Cheetah Mobile Inc.

Building No. 11

Wandong Science and Technology Cultural Innovation Park

No.7 Sanjianfangnanli

Chaoyang District

Beijing 100024

People’s Republic of China

August 21, 2023

VIA CORRESPONDENCE

Jimmy McNamara

Jennifer Thompson

David Edgar

Kathleen Collins

Division of Corporation Finance

Office of Technology

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

|

Re: |

Cheetah Mobile Inc. Form 20-F for the Fiscal Year Ended December 31, 2022 Filed April 18, 2023 File No. 001-36427 |

Dear Mr. McNamara, Ms. Thompson, Mr. Edgar, and Ms. Collins:

This letter sets forth the response of Cheetah Mobile Inc. (the “Company”) to the comments contained in the letter dated July 11, 2023 from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”) regarding the Company’s annual report on Form 20-F for the fiscal year ended December 31, 2022 (the “Form 20-F”).

For ease of review, we have set forth below the numbered comment of the Staff’s letter and the Company’s response thereto. Further, we will include the revisions proposed in our responses to the Staff’s comments in future annual report filings with the Commission, after the Staff’s completion of its review of our responses.

1

Form 20-F for the Fiscal Year Ended December 31, 2022

Introduction, page 1

Response: In response to the Staff’s comment, we propose to revise the definition of “China” or the “PRC” on page 1 of the Form 20-F (page reference is made to the Form 20-F to illustrate the approximate location of the disclosure) in future filings as follows (the added disclosure is underlined and the removed disclosure is crossed out):

In addition, we respectfully advise the Staff that the proposed disclosure below does not include Macau as we do not have operations in Macau.

Furthermore, we propose to revise the lead-in paragraph under “Summary of Risk Factors” at the beginning of “Item 3. Key Information—D. Risk Factors” on page 10 of the Form 20-F as follows (added disclosure is underlined):

“An investment in our ADSs or ordinary shares involves significant risks. The following list summarizes some, but not all, of these risks. All the operational risks associated with being based in and having operations in mainland China as discussed in relevant risk factors under “Item 3. Key Information—D. Risk Factors—Risks Relating to Our Business and Industry” also apply to operations in Hong Kong. With respect to the legal risks associated with being based in and having operations in mainland China as discussed in relevant risk factors under “Item 3. Key Information—D. Risk Factors—Risks Relating to Our Corporate Structure” and “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China,” the laws, regulations and the discretion of mainland China governmental authorities discussed in this annual report are expected to apply to mainland China entities and businesses, rather than entities or businesses in Hong Kong which operate under a different set of laws from mainland China. These risks are discussed more fully in this Item 3. Key Information—D. Risk Factors.”

Item 3. Key Information

Our Holding Company Structure and Contractual Arrangements with the Consolidated Variable

