20-F

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 20-F

|

| |

(Mark One) |

¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2015 |

| OR |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| OR |

¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Date of event requiring this shell company report |

Commission file number: 001-37400

Shopify Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of the Registrant’s name into English)

Canada

(Jurisdiction of incorporation or organization)

150 Elgin Street, 8th Floor

Ottawa, Ontario, Canada K2P 1L4

(Address of principal executive offices)

Joseph A. Frasca

General Counsel

150 Elgin Street, 8th Floor

Ottawa, Ontario, Canada K2P 1L4

Tel.: 613-241-2828, E-mail: legal@shopify.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Class A Subordinate Voting Shares

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

Class B Multiple Voting Shares

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report: As at February 9, 2016, 57,338,837 Class A Subordinate Voting Shares and 23,002,175 Class B Multiple Voting Shares of the Registrant were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. Large accelerated filer o Accelerated filer o Non-accelerated filer þ

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP þ International Financial Reporting Standards as issued by the Other o International Accounting Standards Board o

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 o Item 18 o

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes o No o

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART II |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART III |

| |

| |

| |

| |

Financial Statements | F-1 |

EX-10.8: Stock Option Plan | |

EX-10.9: Fourth Amended and Restated Stock Option Plan | |

EX- 10.10: Long Term Incentive Plan | |

EX-12.1: Section 302 Certification of CEO | |

EX-12.2: Section 302 Certification of CFO | |

EX-13.1: Section 906 Certification of CEO and CFO | |

|

| |

EX-15.1: Management's Discussion & Analysis | |

EX-23.1: Auditor's Consent | |

Information Contained in this Annual Report

All information in this Annual Report on Form 20-F, or our Annual Report, is presented as of February 9, 2016 unless otherwise indicated.

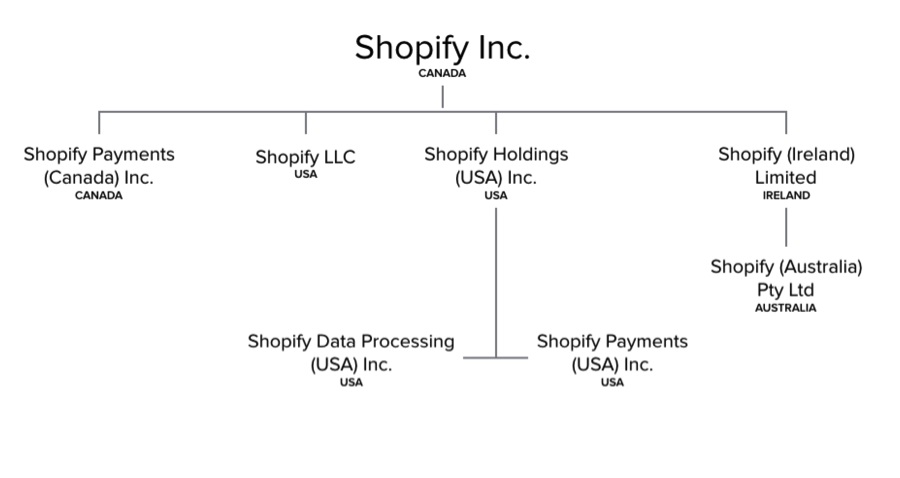

In this Annual Report, references to our “solutions” means the combination of products and services that we offer to merchants, and references to “our merchants” as of a particular date means the total number of unique shops that are paying for a subscription to our platform. Unless the context requires otherwise, references in this Annual Report to “Shopify”, “we”, “us”, “our”, or “the Company” include Shopify and all of its subsidiaries.

Words importing the singular, where the context requires, include the plural and vice versa and words importing any gender include all genders.

Presentation of Financial Information

We prepare and report our consolidated financial statements in accordance with accounting principles generally accepted in the United States of America, or U.S. GAAP. Our reporting currency is U.S. dollars.

Exchange Rate

We express all amounts in this Annual Report in U.S. dollars, except where otherwise indicated. References to “$” and “US$” are to U.S. dollars and references to “C$” are to Canadian dollars. On February 9, 2016, the Bank of Canada noon rates of exchange for the conversion of U.S. dollars into Canadian dollars was $1.00 = C$1.382.

Forward Looking Information

This Annual Report on Form 20-F contains forward-looking statements under the provisions of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act, and forward-looking information within the meaning of applicable Canadian securities legislation. These forward-looking statements are based on our management’s perception of historic trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. Although we believe that the plans, intentions, expectations, assumptions and strategies reflected in these forward-looking statements are reasonable, these statements relate to future events or our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results to be materially different from any future results expressed or implied by these forward-looking statements.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “could,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “continue” or the negative of these terms or other comparable terminology. In addition, any statements or information that refer to expectations, beliefs, plans, projections, objectives, performance or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking. In particular, forward-looking statements in this Annual Report include, but are not limited to, statements about:

| |

• | the size of our addressable markets and our ability to serve those markets; |

| |

• | the achievement of advances in and expansion of our platform and our solutions; |

| |

• | our ability to predict future commerce trends and technology; |

| |

• | the intended growth of our business and making investments to drive future growth; |

| |

• | our ability to reach economies of scale; |

| |

• | the growth of our merchants’ revenues; |

| |

• | the growth of our third-party ecosystem, including formation of strategic partnerships; |

| |

• | potential selective acquisitions and investments; |

| |

• | the expansion of our platform into new markets; |

| |

• | fluctuations in our future gross margin percentages; and |

| |

• | our expectations on future incurred costs. |

Although the forward-looking statements contained in this Annual Report are based upon what we believe are reasonable assumptions, investors are cautioned against placing undue reliance on these statements since actual results may vary from the forward-looking statements. Certain assumptions made in preparing the forward-looking statements include:

| |

• | our ability to generate revenue while controlling our costs and expenses; |

| |

• | our ability to manage our growth effectively; |

| |

• | the absence of material adverse changes in our industry or the global economy; |

| |

• | trends in our industry and markets; |

| |

• | our ability to maintain good business relationships with our merchants, vendors and partners; |

| |

• | our ability to develop solutions that keep pace with the changes in technology, evolving industry standards, changes to the regulatory environment, new product introductions by competitors and changing merchant preferences and requirements; |

| |

• | our ability to protect our intellectual property rights; |

| |

• | our continued compliance with third-party license terms and the non-infringement of third-party intellectual property rights; |

| |

• | our ability to manage and integrate acquisitions; |

| |

• | our ability to retain key personnel; and |

| |

• | our ability to raise sufficient debt or equity financing to support our continued growth. |

