UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22922

Aspiration Funds

(Exact name of registrant as specified in charter)

(Exact name of registrant as specified in charter)

4640 Admiralty Way, Marina Del Rey, California 90292

(Address of principal executive offices) (Zip code)

Matthew J. Beck

116 South Franklin Street, Post Office Box 69, Rocky Mount, North Carolina 27802

(Name and address of agent for service)

Registrant's telephone number, including area code: 252-972-9922

Date of fiscal year end: September 30

Date of reporting period: September 30, 2015

Annual Report 2015

From October 14, 2014 (Date of Initial Public Investment) through September 30, 2015

Aspiration Flagship Fund

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Aspiration Flagship Fund (the "Fund"). The Fund's shares are not deposits or obligations of, or guaranteed by, any depository institution. The Fund's shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested. Neither the Fund nor the Fund's distributor is a bank.

The Aspiration Flagship Fund is distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 100 E. Six Forks Road, Suite 200, Raleigh, NC, 27609. There is no affiliation between the Aspiration Flagship Fund, including its principals, and Capital Investment Group, Inc.

|

Statements in this Annual Report that reflect projections or expectations of future financial or economic performance of the Aspiration Flagship Fund ("Fund") and of the market in general and statements of the Fund's plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include, without limitation, general economic conditions such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

An investment in the Fund is subject to investment risks, including the possible loss of some or the entire principal amount invested. There can be no assurance that the Fund will be successful in meeting its investment objective. Investment in the Fund is also subject to the following risks: correlation risk, investment company risk, allocation risk, underlying fund concentration, leveraging, foreign investing and emerging markets risk, convertible securities risk, business development (BDC) risk, high yield risk, liquidity risk, market risk, short sale risk, commodities risk, ETFs, distressed companies risk, alternative asset class risk, long/short selling risk, arbitrage risk, derivatives risk, natural resources risk, equity securities risk, bonds and other fixed income securities, and management risk. More information about these risks and other risks can be found in the Fund's prospectus.

The performance information quoted in this annual report represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting ncfunds.com.

An investor should consider the investment objectives, risks, charges, and expenses of the Fund carefully before investing. The prospectus contains this and other information about the Fund. A copy of the prospectus is available at aspiration.com or by calling the Advisor at 800-683-8529. The prospectus should be read carefully before investing.

|

|

This Annual Report was first distributed to shareholders on or about November 30, 2015.

For More Information on Your Aspiration Flagship Fund:

See Our Web site at aspiration.com

or

Call Our Shareholder Services Group at 800-683-8529.

Dear Fellow Aspiration Flagship Fund Shareholder,

Aspiration was founded to be a different kind of financial firm – one that was built on trust, shared values, and a relentless focus on the needs of everyday people that much of Wall Street has increasingly ignored.

It was with this mission in mind that we created the Aspiration Flagship Fund. Our goal was to bring elite investment strategies to everyday investors. What we know about the investment approaches of the very wealthiest Americans is that they can often invest in ways that are designed to provide investment returns less linked to the roller coaster of the stock market. By losing less when markets inevitably have down periods, they make it easier for themselves to earn more when the markets trend upward once more.

However, we believe that it is, in fact, everyday investors who can least afford the big drops in the stock market. Our economy is often linked to the stock market. When the stock market goes down, much else might go down as well – our incomes, our job security, our home values, our 401(k)'s. That's why the goal of the Aspiration Flagship Fund is to grow your money steadily over the long-term while trying to reduce the volatile ups and downs of the stock market along the way.

To do this, we look at the broad universe of over 9,300 mutual funds and exchange traded funds and then pick the ones that, in our opinion, are the best of the best. Prioritizing the funds with longer track records, we select the mix of components designed to achieve the ultimate results we are seeking. While our minimum investment is only $500, as opposed to the $6,000 average for the sector, we are able to gain access, through institutional share classes usually only available to investments by large institutions, to funds from some of the best known fund families in America. And then our portfolio managers work on a daily basis to monitor the Fund's performance, make adjustments as needed, and provide oversight of the component elements of our strategy.

So how is the Aspiration Flagship Fund doing? From the standpoint of the purpose and goals of the Fund, the answer from our view is: "Pretty good, but we are constantly looking for ways to improve." The volatility we have seen in the stock market this year is exactly the type of environment we considered when designing the Aspiration Flagship Fund. And as opposed to autopilot strategies, such as index funds, non-actively managed ETFs, or the algorithms of some online investment advisors, our portfolio managers work every day to make adjustments and respond to events.

While the Fund is down somewhat, our drop in 2015, as of the close of the Fund's fiscal period on September 30, was 42% less than that of the S&P 500 – with much less volatility along the way (as measured by standard deviation).

No one likes to lose money, but if you accept that all markets and funds will have up periods and down periods, then two factors become crucial to keep in mind.

First, in today's economy, more wealth is being created by investments than by income from work. To build assets over time, it is important to stay invested and invest more as you can. History has shown it is better to weather down markets than it is to sit on the sidelines and try to time your investment to capture an upswing.

Second, portfolios with liquid alternative strategies like those in the Aspiration Flagship Fund have historically done better over the long run than ones with only index funds tracking the markets through the S&P 500.1 The Fund is designed to be less tied to the precariousness of the stock market. That does not mean total protection; sometimes your investment will still go down. But the reason to smooth out the instability of the stock market is to bring your portfolio greater returns over the long run. We believe a mix of strategies is the best approach.

Investing is not about beating the markets, but about meeting your goals. Your investment portfolio is not just something that lives on a chart on your computer screen. It is the way you reach your hopes for yourself and your family: college, home, retirement, and rainy days. There are never any guarantees in investing. But the mission of the Aspiration Flagship Fund is to generate the returns you need to reach your goals while minimizing the drops along the way.

Thank you again for your investment in the Aspiration Flagship Fund. We take our responsibility to you incredibly seriously. Having earned your trust, we will do everything we can to keep it. If you ever have any questions, please contact us at hello@aspiration.com.

Best,

Andrei Cherny

CEO, Aspiration

1 Based on the S&P 500 and Credit Suisse Liquid Alternative Beta Index (CSLAB) data from December 1997 to December 2013.

|

Average Annual Total Returns

(Unaudited)

Period ended September 30, 2015

|

Three

Months

|

Six

Months

|

Since

Inception*

|

Net Expense

Ratio**

|

Gross

Expense

Ratio***

|

|

Aspiration Flagship Fund –

Without maximum assumed

contribution reduction****

|

(3.18)%

|

(4.51)%

|

(1.21)%

|

0.50%

|

2.39%

|

|

Aspiration Flagship Fund –

With maximum assumed

contribution reduction****

|

(5.18)%

|

(6.51)%

|

(3.21)%

|

0.50%

|

2.39%

|

|

CSLAB Credit Suisse Liquid

Alternative Beta Index

|

(0.88)%

|

(2.63)%

|

1.90%

|

N/A

|

N/A

|

|

S&P 500 Total Return Index

|

(6.44)%

|

(6.18)%

|

(0.66)%

|

N/A

|

N/A

|

The performance data quoted above represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain more current performance data regarding the Fund, including performance data current to the Fund's most recent month-end, please visit aspiration.com or call the Fund at (800) 683-8529. Fee waivers and expenses reimbursements have positively impacted Fund performance.

