ctlt-20220630TRUEFALSE00015967832022--06-30FALSEFYTrueIn preparing the consolidated financial statements as of and for the three and nine months ended March 31, 2023, we identified an error related to the recognition and presentation of net revenue from our Bloomington, Indiana facility in our consolidated financial statements issued with respect to the fiscal year ended June 30, 2022 and certain revenue classification errors with respect to the fiscal years ended June 30, 2022, 2021 and 2020. We evaluated the materiality of the misstatements and concluded that they do not result in a material misstatement of our previously issued consolidated financial statements. However, we determined to revise our consolidated financial statements for the fiscal year ended June 30, 2022 to reflect the impact of the misstatements in the periods impacted. For a more detailed description of this revision, refer to the section entitled “Revision” in Part II, Item 8, Notes to Consolidated Financial Statements, Note 1: Revisions of Previously Issued Financial Statements.100015967832021-07-012022-06-3000015967832021-12-31iso4217:USD00015967832022-08-19xbrli:shares00015967832020-07-012021-06-3000015967832022-06-3000015967832021-06-300001596783us-gaap:FairValueInputsLevel1Member2022-06-3000015967832019-07-012020-06-30iso4217:USDxbrli:shares0001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-07-012022-06-300001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2021-07-012022-06-300001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2020-07-012021-06-300001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2019-07-012020-06-300001596783us-gaap:CommonStockMember2019-06-300001596783us-gaap:AdditionalPaidInCapitalMember2019-06-300001596783us-gaap:RetainedEarningsMember2019-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-3000015967832019-06-300001596783us-gaap:CommonStockMember2019-07-012020-06-300001596783us-gaap:AdditionalPaidInCapitalMember2019-07-012020-06-300001596783us-gaap:RetainedEarningsMember2019-07-012020-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-07-012020-06-300001596783us-gaap:CommonStockMember2020-06-300001596783us-gaap:AdditionalPaidInCapitalMember2020-06-300001596783us-gaap:RetainedEarningsMember2020-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-3000015967832020-06-300001596783us-gaap:CommonStockMember2020-07-012021-06-300001596783us-gaap:AdditionalPaidInCapitalMember2020-07-012021-06-300001596783us-gaap:RetainedEarningsMember2020-07-012021-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012021-06-300001596783us-gaap:CommonStockMember2021-06-300001596783us-gaap:AdditionalPaidInCapitalMember2021-06-300001596783us-gaap:RetainedEarningsMember2021-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300001596783us-gaap:CommonStockMember2021-07-012022-06-300001596783us-gaap:AdditionalPaidInCapitalMember2021-07-012022-06-300001596783us-gaap:RetainedEarningsMember2021-07-012022-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012022-06-300001596783us-gaap:CommonStockMember2022-06-300001596783us-gaap:AdditionalPaidInCapitalMember2022-06-300001596783us-gaap:RetainedEarningsMember2022-06-300001596783us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001596783srt:ScenarioPreviouslyReportedMember2022-06-300001596783ctlt:RevisionAdjustmentsMember2022-06-300001596783srt:RestatementAdjustmentMember2022-06-300001596783srt:ScenarioPreviouslyReportedMember2021-06-300001596783ctlt:RevisionAdjustmentsMember2021-06-300001596783srt:ScenarioPreviouslyReportedMember2021-07-012022-06-300001596783ctlt:RevisionAdjustmentsMember2021-07-012022-06-300001596783srt:RestatementAdjustmentMember2021-07-012022-06-300001596783srt:ScenarioPreviouslyReportedMember2022-04-012022-06-300001596783ctlt:RevisionAdjustmentsMember2022-04-012022-06-3000015967832022-04-012022-06-300001596783srt:RestatementAdjustmentMember2022-04-012022-06-300001596783ctlt:BuildingAndImprovementsMembersrt:MinimumMember2022-06-300001596783srt:MaximumMemberctlt:BuildingAndImprovementsMember2022-06-300001596783srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2022-06-300001596783srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2022-06-300001596783us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2022-06-300001596783srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2022-06-300001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:BiologicsMember2021-07-012022-06-300001596783ctlt:PharmaConsumerHealthMemberctlt:ManufacturingCommercialProductSupplyMember2021-07-012022-06-300001596783ctlt:TotalCatalentBeforeInterSegmentRevenueEliminationctlt:ManufacturingCommercialProductSupplyMember2021-07-012022-06-300001596783ctlt:BiologicsMemberctlt:DevelopmentServicesMember2021-07-012022-06-300001596783ctlt:PharmaConsumerHealthMemberctlt:DevelopmentServicesMember2021-07-012022-06-300001596783ctlt:TotalCatalentBeforeInterSegmentRevenueEliminationctlt:DevelopmentServicesMember2021-07-012022-06-300001596783ctlt:BiologicsMember2021-07-012022-06-300001596783ctlt:SoftgelAndOralTechnologiesMember2021-07-012022-06-300001596783ctlt:TotalCatalentBeforeInterSegmentRevenueElimination2021-07-012022-06-300001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:BiologicsMember2020-07-012021-06-300001596783ctlt:PharmaConsumerHealthMemberctlt:ManufacturingCommercialProductSupplyMember2020-07-012021-06-300001596783ctlt:TotalCatalentBeforeInterSegmentRevenueEliminationctlt:ManufacturingCommercialProductSupplyMember2020-07-012021-06-300001596783ctlt:BiologicsMemberctlt:DevelopmentServicesMember2020-07-012021-06-300001596783ctlt:PharmaConsumerHealthMemberctlt:DevelopmentServicesMember2020-07-012021-06-300001596783ctlt:TotalCatalentBeforeInterSegmentRevenueEliminationctlt:DevelopmentServicesMember2020-07-012021-06-300001596783ctlt:BiologicsMember2020-07-012021-06-300001596783ctlt:SoftgelAndOralTechnologiesMember2020-07-012021-06-300001596783ctlt:TotalCatalentBeforeInterSegmentRevenueElimination2020-07-012021-06-300001596783ctlt:ManufacturingCommercialProductSupplyMemberctlt:BiologicsMember2019-07-012020-06-300001596783ctlt:SoftgelAndOralTechnologiesMemberctlt:ManufacturingCommercialProductSupplyMember2019-07-012020-06-300001596783ctlt:TotalCatalentBeforeInterSegmentRevenueEliminationctlt:ManufacturingCommercialProductSupplyMember2019-07-012020-06-300001596783ctlt:BiologicsMemberctlt:DevelopmentServicesMember2019-07-012020-06-300001596783ctlt:SoftgelAndOralTechnologiesMemberctlt:DevelopmentServicesMember2019-07-012020-06-300001596783ctlt:TotalCatalentBeforeInterSegmentRevenueEliminationctlt:DevelopmentServicesMember2019-07-012020-06-300001596783ctlt:BiologicsMember2019-07-012020-06-300001596783ctlt:SoftgelAndOralTechnologiesMember2019-07-012020-06-300001596783ctlt:TotalCatalentBeforeInterSegmentRevenueElimination2019-07-012020-06-3000015967832020-04-012020-06-300001596783country:US2021-07-012022-06-300001596783country:US2020-07-012021-06-300001596783country:US2019-07-012020-06-300001596783srt:EuropeMember2021-07-012022-06-300001596783srt:EuropeMember2020-07-012021-06-300001596783srt:EuropeMember2019-07-012020-06-300001596783ctlt:InternationalOtherMember2021-07-012022-06-300001596783ctlt:InternationalOtherMember2020-07-012021-06-300001596783ctlt:InternationalOtherMember2019-07-012020-06-300001596783ctlt:SkeletalCellTherapySupportSAMember2020-11-162020-11-160001596783ctlt:AcordaTherapeuticsIncMember2021-02-112021-02-110001596783ctlt:AcordaTherapeuticsIncMember2021-02-110001596783ctlt:DelphiGeneticsSAMember2021-02-232021-02-230001596783ctlt:DelphiGeneticsSAMember2021-02-110001596783ctlt:HepaticCellTherapySupportSAMember2021-02-232021-02-230001596783ctlt:HepaticCellTherapySupportSAMember2021-03-310001596783ctlt:RheinCellTherapeuticsMember2021-08-012021-08-010001596783ctlt:RheinCellTherapeuticsMember2021-08-010001596783ctlt:BetteraHoldingsLLCMember2021-10-012021-10-310001596783us-gaap:FairValueInputsLevel2Memberctlt:A3500SeniorUSDenominatedNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-06-300001596783ctlt:A3500SeniorUSDenominatedNotesMemberMember2022-06-30xbrli:pure0001596783ctlt:BetteraHoldingsLLCMember2021-10-010001596783ctlt:BetteraHoldingsLLCMember2020-04-012020-06-300001596783ctlt:CoreTechnologyMemberctlt:BetteraHoldingsLLCMember2021-10-010001596783us-gaap:CustomerRelationshipsMemberctlt:BetteraHoldingsLLCMember2021-10-010001596783ctlt:VaccineManufacturingAndInnovationCentreMember2022-04-012022-04-300001596783ctlt:VaccineManufacturingAndInnovationCentreMember2022-04-300001596783ctlt:PrincetonCellTherapyMember2022-04-012022-04-300001596783ctlt:PrincetonCellTherapyMember2022-04-300001596783ctlt:BlowFillSealBusinessWoodstockMember2021-07-012022-06-300001596783ctlt:BlowFillSealBusinessWoodstockMember2022-06-300001596783ctlt:BlowFillSealBusinessWoodstockMember2022-01-012022-03-310001596783ctlt:BlowFillSealBusinessWoodstockMember2020-07-012021-06-300001596783ctlt:BiologicsMember2020-06-300001596783ctlt:PharmaConsumerHealthMember2020-06-300001596783ctlt:PharmaConsumerHealthMember2020-07-012021-06-300001596783ctlt:BiologicsMember2021-06-300001596783ctlt:PharmaConsumerHealthMember2021-06-300001596783ctlt:PharmaConsumerHealthMember2021-07-012022-06-300001596783ctlt:BiologicsMember2022-06-300001596783ctlt:PharmaConsumerHealthMember2022-06-300001596783ctlt:CoreTechnologyMember2021-07-012022-06-300001596783ctlt:CoreTechnologyMember2022-06-300001596783us-gaap:CustomerRelationshipsMember2021-07-012022-06-300001596783us-gaap:CustomerRelationshipsMember2022-06-300001596783ctlt:ProductRelationshipsMember2021-07-012022-06-300001596783ctlt:ProductRelationshipsMember2022-06-300001596783us-gaap:OtherIntangibleAssetsMember2021-07-012022-06-300001596783us-gaap:OtherIntangibleAssetsMember2022-06-300001596783ctlt:CoreTechnologyMember2020-07-012021-06-300001596783ctlt:CoreTechnologyMember2021-06-300001596783us-gaap:CustomerRelationshipsMember2020-07-012021-06-300001596783us-gaap:CustomerRelationshipsMember2021-06-300001596783ctlt:ProductRelationshipsMember2020-07-012021-06-300001596783ctlt:ProductRelationshipsMember2021-06-300001596783us-gaap:OtherIntangibleAssetsMember2020-07-012021-06-300001596783us-gaap:OtherIntangibleAssetsMember2021-06-300001596783srt:MaximumMemberctlt:BoltonMember2021-07-012022-06-30ctlt:employees0001596783srt:MaximumMemberctlt:BoltonMember2022-06-300001596783ctlt:BoltonMember2021-07-012022-06-300001596783ctlt:TermLoanThreeFacilityDollarDenominatedMember2022-06-300001596783ctlt:TermLoanThreeFacilityDollarDenominatedMember2021-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:USDollarDenominated500SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:USDollarDenominated500SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:A2375SeniorEuroDenominatedNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:A2375SeniorEuroDenominatedNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:A3125SeniorUSDenominatedNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:A3125SeniorUSDenominatedNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:A3500SeniorUSDenominatedNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001596783ctlt:SeniorUnsecuredTermLoanFacilityMember2022-06-300001596783ctlt:SeniorUnsecuredTermLoanFacilityMember2021-06-300001596783us-gaap:CapitalLeaseObligationsMember2022-06-300001596783us-gaap:CapitalLeaseObligationsMember2021-06-300001596783ctlt:OtherObligationsMember2022-06-300001596783ctlt:OtherObligationsMember2021-06-300001596783ctlt:DebtIssuanceCostsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-06-300001596783ctlt:DebtIssuanceCostsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001596783ctlt:TermLoanTwoFacilityDollarDenominatedMember2021-02-280001596783ctlt:TermLoanThreeFacilityDollarDenominatedMembersrt:MaximumMember2021-07-012022-06-300001596783ctlt:TermLoanThreeFacilityDollarDenominatedMemberctlt:LondonInterbankOfferedRatesLIBORMembersrt:MinimumMember2021-07-012022-06-300001596783ctlt:TermLoanThreeFacilityDollarDenominatedMemberctlt:LondonInterbankOfferedRatesLIBORMember2021-07-012022-06-300001596783us-gaap:RevolvingCreditFacilityMemberctlt:LondonInterbankOfferedRatesLIBORMember2021-07-012022-06-300001596783us-gaap:RevolvingCreditFacilityMemberctlt:LondonInterbankOfferedRatesLIBORMembersrt:MinimumMember2021-07-012022-06-300001596783ctlt:USDollarDenominated500SeniorNotesMember2022-06-300001596783ctlt:A2375SeniorEuroDenominatedNotesMember2022-06-300001596783ctlt:FourPointSevenFivePercentSeniorEuroDenominatedNotesMember2022-06-300001596783ctlt:A3125SeniorUSDenominatedNotesMember2022-06-300001596783ctlt:USDollarDenominated4875SeniorNotesMember2022-06-300001596783ctlt:A3500SeniorUSDenominatedNotesMember2022-06-300001596783us-gaap:AccruedLiabilitiesMember2017-10-012017-10-2300015967832017-10-012017-10-230001596783ctlt:SeniorSecuredCreditFacilityMember2021-07-012022-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:USDollarDenominated500SeniorNotesMember2022-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:USDollarDenominated500SeniorNotesMember2021-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A2375SeniorEuroDenominatedNotesMember2022-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A2375SeniorEuroDenominatedNotesMember2021-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A3125SeniorUSDenominatedNotesMember2022-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A3125SeniorUSDenominatedNotesMember2021-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A3500SeniorUSDenominatedNotesMember2022-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:A3500SeniorUSDenominatedNotesMember2021-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:SeniorSecuredCreditFacilitiesOtherMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:SeniorSecuredCreditFacilitiesOtherMember2022-06-300001596783us-gaap:FairValueInputsLevel2Memberctlt:SeniorSecuredCreditFacilitiesOtherMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:FairValueInputsLevel2Memberctlt:SeniorSecuredCreditFacilitiesOtherMember2021-06-300001596783us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-06-300001596783us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberctlt:DebtIssuanceCostsMember2022-06-300001596783us-gaap:EstimateOfFairValueFairValueDisclosureMemberctlt:DebtIssuanceCostsMember2021-06-3000015967832020-11-232020-11-2300015967832020-11-2300015967832021-11-182021-11-1800015967832021-11-180001596783us-gaap:SeriesAPreferredStockMember2021-07-012022-06-300001596783us-gaap:SeriesAPreferredStockMember2020-07-012021-06-300001596783us-gaap:SeriesAPreferredStockMember2019-07-012020-06-300001596783ctlt:USDenominatedTermLoanMember2022-06-300001596783us-gaap:FairValueInputsLevel2Member2022-06-300001596783us-gaap:FairValueInputsLevel3Member2022-06-300001596783us-gaap:FairValueInputsLevel1Member2021-06-300001596783us-gaap:FairValueInputsLevel2Member2021-06-300001596783us-gaap:FairValueInputsLevel3Member2021-06-300001596783us-gaap:DomesticCountryMember2022-06-300001596783us-gaap:StateAndLocalJurisdictionMember2022-06-300001596783us-gaap:ForeignCountryMember2022-06-300001596783ctlt:ForeignNetOperatingLossEstablishedMember2021-07-012022-06-300001596783us-gaap:PensionPlansDefinedBenefitMember2021-07-012022-06-300001596783us-gaap:PensionPlansDefinedBenefitMember2022-06-300001596783us-gaap:PensionPlansDefinedBenefitMember2021-06-300001596783us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-06-300001596783us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-06-300001596783us-gaap:PensionPlansDefinedBenefitMember2020-06-300001596783us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-06-300001596783us-gaap:PensionPlansDefinedBenefitMember2020-07-012021-06-300001596783us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2020-07-012021-06-300001596783us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-07-012022-06-300001596783us-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-06-300001596783us-gaap:EquitySecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2021-06-300001596783us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-06-300001596783us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2021-06-300001596783us-gaap:CorporateDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2022-06-300001596783us-gaap:CorporateDebtSecuritiesMemberus-gaap:PensionPlansDefinedBenefitMember2021-06-300001596783us-gaap:RealEstateMemberus-gaap:PensionPlansDefinedBenefitMember2022-06-300001596783us-gaap:RealEstateMemberus-gaap:PensionPlansDefinedBenefitMember2021-06-300001596783ctlt:InsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMember2022-06-300001596783ctlt:InsuranceContractsMemberus-gaap:PensionPlansDefinedBenefitMember2021-06-300001596783us-gaap:OtherAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2022-06-300001596783us-gaap:OtherAssetsMemberus-gaap:PensionPlansDefinedBenefitMember2021-06-300001596783us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2022-06-300001596783us-gaap:EquitySecuritiesMember2022-06-300001596783us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2022-06-300001596783us-gaap:DebtSecuritiesMember2022-06-300001596783us-gaap:FairValueInputsLevel2Memberus-gaap:RealEstateMember2022-06-300001596783us-gaap:FairValueInputsLevel3Memberus-gaap:RealEstateMember2022-06-300001596783us-gaap:RealEstateMember2022-06-300001596783us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMember2022-06-300001596783us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel3Member2022-06-300001596783us-gaap:OtherAssetsMember2022-06-300001596783us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2021-06-300001596783us-gaap:EquitySecuritiesMember2021-06-300001596783us-gaap:FairValueInputsLevel2Memberus-gaap:DebtSecuritiesMember2021-06-300001596783us-gaap:DebtSecuritiesMember2021-06-300001596783us-gaap:FairValueInputsLevel2Memberus-gaap:RealEstateMember2021-06-300001596783us-gaap:FairValueInputsLevel3Memberus-gaap:RealEstateMember2021-06-300001596783us-gaap:RealEstateMember2021-06-300001596783us-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMember2021-06-300001596783us-gaap:OtherAssetsMemberus-gaap:FairValueInputsLevel3Member2021-06-300001596783us-gaap:OtherAssetsMember2021-06-300001596783ctlt:EberbachPensionPromissoryNoteOrLoanMember2022-06-300001596783ctlt:InsuranceContractsMemberus-gaap:FairValueInputsLevel3Member2021-06-300001596783us-gaap:FairValueInputsLevel3Memberctlt:OtherUnobservableAssetsMember2021-06-300001596783us-gaap:FairValueInputsLevel3Member2021-07-012022-06-300001596783us-gaap:FairValueInputsLevel3Memberctlt:OtherUnobservableAssetsMember2021-07-012022-06-300001596783ctlt:InsuranceContractsMemberus-gaap:FairValueInputsLevel3Member2021-07-012022-06-300001596783ctlt:InsuranceContractsMemberus-gaap:FairValueInputsLevel3Member2022-06-300001596783us-gaap:FairValueInputsLevel3Memberctlt:OtherUnobservableAssetsMember2022-06-300001596783us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberctlt:Post65Member2022-06-300001596783us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberctlt:Post65Member2021-06-300001596783us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberctlt:Post65Member2021-07-012022-06-300001596783us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMemberctlt:Post65Member2020-07-012021-06-3000015967832020-06-152020-06-1500015967832020-06-1500015967832020-02-062020-02-0600015967832020-02-060001596783ctlt:DesignatedSharesMember2020-06-3000015967832019-05-170001596783us-gaap:AdditionalPaidInCapitalMember2020-11-232020-11-230001596783us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-3100015967832021-07-012022-03-310001596783us-gaap:AccumulatedTranslationAdjustmentMember2019-06-300001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2019-06-300001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2019-06-300001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-06-300001596783us-gaap:AccumulatedTranslationAdjustmentMember2019-07-012020-06-300001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-07-012020-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2019-07-012020-06-300001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2019-07-012020-06-300001596783us-gaap:AccumulatedTranslationAdjustmentMember2020-06-300001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2020-06-300001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2020-06-300001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-06-300001596783us-gaap:AccumulatedTranslationAdjustmentMember2020-07-012021-06-300001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-07-012021-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2020-07-012021-06-300001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-07-012021-06-300001596783us-gaap:AccumulatedTranslationAdjustmentMember2021-06-300001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2021-06-300001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2021-06-300001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-06-300001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-07-012022-06-300001596783us-gaap:AccumulatedTranslationAdjustmentMember2021-07-012022-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2021-07-012022-06-300001596783us-gaap:AccumulatedTranslationAdjustmentMember2022-06-300001596783us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-06-300001596783us-gaap:AociDerivativeQualifyingAsHedgeExcludedComponentParentMember2022-06-300001596783ctlt:ACOIAccumulatedGainLossMarketableSecuritiesMember2022-06-300001596783us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-06-300001596783ctlt:StockCompensationPlanOmnibusMember2021-07-012022-06-300001596783ctlt:StockCompensationPlanOmnibusMember2020-07-012021-06-300001596783ctlt:StockCompensationPlanOmnibusMember2019-07-012020-06-300001596783us-gaap:EmployeeStockOptionMembersrt:MinimumMember2021-07-012022-06-300001596783us-gaap:EmployeeStockOptionMembersrt:MinimumMember2020-07-012021-06-300001596783us-gaap:EmployeeStockOptionMembersrt:MinimumMember2019-07-012020-06-300001596783us-gaap:EmployeeStockOptionMembersrt:MaximumMember2019-07-012020-06-300001596783us-gaap:EmployeeStockOptionMembersrt:MaximumMember2021-07-012022-06-300001596783us-gaap:EmployeeStockOptionMembersrt:MaximumMember2020-07-012021-06-300001596783ctlt:TimeMember2021-06-300001596783ctlt:TimeMember2020-07-012021-06-300001596783ctlt:TimeMember2021-07-012022-06-300001596783ctlt:TimeMember2022-06-300001596783ctlt:PerformanceMember2022-06-300001596783ctlt:TimeBasedRestrictedStockUnitsMember2021-06-300001596783ctlt:TimeBasedRestrictedStockUnitsMember2021-07-012022-06-300001596783ctlt:TimeBasedRestrictedStockUnitsMember2022-06-300001596783us-gaap:PerformanceSharesMember2021-06-300001596783us-gaap:PerformanceSharesMember2021-07-012022-06-300001596783us-gaap:PerformanceSharesMember2022-06-300001596783srt:MinimumMemberus-gaap:PerformanceSharesMember2021-07-012022-06-300001596783srt:MaximumMemberus-gaap:PerformanceSharesMember2021-07-012022-06-300001596783srt:MinimumMemberus-gaap:PerformanceSharesMember2020-07-012021-06-300001596783srt:MaximumMemberus-gaap:PerformanceSharesMember2020-07-012021-06-300001596783ctlt:RTSRPerformanceShareUnitsMember2021-06-300001596783ctlt:RTSRPerformanceShareUnitsMember2021-07-012022-06-300001596783ctlt:RTSRPerformanceShareUnitsMember2022-06-300001596783us-gaap:RestrictedStockUnitsRSUMember2022-06-300001596783us-gaap:RestrictedStockUnitsRSUMember2021-07-012022-06-300001596783us-gaap:RestrictedStockUnitsRSUMember2020-07-012021-06-300001596783us-gaap:RestrictedStockUnitsRSUMember2019-07-012020-06-300001596783ctlt:PharmaConsumerHealthMember2019-07-012020-06-300001596783ctlt:TotalCatalentSubTotalOfSegmentReportingMember2021-07-012022-06-300001596783ctlt:TotalCatalentSubTotalOfSegmentReportingMember2020-07-012021-06-300001596783ctlt:TotalCatalentSubTotalOfSegmentReportingMember2019-07-012020-06-300001596783ctlt:CorporateAndEliminationsMember2022-06-300001596783ctlt:CorporateAndEliminationsMember2021-06-300001596783ctlt:CorporateAndEliminationsMember2021-07-012022-06-300001596783ctlt:CorporateAndEliminationsMember2020-07-012021-06-300001596783ctlt:CorporateAndEliminationsMember2019-07-012020-06-300001596783country:US2022-06-300001596783country:US2021-06-300001596783srt:EuropeMember2022-06-300001596783srt:EuropeMember2021-06-300001596783ctlt:RestOfWorldMember2022-06-300001596783ctlt:RestOfWorldMember2021-06-3000015967832022-08-092022-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Amendment No.1)

