United States

Securities and Exchange Commission

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant [X] | Filed by a Party other than the Registrant [ ] |

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Materials Pursuant to Rule 14a-12 |

CORBUS PHARMACEUTICALS HOLDINGS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials: | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

CORBUS

PHARMACEUTICALS HOLDINGS, INC.

100 River Ridge Drive, Suite 103

Norwood, MA 02062

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on May 25, 2017

To

the Stockholders of

Corbus Pharmaceuticals Holdings, Inc.

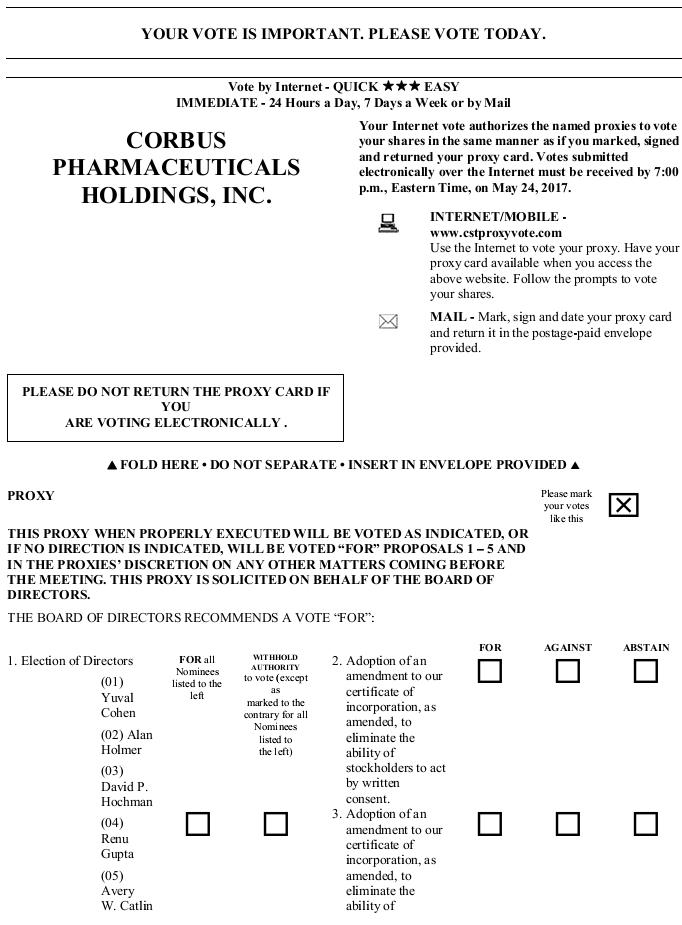

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Corbus Pharmaceuticals Holdings, Inc. will be held at Corbus Pharmaceuticals Holdings, Inc. located at 100 River Ridge Drive, Suite 103, Norwood, MA 02062, on May 25, 2017, beginning at 9:00 a.m. local time. At the Annual Meeting, stockholders will act on the following matters:

| ● | To elect five director nominees to serve as directors until the next annual meeting of stockholders; | |

| ● | To consider and adopt an amendment to our certificate of incorporation, as amended, to eliminate the ability of stockholders to act by written consent; | |

| ● | To consider and adopt an amendment to our certificate of incorporation, as amended, to eliminate the ability of stockholders to call special meetings; | |

| ● | To consider and adopt an amended and restated certificate of incorporation, which shall incorporate the amendments to our certificate of incorporation, as amended, pursuant to Proposals 2 and 3, if both such amendments are approved; | |

| ● | To ratify the appointment of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2017; and | |

| ● | To consider any other matters that may properly come before the Annual Meeting. |

Only stockholders of record at the close of business on April 3, 2017 are entitled to receive notice of and to vote at the Annual Meeting or any postponement or adjournment thereof.

Your vote is important. Whether you plan to attend the meeting or not, you may vote your shares over the Internet or by requesting a printed copy of the proxy materials and marking, signing, dating and mailing the proxy card in the envelope provided. If you attend the meeting and prefer to vote in person, you may do so even if you have already voted your shares. You may revoke your proxy in the manner described in the proxy statement at any time before it has been voted at the meeting.

IMPORTANT NOTICE OF AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 25, 2017.

Our proxy materials including our Proxy Statement for the 2017 Annual Meeting, our Annual report for the fiscal year ended December 31, 2016 and proxy card are available on the Internet at http://www.cstproxy.com/corbuspharma/2017. Under Securities and Exchange Commission rules, we are providing access to our proxy materials by notifying you of the availability of our proxy materials on the Internet.

| By Order of the Board of Directors | |

| /s/ Yuval Cohen | |

| Yuval Cohen | |

| Chief Executive Officer | |

| April 10, 2017 | |

| Norwood, Massachusetts |

| -2- |

CORBUS

PHARMACEUTICALS HOLDINGS, INC.

100 RIVER RIDGE DRIVE, SUITE 103

NORWOOD, MA 02062

PROXY STATEMENT

This proxy statement contains information related to the Annual Meeting of Stockholders to be held on May 25, 2017 at 9:00 a.m. local time, at Corbus Pharmaceuticals Holdings, Inc. (the “Company”) located at 100 River Ridge Drive, Suite 103, Norwood, MA 02062, or at such other time and place to which the Annual Meeting may be adjourned or postponed. The enclosed proxy is solicited by the Board of Directors of Corbus Pharmaceuticals Holdings, Inc. (the “Board”). The proxy materials relating to the Annual Meeting are being mailed to stockholders entitled to vote at the meeting on or about April 10, 2017.

ABOUT THE MEETING

Why are we calling this Annual Meeting?

We are calling the Annual Meeting to seek the approval of our stockholders:

| ● | To elect five director nominees to serve as directors until the next annual meeting of stockholders; | |

| ● | To consider and adopt an amendment to our certificate of incorporation, as amended, to eliminate the ability of stockholders to act by written consent; | |

| ● | To consider and adopt an amendment to our certificate of incorporation, as amended, to eliminate the ability of stockholders to call special meetings; | |

| ● | To consider and adopt an amended and restated certificate of incorporation, which shall incorporate the amendments to our certificate of incorporation, as amended, pursuant to Proposals 2 and 3, if both such amendments are approved; | |

| ● | To ratify the appointment of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2016; and | |

| ● | To consider any other matters that may properly come before the Annual Meeting. |

What are the Board’s recommendations?

Our Board believes that the election of the director nominees identified herein, the amendment and restatement of our certificate of incorporation, as amended, as described herein, and the appointment of EisnerAmper LLP as our independent registered public accounting firm for the year ending December 31, 2017 are advisable and in the best interests of the Company and its stockholders and recommends that you vote FOR these proposals.

Why did I receive a notice in the mail regarding the Internet availability of the proxy materials instead of a paper copy of the proxy materials?

In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to furnish to our stockholders this Proxy Statement and our Fiscal 2016 Annual Report by providing access to these documents on the Internet rather than mailing printed copies. Accordingly, a Notice of Internet Availability of Proxy Materials (the “Notice”) is being mailed to our stockholders of record and beneficial owners which will direct stockholders to a website where they can access our proxy materials and view instructions on how to vote online or by telephone. If you would prefer to receive a paper copy of our proxy materials, please follow the instructions included in the Notice.

| -3- |

Who is entitled to vote at the meeting?

Only stockholders of record at the close of business on the record date, April 3, 2017, are entitled to receive notice of the Annual Meeting and to vote the shares of common stock that they held on that date at the meeting, or any postponement or adjournment of the meeting. Holders of our common stock are entitled to one vote per share on each matter to be voted upon.

