UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2019

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission File Number 001-38308

Greenpro Capital Corp.

(Exact name of registrant issuer as specified in its charter)

| Nevada | 98-1146821 | |

(State or other jurisdiction of incorporation or organization) |

(I.R.S.

Employer Identification No.) |

Room 1701-1703, 17/F., The Metropolis

Tower, 10 Metropolis Drive, Hung Hom, Kowloon,

Hong Kong

(Address of principal executive offices, including zip code)

Registrant’s phone number, including area code (852) 3111 -7718

Securities registered pursuant to Section 12(b) of the Securities Exchange Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, $0.0001 par value | GRNQ | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES [X] NO [ ]

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding twelve months (or shorter period that the registrant was required to submit such files). YES [X] NO [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer [ ] Accelerated Filer [ ] Non-accelerated Filer [X] Smaller reporting company [X]

Emerging growth Company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of voting and non-voting common equity held by non-affiliates of the Registrant as of June 28, 2019 was $21,535,720, based on the last reported sale price.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

As of March 30, 2020, there were 54,723,889 shares, par value $0.0001, of the registrant’s common stock outstanding.

Greenpro Capital Corp.

FORM 10-K

For the Fiscal Year Ended December 31, 2019

Index

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These forward-looking statements are not historical facts but rather are based on current expectations, estimates and projections. We may use words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “foresee,” “estimate” and variations of these words and similar expressions to identify forward-looking statements. These statements are not guaranteed to future performance and are subject to certain risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted. These risks and uncertainties include the following:

| ● | The availability and adequacy of our cash flow to meet our requirements; | |

| ● | Economic, competitive, demographic, business and other conditions in our local and regional markets; | |

| ● | Changes or developments in laws, regulations or taxes in our industry; | |

| ● | Actions taken or omitted to be taken by third parties including our suppliers and competitors, as well as legislative, regulatory, judicial and other governmental authorities; | |

| ● | Competition in our industry; | |

| ● | The loss of or failure to obtain any license or permit necessary or desirable in the operation of our business; | |

| ● | Changes in our business strategy, capital improvements or development plans; | |

| ● | The availability of additional capital to support capital improvements and development; and | |

| ● | Other risks identified in this Annual Report and in our other filings with the Securities and Exchange Commission or the SEC. |

This Annual Report should be read completely and with the understanding that actual future results may be materially different from what we expect. The forward-looking statements included in this Annual Report are made as of the date of this Annual Report and should be evaluated with consideration of any changes occurring after the date of this Annual Report. We will not update forward-looking statements even though our situation may change in the future and we assume no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Use of Defined Terms

Except as otherwise indicated by the context, references in this Annual Report to:

| ● | The “Company,” “we,” “us,” or “our,” “Greenpro” are references to Greenpro Capital Corp., a Nevada corporation. | |

| ● | “Common Stock” refers to the common stock, par value $.0001, of the Company; | |

