| REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Title of each class |

Trading Symbol(s) |

Name of each exchange | ||

* |

|

| Large accelerated filer | ☐ | ☒ | Non-accelerated filer |

☐ | ||||||

| Emerging growth company | ||||||||||

| ☒ | International Financial Reporting Standards as issued | Other ☐ | ||||||

| by the International Accounting Standards Board ☐ |

Page |

||||||

1 |

||||||

2 |

||||||

3 |

||||||

| Item 1. |

3 |

|||||

| Item 2. |

3 |

|||||

| Item 3. |

3 |

|||||

| Item 4. |

64 |

|||||

| Item 4A. |

111 |

|||||

| Item 5. |

111 |

|||||

| Item 6. |

135 |

|||||

| Item 7. |

142 |

|||||

| Item 8. |

147 |

|||||

| Item 9. |

149 |

|||||

| Item 10. |

149 |

|||||

| Item 11. |

156 |

|||||

| Item 12. |

156 |

|||||

159 |

||||||

| Item 13. |

159 |

|||||

| Item 14. |

159 |

|||||

| Item 15. |

159 |

|||||

| Item 16A. |

161 |

|||||

| Item 16B. |

161 |

|||||

| Item 16C. |

161 |

|||||

| Item 16D. |

162 |

|||||

| Item 16E. |

162 |

|||||

| Item 16F. |

163 |

|||||

| Item 16G. |

163 |

|||||

| Item 16H. |

163 |

|||||

| Item 16I. |

163 |

|||||

164 |

||||||

| Item 17. |

164 |

|||||

| Item 18. |

164 |

|||||

| Item 19. |

164 |

|||||

170 |

||||||

| • | “we,” “us,” “our company,” or “our” refers to Cheetah Mobile Inc., its subsidiaries and, in the context of describing our operations and consolidated financial information, the consolidated variable interest entities and their subsidiaries in China, including but not limited to Beijing Mobile, Beijing Network and Beijing Conew. References to the consolidated variable interest entities may include their subsidiaries, depending on the context as appropriate; |

| • | “ADSs” refers to American depositary shares, each of which represents ten of our Class A ordinary shares; |

| • | “China” or the “PRC” refers to the People’s Republic of China, excluding, for the purposes of this annual report, Hong Kong, Macau and Taiwan; |

| • | “Ordinary shares,” prior to the completion of our initial public offering in May 2014, refers to our ordinary shares, par value US$0.000025 per share and, upon the completion of the offering, to our Class A and Class B ordinary shares, par value US$0.000025 per share; |

| • | “RMB” or “Renminbi” refers to the legal currency of China; |

| • | “US$,” “U.S. dollars,” “$,” or “dollars” refers to the legal currency of the United States; “€,” “Euro dollars” or “Euro” refers to the legal currency of the eurozone; |

| • | “¥,” “Japanese Yen” or “JPY” refers to the legal currency of Japan; |

| • | “Kingsoft Corporation Limited” or “Kingsoft Corporation” refers to Kingsoft Corporation Limited, a company listed on the Hong Kong Stock Exchange (Stock Code: 3888); |

| • | Number of “monthly active users,” in reference to all of our products, refers to the number of computers, tablets or smartphones on which one or more of our products have been installed or downloaded and that accessed the internet at least once during the relevant month; and number of “monthly active users,” in reference to an individual product, refers to the number of computers, tablets or smartphones on which such product has been installed or downloaded and that accessed the internet at least once during the relevant month. A single device with multiple applications installed is counted as one user. A single person with applications installed on multiple devices is counted as multiple users. Multiple persons using a single device are counted as one user. The number of monthly active users for our mobile products is based on our internal statistics; |

| • | Number of mobile devices on which our applications have been “installed,” as of a specified date, refers to the cumulative number of mobile devices on which one or more of our applications have been installed as of the specified date; |

| • | “Hong Kong Listing Rules” refers to the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited; |

| • | “Overseas revenues” or “revenues from overseas markets” refers to revenues generated by our operating legal entities incorporated outside China. Such revenues are primarily attributable to customers located outside China, based on our customers’ registered addresses; and |

| • | “Variable interest entities” or “VIEs” refers to those entities incorporated in PRC consolidated in our financial statements and over which our subsidiaries exercise effective control through a series of contractual arrangements. |

| • | our business strategies, plans and priorities, including growth strategies as well as investment and acquisition plans in China and overseas; |

| • | our ability to retain and attract users, customers and business partners, and increase their spending or level of engagement with us; |

| • | our ability to expand and improve our product and service offerings; |

| • | our ability to monetize the user traffic on our platform; |

| • | our future business development, results of operations and financial condition, including the seasonal trends of our results of operations; |

| • | expectations regarding our user growth rate and user engagement; |

| • | expected changes in our revenues and cost or expense items; |

| • | competition and changes in landscape in our industry; |

| • | relevant PRC and foreign government policies and regulations relating to our industry; |

| • | general economic and business condition globally and in China; and |

| • | assumptions underlying or related to any of the foregoing. |

Item 1. |

Identity of Directors, Senior Management and Advisers |

Item 2. |

Offer Statistics and Expected Timetable |

Item 3. |

Key Information |

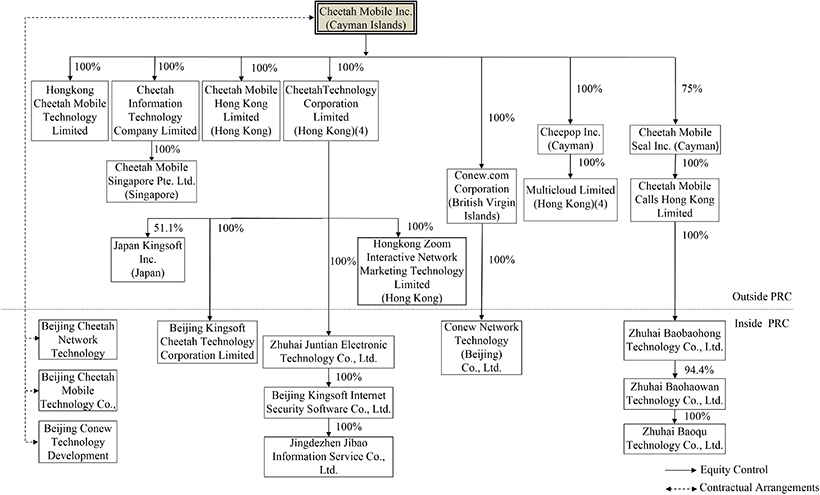

| (1) | We consolidate Beijing Network through contractual arrangements with Beijing Network and Mr. Kun Wang and Mr. Wei Liu, who owns 50% and 50% equity interests in Beijing Network, respectively. |

| (2) | We consolidate Beijing Mobile through contractual arrangements with Beijing Mobile and Mr. Sheng Fu and Ms. Weiqin Qiu, who owns 35% and 65% equity interests in Beijing Mobile, respectively. |

| (3) | We consolidate Beijing Conew through contractual arrangements with Beijing Conew and Mr. Sheng Fu and Mr. Kun Wang, who owns 62.73% and 37.27% equity interests in Beijing Conew, respectively. |

| (4) | Each of Cheetah Technology, Cheetah Mobile Calls Hong Kong Limited and Multicloud Limited has entered into deeds of nominee with the nominee shareholders of certain of our Hong Kong operating entities which we do not control through equity ownership. These deeds of nominee provide us with effective control over such Hong Kong entities, enable transfer of the economic benefits therein to us, and afford us the ability to have the equity interest held by the nominee shareholders transferred to us at our discretion. |

A. |

Selected Financial Data |

Year Ended December 31, |

||||||||||||||||||||||||

2017 (1) |

2018 (2) |

2019 (2) |

2020 (2) |

2021 (2) |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands except for shares, per share and per ADS data) |

||||||||||||||||||||||||

| Selected Consolidated Statements of Comprehensive Income/ (Loss) Data: |

||||||||||||||||||||||||

| Revenues |

4,974,757 |

4,981,705 |

3,587,695 |

1,552,645 |

784,616 |

123,123 |

||||||||||||||||||

| Internet Business (3) |

4,899,842 | 4,847,154 | 3,370,811 | 1,380,906 | 653,759 | 102,589 | ||||||||||||||||||

| AI and others |

74,915 | 134,551 | 216,884 | 171,739 | 130,857 | 20,534 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Cost of revenues (4) |