Forward-looking statements involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect our results. Factors that may cause actual results to differ materially from current expectations include:

| |

• | our rapid growth may not be sustainable and depends on our ability to attract new merchants, retain existing merchants and increase sales to both new and existing merchants; |

| |

• | our business could be harmed if we fail to manage our growth effectively; |

| |

• | we have a history of losses and we may be unable to achieve profitability; |

| |

• | our limited operating history in a new and developing market makes it difficult to evaluate our current business and future prospects and may increase the risk that we will not be successful; |

| |

• | if we fail to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform in a manner that responds to our merchants’ evolving needs, our business may be adversely affected; |

| |

• | a denial of service attack or security breach could delay or interrupt service to our merchants and their customers, harm our reputation or subject us to significant liability; |

| |

• | payment transactions on Shopify Payments may subject us to regulatory requirements and other risks that could be costly and difficult to comply with or that could harm our business; |

| |

• | we rely on a single supplier to provide the technology we offer through Shopify Payments; |

| |

• | if the security of personally identifiable information we store relating to merchants and their customers is breached or otherwise subjected to unauthorized access, our reputation may be harmed and we may be exposed to liability; |

| |

• | if our software contains serious errors or defects, we may lose revenue and market acceptance and may incur costs to defend or settle claims with our merchants; |

| |

• | exchange rate fluctuations may negatively affect our results of operations; |

| |

• | we may be unable to achieve or maintain data transmission capacity; |

| |

• | our growth depends in part on the success of our strategic relationships with third parties; |

| |

• | if we fail to maintain a consistently high level of customer service, our brand, business and financial results may be harmed; |

| |

• | we use a limited number of data centers and any disruption of service at our data facilities could harm our business; |

| |

• | if our solutions do not operate as effectively when accessed through mobile devices, our merchants and their customers may not be satisfied with our solutions; |

| |

• | changes to technologies used in our platform or new versions or upgrades of operating systems and internet browsers could adversely impact the process by which merchants and customers interface with our platform; |

| |

• | the impact of worldwide economic conditions, including the resulting effect on spending by SMBs, may adversely affect our business, operating results and financial condition; |

| |

• | we may be subject to claims by third-parties of intellectual property infringement; |

| |

• | we may be unable to obtain, maintain and protect our intellectual property rights and proprietary information or prevent third-parties from making unauthorized use of our technology; |

| |

• | our use of “open source” software could negatively affect our ability to sell our solutions and subject us to possible litigation; |

| |

• | if we are not able to generate traffic to our website through search engines and social networking sites, our ability to attract new merchants may be impaired and if our merchants are not able to generate traffic to their shops through search engines and social networking sites, their ability to attract consumers may be impaired; |

| |

• | if we fail to effectively maintain, promote and enhance our brand, our business and competitive advantage may be harmed; |

| |

• | if we are unable to hire, retain and motivate qualified personnel, our business will suffer; |

| |

• | we are dependent on the continued services and performance of our senior management and other key employees, the loss of any of whom could adversely affect our business, operating results and financial condition; |

| |

• | activities of merchants or the content of their shops could damage our brand, subject us to liability and harm our business and financial results; |

| |

• | our operating results are subject to seasonal fluctuations; |

| |

• | our business is susceptible to risks associated with international sales and the use of our platform in various countries; |

| |

• | if third-party apps and themes change such that we do not or cannot maintain the compatibility of our platform with these apps and themes, or if we fail to provide third-party apps and themes that our merchants desire to add to their shops, demand for our platform could decline; |

| |

• | we rely on computer hardware, purchased or leased, and software licensed from and services rendered by third-parties in order to provide our solutions and run our business, sometimes by a single-source supplier; |

| |

• | we may not be able to compete successfully against current and future competitors; |

| |

• | we do not have the history with our solutions or pricing models necessary to accurately predict optimal pricing necessary to attract new merchants and retain existing merchants; |

| |

• | we have in the past made and in the future may make acquisitions and investments that could divert management’s attention, result in operating difficulties and dilution to our shareholders and otherwise disrupt our operations and adversely affect our business, operating results or financial position; |

| |

• | provisions of our debt instruments may restrict our ability to pursue our business strategies; |

| |

• | we may need to raise additional funds to pursue our growth strategy or continue our operations, and we may be unable to raise capital when needed or on acceptable terms; |

| |

• | unanticipated changes in effective tax rates or adverse outcomes resulting from examination of our income or other tax returns could adversely affect our operating results and financial condition; |

| |

• | new tax laws could be enacted or existing laws could be applied to us or our merchants, which could increase the costs of our solutions and adversely impact our business; |

| |

• | if we are required to collect state and local business taxes and sales and use taxes in additional jurisdictions, we might be subject to tax liability for past sales; |

| |

• | we may not be able to use a significant portion of our tax carryforwards which could adversely affect our profitability; |

| |

• | we are dependent upon consumers’ and merchants’ willingness to use the internet for commerce; |

| |

• | we may face challenges in expanding into new geographic regions; and |

| |

• | our reported financial results may be materially and adversely affected by changes in accounting principles generally accepted in the United States. |

These risks are described in further detail in the section entitled “Risk Factors” and elsewhere in this Annual Report. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future results. You should read this Annual Report and the documents that we reference in this Annual Report completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements.

The forward-looking statements in this Annual Report represent our views as of the date of this Annual Report. We anticipate that subsequent events and developments may cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. Therefore, these forward-looking statements do not represent our views as of any date other than the date of this Annual Report.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. Selected Financial Data

The selected financial data set forth in the table below for 2015, 2014 and 2013 has been derived from our audited consolidated financial statements as at December 31, 2015 and 2014 and for the years ended December 31, 2015, 2014 and 2013. The consolidated statements of operations data for the year ended December 31, 2012 and the consolidated balance sheet data as of December 31, 2013 have been derived from our audited consolidated financial statements not included in this Annual Report. This selected financial data should be read in conjunction with our consolidated financial statements and are qualified entirely by reference to such consolidated financial statements. The selected financial information may not be indicative of our future performance and should be read in conjunction with Part I - Item 5 “Operating and Financial Review and Prospects” and our audited financial statements which are found immediately following the text of this Annual Report. See also Item 8 “Financial Information”. All of our operations are continuing operations and we have not proposed or paid dividends in any of the periods presented.

