UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-22920

The Advisors’ Inner Circle Fund III

(Exact name of registrant as specified in charter)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Address of principal executive offices) (Zip code)

SEI Investments

One Freedom Valley Drive

Oaks, PA 19456

(Name and address of agent for service)

Registrant’s telephone number, including

area code: (877) 446-3863

Date of fiscal year end: December 31, 2024

Date of reporting period: June 30, 2024

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to stockholders pursuant to Rule

30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

0001593547falseN-CSRSAdvisors' Inner Circle Fund IIIN-1A2024-06-300001593547adic:C000234546Member2024-01-012024-06-3000015935472024-01-012024-06-300001593547adic:C000234546Member2024-06-300001593547adic:C000234545Member2024-01-012024-06-300001593547adic:C000234545Member2024-06-300001593547adic:C000234729Member2024-01-012024-06-300001593547adic:C000234729Member2024-06-300001593547adic:C000234729Memberadic:BarclaysBankVersorMTN8076892CTIMember2024-06-300001593547adic:C000234729Memberadic:GSXAT01CINDEX8076917CTIMember2024-06-300001593547adic:C000234729Memberadic:JPQFMOW1INDEX8076920CTIMember2024-06-300001593547adic:C000234729Memberadic:BNPXDITUINDEX8076905CTIMember2024-06-300001593547adic:C000234729Memberadic:MQIS311INDEX8076927CTIMember2024-06-300001593547adic:C000234729Memberadic:GSGUSEquity8076935CTIMember2024-06-300001593547adic:C000234729Memberadic:BNPXDITUINDEX8076938CTIMember2024-06-300001593547adic:C000234729Memberadic:DBTIDUS5INDEX8076941CTIMember2024-06-300001593547adic:C000234729Memberadic:DBVSCVP8INDEX8076944CTIMember2024-06-300001593547adic:C000234729Memberadic:JPQFMOW1INDEX8076947CTIMember2024-06-300001593547adic:C000234730Member2024-01-012024-06-300001593547adic:C000234730Member2024-06-300001593547adic:C000234730Memberadic:BarclaysBankVersorMTN8076892CTIMember2024-06-300001593547adic:C000234730Memberadic:GSXAT01CINDEX8076917CTIMember2024-06-300001593547adic:C000234730Memberadic:JPQFMOW1INDEX8076920CTIMember2024-06-300001593547adic:C000234730Memberadic:BNPXDITUINDEX8076905CTIMember2024-06-300001593547adic:C000234730Memberadic:MQIS311INDEX8076927CTIMember2024-06-300001593547adic:C000234730Memberadic:GSGUSEquity8076935CTIMember2024-06-300001593547adic:C000234730Memberadic:BNPXDITUINDEX8076938CTIMember2024-06-300001593547adic:C000234730Memberadic:DBTIDUS5INDEX8076941CTIMember2024-06-300001593547adic:C000234730Memberadic:DBVSCVP8INDEX8076944CTIMember2024-06-300001593547adic:C000234730Memberadic:JPQFMOW1INDEX8076947CTIMember2024-06-300001593547adic:C000234544Member2024-01-012024-06-300001593547adic:C000234544Member2024-06-300001593547adic:C000234544Memberadic:TencentHoldings8077165CTIMember2024-06-300001593547adic:C000234544Memberadic:MetaPlatforms8077079CTIMember2024-06-300001593547adic:C000234544Memberadic:Apple8076996CTIMember2024-06-300001593547adic:C000234544Memberadic:ServiceNow8077105CTIMember2024-06-300001593547adic:C000234544Memberadic:Microsoft8077082CTIMember2024-06-300001593547adic:C000234544Memberadic:Amazoncom8076991CTIMember2024-06-300001593547adic:C000234544Memberadic:NVIDIA8077096CTIMember2024-06-300001593547adic:C000234544Memberadic:RegeneronPharmaceuticals8077104CTIMember2024-06-300001593547adic:C000234544Memberadic:PDDHoldings8077185CTIMember2024-06-300001593547adic:C000234544Memberadic:BarrickGold8076999CTIMember2024-06-300001593547adic:C000234543Member2024-01-012024-06-300001593547adic:C000234543Member2024-06-300001593547adic:C000234543Memberadic:TencentHoldings8077165CTIMember2024-06-300001593547adic:C000234543Memberadic:MetaPlatforms8077079CTIMember2024-06-300001593547adic:C000234543Memberadic:Apple8076996CTIMember2024-06-300001593547adic:C000234543Memberadic:ServiceNow8077105CTIMember2024-06-300001593547adic:C000234543Memberadic:Microsoft8077082CTIMember2024-06-300001593547adic:C000234543Memberadic:Amazoncom8076991CTIMember2024-06-300001593547adic:C000234543Memberadic:NVIDIA8077096CTIMember2024-06-300001593547adic:C000234543Memberadic:RegeneronPharmaceuticals8077104CTIMember2024-06-300001593547adic:C000234543Memberadic:PDDHoldings8077185CTIMember2024-06-300001593547adic:C000234543Memberadic:BarrickGold8076999CTIMember2024-06-30iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pureutr:Dadic:Holding

The Advisors' Inner Circle Fund III

FS Multi-Strategy Alternatives Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Class A Shares of the FS Multi-Strategy Alternatives Fund (the "Fund") for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fsinvestments.com/investments/all-investments/fsmmx. You can also request this information by contacting us at 877-924-4766.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

FS Multi-Strategy Alternatives Fund, Class A Shares | $99 | 1.96% |

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover |

|---|

| $1,839,714 | 659 | $10,836 | 392% |

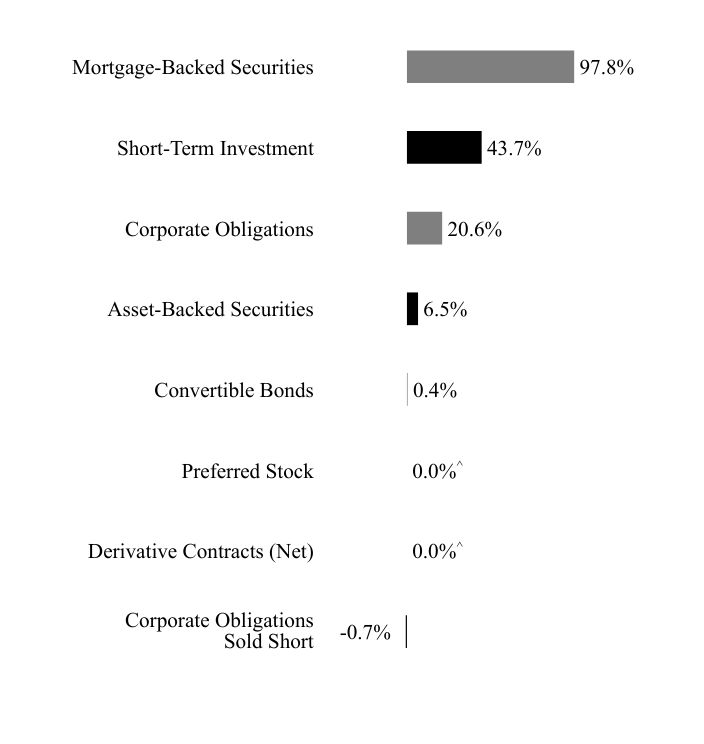

What did the Fund invest in?

Asset WeightingsFootnote Reference*

Value | Value |

|---|

Corporate Obligations

Sold Short | -0.7% |

Derivative Contracts (Net) | 0.0%Footnote Reference^ |

Preferred Stock | 0.0%Footnote Reference^ |

Convertible Bonds | 0.4% |

Asset-Backed Securities | 6.5% |

Corporate Obligations | 20.6% |

Short-Term Investment | 43.7% |

Mortgage-Backed Securities | 97.8% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

Footnote^ | Value shown as 0.0% as a result of rounding. |

Holding Name | Percentage of Total Net Assets |

|---|

Long Securities | |

FNMA or FHLMC TBA, 6.50%, 7/1/2032 | 32.5% |

FNMA or FHLMC TBA, 5.50%, 7/15/2054 | 26.7% |

FNMA or FHLMC TBA, 5.00%, 7/15/2038 | 12.6% |

FNMA or FHLMC TBA, 6.00%, 7/15/2054 | 5.5% |

Barclays Bank Versor MTN | 4.4% |

Short Securities | |

U.S. 10-Year Treasury Note | -0.2% |

Newell Brands | -0.1% |

Fiesta Purchaser | -0.1% |

Cleveland-Cliffs | -0.1% |

Organon | -0.1% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, and holdings, visit or call:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Advisors' Inner Circle Fund III

