UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

OR

|

||

|

|

|

|

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

For the fiscal year ended

|

||

|

|

|

|

|

OR

|

||

|

|

|

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

OR

|

||

|

|

|

|

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

Chief Legal Officer

Telephone: +

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

|

|

The |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As of December 31, 2021, the registrant had outstanding

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Accelerated filer ☐

|

Non-accelerated filer ☐

|

|

|

|

|

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

International Financial Reporting Standards as issued by the

|

Other ☐

|

|

|

International Accounting Standards Board ☐

|

|

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐

ANNUAL REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2021

|

1 | ||

|

1 | ||

|

2 | ||

|

2 | ||

|

2 | ||

|

26 | ||

|

37 | ||

|

37 | ||

|

55 | ||

|

74 | ||

|

76 | ||

|

77 | ||

|

77 | ||

|

85 | ||

|

86 | ||

|

87 | ||

|

87 | ||

|

87 | ||

|

87 | ||

| 88 | ||

| 88 | ||

|

89 | ||

|

89 | ||

|

89 | ||

|

89 | ||

|

89 | ||

| 89 | ||

|

89 | ||

|

89 | ||

| 90 | ||

| • |

changes to the drivers of our growth and our ability to adapt our solutions to IT security market demands; |

| • |

the transition of our business to a subscription model that began in 2021 and our ability to complete our transition goals in the

time frame expected; |

| • |

our sales cycles and multiple pricing and delivery models; |

| • |

unanticipated product vulnerabilities or cybersecurity breaches of our, or our customers’ or partners’

systems; |

| • |

an increase in competition within the Privileged Access Management and Identity Security markets; |

| • |

our ability to hire, train, retain and motivate qualified personnel; |

| • |

our ability to sell into existing and new customers and industry verticals; |

| • |

risks related to our compliance with privacy and data protection laws and regulations; |

| • |

our history of incurring net losses and our ability to achieve profitability in the future; |

| • |

the duration and scope of the COVID-19 pandemic and its impact on global and regional economies and the resulting effect on the demand

for our solutions and on our expected revenue growth rates and costs; |

| • |

our ability to find, complete, fully integrate or achieve the expected benefits of additional strategic acquisitions; |

| • |

our reliance on third-party cloud providers for our operations and SaaS solutions; |

| • |

our ability to expand our sales and marketing efforts and expand our channel partnerships across existing and new geographies;

|

| • |

risks related to sales made to government entities; |

| • |

regulatory and geopolitical risks associated with our global sales and operations (including the current conflict between Russia

and Ukraine) and changes in regulatory requirements or fluctuations in currency exchange rates; |

| • |

the ability of our products to help customers achieve and maintain compliance with government regulations or industry standards;

|

| • |

risks related to intellectual property claims or our ability to protect our proprietary technology and intellectual property rights;

|

| • |

risks related to stock price volatility or activist shareholders; |

| • |

any failure to retain our “foreign private issuer” status or the risk that we may be classified, for U.S. federal income

tax purposes, as a “passive foreign investment company”; |

| • |

risks related to our Convertible Notes, including the potential dilution to existing shareholders and our ability to raise the funds

necessary to pay amounts due under our Convertible Notes; |

| • |

our expectation to not pay dividends on our ordinary shares for the foreseeable future; and |

| • |

risks related to our incorporation and location in Israel. |

| ITEM 1. |

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

| ITEM 2. |

OFFER STATISTICS AND EXPECTED TIMETABLE |

| ITEM 3. |

KEY INFORMATION |

| o |

our revenues may fluctuate as a result of variations in our booking mix from the different licensing and delivery models and the

corresponding timing of revenue recognition – ratably for SaaS subscriptions and the maintenance portion of self-hosted subscriptions,

and upon delivery for perpetual licenses and the license portion of self-hosted subscriptions. For example, if our customers continue

to prefer to buy our solutions as a subscription at a greater rate than we anticipate, our recognized revenues may lag our expectations

and guidance; |

| o |

since fiscal year 2020, we have incurred net losses with declining operating margins, and we expect our operating and net income

losses to continue to increase, and our cash flow from operations to decline (see “—We have incurred net losses, and may not

be able to generate sufficient revenue to achieve and sustain profitability.”); |

| o |

the introduction of new product offerings and solutions may result in longer sales cycles, lost opportunities or less predictable

revenues if our new or existing customers, prospects and partners are less receptive of such advancements (including a transition to SaaS

in order to receive certain functionalities) or require a longer period to assess and select the solutions appropriate to them;

|

| o |

the introduction of more SaaS offerings may lead to extended presale periods due to, among others, comprehensive product and security

reviews and requirements by customers, extensive contract negotiations and more stringent compliance and operational obligations (such

as those related to data protection); |

| o |

our sales force may struggle with selling multiple pricing, licensing and delivery models to customers, prospects and partners, which

may extend sales cycles, reduce the likelihood of sales closing, or lead to increased turnover rates and lower headcount; |

| o |

our research and development teams may find it difficult to deliver functionality and drive innovation across multiple code bases

on a timely basis; and |

| o |

customer demand for migration from self-hosted solutions to SaaS may happen faster than we anticipate, in which case we might not

be able to meet this demand and associated scalability requirements. |

| o |

our ability to attract new customers and to retain existing customers by and through renewals of maintenance services and subscriptions

(see “—If we are unable to acquire new customers or sell additional products and services to our existing customers, our future

revenues and operating results will be harmed.”); |

| o |

the amount and timing of our operating costs and cash collection, which may vary also as a result of fluctuations in foreign currency

exchange rates or changes in taxes or other applicable regulations (see “—We are exposed to fluctuations in currency exchange

rates, which could negatively affect our financial condition and results of operations.”); |

| o |

the rate at which our customers fully deploy their purchased solutions, and our ability to sell additional solutions and services

to current customers; |

| o |

effects from the COVID-19 pandemic or other public health crises, and the global economic changes caused by it (see “—The

COVID-19 pandemic, measures taken in response to it and the resulting global economic environment have adversely affected, and may

adversely affect in the future, our business, financial condition, and results of operations.”); |

| o |

the ability of our support and customer success operations to keep pace with sales to new and existing customers and the expansion

of our solution portfolio and to satisfy customer demands for consultancy and professional services; |

| o |

our ability to successfully expand our business globally; |

| o |

the release timing and success of new product and service introductions by us or our competitors or any other change in the competitive

landscape of the cybersecurity market, including consolidation among our competitors; |

| o |

the introduction of new accounting pronouncements or changes in our accounting policies or practices; |

| o |

changes in our pricing policies or those of our competitors; and |

| o |

the size and discretionary nature of our prospective and existing customers’ IT budgets. |

| o |

greater name recognition, a longer operating history and a larger customer base; |

| o |

larger sales and marketing budgets and resources; |

| o |

broader distribution and established relationships with channel partners, advisory firms and customers; |

| o |

increased effectiveness in protecting, detecting and responding to cyberattacks; |

| o |

greater or localized resources for customer support and provision of services; |

| o |

greater speed at which a solution can be deployed and implemented; |

| o |

greater resources to make acquisitions; |

| o |

lower pricing and attractive packaging; |

| o |

greater operational flexibility and less stringent accounting, auditing and legal standards, applicable to privately held companies;

|

| o |

larger intellectual property portfolios; and |

| o |

greater financial, technical and other resources. |

| o |

failure to fully comply with various, global data privacy and data protection laws (see “—The dynamic regulatory environment

around privacy and data protection may limit our offering or require modification of our products and services, which could limit our

ability to attract new customers and support our current customers and increase our operational expenses. We could also be subject to

investigations, litigation, or enforcement actions alleging that we fail to comply with the regulatory requirements, which could harm

our operating results and adversely affect our business.”); |

| o |

continuing uncertainty of the long term economic, financial, regulatory, trade, tax and legal implications of the withdrawal of the

