Exhibit 99.5

Excerpts from Amendment No. 4 to Form

S-4 as filed with the Securities and Exchange Commission

on April 9, 2014 and incorporated by reference into the Form 8-K filed April 18, 2014

Disclosures incorporated into Item 2.01:

The Redomestication, Business Combination

and Merger Agreement

Redomestication to Delaware

Pursuant to the terms and conditions of

the Merger Agreement, Infinity Corp., a British Virgin Islands business company, will merge with and into Infinity Acquisition,

its wholly owned Delaware subsidiary, with Infinity Acquisition surviving the merger. Infinity Acquisition was formed

in January 2014 for the purposes of effectuating the Business Combination.

At the time of the Redomestication:

| |

·

|

Assuming no Public Shares are tendered pursuant to the Share Tender Offer, each of the 5,750,000 Public Shares then outstanding will be converted automatically into one substantially equivalent share of Infinity Acquisition’s Common Stock; |

| |

·

|

The 1,437,500 Founder Shares will be converted automatically into 1,437,500 shares of Common Stock which will not be transferable for one year after the completion of the Business Combination except that: (1) 50% of such Common Stock will be released from such lock-up arrangement if the closing price of the Common Stock exceeds $9.60 for any 20 trading days within a 30-trading day period following the consummation of the Business Combination, and (2) the remaining 50% of such Common Stock will be released from such lock-up arrangement if the closing price of the Common Stock exceeds $12.00 for any 20 trading days within a 30-trading day period following the consummation of the Business Combination. |

| |

·

|

Assuming no Public Warrants are tendered pursuant to the Warrant Tender Offer (as defined below), each of the 5,750,000 Public Warrants will be converted into one warrant to purchase Common Stock, each exercisable for one share of Common Stock at $10.00 per share, or the Infinity Acquisition Warrants; |

| |

·

|

Each of the 4,820,000 Insider Warrants will be converted into 4,820,000 Insider Warrants of Infinity Acquisition. However, the holders of the Insider Warrants have agreed that Infinity Acquisition has the right to demand that the Insider Warrants be converted into shares of Infinity Acquisition Common Stock, at a ratio of ten warrants for one share of Infinity Acquisition Common Stock, during the thirty day period commencing 31 days after the consummation of the Business Combination; and |

| |

·

|

The underwriters have agreed to convert the 500,000 unit purchase options of Infinity Corp. held by them or their designees into 100,000 shares of Infinity Acquisition’s Common Stock. |

In connection with the Redomestication,

Infinity Acquisition has filed this Registration Statement to register the distribution of Common Stock and Infinity Acquisition

Warrants to Infinity Corp. shareholders and warrantholders. See “The Merger Agreement,” and “Description

of the Combined Company’s Securities Following the Business Combination.”

Upon effectiveness of the Redomestication,

Infinity Corp. will cease to exist and Infinity Acquisition will be the surviving corporation. As a result, Infinity Acquisition

will assume all the property, rights, privileges, agreements, powers and franchises, debts, liabilities, duties and obligations

of Infinity Corp., including any and all agreements, covenants, duties and obligations of Infinity Corp. set forth in the Merger

Agreement.

For further information regarding the Merger

Agreement, see “The Merger Agreement” beginning on page 53 of this prospectus.

Merger with Glori; Merger Consideration

Immediately following the Redomestication,

Merger Sub, a Delaware corporation and wholly owned subsidiary of Infinity Acquisition, will be merged with and into Glori, with

Glori surviving the merger. Pursuant to the terms of the Merger Agreement, in exchange for all of Glori’s outstanding shares

and warrants, Infinity Acquisition will issue to the stockholders and warrantholders of Glori 23,584,557 shares of Common Stock

on a pro rata basis, with 707,537 of such shares set aside in escrow, and have $25.0 million in cash or in kind, including debt

instruments of no more than $2.0 million (including the proceeds of the PIPE Investment, defined below) available in the surviving

company for payment of transaction expenses and for working capital purposes. The shares of Common Stock held by the former Glori

shareholders and warrantholders, or the Lock-up Common Stock, immediately following the Transaction Merger will be subject to a

lock-up agreement, or the Lock-up Agreement. The approximate dollar value of the merger consideration to be paid in Common Stock

by Infinity Acquisition pursuant to the Merger Agreement is approximately $188.7 million based on the purchase price of the Ordinary

Shares of $8.00 per share.

Prior to the Business Combination, as set

forth in Infinity Corp.’s memorandum and articles of association, Infinity Corp. must complete the Share Tender Offer. Pursuant

to the Merger Agreement, Infinity Acquisition will be required to have at least $25.0 million in cash or in kind, including debt

instruments of no more than $2.0 million (including the proceeds of the PIPE Investment), to close the Business Combination.

DESCRIPTION OF THE COMBINED COMPANY’S

SECURITIES

FOLLOWING THE BUSINESS COMBINATION

General

Infinity Acquisition’s Certificate

of Incorporation will authorize the issuance of up to 100,000,000 shares of Common Stock, par value $0.0001 per share, and 5,000,000

shares of Infinity Acquisition preferred stock, par value $0.0001 per share. As of the date of this prospectus, Infinity Acquisition

had 1,000 outstanding shares of common stock, par value $0.01 per share, and no shares of outstanding preferred stock. The Common

Stock and Infinity Acquisition Warrants are expected to be registered pursuant to Section 12 of the Exchange Act. Infinity Acquisition

intends to change its name to Glori Energy Inc. in connection with the consummation of the Business Combination and Glori intends

to change its name to Glori Energy Technology Inc. Accordingly, the Common Stock and Warrants issued by Infinity Acquisition in

connection with the Business Combination will be issued in the name of Glori Energy, Inc. Infinity Acquisition intends to submit

an application to Nasdaq to list the Common Stock and Infinity Acquisition Warrants following the Business Combination; however,

there can be no assurance concerning Infinity Acquisition’s ability to meet Nasdaq’s qualification standards.

Common Stock

In connection with the consummation of

the Business Combination, the 5,750,000 outstanding Public Shares of Infinity Corp. will be converted into 5,750,000 shares of

Common Stock of Infinity Acquisition (assuming no Public Shares are tendered pursuant to the Share Tender Offer). The 1,437,500

Founder Shares will be converted into 1,437,500 shares of Common Stock, which will not be transferable for one year after the completion

of the Business Combination except that: (1) 50% of such Common Stock will be released from such lock-up arrangement if the closing

price of the Common Stock exceeds $9.60 for any 20 trading days within a 30-trading day period following the consummation of the

Business Combination, and (2) the remaining 50% of such Common Stock will be released from such lock-up arrangement if the closing

price of the Common Stock exceeds $12.00 for any 20 trading days within a 30-trading day period following the consummation of the

Business Combination.

The holders of the Common Stock are entitled

to one vote for each share held on all matters to be voted on by stockholders and do not have cumulative voting rights. The holders

of Common Stock are entitled to receive their pro rata share of any dividends, if and when declared by the board of directors out

of funds legally available therefor. In the event of a liquidation, dissolution or winding up of Infinity Acquisition, Infinity

Acquisition’s stockholders are entitled to share ratably in all assets remaining available for distribution to them after

payment of liabilities and after provision is made for each class of stock, if any, having preference over the Infinity Common

Stock. Infinity Acquisition’s common stockholders have no preemptive or other subscription rights.

Preferred Stock

The Infinity Acquisition charter will authorize

the issuance of 5,000,000 shares of blank check preferred stock with such designation, rights and preferences as may be determined

from time to time by Infinity Acquisition’s board of directors. Accordingly, Infinity Acquisition’s board of directors

will be able to, without stockholder approval, issue preferred stock with voting and other rights that could adversely affect the

voting power and other rights of the holders of the Common Stock and could have anti-takeover effects. The ability of Infinity

Acquisition’s board of directors to issue preferred stock without stockholder approval could have the effect of delaying,

deferring or preventing a change of control of Infinity Acquisition or the removal of existing management. No shares of preferred

stock are currently issued or outstanding.

Warrants

In connection with the consummation of

the Business Combination, the 5,750,000 Public Warrants will be converted into 5,750,000 Infinity Acquisition Warrants (assuming

no Public Warrants are tendered pursuant to the Warrant Tender Offer). The 4,820,000 Insider Warrants will be converted into 4,820,000

Infinity Acquisition Insider Warrants.

Each Infinity Acquisition Warrant entitles

the registered holder to purchase one share of Common Stock at a price of $10.00 per share, subject to adjustment as discussed

below, at any time after the completion of the Business Combination. The Infinity Acquisition Warrants will expire five years after

the completion of the Business Combination, at 11:59 p.m., New York City time, or earlier upon redemption or liquidation.

Except as set forth below, Infinity Acquisition

will not be obligated to issue any Common Stock pursuant to the exercise of an Infinity Acquisition Warrant unless a registration

statement under the Securities Act with respect to the Common Stock underlying the Infinity Acquisition Warrant is then effective

and a prospectus relating thereto is current. No Infinity Acquisition Warrant will be exercisable and Infinity Acquisition will

not be obligated to issue Common Stock upon exercise of an Infinity Acquisition Warrant unless Common Stock issuable upon such

Infinity Acquisition Warrant exercise has been registered, qualified or deemed to be exempt under the securities laws of the state

of residence of the registered holder of the Infinity Acquisition Warrants. In the event that the conditions in the two immediately

preceding sentences are not satisfied with respect to an Infinity Acquisition Warrant, the holder of such Infinity Acquisition

Warrant will not be entitled to exercise such warrant and such Infinity Acquisition Warrant may have no value and expire worthless.

In no event will Infinity Acquisition be required to net cash settle any Infinity Acquisition Warrant.

