Exhibit 10.11

Sale and Purchase Agreement

between

EEGO 123 William Owner, LLC,

as Seller

and

ARC NYC123WILLIAM, LLC,

as Purchaser

Premises:

123 William Street

New York, NY

January 27, 2015

TABLE OF CONTENTS

Page

Certain Definitions. | 1 | ||

Sale-Purchase. | 4 | ||

Purchase Price. | 4 | ||

Condition of Title. | 5 | ||

Closing. | 7 | ||

Violations. | 7 | ||

Apportionments. | 7 | ||

Closing Deliveries | 13 | ||

Conditions Precedent. | 17 | ||

Estoppel Certificates. | 18 | ||

11. | Cancellation of Contracts. | 20 | |

12. | Right of Inspection. | 20 | |

13. | Title Insurance. | 22 | |

14. | Return of Deposit. | 24 | |

15. | Purchaser’s Default. | 24 | |

16. | Representations and Warranties. | 24 | |

17. | Broker. | 32 | |

18. | Condemnation and Destruction. | 32 | |

19. | Escrow. | 33 | |

20. | Covenants. | 35 | |

21. | Transfer Taxes. | 39 | |

22. | Non-Liability. | 40 | |

23. | Seller’s Inability to Perform; Seller’s Default. | 40 | |

24. | Condition of Premises. | 41 | |

25. | Environmental Matters. | 42 | |

26. | Tax Reduction Proceedings. | 43 | |

27. | Union Agreement; Other Employment Matters. | 43 | |

28. | Notices. | 45 | |

29. | Entire Agreement. | 46 | |

30. | Amendments. | 47 | |

31. | No Waiver. | 47 | |

32. | Successors and Assigns. | 47 | |

33. | Partial Invalidity. | 47 | |

34. | Section Headings; Incorporation of Exhibits. | 47 | |

35. | Governing Law. | 47 | |

18848190v.10

TABLE OF CONTENTS

(continued)

(continued)

36. | Confidentiality. | 48 | |

37. | No Recording or Notice of Pendency. | 48 | |

38. | Assignment. | 48 | |

39. | Counterparts. | 49 | |

40. | No Third Party Beneficiary. | 49 | |

41. | [Intentionally deleted] | 49 | |

42. | Business Days. | 49 | |

43. | Mortgage Loan Assignment. | 49 | |

44. | Waiver of Trial by Jury. | 50 | |

TABLE OF CONTENTS

(continued)

(continued)

EXHIBITS

1(A) | Description of Land |

1(B) | Leases |

1(C) | Existing Contracts |

1(D) | Telecommunications Contracts |

1(E) | Brokerage Agreements |

1(F) | Union Agreement |

4(A)(i) | Permitted Exceptions |

4(A)(ii) | Title Objections |

8(A)(i) | Form of Bargain and Sale Deed |

8(A)(ii) | Form of Bill of Sale |

8(A)(iii) | Form of Assignment and Assumption of Leases |

8(A)(iv) | Form of Assignment and Assumption of Contracts |

8(A)(viii) | Form of Tenant Notice Letter |

8(A)(ix) | Form of Contractor Notice Letter |

8(A)(xiv) | Form of Assignment and Assumption of Union Agreement |

8 (A)(xix) | Form of Title Affidavit |

10 | Form of Tenant Estoppel Certificate |

16(A)(i) | Rent Arrearages |

16(A)(ii) | Union Employees |

16(A)(xii) | Tax Assessment Reduction Proceedings |

16(A)(xiii) | Security Deposits |

16(A)(xxi) | Landlord’s Work |

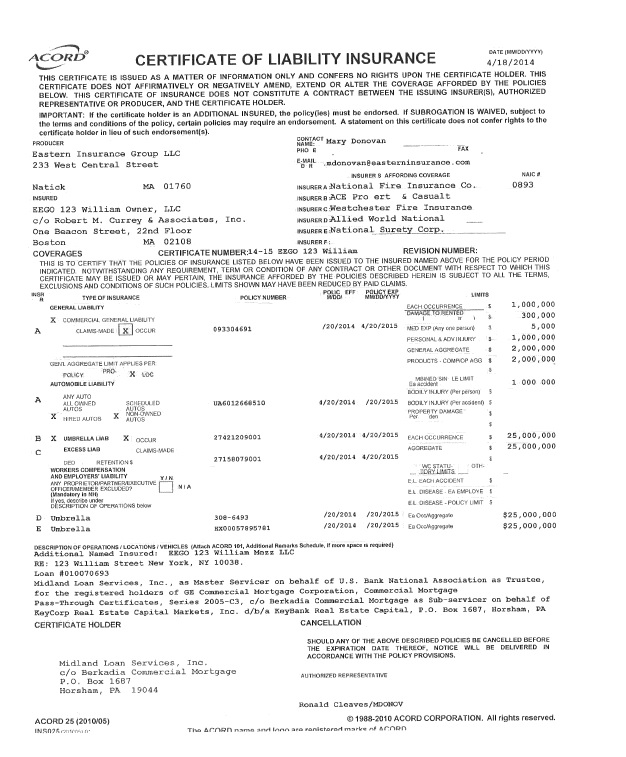

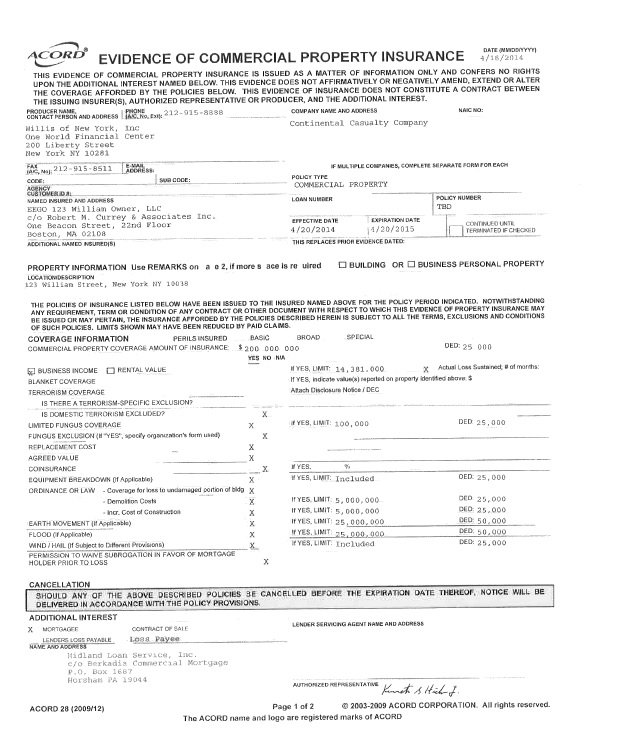

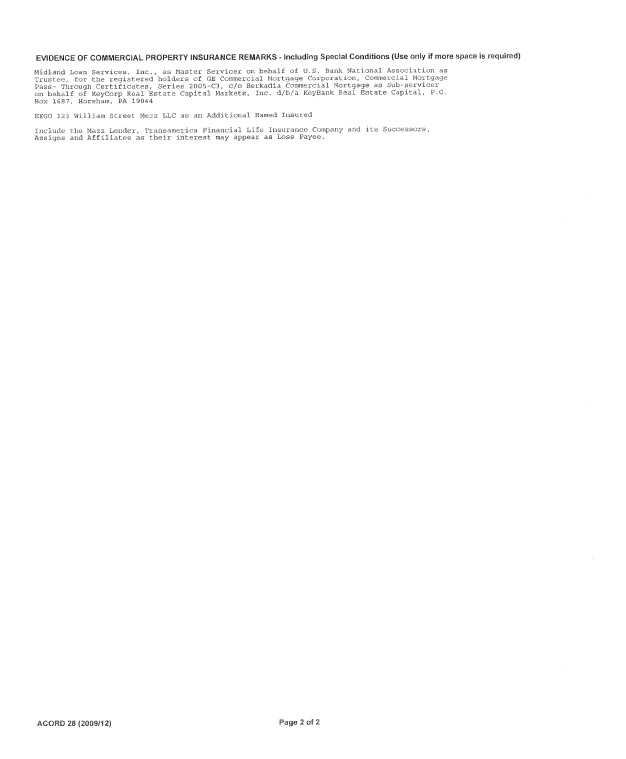

20(A)(iv) | Certificates of Insurance |

20(D) | Seller’s Work |

SALE AND PURCHASE AGREEMENT (this “Agreement”), made as of the _____ day of January, 2015 between EEGO 123 William Owner, LLC, a Delaware limited liability company having an address c/o East End Capital, 600 Madison Avenue, 11th Floor, New York, New York 10022 (“Seller”) and ARC NYC123WILLIAM, LLC, a Delaware limited liability company having an address at c/o American Realty Capital, 405 Park Avenue, New York, New York 10022 (“Purchaser”).