*The Fund's inception date was October 14, 2014 for the Investor Class Shares.

** The Advisor has entered into a contractual agreement (the "Expense Limitation Agreement") with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in amounts that limit the Fund's total operating expenses (exclusive of interest, taxes, brokerage commissions, borrowing costs, fees and expenses of other investment companies in which the Fund invests, and other expenditures which are capitalized in accordance with generally accepted accounting principles, and other extraordinary expenses not incurred in the ordinary course of the Fund's business) to not more than 0.50% of the average daily net assets of the Fund for the current fiscal period. The current term of the Expense Limitation Agreement remains in effect until January 31, 2017. While there can be no assurance that the Expense Limitation Agreement will continue after that date, it is expected to continue from year-to-year thereafter.

***Gross expense ratio is from the Fund's prospectus dated July 9, 2015.

****Contribution reduction assumes a maximum 2% management fee.

|

Aspiration Flagship Fund

|

|||||||||||||||||||

|

Performance Update (Unaudited)

|

|||||||||||||||||||

|

For the period from October 14, 2014 (Date of Initial Public Investment) through September 30, 2015

|

|||||||||||||||||||

|

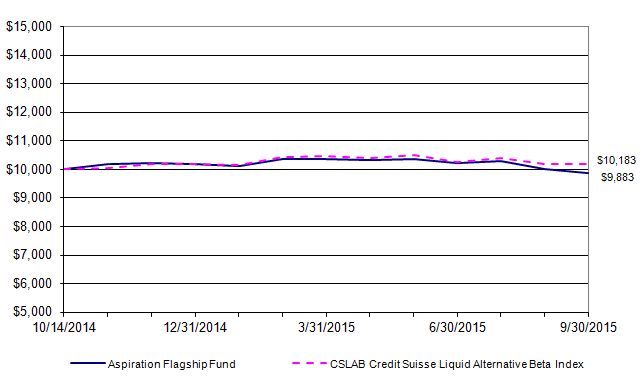

Comparison of the Change in Value of a $10,000 Investment

|

|||||||||||||||||||

|

This graph assumes an initial investment of $10,000 at October 14, 2014 (Date of Initial Public Investment). All dividends and distributions are reinvested. This graph depicts the performance of the Aspiration Flagship Fund versus the CSLAB Credit Suisse Liquid Alternative Beta Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

|

|||||||||||||||||||

|

Average Annual Total Returns

|

|||||||||||||||||||

|

Gross

|

|||||||||||||||||||

|

As of

|

Three

|

Six

|

Since

|

Inception

|

Expense

|

||||||||||||||

|

September 30, 2015

|

Months

|

Months

|

Inception

|

Date

|

Ratio*

|

||||||||||||||

|

Aspiration Flagship Fund - Without maximum

|

-3.18%

|

-4.51%

|

-1.21%

|

10/14/14

|

2.39%

|

||||||||||||||

|

assumed contribution reduction**

|

|||||||||||||||||||

|

Aspiration Flagship Fund - With maximum

|

-5.18%

|

-6.51%

|

-3.21%

|

10/14/14

|

2.39%

|

||||||||||||||

|

assumed contribution reduction**

|

|||||||||||||||||||

|

CSLAB Credit Suisse Liquid Alternative Beta

|

|||||||||||||||||||

|

Index

|

-0.88%

|

-2.63%

|

1.90%

|

N/A

|

N/A

|

||||||||||||||

* The gross expense ratio shown is from the Fund's prospectus dated July 9, 2015.

** Contribution reduction assumes a maximum 2% management fee.

Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions.

|

Aspiration Flagship Fund

|

||||||||||

|

Schedule of Investments

|

||||||||||

|

As of September 30, 2015

|

||||||||||

|

|

Shares

|

Value (Note 1)

|

||||||||

|

EXCHANGE-TRADED PRODUCTS - 19.70%

|

||||||||||

|

*

|

Credit Suisse X-Links Long/Short Equity ETN

|

5,650

|

$

|

149,273

|

||||||

|

Horizons S&P 500 Covered Call ETF

|

1,037

|

42,942

|

||||||||

|

IndexIQ ETF Trust - IQ Hedge Multi-Strategy Tracker ETF

|

10,482

|

301,882

|

||||||||

|

*

|

IQ Merger Arbitrage ETF

|

2,189

|

60,876

|

|||||||

|

iShares Core U.S. Aggregate Bond ETF

|

749

|

82,075

|

||||||||

|

iShares TIPS Bond ETF

|

711

|

78,701

|

||||||||

|

*

|

WisdomTree Managed Futures Strategy Fund

|

2,511

|

104,056

|

|||||||

|

Total Exchange-Traded Products (Cost $845,561)

|

819,805

|

|||||||||

|

OPEN-END FUNDS - 65.74%

|

||||||||||

|

361 Managed Futures Fund

|

13,450

|

154,407

|

||||||||

|

Alger Dynamic Opportunities Fund

|

15,071

|

185,369

|

||||||||

|

AmericaFirst Defensive Growth Fund

|

4,712

|

55,220

|

||||||||

|

AQR Managed Futures Strategy Fund

|

13,870

|

155,898

|

||||||||

|

BlackRock Strategic Income Opportunities Portfolio

|

7,787

|

77,326

|

||||||||

|

Boston Partners Global Long/Short Fund

|

5,397

|

56,348

|

||||||||

|

Boston Partners Long/Short Research Fund

|

6,901

|

103,165

|

||||||||

|

Deutsche Select Alternative Allocation Fund

|

2,560

|

27,006

|

||||||||

|

*

|

Diamond Hill Long-Short Fund

|

3,401

|

78,091

|

|||||||

|

*

|

Eaton Vance Hedged Stock Fund

|

3,087

|

24,916

|

|||||||

|

Financial Investors Trust - Listed Private Equity Fund

|

11,240

|

73,958

|

||||||||

|

FPA New Income, Inc.