SELECTED CONSOLIDATED STATEMENTS OF OPERATIONS DATA

|

| | | | | | | | | | | | | | | |

| Years ended |

| December 31, 2015 | | December 31, 2014 | | December 31, 2013 | | December 31, 2012 |

| (in thousands, except share and per share data) |

Consolidated Statement of Operations Information: | | | | | | | |

Revenues: | | | | | | | |

Subscription solutions | $ | 111,979 |

| | $ | 66,668 |

| | $ | 38,339 |

| | $ | 19,200 |

|

Merchant solutions | 93,254 |

| | 38,350 |

| | 11,913 |

| | 4,513 |

|

| 205,233 |

| | 105,018 |

| | 50,252 |

| | 23,713 |

|

Cost of revenues (1): | | | | | | | |

Subscription solutions | 24,531 |

| | 16,790 |

| | 8,504 |

| | 4,291 |

|

Merchant solutions | 69,631 |

| | 26,433 |

| | 5,009 |

| | 485 |

|

| 94,162 |

| | 43,223 |

| | 13,513 |

| | 4,776 |

|

Gross profit | 111,071 |

| | 61,795 |

| | 36,739 |

| | 18,937 |

|

Operating expenses: | | | | | | | |

Sales and marketing (1) | 70,374 |

| | 45,929 |

| | 23,351 |

| | 12,262 |

|

Research and development (1)(2) | 39,722 |

| | 25,915 |

| | 13,682 |

| | 6,452 |

|

General and administrative (1)(3) | 18,731 |

| | 11,566 |

| | 3,975 |

| | 1,737 |

|

| 128,827 |

| | 83,410 |

| | 41,008 |

| | 20,451 |

|

Loss from operations | (17,756) |

| | (21,615) |

| | (4,269) |

| | (1,514) |

|

Other income (expense) | (1,034) |

| | (696) |

| | (568) |

| | 282 |

|

Net loss and comprehensive loss | $ | (18,790 | ) | | $ | (22,311 | ) | | $ | (4,837 | ) | | $ | (1,232 | ) |

Basic and diluted net loss per share attributable to shareholders (3) | $ | (0.30 | ) | | $ | (0.57 | ) | | $ | (0.13 | ) | | $ | (0.03 | ) |

Weighted average shares used to compute basic and diluted net loss per share attributable to shareholders(4) | 61,716,065 |

| | 38,940,252 |

| | 37,248,710 |

| | 36,155,333 |

|

(1) Includes stock-based compensation expense and related payroll taxes as follows:

|

| | | | | | | | | | | | | | | |

| Years ended |

| December 31, 2015 | | December 31, 2014 | | December 31, 2013 | | December 31, 2012 |

| (in thousands) |

Cost of revenues | $ | 345 |

| | $ | 259 |

| | $ | 113 |

| | $ | 11 |

|

Sales and marketing | 1,351 |

| | 696 |

| | 354 |

| | 66 |

|

Research and development | 6,373 |

| | 2,776 |

| | 1,152 |

| | 282 |

|

General and administrative | 2,419 |

| | 712 |

| | 147 |

| | 49 |

|

| $ | 10,488 |

| | $ | 4,443 |

| | $ | 1,766 |

| | $ | 408 |

|

(2) Net of refundable tax credits ($1,058, $1,295, $891 and $902 for the years ended December 31, 2015, 2014, 2013 and 2012, respectively).

(3) Includes sales and use taxes of $566, $2,182, nil and nil for the years ended December 31, 2015, 2014, 2013 and 2012, respectively.

(4) For the periods preceding our initial public offering, does not give effect to the conversion of Series A, Series B and Series C convertible preferred shares, which occurred upon the consummation of our initial public offering on May 27, 2015.

SELECTED CONSOLIDATED BALANCE SHEET DATA

|

| | | | | | | | | | | |

| Years ended |

| December 31, 2015 | | December 31, 2014 | | December 31, 2013 |

| (in thousands) |

Balance Sheet Information: | | | | | |

Cash, cash equivalents and marketable securities | $ | 190,173 |

| | $ | 59,662 |

| | $ | 83,529 |

|

Working capital | 165,228 |

| | 48,610 |

| | 77,960 |

|

Total assets | 243,712 |

| | 95,193 |

| | 95,788 |

|

Total liabilities | 48,395 |

| | 27,461 |

| | 10,407 |

|

Capital stock | 243,171 |

| | 96,796 |

| | 92,134 |

|

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the offer and use of proceeds

Not applicable.

D. Risk Factors

Investing in our shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information contained in this Annual Report, including our “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, which is attached hereto as Exhibit 15.1 and our audited financial statements and related notes which are found immediately following the text of this Annual Report, before deciding to invest in our Class A subordinate voting shares. The risks and uncertainties described below may not be the only ones we face, and the occurrence of any of the following risks could have a material adverse effect on our business, financial condition, results of operations and future prospects. In these circumstances, the market price of our Class A subordinate voting shares could decline, and you may lose all or part of your investment. This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of a number of factors, including the risks described below. See “Forward Looking Information.”

Risks Related to Our Business and Industry

Our rapid growth may not be sustainable and depends on our ability to attract new merchants, retain existing merchants and increase sales to both new and existing merchants.

We principally generate revenues through the sale of subscriptions to our platform and the sale of additional solutions to our merchants. Our subscription plans typically have a one-month term, although a small percentage of our merchants have annual or multi-year subscription terms. Our merchants have no obligation to renew their subscriptions after their subscription term expires. As a result, even though the number of merchants using our platform has grown rapidly in recent years, there can be no assurance that we will be able to retain these merchants. We have historically experienced merchant turnover as a result of many of our merchants being small- and medium-sized businesses, or SMBs, that are more susceptible than larger businesses to general economic conditions and other risks affecting their businesses. Many of these SMBs are in the entrepreneurial stage of their development and there is no guarantee that their businesses will succeed. Our costs associated with subscription renewals are substantially lower than costs

associated with generating revenue from new merchants or costs associated with generating sales of additional solutions to existing merchants. Therefore, if we are unable to retain merchants or if we are unable to increase revenues from existing merchants, even if such losses are offset by an increase in new merchants or an increase in other revenues, our operating results could be adversely impacted.

We may also fail to attract new merchants, retain existing merchants or increase sales to both new and existing merchants as a result of a number of other factors, including: reductions in our current or potential merchants’ spending levels; competitive factors affecting the software as a service, or SaaS, business software applications market, including the introduction of competing platforms, discount pricing and other strategies that may be implemented by our competitors; our ability to execute on our growth strategy and operating plans; a decline in our merchants’ level of satisfaction with our platform and merchants’ usage of our platform; the difficulty and cost to switch to a competitor may not be significant for many of our merchants; changes in our relationships with third parties, including our partners, app developers, theme designers, referral sources and payment processors; the timeliness and success of new products and services we may offer in the future; the frequency and severity of any system outages; technological change; and our focus on long-term value over short-term results, meaning that we may make strategic decisions that may not maximize our short-term revenue or profitability if we believe that the decisions are consistent with our mission and will improve our financial performance over the long-term.