RECITALS:

A. Seller is the owner of the fee interest in the Premises (as hereinafter defined), commonly known as 123 William Street, New York, New York.

B. Purchaser wishes to purchase, and Seller wishes to sell, all of Seller’s right, title and interest in and to the Premises on the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the mutual covenants set forth in this Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Seller and Purchaser hereby agree as follows:

Certain Definitions.

Certain capitalized terms used in this Agreement shall, for the purposes of this Agreement, have the meanings ascribed to such terms in this Article 1. Other capitalized terms used in this Agreement and not defined in this Article 1 shall have the meanings ascribed to such terms elsewhere in this Agreement.

“Brokerage Agreements” shall mean the agreements between Seller and any leasing brokers which are set forth on Exhibit “1(E)”.

“Building” shall mean the building commonly identified as 123 William Street, New York, New York.

“Escrow Agent” shall mean Kensington Vanguard National Land Services.

“Existing Contracts” shall mean the management, service, telecommunications, information service and maintenance contracts, and all amendments, modifications and/or assignments thereof, affecting the Premises or the operation thereof, all of which are listed on Exhibits “1(C)”, “1(D)” and “1(F)”.

“Fixtures” shall mean all equipment, fixtures and appliances of whatever nature which are (i) affixed to the Land or Improvements and (ii) owned by Seller.

“Hazardous Materials” means (a) those substances included within the definitions of any one or more of the terms “hazardous materials,” “hazardous wastes,” “hazardous substances,” industrial wastes,” and “toxic pollutants,” as such terms are defined under the Relevant Environmental Laws, or any of them, (b) petroleum and petroleum products, including, without limitation, crude oil and any fractions thereof, (c) natural gas, synthetic gas and any mixtures thereof, (d) asbestos and or any material which contains any hydrated mineral silicate, including, without limitation, chrysotile, amosite, crocidolite, tremolite, anthophylite and/or actinolite, whether friable or non-friable (collectively, “Asbestos”), (e) polychlorinated biphenyl (“PCBs”) or PCB-containing materials or fluids, (f) radon, (g) any other hazardous or radioactive substance, material, pollutant, contaminant or waste, (h) any Pathogen (as hereinafter defined), and (i) any other substance with respect to which any Relevant Environmental Law or governmental authority requires environmental investigation, monitoring or remediation.

“Improvements” shall mean the improvements on the Land, including without limitation the Building.

“Land” shall mean the land described on Exhibit “1(A)” and situated in the Borough of Manhattan, City, County and State of New York, and designated as Block 787, Lot 72 in the Borough of Manhattan on the Tax Map of the City of New York, State of New York.

“Leases” (each individually, a “Lease”) shall mean the leases, tenancies, concessions, licenses and occupancies, and all amendments, modifications and/or assignments thereof, affecting the Premises, all of which are as listed on Exhibit “1(B)”, as the same may be

-2-

18848190v.10

amended, modified or extended from time to time in accordance with the terms of this Agreement, or entered into between the date hereof and the Closing Date (as hereinafter defined) in accordance with the terms and conditions of Article 20 hereof, as well as all lease guaranties, if any, delivered in connection therewith.

“New Contracts” shall mean all management, service, telecommunications, information service and maintenance contracts and collective bargaining and other union agreements affecting the Premises or the operation thereof which are entered into by Seller after the date hereof subject to the applicable provisions of this Agreement.

“Pathogen” shall mean any pathogen, toxin or other biological agent or condition, including but not limited to, any fungus, mold, mycotoxin or microbial volatile organic compound.

“Personal Property” shall mean the aggregate of the following:

(i)All site plans, architectural renderings, plans and specifications, engineering plans, as-built drawings, floor plans and other similar plans or diagrams, if any, which (a) relate to the Real Property and (b) are in Seller’s possession or control;

(i) Seller’s right, title and interest, if any, in all licenses, permits, permit applications and warranties, guaranties, indemnities and bonds which (a) relate to the Real Property and (b) are assignable by Seller to Purchaser, without penalty;

(ii) All equipment, appliances, tools, machinery, supplies, building materials and other similar personal property which is (a) owned by Seller as of the date of this Agreement and (b) attached to, appurtenant to or located in the Improvements and/or used in the day-to-day operation or maintenance of the Improvements, but expressly excluding the Fixtures and any and all personal property owned by any property manager, tenants in possession, public or private utilities licensees or contractors. Seller shall not transfer to any third party or remove any Personal Property from the Premises after the date hereof, except for repair or replacement thereof and except in the case of the termination of this Agreement. Notwithstanding the foregoing, “Personal Property” expressly excludes, and Seller shall not be required to convey, and Purchaser shall not be entitled to receive, any items containing the logo of Seller or any of Seller’s affiliates, or any computer programs, software and documentation thereof, electronic data processing systems, program specifications, source codes, logs, input data and report layouts and forms, record file layouts, diagrams, functional specifications and variable descriptions, flow charts and other related materials (collectively, “Operational Systems”);

(iii) All non-exclusive trademarks, logos and trade names (if any) used or useful in connection with the Real Property, but only to the extent that the same are not trademarks or trade names of Seller or any of Seller’s affiliated companies; and

(iv) All rights, privileges, easements and appurtenances to the Land and the Building, if any, including, without limitation, all of Seller’s right, title and interest in and to all operating agreements, reciprocal easement agreements, mineral and water rights and all easements,

-3-

18848190v.10

rights-of-way, air rights, development rights and other appurtenances used or connected with the beneficial use or enjoyment of the Land and the Building.

“Premises” shall mean the aggregate of the Real Property and the Personal Property.

“Purchaser Representatives” shall mean Purchaser’s designees, agents, employees, consultants, appraisers, engineers, contractors and prospective lenders.

“Real Property” shall mean the fee estate of Seller in and to the aggregate of the Land, the Building, the Fixtures, Seller’s right, title and interest, if any, in the streets, roads, lands and alleys in front of and adjacent to the Land, and the hereditaments and appurtenances to the Improvements and the Land, including without limitation all easements, rights-of-way, air rights and other similar interests appertaining to the Land or the Building.

“Relevant Environmental Laws” shall mean any and all laws, rules, regulations, statutes, orders and directives, whether federal, state or local, applicable to the Premises or any part thereof now or hereinafter in effect, in each case as amended or supplemented from time to time including, without limitation all applicable judicial or administrative orders, applicable consent decrees and binding judgments relating to the regulation and protection of human health, safety, the environment and natural resources (including, without limitation, ambient air, surface, water, groundwater, wetlands, land surface or subsurface strata, wildlife, aquatic species and vegetation), including, without limitation, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended (49 U.S.C. §6901 et seq.), the Hazardous Material Transportation Act, as amended (49 U.S.C. §§ 1801 et seq.), the Federal Insecticide, Fungicide, and Rodenticide Act, as amended (7 U.S.C. §§ 136 et seq.), the Resource Conservation and Recovery Act, as amended (42 U.S. §§ 6901 et seq.), the Toxic Substance Control Act, as amended (15 U.S.C. §§ 2601 et seq.), the Clean Air Act, as amended (42 U.S.C. §§ 7401 et seq.), the Federal Water Pollution Control Act, as amended (33 U.S.C. §§ 1251 et seq.) the Occupational Safety and Health Act, as amended (29 U.S.C. §§ 651 et seq.), the Safe Drinking Water Act, as amended (42 U.S. C. §§ 300f et seq.), Environmental Protection Agency regulations pertaining to Asbestos (including, without limitation, 40 C.F.R. Part 61, Subpart M, the United States Environmental Protection Agency Guidelines on Mold Remediation in Schools and Commercial Buildings, the United States Occupational Safety and Health Administration regulations pertaining to Asbestos including, without limitation, 29 C.F.R. Section 1910.1001 and 1926.58), and any state or local counterpart or equivalent of any of the foregoing, and any related federal, state or local transfer of ownership notification or approval statutes. The foregoing, with respect to the environmental condition of the Premises and any adjacent property, and any activities conducted on or at the Premises, including by way of example and not limitation: (i) Hazardous Materials; (ii) air emissions, water discharges, noise emissions and any other environmental, health or safety matter; (iii) the existence of any underground storage tanks that contained or contain Hazardous Materials; and (vi) the existence of pcb contained electrical equipment.

“Security Deposits” (each individually, a “Security Deposit”) shall mean all security deposits and/or letters of credit actually held by Seller under Leases as of the date hereof as listed on Exhibit “16(A)(xiii)” as same may be drawn down, applied and/or retained after the date hereof in accordance with both the applicable Lease and the terms of this Agreement.

-4-

18848190v.10

“Surviving Contracts” shall mean Existing Contracts and New Contracts which are in effect as of the Closing.

“Telecommunications Contracts” shall mean the telecommunications and information service contracts and licenses affecting the Premises or the operation thereof which are listed on Exhibit “1(D)”.