|

1,864

|

18,787

|

||||||||

|

*

|

Gabelli Enterprise Mergers and Acquisitions Fund

|

16,129

|

217,575

|

|||||||

|

Glenmede Secured Options Portfolio

|

10,987

|

129,755

|

||||||||

|

Guggenheim - Macro Opportunities Fund

|

3,991

|

104,162

|

||||||||

|

Hancock Horizon Quantitative Long/Short Fund

|

2,028

|

36,344

|

||||||||

|

Highland Long/Short Healthcare Fund

|

2,325

|

35,961

|

||||||||

|

Iron Strategic Income Fund

|

10,770

|

112,658

|

||||||||

|

Ironclad Managed Risk Fund

|

13,603

|

147,597

|

||||||||

|

KCM Macro Trends Fund

|

5,504

|

64,066

|

||||||||

|

Litman Gregory Masters Alternative Strategies Fund

|

26,943

|

299,063

|

||||||||

|

MainStay Unconstrained Bond Fund

|

8,431

|

72,507

|

||||||||

|

MFS Global Alternative Strategy Fund

|

27,373

|

281,940

|

||||||||

|

PIMCO Unconstrained Bond Fund

|

3,837

|

40,792

|

||||||||

|

TCW/Gargoyle Hedged Value Fund

|

13,955

|

126,573

|

||||||||

|

The Merger Fund

|

3,661

|

55,973

|

||||||||

|

Total Open-End Funds (Cost $2,852,946)

|

2,735,457

|

|||||||||

|

(Continued)

|

||||||||||

|

Aspiration Flagship Fund

|

|||||||||||||||

|

Schedule of Investments - Continued

|

|||||||||||||||

|

As of September 30, 2015

|

|||||||||||||||

|

Shares

|

Value (Note 1)

|

||||||||||||||

|

SHORT-TERM INVESTMENT - 13.66%

|

|||||||||||||||

|

§

|

Fidelity Institutional Money Market Funds - Treasury Portfolio, 0.01%

|

568,440

|

$

|

568,440

|

|||||||||||

|

Total Short-Term Investment (Cost $568,440)

|

568,440

|

||||||||||||||

|

Total Value of Investments (Cost $4,266,947) - 99.10%

|

$

|

4,123,702

|

|||||||||||||

|

Other Assets Less Liabilities - 0.90%

|

37,423

|

||||||||||||||

|

NET ASSETS - 100.00%

|

$

|

4,161,125

|

|||||||||||||

|

*

|

Non-income producing investment

|

||||||||||||||

|

§

|

Represents 7 day effective yield

|

||||||||||||||

|

Summary of Investments

|

|||||||||||||||

|

% of Net

|

|||||||||||||||

|

Assets

|

Value

|

||||||||||||||

|

Exchange-Traded Products

|

19.70%

|

819,805

|

|||||||||||||

|

Open-End Funds

|

65.74%

|

2,735,457

|

|||||||||||||

|

Short-Term Investment

|

13.66%

|

568,440

|

|||||||||||||

|

Other Assets Less Liabilities

|

0.90%

|

37,423

|

|||||||||||||

| Total | 100.00% | $ | 4,161,125 | ||||||||||||

|

See Notes to Financial Statements

|

|||||||||||||||

|

Aspiration Flagship Fund

|

|||

|

Statement of Assets and Liabilities

|

|||

|

As of September 30, 2015

|

|||

|

Assets:

|

|||

|

Investments, at value (cost $4,266,947)

|

$

|

4,123,702

|

|

|

Receivables:

|

|||

|

From Advisor (note 2)

|

29,968

|

||

|

Fund shares sold

|

26,435

|

||

|

Dividends

|

2,838

|

||

|

Prepaid expenses:

|

|||

|

Registration and filing expenses

|

9,825

|

||

|

Fund accounting fees

|

2,246

|

||

|

Other operating expenses

|

761

|

||

|

Deferred offering costs (note 2)

|

10,840

|

||

|

Total Assets

|

4,206,615

|

||

|

Liabilities:

|

|||

|

Payables:

|

|||

|

Fund shares repurchased

|

12,783

|

||

|

Accrued expenses:

|

|||

|

Professional fees

|

28,860

|

||

|

Compliance fees

|

1,750

|

||

|

Distribution and service fees - Investor Class Shares

|

1,119

|

||

|

Distribution expenses

|

450

|

||

|

Shareholder fulfillment expenses

|

350

|

||

|

Custody fees

|

140

|

||

|

Administration fees

|

38

|

||

|

Total Liabilities

|

45,490

|

||

|

Net Assets

|

$

|

4,161,125

|

|

|

Net Assets Consist of:

|

|||

|

Paid in Capital

|

$

|

4,321,331

|

|

|

Accumulated undistributed net investment income

|

7,545

|

||

|

Accumulated net realized loss on investments

|

(24,506)

|

||

|

Net unrealized depreciation on investments

|

(143,245)

|

||

|

Total Net Assets

|

$

|

4,161,125

|

|

|

Shares Outstanding, no par value (unlimited authorized shares)

|

426,657

|

||

|

Net Asset Value, Maximum Offering Price and Redemption Price Per Share

|

$

|

9.75

|

|

|

See Notes to Financial Statements

|

|||

|

Aspiration Flagship Fund

|

|||

|

Statement of Operations

|

|||

|

For the period from October 14, 2014 (Date of Initial Public Investment) through September 30, 2015

|

|||

|

Investment Income:

|

|||

|

Dividends

|

$

|

32,871

|

|

| Total Investment Income |

32,871

|

||

|

Expenses:

|

|||

|

Offering costs (note 2)

|

194,205

|

||

|

Professional fees

|

40,738

|

||

|

Compliance fees (note 2)

|

40,331

|

||

|

Fund accounting fees (note 2)

|

26,470

|

||

|

Administration fees (note 2)

|

24,038

|

||

|

Registration and filing expenses

|

28,982

|

||

|

Transfer Agent fees (note 2)

|

21,299

|

||

|

Insurance fees

|

15,618

|

||

|

Trustee fees and meeting expenses

|

15,000

|

||

|

Custody fees (note 2)

|

9,078

|

||

|

Shareholder fulfillment expenses

|

7,300

|

||

|

Distribution and service fees - Investor Class Shares (note 3)

|

5,623

|

||

|

Distribution expenses (note 2)

|

4,756

|

||

|

Securities pricing fees

|

1,219

|

||

|

Other operating expenses

|

1,112

|

||

|

Total Expenses

|

435,769

|

||

| Expenses reimbursed by advisor (note 2) |

(424,530)

|

||

| Net Expenses |

11,239

|

||

|

Net Investment Income

|

21,632

|

||

|

Realized and Unrealized Loss on Investments

|

|||

|

Net realized loss from investment transactions

|

(24,506)

|

||

|

Net change in unrealized depreciation on investments

|

(143,245)

|

||

|

Net Realized and Unrealized Loss on Investments

|

(167,751)