(1,780,089 | ) | (1,540,633 | ) | (1,241,932 | ) | (475,378 | ) | (257,656 | ) | (40,432 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit |

3,194,668 |

3,441,072 |

2,345,763 |

1,077,267 |

526,960 |

82,691 |

||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income and expenses: |

||||||||||||||||||||||||

| Research and development (4) |

(684,863 | ) | (668,918 | ) | (787,329 | ) | (455,179 | ) | (211,594 | ) | (33,204 | ) | ||||||||||||

| Selling and marketing (4) |

(1,656,505 | ) | (1,910,044 | ) | (1,558,315 | ) | (766,986 | ) | (370,274 | ) | (58,104 | ) | ||||||||||||

| General and administrative (4) |

(407,410 | ) | (430,826 | ) | (587,457 | ) | (380,533 | ) | (191,868 | ) | (30,108 | ) | ||||||||||||

| Impairment of goodwill |

— | — | (545,665 | ) | — | — | — | |||||||||||||||||

| Other operating income/(expenses), net |

990 | 35,938 | 22,091 | (5,684 | ) | 17,205 | 2,700 | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

(2,747,788 | ) | (2,973,850 | ) | (3,456,675 | ) | (1,608,382 | ) | (756,531 | ) | (118,716 | ) | ||||||||||||

| Operating profit (loss) |

446,880 |

467,222 |

(1,110,912 |

) |

(531,115 |

) |

(229,571 |

) |

(36,025 |

) | ||||||||||||||

| Other income/(expenses) |

986,385 | 802,501 | 745,225 | 1,039,362 | (110,000 | ) | (17,263 | ) | ||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income/(Loss) before income taxes |

1,433,265 | 1,269,723 | (365,687 | ) | 508,247 | (339,571 | ) | (53,288 | ) | |||||||||||||||

| Income tax expenses |

(57,602 | ) | (117,000 | ) | (7,904 | ) | (97,090 | ) | (13,633 | ) | (2,139 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income/(loss) |

1,375,663 | 1,152,723 | (373,591 | ) | 411,157 | (353,204 | ) | (55,427 | ) | |||||||||||||||

| Less: Net income/(loss) attributable to noncontrolling interests |

27,469 | (14,186 | ) | (59,614 | ) | (5,575 | ) | (2,078 | ) | (326 | ) | |||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income/(loss) attributable to Cheetah Mobile Inc. |

1,348,194 | 1,166,909 | (313,977 | ) | 416,732 | (351,126 | ) | (55,101 | ) | |||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings/(Losses) per share |

||||||||||||||||||||||||

| Basic |

0.9573 | 0.8048 | (0.2514 | ) | 0.2895 | (0.2469 | ) | (0.0388 | ) | |||||||||||||||

| Diluted |

0.9366 | 0.7839 | (0.2514 | ) | 0.2857 | (0.2469 | ) | (0.0388 | ) | |||||||||||||||

| Earnings/(Losses) per ADS (5) |

||||||||||||||||||||||||

| Basic |

9.5728 | 8.0478 | (2.5140 | ) | 2.8953 | (2.4694 | ) | (0.3875 | ) | |||||||||||||||

| Diluted |

9.3656 | 7.8393 | (2.5140 | ) | 2.8575 | (2.4694 | ) | (0.3875 | ) | |||||||||||||||

| Weighted average number of shares used in computation: |

||||||||||||||||||||||||

| Basic |

1,394,303,326 | 1,403,089,609 | 1,369,041,418 | 1,402,509,386 | 1,430,052,602 | 1,430,052,602 | ||||||||||||||||||

| Diluted |

1,425,154,838 | 1,440,414,849 | 1,369,041,418 | 1,421,067,906 | 1,430,052,602 | 1,430,052,602 | ||||||||||||||||||

| (1) | VAT is presented in cost of revenues rather than net against revenues in accordance with the legacy revenue accounting standard (ASC 605) |

| (2) | VAT is presented as net against revenues rather than in cost of revenues in accordance with the new revenue accounting standard (ASC 606) |

| (3) | Starting from March 31, 2017, we reorganized our operation into three segments: utility products and related services, mobile entertainment business and AI and others. In 2020, we disposed major gaming-related business. As a result, we expect the revenue contribution from our mobile game business to decrease in the foreseeable future. Therefore, we started reporting its revenues and operating profits by two segments: internet business and AI and others. In 2021, we realigned our segments as the chief operating decision maker changes how he manages and assesses our segment performance. Our overseas advertising agency services, which assists domestic companies to launch advertisement on overseas advertising platforms, are changed from the Internet business into AI and others due to the synergies created between the Company’s advertising agency services and global multi-cloud management services. We had retrospectively revised segment information from the previous periods to conform to the requisite presentation for the current period. |

| (4) | Share-based compensation expenses were allocated in cost of revenues and operating expenses as follows: |

Year Ended December 31, |

||||||||||||||||||||||||

2017 (1) |

2018 (2) |

2019 (2) |

2020 (2) |

2021 (2) |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

Cost of revenues |

762 | 206 | 524 | 1,044 | 1,027 | 161 | ||||||||||||||||||

Research and development |

20,691 | 14,224 | 59,771 | 29,091 | 5,996 | 941 | ||||||||||||||||||

Selling and marketing |

39 | 8,967 | 3,818 | (1,087 | ) | 1,339 | 210 | |||||||||||||||||

General and administrative |

51,824 | 61,721 | 63,327 | 51,934 | (1,212 | ) | (190 | ) | ||||||||||||||||

Total |

73,316 | 85,118 | 127,440 | 80,982 | 7,150 | 1,122 | ||||||||||||||||||

| (5) | Each ADS represents ten Class A ordinary shares. |

Year Ended December 31, |

||||||||||||||||||||||||

2017 |

2018 |

2019 |

2020 |

2021 |

||||||||||||||||||||

RMB |

RMB |

RMB |

RMB |

RMB |

US$ |

|||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||

Selected Consolidated Balance Sheets Data: |

||||||||||||||||||||||||

Cash and cash equivalents |

2,317,488 | 2,783,843 | 983,004 | 1,299,658 | 1,583,926 | 248,553 | ||||||||||||||||||

Short-term investments |

1,395,694 | 930,610 | 1,369,118 | 360,803 | 262,813 | 41,241 | ||||||||||||||||||

Total assets |

7,448,931 | 8,292,636 | 7,011,744 | 5,613,483 | 4,978,318 | 781,205 | ||||||||||||||||||

Total current liabilities |

2,165,754 | 1,835,765 | 1,745,119 | 1,572,317 | 1,353,894 | 212,455 | ||||||||||||||||||

Total liabilities |

2,293,721 | 2,010,241 | 2,017,197 | 1,825,091 | 1,618,175 | 253,926 | ||||||||||||||||||

Total mezzanine equity |

649,246 | 687,847 | — | — | — | — | ||||||||||||||||||

Total Cheetah Mobile Inc. shareholders’ equity |

4,293,361 | 5,476,465 | 4,932,278 | 3,747,381 | 3,279,126 | 514,566 | ||||||||||||||||||

Total shareholders’ equity |

4,505,964 | 5,594,548 | 4,994,547 | 3,788,392 | 3,360,143 | 527,279 | ||||||||||||||||||

