SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

MANAGEMENT INVESTMENT COMPANIES

(Exact name of registrant as specified in charter)

|

Statements in this Annual Report that reflect projections or expectations of future financial or economic performance of the Aspiration Redwood Fund (“Fund”) and

of the market in general and statements of the Fund’s plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected,

estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include, without limitation,

general economic conditions such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

An investor should consider the investment objectives, risks,

charges, and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. A copy of the prospectus is available at funds.aspiration.com/redwood/ or by calling the Advisor at

800-683-8529. The prospectus should be read carefully before investing.

|

|

Aspiration Redwood Fund

|

|||||||||||||||||||

|

Performance Update (Unaudited)

|

|||||||||||||||||||

|

For the period from November 16, 2015 (Date of Initial Public Investment) through September 30, 2022

|

|||||||||||||||||||

|

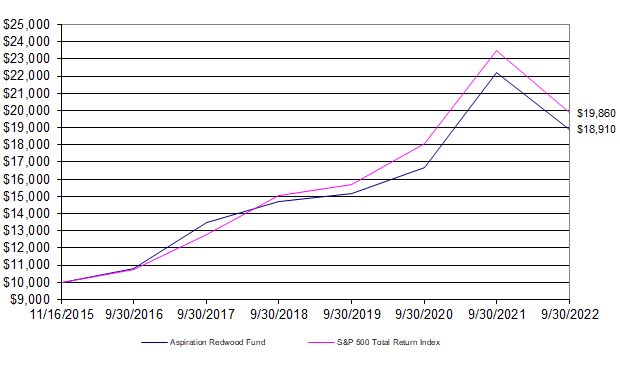

Comparison of the Change in Value of a $10,000 Investment

|

|||||||||||||||||||

|

This graph assumes an initial investment of $10,000 at November 16, 2015 (Date of Initial Public Investment). All dividends and distributions are reinvested. This graph

depicts the performance of the Aspiration Redwood Fund versus the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is

unmanaged. The comparison is shown for illustrative purposes only.

|

|||||||||||||||||||

|

Average Annual Total Returns

|

|||||||||||||||||||

|

Gross

|

Net

|

||||||||||||||||||

|

As of

|

One

|

Five

|

Since

|

Inception

|

Expense

|

Expense

|

|||||||||||||

|

September 30, 2022

|

Year

|

Year

|

Inception

|

Date

|

Ratio*

|

Ratio*

|

|||||||||||||

|

Aspiration Redwood Fund - With maximum

|

|||||||||||||||||||

|

assumed contribution reduction**

|

-18.52%

|

5.00%

|

7.71%

|

11/16/15

|

0.87%

|

0.50%

|

|||||||||||||

|

Aspiration Redwood Fund - Without maximum

|

|||||||||||||||||||

|

assumed contribution reduction

|

-16.52%

|

7.00%

|

9.71%

|

11/16/15

|

0.87%

|

0.50%

|

|||||||||||||

|

S&P 500 Total Return Index

|

-15.47%

|

9.24%

|

10.49%

|

N/A

|

N/A

|

N/A

|

|||||||||||||

|

*

|

The gross and net expense ratios shown are from the Fund's Financial Highlights as of September 30, 2021.

|

||||||||||||||||||

|

**

|

Investors in the Fund are clients of Aspiration Fund Adviser, LLC (the "Advisor") and may pay the Advisor a fee in the amount they believe is fair ranging from 0% to 2%

of the value of their investment in the Fund. The Average Annual Total Returns with a maximum assumed contributed reduction is calculated assuming a maximum advisory fee of 2% is paid by an investor to the Advisor.

|

||||||||||||||||||

|

Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so

that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by

visiting aspiration.com.

|

|||||||||||||||||||

|

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions.

|

|||||||||||||||||||

|

Aspiration Redwood Fund

|

||||||||||

|

Schedule of Investments

|

||||||||||

|

As of September 30, 2022

|

||||||||||

|

Shares

|

Value (Note 1)

|

|||||||||

|

COMMON STOCKS - 94.40%

|

||||||||||

|

Business Services - 1.59%

|

||||||||||

|

*

|

Montrose Environmental Group, Inc.

|

56,799

|

$

|

1,911,286

|

||||||

|

1,911,286

|

||||||||||

|

Communication Services - 2.06%

|

||||||||||

|

*

|

Take-Two Interactive Software, Inc.

|

22,677

|

2,471,793

|

|||||||

|

2,471,793

|

||||||||||

|

Consumer Discretionary - 16.05%

|

||||||||||

|

Costco Wholesale Corp.

|

11,016

|

5,202,526

|

||||||||

|

Dollar Tree, Inc.

|

24,700

|

3,361,670

|

||||||||

|

Estee Lauder Cos., Inc.

|

6,453

|

1,393,203

|

||||||||

|

International Flavors & Fragrance, Inc.

|

15,369

|

1,395,966

|

||||||||

|

Starbucks Corp.

|

22,464

|

1,892,817

|

||||||||

|

Sweetgreen, Inc.

|

75,094

|

1,389,239

|

||||||||

|

The TJX Cos., Inc.

|

52,557

|

3,264,841

|

||||||||

|

Vail Resorts, Inc.