|

||

|

Net Decrease in Net Assets Resulting from Operations

|

$

|

(146,119)

|

|

|

See Notes to Financial Statements

|

|||

|

Aspiration Flagship Fund

|

||||||||

|

Statement of Changes in Net Assets

|

||||||||

|

For the period from October 14, 2014 (Date of Initial Public Investment) through September 30, 2015

|

||||||||

|

Operations:

|

||||||||

| Net investment income |

$

|

21,632

|

||||||

| Net realized loss from investment transactions |

(24,506)

|

|||||||

| Net change in unrealized depreciation on investments |

(143,245)

|

|||||||

|

Decrease in Net Assets Resulting from Operations

|

(146,119)

|

|||||||

|

Distributions to Shareholders:

|

||||||||

|

Net investment income

|

(14,087)

|

|||||||

|

Decrease in Net Assets Resulting from Distributions

|

(14,087)

|

|||||||

|

Beneficial Interest Transactions:

|

||||||||

|

Shares sold

|

5,451,496

|

|||||||

|

Reinvested dividends and distributions

|

14,087

|

|||||||

|

Shares repurchased

|

(1,244,252)

|

|||||||

|

Net Increase in Beneficial Interest Transactions

|

4,221,331

|

|||||||

|

Net Increase in Net Assets

|

4,061,125

|

|||||||

|

Net Assets:

|

||||||||

|

Beginning of period

|

$

|

100,000

|

||||||

|

End of period

|

$

|

4,161,125

|

||||||

|

Undistributed Net Investment Income

|

$

|

7,545

|

||||||

|

Share Information:

|

||||||||

| Shares Sold |

537,653

|

|||||||

| Reinvested Distributions |

1,400

|

|||||||

| Shares repurchased |

(122,396)

|

|||||||

| Net Increase in Shares of Beneficial Interest |

416,657

|

|||||||

|

See Notes to Financial Statements

|

||||||||

|

Aspiration Flagship Fund

|

|||||||

|

Financial Highlights

|

|||||||

|

For a share outstanding during the period from

|

|||||||

|

October 14, 2014 (Date of Initial Public Investment) through September 30, 2015

|

|||||||

|

Net Asset Value, Beginning of Period

|

$

|

10.00

|

|||||

|

Income (Loss) from Investment Operations

|

|||||||

|

Net investment income

|

0.16

|

||||||

|

Net realized and unrealized loss on investments

|

(0.27)

|

||||||

|

Total from Investment Operations

|

(0.11)

|

||||||

|

Less Distributions to Shareholders:

|

|||||||

|

Net investment income

|

(0.14)

|

||||||

|

Total Distributions

|

(0.14)

|

||||||

|

Net Asset Value, End of Period

|

$

|

9.75

|

|||||

|

Total Return (b)(e)

|

(3.21)%

|

||||||

|

Total Return (b)(f)

|

(1.21)%

|

||||||

|

Net Assets, End of Period (in thousands)

|

$

|

4,161

|

|||||

|

Ratios of:

|

|||||||

|

Gross Expenses to Average Net Assets (c)

|

19.23%

|

(a)

|

|||||

|

Net Expenses to Average Net Assets (c)

|

0.50%

|

(a)

|

|||||

|

Net Investment Income to Average Net Assets (c)(d)

|

0.95%

|

(a)

|

|||||

|

Portfolio turnover rate

|

67.24%

|

(b)

|

|||||

|

(a)

|

Annualized

|

||||||

|

(b)

|

Not annualized.

|

||||||

|

(c)

|

Does not include expenses of the investment companies in which the Fund invests.

|

||||||

|

(d)

|

Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests.

|

||||||

|

(e)

|

Performance with maximum assumed contribution reduction of 2%. Contribution reduction assumes a maximum 2% management fee.

|

||||||

|

(f)

|

Performance without maximum assumed contribution reduction of 2%.

|

||||||

|

See Notes to Financial Statements

|

|||||||

Aspiration Flagship Fund

Notes to Financial Statements

1. Organization and Significant Accounting Policies

The Aspiration Flagship Fund (the "Fund") is a series of the Aspiration Funds (the "Trust"). The Trust was organized as a Delaware statutory trust on October 16, 2013 and is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company.

The Fund is a separate diversified series of the Trust and commenced operations on October 14, 2014. The investment objective of the Fund is to seek long-term capital appreciation by providing risk-adjusted returns. The Fund seeks to achieve its investment objective by investing primarily in shares of registered investment companies, including open-end funds, exchange-traded funds ("ETFs"), and closed-end funds that emphasize alternative strategies, such as funds that sell securities short; employ asset allocation, arbitrage, and/or option-hedged strategies; or that invest in distressed securities, the natural resources sector, and business development companies ("BDCs").

The Fund currently has an unlimited number of authorized shares, which are divided into two classes - Investor Class Shares and Class C Shares. Each class of shares has equal rights as to assets of the Fund, and the classes are identical, except for differences in ongoing distribution and service fees and a contingent deferred sales charge on the Class C Shares. Both share classes are subject to distribution plan fees as described in Note 3. Income, expenses (other than distribution and service fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based upon its relative net assets. All classes have equal voting privileges, except where otherwise required by law or when the Trustees determine that the matter to be voted on affects only the interests of the shareholders of a particular class. As of September 30, 2015, no Class C Shares have been issued.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP").

Investment Valuation

The Fund's investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the portfolio security is principally traded closes early or if trading of the particular portfolio security is halted during the day and does not resume prior to the Fund's net asset value calculation) or which cannot be accurately valued using the Fund's normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. A portfolio security's "fair value" price may differ from the price next available for that portfolio security using the Fund's normal pricing procedures. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value.

Each Fund may invest in portfolios of open-end investment companies (the "Underlying Funds"). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the Underlying Funds. Open-ended funds are valued at their respective net asset values as reported by such investment companies.

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: quoted prices in active markets for identical securities

Level 2: other significant observable inputs (including quoted prices for similar securities and identical securities in inactive markets, interest rates, credit risk, etc.)

(Continued)

Aspiration Flagship Fund

Notes to Financial Statements – Continued

Level 3: significant unobservable inputs (including the Fund's own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of September 30, 2015 for the Fund's assets measured at fair value:

|

Aspiration Flagship Fund

|

||||||||

|

Investments in Securities (a)

|

Total

|

Level 1

|

Level 2

|

Level 3

|

||||

|

Assets

|

||||||||

|

Exchange-Traded Products

|

$

|

819,805

|

$

|

819,805

|

$

|

-

|

$

|

-

|

|

Open-End Funds

|

2,735,457

|

2,735,457

|

-

|

-

|

||||

|

Short-Term Investment

|

568,440

|

568,440

|

-

|

-

|

||||

|

Total Assets

|

$

|

4,123,702

|

$

|

4,123,702

|

$

|

-

|

$

|

-

|

(a) The Fund had no transfers into or out of Level 1, 2, or 3 during the initial period ended September 30, 2015. It is the Fund's policy to record transfers at the end of the year.

