SECURITIES

AND

EXCHANGE

COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 31, 2015

Commission

File

Number 333-193565

Greenpro Capital Corp.

(Exact

name of registrant issuer as

specified in its charter)

| Nevada | 98-1146821 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

Suite

2201, 22/F., 50 Gloucester Road, Wanchai, Hong Kong |

(Address

of principal executive

offices, including zip code)

Registrant’s phone number, including area code (852) 3111 -7718

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements involve risks and uncertainties, including, among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses. Such forward-looking statements include, among others, those statements including the words “expects,” “anticipates,” “intends,” “believes” and similar language. Our actual results may differ significantly from those projected in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those discussed in the sections “Description of Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” You should carefully review the risks described in this Current Report on Form 8-K and in other documents we file from time to time with the Securities and Exchange Commission. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of this report. We undertake no obligation to publicly release any revisions to the forward-looking statements or reflect events or circumstances after the date of this document.

Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements.

All references in this Form 8-K to the “Company,” “Greenpro,” “we,” “us” or “our” are to Greenpro Capital Corp. on a consolidated basis.

| Item 1.01 | Entry Into A Material Definitive Agreement |

The information provided in Item 2.01 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

Acquisition of Greenpro Resources Limited.

On July 29, 2015, Greenpro Capital Corp. (“GRNQ”), and Greenpro Resources Limited, a British Virgin Islands corporation and affiliate of GRNQ, (“GRBV”) entered into an Amended and Restated Sale and Purchase Agreement (the “GRBV Purchase Agreement”), pursuant to which GRNQ acquired 100% of the issued and outstanding securities of GRBV (the “Acquisition”). As consideration thereof, GRNQ agreed to issue to the shareholders of GRBV 9,070,000 restricted shares of GRNQ’s common stock (valued at $3,174,500 based on the average closing price of the six trading days preceding July 28, 2015 of $0.35 per share) and pay US$25,500 in cash, representing an aggregate purchase price of US$3,200,000. The purchase price was determined based on the existing business value of GRBV, carrying value of GRBV properties, brand names of GRBV and settlement of GRBV founder initial investment. The Acquisition was completed on July 31, 2015. The foregoing description of the GRBV Purchase Agreement is summary in nature and is qualified in its entirety by a copy of the GRBV Acquisition Agreement filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference.

GRBV provides corporate advisory services such as tax planning, cross-border listing solution and advisory, and transaction services. It also owns real estate in Selangor Darul Ehsan, Malaysia and Kuala Lumpur, Malaysia that are currently being operated as investment properties. Through our acquisition of GRBV, we hope to expand our customer and revenue base as well as broaden the range of services we offer.

Lee Chong Kuang, our Chief Executive Officer, President and director, is also the Chief Executive Officer, President and director of GRBV. Mr. Lee holds 44.6% of our issued and outstanding securities and 50% of the issued and outstanding securities of GRBV. Gilbert Loke Che Chan, our Chief Financial Officer, Secretary, Treasurer and director, is also the Chief Financial Officer and director of GRBV. Mr. Loke holds 44.6% of our issued and outstanding securities and 50% of the issued and outstanding securities of GRBV. Upon the consummation of the Acquisition, Messrs. Lee and Loke collectively received US$25,500 in cash and 9,070,000 shares of our restricted common stock.

| 1 |

CORPORATE HISTORY

Overview

We were incorporated on July 19, 2013 in the state of Nevada under the name Greenpro, Inc.. On May 6, 2015, we changed our name to Greenpro Capital Corp.. Our principal executive office is currently located at Suite 2201, 22/F, Malaysia Building, 50 Gloucester Road, Wanchai, Hong Kong. Our principal telephone number at such location is + (852) 3111 -7718. Our website is at: http://www.greenprocapital.com. and information contained on our web site is not part of this Current Report on Form 8-K or our other filings with the Securities and Exchange Commission (“SEC”).

We currently operate and provide a wide range of business solution services varying from cloud system solution, financial consulting services and corporate accounting services to small and medium-size businesses located in Asia, with an initial focus on Hong Kong, China and Malaysia. Our comprehensive range of services cover cloud accounting solutions, cross-border business solutions, record management services, and accounting outsourcing services. With our acquisition of GRBV, we broadened our offering of cross border business services to include, among other services, tax planning, trust and wealth management, cross border listing advisory services and transaction services. We hope to develop a package solution of services (“Package Solution”) that will build a cloud solution into traditional accounting services. By using a Package Solution, we believe that we can assist our clients to reduce their business costs and improve their revenues.

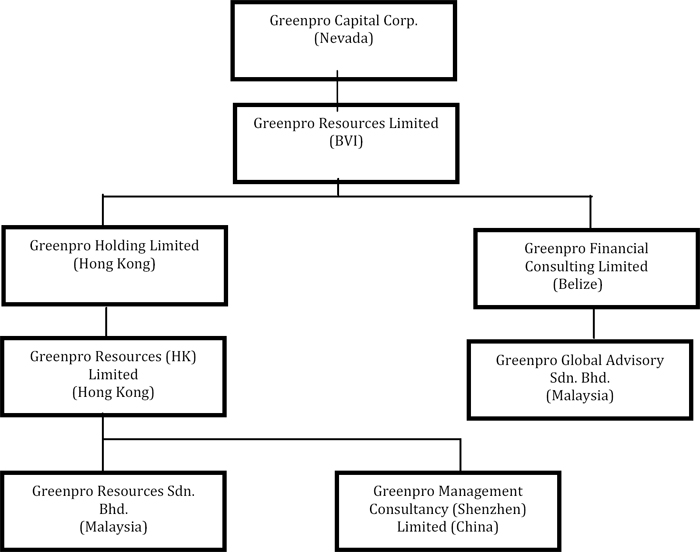

We operate our business through our subsidiaries as set forth below:

| Name | Business |

| Greenpro

Capital Corp. (Nevada, USA) |

Provides cloud system resolution, financial consulting services and corporate accounting services |

| Greenpro

Resources Limited (British Virgin Islands) |

Holding company |

Greenpro Holding Limited (Hong Kong) |

Holds life insurance products |

Greenpro Resources (HK) Limited (Hong Kong) |

Holds Greenpro intellectual property and currently holds six trademarks and applications thereof |

Greenpro Resources Sdn. Bhd. (Malaysia) |

Holds real property usable as offices in Malaysia |

Greenpro Management Consultancy (Shenzhen) Limited (China) |

Provides corporate advisory services such as tax planning, cross-border listing solution and advisory, transaction services in China |

Greenpro Financial Consulting Limited (Belize) |

Provides corporate advisory services such as tax planning, cross-border listing solution and advisory, transaction services |

Greenpro Global Advisory Sdn. Bhd. (Malaysia) |

Provides business advisory services |

Our Proposed Venture Capital Business

In the near future, we hope to enter the venture capital business in Hong Kong with a focus on companies located in Asia and Southeast Asia including Hong Kong, Malaysia, China, Thailand, and Singapore. We expect our venture capital business segment to focus on establishing a business incubator for start-up and high growth companies to support them during their critical growth periods and investing in select start-up and high growth companies. We expect to enter into this business segment through acquisition.

| 2 |

Our corporate structure after the Acquisition is set forth below.