| | | | | | | | |

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2022

or | | | | | | | | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36587

| | | | | | | | |

| CATALENT, INC. | |

| (Exact name of registrant as specified in its charter) |

| | |

| | | | | | | | |

| Delaware | | 20-8737688 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | |

14 Schoolhouse Road | 08873 |

| Somerset, | New Jersey |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (732) 537-6200

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | CTLT | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ý | | Accelerated filer | ¨ | |

| Non-accelerated filer | ¨ | | Smaller reporting company | ¨ | |

| | | Emerging growth company | ¨ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ¨ Yes ☒ No

As of December 31, 2021, the aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates was $21.84 billion. On August 25, 2022, there were 179,895,677 shares of the Registrant’s Common Stock, par value $0.01 per share, issued and outstanding.

EXPLANATORY NOTE

Catalent, Inc. (“Catalent,” the “Company,” “we,” “us,” and “our”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment") to our Annual Report on Form 10-K for the fiscal year ended June 30, 2022, which was filed with the Securities and Exchange Commission (the “SEC”) on August 29, 2022 (the “Original Form 10-K”) to make certain changes, as described below.

In preparing the consolidated financial statements as of and for the three and nine months ended March 31, 2023, we identified an error related to the accounting treatment of a modification to a customer arrangement accounted for under ASC 606, Revenue from Contracts with Customers in our consolidated financial statements issued with respect to the fiscal year ended June 30, 2022. We evaluated the materiality of the error and concluded that it does not result in a material misstatement of our previously issued consolidated financial statements.

However, due to the discovery of this error, we re-evaluated the effectiveness of our internal control over financial reporting (“ICFR”) as of June 30, 2022 and identified a material weakness in our ICFR related to the accounting modifications of customer agreements at our Bloomington, Indiana facility as of that date. For a more detailed description of this material weakness, refer to Part II, Item 9A,“Controls and Procedures.” This Amendment therefore restates our assessment of our ICFR and our disclosure controls and procedures to indicate that they were not effective as of June 30, 2022 because of this material weakness. Our independent registered public accounting firm, Ernst & Young LLP, has also restated its opinion on our ICFR as of June 30, 2022.

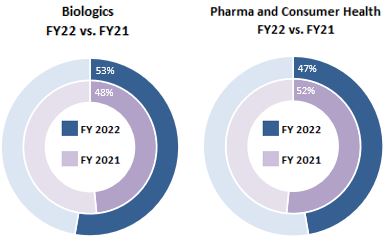

In conjunction with filing this Amendment, we determined to revise our consolidated financial statements for the fiscal year ended June 30, 2022 (as revised, the “Consolidated Financial Statements”) to reflect the impact of the error in the periods impacted. In addition, effective July 1, 2022, we changed our operating structure from four operating and reporting segments to two segments: (i) Biologics, and (ii) Pharma and Consumer Health. The revised consolidated financial statements for the years ended June 30, 2022, 2021 and 2020 contained in this Amendment have been recast retrospectively to reflect the new reporting structure. For additional information and a detailed discussion of the revision and recast, refer to Part II, Item 8, Notes to Consolidated Financial Statements, Note 1, Revisions of Previously Issued Financial Statements and Note 19, Segment and Geographic Information.

“Special Note Regarding Forward-Looking Statements” and Item 1A, “Risk Factors,” of Part I of the Original Form 10-K, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations;” Item 8, “Financial Statements and Supplementary Data,” and Item 9A, “Controls and Procedures,” of Part II of the Original Form 10-K are hereby deleted in their entireties and replaced with “Special Note Regarding Forward-Looking Statements,” Item 1A, Item 7, Item 8, and Item 9A included herein, Item 15, “Exhibits and Financial Statement Schedules,” of Part IV of the Original Form 10-K also has been amended to include a new consent of Ernst & Young LLP and, as required by Rule 12b-15 under the Securities Act of 1934, as amended, to provide new currently dated certifications by our Chief Executive Officer and interim Chief Financial Officer pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002. The new consent is attached to this Amendment as Exhibit 23.1 and the new certifications are attached to this Amendment as Exhibits 31.1, 31.2, 32.1, and 32.2.

The only changes to the Original Form 10-K are those related to the matters described above. Except as described above, this Amendment does not amend, update, or change any other item or disclosure in the Original Form 10-K and does not purport to reflect any information or event subsequent to the filing thereof. As such, this Amendment speaks only as of the date the Original Form 10-K was filed, and the Company has not undertaken herein to amend, update, or change any information contained in the Original Form 10-K to give effect to any subsequent event, other than as expressly indicated in this Amendment. Accordingly, this Amendment should be read in conjunction with the Original Form 10-K and any subsequent filing with the SEC.