As of the record date, we had 50,143,742 outstanding shares of common stock.

Who can attend the meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting. Please note that if you hold your shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of your proxy card delivered to you by your broker or a legal proxy given to you by your broker and check in at the registration desk at the meeting.

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of our common stock outstanding on the record date will constitute a quorum for our meeting. Signed proxies received but not voted and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting.

How do I vote?

You can vote on matters that come before the Annual Meeting via the Internet by following the instructions in the Notice or by submitting your proxy card by mail. If you would prefer to vote by mail, please follow the instructions included in the Notice to receive a paper copy of our proxy materials.

If you are a stockholder of record, to submit your proxy by mail or vote via the Internet, follow the instructions on the proxy card or Notice. If you hold your shares in street name, you may vote via the Internet as instructed by your broker, bank or other nominee.

Your shares will be voted as you indicate on your proxy card. If you vote your proxy but you do not indicate your voting preferences, and with respect to any other matter that properly comes before the meeting, the individuals named on the proxy card will vote your shares FOR the matters submitted at the meeting, or if no recommendation is given, in their own discretion.

If you attend the Annual Meeting and prefer to vote in person, you may do so even if you have already voted your shares by proxy.

What if I vote and then change my mind?

You may revoke your proxy at any time before it is exercised by:

| ● | filing with the Secretary of the Company a notice of revocation; | |

| ● | sending in another duly executed proxy bearing a later date; or | |

| ● | attending the meeting and casting your vote in person. |

For purposes of submitting your vote online, you may change your vote until 7:00 p.m. on May 24, 2017. At this this deadline, the last vote submitted will be the vote that is counted.

| -4- |

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Many of our stockholders hold their shares through a stockbroker, bank or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust, you are considered, with respect to those shares, the stockholder of record. As the stockholder of record, you have the right to grant your voting proxy directly to us or to vote in person at the Annual Meeting.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your broker, bank or nominee which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your broker as to how to vote and are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a signed proxy from the record holder giving you the right to vote the shares. If you do not vote your shares or otherwise provide the stockholder of record with voting instructions, your shares may constitute broker non-votes. The effect of broker non-votes is more specifically described in “What vote is required to approve each proposal?” below.

What vote is required to approve each proposal?

The holders of a majority of our common stock outstanding on the record date must be present, in person or by proxy, at the Annual Meeting in order to have the required quorum for the transaction of business. Pursuant to Delaware corporate law, abstentions and broker non-votes will be counted for the purpose of determining whether a quorum is present.

Assuming that a quorum is present, the following votes will be required:

| ● | With respect to the first proposal (election of directors), directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote, and the director nominees who receive the greatest number of votes at the Annual Meeting (up to the total number of directors to be elected) will be elected. As a result, abstentions and “broker non-votes” (see below), if any, will not affect the outcome of the vote on this proposal. | |

| ● | With respect to the proposal to adopt an amendment to our certificate of incorporation, as amended, to eliminate the ability of stockholders to act by written consent, the affirmative vote of a majority of all of the shares of the common stock outstanding and entitled to vote for such proposal is required to approve this proposal. As a result, abstentions, “broker non-votes” (see below), if any, and any other failure to submit a proxy or vote in person at the meeting will have the same effect as a vote AGAINST Proposal 2. | |

| ● | With respect to the proposal to adopt an amendment to our certificate of incorporation, as amended, to eliminate the ability of stockholders to call special meetings, the affirmative vote of a majority of all of the shares of the common stock outstanding and entitled to vote for such proposal is required to approve this proposal. As a result, abstentions, “broker non-votes” (see below), if any, and any other failure to submit a proxy or vote in person at the meeting will have the same effect as a vote AGAINST Proposal 3. | |

| ● | With respect to the proposal to adopt an amended and restated certificate of incorporation, which shall incorporate the amendments to our certificate of incorporation, as amended, pursuant to Proposals 2 and 3, if both such amendments are approved, the affirmative vote of a majority of all of the shares of the common stock outstanding and entitled to vote for such proposal is required to approve this proposal. As a result, abstentions, “broker non-votes” (see below), if any, and any other failure to submit a proxy or vote in person at the meeting will have the same effect as a vote AGAINST Proposal 4. |

| -5- |

| ● | With respect to the proposal to ratify the appointment of EisnerAmper LLP and approval of any other matter that may properly come before the Annual Meeting, the affirmative vote of a majority of the total votes cast on these proposals, in person or by proxy, is required to approve these proposals. As a result, abstentions and “broker non-votes” (see below), if any, will not affect the outcome of the vote on these proposals. |

Holders of the common stock will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the meeting.

What are “broker non-votes”?

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, your shares are held by your broker, bank or other agent as your nominee, or in “street name,” and you will need to obtain a proxy form from the organization that holds your shares and follow the instructions included on that form regarding how to instruct the organization to vote your shares. If you do not give instructions to your broker, bank or other agent, it can vote your shares with respect to “discretionary” items but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of various national securities exchanges, and, in the absence of your voting instructions, your broker, bank or other agent may vote your shares held in street name on such proposals. Non-discretionary items are proposals considered non-routine under the rules of various national securities exchanges, and, in the absence of your voting instructions, your broker, bank or other agent may not vote your shares held in street name on such proposals and the shares will be treated as broker non-votes. Proposals 1, 2, 3 and 4 are generally considered non-routine matters under the applicable rules. If you do not give your broker specific instructions, the broker may not vote your shares on Proposals 1, 2, 3 and 4 and therefore there may be broker non-votes on Proposal 1, 2, 3 and 4. Proposal 5 involves a matter we believe to be routine and thus if you do not give instructions to your broker, the broker may vote your shares in its discretion on Proposal 5 and therefore no broker non-votes are expected to exist in connection with Proposal 5.

How are we soliciting this proxy?

We are soliciting this proxy on behalf of our Board and will pay all expenses associated therewith. Some of our officers, directors and other employees also may, but without compensation other than their regular compensation, solicit proxies by further mailing or personal conversations, or by telephone, facsimile or other electronic means.

In addition, we have engaged Alliance Advisors, LLC to assist us in soliciting proxies from banks, brokers and nominees. The fees that will be paid to Alliance Advisors, LLC are anticipated to be approximately $7,000, and we will reimburse any out-of-pocket expenses.

We will also, upon request, reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their reasonable out-of-pocket expenses for forwarding proxy materials to the beneficial owners of the capital stock and to obtain proxies.

| -6- |

PROPOSAL 1: TO ELECT FIVE DIRECTORS TO SERVE UNTIL THE NEXT ANNUAL MEETING AND UNTIL THEIR SUCCESSORS HAVE BEEN DULY ELECTED AND QUALIFIED

Our Board is currently composed of five directors. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that director for which the vacancy was created and until the director’s successor is duly elected and qualified.

Each of the nominees listed below is currently one of our directors. If elected at the Annual Meeting, each of these nominees would serve until the next annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. Abstentions and broker non-votes will not be treated as a vote for or against any particular director nominee and will not affect the outcome of the election. Stockholders may not vote, or submit a proxy, for a greater number of nominees than the five nominees named below. The director nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the five director nominees named below. If any director nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by our Board. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

Nominees for Election Until the Next Annual Meeting

The following table sets forth the name, age, position and tenure of each of our directors who are up for re-election at the 2017 Annual Meeting:

| Name | Age | Position(s) | Served as an Officer or Director Since | |||||||

| Yuval Cohen, Ph.D. | 42 | Chief Executive Officer and Director | 2014 | |||||||

| Alan Holmer | 67 | Director (Chairman of the Board) | 2014 | |||||||

| David P. Hochman | 41 | Director | 2014 | |||||||

| Renu Gupta | 61 | Director | 2014 | |||||||

| Avery W. Catlin | 68 | Director | 2014 | |||||||

The following includes a brief biography of each of the nominees standing for election to the Board of Directors at the Annual Meeting, based on information furnished to us by each director nominee, with each biography including information regarding the experiences, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board of Directors to determine that the applicable nominee should serve as a member of our Board of Directors.