FS Multi-Strategy Alternatives Fund / Class A Shares - FSMMX

Semi-Annual Shareholder Report - June 30, 2024

CHI-SA-TSR-2024-5

The Advisors' Inner Circle Fund III

FS Multi-Strategy Alternatives Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Class I Shares of the FS Multi-Strategy Alternatives Fund (the "Fund") for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fsinvestments.com/investments/all-investments/fsmsx. You can also request this information by contacting us at 877-924-4766.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

FS Multi-Strategy Alternatives Fund, Class I Shares | $86 | 1.71% |

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover |

|---|

| $1,839,714 | 659 | $10,836 | 392% |

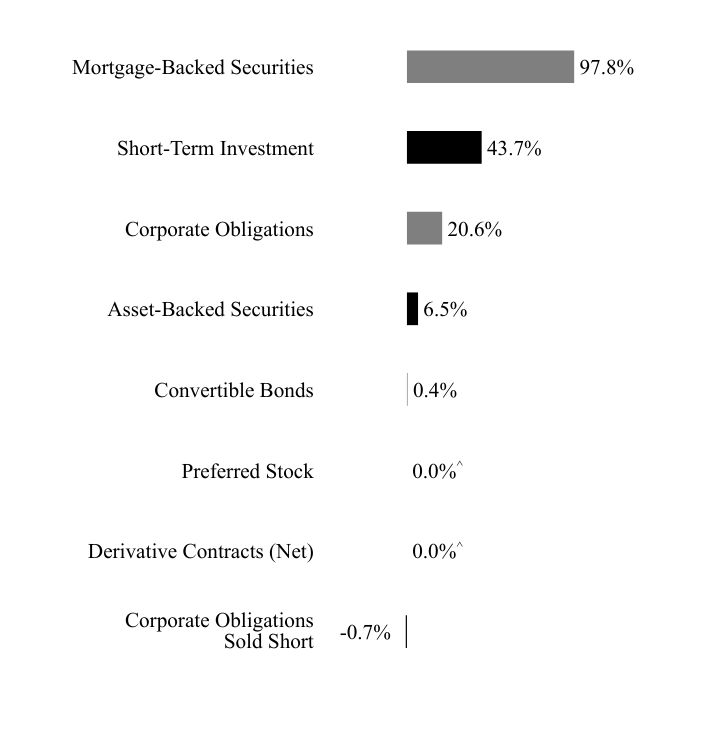

What did the Fund invest in?

Asset WeightingsFootnote Reference*

Value | Value |

|---|

Corporate Obligations

Sold Short | -0.7% |

Derivative Contracts (Net) | 0.0%Footnote Reference^ |

Preferred Stock | 0.0%Footnote Reference^ |

Convertible Bonds | 0.4% |

Asset-Backed Securities | 6.5% |

Corporate Obligations | 20.6% |

Short-Term Investment | 43.7% |

Mortgage-Backed Securities | 97.8% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

Footnote^ | Value shown as 0.0% as a result of rounding. |

Holding Name | Percentage of Total Net Assets |

|---|

Long Securities | |

FNMA or FHLMC TBA, 6.50%, 7/1/2032 | 32.5% |

FNMA or FHLMC TBA, 5.50%, 7/15/2054 | 26.7% |

FNMA or FHLMC TBA, 5.00%, 7/15/2038 | 12.6% |

FNMA or FHLMC TBA, 6.00%, 7/15/2054 | 5.5% |

Barclays Bank Versor MTN | 4.4% |

Short Securities | |

U.S. 10-Year Treasury Note | -0.2% |

Newell Brands | -0.1% |

Fiesta Purchaser | -0.1% |

Cleveland-Cliffs | -0.1% |

Organon | -0.1% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, and holdings, visit or call:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Advisors' Inner Circle Fund III

FS Multi-Strategy Alternatives Fund / Class I Shares - FSMSX

Semi-Annual Shareholder Report - June 30, 2024

CHI-SA-TSR-2024-6

The Advisors' Inner Circle Fund III

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Class A Shares of the FS Managed Futures Fund (the "Fund") for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fsinvestments.com/investments/mutual-fund-reports. You can also request this information by contacting us at 877-924-4766.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

FS Managed Futures Fund, Class A Shares | $26 | 0.50% |

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover |

|---|

| $2,005 | 13 | $0 | 0% |

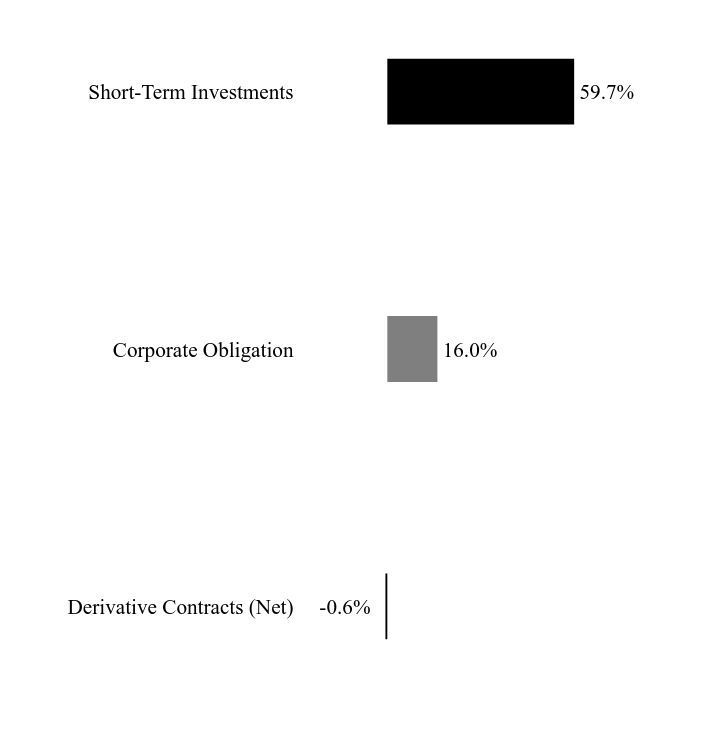

What did the Fund invest in?

Asset WeightingsFootnote Reference*

Value | Value |

|---|

Derivative Contracts (Net) | -0.6% |

Corporate Obligation | 16.0% |

Short-Term Investments | 59.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

Holding Name | | | Percentage of

Total Net Assets |

|---|

Barclays Bank Versor MTN | | | 16.0% |

GSXAT01C Index | | | 0.5% |

JPQFMOW1 Index | | | 0.1% |

BNPXDITU Index | | | 0.0% |

MQIS311 Index | | | 0.0% |

GSG US Equity | | | 0.0% |

BNPXDITU Index | | | 0.0% |

DBTIDUS5 Index | | | 0.0% |

DBVSCVP8 Index | | | 0.0% |

JPQFMOW1 Index | | | 0.0% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, and holdings, visit or call:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Advisors' Inner Circle Fund III

FS Managed Futures Fund / Class A Shares - FMFFX

Semi-Annual Shareholder Report - June 30, 2024

CHI-SA-TSR-2024-3

The Advisors' Inner Circle Fund III

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Class I Shares of the FS Managed Futures Fund (the "Fund") for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fsinvestments.com/investments/mutual-fund-reports. You can also request this information by contacting us at 877-924-4766.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

FS Managed Futures Fund, Class I Shares | $13 | 0.25% |

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover |

|---|

| $2,005 | 13 | $0 | 0% |

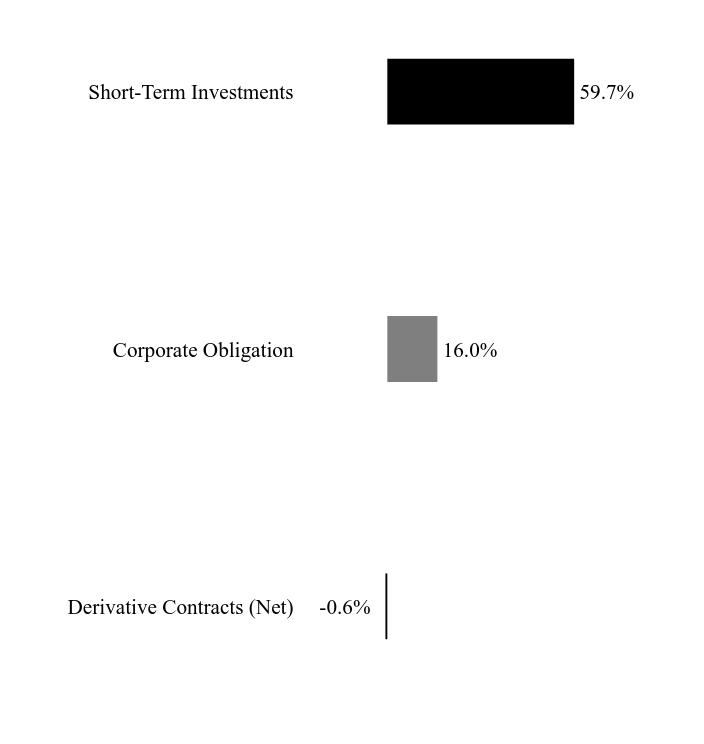

What did the Fund invest in?