CATALENT, INC.

INDEX TO ANNUAL REPORT ON FORM 10-K/A

For the Fiscal Year Ended June 30, 2022

| | | | | | | | |

| Item | | Page |

| PART I | |

| Item 1A. | | |

| PART II | |

| | |

| Item 7. | | |

| | |

| | |

| | |

| Item 8. | | |

| | |

| Item 9A. | | |

| | |

| PART IV | |

| | |

| Item 15. | | |

| | |

| |

PART I

Special Note Regarding Forward-Looking Statements

In addition to historical information, this Amendment of the Company contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts, included in this Annual Report are forward-looking statements. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” “future,” “forward,” “sustain” or the negative version of these words or other comparable words.

These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions, expected future developments, and other factors they believe to be appropriate. Any forward-looking statement is subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements.

Some of the factors that may cause actual results, developments, and business decisions to differ materially from those contemplated by such forward-looking statements include, but are not limited to, those described under the section entitled “Risk Factors” in this Annual Report, which are summarized below:

Summary of Principal Risk Factors

Any investment, including an investment in our common stock, par value $0.01 (the “Common Stock”), involves risk. The following summary highlights certain risks that an investor in our Common Stock should consider. The following should be read in conjunction with the fuller discussion of risk factors we face set forth in "Item 1A. Risk Factors."

Risks Relating to Our Business and the Industry in Which We Operate

•Our business, financial condition, and operations may be adversely affected by global health epidemics, including the pandemic resulting from the SARS-Co-V-2 strain of coronavirus and its variants (“COVID-19”).

•The continually evolving nature of the COVID-19 pandemic and the resulting public health response, including the changing demand for various COVID-19 vaccines and treatments from both patients and governments around the world, may affect sales of the COVID-19 products we manufacture.

•We participate in a highly competitive market, and increased competition may adversely affect our business.

•The demand for our offerings depends in part on our customers’ research and development and the clinical and market success of their products.

•We are subject to product and other liability risks that could exceed our anticipated costs or adversely affect our results of operations, financial condition, liquidity, and cash flows.

•We are a part of the highly regulated healthcare industry, subject to stringent regulatory standards and other applicable laws and regulations, which can change unexpectedly and may adversely impact our business.

•Any failure to implement fully, monitor, and improve our quality management strategy could lead to quality or safety issues and expose us to significant costs, potential liability and adverse publicity.

•If we cannot keep pace with rapid technological advances, our services may become uncompetitive or obsolete.

•Any failure to protect or maintain our intellectual property may adversely affect our competitive edge and result in loss of revenue and reputation.

•Future price fluctuations, material shortages of raw materials, or changes in healthcare policies may have an adverse effect on our results of operations and financial conditions.

•Our ability to use our net operating loss carryforwards and certain other tax attributes may be limited.

•We may be unable to attract or retain key personnel.

•We may be unsuccessful in integrating our acquisitions, and we may expend substantial amounts of cash and incur debt in making acquisitions.

•Our global operations are subject to economic and political risks that could affect the profitability of our operations or require costly changes to our procedures.

•As a global enterprise, fluctuations in the exchange rates of the United States ("U.S.") dollar, our reporting currency, against other currencies could have a material adverse effect on our financial performance and results of operations.

•Tax legislative or regulatory initiatives, new interpretations or developments concerning existing tax laws, or challenges to our tax positions could adversely affect our results of operations and financial condition.

•We use advanced information and communication systems to run our operations, compile and analyze financial and operational data, and communicate among our employees, customers, and counter-parties, and the risks generally associated with information and communications systems could adversely affect our results of operations. We continuously work to install new, and upgrade existing, systems and provide employee awareness training around phishing, malware, and other cybersecurity risks to enhance the protections available to us, but such protections may be inadequate to address malicious attacks or inadvertent compromises affecting data security or the operability of such systems.

•We provide services incorporating various advanced modalities, including protein and plasmid production and cell and gene therapies, and these modalities relate to relatively new modes of treatment that may be subject to changing public opinion, continuing research, and increased regulatory scrutiny, each of which may affect our customers' ability to conduct their businesses, or obtain regulatory approvals for their therapies, and thereby adversely affect these offerings.

Risks Relating to Our Indebtedness

•The size of our indebtedness and the obligations associated with it could limit our ability to operate our business and to finance future operations or acquisitions that would enhance our growth.

•Our debt agreements contain restrictions that may limit our flexibility in conducting certain current and future operations.

•We may not be able to pay our indebtedness when it becomes due.

•Our current and potential future use of derivative financial instruments may expose us to economic losses in the event of price or currency fluctuations.

Risks Relating to Ownership of Our Common Stock

•We have identified a material weakness in our internal control over financial reporting. Failure to remediate the material weakness or any other material weaknesses that we identify in the future could result in material misstatements in our financial statements or cause us to fail to meet our periodic reporting obligations.

•Our stock price has historically been and may continue to be volatile.

•Because we have no plan to pay cash dividends on our Common Stock for the foreseeable future, receiving a return on an investment in our Common Stock may require a sale for a net price greater than was paid for it.

•Provisions in our organizational documents could delay or prevent a change of control.

We caution you that the risks, uncertainties, and other factors referenced above may not contain all of the risks, uncertainties, and other factors that are important to you. In addition, we cannot assure you that we will realize the results, benefits, or developments that we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our business in the way expected. There can be no assurance that (i) we have correctly measured or identified all of the factors affecting our business or the extent of these factors’ likely impact, (ii) the available information with respect to these factors on which such analysis is based is complete or accurate, (iii) such analysis is correct, or (iv) our strategy, which is based in part on this analysis, will be successful. All forward-looking statements in this report apply only as of the date of this report or as of the date they were made, and we undertake no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise, except as required by law.

We file annual, quarterly, and current reports and other information with and furnish additional information to the U.S. Securities and Exchange Commission (the “SEC”). Our filings with the SEC are available to the public on the SEC’s website at www.sec.gov. Those filings are also available to the public on, or accessible through, our website (catalent.com) for free via the “Investors” section as soon as reasonably practicable after we file such material, or furnish it to, the SEC. We also use our website, Facebook page (facebook.com/CatalentPharmaSolutions), LinkedIn page (linkedin.com/company/catalent-pharma-solutions/) and Twitter account (@catalentpharma) as channels of distribution of information concerning our activities, our offerings, our various businesses, and other related matters. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings, and public conference calls and webcasts. The information we file with or furnish to the SEC (other than the information set forth or incorporated in this Annual Report) or contained on or accessible through our website, our social media channels, or any other website that we may maintain is not a part of this Annual Report.

ITEM 1A. RISK FACTORS

If any of the following risks actually occur, our business, financial condition, operating results, or cash flow could be materially and adversely affected. Additional risks or uncertainties not presently known to us, or that we currently believe are immaterial, may also impair our business operations.

Risks Relating to Our Business and the Industry in Which We Operate

Our business, financial condition, and results of operations may be adversely affected by global health epidemics, including the COVID-19 pandemic.

Any public health epidemic, including the COVID-19 pandemic, may affect our operations and those of third parties on which we rely, including our customers and suppliers. Our business, financial condition, and results of operations may be affected by: disruptions in our customers’ abilities to fund, develop, or bring to market products as anticipated; delays in or disruptions to the conduct of clinical trials; cancellations of contracts or confirmed orders from our customers; decreased demand for categories of products in certain affected regions; and inability, difficulty, or additional cost or delays in obtaining key raw materials, components, and other supplies from our existing supply chain; among other factors caused by a public health epidemic, including the COVID-19 pandemic.