Name Change

On May 6, 2015, we changed our name from Greenpro, Inc. to Greenpro Capital Corp. to facilitate our re-branding efforts and develop and enhance our business.

Effective July 21, 2015, our Board of Directors approved a change in the Company’s fiscal year end from October 31 to December 31. The change is intended to improve comparability with industry peers. As a result of the change, we will have a November 2014 fiscal month transition period, the results of which were separately reported in the Company’s Quarterly Report on Form 10-QT covering the period from November 1, 2014 through December 31, 2014, and will be reported in the Company’s Annual Report on Form 10-K for the calendar year ended December 31, 2015. Following the filing of the transitional quarterly report for the November 2014 fiscal month, the Company began reporting on a calendar year schedule with financial results of the quarter ended September 30, 2015, reported on a Quarterly Report on Form 10-Q in November 2015.

On July 31, 2015, we consummated the acquisition of GRBV, as more fully set forth above.

Agreement to Acquire A&G International Limited

On July 31, 2015, GRNQ and Ms. Yap Pei Ling, a 100% shareholder of A&G International Limited, a Belize corporation (“A&G”), entered into a Sale and Purchase Agreement (the “A&G Purchase Agreement”), pursuant to which GRNQ agreed to acquire 100% of the issued and outstanding securities of A&G. As consideration therefor, GRNQ agreed to issue to the shareholder of A&G 1,842,000 restricted shares of GRNQ’s common stock, representing an aggregate purchase price of $957,840 based on the average closing price of the ten trading days preceding July 31, 2015 of $0.52 per share. The purchase price was determined based on the existing business value generated from A&G. The foregoing description of the A&G Purchase Agreement is a summary only and is qualified in its entirety by the copy of the Agreement filed as Exhibit 2.2 to this Current Report on Form 8-K and incorporated herein by reference.

| 3 |

Ms Yap Pei Ling, the director and sole shareholder of A&G, is the spouse of Lee Chong Kuang, our Chief Executive Officer, President and director.

A&G provides corporate and business advisory services through its wholly-owned subsidiaries as set forth below:

| Name | Business |

| Asia UBS Global Limited (Hong Kong) | Provide business advisory services with main focus on Hong Kong company formation advisory and company secretarial service, such as tax planning, bookkeeping and financial review. It focuses on Hong Kong clients. |

| Asia UBS Global Limited (Belize) | Provide business advisory services with main focus on offshore company formation advisory and company secretarial service, such as tax planning, bookkeeping and financial review. It focuses on South East Asia and China clients. |

A chart of A&G’s corporate structure is set forth below.

Agreement to Acquire Falcon Secretaries Limited

On July 31, 2015, GRNQ and Ms. Chen Yan Hong, a 100% shareholder of Falcon Secretaries Limited, 100% shareholder of Ace Corporation Services Limited and 100% shareholder of Shenzhen Falcon Financial Consulting Limited (these companies collectively known as “F&A”), entered into a Sale and Purchase Agreement (the “Falcon Purchase Agreement”), pursuant to which GRNQ agreed to acquire 100% of the issued and outstanding securities of F&A. As consideration therefor, GRNQ agreed to issue to the shareholder of F&A 2,080,200 restricted shares of GRNQ’s common stock, representing an aggregate purchase price of $1,081,704 based on the average closing price of the ten trading days preceding July 31, 2015 of $0.52 per share. The purchase price was determined based on the existing business value generated from F&A.

Ms, Chen Yan Hong, the director and sole shareholder of F&A, is also the director and legal representative of Greenpro Management Consultancy (Shenzhen) Limited, one of the subsidiaries of GRNQ.

F&A provides corporate and business advisory services through its wholly-owned subsidiaries as set forth below:

| Name | Business |

Falcon Secretaries Limited (Hong Kong) |

Provide Hong Kong Company Formation Advisory Services & Company Secretarial Services. Client Base in Hong Kong & China |

Ace Corporate Services Limited (Hong Kong) |

Provide Offshore Company Formation Advisory Services & Company Secretarial Services. Client Base in Hong Kong & China |

Shenzhen Falcon Finance Consulting Limited (China) |

Provide Hong Kong Company Formation Advisory Services & Company Secretarial Services and Financial Services. Client Base in China |

| 4 |

Agreement to Acquire Yabez (Hong Kong) Company Limited

On July 31, 2015, GRNQ, on the one hand, and Mr. Cheng Chi Ho and Ms. Wong Kit Yi, representing 51% & 49%, respectively, of the shareholders of Yabez (Hong Kong) Company Limited, a Hong Kong corporation (“Yabez”), entered into a Sale and Purchase Agreement (the “Yabez Purchase Agreement”), pursuant to which GRNQ agreed to acquire 60% of the issued and outstanding securities of Yabez. As consideration therefor, GRNQ agreed to issue to the shareholders of Yabez 486,171 restricted shares of GRNQ’s common stock, representing an aggregate purchase price of $252,808 based on the average closing price of the ten trading days preceding July 31, 2015 of $0.52 per share. The purchase price was determined based on the existing business value generated from Yabez. Yabez provides Hong Kong company formation advisory services, corporate secretarial services and IT related services to Hong Kong based clients.

We hope to close the acquisitions of A&G, F&A and Yabez at a later date contingent upon the completion of valuations of A&G, F&A and Yabez.

The foregoing descriptions of the A&G Purchase Agreement, the Falcon Purchase Agreement and the Yabez Purchase Agreement are summary in nature and are qualified in their entirety by the copies of the F&A Purchase Agreement and the Yabez Purchase Agreement filed as Exhibits 2.2, 2.3 and 2.4 to this Current Report on Form 8-K and incorporated herein by reference.

Subscription

On August 20, 2015, we completed sale of 625,000 shares of our common stock at a price of $0.80 per share for aggregate gross proceeds of $500,000 in a private placement to ZONG YI HOLDING CO., LTD (the “Zong Yi”) in accordance with the terms and conditions of a Subscription Agreement.

On August 21, 2015, we completed the sale of 500,000 shares of our common stock at a price of $1.00 per share for aggregate gross proceeds of $500,000 in a private placement to Mr. Thanawat Lertwattanarak and Ms. Srirat Chuchottaworn (the “Investors”) with each investor purchasing 250,000 shares. The private placement was made in accordance with the terms of a Subscription Agreement.

The Company expects to use the net proceeds of these sales to purchase real estate, to finance its venture capital business segment in South East Asia covering Hong Kong, Malaysia, China, Thailand, Singapore, and other countries and for working capital purposes.

The shares sold in the private placement were issued in reliance on an exemption from registration under the Securities Act of 1933, as amended, pursuant to Section 4(2) thereof. The bases for the availability of this exemption include the facts that the issuance was a private transaction which did not involve a public offering and the shares were offered and sold to a limited number of investors.

