UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

|

o |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

o |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from to

Commission file number 001-36703

|

Sky Solar Holdings, Ltd. |

|

(Exact name of Registrant as specified in its charter) |

|

|

|

Cayman Islands |

|

(Jurisdiction of incorporation or organization) |

|

|

|

Unit 402, 4th Floor, Fairmont House No.8 Cotton Tree Drive, Admiralty Hong Kong Special Administrative Region People’s Republic of China |

|

(Address of principal executive offices) |

|

|

|

Contact Person: Dr. Hao Wu Principal executive officer Phone: +852 3960 6548 Facsimile: +852 3180 9399 Address: Unit 402, 4th Floor, Fairmont House No.8 Cotton Tree Drive, Admiralty Hong Kong Special Administrative Region People’s Republic of China |

|

*(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

Ordinary Shares, par value |

|

SKYS |

|

NASDAQ Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

|

None |

|

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

|

None |

|

(Title of Class) |

NASDAQ Stock Market LLC (the NASDAQ Capital Market)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

|

|

419,546,514 Ordinary Shares were issued and outstanding as of December 31, 2018 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registration was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer o |

|

Non-accelerated filer x |

|

Emerging growth company x |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. o

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP o |

|

International Financial Reporting Standards as issued |

|

Other o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o Yes o No

FORM 20-F ANNUAL REPORT FISCAL YEAR ENDED DECEMBER 31, 2018

|

|

Page |

|

5 | |

|

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

5 |

|

5 | |

|

5 | |

|

39 | |

|

82 | |

|

114 | |

|

123 | |

|

127 | |

|

129 | |

|

130 | |

|

Item 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

136 |

|

Item 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

139 |

|

141 | |

|

141 | |

|

Item 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

141 |

|

141 | |

|

143 | |

|

143 | |

|

143 | |

|

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

143 |

|

ITEM 16E. PURCHASE OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

143 |

|

143 | |

|

144 | |

|

144 | |

|

145 | |

|

145 | |

|

145 | |

|

146 |

CONVENTIONS THAT APPLY TO THIS ANNUAL REPORT ON FORM 20-F

Unless otherwise indicated, references in this annual report on Form 20-F:

· “ADRs” are to the American depositary receipts, which, if issued, evidence our ADSs;

· “ADSs” are to our American depositary shares, each of which represents eight ordinary shares, par value US$0.0001 per ordinary share;

· “CAD” and “Canadian dollar” are to the legal currency of Canada;

· “China” and the “PRC” are to the People’s Republic of China, excluding, for the purposes of this annual report only, Taiwan and the special administrative regions or Hong Kong and Macau;

· “DG” are to distributed generation;

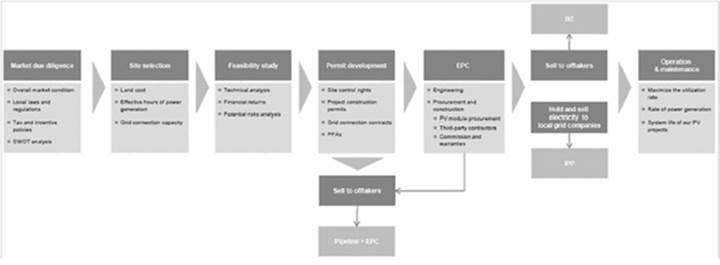

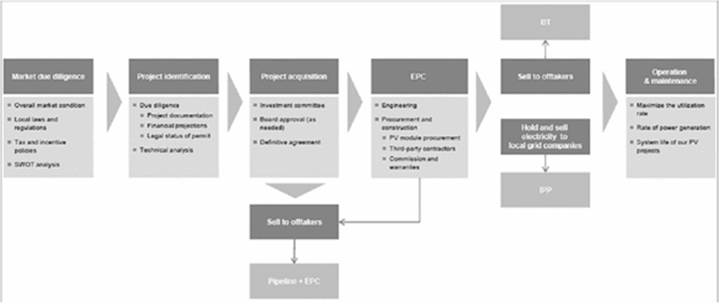

· “EPC” are to engineering, procurement and construction services;

· “Euro” or “EUR” are to the legal currency of the 19 countries comprising the Eurozone;

· “FIT” are to feed-in tariff(s);

· “historical project affiliates” are to certain operating entities in which we have had or currently have non-controlling interests, ChaoriSky Solar Energy S.a r.l., RisenSky Solar Energy S.a r.l., China New Era International Limited, Oky Solar Holdings, Ltd., 1088526 B.C. Ltd. and its subsidiaries, 1091187 B.C, Ltd., OKY Solar 1 K.K and OKY Solar Omut K.K;

· “HK$” are to the legal currency of the special administrative region of Hong Kong;

· “Hudson” are to Hudson Solar Cayman, LP;

· “IPP” are to independent power producer and refer to our business where we own and operate solar parks and derive revenue from selling electricity to the power grid;

· “IPP solar park(s)” are to solar generators which we own for the purpose of generating income from the sale of electricity over the life of the solar park(s);

· “JPY” and “Japanese yen” are to the legal currency of Japan;

· “kWh” are to kilowatt hour(s);

· “MW” are to megawatt(s);

· “Note Purchase Agreement” are to restated note purchase agreement with Hudson as amended on July 15, 2016;

· “O&M” are to operations and maintenance services provided for commercially operating solar parks;

· “ordinary shares” are to our ordinary shares, par value US$0.0001 per share;

· “PPA” are to power purchase agreements;

· “PV” are to photovoltaic;

· “RMB” and “Renminbi” are to the legal currency of China;

· “shovel-ready projects” are to projects that have all permits required for construction and grid connection, even if those projects may lack certain non-discretionary permits for which we have begun the application process and which will be granted and maintained based on our compliance with certain administrative procedures. For more information about our shovel-ready projects, including the anticipated timing of any outstanding permits, see “Item 4. Information on the Company— B. Business Overview — Our IPP Solar Parks.”

· “Silent Partner” are to the third party investor under the two silent partnership agreements entered into by Sky Solar Japan K.K., or SSJ, in September 9, 2014.

· “solar energy system sales” or “selling solar energy systems” refer to projects where we have derived revenue from selling permits and providing EPC services or selling commercially operational solar parks;

· “solar parks in operation” are to solar parks that have completed construction and are selling electricity. For more information about our solar parks in operation, see “Item 4. Information on the Company — B. Business Overview — Our IPP Solar Parks.”

· “solar parks under construction” are to solar parks that have secured site control, energy permits, all key agreements, zoning and environmental permissions and construction permits. For more information about our solar parks under construction, see “Item 4. Information on the Company — B. Business Overview — Our IPP Solar Parks.”

· “solar projects in pipeline” are to solar parks that are being studied for feasibility or have achieved certain milestones, but are not yet ready for construction. For more information about solar parks in our pipeline, see “Item 4. Information on the Company — B. Business Overview — Our IPP Solar Parks.”