Asset WeightingsFootnote Reference*

Value | Value |

|---|

Derivative Contracts (Net) | -0.6% |

Corporate Obligation | 16.0% |

Short-Term Investments | 59.7% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

Holding Name | | | Percentage of

Total Net Assets |

|---|

Barclays Bank Versor MTN | | | 16.0% |

GSXAT01C Index | | | 0.5% |

JPQFMOW1 Index | | | 0.1% |

BNPXDITU Index | | | 0.0% |

MQIS311 Index | | | 0.0% |

GSG US Equity | | | 0.0% |

BNPXDITU Index | | | 0.0% |

DBTIDUS5 Index | | | 0.0% |

DBVSCVP8 Index | | | 0.0% |

JPQFMOW1 Index | | | 0.0% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, and holdings, visit or call:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Advisors' Inner Circle Fund III

FS Managed Futures Fund / Class I Shares - FMGFX

Semi-Annual Shareholder Report - June 30, 2024

CHI-SA-TSR-2024-4

The Advisors' Inner Circle Fund III

FS Chiron Real Development Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Class A Shares of the FS Chiron Real Development Fund (the "Fund") for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fsinvestments.com/investments/all-investments/farlx. You can also request this information by contacting us at 877-924-4766.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

FS Chiron Real Development Fund, Class A Shares | $76 | 1.45% |

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover |

|---|

| $73,219 | 87 | $249 | 196% |

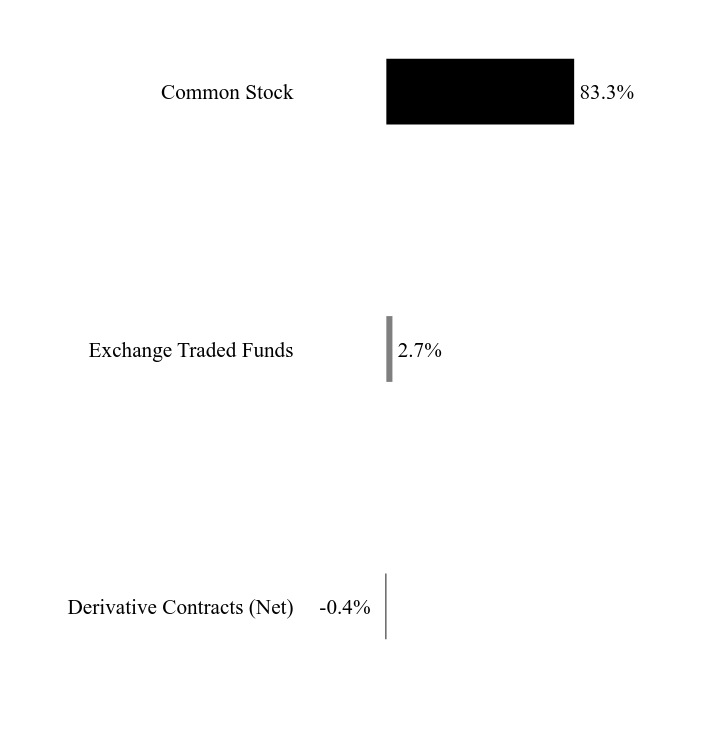

What did the Fund invest in?

Asset WeightingsFootnote Reference*

Value | Value |

|---|

Derivative Contracts (Net) | -0.4% |

Exchange Traded Funds | 2.7% |

Common Stock | 83.3% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

Holding Name | | | Percentage of

Total Net Assets |

|---|

Tencent Holdings | | | 4.9% |

Meta Platforms, Class A | | | 4.1% |

Apple | | | 4.0% |

ServiceNow | | | 3.6% |

Microsoft | | | 3.5% |

Amazon.com | | | 3.5% |

NVIDIA | | | 3.5% |

Regeneron Pharmaceuticals | | | 2.9% |

PDD Holdings | | | 2.5% |

Barrick Gold | | | 2.2% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, and holdings, visit or call:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Advisors' Inner Circle Fund III

FS Chiron Real Development Fund / Class A Shares - FARLX

Semi-Annual Shareholder Report - June 30, 2024

CHI-SA-TSR-2024-2

The Advisors' Inner Circle Fund III

FS Chiron Real Development Fund

Semi-Annual Shareholder Report - June 30, 2024

This semi-annual shareholder report contains important information about Class I Shares of the FS Chiron Real Development Fund (the "Fund") for the period from January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://fsinvestments.com/investments/all-investments/fsrlx/investments/fsrlx. You can also request this information by contacting us at 877-924-4766.

What were the Fund costs for the last six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

FS Chiron Real Development Fund, Class I Shares | $63 | 1.20% |

Key Fund Statistics as of June 30, 2024

| Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover |

|---|

| $73,219 | 87 | $249 | 196% |

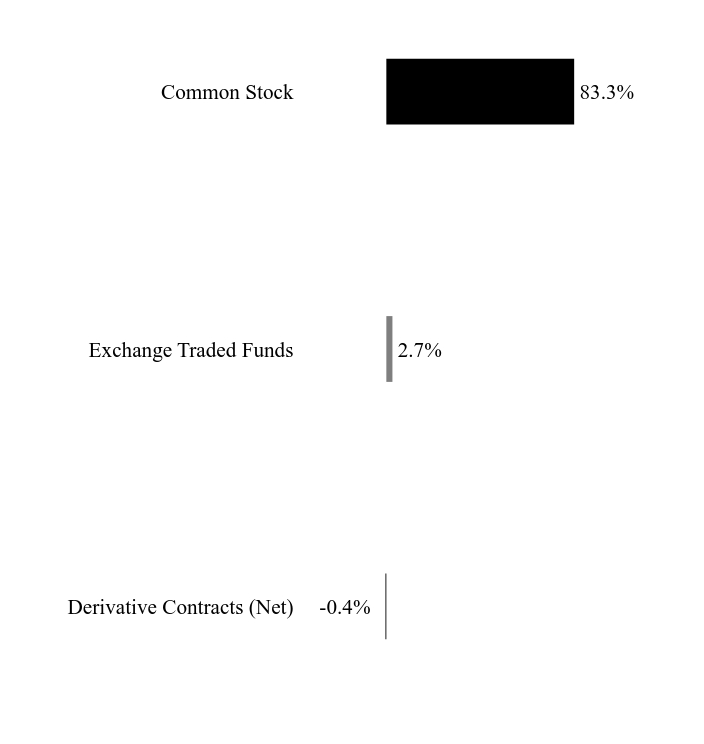

What did the Fund invest in?

Asset WeightingsFootnote Reference*

Value | Value |

|---|

Derivative Contracts (Net) | -0.4% |

Exchange Traded Funds | 2.7% |

Common Stock | 83.3% |

| Footnote | Description |

Footnote* | Percentages are calculated based on total net assets. |

Holding Name | | | Percentage of

Total Net Assets |

|---|

Tencent Holdings | | | 4.9% |

Meta Platforms, Class A | | | 4.1% |

Apple | | | 4.0% |

ServiceNow | | | 3.6% |

Microsoft | | | 3.5% |

Amazon.com | | | 3.5% |

NVIDIA | | | 3.5% |

Regeneron Pharmaceuticals | | | 2.9% |

PDD Holdings | | | 2.5% |

Barrick Gold | | | 2.2% |

There were no material changes during the reporting period.

Changes in and Disagreements with Accountants

There were no changes in or disagreements with accountants during the reporting period.

For additional information about the Fund; including its prospectus, financial information, and holdings, visit or call:

Rule 30e-1 of the Investment Company Act of 1940 permits funds to transmit only one copy of a proxy statement, annual report or semi-annual report to shareholders (who need not be related) with the same residential, commercial or electronic address, provided that the shareholders have consented in writing and the reports are addressed either to each shareholder individually or to the shareholders as a group. This process is known as “householding” and is designed to reduce the duplicate copies of materials that shareholders receive and to lower printing and mailing costs for funds.

The Advisors' Inner Circle Fund III

FS Chiron Real Development Fund / Class I Shares - FSRLX

Semi-Annual Shareholder Report - June 30, 2024

CHI-SA-TSR-2024-1

(b) Not applicable.

Item 2. Code

of Ethics.

Not applicable for semi-annual report.

Item 3. Audit

Committee Financial Expert.

Not applicable for semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable to open-end management investment companies.