No Infinity Acquisition Warrants will be

exercisable for cash unless Infinity Acquisition has an effective and current registration statement covering the Common Stock

issuable upon exercise of the Infinity Acquisition Warrants and a current prospectus relating to such Common Stock. Notwithstanding

the foregoing, if a registration statement covering the Common Stock issuable upon exercise of the Public Warrants is not at the

time of exercise effective, Infinity Acquisition Warrant holders may, until such time as there is an effective registration statement

and during any period during which Infinity Acquisition has failed to maintain an effective registration statement, exercise Infinity

Acquisition Warrants on a cashless basis pursuant to the exemption provided by Section 3(a)(9) of the Securities Act. If cashless

exercise is permitted, each holder of Infinity Acquisition Warrants exercising on a cashless basis would pay the exercise price

by surrendering the Infinity Acquisition Warrants for that number of Common Stock equal to the quotient obtained by dividing: (x)

the product of the number of Common Stock underlying the Infinity Acquisition Warrants, multiplied by the difference between the

Infinity Acquisition Warrant exercise price and the “fair market value” by (y) the fair market value. For these purposes,

fair market value will mean the volume weighted average price of Common Stock as reported during the ten (10) trading day period

ending on the trading day prior to the date that notice of exercise is received by the warrant agent from the holder of such Infinity

Acquisition Warrants or our securities broker or intermediary.

Once the Infinity Acquisition Warrants

become exercisable, Infinity Acquisition may call the Infinity Acquisition Warrants for redemption:

| |

·

|

in whole and not in part; |

| |

·

|

at a price of $0.01 per Infinity Acquisition Warrant; |

| |

·

|

upon not less than 30 days’ prior written notice of redemption, the 30-day redemption period, to each Infinity Acquisition Warrant holder; and |

| |

·

|

if, and only if, the last sale price of Common Stock equals or exceeds $15.00 per share for any 20 trading days within a 30-trading day period ending on the third business day before Infinity Acquisition sends the notice of redemption to the Infinity Acquisition Warrant holders. |

Infinity Acquisition will not redeem the

Infinity Acquisition Warrants unless there is an effective registration statement covering the Common Stock issuable upon exercise

of the Infinity Acquisition Warrants and a current prospectus in respect thereof is available throughout the 30-day redemption

period.

Infinity Acquisition has established the

last of the redemption criterion discussed above to prevent a redemption call unless there is at the time of the call a significant

premium to the Infinity Acquisition Warrant exercise price. If the foregoing conditions are satisfied and Infinity Acquisition

issues a notice of redemption of the Infinity Acquisition Warrants, each Infinity Acquisition Warrant holder will be entitled to

exercise his, her or its Infinity Acquisition Warrant prior to the scheduled redemption date. However, the price of the Common

Stock may fall below the $15.00 redemption trigger price as well as the $10.00 warrant exercise price after the redemption notice

is issued.

A holder of an Infinity Acquisition Warrant

may notify Infinity Acquisition in writing in the event it elects to be subject to a requirement that such holder will not have

the right to exercise such Infinity Acquisition Warrant, to the extent that after giving effect to such exercise, such person (together

with such person’s affiliates), to the warrant agent’s actual knowledge, would beneficially own in excess of 9.8% of

the Common Stock outstanding immediately after giving effect to such exercise.

If the number of outstanding Common Stock

is increased by a share dividend payable in Common Stock, or by a split-up of Common Stock or other similar event, then, on the

effective date of such share dividend, split-up or similar event, the number of Common Stock issuable on exercise of each Infinity

Acquisition Warrant will be increased in proportion to such increase in the outstanding Common Stock. A rights offering to holders

of Common Stock entitling holders to purchase Common Stock at a price less than the fair market value will be deemed a share dividend

of a number of Common Stock equal to the product of (i) the number of Common Stock actually sold in such rights offering (or issuable

under any other equity securities sold in such rights offering that are convertible into or exercisable for Common Stock) multiplied

by (ii) one (1) minus the quotient of (x) the price per share of Common Stock paid in such rights offering divided by (y) the fair

market value. For these purposes (i) if the rights offering is for securities convertible into or exercisable for Common Stock,

in determining the price payable for Common Stock, there will be taken into account any consideration received for such rights,

as well as any additional amount payable upon exercise or conversion and (ii) fair market value means the volume weighted average

price of Common Stock as reported during the ten (10) trading day period ending on the trading day prior to the first date on which

the Common Stock trade on the applicable exchange or in the applicable market, regular way, without the right to receive such rights.

In addition, if Infinity Acquisition, at

any time while the Infinity Acquisition Warrants are outstanding and unexpired, pays a dividend or make a distribution in cash,

securities or other assets to the holders of Common Stock on account of such Common Stock (or other shares into which the Infinity

Acquisition Warrants are convertible), other than (a) as described above or (b) certain ordinary cash dividends, then the Infinity

Acquisition Warrant exercise price will be decreased, effective immediately after the effective date of such event, by the amount

of cash and/or the fair market value of any securities or other assets paid on each share of Common Stock in respect of such event.

If the number of outstanding Common Stock

is decreased by a consolidation, combination, reverse shares split or reclassification of Common Stock or other similar event,

then, on the effective date of such consolidation, combination, reverse shares split, reclassification or similar event, the number

of Common Stock issuable on exercise of each Infinity Acquisition Warrant will be decreased in proportion to such decrease in outstanding

Common Stock.

Whenever the number of Common Stock purchasable

upon the exercise of the Infinity Acquisition Warrants is adjusted, as described above, the warrant exercise price will be adjusted

by multiplying the warrant exercise price immediately prior to such adjustment by a fraction (x) the numerator of which will be

the number of Common Stock purchasable upon the exercise of the Infinity Acquisition Warrants immediately prior to such adjustment,

and (y) the denominator of which will be the number of Common Stock so purchasable immediately thereafter.

The Infinity Acquisition Warrants are issued

in registered form under a warrant agreement between Continental Stock Transfer & Trust Company, as warrant agent, and Infinity

Acquisition. Infinity Acquisition Warrant holders should review a copy of the warrant agreement, a form of which will be filed

as an exhibit to Infinity Acquisition’s registration statement on Form S-4, for a complete description of the terms and conditions

applicable to the Infinity Acquisition Warrants.

The Infinity Acquisition Warrants may be

exercised upon surrender of the warrant certificate on or prior to the expiration date at the offices of the warrant agent, with

the exercise form on the reverse side of the warrant certificate completed and executed as indicated, accompanied by full payment

of the exercise price (or on a cashless basis, if applicable), by certified or official bank check payable to us, for the number

of Infinity Acquisition Warrants being exercised. The Infinity Acquisition Warrant holders do not have the rights or privileges

of holders of Common Stock and any voting rights until they exercise their Infinity Acquisition Warrants and receive Common Stock.

After the issuance of Common Stock upon exercise of the Infinity Acquisition Warrants, each holder will be entitled to one vote

for each share held of record on all matters to be voted on by stockholders.

No fractional shares will be issued upon

exercise of the Infinity Acquisition Warrants. If, upon exercise of Infinity Acquisition Warrants, a holder would be entitled to

receive a fractional interest in a share of Common Stock, Infinity Acquisition will, upon exercise, round up to the nearest whole

number the number of shares of Common Stock to be issued to the Infinity Acquisition Warrant holder.

SUMMARY OF THE PROSPECTUS

This summary highlights selected information

from this prospectus but may not contain all of the information that may be important to you. Accordingly, we encourage you to

read carefully this entire prospectus, including the Merger Agreement. Please read these documents carefully as they are the legal

documents that govern the Business Combination and your rights in the Business Combination.

The Parties

Infinity Acquisition

Glori Acquisition Corp.

c/o Infinity-C.S.V.C. Management Ltd.

3 Azrieli Center (Triangle Tower) 42 nd Floor,

Tel Aviv, Israel, 67023

011-972-3-607-5170

Infinity Acquisition is a wholly owned

subsidiary of Infinity Corp. formed in January 2014 for the purpose of engaging in the Business Combination. Infinity Acquisition

will be the survivor of the Redomestication and will be the parent company of Glori following the Transaction Merger. Infinity

Acquisition intends to change its name to Glori Energy, Inc. in connection with the consummation of the Business Combination.

Infinity Corp.

Infinity Cross Border Acquisition Corporation

c/o Infinity-C.S.V.C. Management Ltd.

3 Azrieli Center (Triangle Tower)}

42nd Floor, Tel Aviv, Israel, 670236342

Telephone: 011-972-3-607-5170

Infinity Corp. is a blank check company

that was incorporated as a British Virgin Islands business company with limited liability on April 6, 2011 (under the name Infinity

China 1 Acquisition Corporation) for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation

with, contractual control arrangement with, purchasing all or substantially all of the assets of, or engaging in any other similar

business combination with one or more operating businesses or assets.

Prior to Infinity Corp.’s initial

public offering, the Initial Shareholders purchased 1,150,000 Founder Shares for a purchase price of $25,000, or approximately

$0.022 per share. On May 24, 2012, Infinity Corp.’s directors approved a 1.25-for-1 forward split of its outstanding Ordinary

Shares, increasing the number of Founder Shares to 1,437,500.

Infinity Corp. consummated its initial

public offering of 5,000,000 Units, each Unit consisting of one Ordinary Share and one Infinity Corp. Warrant to purchase one Ordinary

Share, on July 25, 2012. The underwriters of the IPO were granted an option to purchase up to an additional 750,000 Units to cover

over-allotments, if any. On July 26, 2012, the underwriters exercised the option in full and, on July 27, 2012, the underwriters

purchased all of the over-allotment Units. The net proceeds of the initial public offering, together with approximately $2.4 million

from Infinity Corp.’s sale of 4,820,000 Insider Warrants, collectively, to the Infinity Funds and the underwriters of our

initial public offering, for an aggregate of approximately $46.0 million, were deposited in the Trust Account.