Directors

Yuval Cohen, Ph.D., Chief Executive Officer and Director

Dr. Cohen has served as our Chief Executive Officer and as a director since April 11, 2014. Dr. Cohen joined Corbus Pharmaceuticals, Inc. (formerly JB Therapeutics, Inc.), our wholly-owned subsidiary, as its Chief Executive Officer in July 2013. Prior to joining Corbus Pharmaceuticals, Inc., he was the President and co-founder of Celsus Therapeutics PLC (“Celsus”) (Nasdaq CM: CLTX) from 2005 until February 2013, and as Senior Vice President from February 2013 until June 2013. Dr. Cohen was also a board member of Celsus until December 2013. Starting as a small startup with seed financing, under Dr. Cohen’s leadership, Celsus developed five novel anti-inflammatory drug candidates with two reaching Phase IIb stages focusing on allergies and autoimmune diseases of the skin (eczema), airways (cystic fibrosis and hay fever), digestive tract (inflammatory bowel disease) and eye (conjunctivitis). Dr. Cohen participated in all stages of the pre-clinical and clinical development from project management to interactions with regulatory bodies and with the investment community in fundraising. Apart from his industry experience, he is also the author of a number of peer-reviewed papers and reviews as well as listed inventor on a number of patents. Dr. Cohen holds a BSc (Hons) in microbiology and biochemistry from University of Cape Town, South Africa, and has a Ph.D., summa cum laude, from the Curie Institute of Cancer Research in Paris and the University of Paris V. Dr. Cohen was selected as a director because of his business and leadership experience in the biopharmaceutical sector, as well as a result of having served as a director since our inception.

| -7- |

Alan Holmer, Chairman of the Board

Mr. Holmer has served as a director of Corbus Pharmaceuticals, Inc. since January 2014 and chairman of the board since April 11, 2014. From 1996 to 2005 he served as President and Chief Executive Officer of the Pharmaceutical Research and Manufacturers of America (PhRMA), an organization that represents the worldwide interests of leading pharmaceutical and biotechnology companies, based in Washington, D.C. From 2005 to 2007 and again from February 2009 until its acquisition by Merck in May 2011, Mr. Holmer served as a Director of Inspire Pharmaceuticals, Inc., and at various times as member of its Corporate Governance Committee, Audit Committee, and Drug Development Committee. In addition to his pharmaceutical industry experience, Mr. Holmer has significant expertise in handling legal, international trade and governmental issues, having held various positions within the office of the U.S. Trade Representative, the Commerce Department and the White House, including serving as Deputy U.S. Trade Representative with rank of Ambassador. Mr. Holmer served as Special Envoy for China and the Strategic Economic Dialogue, a position to which he was appointed by Secretary of the Treasury, Henry M. Paulson, Jr. from 2007 to 2009. Mr. Holmer also served as a partner at the international law firm, Sidley & Austin (now Sidley Austin LLP), and as an associate at Steptoe & Johnson LLP. From 2012 to 2016, Mr. Holmer served as Special Counsel in the Washington, D.C. office of Smith, Currie & Hancock LLP. Mr. Holmer has been involved in many community service organizations, including currently serving as the Chairman of the Board of the Metropolitan Washington, D.C., Chapter of the Cystic Fibrosis Foundation. He also served as Co-Chairman of the President’s Advisory Council on HIV/AIDS. Mr. Holmer received an A.B. degree from Princeton University and a J.D. from Georgetown University Law Center. Mr. Holmer was selected as a director because of his background in the pharmaceutical and biotechnology industry and his experience in governance matters.

David P. Hochman, Director

Mr. Hochman has served as a director since December 2013. Since June 2006, Mr. Hochman has been Managing Partner of Orchestra Medical Ventures, LLC (“Orchestra”), an investment firm that employs an innovative strategy to create, build and invest in medical technology companies intended to generate substantial clinical value and investor returns. He is also President of Accelerated Technologies, Inc. (ATI), a medical device accelerator managed by Orchestra. He has over nineteen years of venture capital and investment banking experience. Mr. Hochman is the Chairman of MOTUS GI Holdings, Inc., as well as a director of Caliber Therapeutics, BackBeat Medical, Inc. (where he is also President) and FreeHold Surgical, Inc., all of which are Orchestra portfolio companies. He serves as a director of Adgero Biopharmaceuticals Holdings, Inc. and is the Vice Chairman and a Director of Naked Brand Group Inc. (Nasdaq: NAKD). Prior to joining Orchestra, Mr. Hochman was Chief Executive Officer of Spencer Trask Edison Partners, LLC, an investment partnership focused on early stage healthcare companies. He was also Managing Director of Spencer Trask Ventures, Inc. during which time he led financing transactions for over twenty early-stage companies. Mr. Hochman was a board advisor of Health Dialog Services Corporation, a leader in collaborative healthcare management that was acquired in 2008 by the British United Provident Association for $750 million. From 2005 to 2007, he was a cofounder and board member of PROLOR Biotech, Inc., a biopharmaceutical company developing longer lasting versions of approved therapeutic proteins, which was purchased by Opko Health (NYSE: OPK) in 2013 for over $600 million. He currently serves on the board of two non-profit organizations: the Citizens Committee for New York City and the Mollie Parnis Livingston Foundation. He has a B.A. degree with honors from the University of Michigan. Mr. Hochman was selected as a director due to his leadership experience at other public companies, including pharmaceutical companies, his financial experience and his expertise in governance matters.

| -8- |

Dr. Renu Gupta, Director

Dr. Gupta has served as a director since June 2014. Dr. Gupta has 30 years of drug development, regulatory and senior management experience within the biopharma industry. Dr. Gupta is currently Principal of Global Bio-Pharma, having previously served as the Executive Vice President Development and Chief Medical Officer of Insmed Incorporated (formerly Transave, Inc) (NASDAQ: INSM) from September 2006 until October 2014, and as a Director of the UK subsidiary, Transave Inhalation Biotherapeutics as of May 2008. From May 2003 to August 2006, she held the position of Senior Vice President Development at Antigenics, Inc. Prior to that, she served at Novartis as Vice President and Head of U.S. Clinical Research and Development and Global Head of Cardiovascular, Metabolics, Endocrine and Gastroenterology Research. Dr. Gupta also spent almost 10 years at Bristol-Myers Squibb (BMS), where she was responsible for clinical research, business development and global development and marketing strategy for infectious diseases and immunology. She received her bachelor and medical degrees from the University of Zambia and completed her medical and post-doctoral training at Albert Einstein Medical Center, the Wistar Institute of Anatomy and Biology, the Children’s Hospital of Philadelphia, and the University of Pennsylvania, where she was Adjunct Assistant Professor until 1997. Her work has been published in leading peer-reviewed journals and she has been active in numerous relevant academic and professional societies, and served on NIH study sections as an expert. Dr. Gupta has represented the biopharma industry in FDA and EMA workshops, is a founding member of the Industrial Management Board at the Harvard Medical School, served as Chair of the Medical Advisory Council for Antigenics, Co-chaired Immunology, and Infectious Diseases Scientific advisory Boards for BMS, is a past member of the Scientific Advisory Board at Cerimon Pharmaceuticals, and the Institute of Medicine Forum on Emerging Infections, and is a Board Member of Aim at Melanoma, formerly Charlie Guild Melanoma Foundation. Dr. Gupta was selected as a director because of her leadership experience in regulatory strategy and science, and research and development in the biopharmaceutical industry leading to advancement of molecules from drug discovery to approvals in major global markets.