U.K. from the European Union (“Brexit”). Our U.K. subsidiary is the main entity for sales into Europe. In 2021, the revenues

generated by our U.K. subsidiary from the European Union countries (excluding the U.K.) accounted for 23% of our total global revenue.

Our London office is also our European headquarters and third largest office globally; |

| o |

fluctuations in exchange rates between the U.S. dollar and foreign currencies in markets where we do business (see “—We

are exposed to fluctuations in currency exchange rates, which could negatively affect our financial condition and results of operations.”);

|

| o |

social, economic and political instability, war, civil disturbance or acts of terrorism, conflicts (including the current conflict

between Russia and Ukraine) and security concerns in general, and any wide-spread viruses or epidemics, such as COVID-19; |

| o |

greater difficulty in enforcing contracts and managing collections, as well as longer collection periods; |

| o |

noncompliance with specific anti-bribery laws, without limitation, the U.S. Foreign Corrupt Practices Act and the U.K Bribery Act

of 2010 and the heightened risk of unfair or corrupt business practices in certain geographies, which may include the improper or fraudulent

sales arrangements by us or by our channel partners or service providers that may impact financial results and result in restatements

of, or irregularities in, financial statements; |

| o |

Certain of our activities and products are subject to U.S., Israeli, and possibly other export and trade control and economic sanctions

laws and regulations, which have and may additionally prohibit or restrict our ability to engage in business with certain countries and

customers. If the applicable requirements related to export and trade controls change or expand (such as in response to the Russia and

Ukraine conflict), if we change the encryption functionality in our products, or if we develop other products or export products from

additional jurisdictions, we may need to satisfy additional requirements or obtain specific licenses in order to continue to export our

products in the same global scope. Various countries also regulate the import or export of certain encryption products and other technologies

and services and have enacted laws that could limit our ability to distribute or implement our products in those countries. In addition,

applicable export control and sanctions laws and regulations may impact our ability to sell our products, directly or indirectly, to countries

or territories that are the target of comprehensive sanctions, or to prohibited parties; |

| o |

unexpected changes in regulatory practices and foreign legal requirements, including uncertain tax obligations and effective tax

rates, which may result in recognizing tax losses or lower than anticipated earnings in jurisdictions where we have lower statutory rates

and higher than anticipated earnings in jurisdictions where we have higher statutory rates, or changes in the valuation of our deferred

tax assets and liabilities; |

| o |

compliance with, and the uncertainty of, laws and regulations that apply to our areas of business, including corporate governance,

anti-trust and competition, local and regional employment (including cross-border travel), employee and third-party complaints, limitation

of liability, conflicts of interest, securities regulations and other regulatory requirements affecting trade, local tariffs, product

localization and investment; |

| o |

reduced or uncertain protection of intellectual property rights in some countries; and |

| o |

management communication and integration problems resulting from cultural and geographic dispersion. |

| o |

actual or anticipated fluctuations in our results of operations and the results of other similar companies; |

| o |

variance in our financial performance from the expectations of market analysts; |

| o |

announcements by us or our competitors of significant business developments, changes in service provider relationships, acquisitions

or expansion plans; |

| o |

changes in the prices of our products and services or in our pricing models; |

| o |

our involvement in litigation; |

| o |

our sale of ordinary shares or other securities in the future; |

| o |

market conditions in our industry; |

| o |

changes in key personnel; |

| o |

speculation in the press or the investment community; |

| o |

the trading volume of our ordinary shares; |

| o |

changes in the estimation of the future size and growth rate of our markets; |

| o |

any merger and acquisition activities; and |

| o |

general economic and market conditions. |

| ITEM 4. | INFORMATION ON THE COMPANY |

| A. |

History and Development of the Company |

| B. |

Business Overview |

| • |

Strengthening our Identity Security leadership position by delivering ongoing

innovation. We intend to extend our leadership

position by enhancing our existing products and services, introducing new functionality and developing new solutions to address new use

cases. Our strategy includes both internal development and an active mergers and acquisition program where we acquire or invest in complementary

businesses or technologies. |

| • |

Extending our global go-to-market reach. We sell our solutions through

a high-touch hybrid model that includes direct and indirect sales. We plan to expand our sales reach by adding new direct sales capacity,

expanding our indirect channels by deepening our relationships with existing partners and by adding new value-added resellers, system

integrators, managed security service providers and C3

Alliance partners. We are also expanding our routes to market to include cloud provider marketplaces. |

| • |

Growing our customer base. The

global threat landscape, digitalization of the enterprise, cloud migration and the broad security skills shortage are contributing to

the need for Identity Security solutions. We believe that every organization, regardless of

size or vertical, needs Identity Security and we plan to pursue business with new customers in the enterprise and mid-market, or commercial,

segments of the market. |

| • |

Expanding our relationships with existing customers. As

of December 31, 2021, we had approximately 7,500 customers. We have worked hard to develop strong relationships with our customers, and

our strategy includes our Customer Success team expanding these relationships by growing the number of users who access our solutions

and cross-selling additional products and services. |

| • |

Driving strong adoption of our solutions and retaining our customer base. An

important part of our overall strategy, particularly for our SaaS and self-hosted subscription customers, is delivering fast time to value

from our solutions. We plan to deliver high levels of customer service and support and continue to invest in our Customer Success team

to help ensure that our customers are up and running quickly and derive benefit from our software, which we believe will result in higher

customer retention rates. |

| • |

Attracting, developing and retaining a diverse and inclusive employee base.

A key pillar of our growth strategy is attracting, developing and retaining our employees. Our people are one of our most valuable

assets, and our culture is a key business differentiator for CyberArk. We value diversity and inclusion which allows for the exchange

of ideas, creates a strong community and helps ensure our employees are valued and respected. |

While traditional, perimeter-based security relies on a strategy of trying to separate legitimate users from threat actors and assumes that systems and traffic within the corporate networks and datacenters can be trusted, Zero Trust assumes that the threat actors have already established a network presence and have access to an organization’s applications and systems. In a Zero Trust security model, organizations aim to have every identity authenticated and authorized before granting it access and to do so on a continuous basis.