On July 20, 2012, the Units commenced trading

on the NASDAQ Capital Market (“Nasdaq”) under the symbol “INXBU.” On September 20, 2012, certain of the

Units were voluntarily separated into the Ordinary Shares and Infinity Corp. Warrants underlying the Units and commenced trading

on Nasdaq under the symbols “INXB” and “INXBW,” respectively. Following the separation, the Units continue

trading.

The Units that are not voluntarily separated

into Ordinary Shares and Infinity Corp. Warrants will continue to trade as Units consisting of one Ordinary Share and one Infinity

Corp. Warrant until Infinity Corp. consummates the Business Combination, at which time each Unit will automatically convert into

one share of Common Stock and one Infinity Acquisition Warrant. Upon the consummation of the Business Combination, the Units, Ordinary

Shares and Infinity Corp. Warrants will become eligible for termination of reporting under Section 12(g)(4) of the Exchange Act.

Merger Sub

Glori Merger Subsidiary, Inc.

c/o Infinity-C.S.V.C. Management Ltd.

3 Azrieli Center (Triangle Tower)

42nd Floor, Tel Aviv, Israel, 67023

Telephone: 011-972-3-607-5170

Merger Sub is a wholly owned subsidiary

of Infinity Acquisition formed in January 2014 for the purpose of the Transaction Merger. Merger Sub will merge with

and into Glori, with Glori being the surviving company, upon consummation of the Transaction Merger.

Glori

Glori Energy Inc.

4315 South Drive

Houston, Texas 77053

Telephone: (713) 237-8880

Glori is a technology focused energy company

that deploys its proprietary biotechnology to facilitate the secondary production of oil at less than $10 per barrel. Only one

third of discovered oil is typically recovered during the life of an oilfield, as recovery of the remaining two thirds of oil is

not economically viable with current technology. By activating in-situ microbiology within the reservoir, Glori can efficiently

produce a portion of this remaining oil. Glori acquires, owns and operates mature oilfields into which it applies its AERO System

technology and additionally is deploying its technology in a range of different geographies and geologies for E&P clients.

In furtherance of its acquisition strategy, on February 4, 2014, a wholly-owned subsidiary of Glori entered into a Purchase and

Sale Agreement to acquire the Coke Field Assets (defined below) for approximately $40 million, and this transaction closed on March

14, 2014.

As of January 1, 2014, the net proved developed

producing oil and natural gas reserves associated with the Coke Field Assets based upon estimates provided by William M. Cobb &

Associates, Inc. were 1,749 MBoe (approximately 96% oil and 4% natural gas), and for the month ended December 31, 2013, the average

net daily production associated with the Coke Field Assets was 506 Boe per day (approximately 91% oil and 9% natural gas). Glori

intends to deploy its AERO System technology in the Coke Field Assets in an attempt to improve production rates and overall oil

recovery from these assets.

Glori, which is based in Houston, Texas,

was incorporated as Glori Oil Limited, a Delaware Corporation, in November 2005 and changed its name to Glori Energy Inc. in May

2011. In September 2010, Glori incorporated Glori Canada Ltd. (formerly Glori Oil Ltd.) in the province of Alberta, Canada, with

registration in the province of Saskatchewan, as a wholly-owned subsidiary, to conduct Glori’s business in Canada. In October

2010, Glori activated a previously dormant wholly-owned subsidiary, Glori Holdings Inc. (formerly Glori Oil Holdings Company) (“Glori

Holdings”), to acquire a 100% working interest in the Etzold field. In February 2011, Glori incorporated Glori California

Inc. (formerly Glori Oil California Limited) to conduct its operations in the state of California. In September 2013, Glori incorporated

OOO Glori Energy to conduct its operations in the Russian Federation. In March 2014, Glori formed Glori Energy Production Inc.,

a wholly-owned subsidiary of Glori Holdings, to purchase the Coke Field Assets. Glori, Glori Holdings, Glori Canada Ltd., Glori

Oil (Argentina) Limited, Glori California Inc., Glori Oil S.R.L., OOO Glori Energy, Inc., and Glori Energy Production Inc. comprise

the entities within the Glori corporate structure. Glori has undertaken the dissolution of Glori Oil S.L.R. and is awaiting confirmation

that the dissolution was effective.

In addition to the

initial funding by Glori’s founders, Glori has successfully concluded a series of venture capital and private equity offerings

between 2007 and March 2014 totaling approximately $57.3 million. Glori’s principal stockholders include the following stockholders

and some of their affiliates: GTI Group, Kleiner Perkins Caufield & Byers, Oxford Bioscience Partners, Rawoz Technology Company

Ltd., Malaysian Life Sciences Capital Fund Ltd., Gentry-Glori Energy Investment, Advantage Capital Partners, and Energy Technology

Ventures, LLC, which is a joint venture of General Electric, ConocoPhillips, and NRG Cleantech Investments LLC.

GLORI BUSINESS

Overview

Glori is a technology focused energy company

that deploys its proprietary biotechnology to facilitate the production of oil at less than $10 per barrel. Only about one-third

of the oil discovered in a typical reservoir is recoverable using conventional oil production technology, leaving the remaining

two-thirds trapped in the reservoir rock. Glori’s AERO System technology stimulates the native microorganisms that reside

in the reservoir to improve the recoverability of this trapped oil. Glori derives revenues from fees earned as a service provider

of its technology to third party exploration and production (“E&P”) companies, and also intends to use its technology

to increase oil production in oil fields that it acquires and redevelops in the United States.

Glori has assembled a team of oil industry

professionals with extensive experience in all facets of acquiring and managing oil properties. Glori intends to acquire and redevelop

mature oil fields with historically long-lived, predictable production profiles that fit its criteria for the AERO System. These

are mature active waterfloods, or assets with clear waterflood potential, sandstone reservoirs and onshore in the United States.

Glori believes it can enhance the revenues, cash flows and acquisition returns from such oil fields through well recompletions,

waterflood optimization and implementation of its AERO System of enhanced oil recovery. Glori believes this strategy will enable

it to further demonstrate the efficacy of its AERO System while allowing it to capture the increase in revenues and ultimate recovery.

Glori believes the acquisition of principally proved producing oil reserves, with production and cash flow history, is an economically

attractive, low-risk complement to its service business which is dependent on customer adoption of the AERO System technology.

Glori’s acquisition team is developing a “pipeline” of potential acquisitions, both through direct private negotiations

as well as the public bid process. Further, by owning its own oil properties, Glori can manage the implementation of AERO System

in a controlled environment and accelerate the industry adoption of the technology.

Glori Technology Services

Glori’s AERO System incorporates

a dedicated field deployment unit designed to work with existing waterflood operations. Waterflooding is a commonly used process

of injecting water into the reservoir in order to increase oil recovery. The AERO System does not have any significant new impact

on the environment because it utilizes existing production equipment and infrastructure, and does not change the nature of the

customer’s oil production operations. Implementation of the AERO System does not require the drilling of new wells nor does

it require other significant new capital investment.

Glori believes its AERO System increases

the oil production rate and the ultimate quantity of oil recovered over the life of the oil field, and extends the life of the

field by integrating sophisticated biotechnology with traditional oil production techniques. Glori believes that other enhanced

oil recovery techniques, such as the injection of gas, steam or chemicals into the reservoir, introduce new environmental risks

and are more expensive. Glori’s initial results on commercial field deployment indicate that the AERO System may recover

up to 20% of the oil that remains trapped in a reservoir after the application of conventional oil recovery operations, and may

improve total production rates by 60% to 100%. These initial results on commercial field deployment were published in a paper Glori

published with Merit Energy Company and Statoil and presented at a July 2011 Society of Petroleum Engineers conference, a copy

of which is included as an exhibit to the registration statement of which this prospectus forms a part. However, the true

swept area between these two wells is unknown, and further work is required to resolve the improvement to sweep efficiency and

corresponding incremental benefit. Further work & extension of the pilot is planned.

Based on commercial applications, Glori

believes that, excluding minimal upfront capital investment, Glori’s technology can recover incremental oil at an operating

cost of not more than $6 per barrel, depending on the size and life of the project. For example, with respect to the first commercial

field deployment of Glori’s AERO System, Glori estimates that its cost for this project, excluding minimum upfront capital

costs, research and development costs and selling, general and administrative costs, was approximately $6 per incremental barrel

of oil. Glori expects that the costs for future full scale commercial implementations of its technology would not be higher than

$6 per barrel, particularly if the size of the project is larger than its first AERO System commercial field deployment. However,

these cost estimates are derived from the results for only one project.

Further, Glori believes that the incremental

oil recovered from the Stirrup field pilot well would not have been recovered without implementation of the AERO System because

traditional enhanced oil recovery technologies, such as thermal injection, gas injection and chemical injection, generally require

large scale operations or involve significant costs, making them cost-effective only in larger reservoirs.

Glori has performed extensive laboratory

and field testing to validate, integrate and advance technology transferred from three different scientific groups that collectively

represent decades of funded research and development. Glori’s technology is protected by several patents and patent applications.

Glori and its collaborators, Statoil Petroleum AS, or Statoil, in Norway, The Energy and Resources Institute, or TERI, in India,

and Bio Topics S.A., in Argentina, have applied Glori’s predecessor technologies and the AERO System in more than 100 wells

throughout the world. Glori estimates that these predecessor technology implementations have recovered over six million barrels

of oil that would not have otherwise been recovered. Glori currently has 19 active projects in various stages of analysis and field

deployment with international and domestic exploration and production, or E&P, companies. Glori anticipates continuing to demonstrate

results with its AERO System technology and expand its customer base as well as utilizing AERO System technology on its own oil

fields.