Concentrations of Risk

The Fund seeks to achieve its investment objective by investing primarily in shares of registered investment companies, including open-end funds, exchange-traded funds ("ETFs"), and closed-end funds that emphasize alternative strategies, such as funds that sell securities short; employ asset allocation, arbitrage and/or option-hedged strategies; or that invest in distressed securities, the natural resources sector and business development companies ("BDCs"). Underlying funds will be purchased and sold based upon criteria which include, but are not limited to, correlation with other portfolio holdings and major indices, risk-adjusted returns believed to help the Fund achieve its goals, portfolio diversification, manager diligence, expense ratios, and compliance with the Fund's investment restrictions. The principal risks of investing in the Fund include: correlation risk, investment company risk, allocation risk, underlying fund concentration, leveraging, foreign investing and emerging markets risk, convertible securities risk, BDC risk, high yield risk, liquidity risk, market risk, short sale risk, commodities risk, ETFs, distressed companies risk, alternative asset class risk, long/short selling risk, arbitrage risk, derivatives risk, futures risk, natural resources risk, equity securities, bonds and other fixed income securities, management risk, and new fund risk.

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion/amortization of discounts and premiums. Realized gains and losses are determined on the identified cost basis, which is the same basis used for Federal income tax purposes.

Expenses

The Fund bears expenses incurred specifically on its behalf as well as a portion of Trust level expenses, which are allocated according to methods reviewed annually by the Board of Trustees ("Trustees").

(Continued)

Aspiration Flagship Fund

Notes to Financial Statements – Continued

Distributions

The Fund may declare and distribute dividends from net investment income (if any), annually. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are recorded on ex-date.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

Organization and Deferred Offering Costs

Organization costs of $94,391, which were incurred through July 31, 2014, were reimbursed by the Advisor. The organizational costs are subject to repayment by the Fund until July 31, 2017 (see note 2).

Deferred offering costs of $205,045 consist of legal fees for preparing the initial prospectus and statement of additional information. These offering costs, which are subject to the Expense Limitation Agreement, are amortized to expense over twelve months on a straight-line basis. For the period ended September 30, 2015, $194,205 in deferred offering costs were expensed.

2. Transactions with Related Parties and Service Providers

Advisor

Aspiration Fund Adviser, LLC (the "Advisor") does not impose a set fee to manage individual shareholder accounts. Instead, the shareholders may pay the Advisor a fee to manage their individual accounts in the amount they believe is fair, ranging from 0% to 2% of their net assets. Only clients of the Advisor may invest in the Fund. Those Advisor clients must establish an advisory fee relationship and open an individual account with the Advisor before investing in the Fund. The Fund is responsible for its own operating expenses. For the initial period ended September 30, 2015, no advisory fees were incurred by the Fund.

The Advisor has entered into a contractual agreement (the "Expense Limitation Agreement") with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in amounts that limit the Fund's total operating expenses (exclusive of interest, taxes, brokerage commissions, borrowing costs, fees and expenses of other investment companies in which the Fund invests, and other expenditures which are capitalized in accordance with GAAP, and other extraordinary expenses not incurred in the ordinary course of the Fund's business) to not more than 0.50% of the average daily net assets of the Fund for the current fiscal period. The current term of the Expense Limitation Agreement remains in effect until January 31, 2017. While there can be no assurance that the Expense Limitation Agreement will continue after that date, it is expected to continue from year-to-year thereafter.

The Advisor paid the initial organizational costs of the Fund that were incurred prior to commencement of operations, which amounted to $123,370. During the period ended September 30, 2015, the Advisor elected to bear $28,679 of those organizational costs and not make them subject to recoupment. As of September 30, 2015, $94,691 of the organizational costs are subject to recoupment, provided the Fund is able to make such repayment without causing operating expenses to exceed the annual rate of 0.50% and provided that the fees and expenses are recouped on or before July 31, 2017. For the period ended September 30, 2015, the Advisor reimbursed the Fund $424,530, of which $194,205 related to offering costs expensed during the period ended September 30, 2015, and $230,325 was related to other reimbursements, which are subject to recoupment on or before September 30, 2018 provided that the annual expense ratio does not exceed 0.50%. In addition, the Advisor elected to bear $77,561 of additional offering costs incurred prior to commencement of operations and exclude them from recoupment.

(Continued)

Aspiration Flagship Fund

Notes to Financial Statements – Continued

Sub-Advisor

Emerald Separate Account Management, LLC (the "Sub-Advisor") is responsible for management of the Fund's investment portfolio according to the Fund's investment objective, policies, and restrictions. The Sub-Advisor is subject to the authority of the Board of Trustees and oversight by the Advisor. Pursuant to a sub-advisory agreement between the Advisor and the Sub-Advisor, the Sub-Advisor is entitled to receive an annual sub-advisory fee equal to 30% of the fees received, in arrears, by the Advisor for advisory services provided to the Fund, calculated after the Advisor donates 10% of such fees to charity.

Administrator

For the period from October 14, 2014 (Date of Initial Public Investment) through December 30, 2014, the Fund had engaged Ultimus Fund Solutions, LLC as its Administrator. The Fund paid $4,000 to Ultimus Fund Solutions, LLC for the period they were engaged as Administrator of the Fund.

As of December 31, 2014, the Fund engaged The Nottingham Company as its Administrator (the "Administrator"). The Fund pays a monthly fee to the Administrator based upon the average daily net assets of the Fund and subject to a minimum of $2,000 per month. The Fund incurred $20,038 of fees by the Administrator for the period from December 31, 2014 through September 30, 2015.

Fund Accounting Services

For the period from October 14, 2014 (Date of Initial Public Investment) through December 30, 2014, the Fund had engaged Ultimus Fund Solutions, LLC to provide Fund Accounting Services per the Accounting Services Agreement with the Fund. The Fund paid $4,017 to Ultimus Fund Solutions, LLC for the period they were engaged to provide Fund Accounting Services to the Fund.

As of December 31, 2014, the Fund engaged The Nottingham Company as its Fund Accounting Services Provider. Under the terms of the Fund Accounting and Administration Agreement, the Fund Accounting Service Provider calculates the daily net asset value per share and maintains the financial books and records for the Fund. The Fund incurred $22,453 of fees by The Nottingham Company for the period from December 31, 2014 through September 30, 2015.