Description of Business

Our Services

We provide a range of services as a package solution (the “Package Solution”) to our clients. It is our intention to develop the Package Solution, which will build the cloud solution into the traditional accounting services. By offering the Package Solution, we believe that our potential clients can reduce their business costs and improve their revenues.

Cloud Accounting Solution

We intend to develop a cloud accounting system, which can assist small business clients to manage their books and financial records. The cloud accounting system we intend to develop is a device related to book-keeping and accounting through an Internet based platform. It is a program for organizational finance, which we anticipate will allow users to perform accounting-related functions such as making records of money received by a company, billing a company’s clients, managing the inventory, and recording the financial transactions through the cloud platform.

| 5 |

Besides recording a company’s financial data, the cloud accounting system we expect to develop will be able to assist clients to create the financial statements such as the balance sheets, the income statements and statements of cash flow. It is our belief that the cloud based system will enable the potential clients to keep track of their income and expense, create invoices, manage banking accounts, and prepare monthly accounts for management’s review. The designed functions of this system will include reminding the future clients to properly record assets or revenues for its business therefore assisting them to more effectively and economically prepare financial statements and monitor the financial performance of their businesses. We expect that the potential clients could scale at the speed of their businesses, and expand their businesses into larger markets with the assistance of cloud accounting system.

We hope to begin development of our cloud accounting system by the 3rd quarter of 2016. We may also seek potential partners to jointly develop the cloud accounting system to develop the business.

Cross-Border Business Solutions/Cross-Border Listing Solution

We provide a full range of cross-border services to small to mid-sized businesses to assist them in conducting their business effectively and generate revenue from such service. Our “Cross-Border Business Solution” include the following services:

| · | Advising clients for company formation of in Hong Kong, U.S., British Virgin Island and other overseas jurisdictions | |

| · | Providing assistant in setting up bank accounts with banks in Hong Kong to facilitate clients’ banking operations | |

| · | Providing bank loan referrals services | |

| · | Providing company secretarial services | |

| · | Assisting in applying business registration certificate with the Inland Revenue Department of Hong Kong | |

| · | Providing corporate finance consulting services | |

| · | Providing due diligence investigations and valuation of companies | |

| · | Advising clients regarding debt and company restructuring | |

| · | Providing liquidation, insolvency, bankruptcy and individual voluntary arrangement advice and assistance | |

| · | Designing marketing strategy and promote the company’s business, products and services | |

| · | Providing financial and liquidity analysis | |

| · | Assisting in setting up cloud invoicing system for clients | |

| · | Assisting in liaising with capital funds for raising capitals | |

| · | Assisting in setting up cloud inventory system to assist clients to record, maintain and control their inventories and knowing their inventory levels | |

| · | Assisting in setting up cloud accounting system to enable clients to keep track of their financial performance | |

| · | Assisting client’s payroll matters operated in our cloud payroll system | |

| · | Assisting clients in tax planning, preparing the tax computation and compiling with the filing of profits tax with the Inland Revenue Department of Hong Kong |

Upon our acquisition of GRBV, we also broadened our range of services to include the following:

| · | Cross border listing advisory services | |

| · | International tax planning in China | |

| · | Trust and wealth management | |

| · | Transaction services |

With growing competition and increasing economic sophistication, we believe more companies need strategies for cross-border restructuring and other corporate matters. Our plan is to bundle our Cross Border Business Solution services with our Cloud Accounting Solution.

Record Management Services

We believe that it is important to establish a records management solution across the enterprises that offers our clients a convenient and cost effective way to store, categorize and access business records. We offer our clients a cloud record management system to store our future clients’ business information and supplement our cloud product with general bookkeeping services. We intend to use third party accounting software that has been developed in accordance with the accounting principles in Hong Kong and is compliant with tax legislation to deal with day-to-day accounts to ensure that all bookkeeping records are clear and accurate. In addition, we plan to provide a general ledger to a client as well as spreadsheet, income statements, cash flow statements, and balance sheets. We anticipate that by using our record management solutions, our clients will be able to share and make decision quickly and effectively without wasting valuable resources and becoming more competitive.

| 6 |

Accounting Outsourcing Services

We hope to develop a network of relationships with professional firms from Hong Kong, Malaysia and Singapore, that can provide company secretarial, business centers and virtual offices, book-keeping, tax compliance and planning, audit arrangement, payroll management, business valuation, and or wealth management services to our prospective clients. We also hope to include auditing firms within this network so that they can provide general accounting, financial evaluation and advisory services to our prospective clients that are local to such professional firm. We hope that firms within our professional network will refer to us their international clients that may need our book-keeping, payroll, company secretarial and tax compliance services. We believe that this accounting outsourcing service arrangement will be beneficial to our prospective clients by providing a convenient, one-stop firm for their local and international business and financial compliance and governance needs.

We also plan to engage with strategic partners to assist us in accounting outsourcing services, including Netiquette Software, Xero, and Feng Office.

Our Service Rates

There are two types of fees we will charge based on the services described above. One is project-based fees, where we will charge 10% -25% of the revenues of the projects that are completed by assistance of our services. Such projects include the merger & acquisition projects, the contract compliance projects, and the business planning projects. Another type of fee is a flat rate fee or fixed fee where our professionals provides expertise to our clients and charge the fees based on the estimation of complexity and timing of the project. For example, for the cross-border business solution, we plan to charge our client a monthly fixed fee.

Our Proposed Venture Capital Business Segment

In the near future, we hope to enter the venture capital business in Hong Kong with a focus on companies located in Asia and Southeast Asia including Hong Kong, Malaysia, China, Thailand, and Singapore. We expect our venture capital business segment to focus on establishing a business incubator for start-up and high growth companies to support them during their critical growth periods and investing in select start-up and high growth companies. We expect to enter into this business segment through acquisition.

We believe that a company’s life cycle can be divided as seed stage, start up stage, expansion stage, mature stage and decline stage.

| · | Seed stage: Financing is needed for research, assets and the development of an initial business concept before the business has reached the start-up phase. The company usually has relatively low costs in developing the business idea. The ownership model is considered and implemented. |

| · | Start-up stage: Financing is needed for product development and initial marketing. Firms in this phase may be in the process of setting up a business or they might have been in the business for short time, but not sold their products commercially. In this phase, cost are increasing affectedly because of e.g. product development, market research and the need of recruiting personnel. Low levels of revenues are starting to generate. |

| · | Expansion stage: Financing is needed for the growth and expansion. Capital may be used to finance increased production capacity, product or market development or hire additional personnel. In the early expansion phase, sales and production increase but there is not yet any profit. In the later expansion stage, the business typically needs extra capital in addition to organically generated profit, for further development, marketing or product development. |

We expect that most of a company’s funding needs will occur during the first three stages.

We believe that our business incubators will provide valuable support to young, emerging growth and potential high growth companies at critical junctures of their development. For example, our incubators will offer office space at a below market rental rate. We will also provide our expertise, business contacts, introductions and other resources to assist their development and growth. We believe that the future growth of those prospects start-up companies will be our potential investment opportunities.

| 7 |

In addition to our business incubator, we hope to invest cash and cash equivalents in high growth companies in exchange for an equity position in such companies. We hope to generate deal flow through personal contacts of management as well as through our business incubator. At this time, we do not expect to acquire more than 30% of any single company. We expect to take an active role in the management and operations of our portfolio companies including board representation, strategic marketing, corporate governance, and capital structuring. We hope to provide businesses with a financial cushion at their early stages.

