact the Company’s operations and the operations of the Company’s vendors as a result of quarantines, facility closures, and travel and logistics restrictions. The extent to which the CoVid-19 pandemic impacts the Company’s business, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted, including, but not limited to the duration, spread, severity, and impact of the CoVid-19 pandemic, the effects of the CoVid-19 pandemic on the Company’s customers, suppliers, and vendors and the remedial actions and stimulus measures adopted by local, state and federal governments, and to what extent normal economic and operating conditions can resume. Even after the CoVid-19 pandemic has subsided, the Company may continue to experience adverse impacts to its business as a result of any economic recession or depression that has occurred or may occur in the future. Therefore, the Company cannot reasonably estimate the impact at this time.

| 11 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

This Report on Form 10-Q contains forward-looking statements which involve assumptions and describe our future plans, strategies, and expectations, and are generally identifiable by use of words such as “may,” “will,“ “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project,” or the negative of these words or other variations on these words or comparable terminology. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished.

Such forward-looking statements include statements regarding, among other things, (a) the potential markets for our products, our potential profitability, and cash flows, (b) our growth strategies, (c) anticipated trends in the in-vitro diagnostics industry, (d) our future financing plans, and (e) our anticipated needs for working capital. This information may involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from the future results, performance, or achievements expressed or implied by any forward-looking statements. These statements may be found under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as in this Form 10-Q generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the matters described in this Form 10-Q generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur. In addition to the information expressly required to be included in this filing, we will provide such further material information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not misleading.

Although forward-looking statements in this report reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our filings with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect our actual results may vary materially from those expected or projected.

Except where the context otherwise requires and for purposes of this Form 10-Q only, “we” “us“ “our“ “Company“ “our Company“ and “Global WholeHealth Partners” refer to Global WholeHealth Partners Corporation, a Nevada corporation.

Overview

The Company was founded to develop, manufacture and market in-vitro diagnostic (“IVD”) tests for over-the-counter (“OTC” or consumer), or consumer-use and point-of-care (“POC” or professional) which includes hospitals, physicians’ offices and medical clinics, including those within penal systems throughout the US and abroad. The Company currently manufactures and markets a range of diagnostic test kits for consumer use through OTC sales, and for use by health care professionals, generally located at medical clinics, physician offices and hospitals known POC, in the United States. These test kits are known as in-vitro diagnostic test kits or “IVD” products.

The Company believes, according to publicly available sources, that the IVD industry is a multi-billion dollar industry that is increasing each year. This assessment includes all laboratory hospital-based products, OTC devices, and rapid tests performed at the point-of-care. The Company believes that the following factors can be attributed to the increase in overall need and use of IVD test kits: an aging baby-boomer population; increasing healthcare costs; the ever-growing number of uninsured and under-insured in the U.S. and abroad; and a general increase in consumer awareness, in part due to the wealth of information available on the Internet.

| 12 |

The concepts that distinguish POC technology—operation simple enough for non-laboratory users; little or no maintenance requirement; and rapid, reliable results—mean that it can be applied equally well in many non-clinical settings, such as the OTC market. As advances in medical technology increasingly make it possible to diagnose diseases and physiological conditions from ever-smaller amounts of body fluids, certain diseases and conditions that once required diagnosis by physicians and/or medical technicians inside hospital emergency rooms, exam rooms/bedside studies, or private clinics, can now also be done by inexpensive, easy-to-use diagnostic devices that consumers can use in the comfort and anonymity of their home. Today, the average pharmacy, whether a privately owned neighborhood store, or chain owned, has become an outlet for selling IVD test kits for in-home use.

All of the products we sell are manufactured in an FDA Approved Facility in the USA. An FDA Approved facility is a facility that meets Good Manufacturing Practices (“GMP”) with the FDA.

CoVid-19 / SARS2 Activities

In response to the CoVid-19 / SARS2 (“CoVid-19”) Pandemic, in early January 2020, the Company set out to test and perform the studies necessary to develop a Rapid Diagnostic Test (“RDT”) and Real Time Polymerase Chain Reaction Test (“RT-PCR”). During the quarter, the Company completed the testing necessary to develop both the RDT and RT-PCR tests. RDT test results are available in 10 minutes with an overall accuracy rate of 98%. The RT-PCR test looks for the E-Gene and RdRq-Gene markers and has proven to be 97% accurate. The test is able to be processed in any PCR machine and each test kit includes the required reagents.