| ● | “HK” refers to Hong Kong; | |

| ● | “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States; | |

| ● | “Securities Act” refers to the Securities Act of 1933, as amended; and | |

| ● | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended. |

| 3 |

Corporate History

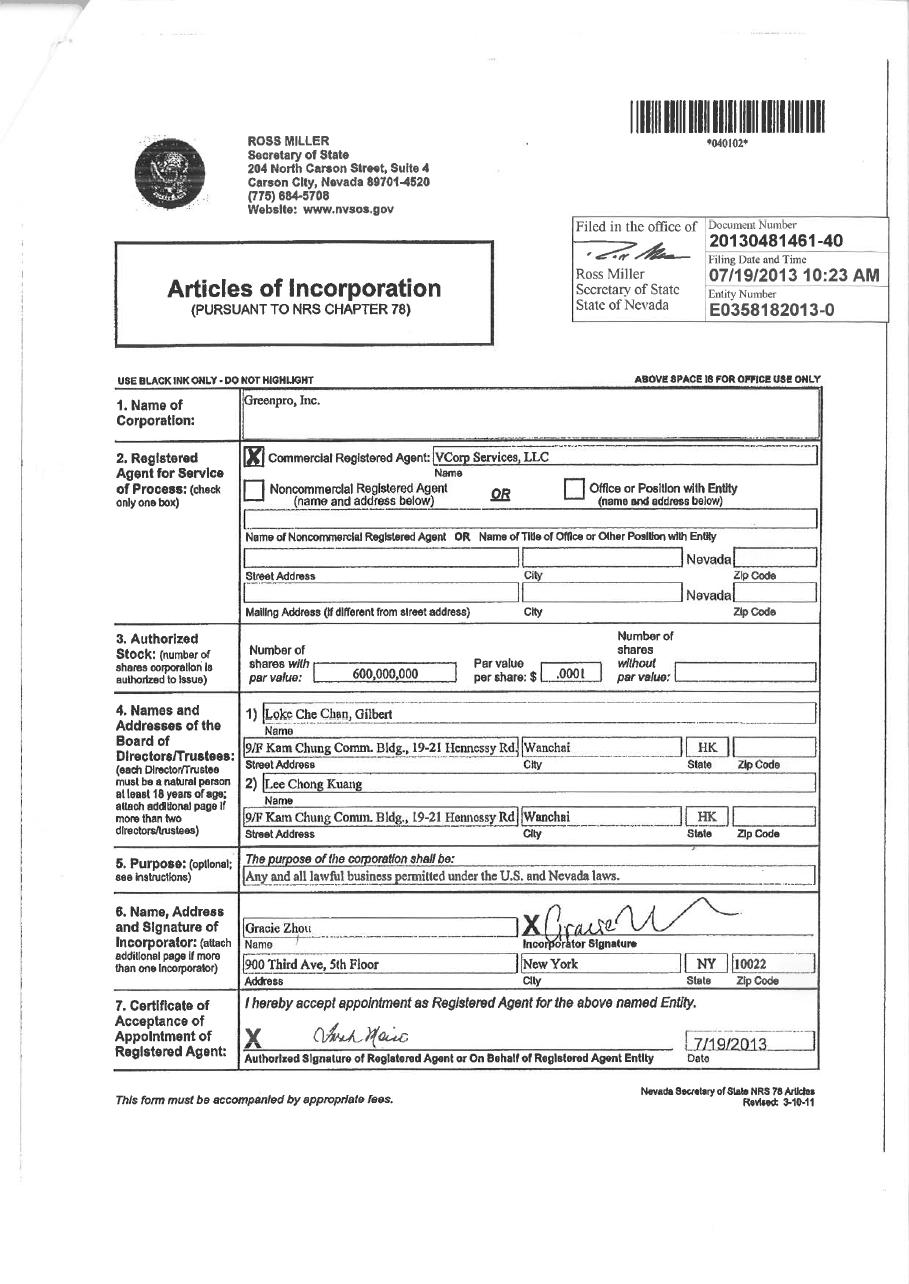

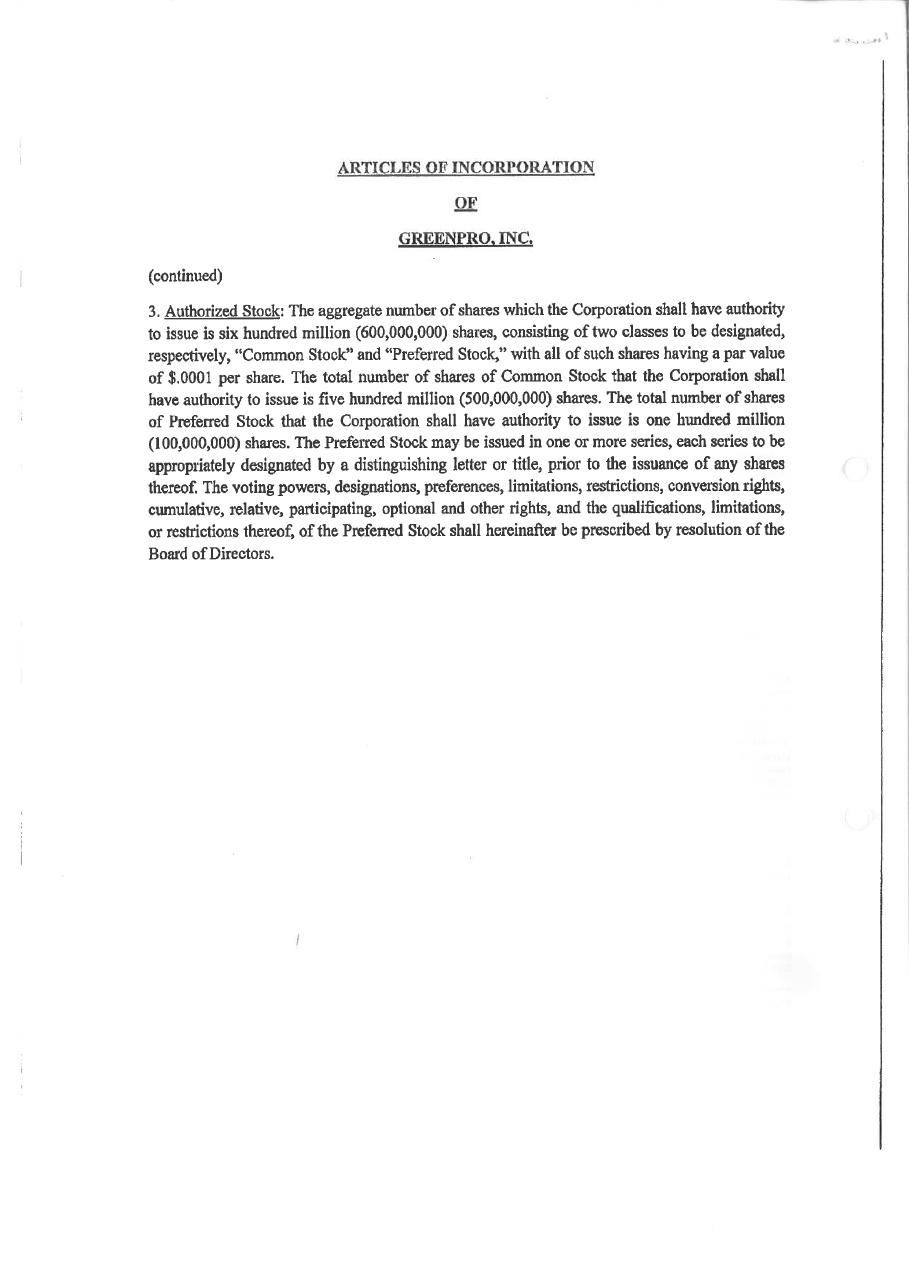

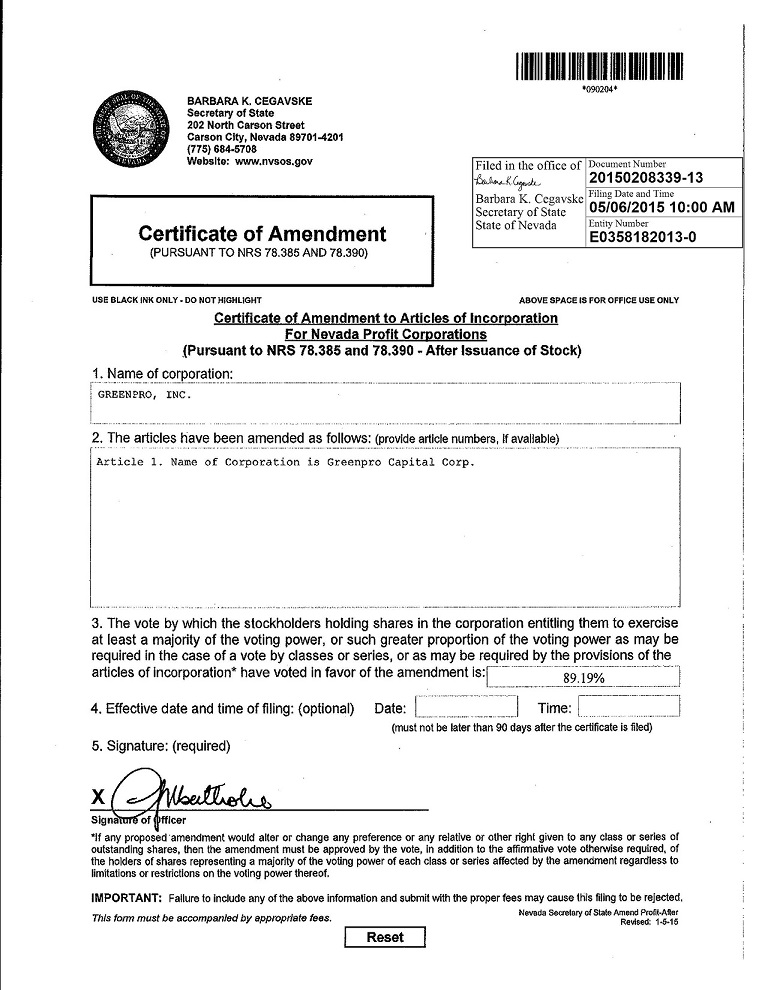

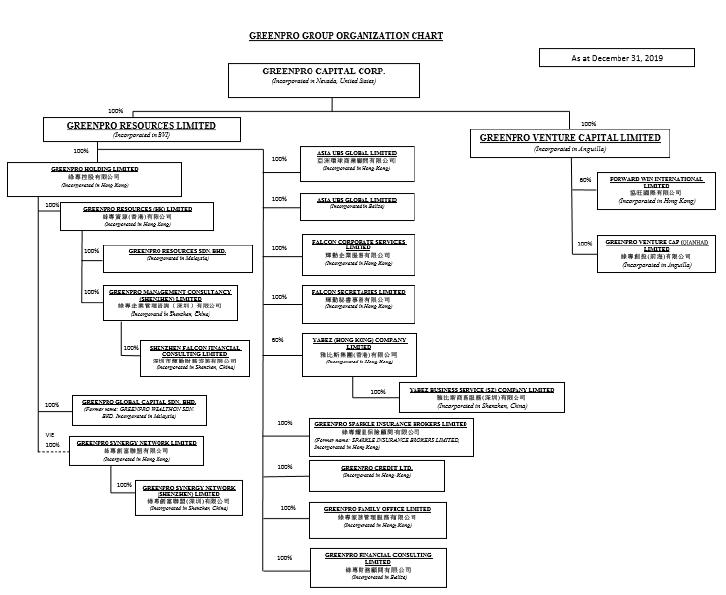

We were incorporated on July 19, 2013 in the state of Nevada under the name Greenpro, Inc. On May 6, 2015, we changed our name to Greenpro Capital Corp. Our corporate structure is set forth below:

A list of our subsidiaries and VIE entities together with a brief description of their business is set forth below:

| Name (Domicile) | Business | |

| Greenpro Capital Corp. (Nevada, USA) | Provides financial consulting services and corporate services. | |

| Greenpro Resources Limited (British Virgin Islands) | A holding company. | |

| Greenpro Holding Limited (Hong Kong) | Holds life insurance products. |

| 4 |

| Greenpro Resources (HK) Limited (Hong Kong) | Holds Greenpro intellectual property and currently holds six trademarks and applications thereof. | |

| Greenpro Resources Sdn. Bhd. (Malaysia) | Holds investment in commercial real estate in Malaysia. | |

| Greenpro Management Consultancy (Shenzhen) Limited (China) | Provides corporate advisory services such as tax planning, cross-border listing solution and advisory, transaction services in China. | |

| Shenzhen Falcon Financial Consulting Limited (China) | Provides Hong Kong company formation advisory services & company secretarial services and financial services. It focuses on China clients. | |

| Greenpro Global Capital Sdn. Bhd. (Formerly known as Greenpro Wealthon Sdn. Bhd.) (Malaysia) | Provides corporate advisory services such as company review, bank loan advisory and bank products analysis services. | |

| Greenpro Financial Consulting Limited (Belize) | Provides corporate advisory services such as tax planning, cross-border listing solution and advisory, transaction services. | |

| Asia UBS Global Limited (Belize) | Provides business advisory services with main focus on offshore company formation advisory and company secretarial service, such as tax planning, bookkeeping and financial review. It focuses on South-East Asia and China clients. | |

| Asia UBS Global Limited (Hong Kong) | Provides business advisory services with main focus on Hong Kong company formation advisory and company secretarial service, such as tax planning, bookkeeping and financial review. It focuses on Hong Kong clients. | |

| Falcon Corporate Services Limited (Hong Kong) | Provides offshore company formation advisory services & company secretarial services. Clients based in Hong Kong & China. | |

| Falcon Secretaries Limited (Hong Kong) | Provides Hong Kong company formation advisory services & company secretarial services. Clients based in Hong Kong & China. | |

| Yabez (Hong Kong) Company Limited (Hong Kong) | Provides Hong Kong company formation advisory services, corporate secretarial services and IT related services to Hong Kong based clients. | |

| Yabez Business Service (SZ) Company Limited (China) | Provides Shenzhen company formation advisory services, corporate secretarial services and IT related services to China based clients. | |

| Greenpro Credit Limited (Hong Kong) | Provides loan and credit services in Hong Kong. Holder of Money Lenders License. |

| 5 |

| Greenpro Family Office Limited (Hong Kong) | Provides professional multi-family office offers services such as wealth planning, administration, asset protection & management, asset consolidation, asset performance monitoring, charity services, tax and legal services, trusteeship and risk management, investment planning & management, and business support services. | |

| Greenpro Venture Capital Limited (Anguilla) | A holding company. | |

| Forward Win International Limited (Hong Kong) | Holds investment in commercial real estate in Hong Kong. | |

| Greenpro Venture Cap (Qianhai) Limited (Anguilla) | A holding company. | |

| Greenpro Synergy Network Limited (Hong Kong) | Provides a borderless platform through networking events and programs in Hong Kong. | |

| Greenpro Synergy Network (Shenzhen) Limited (China) | Provides a borderless platform through networking events and programs in China for our members to seek professional services, business opportunities, and to exchange sources of information and research.

| |

| Greenpro Sparkle Insurance Brokers Limited (Hong Kong) | Provides insurance broker services with an insurance broker license in Hong Kong. |

Acquisition and Reorganization History

Acquisitions of entities under common control:

Acquisition and disposal of Greenpro Capital Village Sdn. Bhd. (formerly known as Weld Asia Global Advisory Sdn. Bhd.), a Malaysia company

On February 25, 2013, Greenpro Financial Consulting Limited, a subsidiary of the Company, acquired 100% of Weld Asia Global Advisory Sdn. Bhd., a Malaysian company, from its shareholders, Lee Chong Kuang, and his spouse, Yap Pei Ling, for MYR2 (approximately $0.50). At the time of the acquisition, Lee Chong Kuang was the Company’s Chief Executive Officer, President and director and the acquisition was accounted for as a transfer among entities under common control.