Compliance Services

Cipperman Compliance Services, LLC provides services as the Trust's Chief Compliance Officer. Cipperman Compliance Services, LLC is entitled to receive customary fees from the Fund for their services pursuant to the Compliance Services agreement with the Fund. During the period ended September 30, 2015, the Fund incurred $40,331 in compliance fees.

Transfer Agent

For the period from October 14, 2014 (Date of Initial Public Investment) through December 30, 2014, Ultimus Fund Solutions, LLC served as the Fund's transfer agent. The Fund paid $2,000 to Ultimus Fund Solutions, LLC for the period they were engaged as Transfer Agent for the Fund.

As of December 31, 2014, Nottingham Shareholder Services, LLC ("Transfer Agent") serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation from the Fund pursuant to the Transfer Agent's fee arrangements with the Fund. The Fund paid $19,299 to Nottingham Shareholder Services, LLC for the period from December 31, 2014 through September 30, 2015.

Distributor

For the period from October 14, 2014 (Date of Initial Public Investment) through December 30, 2014, Ultimus Fund Distributors, LLC served as the Fund's distributor of shares of the Fund. The Fund paid $530 to Ultimus Fund Distributors, LLC for the period they were engaged as the Distributor for the Fund.

As of December 31, 2014, Capital Investment Group, Inc. (the "Distributor") serves as the Fund's principal underwriter and distributor. The Distributor receives $5,000 per year paid in monthly installments for services provided and expenses assumed. The Fund incurred $4,226 of fees by Capital Investment Group, Inc. for the period from December 31, 2014 through September 30, 2015.

(Continued)

Aspiration Flagship Fund

Notes to Financial Statements – Continued

Officers and Trustees of the Trust

During the period from October 14, 2014 (Date of Initial Public Investment) through December 30, 2014, certain officers of the Trust were also officers of Ultimus Fund Solutions, LLC.

As of September 30, 2015, certain officers of the Trust were also officers of the Administrator. A Trustee and an officer are also officers of the Advisor.

3. Distribution and Service Fees

The Trustees, including a majority of the Trustees who are not "interested persons" of the Trust as defined in the 1940 Act and who have no direct or indirect financial interest in such plan or in any agreement related to such plan, adopted a distribution plan pursuant to Rule 12b-1 of the 1940 Act (the "Plan"). The 1940 Act regulates the manner in which a regulated investment company may assume expenses of distributing and promoting the sales of its shares and servicing of its shareholder accounts. The Plan provides that the Fund may incur certain expenses, which may not exceed 0.25% per annum of the average daily net assets of the Investor Class Shares and 1.00% per annum of the average daily net assets of the Class C Shares for each year elapsed subsequent to adoption of the Plan, for payment to the Distributor and others for items such as advertising expenses, selling expenses, commissions, travel or other expenses reasonably intended to result in sales of shares of the Fund or support servicing of shareholder accounts. For the initial period ended September 30, 2015, $5,623 in distribution and service fees were incurred by the Investor Class Shares of the Fund.

4. Purchases and Sales of Investment Securities

For the initial period ended September 30, 2015, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

|

Purchases of Securities

|

Proceeds from Sales of Securities

|

|

$5,094,743

|

$1,371,730

|

5. Federal Income Tax

Distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. There were no such reclassifications as of September 30, 2015.

Management reviewed the Fund's tax positions taken on federal income tax returns for the open tax year/period ended September 30, 2015. As of and during the initial period ended September 30, 2015, the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the initial period, the Fund did not incur any interest or penalties.

Distributions during the initial period ended were characterized for tax purposes as follows:

|

September 30, 2015

|

|

|

Ordinary Income

|

$ 14,087 |

(Continued)

Aspiration Flagship Fund

Notes to Financial Statements – Continued

At September 30, 2015, the tax-basis cost of investments and components of distributable earnings were as follows:

|

Cost of Investments

|

$ |

4,266,959

|

||||

|

Unrealized Appreciation

|

$ |

2,251

|

||||

|

Unrealized Depreciation

|

(145,508)

|

|||||

|

Net Unrealized Depreciation

|

(143,257)

|

|||||

|

Undistributed Net Investment Income

|

7,545

|

|||||

|

Accumulated Long-Term Gains

|

-

|

|||||

|

Post-October Losses

|

(24,494)

|

|||||

|

Capital Loss Carryforward

|

-

|

|||||

|

Accumulated Deficit

|

$ |

(160,206)

|

||||

The difference between book-basis and tax-basis net unrealized depreciation is attributable to the tax deferral of losses from wash sales. For tax purposes, the current year post-October loss was $24,494 realized during the period from November 1, 2014 through September 30, 2015. Post-October losses will be recognized for tax purposes on the first business day of the Fund's next fiscal year, October 1, 2015. There is no Capital Loss Carryforward for the fiscal year ended September 30, 2015.

6. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of September 30, 2015, Aspiration Growth Opportunities II, LP owned 27.61% of the Fund, and a related party, Joseph N. Sanberg owned 0.24% of the Fund. Collectively, Aspiration Growth Opportunities II, LP and Joseph N. Sanberg could be deemed to have a controlling interest in the Fund.

7. Commitments and Contingencies

Under the Trust's organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects risk of loss to be remote.

8. Subsequent Events

In accordance with GAAP, the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Trustees of

Aspiration Flagship Fund

(a series of Aspiration Funds)

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Aspiration Flagship Fund (the "Fund"), a series of Aspiration Funds, as of September 30, 2015, and the related statements of operations and changes in net assets and the financial highlights for the period October 14, 2014 (date of initial public investment) through September 30, 2015. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2015, by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Aspiration Flagship Fund as of September 30, 2015, the results of its operations, the changes in its net assets, and the financial highlights for the period October 14, 2014 (date of initial public investment) through September 30, 2015, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

November 30, 2015

Aspiration Flagship Fund

Additional Information

(Unaudited)

1. Proxy Voting Policies and Voting Record

A copy of the Trust's Proxy Voting and Disclosure Policy and the Advisor's Disclosure Policy are included as Appendix B to the Fund's Statement of Additional Information and are available, without charge, upon request, by calling 800-773-3863, and on the website of the Securities and Exchange Commission ("SEC") at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent period ended June 30 is available (1) without charge, upon request, by calling the Fund at the number above and (2) on the SEC's website at sec.gov.

2. Quarterly Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund's Forms N-Q are available on the SEC's website at sec.gov. You may review and make copies at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 800-SEC-0330. You may also obtain copies without charge, upon request, by calling the Fund at 800-773-3863.

3. Tax Information

We are required to advise you within 60 days of the Fund's fiscal year-end regarding federal tax status of certain distributions received by shareholders during each fiscal year. The following information is provided for the Fund's initial period ended September 30, 2015.

During the initial period ended September 30, 2015, the Fund paid $14,087 in ordinary income distributions and no long-term capital gain distributions.