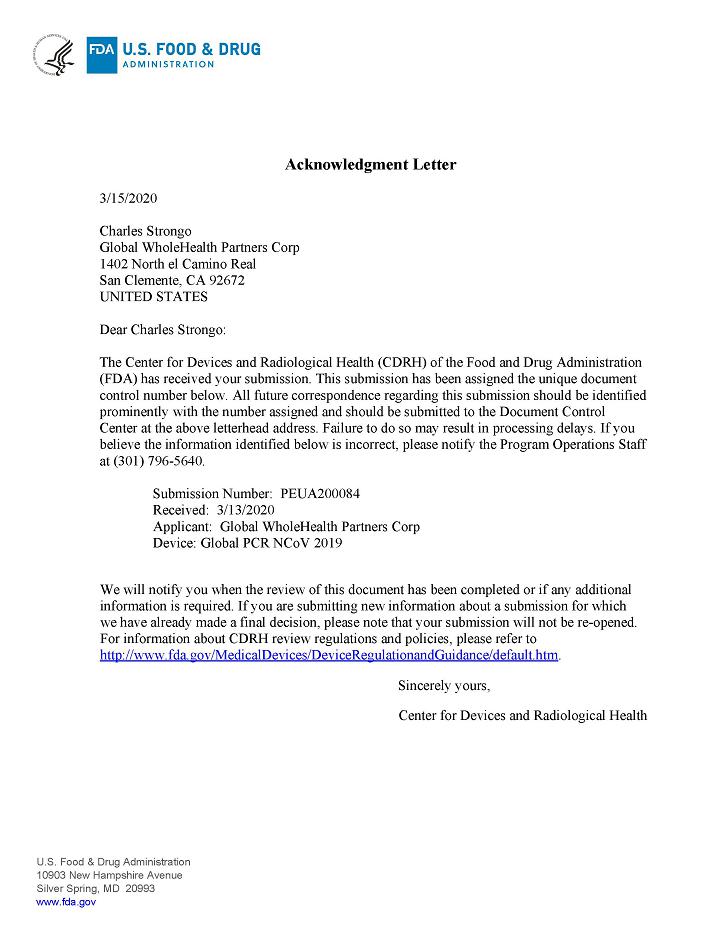

On March 13, 2020 Charles Strongo, CEO filed on the behalf of the Company, the Pre Emergency Use Application (“PEUA”) with the FDA for the RT-PCR Test for CoVid-19. On March 15, 2020, the FDA sent an Official Acknowledgement letter accepting the Company’s application for the RT-PCR Test for CoViD-19. The Company is in the process of responding to FDA inquires.

On April 6, 2020, Mr. Strongo filed on the behalf of the Company a PEUA for the RDT for CoViD-19 test. On April 6th 2020, the FDA sent the Official Acknowledgement Letter accepting the Company’s Application for the RDT. The Company is in the process of responding to FDA inquires.

On April 13, 2020, the Department of NAVY ordered 1,000 RDT tests from the Company under the FDA March 16th guideline, which allows tests to be sold once a tests accuracy is demonstrated to be 90%+ and a PEUA has been filed with the FDA while working with the FDA for approval. The NAVY order was delivered on April 29, 2020 at the NAVY BASE at Point Loma.

The Company has sent RDT samples to 3rd party Labs for evaluations with positive feedback.

The Company anticipates near term sales of its RDT and PCR tests to various domestic and international private and public entities.

The Company is currently developing the next generation of RDT and Microwell CoVid-19 tests to achieve increased accuracy, remove all cross reactivity on the test itself and differentiate between the IgG and IgM antibodies which differentiation aids in an improved understanding of the stage of disease progression.

Industry

The use of diagnostics in quality measures often is supported by clinical practice guidelines. Of all the quality measures contained in The Healthcare Effectiveness Data and Information Set (“HEDIS”) is a widely used set of performance measures in the managed care industry, developed and maintained by the National Committee for Quality Assurance (“NCQA”) and The National Quality Measures Clearinghouse (“NQMC”). We identified guidelines specifically recommending diagnostic use in the NGC for 61.5% of those in HEDIS and 78.5% of those in the NQMC.

| 13 |

Of course, the development of measures for HEDIS, NQMC and other quality assessment initiatives is a relatively new process and represents only a sample of evidence-based use of diagnostics. Nevertheless, this analysis conveys the essential role of diagnostics in health care quality. Further, the incorporation of diagnostics into quality measures serves as a benchmark for assessing underuse of diagnostics and the health and economic impact of such underuse.

