Table of Contents

As filed with the Securities and Exchange Commission on December 17, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Santa Maria Energy Corporation

(Exact name of registrant as specified in its charter)

| Delaware | 1311 | 46-4213481 | ||

| (State or other jurisdiction of incorporation) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2811 Airpark Drive

Santa Maria, California 93455

(805) 938-3320

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

David Pratt

2811 Airpark Drive

Santa Maria, California 93455

(805) 938-3320

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

With copies to:

| Michael E. Dillard Divakar Gupta Latham & Watkins LLP 811 Main Street, Suite 3700 Houston, Texas 77002 (713) 546-5400 |

Laurence S. Levy, Chief Executive Officer Hyde Park Acquisition Corp. II 500 Fifth Avenue 50th floor New York, New York 10110 (212) 644-3450 |

Todd J. Emmerman Katten Muchin Rosenman LLP 575 Madison Avenue New York, New York 10022-2585 (212) 940-8800 |

Approximate date of commencement of the proposed sale of the securities to the public: As soon as practicable after this Registration Statement becomes effective and upon consummation of the merger described in the enclosed document.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, as amended, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share of Stock |

Proposed Maximum Offering Price |

Amount of Registration Fee(5) | ||||

| Common Stock, par value $0.01 per share |

26,096,360(1) | N/A | $132,030,199(2) | $17,006 | ||||

| Preferred Stock, par value $0.01 per share |

50,000(3) | N/A | $50,000,000(4) | $6,440 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Represents the maximum number of shares of common stock of Santa Maria Energy Corporation issuable upon the consummation of the merger described in the joint proxy statement/prospectus. |

| (2) | Estimated solely for the purpose of calculating the registration fee required by Section 6(b) of the Securities Act and calculated in accordance with Rule 457(f)(1)-(2) and Rule 457(c) of the Securities Act, based on the sum of (i) the product of (A) $10.35, the average of the high and low prices per share of Hyde Park Acquisition Corp. II common stock as reported on the NASDAQ Stock Market on December 12, 2013 and (B) 10,068,750, the maximum number of shares of Hyde Park Acquisition Corp. II outstanding common stock that may be exchanged for the merger consideration and (ii) $27,818,636, the aggregate book value of the maximum number of common units of Santa Maria Energy Holdings, LLC that may be exchanged for the merger consideration, computed as of December 12, 2013, the latest practicable date prior to the date hereof for which it was possible to obtain such information. |

| (3) | Represents the maximum number of shares of Preferred Stock of Santa Maria Energy Corporation estimated to be issuable upon consummation of the merger. |

| (4) | The proposed maximum aggregate offering price of Santa Maria Energy Corporation’s Preferred Stock was calculated based upon the aggregate book value of Santa Maria Energy Holdings, LLC preferred units as of December 12, 2013, the latest practicable date prior to the date hereof for which it was possible to obtain such information. |

| (5) | The registration fee for the securities registered hereby has been calculated pursuant to Section 6(b) of the Securities Act of 1933, as amended. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such dates as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this joint proxy statement/prospectus is not complete and may be changed. We may not sell the securities offered by this joint proxy statement/prospectus until the registration statement filed with the Securities and Exchange Commission is effective. This joint proxy statement/prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction where an offer or solicitation is not permitted.

Subject to Completion, Dated December 17, 2013

|

HYDE PARK ACQUISITION CORP. II 500 Fifth Avenue, 50th Floor New York, NY 10110 |

SANTA MARIA ENERGY HOLDINGS, LLC 2811 Airpark Drive Santa Maria, California 93455 |

To the Stockholders of Hyde Park Acquisition Corp. II and the Unitholders of Santa Maria Energy Holdings, LLC:

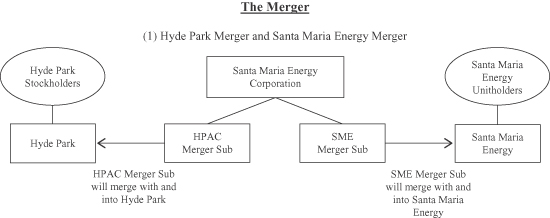

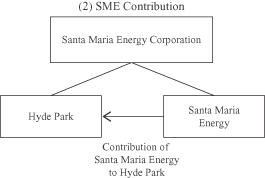

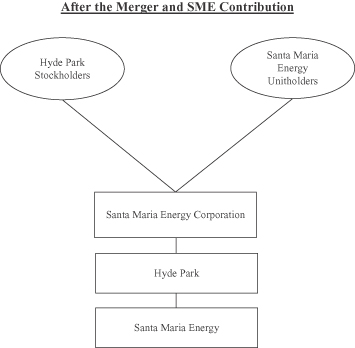

On November 27, 2013, Hyde Park Acquisition Corp. II, a Delaware corporation (“Hyde Park”), Santa Maria Energy Corporation, a Delaware corporation (“Santa Maria Energy Corporation”), HPAC Merger Sub, Inc., a Delaware corporation (“HPAC Merger Sub”), SME Merger Sub, LLC, a Delaware limited liability company (“SME Merger Sub”), and Santa Maria Energy Holdings, LLC, a Delaware limited liability company (“Santa Maria Energy”), entered into an Agreement and Plan of Merger (as amended on December 16, 2013, the “Merger Agreement”) providing for (1) the merger of HPAC Merger Sub, a wholly-owned subsidiary of Santa Maria Energy Corporation, with and into Hyde Park, with Hyde Park surviving as a wholly-owned subsidiary of Santa Maria Energy Corporation (the “Hyde Park Merger”), (2) the merger of SME Merger Sub, a wholly-owned subsidiary of Santa Maria Energy Corporation, with and into Santa Maria Energy, an oil and natural gas exploration and development company, with Santa Maria Energy surviving as a wholly-owned subsidiary of Santa Maria Energy Corporation (the “Santa Maria Energy Merger” and together with the Hyde Park Merger, the “merger”), and (3) the subsequent contribution of Santa Maria Energy to Hyde Park, resulting in Santa Maria Energy becoming a wholly-owned subsidiary of Hyde Park. The stockholders of Hyde Park and the common unitholders of Santa Maria Energy will receive Santa Maria Energy Corporation common stock and the preferred unitholders of Santa Maria Energy will receive Santa Maria Energy Corporation preferred stock as part of the merger.

It is anticipated that, upon consummation of the merger and assuming no conversion of Hyde Park common stock, Hyde Park’s former stockholders will own approximately 38.6% of the outstanding common stock of Santa Maria Energy Corporation and Santa Maria Energy’s former unitholders will own approximately 61.4% of the outstanding common stock of Santa Maria Energy Corporation. In addition, upon consummation of the merger, the former preferred unitholders of Santa Maria Energy will own all of the outstanding preferred stock of Santa Maria Energy Corporation. Santa Maria Energy’s unitholders will not receive any cash as a result of the merger.

Santa Maria Energy unitholders are cordially invited to attend a special meeting of the unitholders of Santa Maria Energy relating to Santa Maria Energy’s proposed merger with Hyde Park. The special meeting of unitholders will be held at a.m., local time, on , 2014 at the offices of Latham & Watkins LLP, 811 Main Street, Suite 3700, Houston, Texas.

At the special meeting, Santa Maria Energy unitholders will be asked to consider and vote upon a proposal to approve the merger (the “merger proposal”) and certain related matters. In addition, Santa Maria Energy will solicit unitholder approval, on an advisory (non-binding) basis, of certain compensation that may be paid or become payable to Santa Maria Energy’s named executive officers in connection with the consummation of the merger (which we refer to as the “merger-related compensation proposal”). Certain of Santa Maria Energy’s unitholders, sometimes referred to herein as the “Kayne Investors,” have agreed, with respect to the merger proposal, to vote all of the outstanding redeemable preferred units (“preferred units”) and all of their common units (representing approximately 30% of Santa Maria Energy’s outstanding common units) “FOR” the merger proposal.

