May 24, 2022

Dear Fellow Shareholders:

2021 was a historic year for CyberArk characterized by transformation, outperformance and acceleration. The result: a record year with strong underlying growth of the business. Excellence in execution and robust

secular tailwinds drove a step-function increase in demand for our solutions. Importantly, we made great progress in our transition to a subscription model, which resonated both with our sales organization and our customers. We consistently

outperformed throughout 2021, delivering against our strategic imperatives to drive growth, execute our subscription transition, deliver innovation and scale our operations. In fact, every quarter was significantly better than the previous, with

business momentum accelerating as we moved through the year.

|

o |

Record total revenue reaching $503 million in 2021

|

|

o |

Record total recurring revenue of $349 million, or 69 percent of total revenue, with growth accelerating to 41 percent year over year

|

|

o |

Record subscription portion of Annual Recurring Revenue, or ARR, reaching $183 million as of December 31, 2021, increasing by 146 percent and representing 46 percent of total ARR (1)

|

|

o |

Record Total ARR increasing by 44 percent to $393 million (1)

|

|

o |

Non-GAAP operating income of $24 million (1)

|

|

o |

Net cash provided by operating activities of $75 million

|

|

o |

Record number of new customers signing more than 975 new logos and reaching more than 7,500 customers

|

|

o |

Added a record number of employees with total number of employees reaching 2,100 at year end

|

|

o |

Introduced cutting-edge solutions like Secure Web Sessions, a SaaS solution empowering customers with continuous authentication and session protection and Dynamic Privilege Access, which reduces the risk of standing access by providing

just-in-time access to hybrid and multi-cloud environments as well as full audit capabilities.

|

Identity Security Strategy

With digital transformation, cloud migration and the most severe threat landscape ever seen, identity has been at the forefront of CISO discussions. Increasing geopolitical

tensions, like we are seeing with the war in Ukraine, have typically resulted in an increase in cyberwarfare. As the global leader in Identity Security, centered on Privileged Access Management (PAM), we are focused on helping protect

organizations against identity oriented cyber attacks, and our solutions have never been more relevant than in the current environment. Today, every identity can become privileged under certain conditions, and we offer an end-to-end Identity

Security platform that provides extensive security controls to reduce that risk, while driving operational efficiency with a frictionless user experience.

We can secure access for any identity – human or machine – to help organizations secure critical business assets, protect their distributed workforce and customers, and

accelerate business in the cloud. In 2021, we continued to execute our strategy to deliver an Identity Security Platform that contextually authenticates each identity, dynamically authorizes the least amount of privilege required, secures

credentials, and thoroughly audits the entire cycle. With solutions like Secure Web Sessions that can continuously monitor, re-authenticate and isolate sessions seamlessly to the end user, we are strongly positioned to deliver on our vision.

Subscription Transition

Momentum continued to build throughout 2021, with our SaaS solutions leading the way as we executed our subscription transformation strategy. Before kicking off the

subscription transition, we outlined a detailed strategy and established a dedicated team to implement the program. We promoted Matt Cohen, who has extensive experience implementing subscription transition programs, to Chief Operating Officer, to

spearhead the execution of the program. We consistently outperformed our subscription transition targets of percentage of bookings from subscription and, in fact, we achieved our subscription transition bookings mix goal in just five quarters, in

March 2022, well ahead of the eight to ten quarters we initially outlined when we formally kicked off our transition in February 2021. We are delivering faster time-to-value for our customers, driving increased velocity of our business as

customers’ add on more products and more users faster under the new model, and creating tremendous value for our shareholders. In addition, we are focused on enhancing our Customer Success, support, and renewals teams to materialize the full

potential of being a subscription company. We are working hard to ensure excellence in execution and in operating as a subscription company, aiming to impress our customers with superior customer support and amazing solutions, which will result

in strong net retention rates.

|

(1)

|

See Appendix A for the definitions of Annual Recurring Revenue, Subscription Portion of Annual Recurring Revenue and non-GAAP operating income as well as a reconciliation of non-GAAP operating income to

GAAP operating income

|

We are now entering the second phase of our subscription transition program – operating as a recurring revenue company. We are laser focused on delighting our customers by

delivering breakthrough innovation, superior customer service, as well as acting as a trusted advisor as we navigate the most challenging cyber threat landscape of our lifetime.

Environmental, Social & Governance (ESG) Program Highlights

Throughout the period of transformation in 2021, we continued to build a more inclusive and sustainable company, including enhancing our ESG program. We strengthened our

oversight of the ESG program through the creation of an internal ESG Committee – a cross functional team of key company employees and management. Additionally, the Board formalized ESG oversight by delegating to relevant committees’ the oversight

of specific ESG-related areas that fall within their primary areas of responsibilities. The Board’s Nominating and Corporate Governance Committee continues to have primary oversight responsibility for the Company’s ESG matters, disclosure and

strategy, entailing the coordination, as necessary, with other Board committees, the Company’s ESG Committee and its Executive Steering Committee. Early in 2022, we expanded the responsibilities of our Senior Vice President Investor Relations to

include our ESG Program. We published our first Environmental, Social, and Governance (ESG) report in December 2021, highlighting the progress we made and identifying key program focus areas: cybersecurity, corporate governance, business ethics

and compliance, Human Capital Management, Diversity, Equity & Inclusion, and environmental stewardship.

Ongoing ESG initiatives include:

Cybersecurity

|

- |

Expanding SOC 2 Type 2 Certification across the CyberArk Identity Security Platform, which involved external verification by an independent audit firm regarding the quality of controls and operating effectiveness around our data

privacy and security safeguards

|

Corporate Governance, Business Ethics and Compliance

|

- |

Strengthening our compliance program by hiring a dedicated VP Compliance and Ethics, enhancing our Code of Conduct and expanding our compliance training program

|

|

- |

Seeking shareholder support to enhance our executive compensation policy (Proposal 2)

|

|

- |

Establishing a dedicated internal audit team, led by our Head of Internal Audit

|

Human Capital Management

|

- |

Implementing an employee recognition program

|

|

- |

Increasing communications between senior leadership and employees

|

|

- |

Expanding our learning development and training program

|

Diversity Equity & Inclusion

|

- |

Enhancing our Diversity, Equity & Inclusion (DE&I) program

|

|

- |

Evaluating DE&I-related metrics

|

Environmental Stewardship

|

- |

Created a global environmental team supporting employee education and further enabling our environmental sustainability initiatives

|

|

- |

Beginning to measure our Scope 1 and Scope 2 GHG emissions

|

|

- |

Constantly evaluating additional ways to reduce our environmental footprint

|

As we look ahead, we intend to continue enhancing our ESG program to expand its impact in support of our constituents – employees, customers, partners, shareholders and

communities. We have also placed an emphasis on building the foundation for tracking additional ESG-related Key Performance Indicators (KPIs) and metrics for our reporting and defined programs for 2022.

Conclusion

Over the last year, digital transformation, cloud migration and attacker innovation accelerated, driving durable growth in the demand environment. Identity Security is at the

center of these macro trends, and our solutions have never been more relevant. We are incredibly proud of the resiliency and amazing execution of the entire CyberArk team, putting us in a great position to continue capitalizing on our tremendous

opportunity in Identity Security in 2022. We are confident that our identity security strategy and subscription transition program will create long-term value for our employees, customers, partners, shareholders and communities.

On behalf of the Board, we invite you to attend our 2022 Annual General Meeting of Shareholders to be held at 4:00 p.m. (Israel time) on June 28, 2022, at our corporate

headquarters at 9 Hapsagot St., Park Ofer B, Petach-Tikva, Israel.

Thank you for your ongoing support of CyberArk.

|

Ehud (Udi) Mokady

Chairman of the Board

Chief Executive Officer

|

Gadi Tirosh

Lead Independent Director

|

Donna Rahav

Chief Legal Officer

|

CYBERARK SOFTWARE LTD.