In its annual report on the state of health care quality in the US, NCQA assessed the impact of under-compliance with HEDIS measures, including those pertaining to diagnostics, on avoidable adverse health events, deaths and costs. Figure 7.7 below shows these impacts for measures pertaining to diagnostics used in breast cancer detection, cholesterol management, colorectal cancer screening and diabetes management.

Figure 7.7 Relationship between Application of Selected HEDIS Diagnostic Quality Measures and Avoidable Adverse Health Events, Deaths and Costs

|

HEDIS Quality Measure |

Percent National Under-use in HEDIS Compliant Health Plans |

Estimated Annual Avoidable Adverse Health Events |

Estimated Annual Avoidable Deaths |

Estimated Annual Avoidable Costs |

| Breast cancer screening | 19.3% | 7,600 breast cancer | 600–1,000 | $ 48 million |

| (biopsy, needle | cases treated in Stage | |||

| aspiration or | IV due to late | |||

| mammography) | diagnosis | |||

| Cholesterol management | 48.9 | 14,600 major coronary events | 6,900–17,000 | $ 87 million |

| Colorectal cancer | 51.9 | 20,000 cases of | 4,200–6,300 | $191 million |

| screening | colorectal cancer | |||

| (FOBT or colonoscopy) | diagnosed/treated at a | |||

| later stage | ||||

|

Diabetes management (HbA1c control) |

20.2 | 14,000 heart attacks, strokes, or amputations | 4,300–9,600 | $573 million |

549 State of health care quality: industry trends and analysis. Washington, DC: National Committee for Quality Trance, 2004.

These and other findings of the 2004 NCQA report on the state of health care quality demonstrate the potential for evidence-based use of diagnostics to improve health care quality and to avoid unnecessary adverse health events, deaths and costs. These studies are the most recent and as time has passed, we all understand that the cost of Health Care has gone up dramatically and therefore the savings to the health care industry is even greater than the studies show (See Figure 7.7 above).

Health care increasingly is subject to demands for improved health and quality of life and constraints on the spending required to deliver these improvements. In vitro diagnostics, henceforth in this report referred to as diagnostics, aid in responding to such demands by enabling accurate detection of health risks and disease at earlier stages and improving treatment and disease management, while diminishing subsequent health problems and their associated costs. Diagnostics serve a key role in the health value chain by influencing the quality of patient care, health outcomes, and downstream resource requirements.

From consumer-friendly at-home pregnancy and glucose monitoring tests to more complex automated laboratory-based systems, these tests are often first-line health decision tools. While diagnostics comprise less than 5% of hospital costs and about 1.6% of all Medicare costs, their findings influence as much as 60-70% of health care decision-making. The value of diagnostics accrues to not only clinicians and patients, but to health care managers, third-party payers, and quality assurance organizations that use diagnostic performance to measure and improve health care quality.

| 14 |

The following data have been culled from various publicly available sources that the Company believes to be accurate but cannot guarantee it. The Company has attempted to provide conservative statistics and believe that it is generally known that the market for IVD products is significant and is continuing to grow.

The pregnancy test is one of the primary home tests used in the world. The Company believes that approximately, 85,000 retail drug stores in the U.S. are selling over $900 million of pregnancy tests alone and continues to increase annually. Presently, it knows of five major manufacturers of this product.

The ovulation test market is generally estimated at $51 million annually and is growing annually. Presently, the Company is aware of four major brand companies that offer this test.

The glucose (diabetes) whole blood test is used to test for abnormal glucose blood levels. A significant number of individuals are affected in the United States with non-insulin dependent diabetes (Type II), many of whom are without knowledge of the disease. This disease, left untreated, can cause cardiovascular disorders and cataracts. With the explosive growth of childhood obesity and general poorer health on Americans, this test can saves thousands of lives.

As mentioned in the table 7.7: Diabetes management: There are 14,000 heart attacks, strokes, or amputations; 4,300–9,600 Deaths, but with Rapid Diagnostic Testing an annual avoidable cost of $573 million per year, and lives saved.

The Company’s most recent OTC product is its colorectal test (colon disorders). The Company estimates the demand for this test to increase with awareness of availability. It knows of only one other company that is currently offering this product. The colorectal Cancer screening tests helps detect the possibility of cancer early and can saves thousands of lives and millions of dollars. Colorectal cancer screening (FOBT) Fecal Occult Blood Test: 20,000 cases of colorectal cancer diagnosed/treated at a later stage and 4,200–6,300 deaths, but with Rapid Diagnostic Testing an annual avoidable cost of $191 million per year and lives saved.