|

6,407

|

1,381,605

|

||||||||

|

19,281,867

|

||||||||||

|

Consumer Staples - 1.49%

|

||||||||||

|

Sprouts Farmers Market, Inc.

|

64,369

|

1,786,240

|

||||||||

|

1,786,240

|

||||||||||

|

Energy - 1.00%

|

||||||||||

|

*

|

Bloom Energy Corp. - Class A

|

60,313

|

1,205,657

|

|||||||

|

1,205,657

|

||||||||||

|

Financials - 18.82%

|

||||||||||

|

Ameriprise Financial, Inc.

|

15,561

|

3,920,594

|

||||||||

|

Bank OZK

|

65,633

|

2,596,441

|

||||||||

|

Lazard Ltd.

|

31,057

|

988,544

|

||||||||

|

Marsh & McLennan Cos.

|

26,616

|

3,973,503

|

||||||||

|

Synchrony Financial, Inc.

|

36,068

|

1,016,757

|

||||||||

|

The Allstate Corp.

|

25,977

|

3,234,916

|

||||||||

|

Visa, Inc.

|

23,153

|

4,113,130

|

||||||||

|

Voya Financial, Inc.

|

45,768

|

2,768,964

|

||||||||

|

22,612,849

|

||||||||||

|

Health Care - 20.30%

|

||||||||||

|

AbbVie, Inc.

|

31,099

|

4,173,797

|

||||||||

|

*

|

Bio-Rad Laboratories, Inc.

|

5,939

|

2,477,394

|

|||||||

|

Ecolab, Inc.

|

10,929

|

1,578,366

|

||||||||

|

Eli Lilly & Co.

|

7,686

|

2,485,268

|

||||||||

|

*

|

Maravai LifeSciences Holdings, Inc.

|

31,753

|

810,654

|

|||||||

|

MSA Safety, Inc.

|

23,558

|

2,574,418

|

||||||||

|

UnitedHealth Group, Inc.

|

12,920

|

6,525,117

|

||||||||

|

*

|

Vertex Pharmaceuticals, Inc.

|

12,990

|

3,761,125

|

|||||||

|

24,386,139

|

||||||||||

|

(Continued)

|

||||||||||

|

Aspiration Redwood Fund

|

||||||||||

|

Schedule of Investments - Continued

|

||||||||||

|

As of September 30, 2022

|

||||||||||

|

Shares

|

Value (Note 1)

|

|||||||||

|

COMMON STOCKS - Continued

|

||||||||||

|

Industrials - 5.29%

|

||||||||||

|

*

|

America Well Corp.

|

125,806

|

$

|

451,644

|

||||||

|

Aptiv PLC

|

31,531

|

2,466,040

|

||||||||

|

Brunswick Corp.

|

14,080

|

921,536

|

||||||||

|

Regal Rexnord Corp.

|

13,575

|

1,905,387

|

||||||||

|

Rivian Automotive, Inc.

|

18,400

|

605,544

|

||||||||

|

6,350,151

|

||||||||||

|

Information Technology - 25.60%

|

||||||||||

|

Adobe Systems, Inc.

|

3,986

|

1,096,947

|

||||||||

|

Advanced Microtechnologies, Inc.

|

40,952

|

2,594,719

|

||||||||

|

*

|

Akamai Technologies, Inc.

|

42,661

|

3,426,532

|

|||||||

|

*

|

Cadence Design Systems, Inc.

|

21,023

|

3,435,789

|

|||||||

|

Micron Technology, Inc.

|

15,488

|

775,949

|

||||||||

|

Microsoft Corp.

|

31,082

|

7,238,998

|

||||||||

|

µ

|

NXP Semiconductors NV

|

22,189

|

3,273,099

|

|||||||

|

*

|

salesforce.com, Inc.

|

15,704

|

2,258,863

|

|||||||

|

*

|

Shoals Technologies Group, Inc.

|

40,597

|

874,865

|

|||||||

|

*

|

SolarEdge Technologies, Inc.

|

2,052

|

474,956

|

|||||||

|

*

|

Vmware, Inc.

|

34,118

|

3,632,202

|

|||||||

|

Western Digital Corp.

|

51,456

|

1,674,893

|

||||||||

|

30,757,812

|

||||||||||

|

Materials - 1.20%

|

||||||||||

|

The Azek Co., Inc.

|

86,930

|

1,444,777

|

||||||||

|

1,444,777

|

||||||||||

|

Utilities - 0.99%

|

||||||||||

|

American Water Works Co., Inc.

|

9,119

|

1,186,929

|

||||||||

|

1,186,929

|

||||||||||

|

Total Common Stocks (Cost $115,082,710)

|

113,395,500

|

|||||||||

|

REAL ESTATE INVESTMENT TRUST - 2.43%

|

||||||||||

|

Prologis, Inc.