“Tenants” (each individually, a “Tenant”) shall mean the current tenants under the Leases.

“Title Insurer” shall mean Kensington Vanguard National Land Services.

“Union Agreement” shall mean the collective bargaining agreements identified in Exhibit “1(F)” with respect to the Union Employees (hereinafter defined).

2. | Sale-Purchase. |

In consideration of, and upon and subject to, the mutual covenants and agreements set forth in this Agreement, and for other good and valuable consideration, the mutual receipt and legal sufficiency of which is hereby acknowledged, Seller agrees to sell and convey all of Seller’s right, title and interest in and to the Premises, the Leases and the Surviving Contracts (as hereinafter defined) to Purchaser, and Purchaser agrees to purchase the Premises, and all of Seller’s rights in and to the Leases and the Surviving Contracts from Seller. Seller and Purchaser agree that no portion of the Purchase Price (as hereinafter defined) is attributable to the Personal Property included in this sale.

3. | Purchase Price. |

The purchase price for the Premises (the “Purchase Price”) is Two Hundred Fifty-Three Million and 00/100 Dollars ($253,000,000.00), payable as follows: (i) Twenty-Five Million Three Hundred Thousand and 00/100 Dollars ($25,300,000.00) (the “Deposit”) within one (1) business day following the date hereof to Escrow Agent, by federal funds, wire transfer of immediately available federal funds to an account designated by Escrow Agent, to be held by Escrow Agent pursuant to and in accordance with the provisions of Article 19 of this Agreement; and (ii) subject to the apportionments and other credits provided for in this Agreement, the balance of the Purchase Price on the Closing Date by federal funds or wire transfer of immediately available federal funds to an account or accounts designated by Seller. Seller and Purchaser agree that one-half of the interest earned on the Deposit shall be credited to the Purchase Price upon the Closing and the balance of the interest on the Deposit shall, upon the Closing, be and remain the property of Seller, and shall not be credited against the Purchase Price. Failure by Purchaser to deliver the Deposit to Escrow Agent as provided above within one (1) business day following the date hereof shall render this Agreement void ab initio.

-5-

18848190v.10

4. | Condition of Title. |

A. The Premises shall be sold, and title thereto conveyed, subject only to (collectively, the “Permitted Exceptions”):

(i) The matters set forth on Exhibit “4(A)(i)”;

(ii) The Leases and the rights of Tenants;

(iii) All Violations (hereinafter defined); except that Seller shall tender payment at Closing to Title Insurer to pay to the appropriate governmental agency any and all fines, fees, penalties, and interest imposed with respect to such Violations through the Closing Date.

(iv) All present and future zoning, building, land use, environmental and other laws, ordinances, codes, restrictions, rules and regulations or other legal requirements of all governmental authorities having jurisdiction with respect to the Premises, including, without limitation, landmark designations and all zoning variances and special exceptions, if any;

(v) Liens, encumbrances, violations and defects (including, without limitation, any mechanics and/or materialmen’s lien or any judgment arising as a result thereof), removal of which is an obligation of a Tenant;

(vi) All presently existing and future liens for unpaid real estate taxes and water and sewer charges not due and payable as of the date of the Closing, subject to adjustment as hereinbelow provided;

(vii) All covenants, restrictions and rights and all easements and agreements for the erection and/or maintenance of water, gas, steam, electric, telephone, sewer or other utility pipelines, poles, wires, conduits or other like facilities, and appurtenances thereto, over, across and under the Premises which are either (a) presently existing or (b) granted to a public utility in the ordinary course, provided that the same shall not have a material adverse effect on the use of the Premises for its current use;

(viii) Statement of facts shown on the survey, dated August 16, 1957, prepared by Charles J. Dearing, as updated on June 6, 2013 by visual examination by Earl A. Lovell – S.P. Belcher, Inc. and any additional facts which would be shown on or by an accurate current survey of the Premises, provided that such additional facts shall not have a material adverse effect on the use of the Premises for its current use;

(ix) The Surviving Contracts;

(x) Consents by any former owner of the Land for the erection of any structure or structures on, under or above any street or streets on which the Land may abut;

-6-

18848190v.10

(xi) Possible encroachments and/or projections of stoop areas, roof cornices, window trims, vent pipes, cellar doors, steps, columns and column bases, flue pipes, signs, piers, lintels, window sills, fire escapes, satellite dishes, protective netting, sidewalk sheds, ledges, fences, coping walls (including retaining walls and yard walls), air conditioners and the like, if any, on, under or above any street or highway, the Building, or any adjoining property, provided that the same shall not have a material adverse effect on the use of the Property for its current use;

(xii) Variations between tax lot lines and lines of record title;

(xiii) Standard exclusions from coverage contained in the form of title policy or “marked-up” title commitment employed by the Title Insurer;

(xiv) Any financing statements, chattel mortgages, encumbrances or mechanics’ or other liens entered into by, or arising from, any financing statements filed on a day more than five (5) years prior to the Closing and any financing statements, chattel mortgages, encumbrances or mechanics’ or other liens filed against property no longer contained in the Premises, provided that the Title Insurer shall remove them as exceptions from the title insurance policy to be issued to Purchaser at Closing or shall affirmatively insure over them at regular rates;

(xv) Any lien or encumbrance arising out of the acts or omissions of Purchaser;

(xvi) Subject to the terms of this Agreement, any other matter which the Title Insurer may raise as an exception to title, provided the Title Insurer will either omit or affirmatively insure against collection or enforcement of same out of the Premises and/or that no prohibition of present use or maintenance of the Premises will result therefrom, as may be applicable;

(xvii) Any encumbrance that will be extinguished upon conveyance of the Property to Purchaser, provided that the Title Insurer shall remove them as exceptions from the title insurance policy to be issued to Purchaser at Closing or shall affirmatively insure over them; and

(xviii) any other matter which, pursuant to the terms of this Agreement, is a permitted condition of the transaction contemplated by this Agreement.

B. Title to the Premises shall be such title as the Title Insurer shall be prepared to insure, subject to the Permitted Exceptions and the provisions of Article 13 hereof.

5. | Closing. |

The “Closing” shall mean the consummation of each of the actions set forth in Article 8 of this Agreement, or the waiver in writing of such action by the party in whose favor such action is intended, and the satisfaction of each condition precedent to the Closing set forth in Article 9 and elsewhere in this Agreement, or the waiver in writing of such condition precedent by the party intended to be benefited thereby. The Closing shall be consummated on March 27, 2015 (TIME BEING OF THE ESSENCE) at 10:00 a.m., with the Purchase Price to be received by 4:00 p.m., to be deemed paid as of such date (Eastern Standard Time) in escrow through Escrow Agent, at its

-7-

18848190v.10

office located at 39 West 37th Street, 7th Floor, New York, New York 10018. Neither party hereto shall be required to be present at the Closing, unless otherwise agreed to by the parties hereto. Purchaser and Seller agree to cause all documents and deliverables required to be delivered by the parties hereunder, and by any necessary third parties, to be delivered to Escrow Agent at its New York City office address on or prior to 1:00 p.m. (Eastern Standard Time) on March 27, 2015 (“Initial Closing Date”; the Initial Closing Date, as same may be extended or adjourned in accordance with this Agreement, is hereinafter referred to as the “Closing Date”). Purchaser shall have the right to accelerate the Initial Closing Date upon ten (10) business days prior written notice to Seller; provided that such accelerated Closing Date shall not be earlier than February 27, 2015 and all conditions precedent to both Purchaser’s and Seller’s respective obligations to close under this Agreement shall have been satisfied (or waived in writing) (but failure to close on such accelerated Closing Date shall not constitute a default by Seller under this Agreement). TIME IS OF THE ESSENCE with respect to Purchaser’s and Seller’s obligation to close on or before the Initial Closing Date, subject to Seller’s right to adjourn the Closing as permitted under this Agreement which adjourned date shall be TIME OF THE ESSENCE with respect to Purchaser’s and Seller’s obligation to close on such date.

6. | Violations. |

The Premises are sold, and Purchaser shall accept same, subject to any and all violations of law, rules, regulations, ordinances, orders or requirements noted in or issued by any Federal, state, county, municipal or other department or governmental agency having jurisdiction against or affecting the Premises whenever noted or issued (collectively, “Violations”) and any conditions which could give rise to any Violations. Other than tendering payment to the Title Insurer at Closing in order to pay the appropriate governmental agency all fines, fees, penalties, and interest imposed with respect to the Violations through the Closing Date, Seller shall have no obligation to cure or remove any Violations.