The Company’s cholesterol OTC test and its cholesterol colorimetric POC test are available to test for abnormal levels of cholesterol in whole blood. There is evidence that a high blood cholesterol level increases the risk of developing arteriosclerosis, and with it the risk of coronary heart disease or stroke. This heart disease is the leading cause of death in the United States, as reported by the American Heart Association. Estimated Annual Avoidable Adverse Health Events are estimated to be approximately 14,600 with estimated annual avoidable deaths of approximately 6,900–17,000 from high Cholesterol. Rapid Diagnostic Tests taken by this populations would save an estimated $87 million per year and lives saved.

The market for drugs-of-abuse tests for the over-the-counter market is generally estimated to be one of the fastest growing markets of all IVD test products. At present, the Company believes that many law enforcement and governmental agencies are using laboratory testing facilities and must wait for results, often taking one week to ten days. The Company’s tests are completed onsite within ten minutes.

A significant number of people are infected by the H-Pylori bacteria, which are associated with ulcers. The Company’s H-Pylori test for the POC is one of its newest products.

All of the Company’s diagnostic tests, over 90 products are available for international distribution. The Company believes that its tests are excellent for distribution and use in underdeveloped countries because, unlike lab and other rapid diagnostic tests, its test kits do not need refrigeration and can withstand extended periods of excessive heat.

Competition

Several companies around the world carry similar products, typically comprised of approximately 10-30 different products. However, we carry the largest line of products that we know of including over 100 products. As of March 31, 2020, Global Wholehealth Partners Corp. has made no sales.

| 15 |

Marketing and Sales

The company plans on selling through large and small distributors, giving the company the greatest opportunity to sell to a greater amount of people, doctors, hospitals, clinics and governments.

Research and Development:

We are continuing to look for needs in the world to create and work with our scientific team and science partners to make a rapid test for the newest diseases, such as ZIKA, EBOLA, TB, and Malaria.

Results of Operations

Three and nine months ended March 31, 2020 compared with the three and nine months ended March 31, 2019

Operating Expenses

A summary of our operating expense for the three months ended March 31, 2020 compared with the three months ended March 31, 2019 follows:

Three Months Ended March 31, | Three Months Ended March 31, | Increase/ | ||||||||||

| 2020 | 2019 | (Decrease) | ||||||||||

| Operating expenses: | ||||||||||||

| Professional fees | $ | 9,000 | $ | 6,738 | $ | 2,262 | ||||||

| Research and development | 443,750 | — | 443,750 | |||||||||

| Selling, general and administrative | 2,629 | 2,270 | 359 | |||||||||

| Total operating expenses | $ | 455,379 | $ | 9,008 | $ | 446,371 |

A summary of our operating expense for the nine months ended March 31, 2020 compared with the nine months ended March 31, 2019 follows:

Nine Months Ended March 31, | Nine Months Ended March 31, | Increase/ | ||||||||||

| 2020 | 2019 | (Decrease) | ||||||||||

| Operating expenses: | ||||||||||||

| Professional fees | $ | 44,900 | $ | 6,738 | $ | 38,162 | ||||||

| Research and development | 443,750 | — | 443,750 | |||||||||

| Selling, general and administrative | 36,625 | 2,810 | 33,755 | |||||||||

| Total operating expenses | $ | 525,275 | $ | 9,608 | $ | 515,667 |

Professional Fees

Professional fees relate to expenditures incurred primarily for legal and accounting services. During the three and nine months ended March 31, 2020 compared to the three and nine months ended March 31, 2019, professional fees increased $2,262 and $38,162, respectively. The increase was due to increased professional and management fees incurred in furtherance of the Company’s business plan and the administration of the public entity.

| 16 |

Research and Product Development

Research and Product Development (“R&D”) costs represent costs incurred to develop our tests and are incurred pursuant to agreements with other third-party providers and certain internal R&D cost allocations when applicable. R&D costs are expensed when incurred. During the three and nine months ended March 31, 2020 compared to the three and nine months ended March 31, 2019, R&D costs increased as a result of a $443,750 increase related to testing and development of the Company’s Co Vid-19 rapid test.