Item 6. Schedule of Investments.

(a) The Schedules of Investments are included as part of the Financial Statements

and Other Information filed under Item 7 of this form.

(b) Not applicable.

Item 7. Financial Statements and Financial Highlights for Open-End

Management Investment Companies.

Financial Statements and Financial Highlights are filed herein.

The

Advisors’ Inner Circle Fund III

FS

Multi-Strategy Alternatives Fund

FS

Managed Futures Fund

FS

Chiron Real Development Fund

|

Semi-Annual

Financial Statements and Other Information |

JUNE

30, 2024 |

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

INVESTMENTS

JUNE

30, 2024 |

TABLE

OF CONTENTS

|

Financial Statements

(Form N-CSRS Item 7) |

|

|

Consolidated Schedules

of Investments |

1 |

|

Glossary |

77 |

|

Consolidated Statements

of Assets and Liabilties |

78 |

|

Consolidated Statements

of Operations |

82 |

|

Consolidated Statements

of Changes in Net Assets |

85 |

|

Consolidated Financial

Highlights |

91 |

|

Notes to Consolidated

Financial Statements |

101 |

|

Board of Trustees

Considerations in Approving the Sub-Advisory Agreement (Form N-CSRS Item 11) |

136 |

The Funds file

their complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal

year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT is available on the Funds’ website at https://fsinvestments.com/investments/mutual-fund-reports.

A description

of the policies and procedures that the Funds use to determine how to vote proxies relating to fund securities, as well as information

relating to how a Fund voted proxies relating to fund securities during the most recent 12-month period ended June 30, will be available

after August 30 (i) without charge, upon request, by calling 1-877-924-4766; and (ii) on the Funds’ website at https://fsinvestments.com/investments/mutual-fund-reports.

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

CONSOLIDATED

SCHEDULE OF INVESTMENTS |

|

(Percentages

are based on Net Assets of $1,839,714 (000)) |

|

MORTGAGE-BACKED

SECURITIES — 97.8% |

| |

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

CAYMAN

ISLANDS — 0.1% |

|

ACREC, Ser 2021-FL1,

Cl E |

|

|

|

|

|

|

|

|

|

Callable 07/16/24

@ $100 |

|

|

|

|

|

|

|

|

|

8.446%, TSFR1M

+ 3.114%, 10/16/36(A) (B) |

|

$ |

1,030 |

|

|

$ |

979 |

|

|

Arbor Realty

Commercial Real Estate Notes, Ser 2022-FL2, Cl E |

|

|

|

|

|

|

|

|

|

Callable 07/15/24

@ $100 |

|

|

|

|

|

|

|

|

|

10.329%, TSFR1M

+ 5.000%, 05/15/37(A) (B) |

|

|

100 |

|

|

|

96 |

|

|

AREIT Trust,

Ser 2022-CRE6, Cl D |

|

|

|

|

|

|

|

|

|

Callable 02/15/25

@ $100 |

|

|

|

|

|

|

|

|

|

8.183%, SOFR30A

+ 2.850%, 01/20/37(A) (B) |

|

|

270 |

|

|

|

262 |

|

|

AREIT Trust,

Ser 2022-CRE6, Cl E |

|

|

|

|

|

|

|

|

|

Callable 02/15/25

@ $100 |

|

|

|

|

|

|

|

|

|

8.733%, SOFR30A

+ 3.400%, 01/20/37(A) (B) |

|

|

200 |

|

|

|

189 |

|

|

MF1, Ser 2021-FL6,

Cl E |

|

|

|

|

|

|

|

|

|

Callable 07/16/24

@ $100 |

|

|

|

|

|

|

|

|

|

8.396%, TSFR1M

+ 3.064%, 07/16/36(A) (B) |

|

|

440 |

|

|

|

401 |

|

|

MF1, Ser 2021-FL7,

Cl E |

|

|

|

|

|

|

|

|

|

Callable 07/16/24

@ $100 |

|

|

|

|

|

|

|

|

|

8.246%, TSFR1M

+ 2.914%, 10/16/36(A) (B) |

|

|

370 |

|

|

|

333 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

2,260 |

|

| |

|

|

|

|

|

|

|

|

|

UNITED

STATES — 97.7% |

|

245 Park Avenue

Trust, Ser 2017-245P, Cl E |

|

|

|

|

|

|

|

|

|

3.779%, 06/05/37(A)

(B) |

|

|

240 |

|

|

|

198 |

|

|

A&D Mortgage

Trust, Ser 2024-NQM1, Cl B1 |

|

|

|

|

|

|

|

|

|

Callable 01/25/27

@ $100 |

|

|

|

|

|

|

|

|

|

8.582%, 02/25/69(A)

(B) |

|

|

1,000 |

|

|

|

1,016 |

|

|

Arbor Realty

Commercial Real Estate Notes, Ser 2021-FL1, Cl D |

|

|

|

|

|

|

|

|

|

Callable 07/15/24

@ $100 |

|

|

|

|

|

|

|

|

|

8.393%, TSFR1M

+ 3.064%, 12/15/35(A) (B) |

|

|

1,572 |

|

|

|

1,518 |

|

|

Arbor Realty

Commercial Real Estate Notes, Ser 2021-FL1, Cl E |

|

|

|

|

|

|

|

|

|

Callable 07/15/24

@ $100 |

|

|

|

|

|

|

|

|

|

8.843%, TSFR1M

+ 3.514%, 12/15/35(A) (B) |

|

|

130 |

|

|

|

122 |

|

The

accompanying notes are an integral part of the consolidated financial statements.

1

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

Arbor Realty

Commercial Real Estate Notes, Ser 2021-FL3, Cl D |

|

|

|

|

|

|

|

|

|

Callable 07/15/24

@ $100 |

|

|

|

|

|

|

|

|

|

7.643%, TSFR1M

+ 2.314%, 08/15/34(A) (B) |

|

$ |

200 |

|

|

$ |

197 |

|

|

Arbor Realty

Commercial Real Estate Notes, Ser 2021-FL3, Cl E |

|

|

|

|

|

|

|

|

|

Callable 07/15/24

@ $100 |

|

|

|

|

|

|

|

|

|

7.993%, TSFR1M

+ 2.664%, 08/15/34(A) (B) |

|

|

640 |

|

|

|

617 |

|

|

Arbor Realty

Commercial Real Estate Notes, Ser 2021-FL4, Cl E |

|

|

|

|

|

|

|

|

|

Callable 07/15/24

@ $100 |

|

|

|

|

|

|

|

|

|

8.843%, TSFR1M

+ 3.514%, 11/15/36(A) (B) |

|

|

1,830 |

|

|

|

1,738 |

|

|

Arbor Realty

Commercial Real Estate Notes, Ser 2022-FL1, Cl D |

|

|

|

|

|

|

|

|

|

Callable 08/15/24

@ $100 |

|

|

|

|

|

|

|

|

|

8.333%, SOFR30A

+ 3.000%, 01/15/37(A) (B) |

|

|

1,580 |

|

|

|

1,525 |

|

|

AREIT Trust,

Ser 2022-CRE7, Cl E |

|

|

|

|

|

|

|

|

|

10.520%, TSFR1M

+ 5.191%, 06/17/39(A) (B) |

|

|

110 |

|

|

|

109 |

|

|

Ashford Hospitality

Trust, Ser 2018-ASHF, Cl D |

|

|

|

|

|

|

|

|

|

7.601%, TSFR1M

+ 2.272%, 04/15/35(A) (B) |

|

|

1,760 |

|

|

|

1,715 |

|

|

Atrium Hotel

Portfolio Trust, Ser 2018-ATRM, Cl F |

|

|

|

|

|

|

|

|

|

9.626%, TSFR1M

+ 4.297%, 06/15/35(A) (B) |

|

|

410 |

|

|

|

402 |

|

|

BBCMS Trust,

Ser 2018-BXH, Cl F |

|

|

|

|

|

|

|

|

|

Callable 10/15/25

@ $100 |

|

|

|

|

|

|

|

|

|

8.451%, TSFR1M

+ 3.122%, 10/15/37(A) (B) |

|

|

690 |

|

|

|

681 |

|

|

BF Mortgage Trust,

Ser 2019-NYT, Cl C |

|

|

|

|

|

|

|

|

|

7.326%, TSFR1M

+ 1.997%, 12/15/35(A) (B) |

|

|

100 |

|

|

|

90 |

|

|

BRAVO Residential

Funding Trust, Ser 2023-NQM3, Cl M1 |

|

|

|

|

|

|

|

|

|

Callable 04/25/26

@ $100 |

|

|

|

|

|

|

|

|

|

4.944%, 09/25/62(A)

(B) |

|

|

1,570 |

|

|

|

1,430 |

|

|

BRAVO Residential

Funding Trust, Ser 2023-NQM7, Cl B2 |

|

|

|

|

|

|

|

|

|

Callable 10/25/26

@ $100 |

|

|

|

|

|

|

|

|

|

8.003%, 09/25/63(A)

(B) |

|

|

170 |

|

|

|

166 |

|

|

BRAVO Residential

Funding Trust, Ser 2024-NQM1, Cl B2 |

|

|

|

|

|

|

|

|

|

Callable 01/25/27

@ $100 |

|

|

|

|

|

|

|

|

|

8.226%, 12/01/63(A)

(B) |

|

|

100 |

|

|

|

98 |

|

The

accompanying notes are an integral part of the consolidated financial statements.