7. | Apportionments. |

A. The following shall be apportioned between Seller and Purchaser at the Closing with respect to the Premises as of 11:59 p.m. of the day immediately preceding the Closing Date, and the net amount thereof either shall be paid by Purchaser to Seller or credited to Purchaser, as the case may be, at the Closing:

(i) Real property taxes and assessments (or installments thereof), payments required to be made to any business improvement district (“BID taxes”) and vault charges, except those required pursuant to Leases to be paid directly to the entity imposing same;

(ii) Water rates and charges, except those required pursuant to Leases to be paid directly to the entity imposing same;

(iii) Sewer taxes and rents, except those required pursuant to Leases to be paid directly to the entity imposing same;

-8-

18848190v.10

(iv) All other operating expenses with respect to the Property, including, but not limited to, salaries, vacation pay, sick pay, health, welfare, employer contributions, and pension and other benefits of the Union Employee(s) (as hereinafter defined), provided Seller shall provide appropriate backup for such items; Seller shall not be charged with termination pay arising by reason of Purchaser's termination of the Union Employee(s) or failure to hire any Union Employee, at or subsequent to the Closing, and Purchaser shall be fully liable for any such termination pay. If personnel engaged at the Property are in the employ of an agent or contractor (including any cleaning company engaged at the Property), then such adjustment or proration shall be made as appropriate with the agent to reach the same economic result as if in the direct employ of Seller but Purchaser shall not be required to hire such non-union employees;

(v) Permit, license and inspection fees, if any, on the basis of the fiscal year for which levied, if the rights with respect thereto are transferred to Purchaser;

(vi) Fuel, if any, at the cost per gallon most recently charged to Seller, based on the supplier’s measurements thereof, plus sales taxes thereon, which measurements shall be given by Seller to Purchaser as close to the Closing Date as is reasonably practicable, and which, absent manifest error, shall be conclusive and binding on the Seller and Purchaser;

(vii) Deposits on account with any utility company servicing the Premises to the extent transferred to (and assumed by) Purchaser shall not be apportioned, but Seller shall receive a credit in the full amount thereof (including accrued interest thereon, if any);

(viii) Rents (as hereinafter defined), if, as and when collected, in accordance with Section 7(F) hereof;

(ix) Leasing Costs, if any, in accordance with Section 20(B) hereof;

(x) Payments due under any Surviving Contracts;

(xi) Purchaser shall receive a credit against the Purchase Price in an amount equal to the prepaid rents received by Seller in connection with the Leases covering any period after the Closing Date

(xii) [Reserved];

(xiii) All other items customarily apportioned in connection with the sale of similar properties similarly located. Notwithstanding the foregoing, Purchaser shall not receive any offset or credit for free rent noted in any lease.

B. Apportionment of real property taxes, BID taxes, water rates and charges, sewer taxes and rents and vault charges shall be made on the basis of the fiscal year for which assessed. If the Closing Date shall occur before the real property tax rate, BID taxes, water rates or charges, sewer taxes or rents or vault charges are fixed, apportionment for any item not yet fixed shall be made on the basis of the real property tax rate, BID taxes, water rates and charges, sewer taxes and rents or vault charges, as applicable, for the preceding year applied to the latest assessed valuation.

-9-

18848190v.10

After the real property taxes, BID taxes, water rates and charges, sewer taxes and rents and vault charges are finally fixed, Seller and Purchaser shall make a recalculation of the apportionment of same after the Closing, and Seller or Purchaser, as the case may be, shall make an appropriate payment to the other based upon such recalculation.

C. The amount of any of the unpaid taxes, assessments, water charges, sewer rents and vault charges which Seller is obligated to pay and discharge, with interest and penalties thereon (if any) to the Closing Date may, at Seller’s option, be allowed to Purchaser out of the balance of the Purchase Price, provided that official bills therefor with interest and penalties thereon (if any) are furnished by Seller at the Closing and provided that Title Insurer will omit same as exceptions from, or insure against collection from the Premises in, Purchaser’s title insurance policy, at no additional cost or expense to Purchaser.

D. If any refund of real property taxes, BID taxes, water rates or charges, sewer taxes or rents or vault charges is made after the Closing Date covering a period prior to the Closing Date, the same shall be applied first to the reasonable out-of-pocket costs incurred in obtaining same (including reasonable attorneys’ fees, accounting fees, consultant fees and filing fees) and the balance, if any, of such refund shall, to the extent received by Purchaser, be paid to Seller (for the period prior to the Closing Date) and to the extent received by Seller, be paid to Purchaser (for the period commencing with the Closing Date). Any payment to Seller or Purchaser pursuant to the immediately preceding sentence shall be net of any amount payable to a Tenant in accordance with its Lease (which payment to such Tenant shall be made promptly by the Purchaser or Seller, as applicable, after such refund is made). Each of Purchaser and Seller hereby agrees to indemnify and hold harmless the other as to any refund payment paid by it to the other for a Tenant.

E. If there are meters measuring water consumption or sewer usage at the Premises, Seller shall obtain readings to a date not more than thirty (30) days prior to the Closing Date. If such readings are not obtained, water rates and charges and sewer taxes and rents, if any, shall be apportioned based upon the last actual meter readings, subject to reapportionment when readings for the relevant period are obtained after the Closing Date. If any of the Tenants pay electric based on a submeter for their electric consumption, then the Seller shall cause any such submeter to be read as close as possible to the Closing Date and upon completion of such reading, the Seller shall bill each such Tenant electric charges, based on such reading. At the Closing, the Seller shall provide the Purchaser with documentation as to any such readings and billings for submetered electric charges.

F. To the extent that Seller or Purchaser receives Rents after the Closing Date, the same shall be held in trust by Seller or Purchaser, as the case may be, and shall be applied in the order of priority set forth in this Section 7(F).

(i) The following terms shall be as defined herein: “Base Rents”: fixed rent, and other amounts of a fixed nature (which may include, without limitation, electric inclusion and supplemental water, HVAC and condenser water charges paid or payable by Tenants; “Overage Rents”: a percentage of the Tenant’s business during a specified annual or other period (sometimes referred to as “percentage rent”), so-called “escalation rent”, and additional rent based upon increases in or otherwise attributable to real estate and BID taxes, operating expenses, utility costs,

-10-

18848190v.10

a cost of living index or porter’s wages or otherwise, but which shall in no event include Reimbursable Payments (as hereinafter defined); “Reimbursable Payments”: overtime heat, air conditioning or other utilities or services; freight elevator; electric inclusion and adjustments related to electric usage (such as rate and/or fuel adjustments and survey); submetered electric; supplemental water, HVAC, and condenser water charges; services or repairs, and labor costs associated therewith, to which a Tenant is obligated to reimburse the landlord under its Lease or for which a Tenant has separately contracted with Seller or its agent; true-ups on account of escalation and/or additional rent for years prior to the year in which the Closing occurs; above standard cleaning; and all other items which are payable to Seller as reimbursement or payment for above standard or overtime services (but which amounts shall not be treated as Reimbursable Payments if already included in a Tenant’s Base Rents); and “Rents”: all amounts due and owing from Tenants, however characterized, including, without limitation, Base Rents, Overage Rents and Reimbursable Payments.

(ii) Base Rents and Overage Rents under the Leases shall be adjusted and prorated on an as, if and when collected basis. Base Rents and Overage Rents collected by Purchaser or Seller after the Closing from any Tenant who owes any such amounts for periods prior to the Closing shall be applied in the following order, but shall be treated separately for such allocation purposes: (a) first, in payment of such amounts owed by such Tenant for the month in which the Closing occurs, (b) second, in payment of such amounts owed by such Tenant for all periods immediately following the month in which the Closing occurs, (c) third, in payment of such amounts owed by such Tenant (if any) for any other period prior to the Closing. Each such amount, less any third party costs of collection (including reasonable attorneys’ fees and expenses) reasonably allocable thereto, shall be paid over as provided above, and the party who receives any such amount shall promptly pay over to the other party any portion thereof to which it is so entitled.

(iii) Reimbursable Payments shall not be apportioned or adjusted; to the extent incurred prior to the Closing Date, Reimbursable Payments incurred prior to Closing shall belong in their entirety to Seller, and shall be retained by Seller, and/or paid over to Seller by Purchaser, as applicable, on an as, if and when collected basis. To the extent a payment is made by a Tenant which is specifically designated as being on account of one or more Reimbursable Payments due to Seller, by reference to a charge, invoice number or otherwise, or is of an amount which is equal to one or more Reimbursable Payments due to Seller, then same shall be treated as a Reimbursable Payment, and shall be paid over to Seller promptly upon receipt thereof.