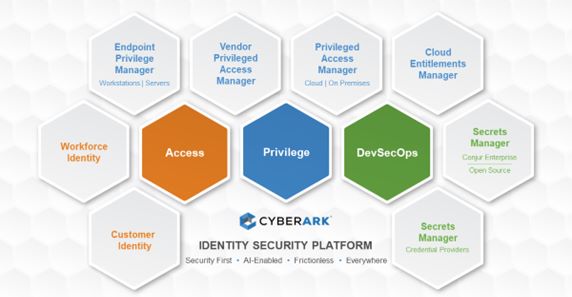

| • |

Privileged Access Manager. CyberArk Privileged Access Manager includes risk-based credential

security and session management to protect against attacks involving privileged access. CyberArk’s self-hosted Privileged Access

Manager solution (formerly known as Core PAS) can be deployed in a self-hosted data center or in a hybrid cloud or a public cloud environment,

either as a perpetual license or as a subscription. CyberArk’s Privileged Access Manager is also provided as a SaaS solution through

CyberArk Privilege Cloud. |

| • |

Vendor Privileged Access Manager. CyberArk Vendor Privileged Access Manager combines Privileged

Access Manager and Remote Access (formerly known as Alero) to provide fast, easy and secure privileged access to third-party vendors who

need access to critical internal systems via CyberArk, without the need to use passwords. By not requiring VPNs or agents, Vendor Privileged

Access Manager removes operational overhead for administrators, makes it easier and quicker to deploy and improves organizational security.

|

| • |

Endpoint Privilege Manager. CyberArk Endpoint Privilege Manager

is a SaaS solution that secures privileges on the endpoint (Windows servers, Windows desktops and Mac desktops) and helps contain attacks

early in their lifecycle. It enables revocation of local administrator rights, while minimizing impact on user productivity, by seamlessly

elevating privileges for authorized applications or tasks. Application control, with automatic policy creation, allows organizations to

prevent malicious applications from executing, and runs unknown applications in a restricted mode. This, combined with credential theft

protection, helps prevent malware such as ransomware from gaining a foothold and contains attacks on the endpoint. |

| • |

Cloud Entitlements Manager. CyberArk Cloud Entitlements Manager

is a SaaS solution that reduces risks that arise from excessive privileges by implementing Least Privilege across cloud environments.

From a centralized dashboard, Cloud Entitlements Manager provides visibility and control of permissions across an organization’s

cloud landscape. Within this single display, Cloud Entitlements Manager offers automatically deployable remediations based on the principle

of Least Privilege, to help organizations strategically remove excessive permissions without disrupting cloud operations. |

| • |

Adaptive Multi-factor Authentication (MFA). Adaptive MFA enables an enterprise to enforce

risk-aware and strong identity assurance controls within the organization. |

| • |

Single Sign-On (SSO). SSO is the ability to use a single secure identity to access all applications

and resources within an organization. CyberArk Identity enables SSO for all types of users (workforce, partners, and consumers) to all

types of workstations, systems, VPNs, and applications both in the cloud and on-premises. |

| • |

Secure Web Sessions. Secure Web Sessions records, audits and protects end-user activity within

designated web applications. The solution uses a browser extension on an end-user’s endpoint to monitor and segregate web apps that

are accessed through SSO and deemed sensitive by business application owners, enterprise IT and security administrators. |

| • |

Application Gateway. With the CyberArk Identity Application Gateway service, customers can

enable secure remote access and expand SSO benefits to on-premises web apps — like SharePoint and SAP — without the complexity

of installing and maintaining VPNs. |

| • |

Identity Lifecycle Management. This module enables CyberArk Identity customers to automate

the joiner, mover, and leaver processes within the organization. This automation is critical to ensure that privileges don’t accumulate,

and a user’s access is turned off as soon as the individual changes roles or leaves the organization. |

| • |

Directory Services. Allows customers to use identity where they control it. In other words,

we do not force our customers to synchronize their on-premises Active Directory implementation with our cloud. Our cloud architecture

can work seamlessly with any existing directory, such as Active Directory, LDAP-based directories, and other federated directories. CyberArk

Identity also provides its own highly scalable and flexible directory for customers who choose to use it. |

| • |

Secrets Manager Credential Providers. Credential Providers can be used to provide and manage

the credentials used by third-party solutions such as security tools, RPA, and IT management software, and also supports internally developed

applications built on traditional monolithic application architectures. Credential Providers works with CyberArk’s on-premises and

SaaS based solutions. |

| • |

Secrets Manager Conjur. For cloud-native applications built using DevOps methodologies, Conjur

Enterprise provides a secrets management solution tailored specifically to the unique requirements of these environments. We also provide

an open-source version to better meet the needs of the developer community. |

| o |

the breadth and completeness of a security solution; |

| o |

reliability and effectiveness in protecting, detecting and responding to cyber-attacks; |

| o |

analytics and accountability at an individual user level; |

| o |

ability of customers to achieve and maintain compliance with compliance standards and audit requirements; |

| o |

strength of sale and marketing efforts, including advisory firms and channel partner relationships; |

| o |

global reach and customer base; |

| o |

scalability and ease of integration with an organization’s existing IT infrastructure and security investments; |

| o |

brand awareness and reputation; |

| o |

innovation and thought leadership; |

| o |

quality of customer support and professional services; |

| o |

speed at which a solution can be deployed and implemented; and |

| o |

price of a solution and cost of maintenance and professional services. |

| C. |

Organizational Structure |

|

Name of Subsidiary |

Place of Incorporation |

|

CyberArk Software, Inc. |

Delaware, United States |

|

Cyber-Ark Software (UK) Limited |

United Kingdom |

|

CyberArk Software (Singapore) PTE. LTD. |

Singapore |

|

CyberArk Software (DACH) GmbH |

Germany |

|

CyberArk Software Italy S.r.l. |

Italy |

|

CyberArk Software (France) SARL |

France |

|

CyberArk Software (Netherlands) B.V. |

Netherlands |

|

CyberArk Software (Australia) Pty Ltd.

CyberArk Software (Japan) K.K.

CyberArk Software Canada Inc.