· “US$” and “U.S. dollar” are to the legal currency of the United States of America;

· “watt” or “W” are to the measurement of total electrical power, where “kilowatt” or “kW” means one thousand watts, “megawatts” or “MW” means one million watts and “gigawatt” or “GW” means one billion watts; and

· “we,” “us,” “our company,” “our” and “Sky Solar” are to Sky Solar Holdings, Ltd., its former parent company Sky Power Group Ltd., its predecessor entities and its consolidated subsidiaries.

We calculate the size of the PV market based on the volume of PV modules delivered to installation sites, including modules awaiting installation or connection to the power grid. Unless otherwise stated, the PV market relates to annual volume. PV panels generate direct current (DC) electricity, while electricity systems are based on alternating current (AC) electricity. The data presented in DC power numbers are, on average, greater by approximately 15% than the equivalent AC power numbers. All historical and forecast data are presented in DC power numbers. Certain reported AC power numbers have been converted to the equivalent DC power numbers. Our permits are generally calculated using AC power numbers and such AC power numbers have been converted to the equivalent DC power numbers in this annual report.

We calculate the attributable capacity of a solar park by multiplying the percentage of our equity ownership in the solar park by the total capacity of the solar park. Unless specifically indicated or the context otherwise requires, capacity of a solar park in this annual report refers to attributable capacity.

The conversion of Euros, Japanese yen, Renminbi, CAD and Hong Kong dollars into U.S. dollars in this annual report, made solely for the convenience of readers, is based on the noon buying rates in the city of New York for cable transfers of Euros, Japanese yen, Renminbi, CAD and Hong Kong dollars, respectively, as certified for customs purposes by the Federal Reserve Bank of New York as of December 31, 2018, which was EUR1.1456 to US$1.00, JPY109.7000 to US$1.00, RMB6.8755 to US$1.00, CAD1.3644 to US$1.00 and HK$7.8305 to US$1.00, respectively, unless indicated otherwise. No representation is intended to imply that the Euro, Japanese yen, Renminbi and Hong Kong dollar amounts could have been, or could be, converted, realized or settled into U.S.dollars at the foregoing rates or any other rate.

FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F contains statements of a forward-looking nature. All statements other than statements of historical facts are forward-looking statements. These forward-looking statements are made under the “safe harbor” provision under Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and as defined in the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. In some cases, these forward-looking statements can be identified by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,” “is/are likely to” or other similar expressions. These forward-looking statements relate to, among others:

· permitting, development and construction of our project pipeline according to schedule;

· average solar radiation hours globally and in the regions in which we operate;

· developments in, or changes to, laws, regulations, governmental policies and incentives, taxation affecting our operations;

· adverse changes or developments in the industry we operate;

· our ability to obtain additional financing;

· required payments of principal or related interest and other risks of our debt financing;

· our ability to maintain and enhance our market position;

· our ability to successfully implement any of our business strategies;

· the resolution of the dispute with Hudson regarding the Note Purchase Agreement (the “Hudson Dispute”) and related actions and proceedings;

· our ability to establish and operate new solar parks;

· our intention to operate in new markets and jurisdictions;

· our ability to explore new applications of solar energy and obtain business opportunities from other source of renewable energy;

· general political and economic conditions and macro-economic measures taken by the governments to manage economic growth in the geographical markets where we conduct our business;

· material changes in the costs of the PV modules and other equipment required for our operations;

· fluctuations in inflation, interest rates and exchange rates;

· the ramifications of our recent senior management changes and the potential sale of our securities by our former CEO, former chairman, and controlling shareholder, including public perception that our future direction, strategy or leadership is uncertain;

· a putative shareholder class action against our company, our chief executive officer and chief financial officer and our directors;

· other risks outlined in our filings with the United States Securities and Exchange Commission, or the SEC, including our registration statements on Form F-1, as amended; and

· those other risks identified in “Item 3. Key Information — D. Risk Factors” of this annual report on Form 20-F.

These forward-looking statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements are reasonable, we cannot assure you that our expectations will turn out to be correct. Our actual results could be materially different from or worse than our expectations.

The forward-looking statements made in this annual report on Form 20-F relate only to events or information as of the date on which the statements are made in this annual report on Form 20-F. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

A. Selected Financial Data

The following selected consolidated statements of profit or loss and other comprehensive income (expense) data for the years ended December 31, 2016, 2017 and 2018 and the selected consolidated statements of financial position data as of December 31, 2017 and 2018 have been derived from our audited consolidated financial statements included elsewhere in this annual report on Form 20-F. Our selected consolidated statements of profit or loss and other comprehensive income (expense) data for the year ended December 31, 2014 and 2015 and our selected consolidated statements of financial position data as of December 31, 2014, 2015 and 2016 have been derived from our audited consolidated financial statements not included in this annual report on Form 20-F. Our audited consolidated financial statements are prepared and presented in accordance with International Financial Reporting Standards, or IFRS, issued by International Accounting Standards Board.

Our historical results for any period are not necessarily indicative of results to be expected for any future period. You should read the following selected consolidated financial data in conjunction with the consolidated financial statements and related notes and the information under “Item 5. Operating and Financial Review and Prospects.”

Selected Consolidated Statements of Profit or Loss and other Comprehensive Income (Loss)

|

|

|

Year Ended December 31, |

| ||||||||

|

|

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

|

|

|

(US$ in thousands, except for per share information or as otherwise noted) |

| ||||||||

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Related parties |

|

1,788 |

|

4,450 |

|

788 |

|

286 |

|

324 |

|

|

Non-related parties |

|

31,097 |

|

42,705 |

|

65,137 |

|

56,447 |

|

64,345 |

|

|

Total revenue |

|

32,885 |

|

47,155 |

|

65,925 |

|

56,733 |

|

64,669 |

|

|

Cost of sales and services |

|

(20,747 |

) |

(18,533 |

) |

(30,911 |

) |

(23,201 |

) |

(30,262 |

) |

|

Gross profit |

|

12,138 |

|

28,622 |

|

35,014 |

|

33,532 |

|

34,407 |

|

|

Impairment loss on IPP solar parks |

|

(1,549 |

) |

(1,835 |

) |

(2,151 |

) |

(5,221 |

) |

(4,541 |

) |

|

Provision on receivables and other non-current assets |

|

(2,200 |

) |

(1,071 |

) |

— |

|

— |

|

(626 |

) |

|

Selling expenses |

|

(1,160 |

) |

(1,171 |

) |

(882 |

) |

(554 |

) |

(2,610 |

) |

|

Administrative expenses |

|

(63,770 |

)(1) |

(22,556 |

) |

(29,744 |

) |

(25,110 |

) |

(27,948 |

) |

|

Other operating income |

|

6,293 |

|

197 |

|

13,163 |

|

2,068 |

|

25,630 |

|

|

Reversal of provision for other taxes |

|

— |

|

6,025 |

|

— |

|

— |

|

— |

|

|

(Loss) profit from operations |

|

(50,248 |

) |

8,211 |

|

15,400 |

|

4,715 |

|

24,312 |

|

|

Investment income |

|

405 |

|

349 |

|

498 |

|

7,891 |

|

580 |

|

|

Other losses |

|

(15,647 |

) |

(6,901 |

) |

(4,971 |

) |

(39,986 |

) |

(22,397 |

) |

|

Finance costs |

|

(3,817 |

) |

(3,897 |

) |

(6,368 |

) |

(12,200 |

) |

(17,330 |

) |

|

Other expenses |

|

(3,526 |

) |

— |

|

— |

|

— |

|

— |

|

|

(Loss) profit before taxation |

|

(72,833 |

) |

(2,238 |

) |

4,559 |

|

(39,580 |

) |

(14,835 |

) |

|

Income tax (expense) credit |

|

(910 |

) |

684 |

|

(1,277 |

) |

6,530 |

|

(7,285 |

) |

|

(Loss) profit for the year |

|

(73,743 |

) |

(1,554 |

) |

3,282 |

|

(33,050 |

) |

(22,120 |

) |

|

Other comprehensive (loss) income that may be subsequently reclassified to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|