For the Year Ended December 31, 2021 |

||||||||||||||||||||

Cheetah Mobile Inc. |

Company Subsidiaries |

Consolidated Variable Interest Entities |

Eliminations |

Consolidated Total |

||||||||||||||||

(RMB, in thousands) |

||||||||||||||||||||

| Revenues |

— | 894,352 | 320,942 | (430,678 | ) | 784,616 | ||||||||||||||

| Net (loss) income |

(351,126 | ) | (358,345 | ) | (8,489 | ) | 364,756 | (353,204 | ) | |||||||||||

For the Year Ended December 31, 2020 |

||||||||||||||||||||

Cheetah Mobile Inc. |

Company Subsidiaries |

Consolidated Variable Interest Entities |

Eliminations |

Consolidated Total |

||||||||||||||||

(RMB, in thousands) |

||||||||||||||||||||

| Revenues |

— | 1,316,872 | 659,626 | (423,853 | ) | 1,552,645 | ||||||||||||||

| Net income (loss) |

416,732 | (48,734 | ) | (8,825 | ) | 51,984 | 411,157 | |||||||||||||

For the Year Ended December 31, 2019 |

||||||||||||||||||||

Cheetah Mobile Inc. |

Company Subsidiaries |

Consolidated Variable Interest Entities |

Eliminations |

Consolidated Total |

||||||||||||||||

(RMB, in thousands) |

||||||||||||||||||||

| Revenues |

— | 3,462,093 | 586,404 | (460,802 | ) | 3,587,695 | ||||||||||||||

| Net (loss) income |

(313,977 | ) | (906,989 | ) | (88,559 | ) | 935,934 | (373,591 | ) | |||||||||||

As of December 31, 2021 |

||||||||||||||||||||

Cheetah Mobile Inc. |

Company Subsidiaries |

Consolidated Variable Interest Entities |

Eliminations |

Consolidated Total |

||||||||||||||||

(RMB, in thousands) |

||||||||||||||||||||

Cash and cash equivalents |

20,401 | 1,526,029 | 37,496 | — | 1,583,926 | |||||||||||||||

Restricted cash |

— | 637 | 144 | — | 781 | |||||||||||||||

Short-term investments |

— | 142,616 | 120,197 | — | 262,813 | |||||||||||||||

Due from related parities |

— | 46,709 | 54,624 | — | 101,333 | |||||||||||||||

Others |

147,396 | 467,870 | 34,368 | — | 649,634 | |||||||||||||||

Total current assets |

167,797 |

2,183,861 |

246,829 |

— |

2,598,487 |

|||||||||||||||

Investments in subsidiaries |

897,699 | — | — | (897,699 | ) | — | ||||||||||||||

Due from related parities |

— | 111,335 | — | — | 111,335 | |||||||||||||||

Others |

449,850 | 1,465,166 | 353,480 | — | 2,268,496 | |||||||||||||||

Total non-current assets |

1,347,549 |

1,576,501 |

353,480 |

(897,699 |

) |

2,379,831 |

||||||||||||||

Amount due from Group companies |

3,124,311 | 2,229,709 | 706,646 | (6,060,666 | ) | — | ||||||||||||||

Total assets |

4,639,657 |

5,990,071 |

1,306,955 |

(6,958,365 |

) |

4,978,318 |

||||||||||||||

Due to related parties |

— | 8,735 | 29,025 | — | 37,760 | |||||||||||||||

Others |

31,107 | 1,129,974 | 155,053 | — | 1,316,134 | |||||||||||||||

Total current liabilities |

31,107 |

1,138,709 |

184,078 |

— |

1,353,894 |

|||||||||||||||

Total non-current liabilities |

169,629 |

86,705 |

7,947 |

— |

264,281 |

|||||||||||||||

Amount due to Group companies |

1,159,795 | 3,876,360 | 1,024,511 | (6,060,666 | ) | — | ||||||||||||||

Total liabilities |

1,360,531 |

5,101,774 |

1,216,536 |

(6,060,666 |

) |

1,618,175 |

||||||||||||||

As of December 31, 2020 |

||||||||||||||||||||

Cheetah Mobile Inc. |

Company Subsidiaries |

Consolidated Variable Interest Entities |

Eliminations |

Consolidated Total |

||||||||||||||||

(RMB, in thousands) |

||||||||||||||||||||

Cash and cash equivalents |

18,243 | 1,253,355 | 28,060 | — | 1,299,658 | |||||||||||||||

Restricted cash |

— | 653 | 144 | — | 797 | |||||||||||||||

Short-term investments |

— | 360,788 | 15 | — | 360,803 | |||||||||||||||

Due from related parities |

86,296 | 77,354 | 60,673 | — | 224,323 | |||||||||||||||

Others |

131,128 | 838,281 | 91,871 | — | 1,061,280 | |||||||||||||||

Total current assets |

235,667 |

2,530,431 |

180,763 |

— |

2,946,861 |

|||||||||||||||

Investments in subsidiaries |

2,625,791 | — | — | (2,625,791 | ) | — | ||||||||||||||

Due from related parities |

— | 3,522 | — | — | 3,522 | |||||||||||||||

Others |

492,714 | 1,850,158 | 320,228 | — | 2,663,100 | |||||||||||||||

Total non-current assets |

3,118,505 |

1,853,680 |

320,228 |

(2,625,791 |

) |

2,666,622 |

||||||||||||||

Amount due from Group companies |

1,343,691 | 1,378,140 | 684,257 | (3,406,088 | ) | — | ||||||||||||||

Total assets |

4,697,863 |

5,762,251 |

1,185,248 |

(6,031,879 |

) |

5,613,483 |

||||||||||||||

Due to related parties |

86,296 | (57,707 | ) | 20,349 | — | 48,938 | ||||||||||||||

Others |

25,662 | 1,377,325 | 120,392 | — | 1,523,379 | |||||||||||||||

Total current liabilities |

111,958 |

1,319,618 |

140,741 |

— |

1,572,317 |

|||||||||||||||

Total non-current liabilities |

170,684 |

59,949 |

22,141 |

— |

252,774 |

|||||||||||||||

Amount due to Group companies |

667,840 | 1,810,356 | 927,892 | (3,406,088 | ) | — | ||||||||||||||

Total liabilities |

950,482 |

3,189,923 |

1,090,774 |

(3,406,088 |

) |

1,825,091 |

||||||||||||||

For the Year Ended December 31, 2021 |

||||||||||||||||||||

Cheetah Mobile Inc. |

Company Subsidiaries |

Consolidated Variable Interest Entities |

Eliminations |

Consolidated Total |

||||||||||||||||

(RMB, in thousands) |

||||||||||||||||||||

Net cash provided by/(used in) operating activities |

666 | (121,934 | ) | 209,357 | 14,722 | 102,811 | ||||||||||||||

Net cash (used in)/provided by investing activities |

(864,999 | ) | 251,806 | (255,027 | ) | 1,089,056 | 220,836 | |||||||||||||

Net cash provided by/(used in) financing activities |

891,960 | 111,085 | 91,093 | (1,103,778 | ) | (9,640 | ) | |||||||||||||

For the Year Ended December 31, 2020 |

||||||||||||||||||||

Cheetah Mobile Inc. |

Company Subsidiaries |

Consolidated Variable Interest Entities |

Eliminations |

Consolidated Total |

||||||||||||||||

(RMB, in thousands) |

||||||||||||||||||||

Net cash (used in)/provided by operating activities |

(2,186 | ) | 419,715 | (36,196 | ) | (427,465 | ) | (46,132 | ) | |||||||||||

Net cash provided by investing activities |

1,345,523 | 85,901 | 21,168 | 427,771 | 1,880,363 | |||||||||||||||

Net cash (used in)/provided by financing activities |

(1,453,285 | ) | 2,934 | — | (306 | ) | (1,450,657 | ) | ||||||||||||

For the Year Ended December 31, 2019 |

||||||||||||||||||||

Cheetah Mobile Inc. |

Company Subsidiaries |

Consolidated Variable Interest Entities |

Eliminations |

Consolidated Total |

||||||||||||||||

(RMB, in thousands) |

||||||||||||||||||||

Net cash (used in)/provided by operating activities |

(15,258 | ) | (1,407,336 | ) | 62,401 | 1,120,649 | (239,544 | ) | ||||||||||||

Net cash provided by/(used in) investing activities |

375,584 | (270,775 | ) | (69,386 | ) | (1,120,649 | ) | (1,085,226 | ) | |||||||||||

Net cash (used in)/provided by financing activities |

(494,055 | ) | 8,985 | — | — | (485,070 | ) | |||||||||||||

B. |

Capitalization and Indebtedness |

C. |

Reasons for the Offer and Use of Proceeds |

D. |

Risk Factors |

| • | Our products monthly active users decreased in the past years and may continue to decrease in the future, which would materially and adversely affect our business, financial condition and results of operations would be materially and adversely affected. |

| • | Because a limited number of customers contribute to a significant portion of our revenues, our revenues and results of operations could be materially and adversely affected if we were to lose a significant customer or a significant portion of its business. |

| • | We are subject to risks and uncertainties faced by companies in a rapidly evolving industry. |

| • | If we fail to compete effectively, our business, financial condition and results of operations may be materially and adversely affected. |

| • | We have certain operations in international markets. If we fail to meet the challenges presented by our overseas operations, our business, financial conditions and results of operations may be adversely affected. |

| • | Actual or alleged failure to comply with Chinese laws and regulations on data privacy and protection laws and regulations could damage our reputation, discourage current and potential users from using our products and services applications and subject us to damages, administrative penalties and criminal liabilities, which could have material adverse effects on our business and results of operations. |