|

28,700

|

2,915,920

|

||||||||

|

Total Real Estate Investment Trust (Cost $2,480,457)

|

2,915,920

|

|||||||||

|

SHORT-TERM INVESTMENT - 3.13%

|

||||||||||

|

§

|

Fidelity Investments Money Market Treasury Portfolio -

|

|||||||||

|

Class I, 0.01%

|

3,759,728

|

3,759,728

|

||||||||

|

Total Short-Term Investment (Cost $3,759,728)

|

3,759,728

|

|||||||||

|

(Continued)

|

||||||||||

|

Aspiration Redwood Fund

|

||||||||||

|

Schedule of Investments - Continued

|

||||||||||

|

As of September 30, 2022

|

||||||||||

|

Value (Note 1)

|

||||||||||

|

Total Value of Investments (Cost $121,322,895) - 99.96%

|

$

|

120,071,148

|

||||||||

|

Other Assets Less Liabilities - 0.04%

|

53,456

|

|||||||||

|

NET ASSETS - 100.00%

|

$

|

120,124,604

|

||||||||

|

§

|

Represents 7-day effective yield as of September 30, 2022.

|

|||||||||

|

*

|

Non-income producing investment

|

|||||||||

|

µ

|

American Depositary Receipt

|

|||||||||

|

The following acronym or abbreviation is used in this Schedule:

|

||||||||||

|

NV - Netherlands Security

|

||||||||||

|

Summary of Investments

|

||||||||||

|

% of Net

|

||||||||||

|

By Sector

|

Assets

|

Value

|

||||||||

|

Business Services

|

1.59%

|

$ 1,911,286

|

||||||||

|

Communication Services

|

2.06%

|

2,471,793

|

||||||||

|

Consumer Discretionary

|

16.05%

|

19,281,867

|

||||||||

|

Consumer Staples

|

1.49%

|

1,786,240

|

||||||||

|

Energy

|

1.00%

|

1,205,657

|

||||||||

|

Financials

|

18.82%

|

22,612,849

|

||||||||

|

Health Care

|

20.30%

|

24,386,139

|

||||||||

|

Industrials

|

5.29%

|

6,350,151

|

||||||||

|

Information Technology

|

25.60%

|

30,757,812

|

||||||||

|

Materials

|

1.20%

|

1,444,777

|

||||||||

|

Utilities

|

0.99%

|

1,186,929

|

||||||||

|

Real Estate Investment Trust

|

2.43%

|

2,915,920

|

||||||||

|

Short-Term Investment

|

3.13%

|

3,759,728

|

||||||||

|

Other Assets Less Liabilities

|

0.04%

|

53,456

|

||||||||

|

Total Net Assets

|

100.00%

|

$120,124,604

|

||||||||

|

See Notes to Financial Statements

|

||||||||||

|

Aspiration Redwood Fund

|

|||

|

Statement of Assets and Liabilities

|

|||

|

As of September 30, 2022

|

|||

|

Assets:

|

|||

|

Investments, at value (cost $121,322,895)

|

$

|

120,071,148

|

|

|

Receivables:

|

|||

|

Fund shares sold

|

44,400

|

||

|

Dividends and interest

|

67,387

|

||

|

From Advisor

|

90,356

|

||

|

Prepaid expenses:

|

|||

|

Registration and filing expenses

|

17,653

|

||

|

Transfer agent fees

|

30

|

||

|

Total assets

|

120,290,974

|

||

|

Liabilities:

|

|||

|

Payables:

|

|||

|

Fund shares repurchased

|

20,971

|

||

|

Accrued expenses:

|

|||

|

Trustee fees and meeting expenses

|

53,303

|

||

|

Professional fees

|

51,345

|

||

|

Custody fees

|

26,798

|

||

|

Shareholder fulfillment fees

|

7,086

|

||

|

Distribution and service fees (note 3)

|

5,881

|

||

|

Administration fees

|

627

|

||

|

Security pricing fees

|

348

|

||

|

Compliance fees

|

11

|

||

|

Total liabilities

|

166,370

|

||

|

Net Assets

|

$

|

120,124,604

|

|

|

Net Assets Consist of:

|

|||

|

Paid in Capital

|

$

|

119,017,349

|

|

|

Distributable earnings

|

1,107,255

|

||

|

Total Net Assets

|

$

|

120,124,604

|

|

|

Shares Outstanding, no par value (unlimited authorized shares)

|

9,208,949

|

||

|

Net Asset Value, Maximum Offering Price, and Redemption Price Per Share

|

$

|

13.04

|

|

|

See Notes to Financial Statements

|

|||

|

Aspiration Redwood Fund

|

|||

|

Statement of Operations

|

|||

|

For the fiscal year ended September 30, 2022

|

|||

|

Investment Income:

|

|||

|

Dividends

|

$

|

2,404,088

|

|

|

Total Investment Income

|

2,404,088

|

||

|

Expenses:

|

|||

|

Transfer agent fees (note 2)

|

599,408

|

||

|

Trustee fees and meeting expenses

|

194,130

|

||

|

Administration fees (note 2)

|

138,237

|

||

|

Custody fees (note 2)

|

109,307

|

||

|

Professional fees

|

53,781

|

||

|

Registration and filing expenses

|

47,533

|

||

|

Fund accounting fees (note 2)

|

40,827

|

||

|

Compliance fees (note 2)

|

11,961

|

||

|

Distribution and service fees (note 3)