Currency translation difference |

|

(11,114 |

) |

(10,310 |

) |

(57 |

) |

5,579 |

|

(3,190 |

) |

|

Share of other comprehensive income of associates |

|

— |

|

— |

|

136 |

|

— |

|

— |

|

|

Fair value loss arising from cash flow hedges |

|

— |

|

(680 |

) |

(446 |

) |

— |

|

— |

|

|

Release of cumulative fair value loss from cash flow hedges upon disposal of subsidiary |

|

— |

|

— |

|

1,126 |

|

— |

|

— |

|

|

Total comprehensive income |

|

(84,857 |

) |

(12,544 |

) |

4,041 |

|

(27,471 |

) |

(25,310 |

) |

|

Earnings (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(0.21 |

) |

0.00 |

|

0.01 |

|

(0.1 |

) |

(0.05 |

) |

|

Diluted |

|

(0.21 |

) |

0.00 |

|

0.01 |

|

(0.1 |

) |

(0.05 |

) |

|

Earnings (loss) per ADS(2) |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

(1.66 |

) |

(0.03 |

) |

0.08 |

|

(0.8 |

) |

(0.42 |

) |

|

Diluted |

|

(1.66 |

) |

(0.03 |

) |

0.08 |

|

(0.8 |

) |

(0.42 |

) |

|

Other Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(3) |

|

(1,232 |

) |

15,708 |

|

32,223 |

|

31,136 |

|

53,505 |

|

(1) Includes a one-time equity incentive fee expense of US$42.9 million in 2014.

(2) Each ADS represents eight ordinary shares.

(3) See “—Adjusted EBITDA” below.

Revenue Categories

|

|

|

Year Ended December 31, |

| ||||||||

|

|

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

|

|

|

(US$ in thousands) |

| ||||||||

|

Electricity generation income(1) |

|

22,205 |

|

35,479 |

|

53,658 |

|

53,614 |

|

61,438 |

|

|

Solar energy system sales |

|

6,939 |

|

9,392 |

|

9,711 |

|

285 |

|

198 |

|

|

Other(2) |

|

3,741 |

|

2,284 |

|

2,556 |

|

2,834 |

|

3,033 |

|

|

Total Revenue |

|

32,885 |

|

47,155 |

|

65,925 |

|

56,733 |

|

64,669 |

|

(1) Represents revenue from selling electricity from IPP solar parks

(2) Represents revenue from the sale of solar modules and the provisions of O&M services.

Selected Consolidated Statements of Financial Position

|

|

|

Year Ended December 31, |

| ||||||||

|

|

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

|

|

|

(US$ in thousands) |

| ||||||||

|

Current assets |

|

95,496 |

|

80,973 |

|

166,168 |

|

138,402 |

|

174,720 |

|

|

Non-current assets |

|

194,090 |

|

280,107 |

|

310,078 |

|

442,706 |

|

410,497 |

|

|

IPP solar parks |

|

180,610 |

|

259,423 |

|

271,253 |

|

397,405 |

|

353,050 |

|

|

Total assets |

|

289,586 |

|

361,080 |

|

476,246 |

|

581,108 |

|

585,217 |

|

|

Current liabilities |

|

100,859 |

|

74,210 |

|

69,112 |

|

171,933 |

|

224,348 |

|

|

Non-current liabilities |

|

64,978 |

|

174,151 |

|

273,212 |

|

302,947 |

|

282,662 |

|

|

Total equity |

|

123,749 |

|

112,719 |

|

133,922 |

|

106,228 |

|

78,207 |

|

Adjusted EBITDA

To provide investors with additional information regarding our financial results, we have disclosed in this annual report Adjusted EBITDA, a non-IFRS financial measure. We present this non-IFRS financial measure because it is used by our management to evaluate our operating performance. We also believe that this non-IFRS financial measure provides useful information to investors and others in understanding and evaluating our consolidated results of operations in the same manner as our management and in comparing financial results across accounting periods and to those of our peer companies.

Adjusted EBITDA, as we present it, represents profit or loss for the period before taxes, depreciation and amortization, adjusted to eliminate the impact of share-based compensation expense, interest expenses, impairment loss and IPO expenses.

The use of the Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our financial results as reported under IFRS. Some of these limitations are: (a) although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; (b) Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; (c) Adjusted EBITDA does not reflect the potentially dilutive impact of equity-based compensation; (d) Adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us; and (e) other companies, including companies in our industry, may calculate Adjusted EBITDA or similarly titled measures differently, which reduces their usefulness as a comparative measure. Because of these and other limitations, you should consider Adjusted EBITDA alongside our other IFRS-based financial performance measures, such as (loss) profit for the period and our other IFRS financial results. The following table presents a reconciliation of Adjusted EBITDA to (loss) profit for the period, the most directly comparable IFRS measure, for each of the periods indicated:

|

|

|

As of and for the Year Ended December 31, |

| ||||||||

|

|

|

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

|

|

|

|

(US$ in thousands) |

| ||||||||

|

(Loss) profit for the year |

|

(73,743 |

) |

(1,554 |

) |

3,282 |

|

(33,050 |

) |

(22,120 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense (benefit) |

|

910 |

|

(684 |

) |

1,277 |

|

(6,530 |

) |

7,285 |

|

|

Depreciation of property, plant and equipment |

|

531 |

|

281 |

|

271 |

|

298 |

|

204 |

|

|

Depreciation of solar parks |

|

6,177 |

|

9,229 |

|

14,208 |

|

14,272 |

|

19,414 |

|

|

Amortization |

|

214 |

|

102 |

|

71 |

|

44 |

|

52 |

|

|

Share-based payment charged into profit or loss |

|

43,941 |

|

1,389 |

|

997 |

|

(223 |

) |

— |

|

|

Interest expenses |

|

3,817 |

|

3,897 |

|

6,368 |

|

12,200 |

|

17,330 |

|

|

Impairment loss on IPP solar parks |

|

1,549 |

|

1,835 |

|

2,151 |

|

5,221 |

|

4,541 |

|

|

Fair value changes of financial liabilities-FVTPL |

|

9,646 |

|

5,686 |

|

2,957 |

|

39,105 |

|

25,607 |

|

|

Fair value changes of financial assets-FVTPL |

|

— |

|

— |

|

— |

|

— |

|

814 |

|

|

Hedge ineffectiveness on cash flow hedges and net loss arising on interest rate swap designated as FVTPL |