Our business process for our investing side of the venture capital business segment are as follows:

| · | Step 1. Generating Deal Flow: We expect to actively search for entrepreneurial firms through personal contacts and to generate deal flow through our business incubator. We also anticipate that entrepreneurs will approach us for financing. |

| · | Step 2. Investment Decision: We will evaluate, examine and engage in due diligence of a prospective portfolio company, including but not limited to product/services viability, market potential and integrity as well as capability of the management. After that both parties arrive at an agreed value for the deal. Following that is a process of negotiation, which if successful, ends with capital transformation and restructuring. |

| · | Step 3. Business Development and Value Adding: In addition to capital contribution, we expect to provide expertise, knowledge and relevant business contacts to the company. |

| · | Step 4. Exit: There are several ways to exit an investment in a company. Common exits are: |

· IPO (Initial Public Offering): The venture’s shares are offered in a public sale on an established securities market.

· Trade sale (Acquisition): The entire venture is sold to another company.

· Secondary sale: The venture capital firm’s sell their part of the venture’s shares only.

· Buyback or MBO: Either the entrepreneur or the management of the firm buys back the venture capital company’s shares of the firm.

· Reconstruction, liquidation or bankruptcy: If the project fails the venture capital firm’s will restructure or close down the venture.

Our objective for equity investors is to achieve a superior rate of return through the eventual and timely disposal of investments. We expect to look for businesses that meet the following criteria:

| · | high growth prospects |

| · | ambitious teams |

| · | viability of product or service |

| · | experienced management |

| · | ability to convert plans into reality |

| · | justification of venture capital investment and investment criteria |

Sales and Marketing

We plan to deploy three strategies to accomplish our goal in marketing the brand of Greenpro: leadership, market segmentation, and sales management process development.

| · | Building Brand Image: Greenpro’s marketing efforts will focus on building the image of our extensive knowledge and expertise of our professionals and expertise. We intend to conduct the market campaign through media visibility, seminars, webinars, and the creation of a wide variety of white papers, newsletters, books, and other information offerings to build the image of our professional services. | |

| · | Market segmentation: We plan to devote our marketing resources to the highly measurable and high return on investment tactics that specifically target those industries and areas where Greenpro has particularly deep experience and capabilities. These efforts typically involve local, regional or national trade show and event sponsorships, targeted direct mail, email, and telemarketing campaigns, and practice and industry specific micro-sites, newsletters, etc. in the Asia region. | |

| · | Social Media: We plan to begin a social media campaign utilizing blogs, twitter, Facebook, and LinkedIn after we secure sufficient financing. A targeted campaign will be made to the following groups of clients: law firms, auditing firms, consulting firms, small to mid-size enterprises in different industries, including biotechnologies, intellectual property, information technologies and real estate. |

| 8 |

Market Opportunities

It is our intention to assist our potential clients at lower costs to prepare their financial statements and to provide security based on such financial information since the data is stored on the cloud system. We anticipate a market with growing needs in South East Asia. Today there is an increasing need for enterprises in different industries to maximize their performances with cost effective methods. We believe our services will create numerous competitive advantages for our potential clients. With the support from Greenpro, we believe our future clients can focus on developing their businesses and expanding their own client portfolio.

We believe the main drivers for the growth of our business are the products and services together with the resources such as office network, professional staff members, and operation tools to make the advisory and consulting business more competitive.

Customers

Prior to the consummation of the Acquisition, we generated minimal revenue from three clients in Hong Kong in the ordinary course of business. The revenue generated relates to our assistance on the clients’ company formation and secretary services. After the consummation of the Acquisition, we expect to generate revenues from clients located globally including those from Hong Kong, China, Malaysia, Singapore, Indonesia, Thailand, Australia, Japan, Korea, Taiwan, Russia, USA, Malta, and France.

We currently provide professional business services to small to mid-size companies from various countries and in various industries. We also plan to serve as support to professional service providers such as auditing firms and law firms. We also provide various professional services to our clients and enable them to focus their resources on their own operational competencies. Depending on a client’s size and capabilities, it has the option to choose to utilize one, some or many of the diverse and integrated services to be offered by Greenpro. Our service will seek to cover the traditional accounting services bundled with cloud accounting solution together with business consulting and advisory. We intend to focus on developing our client base in Hong Kong, China and Malaysia.

Our proposed venture capital business segment will initial focus on Hong Kong and Southeast Asia start-ups and high growth companies. We hope to generate deal flow through personal contacts of our management team as well as through our proposed business incubator.

Competition

Our industry is highly competitive. We compete with local and international financial advisory and corporate business service companies such as Cornerstone Management Group in Hong Kong, CST Tax Advisor in Singapore and Maceda Valencia & Co in Philippines that provide services comparable to our Packaged Solution. We also compete with numerous local and international financial advisory and corporate business service companies that do not offer our broad range of services but focus on specialized areas such as tax planning, cross-border solutions, and the like. Some of our competitors may provide a broader selection of services, including investment banking services, which may position them better among customers who prefer to use a single company to meet all of their financial and business advisory needs. In addition, some of our competitors are substantially larger than we are, may have substantially greater resources than we do or may offer a broader range of products and services than we do. We believe that we compete on the basis of a number of factors, including breadth of service and product offerings, one stop convenience, pricing, marketing expertise, service levels, technological capabilities and integration, brand and reputation.

Government Regulation

We intend to provide our Package Solution initially in Hong Kong, China and Malaysia, which regions both welcome outsourcing support services and they are the central and regional markets for many customers doing cross border businesses in Asia. We plan to target those customers from South East Asia doing international business and plan to provide the Package Solution to meet their needs. Our planned Packaged Solution will be structured in Hong Kong for customers and we plan to outsource to the lower cost country like Malaysia which encourages and welcomes the outsourcing services.

| 9 |

The following regulations are the applicable laws and regulations that may be applicable to us:

Hong Kong

Our businesses located in Hong Kong are subject to the general laws in Hong Kong governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws. Because our website is maintained through the server in Hong Kong, we expect that we will be required to comply with the rules of regulations of Hong Kong governing the data usage and regular terms of service applicable to our potential customers. As the information of our potential customers is preserved in Hong Kong, we will need to comply with the Hong Kong Personal Data (Privacy) Ordinance (Cap 486).

The Employment Ordinance is the main piece of legislation governing conditions of employment in Hong Kong since 1968. It covers a comprehensive range of employment protection and benefits for employees, including Wage Protection, Rest Days, Holidays with Pay, Paid Annual Leave, Sickness Allowance, Maternity Protection, Statutory Paternity Leave, Severance Payment, Long Service Payment, Employment Protection, Termination of Employment Contract, Protection Against Anti-Union Discrimination.