Additionally, we anticipate that our growth rate will decline over time to the extent that the number of merchants using our platform increases and we achieve higher market penetration rates. To the extent our growth rate slows, our business performance will become increasingly dependent on our ability to retain existing merchants and increase sales to existing merchants.

Our business could be harmed if we fail to manage our growth effectively.

The rapid growth we have experienced in our business places significant demands on our operational infrastructure. The scalability and flexibility of our platform depends on the functionality of our technology and network infrastructure and its ability to handle increased traffic and demand for bandwidth. The growth in the number of merchants using our platform and the number of orders processed through our platform has increased the amount of data and requests that we process. Any problems with the transmission of increased data and requests could result in harm to our brand or reputation. Moreover, as our business grows, we will need to devote additional resources to improving our operational infrastructure and continuing to enhance its scalability in order to maintain the performance of our platform.

Our growth has placed, and will likely continue to place, a significant strain on our managerial, administrative, operational, financial and other resources. We have grown from 334 employees at December 31, 2013 to 1,048 employees and contractors at December 31, 2015. We intend to further expand our overall business, including headcount, with no assurance that our revenues will continue to grow. As we grow, we will be required to continue to improve our operational and financial controls and reporting procedures and we may not be able to do so effectively. In addition, some members of our management do not have significant experience managing a large global business operation, so our management may not be able to manage such growth effectively. As such, we may be unable to manage our expenses effectively in the future, which may negatively impact our gross profit or operating expenses.

In addition, we believe that an important contributor to our success has been our corporate culture, which we believe fosters innovation, teamwork, passion for our merchants and a focus on attractive design and technologically advanced and well-crafted software. Most of our employees have been with us for fewer than two years as a result of our rapid growth. As we continue to grow, we must effectively integrate, develop and motivate a growing number of new employees, and we must effectively preserve our ability to execute quickly on new features and initiatives. As a result, we may find it difficult to maintain our corporate culture, which could limit our ability to innovate and operate effectively. Any failure to preserve our culture could also negatively affect our ability to retain and recruit personnel, to continue to perform at current levels or to execute on our business strategy effectively and efficiently.

We have a history of losses and we may be unable to achieve profitability.

We incurred net losses of $18.8 million in 2015, $22.3 million in 2014, and $4.8 million in 2013. At December 31, 2015, we had an accumulated deficit of $47.9 million. These losses and accumulated deficit are a result of the substantial investments we made to grow our business and we expect to make significant expenditures to expand our business in the future. We expect to increase our investment in sales and marketing as we continue to spend on marketing activities and expand our partner referral programs. We plan to increase our investment in research and development as we continue to introduce new products and services to extend the functionality of our platform. We also intend to invest in maintaining our high level of merchant service and support, which we consider critical for our continued success. In order to support the continued growth of our business and to comply with continuously changing security and operational requirements, we plan to continue investing in our data center and network infrastructure. These increased expenditures will make it harder for us to achieve profitability and we cannot predict if we will achieve profitability in the near term or at all. Historically, our costs have increased each year due to these factors and we expect to continue to incur increasing costs to support our anticipated future growth. We also expect to incur additional general and administrative expenses as a result of both our growth and the increased costs associated with being a public company. If the costs associated with acquiring new merchants materially rise in the future, including the fees we pay to third parties to market our platform, our expenses may rise significantly. If we are unable to generate adequate revenue growth and manage our expenses, we may continue to incur significant losses and may not achieve or maintain profitability.

We may make decisions that would reduce our short-term operating results if we believe those decisions will improve the experiences of our merchants and their customers and if we believe such decisions will improve our operating results over the long term. These decisions may not be consistent with the expectations of investors and may not produce the long-term benefits that we expect, in which case our business may be materially and adversely affected.

Our limited operating history in a new and developing market makes it difficult to evaluate our current business and future prospects and may increase the risk that we will not be successful.

We launched the Shopify platform in 2006 and the majority of our revenue growth has occurred in 2013, 2014 and 2015. This short history makes it difficult to accurately assess our future prospects. We also operate in a new and developing market that may not develop as we expect. You should consider our future prospects in light of the challenges and uncertainties that we face, including the fact that our business has grown rapidly and it may not be possible to discern fully the trends that we are subject to, that we operate in a new and developing market and that elements of our business strategy are new and subject to ongoing development. We have encountered and will continue to encounter risks and difficulties frequently experienced by growing companies in rapidly changing industries, including increasing and unforeseen expenses as we continue to grow our business. If we do not manage these risks successfully, our business, results of operations and prospects will be harmed.

If we fail to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform in a manner that responds to our merchants’ evolving needs, our business may be adversely affected.

The markets in which we compete are characterized by constant change and innovation and we expect them to continue to evolve rapidly. Our success has been based on our ability to identify and anticipate the needs of our merchants and design a platform that provides them with the tools they need to operate their businesses. Our ability to attract new merchants, retain existing merchants and increase sales to both new and existing merchants will depend in large part on our ability to continue to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform.

We may experience difficulties with software development that could delay or prevent the development, introduction or implementation of new solutions and enhancements. Software development involves a significant amount of time for our research and development team, as it can take our developers months to update, code and test new and upgraded solutions and integrate them into our platform. We must also continually update, test and enhance our software platform. For example, our design team spends a significant amount of time and resources incorporating various

design enhancements, such as customized colors, fonts, content and other features, into our platform. The continual improvement and enhancement of our platform requires significant investment and we may not have the resources to make such investment. Our improvements and enhancements may not result in our ability to recoup our investments in a timely manner, or at all. To the extent we are not able to improve and enhance the functionality, performance, reliability, design, security and scalability of our platform in a manner that responds to our merchants’ evolving needs, our business, operating results and financial condition will be adversely affected.

A denial of service attack or security breach could delay or interrupt service to our merchants and their customers, harm our reputation or subject us to significant liability.

In the past, we have been subject to distributed denial of service, or DDoS, attacks, a technique used by hackers to take an internet service offline by overloading its servers. Our platform and our third-party apps may be subject to DDoS attacks in the future and we cannot guarantee that applicable recovery systems, security protocols, network protection mechanisms and other procedures are or will be adequate to prevent network and service interruption, system failure or data loss. Moreover, our platform and our third-party apps could be breached if vulnerabilities in our platform or our third-party apps are exploited by unauthorized third parties. Since techniques used to obtain unauthorized access change frequently and the size of DDoS attacks are increasing, we may be unable to implement adequate preventative measures or stop the attacks while they are occurring. A DDoS attack or security breach could delay or interrupt service to our merchants and their customers and may deter consumers from visiting our merchants’ shops. In addition, any actual or perceived DDoS attack or security breach could damage our reputation and brand, expose us to a risk of litigation and possible liability and require us to expend significant capital and other resources to alleviate problems caused by the DDoS attack or security breach. Some jurisdictions have enacted laws requiring companies to notify individuals of data security breaches involving certain types of personal data and our agreements with certain merchants require us to notify them in the event of a security incident. Such mandatory disclosures could lead to negative publicity and may cause our merchants to lose confidence in the effectiveness of our data security measures. Moreover, if a high profile security breach occurs with respect to another SaaS provider, merchants may lose trust in the security of the SaaS business model generally, which could adversely impact our ability to retain existing merchants or attract new ones.