In 2015, Weld Asia Global Advisory Sdn. Bhd. was renamed Greenpro Capital Village Sdn. Bhd. (“GCVSB”). On October 1, 2015, the Company sold 49% of the outstanding shares of GCVSB to QSC Asia Sdn. Bhd., an unrelated party, for MYR49,000 (approximately $12,794). On June 26, 2019, the Company disposed of GCVSB due to continued losses incurred by GCVSB, and sold its remaining 51% interest in GCVSB to Ms. Tan Tee Yong, an unrelated party, for MYR51 (approximately $12).

Acquisition of Greenpro Resources Limited, a British Virgin Islands company

On July 31, 2015, we acquired 100% of the issued and outstanding securities of Greenpro Resources Limited, a British Virgin Islands corporation (“GRBVI”), which had been our affiliate at the time of the acquisition. As consideration thereof, we issued 9,070,000 restricted shares of our common stock and paid $25,500 in cash.

At the time of the acquisition of GRBVI, Lee Chong Kuang was the Company’s Chief Executive Officer, President and director, and Loke Che Chan Gilbert was the Company’s Chief Financial Officer, Secretary, Treasurer and director of the Company, and Messrs. Lee and Loke each held a 44.6% interest in the Company. At the time of the acquisition of GRBVI, Mr. Lee was GRBVI’s Chief Executive Officer and director, and Mr. Loke was GRBVI’s Chief Financial Officer and director, and Messrs. Lee and Loke each held a 50% interest in GRBVI. Upon the consummation of the acquisition, Messrs. Lee and Loke received, in the aggregate, $25,500 in cash and 9,070,000 shares of restricted common stock of the Company, and the acquisition was accounted for as a transfer among entities under common control.

| 6 |

Acquisition of A&G International Limited, a Belize company

On September 30, 2015, we acquired 100% of the issued and outstanding securities of A&G International Limited, a Belize corporation (“A&G”), from Ms. Yap Pei Ling. Yap Pei Ling, a director and sole shareholder of A&G, is the spouse of Lee Chong Kuang, the Chief Executive Officer, President and director of the Company.

In connection therewith, we issued to Yap Pei Ling, 1,842,000 restricted shares of our common stock and the acquisition was accounted for as a transfer among entities under common control.

A&G provided corporate and business advisory services through its wholly owned subsidiaries, Asia UBS Global Limited, a Hong Kong limited company (“AUH”) and Asia UBS Global Limited, a Belize Corporation (“AUB”).

On December 30, 2015, A&G transferred all the issued and outstanding securities of AUH and AUB to GRBVI in order to simplify our corporate structure. Then A&G, a corporation with no assets, was subsequently transferred back to Ms. Yap Pei Ling.

Acquisition of Greenpro Venture Capital Limited, an Anguilla corporation

On September 30, 2015, the Company acquired all the issued and outstanding securities of Greenpro Venture Capital Limited, an Anguilla corporation (“GVCL”), from its shareholders, Lee Chong Kuang and Loke Che Chan Gilbert, respectively. At the time of the acquisition of GVCL, Lee Chong Kuang was the Company’s Chief Executive Officer, President and director, and Loke Che Chan Gilbert was the Company’s Chief Financial Officer, Secretary, Treasurer and director of the Company, and Messrs. Lee and Loke each held a 43.02% interest in the Company. At the time of the acquisition of GVCL, Mr. Lee was GVCL’s Chief Executive Officer and director, and Mr. Loke was GVCL’s Chief Financial Officer and director, and Messrs. Lee and Loke each held a 50% interest in GVCL. Upon the consummation of the acquisition, Messrs. Lee and Loke received, in the aggregate, $6,000 in cash and 13,260,000 shares of restricted common stock of the Company, and the acquisition was accounted for as a transfer among entities under common control.

Incorporation and deregistration of Greenpro Capital Pty Ltd, an Australian company

Greenpro Capital Pty Ltd was formed on May 11, 2016 with 50% held by one of our subsidiaries, Greenpro Holding Limited (“GHL”), and 50% held by Mohammad Reza Masoumi Al Agha, an unrelated party. On June 29, 2018, both parties agreed to the deregistration of Greenpro Capital Pty Ltd due to discrepancies on the direction of the business.

Acquisition of Greenpro Wealthon Sdn. Bhd., a Malaysian company

On May 23, 2016, our subsidiary, Greenpro Holding Limited (“GHL”) acquired 400 shares, representing 40% of the outstanding shares of Greenpro Wealthon Sdn. Bhd., from our director, Mr. Lee Chong Kuang for MYR1 (approximately $0.25). On June 7, 2016, Greenpro Wealthon Sdn. Bhd. issued another 200 shares to GHL at the price of MYR120,000 (approximately $30,000), resulting in GHL owing 60% of Greenpro Wealthon Sdn. Bhd.

On June 13, 2018, Greenpro Wealthon Sdn. Bhd. was renamed to Greenpro Global Capital Sdn. Bhd. (“GGCSB”). On August 30, 2018, the remaining 40% of the outstanding shares of GGCSB were transferred to GHL, and currently GHL holds 100% of GGCSB.

| 7 |

Acquisition of Greenpro Family Office Limited, a Hong Kong company

On July 21, 2017, Greenpro Resources Limited (“GRBVI”), a wholly owned subsidiary of GRNQ, acquired 51% of the outstanding shares of Greenpro Family Office Limited (“GFOL”). Loke Che Chan Gilbert, our Chief Financial Officer, was the sole shareholder of GFOL before the transaction and the acquisition was accounted for as a transfer among entities under common control. On September 21, 2018, the remaining 49% shareholdings of GFOL were transferred to GRBVI, and currently GRBVI holds 100% of GFOL.

Incorporation and disposal of Greenpro International Limited, a Seychelles company

Greenpro International Limited (“GIL”) was formed on July 4, 2018 with 80% held by Greenpro Venture Capital Limited (“GVCL”), one of our subsidiaries, and 20% was held by Mr. Loke Yu, a family member of Loke Che Chan Gilbert, one of the directors of GRNQ. On September 18, 2018, GVCL transferred all the issued and outstanding securities of Greenpro Property Development Limited (“GPDL”) (formerly known as Chief Billion Limited), a Hong Kong Corporation, to GIL.

On May 31, 2019, GVCL disposed of its 80% interest in GIL, to Mr. Loke Yu at a consideration of HKD80 (approximately $10), due to the continuing losses incurred by GIL and GPDL.

VIE Structure and Arrangements

Greenpro Synergy Network Ltd (“GSN”) was incorporated in Hong Kong on March 2, 2016, as a variable interest entity (“VIE”), which is required to consolidate with the Company. GSN’s principal activities are to hold certain of our universal life insurance policies. Our directors, Loke Che Chan, Gilbert and Lee Chong Kuang, are also the shareholders of GSN. We control GSN through a series of contractual arrangements (the “VIE Agreements”) between GHL and GSN. The VIE agreements include (i) an Exclusive Business Cooperation Agreement, (ii) a Loan Agreement, (iii) a Share Pledge Agreement, (iv) a Power of Attorney and (v) an Exclusive Option Agreement with the shareholders of GSN.

Set forth below is a more detailed description of each of the VIE agreement.

Exclusive Business Cooperation Agreement: Pursuant to the Exclusive Business Cooperation Agreement, GHL serves as an exclusive provider of technical support, consulting services and management services to GSN. In consideration of such services, GSN agreed to pay a service fee to GHL, which is based on the time of services rendered multiplied by the corresponding rate, plus amount of the services fees or a ratio decided by the board of directors of GHL. The Agreement has a term of 10 years but may be extended by GHL at its discretion.

Loan Agreement: Pursuant to the Loan Agreement, GHL granted interest-free loans to the shareholders of GSN for the sole purpose of increasing the registered capital of GSN. These loans are eliminated with the capital of GSN during consolidation.