Selling, General and Administrative

Selling, general and administrative (“SG&A”) costs include all expenditures related to personnel, travel and entertainment, public company compliance costs, insurance and other office related costs. During the three and nine months ended March 31, 2020 compared to the three and nine months ended March 31, 2019, SG&A increased $359 and $33,755, respectively. The increase was due to increased cost incurred in furtherance of the Company’s business plan and the administration of the public entity.

Other Income

Other income increased $443,750 as a result of the forgiveness of debt incurred related to the Company’s CoVid-19 test costs, please see Note 4 and Note 5 to the Company’s Consolidated Financial Statements for additional information.

Liquidity and Capital Resources

As of March 31, 2020, our assets consisted of $668 in cash and $23,372 in inventory compared to current liabilities of $65,747. From inception to March 31, 2020, we have incurred an accumulated deficit of $544,607. This loss has been incurred through a combination of professional fees, R&D and SG&A costs to support our plans to develop our business. During the nine months ended March 31, 2020 and 2019, the Company had no revenue and incurred a loss from operations of $525,275 and $9,608, respectively. The Company has incurred losses since inception and may not be able to generate sufficient net revenue from its business in the future to achieve or sustain profitability. The Company currently has insufficient funds to operate over the next twelve months. To finance our operations, we are currently pursuing additional funds through equity or debt financing or a combination thereof. The Company currently has no commitments to obtain any such financing, and there can be no assurance that financing will be available in amounts or on terms acceptable to the Company, if at all.

Summary of Cash Flows

Presented below is a table that summarizes the cash provided or used in our activities and the amount of the respective increases or decreases in cash provided by (used in) those activities between the fiscal periods:

| Nine Months Ended March 31, | Increase/ | |||||||||||

| 2020 | 2019 | Decrease | ||||||||||

| Operating activities | $ | (102,125 | ) | $ | — | $ | 102,125 | |||||

| Investing activities | — | — | — | |||||||||

| Financing activities | 82,875 | — | 82,875 | |||||||||

| Net increase (decrease) in cash and cash equivalents | $ | (19,250 | ) | $ | — | $ | 185,000 | |||||

Operating Activities

Net cash used in operating activities increased $102,125 due to increases in professional fees and SG&A costs.

Investing Activities

The Company had no investing activities during the three and nine months ended March 31, 2020 or 2019.

| 17 |

Financing Activities

During the nine months ended March 31, 2020, the Company received $20,000 upon the sale of 2,000,000 shares of common stock to LionsGate for $0.01 per share and net related party advances totaling $62,875.

Other Contractual Obligations

None.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

Recently Issued Accounting Pronouncements

See Note 2 to our Financial Statements for more information regarding recent accounting pronouncements and their impact to our results of operations and financial position.

New Accounting Standards to be Adopted Subsequent to March 31, 2020

None.

Critical Accounting Policies and Significant Judgments’ and Use of Estimates

We have prepared our consolidated financial statements in conformity with accounting principles generally accepted in the United States. Our preparation of these financial statements and related disclosures requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting periods. These estimates can also affect supplemental disclosures including information about contingencies, risk and financial condition. Critical accounting estimates are defined as those that are reflective of significant judgments and uncertainties and potentially yield materially different results under different assumptions or conditions. Given current facts and circumstances, we believe that our estimates and assumptions are reasonable, adhere to GAAP and are consistently applied. We evaluate our estimates and judgments on an ongoing basis. Actual results may differ from these estimates under different assumptions or conditions. Our critical accounting policies are more fully described above under the Notes to Financial Statements “NOTE 2 – Summary of Significant Accounting Policies”.

Related Party Transactions

For a discussion of our Related Party Transactions, refer to “Note 4 - Related Party Transactions” to our Financial Statements included elsewhere in this Quarterly Report on Form 10-Q.

Item 4. Controls and Procedures

Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we conducted an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934 (the “Exchange Act”), as of the end of the period covered by this quarterly report. Based on this evaluation, our Chief Executive Officer and Chief Financial Officer concluded that as of March 31, 2020, that our disclosure controls and procedures were effective such that the information required to be disclosed in our SEC filings is recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

| 18 |

Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) that occurred during the period covered by this report that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1A. Risk Factors

Co Vid-19 Pandemic Impact and Risk

At this time, it is not possible to fully assess the impact of the Co Vid-19 pandemic on the Company’s operations and capital requirements. Should the Co Vid-19 pandemic continue, it may adversely affect the Company’s ability to (i) retain employees and consultants; (ii) obtain additional financing on terms acceptable to the Company, if at all; (iii) delay regulatory submissions and approvals; (iv) delay, limit or preclude the Company from securing manufacturing sites or partnerships; (v) delay, limit or preclude the Company from achieving technology or product development goals, milestones, or objectives; and (vi) preclude or delay entry into joint venture or partnership arrangements. The occurrence of any one or more of such events may affect the Company’s ability to execute on its business plan.