|

— |

|

585 |

|

641 |

|

(201 |

) |

(248 |

) |

|

IPO expenses |

|

3,526 |

|

— |

|

— |

|

— |

|

— |

|

|

Reversal of provision for other taxes |

|

— |

|

(6,025 |

) |

— |

|

— |

|

— |

|

|

Impairment on the receivables and other non-current assets* |

|

2,200 |

|

1,071 |

|

— |

|

— |

|

626 |

|

|

Adjusted EBITDA |

|

(1,232 |

) |

15,708 |

|

32,223 |

|

31,136 |

|

53,505 |

|

* Impairment on other non-current assets included for period of 2018 primarily related to the application of expected credit loss model is in accordance with IFRS 9.

We do not consider historical Adjusted EBITDA prior to the year 2014 to be representative of future Adjusted EBITDA, as our revenue model changed from primarily generating revenue from selling solar energy systems to primarily generating revenue from selling electricity in the fourth quarter of 2013. We believe that Adjusted EBITDA is an important measure for evaluating the results of our IPP business.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in our ADSs involves a high degree of risk. Full and careful consideration should be given to the risks described below, together with other public information on our company, including our filings with securities regulators. Our business, financial condition and results of operations could be materially and adversely affected by any of the risks set forth herein, which could cause the trading price of our ADSs to decline and, therefore, holders to lose all or part of the value of their investments.

Risks Related to Our Business and Industry

Our growth prospects and future profitability depend to a significant extent on global liquidity, our relationships with our financing parties, and the availability of additional funding options with acceptable terms.

We require a significant amount of cash to fund the installation and construction of our projects and other aspects of our operations. We may also require additional cash due to changing business conditions or other future developments, including any investments or acquisitions we may decide to pursue in order to remain competitive. Historically, we fund our project development through debt and equity financing, including but not limited to bank loans, convertible notes, proceeds from our IPO and cash from our operating activities. We expect to continue to expand our business with different financing options, including bank loans, debt or equity securities, financial leases and securitization.

Our financing parties may fail to fully perform their obligations or meet our expectations or cooperate with us satisfactorily for various reasons. Conversely, we may fail to fully perform our obligations due to changing market conditions or other factors. In addition, there can be no assurance that we will be able to maintain such relationships or enter into new relationships on terms or at costs that we find attractive or acceptable. Any deterioration in our existing relationships or failure to enter into new relationships with suitable partners on commercially acceptable terms to finance our project developments may have an adverse impact on our growth prospects and future profitability

For example, we entered into a strategic partnership agreement with Hudson in September 2015 to fund solar projects in Latin America, and to collaborate on identifying and acquiring suitable renewable assets in Japan and the United States. As we have seen a deterioration in cooperation since late 2018, it is unlikely that Hudson would be a source of additional funding, particularly while the Hudson Dispute remains unresolved. If Hudson is successful in its claim, we will be required to pay the amount as sought by Hudson and we may not have sufficient resource. As of the date of this report, Hudson already took enforcement action and control over certain of our subsidiaries, which together held six operating IPP solar parks with carrying amount of US$107.5 million, or 71.7MW as of December 31, 2018. See “Item 8. Financial Information — A. Consolidated Statements and Other Financial Information — Legal Proceedings — Hudson Dispute.” Subject to the outcome of the New York litigation, we intend to take action to regain the control of these two companies, but we cannot assure you that we may be successful.

Our ability to obtain external financing is subject to a number of uncertainties, including:

· our future financial condition, results of operations and cash flows;

· the general condition of global equity and debt capital markets;

· regulatory and government support in the form of tax credits, rebates, FIT price support schemes and other incentives;

· the continued confidence of banks and other financial institutions in our company and the PV industry;

· economic, political and other conditions in the jurisdictions where we operate; and

· our ability to comply with any financial covenants under the debt financing.

In addition, historical project affiliates in which we have held non-controlling interests have secured financing from financial institutions where our affiliates’ other equity owners have acted as financial guarantors. The ability of our affiliates to obtain financing depends on the ability of our affiliates’ other equity owners to secure financing, provide acceptable guarantees for financing and comply with any applicable financial covenants. Due to our minority position, we may not be able to control the ability of the affiliate to comply with any applicable financial covenants or other obligations under the loan.

Any additional equity financing may be dilutive to our shareholders and any debt financing may require restrictive covenants. Additional funds may not be available on terms commercially acceptable to us. Failure to manage discretionary spending and raise additional capital or debt financing as required may adversely impact our ability to achieve our intended business objectives. We may from time to time offer additional securities, which may cause significant dilution. See “—We may issue additional ordinary shares, other equity or equity-linked or debt securities, which may materially and adversely affect the price of our ordinary shares or ADSs. Hedging activities may depress the trading price of our ordinary shares.”

Our substantial indebtedness could adversely affect our business, financial condition and results of operations.

We require a significant amount of cash to meet our capital requirements and fund our operations, including payments to suppliers for PV modules and balance-of-system components and to contractors for design, engineering, procurement and construction services. We believe our substantial indebtedness will increase as we may need to finance the payment of outstanding principal, accrued and unpaid interest and make-whole payment amount under the Note Purchase Agreement, and continue to develop our IPP business. As of December 31, 2018, we had US$49.7 million in outstanding short-term borrowings (including the current portion of long-term borrowings) and US$207.1 million in outstanding long-term borrowings (excluding the current portion), and incurred US$17.3 million interest expense.

Our debt could have significant consequences on our operations, including:

· reducing the availability of our cash flow to fund working capital, capital expenditures, acquisitions and other general corporate purposes as a result of our debt service obligations;

· limiting our ability to obtain additional financing;

· limiting our flexibility in planning for, or reacting to economic downturns;

· increasing our vulnerability to, changes in our business, the industry in which we operate and the general economy; and

· potentially increasing the cost of any additional financing.

Any of these factors and other consequences that may result from our substantial indebtedness could have an adverse effect on our business, financial condition and results of operations as well as our ability to meet our payment obligations under our debt. Our ability to meet our payment obligations under our outstanding debt depends on our ability to generate significant cash flow in the future. This, to some extent, is subject to general economic, financial, competitive, legislative and regulatory factors as well as other factors that are beyond our control.

If we do not successfully execute our financing plan, we may have to sell certain of our operating IPP solar parks or risk not being able to continue as a going concern.

We are in need of additional funding to sustain our business as a going concern. As of December 31, 2018, our current liabilities of US$224.3 million, which included US$121.9 million other current liability due on April 1, 2019 according to the settlement agreement with the silent partnership in Japan, exceeded our current assets by approximately US$49.6 million. In 2018, we incurred net loss of US$22.1 million.