(iv) Purchaser shall bill Tenants who owe Rents for periods prior to the Closing on a monthly basis for a period of nine (9) consecutive months following the Closing and shall use commercially reasonable efforts to collect such past due Rents (which efforts shall include, but not be limited to, including such amounts in Purchaser’s invoices and notices for rents due for the period after Closing, but excluding litigation or otherwise seeking to terminate the Leases) but Purchaser shall have no liability for the failure to collect any such amounts. Purchaser shall have no obligation to commence any action or proceeding to collect any such past due Rents, provided, however, if Purchaser in fact commences any such action or proceeding, the amount sought shall include all Rents unpaid for the period prior to the Closing. Notwithstanding the foregoing, if Purchaser shall fail to collect such past due Rents after such nine (9) month period, Seller shall have

-11-

18848190v.10

the right to pursue Tenants to collect such delinquencies (including, without limitation, the prosecution of one or more lawsuits, but Seller shall not be entitled to pursue an action for eviction); provided, however, that in no event shall Seller have the right to terminate, or cause the termination of, the Lease of any such Tenants.

(v) Purchaser shall (a) promptly render bills to the applicable Tenants for any Overage Rent in respect of a period that shall have expired prior to the Closing but which is payable after the Closing, (b) bill Tenants for any such Overage Rent on a monthly basis for a period of nine (9) consecutive months thereafter and (c) use commercially reasonable efforts to collect such Overage Rent (which efforts shall include but not be limited to, including such amounts in Buyer’s invoices and notices for rents due for the period after the Closing) but Purchaser shall have no liability for the failure to collect any such amounts. Notwithstanding the foregoing, if Purchaser shall be unable to collect such Overage Rent after such nine (9) month period, Seller shall have the right to pursue Tenants to collect such delinquencies (including, without limitation, the prosecution of one or more lawsuits but Seller shall not be entitled to pursue and action for eviction); provided, however, that in no event shall Seller have the right to terminate, or cause the termination of, the Lease of any such Tenants. From and after the Closing, Seller shall furnish to Purchaser calculations of the amounts due from Tenants on account of Overage Rent for periods prior to the Closing, and such other information relating to the period prior to the Closing as is reasonably necessary for the billing of any such Overage Rent. Purchaser shall bill Tenants for Overage Rent for periods prior to the Closing in accordance with and on the basis of such information furnished by Seller. Purchaser shall deliver to Seller, concurrently with the delivery to Tenants, copies of all statements relating to Overage Rent for periods prior to the Closing Date.

(vi) Overage Rent for the calendar year in which the Closing occurs shall be apportioned between Seller and Purchaser using a percentage derived by dividing the total operating expenses incurred for those operating expenses which are used by Seller in determining the operating expense pool for the calendar year in question over each parties’ actual expenses incurred for such operating expenses. Seller shall be entitled to receive the proportion of such Overage Rent (less a like portion of any out-of-pocket costs and expenses (including reasonable attorneys’ fees and expenses) incurred in the collection of such Overage Rent) that the portion of such period occurring prior to the Closing bears to the entire such period, and Purchaser shall be entitled to receive the proportion of such Overage Rent (less a like portion of any out-of-pocket costs and expenses (including reasonable attorneys’ fees and expenses) incurred in the collection of such Overage Rent) that the portion of such period from and after the Closing bears to the entire such period. If, prior to the Closing, Seller shall receive any installment of Overage Rent attributable to Overage Rent for periods from and after the Closing, such sum shall be apportioned at the Closing. If, after the Closing, Purchaser shall receive any installment of Overage Rent attributable to Overage Rent for periods prior to the Closing, such sum (less any out-of-pocket costs and expenses (including reasonable counsel fees) incurred by Purchaser in the collection of such Overage Rent) shall be paid by Purchaser to Seller promptly after Purchaser receives payment thereof.

(vii) To the extent that any payment on account of Overage Rent is required to be paid periodically by Tenants for any calendar year (or, if applicable, any lease year or any other applicable accounting period), and at the end of such calendar year (or lease year or other

-12-

18848190v.10

applicable accounting period, as the case may be) such estimated amounts are to be recalculated based upon the actual expenses, taxes or other relevant factors for that calendar year (or lease year or other applicable accounting period, as the case may be), then Purchaser agrees to so recalculate same, subject to Seller’s review and reasonable approval of such recalculation, and to bill such Tenants for all amounts due from such Tenants on account therefor, within nine (9) months after the end of such calendar year (or lease year or other applicable accounting period, as the case may be). At the time(s) of final calculation and collection from (or refund to) each Tenant of the amounts in reconciliation of actual Overage Rent, there shall be a re-proration between Seller and Purchaser in accordance with this Agreement and Seller and Purchaser shall each be entitled to (or responsible for, as the case may be) the amounts attributable to such party’s period of ownership of the Premises, provided that Seller shall have no liability for amounts due to Tenants if Purchaser shall have failed to obtain Seller’s prior approval of any such recalculation. Purchaser shall indemnify and hold Seller harmless from any and all losses, costs, damages, liens, claims, counterclaims, liabilities and expenses (including, but not limited to, reasonable attorneys’ fees, court costs and disbursements) incurred by Seller as the result of Purchaser failing to pay over to any Tenant any amount paid by Seller to Purchaser on account of Overage Rent. The Seller, on or prior to the Closing, shall complete the reconciliations with the Tenants for Overage Rent for calendar year 2014 and all prior years and to the extent any such Tenant overpaid such Overage Rent, the Seller shall, on or prior to the Closing, refund any such overpayment of Overage Rent to each such applicable Tenant. At the Closing, the Seller shall provide documentation to Purchaser as to the completion of such reconciliations. Seller hereby agrees to indemnify and hold Purchaser harmless from any and all losses, costs, damages, liens, claims, counterclaims, liabilities and expenses (including, but not limited to, reasonable attorneys’ fees, court costs and disbursements) incurred by Purchaser as a result of the Seller’s failure to refund any overpayment of Overage Rent due by the Seller to any Tenant for any time period prior to the Closing.

(viii) Until such time as all amounts required to be paid to Seller by Purchaser pursuant to this Section 7(F) shall have been paid in full to the extent the Purchaser collects any arrears in Base Rents and/or Overage Rent owed to the Seller, Purchaser shall furnish to Seller a reasonably detailed monthly accounting of cash receipts from Tenants (accompanied by aged receivable reports) with a reasonably detailed accounting of amounts allocable to Seller pursuant to this Agreement, which accounting shall be delivered to Seller for each such applicable month, within twenty (20) days after the end thereof. Seller and Purchaser and their representatives shall each have the right from time to time for a period of one (1) year following the Closing, on prior notice to the other party, during ordinary business hours on business days, to review each other’s rental records with respect to the Premises to ascertain the accuracy of any such accountings during the Seller’s and Purchaser’s respective periods of ownership for the Premises.

G. If any adjustment or apportionment is miscalculated at the Closing, or the complete and final information necessary for any adjustment is unavailable at the Closing, the affected adjustment shall be calculated after the Closing. The provisions of this Article 7 shall survive the Closing Date for a period of one (1) year.

-13-

18848190v.10

8. | Closing Deliveries. |

A. At the Closing, Seller shall deliver to Purchaser, executed and acknowledged, as applicable:

(i) A bargain and sale deed without covenants against grantor’s acts, sufficient to convey fee title to the Land and Improvements subject to and in accordance with the provisions of this Agreement, in the form attached hereto as Exhibit “8(A)(i)”, and made a part hereof (the “Deed”);

(ii) A general bill of sale for the Personal Property, in the form of Exhibit “8(A)(ii)”, conveying, lien free (other than Permitted Exceptions) and as more particularly set forth therein, to Purchaser all of Seller’s right, title and interest in and to the Personal Property;

(iii) An assignment and assumption, in the form of Exhibit “8(A)(iii)”, which provides for, as more particularly set forth therein, the assignment by Seller of all of Seller’s right, title and interest as landlord in and to the Leases, all guaranties delivered in connection therewith and all security deposits thereunder, and the assumption by Purchaser of all of Seller’s obligations as landlord under the Leases arising from and after the Closing Date (the “Assignment of Leases”);

(iv) An assignment and assumption, in the form of Exhibit “8(A)(iv)”, which provides for, as more particularly set forth therein, the assignment by Seller of all of Seller’s right, title and interest in and to all of the Surviving Contracts and Brokerage Agreements and the assumption by Purchaser of all of Seller’s obligations under such Surviving Contracts and Brokerage Agreements arising from and after the Closing Date (the “Assignment of Contracts”);

(v) (vi) The cash Security Deposits under Leases then in effect and then actually held by Seller (together with accrued interest thereon, if any, less Seller’s proportionate share of administrative fees, if any) by payment of the aggregate amount thereof to Purchaser or a credit to Purchaser against the Purchase Price, at Seller’s option.