Glori was incorporated as Glori Oil Limited,

a Delaware Corporation, in November 2005 and changed its name to Glori Energy Inc. in May 2011. In September 2010, Glori incorporated

Glori Canada Ltd. (formerly Glori Oil Ltd.) in the province of Alberta, Canada, with registration in the province of Saskatchewan,

as a wholly-owned subsidiary, to conduct Glori’s business in Canada. In October 2010, Glori activated Glori Holdings to acquire

a 100% working interest in the Etzold field, in Kansas. In February 2011, Glori incorporated Glori California Inc. (formerly Glori

Oil California Limited) to conduct its operations in the state of California. In September, 2013, Glori incorporated OOO Glori

Energy to conduct its operations in the Russian Federation. In March 214, Glori formed Glori Energy Production Inc., a wholly-owned

subsidiary of Glori Holdings, to purchase the Coke Field Assets. Glori Energy Inc., Glori Holdings, Glori Canada Ltd., Glori Oil

(Argentina) Limited, Glori California Inc., OOO Glori Energy Inc., Glori Energy, Glori Oil S.R.L. and Glori Energy Production Inc.

comprise the entities within the Glori corporate structure. Glori has undertaken the dissolution of Glori Oil S.L.R. and is awaiting

confirmation that the dissolution was effective.

In addition to the initial funding by Glori’s

founders, Glori has successfully concluded a series of venture capital and private equity offerings between 2007 and March 2014

totaling approximately $63.8 million. Glori’s principal stockholders include the following stockholders and some of their

affiliates: GTI Group, Kleiner Perkins Caufield & Byers, Oxford Bioscience Partners, Rawoz Technology Company Ltd., Malaysian

Life Sciences Capital Fund Ltd., Gentry-Glori Energy Investments, LLC, Advantage Capital Partners, and Energy Technology Ventures,

LLC, which is a joint venture of General Electric, ConocoPhillips, and NRG Cleantech Investments LLC.

Glori Market Opportunity

Glori’s market for its AERO System

consists of domestic and international oil production waterflood sites. According to the EIA report, demand for oil globally is

projected to grow from 85.7 million barrels per day in 2008 to 112.2 million barrels per day in 2035, representing a compound annual

growth rate of 1%. As oil trades on a global market, the price of oil is not significantly sensitive to local demand and supply

fluctuations. While global demand for oil is forecasted to grow, there is an increasing gap between new discoveries and production,

decreasing the world’s oil reserves, as it is becoming harder and more expensive to find new oil reservoirs. As a result,

enhanced oil recovery technology to improve oil production at mature fields is increasingly important to offset declining reserves.

Conventional oil recovery operations, including

waterflood, are commonly believed to only extract around one third of the original oil in place in a reservoir, leaving large quantities

behind at the end of life of an oil field. According to the Oil and Gas Journal, “ Global Oil Reserves-2: Recovery factors

leave EOR plenty of room for growth” , Volume 105, Issue 42, dated November 12, 2007, a one percent increase in the efficiency

of global hydrocarbon recovery would expand conventional oil reserves by 88 billion barrels, which would be enough to replace three

years of world production at the current rate.

According to EIA data released in July

2011, waterflooding accounts for more than one-half of the United States domestic oil production, or over 2.5 million barrels of

oil per day. Glori estimates the annual incremental production opportunity for oil producers using the AERO System to be greater

than $10 billion in the United States based on an assumed price of $80.00 per barrel and a total production rate increase from

the application of Glori’s AERO System of only 30%. As the United States accounts for approximately 9% of the world’s

oil production according to the IEA, May 2011 Oil Market Report, the potential annual international market is substantially larger.

Glori believes its AERO System represents

the most cost effective enhanced oil recovery method from both a capital expenditure and an operating cost perspective. Glori anticipates

its primary competition for this sizable market will come from traditional enhanced oil recovery technologies, such as thermal

injection, gas injection and chemical injection, as well as from other microbial enhanced oil recovery methods. Glori believes

that its AERO System is superior to traditional enhanced oil recovery technologies both economically and environmentally and that

the AERO System is able to recover oil that traditional enhanced oil recovery methods cannot recover on an economic basis. Because

the AERO System works with naturally occurring microbes in the reservoir, Glori believes its processes do not cause any damage

to the environment. Glori also views its AERO System as presenting the lowest capital expenditure profile of any traditional enhanced

oil recovery technology since it requires no new meaningful infrastructure investment. In addition, Glori considers oil produced

using its AERO System to have a distinct cost advantage over many renewable energy sources, including biofuels, in that the oil

can be sold directly into existing markets using existing infrastructure.

According to a November 2007 Oil &Gas

Journal article, about 50% of the world’s oil lies in small to medium sized reservoirs, which are generally untouched by

traditional enhanced oil recovery processes. Glori’s AERO System is well suited for smaller and medium sized reservoirs because

its technology does not require large scale operations to be economical, unlike thermal injection, gas injection and chemical injection.

According to the United States Environmental

Protection Agency, approximately 144,000 wells were being used for waterflooding of oil reservoirs in the United States. Glori’s

AERO System is currently designed for sandstone reservoirs with a permeability range greater than 50 milli-darcies.

Technology

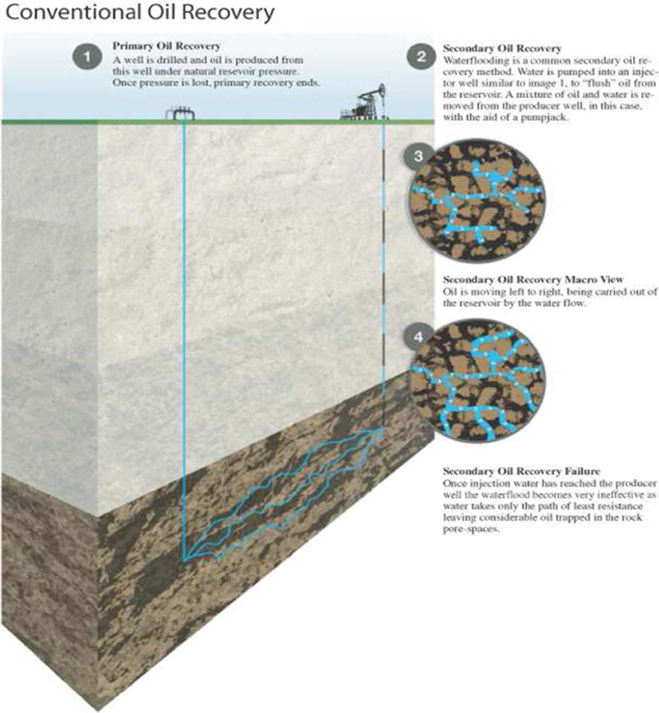

Traditional Oil Production

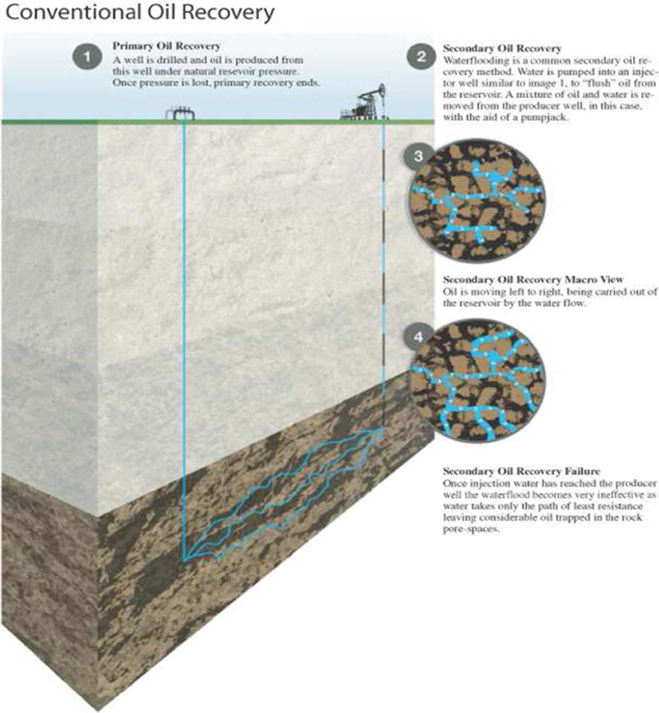

Traditional oil production is carried out

through primary reservoir pressure, artificial lift mechanisms and pumps followed by water injection, also known as waterflood,

which increases reservoir pressure and displaces some of the oil remaining in the reservoir. However, two-thirds of the original

oil in place typically remains trapped in the oil reservoir even after waterflooding.

Glori’s Technology

Microbes residing in oil reservoirs have

the natural ability to use oil as a food source to facilitate growth given the right conditions. Growth of microbes on the oil

is a fundamental requirement for AERO System functionality. Since the oil acts as a food source, the bulk of ingredients to fuel

the AERO System are already in the reservoir, limiting the externally added components to the specific nutrients Glori introduces

and water, and the microbial growth and action occur only where the oil is trapped. This process is complex and depends on several

distinct groups of microbes performing specialized tasks in the chain of biological reactions. The complexity of the process makes

it vulnerable to disruption from external changes in the surrounding environment. Glori leverages its knowledge of how to establish

a consistent environment with the right characteristics for mobilization of trapped oil in its AERO System. Glori does not introduce

specific microbes selected for its purposes, nor does it rely upon genetically-engineered microorganisms. Instead Glori adds customized

nutrients to the reservoir to grow the existing indigenous microbes in that reservoir.