2

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

BRAVO Residential

Funding Trust, Ser 2024-NQM3, Cl B2 |

|

|

|

|

|

|

|

|

|

Callable 03/25/27

@ $100 |

|

|

|

|

|

|

|

|

|

8.407%, 03/25/64(A)

(B) |

|

$ |

100 |

|

|

$ |

98 |

|

|

BX Trust, Ser

2018-GW, Cl G |

|

|

|

|

|

|

|

|

|

8.546%, TSFR1M

+ 3.217%, 05/15/35(A) (B) |

|

|

2,227 |

|

|

|

2,214 |

|

|

BX Trust, Ser

2018-GWMZ, Cl MC |

|

|

|

|

|

|

|

|

|

11.114%, TSFR1M

+ 5.785%, 05/15/37(A) (B) |

|

|

1,580 |

|

|

|

1,571 |

|

|

BX Trust, Ser

2021-SDMF, Cl F |

|

|

|

|

|

|

|

|

|

7.381%, TSFR1M

+ 2.051%, 09/15/34(A) (B) |

|

|

1,919 |

|

|

|

1,842 |

|

|

CAFL Issuer,

Ser 2021-RTL1, Cl A2 |

|

|

|

|

|

|

|

|

|

Callable 07/28/24

@ $100 |

|

|

|

|

|

|

|

|

|

3.104%, 03/28/29(A)

(C) |

|

|

498 |

|

|

|

484 |

|

|

Cascade Funding

Mortgage Trust, Ser 2021-FRR1, Cl CK98 |

|

|

|

|

|

|

|

|

|

08/29/29(A)

(D) |

|

|

260 |

|

|

|

159 |

|

|

Chase Home Lending

Mortgage Trust, Ser 2024-4, Cl AX1, IO |

|

|

|

|

|

|

|

|

|

Callable 12/25/36

@ $100 |

|

|

|

|

|

|

|

|

|

0.238%, 03/25/55(A)

(B) |

|

|

10,779 |

|

|

|

51 |

|

|

Chase Home Lending

Mortgage Trust, Ser 2024-5, Cl AX1, IO |

|

|

|

|

|

|

|

|

|

Callable 01/25/37

@ $100 |

|

|

|

|

|

|

|

|

|

0.301%, 04/25/55(A)

(B) |

|

|

14,460 |

|

|

|

91 |

|

|

Citigroup Commercial

Mortgage Trust, Ser 2013-375P, Cl B |

|

|

|

|

|

|

|

|

|

3.635%, 05/10/35(A)

(B) |

|

|

1,500 |

|

|

|

1,440 |

|

|

Citigroup Commercial

Mortgage Trust, Ser 2013-375P, Cl D |

|

|

|

|

|

|

|

|

|

3.635%, 05/10/35(A)

(B) |

|

|

210 |

|

|

|

196 |

|

|

CLNY Trust, Ser

2019-IKPR, Cl D |

|

|

|

|

|

|

|

|

|

7.468%, TSFR1M

+ 2.139%, 11/15/38(A) (B) |

|

|

260 |

|

|

|

246 |

|

|

COLT Mortgage

Loan Trust, Ser 2022-7, Cl B2 |

|

|

|

|

|

|

|

|

|

Callable 07/25/25

@ $100 |

|

|

|

|

|

|

|

|

|

6.285%, 04/25/67(A)

(B) |

|

|

180 |

|

|

|

168 |

|

|

COLT Mortgage

Loan Trust, Ser 2023-1, Cl B2 |

|

|

|

|

|

|

|

|

|

Callable 04/25/26

@ $100 |

|

|

|

|

|

|

|

|

|

8.079%, 04/25/68(A)

(B) |

|

|

140 |

|

|

|

136 |

|

|

COLT Mortgage

Loan Trust, Ser 2024-2, Cl B2 |

|

|

|

|

|

|

|

|

|

Callable 03/25/27

@ $100 |

|

|

|

|

|

|

|

|

The

accompanying notes are an integral part of the consolidated financial statements.

3

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

8.443%, 04/25/69(A)

(B) |

|

$ |

100 |

|

|

$ |

98 |

|

|

COLT Mortgage

Loan Trust, Ser 2024-INV1, Cl B1 |

|

|

|

|

|

|

|

|

|

Callable 01/25/27

@ $100 |

|

|

|

|

|

|

|

|

|

8.161%, 12/25/68(A)

(B) |

|

|

100 |

|

|

|

100 |

|

|

COLT Mortgage

Loan Trust, Ser 2024-INV2, Cl B1 |

|

|

|

|

|

|

|

|

|

Callable 04/25/27

@ $100 |

|

|

|

|

|

|

|

|

|

8.188%, 05/25/69(A)

(B) |

|

|

140 |

|

|

|

140 |

|

|

COMM Mortgage

Trust, Ser 2013-CR8, Cl D |

|

|

|

|

|

|

|

|

|

Callable 05/10/25

@ $100 |

|

|

|

|

|

|

|

|

|

3.659%, 06/10/46(A)

(B) |

|

|

170 |

|

|

|

162 |

|

|

COMM Mortgage

Trust, Ser 2013-CR8, Cl E |

|

|

|

|

|

|

|

|

|

Callable 05/10/25

@ $100 |

|

|

|

|

|

|

|

|

|

4.000%, 06/10/46(A)

(B) |

|

|

150 |

|

|

|

141 |

|

|

COMM Mortgage

Trust, Ser 2013-CR8, Cl F |

|

|

|

|

|

|

|

|

|

Callable 05/10/25

@ $100 |

|

|

|

|

|

|

|

|

|

4.000%, 06/10/46(A)

(B) |

|

|

330 |

|

|

|

304 |

|

|

COMM Mortgage

Trust, Ser 2014-LC15, Cl D |

|

|

|

|

|

|

|

|

|

Callable 02/10/25

@ $100 |

|

|

|

|

|

|

|

|

|

4.948%, 04/10/47(A)

(B) |

|

|

309 |

|

|

|

287 |

|

|

COMM Mortgage

Trust, Ser 2015-PC1, Cl C |

|

|

|

|

|

|

|

|

|

Callable 06/10/25

@ $100 |

|

|

|

|

|

|

|

|

|

4.423%, 07/10/50(B) |

|

|

1,710 |

|

|

|

1,512 |

|

|

COMM Mortgage

Trust, Ser 2019-521F, Cl B |

|

|

|

|

|

|

|

|

|

6.576%, TSFR1M

+ 1.247%, 06/15/34(A) (B) |

|

|

510 |

|

|

|

459 |

|

|

COMM Mortgage

Trust, Ser 2024-WCL1, Cl D |

|

|

|

|

|

|

|

|

|

8.589%, TSFR1M

+ 3.289%, 06/15/41(A) (B) |

|

|

1,000 |

|

|

|

997 |

|

|

Connecticut Avenue

Securities Trust, Ser 2024-R01, Cl 1B2 |

|

|

|

|

|

|

|

|

|

Callable 01/25/29

@ $100 |

|

|

|

|

|

|

|

|

|

9.335%, SOFR30A

+ 4.000%, 01/25/44(A) (B) |

|

|

150 |

|

|

|

155 |

|

|

Connecticut Avenue

Securities Trust, Ser 2024-R02, Cl 1B2 |

|

|

|

|

|

|

|

|

|

Callable 02/25/29

@ $100 |

|

|

|

|

|

|

|

|

|

9.035%, SOFR30A

+ 3.700%, 02/25/44(A) (B) |

|

|

350 |

|

|

|

358 |

|

|

CORE Mortgage

Trust, Ser 2019-CORE, Cl E |

|

|

|

|

|

|

|

|

|

7.276%, TSFR1M

+ 1.947%, 12/15/31(A) (B) |

|

|

1,604 |

|

|

|

1,435 |

|

|

Cross Mortgage

Trust, Ser 2023-H2, Cl B1 |

|

|

|

|

|

|

|

|

|

Callable 10/25/26

@ $100 |

|

|

|

|

|

|

|

|

The

accompanying notes are an integral part of the consolidated financial statements.