Share Pledge Agreement: Pursuant to the Share Pledge Agreement, the shareholders of GSN pledged to GHL a first security interest in all their equity interests in GSN to secure GSN’s timely and complete payment, and performance of its obligations under the Exclusive Business Cooperation Agreement. During the term of the Share Pledge Agreement, the pledgors agreed, among other things, not to transfer, place or permit the existence of any security interest or other encumbrance on their interest in GSN without a prior written consent of GHL. The pledge remains in effect until 10 years after the obligations under the principal agreement will have been fulfilled. However, upon the full payment of the consulting and service fees under the Exclusive Business Cooperation Agreement and upon the termination of GSN’s obligations under the Exclusive Business Cooperation Agreement, the Share Pledge Agreement shall be terminated and GHL shall terminate this agreement as soon as reasonably practicable.

Power of Attorney: Pursuant to the Power of Attorney, Messrs. Lee and Loke, as the shareholders of GSN, granted to GHL the right to (i) attend the shareholder meetings of GSN (ii) exercise all shareholder rights (including voting rights) with respect to such equity interests in GSN and (iii) designate and appoint on behalf of such shareholders any legal representatives, directors, supervisors, and other senior management members of GSN. The Power of Attorney is irrevocable and is continuously valid from the date of execution of such Power of Attorney, so long as such persons remain shareholders of GSN.

| 8 |

Exclusive Option Agreement: Pursuant to the Exclusive Option Agreement, the shareholders of GSN granted to GHL an irrevocable and exclusive right and option to purchase all of their equity interests in GSN. The purchase price shall be equal to the capital paid in by the shareholders, adjusted pro rata for the purchase of less than all the equity interests. The Agreement is effective for a term of 10 years and may be renewed at GHL’s discretion.

Other Acquisitions:

Acquisition of Yabez (Hong Kong) Company Limited, a Hong Kong company and its wholly owned subsidiary, Yabez Business Service (SZ) Company Limited, a Shenzhen, China company

On September 30, 2015, we acquired 60% of the issued and outstanding securities of Yabez (Hong Kong) Company Limited, a Hong Kong corporation, together with its wholly owned subsidiary, Yabez Business Service (SZ) Company Limited in Shenzhen, China (“Yabez”). As consideration thereto, we issued to the shareholders of Yabez 486,171 restricted shares of our common stock, representing an aggregate purchase price of $252,808 based on the average closing price of the ten trading days preceding the date of the acquisition agreement on July 31, 2015, of $0.52 per share. The purchase price was determined based on the business value generated from Yabez at the time of acquisition. Yabez provides company formation advisory services, corporate secretarial services and IT related services to both of Hong Kong and Shenzhen based clients.

Acquisition of Falcon Secretaries Limited and Ace Corporate Services Limited, Hong Kong companies, and Shenzhen Falcon Financial Consulting Limited, a Shenzhen, China company

On September 30, 2015, we acquired all the issued and outstanding securities of Falcon Secretaries Limited, Ace Corporate Services Limited and Shenzhen Falcon Financial Consulting Limited (these companies collectively known as “F&A”). As consideration thereto, we issued to Ms. Chen Yanhong, a sole shareholder of F&A, 2,080,200 restricted shares of our common stock, representing an aggregate purchase price of $1,081,704 based on the average closing price of the ten trading days preceding the date of the acquisition agreement on July 31, 2015, of $0.52 per share. The purchase price was determined based on the business value generated from F&A at the time of acquisition. Ace Corporate Services Limited renamed to Falcon Corporate Services Limited on August 26, 2016.

Ms. Chen Yanhong, a director and sole shareholder of F&A, is also a director and legal representative of Greenpro Management Consultancy (Shenzhen) Limited, one of our subsidiaries in Shenzhen, China.

Acquisition and disposal of Billion Sino Holdings Limited, a Seychelles company

On April 25, 2017, the Company acquired 60% of the issued shares of Billion Sino Holdings Limited, a Seychelles corporation (“BSHL”) from two unrelated individuals who collectively owned 100% of BSHL. As consideration thereto, the Company agreed to issue an aggregate of 340,645 restricted shares of the Company’s common stock valued at $851,163.

On November 20, 2018, due to continuing losses incurred by BSHL, the Company decided to dispose of its interest in BSHL. The Company sold its 60% interest in BSHL for $60.

Acquisition of Gushen Credit Limited, a Hong Kong company

On April 27, 2017, GRBVI, a wholly owned subsidiary of the Company and Gushen Credit Limited, a Hong Kong corporation, entered into an Asset Purchase Agreement, pursuant to which GRBVI purchased all assets of Gushen Credit Limited. As consideration thereto, GRBVI agreed to pay a purchase price of $105,000.

Gushen Credit Limited operates a money lending business in Hong Kong, located at 1701-03, 17/F, Metropolis Tower, 10 Metropolis Drive, Hung Hom, Kowloon, Hong Kong. On April 28, 2017, Gushen Credit Limited sold two (2) ordinary shares, representing 100% of its ownership, at a total consideration of $0.26 in cash to GRBVI. The purchase price was determined based on the mutual agreement between Gushen Credit Limited and GRBVI. Gushen Credit Limited was renamed to Greenpro Credit Limited on May 16, 2017.

Incorporation and disposal of Greenpro Management PTY Limited, an Australian company

Greenpro Management PTY Limited (“GMPTY”) was formed on August 20, 2018 with 100% held by GHL, one of the subsidiaries of the Company.

On June 21, 2019, due to the continuing losses incurred by GMPTY, the Company decided to dispose of GMPTY. The Company sold 49% of the issued and outstanding shares of GMPTY to Mr. Yan Yanbo and sold 51% of the issued and outstanding shares of GMPTY to Ms. Xiao Feng Huang, for total consideration of AUD1,400 (approximately $947).

Acquisition of Sparkle Insurance Brokers Limited, a Hong Kong company

On January 2, 2019, the Company acquired Sparkle Insurance Brokers Limited (“Sparkle”) (renamed to Greenpro Sparkle Brokers Limited on April 4, 2019) from Mr. Teh Boo Yim and Ms. Teh Jocelyn Nga Man, the former 100% shareholders of Sparkle for total consideration of $170,322, made up of $129,032 in cash and the issuance of 8,602 shares of the Company’s common stock valued at $41,290. The shares were valued based on the closing price of the Company’s common stock of $4.80 per share at acquisition. The Company aims to expand its long term and general insurance services through the acquisition of Sparkle.

| 9 |

Business Overview

We currently operate and provide a wide range of business solution services to small and medium-size businesses located in South-East Asia and East Asia, with an initial focus on Hong Kong, China and Malaysia, and subsequently in Thailand and Taiwan. Our comprehensive range of services includes cross-border business solutions, record management services, and accounting outsourcing services. Our cross-border business services include, among other services, tax planning, trust and wealth management, cross border listing advisory services and transaction services. As part of the cross-border business solutions, we have developed a package solution of services (“Package Solution”) that can reduce business costs and enhance revenues.

We also operate a venture capital business through Greenpro Venture Capital Limited, an Anguilla corporation. Our venture capital business is focused on (1) establishing a business incubator for start-up and high growth companies to support such companies during critical growth periods, which includes education and support services, and (2) searching for investment opportunities in selected start-up and high growth companies, which we expect can generate significant returns to the Company. We expect to target companies located in Asia including Hong Kong, Malaysia, China, Thailand and Singapore. We anticipate our venture capital business also engaging in the purchase or the lease of commercial properties in the same Asian region.

Our Services

We provide a range of services to our clients as part of the Package Solution that we have developed. We believe that our clients can reduce their business costs and enhance their revenues by utilizing our Package Solution.

Cross-Border Business Solutions/Cross-Border Listing Solutions

We provide a full range of cross-border services to small to medium-sized businesses to assist them in conducting their business effectively. Our “Cross-Border Business Solution” includes the following services:

| ● | Advising clients on company formation in Hong Kong, the United States, the British Virgin Islands and other overseas jurisdictions; | |

| ● | Assisting companies to set up bank accounts with banks in Hong Kong to facilitate clients’ banking operations; | |

| ● | Providing bank loan referral services; | |

| ● | Providing company secretarial services; | |

| ● | Assisting companies in applying for business registration certificates with the Inland Revenue Department of Hong Kong; | |

| ● | Providing corporate finance consulting services; | |

| ● | Providing due diligence investigations and valuations of companies; | |

| ● | Advising clients regarding debt and company restructurings; | |

| ● | Providing liquidation, insolvency, bankruptcy and individual voluntary arrangement advice and assistance; | |

| ● | Designing a marketing strategy and promoting the company’s business, products and services; | |

| ● | Providing financial and liquidity analysis; | |

| ● | Assisting in setting up cloud invoicing systems for clients; |

| 10 |

| ● | Assisting in liaising with investors for the purposes of raising capital; | |

| ● | Assisting in setting up cloud inventory systems to assist clients to record, maintain and control their inventories and track their inventory levels; | |

| ● | Assisting in setting up cloud accounting systems to enable clients to keep track of their financial performance; | |

| ● | Assisting clients in payroll matters operated in our cloud payroll system; | |

| ● | Assisting clients in tax planning, preparing the tax computation and making tax filings with the Inland Revenue Department of Hong Kong; | |

| ● | Cross-border listing advisory services, including but not limited to, United States, United Kingdom, Hong Kong, and Australia; | |

| ● | International tax planning in China; | |

| ● | Advising on Trust and wealth management; and | |

| ● | Transaction services. |

There is a growing market in Asia of companies who are seeking to go public and become listed on a recognized exchange in a foreign jurisdiction. We see tremendous opportunity to the extent that this trend continues worldwide. With respect to cross border listing advisory services, we are assisting private companies in their desire to list and trade on public exchanges, including the U.S. NASDAQ and OTC Markets. The Jumpstart Our Business Startups Act, or JOBS Act, signed in 2012, eases the initial public offering (“IPO”) process for “emerging growth companies” and reduces their regulatory burden, (2) improves the ability of these companies to access capital through private offerings and small public offerings without SEC registration, and (3) allows private companies with a substantial shareholder base to delay becoming a public reporting company.