While the COVID-19 pandemic has not had a material negative effect on our overall business, financial condition or results of operations to date, our customers and suppliers have in some cases experienced negative impacts due to disruptions in supply chains and disruptions to the operations of the FDA and other drug regulatory authorities, which resulted in, among other things, delays of inspections, reviews, and approvals of our customers’ products, as well as the volume and timing of orders from these customers. Such impacts may affect our business in the future. Governmental restrictions related to the COVID-19 pandemic, which continue to evolve, including travel restrictions, quarantines, shelter-in-place orders, business closures, new safety requirements or regulations, or restrictions on the import or export of certain materials, or other operational issues related to the COVID-19 pandemic may have an adverse effect on our business and results of operations.

We continue to monitor developments related to the COVID-19 pandemic and its effects on our business, operations, and financial condition. For purposes of our operational and financial planning, we have made, and update when appropriate, certain assumptions regarding the duration, severity, and global economic impact of the pandemic in different regions, and the need for continued manufacture and supply of COVID-19 vaccines and treatments, each of which remains uncertain. However, despite careful planning, our assumptions may not be accurate, as the extent to which COVID-19 may affect our future results will depend on future developments that are uncertain, including: the duration of the pandemic; emerging information concerning the severity and incidence of the virus and its variants; the emergence of additional virus variants; regional resurgences of the virus globally; the safety, efficacy, and availability of vaccines and treatments for COVID-19 (including its variants); the rate at which the population globally becomes vaccinated against COVID-19; the global economic impact of the pandemic; the actions of governments and regulatory authorities to contain the pandemic or control the supply of vaccines and treatments; and the actions the pharmaceutical industry, competitors, suppliers, customers, patients, and others may take to contain or address the pandemic’s direct and indirect effects.

Our Biologics segment, in particular, has reported substantial revenue from the testing, manufacturing, and packaging of COVID-19-related products for our customers. While this positive impact is expected to continue through at least the remainder of calendar 2022 and into calendar 2023, the duration and extent of future revenues from such testing, manufacturing, and packaging of COVID-19-related products is uncertain and dependent upon customer demand. See also "—Risks Related to Our Business and the Industry in Which We Operate—The continually evolving nature of the COVID-19 pandemic and the resulting public health response, including the changing demand for various COVID-19 vaccines and treatments from both patients and governments around the world, may affect sales of the COVID-19 products we manufacture."

In addition, the impact of the COVID-19 pandemic or any other public health epidemic could exacerbate other risks we face, including those described elsewhere in "Risk Factors."

The continually evolving nature of the COVID-19 pandemic and the resulting public health response, including the changing demand for various COVID-19 vaccines and treatments from both patients and governments around the world, may affect sales of the COVID-19 products we manufacture.

We manufacture or provide services for a variety of products intended for the prevention or treatment of COVID-19 and its symptoms and effects, including both vaccines and treatments. No single one of these products is material to our business. Certain of these products are subject to “take-or-pay” provisions that require the customer to either purchase a minimum

amount of product or pay any shortfall resulting from purchases not made. Such provisions should mitigate risks relating to any future uncertainty in the demand for these products.

The COVID-19-related products we develop and manufacture have not yet received full marketing approval from certain regulatory authorities around the world for certain patient populations, although some of these are being marketed and sold to such populations pursuant to an emergency use authorization (EUA) from the FDA or the equivalent authorization from non-U.S. regulatory authorities. Should any of these COVID-19-related products be denied any necessary regulatory approval, the demand for such product could decrease significantly and therefore decrease customer orders for additional development, manufacturing, or packaging of those products, although the financial effect on us may be mitigated by any take-or-pay provision in place with respect to that product. Additionally, the need for continued manufacture and supply of vaccines (including “booster” doses) and therapies to address the COVID-19 pandemic, including new and developing variants of COVID-19, is highly uncertain and subject to various political, economic, and regulatory factors that are outside of our control. Should the U.S. or other major regions worldwide determine that additional manufacture of COVID-19 vaccines, boosters, or therapies is no longer necessary, it could adversely affect our revenue and financial condition. In addition, highly-public political and social debate relating to the need for, efficacy of, or side effects related to one or more specific COVID-19 vaccines could contribute to changes in public perception of one or more COVID-19 vaccines manufactured by us, which could decrease demand for a COVID-19 related product we develop, manufacture, or package.

The demand for our offerings depends in part on our customers’ research and development and the clinical and market success of their products. Our business, financial condition, and results of operations may be harmed if our customers spend less on, or are less successful in, these activities. In addition, customer spending may be affected by, among other things, the COVID-19 pandemic or recessionary economic conditions caused in whole or in part by the pandemic, the Ukrainian-Russian war, or the rise in inflation worldwide.

Our customers are engaged in research, development, production, and marketing of pharmaceutical, biotechnology, and consumer health products. The amount of customer spending on research, development, production, and marketing, as well as the outcomes of such research, development, and marketing activities, have a large impact on our sales and profitability, particularly the amount our customers choose to spend on our offerings. Available resources, including funding for our biotechnology and other customers, the need to develop new products, and consolidation in the industries in which our customers operate may have an impact on such spending. Our customers and potential customers finance their research and development spending from private and public sources. A reduction in available financing for and spending by our customers, for these reasons or because of the direct or indirect effects of the COVID-19 pandemic, inflation, and the Ukrainian-Russian war or other regional or global conflicts, could have a material adverse effect on our business, financial condition, and results of operations. If our customers are not successful in attaining or retaining product sales due to market conditions, reimbursement issues, or other factors, our results of operations may be materially adversely affected.

We participate in a highly competitive market, and increased competition may adversely affect our business.

We operate in a market that is highly competitive. We compete with multiple companies as to each of our offerings and in every region of the globe in which we operate, including competing with other companies that offer advanced delivery technologies, outsourced dose form or biologics manufacturing, clinical trials support services, or development services to pharmaceutical, biotechnology, and consumer health companies globally. We also compete in some cases with the internal operations of those pharmaceutical, biotechnology, and consumer health customers that also have manufacturing capabilities and choose to source these services internally.

We face substantial competition in each of our markets. Competition is driven by proprietary technologies and know-how, capabilities, consistency of operational performance, quality, price, value, responsiveness, and speed. Some competitors have greater financial, research and development, operational, and marketing resources than we do. Competition may also increase as additional companies enter our markets or use their existing resources to compete directly with ours. Expanded competition from companies in low-cost jurisdictions, such as India and China, may in the future adversely affect our results of operations or limit our growth. Greater financial, research and development, operational, and marketing resources may allow our competitors to respond more quickly with strategic acquisitions, or with new, alternative, or emerging technologies. Changes in the nature or extent of our customers’ requirements may render our offerings obsolete or non-competitive and could adversely affect our results of operations and financial condition.

We are subject to product and other liability risks that could exceed our anticipated costs or adversely affect our results of operations, financial condition, liquidity, and cash flows.

We are subject to potentially significant product liability and other liability risks that are inherent in the design, development, manufacture, and marketing of our offerings. We may be named as a defendant in product liability lawsuits, which may allege that our offerings have resulted or could result in an unsafe condition or injury to consumers. Such lawsuits,

even those without merit, could be costly to defend and could result in reduced sales, significant liabilities, adverse publicity, and diversion of management’s time, attention, and resources.