After careful consideration, Santa Maria Energy’s board of managers has determined that the merger proposal is fair to and in the best interests of Santa Maria Energy and its unitholders. Santa Maria Energy’s board of managers unanimously recommends that you vote or give instructions to vote “FOR” the adoption of the merger proposal and the merger related compensation proposal. When you consider the recommendation of Santa Maria Energy’s board of managers in favor of these proposals, you should keep in mind that certain of Santa Maria Energy’s managers and officers have interests in the merger that may conflict with your interests as a unitholder. See the section entitled, “The Merger — Interests of Santa Maria Energy Managers, Officers and Others in the Merger.”

Table of Contents

Hyde Park stockholders are cordially invited to attend a special meeting of the stockholders of Hyde Park relating to Hyde Park’s proposed merger with Santa Maria Energy. The special meeting of stockholders will be held at 10:00 a.m., eastern time, on , 2014, at the offices of Katten Muchin Rosenman LLP, 575 Madison Avenue, New York, New York 10022.

At the special meeting, Hyde Park stockholders will be asked to consider and vote upon a proposal to approve the merger and certain related matters.

As provided in Hyde Park’s amended and restated certificate of incorporation, each Hyde Park stockholder who holds shares of common stock issued in Hyde Park’s initial public offering, which we sometimes refer to as “IPO shares,” has the right to vote either for or against the merger proposal and at the same time demand that Hyde Park convert such stockholder’s shares into cash in an amount equal to such stockholder’s pro rata portion of the trust account which contains a substantial portion of the net proceeds of Hyde Park’s initial public offering. These IPO shares will be converted into cash only if the merger is completed, the stockholder demanding such conversion continues to hold such stockholder’s shares through the closing date of the merger and such stockholder tenders his, her or its stock certificate to Hyde Park in advance of the special meeting. However, a holder of IPO shares (or a “group” of holders of IPO shares, as discussed below) will be restricted from seeking conversion rights with respect to 20% or more of the aggregate IPO shares. Hyde Park does not have a maximum conversion threshold under its amended and restated certificate of incorporation, although under Hyde Park’s amended and restated certificate of incorporation, the merger may not be consummated unless Hyde Park maintains net tangible assets of at least $5,000,001 upon consummation of the merger. In addition, it is a condition to closing the merger that after giving effect to the exercise of conversion rights by Hyde Park stockholders, Hyde Park shall have at least $40 million of cash in its trust account. Hyde Park’s shares of common stock are listed on the NASDAQ Capital Market, which we refer to as “NASDAQ,” under the ticker symbol “HPAC.” Prior to exercising conversion rights, Hyde Park stockholders should verify the market price of Hyde Park’s common stock as they may receive higher proceeds from the sale of their common stock in the public market than from exercising their conversion rights.

Hyde Park’s initial stockholders, sometimes referred to herein as the “Hyde Park sponsors,” have agreed, with respect to the merger proposal, to vote their 2,568,750 shares of Hyde Park common stock acquired prior to Hyde Park’s initial public offering or simultaneously therewith in a private placement of Hyde Park common stock, representing an aggregate of approximately 25.5% of the outstanding shares of Hyde Park common stock, as well as any public shares of Hyde Park common stock that they have acquired or will acquire, “FOR” the merger proposal.

After careful consideration, Hyde Park’s board of directors has determined that the merger proposal is fair to and in the best interests of Hyde Park and its stockholders. Hyde Park’s board of directors unanimously recommends that you vote or give instructions to vote “FOR” the adoption of the merger proposal. When you consider the recommendation of Hyde Park’s board of directors in favor of the merger proposal, you should keep in mind that certain of Hyde Park’s directors and officers have interests in the merger that may conflict with your interests as a stockholder. See the section entitled, “The Merger — Interests of Hyde Park Directors, Officers and Others in the Merger.”