When the analysis and process development

for the candidate field have been completed, the project moves into the deployment phase. Glori has designed its deployment systems

to integrate with current oilfield waterflood equipment to simplify installation. This has resulted in modular field units that

can be customized for continuous input of nutrients to the reservoir. Glori’s field units are equipped with sensors to monitor

performance remotely, which allows us to service oil fields efficiently in remote locations. The oil that is produced from the

utilization of the AERO System is delivered to market using the existing wells and pipelines that are already available to the

oil producer. The additional oil that is captured by the AERO System is not altered in the process. Glori has verified this process

by continuous operation of an oil field pilot project for more than three years during which no significant change in the n-alkane

distribution could be detected. Oil is composed of a large collection of carbon-containing molecules, or hydrocarbons. A significant

percentage of these hydrocarbons are n-alkanes, on average, about 30%. Oil quality reflects the compositional characteristics of

its hydrocarbons. Removal of n-alkanes from crude oil results in decreased oil quality; thus, the measure of n-alkanes is a measure

of oil quality. Removal of n-alkanes from oil commonly occurs by biodegradation caused by microbes. Oil biodegrading organisms

have a specific order of preference for compounds that they remove from oil. Degradation of crude oil tends to remove n-alkanes

first. Therefore, measurement of n-alkanes before, during, and after technology application represents a measure of the ability

of the process to affect oil quality. The result of “no significant change in n-alkane distribution” demonstrates Glori’s

technology has no measurable effect on oil quality.

Depending on the amount of oil trapped

in the reservoir, Glori is expecting the production benefits from AERO System deployment to be sustained over many years until

up to an additional 20% of the remaining oil has been produced. While Glori currently applies the technology to mature waterfloods,

Glori anticipates further performance improvements when its AERO System process is initiated at an earlier stage of oil recovery.

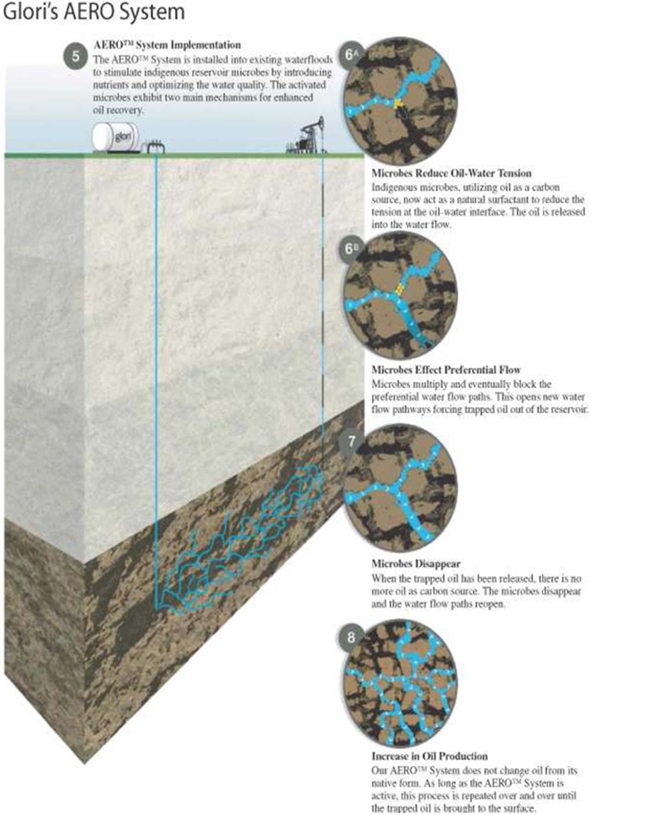

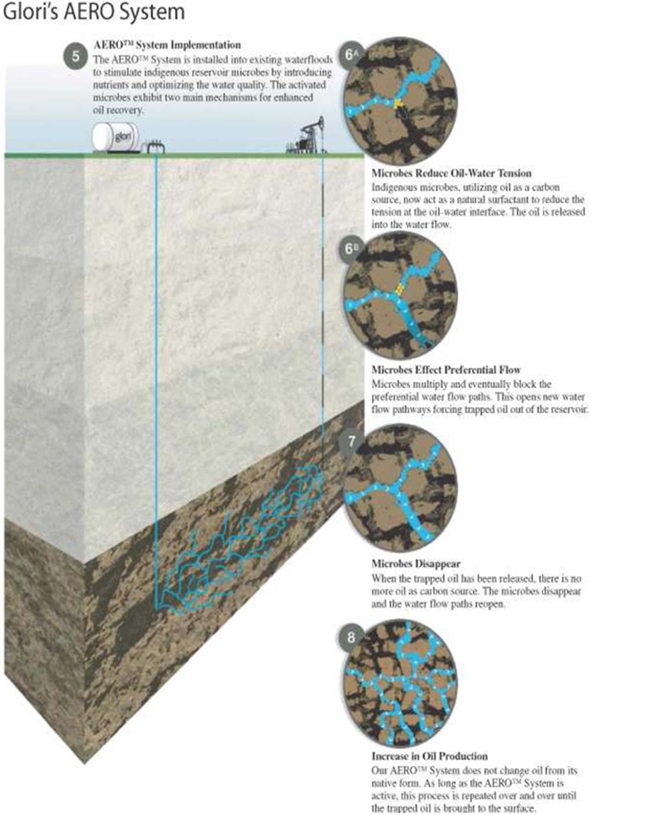

The diagram below illustrates traditional oil recovery and the AERO System.

As part of the

implementation of the AERO System process, Glori analyzes the injection water and water treatment system at the candidate oil field

to determine if the water quality is compatible with AERO System requirements. Glori does not need potable water for the AERO System

to be successful, but it does need the water to be non-toxic to the microbes. Glori’s results indicate that the AERO System

may recover up to 9-12% of the original oil in place in a reservoir.

Research and Development

Glori’s research and development

strategy seeks to extend the reach and effectiveness of the AERO System by focusing on the fundamental mechanisms of microbe-oil

interactions. Glori has made significant investments in the development of the AERO System and will continue to fund further technology

development in the future. Deployment of the AERO System enables and activates key microbial functionalities within an oil reservoir.

These functionalities mobilize otherwise trapped oil resulting in increased production of oil. The functionalities required for

successful deployment of the AERO System will be analogous between different reservoir conditions, but the microbes performing

them and the nutrients required to best stimulate their growth may be different. To understand this complex system of diverse microbes

and their interactions requires understanding the molecular mechanisms at work. As Glori’s knowledge of the biochemistry

of oil mobilization by the AERO System develops, it expects to have the ability to both improve current deployment strategies and

deploy the AERO System in a greater range of reservoir conditions.

Combined, these research and development

programs are designed to drive down costs per incremental barrel of oil produced by increasing oil yield and production rates as

well as by increasing both the number of candidate oil fields and the scale of deployment.

In 2006, Glori obtained technology and

intellectual property from TERI, a research company based in India, and implemented several field projects. In 2008, Glori acquired

know-how of Biotopics, an Argentine company working on related microbial technology in the enhanced oil recovery industry, through

a technology development agreement and retained key employees of Biotopics. In 2009, Glori entered into a technology cooperation

agreement with Statoil, which has been replaced by an updated 2011 agreement, to incorporate intellectual property and know-how

that Statoil has been developing for many years. Glori scientists and engineers have been able to further develop and expand the

intellectual property and know-how obtained from these three technology partners to create the AERO System. In addition, Glori

is working with the Winogradsky Institute of Microbiology in Moscow on AERO System technology for carbonates.

Glori’s Competitive Strengths

| |

·

|

Disruptive and proven technology: Glori believes that the AERO System is a transformative and disruptive innovation that manipulates the existing reservoir microbial communities to improve the recovery of oil in waterflood oil fields. Glori believes its AERO System is applicable in more oil fields than other existing enhanced oil recovery technologies. Unlike many other new and emerging clean-energy technologies, Glori has not only demonstrated the commercial efficacy of its technology, but has passed the significant milestone of one million incremental gallons of oil produced via the AERO System. Glori currently has 19 active projects in various stages of analysis and field deployment of the AERO System technology. |

| |

·

|

Attractive returns from acquisition of oil fields: Glori intends to acquire mature oil fields which are under waterflood or are good candidates for waterflood. By acquiring oil fields and implementing the AERO System technology, Glori can capture 100% of the increase in production, revenues and ultimate oil recovery, resulting in the potential for superior acquisition returns. Additionally, by acquiring its own fields, Glori expects to accelerate the industry adoption of its technology. |

| |

·

|

Established commercial contracts: Glori customers include international oil companies and independent oil and gas companies in North America. Glori has had active projects with more than 19 companies. |

| |

·

|

Profitable stand-alone economics: Glori’s current commercial application of the AERO System is profitable on a project level basis. For example, Glori estimates that the total operating cost per barrel, excluding minimal upfront capital costs, attributed to the use of Glori’s technology over the life of Glori’s first project, based on the first year of operation, was approximately $6 per incremental barrel of oil. Unlike many other emerging clean-energy technologies, successful commercialization of the AERO System does not depend on the availability of government subsidies or mandates. |

| |

·

|

Capital-light technology: Unlike other enhanced oil recovery processes, the AERO System has a capital-light deployment strategy. The AERO System is applied to a reservoir by utilizing Glori’s field deployment module, which requires relatively minor capital investment, alongside Glori’s existing wells. Glori believes its technology has the potential to create a sustainable source of additional economic oil production that will extend the lives of oil fields and related infrastructure for many years. |

| |

·

|

Clean alternative to traditional enhanced oil recovery: Glori’s AERO System increases the oil recoverable from an existing field using infrastructure already built and in place. Deployed in a waterflood reservoir, no new wells need to be drilled, no new pipelines are laid, no new significant energy input is required into the process and there is no new disruption to the environment. Furthermore, because the activity is biological and occurs in the reservoir, there is minimal consequent carbon dioxide or greenhouse gas footprint. Once the application of the AERO System ends, the microbes in the reservoir are no longer supplied with nutrients and the reservoir will return to its pre-treatment status. By way of comparison, other enhanced oil recovery techniques require significant energy input, such as thermal injection, or significant additional infrastructure to implement, such as gas injection. In addition, other enhanced oil recovery techniques introduce new environmental impacts, in particular gas injection and chemical injection techniques, which result in a sizable carbon dioxide or greenhouse gas footprint or the addition of a large quantity of chemicals or polymers into the reservoir. |

| |

·

|

Intellectual property position: Glori’s intellectual property, consisting of substantial know-how and trade secrets, is the result of decades of research and development by Glori, Statoil Petroleum AS, or Statoil, in Norway, The Energy and Resources Institute, or TERI, in India, and Bio Topics S.A., or Biotopics, in Argentina. In addition, Glori is working with the Winogradsky Institute of Microbiology in Moscow on AERO System technology for carbonates. Glori also has multiple patents and patent applications. Glori believes its intellectual property and decades of research provide it with a strong competitive advantage and creates a high barrier to entry. See the section titled “Intellectual Property Portfolio” for further discussion. |

| |

·

|

Experienced management and technical team: Glori’s management and technical team’s expertise includes microbiology, chemistry and biochemistry, microbial genomics, engineering, geology and geosciences, petroleum engineering, reservoir engineering and production management, and in their respective careers, Glori’s team members played key roles in the commercialization of dozens of successful large-scale industrial biotechnology and traditional oilfield acquisition and development projects. |