Payment transactions on Shopify Payments may subject us to regulatory requirements and other risks that could be costly and difficult to comply with or that could harm our business.

Many of our merchants use Shopify Payments, an integrated payment processing solution that allows them to accept payments on major payment cards. We are subject to a number of risks related to payments processed through Shopify Payments, including:

| |

• | we pay interchange and other fees, which may increase our operating expenses; |

| |

• | if we are unable to maintain our chargeback rate at acceptable levels, our credit card fees may increase or credit card issuers may terminate their relationship with us; |

| |

• | increased costs and diversion of management time and effort and other resources to deal with fraudulent transactions or chargeback disputes; |

| |

• | potential fraudulent or otherwise illegal activity by merchants, their customers, developers, employees or third parties; |

| |

• | restrictions on funds or required reserves related to payments; and |

| |

• | additional disclosure and other requirements, including new reporting regulations and new credit card association rules. |

We are required by our payment processors to comply with payment card network operating rules and we have agreed to reimburse our payment processors for any fines they are assessed by payment card networks as a result of any rule violations by us or our merchants. The payment card networks set and interpret the card rules. In addition, we face the risk that one or more payment card networks or other processors may, at any time, assess penalties against us or terminate our ability to accept credit card payments or other forms of online payments from customers, which would have an adverse effect on our business, financial condition and operating results.

If we fail to comply with the rules and regulations adopted by the payment card networks, including the Payment Card Industry Data Security Standard, or PCI DSS, we would be in breach of our contractual obligations to our payment processors, financial institutions, partners and merchants. Such failure to comply may subject us to fines, penalties, damages, higher transaction fees and civil liability, and could eventually prevent us from processing or accepting payment cards or could lead to a loss of payment processor partners, even if there is no compromise of customer information.

We are currently subject to a variety of laws and regulations in Canada, the United States, the United Kingdom and elsewhere related to payment processing, including those governing cross-border and domestic money transmission, gift cards and other prepaid access instruments, electronic funds transfers, foreign exchange, anti-money laundering, counter-terrorist financing, banking and import and export restrictions. Depending on how Shopify Payments and our other merchant solutions evolve, we may be subject to additional laws in Canada, the United States, the United Kingdom, Australia and elsewhere. In some jurisdictions, the application or interpretation of these laws and regulations is not clear. Our efforts to comply with these laws and regulations could be costly and result in diversion of management time and effort and may still not guarantee compliance. In the event that we are found to be in violation of any such legal or regulatory requirements, we may be subject to monetary fines or other penalties such as a cease and desist order, or we may be required to make changes to our platform, any of which could have an adverse effect on our business, financial condition and results of operations.

We rely on a single supplier to provide the technology we offer through Shopify Payments.

In order to provide Shopify Payments, we have entered into payment service provider agreements with Stripe Inc., or Stripe. These payment service provider agreements renew every 12 months, unless either party provides a notice of termination prior to the end of the then current term. These agreements are integral to Shopify Payments and any disruption or problems with Stripe or its services could have an adverse effect on our reputation, results of operations and financial results. If Stripe were to terminate its relationship with us, we could incur substantial delays and expense in finding and integrating an alternative payment service provider into Shopify Payments, and the quality and reliability of such alternative payment service provider may not be comparable. Any long term or permanent disruption in Shopify Payments would decrease our revenues from merchant solutions, since our merchants would be required to use one of the alternative payment gateways offered through our platform.

We store personally identifiable information of our merchants and their customers. If the security of this information is compromised or otherwise subjected to unauthorized access, our reputation may be harmed and we may be exposed to liability.

We store personally identifiable information, credit card information and other confidential information of our merchants and their customers. The third-party apps sold on our platform may also store personally identifiable information, credit card information and other confidential information of our merchants and their customers. We do not regularly monitor or review the content that our merchants upload and store and, therefore, do not control the substance of the content on our servers, which may include personal information. We may experience successful attempts by third parties to obtain unauthorized access to the personally identifiable information of our merchants and their customers. This information could also be otherwise exposed through human error, malfeasance or otherwise. The unauthorized access or compromise of this personally identifiable information could have a material adverse affect on our business, financial condition and results of operations. Even if such a data breach were to affect one or more of our competitors, the resulting consumer concern could negatively affect our merchants and our business.

We are also subject to federal, state, provincial and foreign laws regarding privacy and protection of data. Some jurisdictions have enacted laws requiring companies to notify individuals of data security breaches involving certain types of personal data and our agreements with certain merchants require us to notify them in the event of a security incident. We post on our website our privacy policy and terms of service, which describe our practices concerning the use, transmission and disclosure of merchant data and data relating to their customers. In addition, the interpretation of data protection laws in the United States, Canada, the European Union and elsewhere, and their application to the internet, is unclear and in a state of flux. There is a risk that these laws may be interpreted and applied in conflicting

ways from jurisdiction to jurisdiction, and in a manner that is not consistent with our current data protection practices. Changes to such data protection laws may impose more stringent requirements for compliance and impose significant penalties for non-compliance. Any such new laws or regulations, or changing interpretations of existing laws and regulations, may cause us to incur significant costs and expend significant effort to ensure compliance. Because our services are accessible worldwide, certain foreign jurisdictions may claim that we are required to comply with their laws, including in jurisdictions where we have no local entity, employees or infrastructure.

Our failure to comply with federal, state, provincial and foreign laws regarding privacy and protection of data could lead to significant fines and penalties imposed by regulators, as well as claims by our merchants or their customers. These proceedings or violations could force us to spend money in defense or settlement of these proceedings, result in the imposition of monetary liability, diversion of management’s time and attention, increase our costs of doing business, and materially adversely affect our reputation and the demand for our solutions. In addition, if our security measures fail to protect credit card information adequately, we could be liable to both our merchants and their customers for their losses, as well as our payments processing partners under our agreements with them. As a result, we could be subject to fines and higher transaction fees, we could face regulatory action, and our merchants could end their relationships with us. There can be no assurance that the limitations of liability in our contracts would be enforceable or adequate or would otherwise protect us from any such liabilities or damages with respect to any particular claim. We also cannot be sure that our existing insurance coverage and coverage for errors and omissions will continue to be available on acceptable terms or will be available in sufficient amounts to cover one or more large claims, or that our insurers will not deny coverage as to any future claim. The successful assertion of one or more large claims against us that exceeds our available insurance coverage, or changes in our insurance policies, including premium increases or the imposition of large deductible or co-insurance requirements, could have an adverse effect on our business, financial condition and results of operations.