An employer must also comply with all legal obligations under the Mandatory Provident Fund Schemes Ordinance, (CAP485). These include enrolling all qualifying employees in MPF schemes and making MPF contributions for them. Except for exempt persons, employer should enroll both full-time and part-time employees who are at least 18 but under 65 years of age in an MPF scheme within the first 60 days of employment. The 60-day employment rule does not apply to casual employees in the construction and catering industries.

We are required to make MPF contributions for our Hong Kong employees once every contribution period (generally the wage period). Employers and employees are each required to make regular mandatory contributions of 5% of the employee’s relevant income to an MPF scheme, subject to the minimum and maximum relevant income levels. For a monthly-paid employee, the minimum and maximum relevant income levels are $7,100 and $30,000 respectively.

Malaysia

Our businesses located in Malaysia are subject to the general laws in Malaysia governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws including the Computer Crime Act 1997 and The Copyright (Amendment) Act 1997. We believe that the focus of these laws realize it is an issue of censorship in Malaysia. But we believe this issue will not impact our businesses because the censorship focus on media controls and does not relate to cloud based technology we plan to use.

Our real estate investments are subject to extensive local, city, county and state rules and regulations regarding permitting, zoning, subdivision, utilities and water quality as well as federal rules and regulations regarding air and water quality and protection of endangered species and their habitats. Such regulation may result in higher than anticipated administrative and operational costs.

China

A portion of our acquired businesses is located in China and subject to the general laws in China governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws.

Employment Contracts

The Employment Contract Law was promulgated by the National People’s Congress’ Standing Committee on June 29, 2007 and took effect on January 1, 2008. The Employment Contract Law governs labor relations and employment contracts (including the entry into, performance, amendment, termination and determination of employment contracts) between domestic enterprises (including foreign-invested companies), individual economic organizations and private non-enterprise units (collectively referred to as the “employers”) and their employees.

a. Execution of employment contracts

Under the Employment Contract Law, an employer is required to execute written employment contracts with its employees within one month from the commencement of employment. In the event of contravention, an employee is entitled to receive double salary for the period during which the employer fails to execute an employment contract. If an employer fails to execute an employment contract for more than 12 months from the commencement of the employee’s employment, an employment contract would be deemed to have been entered into between the employer and employee for a non-fixed term.

| 10 |

b. Right to non-fixed term contracts

Under the Employment Contract Law, an employee may request for a non-fixed term contract without an employer’s consent to renew. In addition, an employee is also entitled to a non-fixed term contract with an employer if he has completed two fixed term employment contracts with such employer; however, such employee must not have committed any breach or have been subject to any disciplinary actions during his employment. Unless the employee requests to enter into a fixed term contract, an employer who fails to enter into a non-fixed term contract pursuant to the Employment Contract Law is liable to pay the employee double salary from the date the employment contract is renewed.

c. Compensation for termination or expiry of employment contracts

Under the Employment Contract Law, employees are entitled to compensation upon the termination or expiry of an employment contract. Employees are entitled to compensation even in the event the employer (i) has been declared bankrupt; (ii) has its business license revoked; (iii) has been ordered to cease or withdraw its business; or (iv) has been voluntarily liquidated. Where an employee has been employed for more than one year, the employee will be entitled to such compensation equivalent to one month’s salary for every completed year of service. Where an employee has employed for less than one year, such employee will be deemed to have completed one full year of service.

d. Trade union and collective employment contracts

Under the Employment Contract Law, a trade union may seek arbitration and litigation to resolve any dispute arising from a collective employment contract; provided that such dispute failed to be settled through negotiations. The Employment Contract Law also permits a trade union to enter into a collective employee contract with an employer on behalf of all the employees.

Where a trade union has not been formed, a representative appointed under the recommendation of a high-level trade union may execute the collective employment contract. Within districts below county level, collective employment contracts for industries such as those engaged in construction, mining, food and beverage and those from the service sector, etc., may be executed on behalf of employees by the representatives from the trade union of each respective industry. Alternatively, a district-based collective employment contract may be entered into.

As a result of the Employment Contract Law, all of our employees have executed standard written employment agreements with us. We have not experienced any significant labor disputes or any difficulties in recruiting staff for our operations.

On October 28, 2010, the National People’s Congress of China promulgated the PRC Social Insurance Law, which became effective on July 1, 2011. In accordance with the PRC Social Insurance Law, the Interim Regulations on the Collection and Payment of Social Security Fund and other relevant laws and regulations, China establishes a social insurance system including basic pension insurance, basic medical insurance, work-related injury insurance, unemployment insurance and maternity insurance. An employer shall pay the social insurance for its employees in accordance with the rates provided under relevant regulations and shall withhold the social insurance that should be assumed by the employees. The authorities in charge of social insurance may request an employer’s compliance and impose sanctions if such employer fails to pay and withhold social insurance in a timely manner. Under the Regulations on the Administration of Housing Fund effective in 1999, as amended in 2002, PRC companies must register with applicable housing fund management centers and establish a special housing fund account in an entrusted bank. Both PRC companies and their employees are required to contribute to the housing funds.

The Ministry of Human Resources and Social Security promulgated the Interim Provisions on Labor Dispatch on January 24, 2014. The Interim Provisions on Labor Dispatch, which became effective on March 1, 2014, sets forth that labor dispatch should only be applicable to temporary, auxiliary or substitute positions. Temporary positions shall mean positions subsisting for no more than six months, auxiliary positions shall mean positions of non-major business that serve positions of major businesses, and substitute positions shall mean positions that can be held by substitute employees for a certain period of time during which the employees who originally hold such positions are unable to work as a result of full-time study, being on leave or other reasons. The Interim Provisions further provides that, the number of the dispatched workers of an employer shall not exceed 10% of its total workforce, and the total workforce of an employer shall refer to the sum of the number of the workers who have executed labor contracts with the employer and the number of workers who are dispatched to the employer.

Foreign Exchange Control and Administration

Foreign exchange in China is primarily regulated by:

| · | The Foreign Currency Administration Rules (1996), as amended; and |

| · | The Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), or the Administration Rules. |

Under the Foreign Currency Administration Rules, if documents certifying the purposes of the conversion of RMB into foreign currency are submitted to the relevant foreign exchange conversion bank, the RMB will be convertible for current account items, including the distribution of dividends, interest and royalties payments, and trade and service-related foreign exchange transactions. Conversion of RMB for capital account items, such as direct investment, loans, securities investment and repatriation of investment, however, is subject to the approval of SAFE or its local counterpart.