Avery W. (Chip) Catlin, Director

Mr. Catlin has served as a director since August 2014. Currently, Mr. Catlin also serves as Senior Vice President, Chief Financial Officer, and Secretary of Celldex Therapeutics, Inc. (Nasdaq: CLDX), a public biopharmaceutical company. Prior to joining Celldex Therapeutics, Inc. (Nasdaq: CLDX) in January 2000, he served as Vice President, Operations and Finance, and Chief Financial Officer of Endogen, Inc., a public life science research products company, from 1996 to 1999. From 1992 to 1996, he held various financial positions at Repligen Corporation (Nasdaq: RGEN), a public biopharmaceutical company, serving the last two years as Chief Financial Officer. Earlier in his career, he held the position of Chief Financial Officer at MediSense, Inc., a Massachusetts-based medical device company. Mr. Catlin received his B.A. degree from the University of Virginia and M.B.A. from Babson College and is a Certified Public Accountant. Mr. Catlin was selected as a director due to his leadership experience at other public companies, and his financial and accounting experience and his expertise in governance matters.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE ELECTION OF THE DIRECTOR NOMINEES.

| -9- |

CORPORATE GOVERNANCE

Board of Director Composition

Our Board currently consists of five members. Our directors hold office until their successors have been elected and qualified or until the earlier of their resignation or removal.

We have no formal policy regarding board diversity. Our priority in selection of board members is identification of members who will further the interests of our stockholders through his or her established record of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, knowledge of our business and understanding of the competitive landscape.

Board of Director Meetings

Our Board met seven times in 2016. Each of the directors attended at least 75% of the aggregate of (i) the total number of meetings of our Board (held during the period for which such directors served on the Board) and (ii) the total number of meetings of all committees of our Board on which the director served (during the periods for which the director served on such committee or committees). All five (5) of our directors attended our 2016 Annual Meeting of Stockholders. We do not have a formal policy requiring members of the Board to attend our annual meetings.

Director Independence

Our common stock is listed on The NASDAQ Stock Market. Under the rules of The NASDAQ Stock Market, independent directors must comprise a majority of our Board. In addition, the rules of The NASDAQ Stock Market require that all the members of such committees be independent. Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Compensation committee members must also satisfy the independence criteria established by The NASDAQ Stock Market in accordance with Rule 10C-1 under the Exchange Act. Under the rules of The NASDAQ Stock Market, a director will only qualify as an “independent director” if, among other qualifications, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Board undertook a review of its composition, the composition of its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board has determined that Mr. Holmer, Dr. Gupta and Mr. Catlin do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the Rules of the NASDAQ Stock Market and the SEC.

In making this determination, our Board considered the relationships that each non-employee director has with our Company and all other facts and circumstances our Board deemed relevant in determining their independence. We intend to comply with the other independence requirements for committees within the time periods specified above.

Board Committees

Our Board has established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Our Board may establish other committees to facilitate the management of our business. The composition and functions of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our Board. Each of these committees operate under a charter that has been approved by our Board.

Audit Committee. Our Audit Committee consists of Mr. Holmer, Dr. Gupta and Mr. Catlin, and Mr. Catlin is the Chairman of the Audit Committee. Our Audit Committee met five times in 2016. Our Board has determined that the three directors currently serving on our Audit Committee are independent within the meaning of The NASDAQ Marketplace Rules and Rule 10A-3 under the Exchange Act. In addition, our Board has determined that Mr. Catlin qualifies as an audit committee financial expert within the meaning of SEC regulations and The NASDAQ Marketplace Rules.

| -10- |

The Audit Committee oversees and monitors our financial reporting process and internal control system, reviews and evaluates the audit performed by our registered independent public accountants and reports to our Board any substantive issues found during the audit. The Audit Committee will be directly responsible for the appointment, compensation and oversight of the work of our registered independent public accountants. The Audit Committee reviews and approves all transactions with affiliated parties. Our Board has adopted a written charter for the Audit Committee. A copy of the charter is posted under the “Investors” tab under “Governance” in our website, which is located at www.corbuspharma.com.

Compensation Committee. Our Compensation Committee consists of Mr. Holmer, Dr. Gupta and Mr. Catlin, and Mr. Holmer is the Chairman of the Compensation Committee. Our Compensation Committee met eight times in 2016. Our Board has determined that the three directors currently serving on our Compensation Committee are independent under the listing standards, are “non-employee directors” as defined in Rule 16b-3 promulgated under the Exchange Act and are “outside directors” as that term is defined in Section 162(m) of the Internal Revenue Code of 1986, as amended.

The Compensation Committee provides advice and makes recommendations to our Board in the areas of employee salaries, benefit programs and director compensation. The Compensation Committee also reviews and approves corporate goals and objectives relevant to the compensation of our President, Chief Executive Officer, and other officers and makes recommendations in that regard to our Board as a whole.

In 2016, the Compensation Committee directly engaged independent compensation consultants, Willis Towers Watson, and subsequently Radford, a part of Aon Hewitt, a business unit of Aon plc, to provide advice and recommendations on the structure, amount and form of executive and director compensation and the competitiveness thereof. At the request of the Compensation Committee, the compensation consultants provided, among other things, comparative data from selected peer companies. The compensation consultants report directly to the Compensation Committee. The Compensation Committee’s decision to hire either of the compensation consultants was not made or recommended by Company management. Neither compensation consultant has performed any work for the Company in 2016 except with respect to the work that it has done directly for the Compensation Committee.

Our Board has adopted a written charter for the Compensation Committee. A copy of the charter is posted under the “Investors” tab under “Governance” in our website, which is located at www.corbuspharma.com.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee consists of Mr. Holmer, Dr. Gupta and Mr. Catlin, and Dr. Gupta is the Chairman of the Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee met one time in 2016. The Nominating and Corporate Governance Committee nominates individuals to be elected to the full board by our stockholders. The Nominating and Corporate Governance Committee considers recommendations from stockholders if submitted in a timely manner in accordance with the procedures set forth in our bylaws and will apply the same criteria to all persons being considered. All members of the Nominating and Corporate Governance Committee are independent directors as defined under the NASDAQ listing standards. Our Board has adopted a written charter for the Nominating and Corporate Governance Committee. A copy of the charter is posted under the “Investors” tab under “Governance” in our website, which is located at www.corbuspharma.com.

Stockholder nominations for directorships

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting their names and background to the Secretary of the Company at the address set forth below under “Stockholder Communications” in accordance with the provisions set forth in our bylaws. All such recommendations will be forwarded to the Nominating and Corporate Governance Committee, which will review and only consider such recommendations if appropriate biographical and other information is provided, including, but not limited to, the items listed below, on a timely basis. All security holder recommendations for director candidates must be received by the Company in the timeframe(s) set forth under the heading “Stockholder Proposals” below.

| -11- |

| ● | the name and address of record of the security holder; | |

| ● | a representation that the security holder is a record holder of the Company’s securities, or if the security holder is not a record holder, evidence of ownership in accordance with Rule 14a-8(b)(2) of the Securities Exchange Act of 1934; | |

| ● | the name, age, business and residential address, educational background, current principal occupation or employment, and principal occupation or employment for the preceding five (5) full fiscal years of the proposed director candidate; | |

| ● | a description of the qualifications and background of the proposed director candidate and a representation that the proposed director candidate meets applicable independence requirements; | |

| ● | a description of any arrangements or understandings between the security holder and the proposed director candidate; and | |

| ● | the consent of the proposed director candidate to be named in the proxy statement relating to the Company’s annual meeting of stockholders and to serve as a director if elected at such annual meeting. |

Assuming that appropriate information is provided for candidates recommended by stockholders, the Nominating and Corporate Governance Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by members of the Board or other persons, as described above and as set forth in its written charter.