Interest Entities, page 3

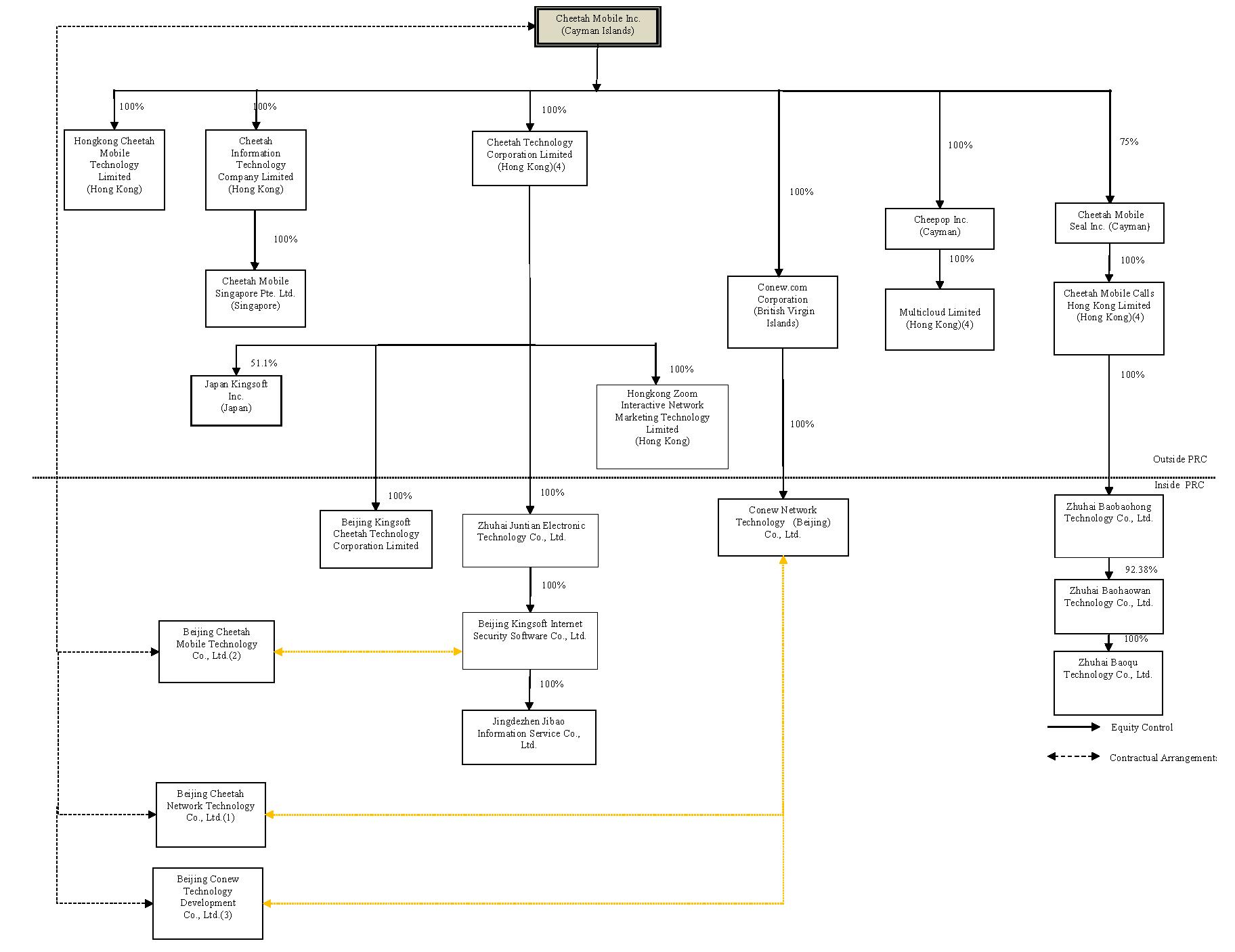

2. The dotted line in your corporate diagram appears to indicate that Cheetah Mobile, Inc. (the company) is a party to the contractual arrangements with the variable interest entities (VIEs) that provide them with the power and economics to control the VIEs. We note from your disclosures on page F-17 that in December 2019 the Contractual Agreements with certain VIEs were amended and replaced such that it appears certain rights were transferred from the Former Primary Beneficiaries to the company. The Agreements transferred to Cheetah Mobile, Inc. appear to provide you with the power to direct the activities of the VIE that most significantly impact the VIE, however, other Agreements such as the Exclusive Technology Development, Support and Consultancy Agreements, which provide the company with economic control over the VIEs appear to be between the Former Primary Beneficiaries and the VIEs. Please confirm and if true revise your diagram to show dotted lines between the VIEs and each of the entities for which contractual arrangements exist that allow for consolidation of the VIEs. Also, revise the introductory paragraph as well as footnotes (1), (2) and (3) to disclose each of the parties to the VIE arrangements (i.e. Cheetah Mobile, Inc, Former Primary Beneficiaries, and the VIE shareholders). Lastly, define the Former Primary Beneficiaries and ensure you refer to names similar to those included in the diagram.

2

Response: In response to the Staff’s comment, we propose to revise the introductory paragraph to the referenced corporate diagram in future filings as follows (the added disclosure is underlined and the removed disclosure is crossed out), to disclose each of the parties to the VIE arrangements and to define the Former Primary Beneficiaries:

“Our Holding Company Structure and Contractual Arrangements with the Consolidated Variable Interest Entities

Cheetah Mobile Inc. is not a Chinese operating company but a Cayman Islands holding company with no equity ownership in its consolidated variable interest entities. We conduct our operations in China through (i) our PRC subsidiaries and (ii) the consolidated variable interest entities and their subsidiaries with which we have maintained contractual arrangements, including but not limited to Beijing Mobile, Beijing Network and Beijing Conew.

PRC laws and regulations restrict and impose conditions on foreign investment in the internet industry, including the mobile internet industry. Accordingly, we operate part of our business in China through the consolidated variable interest entities, and rely on contractual arrangements among our PRC subsidiaries the consolidated variable interest entities and their shareholders to control the business operations of the consolidated variable interest entities. We exercise effective control over the consolidated variable interest entities through a series of contractual arrangements among (a) our company, (b) certain of our PRC subsidiaries, including but not limited to, Beijing Kingsoft Internet Security Software Co., Ltd., or Beijing Security, and Conew Network Technology (Beijing) Co., Ltd., or Conew Network, (c) the consolidated variable interest entities, and (d) the shareholders of the consolidated variable interest entities. External revenues contributed by the consolidated variable interest entities accounted for 36.6%, 33.1% and 31.8% of our total revenues for the years of 2020, 2021 and 2022, respectively.

As used in this annual report, “we,” “us,” “our company,” or “our” refers to Cheetah Mobile Inc., its subsidiaries and, in the context of describing our operations and consolidated financial information, the consolidated variable interest entities and their subsidiaries in China, including but not limited to Beijing Mobile, Beijing Network and Beijing Conew. References to the consolidated variable interest entities may include their subsidiaries, depending on the context as appropriate. Beijing Security and Conew Network are collectively referred to as the “Former Primary Beneficiaries.” For a detailed description of the former contractual agreements which provided the Former Primary Beneficiaries with effective control over the consolidated variable interest entities before December 2019, see Note 1 to our consolidated financial statements, which are included in this annual report.”

Furthermore, we propose to revise the referenced diagram, including the footnotes, in future filings as follows (the added dotted lines in the diagram are in orange, the added disclosure in footnotes is underlined and the removed disclosure in footnotes is crossed out), subject to updates and adjustments to be made in connection with any material development of the subject matter being disclosed:

“The following diagram summarizes our corporate structure and identifies our significant subsidiaries and VIEs as of the date of this annual report.

3

Notes:

4

3. Please revise footnotes (1), (2) and (3) to disclose the relationship of the VIE shareholders to the company, if any.

Response: In response to the Staff’s comment, we propose to revise the referenced footnotes, as detailed in our responses to comment 2 above in future filings.

4. Please explain to us footnote (4). Clarify which of the Hong Kong operating entities you do not control through equity ownership and how the deeds of nominee provide you with effective control over such entities.

Response: We respectfully advise the Staff that the Hong Kong operating entities, which we do not control through equity ownership as referenced in footnote (4) of the corporate diagram on page 3 of the Form 20-F, are not considered to be significant subsidiaries under Rule 1-02(w) of Regulation S-X, either individually or in the aggregate. Therefore, we have determined that it is neither meaningful to investors, nor are we required to present such Hong Kong operating entities in the corporate diagram or the related footnotes.

Furthermore, we respectfully advise the Staff that the deeds of nominee between each of Cheetah Technology, Cheetah Mobile Calls Hong Kong Limited and Multicloud Limited, each of which is referred to as a Hong Kong Beneficial Owner in this submission, on one hand, and the respective nominee shareholders of the relevant Hong Kong operating entity, on the other hand, are substantially similar. Pursuant to the deeds, the respective nominee shareholders of the relevant Hong Kong operating entity shall, among others, (i) promptly transfer all dividends, interest, bonuses, distributions, or other payments paid to the respective nominee shareholders in respect of the shares to the relevant Hong Kong Beneficial Owner after receipt of the foregoing, (ii) as the relevant Hong Kong Beneficial Owner directs, exercise all voting and other rights, powers and privileges attaching to the shares or vested as registered holders of the shares, (iii) as the relevant Hong Kong Beneficial Owner directs, transfer the shares at such consideration determined by the relevant Hong Kong Beneficial Owner, (iv) without the prior written consent of the relevant Hong Kong Beneficial Owner, not transfer, sell, hypothecate or dispose of the shares, and (v) irrevocably appoint the relevant Hong Kong Beneficial Owner as their attorney to exercise all rights, powers and privileges attaching to the shares or being exercised by the registered holder of the shares, and for such purpose to do all such acts and things and execute all such deeds and other documents as the relevant Hong Kong Beneficial Owner deems fit in its absolute discretion.