| • | Our business is subject to complex and evolving laws and regulations regarding privacy, data protection, and other matters both within and outside China. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in claims, changes to our business practices, monetary penalties, increased cost of operations, or declines in user growth or engagement, or otherwise harm our business. |

| • | Our shopping-mall coupon-selling business could be negatively impacted by COVID-19. Shops could be closed and restaurants could stop eat-in due to COVID-19, which could have adverse effects on our business and results of operations. |

| • | We are a Cayman Islands holding company conducting our operations in China through (i) our PRC subsidiaries and (ii) the VIEs with which we have maintained contractual arrangements. We have no equity ownership in the VIEs and their subsidiaries. Holders of our Class A ordinary shares or the ADSs hold equity interest in Cheetah Mobile Inc., our Cayman Islands holding company, and do not have direct or indirect equity interests in the VIEs and their subsidiaries. If the PRC government deems that our contractual arrangements with the VIEs do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations. Our holding company in the Cayman Islands, the VIEs, and investors of our company face uncertainty about potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the VIEs and, consequently, significantly affect the financial performance of the VIEs and our company as a group. |

| • | We rely on contractual arrangements with the VIEs and their shareholders for the operation of our business in China, which may not be as effective as direct ownership. |

| • | Uncertainties in the interpretation and enforcement of Chinese laws and regulations could limit the legal protections available to you and us. |

| • | The PRC government’s significant oversight over our business operation could result in a material adverse change in our operations and the value of our ADSs. |

| • | The approval of and filing with the CSRC or other PRC government authorities may be required in connection with our future offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing. |

| • | A severe or prolonged downturn in the global economy could materially and adversely affect our business and financial condition. |

| • | We may be adversely affected by the complexity of, and uncertainties and changes in, PRC regulation on mobile and PC internet businesses and companies. |

| • | It may be difficult for overseas regulators to conduct investigation, collect evidence or obtain materials or data within China. |

| • | The PCAOB is currently unable to inspect our auditor in relation to their audit work performed for our financial statements and the inability of the PCAOB to conduct inspections over our auditor deprives our investors with the benefits of such inspections. |

| • | The ADSs will be prohibited from trading in the United States under the HFCAA in 2024 if the PCAOB is unable to inspect or fully investigate auditors located in China, or in 2023 if proposed changes to the law are enacted. The delisting of the ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment. |

| • | The trading price of our ADSs has been volatile and may continue to be volatile regardless of our operating performance. |

| • | We believe that we were a passive foreign investment company, or PFIC, for United States federal income tax purposes for the taxable year ended December 31, 2021, which could subject United States investors in the ADSs or Class A ordinary shares to significant adverse United States income tax consequences. |

| • | we fail to maintain the popularity of our existing products for users; |

| • | we are unsuccessful in launching new and popular applications in a cost-effective manner to further diversify our product offerings and increase user engagement; |

| • | technical or other problems prevent us from delivering our products or services in a rapid and reliable manner or otherwise affect user experience; |

| • | strategic investments or acquisitions that we make to diversify or improve our products or services offerings fail to generate the favorable results or synergies that we anticipate; |

| • | there are user concerns related to privacy, safety, security or other factors; |

| • | our competitors may launch or develop products and services similar to ours, which may result in a loss of existing users or reduced growth in new users; |

| • | products adopting new technologies displace our products; |

| • | there are adverse changes in our products or services that are mandated by, or that we elect to make to address, legislation, regulatory authorities or litigation, including settlements or consent decrees; |

| • | there are regulatory enforcement actions or negative publicity for actual or perceived defects of our products and services; |

| • | we fail to provide adequate customer service to users; or |

| • | we do not maintain our brand image, or our reputation is damaged. |

| • | successfully implement our plan to further develop and monetize our mobile platform; |

| • | offer new, innovative products and services and enhance our existing products and services with innovative and advanced technology to attract and retain a larger user base; |

| • | retain existing customers, attract additional customers and restore collaborations with lost customers, and increase spending per customer; |

| • | maintain our relationships with important suppliers, such as bandwidth suppliers, on favorable terms; |

| • | respond to evolving user preferences and industry changes; |

| • | respond to competitive market conditions; |

| • | upgrade our technology to support traffic, product and service offerings; |

| • | maintain effective control of our costs and expenses; |

| • | respond to changes in the regulatory environment and manage legal risks, including those associated with intellectual property rights; and |

| • | execute our strategic investments and acquisitions and post-acquisition integrations effectively. |

| • | challenges in formulating effective marketing strategies targeting mobile internet users from various jurisdictions and cultures, who have a diverse range of preferences and demands; |

| • | challenges in identifying appropriate local business partners and establishing and maintaining good working relationships with them. |

| • | local competition; |

| • | challenges in meeting local advertiser demands as well as online marketing practices and conventions; |

| • | differences in user and advertiser reception and perception of our applications internationally; |

| • | challenges in building direct sales operations in the oversea market; |

| • | fluctuations in currency exchange rates; |

| • | compliance with applicable foreign laws and regulations, including but not limited to internet content requirements, foreign exchange controls, cash repatriation restrictions, intellectual property protection rules and data privacy requirements; |

| • | exposure to different tax jurisdictions that may subject us to greater fluctuations in our effective tax rate and assessments in multiple jurisdictions on various tax-related assertions, including transfer pricing adjustments and permanent establishment; and |

| • | increased costs associated with doing business in foreign jurisdictions. |

| • | our ability to provide a convenient and reliable user experience as user preferences evolve and we expand into new applications; |

| • | our ability to increase brand awareness among existing and potential users and customers through various marketing and promotional activities; |

| • | our ability to adopt new technologies or adapt our applications to meet user needs or the expectations of our customers; |

| • | our ability to maintain and enhance our brands in the face of potential challenges from third parties; |

| • | actions by third parties, through whom we collect revenues and perform other business functions, that may affect our reputation; and |

| • | our ability to differentiate our brands and products from those of Kingsoft Corporation. |

| • | levying fines or confiscating our income or the income of our PRC entities; |

| • | revoking or suspending the business licenses or operating licenses of our PRC entities; |

| • | shutting down our servers or blocking our platform, discontinuing or placing restrictions or onerous conditions on our operations; |

| • | requiring us to discontinue or restrict our operations; and |

| • | taking other regulatory or enforcement actions that could be harmful to our business. |

| • | variations in our revenues, earnings and cash flow; |

| • | announcements of new investments, acquisitions, strategic partnerships, or joint ventures by us or our competitors; |

| • | announcements of disposal of business or assets; |

| • | announcements of new services and expansions by us or our competitors; |

| • | announcement of termination of partnership by important customers/vendors; |

| • | changes in financial estimates by securities analysts; |

| • | fluctuations in our user or other operating metrics; |

| • | fluctuations in the stock price of Kingsoft Corporation, one of our principal shareholders, or news about Kingsoft Corporation that has an impact on us; |

| • | failure on our part to realize monetization opportunities as expected; |

| • | changes in revenues generated from our top customers; |

| • | additions or departures of key personnel; |

| • | detrimental negative publicity about us, our management, our competitors or our industry; |

| • | short seller reports that make allegations against us or our affiliates, even if unfounded; |

| • | regulatory developments affecting us or our industry; and |

| • | potential litigation or regulatory investigations. |

| • | recognize or enforce against us judgments of courts of the United States based on certain civil liability provisions of U.S. securities laws; and |

| • | impose liabilities against us, in original actions brought in the Cayman Islands, based on certain civil liability provisions of U.S. securities laws that are penal in nature. |

| • | we have failed to timely provide the depositary with notice of meeting and related voting materials; |

| • | we have instructed the depositary that we do not wish a discretionary proxy to be given; |

| • | we have informed the depositary that there is substantial opposition as to a matter to be voted on at the meeting; |

| • | a matter to be voted on at the meeting would have a material adverse impact on shareholders; or |

| • | the voting at the meeting is to be made on a show of hands. |

Item 4. |

Information on the Company |

A. |

History and Development of the Company |

B. |

Business Overview |

| • | Advertisement Law of the People’s Republic of China, promulgated by the Standing Committee of the National People’s Congress on October 27, 1994 and effective since February 1, 1995, the latest version of which became effective on April 29, 2021; |

| • | Administrative Regulations for Advertising, promulgated by the State Council on October 26, 1987 and effective since December 1, 1987; and |

| • | Interim Measures for the Administration of Internet Advertisements, promulgated by the SAIC on July 4, 2016 and effective on September 1, 2016. |