9 Hapsagot St., Park Ofer B, POB 3143, Petach-Tikva, 4951040, Israel

+972-3-918-0000

May 24, 2022

Dear CyberArk Software Ltd. Shareholders:

We cordially invite you to attend the 2022 Annual General Meeting of Shareholders (the “Meeting”) of CyberArk Software Ltd. (the “Company”) to be held at 4:00 p.m. (Israel time) on June 28, 2022, at the Company’s offices at 9 Hapsagot St., Park Ofer B, Petach-Tikva, Israel.

The Meeting is being called for the following purposes:

| (1) |

(i) |

To re-elect each of Gadi Tirosh and Amnon Shoshani, and to elect Avril England, each for a term of approximately three years as a Class II director of the Company, until

the Company’s annual general meeting of shareholders to be held in 2025 and until his or her respective successor is duly elected and qualified; and |

| |

(ii) |

To re-elect François Auque for a term of approximately two years as a Class I director of the Company, until the Company’s annual general meeting of shareholders to be held in 2024 and until his successor is duly elected and

qualified;

|

| (2) |

To approve a compensation policy for the Company’s executives and directors, in accordance with the requirements of the Israeli Companies Law, 5759-1999 (the “Companies Law”);

|

| (3) |

To authorize, in accordance with the requirements of the Companies Law, the Company’s Chairman of the Board and Chief Executive Officer, Ehud (Udi) Mokady, to continue serving as the Chairman of the Board and the Company’s Chief

Executive Officer, for a period of two years; and

|

| (4) |

To approve the re-appointment of Kost Forer Gabbay & Kasierer, registered public accounting firm, a member firm of Ernst & Young Global, as the Company’s independent registered public accounting firm for the year ending

December 31, 2022 and until the Company’s 2023 annual general meeting of shareholders, and to authorize the Board of Directors of the Company (the “Board”) to fix such accounting firm’s annual

compensation.

|

Members of the Company’s management will be available at the Meeting to discuss the consolidated financial statements of the Company for the fiscal year ended December 31,

2021.

The Board unanimously recommends that you vote in favor of each of the foregoing proposals, which are more fully described in the accompanying proxy statement.

We know of no other matters to be submitted at the Meeting other than as specified herein. If any other business is properly brought before the Meeting, the persons named as

proxies may vote in respect thereof in accordance with the recommendation of the Board or, absent such recommendation, using their best judgment.

Shareholders of record at the close of business on May 20, 2022, are entitled to vote at the Meeting.

Detailed proxy voting instructions are provided both in the proxy statement and on the enclosed proxy card, including for voting by telephone or the Internet. It is important

that your shares be represented and voted at the Meeting. Accordingly, after reading the accompanying proxy statement, please mark, date, sign and mail the enclosed proxy card as promptly as possible in the enclosed stamped envelope or follow the

instructions for voting by telephone or the Internet. If voting by mail, the proxy must be received by the Company’s transfer agent or at the Company’s registered office at 9 Hapsagot St., Park Ofer B, Petach-Tikva, Israel, not later than 11:59

p.m. (EDT) on June 27, 2022 to be validly included in the tally of ordinary shares voted at the Meeting. If you are a shareholder who holds shares in “street name” (i.e., through a bank, broker or other nominee), an earlier deadline may apply to

receipt of your proxy card. An electronic copy of the enclosed proxy materials will also be available for viewing at http://investors.cyberark.com. The full text of the proposed resolutions, together with the form of proxy card for the

Meeting, may also be viewed prior to the Meeting at the registered office of the Company from Sunday to Thursday (excluding holidays), 10:00 a.m. to 5:00 p.m. (Israel time). The Company’s telephone number at its registered office is

+972-3-918-0000.

| |

Sincerely,

Ehud (Udi) Mokady

Chairman of the Board & Chief Executive Officer

|

CYBERARK SOFTWARE LTD.

9 Hapsagot St., Park Ofer B, POB 3143, Petach-Tikva, 4951040, Israel

+972-3-918-0000

__________________________

PROXY STATEMENT

__________________________

2022 ANNUAL GENERAL MEETING OF SHAREHOLDERS

This proxy statement (the “Proxy Statement”) is being furnished in connection with the solicitation of proxies on behalf of the Board of

Directors (the “Board”) of CyberArk Software Ltd. (to which we refer as “we,” “us,” “CyberArk”

or the “Company”) to be voted at the 2022 Annual General Meeting of Shareholders (the “Meeting”) and at any postponement or adjournment thereof. The Meeting will be

held at 4:00 p.m. (Israel time) on June 28, 2022, at our offices at 9 Hapsagot St., Park Ofer B, Petach-Tikva, Israel.

This Proxy Statement and the enclosed proxy card are being made available on or about May 24, 2022, to holders of the Company’s ordinary shares, nominal (par) value NIS 0.01

per share (“ordinary shares”), as of the close of business on May 20, 2022, the record date for the Meeting (the “Record Date”). You are entitled to vote at the

Meeting if you hold ordinary shares as of the close of business on the Record Date.

See “How You Can Vote” below for information on how you can vote your shares at the Meeting. Our Board urges you to vote your shares so that they will be counted at the Meeting

or at any postponements or adjournments of the Meeting.

Agenda Items

|

Proposals

|

Board Recommendation

|

Further Details

|

|

1.

|

|

|

✔ FOR

|

Pages 17 to 18

|

|

|

(i)

|

To re-elect each of Gadi Tirosh and Amnon Shoshani, and to elect Avril England, each for a term of approximately three years as a Class II director of the Company, until the Company’s

annual general meeting of shareholders to be held in 2025 and until his or her respective successor is duly elected and qualified; and

|

|

|

| |

(ii)

|

To re-elect François Auque for a term of approximately two years as a Class I director of the Company, until the Company’s annual general meeting of shareholders to be held in 2024 and until his successor

is duly elected and qualified;

|

|

|

|

2.

|

To approve a compensation policy for the Company’s executives and directors, in accordance with the requirements of the Israeli Companies Law, 5759-1999 (the “Companies Law”)

|

✔ FOR

|

Pages 19 to 21

|

|

3.

|

To authorize, in accordance with the requirements of the Companies Law, the Company’s Chairman of the Board and Chief Executive Officer, Ehud (Udi) Mokady, to continue serving as the Chairman of the Board

and the Company’s Chief Executive Officer, for a period of two years.

|

✔ FOR

|

Pages 22 to 26

|

|

4.

|

To approve the re-appointment of Kost Forer Gabbay & Kasierer, registered public accounting firm, a member firm of Ernst & Young

Global, as the Company’s independent registered public accounting firm for the year ending December 31, 2022 and until the Company’s 2023 annual general meeting of shareholders, and to authorize the Board to fix such accounting firm’s

annual compensation. |

✔ FOR

|

Pages 27 to 28

|

We are not aware of any other matters that will come before the Meeting. If any other matters are presented properly at the Meeting, the persons designated as proxies intend to

vote upon such matters in accordance with the recommendation of the Board or, absent such recommendation, using their best judgment.

Quorum

On the Record Date, we had 40,716,329 ordinary shares issued and outstanding. Each ordinary share outstanding as of the close of business on the Record Date is entitled to one

vote on each of the proposals to be presented at the Meeting. Under our articles of association (the “Articles”), the Meeting will be properly convened if at least two shareholders attend the Meeting in

person or sign and return proxies, provided that they hold shares representing at least 25% of the voting power of our Company. If a quorum is not present within half an hour from the time scheduled for the Meeting, the Meeting will be adjourned

for one week (to the same day of the week, time and place), or to a day, time and place determined by the Chairman of the Meeting (which may be earlier or later than said time). At such adjourned meeting the presence of any shareholder in person

or by proxy (regardless of the voting power represented by his, her or its shares) will constitute a quorum.

Abstentions and “broker non-votes” (if any) are counted as present for purposes of determining a quorum.