As a result of the deeds, the Hong Kong Beneficial Owner has the power to direct the activities that most significantly impact the relevant Hong Kong operating entity’s economic performance and obtains the ability to approve decisions made by the relevant Hong Kong operating entity. In addition, the Hong Kong Beneficial Owner is obligated to absorb losses or receive economic benefits from the relevant Hong Kong operating entity that could be significant to the relevant Hong Kong operating entity, since the Hong Kong Beneficial Owner owns 100% of the interests related to the shares of the Hong Kong operating entity, which includes but not limited to dividends, interests, bonus, distributions, consideration for share transfer. Based on the foregoing, we have determined that we exercise effective control over such Hong Kong operating entities through the deeds of nominee in accordance with Accounting Standards Codification (ASC) Topic 810, Consolidation.

Financial Information Related to the Consolidated Variable Interest Entities, page 8

5. The condensed consolidating schedules should present major line items, such as revenue and cost of goods/services, subtotals and intercompany amounts, such as separate line items for intercompany receivables and investment in subsidiaries. As such, please address the following as it relates to your consolidating worksheets:

• With regard to the columns labeled "Company Subsidiaries," revise to include separate columns in each schedule for your WFOEs to the extent the WFOEs are included in this column.

• Revise the selected condensed consolidating statements of operations and comprehensive income (loss) data to include separate line items for income/expense related to the service fees paid by the VIEs to the WFOEs pursuant to the contractual arrangements.

5

• Include separate line items for share of income (loss) from equity-owned subsidiaries and share of income (loss) from VIEs.

• Tell us whether the line item titled "investment in subsidiaries" in the selected condensed consolidating balance sheet data includes the net assets of the VIEs. If so, revise to include such amounts in a separate line item clearly distinguishing the investment in the equity-owned entities from the VIE contractual arrangements.

• Separate the amounts due to/due from the VIEs to either the Company Subsidiaries or Cheetah Mobile Inc. from the Amount due to/due from Group companies line items.

Response: In response to the Staff’s comment, we propose to revise the disclosure on pages 8-10 of the Form 20-F in future filings as follows (the added disclosure is underlined and the removed disclosure is crossed out):

“Financial Information Related to The Consolidated Variable Interest Entities

The following table presents the condensed consolidating schedule of financial information of Cheetah Mobile Inc., its subsidiaries wholly foreign-owned entities, or WFOEs, its other subsidiaries, and its consolidated variable interest entities and other entities as of the dates presented.