Board Leadership Structure and Role in Risk Oversight

The positions of our chairman of the Board and chief executive officer are separated. Separating these positions allows our chief executive officer to focus on our day-to-day business, while allowing the chairman of the Board to lead our Board in its fundamental role of providing advice to and independent oversight of management. Our Board recognizes the time, effort and energy that the chief executive officer must devote to his position in the current business environment, as well as the commitment required to serve as our chairman, particularly as our Board’s oversight responsibilities continue to grow. Our Board also believes that this structure ensures a greater role for the independent directors in the oversight of our Company and active participation of the independent directors in setting agendas and establishing priorities and procedures for the work of our Board. This leadership structure also is preferred by a significant number of our stockholders. Our Board believes its administration of its risk oversight function has not affected its leadership structure.

Although our bylaws do not require our chairman and chief executive officer positions to be separate, our Board believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Risk is inherent with every business, and how well a business manages risk can ultimately determine its success. We face a number of risks, including those described under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and other reports filed with the SEC. Our Board is actively involved in oversight of risks that could affect us. This oversight is conducted primarily by our full Board, which has responsibility for general oversight of risks.

Our Board will satisfy this responsibility through full reports by each committee chair regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks within our Company. Our Board believes that full and open communication between management and our Board is essential for effective risk management and oversight.

Stockholder Communications

Our Board will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. Absent unusual circumstances or as contemplated by committee charters, and subject to advice from legal counsel, the Secretary of the Company is primarily responsible for monitoring communications from stockholders and for providing copies or summaries of such communications to the Board as he considers appropriate.

| -12- |

Communications from stockholders will be forwarded to all directors if they relate to important substantive matters or if they include suggestions or comments that the Secretary considers to be important for the Board to know. Communication relating to corporate governance and corporate strategy are more likely to be forwarded to the Board than communications regarding personal grievances, ordinary business matters, and matters as to which the Company tends to receive repetitive or duplicative communications.

Stockholders who wish to send communications to the Board should address such communications to: The Board of Directors, Corbus Pharmaceuticals Holdings, Inc., 100 River Ridge Drive, Suite 103, Norwood, MA 02062, Attention: Secretary.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our employees, officers and directors. A copy of the code is posted under the “Investors” tab under “Governance” in our website, which is located at www.corbuspharma.com. We intend to disclose future amendments to certain provisions of our code of business conduct and ethics, or waivers of such provisions applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and our directors, on our website identified above or in a Current Report on Form 8-K.

Limitation of Directors Liability and Indemnification

The Delaware General Corporation Law (the “DGCL”) authorizes corporations to limit or eliminate, subject to certain conditions, the personal liability of directors to corporations and their stockholders for monetary damages for breach of their fiduciary duties. Our certificate of incorporation limits the liability of our directors to the fullest extent permitted by Delaware law. In addition, we have entered into indemnification agreements with certain of our directors and officers whereby we have agreed to indemnify those directors and officers to the fullest extent permitted by law, including indemnification against expenses and liabilities incurred in legal proceedings to which the director or officer was, or is threatened to be made, a party by reason of the fact that such director or officer is or was a director, officer, employee or agent of the Company, provided that such director or officer acted in good faith and in a manner that the director or officer reasonably believed to be in, or not opposed to, the best interests of the Company.

We have director and officer liability insurance to cover liabilities our directors and officers may incur in connection with their services to us, including matters arising under the Securities Act. Our certificate of incorporation and bylaws also provide that we will indemnify our directors and officers who, by reason of the fact that he or she is one of our officers or directors, is involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative related to their board role with us.

There is no pending litigation or proceeding involving any of our directors, officers, employees or agents in which indemnification will be required or permitted. We are not aware of any threatened litigation or proceeding that may result in a claim for such indemnification.

Executive Officers

The following table sets forth certain information regarding our current executive officers:

| Name | Age | Position(s) | Serving in Position Since | |||||||

| Yuval Cohen, Ph.D. | 42 | Chief Executive Officer, Director | 2014 | |||||||

| Mark Tepper, Ph.D. | 59 | President and Chief Scientific Officer | 2014 | |||||||

| Barbara White, M.D. | 66 | Chief Medical Officer | 2014 | |||||||

| Sean Moran | 59 | Chief Financial Officer | 2014 | |||||||

| -13- |

Our executive officers are elected by, and serve at the discretion of, our Board. The business experience for the past five years, and in some instances, for prior years, of each of our executive officers is as follows:

Management

Yuval Cohen, Ph.D., Chief Executive Officer and Director

See description under “Proposal 1”.

Mark A. Tepper, Ph.D., President and Chief Scientific Officer

Dr. Tepper has served as our President and Chief Scientific Officer since April 11, 2014. He has more than twenty five years of management experience in pharmaceutical Research & Development. During the last 14 years, Dr. Tepper has focused on identifying unique early stage biotechnology assets which fill a significant unmet medical need and has founded or co-founded three new biotech companies, including our company, to commercialize these assets. Prior to joining Corbus Pharmaceuticals, Inc. (formerly JB Therapeutics), our wholly-owned subsidiary, in January 2012, Dr. Tepper was a consultant to the biotechnology and pharmaceutical industry from 2009-2011. Prior to that he was President and Chief Executive Officer of NKT Therapeutics Inc. from 2007-2008 and before that President of RXi Pharmaceuticals from 2003 to 2007. Dr. Tepper served at EMD Serono from 1995 to 2002, most recently as Vice President of Research and Operations where he played a key role in the development and commercialization of the fertility drug Gonal-F and multiple sclerosis drug Rebif. While with Bristol Myers Squibb from 1988 to 1995, most recently as Senior Research Investigator, he was a member of the project team responsible for developing the cancer drug Taxol and the rheumatoid arthritis drug Orencia. Dr. Tepper received a Ph.D. in Biochemistry & Biophysics from Columbia University, College of Physicians & Surgeons, New York, and a B.A in Chemistry with Highest Honors from Clark University, Worcester, Massachusetts. He gained postdoctoral training at the University of Massachusetts Medical School, Worcester, Massachusetts in the laboratory of Professor Michael P. Czech.

Barbara White, M.D., Chief Medical Officer

Dr. White has served as our Chief Medical Officer since August 2014. Previously, Dr. White served as Senior Vice President and Head of Research and Development at Stiefel, a dermatological pharmaceutical division of GlaxoSmithKline, a public pharmaceutical company, from 2011 to 2013. From 2010 to 2011, Dr. White was Vice President and Head of Immunology Therapeutic Area at UCB, a public biopharmaceutical manufacturing company. At MedImmune, LLC, a subsidiary of AstraZeneca plc, a public pharmaceutical company, Dr. White served first as Senior Director of Clinical Development from 2006 until 2007, and then as Vice President until 2010. Prior to her pharmaceutical career, Dr. White was Professor and Associate Chair of Research, Department of Medicine, at the University of Maryland School of Medicine. She was formerly Associate Chief of Staff, Research Service, at the Baltimore Veteran Administration (VA) Medical Center, where her research focused on immune-mediated mechanisms of lung fibrosis in scleroderma. Barbara also previously served as Co-Director of the Johns Hopkins University and University of Maryland Scleroderma Center. Barbara received her medical degree from the University of Pennsylvania School of Medicine and is board certified in internal medicine, rheumatology and allergy/clinical immunology. She completed her postdoctoral studies in basic cellular immunology at the National Institutes of Health.