CyberArk USA Engineering, GP, LLC |

Australia

Japan

Canada

Delaware, United States |

|

CyberArk Software (Spain), S.L. |

Spain |

|

CyberArk Software (India) Private Limited |

India |

| D. |

Property, Plant and Equipment |

| ITEM 4A. | UNRESOLVED STAFF COMMENTS |

| ITEM 5. |

OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

|

Year ended December 31, |

||||||||||||

|

2019 |

2020 |

2021 |

||||||||||

|

($ in millions) |

||||||||||||

|

Total ARR (as of period-end) |

$ |

192 |

$ |

274 |

$ |

393 |

||||||

|

Subscription Portion of Annual Recurring Revenue (as of period-end) |

$ |

19 |

$ |

74 |

$ |

183 |

||||||

|

Recurring revenues |

$ |

176 |

$ |

247 |

$ |

349 |

||||||

|

Deferred revenue (as of period-end) |

$ |

190 |

$ |

243 |

$ |

317 |

||||||

| A. |

Operating Results |

|

Year ended December 31, |

||||||||||||||||||||||||

|

2019 |

2020 |

2021 |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% of Revenues |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

United States |

$ |

233,945 |

53.9 |

% |

$ |

246,811 |

53.1 |

% |

$ |

253,811 |

50.5 |

% | ||||||||||||

|

EMEA |

129,730 |

29.9 |

|

141,866 |

30.6 |

|

163,328 |

32.5 |

| |||||||||||||||

|

Rest of World |

70,220 |

16.2 |

|

75,754 |

16.3 |

|

85,778 |

17.0 |

| |||||||||||||||

|

Total revenues |

$ |

433,895 |

100.0 |

% |

$ |

464,431 |

100.0 |

% |

$ |

502,917 |

100.0 |

% | ||||||||||||

| o |

Cost of Subscription Revenues. Cost of subscription revenues consists primarily of cloud

infrastructure costs, amortization of intangible assets, personnel costs for our global cloud organization that consist primarily of salaries,

benefits, bonuses and share-based compensation and depreciation of internal use software capitalization. As we shift more of our sales

to SaaS and self-hosted subscription offerings, we expect the absolute cost of subscription revenues and the cost of subscription revenues

as a percentage of revenues to increase. |

|

o |

Cost of Perpetual

License Revenues. Cost of perpetual license revenues consists primarily of allocated personnel costs to support delivery and operations

related to perpetual licenses, appliances expenses and costs incurred by amortization of intangible assets. Personnel costs consist primarily

of salaries, benefits, bonuses and share-based compensation. As we shift more of our sales to SaaS and self-hosted subscription contracts,

we expect the absolute cost of perpetual license revenues and the cost of perpetual license revenues as a percentage of revenues to decrease.

|

| o |

Cost of Maintenance and Professional Services Revenues. Cost of maintenance related to perpetual

license contracts and professional services revenues primarily consists of allocated personnel costs for our global customer support and

professional services organization. Such costs consist primarily of salaries, benefits, bonuses, share-based compensation and subcontractors’

fees. We expect the absolute cost of maintenance and professional services revenues to increase as our customer base grows and as we hire

additional professional services and technical support personnel. |

|

Year ended December 31, |

||||||||||||||||||||||||

|

2019 |

2020 |

2021 |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% of Revenues |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

Revenues: |

||||||||||||||||||||||||

|

Subscription

|

$ |

18,168 |

4.2 |

% |

$ |

56,425 |

12.1 |

% |

$ |

134,628 |

26.8 |

% | ||||||||||||

|

Perpetual license

|

221,955 |

51.1 |

176,061 |

37.9 |

115,738 |

23.0 |

||||||||||||||||||

|

Maintenance and professional services |

193,772 |

44.7 |

231,945 |

50.0 |

252,551 |

50.2 |

||||||||||||||||||

|

Total revenues

|

433,895 |

100.0 |

464,431 |

100.0 |

502,917 |

100.0 |

||||||||||||||||||

|

Cost of revenues: |

||||||||||||||||||||||||

|

Subscription

|

5,611 |

1.3 |

17,513 |

3.8 |

25,837 |

5.2 |

||||||||||||||||||

|

Perpetual license

|

7,900 |

1.8 |

4,925 |

1.1 |

3,904 |

0.8 |

||||||||||||||||||

|

Maintenance and professional services |

49,104 |

11.3 |

60,133 |

12.9 |

63,566 |

12.6 |

||||||||||||||||||

|

Total cost of revenues

|

62,615 |

14.4 |

82,571 |

17.8 |

93,307 |

18.6 |

||||||||||||||||||

|

Gross profit

|

371,280 |

85.6 |

381,860 |

82.2 |

409,610 |

81.4 |

||||||||||||||||||

|

Operating expenses: |

||||||||||||||||||||||||

|

Research and development

|

72,520 |

16.7 |

95,426 |

20.5 |

142,121 |

28.2 |

||||||||||||||||||

|

Sales and marketing

|

184,168 |

42.4 |

219,999 |

47.4 |

274,401 |

54.6 |

||||||||||||||||||

|

General and administrative

|

52,308 |

12.1 |

60,429 |

13.0 |

71,425 |

14. 2 |

||||||||||||||||||

|

Total operating expenses

|

308,996 |

71.2 |

375,854 |

80.9 |

487,947 |

97. 0 |

||||||||||||||||||

|

Operating income (loss)

|

62,284 |

14.4 |

6,006 |

1.3 |

(78,337 |

) |

(15.6 |

) | ||||||||||||||||

|

Financial income (expense), net

|

7,800 |

1.8 |

(6,395 |

) |

(1.4 |

) |

(12,992 |

) |

(2.6 |

) | ||||||||||||||

|

Income (loss) before taxes on income |

70,084 |

16.2 |

(389 |

) |

(0.1 |

) |

(91,329 |

) |

(18.2 |

) | ||||||||||||||

|

Tax benefit (taxes on income)

|

(7,020 |

) |

(1.6 |

) |

(5,369 |

) |

(1.2 |

) |

7,383 |

1.5 |

||||||||||||||

|

Net income (loss)