Under the Administration Rules for the Settlement, Sale and Payment of Foreign Exchange, foreign-invested enterprises may only buy, sell and/or remit foreign currencies at banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from SAFE or its local counterpart.

| 11 |

As an offshore holding company with a PRC subsidiary, we may (i) make additional capital contributions to our PRC subsidiaries, (ii) establish new PRC subsidiaries and make capital contributions to these new PRC subsidiaries, (iii) make loans to our PRC subsidiaries or consolidated affiliated entities, or (iv) acquire offshore entities with business operations in China in offshore transactions. However, most of these uses are subject to PRC regulations and approvals. For example:

| · | capital contributions to our PRC subsidiaries, whether existing or newly established ones, must be approved by the Ministry of Commerce or its local counterparts; |

| · | loans by us to our PRC subsidiaries, each of which is a foreign-invested enterprise, to finance their activities cannot exceed statutory limits and must be registered with SAFE or its local branches; and |

| · | loans by us to our consolidated affiliated entities, which are domestic PRC entities, must be approved by the National Development and Reform Commission and must also be registered with SAFE or its local branches. |

On August 29, 2008, SAFE issued the Circular on the Relevant Operating Issues Concerning the Improvement of the Administration of the Payment and Settlement of Foreign Currency Capital of Foreign-Invested Enterprises, or SAFE Circular 142. Pursuant to SAFE Circular 142, RMB resulting from the settlement of foreign currency capital of a foreign-invested enterprise must be used within the business scope as approved by the applicable government authority and cannot be used for domestic equity investment, unless it is otherwise approved. Documents certifying the purposes of the settlement of foreign currency capital into RMB, including a business contract, must also be submitted for the settlement of the foreign currency. In addition, SAFE strengthened its oversight of the flow and use of RMB capital converted from foreign currency registered capital of a foreign-invested company. The use of such RMB capital may not be altered without SAFE’s approval, and such RMB capital may not be used to repay RMB loans if such loans have not been used. Violations of SAFE Circular 142 could result in severe monetary fines or penalties. We expect that our use of RMB funds have been, and will be, within the approved business scope of our PRC subsidiary. We believe that our PRC subsidiary is permitted to conduct its castor seeds distribution operations and provide consulting services to castor farmers. However, we may not be able to use such RMB funds to make equity investments in the PRC through our PRC subsidiaries. There are no costs associated with applying for registration or approval of loans or capital contributions with or from relevant PRC governmental authorities, other than nominal processing charges. Under PRC laws and regulations, the PRC governmental authorities are required to process such approvals or registrations or deny our application within a prescribed time period, which is usually less than 90 days. The actual time taken, however, may be longer due to administrative delays. We cannot assure you that we will be able to obtain these government registrations or approvals on a timely basis, if at all, with respect to our operations in China. If we fail to receive such registrations or approvals, our ability to use the proceeds from our funds to capitalize our PRC operations may be negatively affected, which could materially and adversely affect our liquidity and ability to fund and expand our business.

Insurance

We do not current maintain property, business interruption and casualty insurance. As our business matures, we expect to obtain such insurance in accordance customary industry practices in Malaysia, Hong Kong and China, as applicable.

Employees

As of the date of this Current Report, we have 28 employees, including our Chief Executive Officer and Chief Financial Officer, located in the following territories:

| Country/Territory | Number of Employees |

| Malaysia | 7 |

| China | 12 |

| Hong Kong | 9 |

As a result of the Employment Contract Law, all of our employees in China have executed standard written employment agreements with us.

| 12 |

We are required to contribute to the Employees Provident Fund under a defined contribution pension plan for all eligible employees in Malaysia between the ages of eighteen and fifty-five. We are required to contribute a specified percentage of the participant’s income based on their ages and wage level. The participants are entitled to all of our contributions together with accrued returns regardless of their length of service with the company. For the years ended December 31, 2014 and 2013, and the six month period ended June 30, 2015, are $1,211, $1,078 and $1,667 respectively.

We are required to contribute to the MPF for all eligible employees in Hong Kong between the ages of eighteen and sixty five. We are required to contribute a specified percentage of the participant’s income based on their ages and wage level. For the years ended December 31, 2014 and 2013, and the six month period ended June 30, 2015, Greenpro Resources Limited and its subsidiaries do not have employees in Hong Kong. For the years ended December 31, 2014 and 2013, and the six month period ended June 30, 2015, the MPF contribution by Greenpro Capital Corp.are $489, $0 and $2,783 respectively. We have not experienced any significant labor disputes or any difficulties in recruiting staff for our operations.

We are required to contribute to the Social Insurance Schemes and Housing fund Schemes for all eligible employees in PRC. For the years ended December 31, 2014 and 2013, and the six month period ended June 30, 2015, are $1,876, $0 and $1,316 respectively.

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks.

Risks Relating to our Business

Our ability to generate revenue to support our operations is uncertain, we have a limited operating history that you can use to evaluate us, and the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company.

We are in the early stages of our business and have a limited history of generating revenues. We have a limited operating history upon which you can evaluate our potential for future success, and we are subject to the additional risks affecting early-stage businesses. Rather than relying on historical information, financial or otherwise, to evaluate our Company, you should evaluate our Company in light of your assessment of the growth potential of our business and the expenses, delays, uncertainties, and complications typically encountered by early-stage businesses, many of which will be beyond our control. Early-stage businesses in rapidly evolving markets commonly face risks, such as the following:

| · | uncertain revenue generation; |

| · | operational difficulties; |

| · | lack of sufficient capital; |

| · | competition from more advanced enterprises; and |

| · | unanticipated problems, delays, and expenses relating to the development and implementation of business plans. |

We are not currently profitable and may not ever become profitable.

After our acquisition of GRBV, we generated net income of approximately $296,000. We incurred a net loss of approximately $52,000 and $99,000 for the years ended December 31, 2014 and 2013, respectively. We expect to incur substantial losses for the foreseeable future in connection with our proposed acquisitions and may never become profitable. We may experience negative cash flow for the foreseeable future if we are not able to fund the expansion of our business plan through operations or additional financing. We may not be able to generate these revenues or achieve or maintain profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our business. We are a development stage company with limited operating history and we face a high risk of business failure which could result in the loss of your investment.

Our limited operating history may make it difficult for us to accurately forecast our operating results and control our business expense which means we face a high risk of business failure which could result in the loss of your investment.

Our planned expense levels are, and will continue to be, based in part on our expectations, which are difficult to forecast accurately based on our stage of development and factors outside of our control. We may be unable to adjust spending in a timely manner to compensate for any unexpected developments. Further, business development expenses may increase significantly as we expand operations or make acquisitions. To the extent that any unexpected expenses precede, or are not rapidly followed by, a corresponding increase in revenue, our business, operating results, and financial condition may be materially and adversely affected which could result in the loss of your investment.

| 13 |

We may grow our business through acquisitions in the near future, which may result in operating difficulties, dilution, and other harmful consequences.

We expect to achieve our business plan through organic growth but may consider acquisitions and investments. We periodically evaluate an array of potential strategic transactions and may make one or more acquisitions in the near future. The process of integrating an acquired company, business, or technology may create unforeseen operating difficulties and expenditures. The areas where we face risks include:

| · | Implementation or remediation of controls, procedures, and policies at the acquired company; |

| · | Diversion of management time and focus from operating our business to acquisition integration challenges; |

| · | Cultural challenges associated with integrating employees from the acquired company into our organization; |

| · | Retention of employees from the businesses we acquire; |

| · | Integration of the acquired company’s accounting, management information, human resource, and other administrative systems; |

| · | Liability for activities of the acquired company before the acquisition, including patent and trademark infringement claims, violations of laws, commercial disputes, tax liabilities, and other known and unknown liabilities; |

| · | Litigation or other claims in connection with the acquired company, including claims from terminated employees, customers, former stockholders, or other third parties; |

| · | In the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political, and regulatory risks associated with specific countries; and |

| · | Failure to successfully further develop the acquired product, service or technology. |

Our failure to address these risks or other problems encountered in connection with future acquisitions and investments could cause us to fail to realize the anticipated benefits of such acquisitions or investments, incur unanticipated liabilities, and harm our business generally.