| • | Administrative Measures for Broadcasting Audio/Video Programs through the Internet and Other Information Networks, or the Audio/Video Broadcasting Measures, issued by SARFT on July 6, 2004, effective since October 11, 2004 and updated in August 2015 (SARFT Order [2015] No. 3), which were superseded by Administrative Measures for Private Network and Directional Broadcast Audio/ Video Program Service (SARFT Order [2016] No. 6 or Order 6), which was promulgated on April 25, 2016 and became effective on June 1, 2016 and subsequently amended on March 23, 2021; |

| • | Administrative Provisions for Internet Audio/Video Program Service, commonly known as Circular 56, jointly promulgated by the SARFT and the MIIT on December 20, 2007, effective since January 31, 2008 and updated in August 2015 (SARFT Order [2015] No. 3); |

| • | Notice on Issuing the “Catalogue of Classification of Internet Audio/Video Program Services (Provisional)”, or the Classification Catalogue, promulgated by the SARFT on March 17, 2010, effective since then and updated in March 2017 (SARFT Announcement [2017] No. 1); and |

| • | Notice on Strengthening the Administration of Internet Audio/Video Content, or the Internet Audio/ Video Content Notice, promulgated by SARFT on March 31, 2009 and effective since then. |

| • | Product Quality Law of the PRC, which was promulgated by the Standing Committee of the National People’s Congress of the People’s Republic of China on February 22, 1993 and subsequently amended on July 8, 2000, August 27, 2009 and December 29, 2018; |

| • | E-Commerce Law of the People’s Republic of China, which was promulgated by the Standing Committee of the National People’s Congress of the People’s Republic of China on August 31, 2018 and became effective on January 1, 2019, |

| • | Measures for the Administration of the Recall of Defective Consumer Goods, which was promulgated by the General Administration of Quality Supervision, Inspection and Quarantine (having been restructured and named to the SAMR), on October 21, 2015 and became effective on January 1, 2016, |

| • | Interim Provisions on the Administration of Recall of Consumer Goods, which was promulgated by the SAMR on November 21, 2019 and became effective on January 1, 2020 Measures for the Administration of the Restricted Use of the Hazardous Substances Contained in Electrical and Electronic Products, which was promulgated by the National Development and Reform Commission, the Ministry of Science and Technology, the Ministry of Finance, the Ministry of Environmental Protection, the Ministry of Commerce, the General Administration of Customs and the General Administration of Quality Supervision, Inspection and Quarantine on January 6, 2016 and became effective on July 1, 2016, |

| • | Civil Code of the PRC, which was promulgated by the National People’s Congress on May 28, 2020 and became effective on January 1, 2021, |

| • | Measures for the Supervision and Administration of Online Transactions, which was promulgated by the State Administration for Market Regulation on March 15, 2021 and became effective on May 1, 2021. |

| • | Administrative Measures for the Verification and Approval and Record-Filing of Outbound Investment Projects, or the NDRC Order No. 9, promulgated by the NDRC on April 8, 2014, effective since May 8, 2014 and updated in December 27, 2014 (NDRC Order No. 20), which was repealed by Administrative Measures for Outbound Investment by Enterprises, or the NDRC Order No. 11, promulgated by NDRC on December 26, 2017, effective since March 1, 2018 (NDRC Order No. 11); |

| • | Catalogue of Investment Projects Subject to Government Verification and Approval (2016 Version), promulgated by the State Council on December 12, 2016, effective since then; |

| • | Administrative Measures for Outbound Investment, issued by the MOFCOM on September 6, 2014, effective since October 6, 2014; and |

| • | Notice of the State Administration of Foreign Exchange on Further Simplifying and Improving the Policies of Foreign Exchange Administration Applicable to Direct Investment, promulgated by the SAFE on February 13, 2015, effective since then. The Annex of this notice, named Guidelines for Direct Investment Foreign Exchange Business Operations, was partially repealed according to Notice by the State Administration of Foreign Exchange of Repealing or Invalidating Five Regulatory Documents on Foreign Exchange Administration and Clauses of Seven Regulatory Documents on Foreign Exchange Administration. |

| • | the primary location of the day-to-day |

| • | decisions relating to the enterprise’s financial and human resource matters are made or are subject to approval of organizations or personnel in the PRC; |

| • | the enterprise’s primary assets, accounting books and records, company seals and board and shareholder resolutions are located or maintained in the PRC; and |

| • | 50% or more of voting board members or senior executives habitually reside in the PRC. |

| • | Labor Law of the People’s Republic of China, promulgated by the Standing Committee of the National People’s Congress on July 5, 1994, effective since January 1, 1995 and amended on August 27, 2009 and December 29, 2018; |

| • | Labor Contract Law of the People’s Republic of China, promulgated by the Standing Committee of the National People’s Congress on June 29, 2007 and effective since January 1, 2008 and amended on December 28, 2012; |

| • | Implementation Rules of the PRC Labor Contract Law, promulgated by the State Council on September 18, 2008 and effective since September 18, 2008; |

| • | Work-related Injury Insurance Regulations, promulgated by the State Council on April 27, 2003 and effective since January 1, 2004 and amended on December 20, 2010; |

| • | Interim Provisions on Registration of Social Insurance, promulgated by the Ministry of Human Resources and Social Security (formerly the Ministry of Labor and Social Security) on March 19, 1999 and effective since March 19, 1999 and repealed by the Decision of the Ministry of Human Resources and Social Security on April 28, 2019; |

| • | Interim Regulations on the Collection and Payment of Social Insurance Fees, promulgated by the State Council on January 22, 1999 and effective since January 22, 1999; |

| • | Social Insurance Law promulgated by the National People’s Congress on October 28, 2010, effective since July 1, 2011 and amended on December 29, 2018; and |

| • | Regulations on Unemployment promulgated by the State Council on January 22, 1999, effective since January 22, 1999. |

| • | exercise effective control over the VIEs; |

| • | receive substantially all of the economic benefits of the VIEs in consideration for the services provided by Beijing Security and Conew Network, our wholly-owned subsidiaries in China; and |

| • | have an exclusive option to purchase all of the equity interests in the VIEs, when and to the extent permitted under PRC law, regulations or legal proceedings. |

| • | the corporate structure of our PRC subsidiaries and VIEs does not result in any violation of all existing PRC laws and regulations; |

| • | each of the VIE agreements among us or our first-tier subsidiaries, either Beijing Security or Conew Network, Cheetah Mobile Inc., each of the VIEs and its respective shareholders (as the case may be) governed by PRC law is valid and binding, and does not result in any violation of PRC laws or regulations currently in effect; and |

| • | each of our PRC subsidiaries and VIEs has the necessary corporate power and authority to conduct its business as described in its business scope under its business license. The business licenses of each of our PRC subsidiaries and VIEs are in full force and effect. Each of our PRC subsidiaries and VIEs is capable of suing and being sued and may be the subject of any legal proceedings in PRC courts. To the best of our PRC legal counsel’s knowledge after due inquiries, none of our PRC subsidiaries and VIEs or their respective assets is entitled to any immunity, on the grounds of sovereignty, from any action, suit or other legal proceedings, or from enforcement, execution or attachment. |

Item 4A. |

Unresolved Staff Comments |

Item 5. |

Operating and Financial Review and Prospects |

Years Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% of revenues |

RMB |

% of revenues |

RMB |

US$ |

% of revenues |

||||||||||||||||||||||

| Internet business |

3,370,811 | 94.0 | 1,380,906 | 88.9 | 653,759 | 102,589 | 83.3 | |||||||||||||||||||||

| AI and others |

216,884 | 6.0 | 171,739 | 11.1 | 130,857 | 20,534 | 16.7 | |||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Revenues |