Our management reviews our forecasted cash flows on an on-going basis to ensure that we will have sufficient capital from a combination of internally generated cash flows and proceeds from financing activities and assets disposition, if required, in order to fund our working capital and capital expenditures. For example, as of December 31, 2018, excluding the US$121.9 million current liabilities in connection with the purchase of TK interest pursuant to the TK Interest Agreement, for which we made the payment on March 29, 2019, with a combination of (i) the proceeds in the aggregate of JPY9.4 billion (US$85.7 million) from the sale of 12 Japan IPP solar parks, (ii) cash in bank of JPY3.4 billion (US$31.0 million), and (iii) the proceeds from the drawdown in the amount of JPY2.8 billion (US$25.5 million) under a loan from a third party in Japan, our other remaining current assets of US$98.7 million were US$3.7 million less than our remaining current liability of US$102.4 million.

In addition to the current liabilities of US$224.3 million, as of December 31, 2018, we have committed to capital expenditure of US$30.9 million relating to the construction of solar parks contracted for but not provided for in the consolidated financial statements as of December 31, 2018. Besides, Hudson accelerated the debt collection by sending a notice dated January 22, 2019, declaring that all Obligations (as defined in the Note Purchase Agreement), including the outstanding principal, accrued and unpaid interest and make-whole payment amount thereof, were immediately due, See “Item 8. Financial Information — A. Consolidated Statements and Other Financial Information — Legal Proceedings.” Depending upon the potential resolution of the Hudson Dispute and the related actions and proceedings, we may need to seek additional sources of liquidity. Our principal sources of liquidity to date have been debt and equity financing, including but not limited to bank loans, convertible notes, proceeds from our IPO and cash from our operating activities.

We cannot assure you that we will successfully execute our financing plan. If we do not successfully execute this plan, we may have to sell operating IPP parks and not be able to continue as a going concern. Such failure could materially and adversely affect our financial condition, results of operations and business prospects.

Our failure to comply with financial and other covenants under our loan agreements or other financing arrangements, may materially and adversely affect our financial condition, results of operations and business prospects .

Our loan agreements usually contain financial and other covenants that require us to maintain certain financial ratios or impose certain restrictions on disposition and encumbrance of our assets or the conduct of our business. Our financing parties have alleged and may from time to time allege, that we fail to comply with covenants under these agreements. For example, see “Item 8. Financial Information — A. Consolidated Statements and Other Financial Information — Legal Proceedings — Hudson Dispute.” An event of default under a financing arrangement may result in acceleration of the principal amounts and interests, and trigger cross-default provisions of other financing agreements. For example, the Hudson Dispute may trigger an event of default under the financing documents of our borrowing with Inter-American Development Bank, even though we have not yet received notice from Inter-American Development Bank as of the date of this annual report. If we are required to repay a significant portion or all of our existing indebtedness prior to their maturity, we may lack sufficient financial resources to do so. We are typically required to provide certain collateral under the financing arrangements, including our solar park assets or account or trade receivables for sale of electricity of our solar parks. To the extent we cannot repay our indebtedness, holders of the collateral may auction or sell the assets or interest of our solar parks to enforce their rights, which will materially and adversely affect our financial condition, results of operations and business prospects. Furthermore, a breach of financial and other covenants will also restrict our ability to pay dividends. Any of those events could have a material adverse effect on our financial condition, results of operations and business prospects.

We have been involved in several actions and proceedings, including those in connection with the Hudson Dispute, and being named as a defendant in a putative class action lawsuit. We have also been, and in the future may be, the target of other lawsuits or other allegations by third parties, which could adversely affect our business, financial conditions, results of operations, cash flows, reputation and our ADS trading price.

We have been, and in the future may be, the target of lawsuits or other allegations by third parties, which in the past included, and may in the future include, disputes with our business and funding partners, shareholder class action lawsuits, and malicious allegations, anonymous or otherwise, regarding our personnel, business, operations, accounting, corporate history, prospects or business ethics. For example, Hudson alleged in a series of letters that events of default under the Note Purchase Agreement had occurred .Hudson also sent a notice of acceleration dated January 22, 2019, declaring that all Obligations (as defined in the Note Purchase Agreement), including the alleged outstanding principal, accrued and unpaid interest were immediately due. We dispute that amount is due. On January 22, 2019, Hudson sent a demand on guaranty to us and certain of our subsidiaries who are guarantors of the notes under the Note Purchase Agreement pursuant to a guaranty dated September 18, 2015. Hudson also initiated proceedings in some of the jurisdictions where our business, subsidiaries and guarantors are located to enforce Hudson’s collateral under the Note Purchase Agreement. Hudson exercised its purported rights to enforce its share pledge under the Note Purchase Agreement for Energy Capital Investment S.à.r.l. and its 100% owned subsidiary Renewable Capital Investment 2 S.L. Therefore, Energy Capital Investment S.à.r.l. and Renewable Capital Investment 2 S.L. and its five consolidated Uruguayan special purpose vehicle entities were taken over by Hudson on January 24, 2019. These two subsidiaries hold six operating IPP solar parks with 71.7 MW of production capacity and carrying amount of US$107.5 million. We have advised Hudson that it is not entitled to enforce its share pledges under the Note Purchase Agreement and further advised Hudson of its fiduciary duties in connection with Energy Capital Investment S.à.r.l. and Renewable Capital Investment 2 S.L. On February 8, 2019, Hudson filed an action captioned Hudson Solar Cayman, LP v. Sky Solar Holdings, Ltd., et al. in the Supreme Court of the State of New York, County of New York seeking summary judgment in lieu of a complaint to, among other things, accelerate amounts allegedly due under the Note Purchase Agreement and enforce certain guaranties related to the Note Purchase Agreement against Sky Solar, Sky Solar Power LTD., and Sky International Enterprise Group Limited. On March 11, 2019, we filed an opposition brief in New York Supreme Court to oppose summary judgment. On March 14, 2019, Hudson filed a reply to our opposition brief. Additional information concerning this action is publicly available in court filings under Index No. 650847/2019 (Cohen, J.). Subject to the outcome of the New York litigation, we intend to take action to regain the control of Energy Capital Investment S.à.r.l. and Renewable Capital Investment 2 S.L., but we cannot assure you that we will be successful. Hudson also recently served statutory demands on such guarantors in the Cayman Islands, the British Virgin Islands, and Hong Kong demanding repayment of accelerated amounts allegedly outstanding under the guaranties for the Note Purchase Agreement, which demands were subsequently withdrawn. In addition, Hudson also exercised its purported rights to enforce another share pledge under the Note Purchase Agreement for Lumens Holdings 1, LLC— an entity in respect of approximately 22 MW of operating solar assets in the United States (the “Sunpeak Projects”). Thereafter, Hudson scheduled an auction of the limited liability interests in Lumens Holdings 1, LLC We immediately informed Hudson that its enforcement of the share pledge in connection with Lumens Holdings 1, LLC and its subsequent attempt to conduct an auction for the entity’s interests was premature and patently improper. Consequently, Hudson postponed the auction indefinitely and recently indicated no auction is presently scheduled. Hudson confirmed that it will not proceed with an auction on or prior to June 15, 2019. As of the date of this annual report, the only pending judicial proceeding initiated by Hudson against us is Hudson’s summary judgment proceeding in New York Supreme Court. If the New York Supreme Court rules in Hudson’s favor on its motion for summary judgment in lieu of complaint, we may be required to pay the amounts Hudson seeks in its motion, including amounts for outstanding principal, accrued and unpaid interest and make-whole. We may not have sufficient resources to pay those amounts. Hudson may also be able to enforce its rights under the guaranty or collateral provided to it under the Note Purchase Agreement, which may result in us losing control of our business and assets. Notwithstanding the above, we intend to continue to vigorously defend against Hudson’s summary judgment proceeding in New York Supreme Court and any other actions and proceedings Hudson may commence against us in order to prevent Hudson from controlling our business and assets and to minimize interruptions to our business and operations on a go-forward basis. However, we cannot assure you that we will be successful in defending against these actions and proceedings. In addition, we will have to defend against the securities class action lawsuit described in “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal Proceedings—Hudson Dispute,” including any appeals of such lawsuit should our initial defense be unsuccessful. The total direct costs associated with these legal actions and other proceedings recorded were approximately US$1.5 million for 2017 and nil for 2018.