Future acquisitions may also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, or amortization expenses, or write-offs of goodwill, any of which could harm our financial condition. Also, the anticipated benefit of many of our acquisitions may not materialize.

If we are unable to successfully manage growth, our business and operating results could be adversely affected.

We expect the growth of our business and operations to place significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, the quality of our products and services could suffer, which could negatively affect our reputation and operating results. Our expansion and growth in international markets heighten these risks as a result of the particular challenges of supporting a rapidly growing business in an environment of multiple languages, cultures, customs, legal systems, alternative dispute systems, regulatory systems, and commercial infrastructures. To effectively manage this growth, we will need to develop and improve our operational, financial and management controls, and our reporting systems and procedures. These systems enhancements and improvements may require significant capital expenditures and management resources. Failure to implement these improvements could hurt our ability to manage our growth and our financial position.

We may need to raise additional financing to support our operations and future acquisitions, but we cannot be sure that we will be able to obtain additional financing on terms favorable to us when needed. If we are unable to obtain additional financing to meet our needs, our operations may be adversely affected or terminated.

We have limited financial resources. There can be no assurance that we will be able to obtain financing to fund our operations in light of factors beyond our control such as the market demand for our securities, the state of financial markets, generally, and other relevant factors. Any sale of our Common Stock in the future may result in dilution to existing stockholders. Furthermore, there is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay any future indebtedness or that we will not default on our future debts, which would thereby jeopardize our business viability. We may not be able to borrow or raise additional capital in the future to meet our needs, which might result in the loss of some or all of your investment in our Common Stock. Even if we do raise sufficient capital and generate revenues to support our operating expenses, there can be no assurance that the revenue will be sufficient to enable us to develop our business to a level where it will generate profits and cash flows from operations, or provide a return on investment. In addition, if we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our stockholders could be significantly diluted, the newly-issued securities may have rights, preferences or privileges senior to those of existing stockholders and the trading price of our Common Stock could be adversely affected. Further, if we obtain additional debt financing, a substantial portion of our operating cash flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued could impose significant restrictions on our operations. If we are unable to continue as a going concern, you may lose your entire investment.

| 14 |

Conflicts of interest of Lee Chong Kuang, our Chief Executive Officer, President, and a director, may affect our ability to conduct operations and generate revenues.

Lee Chong Kuang, our Chief Executive Officer, President, and a director, is also the Chief Financial Officer, Treasurer, and a director of Odenza Corp. (“Odenza”), a shell company which is also reporting issuer with the SEC. Both the Company and Odenza require additional financing in order to grow their respective businesses, both in their early stages of development. As an officer and director of both the Company and Odenza, Mr. Lee has a conflict of interest because if Mr. Lee avails himself of knowledge he has of financing, he has a duty to both the Company and Odenza to bring the financing opportunity to each company, though likely only one company may has such a financing opportunity. The risk that you could lose your investment in the Company is increased by Mr. Lee being a director and officer of Odenza because he may introduce financing opportunities to Odenza instead of the Company. Currently, Mr. Lee presently devotes approximately 40 hours per week working on matters related to the Company and approximately three to five hours per week working on matters related to Odenza. If this ratio changes in favor of Odenza, the Company may be adversely affected.

Conflicts of interest of Gilbert Loke, our Chief Financial Officer, Treasurer, Secretary, and a director, may affect our ability to conduct operations and generate revenues.

Gilbert Loke, our Chief Financial Officer, Treasurer, Secretary, and a director, is also the Chief Financial Officer, Treasurer, Secretary, and a director of CGN Nanotech, Inc. (“CGN”), a shell company which filed a registration statement on Form S-1 with the SEC on March 3, 2015, as amended by that Amendment No. 1 filed with the SEC on July 13, 2015. Both the Company and CGN require additional financing in order to grow their respective businesses, both in their incipient stages of development. As an officer and director of both the Company and CGN, Mr. Loke has a conflict of interest because if Mr. Loke avails himself of knowledge he has of financing, he has a duty to both the Company and CGN to bring the financing opportunity to each Company, though likely only one company may has such a financing opportunity. The risk that you could lose your investment in the Company is increased by Mr. Loke being a director and officer of CGN because he may introduce financing opportunities to CGN instead of the Company. Currently, Mr. Loke devotes approximately 40 hours per week working on matters related to the Company and approximately three to five hours per week working on matters related to CGN. If this ratio changes in favor of Odenza, the Company may be adversely affected.

We currently have no insurance coverage and could face significant liabilities in connection with our products and services and business operations, which if incurred beyond any insurance limits, would adversely affect our business and financial condition.

We are subject to a variety of potential liabilities connected to the business and financial advisory services that we provide. As a business providing tax and regulatory related services, we may become liable for any penalties or fees caused by erroneous or untimely advice or any unexpected results. Any such claim of liability, whether meritorious or not, could be time-consuming and/or result in costly litigation. We currently carry no insurance, and although we intend to obtain insurance against these risks, no assurance can be given that such insurance will be adequate to cover related liabilities or will be available in the future or, if available, that premiums will be commercially justifiable. If we were to incur any substantial liability and related damages were not covered by our insurance or exceeded policy limits, or if we were to incur such liability at a time when we are not able to obtain liability insurance, our business, financial conditions, and results of operations could be materially adversely affected and may result in the loss of part or all of your investment in the Company.

| 15 |

Other factors can have a material adverse effect on our future profitability and financial condition.

Many other factors can affect our profitability and financial condition, including:

| · | changes in, or interpretations of, laws and regulations including changes in accounting standards and taxation requirements; | |

| · | changes in the rate of inflation, interest rates and the performance of investments held by us; | |

| · | changes in the creditworthiness of counterparties that transact business with; | |

| · | changes in business, economic, and political conditions, including: war, political instability, terrorist attacks, the threat of future terrorist activity and related military action; natural disasters; the cost and availability of insurance due to any of the foregoing events; labor disputes, strikes, slow-downs, or other forms of labor or union activity; and, pressure from third-party interest groups; | |

| · | changes in our business and investments and changes in the relative and absolute contribution of each to earnings and cash flow resulting from evolving business strategies, changing product mix, changes in tax rates and opportunities existing now or in the future; | |

| · | difficulties related to our information technology systems, any of which could adversely affect business operations, including any significant breakdown, invasion, destruction, or interruption of these systems; | |

| · | changes in credit markets impacting our ability to obtain financing for our business operations; or | |

| · | legal difficulties, any of which could preclude or delay commercialization of products or technology or adversely affect profitability, including claims asserting statutory or regulatory violations, adverse litigation decisions, and issues regarding compliance with any governmental consent decree. | |

Adverse developments in the global economy restricting the credit markets may materially and negatively impact our business.