(a) If one or more Security Deposit is wholly or partially comprised of a letter of credit (collectively, the “Letters of Credit”), Seller shall use commercially reasonable efforts to transfer the Letters of Credit to Purchaser as of the Closing Date, the cost and expense of which Purchaser shall pay, and on the Closing Date Seller shall deliver to Purchaser all original Letters of Credit, with all amendments thereto, actually held by Seller. As to those Letters of Credits which are not transferred to Purchaser at Closing (collectively, the “Non-Transferable Letters of Credit”), Seller shall execute at Closing the documentation necessary to cause the transfer or re-issuance of the Non-Transferable Letters of Credit and Seller and Purchaser shall reasonably cooperate with each other on the Closing Date and following the Closing so as to effectuate the transfer of same to Purchaser and cause Purchaser to be the beneficiary thereunder or to obtain a replacement letter of credit showing Purchaser as the beneficiary thereunder. Until the Non-Transferable Letters of Credit shall be transferred to Purchaser or replaced, as aforesaid, Purchaser shall hold the same, but upon request may deliver the same to Seller (if necessary), who shall then draw upon the same and deliver the proceeds to Purchaser or return the same to the applicable Tenant, in each case upon Purchaser’s written instruction. Seller shall also deliver to

-14-

18848190v.10

Purchaser at Closing such documentation, including, without limitation, sight drafts executed in blank, as Purchaser shall reasonably require in connection with drawing under the Non-Transferable Letters of Credit in Seller’s name. Purchaser shall indemnify and hold Seller harmless from any and all losses, costs, damages, liens, claims, counterclaims, liabilities and expenses (including, but not limited to, reasonable attorneys’ fees, court costs and disbursements) incurred by Seller as the result of Seller taking any steps pursuant to a request of Purchaser, including drawing, or seeking to draw, on any Tenant’s Security Deposit. The provisions of this Section 8(A)(v)(b) shall survive the Closing;

(vii) Executed original counterparts of all Leases, guaranties of Leases and Surviving Contracts, or copies thereof to the extent executed original counterparts are not in Seller’s possession or control, all of which shall be certified by Seller as true and correct to Seller’s Actual Knowledge, subject to the limitations set forth in Section 16(C) of this Agreement;

(viii) A certification of non-foreign status, in form required by Internal Revenue Code Section 1445 and the regulations issued thereunder;

(ix) Notice letters to the Tenants, in the form of Exhibit “8(A)(viii)” (the “Notice Letters”), to be prepared by Purchaser;

(x) Notice letters to contractors under Surviving Contracts, in the form of Exhibit “8(A)(ix)” (the “Contractor Letters”), to be prepared by Purchaser;

(xi) The Tenant Estoppels (as hereinafter defined), including any applicable Seller Estoppel (as hereinafter defined) required to be delivered under Article 10 hereof;

(xii) A Real Property Transfer Tax Return with respect to the New York City Real Property Transfer Tax (the “RPT Form”);

(xiii) A New York State Real Estate Transfer Tax Return and Credit Line Mortgage Certificate with respect to the New York State Real Estate Transfer Tax (the “Form TP-584”);

(xiv) A New York State Real Property Transfer Report Form RP-5217 NYC (the “RP-5217”);

(xv) A Department of Housing Preservation and Development Affidavit in Lieu of Registration Statement (the “Non-Multiple Dwelling Affidavit”);

(xvi) Evidence of authority, good standing (if applicable) and due authorization of Seller to enter into the within transaction and to perform all of its obligations hereunder, including, without limitation, the execution and delivery of all of the closing documents required by this Agreement, and setting forth such additional facts, if any, as may be needed to show that the transaction is duly authorized and is in conformity with Seller’s organizational documents and applicable laws and to enable Title Insurer to omit all exceptions regarding Seller’s standing, authority and authorization;

-15-

18848190v.10

(xvii) An assignment and assumption agreement with respect to the Union Agreement and Union Employees in the form of Exhibit “8(A)(xvi)” (the “Assumption of Union Agreement”), which shall be assumed by Purchaser or as Purchaser shall direct as provided in Section 27; provided, however, so long as Purchaser assumes the two Master Services Agreements with Core Industries and Pritchard Industries identified on Exhibit “1(C)” as part of the Assignment of Contracts, then the obligation to execute the Assumption of Union Agreement shall be waived by both Purchaser and Seller;

(xviii) To the extent not available as a matter of public record and in Seller’s possession or control (a) those transferable licenses and permits, authorizations and approvals pertaining to the Premises which are not posted at the Premises and (b) all transferable guarantees and warranties which Seller has received in connection with any work or services performed or equipment installed during Seller’s period of ownership at the Premises;

(xix) Documentation as reasonably required by the Purchaser to calculate the Overage Rent due and owing after the Closing;

(xx) A title affidavit in substantially the form attached hereto as Exhibit “8(A)(xix)” (the “Title Affidavit”);

(xxi) A closing statement (the “Closing Statement”);

(xxii) Evidence of Seller’s termination of any existing management and/or leasing agency agreements pertaining to the Premises;

(xxiii) An updated rent roll, arrears report and schedule of security deposits and letters of credit, certified to Seller’s Actual Knowledge to be true and correct in all material respects, subject to the limitations set forth in Section 16(C) of this Agreement;

(xxiv) A certificate from Seller, certifying to Purchaser that all of Seller’s representations and warranties provided for in Section 16 of this Agreement are true and correct in all material respects as of the Closing Date, but subject to the limitations set forth in Sections 9(B) and (C) and 16(C), (D) and (E) of this Agreement;

(xxv) A Form 1099-S Statement for Recipient of Proceeds from Real Estate Transaction;

(xxvi) All tenant files, to the extent in Seller’s possession or control;

(xxvii) All keys, security codes, pass cards and like for the Premises, to the extent in Seller’s possession or control; and

(xxviii) Such other instruments or documents which by the terms of this Agreement are to be delivered by Seller at the Closing.

B. At the Closing, Purchaser shall deliver to Seller, executed and acknowledged, as applicable:

-16-

18848190v.10

(i) The balance of the Purchase Price and all other amounts payable by Purchaser to Seller at the Closing pursuant to this Agreement;

(ii) The Assignment of Leases;

(iii) The Assignment of Contracts;

(iv) The Tenant Notice Letters;

(v) The Contractor Notice Letters;

(vi) The RPT Form;

(vii) The RP-5217;

(viii) The Form TP-584;

(ix) The Assumption of Union Agreement (subject to Section 27(B));

(x) [Reserved];

(xi) Evidence of authority, good standing (if applicable) and due authorization of Purchaser to enter into the within transaction and to perform all of its obligations hereunder, including, without limitation, the execution and delivery of all of the closing documents required by this Agreement, and setting forth such additional facts, if any, as may be needed to show that the transaction is duly authorized and is in conformity with Purchaser’s organizational documents and applicable laws;

(xii) An acknowledgement or receipt for each of the Security Deposits paid over or credited to Purchaser at the Closing;

(xiii) A certificate from Purchaser, certifying to Seller that all of Purchaser’s representations and warranties provided for in Section 16(B) of this Agreement are true and correct in all material respects as of the Closing Date;

(xiv) The Closing Statement; and

(xv) Such other instruments or documents which by the terms of this Agreement are to be delivered by Purchaser at Closing.

C. The acceptance of the Deed by Purchaser shall be deemed to be full performance and discharge of any and all obligations on the part of Seller to be performed pursuant to the provisions of this Agreement, except where such agreements and obligations are specifically stated to survive.

-17-

18848190v.10

9. | Conditions Precedent. |

A. Seller’s obligations under this Agreement are subject to satisfaction of the following conditions precedent, which may be waived in whole or in part by Seller, provided such waiver is in writing and signed by Seller on or before the Closing Date:

(xvi) Purchaser shall have paid or tendered payment of the Purchase Price and paid all other amounts payable by Purchaser pursuant to the terms hereof;

(xvii) Purchaser shall have delivered to or for the benefit of Seller, on or before the Closing Date, all of the documents and items required to be delivered by Purchaser pursuant to Article 8 hereof and Purchaser shall have performed in all material respects all of its other obligations hereunder to be performed on or before the Closing Date; and

(xviii) All of Purchaser’s representations and warranties made in this Agreement shall be true and correct in all material respects as of the date hereof and as of the Closing Date as if then made.

B. Purchaser’s obligations under this Agreement are subject to the satisfaction of the following conditions precedent which may be waived in whole or in part by Purchaser, provided such waiver is in writing and signed by Purchaser on or before the Closing Date:

(i) Seller shall have delivered to or for the benefit of Purchaser, on or before the Closing Date, all of the documents and items required to be delivered by Seller pursuant to Article 8 hereof and Seller shall have performed in all material respects all of its obligations hereunder to be performed on or before the Closing Date; and

(ii) Subject to the other provisions of this Agreement, all of Seller’s representations and warranties made in this Agreement shall be true and correct in all material respects as of the date hereof and as of the Closing Date as if then made, and shall survive for a period of one-hundred eighty (180) days following the Closing Date, other than those representations or warranties made as of a specific date, or with reference to previously dated materials, in which event such representations and warranties shall be true and correct as of the date thereof or as of the date of such materials, as applicable. For purposes hereof, a representation or warranty shall not be deemed to have been breached if the representation or warranty is not true and correct in all material respects as of the Closing Date by reason of changed facts or circumstances arising after the date hereof which did not arise by reason of a breach of any covenant made by Seller under this Agreement.