|

6,023

|

||

|

Security pricing fees

|

5,953

|

||

|

Total Expenses

|

1,207,160

|

||

|

|

|||

|

Expenses reimbursed by advisor (note 2)

|

(501,351)

|

||

|

|

|||

|

Net Expenses

|

705,809

|

||

|

Net Investment Income

|

1,698,279

|

||

|

Realized and Unrealized Gain (Loss) on Investments

|

|||

|

Net realized gain from investment transactions

|

2,925,561

|

||

|

|

|||

|

Change in unrealized depreciation on investments

|

(28,436,607)

|

||

|

Realized and Unrealized Loss on Investments

|

(25,511,046)

|

||

|

Net Decrease in Net Assets Resulting from Operations

|

$

|

(23,812,767)

|

|

|

See Notes to Financial Statements

|

|||

|

Aspiration Redwood Fund

|

||||||||||

|

Statements of Changes in Net Assets

|

||||||||||

|

For the fiscal years ended September 30,

|

2022

|

2021

|

||||||||

|

Operations:

|

||||||||||

|

Net investment income

|

$

|

1,698,279

|

$

|

801,258

|

||||||

|

Net realized gain on investment transactions

|

2,925,561

|

13,717,571

|

||||||||

|

Net change in unrealized appreciation (depreciation) on investments

|

(28,436,607)

|

19,158,365

|

||||||||

|

Net Increase in Net Assets from Operations

|

(23,812,767)

|

33,677,194

|

||||||||

|

Distributions to Shareholders

|

(14,504,214)

|

-

|

||||||||

|

Return of Capital

|

-

|

-

|

||||||||

|

Decrease in Net Assets Resulting from Distributions

|

(14,504,214)

|

-

|

||||||||

|

Beneficial Interest Transactions

|

||||||||||

|

Shares sold

|

24,136,693

|

29,892,282

|

||||||||

|

Reinvested dividends and distributions

|

14,438,187

|

-

|

||||||||

|

Shares repurchased

|

(20,195,710)

|

(23,728,212)

|

||||||||

|

Net Increase in Beneficial Interest Transactions

|

18,379,170

|

6,164,070

|

||||||||

|

Net Increase in Net Assets

|

(19,937,811)

|

39,841,264

|

||||||||

|

Net Assets:

|

||||||||||

|

Beginning of year

|

140,062,415

|

100,221,151

|

||||||||

|

End of year

|

$

|

120,124,604

|

$

|

140,062,415

|

||||||

|

Share Information:

|

||||||||||

|

Shares Sold

|

1,517,243

|

1,833,837

|

||||||||

|

Reinvested Distributions

|

834,484

|

-

|

||||||||

|

Shares repurchased

|

(1,274,826)

|

(1,462,587)

|

||||||||

|

Net Increase in Shares of Beneficial Interest

|

1,076,901

|

371,250

|

||||||||

|

See Notes to Financial Statements

|

||||||||||

|

Aspiration Redwood Fund

|

||||||||||||||

|

Financial Highlights

|

||||||||||||||

|

For a share outstanding during each

|

Investor Class Shares

|

|||||||||||||

|

of the fiscal years ended September 30,

|

2022

|

2021

|

2020

|

2019

|

2018

|

|||||||||

|

Net Asset Value, Beginning of Year

|

$

|

17.22

|

$

|

12.91

|

$

|

12.81

|

$

|

13.63

|

$

|

12.82

|

||||

|

Income (Loss) from Investment Operations

|

||||||||||||||

|

Net investment income (loss)

|

0.18

|

0.10

|

0.15

|

0.14

|

0.14

|

|||||||||

|

Net realized and unrealized gain (loss)

|

||||||||||||||

|

on investments

|

(2.61)

|

4.21

|

1.15

|

0.06

|

1.25

|

|||||||||

|

Total from Investment Operations

|

(2.43)

|

4.31

|

1.30

|

0.20

|

1.39

|

|||||||||

|

Less Distributions to Shareholders From:

|

||||||||||||||

|

Net investment income

|

(0.22)

|

-

|

(0.58)

|

(0.12)

|

(0.06)

|

|||||||||

|

Net realized gains

|

(1.53)

|

-

|

(0.59)

|

(0.90)

|

(0.52)

|

|||||||||

|

Return of capital

|

-

|

-

|

(0.03)

|

-

|

-

|

|||||||||

|

Total Distributions

|

(1.75)

|

-

|

(1.20)

|

(1.02)

|

(0.58)

|

|||||||||

|

Net Asset Value, End of Year

|

$

|

13.04

|

$

|

17.22

|

$

|

12.91

|

$

|

12.81

|

$

|

13.63

|

||||

|

Total Return (a)

|

(16.52)%

|

33.38%

|

9.96%

|

2.95%

|

11.28%

|

|||||||||

|

Net Assets, End of Year (in thousands)

|

$

|

120,125

|

$

|

140,062

|

$

|

100,221

|

$

|

84,597

|

$

|

79,130

|

||||

|

Ratios of:

|

||||||||||||||

|

Gross Expenses to Average Net Assets

|

0.86%

|

0.87%

|

1.28%

|

1.50%

|

1.41%

|

|||||||||

|

Net Expenses to Average Net Assets

|

0.50%

|

0.50%

|

0.50%

|

0.50%

|

0.50%

|

|||||||||

|

Net Investment Income to Average

|

||||||||||||||

|

Net Assets

|

1.20%

|

0.62%

|

0.78%

|

1.23%

|

1.06%

|

|||||||||

|

Portfolio turnover rate

|

20.03%

|

33.31%

|

161.38%

|

135.10%

|

110.18%

|

|||||||||

|

(a)

|

Investors in the Fund are clients of Aspiration Fund Adviser, LLC (the "Advisor") and may pay the Advisor a fee in the amount they believe is fair ranging from 0% to 2% of

the value of their investment in the Fund. Assuming a maximum advisory fee of 2% is paid by an investor to the Advisor, the Total Return of an investment in the Fund would have been (18.52)%, 31.38%, 7.96%, 0.95%, and 9.28% for the years

ended September 30, 2022, 2021, 2020, 2019, and 2018, respectively.

|

|||||||||||||

|

See Notes to Financial Statements

|

||||||||||||||

| Aspiration Redwood Fund |

| Notes to Financial Statements |

| As of September 30, 2022 |

| Aspiration Redwood Fund |

| Notes to Financial Statements – Continued |

| As of September 30, 2022 |

|

Aspiration Redwood Fund

|

||||||||

|

Investments in Securities (a)

|

Total

|

Level 1

|

Level 2

|

Level 3

|

||||

|

Investments

|

||||||||

|

Common Stocks*

|

$

|

113,395,500

|

$

|

113,395,500

|

$

|

-

|

$

|

-

|

|

Real Estate Investment Trust

|

2,915,920

|

2,915,920

|

-

|

-

|

||||

|

Short-Term Investment

|

3,759,728

|

3,759,728

|

-

|

-

|

||||

|

Total Investments

|

$

|

120,071,148

|

$

|

120,071,148

|

$

|

-

|

$

|

-

|

| Aspiration Redwood Fund |

| Notes to Financial Statements – Continued |

| As of September 30, 2022 |

| Aspiration Redwood Fund |

| Notes to Financial Statements – Continued |

| As of September 30, 2022 |

|

2.

|

Transactions with Related Parties and Service Providers

|

|

Fiscal Year/Period End

|

Reimbursement Amount

|

Repayment Date Expiration

|

|

September 30, 2022

|

$501,351

|

September 30, 2025

|

|

September 30, 2021

September 30, 2020

|

$480,413

$715,381

|

September 30, 2024

September 30, 2023

|

| Aspiration Redwood Fund |

| Notes to Financial Statements – Continued |

| As of September 30, 2022 |

|

3.

|

Distribution and Service Fees

|

|

4.

|

Purchases and Sales of Investment Securities

|

|

Purchases of Securities

|

Proceeds from Sales of Securities

|

|

$32,461,778

|

$27,840,201

|

|

September 30, 2022

|

September 30, 2021

|

||

|

Ordinary Income

|

$ 11,195,211

|

$ -

|

|

|

Long-Term Capital Gains

|

3,309,003

|

-

|

|

|

(Continued) |

| Aspiration Redwood Fund |

| Notes to Financial Statements – Continued |

| As of September 30, 2022 |

|

Cost of Investments

|

$121,976,291

|

|||||

|

Gross Unrealized Appreciation

|

12,651,046

|

|||||

|

Gross Unrealized Depreciation

|

(14,556,189)

|

|||||

|

Net Unrealized Depreciation

|

(1,905,143)

|

|||||

|

Undistributed Net Investment Income

|

1,123,804

|

|||||

|

Accumulated Capital Gains

|

1,888,594

|

|||||

|

Distributable Earnings

|

$ 1,107,255

|

|||||

|

taitweller.com

|

| Aspiration Redwood Fund |

|

Additional Information

(Unaudited)

|

| As of September 30, 2022 |

|

1.

|

Proxy Voting Policies and Voting Record

|

|

2.

|

Quarterly Portfolio Holdings

|

|

3.

|

Tax Information

|

|

4.

|

Schedule of Shareholder Expenses

|

|

|

(Continued) |

| Aspiration Redwood Fund |

|

Additional Information

(Unaudited)

|

| As of September 30, 2022 |

|

Investor Class Shares

|

Beginning

Account Value

April 1, 2022

|

Ending

Account Value

September 30, 2022

|

Expenses Paid

During Period*

|

|

Actual

Hypothetical (5% annual return before expenses)

|

|||

|

$1,000.00

|

$ 808.40

|

$2.27

|

|

|

$1,000.00

|

$1,022.56

|

$2.54

|

|

(i)

|

Nature, Extent, and Quality of Services. The Trustees considered the responsibilities of the Sub-Advisor under the Investment Sub-Advisory Agreements.