Milestones and Commercialization Strategy

Technology Milestones

Confirmation of microbial activity:

Glori has determined through field sampling and laboratory testing that essentially all hydrocarbon bearing reservoirs either contain

microbes or can be injected with source water that does contain microbes that are capable of utilizing the residual hydrocarbon

to grow, and in doing so create biomass as biofilms. Glori is continuously refining its methodologies to grow these microbes and

Glori’s criteria for selection of nutrients to facilitate certain functionalities in the process. Below is a table that shows,

from the sample set Glori has tested, 80% of hydrocarbon bearing reservoirs contain microbes suitable for enhanced recovery. For

those that do not show evidence of viable microbes, there is associated “source water” (usually from a subterranean

reservoir at a different depth from the target reservoir) that does contain viable microbes:

| | |

Evidence of viable microbes in: | |

| | |

Production

system | | |

Source

water | | |

Production +

Source Water | |

| Reservoirs tested | |

| 18 | | |

| 6 | | |

| 6 | |

| Positive findings | |

| 83 | % | |

| 100 | % | |

| 100 | % |

Improvement in oil recovery factors:

Over the past five years, Glori has achieved a number of significant advances in its research and development effort. Glori’s

application of technology progressed from small, discreet application at producing wells under a “huff and puff” process

(whereby the nutrient mix is injected into a producer well which is then shut-in for a period of days to allow the microbes to

grow before the well is re-opened to production), to full scale application at injection wells under a continuous injection process.

In addition, Glori added microbial genomics and bioinformatics capabilities in its laboratory facilities to further advance Glori

understanding of the microbial processes involved in oil mobilization.

Development of Glori’s AERO System

technology: In 2010, Glori implemented its pilot commercial AERO System project in the field. In April 2011, Glori applied

for patent protection of this technology. In 2012, Glori applied for two additional patents associated with exploitation of the

AERO mechanism.

Commercialization Milestones

Demonstration of commercial application:

Between 2007 and 2009, Glori demonstrated that proprietary nutrient formulations delivered through its “huff and puff”

process could accelerate the production of oil through improvement of flow conditions in the near wellbore environment of a production

well. Thereafter, Glori applied the AERO System technology at the water injector well continuously and demonstrated improved recovery

rates at economically attractive costs. The AERO System implementation builds on predecessor technology implementations that collectively

account for over 100 treatments in different wells in multiple locations around the world including the United States, Argentina,

the North Sea and India.

Commercialization Strategy

Glori’s mission is to use microbiology

to efficiently recover large quantities of oil currently trapped in reservoirs using existing oil wells. To achieve this Glori

intends to:

| |

·

|

Acquire and operate oilfields: Deployment of the AERO System technology to its own oil fields will enable Glori to capture 100% of the revenues and cash flow benefit from the increased production and to generate enhanced acquisition returns. In October 2010, Glori acquired the North Etzold field to demonstrate the application of the AERO System. To accelerate adoption of the AERO System, Glori plans to strategically acquire and develop additional mature oil fields in geographies that it expects will improve its portfolio of field successes. |

| |

·

|

Expand Glori’s project portfolio: As of December 31, 2013, Glori had seven customer projects in the Field Deployment stage and another 12 in the Reservoir Analysis and Treatment Design phase. Glori expects to initiate a growing number of projects that are currently in various stages of evaluation. As Glori continues to develop its customer base, it expects its AERO System revenues to grow significantly. |

| |

·

|

Optimize Glori’s performance and expand the applicability of the AERO System: While Glori is already active on a commercial scale, it intends to continue to improve its performance and predictability of the AERO System using the Etzold field laboratory as well as additional customer projects and assets Glori acquires. Glori believes that in the future it will develop additional capabilities that will expand the types of fields to which it can apply its technology, such as expanding the applicability of Glori’s technology to carbonate reservoirs. |

| |

·

|

Accelerate execution by leveraging additional strategic partnerships: Commercialization of Glori’s technology could be further accelerated and expanded through additional strategic partnerships. Glori currently has collaboration arrangements with Statoil and TERI. Glori is currently exploring collaboration opportunities with a number of major oil companies and other potential partners. |

AERO System Service Offering

Glori employs a two-step process to screen

and evaluate an oilfield for AERO System suitability, whether for an oil field to be acquired or for a customer. This process ensures

a systematic, engineered and customized approach to technology deployment in each reservoir. The same process is used to screen

an oilfield acquisition.

Reservoir Analysis and Treatment Design

Phase (Analysis Phase) : Glori obtains representative oil and water samples from the reservoir as part of its screening process

to evaluate AERO System potential. Samples are taken to Glori’s Houston laboratory where detailed geochemical analysis is

performed. The heart of the Analysis Phase deals with microbiological activities, where the indigenous formation microbes are analyzed

for functionality. The general activities for the Analysis Phase are:

| |

·

|

Review field characteristics data; |

| |

·

|

Perform a geological suitability analysis of the target structure; |

| |

·

|

Collect samples from targeted wells; |

| |

·

|

Conduct geochemical characterization of oil and water; |

| |

·

|

Determine the indigenous microbes present in the reservoir fluids. |

| |

·

|

Incubate and study indigenous microbes; and |

| |

·

|

Develop an optimal nutrient package for field application including any needed modifications to the field injection water. |

Tests are performed at Glori’s Houston

laboratory using microbes from the reservoir and nutrient media with the formation water and oil to verify AERO System performance

under simulated reservoir conditions. Several iterations of tests are often performed to optimize the system compositions to achieve

the optimal AERO System activity. If microbial growth and economical oil recovery can be demonstrated, the project then moves forward

to the Field Deployment Phase.. The Reservoir Analysis and Treatment Design phase typically takes an aggregate of two months to

complete.

Field Deployment Phase : Once the

viability of the AERO System is demonstrated in the Analysis Phase, a detailed project development plan is finalized, and the project

proceeds to the Field Deployment Phase where the AERO System is initiated in the oil field to stimulate the indigenous microbes

in the oil bearing reservoir.

Glori mobilizes skid-mounted injection

equipment to the field location. This equipment has been specially designed and tested by Glori at its Houston facility, and is

manufactured by select third parties. The equipment is continuously monitored and operated remotely from Glori’s project

command center in Houston. The equipment remains on the lease throughout the duration of AERO System activities. It is usually

installed near the waterflood water injection plant where Glori’s microbial nutrient media are injected into waterflood flowlines

for delivery to the reservoir.

Once initiated, Glori and its customer

continually evaluate the technical, operational and economic results of the Field Deployment Phase activity. Assuming the project

meets the desired criteria, Glori works with the customer to prepare a project expansion plan, up to and including full-field deployment

of the AERO System.

Typically Glori starts the Field Deployment

Phase as an initial field validation in a small section of a producing field. Results from the AERO System are typically detected

within two to three months after it initiates the Field Deployment Phase. After the initial Field Deployment Phase field validation

is complete, Glori expects to enter into a longer term contract with its customer to continue the use of the AERO System in the

entire or in specific areas of the oil field.

Sales and Marketing

Glori uses a direct sales channel to market

its AERO System technology to the E&P industry. As of December 31, 2013, the business development group is comprised of four

people, based in Houston and Fort Worth.

Because of the uniqueness of Glori’s

technology and the early stage of its development, Glori must educate its customers on its technology in order to generate business.

Customers generally introduce Glori to their operations on a limited scope and generally in their lowest-priority oil field in

order to test the technology. This approach results in a trial that is suboptimal, but Glori believes will generate additional

opportunities to expand its relationship with the customer once Glori’s technology is proven to them.

Customers

Glori has entered into master service agreements

that define its legal relationships with oil producers. The scope of work and commercial terms for a particular project are defined

in a separate document specific to that project. Most of Glori’s contracts are for a pilot implementation of the AERO System

and incorporate a fee for service for the Analysis Phase and a monthly charge for initial Field Deployment Phase validation. After

completion of the initial Field Development Phase, Glori anticipates that successful field validation performance will lead to

negotiated evergreen contracts for continued Field Development Phase activities.