Vote Required for Approval of Each of the Proposals

The affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon is necessary for the approval of each

of the proposals to be presented at the Meeting. In addition, the approval of Proposals 2 and 3 requires that either (i) such majority includes at least a majority of the votes cast by present and voting shareholders who are not “controlling

shareholders” (as defined below) and who do not have a “personal interest” (as defined below) in the matter; or (ii) that the votes cast against such proposal by the shareholders who are not “controlling shareholders” and who do not have a

“personal interest” do not exceed two percent (2%) of the aggregate voting power of the Company (the “Special Majority”). Except for the purpose of determining a quorum, abstentions from voting and “broker

non-votes” (if any) are not treated as votes cast and are not counted in determining the outcome of any of these proposals.

Pursuant to the Companies Law, in order for your vote to be counted for purposes of the Special Majority, you must indicate on your proxy or

inform the Company at the Meeting and prior to voting thereon, that (i) you are not a controlling shareholder of the Company, and (ii) you do not have a “personal interest” in the approval of Proposal 2

or 3. (any person or entity that do not meet the qualifications in both (i) and (ii) above shall be referred to hereinafter as an “Interested Party”).

Under the Companies Law, the term “personal interest” is defined as shareholder’s personal interest in an action or a transaction of a company (i) including the personal

interest of the shareholder’s spouse, siblings, parents, grandparents, descendants, spouse’s descendants, siblings or parents or the spouse of any of such persons, and the personal interest of any entity in which the shareholder or one of the

aforementioned relatives of the shareholder serves as a director or chief executive officer, owns 5% or more of such entity’s outstanding shares or voting rights or has the right to appoint one or more directors or the chief executive officer,

and (ii) excluding a personal interest arising solely from holding the Company’s ordinary shares. Under the Companies Law, in the case of a person voting by proxy, “personal interest” includes the personal interest of either the proxy holder or

the shareholder granting the proxy, whether or not the proxy holder has discretion over how to vote.

Under the Companies Law, a “controlling shareholder” is any shareholder that has the ability to direct our activities (other than by means of being a director or other office

holder of the Company). A person is presumed to be a controlling shareholder if it holds or controls, by itself or together with others, 50% or more of any one of the “means of control” of the Company. “Means of control” is defined under Israeli

law as any one of the following: (i) the right to vote at a general meeting of the Company, or (ii) the right to appoint directors of the Company or its chief executive officer.

In order for your vote to be counted for purposes of the Special Majority, you will be requested to indicate that you are not an Interested Party with

respect to Proposal 2 or 3 by marking “YES” under Item 2A and 3A in the enclosed proxy card, voting instruction form or in your electronic or telephonic submission. In the alternative, if you believe that you are an Interested Party, and your

vote should not be counted for the purposes of the Special Majority, you should mark “No” accordingly. If you do not mark any box in Item 2A and 3A, your vote will not be counted on the proposal.

As of the date of this Proxy Statement, we are not aware of any controlling shareholders as defined above, and therefore, we believe that, other than our directors, officers

and their relatives, none of our shareholders should have a personal interest in Proposal 2 or 3. Thus, we believe any other shareholders should indicate they are not an Interested Party with respect to Proposal 2 or 3 by marking “YES” under Item

2A and 3A in their proxy card, voting instruction form or in their electronic or telephonic submission. If you are unsure whether you are a controlling shareholder or

have a personal interest in the proposal, please contact our proxy solicitor, Innisfree M&A Incorporated, toll-free at 1 (888) 750-5834 (from the U.S. or Canada) or at +1 (412) 232-3651 (from other locations), or, if you hold your shares in

“street name,” you may also contact the representative managing your account, who would then contact us on your behalf. We reserve the right to determine whether to exclude votes by a shareholder that is clearly known to us as having personal

interest, or to include the votes in the opposite circumstances (known not to have personal interest).

How You Can Vote

You can vote either in person at the Meeting or by authorizing another person as your proxy, whether or not you attend the Meeting. You may vote in any of the manners below:

|

●

|

By mail—If you are a shareholder of record, you can submit a proxy by completing, dating, signing and returning your proxy card

in the postage-paid envelope provided. You should sign your name exactly as it appears on the enclosed proxy card. If you are signing in a representative capacity (for example, as a guardian, executor, trustee, custodian, attorney or

officer of a corporation), please indicate your name and title or capacity. If you hold shares in “street name,” you have the right to direct your brokerage firm, bank or other similar organization on how to vote your shares, and the

brokerage firm, bank or other similar organization is required to vote your shares in accordance with your instructions. To provide instructions to your brokerage firm, bank or other similar organization by mail, please complete, date,

sign and return your voting instruction form in the postage-paid envelope provided by your brokerage firm, bank or other similar organization;

|

|

●

|

By telephone—If you are a shareholder of record, you can submit a proxy by telephone by calling the toll-free number listed on

the enclosed proxy card, entering your control number located on the enclosed proxy card and following the prompts. If you hold shares in “street name,” and if the brokerage firm, bank or other similar organization that holds your shares

offers telephone voting, you may follow the instructions shown on the enclosed voting instruction form in order to submit a proxy by telephone; or

|

|

●

|

By Internet—If you are a shareholder of record, you can submit a proxy over the Internet by logging on to the website listed on

the enclosed proxy card, entering your control number located on the enclosed proxy card and submitting a proxy by following the on-screen prompts. If you hold shares in “street name,” and if the brokerage firm, bank or other similar

nominee that holds your shares offers Internet voting, you may follow the instructions shown on the enclosed voting instruction form in order to submit your proxy over the Internet.

|

We currently intend to hold the Annual Meeting in person, and depending on certain circumstances, may hold the Meeting virtually at the above date and time instead. If you wish

to attend the Meeting in person and are unable to do so, please contact us at proxies@cyberark.com or our proxy solicitor (see “Assistance with Voting” below). In the event that we determine that a change to a virtual meeting format is advisable

or required, an announcement of such change will be published in a Form 6-K filed with the Securities and Exchange Commission.

Shareholders of Record

If you are a shareholder of record, that is, your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, these

proxy materials are being sent directly to you by our transfer agent. As the shareholder of record, you have the right to provide your voting proxy directly to the Corporate Secretary of our Company or to vote in person at the Meeting. If you do

not wish to attend the Meeting and wish to vote your ordinary shares, you should submit a proxy in one of the above-mentioned manners. If you have lost or misplaced the proxy card mailed to you, you may request another by calling our proxy

solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834 (from the U.S. or Canada) or at +1 (412) 232-3651 (from other locations).

We will not be able to count a proxy card unless we receive it at our principal executive offices at 9 Hapsagot St., Park Ofer B, POB 3143, Petach-Tikva, 4951040, Israel, or

our registrar and transfer agent receives it in the enclosed envelope no later than 11:59 p.m. (EDT) on June 27, 2022.

Please follow the instructions on the proxy card. If you provide specific instructions (by marking a box) with regard to the proposals, your shares will be voted as you

instruct. If you sign and return your proxy card without giving specific instructions with respect to a particular proposal, your shares will be voted by the persons named as proxies in accordance with the recommendation of the Board. The persons

named as proxies in the enclosed proxy card will furthermore vote in accordance with the recommendation of the Board or, absent such recommendation, using their best judgment on any other matters that may properly come before the Meeting.

In the enclosed proxy card, voting instruction form or in your electronic or telephonic submission you

will be requested to indicate whether you are an Interested Party with respect to Proposal 2 or 3. In order to provide for proper counting of shareholder votes, if you have not confirmed that you are not an Interested Party with respect to

Proposal 2 or 3 by marking “YES” under Item 2A and 3A in the proxy card or voting instruction form or in your electronic or telephonic submission, your vote will not be counted for purposes of the Special Majority.

Shareholders Holding in “Street Name”

If your ordinary shares are held in a brokerage account or through a bank, trustee or other nominee, you are considered to be the beneficial owner of shares held in “street

name.” Proxy materials are being furnished to you together with a voting instruction form by the broker, bank, trustee or other nominee or an agent hired by the broker, trustee or nominee. Please follow the instructions on that form to direct

your broker, bank, trustee or other nominee how to vote your shares. Many nominees provide means to vote by telephone or by Internet. Alternatively, if you wish to attend the Meeting and vote in person, you must obtain a “legal proxy” from the

broker, trustee or nominee that holds your shares, giving you the right to vote your shares at the Meeting.