The Trustees reviewed the services being provided by the Sub-Advisor to the Fund including, without limitation, the quality of its investment advisory services since the Fund’s inception (including research and recommendations with

respect to portfolio securities) and its procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives, policies, and limitations. The Trustees evaluated: the Sub-Advisor’s

staffing, personnel, and methods of operating; the education and experience of the Sub-Advisor’s personnel; the Sub-Advisor’s compliance program; and its financial condition. After reviewing the foregoing information and further

information in the memorandum from the Sub-Advisor (e.g., descriptions of the Sub-Advisor’s business, compliance program, and the Sub-Advisor’s Form ADV), the Board concluded that the nature, extent, and quality of the services

provided by the Sub-Advisor were satisfactory and adequate for the Fund.

|

|

(ii)

|

Performance. The Trustees compared the performance of the Fund with the performance of its benchmark index, comparable funds with similar strategies

managed by other investment advisers, and applicable peer group data (e.g., Broadridge peer group average). The Trustees also considered the consistency of the Sub-Advisor’s management of the Fund with its investment objective,

policies, and limitations. After reviewing the investment performance of the Fund, the Sub-Advisor’s experience managing the Fund, the Sub-Advisor’s historical investment performance, and other factors, the Board concluded that the

investment performance of the Fund and the Sub-Advisor was satisfactory.

|

|

|

(Continued) |

| Aspiration Redwood Fund |

|

Additional Information

(Unaudited)

|

| As of September 30, 2022 |

|

(iii)

|

Fees and Expense; Fall-out Benefits to the Sub-Advisor. The Trustees noted that the fee under the Investment Sub-Advisory Agreements was a percentage of

fees received by the Advisor from clients of the Advisor invested in the Fund, calculated after the Advisor’s 10% donation to charity. The Trustees evaluated the Sub-Advisor’s staffing, personnel, and methods of operating; the

education and experience of the Sub-Advisor’s personnel; compliance program; the financial condition of the Sub-Advisor; the asset level of the Fund; and the overall expenses of the Fund.

|

|

(iv)

|

Profitability. The Board reviewed the Sub-Advisor’s profitability analysis in connection with its management of the Fund over the past twelve months.

The Board considered the quality of the Sub-Advisor’s service to the Fund, and after further discussion, concluded that the Sub-Advisor’s level of profitability was not excessive.

|

|

(v)

|

Economies of Scale. In this regard, the Trustees reviewed the Fund’s operational history and noted that the size of the Fund had not provided an

opportunity to realize economies of scale. The Trustees noted that the Fund was a relatively small size and economies of scale were unlikely to be achievable in the near future. It was pointed out that breakpoints in the advisory

fee could be reconsidered in the future.

|

|

|

(Continued) |

| Aspiration Redwood Fund |

|

Additional Information

(Unaudited)

|

| As of September 30, 2022 |

|

(i)

|

Nature, Extent, and Quality of Services. The Trustees reviewed the services being provided by the Advisor to the Fund including, without limitation, the

quality of its investment advisory services since the Fund’s inception; its procedures for overseeing the Sub-Advisor’s investment process and decisions, and assuring compliance with the Fund’s investment objectives, policies and

limitations; its coordination of services for the Fund among the Fund’s service providers; and its efforts to promote the Fund, grow the Fund’s assets and assist in the distribution of the Fund’s shares. The Trustees also evaluated:

the Advisor’s staffing, personnel, and methods of operation; the education and experience of the Advisor’s personnel; the Advisor’s compliance program; and the financial condition of the Advisor. After reviewing the foregoing

information and further information from the Advisor, the Board concluded that the nature, extent, and quality of the services provided by the Advisor were satisfactory and adequate for the Fund.

|

|

(ii)

|

Performance. The Trustees considered that they had previously compared the performance of the Fund with the performance of its benchmark index,

comparable funds with similar strategies managed by other investment advisers, and applicable peer group data (e.g., Broadridge peer group averages); the consistency of the Advisor’s management of the Fund with its investment

objective, policies and limitations; the short-term investment performance of the Fund; the Advisor’s experience overseeing the management of the Fund; and the Advisor’s historical investment performance. Upon further consideration,

the Board concluded that the investment performance of the Fund and the Advisor was satisfactory.

|

|

(iii)

|

Fees and Expenses; Fall-out Benefits to the Advisor. The Board considered the fees and expenses in connection with the Advisor’s management of the Fund,

including any fall-out benefits derived by the Advisor and its affiliates resulting from its relationship with the Fund. In considering the costs of the services provided by the Advisor and the benefits derived by the Advisor and

its affiliates, the Trustees noted that the management fee for the Fund is 0% of average daily net assets, with shareholders being made up entirely of clients of the Advisor, and that those clients pay the Advisor directly, rather

than through the Fund via a management fee charged to the Fund.

|

|

|

(Continued) |

| Aspiration Redwood Fund |

|

Additional Information

(Unaudited)

|

| As of September 30, 2022 |

|

(iv)

|

Profitability. The Trustees considered that they had previously reviewed the Advisor’s profitability in connection with its management of the Fund. The

Board considered the quality of the Advisor’s service to the Fund, in connection with the Advisor’s “Pay What Is Fair” model.

|

|

(v)

|

Economies of Scale. The Trustees noted that the Fund does not have a traditional advisory fee. The Trustees noted that shareholders would benefit from

their ability to individually allocate between 0.0% and 2.0% of the net asset value of their account per year as payment to the Advisor.