The Company’s priority and commitment is to the health and security of its team members, their families and its partners through this unprecedented event.

Item 5. Other information

On January 1, 2020, in addition to the position

of CEO, the Board of Directors appointed Charles Strongo to the position of Secretary commensurate with the resignation of Sara

Gonzales. The resignation by Ms. Gonzales was not the result of any disagreement with the Company on any matter relating to the

Company’s operations, policies or practices.

| 19 |

Item 6. Exhibits

| Exhibit No. | Description of Exhibit |

| 10.1 | |

| 99.1 | Acknowledgement Letter from the FDA dated March 15, 2020* |

| 99.2 | |

| 31.1 | Certification of Principal Executive Officer Pursuant to Rule 13a-14 of the Securities Exchange Act of 1934, As Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* |

| 31.2 | Certification of Principal Financial Officer Pursuant to Rule 13a-14 of the Securities Exchange Act of 1934, As Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002* |

| 32.1 | Certification of Principal Executive Officer and Principal Financial Officer Pursuant to 18 U.S.C. Section 1350, As Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002* |

| 101.INS | XBRL Instance Document** |

| 101.SCH | XBRL Taxonomy Extension Schema Document** |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document** |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document** |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document** |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document** |

| ____________________ |

*Filed herewith

** Furnished herewith. XBRL (eXtensible Business Reporting Language) information is furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections.

| 20 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Global WholeHealth Partners Corp.

By: /S/ Charles Strongo

Charles Strongo

Chief Executive Officer and Director

(Principal Executive Officer)

Date: May 7, 2020

| 21 |

Exhibit 31.1

CERTIFICATION PURSUANT TO RULE 13A-14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Charles Strongo, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Global WholeHealth Partners Corp. (the “Registrant”);

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | As the registrant’s certifying officer I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant is made known to me by others within those entities, particularly during the period in which this report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under my supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report my conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and |

| 5. | As the registrant's certifying officer I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant’s Board of Directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

Date: May 7, 2020

/s/ Charles Strongo

Charles Strongo

Chief Executive Officer and Director

(Principal Executive Officer)

Exhibit 31.2

CERTIFICATION PURSUANT TO RULE 13A-14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Richard Johnson, certify that:

1. I have reviewed this quarterly report on Form 10-Q of Global WholeHealth Partners Corp (the “Registrant”);

| 2. | Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. | Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. | As the registrant’s certifying officer I am responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| (a) | Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under my supervision, to ensure that material information relating to the registrant is made known to me by others within those entities, particularly during the period in which this report is being prepared; |

| (b) | Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under my supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| (c) | Evaluated the effectiveness of the registrant's disclosure controls and procedures and presented in this report my conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| (d) | Disclosed in this report any change in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant's internal control over financial reporting; and |

| 5. | As the registrant's certifying officer I have disclosed, based on my most recent evaluation of internal control over financial reporting, to the registrant's auditors and the audit committee of the registrant’s Board of Directors (or persons performing the equivalent functions): |

| (a) | All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| (b) | Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

Date: May 7, 2020

/s/ Richard Johnson

Richard Johnson

Chief Financial Officer and Director

(Principal Financial Officer)

Exhibit 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

The undersigned, as the Chief Executive Officer and the Chief Financial Officer of Global WholeHealth Partners Corp., respectively, certifies that, to the best of their knowledge and belief, the Quarterly Report on Form 10-Q for the three and nine months ended March 31, 2020 that accompanies this certification fully complies with the requirements of Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and the information contained in the quarterly report fairly presents, in all material respects, the financial condition and results of operations of Global WholeHealth Partners Corp. at the dates and for the periods indicated. The foregoing certification is made pursuant to 906 of the Sarbanes-Oxley Act of 2002 (18 U.S.C. 1350) and shall not be relied upon for any other purpose.

Date: May 7, 2020

/s/ Charles Strongo

Charles Strongo

Chief Executive Officer and Director

(Principal Executive Officer)

Date: May 7, 2020

/s/ Richard Johnson

Richard Johnson

Chief Financial Officer and Director

(Principal Financial Officer)