Furthermore, product liability claims and lawsuits, regardless of their ultimate outcome, could have a material adverse effect on our business operations, financial condition, and reputation and on our ability to attract and retain customers. The availability of product liability insurance for companies in the pharmaceutical industry is generally more limited than insurance available to companies in other industries. We maintain product liability insurance with annual aggregate limits in excess of $25 million. There can be no assurance that a successful product liability or other claim would be adequately covered by our applicable insurance policies or by any applicable contractual indemnity or liability limitations.

Failure to comply with existing and future regulatory requirements, including changing regulatory standards or changing interpretations of existing standards, could adversely affect our results of operations and financial condition or result in claims from customers. In addition, changes to our procedures or additional procedures, implemented to comply with public health orders or best practice guidelines as a result of the COVID-19 pandemic, may increase our costs or reduce our productivity and thereby affect our business, financial condition, or results of operations.

The healthcare industry is highly regulated. We, and our customers, are subject to various local, state, federal, national, and transnational laws and regulations, which include the operating, quality, and security standards of the FDA, the DEA, various state boards of pharmacy, state health departments, the DHHS, similar bodies of the U.K., the E.U. and its member states, and other comparable agencies around the world, and, in the future, any change to such laws and regulations or the interpretation or application thereof could adversely affect us. Among other rules affecting us, we are subject to laws and regulations concerning cGMP and drug safety. As a result of the COVID-19 pandemic or other public health activity, new public health orders or best practice guidelines may increase our costs to operate or reduce our productivity, thereby affecting our business, financial condition, or results of operations.

Failure by us or by our customers to comply with the requirements of applicable laws and regulations or requests from regulatory authorities could result in warning letters, product recalls or seizures, monetary sanctions, injunctions to halt manufacture or distribution, restrictions on our operations, civil or criminal sanctions, or withdrawal of existing or denial of pending approvals, permits, or registrations, including those relating to products or facilities. In addition, any such failure relating to the products or services we provide could expose us to contractual or product liability claims as well as claims from our customers, including claims for reimbursement for lost or damaged active pharmaceutical ingredients, which cost could be significant.

In addition, any new offering or product classified as a pharmaceutical or medical device must undergo lengthy and rigorous clinical testing and other extensive, costly, and time-consuming procedures mandated by the FDA, the EMA, and other equivalent local, state, federal, national, and transnational regulatory authorities in the jurisdictions that regulate our offerings and products.

Although we believe that we comply in all material respects with applicable laws and regulations, there can be no assurance that a regulatory agency or tribunal would not reach a different conclusion concerning the compliance of our operations with applicable laws and regulations. In addition, there can be no assurance that we will be able to maintain or renew existing permits, licenses, or other regulatory approvals or obtain, without significant delay, future permits, licenses, or other approvals needed for the operation of our businesses. Any noncompliance by us or our customers with applicable law or regulation or the failure to maintain, renew, or obtain necessary permits and licenses could have an adverse effect on our results of operations and financial condition. Furthermore, loss of a permit, license, or other approval in any one portion of our business may have indirect consequences in another portion of our business if regulators or customers adjust their reviews of such other portion as a result or customers cease business with such other portion due to fears that such loss is a sign of broader concerns about our ability to deliver products or services of sufficient quality.

Failure to provide quality offerings to our customers could have an adverse effect on our business, and the market price of our Common Stock and may subject us to regulatory action or costly litigation.

Our results depend on our ability to execute and improve when necessary our quality management strategy and systems, and effectively train and maintain our workforce with respect to quality management. Quality management plays an essential role in determining and meeting customer requirements, preventing defects, and improving our offerings, and, despite our network of quality systems, a quality or safety issue, including with respect to a high-revenue product such as a COVID-19 vaccine or therapy, could have an adverse effect on our business, financial condition, stock price, or results of operations and may subject us to regulatory action, including a product recall, product seizure, injunction to halt manufacture or distribution, or restriction on our operations; monetary fines; or other civil or criminal sanctions. In addition, such an issue could subject us to

adverse publicity and costly litigation, including claims from our customers for reimbursement for the cost of lost or damaged active pharmaceutical ingredients or other related losses, the cost of which could be significant.

The services and offerings we provide are highly exacting and complex, and, if we encounter problems providing the services or support required, our business could suffer.

The offerings we provide are highly exacting and complex, due in part to complex and exacting manufacturing processes and strict regulatory requirements. From time to time, problems may arise in connection with facility operations or during preparation or provision of an offering, in both cases for a variety of reasons including, but not limited to, equipment malfunction, sterility variances or failures, failure to follow specific protocols and procedures, problems with raw materials, environmental factors, and damage to, or loss of, manufacturing operations due to fire, flood, or similar causes. Such problems could affect production of a particular batch or series of batches, require the destruction of or otherwise result in the loss of product or materials used in the production of product, or could halt facility production altogether. This could, among other things, lead to increased costs, lost revenue, damage to customer relations, reimbursement to customers for lost active pharmaceutical ingredients or other related losses, time and expense spent investigating the cause, lost production time, and, depending on the cause, similar losses with respect to other batches or products. Production problems in our biologic manufacturing operations could be particularly significant because the cost of raw materials is often appreciably higher than in our other businesses. If problems are not discovered before the product is released to the market, recall and product liability costs may also be incurred. In addition, such risks may be greater at facilities that are new or going through significant expansion or renovation. The risks associated with running a highly complex facility doing exacting work with substantial regulatory oversight are enhanced for our larger sites, like our Bloomington, Indiana, Harmans, Maryland, St. Petersburg, Florida, or Swindon U.K. sites, which generally generate much more revenue.

If we cannot keep pace with rapid technological advances, our services may become uncompetitive or obsolete, and our revenue and profitability may decline.

The healthcare industry is characterized by rapid technological change. Demand for our offerings may change in ways we may not anticipate because of evolving industry standards as well as a result of evolving customer needs that are increasingly sophisticated and varied and the introduction by others of new offerings and technologies that provide alternatives to our offerings. Several of our higher margin offerings are based on proprietary technologies. To the extent that such technologies are protected by patents, their related offerings may become subject to competition as the patents expire. Without the timely introduction of enhanced or new offerings and technologies, our offerings may become obsolete or uncompetitive over time, in which case our revenue and operating results would suffer. For example, if we are unable to respond to changes in the nature or extent of the technological or other needs of our pharmaceutical customers through enhancing our offerings, our competition may develop offerings that are more competitive than ours and we could find it more difficult to renew or expand existing agreements or obtain new agreements. Potential innovations intended to facilitate enhanced or new offerings generally will require a substantial investment before we can determine their commercial viability, and we may not obtain access to the innovations or have financial resources sufficient to fund all desired innovations.

Even if we succeed in creating or acquiring enhanced or new offerings from these innovations, they may still fail to result in commercially successful offerings or may not produce revenue in excess of the costs of development, and they may be rendered obsolete by changing customer preferences or the introduction by our competitors of offerings embodying new technologies or features. Finally, innovations may not be accepted quickly in the marketplace because of, among other things, entrenched patterns of clinical practice, the need for regulatory clearance, and uncertainty over market access or government or third-party reimbursement.

We and our customers depend on patents, copyrights, trademarks, know-how, trade secrets, and other forms of intellectual property protections, but these protections may not be adequate.