Glori’s customer base comprises international

oil companies and independent oil and gas companies in North America. During 2011, three individual E&P companies exceeded

10% of Glori’s total service revenues for the year: Merit Energy Company LLC, Husky Oil Operations Limited, and Hilcorp Energy

Company. During 2012, six individual E&P companies exceeded 10% of Glori’s total service revenues for the year: Cenovus

Energy Inc., Enerplus Corporation, Denbury Onshore, LLC, Merit Energy Company LLC, Husky Oil Operations Limited, and Riyam Engineering

& Services LLC/ Petroleum Development Oman. During 2013, four individual E&P companies exceeded 10% of Glori’s total

service revenues for the year: Cenovus Energy Inc., ConocoPhillips Company, T-C Oil Company, LLC and Merit Energy Company.

Oilfield Acquisition Strategy

Glori intends to acquire and redevelop

mature oil fields with historically long-lived, predictable production profiles. Glori believes it can enhance the revenues, cash

flows and acquisition returns from such oil fields through well recompletions, secondary recovery, waterflood optimization and

implementation of its AERO System of enhanced oil recovery. Glori also plans to selectively acquire fields which may have low current

production but have (i) excellent reservoir qualities, (ii) significant original oil in place remaining, and (iii) provide opportunities

to re-enter existing wells, return them to production, and deploy the AERO System to capture significant economic quantities of

oil. Glori believes this strategy will enable it to further demonstrate the efficacy of its AERO System while allowing it to capture

the increase in revenues and ultimate recovery. Often these mature fields have not been fully exploited and have not been exposed

to enhanced oil recovery technologies. Additionally, by owning its own oil properties Glori will be able to manage the implementation

of the AERO System in a controlled environment and accelerate the industry adoption of the technology. Glori has assembled a team

of oil industry professionals with extensive experience in all facets of acquiring and managing oil properties. Glori is seeking

and evaluating acquisitions that fit its criteria for the AERO System. These fields are mature active waterfloods, or assets with

clear waterflood potential, sandstone reservoirs and are located onshore in the United States. Glori’s acquisition team is

developing a “pipeline” of potential acquisitions, both through direct private negotiations as well as the public bid

process.

Glori’s Properties

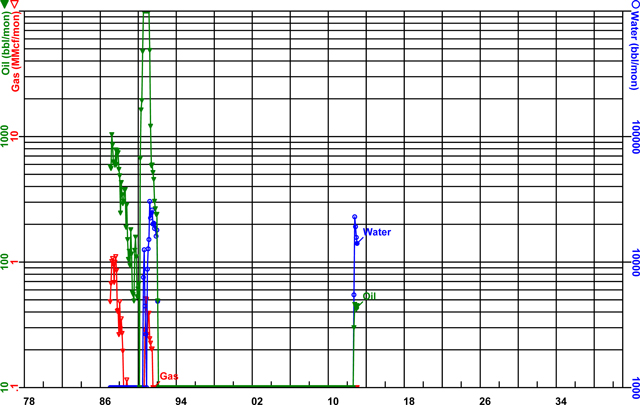

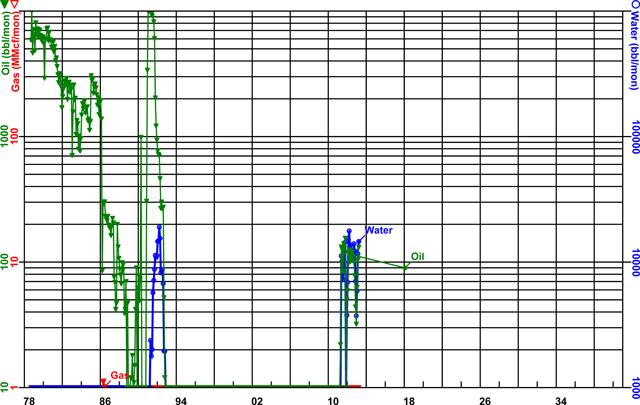

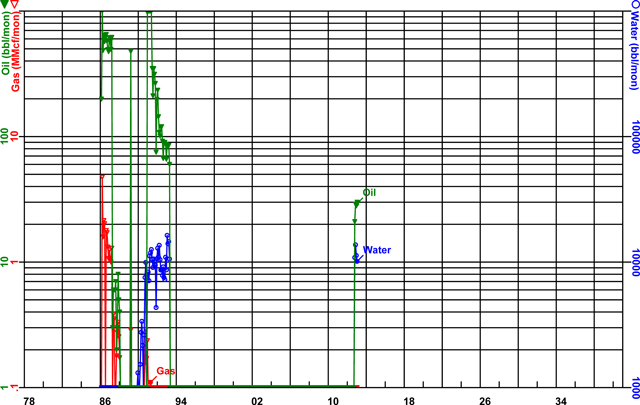

The Coke Field Acquisition

On March 14, 2014, Glori Energy Production

Inc. closed the acquisition of the Coke Field Assets for a purchase price of approximately $40 million as described elsewhere in

this prospectus. The Coke Field Assets are in the East Texas Basin, located in Wood County, Texas, and include total acreage of

2,446, an average Working Interest percentage of 98.2% (average of Producing well Working Interest). As of January 1, 2014, the

net proved developed producing oil and natural gas reserves associated with the Coke Field Assets based upon estimates provided

by William M. Cobb & Associates, Inc. were 1,749 MBoe (approximately 96% oil and 4% natural gas), and for the month ended December

31, 2013, the average net daily production associated with the Coke Field Assets was 506 Boe per day (approximately 91% oil and

9% natural gas).

The Coke Field Assets are comprised of

the majority of the Coke Field along with three leases in the Quitman Field. All leases will be operated by Glori. Glori will become

the operator on March 15, 2014. The Coke Field is a salt dome structure discovered in 1942. The primary oil producing zone has

been the upper Paluxy formation at about 6300 ft. which has a natural water drive. Glori’s Working Interest is 100% in all

the Paluxy wells. The Sub-Clarksville formation occurs at about 4100 ft and a unit has been formed across the whole field. Glori’s

Working Interest in the Sub-Clarksville unit is 83.26%. Glori’s Working Interest is 100% in the three Quitman Field leases.

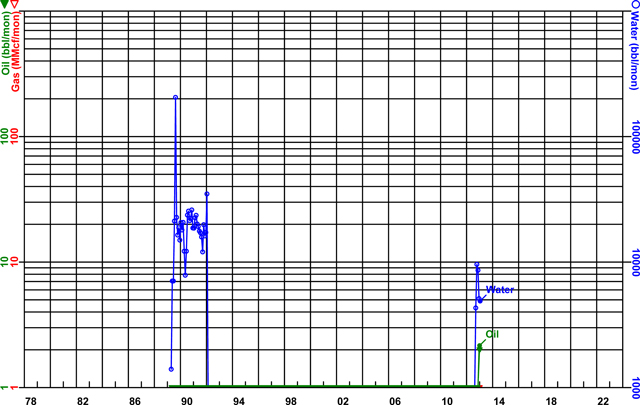

The Etzold Field Acquisition

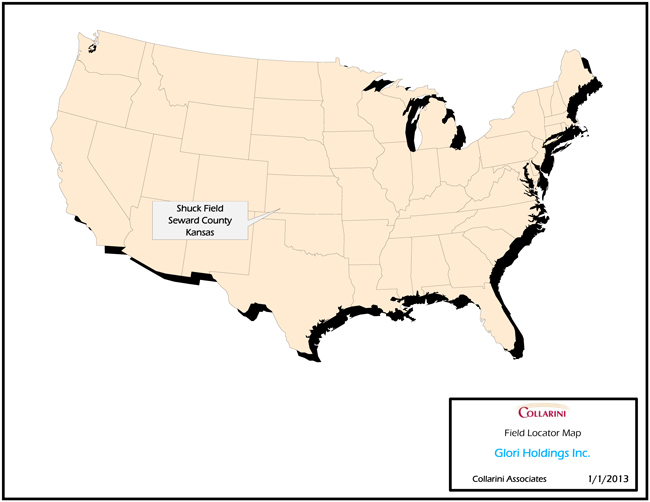

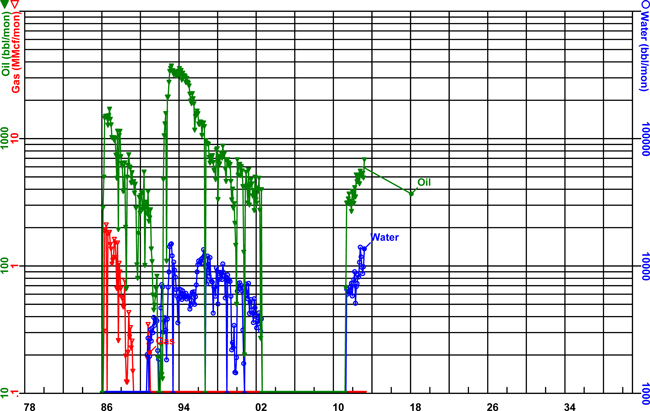

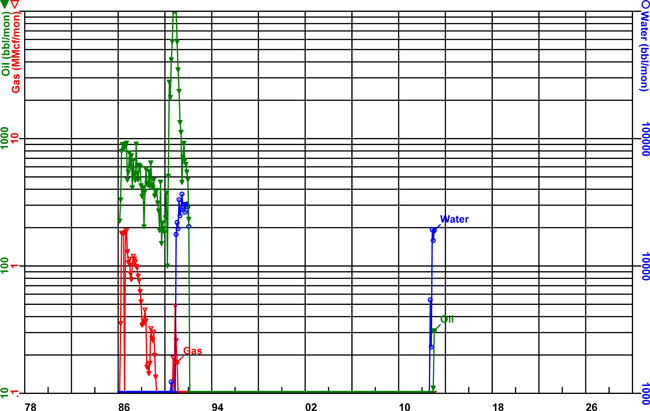

In the fourth quarter of 2010, Glori acquired

the North Etzold field, a non-producing oilfield in Seward County, Kansas. North Etzold is part of the Shuck Field and produces

from the Chester sandstone. Reservoir properties are around 12 – 14% porosity and 40 – 70 milli-darcies permeability.