Addressing and responding to litigation and disputes represents a significant draw on our resources, both due to the involvement of members of management and the need to retain external advisors. Any decision that is not favorable to us or appeals by opposing parties would also represent a draw on our resources. We cannot predict what the result of any appeal might be, which could materially and adversely affect our business, financial conditions, results of operations, cash flows, reputation and ADS trading price.

Beyond what is described above and discussed below, in “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal Proceedings”, we are currently unable in the aggregate to estimate the possible loss or possible range of loss, if any, associated with the outstanding litigation matters. Any adverse outcome of these cases, including any appeal that is not in our favor, could have a material adverse effect on our business, financial condition, results of operation, cash flows, reputation and ADS trading price. In addition, there can be no assurance that our insurance carriers will cover all or part of the defense costs, or any liabilities that may arise from these matters. The litigation process may utilize a significant portion of our cash resources and divert management’s attention from the day-to-day operations of our company, all of which could harm our business. We also may be subject to claims for indemnification related to these matters, and we cannot predict the impact that indemnification claims may have on our business or financial results.

In addition, in October 2014, counsel representing certain former employees of Sky Solar Holdings Co., Ltd., a former shareholder of Sky Solar Power Ltd., sent letters threatening litigation, and certain of these claimants sent harassing emails, short messages and letters to certain of our shareholders, directors and professional advisors alleging that they were deprived of the economic benefits of their holdings in Sky Solar Holdings Co., Ltd. as a result of (i) an alleged failure of sufficient advance notice of the restructuring of Sky Solar Holdings Co., Ltd. and the transfer of assets from Sky Solar Holdings Co., Ltd. to us, and (ii) a purported improper use by Mr. Su of a proxy that such shareholders had granted him to attend shareholder meetings and vote shares on their behalf. In March 2015, a group of former employees and shareholders of Sky Solar Holdings Co., Ltd commenced an arbitration with the Hong Kong International Arbitration Centre, or HKIAC, against our former CEO and former chairman, Mr. Su, and his wholly-owned subsidiary Flash Bright Power Limited (“Flash Bright”) in connection with the restructuring of Sky Solar Holdings Co., Ltd. Sky Solar Holdings Co., Ltd is not a party to the arbitration. Since the commencement of these proceedings, three of the six claimants have withdrawn their claims. In May 2018, an unfavorable arbitral award was granted (the “HKIAC Award”). In January 2019, the claimants applied to the United States District Court Southern District of New York for an order of attachment against the personal property of our former CEO and former chairman Mr. Su, including the ordinary shares and ADS held by Flash Bright, which are among the subject shares under a stock purchase agreement between, among others, Flash Bright and Japan NK Investment K.K. dated March 1, 2019. The order of attachment was granted by the court on March 19, 2019. Although we are not a party to these proceedings, these allegations represented a significant matter requiring close engagement by our management. It is also possible that any allegations and arbitral awards against us or our executives will be publicly disseminated through various media, including, without limitation, internet chat rooms, blogs, social networks or other websites. Any attempted enforcement of the arbitral awards or public dissemination of any of these allegations and arbitral awards by these claimants could adversely affect our business, financial conditions, results of operations, cash flows, reputation and ADS trading price.

Other claims may be brought against or by us from time to time regarding, for example, defective or incomplete work, defective products, personal injuries or deaths, damage to or destruction of property, breach of warranty, late completion of work, delayed payments, intellectual property rights or regulatory compliance, and may subject us to litigation, arbitration and other legal proceedings, which may be expensive, lengthy, disruptive to normal business operations and require significant attention from our management. If we are found to be liable on any claims made against us, we would incur a charge against earnings to the extent that a sufficient reserve had not been implemented. Charges and write-downs associated with such legal proceedings could have a material adverse effect on our business, financial condition, results of operations, cash flows, reputation, and ADS trading price. Moreover, legal proceedings, particularly those resulting in judgments or findings against us, may harm our reputation and competitiveness in the market.

The reduction, modification or elimination of government subsidies and economic incentives may reduce the economic benefits of our existing solar parks and our opportunities to develop or acquire suitable new solar parks.

In many countries where we are currently or intend to become active, solar power markets, particularly the market of on- grid PV systems, would not be commercially viable without government subsidies or economic incentives. The cost of generating electricity from solar energy in these markets currently exceeds, and very likely will continue to exceed for the foreseeable future, the cost of generating electricity from conventional or some other non-solar renewable energy sources. These subsidies and incentives have been primarily in the form of FIT price support schemes, tax credits, net metering and other incentives to end users, distributors, system integrators and manufacturers of solar energy products.