|

|

|

(Continued) |

| Aspiration Redwood Fund |

|

Additional Information

(Unaudited)

|

| As of September 30, 2022 |

|

Name, Age

and Address |

Position

held with Funds or Trust |

Length of

Time

Served

|

Principal Occupation

During Past 5 Years |

Number of

Portfolios in

Fund

Complex

Overseen by

Trustee

|

Other Directorships

Held by Trustee During Past 5 Years |

|

Independent Trustees

|

|||||

|

Chuck Daggs

(1947) 116 South Franklin Street Rocky Mount, NC 27804 |

Chairman and Independent Trustee

|

Trustee Since 06/2018, Chair since 09/2021

|

Trustee, University of Maryland (January 2014 – Present); Chairman of the Board for Kipp Bay Area School (January 2000 – Present).

|

1

|

Trustee, University of Maryland; Chairman of the Board, Kipp Bay Area Schools.

|

|

Coby A. King

(1960) 116 South Franklin Street Rocky Mount, NC 27804 |

Independent Trustee

|

Since 01/2016

|

President and Chief Executive Officer of High Point Strategies, LLC (Public Affairs Consulting) since 2013.

|

1

|

Treasurer of the Board, Valley Industry & Commerce Association (VICA).

|

|

|

(Continued) |

| Aspiration Redwood Fund |

|

Additional Information

(Unaudited)

|

| As of September 30, 2022 |

|

Name, Age

and Address |

Position

held with Funds or Trust |

Length of

Time

Served

|

Principal Occupation

During Past 5 Years |

Number of

Portfolios in

Fund

Complex

Overseen by

Trustee

|

Other Directorships

Held by Trustee During Past 5 Years |

|

David L. Kingsdale

(1963) 116 South Franklin Street Rocky Mount, NC 27804 |

Independent Trustee

|

Since 10/2014

|

Chief Executive Officer of Millennium Dance Media, LLC since 2010; Principal of DLK, Inc. (media consulting agency) since 2005;

Principal of King’s Ransom, LLC (mergers and acquisitions) 06/2021-present; Head of Acquisitions, Acceleration LLC, 05/2018-05/2021.

|

1

|

The Giving Back Fund (nonprofit sector); Prime Access Capital (financial services).

|

|

Interested Trustee*

|

|||||

|

Andrei Cherny (a)

(1975) 116 South Franklin Street Rocky Mount, NC 27804 |

Interested Trustee, Principal Executive Officer, and President

|

Trustee Since 08/2017; President Since 2/2014

|

Chief Executive Officer of Aspiration Partners, LLC since 2013.

|

1

|

Board Member and President for Democracy: a Journal of Ideas (public sector).

|

|

Alexandra Horigan

(1983) 116 South Franklin Street Rocky Mount, NC 27804 |

Interested Trustee

|

Since 08/2017

|

Vice President of Strategic Initiatives of Aspiration Partners, Inc. since 2018; Vice President of Operations of Aspiration Partners,

Inc. (2012-2018).

|

1

|

None

|

|

*Basis of Interestedness. Mr. Cherny and Ms. Horigan are each an Interested Trustee because

each is an Officer of Aspiration Fund Advisers, LLC, the investment adviser to the Fund.

|

|||||

|

Name and

Date of Birth |

Position held with

Funds or Trust |

Length

of Time Served |

Principal Occupation

During Past 5 Years |

|

Officers

|

|||

|

Douglas Tyre

(1980) 116 South Franklin Street Rocky Mount, NC 27804 |

Chief Compliance Officer

|

Since 12/2020

|

Compliance Director, AGA Global (previously, Cipperman Compliance Services, LLC) (07/2019 – Present). Assistant Compliance Director,

Cipperman Compliance Services, LLC (2018 – 2019). Manager, Cipperman Compliance Services, LLC (2014 – 2017).

|

|

Mike Shuckerow

( 1971) 116 South Franklin Street Rocky Mount, NC 27804 |

Treasurer, Principal Accounting Officer, and Principal Financial Officer

|

Since 12/2020

|

Chief Legal Officer, Aspiration Partners, Inc. (2019 – present); Chief Executive Officer, Aspiration Financial, LLC (2019 – present);

Board Advisor, Vestwell (2016 – present); Head of Legal and Compliance, Vestwell (2016 – 2018).

|

|

Tracie A. Coop

(1976) 116 South Franklin Street Rocky Mount, NC 27804 |

Secretary

|

Since 12/2019

|

General Counsel, The Nottingham Company since 2019; Vice President and Managing Counsel, State Street Bank and Trust Company from 2015

to 2019.

|

|

|

(Continued) |

| Aspiration Redwood Fund |

|

Additional Information

(Unaudited)

|

| As of September 30, 2022 |

|

(a)

|

Change in Principal Executive Officer and President

|

|

For Shareholder Service Inquiries:

Aspiration Fund Adviser, LLC

4551 Glencoe Avenue

Marina Del Rey, CA 90292

|

For Investment Advisor Inquiries:

Aspiration Fund Adviser, LLC

4551 Glencoe Avenue

Marina Del Rey, CA 90292

|

|

Telephone:

800-683-8529

World Wide Web @:

aspiration.com

|

Telephone:

800-683-8529

World Wide Web @:

aspiration.com

|

| Item 2. | CODE OF ETHICS. |

| (a) |

The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to the registrant’s principal executive officer, principal financial

officer, and principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party (the “Code of Ethics”).