Selected Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) Data

|

For the Year Ended December 31, 2022 |

|

||||||||||||||||

|

Cheetah |

|

WFOEs |

|

Other Subsidiaries |

|

Consolidated Variable Interest Entities |

|

Eliminations |

|

Consolidated |

|

||||||

|

(RMB, in thousands) |

|

||||||||||||||||

Revenues |

|

— |

|

|

80,522 |

|

|

834,233 |

|

|

344,288 |

|

(293,552) (374,977) |

|

|

884,066 |

|

|

Service fee revenue from VIEs and their subsidiaries |

|

— |

|

|

24,180 |

|

191,165* |

|

|

— |

|

|

(215,345 |

) |

|

— |

|

|

Service fee expenses charged by WFOEs and their subsidiaries |

|

— |

|

|

— |

|

|

— |

|

|

(215,345 |

) |

|

215,345 |

|

|

— |

|

Share of (loss) income from WFOEs and other subsidiaries |

|

(475,119 |

) |

|

— |

|

|

— |

|

|

— |

|

|

475,119 |

|

|

— |

|

Share of income (loss) from VIEs and their subsidiaries |

|

3,409 |

|

|

3,820 |

|

|

— |

|

|

— |

|

|

(7,229 |

) |

|

— |

|

Net (loss) income |

|

(513,475 |

) |

|

(99,032 |

) |

|

(387,372 |

) |

|

3,792 |

|

|

475,396 |

|

|

(520,691 |

) |

|

For the Year Ended December 31, 2021 |

|

||||||||||||||||

|

Cheetah |

|

WFOEs |

|

Other Subsidiaries |

|

Consolidated Variable Interest Entities |

|

Eliminations |

|

Consolidated |

|

||||||

|

(RMB, in thousands) |

|

||||||||||||||||

Revenues |

|

— |

|

|

206,763 |

|

|

742,225 |

|

|

320,942 |

|

(430,678) (485,314) |

|

|

784,616 |

|

|

Service fee revenue from VIEs and their subsidiaries |

|

— |

|

|

— |

|

162,500* |

|

|

— |

|

|

(162,500 |

) |

|

— |

|

|

Service fee expenses charged by WFOEs and their subsidiaries |

|

— |

|

|

— |

|

|

— |

|

|

(162,500 |

) |

|

162,500 |

|

|

— |

|

Share of (loss) income from WFOEs and other subsidiaries |

|

(343,670 |

) |

|

— |

|

|

— |

|

|

— |

|

|

343,670 |

|

|

— |

|

Share of (loss) income from VIEs and their subsidiaries |

|

(8,946 |

) |

|

(8,895 |

) |

|

— |

|

|

— |

|

|

17,841 |

|

|

— |

|

Net (loss) income |

|

(351,126 |

) |

|

(55,729 |

) |

|

(283,692 |

) |

|

(8,489 |

) |

364,756 345,832 |

|

|

(353,204 |

) |

|

|

For the Year Ended December 31, 2020 |

|

||||||||||||||||

|

Cheetah |

|

WFOEs |

|

Other Subsidiaries |

|

Consolidated Variable Interest Entities |

|

Eliminations |

|

Consolidated |

|

||||||

|

(RMB, in thousands) |

|

||||||||||||||||

Revenues |

|

— |

|

|

229,566 |

|

|

1,298,937 |

|

|

659,626 |

|

(423,853) (635,484) |

|

|

1,552,645 |

|

|

Service fee revenue from VIEs and their subsidiaries |

|

— |

|

|

— |

|

159,296* |

|

|

— |

|

|

(159,296 |

) |

|

— |

|

|

Service fee expenses charged by WFOEs and their subsidiaries |

|

— |

|

|

— |

|

|

— |

|

|

(159,296 |

) |

|

159,296 |

|

|

— |

|

Share of income (loss) from WFOEs and other subsidiaries |

|

48,744 |

|

|

— |

|

|

— |

|

|

— |

|

|

(48,744 |

) |

|

— |

|

Share of (loss) income from VIEs and their subsidiaries |

|

(9,488 |

) |

|

(10,340 |

) |

|

— |

|

|

— |

|

|

19,828 |

|

|

— |

|

Net income (loss) |

|

416,732 |

|

|

(144,755 |

) |

|

164,532 |

|

|

(8,825 |

) |

51,984 (16,527) |

|

|

411,157 |

|

|

*Representing the revenue related to the service fees paid by the VIEs and their subsidiaries to the subsidiaries of the WFOEs pursuant to the VIE contractual arrangements.

6

Selected Condensed Consolidated Balance Sheets Data

|

As of December 31, 2022 |

|

||||||||||||||||

|

Cheetah |

|

WFOEs |

|

Other Subsidiaries |

|

Consolidated Variable Interest Entities |

|

Eliminations |

|

Consolidated |

|

||||||

|

(RMB, in thousands) |

|

||||||||||||||||

Cash and cash equivalents |

|

130,746 |

|

|

20,588 |

|

|

1,142,733 |

|

|

221,732 |

|

|

— |

|

|

1,515,799 |

|

Restricted cash |

|

— |

|

|

— |

|

|

696 |

|

|

— |

|

|

— |

|

|

696 |

|

Short-term investments |

|

— |

|

|

— |

|

|

93,147 |

|

|

63,035 |

|

|

— |

|

|

156,182 |

|

Due from related parties, net |

|

— |

|

|

9,897 |

|

|

163,496 |

|

|

25,706 |

|

|

— |

|

|

199,099 |

|

Others |

|

111,986 |

|

|

5,308 |

|

|

1,092,211 |

|

|

42,414 |

|

|

— |

|

|

1,251,919 |

|

Total current assets |

|

242,732 |

|

|

35,793 |

|

|

2,492,283 |

|

|

352,887 |

|

|

— |

|

|

3,123,695 |

|

Investments in subsidiaries |

474,435 397,930 |

|

|

— |

|

|

— |

|

|

— |

|

(474,435) (397,930) |

|

|

— |

|

||

Contractual interests in VIEs and their subsidiaries |

|

76,505 |

|

|

85,861 |

|

|

— |

|

|

— |

|

|

(162,366 |

) |

|

— |

|

Due from related parties, net |

|

— |

|

|

— |

|

|

3,840 |

|

|

— |

|

|

— |

|

|

3,840 |

|

Others |

|

477,366 |

|

|

31,888 |

|

|

1,139,611 |

|

|

363,019 |

|

|

— |

|

|

2,011,884 |

|

Total non-current assets |

|

951,801 |

|

|

117,749 |

|

|

1,143,451 |

|

|

363,019 |

|

(474,435) (560,296) |

|

|

2,015,724 |

|

|

Amount due from Cheetah Mobile Inc. |

|

— |

|

|

187 |

|

|

485,280 |

|

|

4,876 |

|

|

(490,343 |

) |

|

— |

|

Amount due from WFOEs |

|

1,910 |

|

|

— |

|

|

573,293 |

|

|

82,583 |

|

|

(657,786 |

) |

|

— |

|

Amount due from other subsidiaries |

|

2,343,678 |

|

|

886,105 |

|

|

— |

|

|

649,670 |

|

|

(3,879,453 |

) |

|

— |

|

Amount due from VIEs and their subsidiaries |

|

— |

|

|

340,807 |

|

|

770,390 |

|

|

— |

|

|

(1,111,197 |

) |

|

— |

|

Amount due from Group companies |

|

2,345,588 |

|

|

1,227,099 |

|

|

1,828,963 |

|

|

737,129 |

|

(4,679,381) (6,138,779) |

|

|

— |

|

|

Total assets |

|

3,540,121 |

|

|

1,380,641 |

|

|

5,464,697 |

|

|

1,453,035 |

|

(5,153,816) (6,699,075) |

|

|

5,139,419 |

|

|

Due to related parties |

|

— |

|

|

404 |

|

|

8,945 |

|

|

14,280 |

|

|

— |

|

|

23,629 |

|

Others |

|

23,700 |

|

|

41,819 |

|

|

1,476,813 |

|

|

212,566 |

|

|

— |

|

|

1,754,898 |

|

Total current liabilities |

|

23,700 |

|

|

42,223 |

|

|

1,485,758 |

|

|

226,846 |

|

|

— |

|

|

1,778,527 |

|

Total non-current liabilities |

|

181,508 |

|

|

19,656 |

|

|

52,603 |

|

|

2,339 |

|

|

— |

|

|

256,106 |

|

Amount due to Cheetah Mobile Inc. |

|

— |

|

|

1,648 |

|

|

2,532,691 |

|

|

— |

|

|

(2,534,339 |

) |

|

— |

|

Amount due to WFOEs |

|

449 |

|

|

— |

|

|

875,256 |

|

|

299,888 |

|

|

(1,175,593 |

) |

|

— |

|

Amount due to other subsidiaries |

|

296,256 |

|

|

584,148 |

|

|

— |

|

|

843,260 |

|

|

(1,723,664 |

) |

|

— |

|

Amount due to VIEs and their subsidiaries |

|

4,877 |

|

|

123,503 |

|

|

576,803 |

|

|

— |

|

|

(705,183 |

) |

|

— |

|

Amount due to Group companies |

|

301,582 |

|

|

709,299 |

|

|

3,984,750 |

|

|

1,143,148 |

|

(4,679,381) (6,138,779) |

|

|

— |

|

|

Total liabilities |

|

506,790 |

|

|

771,178 |

|

|

5,523,111 |

|

|

1,372,333 |

|

(4,679,381) (6,138,779) |

|

|

2,034,633 |

|

|

Selected Condensed Consolidated Balance Sheets Data (Continued)