3,587,695 |

100.0 |

1,552,645 |

100.0 |

784,616 |

123,123 |

100.0 |

|||||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| • | User base and user engagement in key markets |

| • | Fee arrangements with our significant customers. |

| • | Ability to provide targeted advertising. |

| • | Number of paying users |

Years Ended December 31, |

||||||||||||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||||||||||||

RMB |

% of revenues |

RMB |

% of revenues |

RMB |

US$ |

% of revenues |

||||||||||||||||||||||

(in thousands, except percentages) |

||||||||||||||||||||||||||||

| Operating income and expenses |

||||||||||||||||||||||||||||

| Research and development |

(787,329 | ) | (21.9 | ) | (455,179 | ) | (29.3 | ) | (211,594 | ) | (33,204 | ) | (27.0 | ) | ||||||||||||||

| Selling and marketing |

(1,558,315 | ) | (43.4 | ) | (766,986 | ) | (49.4 | ) | (370,274 | ) | (58,104 | ) | (47.2 | ) | ||||||||||||||

| General and administrative |

(587,457 | ) | (16.4 | ) | (380,533 | ) | (24.5 | ) | (191,868 | ) | (30,108 | ) | (24.5 | ) | ||||||||||||||

| Impairment of goodwill |

(545,665 | ) | (15.2 | ) | — | — | — | — | — | |||||||||||||||||||

| Other operating income (expenses), net |

22,091 | 0.6 | (5,684 | ) | (0.4 | ) | 17,205 | 2,700 | 2.2 | |||||||||||||||||||

| Total operating income and expenses |

(3,456,675 | ) | (96.3 | ) | (1,608,382 | ) | (103.6 | ) | (756,531 | ) | (118,716 | ) | (96.5 | ) | ||||||||||||||

Year Ended December |

||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||||

(in thousands) |

||||||||||||||||||

| Cayman Islands |

Income before income tax | 332,254 | 488,844 | 17,406 | 2,731 | |||||||||||||

| Income tax expenses computed at the PRC statutory tax rate of 25% | 83,063 | 122,212 | 4,352 | 683 | ||||||||||||||

| Income tax expenses computed at Cayman Islands statutory tax rate of 0% | — | — | — | — | ||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Effect of differing tax rates in different jurisdictions |

(83,063 |

) |

(122,212 |

) |

(4,352 |

) |

(683 |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| USA |

Income (Loss) before income tax | 1,306 | (6,559 | ) | (1,350 | ) | (212 | ) | ||||||||||

| Income tax expenses (benefits) computed at the PRC statutory tax rate of 25% | 326 | (1,640 | ) | (338 | ) | (53 | ) | |||||||||||

| Income tax expenses (benefits) computed at the U.S. statutory tax rate of 21% | 274 | (1,376 | ) | (284 | ) | (45 | ) | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Effect of differing tax rates in different jurisdictions |

(52 |

) |

262 |

54 |

8 |

|||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| Hong Kong |

(Loss) Income before income tax | (319,449 | ) | 324,517 | 147,306 | 23,115 | ||||||||||||

| Income tax (benefits) expenses computed at the PRC statutory tax rate of 25% | (79,862 | ) | 81,129 | 36,826 | 5,779 | |||||||||||||

| Income tax (benefits) expenses computed at the Hong Kong statutory tax rate of 16.5% | (52,707 | ) | 53,545 | 24,305 | 3,814 | |||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Effect of differing tax rates in different jurisdictions |

27,155 |

(27,584 |

) |

(12,521 |

) |

(1,965 |

) | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| Singapore |

Income before income tax | 68,594 | 18,149 | (3,515 | ) | (552 | ) | |||||||||||

| Income tax expenses computed at the PRC statutory tax rate of 25% | 17,148 | 4,537 | (879 | ) | (138 | ) | ||||||||||||

| Income tax expenses computed at the Singapore statutory tax rate of 17% | 11,661 | 3,085 | (598 | ) | (94 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Effect of differing tax rates in different jurisdictions |

(5,487 |

) |

(1,452 |

) |

281 |

44 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| PRC |

Income (Loss) before income tax | (589,754 | ) | (325,686 | ) | (490,025 | ) | (76,897 | ) | |||||||||

| Income tax expenses (benefits) computed at the PRC statutory tax rate of 25% | (147,439 | ) | (81,421 | ) | (122,506 | ) | (19,224 | ) | ||||||||||

Year Ended December |

||||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||||

(in thousands) |

||||||||||||||||||

| Income tax expenses (benefits) computed at the PRC statutory tax rate of 25% | (147,439 | ) | (81,421 | ) | (122,506 | ) | (19,224 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Effect of differing tax rates in different jurisdictions |

— |

— |

— |

— |

||||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| France |

Income (Loss) before income tax | (244,796 | ) | 338 | (1,751 | ) | (275 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| Income tax expenses (benefits) computed at the PRC statutory tax rate of 25% | (61,199 | ) | 84 | (438 | ) | (69 | ) | |||||||||||

| Income tax expenses (benefits) computed at the French statutory tax rate of 26.5% | (81,515 | ) | 112 | (464 | ) | (73 | ) | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Effect of differing tax rates in different jurisdictions |

(20,316 |

) |

28 |

(26 |

) |

(4 |

) | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| Taiwan |

(Loss) Income before income tax | (1,053 | ) | 122 | (2,064 | ) | (324 | ) | ||||||||||

| Income tax (benefits) expenses computed at the PRC statutory tax rate of 25% | (263 | ) | 31 | (516 | ) | (81 | ) | |||||||||||

| Income tax (benefits) expenses computed at the Taiwan statutory tax rate of 20% | (211 | ) | 24 | (413 | ) | (65 | ) | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Effect of differing tax rates in different jurisdictions |

52 |

(7 |

) |

103 |

16 |

|||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| Others |

Income (Loss) before income tax | 387,211 | 8,522 | (5,578 | ) | (874 | ) | |||||||||||

| Income tax expenses computed at the PRC statutory tax rate of 25% | 96,803 | 2,130 | (1,395 | ) | (219 | ) | ||||||||||||

| Income tax expenses computed at the statutory tax rates of such other jurisdictions | 455 | 2,627 | (1,698 | ) | (266 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Effect of differing tax rates in different jurisdictions |

(96,348 |

) |

497 |

(303 |

) |

(47 |

) | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

| Total |

Income (Loss) before income tax | (365,687 | ) | 508,247 | (339,571 | ) | (53,288 | ) | ||||||||||

| Income tax expenses (benefits) computed at the PRC statutory tax rate of 25% | (91,423 | ) | 127,062 | (84,894 | ) | (13,322 | ) | |||||||||||

| Income tax expenses (benefits) computed at the statutory tax rate of different jurisdictions | (269,482 | ) | (23,404 | ) | (101,658 | ) | (15,953 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Effect of differing tax rates in different jurisdictions |

(178,059 |

) |

(150,466 |

) |

(16,764 |

) |

(2,631 |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||||

Year Ended December |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| PRC (1) |

84,520 | 18,671 | 44,909 | 7,047 | ||||||||||||

| Others |

— | — | — | — | ||||||||||||

| Total |

84,520 |

18,671 |

44,909 |

7,047 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Certain of our PRC entities are entitled to tax holiday as new software development enterprise or high new technology enterprise. For details, see “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Taxation—Taxation in Different Jurisdictions—PRC—Enterprise Income Tax.” |

Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Selected Consolidated Statements of Comprehensive income (loss): |

||||||||||||||||

| Revenues |

3,587,695 | 1,552,645 | 784,616 | 123,123 | ||||||||||||

| Internet business |

3,370,811 | 1,380,906 | 653,759 | 102,589 | ||||||||||||

| AI and others |

216,884 | 171,739 | 130,857 | 20,534 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Cost of revenues (1) |

(1,241,932 | ) | (475,378 | ) | (257,656 | ) | (40,432 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Gross profit |

2,345,763 |

1,077,267 |

526,960 |

82,691 |

||||||||||||

| Operating income and expenses |

||||||||||||||||

| Research and development (1) |

(787,329 | ) | (455,179 | ) | (211,594 | ) | (33,204 | ) | ||||||||

| Selling and marketing (1) |

(1,558,315 | ) | (766,986 | ) | (370,274 | ) | (58,104 | ) | ||||||||

| General and administrative (1) |

(587,457 | ) | (380,533 | ) | (191,868 | ) | (30,108 | ) | ||||||||

| Impairment of goodwill |

(545,665 | ) | — | — | — | |||||||||||

| Other operating income (expenses), net |

22,091 | (5,684 | ) | 17,205 | 2,700 | |||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total operating expenses, net |

(3,456,675 |

) |

(1,608,382 |

) |

(756,531 |

) |

(118,716 |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Operating loss |

(1,110,912 |

) |

(531,115 |

) |

(229,571 |

) |

(36,025 |

) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Other income (expenses) |

||||||||||||||||

| Interest income, net |

110,010 | 35,655 | 25,391 | 3,984 | ||||||||||||

| Foreign exchange gain, net |

49 | 39,393 | 24,288 | 3,811 | ||||||||||||

| Other income |

887,494 | 1,081,506 | 252,998 | 39,700 | ||||||||||||

| Other expense |

(252,328 | ) | (117,192 | ) | (412,677 | ) | (64,758 | ) | ||||||||

| (Loss) income before income taxes |

(365,687 |

) |

508,247 |

(339,571 |

) |

(53,288 |

) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Income tax expenses |

(7,904 | ) | (97,090 | ) | (13,633 | ) | (2,139 | ) | ||||||||

| Net (loss) income |

(373,591 |

) |

411,157 |

(353,204 |

) |

(55,427 |

) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Less: net loss attributable to noncontrolling interests |