|

| (c) |

During the period covered by this report, there have been no substantive amendments to the provisions of the Code of Ethics.

|

| (d) |

During the period covered by this report, the registrant did not grant any waivers to the provisions of the Code of Ethics.

|

| (f)(1) |

A copy of the Code of Ethics is filed with this Form N-CSR as Exhibit 13(a)(1).

|

| Item 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

| Item 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

|

(a)

|

Audit Fees – Audit fees billed for the Aspiration Redwood Fund (the Fund”), a series of the Trust, for the last two fiscal years

are reflected in the table below.

|

|

Fund

|

September 30, 2021

|

|

Aspiration Redwood Fund

|

$30,000

|

|

Fund

|

September 30, 2022

|

|

Aspiration Redwood Fund

|

$20,000

|

|

(b)

|

Audit-Related Fees –There were no additional fees billed in the fiscal year ended September 30, 2021, for

assurance and related services by the Former Accountant that were reasonably related to the performance of the audit of the registrant’s financial statements and that were not reported under paragraph (a) of this Item.

|

|

(c)

|

Tax Fees – The tax fees billed in the fiscal year ended September 30, 2021, for professional services rendered by the Former

Accountant for tax compliance, tax advice, and tax planning are reflected in the table below. These services were for the completion of the Fund’s federal and state income tax returns, excise tax returns, and assistance with distribution

calculations.

|

|

Fund

|

September 30, 2021

|

|

Aspiration Redwood Fund

|

$17,500

|

|

Fund

|

September 30, 2022

|

|

Aspiration Redwood Fund

|

$5,000

|

|

(d)

|

All Other Fees – There were no other fees billed in the fiscal year ended September 30, 2021, for products

and services provided by the Former Accountant, other than the services reported in paragraphs (a) through (c) of this Item.

|

|

(e)(1)

|

The registrant’s Board of Trustees pre-approved the engagement of the Former Accountant for the fiscal year ended

September 30, 2021, at an audit committee meeting of the Board of Trustees called for such purpose. The registrant’s Board of Trustees pre-approved the engagement of the Accountant for the fiscal year ended September 30, 2022, at an audit

committee meeting of the Board of Trustees called for such purpose and will pre-approve the Accountant for each fiscal year thereafter at an audit committee meeting called for such purpose. The charter of the audit committee states that

the audit committee should pre-approve any audit services and, when appropriate, evaluate and pre-approve any non-audit services provided by the Accountant to the registrant and to pre-approve, when appropriate, any non-audit services

provided by the Accountant to the registrant’s investment adviser, or any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant if the engagement relates

directly to the operations and financial reporting of the registrant.

|

|

(2)

|

There were no services as described in each of paragraph (b) through (d) of this Item that were approved by the

audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

|

| (f) |

Not applicable.

|

| (g) |

Aggregate non-audit fees billed by the Former Accountant to the Fund for services rendered for the fiscal year ended September 30, 2021 were $17,500. There were no fees billed by the

Former Accountant for non-audit services rendered to the Fund’s investment adviser, or any other entity controlling, controlled by, or under common control with the Fund’s investment adviser.

|

| (h) |

Not applicable.

|

| Item 5. | AUDIT COMMITTEE OF LISTED REGISTRANTS. |

| Item 6. | SCHEDULE OF INVESTMENTS. |

|

Item 7.

|

DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

| Item 8. | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

|

Item 9.

|

PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS. |

| Item 10. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. |

| Item 11. | CONTROLS AND PROCEDURES. |

| (a) |

The President, Principal Executive Officer, and Principal Financial Officer and the Treasurer and Principal Accounting Officer have concluded that the registrant’s disclosure

controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940) are effective based on their evaluation of the disclosure controls and procedures required by Rule 30a-3(b) under the Investment Company Act of

1940 and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as of a date within 90 days of the filing of this report.

|

| (b) |

There were no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the

period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

|

| Item 12. | DISCLOSURE OF SECURITIES LENDING ACTIVITIES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES. |

| Item 13. | EXHIBITS. |

| (a)(1) |

Code of Ethics required by Item 2 of Form N-CSR is filed herewith.

|

| (a)(2) |

Certifications pursuant to Rule 30a-2(a) under the Investment Company Act of 1940 are

filed herewith.

|

| (a)(3) |

Not applicable.

|

| (a)(4) |

The information regarding the change in the Registrant's independent public

accounting firm pursuant to Item 4 of Form 8-K and Item 304(a)(1) of Regulation S-K is filed herewith.

|

| (b) |

Certifications pursuant to Rule 30a-2(b) under the Investment Company Act of 1940 and

Section 906 of the Sarbanes-Oxley Act of 2002 are filed herewith.

|

|

Aspiration Funds

|

|

|

/s/ Olivia Albrecht

|

|

|

Date: February 8, 2023

|

Olivia Albrecht

President, Principal Executive Officer, and Principal Financial Officer

|

|

/s/ Olivia Albrecht

|

|

|

Date: February 8, 2023

|

Olivia Albrecht

President, Principal Executive Officer, and Principal Financial Officer

|