|

$ |

63,064 |

14.5 |

% |

$ |

(5,758 |

) |

(1.2 |

)% |

$ |

(83,946 |

) |

(16.7 |

)% | ||||||||||

|

Year ended December 31, |

||||||||||||||||||||||||

|

2020 |

2021 |

Change |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

Revenues: |

||||||||||||||||||||||||

|

Subscription |

$ |

56,425 |

12.1 |

% |

$ |

134,628 |

26.8 |

% |

$ |

78,203 |

138.6 |

% | ||||||||||||

|

Perpetual license

|

176,061 |

37.9 |

115,738 |

23.0 |

(60,323 |

) |

(34.3 |

) | ||||||||||||||||

|

Maintenance and professional services |

231,945 |

50.0 |

252,551 |

50.2 |

20,606 |

8.9 |

||||||||||||||||||

|

Total revenues

|

$ |

464,431 |

100.0 |

% |

$ |

502,917 |

100.0 |

% |

$ |

38,486 |

8.3 |

% | ||||||||||||

|

Year ended December 31, |

||||||||||||||||||||||||

|

2020 |

2021 |

Change |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

Cost of revenues: |

||||||||||||||||||||||||

|

Subscription

|

$ |

17,513 |

3.8 |

% |

$ |

25,837 |

5.2 |

% |

$ |

8,324 |

47.5 |

% | ||||||||||||

|

Perpetual license

|

4,925 |

1.1 |

3,904 |

0.8 |

(1,021 |

) |

(20.7 |

) | ||||||||||||||||

|

Maintenance and professional services |

60,133 |

12.9 |

63,566 |

12.6 |

3,433 |

5.7 |

| |||||||||||||||||

|

Total cost of revenues

|

$ |

82,571 |

17.8 |

% |

$ |

93,307 |

18.6 |

% |

$ |

10,736 |

13.0 |

% | ||||||||||||

|

Gross profit

|

$ |

381,860 |

82.2 |

% |

$ |

409,610 |

81.4 |

% |

$ |

27,750 |

7.3 |

% | ||||||||||||

|

Year ended December 31, |

||||||||||||||||||||||||

|

2020 |

2021 |

Change |

||||||||||||||||||||||

|

Amount |

% of Revenues |

Amount |

% of Revenues |

Amount |

% |

|||||||||||||||||||

|

($ in thousands) |

||||||||||||||||||||||||

|

Operating expenses: |

||||||||||||||||||||||||

|

Research and development

|

$ |

95,426 |

20.5 |

% |

$ |

142,121 |

28.2 |

% |

$ |

46,695 |

48.9 |

% | ||||||||||||

|

Sales and marketing

|

219,999 |

47.4 |

274,401 |

54.6 |

54,402 |

24.7 |

||||||||||||||||||

|

General and administrative

|

60,429 |

13.0 |

71,425 |

14.2 |

10,996 |

18.2 |

||||||||||||||||||

|

Total operating expenses

|

$ |

375,854 |

80.9 |

% |

$ |

487,947 |

97.0 |

% |

$ |

112,093 |

29.8 |

% | ||||||||||||

| B. |

Liquidity and Capital Resources |

|

Year Ended December 31, |

||||||||

|

2020 |

2021 |

|||||||

|

($ in thousands) |

||||||||

|

Net cash provided by operating activities

|

$ |

106,769 |

$ |

74,740 |

||||

|

Net cash used in investing activities

|

(412,387 |

) |

(228,194 |

) | ||||

|

Net cash provided by financing activities

|

13,249 |

10,949 |

||||||

|

($ in thousands) |

Total |

Less than 1

year |

1 – 3 years |

3 – 5 years |

||||||||||||

|

|

||||||||||||||||

|

Operating lease obligations(1) |

$ |

17,596 |

$ |

7,017 |

$ |

9,993 |

$ |

586 |

||||||||

|

Uncertain tax obligations(2) |

3,870 |

— |

— |

— |

||||||||||||

|

Severance pay(3) |

8,271 |

— |

— |

— |

||||||||||||

|

0.00% Convertible Senior Notes due 2024(4) |

575,000 |

— |

575,000 |

— |

||||||||||||

|

|

||||||||||||||||

|

Total |

$ |

604,737 |

$ |

7,017 |

$ |

584,993 |

$ |

586 |

||||||||

| C. |

Research and Development, Patents and Licenses, etc. |

| D. |

Trend Information |

| E. | Critical Accounting Estimates |

| o |

the expenditures are approved by the relevant Israeli government ministry, determined by the field of research; |

| o |

the research and development is for the promotion or development of the company; and |

| o |

the research and development is carried out by or on behalf of the company seeking the deduction. |

| o |

amortization of the cost of purchased know-how, patents and rights to use a patent and know-how which are used for the development

or promotion of the Industrial Enterprise, over an eight-year period commencing on the year in which such rights were first exercised;

|

| o |

under limited conditions, an election to file consolidated tax returns together with Israeli Industrial Companies controlled by it;

and |

| o |

expenses related to a public offering of shares in a stock exchange are deductible in equal amounts over three years commencing on

the year of offering. |

| ITEM 6. | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

| A. |

Directors and Senior Management |

|

Name |

Age |

Position | ||

|

Senior Management |

||||

|

Ehud (Udi) Mokady |

53 |

Chairman of the Board and Chief Executive Officer and Founder | ||

|

Joshua Siegel |

58 |

Chief Financial Officer | ||

|

Chen Bitan |

52 |

General Manager Israel, Chief Product Officer | ||

|

Matthew Cohen |

46 |

Chief Operating Officer | ||

|

Donna Rahav |

43

|

Chief Legal Officer | ||

|

Directors |

||||

|

Gadi Tirosh(1)(3)(4)(5) |

55 |

Lead Independent Director | ||

|

Ron Gutler(1)(2)(4)(5) |

64 |

Director | ||

|

Kim Perdikou(1)(2)(3)(4)(5) |

64 |

Director | ||

|

David Schaeffer(5) |

65 |

Director | ||

|

Amnon Shoshani(3)(5) |

58 |

Director | ||

|

François Auque(2)(5) |

65 |

Director | ||

|

Avril England(4)(5) |

53 |

Director |

| (1) |

Member of our compensation committee. |

| (2) |

Member of our audit committee. |

| (3) |

Member of our nominating and corporate governance committee. |

| (4) |

Member of our strategy committee. |

| (5) |

Independent director under the rules of Nasdaq. |

| B. |

Compensation |

|

Information Regarding the Covered Executive(1) |

||||||||||||||||

|

Name and Principal Position(2) |

Base Salary |

Benefits and Perquisites (3) |

Variable Compensation (4) |

Equity-Based Compensation (5) |

||||||||||||

|

Ehud (Udi) Mokady, Chairman of the Board & CEO

|

$ |

415,000 |

$ |

325,324 |

$ |

695,320 |

$ |

10,970,738 |

||||||||

|

Joshua Siegel, Chief Financial Officer

|

422,231 |

127,886 |

393,740 |

4,306,569 |

||||||||||||

|

Matthew Cohen, Chief Operating Officer

|

412,000 |

88,662 |

690,432 |

3,674,682 |

||||||||||||

|

Chen Bitan, General Manager Israel, Chief Product Officer

|

366,493 |

206,051 |

323,690 |

2,227,113 |

||||||||||||

|

Clarence Hinton, Chief Strategy Officer

|

330,000 |

71,012 |

300,010 |

1,788,878 |

||||||||||||

| (1) |

In accordance with Israeli law, all amounts reported in the table are in terms of cost to our Company, as recorded in our financial

statements for the year ended December 31, 2021. |

| (2) |

All current officers listed in the table are full-time employees. Cash compensation amounts denominated in currencies other than

the U.S. dollar were converted into U.S. dollars at the average conversion rate for the year ended December 31, 2021. |

| (3) |

Amounts reported in this column include benefits and perquisites, including those mandated by applicable law. Such benefits and perquisites

may include, to the extent applicable to each executive, payments, contributions and/or allocations for savings funds, pension, severance,

vacation, car or car allowance, medical insurances and benefits, risk insurances (such as life, disability and accident insurances), convalescence

pay, payments for Medicare and social security, tax gross-up payments and other benefits and perquisites consistent with our guidelines,

regardless of whether such amounts have actually been paid to the executive. |

| (4) |

Amounts reported in this column refer to Variable Compensation such as incentives and earned or paid bonuses as recorded in our financial

statements for the year ended December 31, 2021. |

| (5) |

Amounts reported in this column represent the expense recorded in our financial statements for the year ended December 31, 2021

with respect to equity-based compensation, reflecting also equity awards made in previous years which have vested during the current year.