Through our cross-border listing advisory services, we seek to form the bridge between these companies seeking to conduct their IPO (or in some cases self-directed public offerings), and their goal of becoming a listed company on a recognized U.S. national exchange, such as NASDAQ and the NYSE.

While there are several alternatives for companies seeking to go public and trade on the U.S. OTC markets, we primarily focus on three methods:

| ● | Registration Statement on Form S-1 | |

| ● | Regulation A+ offering | |

| ● | The Form 10 shell company |

The manner in which the OTC markets are structured provides companies the ability to “uplist” in the marketplace as they provide better transparency. These OTC markets include:

| ● | OTCQX Best Marketplace: offers transparent and efficient trading of established, investor-focused U.S. and global companies. | |

| ● | OTCQB Venture Marketplace: for early-stage and developing U.S. and international companies that are not yet able to qualify for OTCQX. | |

| ● | OTC Pink Open Marketplace: offers trading in a wide spectrum of securities through any broker. With no minimum financial standards, this market includes foreign companies that limit their disclosure, penny stocks and shells, as well as distressed, delinquent, and dark companies not willing or able to provide adequate information to investors. |

| 11 |

We act as a case reference for our clients, as we originally had our shares quoted in the OTC markets and subsequently “uplisted” to The Nasdaq Stock Market LLC., a U.S. national securities exchange.

With growing competition and increasing economic sophistication, we believe more companies need strategies for cross-border restructuring and other corporate matters. Our plan is to bundle our Cross-Border Business Solution services with our cloud accounting solutions and Accounting Outsourcing Services described below.

Accounting Outsourcing Services

We intend to develop relationships with professional firms from Hong Kong, Malaysia, China and Thailand that can provide company secretarial, business centers and virtual offices, book-keeping, tax compliance and planning, payroll management, business valuation, and wealth management services to our clients. We intend to include local accounting firms within this network to provide general accounting, financial evaluation and advisory services to our clients. Our expectation is that firms within our professional network will refer their international clients to us that may need our book-keeping, payroll, company secretarial and tax compliance services. We believe that this accounting outsourcing service arrangement will be beneficial to our clients by providing a convenient, one-stop firm for their local and international business and financial compliance and governance needs.

Our Service Rates

We intend to have a two-tiered rate system based upon the type of services being offered. We may impose project-based fees, where we charge 10% -25% of the revenues generated by the client on projects that are completed using our services, such as transaction projects, contract compliance projects, and business planning projects. We may also charge a flat rate fee or fixed fee based on the estimated complexity and timing of a project when our professionals provide specified expertise to our clients on a project. For example, for the cross-border business solutions, we plan to charge our client a monthly fixed fee.

Our Venture Capital Business Segment

Venture Capital Investment

As a result of our acquisition of Greenpro Venture Capital Limited (“GVCL”) in 2015, we entered the venture capital business in Hong Kong with a focus on companies located in South-East Asia and East Asia, including Hong Kong, Malaysia, China, Thailand and Singapore. Our venture capital business is focused on (1) establishing a business incubator for start-up and high growth companies to support such companies during critical growth periods and (2) investment opportunities in select start-up and high growth companies.

We believe that a company’s life cycle can be divided into five stages, including the seed stage, start-up stage, expansion stage, mature stage and decline stage. We anticipate that most of a company’s funding needs will occur during these first three stages.

| ● | Seed stage: Financing is needed for assets, and research and development of an initial business concept. The company usually has relatively low costs in developing the business idea. The ownership model is considered and implemented. | |

| ● | Start-up stage: Financing is needed for product development and initial marketing. Firms in this phase may be in the process of setting up a business or they might have been in operating the business for a short period of time but may not have sold their products commercially. In this phase, costs are increasing due to product development, market research and the need to recruit personnel. Low levels of revenues are starting to generate. | |

| ● | Expansion stage: Financing is needed for growth and expansion. Capital may be used to finance increased production capacity, product or marketing development or to hire additional personnel. In the early expansion phase, sales and production increases but there is not yet any profit. In the later expansion stage, the business typically needs extra capital in addition to organically generated profit, for further development, marketing or product development. |

| 12 |

We intend for our business incubators to provide valuable support to young, emerging growth and potential high growth companies at critical junctures of their development. For example, our incubators will offer office space at a below market rental rate. We will also provide our expertise, business contacts, introductions and other resources to assist their development and growth. Depending on each individual circumstance, we may also take an active advisory role in our venture capital companies including board representation, strategic marketing, corporate governance, and capital structuring. We believe that there will be potential investment opportunities for us in these start-up companies.

Our business processes for our investment strategy in select start-up and high growth companies is as follows:

| ● | Step 1. Generating Deal Flow: We expect to actively search for entrepreneurial firms and to generate deal flow through our business incubator and the personal contacts of our executive team. We also anticipate that entrepreneurs will approach us for financing. | |

| ● | Step 2. Investment Decision: We will evaluate, examine and engage in due diligence of a prospective portfolio company, including but not limited to product/services viability, market potential and integrity as well as capability of the management. After that both parties arrive at an agreed value for the deal. Following that is a process of negotiation, which if successful, ends with capital transformation and restructuring. | |

| ● | Step 3. Business Development and Value Adding: In addition to capital contribution, we expect to provide expertise, knowledge and relevant business contacts to the company. | |

| ● | Step 4. Exit: There are several ways to exit an investment in a company. Common exits are: |

| ○ | IPO (Initial Public Offering): The company’s shares are offered in a public sale on an established securities market. | |

| ○ | Trade sale (Acquisition): The entire company is sold to another company. | |

| ○ | Secondary sale: The company’s firm sells only part of its shares. | |

| ○ | Buyback or MBO: Either the entrepreneur or the management of the company buys back the company’s shares of the firm. | |

| ○ | Reconstruction, liquidation or bankruptcy: If the project fails the company will restructure or close down the operations. |

Our objective is to achieve a superior rate of return through the eventual and timely disposal of investments. We expect to look for businesses that meet the following criteria:

| ● | high growth prospects | |

| ● | ambitious teams | |

| ● | viability of product or service | |

| ● | experienced management | |

| ● | ability to convert plans into reality | |

| ● | justification of venture capital investment and investment criteria |

| 13 |

Our Venture Capital Related Education and Support Services.

In addition to providing venture capital services through GVCL, we also provide educational and support services that we believe will be synergistic with our venture capital business. We have arranged seminars called the CEO & Business Owners Strategic Session (“CBOSS”) in Malaysia and Singapore for business owners who are interested in the following:

| ● | Developing their business globally; | |

| ● | Expanding business with increased capital funding; | |

| ● | Creating a sustainable SME business model; | |

| ● | Accelerating the growth of the business; or | |

| ● | Significantly increasing company cash flows. |

The objective of the CBOSS seminar is to educate the chief executive officers or business owners on how to acquire “smart capital” and the considerations involved. The seminar includes an introduction to the basic concepts of “smart capital,” “wealth and value creation,” recommendation and planning and similar topics. We believe that this seminar will synergistically support our venture capital business segment.

China Service Centers Expansion

Our expansion strategy is to establish service centers in Northern and Southwest China, as well as the Greater Bay Area in Guangdong Province (the Chinese government’s plan to link the cities of Hong Kong, Macau, Guangzhou, Shenzhen, Zhuhai, Dongguan, Foshan, Zhongshan, Jiangmen, Zhaoqing and Huizhou (i.e. “2+9”) into an integrated economic and business hub). The centers will cater to customers’ needs by providing and delivering professional, high quality service and assistance before, during, and after the customer’s requirements are met. The expansion plan in each city would be based on various factors, such as business opportunities, office property availability and job market conditions. We also intend to cooperate with different business partners, utilizing their networks and resources in the target markets, to establish additional business opportunities.