Historical cumulative production for North Etzold was 1,283,343 barrels of oil at the time Glori started the redevelopment in 2011.

The North Etzold field consisted of 14 shut-in wells which had been stripped of wellbore tubulars, artificial lift equipment and

the associated oil and water processing and storage facilities. In the first quarter of 2011, Glori recompleted some of these wells

and commenced injection into two wells and producing from two wells (the “Phase 1 Recompletion”). The Phase 1 Recompletion

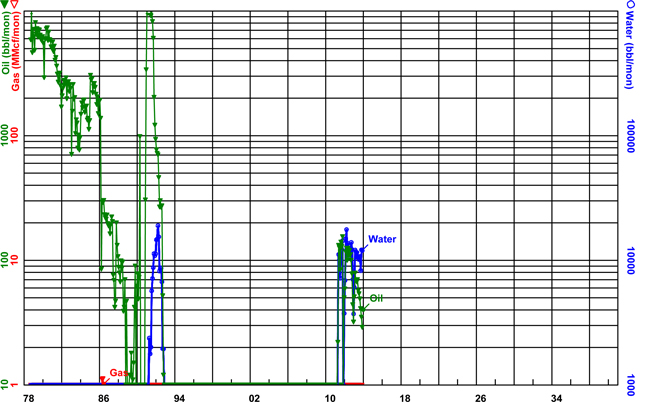

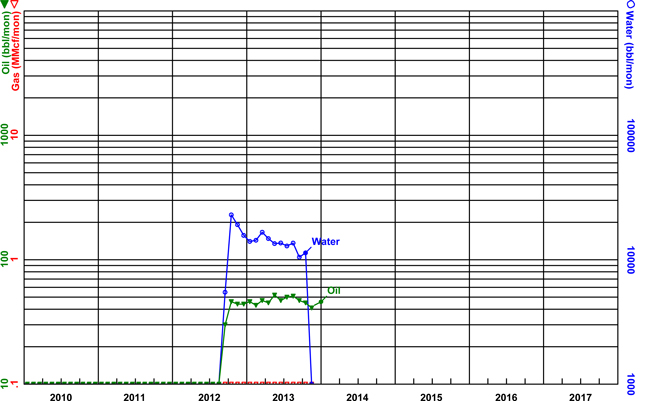

included approximately $501,000 for AERO System implementation. Based on production data measured at the primary production well,

after the implementation of the AERO System the daily production rate from the impacted well increased by 45% from the average

measured for the three months prior to the AERO System implementation. As secondary production proceeds, the oil reservoir gradually

depletes and the daily production rate decreases until production is no longer economical. Accordingly, the incremental oil associated

with implementation of the AERO system will also continue only as long as oil can continue to be produced economically. This oil

field has served as a controlled environment to implement revisions in technology and surface systems to accelerate development

and adoption of Glori’s AERO System technology.

Based upon the favorable results of the

Phase 1 Recompletion, Glori recompleted other producing wells within North Etzold as part of the second redevelopment of the North

Etzold field (the “Phase 2 Recompletion”). Unlike the Phase 1 Recompletion, which was completed prior to implementation

of the AERO System, the Phase 2 Recompletion included AERO System implementation as part of the overall recompletion. Because the

Phase 2 Recompletion benefited from costs incurred in implementing the AERO System in the Phase I Recompletion, including a source

water well and hardware, Glori estimates that the cost of the AERO System implementation for the Phase 2 Recompletion was approximately

$5,000, which related primarily to plumbing modifications. The North Etzold field was operated for approximately one year and averaged

net daily oil production of approximately 4 barrels. The revenue obtained from this production did not cover the direct production

costs and, therefore, the response from the Phase 2 Recompletion was not commercially viable. As a result, no further redevelopment

of the North Etzold field was undertaken. In total, approximately 3,256 incremental barrels of oil were recovered from the North

Etzold field after implementation of the AERO System, with associated costs totaling approximately $506,000.

In September 2012, Glori acquired the contiguous

South Etzold field, consisting of four shut-in wells in similar condition to the North Etzold field acquisition (collectively these

fields are referred to as “Etzold”). Glori maintains a 100% working interest in the Etzold field, which is comprised

of approximately 760 surface acres. Based on the results of the Phase 2 Recompletion, redevelopment on the South Etzold field never

commenced.

Management periodically assesses the carrying

value of the Etzold field compared to its estimated fair value, and in the fourth quarter of 2013, based upon the unfavorable response

to the Phase 2 Recompletion effort in the North Etzold field, determined that the historical carrying value of this asset significantly

exceeded its fair value as of December 31, 2013, and accordingly, determined that a charge of $2.2 million to reduce the carrying

value was appropriate. The revision in the carrying value results from the removal of behind the pipe, proved developed producing

reserves previously considered commercially viable and now reserve estimates are based entirely on the Phase 1 Recompletion of

the North Etzold field.

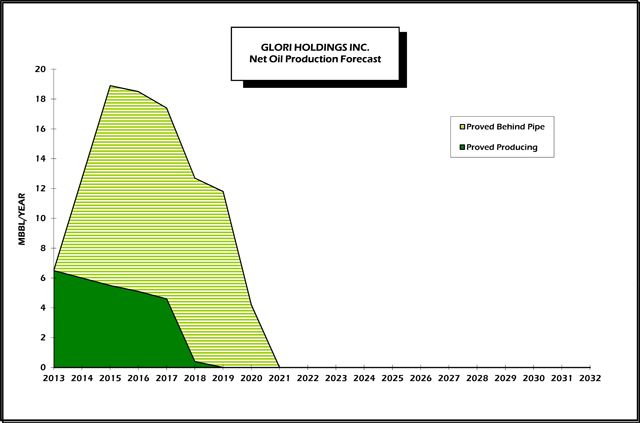

Collarini Associates, one of Glori’s

independent petroleum engineering firms, has estimated that as of January 1, 2014, proved reserves net to Glori’s interest

in its property was approximately 18 MBoe, all of which were classified as PDP. The proved reserves are generally characterized

as long-lived, with predictable production profiles. The technical person primarily responsible for preparing the relevant reserve

report is Mr. Mitchell C. Reece. Mr. Reece attended Texas A&M University and graduated in 1979 with a Bachelor of Science Degree

in Petroleum Engineering. Mr. Reece is a Registered Professional Engineer in the State of Texas, United States of America, and

has in excess of 30 years’ experience in petroleum engineering studies and evaluation.

Suppliers

Glori has preferred suppliers of nutrient

chemicals. However, Glori’s raw material ingredients are widely available, and Glori is not dependent upon any one company

for supplies needed for its business. Also, there are no geographical limitations on the availability of these materials. Currently,

the raw materials are delivered directly to Glori’s Houston, Texas facility while a third party blends its formula in Alberta,

Canada. Glori anticipates expanding this strategy to each geographical region, utilizing local suppliers to minimize logistical

costs.

Competition

Glori competes for projects with other

microbial technology enhanced oil recovery companies, emerging enhanced oil recovery technologies and traditional enhanced oil

recovery technologies.

Other Microbial Enhanced Oil Recovery Companies

There are other companies developing or

planning to commercialize microbial technology that is similar to Glori’s AERO System. These companies include Titan Oil

Recovery, Inc., Geo Fossil Fuels, LLC and Micro-Bac International, Inc. Glori believes that the enhanced oil recovery market is

large enough to support multiple competitors if the technology of these companies proves to be competitive with ours.

Emerging Enhanced Oil Recovery Technologies

Glori is aware of other companies developing

or planning to commercialize different technologies for enhanced oil recovery. These technologies include low salinity water, polymer

and wave vibration. TIORCO (a Nalco Company) is the biggest of the companies, of which Glori is aware, involved in deployment of

any of these technologies. Glori believes that the economics of the AERO System are more attractive, resulting in a lower capital

investment and a lower operating cost, than these other new technologies.

Traditional Enhanced Oil Recovery Technologies

Traditional enhanced oil recovery technologies

include thermal injection (for example, steam), gas injection (for example, carbon dioxide) and chemical injection (for example,

surfactants and polymers). Thermal injection such as steam is used to heat the oil to make it flow more easily through the reservoir.

Gas injection is used to increase pressure in the reservoir and increase the viscosity of the oil. Chemical injection is used to

reduce surface tension of the oil to allow it to flow better through the reservoir.

According to a November 2007 Oil &

Gas Journal article, about 50% of the world’s oil lies in small to medium sized reservoirs, which are generally untouched

by traditional enhanced oil recovery processes. Glori’s AERO System is well suited for smaller and medium sized reservoirs

because its technology does not require large scale operations to be economical, unlike thermal injection, gas injection and chemical

injection.

Glori believes that the economics of its

AERO System are more attractive, resulting in a lower capital investment and a lower operating cost than these more traditional

technologies. Additionally, the AERO System has a lower environmental impact since Glori process uses infrastructure that is already

in place and nutrients that are not harmful to the environment.

Title to Properties

Prior to completing

an acquisition of producing oil and natural gas leases, Glori performs title reviews on the most significant leases and, depending

on the materiality of properties, it may obtain a title opinion, obtain an updated title review or opinion or review previously

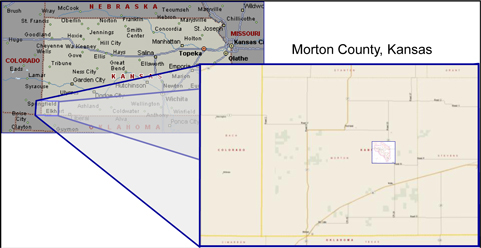

obtained title opinions. Glori’s oil and natural gas properties are subject to customary royalty and other interests, liens