-18-

18848190v.10

C. Notwithstanding anything to the contrary contained in this Agreement, (i) Seller does not represent or warrant that any Lease will be in force or effect at Closing, that any Tenant will have performed its obligations under its Lease or that any Tenant will not be the subject of bankruptcy proceedings and (ii) the existence of any default by a Tenant, the failure by a Tenant to perform its obligations under its Lease, the termination of any Lease prior to Closing by reason of the Tenant’s default (if in accordance with the other provisions of this Agreement) or the existence of bankruptcy proceedings pertaining to any Tenant shall not affect Purchaser’s obligations hereunder in any manner or entitle Purchaser to an abatement of or credit against the Purchase Price or give rise to any other claim on the part of Purchaser.

D. Seller shall be entitled to one or more adjournments, not to exceed sixty (60) days in the aggregate (along with all of Seller’s other adjournments under this Agreement), of the Closing Date to attempt to satisfy any of the conditions described in Section 9B above.

10. | Estoppel Certificates. |

A. As soon as reasonably practicable after the date hereof, Seller shall send to all of the Tenants a request to deliver estoppel certificates (individually, an “Estoppel” and, collectively, the “Estoppels”). Thereafter, Seller shall use reasonably diligent efforts to obtain and to deliver to Purchaser Estoppels from all of the Tenants. Seller shall obtain Estoppels from the following Tenants: McAloon & Friedman, P.C., General Services Administration, Securities Training Corporation, Open Kitchen 123 and International Center for the Disabled (collectively, the “Required Estoppel Tenants”). Each Estoppel shall either (i) be substantially in the form attached hereto as Exhibit 10 and made a part hereof, it being agreed that (a) the inclusion of qualifications as to knowledge or word of similar import, (b) references to a general condition statement such as “we reserve all rights” or “subject to our audit of ____ years operating expenses or taxes,” (c) non-material modifications, (d) modifications thereof to conform the same to Leases or other information delivered or available to Purchaser prior to the date of the execution of this Agreement shall not cause in each instance the Estoppel to be non-compliant or (ii) be on such other form as may be provided by any Tenant, provided that it certifies the matters contained in Exhibit 10; or (iii) in the event that any Lease provides for the form or content of an Estoppel that such Tenant shall be required to deliver, then such Tenant’s estoppel may be in such form or contain only those matters as an estoppel is required to address pursuant to the related Lease, without giving effect to any requirement regarding “additional information reasonably requested by the lessor” or words of similar import. Purchaser acknowledges that the following NYS tenants use their own estoppel form which Purchaser agrees may be used in lieu of the form annexed hereto: NYS Department of State, NYS Emergency Financial Control Board for New York City, NYS Office of Court Administration and NYS Comptroller’s Office. Each Estoppel, in any of the foregoing forms, shall be executed and delivered by the Tenant, confirming in all material respects only such matters as an estoppel is required to address pursuant to the related Lease, it being understood and agreed that, for the purposes of this Section 10(A), an estoppel shall fail to confirm the applicable matters in all material respects if and only if the aggregate adverse economic impact as a result of all such failures is equal to or exceeds the Floor, as defined in Section 16(C) herein (Estoppels that do confirm such applicable matters are referred to herein as the “Confirming Estoppels”). Notwithstanding the foregoing, Seller shall have no obligation to deliver an Estoppel from any Tenant which is in default

-19-

18848190v.10

in the payment of fixed rent or other fixed charges under its Lease or subject to bankruptcy proceedings as of the Closing (or on account of a rejected lease in bankruptcy), and the Required Percentage shall be reduced in the same proportion as the square footage of the Tenant then in default or bankruptcy and/or the rejected lease bears to the rentable square footage leased as of the date hereof (the “Adjustment Factor”). In the event that Seller is unable to obtain Confirming Estoppels from Tenants occupying seventy-five percent (75%) of the leased rentable square footage of the Premises (the “Required Percentage”), Seller may, at its option, deliver one or more certificates in lieu thereof in substantially the same form as the form of Estoppel attached hereto as Exhibit 10 (each, a “Seller Certificate”) with respect to the Leases; provided, however, that such Seller Certificate is subject to the limitations set forth in Sections 16(C) and this Section 10(A). In all events, Purchaser shall not be obligated to accept Seller Certificates in excess of ten percent (10%) of the leased rentable square footage of the Building or in place of an Estoppel from the Required Estoppel Tenants. For the sake of clarity, Seller’s obligation at Closing is to deliver Confirming Estoppels covering at least seventy-five percent (75%) of the leased rentable square footage of the Premises (of which ten percent (10%) may be in the form of a Seller Certificate and which must also include Confirming Estoppels from the Required Estoppel Tenants). Seller’s liability under each Seller’s Certificate shall expire on the earlier to occur of (a) the date of delivery to Purchaser of a Confirming Estoppel covering the amount of square footage covered by the Seller’s Certificate which has been given, or (b) the date which is one-hundred eighty (180) days after the Closing. Subject to Section 10(B) below, Seller’s failure to deliver Confirming Estoppels (or Seller’s Certificates, as applicable) under this Article 10 shall constitute a failure of a condition to Purchaser’s obligations hereunder and not a default by Seller, and Purchaser shall not be entitled to specific performance of such obligation of Seller to deliver such Confirming Estoppels. Claims of any Tenant set forth in any Estoppel shall not be deemed (alone or in combination with other matters), to cause such Estoppel not to be a Confirming Estoppel in the event such claims are based on the (i) facts disclosed in writing or available to Purchaser prior to Purchaser’s execution of this Agreement, (ii) an assertion by any Tenant that there are amounts due from Seller to such Tenant allocable to periods prior to the Closing and which, under the terms of this Agreement, Seller has agreed to pay (Seller, at its sole option, shall either pay such amounts to Tenant on or prior to the Closing Date or credit Purchaser at Closing against the Purchase Price in such amounts, or Seller shall deposit with Escrow Agent, as escrow agent, such amounts to be held in escrow pursuant to an escrow agreement reasonably acceptable to Escrow Agent, Seller and Purchaser. Such escrow agreement shall provide that amounts in escrow shall be released to Seller in the event a Confirming Estoppel is received within ninety (90) days after Closing, otherwise it shall be released to Purchaser (provided that if a credit is given, Seller shall have no liability to such tenant or to Purchaser with respect to such claim); or (iii) failure of the landlord to keep the Premises, the building systems or other improvements or equipment in good order and repair or to make required repairs or improvements thereto (it being agreed that Seller shall not be obligated to make any such repairs or improvements, and Purchaser hereby expressly agrees that for all purposes of this Agreement the obligation to make any such repairs or improvements shall be conclusively deemed to have arisen or accrued after the Closing).

B. Following the receipt by Seller of an original Confirming Estoppel from a Tenant, upon the request of Purchaser, Seller agrees to send such Tenants a form of SNDA (upon receipt thereof from Purchaser’s lender), which SNDA shall be among Purchaser, Purchaser’s Lender and

-20-

18848190v.10

such Tenant, in connection with Purchaser’s financing. Notwithstanding the immediately preceding sentence, it is expressly understood and acknowledged by Purchaser that this Contract and Purchaser’s obligations hereunder are not contingent or conditioned upon the execution and return by Tenant of such SNDA nor entitle Purchaser to a reduction in the Purchase Price.

C. Seller shall not be required to expend any money, provide financial accommodations or commence any litigation in connection with obtaining such Estoppels.

D. Seller shall be entitled to one or more adjournments, not to exceed sixty (60) days in the aggregate (along with all of Seller’s other adjournments under this Agreement), of the Closing Date to obtain Tenant Estoppels.

11. | Cancellation of Contracts. |

If Purchaser desires that Seller cancel any Existing Contract, and such Existing Contract is cancelable without cause upon no more than thirty (30) days’ notice by Seller or without payment of a cancellation fee or any other consideration (the “Desired Cancelled Contracts”), Purchaser shall provide Seller with a list thereof within four (4) business days prior to Closing. Seller shall, on or before the Closing Date, notify all parties under the Desired Cancelled Contracts of such cancellation. Purchaser understands and agrees that certain Desired Cancelled Contracts may remain in effect after the Closing through the expiration of the contractual termination period thereunder and that Purchaser shall be responsible for all payments and other obligations under such Desired Cancelled Contracts accruing after the Closing. Notwithstanding anything to the contrary contained herein, the existing property management and leasing agency agreement with East End Realty shall be terminated by Seller as of the Closing and Seller shall be responsible for all costs and expenses associated therewith. The “Surviving Contracts” shall mean the New Contracts and the Existing Contracts, excluding those Desired Cancelled Contracts which have actually been cancelled with an effective cancellation date on or before the Closing.