4

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

8.451%, 11/25/68(A)

(B) |

|

$ |

760 |

|

|

$ |

769 |

|

|

CSMC Trust, Ser

2017-CHOP, Cl H |

|

|

|

|

|

|

|

|

|

12.794%, PRIME

+ 4.294%, 07/15/32(A) (B) |

|

|

690 |

|

|

|

621 |

|

|

CSMC Trust, Ser

2017-PFHP, Cl A |

|

|

|

|

|

|

|

|

|

6.326%, TSFR1M

+ 0.997%, 12/15/30(A) (B) |

|

|

150 |

|

|

|

145 |

|

|

CSMC Trust, Ser

2021-GATE, Cl C |

|

|

|

|

|

|

|

|

|

8.150%, TSFR1M

+ 2.821%, 12/15/36(A) (B) |

|

|

300 |

|

|

|

282 |

|

|

CSMC Trust, Ser

2021-GATE, Cl D |

|

|

|

|

|

|

|

|

|

9.000%, TSFR1M

+ 3.671%, 12/15/36(A) (B) |

|

|

480 |

|

|

|

442 |

|

|

CSMC Trust, Ser

2022-ATH3, Cl B1 |

|

|

|

|

|

|

|

|

|

Callable 08/25/25

@ $100 |

|

|

|

|

|

|

|

|

|

7.100%, 08/25/67(A)

(B) |

|

|

730 |

|

|

|

709 |

|

|

CyrusOne Data

Centers Issuer I, Ser 2024-3A, Cl A2 |

|

|

|

|

|

|

|

|

|

4.650%, 05/20/49(A) |

|

|

120 |

|

|

|

109 |

|

|

Ellington Financial

Mortgage Trust, Ser 2022-3, Cl M1 |

|

|

|

|

|

|

|

|

|

Callable 07/25/25

@ $100 |

|

|

|

|

|

|

|

|

|

5.007%, 08/25/67(A)

(B) |

|

|

200 |

|

|

|

175 |

|

|

FHLMC Multifamily

Structured Credit Risk, Ser 2021-MN1, Cl B1 |

|

|

|

|

|

|

|

|

|

Callable 09/25/32

@ $100 |

|

|

|

|

|

|

|

|

|

13.085%, SOFR30A

+ 7.750%, 01/25/51(A) (B) |

|

|

130 |

|

|

|

141 |

|

|

FHLMC Multifamily

Structured Credit Risk, Ser 2021-MN3, Cl M2 |

|

|

|

|

|

|

|

|

|

Callable 09/25/36

@ $100 |

|

|

|

|

|

|

|

|

|

9.335%, SOFR30A

+ 4.000%, 11/25/51(A) (B) |

|

|

40 |

|

|

|

40 |

|

|

FHLMC Multifamily

Structured Credit Risk, Ser 2022-MN4, Cl B1 |

|

|

|

|

|

|

|

|

|

Callable 08/25/37

@ $100 |

|

|

|

|

|

|

|

|

|

14.835%, SOFR30A

+ 9.500%, 05/25/52(A) (B) |

|

|

130 |

|

|

|

145 |

|

|

FHLMC Multifamily

Structured Credit Risk, Ser 2022-MN4, Cl M2 |

|

|

|

|

|

|

|

|

|

Callable 08/25/37

@ $100 |

|

|

|

|

|

|

|

|

|

11.835%, SOFR30A

+ 6.500%, 05/25/52(A) (B) |

|

|

867 |

|

|

|

962 |

|

|

FHLMC Multifamily

Structured Credit Risk, Ser 2023-MN7, Cl B1 |

|

|

|

|

|

|

|

|

|

Callable 09/25/31

@ $100 |

|

|

|

|

|

|

|

|

The

accompanying notes are an integral part of the consolidated financial statements.

5

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

14.185%, SOFR30A

+ 8.850%, 09/25/43(A) (B) |

|

$ |

180 |

|

|

$ |

194 |

|

|

FHLMC Multifamily

Structured Credit Risk, Ser 2023-MN7, Cl M2 |

|

|

|

|

|

|

|

|

|

Callable 09/25/31

@ $100 |

|

|

|

|

|

|

|

|

|

11.035%, SOFR30A

+ 5.700%, 09/25/43(A) (B) |

|

|

500 |

|

|

|

542 |

|

|

FHLMC, Ser 2017-356,

Cl S5, IO |

|

|

|

|

|

|

|

|

|

0.553%, 09/15/47(B) |

|

|

21,222 |

|

|

|

2,278 |

|

|

FHLMC, Ser 2017-357,

IO |

|

|

|

|

|

|

|

|

|

4.500%, 09/15/47 |

|

|

13,481 |

|

|

|

2,910 |

|

|

FHLMC, Ser 2019-4927,

IO |

|

|

|

|

|

|

|

|

|

5.000%, 11/25/49 |

|

|

8,874 |

|

|

|

2,084 |

|

|

FHLMC, Ser 2020-4973,

Cl BI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 05/25/50 |

|

|

21,058 |

|

|

|

4,810 |

|

|

FHLMC, Ser 2020-4973,

Cl IK, IO |

|

|

|

|

|

|

|

|

|

5.000%, 05/25/50 |

|

|

9,121 |

|

|

|

1,757 |

|

|

FHLMC, Ser 2020-4986,

IO |

|

|

|

|

|

|

|

|

|

4.500%, 06/25/50 |

|

|

16,212 |

|

|

|

3,618 |

|

|

FHLMC, Ser 2020-4989,

Cl EI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 07/25/50 |

|

|

14,504 |

|

|

|

2,928 |

|

|

FHLMC, Ser 2020-4998,

Cl KI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 08/25/50 |

|

|

17,308 |

|

|

|

3,613 |

|

|

FHLMC, Ser 2020-5003,

Cl LI, IO |

|

|

|

|

|

|

|

|

|

2.500%, 08/25/50 |

|

|

16,242 |

|

|

|

1,838 |

|

|

FHLMC, Ser 2020-5015,

Cl BI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 09/25/50 |

|

|

15,875 |

|

|

|

3,189 |

|

|

FHLMC, Ser 2020-5019,

Cl MI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 10/25/50 |

|

|

21,819 |

|

|

|

4,645 |

|

|

FHLMC, Ser 2020-5038,

Cl HI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 11/25/50 |

|

|

24,482 |

|

|

|

5,239 |

|

|

FHLMC, Ser 2021-5093,

Cl GI, IO |

|

|

|

|

|

|

|

|

|

3.000%, 03/25/51 |

|

|

15,079 |

|

|

|

2,583 |

|

|

FHLMC, Ser 2021-5104,

Cl GI, IO |

|

|

|

|

|

|

|

|

|

3.500%, 06/25/49 |

|

|

17,650 |

|

|

|

3,146 |

|

|

FHLMC, Ser 2021-5112,

Cl KI, IO |

|

|

|

|

|

|

|

|

|

3.500%, 06/25/51 |

|

|

20,425 |

|

|

|

3,787 |

|

|

FHLMC, Ser 2021-5134,

Cl BI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 08/25/51 |

|

|

21,039 |

|

|

|

4,661 |

|

The

accompanying notes are an integral part of the consolidated financial statements.

6

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

FHLMC, Ser 2021-5152,

Cl YI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 10/25/49 |

|

$ |

13,311 |

|

|

$ |

2,755 |

|

|

FHLMC, Ser 2021-5154,

Cl GI, IO |

|

|

|

|

|

|

|

|

|

2.000%, 03/25/42 |

|

|

24,259 |

|

|

|

1,376 |

|

|

FHLMC, Ser 2021-5163,

Cl JI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 09/25/51 |

|

|

19,653 |

|

|

|

3,927 |

|

|

FHLMC, Ser 2021-5163,

Cl NI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 11/25/51 |

|

|

8,844 |

|

|

|

1,937 |

|

|

FHLMC, Ser 2021-5182,

IO |

|

|

|

|

|

|

|

|

|

4.000%, 04/25/51 |

|

|

13,116 |

|

|

|

2,789 |

|

|

FHLMC, Ser 2021-5184,

IO |

|

|

|

|

|

|

|

|

|

4.000%, 01/25/52 |

|

|

18,386 |

|

|

|

3,722 |

|

|

FHLMC, Ser 2022-5191,

Cl NI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 06/15/42 |

|

|

13,264 |

|

|

|

2,427 |

|

|

FHLMC, Ser 2022-5250,

Cl SA, IO |

|

|

|

|

|

|

|

|

|

08/25/52(B)