Under the rules of the Nasdaq Stock Market LLC (“Nasdaq”), brokers, trustees or other nominees that hold shares in “street name” for

clients only have authority to vote on “routine” proposals where they have not received voting instructions from beneficial owners, and a “broker non-vote” occurs when brokers, trustees or other nominees are unable to vote on “non-routine”

proposals. The only item on the Meeting agenda that we believe may be considered “routine” is Proposal 4 relating to the reappointment of the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022;

however, we expect that this will not be treated as a routine matter since our Proxy Statement is prepared in compliance with the Companies Law, rather than the rules applicable to domestic U.S. reporting companies.

Thus, if you, as a beneficial owner of the shares, do not provide specific instructions to your broker, trustee or other nominee on a specific proposal, your broker, trustee

or other nominee will not be allowed to exercise its voting discretion with respect to that proposal. If your shares are held of record by a broker, trustee or other nominee, we urge you to give instructions to your broker, trustee or other

nominee as to how your shares should be voted so that you thereby participate in the voting on these important matters. Additionally, we remind you when you provide instructions to your broker, trustee or other nominee, you will be requested to

indicate whether you are an Interested Party with respect to Proposal 2 or 3. If you have not confirmed that you are not an Interested Party with respect to Proposal 2 or 3 by marking “YES” under Item 2A and 3A

in the proxy card or your voting instructions form or in your electronic or telephonic submission, your vote will not be counted for purposes of the Special Majority for purposes of Proposal 2 and Proposal 3.

Who Can Vote

You are entitled to receive notice of, and vote at, the Meeting if you are a shareholder of record at the close of business on the Record Date, in person or through a broker,

trustee or other nominee that is one of our shareholders of record at such time, or which appear in the participant listing of a securities depository on that date.

Revocation of a Proxy

Shareholders of record may revoke the authority granted by their execution of proxies at any time before the effective exercise thereof by filing with us a written notice of

revocation or duly executed proxy bearing a later date, or by voting in person at the Meeting. Shareholders who hold shares in “street name” should follow the directions of, or contact, the bank, broker or nominee if they desire to revoke or

modify previously submitted voting instructions.

Any shareholder of the Company who intends to present a proposal at the Meeting must satisfy the requirements of the Companies Law and our Articles. Under the Companies Law,

only shareholders who hold at least 1% of the Company’s outstanding voting rights are entitled to request that the Board include a proposal in a shareholders’ meeting, provided that such proposal is deemed appropriate by the Board for

consideration by shareholders at such meeting. Such shareholders may present proposals for consideration at the Meeting by submitting their proposals in writing to our Chief Legal Officer at the following address: CyberArk Software Ltd., 9

Hapsagot St., POB 3143, Petach-Tikva, 4951040, Israel, or by facsimile to +972-3-9180028, Attn: Donna Rahav, Chief Legal Officer. For a shareholder proposal to be considered for inclusion in the Meeting, our Chief Legal Officer must receive the

written proposal no later than May 31, 2022.

Solicitation of Proxies

Proxies are being made available to shareholders on or about May 24, 2022. We have retained Innisfree M&A Incorporated to assist with the solicitation of proxies in

connection with the Meeting. Innisfree M&A Incorporated will receive customary fees plus out-of-pocket expenses in connection with the performance of its services. Certain officers, directors, employees, and agents of the Company, none of

whom will receive additional compensation therefor, may also solicit proxies by telephone, email or other personal contact. We will bear the cost for the solicitation of the proxies, including postage, printing and handling, and will reimburse

the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of shares.

Voting Results

The final voting results will be tallied by the Company’s Chief Legal Officer based on the information provided by the Company’s transfer agent or otherwise, and the overall

results of the Meeting will be published following the Meeting in a report of foreign private issuer on Form 6-K that will be furnished to the Securities and Exchange Commission (the “SEC”).

Availability of Proxy Materials

Copies of the proxy card and this Proxy Statement were furnished to the SEC under cover of a Form 6-K and are also available at the “Investor Relations” section of our website

at http://investors.cyberark.com. The contents of that website are not a part of this Proxy Statement and are not incorporated by reference herein.

Assistance with Voting

If you have questions about how to vote your shares, you may contact our proxy solicitor, Innisfree M&A Incorporated, toll-free at 1 (888) 750-5834 (from the U.S. or

Canada) or at +1 (412) 232-3651 (from other locations).

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

In addition to historical facts, this Proxy Statement contains forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended,

Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking

statements express the current beliefs and expectations of CyberArk’s management. In some cases, forward-looking statements may be identified by terminology such as “believe,” “continue,” “intend,” “plan,” “expect,” “potential” or the negative of

these terms or other similar expressions. Such statements involve a number of known and unknown risks and uncertainties that could cause the Company’s future results, levels of activity, performance or achievements to differ materially from the

results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Important factors that could cause or contribute to such differences include risks relating to: changes to the drivers of the

Company’s growth and its ability to adapt its solutions to IT security market demands; the transition of the Company’s business to a subscription model that began in 2021 and its ability to complete its transition goals in the time frame

expected; the Company’s sales cycles and multiple pricing and delivery models; unanticipated product vulnerabilities or cybersecurity breaches of the Company’s, or the Company’s customers’ or partners’ systems; an increase in competition within

the Privileged Access Management and Identity Security markets; the Company’s ability to hire, train, retain and motivate qualified personnel; the Company’s ability to sell into existing and new customers and industry verticals; risks related to

compliance with privacy and data protection laws and regulations; the Company’s history of incurring net losses and our ability to achieve profitability in the future; the duration and scope of the COVID-19 pandemic and its impact on global and

regional economies and the resulting effect on the demand for the Company’s solutions and on its expected revenue growth rates and costs; the Company’s ability to find, complete, fully integrate or achieve the expected benefits of additional

strategic acquisitions; reliance on third-party cloud providers for the Company’s operations and SaaS solutions; the Company’s ability to expand its sales and marketing efforts and expand its channel partnerships across existing and new

geographies; risks related to sales made to government entities; regulatory and geopolitical risks associated with global sales and operations (including the current conflict between Russia and Ukraine) and changes in regulatory requirements or

fluctuations in currency exchange rates; the ability of the Company’s products to help customers achieve and maintain compliance with government regulations or industry standards; risks related to intellectual property claims or the Company’s

ability to protect its proprietary technology and intellectual property rights; and other factors discussed under the heading “Risk Factors” in the Company’s most recent annual report on Form 20-F filed with the Securities and Exchange

Commission. These forward-looking statements are made only as of the date hereof, and the Company undertakes no obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

SECURITY OWNERSHIP BY CERTAIN BENEFICIAL OWNERS

The following table sets forth the number of ordinary shares beneficially owned by all persons known by us to beneficially own more than 5% of our ordinary shares, as of May

20, 2022, based on public filings or information provided to us by such shareholders, and calculated using the 40,716,329 ordinary shares we had issued and outstanding at such time.

|

|

|

Shares Beneficially Owned

|

|

|

Name of Beneficial Owner

|

|

Number

|

|

|

Percentage

|

|

|

Principal Shareholders

|

|

|

|

|

|

|

|

Wasatch Advisors, Inc. (1)

|

|

|

3,691,565

|

|

|

|

9.1%

|

|

|

(1)

|

Based on a Schedule 13G/A filed on February 10, 2022, by Wasatch Advisors, Inc. (“Wasatch”), shares beneficially owned consist of 3,691,565 ordinary shares over which Wasatch has sole

voting and dispositive power. The address of Wasatch is 505 Wakara Way, Salt Lake City, UT 84108.

|

COMPENSATION OF CERTAIN EXECUTIVE OFFICERS AND DIRECTORS

For information about the compensation, on an individual basis, of our five most highly compensated office holders during or with respect to the year ended December 31, 2021, as

required by regulations promulgated under the Companies Law, see “Item 6.B. Compensation” of our annual report on Form 20-F for the year ended December 31, 2021, filed with the SEC on March 10, 2022, and available on the “Investor Relations”

section of our website at http://investors.cyberark.com or through the SEC’s website at www.sec.gov.