The availability and size of such subsidies and incentives depend, to a large extent, on political and policy developments relating to environmental concerns in a given country. Changes in policies could lead to a significant reduction in or a discontinuation of the support for renewable energies in such country. Government subsidies and incentives for solar energy were recently reduced in some countries and may be further reduced or eliminated in the future. For example, in December 2015, following a ministerial decision, a levy of 3.6% was imposed on the electricity sold by PV stations in Greece from January 1, 2016 onwards. On May 31, 2018, the National Development and Reform Commission, the Ministry of Finance and National Energy Administration of China jointly announced a new policy to lower the solar feed-in-tariff, halt subsidized utility-scale development, and implement a quota for distributed projects in China. The United States federal government currently offers an investment tax credit (“Federal ITC”) under Section 48 of the U.S. Internal Revenue Code, for the installation of commercial solar power. The Federal ITC will reduce gradually from 2020. Compared with the current Federal ITC (30% of the cost of the system for projects which begin construction by December 31, 2019), the Federal ITC for new commercial solar energy systems will be 26% and 22% for projects which began construction from January 1, 2020 to December 31, 2021, respectively, which will further decrease to 10% from 2022. Solar parks that meet the deadlines above for the commencement of construction must be placed in service before January 1, 2024 to qualify for the credits at the levels set out above. In June 2018, the Internal Revenue Service (“IRS”) released its guidance setting forth the requirements for establishing the beginning of construction for solar energy projects. Accordingly, the profitability of our new solar projects in the United States will be adversely affected by the reduction in, or the expiration of, the Federal ITC. Further, under tax reform legislation enacted in the United States in 2017, the tax rates applicable to corporations in the United States have been substantially reduced, from a maximum rate of 35% to a maximum rate of 21%. This may result in the reduced demand of investors in investments in solar parks with Federal ITC, which may in turn increase our costs of capital to be used in constructing these projects. While some of the reductions in government subsidies and economic incentives apply only to future solar parks, they could diminish our opportunities to continue to develop or acquire suitable newly developed solar parks. Some of these reductions may apply retroactively to existing solar parks, which could significantly reduce the economic benefits we receive from the existing solar parks. Moreover, some of the solar program subsidies and incentives expire or decline over time, are limited in total funding, require renewal from regulatory authorities or require us to meet certain investment or performance criteria. A significant reduction in the scope or discontinuation of government incentive programs in our target markets and globally could have a material adverse effect on our business, financial condition, results of operations and prospects.

We conduct our business operations globally and are subject to global and local risks related to economic, regulatory, social and political uncertainties.

We conduct our business operations in a number of countries and, as of December 31, 2018, had completed 406.2 MW of solar parks globally. As of December 31, 2018, we owned and operated 211.0 MW of solar parks as an IPP. In addition, as of December 31, 2018, we had 5.4 MW of solar parks under construction, 136.4 MW of shovel-ready projects and 242.6 MW of solar parks in pipeline in four countries. Our business is therefore subject to diverse and constantly changing economic, regulatory, social and political conditions in the jurisdictions in which we operate.

Operating in the international marketplace exposes us to a number of risks globally and in each of the jurisdictions where we operate, including, without limitation:

· economic and financial conditions, including the stability of credit markets, foreign currency controls and fluctuations;

· the supply and prices of other energy products such as oil, coal and natural gas in the relevant jurisdictions;

· changes in government regulations, policies, tax, subsidies and incentives, particularly those concerning the electric utility industry and the solar industry;

· complex regulations in numerous jurisdictions, including trade restrictions or embargoes;

· political risks, including risks of expropriation and nationalization of assets, potential losses due to civil unrests, acts of terrorism and war, regional and global political or military tensions, strained or altered foreign relations, and trade protectionism, restrictions or embargoes;

· compliance with local environmental, safety, health and other labor laws and regulations, which can be onerous and costly, as the magnitude, complexity and continuous amendments to the laws and regulations are difficult to predict and liabilities, costs, obligations and requirements associated with these laws and regulations can be substantial;

· dependence on governments, utility companies and other entities for electricity, water, telecommunications, transportation and other utilities or infrastructure needs;

· local corporate governance and other legal requirements;

· difficulties with local operating and market conditions, particularly regarding customs, taxation and labor; and

· failure of our contractual parties to honor their obligations to us, and potential disputes with clients, contractors, suppliers or local residents or communities.

At the end of September 2014, five out of the ten general electricity utilities in Japan announced plans to temporarily suspend reviews of proposals from solar energy producers, such as us, due to a foreseeable shortage in their available power transmission capacity in light of the popularity of the FIT program. The five utilities in question are Kyushu Electric Power, Shikoku Electric Power and Okinawa Electric Power, which operate in the west of Japan, and Hokkaido Electric Power and Tohoku Electric Power, which operate in the northeast. Such temporary suspension has been lifted in exchange for the introduction of a new rule referred to as the “designated electric company system.” In cases where the interconnection amounts applied for have already surpassed or are expected to surpass available interconnection amounts under the current rules, electric companies will be able to use the “designated electric company system” to grant interconnection on the premise that such interconnection may be subject to uncompensated curtailment beyond 30 days or 360 hours per year. Power Co., Inc., Tohoku Electric Power Co., Inc., Hokuriku Electric Power Co., Inc., Chugoku Electric Power Co., Inc., Shikoku Electric Power Co., Ltd., Kyushu Electric Power Co., Ltd., and Okinawa Electric Power Co., Inc.) out of the ten general electricity utilities in Japan have been designated as “designated electric companies” for solar projects. While such uncompensated unlimited curtailment will not apply to projects that received the interconnection acceptance before the interconnection application amount surpassed the available interconnection capacity for each relevant electricity utility, we may still experience adverse effect in relation thereto and our future expansion options under the FIT program may be materially and adversely affected. Furthermore, an announcement was made in February 2016 regarding a cabinet decision concerning the “Amendment Bill for Partial Amendment of the Act on Special Measures Concerning Procurement of Electricity from Renewable Energy Sources by Electricity Utilities (FIT Act), etc.” which was submitted in the 190th ordinary session of the Diet. On April 1, 2017, the Amendment of the FIT Act has been enacted. The Amendment of the FIT Act has drastically revised the FIT scheme in order to achieve the dual goal of “maximal implementation of renewable energy and suppression of burden by the citizens.” Some of the main points of the revision are establishing an FIT approval (setsubi nintei) system in light of the incidence of non-operational projects, refining existing schemes in order to ensure the appropriate operation of business throughout the entire business period, setting targets on the mid- to long-term FIT price and disclosure of the FIT price for a multiple-year period, for example, by implementing a bidding system and changing the entities that are obligated to purchase renewable electricity.

Furthermore, since the latter part of 2016, there have been certain notable changes in the Ontario government’s energy policy regarding PPAs. As a result, the second Large Renewal Project program (LRP II) was cancelled, and there will be no further rounds of FIT applications for renewable energy project applications in Ontario. In addition, the outcome Ontario Provincial election scheduled for June 7, 2018 could result in additional uncertainty with the Ontario renewable energy sector. Accordingly, Ontario is no longer a key market for obtaining future PPAs. However, other provinces in Canada have begun work on potential new programs to encourage greater use of renewable energy, potentially utilizing PPAs or otherwise.

In May 2017, U.S. International Trade Commission initiated global safeguard investigation to determine whether crystalline silicon photovoltaic (“CSPV”) cells (whether or not partially or fully assembled into other products) are being imported into the United States in such increased quantities as to be a substantial cause of serious injury, or the threat thereof, to the domestic industry producing an article like or directly competitive with the imported articles (“Section 201 Investigation”). The Section 201 Investigations are not country specific. They involve imports of the products under investigation from all sources, including China. In September 2017, the U.S. International Trade Commission voted affirmatively in respect of whether imports of CSPV cells (whether or not partially or fully assembled into other products) are causing serious injury to domestic producers of CSPV products. On January 22, 2018, the U.S. President made the final decision to provide a remedy to the U.S. industry, and the CSPV cells/modules concerned are subject to the safeguard measures established in the U.S. President’s final result, which includes that the CSPV cells and modules imported will be subject to additional duties of 30%, 25%, 20% and 15% from the first year to the fourth year, respectively, except for the first 2.5 GW of all imported CSPV cells concerned in each of those four years, which are excluded from the additional tariff. It is believed that the costs of solar power projects in the United States may increase and the demand for solar PV products in the United States may be adversely impacted due to the decision of the White House under the Section 201 Investigation. The final decision of the Section 201 Investigation may directly lead to an increase in the cost of U.S. solar power projects, which may lead to an overall reduction in our profitability.