(D) |

|

|

44,235 |

|

|

|

2,744 |

|

|

FHLMC, Ser 2022-5252,

Cl SP, IO |

|

|

|

|

|

|

|

|

|

0.015%, 09/25/52(B) |

|

|

30,968 |

|

|

|

1,585 |

|

|

FHLMC, Ser 2022-5270,

Cl IB, IO |

|

|

|

|

|

|

|

|

|

4.500%, 09/25/50 |

|

|

11,018 |

|

|

|

2,276 |

|

|

FHLMC, Ser 2022-5279,

Cl IM, IO |

|

|

|

|

|

|

|

|

|

4.000%, 11/25/51 |

|

|

10,032 |

|

|

|

1,992 |

|

|

FHLMC, Ser 2023-406,

Cl S43, IO |

|

|

|

|

|

|

|

|

|

1.865%, 10/25/53(B) |

|

|

45,291 |

|

|

|

3,775 |

|

|

FHLMC, Ser 2023-406,

Cl S44, IO |

|

|

|

|

|

|

|

|

|

1.665%, 10/25/53(B) |

|

|

88,545 |

|

|

|

6,891 |

|

|

FHLMC, Ser 2023-406,

Cl S5, IO |

|

|

|

|

|

|

|

|

|

0.715%, 10/25/53(B) |

|

|

69,671 |

|

|

|

3,440 |

|

|

FHLMC, Ser 2023-5290,

Cl TS, IO |

|

|

|

|

|

|

|

|

|

0.915%, 12/25/52(B) |

|

|

48,914 |

|

|

|

3,287 |

|

|

FHLMC, Ser 2023-5296,

Cl ST, IO |

|

|

|

|

|

|

|

|

|

0.915%, 11/25/52(B) |

|

|

48,280 |

|

|

|

3,996 |

|

|

FHLMC, Ser 2023-5336,

Cl SA, IO |

|

|

|

|

|

|

|

|

|

0.465%, 09/25/53(B) |

|

|

67,069 |

|

|

|

2,771 |

|

|

FHLMC, Ser 2023-5344,

Cl SA, IO |

|

|

|

|

|

|

|

|

|

0.315%, 10/25/53(B) |

|

|

68,909 |

|

|

|

2,740 |

|

|

FHLMC, Ser 2023-5354,

Cl SL, IO |

|

|

|

|

|

|

|

|

|

1.515%, 11/25/53(B) |

|

|

46,270 |

|

|

|

3,386 |

|

|

FHLMC, Ser 2024-5412,

Cl MI, IO |

|

|

|

|

|

|

|

|

|

5.000%, 01/25/49 |

|

|

16,562 |

|

|

|

2,732 |

|

The

accompanying notes are an integral part of the consolidated financial statements.

7

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

FNMA or FHLMC

TBA |

|

|

|

|

|

|

|

|

|

6.500%, 07/01/32 |

|

$ |

588,000 |

|

|

$ |

598,428 |

|

|

6.000%, 07/15/54 |

|

|

100,000 |

|

|

|

100,277 |

|

|

5.500%, 07/15/54 |

|

|

499,000 |

|

|

|

492,119 |

|

|

5.000%, 07/15/38 |

|

|

240,000 |

|

|

|

231,938 |

|

|

FNMA, Ser 2012-75,

Cl DS, IO |

|

|

|

|

|

|

|

|

|

0.500%, 07/25/42(B) |

|

|

9,137 |

|

|

|

951 |

|

|

FNMA, Ser 2018-73,

Cl SC, IO |

|

|

|

|

|

|

|

|

|

0.750%, 10/25/48(B) |

|

|

20,193 |

|

|

|

1,978 |

|

|

FNMA, Ser 2019-49,

Cl IC, IO |

|

|

|

|

|

|

|

|

|

4.500%, 05/25/44 |

|

|

9,169 |

|

|

|

1,020 |

|

|

FNMA, Ser 2020-41,

Cl IP, IO |

|

|

|

|

|

|

|

|

|

4.000%, 09/25/49 |

|

|

12,194 |

|

|

|

2,377 |

|

|

FNMA, Ser 2020-57,

Cl IB, IO |

|

|

|

|

|

|

|

|

|

4.500%, 08/25/50 |

|

|

31,739 |

|

|

|

6,755 |

|

|

FNMA, Ser 2020-76,

Cl MI, IO |

|

|

|

|

|

|

|

|

|

5.500%, 11/25/50 |

|

|

12,418 |

|

|

|

3,158 |

|

|

FNMA, Ser 2020-77,

Cl HI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 11/25/50 |

|

|

17,994 |

|

|

|

3,681 |

|

|

FNMA, Ser 2020-89,

Cl KI, IO |

|

|

|

|

|

|

|

|

|

4.000%, 12/25/50 |

|

|

23,260 |

|

|

|

4,565 |

|

|

FNMA, Ser 2021-27,

Cl EI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 05/25/51 |

|

|

24,293 |

|

|

|

5,445 |

|

|

FNMA, Ser 2021-4,

Cl IV, IO |

|

|

|

|

|

|

|

|

|

4.500%, 06/25/50 |

|

|

12,956 |

|

|

|

2,899 |

|

|

FNMA, Ser 2021-62,

Cl DI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 09/25/48 |

|

|

9,742 |

|

|

|

2,182 |

|

|

FNMA, Ser 2021-62,

Cl HI, IO |

|

|

|

|

|

|

|

|

|

2.500%, 08/25/51 |

|

|

13,498 |

|

|

|

1,850 |

|

|

FNMA, Ser 2021-87,

Cl GI, IO |

|

|

|

|

|

|

|

|

|

3.500%, 12/25/51 |

|

|

27,556 |

|

|

|

5,202 |

|

|

FNMA, Ser 2021-91,

Cl NI, IO |

|

|

|

|

|

|

|

|

|

3.500%, 01/25/52 |

|

|

20,892 |

|

|

|

3,921 |

|

|

FNMA, Ser 2022-16,

Cl QI, IO |

|

|

|

|

|

|

|

|

|

3.500%, 04/25/52 |

|

|

27,197 |

|

|

|

3,157 |

|

|

FNMA, Ser 2022-74,

Cl SA, IO |

|

|

|

|

|

|

|

|

|

10/25/52(B)

(D) |

|

|

56,602 |

|

|

|

1,835 |

|

|

FNMA, Ser 2022-74,

Cl US, IO |

|

|

|

|

|

|

|

|

|

11/25/52(B)

(D) |

|

|

66,889 |

|

|

|

2,363 |

|

The

accompanying notes are an integral part of the consolidated financial statements.

8

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

FNMA, Ser 2022-90,

Cl CI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 05/25/50 |

|

$ |

22,386 |

|

|

$ |

4,639 |

|

|

FNMA, Ser 2023-11,

Cl HS, IO |

|

|

|

|

|

|

|

|

|

0.840%, 04/25/53(B) |

|

|

128,169 |

|

|

|

5,652 |

|

|

FNMA, Ser 2023-11,

Cl SA, IO |

|

|

|

|

|

|

|

|

|

0.915%, 04/25/53(B) |

|

|

60,964 |

|

|

|

3,529 |

|

|

FNMA, Ser 2023-19,

Cl SB, IO |

|

|

|

|

|

|

|

|

|

1.515%, 05/25/53(B) |

|

|

20,388 |

|

|

|

1,505 |

|

|

FNMA, Ser 2023-431,

Cl C35, IO |

|

|

|

|

|

|

|

|

|

2.000%, 07/25/37 |

|

|

64,839 |

|

|

|

4,549 |

|

|

FNMA, Ser 2024-11,

Cl IK, IO |

|

|

|

|

|

|

|

|

|

6.500%, 03/25/54 |

|

|

12,146 |

|

|

|

2,662 |

|

|

FNMA, Ser 2024-12,

Cl DS, IO |

|

|

|

|

|

|

|

|

|

0.715%, 03/25/54(B) |

|

|

47,509 |

|

|

|

2,573 |

|

|

FNMA, Ser 2024-22,

Cl SA, IO |

|

|

|

|

|

|

|

|

|

0.765%, 05/25/54(B) |

|

|

81,101 |

|

|

|

4,741 |

|

|

FNMA, Ser 2024-24,

Cl SB, IO |

|

|

|

|

|

|

|

|

|

1.265%, 09/25/53(B) |

|

|

48,764 |

|

|

|

3,281 |

|

|

Fontainebleau

Miami Beach Trust, Ser 2019-FBLU, Cl F |

|

|

|

|

|

|

|

|

|

4.095%, 12/10/36(A)

(B) |

|

|

1,500 |

|

|

|

1,448 |

|

|

GCAT Trust, Ser

2024-NQM2, Cl B1 |

|

|

|

|

|

|

|

|

|

Callable 06/25/27

@ $100 |

|

|

|

|

|

|

|

|

|

7.860%, 06/25/59(A)