Sean Moran, CPA, MBA, Chief Financial Officer

Mr. Moran has served as our Chief Financial Officer since April 11, 2014. Mr. Moran joined Corbus Pharmaceuticals, Inc. (formerly JB Therapeutics), our wholly-owned subsidiary, as its Chief Financial Officer in January 2014. Mr. Moran has twenty years of senior financial experience with emerging biotechnology, drug delivery and medical device companies. Mr. Moran has worked at three different companies that completed initial public offerings and maintained a listing on a public exchange. Before joining our company, Mr. Moran served as Chief Financial Officer for InVivo Therapeutics Corporation from 2010 to 2013, Celsion Corporation from 2008 to 2010, Transport Pharmaceuticals Inc. from 2006 to 2008, Echo Therapeutics Inc. from 2002 to 2006, SatCon Technology Corporation from 2000 to 2002, and Anika Therapeutics Inc. from 1993 to 2000. Mr. Moran is a CPA by training and earned his M.B.A. and a B.S. in Accounting from Babson College.

| -14- |

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table presents information regarding the total compensation awarded to, earned by, or paid to our chief executive officer and the two most highly-compensated executive officers (other than the chief executive officer) who were serving as executive officers as of December 31, 2016 and December 31, 2015 for services rendered in all capacities to us for the year ended December 31, 2016 and December 31, 2015. These individuals are our named executive officers for 2016.

Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) (2) | Non-equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||||||||

| Yuval Cohen | 2016 | $ | 370,000 | $ | 185,000 | $ | - | $ | 1,493,403 | $ | - | $ | - | $ | 2,048,403 | |||||||||||||||||

| Chief Executive Officer | 2015 | 240,000 | 136,950 | (1) | - | - | - | - | 376,950 | |||||||||||||||||||||||

| Mark Tepper | 2016 | 320,000 | 144,000 | - | 1,191,055 | - | - | 1,655,055 | ||||||||||||||||||||||||

| President and Chief Scientific Officer | 2015 | 240,000 | 136,950 | (1) | - | - | - | 376,950 | ||||||||||||||||||||||||

| Barbara White | 2016 | 345,000 | 138,000 | - | 1,191,055 | - | - | 1,674,055 | ||||||||||||||||||||||||

| Chief Medical Officer | 2015 | 300,000 | 136,125 | (1) | - | - | - | - | 436,125 | |||||||||||||||||||||||

| (1) | Our Compensation Committee had not previously determined the amounts of performance-based cash bonuses payable to our executive officers for the fiscal year ended December 31, 2015. On August 11, 2016, the Compensation Committee approved bonuses for the year ended December 31, 2015 in the amounts of $136,950, $136,950, and $136,125 for Yuval Cohen, Mark Tepper, and Barbara White, respectively, which were paid on August 16, 2016. In determining the amounts of the cash bonuses to be paid, the Compensation Committee considered that we did not pay performance-based cash bonuses for the fiscal year ended December 31, 2014. | |

| (2) | Amounts reflect the grant date fair value of option awards granted in 2016 in accordance with Accounting Standards Codification Topic 718. For information regarding assumptions underlying the valuation of equity awards, see Note 3 to our Consolidated Financial Statements and the discussion under “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Critical Accounting Policies and Estimates-Stock-Based Compensation” included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016. These amounts do not correspond to the actual value that may be received by the named executive officers if the stock options are exercised. |

| -15- |

Employment Agreements with Our Named Executive Officers

On April 11, 2014, we entered into an employment agreement with Dr. Yuval Cohen, which is effective for a period of two years. Dr. Cohen’s employment agreement provides for him to serve as Chief Executive Officer and provides for an annual base salary of $240,000 and a signing bonus of $45,000. In addition, Dr. Cohen is eligible to receive an annual bonus, which is targeted at up to 33% of his base salary but which may be adjusted by our Board based on his individual performance and our performance as a whole. On April 11, 2014, Dr. Cohen received a grant of options covering 312,728 shares of common stock at an exercise price of $1.00 per share. These options vest 25% on the one year anniversary of the grant date and the remainder in equal monthly installments over three years, with full acceleration of vesting on a change in control (as defined in our 2014 Equity Compensation Plan). Pursuant to the terms of the employment agreement, Dr. Cohen is eligible to receive, from time to time, equity awards under our existing equity incentive plan, or any other equity incentive plan we may adopt in the future, and the terms and conditions of such awards, if any, will be determined by our Board or Compensation Committee, in their discretion. Dr. Cohen is subject to non-compete and non-solicitation provisions, which apply during the term of his employment and for a period of twelve months following termination of his employment. In addition, the employment agreement contains customary confidentiality and assignment of inventions provisions. If we terminate Dr. Cohen’s employment without cause or he terminates his employment for good reason during the term of his employment agreement, we are required to pay him as severance twelve months of his base salary plus reimbursement of the cost of COBRA coverage (or the cost of other comparable coverage if COBRA reimbursement would incur tax penalties or violate the law) for twelve months, and he may be paid a pro-rated bonus, each subject to his timely execution of a general release and continuing compliance with covenants. Dr. Cohen’s severance payments and other applicable payments and benefits will be subject to reduction to the extent doing so would put him in a better after-tax position after taking into account any excise tax he may incur under Internal Revenue Code Section 4999 in connection with any change in control of us or his subsequent termination of employment.

On April 11, 2016, we entered into an amendment to the employment agreement with Dr. Cohen to provide an increase in Dr. Cohen’s 2016 annual base salary and his bonus targets for fiscal year 2016 and to extend the term of his employment agreement for an additional two year period. Pursuant to the terms of the amendment, Dr. Cohen will receive an annual base salary of $370,000 for fiscal year 2016 and is eligible to receive an annual bonus for fiscal year 2016 targeted up to 50% of his base salary which may be adjusted by our Board based on his individual performance and our performance as a whole. Dr. Cohen’s annual base salary and his targeted annual bonus may be adjusted annually by the Board. The changes to Dr. Cohen’s compensation pursuant to the amendment were effective as of January 1, 2016 and the term of the employment agreement expires on April 11, 2018.

On April 11, 2014, we entered into an employment agreement with Sean Moran, which we amended and restated on June 26, 2014. Mr. Moran’s employment agreement provides for him to serve as Chief Financial Officer and provides for an annual base salary of $200,000 and a signing bonus of $20,000. In addition, Mr. Moran is eligible to receive an annual bonus, which is targeted at up to 33% of his base salary but which may be adjusted by our Board based on his individual performance and our performance as a whole. Mr. Moran’s employment agreement is on an at will basis for an indefinite term. On April 11, 2014, Mr. Moran, received a grant of options covering 107,220 shares of common stock at an exercise price of $1.00 per share. These options vest 25% on the one year anniversary of the grant date and the remainder in equal monthly installments over three years, with full acceleration of vesting on a change in control (as defined in our 2014 Equity Compensation Plan). Pursuant to the terms of the employment agreement, Mr. Moran is eligible to receive, from time to time, equity awards under our existing equity incentive plan, or any other equity incentive plan we may adopt in the future, and the terms and conditions of such awards, if any, will be determined by our Board or Compensation Committee, in their discretion. Mr. Moran is subject to non-compete and non-solicitation provisions, which apply during the term of his employment and for a period of twelve months following termination of his employment. In addition, the employment agreement contains customary confidentiality and assignment of inventions provisions. Mr. Moran’s applicable payments and benefits payable under the terms of his amended and restated employment agreement, as of June 26, 2014, will be subject to reduction to the extent doing so would put him in a better after-tax position after taking into account any excise tax he may incur under Internal Revenue Code Section 4999 in connection with any change in control of us or his subsequent termination of employment.