In 2018, Bulgaria changed its legislation in relation to the FIT price support scheme by long term PPAs, which was changed by premium support scheme for PV stations with installed capacity of 4 and above 4 MW. PPAs have been replaced by premium agreements, concluded between each producer and the State Fund “Security of the Electricity System” (“FSES”). Premium agreements have been signed by the end of October 2018 and in force no later than January 1, 2019 and validity for the term of the signed PPA for the given PV station.

In order to receive additional premium determined by Energy and Water Regulatory Commission (“EWRC”), the producers are required to sell the electricity produced at the free market . The EWRC may modify the determined premiums, but only once in every six months, provided that there is a material change between the estimated market price for the base energy load for that period and the estimated one for the remaining period on the free market. In a nutshell, previous FIT is replaced by the sum of free market price plus premium. The free market prices are continuously increasing recently, resulting in the increase of electricity proceeds and corresponding O&M revenue However, it may also lead to the fluctuation of the future O&M revenue in Bulgaria.

In December 2018, the Ministry of Economy, Trade and Industry (“METI”) in Japan determined new measures to reduce the public burden caused by the non-operation of approved commercial facilities for photovoltaic power generation under FIT scheme. Pursuant to the new measures, each non-operation of commercial facility for photovoltaic power generation (>10KW), approved between 2012 and 2014 under the FIT scheme and with the interconnection contract signed before July 31, 2016, is generally required to submit the commencement application to the utility company.

Any non-operation of commercial facility for photovoltaic power generation which is not in accord with the timeline, the approved FIT will be adjusted to the new one which is two years before the application acceptance of utility company. For example, if the application is accepted in 2019, the adjusted FIT will be JPY21 per kWh, which is the FIT of 2017 fiscal year. Due to the new measures, some of our projects in Japan may be suffered from FIT loss.

To the extent that our business operations are affected by unexpected and adverse economic, regulatory, social and political conditions in the jurisdictions in which we have operations, we may experience project disruptions, loss of assets and personnel, and other indirect losses that could adversely affect our business, financial condition and results of operations.

We are expanding our business into China, which may expose our business to new risks that may materially and adversely affect our future prospects and results of operations.

We substantially expanded our business in China in 2018. In March 2018, Suzhou Tianlian New Energy Limited, one of our subsidiaries, entered into two 25-year PPA with two wholly-owned subsidiaries of Shenzhen Kaifa Technology Co., Ltd. to develop a 1.7 MW rooftop solar project in Suzhou, China, which is our first DG project in China. We also entered into two 25-year PPAs with two private companies to develop, one solar project of 0.8 MW waiting for construction permit and one solar project of 1.1 MW in development stage in Kunshan, China by the end of first quarter of 2019. Our ability to successfully implement our business expansion strategy into China is subject to various risks and uncertainties, including, in addition to the general risks and uncertainties for development of solar projects:

· failure to renew the grid connection and dispatch agreements with the grid providers and energy management contracts;

· uncertainty of PPAs and project-level financing arrangements;

· the grid providers’ failure or unwillingness to fulfill their related contractual obligations;

· fluctuations of the price of electricity, particularly the decrease in the public utility rate;

· access to project financing and other sources of capital to finance our China investments, which may not be available on reasonable terms or at all given the fact that Chinese capital and foreign exchange markets are less developed relative to the countries where we have worked in the past;

· curtailment of power purchase amounts promised by utilities due to lack of sufficient transmission grid infrastructure;

· regulations creating significant burdens or limiting entirely the ability of Chinese residents to repatriate capital into China, which affects our ability to finance Chinese investment through funds we have obtained or we will obtain from abroad;

· our short operational history as a downstream solar park developer in China;

· delays in obtaining land rights and related permits and other required governmental permits and approvals;

· potential difficulties in collecting payments from large state-owned enterprises or utilities, due to certain aspects of the Chinese legal system;

· potential challenges from local residents, government organizations, and others who may not support our projects;

· potential conflict with our module and other equipment suppliers as a result of our direct competition with certain of their downstream ventures; and

· the enforcement of the deed of non-competition and right of first refusal with our director and former chief executive officer Mr. Weili Su with respect to his business in China. See “—We have entered into a deed of non-competition and right of first refusal with our director and former chief executive officer Mr. Weili Su with respect to his businesses in China, which may result in a transaction that is not on an arm’s length basis” and “—We rely on licensing arrangements with entities controlled by our director and former chief executive officer, Mr. Su to use the trademark “Sky Solar.” Any improper use of these trademarks by us, our licensor or any other third parties could materially and adversely affect our business, financial condition and results of operations.”

If we are unable to effectively manage these risks, we may not be able to successfully execute our expansion plan in China and face a loss of the time, effort and capital invested there. We may not be able to manage our business growth strategy as planned and our results of operations may be adversely affected.

As we may enter new markets in different jurisdictions and expand our business to new areas, we face different regulatory regimes, business practices, governmental requirements and industry conditions and we may spend substantial resources familiarizing ourselves with the new environment and conditions.

As we may enter new markets in different jurisdictions and expand our business to new areas, we will face different regulatory regimes, business practices, governmental requirements and industry conditions. As a result, our prior experiences and knowledge in other jurisdictions may not be relevant, and we may spend substantial resources familiarizing ourselves with the new environment and conditions. For example, as we are expanding further into the U.S. and China markets, additional risks and permitting delays, as well as, project development and timing issues in a highly regulated market may be significant.

In the United States, federal, state and local government regulations and policies concerning the electric utility industry, utility rate structures, interconnection procedures, and internal policies of electric utilities, heavily influence the market for electricity generation products and services. These regulations and policies often relate to electricity pricing and the interconnection of distributed electricity generation systems to the power grid. Policies and regulations that promote renewable energy have been challenged by traditional utilities and questioned by those in government and others arguing for less governmental spending and involvement in the energy market. To the extent that such views are reflected in government policy, the changes in such policies and regulations could adversely affect our results of operations, cost of capital and growth prospects.

Further, federal, regional, state or local regulations and policies could be changed to provide for new rate programs that undermine the economic returns for both new and existing solar parks in operation by charging additional, non-negotiable fixed or demand charges or other fees or reductions in the number of solar projects allowed under net metering policies. National, regional, state or local government energy policies, law and regulation supporting the creation of or regulating entry into wholesale energy markets is currently, and may continue to be, subject to challenges, modifications and restructuring proposals, which may result in limitations on the commercial strategies available to us for the sale of our power.