If our software contains serious errors or defects, we may lose revenue and market acceptance and may incur costs to defend or settle claims with our merchants.

Software such as ours often contains errors, defects, security vulnerabilities or software bugs that are difficult to detect and correct, particularly when first introduced or when new versions or enhancements are released. Despite internal testing, our platform may contain serious errors or defects, security vulnerabilities or software bugs that we may be unable to successfully correct in a timely manner or at all, which could result in lost revenue, significant expenditures of capital, a delay or loss in market acceptance and damage to our reputation and brand, any of which could have an adverse effect on our business, financial condition and results of operations. Furthermore, our platform is a multi-tenant cloud based system that allows us to deploy new versions and enhancements to all of our merchants simultaneously. To the extent we deploy new versions or enhancements that contain errors, defects, security vulnerabilities or software bugs to all of our merchants simultaneously, the consequences would be more severe than if such versions or enhancements were only deployed to a smaller number of our merchants.

Since our merchants use our services for processes that are critical to their businesses, errors, defects, security vulnerabilities, service interruptions or software bugs in our platform could result in losses to our merchants. Our merchants may seek significant compensation from us for any losses they suffer or cease conducting business with us altogether. Further, a merchant could share information about bad experiences on social media, which could result in damage to our reputation and loss of future sales. There can be no assurance that provisions typically included in our agreements with our merchants that attempt to limit our exposure to claims would be enforceable or adequate or would otherwise protect us from liabilities or damages with respect to any particular claim. Even if not successful, a claim brought against us by any of our merchants would likely be time-consuming and costly to defend and could seriously damage our reputation and brand, making it harder for us to sell our solutions.

Exchange rate fluctuations may negatively affect our results of operations.

While most of our revenues are denominated in U.S. dollars, a significant portion of our operating expenses are incurred in Canadian dollars. As a result, our results of operations will be adversely impacted by an increase in the value of the Canadian dollar relative to the U.S. dollar. Exchange rate fluctuations may also affect our merchant

solutions. For example, we generate revenue through Shopify Payments in the local currency of the country in which the applicable merchant is located. As a result, we will be further exposed to currency fluctuations to the extent non-U.S. dollar revenues from Shopify Payments increase. The value of the Canadian dollar relative to the U.S. dollar has varied significantly and investors are cautioned that past and current exchange rates are not indicative of future exchange rates.

We may be unable to achieve or maintain data transmission capacity.

Our merchants often draw significant numbers of consumers to their shops over short periods of time, including from events such as new product releases, holiday shopping seasons and flash sales, which significantly increases the traffic on our servers and the volume of transactions processed on our platform. Our servers may be unable to achieve or maintain data transmission capacity high enough to handle increased traffic or process orders in a timely manner. Our failure to achieve or maintain high data transmission capacity could significantly reduce demand for our solutions. In the future, we may be required to allocate resources, including spending substantial amounts of money, to build, purchase or lease additional data centers and equipment and upgrade our technology and network infrastructure in order to handle the increased load. Our ability to deliver our solutions also depends on the development and maintenance of internet infrastructure by third-parties, including the maintenance of reliable networks with the necessary speed, data capacity and bandwidth. If one of these third-parties suffers from capacity constraints, our business may be adversely affected. In addition, because we and our merchants generate a disproportionate amount of revenue in the fourth quarter, any disruption in our merchants’ ability to process and fulfill customer orders in the fourth quarter could have a disproportionately negative effect on our operating results.

Our growth depends in part on the success of our strategic relationships with third parties.

We anticipate that the growth of our business will continue to depend on third-party relationships, including relationships with our app developers, theme designers, referral sources, resellers, payment processors and other partners. In addition to growing our third-party partner ecosystem, we intend to pursue additional relationships with other third-parties, such as technology and content providers and implementation consultants. Identifying, negotiating and documenting relationships with third parties requires significant time and resources as does integrating third-party content and technology. Some of the third parties that sell our services have the direct contractual relationships with the merchants, and therefore we risk the loss of such merchants if the third parties fail to perform their obligations. Our agreements with providers of cloud hosting, technology, content and consulting services are typically non-exclusive and do not prohibit such service providers from working with our competitors or from offering competing services. These third-party providers may choose to terminate their relationship with us or to make material changes to their businesses, products or services. Our competitors may be effective in providing incentives to third parties to favor their products or services or to prevent or reduce subscriptions to our platform. In addition, these providers may not perform as expected under our agreements or under their agreements with our merchants, and we or our merchants may in the future have disagreements or disputes with such providers. If we lose access to products or services from a particular supplier, or experience a significant disruption in the supply of products or services from a current supplier, especially a single-source supplier, it could have an adverse effect on our business and operating results.

If we fail to maintain a consistently high level of customer service, our brand, business and financial results may be harmed.

We believe our focus on customer service and support is critical to onboarding new merchants and retaining our existing merchants and growing our business. As a result, we have invested heavily in the quality and training of our support team along with the tools they use to provide this service. If we are unable to maintain a consistently high level of customer service, we may lose existing merchants. In addition, our ability to attract new merchants is highly dependent on our reputation and on positive recommendations from our existing merchants. Any failure to maintain a consistently high level of customer service, or a market perception that we do not maintain high-quality customer service, could adversely affect our reputation and the number of positive merchant referrals that we receive.

We use a limited number of data centers to deliver our services. Any disruption of service at these facilities could harm our business.

We currently manage our services and serve all of our merchants from two third-party data center facilities. While we own the hardware on which our platform runs and deploy this hardware to the data center facilities, we do not control the operation of these facilities. We have experienced, and may in the future experience, failures at the third-party data centers where our hardware is deployed from time to time. Data centers are vulnerable to damage or interruption from human error, intentional bad acts, earthquakes, hurricanes, floods, fires, war, terrorist attacks, power losses, hardware failures, systems failures, telecommunications failures and similar events. Any of these events could result in lengthy interruptions in our services. Changes in law or regulations applicable to data centers in various jurisdictions could also cause a disruption in service. Interruptions in our services would reduce our revenue, subject us to potential liability and adversely affect our ability to retain our merchants or attract new merchants. The performance, reliability and availability of our platform is critical to our reputation and our ability to attract and retain merchants. Merchants could share information about bad experiences on social media, which could result in damage to our reputation and loss of future sales. The property and business interruption insurance coverage we carry may not be adequate to compensate us fully for losses that may occur.