Assumptions and key variables used in the calculation of such amounts are described in Note 12 to our audited consolidated financial statements,

which are included in this annual report. |

|

RSUs |

Business PSUs |

Relative TSR PSUs | ||

|

2020 |

Percentage |

50% |

30% |

20% |

|

Amount |

27,700 |

16,600 |

11,100 | |

|

2021 |

Percentage |

~40% |

~40% |

20% |

|

Amount |

25,300 |

25,290 |

12,650 | |

|

2022 |

Percentage |

40% |

40% |

20% |

|

Amount |

24,600 |

24,600 |

12,300 |

|

Year of Grant |

Number of Business PSUs Granted (on Target) |

Performance Targets |

Performance Criteria Achievement Rate |

Number of PSUs Earned |

Earning Rate |

|

2020 |

16,600 |

• Annual revenue

• Non-GAAP profitability

• License-derived revenue |

80% |

9,830 |

60% |

|

2021 |

25,290 |

• Annual recurring revenue

• Percentage of new license subscription

bookings out of total new license bookings,

on an annualized basis |

111% |

46,370 |

183% |

|

2022 |

24,600 |

• Annual recurring revenue

• Total new license

bookings, on an

annualized basis |

To be determined at the end of the performance period | ||

| C. |

Board Practices |

| o |

providing leadership to the board of directors if circumstances arise in which the role of the Chairman of the Board may be, or may

be perceived to be, in conflict, and responding to any reported conflicts of interest, or potential conflicts of interest, arising for

any director; |

| o |

presiding as chairman of meetings of the board of directors at which the Chairman of the Board is not present, including executive

sessions of the independent members of the board of directors; |

| o |

serving as liaison between the Chairman of the Board and the independent members of the Board; |

| o |

approving meeting agendas for the board of directors; |

| o |

approving information sent to the board of directors; |

| o |

approving meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

| o |

having the authority to call meetings of the independent members of the board; |

| o |

ensuring that he or she is available for consultation and direct communication with shareholders, as appropriate; |

| o |

recommending that the board of directors retain consultants or advisers that report directly to the board; |

| o |

conferring with the Chairman of the Board on important board of directors matters and ensuring the board of directors focuses on

key issues and tasks facing the Company; and |

| o |

performing such other duties as the board of directors may from time to time delegate to assist the board of directors in the fulfillment

of its duties. |

| o |

overseeing of our accounting and financial reporting process and the audits of our financial statements, the effectiveness of our

internal control over financial reporting and making such reports as may be required of an audit committee under the rules and regulations

promulgated under the Exchange Act; |

| o |

retaining and terminating our independent registered public accounting firm subject to the approval of our board of directors and,

in the case of retention, of our shareholders and recommending the terms of audit and non-audit services provided by the independent registered

public accounting firm for pre-approval by our board of directors and related fees and terms; |

| o |

establishing systems of internal control over financial reporting, including communication and implementation thereof and the assessment

of the internal controls in accordance with the Sarbanes-Oxley Act, and any attestation by the independent registered public accounting

firm; |

| o |

determining whether there are deficiencies in the business management practices of our Company, including in consultation with our

internal auditor or the independent registered public accounting firm, and making recommendations to the board of directors to improve

such practices; |

| o |

determining whether to approve certain related party transactions (see “Item 6.C. Board Practices —Approval of Related

Party Transactions under Israeli Law”); |

| o |

recommending to the board of directors the retention and termination of our internal auditor, and determining the internal auditor's

fees and other terms of engagement, in accordance with the Companies Law; |

| o |

approving the working plan proposed by the internal auditor and reviewing and discussing the work of the internal auditor on a quarterly

basis; |

| o |

reviewing our cybersecurity risks and controls with senior management, keeping our board informed of key issues related to cybersecurity;

|

| o |

establishing procedures for the handling of employees’ complaints as to the deficiencies in the management of our business

and the protection to be provided to such employees; and |

| o |

performing such other duties consistent with the audit committee charter, our governing documents, stock exchange rules and applicable

law that may be requested by the board of directors from time to time, including discussing with management policies and practices that

govern the process by which the Company undertakes risk assessment and management in sensitive areas. |

| o |

recommending to the board of directors for its approval a compensation policy and subsequently reviewing it from time to time, assessing

its implementation and recommending periodic updates, whether a new compensation policy should be adopted or an existing compensation

policy should continue in effect; |

| o |

reviewing, evaluating and making recommendations regarding the terms of office, compensation and benefits for our office holders,

including the non-employee directors, taking into account our compensation policy; |

| o |

exempting certain compensation arrangements from the requirement to obtain shareholder approval under the Companies Law (including

with respect to the Chief Executive Officer); and |

| o |

reviewing and granting equity-based awards pursuant to our equity incentive plans to the extent such authority is delegated to the

compensation committee by our board of directors and the reserving of additional shares for issuance thereunder. |

| o |

overseeing and assisting our board of directors in reviewing and recommending nominees for election as directors and as members of

the committees of the board of directors; |

| o |

establishing procedures for, and administering the performance of the members of our board and its committees; |

| o |

evaluating and making recommendations to our board of directors regarding the termination of membership of directors; |

| o |

reviewing, evaluating and making recommendations regarding management succession and development; |

| o |

reviewing and making recommendations to our board of directors regarding board member qualifications, composition and structure and

the nature and duties of the committees and qualifications of committee members; |

| o |

establishing and maintaining effective corporate governance policies and practices, including, but not limited to, developing and

recommending to our board of directors a set of corporate governance guidelines applicable to our Company; and |

| o |

provide oversight of the Company’s efforts with regard to environmental, social and governance (“ESG”) matters,

disclosure and strategy, as well as coordinate, as necessary, with other committees of the board of directors and the Company’s

ESG committee and steering committee, which are comprised of key Company employees and management. |

| o |

a person (or a relative of a person) who holds more than 5% of the company’s outstanding shares or voting rights; |

| o |

a person (or a relative of a person) who has the power to appoint a director or the general manager of the company; |

| o |

an office holder (including a director) of the company (or a relative thereof); or |

| o |

a member of the company’s independent accounting firm, or anyone on his or her behalf. |

| o |

information on the advisability of a given action brought for his or her approval or performed by virtue of his or her position;

and |

| o |

all other important information pertaining to any such action. |

| o |

refrain from any conflict of interest between the performance of his or her duties to the company and his or her duties or personal

affairs; |

| o |

refrain from any action which competes with the company’s business; |

| o |

refrain from exploiting any business opportunity of the company in order to receive a personal gain for himself or herself or others;

and |

| o |

disclose to the company any information or documents relating to the company’s affairs which the office holder received as

a result of his or her position as an office holder. |

| o |

a transaction other than in the ordinary course of business; |

| o |

a transaction that is not on market terms; or |

| o |

a transaction that may have a material impact on a company’s profitability, assets or liabilities. |

| o |

an amendment to the company’s articles of association; |

| o |

an increase of the company’s authorized share capital; |

| o |

a merger; or |

| o |

the approval of related party transactions and acts of office holders that require shareholder approval. |

| o |

a monetary liability incurred by or imposed on him or her in favor of another person pursuant to a judgment, including a settlement

or arbitrator’s award approved by a court. However, if an undertaking to indemnify an office holder with respect to such liability

is provided in advance, then such undertaking must be limited to certain events which, in the opinion of the board of directors, can be

foreseen based on the company’s activities when the undertaking to indemnify is given, and to an amount or according to criteria

determined by the board of directors as reasonable under the circumstances, and such undertaking shall detail the foreseen events and

described above amount or criteria; |

| o |

reasonable litigation expenses, including reasonable attorneys’ fees, incurred by the office holder (1) as a result of

an investigation or proceeding instituted against him or her by an authority authorized to conduct such investigation or proceeding, provided

that (i) no indictment was filed against such office holder as a result of such investigation or proceeding; and (ii) no financial

liability was imposed upon him or her as a substitute for the criminal proceeding as a result of such investigation or proceeding or,

if such financial liability was imposed, it was imposed with respect to an offense that does not require proof of criminal intent; or