|

As of December 31, 2021 |

|

||||||||||||||||

|

Cheetah |

|

WFOEs |

|

Other Subsidiaries |

|

Consolidated Variable Interest Entities |

|

Eliminations |

|

Consolidated |

|

||||||

|

(RMB, in thousands) |

|

||||||||||||||||

Cash and cash equivalents |

|

20,401 |

|

|

7,935 |

|

|

1,518,094 |

|

|

37,496 |

|

|

— |

|

|

1,583,926 |

|

Restricted cash |

|

— |

|

|

— |

|

|

637 |

|

|

144 |

|

|

— |

|

|

781 |

|

Short-term investments |

|

— |

|

|

6,965 |

|

|

135,651 |

|

|

120,197 |

|

|

— |

|

|

262,813 |

|

Due from related parties, net |

|

— |

|

|

14,792 |

|

|

31,917 |

|

|

54,624 |

|

|

— |

|

|

101,333 |

|

Others |

|

147,396 |

|

|

31,277 |

|

|

436,593 |

|

|

34,368 |

|

|

— |

|

|

649,634 |

|

Total current assets |

|

167,797 |

|

|

60,969 |

|

|

2,122,892 |

|

|

246,829 |

|

|

— |

|

|

2,598,487 |

|

Investments in subsidiaries |

897,699 810,187 |

|

|

— |

|

|

— |

|

|

— |

|

(897,699) (810,187) |

|

|

— |

|

||

Contractual interests in VIEs and their subsidiaries |

|

87,512 |

|

|

99,041 |

|

|

— |

|

|

— |

|

|

(186,553 |

) |

|

— |

|

Due from related parties, net |

|

— |

|

|

— |

|

|

111,335 |

|

|

— |

|

|

— |

|

|

111,335 |

|

Others |

|

449,850 |

|

|

33,767 |

|

|

1,431,399 |

|

|

353,480 |

|

|

— |

|

|

2,268,496 |

|

Total non-current assets |

|

1,347,549 |

|

|

132,808 |

|

|

1,542,734 |

|

|

353,480 |

|

(897,699) (996,740) |

|

|

2,379,831 |

|

|

Amount due from Cheetah Mobile Inc. |

|

— |

|

|

187 |

|

|

1,223,784 |

|

|

4,464 |

|

|

(1,228,435 |

) |

|

— |

|

Amount due from WFOEs |

|

1,872 |

|

|

— |

|

|

473,019 |

|

|

74,620 |

|

|

(549,511 |

) |

|

— |

|

Amount due from other subsidiaries |

|

3,122,439 |

|

|

886,200 |

|

|

— |

|

|

627,562 |

|

|

(4,636,201 |

) |

|

— |

|

Amount due from VIEs and their subsidiaries |

|

— |

|

|

367,735 |

|

|

638,003 |

|

|

— |

|

|

(1,005,738 |

) |

|

— |

|

Amount due from Group companies |

|

3,124,311 |

|

|

1,254,122 |

|

|

2,334,806 |

|

|

706,646 |

|

(6,060,666) (7,419,885) |

|

|

— |

|

|

Total assets |

|

4,639,657 |

|

|

1,447,899 |

|

|

6,000,432 |

|

|

1,306,955 |

|

(6,958,365) (8,416,625) |

|

|

4,978,318 |

|

|

Due to related parties |

|

— |

|

|

6,611 |

|

|

2,124 |

|

|

29,025 |

|

|

— |

|

|

37,760 |

|

Others |

|

31,107 |

|

|

50,389 |

|

|

1,079,585 |

|

|

155,053 |

|

|

— |

|

|

1,316,134 |

|

Total current liabilities |

|

31,107 |

|

|

57,000 |

|

|

1,081,709 |

|

|

184,078 |

|

|

— |

|

|

1,353,894 |

|

Total non-current liabilities |

|

169,629 |

|

|

32,353 |

|

|

54,352 |

|

|

7,947 |

|

|

— |

|

|

264,281 |

|

Amount due to Cheetah Mobile Inc. |

|

— |

|

|

1,649 |

|

|

3,191,310 |

|

|

— |

|

|

(3,192,959 |

) |

|

— |

|

Amount due to WFOEs |

|

411 |

|

|

— |

|

|

864,115 |

|

|

324,134 |

|

|

(1,188,660 |

) |

|

— |

|

Amount due to other subsidiaries |

|

1,154,920 |

|

|

495,101 |

|

|

— |

|

|

700,377 |

|

|

(2,350,398 |

) |

|

— |

|

Amount due to VIEs and their subsidiaries |

|

4,464 |

|

|

118,223 |

|

|

565,181 |

|

|

— |

|

|

(687,868 |

) |

|

— |

|

Amount due to Group companies |

|

1,159,795 |

|

|

614,973 |

|

|

4,620,606 |

|

|

1,024,511 |

|

(6,060,666) (7,419,885) |

|

|

— |

|

|

Total liabilities |

|

1,360,531 |

|

|

704,326 |

|

|

5,756,667 |

|

|

1,216,536 |

|

(6,060,666) (7,419,885) |

|

|

1,618,175 |

|

|

7

Selected Condensed Consolidated Cash Flows Data

|

For the Year Ended December 31, 2022 |

|

||||||||||||||||

|

Cheetah |

|

WFOEs |

|

Other Subsidiaries |

|

Consolidated Variable Interest Entities |

|

Eliminations |

|

Consolidated |

|

||||||

|

(RMB, in thousands) |

|

||||||||||||||||

Net cash (used in)/provided by operating activities |

|

(26,054 |

) |

|

(27,339 |

) |

|

(525,259 |

) |

|

154,403 |

|

|

— |

|

|

(424,249 |

) |

Net cash (used in)/ provided by investing activities |

|

137,160 |

|

|

3,080 |

|

|

(23,696 |

) |

|

(98,598 |

) |

165,373 171,106 |

|

|

189,052 |

|

|

Net cash provided by/(used in) financing activities |

|

— |

|

|

36,912 |

|

|

867 |

|

|

128,461 |

|

(165,373) (171,106) |

|

|

(4,866 |

) |

|

|

For the Year Ended December 31, 2021 |

|

||||||||||||||||

|

Cheetah |

|

WFOEs |

|

Other Subsidiaries |

|

Consolidated Variable Interest Entities |

|

Eliminations |

|

Consolidated |

|

||||||

|

(RMB, in thousands) |

|

||||||||||||||||

Net cash provided by/(used in) operating activities |

|

666 |

|

|

(52,219 |

) |

|

(69,715 |

) |

|

209,357 |

|

|

14,722 |

|

|

102,811 |

|

Net cash (used in)/provided by investing activities |

|

(864,999 |

) |

|

(17,177 |

) |

|

268,983 |

|

|

(255,027 |

) |

|

1,089,056 |

|

|

220,836 |

|

Net cash provided by/(used in) financing activities |

|

891,960 |

|

|

18,510 |

|

|

92,575 |

|

|

91,093 |

|

|

(1,103,778 |

) |

|

(9,640 |

) |

|

For the Year Ended December 31, 2020 |

|

||||||||||||||||

|

Cheetah |

|

WFOEs |

|

Other Subsidiaries |

|

Consolidated Variable Interest Entities |

|

Eliminations |

|

Consolidated |

|

||||||

|

(RMB, in thousands) |

|

||||||||||||||||

Net cash (used in)/provided by operating activities |

|

(2,186 |

) |

|

(15,537 |

) |

|

435,252 |

|

|

(36,196 |

) |

|

(427,465 |

) |

|

(46,132 |

) |

Net cash provided by investing activities |