Our agreements with our third-party data facility providers terminate on May 31, 2018 and September 15, 2018, respectively. The agreements do not provide for early termination without cause, as defined therein. Upon expiration of the initial term, both agreements will automatically renew for successive 12-month periods unless appropriate notice is provided. However, when our agreements with the third-party data facilities terminate, the owners of the data facilities have no obligation to renew their agreements with us on commercially reasonable terms, or at all. If we are unable to renew these agreements on commercially reasonable terms, or if the owners of the data facilities decide to close such facilities, we may be required to transfer to new data center facilities and we may incur costs and possible service interruption in connection with doing so.

Mobile devices are increasingly being used to conduct commerce, and if our solutions do not operate as effectively when accessed through these devices, our merchants and their customers may not be satisfied with our services, which could harm our business.

We are dependent on the interoperability of our platform with third-party mobile devices and mobile operating systems as well as web browsers that we do not control. Any changes in such devices, systems or web browsers that degrade the functionality of our platform or give preferential treatment to competitive services could adversely affect usage of our platform. Effective mobile functionality is integral to our long-term development and growth strategy. In the event that our merchants and their customers have difficulty accessing and using our platform on mobile devices, our business and operating results could be adversely affected.

Our business and prospects would be harmed if changes to technologies used in our platform or new versions or upgrades of operating systems and internet browsers adversely impact the process by which merchants and consumers interface with our platform.

We believe the simple and straightforward interface for our platform has helped us to expand and offer our solutions to merchants with limited technical expertise. In the future, providers of internet browsers could introduce new features that would make it difficult for merchants to use our platform. In addition, internet browsers for desktop or mobile devices could introduce new features, change existing browser specifications such that they would be incompatible with our platform, or prevent consumers from accessing our merchants’ shops. Any changes to technologies used in our platform, to existing features that we rely on, or to operating systems or internet browsers that make it difficult for merchants to access our platform or consumers to access our merchants’ shops, may make it more difficult for us to maintain or increase our revenues and could adversely impact our business and prospects.

The impact of worldwide economic conditions, including the resulting effect on spending by SMBs, may adversely affect our business, operating results and financial condition.

A majority of the merchants that use our platform are SMBs and many of our merchants are in the entrepreneurial stage of their development. Our performance is subject to worldwide economic conditions and their impact on levels of spending by SMBs and their customers. SMBs and entrepreneurs may be disproportionately affected by economic downturns. SMBs and entrepreneurs frequently have limited budgets and may choose to allocate their spending to items other than our platform, especially in times of economic uncertainty or recessions.

Economic downturns may also adversely impact retail sales, which could result in merchants who use our platform going out of business or deciding to stop using our services in order to conserve cash. Weakening economic conditions may also adversely affect third-parties with whom we have entered into relationships and upon which we depend in order to grow our business. Uncertain and adverse economic conditions may also lead to increased refunds and chargebacks, any of which could adversely affect our business.

We may be subject to claims by third-parties of intellectual property infringement.

The software industry is characterized by the existence of a large number of patents and frequent claims and related litigation regarding patents and other intellectual property rights. Third parties have in the past asserted, and may in the future assert, that our platform, solutions, technology, methods or practices infringe, misappropriate or otherwise violate their intellectual property or other proprietary rights. Such claims may be made by our competitors seeking to obtain a competitive advantage or by other parties. Additionally, in recent years, non-practicing entities have begun purchasing intellectual property assets for the purpose of making claims of infringement and attempting to extract settlements from companies like ours. The risk of claims may increase as the number of solutions that we offer and competitors in our market increases and overlaps occur. In addition, to the extent that we gain greater visibility and market exposure, we face a higher risk of being the subject of intellectual property infringement claims.

Any such claims, regardless of merit, that result in litigation could result in substantial expenses, divert the attention of management, cause significant delays in introducing new or enhanced services or technology, materially disrupt the conduct of our business and have a material and adverse effect on our brand, business, financial condition and results of operations. Although we do not believe that our proprietary technology, processes and methods have been patented by any third party, it is possible that patents have been issued to third parties that cover all or a portion of our business. As a consequence of any patent or other intellectual property claims, we could be required to pay substantial damages, develop non-infringing technology, enter into royalty-bearing licensing agreements, stop selling or marketing some or all of our solutions or re-brand our solutions. We may also be obligated to indemnify our merchants or partners or pay substantial settlement costs, including royalty payments, in connection with any such claim or litigation and to obtain licenses, modify applications or refund fees, which could be costly. If it appears necessary, we may seek to secure license rights to intellectual property that we are alleged to infringe at a significant cost, potentially even if we believe such claims to be without merit. If required licenses cannot be obtained, or if existing licenses are not renewed, litigation could result. Litigation is inherently uncertain and can cause us to expend significant money, time and attention to it, even if we are ultimately successful. Any adverse decision could result in a loss of our proprietary rights, subject us to significant liabilities, require us to seek licenses for alternative technologies from third-parties, prevent us from offering all or a portion of our solutions and otherwise negatively affect our business and operating results.

We may be unable to obtain, maintain and protect our intellectual property rights and proprietary information or prevent third-parties from making unauthorized use of our technology.

Our trade secrets, trademarks, trade dress, domain names, copyrights, trade secrets and other intellectual property rights are important to our business. We rely on a combination of confidentiality clauses, assignment agreements and license agreements with employees and third parties, trade secrets, copyrights and trademarks to protect our intellectual property and competitive advantage, all of which offer only limited protection. The steps we take to protect our intellectual property require significant resources and may be inadequate. We will not be able to protect our intellectual

property if we are unable to enforce our rights or if we do not detect unauthorized use of our intellectual property. We may be required to use significant resources to monitor and protect these rights. Despite our precautions, it may be possible for unauthorized third parties to copy our platform and use information that we regard as proprietary to create services that compete with ours. Some license provisions protecting against unauthorized use, copying, transfer and disclosure of our proprietary information may be unenforceable under the laws of certain jurisdictions and foreign countries. Further, we hold no issued patents and thus would not be entitled to exclude or prevent our competitors from using our proprietary technology, methods and processes to the extent independently developed by our competitors.