(2) in connection with a monetary sanction or liability imposed on him or her in favor of an injured party in certain Administrative

proceedings; |

| o |

expenses incurred by an office holder in connection with Administrative proceedings instituted against such office holder, or certain

compensation payments made to an injured party imposed on an office holder by Administrative proceedings, including reasonable litigation

expenses and reasonable attorneys’ fees; and |

| o |

reasonable litigation expenses, including attorneys’ fees, incurred by the office holder or imposed by a court in proceedings

instituted against him or her by the company, on its behalf, or by a third party, or in connection with criminal proceedings in which

the office holder was acquitted, or as a result of a conviction for an offense that does not require proof of criminal intent. |

| o |

a breach of duty of care to the company or to a third party, to the extent such a breach arises out of the negligent conduct of the

office holder; |

| o |

a breach of the duty of loyalty to the company, provided that the office holder acted in good faith and had a reasonable basis to

believe that the act would not harm the company; |

| o |

a monetary liability imposed on the office holder in favor of a third party; |

| o |

a monetary liability imposed on the office holder in favor of an injured party in certain Administrative proceedings; and |

| o |

expenses incurred by an office holder in connection with certain Administrative proceedings, including reasonable litigation expenses

and reasonable attorneys’ fees. |

| o |

a breach of the duty of loyalty, except for indemnification and insurance for a breach of the duty of loyalty to the company to the

extent that the office holder acted in good faith and had a reasonable basis to believe that the act would not prejudice the company;

|

| o |

a breach of duty of care committed intentionally or recklessly, excluding a breach arising out of the negligent conduct of the office

holder; |

| o |

an act or omission committed with intent to derive illegal personal benefit; or |

| o |

a civil or criminal fine, monetary sanction or forfeit levied against the office holder. |

| D. |

Employees |

|

As of December 31, |

||||||||||||

|

Department |

2019 |

2020 |

2021 |

|||||||||

|

Sales and marketing

|

656 |

772 |

941 |

|||||||||

|

Research and development

|

349 |

464 |

643 |

|||||||||

|

Services and support

|

253 |

309 |

381 |

|||||||||

|

General and administrative

|

122 |

144 |

175 |

|||||||||

|

Total

|

1,380 |

1,689 |

2,140 |

|||||||||

| • |

each person or entity known by us to own beneficially 5% or more of our outstanding shares; |

| • |

each of our directors and senior management individually; and |

| • |

all of our senior management and directors as a group. |

|

Shares Beneficially Owned |

||||||||

|

Name of Beneficial Owner |

Number |

% |

||||||

|

Principal Shareholders |

||||||||

|

Wasatch Advisors, Inc. (1) |

3,691,565 |

9.2 |

% | |||||

|

Senior Management and

Directors |

||||||||

|

Ehud (Udi) Mokady(2) |

* |

* |

||||||

|

Joshua Siegel |

* |

* |

||||||

|

Chen Bitan |

* |

* |

||||||

|

Matthew Cohen |

* |

* |

||||||

|

Donna Rahav |

* |

* |

||||||

|

Gadi Tirosh |

* |

* |

||||||

|

Ron Gutler |

* |

* |

||||||

|

Kim Perdikou |

* |

* |

||||||

|

David Schaeffer |

* |

* |

||||||

|

Amnon Shoshani |

* |

* |

||||||

|

François Auque |

* |

* |

||||||

|

Avril England |

* |

* |

||||||

|

All senior management and directors as a group (12 persons) |

578,502 |

1.4 |

% | |||||

| (1) |

Based on a Schedule 13G/A filed on February 10, 2022, by Wasatch Advisors, Inc. (“Wastach”), shares beneficially owned

consist of 3,691,565 ordinary shares over which Wastach has sole voting and dispositive power. The address of Wasatch is 505 Wakara Way,

Salt Lake City, UT 84108. |

| (2) |

Mr. Mokady’s shares include 12,600 shares held in trust for family members over which Mr. Mokady is the beneficial

owner. |

| ITEM 8. | FINANCIAL INFORMATION |

| ITEM 9. | THE OFFER AND LISTING |

| ITEM 10. | ADDITIONAL INFORMATION |

| • |

banks, financial institutions or insurance companies; |

| • |

real estate investment trusts, regulated investment companies or grantor trusts; |

| • |

brokers, dealers or traders in securities, commodities or currencies; |

| • |

tax-exempt entities, accounts or organizations, including an “individual retirement account” or “Roth IRA”

as defined in Section 408 or 408A of the Code, respectively; |

| • |

certain former citizens or long-term residents of the United States; |

| • |

persons that receive our ordinary shares as compensation for the performance of services; |

| • |

persons that hold our ordinary shares as part of a “hedging,” “integrated” or “conversion” transaction

or as a position in a “straddle” for United States federal income tax purposes; |

| • |

persons subject to special tax accounting rules as a result of any item of gross income with respect to the ordinary shares being

taken into account in an applicable financial statement; |

| • |

partnerships (including entities or arrangements classified as partnerships for United States federal income tax purposes) or other

pass-through entities or arrangements, or indirect holders that hold our ordinary shares through such an entity or arrangement;

|

| • |

S corporations; |

| • |

holders whose “functional currency” is not the U.S. dollar; or |

| • |

holders that own directly, indirectly or through attribution 10.0% or more of the voting power or value of our shares. |

| • |

a citizen or individual resident of the United States; |

| • |

a corporation (or other entity treated as a corporation for United States federal income tax purposes) created or organized in or

under the laws of the United States or any state thereof, including the District of Columbia; |

| • |

an estate the income of which is subject to United States federal income taxation regardless of its source; or |

| • |

a trust if such trust has validly elected to be treated as a United States person for United States federal income tax purposes or

if (1) a court within the United States is able to exercise primary supervision over its administration and (2) one or more