|

1,345,523 |

|

|

(3,219 |

) |

|

81,064 |

|

|

21,168 |

|

427,771 435,827 |

|

|

1,880,363 |

|

|

Net cash (used in)/provided by financing activities |

|

(1,453,285 |

) |

|

8,056 |

|

|

2,934 |

|

|

— |

|

(306) (8,362) |

|

|

(1,450,657 |

) |

|

”

Item 16I. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections, page 125

6. We note your statement that you reviewed your register of members and public filings made by your shareholders in connection with your required submission under paragraph (a). Please supplementally describe any additional materials that were reviewed and tell us whether you relied upon any legal opinions or third party certifications such as affidavits as the basis for your submission. In your response, provide a similarly detailed discussion of the materials reviewed and legal opinions or third party certifications relied upon in connection with the required disclosures under paragraphs (b)(2) and (3).

Response:

Ownership and/or controlling financial interest held by governmental entity of mainland China with respect to the Company

In connection with the required disclosures under paragraphs (a) and (b)(3) of Item 16I with respect to the Company, we respectfully submit that we relied on the beneficial ownership schedules, namely, Schedule 13Gs, Schedule 13Ds and the amendments thereto, filed by the Company’s major shareholders. Because such major shareholders are legally obligated to file beneficial ownership schedules with the Commission, we believe such reliance is reasonable and sufficient. Based on the examination of the Schedule 13Gs, Schedule 13Ds and the amendments thereto filed by the Company’s major shareholders, other than Kingsoft Corporation Limited, Tencent Holdings Limited, Mr. Sheng Fu and his wholly-owned company, Sheng Global Limited, no shareholder beneficially owned 5% or more of the Company’s total outstanding shares as of March 31, 2023.

Sheng Global Limited is wholly owned by Mr. Sheng Fu, chief executive officer and chairman of the board of directors of the Company. Additionally, each of Kingsoft Corporation Limited (HKEX: 3888) and Tencent Holdings Limited (HKEX: 700) is a publicly traded company listed on the Main Board of The Stock Exchange of Hong Kong Limited.

8

Regarding Kingsoft Corporation Limited, the interim report filed on September 23, 2022 indicates that other than Color Link Management Limited, Tencent Holdings Limited, Topclick Holdings Limited, and Brown Brothers Harriman & Co., no shareholder held interest in 5% or more of any class of voting shares of Kingsoft Corporation Limited as of June 30, 2022. Color Link Management Limited is wholly owned by Mr. Jun Lei; Topclick Holdings Limited is wholly owned by Mr. Pak Kwan KAU. It is disclosed on its website that Brown Brothers Harriman & Co. is a privately held financial institution, and that its partners, limited partners and managing directors are all natural persons.

In terms of Tencent Holdings Limited, according to its annual report filed on April 6, 2023, other than MIH Internet Holdings B.V. and Advance Data Services Limited, no shareholder held interest in 5% or more of any class of voting shares of Tencent Holdings Limited as of December 31, 2022. Advance Data Services Limited is wholly owned by Mr. Huateng Ma. MIH Internet Holdings B.V. is controlled by Naspers Limited (JSE: NPN), a publicly traded company listed on the Johannesburg Stock Exchange, and held through its majority-owned subsidiary, Prosus N.V. (XAMS and JSE: PRX), a publicly traded company listed on the Euronext Amsterdam with a secondary, inward listing on the Johannesburg Stock Exchange.

Based on the foregoing, to our best knowledge, Kingsoft Corporation Limited and Tencent Holdings Limited are not owned or controlled by a governmental entity of mainland China or the Cayman Islands.

Furthermore, we have examined the Company’s shareholder composition as of March 31, 2023. Based on its register of members as of that date, the Company’s shareholders consisted of: (i) the Bank of New York Mellon, (ii) natural person shareholders and entities owned or controlled, directly or indirectly, by certain natural persons who are members of the management and key employees of the Company, and (iii) institutional shareholders.

Based on the foregoing, we have determined that the Company is not owned or controlled by governmental entities in mainland China or the Cayman Islands, and that the governmental entities in mainland China do not have a controlling financial interest in the Company.

Ownership held by governmental entity of the Cayman Islands with respect to the Company

In connection with the required disclosures under paragraph (b)(2) of Item 16I with respect to the Company, based on the analysis above, to our best knowledge, no governmental entities in the Cayman Islands own any shares of the Company.

Ownership and/or controlling financial interest held by governmental entities in applicable foreign jurisdictions with respect to the Company’s consolidated foreign operating entities, including the consolidated variable interest entities

In connection with the required disclosures under paragraphs (b)(2) and (b)(3) of Item 16I with respect to the Company’s consolidated foreign operating entities, including the consolidated variable interest entities, we respectfully submit that we conduct operations through (i) operating subsidiaries in which the Company has equity ownership, and (ii) contractual arrangements with the consolidated variable interest entities and their respective subsidiaries.