The recent downturn in the world’s major economies and the constraints in the credit markets have heightened or could continue to heighten a number of material risks to our business, cash flows and financial condition, as well as our future prospects. Continued issues involving liquidity and capital adequacy affecting lenders could affect our ability to access credit facilities or obtain debt financing and could affect the ability of lenders to meet their funding requirements when we need to borrow. Further, in the uncertain event that a public market for our stock develops and is maintained, the volatility in the equity markets may make it difficult in the future for us to access the equity markets for additional capital at attractive prices, if at all. If we are unable to obtain credit or access capital markets, our business could be negatively impacted.

Risks Related to our International Operations

We are subject to risks associated with doing business globally including compliance with domestic and foreign laws and regulations, economic downturns, political instability and other risks that could adversely affect our operating results.

We conduct our businesses globally and have assets located in several countries and geographic areas. Our oilseeds operations are in Malaysia, Hong Kong and China, and we have acquired commercial real estate in Malaysia. We are required to comply with numerous and broad reaching laws and regulations administered by United States federal, state and local, and foreign governmental authorities. We must also comply with other general business regulations such as those directed toward accounting and income taxes, anti-corruption, anti-bribery, global trade, handling of regulated substances, and other commercial activities, conducted by our employees and third party representatives globally. Any failure to comply with applicable laws and regulations could subject us to administrative penalties and injunctive relief, and civil remedies including fines, injunctions, and recalls of our products. In addition, changes to regulations or implementation of additional regulations may require us to modify existing processing facilities and/or processes, which could significantly increase operating costs and negatively impact operating results.

We operate in both developed and emerging markets which are subject to impacts of economic downturns, including decreased demand for our products, reduced availability of credit, or declining credit quality of our suppliers, customers, and other counterparties. We anticipate that emerging market areas could be subject to more volatile economic, political and market conditions. Economic downturns and volatile conditions may have a negative impact on our operating results and ability to execute its business strategies.

| 16 |

Our operating results may be affected by changes in trade, monetary, fiscal and environmental policies, laws and regulations, and other activities of governments, agencies, and similar organizations. These conditions include but are not limited to changes in a country’s or region’s economic or political conditions, trade regulations affecting production, pricing and marketing of products, local labor conditions and regulations, reduced protection of intellectual property rights, changes in the regulatory or legal environment, restrictions on currency exchange activities, currency exchange fluctuations, burdensome taxes and tariffs, enforceability of legal agreements and judgments, other trade barriers, and regulation or taxation of greenhouse gases. International risks and uncertainties, including changing social and economic conditions as well as terrorism, political hostilities, and war, may limit our ability to transact business in these markets and may adversely affect our revenues and operating results.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act, or FCPA, and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We will have operations, agreements with third parties and make sales in Asia, which may experience corruption. Our proposed activities in Asia create the risk of unauthorized payments or offers of payments by one of the employees, consultants, or sales agents of our Company, because these parties are not always subject to our control. It will be our policy to implement safeguards to discourage these practices by our employees. Also, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, or sales agents of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold our Company liable for successor liability FCPA violations committed by companies in which we invest or that we acquire.

We expect our revenues to be paid in non-U.S. currencies, and if currency exchange rates become unfavorable, we may lose some of the economic value of the revenues in U.S. dollar terms.

Our operations are conducted in Malaysia, Hong Kong and China and our operating currencies are the Malaysian Ringgit, the Hong Kong Dollar and the Renminbi. Since we conduct business in currencies other than U.S. dollars but report our financial results in U.S. dollars, we face exposure to fluctuations in currency exchange rates. For instance, if currency exchange rates were to change unfavorably, the U.S. dollar equivalent of our operating income recorded in foreign currencies would be diminished.

We currently do not, but may in the future, implement hedging strategies, such as forward contracts, options, and foreign exchange swaps to mitigate this risk. There is no assurance that our efforts will successfully reduce or offset our exposure to foreign exchange fluctuations. Additionally, hedging programs expose us to risks that could adversely affect our financial results, including the following:

| · | We have limited experience in implementing or operating hedging programs. Hedging programs are inherently risky and we could lose money as a result of poor trades; |

| · | We may be unable to hedge currency risk for some transactions or match the accounting for the hedge with the exposure because of a high level of uncertainty or the inability to reasonably estimate our foreign exchange exposures; |

| · | We may be unable to acquire foreign exchange hedging instruments in some of the geographic areas where we do business, or, where these derivatives are available, we may not be able to acquire enough of them to fully offset our exposure; |

| · | We may determine that the cost of acquiring a foreign exchange hedging instrument outweighs the benefit we expect to derive from the derivative, in which case we would not purchase the derivative and would be exposed to unfavorable changes in currency exchange rates; |

| · | To the extent we recognize a gain on a hedge transaction in one of our subsidiaries that is subject to a high statutory tax rate, and a loss on the related hedged transaction that is subject to a lower rate, our effective tax rate would be higher; and |

| · | Significant fluctuations in foreign exchange rates could greatly increase our hedging costs. |

| 17 |

We anticipate increased exposure to exchange rate fluctuations as we expand the breadth and depth of our international sales.

In our financial statements, we translate our local currency financial results into U.S. dollars based on average exchange rates prevailing during a reporting period or the exchange rate at the end of that period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currency denominated transactions could result in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions could result in increased revenue, operating expenses and net income for our international operations.

We are susceptible to economic conditions in Malaysia where a significant portion of our principal business, assets, suppliers, merchants and customers are located.

Our business and assets are primarily located in Malaysia. As of December 31, 2014 and 2013, most of our long-lived assets were located in Malaysia and for the fiscal years ended December 31, 2014, and 2013, there were approximately 78% and 100%, respectively of our sales revenue were generated from customers located in Malaysia. Our results of operations, financial state of affairs and future growth are, to a significant degree, subject to Malaysia’s economic, political and legal development and related uncertainties. Our operations and results could be materially affected by a number of factors, including, but not limited to:

| · | Changes in policies by the Malaysian government resulting in changes in laws or regulations or the interpretation of laws or regulations; changes in taxation, |

| · | changes in employment restrictions; |

| · | import duties, and |

| · | currency revaluation. |

Because our holding company structure creates restrictions on the payment of dividends, our ability to pay dividends is limited.

We are a holding company whose primary assets are our ownership of the equity interests in our subsidiaries. We conduct no other business and, as a result, we depend entirely upon our subsidiaries’ earnings and cash flow. If we decide in the future to pay dividends, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries. Our subsidiaries and projects may be restricted in their ability to pay dividends, make distributions or otherwise transfer funds to us prior to the satisfaction of other obligations, including the payment of operating expenses or debt service, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions. If future dividends are paid in the Malaysian Ringgit, the Hong Kong Dollar or the Renminbi, fluctuations in the exchange rate for the conversion of any of these currencies into U.S. dollars may adversely affect the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars. We do not presently have any intention to declare or pay dividends in the future. You should not purchase shares of our common stock in anticipation of receiving dividends in future periods.