CORPORATE GOVERNANCE

Overview

CyberArk is committed to effective corporate governance and independent oversight by our Board. Our programs and policies are founded on the guiding principle that the Board is

accountable for representing the best interests of our shareholders. We accomplish that primarily through Board independence, diversity of experience and engagement with shareholders and other key constituents.

Shareholder Engagement

We believe that effective corporate governance includes regular, constructive conversations with our shareholders, and we value our shareholders’ continued feedback and

opinions. We are committed to maintaining an active dialogue to understand the priorities and concerns of our shareholders. All feedback is reviewed and implemented as appropriate for the Company’s strategy, business growth and maturity stage. As

part of our investor relations program, we engage with the vast majority of our institutional shareholders throughout the calendar year in our quarterly earnings calls, investor conferences and investor meetings. Since 2016, we have annually

conducted substantive discussions with shareholders on executive compensation, corporate governance, corporate performance, strategy and more recently on our ESG program. In 2021, for example, we engaged with over 85 percent of our top 20

shareholders, which represented about 44 percent of our outstanding shares. Our engagement has played a critical role in enhancing our strategy and applicable policies. In November 2021, we introduced an off-cycle engagement program, which was

led by our lead independent director (“Lead Director”) and the Chairperson of the Nominating and Corporate Governance Committee, primarily related to the continued service of the Company’s Chief Executive

Officer (the “CEO”) as the Chairman of the Board, and our ESG strategy. We have implemented the feedback received during these discussions in our corporate and ESG strategy, as appropriate and as further

reflected in our voluntary ESG report published in December 2021, and in Proposal 2 and Proposal 3 below. Such feedback included, among other topics, oversight of our ESG program, shareholding requirements for executives and the duration of the

combined Chairman of the Board and CEO Role. Maintaining an active dialogue with our shareholders is consistent with our corporate values of open communication and accountability, and we intend to continue these efforts in the future.

Board Structure

Our Articles provide that we may have no fewer than four and no more than nine directors, as may be fixed from time to time by the Board. Our Board currently consists of eight

directors. Independence is a key pillar of our corporate governance, and each of our seven current non-employee directors is independent under Nasdaq corporate governance rules, which require a majority of our directors to be independent. Our

directors are divided into three classes with staggered three-year terms. Each class of directors consists, as nearly as possible, of one-third of the total number of directors constituting the entire Board. At each annual general meeting of our

shareholders, the term of office of only one class of directors expires. The election or re-election of such class of directors is for a term of office that expires as of the date of the third annual general meeting following such election or

re-election. Each director holds office until the annual general meeting of our shareholders in which their term expires, unless they are removed by a vote of 65% of the total voting power of our shareholders at a general meeting of our

shareholders or upon the occurrence of certain events, in accordance with the Companies Law and our Articles. The Nominating and Corporate Governance Committee and the Board approved a board refreshment program, including committing to introduce

a new Board member at least every five years, and rotated the committee membership to include our newest Board members, Mr. Auque and Ms. England, in our Audit and Strategy Committees, respectively.

Board Composition and Qualifications

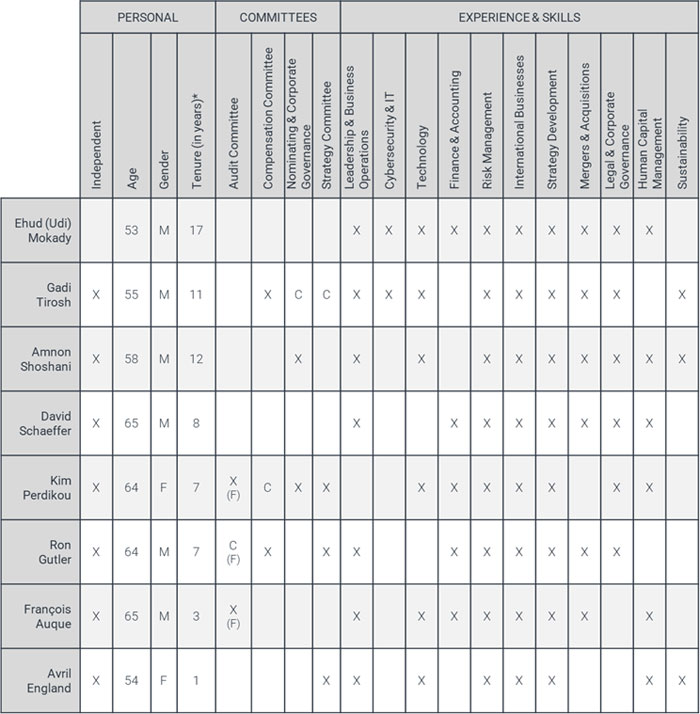

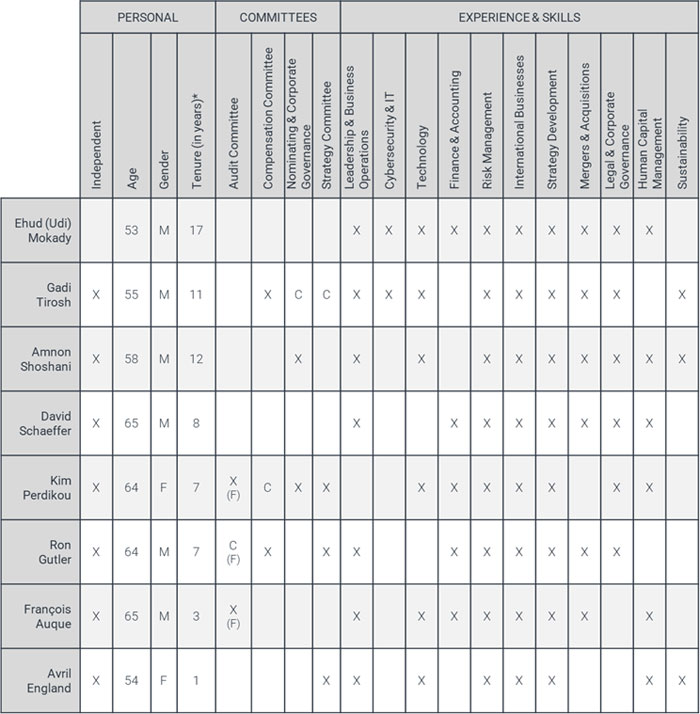

Our Board provides independent oversight of the Company and management. Our Board consists of diverse, experienced and qualified members. The Board skills matrix below

represents the key skills that our Board identified as particularly valuable to the effective oversight of the Company and the execution of our strategy, as well as diversity characteristics of our directors (25 percent of whom are women). This

matrix highlights the depth and breadth of skills of our Board members.

Avril England Franpois Auque Ron Gutter Kim Perd^kou X X X X in o UI £ £ “H £ T] k co 3x 3

3X X o X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X X avid Schaeffer Amnon Shoshani qsojij. ipeo Ehud (Udi) Mokady X X X Independent PERSONAL o UI cn CO cn Gn m W Age £ £ Gender 00 > ro k k Tenure (in years)* Audit

Committee COMMITTEES X Compensation Committee X o Nominating & Corporate Governance o Strategy Committee X X X X Leadership & Business Operations EXPERIENCES SKILLS X X Cybersecurity & IT X X X Technology X X Finance &

Accounting X X X X Risk Management X X X X International Businesses X X X X Strategy Development X X X X Mergers & Acquisitions X x X X Legal & Corporate Governance X X X Human Capital Management X X Sustainability

*As of the date of the Meeting C = Chairperson (F) =

Financial Expert

Board Leadership and Lead Independent Director

Mr. Mokady, our founder, has been on the Board since inception and has served as our CEO, since 2005. Since June 2016, he has also served as Chairman of our Board following the

approval of our shareholders, which was reaffirmed in July 2019. At the 2016 and 2019 annual general meetings, our shareholders determined that, for so long as the positions of the CEO and Chairman of the Board are combined, our Board will

appoint a Lead Director to facilitate strong, independent Board leadership and effective independent oversight. Our Lead Director is selected by our non-executive Board members from among the independent directors of the Board who have served a

minimum of one year as a director. Additionally, if at any meeting of the Board the Lead Director is not present, one of the following individuals, in the order listed, will act as Lead Director for the duration of such meeting: the Chairperson

of the Audit Committee, the Chairperson of the Compensation Committee, or an independent member of the Board appointed by a majority of the independent members of the Board present. Mr. Gadi Tirosh currently serves as our Lead Director. For more

information regarding the authorities and responsibilities of the Lead Director, please refer to Proposal 3 below.