9

We respectfully advise the Staff that the Company’s principal subsidiaries and the consolidated variable interest entities as of December 31, 2022 are set out on page F-14 of the Form 20-F. These entities are all consolidated foreign operating entities of the Company incorporated in various jurisdictions, which are discussed below.

The consolidated variable interest entities are Beijing Cheetah Network Technology Co., Ltd., or Beijing Network, Beijing Conew Technology Development Co., Ltd., or Beijing Conew, and Beijing Cheetah Mobile Technology Co., Ltd., or Beijing Mobile, which we collectively refer to as the VIEs in the submission.

These consolidated foreign operating entities are incorporated in the following jurisdictions: mainland China, Hong Kong, Japan, and Singapore. The Company holds 100% equity interests in each such foreign operating entity, with the exceptions of Japan Kingsoft Inc., Zhuhai Baoqu Technology Co., Ltd., and the VIEs.

The equity interests in Japan Kingsoft Inc. are beneficially owned by Kingsoft Corporation Limited and an affiliated entity, certain natural persons, the company’s employees through an employee stock ownership plan, as well as an entity owned or controlled by third-party natural person shareholders. In addition, the equity interests in Zhuhai Baoqu Technology Co., Ltd. are beneficially owned by the Company and employees of Zhuhai Baoqu Technology Co., Ltd. and its affiliated entities. Therefore, no governmental entities in mainland China, Hong Kong, Japan, or Singapore own any shares of the Company’s principal subsidiaries.

In terms of the VIEs, as disclosed in the Form 20-F, the Company, through its PRC subsidiaries, is the primary beneficiary of the VIEs. It has the power to direct the activities of the VIEs and is entitled to receive substantially all economic interests in the VIEs, even though it does not necessarily receive all of the VIEs’ revenues. Furthermore, as disclosed in the Form 20-F and detailed in our responses to comment 2 above, each of the shareholders of the VIEs is a natural person:

Therefore, no governmental entities in mainland China own any shares of the VIEs, and the governmental entities in mainland China do not have a controlling financial interest in the VIEs.

Based on the foregoing, we have determined that no governmental entities in mainland China, Hong Kong, Japan, or Singapore own any shares of the Company’s principal subsidiaries or the VIEs, and that the governmental entities in mainland China do not have a controlling financial interest in the Company’s principal subsidiaries or the VIEs.

We respectfully submit that we did not rely upon any legal opinions or third party certifications such as affidavits as the basis of our submission.

7. In order to clarify the scope of your review, please supplementally describe the steps you have taken to confirm that none of the members of your board or the boards of your consolidated foreign operating entities are officials of the Chinese Communist Party. For instance, please tell us how the board members’ current or prior memberships on, or affiliations with, committees of the Chinese Communist Party factored into your determination. In addition, tell us whether you have relied upon third party certifications such as affidavits as the basis for your disclosure.

Response: We respectfully submit that the Company has asked all of its directors to complete a questionnaire as part of its annual compliance procedures. Each director has confirmed in such questionnaire that such director is not an official of the Chinese Communist Party.

In addition, we respectfully submit that the directors of the Company’s consolidated foreign operating entities, including the VIEs, are either (i) directors of the Company or (ii) current or former employees of the

10

Company or its consolidated foreign operating entities. The directors of the Company are discussed above. In terms of current or former employees of the Company or its consolidated foreign operating entities, based on the relevant employment profiles, we have determined that the applicable employees are not officials of the Chinese Communist Party.

We respectfully submit that we did not rely upon any legal opinions or third party certifications such as affidavits as the basis of our submission.

8. We note that your disclosures pursuant to Items 16I(b)(2), (b)(3), and (b)(5) are provided for “Cheetah Mobile Inc. or the VIEs.” We also note that your disclosures on pages 3 and F-14, along with your list of significant subsidiaries and VIEs in Exhibit 8.1, appear to indicate that you have consolidated foreign operating entities in Hong Kong and countries outside China that are not included in your VIEs. Please note that Item 16I(b) requires that you provide disclosures for yourself and your consolidated foreign operating entities, including variable interest entities or similar structures.

• With respect to (b)(2), supplementally clarify the jurisdictions in which your consolidated foreign operating entities are organized or incorporated and provide the percentage of your shares or the shares of your consolidated operating entities owned by governmental entities in each foreign jurisdiction in which you have consolidated operating entities in your supplemental response.

Response: We respectfully submit to the Staff that, based on the analysis in the response to comment 6, to the best of our knowledge, no governmental entities in mainland China, Hong Kong, Japan, or Singapore own shares of the Company, its principal subsidiaries or the VIEs.

• With respect to (b)(3) and (b)(5), provide the required information for you and all of your consolidated foreign operating entities in your supplemental response.

Response: With respect to the required submission under paragraph (b)(3) of Item 16I, we respectfully submit that, based on the analysis in the response to comment 6, the governmental entities in mainland China do not have a controlling financial interest in the Company, its principal subsidiaries or the VIEs. With respect to the required submission under paragraph (b)(5) of Item 16I, please refer to the response to comment 9 below.

9. With respect to your disclosure pursuant to Item 16I(b)(5), we note you have included language that such disclosure is “to our best knowledge.” Please supplementally confirm without qualification, if true, that your articles and the articles of your consolidated foreign operating entities do not contain wording from any charter of the Chinese Communist Party.

Response: We confirm without qualification that the Company’s articles and the articles of its consolidated foreign operating entities do not contain any charter of the Chinese Communist Party.

Notes to the Consolidated Financial Statements

Note 1. Organization and Principal Activities, page F-14

10. For each of the subsidiaries listed here, please revise to identify which of those subsidiaries are the "Former Primary Beneficiaries" of the VIEs. Also, tell us why several of the entities included in the corporate diagram on page 3 are not listed here, or revise as necessary. For example, the disclosures here do not appear to include HongKong Cheetah Mobile Technology, Conew.com Corporation, Cheepop, Inc., Multicould limited, Cheetah Mobile Seal, Cheetah Mobile Calls HK, Zhuhai Baobaohong Technology, Zhuhai Baohaowan Technology, Zhuhai Juntian Electronic Technology.