Sales and Marketing

We plan to deploy three strategies to market the Greenpro brand: leadership, market segmentation and sales management process development.

| ● | Building Brand Image: Greenpro’s marketing efforts will focus on building the image of our extensive expertise and knowledge of our professionals. We intend to conduct a marketing campaign through media visibility, seminars, webinars, and the creation of a wide variety of white papers, newsletters, books, and other information. | |

| ● | Market segmentation: We plan to devote marketing resources to highly measurable and high return on investment tactics that specifically target those industries and areas where Greenpro has particularly deep experience and capabilities. These efforts typically involve local, regional or national trade show and event sponsorships, targeted direct mail, email, and telemarketing campaigns, and practice and industry specific micro-sites and newsletters in the Asian region. | |

| ● | Social Media: We plan to begin a social media campaign utilizing blogs, Twitter, Facebook and LinkedIn after we secure sufficient financing. A targeted campaign will be made to the following groups of clients: law firms, auditing firms, consulting firms and small to medium-size enterprises in different industries, including biotechnology, intellectual property, information technologies and real estate. |

| 14 |

Worldwide Wealth Wisdom Development

Worldwide Wealth Wisdom Development (“WWW”) is our marketing and promotional campaign, which is focused on building long-term awareness of our brand. WWW targets the following markets (i) business owners and senior management; (ii) high and medium net worth individuals in China and (iii) financial services providers, such as Certified Financial Planners in China. The campaign involves sharing content, knowledge and information about wealth management, including wealth creation, wealth protection and wealth succession.

The objectives of WWW are:

| 1. | To arouse public awareness resulting in the recognition of Greenpro as a well-known advocate of the wealth principles described above; |

| 2. | For our philosophy to gain recognition so that our clients are confident and comfortable with our services and trust us; |

| 3. | To educate existing clients and potential prospects; and |

| 4. | To act as a channel of communication to gather market data and feedback. |

Set forth below are the marketing strategies we expect to develop.

Awareness & Optimization

| 1. | Email Blasts and E-Newsletter |

Email blasts are one of the commonly used tactics to disseminate information. Our email database will be collected through leads generated by online marketing (social media) and promotional events. Future event invitations and monthly/quarterly newsletters will be sent to the email database in order to boost event participation and provide updates on Company development.

| 2. | Media PR and News Releases |

Our post event information will be sent to news and media platforms as part of our publicity effort to increase public awareness about our events and developments, and to encourage more participants to join our upcoming events. We will also share our analysis on various industries and industry trends to the media network providers for free. We believe that this strategy will strengthen the relationship between Greenpro and the media network providers.

| 3. | Social Media |

To generate more leads and subscribers, two to four articles related to wealth management will be shared in our official WeChat account. These articles are tools we use to share content online, through social media platforms such as WeChat, Jinri Toutiao and Facebook, which increases our online presence.

| 4. | Online Search Engine Optimization |

Online Search Engine Optimization (SEO) will be used as a supporting strategy to enhance our online presence campaign. We will seek a SEO expert team in China and Malaysia to assist in the promotion of the campaign by using an advertising and keyword tagging strategy to drive traffic to our social media accounts and our company website. The major search engines are Baidu and Google as these are the common search engine worldwide.

Interaction & Conversion

| 1. | Seminars and Conferences |

Seminars and conferences will be held once a month to deliver and educate the attendees on wealth management. We target between 80 and 100 attendees each time. We intend to invite professionals and strategic partners to share their ideas, resources and knowhow in the seminars and conferences. The seminars and conferences will focus on our three core wealth management principles, namely “Wealth Creation, Wealth Protection and Wealth Succession”.

| 15 |

| 2. | Private Events by Invitation |

Private and exclusive events are planned to be held quarterly with a target between 30 and 40 attendees. These events are exclusive and by-invitation only, at which we will share insights into our services and explain to attendees how they can proceed with wealth management planning.

| 3. | Small Group Meet Ups and Networking |

Small Group Meet Ups will be held twice a month targeting the public with an estimated five to ten attendees per session. The objective of these sessions is to encourage idea exchanges, to provide a platform for networking and potentially future collaboration opportunities, and foster better understanding between the participants and us, as well as among themselves.

Market Opportunities

We believe the main drivers for the growth of our business are the products and services together with the resources such as an office network, professional staff members and operational tools to make the advisory and consulting business more competitive.

We intend to assist our clients in the cost-effective preparation of their financial statements and provide security based on such financial information since the data will be stored in the cloud system. We anticipate a market with growing needs in Asia. We believe that there is currently an increasing need for enterprises in different industries to maximize their performance with cost-effective methods. We believe our services will create numerous competitive advantages for our clients. We believe that with us handling the administrative and logistic support, our clients can focus on developing their businesses and expanding their own client portfolio.

Customers

Our revenues are generated from clients located globally, including those from Hong Kong, China, Malaysia, Singapore, Indonesia, Thailand, Australia, Japan, Taiwan, Russia and the United States. Our venture capital business will initially focus on Hong Kong and other Asian start-ups and high growth companies. We hope to generate deal flow through personal contacts of our management team as well as through our business incubator.

We generated revenues of $4,484,822 during the fiscal year ended December 31, 2019 and $4,213,360 during the fiscal year ended December 31, 2018. We are not a party to any long-term agreements with our customers.

Competition

We operate in a mature, competitive industry. We consider our focus to be on a niche market of small and medium-sized businesses. Competition in the general field of business advisory services is quite intense, particularly in Hong Kong. We face competition principally from established law firms and consulting service providers in the corporate finance industry, such as Marbury, King & Wood Mallesons, QMIS Financial Group, First Asia Finance Group Limited and their respective affiliates, as well as from certain accounting firms, including those that specialize in a tax planning and corporate restructuring. The competition in China and Malaysia is not as fierce as in Hong Kong. Our major competitors in China are JP Investment Group and QMIS Financial Group while our major competitors in Malaysia are Global Bridge Management Sdn. Bhd. and QMIS Financial Group. These competitors generate significant traffic and have established brand recognition and financial resources. New or existing competition that uses a business model that is different from our business model may pressure us to change so that we can remain competitive.

| 16 |

We believe that the principal competitive factors in our market include quality of analysis; applicability and efficacy of recommendations; strength and depth of relationships with clients; ability to meet the changing needs of current and prospective clients; and service scope. By utilizing our competitive strengths, we believe that we have a competitive edge over other competitors due to the breadth of our service offerings, one stop convenience, pricing, marketing expertise, coverage network, service levels, track record, brand and reputation. We are confident we can retain and enlarge our market share.

Intellectual Property

We intend to protect our investment in the research and development of our products and technologies. We intend to seek the widest possible protection for significant product and process developments in our major markets through a combination of trade secrets, trademarks, copyrights and patents, if applicable. We anticipate that the form of protection will vary depending upon the level of protection afforded by a particular jurisdiction. Currently, our revenue is derived principally from our operations in Hong Kong, China and Malaysia, where intellectual property protection may be limited and difficult to enforce. In such instances, we may seek protection of our intellectual property through measures taken to increase the confidentiality of intellectual property.

We have registered trademarks as a means of protecting the brand names of our companies and products. We intend to protect our trademarks against infringement, and also seek to register design protection where appropriate. Currently, there are six trademarks registered under the name of Greenpro Resources (HK) Limited.

| Trademark Owner | Country / Territory | Registration Date | Brief Description | |||

Greenpro Resources (HK) Limited |

Hong Kong | August 11, 2010, June 25, 2013 and December 3, 2014 | Advertising, business management, business administration, office functions, research services, education, training | |||

| U.S.A. | February 2, 2016 | Business administration services, Business assistance, management and information services, Business knowledge management and consulting services | ||||

| China | December 28, 2014 | Advertising, business management, business administration, office functions and research services | ||||

| Singapore | July 22, 2013 | Advisory services related to business management and administration, computer software and security |

We rely on trade secrets and un-patentable know-how that we seek to protect, in part, by confidentiality agreements. Our policy is to require all employees to execute confidentiality agreements upon the commencement of employment with us. These agreements provide that all confidential information developed or made known to the individual through individual’s relationship with us, to be kept confidential and do not disclose to third parties except in specific circumstances. The agreements also provide that all inventions conceived by the individual while rendering services to us shall be assigned to us as the exclusive property of our company. There can be no assurance, however, that all persons who we desire to sign such agreements will sign, or if they do, that these agreements will not be breached, that we would have adequate remedies for any breach, or that our trade secrets or unpatentable know-how will not otherwise become known or be independently developed by competitors.