(59,614 | ) | (5,575 | ) | (2,078 | ) | (326 | ) | ||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Net (loss) income attributable to Cheetah Mobile Inc. |

(313,977 |

) |

416,732 |

(351,126 |

) |

(55,101 |

) | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| (1) | Share-based compensation expenses were allocated in cost of revenues and operating expenses as follows: |

Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Cost of revenues |

524 |

1,044 |

1,027 |

161 |

||||||||||||

| Research and development |

59,771 |

29,091 |

5,996 |

941 |

||||||||||||

| Selling and marketing |

3,818 |

(1,087 |

) |

1,339 |

210 |

|||||||||||

| General and administrative |

63,327 |

51,934 |

(1,212 |

) |

(190 |

) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Total |

127,440 |

80,982 |

7,150 |

1,122 |

||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

Revenues: |

||||||||||||||||

Internet business |

||||||||||||||||

Online advertising |

2,074,256 | 855,430 | 354,604 | 55,645 | ||||||||||||

Internet value-added services |

1,296,555 | 525,476 | 299,155 | 46,944 | ||||||||||||

AI and Others |

||||||||||||||||

Advertising agency services |

73,762 | 84,993 | 61,588 | 9,665 | ||||||||||||

Multi-cloud Management Services |

— | 3,501 | 41,443 | 6,503 | ||||||||||||

Technical and other consulting services |

58,607 | 35,504 | 17,236 | 2,704 | ||||||||||||

Sale of AI hardware products |

84,515 | 47,741 | 10,590 | 1,662 | ||||||||||||

Total consolidated revenues |

3,587,695 |

1,552,645 |

784,616 |

123,123 |

||||||||||||

As of December 31, |

||||||||||||

2019 |

2020 |

2021 |

||||||||||

(in thousands of RMB) |

||||||||||||

Cash located outside of the PRC |

||||||||||||

—held by Company and Subsidiaries in US dollars |

570,235 | 955,720 | 1,210,677 | |||||||||

—held by Company and Subsidiaries in RMB |

801 | 1,088 | 206,901 | |||||||||

—held by Company and Subsidiaries in others |

93,629 | 101,899 | 72,092 | |||||||||

—held by VIEs in US dollars |

6,962 | 58 | 28 | |||||||||

—held by VIEs in others |

4,375 | 12 | 7 | |||||||||

Cash located in the PRC |

||||||||||||

—held by Company and Subsidiaries in RMB |

211,903 | 202,168 | 47,454 | |||||||||

—held by Company and Subsidiaries in US dollars |

63,373 | 9,630 | 9,306 | |||||||||

—held by Company and Subsidiaries in others |

254 | 1,093 | — | |||||||||

—held by VIEs in RMB |

31,464 | 27,982 | 37,453 | |||||||||

—held by VIEs in US dollars |

8 | 8 | 8 | |||||||||

Total cash and cash equivalents |

983,004 |

1,299,658 |

1,583,926 |

|||||||||

As of December 31, |

||||||||||||

2019 |

2020 |

2021 |

||||||||||

(in thousands of RMB) |

||||||||||||

| Short-term investments located outside of the PRC |

||||||||||||

| —Time deposits located outside the PRC |

230,215 | 358,976 | 640 | |||||||||

| —Other short-term investment located outside the PRC |

146,723 | — | — | |||||||||

| Short-term investments located in the PRC |

||||||||||||

| —Time deposits located in the PRC |

992,180 | 1,827 | 262,173 | |||||||||

| |

|

|

|

|

|

|||||||

| Total short-term investments |

1,369,118 | 360,803 | 262,813 | |||||||||

| |

|

|

|

|

|

|||||||

Year Ended December 31, |

||||||||||||||||

2019 |

2020 |

2021 |

||||||||||||||

RMB |

RMB |

RMB |

US$ |

|||||||||||||

(in thousands) |

||||||||||||||||

| Net cash (used in) provided by operating activities |

(239,544 | ) | (46,132 | ) | 102,811 | 16,133 | ||||||||||

| Net cash provided by (used in) investing activities |

(1,085,226 | ) | 1,880,363 | 220,836 | 34,654 | |||||||||||

| Net cash used in financing activities |

(485,070 | ) | (1,450,657 | ) | (9,640 | ) | (1,513 | ) | ||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

5,506 | (68,763 | ) | (29,755 | ) | (4,669 | ) | |||||||||

| Cash, cash equivalents and restricted cash at the beginning of year |

2,789,976 | 985,642 | 1,300,455 | 204,070 | ||||||||||||

| Net (decrease) increase in cash, cash equivalents and restricted cash |

(1,804,334 | ) | 314,813 | 284,252 | 44,605 | |||||||||||

| Cash, cash equivalents and restricted cash at the end of year |

985,642 | 1,300,455 | 1,584,707 | 248,675 | ||||||||||||

Payment due by period |

||||||||||||||||||||

Total |

Less than 1 Year |

1-3 Years |

3-5 Years |

More Than 5 Years |

||||||||||||||||

| (In thousands of RMB) | ||||||||||||||||||||

Operating lease obligations |

52,910 | 17,906 | 28,727 | 6,277 | — | |||||||||||||||

Purchase obligations |

108,334 | 54,167 | 54,167 | — | — | |||||||||||||||

Total |

161,244 |

72,073 |

82,894 |

6,277 |

— |

|||||||||||||||

Item 6. |

Directors, Senior Management and Employees |

A. |

Directors and Senior Management |

Directors and Executive Officers |

Age |

Position/Title | ||

| Sheng Fu | 44 | Chief Executive Officer and Chairman of the Board of Directors | ||

| Tao Zou | 46 | Director | ||

| Jie Xiao | 47 | Director and Senior Vice President | ||

| Ning Zhang | 48 | Independent Director | ||

| Michael Jinbo Yao | 45 | Independent Director | ||

| Dr. Yi Ma | 49 | Independent Director | ||

| Dr. Yun Zhang | 45 | Independent Director | ||

| Thomas Jintao Ren | 44 | Chief Financial Officer | ||

| Edward Mingyan Sun | 39 | Senior Vice President |

Number of Restricted Shares Outstanding |

Purchase Price(US$/Share) |

Date of Grant |

Expiration Date | |||||||||

Edward Mingyan Sun |

* | N/A | October 1, 2017 | January 1, 2024 | ||||||||

| * | N/A | May 1, 2017 | April 24, 2024 | |||||||||

| * | N/A | April 1, 2018 | January 1, 2024 | |||||||||

Thomas Jintao Ren |

* | N/A | March 22, 2020 | January 1, 2024 | ||||||||

Individuals as a group |

— | — | — | |||||||||

Total |

||||||||||||

| * | Less than 1% of our total outstanding Class A and Class B ordinary shares. |

| • | selecting the independent registered public accounting firm and pre-approving all auditing and non-auditing services permitted to be performed by the independent registered public accounting firm; |

| • | reviewing with the independent registered public accounting firm any audit problems or difficulties and management’s response; |

| • | reviewing and approving all proposed related party transactions, as defined in Item 404 of Regulation S-K under the Securities Act; |

| • | discussing the annual audited financial statements with management and the independent registered public accounting firm; |

| • | reviewing major issues as to the adequacy of our internal controls and any special audit steps adopted in light of any material control deficiencies; |

| • | annually reviewing and reassessing the adequacy of our audit committee charter; |

| • | meeting separately and periodically with management and the independent registered public accounting firm; and |

| • | reporting regularly to the board. |

| • | reviewing and approving, or recommending to the board for its approval, the compensation for our chief executive officer and other executive officers; |

| • | reviewing and recommending to the board for determination with respect to the compensation of our non-employee directors; |

| • | reviewing periodically and approving any incentive compensation or equity plans, programs or similar arrangements; and |

| • | selecting compensation consultant, legal counsel or other adviser only after taking into consideration all factors relevant to that person’s independence from management. |

| • | recommending nominees to the board for election or re-election to the board, or for appointment to fill any vacancy on the board; |

| • | reviewing annually with the board the current composition of the board with regard to characteristics such as independence, skills, experience, expertise, diversity, and availability of service to us; |