Dividend and distributions received by retirement plans such as IRAs, Keogh-type plans, and 403(b) plans need not be reported as taxable income. However, many retirement plans may need this information for their annual information meeting.

4. Schedule of Shareholder Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, and (2) ongoing costs, including investment advisory fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The last line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

(Continued)

Aspiration Flagship Fund

Additional Information

(Unaudited)

|

Investor Class Shares

|

Beginning

Account Value

April 1, 2015

|

Ending

Account Value

September 30, 2015

|

Expenses Paid

During Period*

|

|

Actual

Hypothetical (5% annual return before expenses)

|

|||

|

$1,000.00

|

$1,060.00

|

$2.58

|

|

|

$1,000.00

|

$1,022.56

|

$2.54

|

*Expenses are equal to the average account value over the period multiplied by the Fund's annualized expense ratio, multiplied by 183/365 (to reflect the initial period).

5. Approval of Advisory Agreement

The Advisor supervises the Fund's investments pursuant to an Investment Advisory Agreement. At the organizational meeting of the Fund's Board of Trustees on February 24, 2014, the Trustees approved the Investment Advisory Agreement through January 1, 2016 for an initial term of two years, at which time the Agreement would continue year-to-year thereafter. In considering whether to approve the Investment Advisory Agreement, the Trustees reviewed and considered the information they deemed reasonably necessary, including the following material factors: (i) the nature, extent, and quality of the services provided by the Advisor; (ii) investment performance of the Advisor; (iii) the costs of the services to be provided; (iv) the investment advisory fee rates; (v) the Advisor's profitability; and (vi) the extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Fund's investors.

At the meeting, the Trustees reviewed various informational materials including, without limitation, the Investment Advisory Agreement for the Fund; a memorandum from the Advisor to the Trustees containing information about the Advisor, its business, its finances, its personnel, its services to the Fund, and comparative expense ratio information for other mutual funds with a strategy similar to the Fund; and a memorandum from the Fund's legal counsel that summarized the fiduciary duties and responsibilities of the Board of Trustees in reviewing and approving the Investment Advisory Agreement, including the types of information and factors that should be considered in order to make an informed decision. Trust Counsel stated that the Fund will not pay an advisory fee to the Advisor. He explained that only clients of the Advisor may invest in the Fund, and that such clients have the discretion to pay the Advisor a fee in an amount they deem to be fair and reasonable. Trust Counsel then referred to the Expense Limitation Agreement and explained that the Advisor has agreed to reimburse the Fund's operating expenses to the extent necessary to limit the Fund's total annual operating expenses to 0.50% of the Fund's average daily net assets through January 31, 2017. He noted that the Expense Limitation Agreement also permits the Advisor to recoup any expense reimbursements from the Fund for a period of three years following such reimbursement, provided such recoupment does not cause the Fund's total annual operating expenses to exceed 0.50% of the Fund's average daily net assets.

In considering the nature, extent, and quality of the services provided by the Advisor, the Trustees considered statistical information regarding the Fund's projected expense ratio and its various components, including contractual expense reimbursements. The Trustees also considered comparisons of this expense ratio to the expense information of the Fund's peer group, as determined by the Advisor, and funds within the Morningstar category of Multi-alternative Funds. The Trustees noted that the overall expense ratio of the Fund, after expense reimbursements, will be significantly lower than the average and median expense ratios for Multi-alternative Funds and lower than the annual net expense ratio reported by Morningstar for each of the nine funds in the peer group for the Fund identified by the Advisor.

In considering the investment performance of the Advisor, the Trustees noted that the Fund had not yet started operations and did not have a performance track record. The Trustees reviewed investment performance data of other Multi-alternative Funds prepared by Morningstar.

In considering the costs of the services to be provided, the Trustees considered statistical information regarding the Fund's projected expense ratio and its various components, including contractual expense reimbursements. It also considered comparisons of this expense ratio to the expense information for the Fund's peer group, as determined by the Advisor, and funds within the Morningstar category of Multi-alternative Funds. The Trustees noted that the overall expense ratio of the Fund, after expense reimbursements, will be significantly lower than the average and median expense ratios for Multi-alternative Funds and lower than the annual net expense ratio reported by Morningstar for each of the nine funds in the peer group for the Fund identified by the Advisor. The Trustees observed that, under the expense cap arrangement agreed to by the Advisor, shareholders of the Fund are provided a competitive expense ratio during the first twelve months of the Fund's operations.

(Continued)

Aspiration Flagship Fund

Additional Information

(Unaudited)

In considering the investment advisory fee rates, the Trustees discussed the Fund's lack of an advisory fee under the Investment Advisory Agreement. The Trustees noted that the mutual funds that the Fund proposes to invest in will have advisory fees. Additionally, the Trustees received and reviewed information regarding the advisory fee rates of other funds in its relevant peer group of Multi-alternative Funds. The Trustees determined that under the circumstances, the advisory fee of 0.00% of the Fund's average daily net assets is fair and reasonable.

In considering the profitability of the Advisor, the Trustees discussed the projected profitability of the Advisor and the other ancillary benefits that the Advisor may receive with regard to providing advisory services to the Fund. The Advisory will receive advisory fees at the account level as an indirect benefit that is determined by each investor. The Trustees agreed to look at the Advisor's actual profitability after the Fund commenced operations.

In considering the extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect those economies of scale for the benefit of the Fund's investors, the Trustees noted that Fund shareholders will benefit from the absence of a Fund advisory fee, as well as the 50 basis point expense cap.

The Advisor also has undertaken to disclose the aggregate amount of advisory fees received by the Advisor and, as of December 31, 2014, the aggregate amount of advisory fees was $0.

Based upon all of the foregoing considerations, the Board of Trustees, including a majority of the Independent Trustees, approved the Investment Advisory Agreement for the Fund.

6. Information about Trustees and Officers

The business and affairs of the Fund and the Trust are managed under the direction of the Board of Trustees of the Trust. Information concerning the Trustees and officers of the Trust and Fund is set forth below. Generally, each Trustee and officer serves an indefinite term or until certain circumstances such as their resignation, death, or otherwise as specified in the Trust's organizational documents. Any Trustee may be removed at a meeting of shareholders by a vote meeting the requirements of the Trust's organizational documents. The Statement of Additional Information of the Fund includes additional information about the Trustees and officers and is available, without charge, upon request by calling the Fund at 1-800-773-3863. The address of each Trustee and officer, unless otherwise indicated below, is 116 South Franklin Street, Rocky Mount, North Carolina 27804. The Independent Trustees each received aggregate compensation of $10,000 during the initial period ended September 30, 2015 from the Fund for their services to the Fund and Trust.