United States persons have the authority to control all of the substantial decisions of such trust. |

| • |

at least 75% of its gross income is “passive income”; or |

| • |

at least 50% of the average quarterly value of its total gross assets (which may be measured in part by the market value of our ordinary

shares, which is subject to change) is attributable to assets that produce “passive income” or are held for the production

of passive income. |

| ITEM 11. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

|

Period |

Change in Average Exchange Rate of the NIS Against the U.S. dollar (%) |

|||

|

2021 |

(6.2 |

) | ||

|

2020 |

(3.6 |

) | ||

|

2019 |

(0.9 |

) | ||

| ITEM 12. | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

| ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

| ITEM 15. | CONTROLS AND PROCEDURES |

| • |

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions

of our assets; |

| • |

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance

with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations

of our management and directors; and |

| • |

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets

that could have a material effect on the financial statements. |

| ITEM 16A. |

AUDIT COMMITTEE FINANCIAL EXPERT |

| ITEM 16B. |

CODE OF ETHICS |

| ITEM 16C. |

PRINCIPAL ACCOUNTANT FEES AND SERVICES |

|

2020 |

2021 |

|||||||

|

($ in thousands) |

||||||||

|

Audit Fees |

$ |

633 |

$ |

746 |

||||

|

Audit-Related Fees |

275 |

155 |

||||||

|

Tax Fees |

312 |

367 |

||||||

|

All Other Fees |

11 |

48 |

||||||

|

Total |

$ |

1,231 |

$ |

1,316 |

||||

| ITEM 16D. |

EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

| ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

| ITEM 16F. |

CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT |

| ITEM 16G. |

CORPORATE GOVERNANCE |

| ITEM 16H. |

MINE SAFETY DISCLOSURE |

| ITEM 16I. |

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

| ITEM 17. |

FINANCIAL STATEMENTS |

| ITEM 18. |

FINANCIAL STATEMENTS |

| ITEM 19. |

EXHIBITS |

|

Exhibit No. |

Description | |

|

101.INS |

iXBRL Document | |

|

101.SCH |

iXBRL Taxonomy Extension Schema Document | |

|

101.CAL |

iXBRL Taxonomy Extension Calculation Linkbase Document | |

|

101.DEF |

iXBRL Taxonomy Definition Linkbase Document | |

|

101.LAB |

iXBRL Taxonomy Extension Label Linkbase Document | |

|

101.PRE |

iXBRL Taxonomy Extension Presentation Linkbase Document | |

|

104 |

Cover Page Interactive Data File (the cover page iXBRL tags are embedded within the Inline iXBRL document)

|

|

|

CyberArk Software Ltd. |

| |

|

|

|

|

|

|

Date: March 10, 2022 |

By: |

/s/ Ehud Mokady |

|

|

|

|

Ehud Mokady |

|

|

|

|

Chairman of the Board & Chief Executive Officer |

|

|

Page

|

|

|

Reports of Independent Registered Public Accounting Firm (PCAOB ID

|

F-2 - F-5

|

|

F-6 - F-7

|

|

|

F-8

|

|

|

F-9

|

|

|

F-10 - F-11

|

|

|

F-12 - F-47

|

|

Revenue recognition

|

||

|

Description of the Matter

|

As explained in Note 2 to the consolidated financial statements, the Company substantially generates revenues from providing the rights to access its SaaS solutions and licensing the rights to use its software products, maintenance and professional services. The Company enters into contracts with customers that include combinations of products and services, which are generally distinct and recorded as separate performance obligations. The transaction price is then allocated to the distinct performance obligations based on a relative standalone selling price basis and revenue is recognized when control of the distinct performance obligation is transferred to the customer.

|

|

|

Auditing the Company's recognition of revenue involved a high degree of auditor judgment due to the effort to evaluate 1) the identification and determination of whether products and services, such as software licenses and related services, are considered distinct performance obligations that should be accounted for separately versus together and 2) the determination of stand-alone selling prices for each distinct performance obligation.

|

||

|

How We Addressed the Matter in Our Audit

|

We obtained an understanding, evaluated the design and tested the operating effectiveness of internal controls related to the identification of distinct performance obligations, and the determination of stand-alone selling prices for each distinct performance obligation.

|

|

|

Our audit procedures also included, among others, selecting a sample of customer contracts and reading contract source documents for each selection, including the executed contract and purchase order and evaluating the appropriateness of management's application of significant accounting policies on the contracts. We tested management's identification of significant terms for completeness, including the identification and determination of distinct performance obligations. We also evaluated the reasonableness of management's estimate of stand-alone selling prices for products and services and tested the mathematical accuracy of management's calculations of revenue.Finally, we assessed the appropriateness of the related disclosures in the consolidated financial statements.

|

|

December 31,

|

||||||||

|

2020

|

2021

|

|||||||

|

ASSETS

|

||||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash and cash equivalents

|

$

|

|

$

|

|

||||

|

Short-term bank deposits

|

|

|

||||||

|

Marketable securities

|

|

|

||||||

|

Trade receivables (net of allowance for credit losses of $

|

|

|

||||||

|

Prepaid expenses and other current assets

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

LONG-TERM ASSETS:

|

||||||||

|

Marketable securities

|

|

|

||||||

|

Property and equipment, net

|

|

|

||||||

|

Intangible assets, net

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Other long-term assets

|

|

|

||||||

|

Deferred tax assets

|

|

|

||||||

|

Total long-term assets

|

|

|

||||||

|

TOTAL ASSETS

|

$

|

|

$

|

|

||||

|

December 31,

|

||||||||

|

2020

|

2021

|

|||||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES:

|

||||||||

|

Trade payables

|

$

|

|

$

|

|

||||

|

Employees and payroll accruals

|

|

|

||||||

|

Accrued expenses and other current liabilities

|

|

|

||||||

|

Deferred revenue

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

LONG-TERM LIABILITIES:

|

||||||||

|

Convertible senior notes, net

|

|

|

||||||

|

Deferred revenue

|

|

|

||||||

|

Other long-term liabilities

|

|

|

||||||

|

Total long-term liabilities

|

|

|

||||||

|

TOTAL LIABILITIES

|

|

|

||||||

|

COMMITMENTS AND CONTINGENCIES

|

||||||||

|

SHAREHOLDERS' EQUITY:

|

||||||||

|

Ordinary shares of NIS

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Accumulated other comprehensive income

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Total shareholders' equity

|

|

|

||||||

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

$

|

|

$

|

|

||||

|

Year ended

December 31,

|

||||||||||||

|

2019

|

2020

|

2021

|

||||||||||

|

Revenues:

|

||||||||||||

|

Subscription

|

$

|

|

$

|

|

$

|

|

||||||

|

Perpetual license

|

|

|

|

|||||||||

|

Maintenance and professional services

|

|

|

|

|||||||||

|

|

|

|

||||||||||

|

Cost of revenues:

|

||||||||||||

|

Subscription

|

|

|

|

|||||||||

|

Perpetual license

|

|

|

|

|||||||||

|

Maintenance and professional services

|

|

|

|

|||||||||

|

|

|

|

||||||||||

|

Gross profit

|

|

|

|

|||||||||

|

Operating expenses:

|

||||||||||||