Government Regulation

We provide our Package Solution initially in Hong Kong, China and Malaysia, which we believe are locations that would need outsourcing support services. Further, we believe these markets are the central and regional markets for many customers doing cross border business in Asia. We target those customers from Asia doing international business and plan to provide our Package Solution to meet their needs. Our planned Package Solution will be structured in Hong Kong, but services may be outsourced to lower cost jurisdictions such as Malaysia and China, which encourage and welcome outsourcing services.

| 17 |

The following regulations are the laws and regulations that may be applicable to us:

Hong Kong

Our businesses located in Hong Kong are subject to the general laws in Hong Kong governing businesses, including labor, occupational safety and health, general corporations, intellectual property and other similar laws. Because our website is maintained through the server in Hong Kong, we expect that we will be required to comply with the rules and regulations and Hong Kong governing the data usage and regular terms of service applicable to our potential customers. As the information of our potential customers is preserved in Hong Kong, we will need to comply with the Hong Kong Personal Data (Privacy) Ordinance (Cap 486).

The Employment Ordinance is the main piece of legislation governing conditions of employment in Hong Kong. It covers a comprehensive range of employment protection and benefits for employees, including Wage Protection, Rest Days, Holidays with Pay, Paid Annual Leave, Sickness Allowance, Maternity Protection, Statutory Paternity Leave, Severance Payment, Long Service Payment, Employment Protection, Termination of Employment Contract, Protection against Anti-Union Discrimination.

An employer must also comply with all legal obligations under the Mandatory Provident Fund Schemes Ordinance, (Cap 485). These include enrolling all qualifying employees in Mandatory Provident Fund (“MPF”) schemes and making MPF contributions for them. Except for exempt persons, employers should enroll both full-time and part-time employees who are at least 18 but under 65 years of age in an MPF scheme within the first 60 days of employment. The 60-day employment rule does not apply to casual employees in the construction and catering industries.

We are required to make MPF contributions for our Hong Kong employees once every contribution period (generally the wage period). Employers and employees are each required to make regular mandatory contributions of 5% of the employee’s relevant income to an MPF scheme, subject to the minimum and maximum relevant income levels. For a monthly-paid employee, the minimum and maximum relevant income levels are $7,100 and $30,000 respectively.

We comply with the above applicable ordinances and regulations in Hong Kong and have not been involved any lawsuit or prosecuted by the local authority resulting from any breach of the ordinances and regulations.

Malaysia

Our businesses located in Malaysia are subject to the general laws in Malaysia governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws including the Computer Crime Act 1997 and The Copyright (Amendment) Act 1997. We believe that the focus of these laws is censorship in Malaysia, however we believe this does not impact our businesses because the censorship focus is on media controls and does not relate to cloud base technology which we plan to use.

Our real estate investments are subject to extensive local, city, county and state rules and regulations regarding permitting, zoning, subdivision, utilities and water quality as well as federal rules and regulations regarding air and water quality and protection of endangered species and their habitats. Such regulation may result in higher than anticipated administrative and operational costs.

We comply with the above applicable ordinances and regulations in Malaysia and have not involved any lawsuit or prosecuted by the local authority resulting from any breach of the ordinances and regulations.

China

A portion of our acquired businesses located in China and subject to the general laws in China governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws.

| 18 |

Employment Contracts

The Employment Contract Law was promulgated by the National People’s Congress’ Standing Committee on June 29, 2007 and took effect on January 1, 2008. The Employment Contract Law governs labor relations and employment contracts (including the entry into, performance, amendment, termination and determination of employment contracts) between domestic enterprises (including foreign-invested companies), individual economic organizations and private non-enterprise units (collectively referred to as the “employers”) and their employees.

a. Execution of employment contracts

Under the Employment Contract Law, an employer is required to execute written employment contracts with its employees within one month from the commencement of employment. In the event of contravention, an employee is entitled to receive double salary for the period during which the employer fails to execute an employment contract. If an employer fails to execute an employment contract for more than 12 months from the commencement of the employee’s employment, an employment contract would be deemed to have been entered into between the employer and employee for a non-fixed term.

b. Right to non-fixed term contracts

Under the Employment Contract Law, an employee may request a non-fixed term contract without an employer’s consent to renew. In addition, an employee is also entitled to a non-fixed term contract with an employer if he has completed two fixed term employment contracts with such employer; however, such employee must not have committed any breach or have been subject to any disciplinary actions during his employment. Unless the employee requests to enter into a fixed term contract, an employer who fails to enter into a non-fixed term contract pursuant to the Employment Contract Law is liable to pay the employee double salary from the date the employment contract is renewed.

c. Compensation for termination or expiry of employment contracts

Under the Employment Contract Law, employees are entitled to compensation upon the termination or expiry of an employment contract. Employees are entitled to compensation even in the event the employer (i) has been declared bankrupt; (ii) has its business license revoked; (iii) has been ordered to cease or withdraw its business; or (iv) has been voluntarily liquidated. Where an employee has been employed for more than one year, the employee will be entitled to such compensation equivalent to one month’s salary for every completed year of service. Where an employee has been employed for less than one year, such employee will be deemed to have completed one full year of service.

d. Trade union and collective employment contracts

Under the Employment Contract Law, a trade union may seek arbitration and litigation to resolve any dispute arising from a collective employment contract provided that such dispute failed to be settled through negotiations. The Employment Contract Law also permits a trade union to enter into a collective employee contract with an employer on behalf of all the employees.

Where a trade union has not been formed, a representative appointed under the recommendation of a high-level trade union may execute the collective employment contract. Within districts below county level, collective employment contracts for industries such as those engaged in construction, mining, food and beverage and those from the service sector, etc., may be executed on behalf of employees by the representatives from the trade union of each respective industry. Alternatively, a district-based collective employment contract may be made.

As a result of the Employment Contract Law, all our employees have executed standard written employment agreements with us. We have not experienced any significant labor disputes or any difficulties in recruiting staff for our operations.

| 19 |

On October 28, 2010, the National People’s Congress of China promulgated the PRC Social Insurance Law, which became effective on July 1, 2011. In accordance with the PRC Social Insurance Law, the Interim Regulations on the Collection and Payment of Social Security Fund and other relevant laws and regulations, China establishes a social insurance system including basic pension insurance, basic medical insurance, work-related injury insurance, unemployment insurance and maternity insurance. An employer shall pay the social insurance for its employees in accordance with the rates provided under relevant regulations and shall withhold the social insurance that should be assumed by the employees. The authorities in charge of social insurance may request an employer’s compliance and impose sanctions if such employer fails to pay and withhold social insurance in a timely manner. Under the Regulations on the Administration of Housing Fund effective in 1999, as amended in 2002, PRC companies must register with applicable housing fund management centers and establish a special housing fund account in an entrusted bank. Both PRC companies and their employees are required to contribute to the housing funds.

The Ministry of Human Resources and Social Security promulgated the Interim Provisions on Labor Dispatch on January 24, 2014. The Interim Provisions on Labor Dispatch, which became effective on March 1, 2014, sets forth that labor dispatch should only be applicable to temporary, auxiliary or substitute positions. Temporary positions shall mean positions subsisting for no more than six months, auxiliary positions shall mean positions of non-major business that serve positions of major businesses, and substitute positions shall mean positions that can be held by substitute employees for a certain period of time during which the employees who originally hold such positions are unable to work as a result of full-time study, being on leave or other reasons. The Interim Provisions further provides that, the number of the dispatched workers of an employer shall not exceed 10% of its total workforce, and the total workforce of an employer shall refer to the sum of the number of the workers who have executed labor contracts with the employer and the number of workers who are dispatched to the employer.

Foreign Exchange Control and Administration

Foreign exchange in China is primarily regulated by:

| ● | The Foreign Currency Administration Rules (1996), as amended; and | |

| ● | The Administration Rules of the Settlement, Sale and Payment of Foreign Exchange (1996), or the Administration Rules. |

Under the Foreign Currency Administration Rules, if documents certifying the purposes of the conversion of RMB into foreign currency are submitted to the relevant foreign exchange conversion bank, the RMB will be convertible for current account items, including the distribution of dividends, interest and royalty payments, and trade and service-related foreign exchange transactions. Conversion of RMB for capital account items, such as direct investment, loans, securities investment and repatriation of investment, however, is subject to the approval of SAFE or its local counterpart.

Under the Administration Rules for the Settlement, Sale and Payment of Foreign Exchange, foreign-invested enterprises may only buy, sell and/or remit foreign currencies at banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from SAFE or its local counterpart.