We enter into confidentiality and invention assignment agreements with our employees and consultants and enter into confidentiality agreements with the parties with whom we have strategic relationships and business alliances. No assurance can be given that these agreements will be effective in controlling access to our proprietary information and trade secrets. The confidentiality agreements on which we rely to protect certain technologies may be breached, may not be adequate to protect our confidential information, trade secrets and proprietary technologies and may not provide an adequate remedy in the event of unauthorized use or disclosure of our confidential information, trade secrets or proprietary technology. Further, these agreements do not prevent our competitors or others from independently developing software that is substantially equivalent or superior to our software. In addition, others may independently discover our trade secrets and confidential information, and in such cases, we likely would not be able to assert any trade secret rights against such parties. Additionally, we may from time to time be subject to opposition or similar proceedings with respect to applications for registrations of our intellectual property, including our trademarks. While we aim to acquire adequate protection of our brand through trademark registrations in key markets, occasionally third parties may have already registered or otherwise acquired rights to identical or similar marks for services that also address our market. We rely on our brand and trademarks to identify our platform and to differentiate our platform and services from those of our competitors, and if we are unable to adequately protect our trademarks third parties may use our brand names or trademarks similar to ours in a manner that may cause confusion in the market, which could decrease the value of our brand and adversely affect our business and competitive advantages.

Policing unauthorized use of our intellectual property and misappropriation of our technology and trade secrets is difficult and we may not always be aware of such unauthorized use or misappropriation. Despite our efforts to protect our intellectual property rights, unauthorized third-parties may attempt to use, copy or otherwise obtain and market or distribute our intellectual property rights or technology or otherwise develop services with the same or similar functionality as our platform. If our competitors infringe, misappropriate or otherwise misuse our intellectual property rights and we are not adequately protected, or if our competitors are able to develop a platform with the same or similar functionality as ours without infringing our intellectual property, our competitive advantage and results of operations could be harmed. Litigation brought to protect and enforce our intellectual property rights could be costly, time consuming and distracting to management and could result in the impairment or loss of portions of our intellectual property. As a result, we may be aware of infringement by our competitors but may choose not to bring litigation to enforce our intellectual property rights due to the cost, time and distraction of bringing such litigation. Furthermore, if we do decide to bring litigation, our efforts to enforce our intellectual property rights may be met with defenses, counterclaims and countersuits challenging or opposing our right to use and otherwise exploit particular intellectual property, services and technology or the enforceability of our intellectual property rights. Our inability to protect our proprietary technology against unauthorized copying or use, as well as any costly litigation or diversion of our management’s attention and resources, could delay further sales or the implementation of our solutions, impair the functionality of our platform, prevent or delay introductions of new or enhanced solutions, result in our substituting inferior or more costly technologies into our platform or injure our reputation. Furthermore, many of our current and potential competitors have the ability to dedicate substantially greater resources to developing and protecting their technology or intellectual property rights than we do.

Our use of “open source” software could negatively affect our ability to sell our solutions and subject us to possible litigation.

Our solutions incorporate and are dependent to a significant extent on the use and development of “open source” software and we intend to continue our use and development of open source software in the future. Such open source software is generally licensed by its authors or other third-parties under open source licenses and is typically freely accessible, usable and modifiable. Pursuant to such open source licenses, we may be subject to certain conditions, including requirements that we offer our proprietary software that incorporates the open source software for no cost, that we make available source code for modifications or derivative works we create based upon, incorporating or using the open source software and that we license such modifications or derivative works under the terms of the particular open source license. If an author or other third party that uses or distributes such open source software were to allege that we had not complied with the conditions of one or more of these licenses, we could be required to incur significant legal expenses defending against such allegations and could be subject to significant damages, enjoined from the sale of our solutions that contained or are dependent upon the open source software and required to comply with the foregoing conditions, which could disrupt the distribution and sale of some of our solutions. Litigation could be costly for us to defend, have a negative effect on our operating results and financial condition or require us to devote additional research and development resources to change our platform. The terms of many open source licenses to which we are subject have not been interpreted by U.S. or foreign courts. As there is little or no legal precedent governing the interpretation of many of the terms of certain of these licenses, the potential impact of these terms on our business is uncertain and may result in unanticipated obligations regarding our solutions and technologies. It is our view that we do not distribute our software, since no installation of our software is necessary and our platform is accessible solely through the “cloud.” Nevertheless, this position could be challenged. Any requirement to disclose our proprietary source code, termination of open source license rights or payments of damages for breach of contract could be harmful to our business, results of operations or financial condition, and could help our competitors develop products and services that are similar to or better than ours.

In addition to risks related to license requirements, usage of open source software can lead to greater risks than the use of third-party commercial software, as open source licensors generally do not provide warranties, controls on the origin or development of the software, or remedies against the licensors. Many of the risks associated with usage of open source software cannot be eliminated and could adversely affect our business.

Although we believe that we have complied with our obligations under the various applicable licenses for open source software, it is possible that we may not be aware of all instances where open source software has been incorporated into our proprietary software or used in connection with our solutions or our corresponding obligations under open source licenses. We do not have robust open source software usage policies or monitoring procedures in place. We rely on multiple software programmers to design our proprietary software and we cannot be certain that our programmers have not incorporated open source software into our proprietary software that we intend to maintain as confidential or that they will not do so in the future. To the extent that we are required to disclose the source code of certain of our proprietary software developments to third-parties, including our competitors, in order to comply with applicable open source license terms, such disclosure could harm our intellectual property position, competitive advantage, results of operations and financial condition. In addition, to the extent that we have failed to comply with our obligations under particular licenses for open source software, we may lose the right to continue to use and exploit such open source software in connection with our operations and solutions, which could disrupt and adversely affect our business.

We rely on search engines and social networking sites to attract a meaningful portion of our merchants. If we are not able to generate traffic to our website through search engines and social networking sites, our ability to attract new merchants may be impaired. In addition, if our merchants are not able to generate traffic to their shops through search engines and social networking sites, their ability to attract consumers may be impaired.

Many of our merchants locate our website through internet search engines, such as Google, and advertisements on social networking sites, such as Facebook. The prominence of our website in response to internet searches is a critical

factor in attracting potential merchants to our platform. If we are listed less prominently or fail to appear in search results for any reason, visits to our website could decline significantly, and we may not be able to replace this traffic.

Similarly, many consumers locate our merchants’ shops through internet search engines and advertisements on social networking sites. If our merchants’ shops are listed less prominently or fail to appear in search results for any reason, visits to our merchants’ shops could decline significantly. As a result, our merchants’ businesses may suffer, which would affect the GMV that they process through our platform and could affect the ability of such merchants to pay for our solutions.

Search engines revise their algorithms from time to time in an attempt to optimize their search results. If search engines modify their algorithms, our website and our merchants’ shops may appear less prominently or not at all in search results, which could result in reduced traffic to our website and to our merchants’ shops.