Response: We respectfully advise the Staff that as detailed in our response to comment 2 above, the “Former Primary Beneficiaries” of the VIEs refer to Beijing Security and Conew Network. In response to the Staff’s comment, we propose to add appropriate footnotes to the subsidiary list on page F-14 of the Form 20-F in future filings to prominently denote that Beijing Security and Conew Network are the “Former Primary Beneficiaries” of the VIEs.

Furthermore, we respectfully advise the Staff that Multicloud Limited, one of the referenced entities included in the corporate diagram on page 3 of the Form 20-F, was listed on page F-14 of the Form 20-F.

11

The other referenced entities, namely Hongkong Cheetah Mobile Technology Limited, Conew.com Corporation, Cheepop Inc., Cheetah Mobile Seal Inc., Cheetah Mobile Calls Hong Kong Limited, Zhuhai Baobaohong Technology Co., Ltd., Zhuhai Baohaowan Technology Co., Ltd., and Zhuhai Juntian Electronic Technology Co., Ltd., are intermediate holding companies of the Company with no material operations. Accordingly, we do not include them as principal subsidiaries on page F-14 of the Form 20-F.

Note 2. Summary of Significant Accounting Policies

Cash and cash equivalents, page F-21

11. Please provide us with a detailed breakdown of the items included in your total cash and cash equivalents as of December 31, 2022. Ensure that at a minimum, you separately provide amounts held in cash, time deposits and highly liquid investments. To the extent you hold any type of "highly liquid investments," tell us what they are and provide the amounts held in each type of investment.

Response: In response to the Staff’s comment, we set forth below the detailed breakdown of the items included in our total cash and cash equivalents as of December 31, 2022:

|

As of December 31, 2022 |

|

||||

|

RMB |

|

US$ |

|

||

|

(in thousands) |

|

||||

Cash in hand |

|

14 |

|

|

2 |

|

Current deposits |

|

768,591 |

|

|

111,435 |

|

Time deposits with original stated maturity of three months or less |

|

747,194 |

|

|

108,333 |

|

Total cash and cash equivalents |

|

1,515,799 |

|

|

219,770 |

|

Revenue Recognition

(1) Internet business, page F-26

12. Please clarify whether the customer takes possession of the software in your hosted software subscription arrangement or whether the subscription provides access to the software. Refer to ASC 606-10-55-54(a). To the extent it is the former, explain further how you determined that the software license, when-and-if-available updates and related services are a single performance obligation and how you applied the guidance in ASC 606-10-25-21. Also, tell us the amount of revenue recognized from these arrangements for each period presented.

Response: We respectfully advise the Staff that for the non-cancellable VIP membership services and hosted software subscription services to individual and enterprise customers, the customer does not take possession of the software and our software mainly provides online services, which allow customers to use our online services such as anti-virus, security protection, etc. The customer does not have the contractual right to take possession of the software and the online services makes it impossible for the customer to run the software on his own or by contracting with an unrelated third party. The customer can benefit only in conjunction with the related online services. The software license, what-and-if-available updates and related services are not considered distinct, and all revenue is recognized over the period in which the online services are provided.

Besides of the above software online services, we provide on-premise software where the license provides the customer with a right to use the software as it exists when made available to the customer. We sell specific version of the software to the customer, and provide post-contract services such as post-delivery telephone support and post-contract customer support for the customer. Software upgrades, such as version iteration, are additionally charged. Post-contract services are mainly provided to answer questions about the use and the installation of the software which would not fulfill a promise to a customer, and the yearly cost to provide the post-contract services is around RMB100 thousand to RMB120 thousand. We deem that the post-contract services are immaterial and all revenue is recognized upfront at the point in time when the software is made available to the customer. For the years ended December 31, 2020, 2021 and 2022, revenues from the on-premise software sales were RMB37 million, RMB33 million and RMB22 million, respectively, which accounted for less than 5% of the total revenues for the corresponding period.

12

General

13. Please provide a comprehensive legal analysis explaining whether Cheetah Mobile Inc. or any of its subsidiaries (collectively, the “Company”) currently meets the definition of “investment company” under Section 3(a)(1)(C) of the Investment Company Act (the “Company Act”). Include in your analysis the relevant calculation(s) under Section 3(a)(1)(C) (including, where required by the statute, on an unconsolidated basis), identifying each constituent part of the numerator(s) and denominator(s). Your analysis should identify and explain which assets held by the company are “investment securities” for purposes of Section 3(a)(2) of the Company Act and specifically address how you treat the securities issued by your subsidiaries and the contractual relationships between your subsidiaries and the variable interest entities. Provide legal support for any substantive determinations and/or characterizations of assets that are material to your calculations. If the company proposes to rely on any exclusion or exemption, provide a detailed legal analysis supporting your determination that the exclusion/exemption is available to the relevant entity or entities.

Response: We respectfully advise the Staff that we expect to submit the response to this comment by September 1, 2023.

14. Please provide the unconsolidated financial statements that formed the basis for your calculation of assets for purposes of Section 3(a)(1)(C).

Response: We respectfully advise the Staff that we expect to submit the response to this comment by September 1, 2023.

15. Please include a risk factor that: (1) explains in detail why the company believes that it is not an investment company for purposes of Section 3(a) the Company Act, with reference to key material facts and characteristics of the business and the specific provisions of the Company Act relevant to your conclusion; and (2) describes the consequences to the company and its investors were the Commission or its staff to determine that the company is an investment company.

Response: We respectfully advise the Staff that we expect to submit the response to this comment by September 1, 2023.

* * *

13

If you have any additional questions or comments regarding the Form 20-F, please contact the undersigned at thomas.ren@cmcm.com or at +8610 6292 7779, ext. 6661 (office), or our U.S. counsel, Steve Lin at steve.lin@kirkland.com or at +8610 5737 9315 (office) or +86 18610495593 (mobile), of Kirkland & Ellis International LLP. Thank you.

|

|

|

Very truly yours, |

||

|

|

|

By: |

|

/s/ Thomas Jintao Ren |

|

|

Name: Thomas Jintao Ren |

|

|

Title: Chief Financial Officer |

cc: |

Steve Lin, Esq., Partner, Kirkland & Ellis International LLP Chris (Yiming) Zhao, Partner, Marcum Asia CPAs LLP

|

14