As an offshore holding company with a PRC subsidiary, we may (i) make additional capital contributions to our PRC subsidiaries, (ii) establish new PRC subsidiaries and make capital contributions to these new PRC subsidiaries, (iii) make loans to our PRC subsidiaries or consolidated affiliated entities, or (iv) acquire offshore entities with business operations in China in offshore transactions. However, most of these uses are subject to PRC regulations and approvals. For example:

| ● | Capital contributions to our PRC subsidiaries, whether existing or newly established ones, must be approved by the Ministry of Commerce or its local counterparts; | |

| ● | Loans by us to our PRC subsidiaries, each of which is a foreign-invested enterprise, to finance their activities cannot exceed statutory limits and must be registered with SAFE or its local branches; and | |

| ● | Loans by us to our consolidated affiliated entities, which are domestic PRC entities, must be approved by the National Development and Reform Commission and must also be registered with SAFE or its local branches. |

| 20 |

On August 29, 2008, SAFE promulgated the Circular on the Relevant Operating Issues concerning the Improvement of the Administration of Payment and Settlement of Foreign Currency Capital of Foreign-invested Enterprises, or “Circular 142”. On March 30, 2015, SAFE issued the Circular of the State Administration of Foreign Exchange Concerning Reform of the Administrative Approaches to Settlement of Foreign Exchange Capital of Foreign-invested Enterprises, or “Circular 19”, which became effective on June 1, 2015, to regulate the conversion by foreign invested enterprises, or FIEs, of foreign currency into RMB by restricting how the converted RMB may be used. Circular 19 requires that RMB converted from the foreign currency-dominated capital of a FIE shall be managed under the Accounts for FX settlement and pending payment. The expenditure scope of such Accounts includes expenditure within the business scope, payment of funds for domestic equity investment and RMB deposits, repayment of the RMB loans after completed utilization and so forth. A FIE shall truthfully use its capital by itself within the business scope and shall not, directly or indirectly, use its capital or RMB converted from the foreign currency-dominated capital for (i) expenditure beyond its business scope or expenditure prohibited by laws or regulations, (ii) disbursing RMB entrusted loans (unless permitted under its business scope), repaying inter-corporate borrowings (including third-party advance) and repaying RMB bank loans already refinanced to any third party. Where a FIE, other than a foreign-invested investment company, foreign-invested venture capital enterprise or foreign-invested equity investment enterprise, makes domestic equity investment by transferring its capital in the original currency, it shall obey the current provisions on domestic re-investment. Where such a FIE makes domestic equity investment by its RMB conversion, the invested enterprise shall first go through domestic re-investment registration and open a corresponding Accounts for FX settlement and pending payment, and the FIE shall thereafter transfer the conversion to the aforesaid Account according to the actual amount of investment. In addition, according to the Regulations of the People’s Republic of China on Foreign Exchange Administration, which became effective on August 5, 2008, the use of foreign exchange or RMB conversion may not be changed without authorization.

Violations of the applicable circulars and rules may result in severe penalties, including substantial fines as set forth in the Foreign Exchange Administration Regulations.

In light of the various requirements imposed by PRC regulations on loans to and direct investment in PRC entities by offshore holding companies, we cannot assure you that we will always be able to complete the necessary government registrations or obtain the necessary government approvals on a timely basis, if at all, with respect to future loans to our PRC subsidiary or future capital contributions by us to our PRC subsidiary. If we fail to complete such registrations or obtain such approvals, our ability to capitalize or otherwise fund our PRC operations may be negatively affected, which could materially and adversely affect our liquidity and our ability to fund and expand our business.

Currently, we are in compliance with the above applicable ordinances and regulations in China and have not involved any lawsuit or prosecuted by the local authority resulting from any breach of the ordinances and regulations.

Insurance

We do not current maintain property, business interruption and casualty insurance. As our business matures, we expect to obtain such insurance in accordance with customary industry practices in Malaysia, Hong Kong and China, as applicable.

Seasonality

Our businesses are not subject to seasonality.

Employees

As of March 30, 2020, we have 60 employees, located in the following territories:

| Country/Territory | Number of Employees | |

| Malaysia | 16 | |

| China | 28 | |

| Hong Kong | 16 |

| 21 |

As a result of the Employment Contract Law, all our employees in China have executed standard written employment agreements with us.

We are required to contribute to the Employees Provident Fund under a defined contribution pension plan for all eligible employees in Malaysia between the ages of eighteen and fifty-five. We are required to contribute a specified percentage of the participant’s income based on their ages and wage level. The participants are entitled to all of our contributions together with accrued returns regardless of their length of service with the company. For the years ended December 31, 2019 and 2018, the contributions are $48,216 and $46,725, respectively.

We are required to contribute to the MPF for all eligible employees in Hong Kong between the ages of eighteen and sixty-five. We are required to contribute a specified percentage of the participant’s income based on their ages and wage level. For the years ended December 31, 2019 and 2018, the MPF contributions by the Company were $54,638 and $38,691, respectively. We have not experienced any significant labor disputes or any difficulties in recruiting staff for our operations.

We are required to contribute to the Social Insurance Schemes and Housing Fund Schemes for all eligible employees in PRC. For the years ended December 31, 2019 and 2018, the contributions were $34,460 and $24,091, respectively.

Executive Office

Our principal executive office is located at Room 1701-1703, 17/F., The Metropolis Tower, 10 Metropolis Drive, Hung Hom, Kowloon, Hong Kong. Our principal telephone number is +852 3111 7718. Our website is at: http://www.greenprocapital.com. The information contained on our website is not, and should not be interpreted to be, a part of this Form 10-K.

Future Development Plan

Greenpro is in the process of carrying out the following development plans.

| 1. | Expansion of Corporate Finance Services: |

We plan to further expand our corporate finance services business. Our corporate finance services include financial advisory services relating to listings in the US capital markets (e.g., NASDAQ and OTC Markets) and listings in Hong Kong, mergers and acquisitions, investment valuation, project management and other financial advisory services. We intend to enhance our corporate finance business in China, Hong Kong, Malaysia and Thailand, by engaging in more marketing activities and expanding our business network to these regions.

| 2. | Big Data Analytics and Artificial Intelligence Development: |

Greenpro has partnered with Fusionex Innovations Sdn. Bhd. (“Fusionex”) to explore enhanced customer servicing (“CS”) through Big Data Analytics (“BDA”) and Artificial Intelligence (“AI”). The cooperation aims to explore financial technology initiatives or projects for the financial services sector, including enhanced CS through the use of BDA and AI, in order to extend business product offerings and services to our customer base. Greenpro believes the ability of Fusionex in database and Business Intelligence to capture and analyze data in any form will allow Greenpro to use continuous intelligence and augmented analytics when serving our customers, and also explore advanced technologies such as Data Visualization and Voice enabled interactions. Greenpro believes leveraging Fusionex’s advanced technology, expertise and experience in developing a secured FinTech system for the mass market will be especially well received by the new mobile-driven, social-sharing and tech-savvy customer generation. With Fusionex’s capability to capture such a large population, Greenpro is confident that this partnership will create value both for Greenpro and its clients.

| 3. | Wealth Products Development: |

Greenpro has partnered with B&G Capital Resources (“B&G”) and Kingsley Edugroup Limited (“Kingsley”) to launch the Greenpro EduHome Trust program (“EduHome”), which focuses on mass market, in response to increasing popularity of the Malaysia My Second Home program (“MM2H”). EduHome intends to provide an innovative trust solution of investment and educational opportunities from the MM2H program in Malaysia, one of Southeast Asia’s most vibrant economy. Greenpro expects this program will benefit 616 families and contribute investment of over USD210 million into the Malaysian economy. Greenpro believes many of the Hong Kong and Greater Bay Area residents seek a serene and secure environment to cultivate learning for the next generation of leaders. This is precisely what EduHome is intended to provide through the Kingsley International School and the Beaumont Residence in Kingsley Hills.

| 4. | ADAQ Development: |

ADAQ is a next generation online financial information platform which facilitates connecting private high growth emerging companies with access to potential investors and synergetic companies. ADAQ is dedicated to equip emerging growth companies in the Asia Pacific region with the guidance and information to identify, build and stream their sustainable core values. In addition, it offers an acceleration program to incubate and assist companies to accelerate the process by which they seek to list on international exchanges such as New York Stock Exchange (“NYSE”), NASDAQ and Hong Kong Stock Exchange (“HKEX”).

| 22 |

| ● | ADAQ has three major functions: |

1. Corporate Value Building Program

2. Online platform and acceleration process to International Capital Market Listing

3. Online Financial Information Market

We intend to strengthen the development of ADAQ as an acceleration platform to assist high growth emerging companies in the ASEAN regions covering Malaysia, Thailand, Singapore, Indonesia, Myanmar, Laos and Vietnam, and China to obtain funding and prepare for an IPO. An increasing number of companies across South-East Asia and the Greater Bay Area are interested in listing on the ADAQ market platform. We believe the successful development of the platform will heighten the prospects of Greenpro’s venture capital projects, aiming to achieve success and to widen market coverage to source for new potential projects.

| ● | Wealth Management Portfolio Development. The increase in the number of high-net-worth individuals in the Asia Pacific Region has created opportunities and needs for cross-border wealth management services. Leveraging our competitive advantages with integrated financial services and strategic offices, we look forward to enhancing our strategic development in wealth management, fund management and asset management businesses. We continue to look for partnerships to explore the potential of wealth management, fund management and asset management services, and provide with the assistance from our affiliates customized wealth creation, wealth protection and wealth succession solutions for medium, high and ultra-high net worth individuals/families in the Asian region. We also expect to place more efforts into the development of our Wealth Network Database through Greenpro Synergy Network (“G.S.N.”) – a wealth and investment community focusing on wealth related information sharing. |