| • | selecting and recommending to the board the directors to serve as members of each standing committee of the board; and |

| • | developing and reviewing periodically the corporate governance principles adopted by the board to ensure appropriateness and compliance with the requirements of the NYSE, and to recommend any desirable changes to the board. |

| Function |

Number of Employees |

|||

| Operations |

90 | |||

| Research and development |

407 | |||

| Sales and marketing |

185 | |||

| General and administrative |

169 | |||

| |

|

|||

| Total |

851 | |||

| |

|

|||

Item 7. |

Major Shareholders and Related Party Transactions |

| • | each of our current directors and executive officers; and |

| • | each person known to us to own beneficially more than 5% of our shares. |

Shares Beneficially Owned |

Ordinary Shares Beneficially Owned |

Voting Power |

||||||||||||||

Class A Ordinary Shares |

Class B Ordinary Shares |

%(1) |

%(2) |

|||||||||||||

| Directors and Executive Officers**: |

||||||||||||||||

| Sheng Fu (3) |

31,012,650 | 68,599,088 | 7.0 | 46.4 | ||||||||||||

| Tao Zou (4) |

— | — | — | — | ||||||||||||

| Jie Xiao |

* | * | * | * | ||||||||||||

| Ning Zhang (5) |

* | — | * | — | ||||||||||||

| Michael Jinbo Yao (6) |

* | — | * | — | ||||||||||||

| Dr. Yi Ma (7) |

* | — | * | — | ||||||||||||

| Dr. Yun Zhang (8) |

* | — | * | — | ||||||||||||

| Thomas Jintao Ren |

* | — | * | — | ||||||||||||

| Edward Mingyan Sun |

* | * | * | * | ||||||||||||

| All directors and executive officers as a group |

43,823,810 | 71,899,088 | 8.1 | 46.9 | ||||||||||||

| Principal Shareholders: |

||||||||||||||||

| Kingsoft Corporation Limited (9) |

11,800,547 | 662,806,049 | 47.5 | 26.1 | ||||||||||||

| Tencent Holdings Limited (10) |

15,031,120 | 220,481,928 | 16.6 | 21.9 | % | |||||||||||

| Sheng Global Limited (11) |

29,996,440 | 65,439,278 | 6.7 | 6.7 | ||||||||||||

| * | Less than 1% of our total outstanding Class A and Class B ordinary shares. |

| ** | Unless otherwise indicated in the notes below, the business address for our directors and executive officers is Building No. 11Wandong Science and Technology Cultural Innovation Park No.7 Sanjianfangnanli, Chaoyang District, Beijing 100024, People’s Republic of China. |

| (1) | Percentage ownership is calculated by dividing the number of Class A and Class B ordinary shares beneficially owned by a given person or group by the sum of (i) 1,420,620,585 ordinary shares and (ii) the number of Class A and Class B ordinary shares that such person or group has the right to acquire upon exercise of option, warrant or other right within 60 days after March 31, 2022. |

| (2) | Percentage of total voting power represents voting power based on both Class A and Class B ordinary shares held by a given person or group with respect to the sum of all outstanding shares of our Class A and Class B ordinary shares. The holders of our Class B ordinary shares are entitled to ten votes per share, and holders of our Class A ordinary shares are entitled to one vote per share. |

| (3) | Represents (i) 25,996,440 Class A ordinary shares represented by restricted ADSs and 58,139,278 Class B ordinary shares held by Sheng Global Limited, a British Virgin Islands company wholly owned by Mr. Fu, (ii) 4,000,000 Class A ordinary shares (represented by restricted ADSs) and 7,300,000 Class B ordinary shares beneficially owned by Sheng Global Limited through FaX Vision Corporation, a British Virgin Islands company controlled by Sheng Global Limited, (iii) 585,800 Class B ordinary shares that have vested to Mr. Fu under our 2011 Plan, and (iv) 1,016,210 Class A ordinary shares and 2,574,010 Class B ordinary shares that have vested to Mr. Fu under our 2013 Plan. Kingsoft Corporation have delegated approximately 39.4% voting power of our company held by Kingsoft Corporation to Mr. Sheng Fu, effective October 1, 2017. For further details, see “Item 4. Information on the Company—A. History and Development of the Company”. |

| (4) | The business address of Mr. Zou is c/o Kingsoft Corporation Limited, Building D, Xiaomi Campus, No.33 Xierqi Middle Road, Haidian District, Beijing, People’s Republic of China. |

| (5) | The business address of Ning Zhang is 25th Floor, Shanghai Tower, No. 501, Yincheng Middle Road, Pudong New Area, Shanghai, PRC. |

| (6) | The business address of Mr. Yao is Building 101, 10 Jiuxianqiao North Road Chaoyang District, Beijing, PRC. |

| (7) | The business address of Dr. Ma is ECS Department, 333A Cory Hall#1770 University of California,Berkeley,CA 94720-1770,USA. |

| (8) | The business address of Dr. Zhang is 6402 Middleburg Ln, Bethesda, MD 20817, USA . |

| (9) | Represents (i) 5,040,877 Class A ordinary shares, (ii) 6,759,670 Class A ordinary shares represented by ADSs, and (iii) 662,806,049 Class B ordinary shares held by Kingsoft Corporation. Kingsoft Corporation is a Cayman Islands company listed on the Hong Kong Stock Exchange (Stock Code: 3888). Kingsoft Corporation have delegated approximately 39.4% voting power of our company held by Kingsoft Corporation to Mr. Sheng Fu, effective October 1, 2017. For further details, see “Item 4. Information on the Company—A. History and Development of the Company”. Kingsoft Corporation’s business address is Building D, Xiaomi Campus, No.33 Xierqi Middle Road, Haidian District, Beijing, People’s Republic of China. |

| (10) | Represents (i) 745,410 Class A ordinary shares and 14,285,710 Class A ordinary shares represented by ADSs held by THL E Limited, a British Virgin Islands company wholly owned by Tencent Holdings Limited, and (ii) 220,481,928 Class B ordinary shares held by TCH Copper Limited, a British Virgin Islands company wholly owned by Tencent Holdings Limited, as reported on the Schedule 13D jointly filed by TCH Copper Limited, Tencent Holdings Limited and THL E Limited on May 19, 2014. Tencent Holdings Limited is a Cayman Islands company listed on the Hong Kong Stock Exchange (Stock Code: 700). The business address of Tencent Holdings Limited is 29/F, Three Pacific Place, No. 1 Queen’s Road East, Wan Chai, Hong Kong. |

| (11) | Represents (i) 25,996,440 Class A ordinary shares represented by restricted ADSs and 58,139,278 Class B ordinary shares held by Sheng Global Limited and (ii) 4,000,000 Class A ordinary shares and 7,300,000 Class B ordinary shares held by FaX Vision Corporation, a British Virgin Islands company controlled by Sheng Global Limited. The registered address of Sheng Global Limited is Palm Grove House, P.O. Box 438, Road Town, Tortola, British Virgin Islands. |

| • | Promotion services pre-installation, bundle promotion, joint operation and publishing online advertisement; |

| • | Licensing services |

| • | Miscellaneous services |

Item 8. |

Financial Information |

Item 9. |

The Offer and Listing |

F. |

Expenses of the Issue |

Item 10. |

Additional Information |

| • | such excess distribution and/or gain will be allocated ratably over the U.S. holder’s holding period for the ADSs or Class A ordinary shares; |

| • | such amount allocated to the current taxable year and any taxable years in the U.S. holder’s holding period prior to the first taxable year in which we are a PFIC, or pre-PFIC year, will be taxable as ordinary income; |

| • | such amount allocated to each prior taxable year, other than a pre-PFIC year, will be subject to tax at the highest tax rate in effect applicable to the U.S. holder for that year; and an interest charge generally applicable to underpayments of tax will be imposed on the tax attributable to each prior taxable year, other than a pre-PFIC year. |

Item 11. |

Quantitative and Qualitative Disclosures about Market Risk |

Item 12. |

Description of Securities Other than Equity Securities |

Persons depositing or withdrawing shares must pay: |

For: | |

| $5.00 (or less) per 100 ADSs (or portion of 100 ADSs) | • Issuance of ADSs, including issuances resulting from a distribution of shares or rights or other property | |

• Cancellation of ADSs for the purpose of withdrawal, including if the deposit agreement terminates | ||

| $.05 (or less) per ADS | • Any cash distribution to ADS holders | |