Board Oversight of Risk Management

One of the main responsibilities of our Board is to effectively monitor and manage the Company’s evolving risk profile. Our committees play a vital role in supporting the Board’s risk oversight

responsibilities, as follows:

|

Committee

|

Risk Oversight Areas of Focus

|

|

Audit

|

• Our overall risk assessment and strategy for managing enterprise risk

• Accounting and financial reporting, legal and compliance

• Cybersecurity, including product and information security

|

|

Compensation

|

• Compensation policies and practices related to our directors, CEO, executives and employees

• Our human capital management and diversity, equity and inclusion strategy

|

|

Nominating and Corporate Governance

|

• ESG program, including corporate governance and environmental stewardship

|

|

Strategy

|

• Our long-term business and corporate strategy, including organic and in-organic growth

|

The committees receive regular updates from the relevant functions within the Company responsible for the management and mitigation of the different areas of risk. In addition, the committees hold

closed executive sessions with individual members of CyberArk’s leadership team as well as our internal and external audit functions. The committee chairs apprise the Board regularly of committee discussions, decisions and actions taken.

Board and Committee Effectiveness and Meetings

Our Board and committees are committed to conducting their duties effectively and in the best interest of CyberArk and our shareholders. Our Board performs an annual

self-assessment to evaluate its effectiveness in fulfilling its obligations, which is overseen by the Lead Director and the Nominating and Corporate Governance Committee. As part of the assessment, directors, relevant members of management and

outside counsel provide feedback on a variety of topics such as Board and committees’ effectiveness and composition. Our Chief Legal Officer and Corporate Secretary summarize these individual assessments and discuss the results with the

Nominating and Corporate Governance Committee and the Board. The Board then takes such further action or guides management on key findings, as it deems appropriate.

During 2021, our Board met six times and acted three times by written consent; our Audit Committee met six times; our Compensation Committee met six times and acted once by

written consent; our Nominating and Corporate Governance Committee met four times; and our Strategy Committee met twice and acted once by written consent. Each of the incumbent directors (including the director nominees for re-election and

election) attended at least 75% of our Board meetings and the meetings of each of the committees of the Board on which they served.

We recognize the importance of keeping our Board members current on market trends, industry events, and best practices, as well as enhancing their knowledge of the Company’s

evolving product portfolio, go-to-market motion and research and development programs. New Board members undergo our onboarding process, including onboarding guides and tailored trainings. In addition, we provide continuing director education,

which may include internally developed materials and presentations, or programs presented by third parties and encourage our directors to attend CyberArk events such as our annual “Impact” customer event.

Considerations in Evaluating Director Nominees

Our Nominating and Corporate Governance Committee undertakes an evaluation process of the qualifications of the Board members and identifies potential areas where we may

enhance our Board, including size, composition and additional expertise. We look for Board members with the highest levels of integrity and ethics that align with our corporate values. Our strong corporate culture has been key to our long-term

success, and we believe the tone is set at the top with our Board. To represent the best interest of our shareholders, we remain committed to maintaining a Board that is inclusive and endeavors to have varied expertise, experience and diversity

including experience, gender, racial and ethnic diversity considerations among its members. We consider director nominees’ suitability for their role also based on the following criteria:

Considerations

| |

|

|

|

BUSINESS EXPERTISE

|

INDUSTRY EXPERIENCE

|

DIVERSITY

|

| |

|

|

|

o

o

o

o

o

o

o

o

|

Corporate governance

Financial

Go-to-market strategy

Product management

Leadership

M&A

Risk management

Strategy

|

o

o

o

o

o

o

o

o

|

Alliances and partnerships

B2B

Cloud

Competitive analysis

Cybersecurity

Public sector

SaaS or Software

Information Technology

|

o Cultural background

o Ethnicity

o Gender identity

o Race

o Sexual orientation

|

Board Diversity Matrix

The table below provides certain information regarding the diversity of our Board as of the date of this Proxy Statement. Each of the categories listed in the

table has the meaning ascribed to it in NASDAQ Listing Rule 5605(f).

|

Country of Principle Executive Offices:

|

Israel

|

|

Foreign Private Issuer:

|

Yes

|

|

Disclosure Prohibited under Home Country Law:

|

No

|

|

Total Number of Directors:

|

8

|

|

|

Female

|

Male

|

Non-Binary

|

Did not Disclose Gender

|

|

Part I: Gender Identity

|

|

|

Directors

|

2

|

6

|

--

|

--

|

|

Part II: Demographic Background

|

|

|

Underrepresented Individual in Home Country Jurisdiction

|

--

|

|

LGBTQ+

|

--

|

|

Did Not Disclose Demographic Background

|

2

|

CEO EQUITY PLAN & DIRECTOR COMPENSATION

Equity Plan Governance

Our Board and its Compensation Committee have consistently taken a disciplined approach to effectively manage the long-term dilutive impact of our equity incentive grants, and are

committed to continue balancing the scope of our equity compensation program with its impact on our earnings per share. The Compensation Committee and Board regularly review the Company’s equity compensation methodology to ensure it supports

the achievement of our financial and strategic objectives and remains in line with market practices, while effectively managing the level of shareholder dilution and increases in our share-based compensation in proportion to our overall

revenue. Some of the measures we have undertaken to effectively manage dilution include authorizing the reservation of shares for issuance under the Company’s 2014 share incentive plan (the “2014 Plan”)

between 2017 and 2021 at a rate significantly lower than that permissible under the 2014 Plan, and reducing the overall number of shares reserved for issuance under the 2014 Plan by 900,000 ordinary shares in June 2019. We have continuously

enhanced our equity compensation program to weight more towards the grant of performance share units (“PSUs”) versus time-based stock options, initially with respect to our CEO and subsequently to all our

executives and other senior managers.

The Compensation Committee has engaged Aon’s Human Capital Solutions practice a division of Aon plc (formerly known as Radford), as an independent, outside consultant, to

provide it with advice related to our executive and non-employee director compensation programs and to assist in the design, formulation, analysis and implementation of our compensation program. The information provided by Aon relating to the

compensation practices of peer companies aids the decision-making process of the Compensation Committee and Board and supports our ability to inform our shareholders of the Company’s relative positioning on compensation., The Compensation

Committee and Board make their final decisions relating to annual executive compensation in reliance on various considerations, including the information provided by Aon, as applicable, with a focus on the individual performance of our

executives.