(Continued)

Aspiration Flagship Fund

Additional Information

(Unaudited)

|

Name, Age

and Address |

Position

held with Funds or Trust |

Length

of Time

Served

|

Principal Occupation

During Past 5 Years |

Number of

Portfolios in

Fund

Complex

Overseen

by Trustee

|

Other Directorships

Held by Trustee During Past 5 Years |

|

Independent Trustees

|

|||||

|

Xavier A. Gutierrez

(1973) 116 South Franklin Street Rocky Mount, NC 27804 |

Independent

Trustee and

Chairman

|

Since

2/2014

|

President and Chief Investment Officer of Meruelo Group (diversified holding company) since 2010; President and Chief Investment Officer of Meruelo Investment Partners (private equity investments and private investments) since 2010. Previously, Principal and Managing Director of Phoenix Realty Group (real estate private equity firm) from 2003 until 2010.

|

2

|

Sizmek, Inc.

|

|

David L. Kingsdale

(1963) 116 South Franklin Street Rocky Mount, NC 27804 |

Independent

Trustee

|

Since

10/2014

|

Chief Executive Officer of Millennium Dance Media, LLC since 2010; Owner of DLK, Inc. (media consulting agency) from 2009 until 2010.

|

2

|

The Giving Back Fund; Prime Access Capital.

|

|

Interested Trustee*

|

|||||

| Joseph Sanberg

(1979)

116 South Franklin Street Rocky Mount, NC

27804

|

Trustee | Since

2/2014

|

Investor since 2009. | 2 | None. |

| * Basis of Interestedness. Mr. Sanberg is an Interested Trustee because he is an indirect control owner of the Advisor. | |||||

|

Other Officers

|

|||||

|

Andrei Cherny

(1975) 116 South Franklin Street Rocky Mount, NC 27804 |

President

|

Since

2/2014

|

Chief Executive Officer of Aspiration Fund Adviser, LLC since 2013; Chair, Board Member and President of Democracy: a Journal of Ideas since 2009. Previously, Managing Director of Burson-Marsteller (public relations and communications firm) from 2012 until 2013; Senior Adviser of Burson-Marsteller from 2010 until 2012.

|

n/a

|

n/a

|

|

Katherine M. Honey

(1975) 116 South Franklin Street Rocky Mount, NC 27804 |

Secretary

|

Since

12/2014

|

EVP of The Nottingham Company since 2008.

|

n/a

|

n/a

|

|

Ashley E. Harris

(1984) 116 South Franklin Street Rocky Mount, NC 27804 |

Treasurer

|

Since

12/2014

|

Fund Accounting Manager and Financial Reporting, The Nottingham Company since 2008.

|

n/a

|

n/a

|

|

Ryan DelGuidice

(1990) 480 East Swedesford Road Wayne, PA 19087 |

Chief

Compliance

Officer

|

Since

12/2014

|

Manager of Cipperman Compliance Services since 2013; Regulatory Administration Associate of BNY Mellon.

|

n/a

|

n/a

|

Aspiration Flagship Fund

is a series of

Aspiration Funds

|

For Shareholder Service Inquiries:

|

For Investment Advisor Inquiries:

|

|

Nottingham Shareholder Services, LLC

|

Aspiration Fund Adviser, LLC

|

|

116 South Franklin Street

|

4640 Admiralty Way

|

| Post Office Drawer 4365 | Marina Del Rey, CA 90292 |

| Rocky Mount, North Carolina 27803 | |

| Telephone: | Telephone: |

| 800-773-3863 | 800-683-8529 |

| World Wide Web @: | World Wide Web @: |

| ncfunds.com | aspiration.com |

|

Item 2.

|

CODE OF ETHICS.

|

|

|

|

|

(a)

|

The registrant, as of the end of the period covered by this report, has adopted a code of ethics that applies to its Principal Executive Officer, Principal Financial Officer, and Principal Accounting Officer(s), or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party.

|

| (c) | There have been no substantive amendments during the period covered by this report. |

| (d) | The registrant has not granted, during the period covered by this report, any waivers, including an implicit waiver. |

| (f)(1) | A copy of the code of ethics that applies to the registrant's Principal Executive Officer and Principal Financial Officer is filed pursuant to Item 12.(a)(1) below. |

| Item 3. | AUDIT COMMITTEE FINANCIAL EXPERT. |

| The registrant's Board of Trustees has determined that the registrant has an audit committee financial expert, as defined in Item 3 of Form N-CSR, serving on its audit committee. | |

| As of the date of this report, September 30, 2015, the registrant's audit committee financial expert is Mr. Xavier A. Gutierrez, Jr. Mr. Gutierrez is "independent" for purposes of Item 3 of Form N-CSR. | |

| Item 4. | PRINCIPAL ACCOUNTANT FEES AND SERVICES. |

| (a) | Audit Fees – Audit fees billed for the registrant for the fiscal year ended September 30, 2015 are reflected in the table below. These amounts represent aggregate fees billed by the registrant's independent accountant, Cohen Fund Audit Services ("Accountant"), in connection with the annual audits of the registrant's financial statements and for services normally provided by the Accountant in connection with the registrant's statutory and regulatory filings. |

|

Fund

|

2015

|

|

Aspiration Flagship Fund

|

$13,500

|

|

(b)

|

Audit-Related Fees – There were no additional fees billed in the fiscal year ended September 30, 2015 for assurance and related services by the Accountant that were reasonably related to the performance of the audit of the registrant's financial statements that were not reported under paragraph (a) of this Item.

|

|

|

|

|

|

|

|

(c)

|

Tax Fees – The tax fees billed in the fiscal year ended for September 30, 2015 for professional services rendered by the Accountant for tax compliance, tax advice, and tax planning are reflected in the table below. These services were for the completion of each fund's federal, state, and excise tax returns and assistance with distribution calculations.

|

|

Fund

|

2015

|

|

Aspiration Flagship Fund

|

$3,000

|

|

(d)

|

All Other Fees –There were no other fees billed by the Accountant which were not disclosed in Items (a) through (c) above during the fiscal year ended September 30, 2015.

|

|

|

|

|

(e)(1)

|

The registrant's Board of Trustees pre-approved the engagement of the Accountant for the last fiscal year at an audit committee meeting of the Board of Trustees called for such purpose and will pre-approve the Accountant for each fiscal year thereafter at an audit committee meeting called for such purpose. The charter of the audit committee states that the audit committee should pre-approve any audit services and, when appropriate, evaluate and pre-approve any non-audit services provided by the Accountant to the registrant and to pre-approve, when appropriate, any non-audit services provided by the Accountant to the registrant's investment adviser, or any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant if the engagement relates directly to the operations and financial reporting of the registrant

|

| (2) | There were no services as described in each of paragraph (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Not Applicable |