| -16- |

On April 11, 2016, we entered into an amendment to the employment agreement with Mr. Moran to provide an increase in Mr. Moran’s 2016 annual base salary and his bonus targets for fiscal year 2016 and to provide for a two year term of employment under the terms and conditions set forth in his employment agreement. Pursuant to the terms of the amendment, Mr. Moran will receive an annual base salary of $305,000 for fiscal year 2016 and is eligible to receive an annual bonus for fiscal year 2016 targeted up to 40% of his base salary which may be adjusted by our Board based on his individual performance and our performance as a whole. Mr. Moran’s annual base salary and his targeted annual bonus may be adjusted annually by the Board. The changes to Mr. Moran’s compensation pursuant to the amendment were effective as of January 1, 2016. In addition, pursuant to the terms of the amendment, if we terminate Mr. Moran’s employment without cause or he terminates his employment for good reason during the term of his employment agreement, we are required to pay him as severance twelve months of his base salary plus reimbursement of the cost of COBRA coverage (or the cost of other comparable coverage if COBRA reimbursement would incur tax penalties or violate the law) for twelve months, and he may be paid a pro-rated bonus, each subject to his timely execution of a general release and continuing compliance with covenants. Mr. Moran’s severance payments and other applicable payments and benefits payable pursuant to the terms of his amended and restated employment agreement, as subsequently amended on April 11. 2016, will be subject to reduction to the extent doing so would put him in a better after-tax position after taking into account any excise tax he may incur under Internal Revenue Code Section 4999 in connection with any change in control of us or his subsequent termination of employment. Pursuant to the terms of the amendment, the term of Mr. Moran’s employment agreement expires on April 11, 2018.

On April 11, 2014, we entered into an employment agreement with Dr. Mark Tepper, which is effective for a period of two years. Dr. Tepper’s employment agreement provides for him to serve as President and Chief Scientific Officer and provides for an annual base salary of $240,000. In addition, Dr. Tepper is eligible to receive an annual bonus, which is targeted at up to 33% of his base salary but which may be adjusted by our Board based on his individual performance and our performance as a whole. On April 11, 2014, Dr. Tepper received a grant of options covering 271,600 shares of common stock at an exercise price of $1.00 per share. These options vest 25% on the one year anniversary of the grant date and the remainder in equal monthly installments over three years, with full acceleration of vesting on a change in control (as defined in our 2014 Equity Compensation Plan). Pursuant to the terms of the employment agreement, Dr. Tepper is eligible to receive, from time to time, equity awards under our existing equity incentive plan, or any other equity incentive plan we may adopt in the future, and the terms and conditions of such awards, if any, will be determined by our Board or Compensation Committee, in their discretion. Dr. Tepper is subject to non-compete and non-solicitation provisions, which apply during the term of his employment and for a period of twelve months following termination of his employment. In addition, the employment agreement contains customary confidentiality and assignment of inventions provisions. If we terminate Dr. Tepper’s employment without cause or he terminates his employment for good reason during the term of his employment agreement, we are required to pay him as severance twelve months of his base salary plus reimbursement of the cost of COBRA (or the cost of other comparable coverage if COBRA reimbursement would incur tax penalties or violate the law) for twelve months, and he may be paid a pro-rated bonus, each subject to his timely execution of a general release and continuing compliance with covenants. Dr. Tepper’s severance payments and other applicable payments and benefits will be subject to reduction to the extent doing so would put him in a better after-tax position after taking into account any excise tax he may incur under Internal Revenue Code Section 4999 in connection with any change in control of us or his subsequent termination of employment.

On April 11, 2016, we entered into an amendment to the employment agreement with Mr. Tepper to provide an increase in Mr. Tepper’s 2016 annual base salary and his bonus targets for fiscal year 2016 and to extend the term of his employment agreement for an additional two year period. Pursuant to the terms of the amendment, Mr. Tepper will receive an annual base salary of $320,000 for fiscal year 2016 and is eligible to receive an annual bonus for fiscal year 2016 targeted up to 45% of his base salary which may be adjusted by our Board based on his individual performance and our performance as a whole. Mr. Tepper’s annual base salary and his targeted annual bonus may be adjusted annually by the Board. The changes to Mr. Tepper’s compensation pursuant to the amendment were effective as of January 1, 2016 and the term of the employment agreement expires on April 11, 2018.

We have entered into a letter agreement with Barbara White, M.D. Dr. White’s letter agreement provides for her to serve as Chief Medical Officer and provides for an annual base salary of $300,000. In addition, Dr. White is eligible to receive an annual bonus, which is targeted at up to 33% of her base salary but which may be adjusted by our Board based on her individual performance and our performance as a whole. Dr. White’s letter agreement is on an at will basis for an indefinite term. On September 23, 2014, Dr. White received a grant of options covering 250,000 shares of common stock at an exercise price of $1.00 per share. These options vest 25% on the one year anniversary of the grant date and the remainder in equal monthly installments over three years, with full acceleration of vesting on a change in control (as defined in our 2014 Equity Compensation Plan). Dr. White is subject to non-compete and non-solicitation provisions, which apply during the term of her employment. In addition, the letter agreement contains customary confidentiality and assignment of inventions provisions.

| -17- |

On April 11, 2016, we entered into an employment agreement with Dr. White which is effective for a period of two years from the date thereof. Dr. White’s employment agreement provides for her to serve as Chief Medical Officer and provides for an annual base salary of $345,000 for fiscal year 2016. In addition, Dr. White is eligible to receive an annual bonus for fiscal year 2016, which is targeted at up to 40% of her base salary which may be adjusted by our Board based on her individual performance and our performance as a whole. Dr. White’s annual base salary and annual bonus figures were effective as of January 1, 2016. Dr. White’s annual base salary and her targeted annual bonus may be adjusted annually by the Board. Pursuant to the terms of the employment agreement, Dr. White is eligible to receive, from time to time, equity awards under our existing equity incentive plan, or any other equity incentive plan we may adopt in the future, and the terms and conditions of such awards, if any, will be determined by our Board or Compensation Committee, in their discretion. Dr. White is subject to non-compete and non-solicitation provisions, which apply during the term of her employment and for a period of twelve months following termination of her employment. In addition, the employment agreement contains customary confidentiality and assignment of inventions provisions. If we terminate Dr. White’s employment without cause or she terminates her employment for good reason during the term of the employment agreement, we are required to pay her as severance twelve months of her base salary plus reimbursement of the cost of COBRA coverage (or the cost of other comparable coverage if COBRA reimbursement would incur tax penalties or violate the law) for twelve months, and she may be paid a pro-rated bonus, each subject to her timely execution of a general release and continuing compliance with covenants. Dr. White’s severance payments and other applicable payments and benefits will be subject to reduction to the extent doing so would put her in a better after-tax position after taking into account any excise tax she may incur under Internal Revenue Code Section 4999 in connection with any change in control of us or her subsequent termination of employment. The term of Dr. White’s employment agreement expires on April 11, 2018.

Outstanding Equity Awards at Fiscal Year-End

The following table summarizes, for each of the named executive officers, the number of shares of common stock underlying outstanding stock options held as of December 31, 2016.