12. | Right of Inspection. |

A. Purchaser and Purchaser’s Representatives, prior to the Closing and during regular business hours, upon at least two (2) business days’ prior written notice to Seller, may inspect the Premises, provided that (i) Purchaser and Purchaser’s Representatives shall not communicate with any Tenants or occupants of the Premises without, in each instance, the prior written consent of Seller, which consent may be withheld in Seller’s sole discretion; provided, however, that Purchaser and Purchaser’s Representatives may, through Seller, schedule meetings during regular business hours with any Tenant on the following conditions: (a) no such meeting shall be scheduled until the applicable Tenant has delivered an Estoppel; (b) no such meeting shall occur unless Seller and/or Seller’s leasing agent is in attendance (for such purposes, Seller agrees to make its leasing agent available at reasonable times during regular business hours upon at least two (2) business days prior written notice); and (c) Seller makes no guaranty or assurance that any Tenant will consent to such a meeting, (ii) Purchaser and Purchaser’s Representatives shall not perform any invasive tests with respect to the Premises without the prior written consent of Seller in each instance, which consent may be withheld in Seller’s sole but reasonable discretion, (iii) Purchaser shall have no additional rights or remedies under this Agreement as a result of such inspection(s) or any findings in connection

-21-

18848190v.10

therewith and (iv) Purchaser may exercise such right of access no more than five (5) times, plus a final inspection prior to the Closing, plus such additional times as to which Seller may consent in Sellers sole discretion. Any entry upon the Premises shall be performed in a manner which is not unreasonably disruptive to Tenants or occupants of the Premises or the normal operation of the Premises and shall be subject to the rights of any Tenants or occupants of the Premises. Purchaser and Purchaser’s Representatives shall (i) exercise reasonable care at all times that Purchaser shall be present upon the Premises, (ii) at Purchaser’s expense, Purchaser and Purchaser shall cause Purchasers Representatives to observe and comply with all applicable laws and any conditions imposed by any insurance policy then in effect with respect to the Premises and (iii) not engage in any activities which would violate the provisions of any permit or license pertaining to the Premises. Seller shall have the right to have a representative of Seller accompany Purchaser and Purchaser’s Representatives during any such communication or entry upon the Premises.

B. Additionally, in conducting any inspection of the Premises or otherwise accessing the Premises, neither Purchaser nor any of Purchaser’s Representatives shall (i) contact or have any discussions with any of Seller’s employees, agents or representatives, or contractors providing services to, the Premises, unless in each case Purchaser obtains the prior consent of Seller, which may be withheld in Seller’s sole discretion, it being agreed that all such contacts or discussions shall, pending any such approval, be directed to Adam Pagoda, or (ii) damage the Premises. Purchaser agrees to be responsible for the cost of repairing and restoring any damage or disturbance which Purchaser or Purchaser’s Representatives shall cause to the Premises incurred by Seller in connection therewith. All inspection fees, appraisal fees, engineering fees and other costs and expenses of any kind incurred by Purchaser or Purchaser’s Representatives relating to such inspection or its other access shall be at the sole expense of Purchaser. If Closing hereunder shall not occur for any reason whatsoever, Purchaser shall: (A) at the request of Seller, promptly deliver to Seller, at no cost to Seller, and without representation or warranty, the originals of all tests, reports and inspections of the Premises, made and conducted by a third party for Purchaser or Purchaser’s Representatives or for Purchaser’s benefit which are in the possession or control of Purchaser, without any representation or warranty with respect thereto, and (B) promptly return to Seller copies of all due diligence materials delivered by Seller to Purchaser and shall destroy all copies of abstracts thereto. Purchaser and Purchaser’s Representatives shall not be permitted to conduct borings of the Premises or drilling in or on the Premises, or any other minimally invasive testing in connection with the preparation of an environmental audit or in connection with any other inspection of the Premises without the prior written consent of Seller, which shall not be unreasonably withheld (and, if such consent is given, Purchaser shall be responsible for the cost of repairing and restoring any damage as aforesaid and shall reimburse Seller upon demand for any costs incurred by Seller in connection therewith).

C. Purchaser hereby agrees to indemnify, defend and hold Seller, its officers, shareholders, partners, members, directors, employees, attorneys and agents harmless from and against any and all liability, loss, cost, judgment, claim, damage or expense (including, without limitation, attorneys’ fees and expenses), resulting from or arising out of the entry upon the Premises by Purchaser and its employees, agents, consultants, contractors and advisors. The foregoing indemnification shall survive the Closing or the termination of this Agreement.

-22-

18848190v.10

D. As a condition precedent to entering the Premises in connection with any inspection, Purchaser shall maintain or cause to be maintained, at Purchaser’s sole cost and expense, a policy of comprehensive general public liability and property damage insurance by an insurer or syndicate of insurers reasonably acceptable to Seller: (a) with a combined single limit of not less than Three Million Dollars ($3,000,000.00) general liability and Five Million Dollars ($5,000,000.00) excess umbrella liability, or any combination thereof, with a limit of not less than Eight Million Dollars ($8,000,000.00), (b) insuring Purchaser, Seller, their respective affiliates, Seller’s lender and any other person or entity related to Seller or involved with the transaction contemplated by this Agreement (such additional persons or entities to be designated in writing by Seller), as additional insureds, against any injuries or damages to persons or property that may result from or are related to (x) Purchaser’s or Purchaser’s Representatives entry upon the Premises and (y) any inspection or other activity conducted thereon by Purchaser or Purchaser’s Representatives and (c) containing a provision to the effect that insurance provided by Purchaser hereunder shall be primary and noncontributing with any other insurance available to Seller. Purchaser shall deliver evidence of such insurance coverage to Seller prior to the commencement of the first inspection and proof of continued coverage prior to any subsequent inspection.

E. Notwithstanding any provision in this Agreement to the contrary, neither Purchaser nor any of Purchaser’s Representatives shall contact any Federal, state, county, municipal or other department or governmental agency regarding the Premises (other than accessing publicly available documents) without Seller’s prior written consent thereto which consent may be withheld in Seller’s sole discretion, provided that Title Insurer may order customary searches. In addition, if Seller’s consent is obtained by Purchaser, Seller shall be entitled to receive at least five (5) business days prior written notice of the intended contact and shall be entitled to have a representative present when Purchaser has any such contact with any governmental official or representative.

13. | Title Insurance. |

A. Title Insurer has issued and delivered to Purchaser and Seller a title insurance report and commitment dated December 10, 2014 for a fee owner’s title insurance policy (Title No. 820212(0–NY-CR-KV)B (“Seller’s Title Commitment”). Purchaser may order a new report (the “Commitment”) from Title Insurer and any update of the Commitment from Title Insurer. At Closing, Purchaser shall cause title to the Premises to be insured by the Title Insurer at Purchaser’s sole cost and expense. Except as otherwise expressly provided in this Agreement, Seller shall have no obligation to remove any exception to title. Except for the items identified in Exhibit “4(a)(ii)” (the “Known Title Objections”), Purchaser unconditionally waives any right to object to any matters set forth in Seller’s Title Commitment. At Closing, Seller shall deliver and Purchaser shall accept the Premises subject only to the Permitted Exceptions. If exceptions to title appear on the Commitment or any update or continuation of the Commitment (each a “Continuation”) which are not Permitted Exceptions or Required Removal Items, Purchaser shall notify Seller thereof within the earlier of five (5) business days after Purchaser receives such Continuation and the last business day prior to the Closing Date, time being of the essence, and if Seller is unable, or elects not to attempt, to eliminate such exceptions to title, or if Seller elects to attempt to eliminate any such exceptions to title but is unable to do so or thereafter decides not to eliminate the same, and accordingly, is unable to convey title to the Premises in accordance with the provisions of this

-23-

18848190v.10

Agreement, Seller shall so notify Purchaser and, within five (5) business days after receipt of such notice from Seller, Purchaser shall elect either (i) to terminate this Agreement by notice given to Seller (time being of the essence with respect to Purchaser’s notice), in which event the provisions of Article 14 of this Agreement shall apply, or (ii) to accept title to the Premises subject to such exceptions, without any abatement of the Purchase Price. If Purchaser shall not notify Seller of such election within such five (5) business day period, time being of the essence, Purchaser shall be deemed to have elected clause (ii) above with the same force and effect as if Purchaser had elected clause (ii) within such five (5) business day period.

B. If the Commitment discloses judgments, bankruptcies or similar returns against persons or entities having names the same as or similar to that of Seller but which returns are not against Seller, Seller, on request, shall deliver to Purchaser or Title Insurer affidavits reasonably acceptable to Seller to the effect that such judgments, bankruptcies or returns are not against Seller.