As of May 20, 2022, 2,952,823 ordinary shares underlying share-based awards were outstanding under the Company’s 2011 Share Incentive Plan, 2014 Plan and the 2019 Employee Stock

Purchase Plan and 1,263,393 ordinary shares were reserved for future grant under such plans, reflecting a dilution rate of 9.6 %. Aon’s survey data reflected that while the Company’s revenue multiples were over the 65th percentile and its one-

and three-year total shareholder returns were over the 70th percentile, its 2021 and three-year average burn rate, issued equity overhang and total equity overhang were each positioned favorably at or below the 25th percentile among

the Company’s current compensation peer group, comprised of:

In June 2020, the Company’s shareholders approved a three-year Equity Plan for our CEO (the “CEO Equity Plan”), authorizing the

Compensation Committee and Board to approve CEO equity grants for 2021 and 2022; all subject to the terms of the CEO Equity Plan. In February 2022, the Compensation Committee and the Board approved an equity grant to Mr. Mokady (the “CEO 2022 Grant”), consistent with and subject to the terms of the CEO Equity Plan. The equity mix of the CEO 2022 Grant, and corresponding number of underlying shares – assuming achievement of target level

performance for all PSUs granted – are as follows:

| |

Restricted Share Units

|

Performance Share Units

|

| |

|

Business-related Performance Criteria

|

Relative TSR Performance Criteria

|

|

Percentage (appx.)

|

40%

|

40%

|

20%

|

|

Number of Shares

|

24,600

|

24,600

|

12,300

|

For more information regarding the CEO Equity Plan, see “Proposal 3” of our 2020 Proxy Statement, filed with the SEC on May 26, 2020, and “Item 6.B Compensation – CEO Equity

Plan” of our annual report on Form 20-F for the year ended December 31, 2021, filed with the SEC on March 10, 2022.

Compensation of Non-Executive Directors

As of July 1, 2019, following the approval of our shareholders, our non-executive directors are entitled to the following compensation:

Cash Compensation

Annual fees with respect to each twelve months of service in the amounts of:

| |

Lead Director

|

Member

|

|

Board

|

US$52,500

|

US$35,000

|

Additional fees with respect to each twelve months of service on Board committees in the amounts of:

|

Committee

|

Chairperson

|

Member

|

|

Audit

|

US$20,000

|

US$10,000

|

|

Compensation

|

US$12,000

|

US$6,000

|

|

Nominating and Corporate Governance

|

US$8,000

|

US$4,000

|

|

Strategy

|

US$8,000

|

US$4,000

|

Directors are also entitled to be reimbursed for reasonable travel, accommodation and other expenses incurred by them in connection with attending Board and committee meetings

and performing their functions as directors of the Company.

Equity-Based Compensation

Directors are entitled to equity awards of restricted share units in the value of:

|

New Appointment Award

|

Up to US$350,000

|

|

Subsequent Annual Award

|

US$200,000

|

For more information on director compensation, see “Proposal 2” of our 2019 Proxy Statement, filed with the SEC on May 21, 2019, “Item 6.B. Compensation—Compensation of

Directors and Senior Management” and “Item 6.C. Board Practices—Compensation of Directors” of our annual report on Form 20-F for the year ended December 31, 2021, filed with the SEC on March 10, 2022.

ENVIRONMENTAL, SOCIAL & GOVERNANCE (ESG)

Overview

From our mission to our corporate values, to our execution of initiatives to enhance the durability of our growth, we strive to integrate ESG factors into our decision-making

processes and weave them throughout our strategy development and risk management processes. The evolution of our ESG initiatives is most visible through the ongoing improvements in our corporate governance practices since our initial public

offering in 2014. This has included strengthening Board oversight, aligning our executive compensation programs with performance, increasing our transparency into our decision-making processes and broadening our shareholder outreach program. We

recognize that the successful implementation of sustainable and responsible business practices is integral to delivering long-term value.

Alongside our strategy, risk management initiatives and corporate oversight, we are further evolving our ESG program. With the support of external experts, as well as input from internal and

external stakeholders, in 2021, we completed a detailed assessment to identify ESG issues that are high priority to our business, our shareholders and other stakeholders. The assessment took into consideration leading ESG voluntary reporting

frameworks including the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-related Financial Disclosures (TCFD), the Global Reporting Initiative (GRI), Stakeholder Capitalism Metrics established by the International

Business Council of the World Economic Forum and leading ESG ratings agencies. In December 2021, we published our inaugural ESG Report, which provides further detail on our efforts. For more information on our ESG-related activities, please visit

our website at https://www.cyberark.com/company/esg/. Neither the ESG Report nor the contents of our website are incorporated into this proxy statement.

ESG Oversight

To provide more structure and enhance disclosure around the ESG program, we formally established an internal ESG Committee in 2021, comprised of senior leaders across functions

including Legal and Compliance, Human Resources, Investor Relations, Information Technology and Product Management. The ESG Committee reports to an Executive Steering Committee that includes the CEO and is overseen by the Nominating and Corporate

Governance Committee and ultimately the full Board. At the Board level, the Nominating and Corporate Governance Committee has primary ESG oversight responsibility. This allows the members to have a holistic view across our broad set of strategic

ESG initiatives, more effectively oversee the management and mitigation of ESG-related risks, monitor the implementation of policies and programs, and evaluate our success. The other committees of the Board have oversight responsibilities on

certain ESG-related matters which fall within their primary areas of responsibility (for example the Audit Committee oversees risk management, cybersecurity and investor communications, and the Compensation Committee oversees Human Capital

Management as well as Diversity, Equity & Inclusion).

ESG Focus Areas

To help enhance and evaluate priorities for our ESG program, we completed a comprehensive assessment in 2021 to identify key issues, topics and focus areas relevant to our

business. These areas include cybersecurity, business ethics and compliance, Human Capital Management, Diversity, Equity & Inclusion, and environmental stewardship. This is an ongoing process that we will continue to revisit.

Cybersecurity. Cybersecurity is our business. Protecting our network, our

solutions, our employees, our customers and our partners is the foundation of our success. At the same time, our internal cybersecurity and privacy programs, which include complying with and in many cases exceeding industry standards, are

critical components of our overall strategy execution. We continue to make ongoing investments in people, processes and technologies to mitigate risks to our business, build trust and help our customers protect against advanced cyberattacks.

In recognition of the potential impact on our business, we maintain a cybersecurity governance structure at the highest levels of the company. Our Chief Information Technology

Officer and dedicated security teams oversee corporate information security standards, practices and controls across all critical Company data and assets. At the Board level, the Audit Committee has oversight of our cybersecurity program and

reviews comprehensive network or product security once a quarter.

Our comprehensive program is centered on risk management, product and SaaS security, business continuity and training. Our dedicated security teams work to continuously improve

our secure development, security operations and threat-mitigation practices. CyberArk conducts formal risk assessments on its corporate network on at least an annual basis. Our risk management program is based on ISO/IEC 27001:2013 Information

Security Management System Standard and follows the National Institute of Standards and Technology (NIST) cybersecurity framework. In addition, the results of our annual assessment are included in the annual mitigation plan, which is presented to

and monitored by the Audit Committee. A critical part of our cybersecurity program is internal training and awareness such as mandatory annual training and regular drills related to phishing and social engineering. Furthermore, we continue to

make ongoing investments to help our customers protect against advanced cyberattacks and have invested in and secured various certifications including SOC 2 Type 2 and ISO/IEC 27001:2013. The SOC 2 Type 2 certification, achieved in April 2022 and

which spans the CyberArk SaaS portfolio, included external verification by an independent audit firm regarding the quality of controls and operating effectiveness around our security safeguards.

The security and privacy of our customers’ data is paramount. We are committed to respecting privacy rights by complying with applicable privacy and data protection laws. For

more information, see our ESG report and key privacy documents available at www.cyberark.com, none of which are incorporated by reference in this proxy statement.

Business Ethics and Compliance. We are committed to promoting integrity, honesty and professionalism and maintaining the highest

standards of ethical conduct in all of our activities and aim to foster a culture of openness that promotes communication across the Company. To support this approach, we have focused our business ethics and compliance program around the three

main pillars of policies, training and awareness, and evaluation and enforcement. Our Code of Conduct is the foundation of our ethics and compliance program. CyberArk employees and executive officers certify their compliance with our Code of

Conduct and other company policies. We conduct frequent training on our Code of Conduct, anti-corruption and bribery, insider trading, data privacy and cybersecurity. We also work with internal and external subject matter experts to turn our

policies into practice, investigate potential transgressions, adapt and improve policies based on employee feedback and changing circumstances, and engage our peers in discussions regarding their practices.