We rely on a combination of know-how, trade secrets, patents, copyrights, trademarks, and other intellectual property laws, nondisclosure and other contractual provisions, and technical measures to protect many of our offerings and intangible assets. These proprietary rights are important to our ongoing operations. There can be no assurance that these protections will provide uniqueness or meaningful competitive differentiation in our offerings or otherwise be commercially valuable or that we will be successful in obtaining additional intellectual property or enforcing our intellectual property rights against unauthorized users. Our exclusive rights under certain of our offerings are protected by patents, some of which will expire in the near term. When patents covering an offering expire, loss of exclusivity may occur, which may force us to compete with third parties, thereby negatively affecting our revenue and profitability.

Our proprietary rights may be invalidated, circumvented, or challenged. We may in the future be subject to proceedings seeking to oppose or limit the scope of our patent applications or issued patents. In addition, in the future, we may need to take legal actions to enforce our intellectual property rights, to protect our trade secrets, or to determine the validity or scope of the proprietary rights of others. Legal proceedings are inherently uncertain, and the outcome of such proceedings may be unfavorable to us. Any legal action regardless of outcome might result in substantial costs and diversion of resources and management attention.

There can be no assurance that our confidentiality agreements will not be breached, our trade secrets will not otherwise become known by competitors, or that we will have adequate remedies in the event of unauthorized use or disclosure of proprietary information. Even if the validity and enforceability of our intellectual property is upheld, an adjudicator might construe our intellectual property not to cover the alleged infringement. In addition, intellectual property enforcement may be unavailable or practically ineffective in some countries. There can be no assurance that our competitors will not independently develop technologies that are substantially equivalent or superior to our technology or that third parties will not design around our intellectual property claims to produce competitive offerings. The use of our technology or similar technology by others could reduce or eliminate any competitive advantage we have developed, cause us to lose sales, or otherwise harm our business.

While we continue to apply in the U.S. and certain other countries for registration of a number of trademarks, service marks, and patents, and also claim common law rights in various trademarks and service marks, there can be no assurance that third parties will not oppose our applications in the future. In addition, it is possible that in some cases we may be unable to obtain the registrations for trademarks, service marks, and patents for which we have applied, and a failure to obtain trademark and patent registrations in the U.S. or other countries could limit our ability to protect our trademarks and proprietary technologies and impede our marketing efforts in those jurisdictions.

License agreements with third parties control our rights to use certain patents, software, and information technology systems and proprietary technologies owned by third parties, some of which are important to our business. Termination of these license agreements for any reason could result in the loss of our rights to this intellectual property, causing an adverse change in our operations or the inability to commercialize certain offerings.

In addition, many of our branded pharmaceutical customers rely on patents to protect their products from generic competition. Because incentives exist in some countries, including the U.S., for generic pharmaceutical companies to challenge these patents, pharmaceutical and biotechnology companies are under the ongoing threat of challenges to their patents. If the patents on which our customers rely were successfully challenged and, as a result, the affected products become subject to generic competition, the market for our customers’ products could be significantly adversely affected, which could have an adverse effect on our results of operations and financial condition. We attempt to mitigate these risks by making our offerings available to generic as well as branded manufacturers and distributors, but there can be no assurance that we will be successful in marketing these offerings.

Our offerings or our customers’ products may infringe on the intellectual property rights of third parties.

From time to time, third parties have asserted intellectual property infringement claims against us and our customers, and there can be no assurance that third parties will not assert infringement claims against either us or our customers in the future. While we believe that our offerings do not infringe in any material respect upon proprietary rights of other parties, and that meritorious defenses would exist with respect to any assertion to the contrary, there can be no assurance that we could successfully avoid being found to infringe on the proprietary rights of others. Patent applications in the United States and certain other countries are generally not publicly disclosed until the patent is issued or published, and we and our customers may not be aware of currently filed patent applications that relate to our or their products, offerings, or processes. If patents later issue on these applications, we or they may be found liable for subsequent infringement. There has been substantial litigation in the pharmaceutical and biotechnology industries with respect to the manufacture, use, and sale of products that are the subject of conflicting patent rights.

Any claim that our offerings or processes infringe third-party intellectual property rights (including claims arising through our contractual indemnification of our customers), regardless of the claim’s merit or resolution, could be costly and may divert the efforts and attention of our management and technical personnel. We may not prevail against any such claim given the complex technical issues and inherent uncertainties in intellectual property matters. If any such claim results in an adverse outcome, we could, among other things, be required to: pay substantial damages (potentially including treble damages in the U.S.); cease the manufacture, use, or sale of the infringing offerings or processes; discontinue the use of the infringing technology; expend significant resources to develop non-infringing technology; license technology from the third party claiming infringement, which license may not be available on commercially reasonable terms or at all; and lose the opportunity

to license our technology to others or to collect royalty payments based upon successful protection and assertion of our intellectual property against others.

In addition, our customers’ products may be subject to claims of intellectual property infringement and such claims could materially affect our business if their products cease to be manufactured or they have to discontinue the use of the infringing technology.

Any of the foregoing could affect our ability to compete or have a material adverse effect on our business, financial condition, and results of operations.

Events that diminish, tarnish, or otherwise damage our brand may have an adverse effect on our future financial condition and results of operations.

We have built a strong brand in “Catalent,” with high overall and generally favorable awareness of the brand in our established markets and with target customers. Our brand identity is a competitive advantage for us in sales and marketing, which is evidenced by our customer mix among top branded drug, generics, biologics, and consumer health marketers. We have spent and continue to spend substantial time, money, and other resources to establish both our brand awareness and a favorable perception of our brand in relevant markets. Among other strategies, we participate in major international trade shows in our established markets and ensure visibility into our offerings through a comprehensive print and on-line advertising and publicity program. It is possible that a single event, or aggregation of several events, may diminish, tarnish, or otherwise damage our brand and adversely affect our future financial condition and results of operations.

For example, meaningful interruptions to our ability to reliably supply one or more customers with products on time, whether as a result of supply chain disruptions or manufacturing delays or defects, may diminish our customers’ confidence in our ability to timely meet our commitments, thereby damaging our brand. In addition, we are subject to various local, state, federal, national, and transnational laws and regulations, including the operating, quality, and security standards of the FDA, the DEA, and similar bodies of the U.K., the E.U., and other comparable agencies around the world. Highly public or significant negative reports or findings from a regulatory agency with respect to one or more manufacturing or quality defects in our operations, inspections of our facilities, or other routine reviews could cause negative public perception of our operations, negatively impacting our brand, and adversely affecting our financial condition and results of operations. In addition, many of the other risks we face, including those described elsewhere in "Risk Factors" could diminish, tarnish, or otherwise damage our brand.

Our future results of operations are subject to fluctuations in the costs, availability, and suitability of the components of the products we manufacture, including active pharmaceutical ingredients, excipients, purchased components, and raw materials. In addition, the COVID-19 pandemic and the ongoing supply-chain disruptions triggered by a combination of the pandemic and the Ukrainian-Russian war may interfere with the operations of certain of our direct or indirect suppliers or with international trade for these supplies, which may either raise our costs or reduce the productivity or slow the timing of our operations.

We depend on various active pharmaceutical ingredients, components, compounds, raw materials, and energy supplied primarily by third parties for our offerings. Our customers also frequently provide to us their active pharmaceutical or biologic ingredient for formulation or incorporation in the finished product and may supply other raw materials as well. It is possible that any of our or our customers’ supplier relationships could be interrupted due to changing regulatory requirements, import or export restrictions, natural disasters, international supply disruptions, including those caused by public health emergencies such as the COVID-19 pandemic, and the ongoing Ukrainian-Russian war, geopolitical issues, operational or quality issues at the suppliers’ facilities, and other events, or could be terminated in the future.