Number of securities underlying unexercised options (#) | Equity Incentive Plan | |||||||||||||||||||||

| Name | Exercisable | Unexercisable | Awards: Number of Securities Underlying Unexercised Unearned Options (#) | Option Exercise Price ($) | Option Expiration Date | |||||||||||||||||

| Yuval Cohen | 15,089 | (1) | $ | 0.17 | 7/1/2023 | |||||||||||||||||

| 157,050 | (2) | 58,334 | (2) | $ | 0.17 | 1/28/2024 | ||||||||||||||||

| 188,485 | (3) | 104,243 | (3) | $ | 1.00 | 4/11/2024 | ||||||||||||||||

| 434,583 | (4) | 195,417 | (4) | 70,000 | (4) | $ | 1.00 | 10/22/2024 | ||||||||||||||

| - | (7) | 530,000 | (7) | 1.40 | 1/7/2026 | |||||||||||||||||

| - | (8) | 150,000 | (8) | 8.71 | 10/6/2026 | |||||||||||||||||

| Mark Tepper | 150,889 | (5) | $ | 0.11 | 7/1/2020 | |||||||||||||||||

| 181,067 | (3) | 90,533 | (3) | $ | 1.00 | 4/11/2024 | ||||||||||||||||

| 186,250 | (4) | 83,750 | (4) | 30,000 | (4) | $ | 1.00 | 10/22/2024 | ||||||||||||||

| - | (7) | 240,000 | (7) | 1.40 | 1/7/2026 | |||||||||||||||||

| - | (8) | 150,000 | (8) | 8.71 | 10/6/2026 | |||||||||||||||||

| Barbara White | 140,625 | (6) | 109,375 | (6) | $ | 1.00 | 9/23/2024 | |||||||||||||||

| - | (7) | 240,000 | (7) | $ | 1.40 | 1/7/2026 | ||||||||||||||||

| - | (8) | 150,000 | (8) | 8.71 | 10/6/2026 | |||||||||||||||||

| (1) | Represents options to purchase shares of our common stock granted on July 1, 2013. The shares underlying the option vested in 12 equal monthly installments commencing on July 1, 2013. |

| (2) | Represents options to purchase shares of our common stock granted on January 28, 2014. 25% of the option vested on January 28, 2015, with the remaining 75% of the option vesting in equal monthly installments over a period of 36 months commencing on January 28, 2015. |

| -18- |

| (3) | Represents options to purchase shares of our common stock granted on April 11, 2014. 25% of the option vested on April 11, 2015, with the remaining 75% of the option vesting in equal monthly installments over a period of 36 months commencing on April 11, 2015. |

| (4) | Represents options to purchase shares of our common stock granted on October 22, 2014. 12.5% of the option vested on October 22, 2015 and 37.5% of the option vests in equal monthly installments over a period of 36 months commencing on October 22, 2015. The remaining 50% of the option vests in tranches between 5% and 10% upon the achievement of eight individual business milestones. |

| (5) | Represents options to purchase shares of our common stock granted on July 1, 2010. 25% of the option vested on grant date and 12.5% of the remaining portion of the option vested in equal quarterly installments over a period of six quarters. |

| (6) | Represents options to purchase shares of our common stock granted on September 23, 2014. 25% of these options vests on September 19, 2015 with the remaining 75% of the option vesting in equal monthly installments over a period of 36 months commencing on September 19, 2015. |

| (7) | Represents options to purchase shares of our common stock granted on January 7, 2016. 25% of these options vests on January 7, 2017 with the remaining 75% of the option vesting in equal monthly installments over a period of 36 months commencing on January 7, 2017. |

| (8) | Represents options to purchase shares of our common stock granted on October 6, 2016. 25% of these options vests on October 6, 2017 with the remaining 75% of the option vesting in equal monthly installments over a period of 36 months commencing on October 6, 2017. |

Director Compensation

Director Compensation Table - 2016

The following table sets forth information concerning the compensation paid to certain of our non-employee directors during 2016.

| Name | Fees Earned or Paid in Cash ($) | Option Awards ($)(1) | Total ($) | |||||||||

| Alan Holmer (2) | 50,000 | 115,629 | 165,629 | |||||||||

| Avery Catlin (3) | 45,000 | 115,629 | 160,629 | |||||||||

| David Hochman (4) | 35,000 | 442,419 | 477,419 | |||||||||

| Renu Gupta (5) | 40,000 | 115,629 | 155,629 | |||||||||

| (1) | Amounts reflect the aggregate grant date fair value of each stock option granted in 2016, in accordance with the Accounting Standards Codification Topic 718. These amounts do not correspond to the actual value that may be received by the directors if the stock options are exercised. |

| (2) | The aggregate number of shares of common stock underlying stock options outstanding as of December 31, 2016 held by Mr. Holmer was 138,861. |

| (3) | The aggregate number of shares of common stock underlying stock options outstanding as of December 31, 2016 held by Mr. Catlin was 120,000. |

| (4) | The aggregate number of shares of common stock underlying stock options outstanding as of December 31, 2016 held by Mr. Hochman was 170,000. |

| (5) | The aggregate number of shares of common stock underlying stock options outstanding as of December 31, 2016 held by Dr. Gupta was 120,000. |

| -19- |

Non-Employee Director Compensation Policy

Our Board has approved a director compensation policy for our non-employee directors. Other than reimbursement for reasonable expenses incurred in connection with attending Board and committee meetings, this policy provides for the following cash compensation effective January 2016:

| ● | each non-employee director is entitled to receive an annual fee from us of $35,000; | |

| ● | the chair of our Board will receive an annual fee from us of $10,000; | |

| ● | the chair of our audit committee will receive an annual fee from us of $10,000; | |

| ● | the chair of our compensation committee will receive an annual fee from us of $5,000; and | |

| ● | the chair of our nominating and corporate governance committee will receive an annual fee from us of $5,000. |

Each non-employee director that joins our Board receives an initial option grant to purchase 50,000 shares of our common stock under our existing equity incentive plan, or any other equity incentive plan we may adopt in the future, which shall vest in 24 equal monthly installments, the first vesting date to occur on the one-month anniversary of the grant date. Each non-employee director also receives an annual option grant in an amount to be determined annually by our Compensation Committee in consultation with an independent compensation consultant, to purchase shares of our common stock under our existing equity incentive plan, or any other equity incentive plan we may adopt in the future, which shall vest in 24 equal monthly installments, the first vesting date to occur on the one-month anniversary of the grant date. Upon a change in control, as defined in our equity incentive plan, 100% of the shares underlying these options shall become vested and exercisable immediately prior to such change in control.

Scientific Advisory Board Compensation

We do not currently have a policy regarding compensation for our scientific advisory board members; however each member of the scientific advisory board is eligible to receive a payment of $15,000 per year and an initial grant of 30,000 options to purchase shares of our common stock at the fair market value on the date of grant.

2014 Equity Compensation Plan

General

On March 26, 2014, our Board adopted the 2014 Equity Compensation Plan, or the 2014 Plan, subject to stockholder approval, which was received on April 1, 2014, pursuant to the terms described herein.

The general purpose of the 2014 Plan is to provide a means whereby eligible employees, officers, non-employee directors and other individual service providers develop a sense of proprietorship and personal involvement in our development and financial success, and to encourage them to devote their best efforts to our business, thereby advancing our interests and the interests of our stockholders. By means of the 2014 Plan, we seek to retain the services of such eligible persons and to provide incentives for such persons to exert maximum efforts for our success and the success of our subsidiaries.

| -20- |

Equity Compensation Plan Information

The following table provides certain information with respect to all of the Corbus equity compensation plans in effect as of December 31, 2016:

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans approved by security holders | 7,898,679 | $ | 2.29 | 2,840,133 | ||||||||