(B) |

|

|

1,000 |

|

|

|

1,000 |

|

|

GCAT Trust, Ser

2024-NQM2, Cl B2 |

|

|

|

|

|

|

|

|

|

Callable 06/25/27

@ $100 |

|

|

|

|

|

|

|

|

|

8.136%, 06/25/59(A)

(B) |

|

|

210 |

|

|

|

203 |

|

|

GNMA, Ser 2010-35,

Cl AS, IO |

|

|

|

|

|

|

|

|

|

0.297%, 03/20/40(B) |

|

|

10,889 |

|

|

|

776 |

|

|

GNMA, Ser 2010-37,

Cl SG, IO |

|

|

|

|

|

|

|

|

|

0.247%, 03/20/40(B) |

|

|

8,571 |

|

|

|

598 |

|

|

GNMA, Ser 2011-70,

Cl WI, IO |

|

|

|

|

|

|

|

|

|

12/20/40(B)

(D) |

|

|

17,143 |

|

|

|

614 |

|

|

GNMA, Ser 2015-123,

Cl SE, IO |

|

|

|

|

|

|

|

|

|

0.267%, 09/20/45(B) |

|

|

10,051 |

|

|

|

990 |

|

|

GNMA, Ser 2016-77,

Cl SC, IO |

|

|

|

|

|

|

|

|

|

0.647%, 10/20/45(B) |

|

|

13,717 |

|

|

|

1,512 |

|

|

GNMA, Ser 2017-179,

Cl TI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 12/20/47 |

|

|

12,248 |

|

|

|

2,646 |

|

The

accompanying notes are an integral part of the consolidated financial statements.

9

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

GNMA, Ser 2018-100,

Cl S, IO |

|

|

|

|

|

|

|

|

|

0.747%, 07/20/48(B) |

|

$ |

10,626 |

|

|

$ |

1,112 |

|

|

GNMA, Ser 2018-21,

Cl PI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 02/20/48 |

|

|

25,109 |

|

|

|

5,372 |

|

|

GNMA, Ser 2018-89,

Cl LS, IO |

|

|

|

|

|

|

|

|

|

0.747%, 06/20/48(B) |

|

|

17,187 |

|

|

|

1,841 |

|

|

GNMA, Ser 2018-91,

Cl SH, IO |

|

|

|

|

|

|

|

|

|

0.797%, 07/20/48(B) |

|

|

10,598 |

|

|

|

1,068 |

|

|

GNMA, Ser 2018-91,

Cl SJ, IO |

|

|

|

|

|

|

|

|

|

0.797%, 07/20/48(B) |

|

|

11,326 |

|

|

|

1,156 |

|

|

GNMA, Ser 2019-133,

Cl EI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 04/20/49 |

|

|

9,473 |

|

|

|

2,043 |

|

|

GNMA, Ser 2020-127,

Cl IY, IO |

|

|

|

|

|

|

|

|

|

4.000%, 08/20/50 |

|

|

14,555 |

|

|

|

2,884 |

|

|

GNMA, Ser 2020-148,

Cl IP, IO |

|

|

|

|

|

|

|

|

|

4.500%, 02/20/48 |

|

|

21,779 |

|

|

|

4,660 |

|

|

GNMA, Ser 2020-4,

IO |

|

|

|

|

|

|

|

|

|

5.000%, 01/20/50 |

|

|

17,082 |

|

|

|

3,296 |

|

|

GNMA, Ser 2020-53,

Cl QI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 08/20/49 |

|

|

11,334 |

|

|

|

2,323 |

|

|

GNMA, Ser 2020-61,

IO |

|

|

|

|

|

|

|

|

|

4.500%, 05/20/50 |

|

|

17,318 |

|

|

|

3,437 |

|

|

GNMA, Ser 2021-139,

Cl WI, IO |

|

|

|

|

|

|

|

|

|

4.048%, 11/20/45(B) |

|

|

13,587 |

|

|

|

2,223 |

|

|

GNMA, Ser 2021-158,

Cl JI, IO |

|

|

|

|

|

|

|

|

|

5.000%, 02/20/50 |

|

|

10,400 |

|

|

|

2,385 |

|

|

GNMA, Ser 2021-215,

Cl SB, IO |

|

|

|

|

|

|

|

|

|

1.000%, 12/20/51(B) |

|

|

16,664 |

|

|

|

768 |

|

|

GNMA, Ser 2021-216,

Cl IC, IO |

|

|

|

|

|

|

|

|

|

3.000%, 12/20/51 |

|

|

29,888 |

|

|

|

3,752 |

|

|

GNMA, Ser 2021-78,

Cl IC, IO |

|

|

|

|

|

|

|

|

|

4.000%, 05/20/51 |

|

|

28,545 |

|

|

|

5,070 |

|

|

GNMA, Ser 2022-148,

Cl SJ, IO |

|

|

|

|

|

|

|

|

|

0.667%, 08/20/52(B) |

|

|

39,832 |

|

|

|

2,528 |

|

|

GNMA, Ser 2022-153,

Cl SG, IO |

|

|

|

|

|

|

|

|

|

0.117%, 09/20/52(B) |

|

|

39,079 |

|

|

|

1,376 |

|

|

GNMA, Ser 2022-188,

Cl IE, IO |

|

|

|

|

|

|

|

|

|

4.500%, 01/20/50 |

|

|

14,174 |

|

|

|

2,674 |

|

|

GNMA, Ser 2022-193,

Cl SA, IO |

|

|

|

|

|

|

|

|

|

11/20/52(B)

(D) |

|

|

80,070 |

|

|

|

1,691 |

|

The

accompanying notes are an integral part of the consolidated financial statements.

10

|

THE

ADVISORS’ INNER CIRCLE FUND III |

FS

MULTI-STRATEGY

ALTERNATIVES

FUND

JUNE

30, 2024

(Unaudited) |

|

MORTGAGE-BACKED

SECURITIES — continued |

|

|

|

Face Amount (000) |

|

|

Fair Value (000) |

|

|

UNITED

STATES — (continued) |

|

GNMA, Ser 2022-212,

Cl SA, IO |

|

|

|

|

|

|

|

|

|

0.817%, 12/20/52(B) |

|

$ |

33,209 |

|

|

$ |

1,485 |

|

|

GNMA, Ser 2022-213,

Cl TS, IO |

|

|

|

|

|

|

|

|

|

1.517%, 12/20/52(B) |

|

|

17,066 |

|

|

|

1,087 |

|

|

GNMA, Ser 2022-23,

Cl WI, IO |

|

|

|

|

|

|

|

|

|

4.500%, 02/20/52 |

|

|

9,252 |

|

|

|

1,901 |

|

|

GNMA, Ser 2022-30,

Cl IG, IO |

|

|

|

|

|

|

|

|

|

3.000%, 02/20/52 |

|

|

25,621 |

|

|

|

3,724 |

|

|

GNMA, Ser 2022-34,

Cl IT, IO |

|

|

|

|

|

|

|

|

|

4.000%, 01/20/51 |

|

|

15,885 |

|

|

|

3,234 |

|

|

GNMA, Ser 2022-5,

Cl NI, IO |

|

|

|

|

|

|

|

|

|

3.000%, 01/20/52 |

|

|

25,574 |

|

|

|

3,549 |

|

|

GNMA, Ser 2023-4,

Cl SG, IO |

|

|

|

|

|

|

|

|

|

0.917%, 01/20/53(B) |

|

|

85,159 |

|

|

|

5,672 |

|

|

GNMA, Ser 2023-5,

Cl SC, IO |

|

|

|

|

|

|

|

|

|

0.867%, 01/20/53(B) |

|

|

66,173 |

|

|

|

3,074 |

|

|

GNMA, Ser 2023-82,

Cl US, IO |

|

|

|

|

|

|

|

|

|

1.417%, 06/20/53(B) |

|

|

32,084 |

|

|

|

1,471 |

|

|

GNMA, Ser 2024-65,

Cl SU, IO |

|

|

|

|

|

|

|

|

|

0.817%, 05/20/53(B) |

|

|

72,724 |

|

|

|

3,701 |

|

|

GS Mortgage Securities

Trust, Ser 2017-SLP, Cl G |

|

|

|

|

|

|

|

|

|

4.744%, 10/10/32(A)

(B) |

|

|

1,790 |

|

|

|

1,645 |

|

|

GS Mortgage-Backed

Securities Trust, Ser 2021-PJ4, Cl AIOS, IO |

|

|

|

|

|

|

|

|

|

Callable 12/25/44

@ $100 |

|

|

|

|

|

|

|

|

|

0.220%, 09/25/51(A)

(B) |

|

|

2,764 |

|

|

|