For more information, see “Item 16.B. Code of Ethics” of our annual report on Form 20-F for the year ended December 31, 2021, filed with the SEC on March 10, 2022.

Human Capital Management. The foundation and important differentiator of our Human Capital Management (HCM) strategy is our culture,

centered on our core company values:

We are committed to hiring and retaining talented, smart, bold, but humble employees to promote innovation and a strong, diverse and inclusive culture which we believe

contributes to our business success. Our Chief Human Resources Officer, who reports directly to our Chief Executive Officer, oversees our broad and comprehensive initiatives to effectively recruit, retain and develop our employees.

Our HCM strategy is focused on creating solutions to attract, develop, engage and retain top diverse talent. We offer a total rewards approach that includes variable pay

programs to drive target achievements, long-term incentives such as equity-based compensation and customized benefits packages across all our regions. We provide an environment where employees are encouraged to seek work-life alignment and career

development opportunities. In 2022, we are significantly enhancing our learning and development program including formalized career path curriculum, leadership development and management training. We believe that our approach has helped us grow

our employee base by more than 47% over the last three years.

To help foster a culture of engagement, senior leaders regularly engage with employees through programs such as our quarterly All-Hands Meetings as well as quarterly Leadership

Conferences. Using a third party, we conduct an annual comprehensive employee engagement survey throughout all regions and departments. In our first annual survey in 2021, we had a participation rate of 74%. Results were above industry benchmarks

in all surveyed areas and showed a high engagement score as 80% of surveyed employees were pleased with their overall experience and would recommend CyberArk to a peer. In our second annual survey in 2022, our participation rate increased to 81%

and our overall engagement score increased as well. We utilize this feedback to enhance and improve overall employee experience, our culture and our strategy.

The COVID-19 pandemic increased our focus on the health, safety and wellness of our employees, which continues to be our top priority. We shifted our operations to enable

employees to work from home and have since implemented hybrid work arrangements for all of our employees.

Diversity, Equity and Inclusion. Diversity, Equity and Inclusion (DE&I) is critical to the successful execution of our strategy of

bringing different perspectives to the table, strengthening decision-making processes, driving innovation, and creating a strong community so that our employees may be given fair and equal opportunities. Our DE&I program is overseen by the

Compensation Committee and the Board. Globally, our DE&I initiatives are focused on gender representation and on the regional level, we are implementing programs geared toward supporting underrepresented groups in each of our geographies. Our

initiatives have included introducing a company mission statement for DE&I; creating learning and development programs for employees, including one-on-one coaching sessions for our executive leadership team; establishing our first dedicated

employee resource groups; introducing mentorship as well as “returnship” programs; and continuously improving our recruitment and hiring practices including neurodiversity and junior hiring programs as well as internal mobility opportunities.

For more information on our HCM and DE&I initiatives, see “Item 6.D. Employees” of our annual report on Form 20-F for the year ended December 31, 2021, filed with the SEC

on March 10, 2022.

Environmental Stewardship. As an enterprise software company, our environmental footprint is smaller than organizations of comparable

size in other industries. In addition, most of our IT infrastructure runs in a public cloud environment, which reduces our total environmental impact especially as our main vendor has stated a commitment to clean energy. In early 2021, we created

a global environmental team to implement a more comprehensive environmental employee-led stewardship program and evaluate additional ways to further reduce our environmental footprint. This includes rolling out formal education and training,

expanding our environmentally responsible procurement initiatives, and developing strategies to conserve energy and reduce waste. We are also working to identify environmentally related Key Performance Indicators (KPIs) that will help

stakeholders assess our progress and are taking steps to begin quantifying our Scope 1 and Scope 2 GHG emissions.

PROPOSAL 1

RE-ELECTION AND ELECTION OF OUR CLASS II DIRECTORS AND

RE-ELECTION OF OUR CLASS I DIRECTOR

Background

Our shareholders are being asked to (i) re-elect each of Gadi Tirosh and Amnon Shoshani, and to elect Avril England, each as a Class II director; and (ii) re-elect François

Auque as a Class I director.

Our current directors are divided among the three classes as follows:

(1) our Class I directors are Ehud (Udi) Mokady and David Schaeffer, whose current terms expire at our 2024 annual general meeting of shareholders and upon the election and

qualification of their respective successors

(2) our Class II directors are Gadi Tirosh, Amnon Shoshani and Avril England, whose current terms expire at the Meeting and upon the election and qualification of their

respective successors, and

(3) our Class III directors are Ron Gutler, Kim Perdikou and François Auque, whose current terms expire at our 2023 annual general meeting of shareholders and upon the election

and qualification of their respective successors.

Re-Election and Election of Class II Directors and Re-Election of Class I Director

The Nominating and Corporate Governance Committee and Board recommended that we nominate (i) our current Class II directors, Mr. Gadi Tirosh and Mr. Amnon Shoshani, for

re-election, and Ms. Avril England, for election, each as a Class II director at the Meeting, and each for a term of approximately three years following the Meeting; and (ii) Mr. François Auque, a current Class III director, for re-election to

our Board as a Class I director, for a term of approximately two years following the Meeting, in order to provide for a more diversified experience within the different classes. Mr. Auque, Mr. Gutler and Ms. Perdikou are considered financial

experts. The Board believes having Mr. Auque as a Class I director will balance the experience within the classes. The director nominees did not participate in the discussion and applicable vote regarding their nomination for re-election. In the

event that Mr. Auque is not re-elected as a Class I director, in accordance with the foregoing terms, Mr. Auque will remain a Class III director, which term expires at the annual general meeting of shareholders to be held in 2023.

Director Nominees’ Qualifications and Independence

Each of the director nominees has consented to being named in this Proxy Statement and has advised the Company that he or she is willing, able and ready to serve as a director

of the respective class if elected. Additionally, in accordance with the Companies Law, each of the director nominees has certified to us that he or she meets all the requirements of the Companies Law for election as a director of a public

company and possesses the necessary qualifications and has sufficient time to fulfill their duties as directors of the Company, taking into account the size and needs of our Company. We do not have any arrangements, understandings or agreements

with respect to the election of any of the director nominees at the Meeting. Each of the director nominees is independent under Nasdaq corporate governance rules.

Biographies of Director Nominees

Set forth below is certain biographical information regarding the background and experience of Mr. Tirosh, Mr. Shoshani, Ms. England and Mr. Auque. For more information

regarding the experience and skills of the director nominees, please refer to the Board Composition and Qualification section above.

Gadi Tirosh has served as a member of our Board since June 2011, as Chairman of the Board between July 2013 and June 2016 and as Lead

Director since June 2016. Since 2020, Mr. Tirosh has served as Venture Partner at DisruptiveAI, an Israeli venture capital firm that focuses on innovative artificial intelligence companies. From 2018 to 2020, Mr. Tirosh served as Venture Partner

at Jerusalem Venture Partners, an Israeli venture capital firm that focuses, among other things, on cybersecurity companies and operates the JVP Cyber Labs incubator. From 2005 to 2018, he served as Managing Partner at Jerusalem Venture Partners.

From 1999 to 2005, he served as Corporate Vice President of Product Marketing and as a member of the executive committee for NDS Group Ltd. (Nasdaq: NNDS) later acquired by Cisco Systems, Inc. a provider of end-to-end software solutions to the

pay-television industry, including content protection and video security. Mr. Tirosh holds a Bachelor of Science in computer science and mathematics and an Executive MBA from the Hebrew University in Jerusalem, Israel.

Amnon Shoshani has served as a member of our Board since November 2009. Since February 1995, Mr. Shoshani has served as the Founder and

Managing Partner of Cabaret Holdings Ltd. and, since March 1999, he has also served as Managing Partner of Cabaret Security Ltd., CyberArk’s founding investor and Cabaret and ArbaOne Inc. ventures activities where he had a lead role in managing

the group’s portfolio companies. Since 2018, Mr. Shoshani has served as the President and Chairman of the Board of Smartech, a portfolio company of Cabaret and ArbaOne, that provides game changing technologies to the industrial world. Between