Enclosed is a notice of special meeting of the Hyde Park stockholders, a notice of the special meeting of the Santa Maria Energy unitholders and joint proxy statement/prospectus containing detailed information concerning the merger proposal and the transactions contemplated thereby as well as detailed information concerning the other proposals to be considered by Hyde Park stockholders and Santa Maria Energy unitholders. Whether or not you plan to attend the special meeting of Hyde Park stockholders or Santa Maria Energy unitholders, we urge you to read this material carefully.

|

Laurence S. Levy Executive Chairman of the Board and Chief Executive Officer Hyde Park Acquisition Corp. II

|

David Pratt President Santa Maria Energy Holdings, LLC | |

Table of Contents

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE HYDE PARK SPECIAL MEETING OR THE SANTA MARIA ENERGY SPECIAL MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS SOON AS POSSIBLE IN THE ENVELOPE PROVIDED.

IF A SANTA MARIA ENERGY UNITHOLDER SIGNS AND RETURNS ITS PROXY CARD WITHOUT AN INDICATION OF HOW IT WISHES TO VOTE, ITS UNITS WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS.

IF A HYDE PARK STOCKHOLDER SIGNS AND RETURNS ITS PROXY CARD WITHOUT AN INDICATION OF HOW IT WISHES TO VOTE, ITS SHARES WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS, AND IT WILL NOT BE ELIGIBLE TO HAVE ITS SHARES CONVERTED INTO CASH. TO EXERCISE CONVERSION RIGHTS, A HYDE PARK STOCKHOLDER MUST AFFIRMATIVELY VOTE EITHER FOR OR AGAINST THE MERGER PROPOSAL, DEMAND THAT HYDE PARK CONVERT ITS SHARES INTO CASH NO LATER THAN THE CLOSE OF THE VOTE ON THE MERGER PROPOSAL, AND TENDER ITS STOCK TO HYDE PARK’S TRANSFER AGENT PRIOR TO THE VOTE AT THE SPECIAL MEETING. HYDE PARK STOCKHOLDERS MAY TENDER THEIR STOCK BY EITHER DELIVERING THEIR STOCK CERTIFICATES TO THE TRANSFER AGENT OR BY DELIVERING THEIR SHARES ELECTRONICALLY USING DEPOSITORY TRUST COMPANY’S DWAC (DEPOSIT WITHDRAWAL AT CUSTODIAN) SYSTEM. IF THE MERGER IS NOT COMPLETED, THEN THESE SHARES WILL NOT BE CONVERTED INTO CASH AND ANY STOCK CERTIFICATES WILL PROMPTLY BE RETURNED TO HYDE PARK STOCKHOLDERS. IF A HYDE PARK STOCKHOLDER HOLDS ITS SHARES IN STREET NAME, IT WILL NEED TO INSTRUCT THE ACCOUNT EXECUTIVE AT ITS BANK OR BROKER TO WITHDRAW THE SHARES FROM ITS ACCOUNT IN ORDER TO EXERCISE ITS CONVERSION RIGHTS. SEE THE SECTION ENTITLED “THE HYDE PARK SPECIAL MEETING—CONVERSION RIGHTS” FOR MORE SPECIFIC INSTRUCTIONS.

Neither the Securities and Exchange Commission nor any state securities commission or agency has determined if this joint proxy statement/prospectus is truthful, adequate or complete or approved or disapproved of the merger or the securities issuable in connection with the merger. Any representation to the contrary is a criminal offense.

SEE “RISK FACTORS” BEGINNING ON PAGE 43 FOR A DISCUSSION OF VARIOUS FACTORS THAT HYDE PARK STOCKHOLDERS AND SANTA MARIA ENERGY UNITHOLDERS SHOULD CONSIDER IN CONNECTION WITH THE MERGER AND OTHER PROPOSALS.

The accompanying joint proxy statement/prospectus is dated , 2014 and is first being mailed to Hyde Park stockholders and Santa Maria Energy unitholders on or about , 2014.

Table of Contents

HYDE PARK ACQUISITION CORP. II

500 Fifth Avenue, 50th Floor

New York, NY 10110

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON , 2014

TO THE STOCKHOLDERS OF HYDE PARK ACQUISITION CORP. II:

NOTICE IS HEREBY GIVEN that a special meeting of stockholders, including any adjournments or postponements thereof, of Hyde Park Acquisition Corp. II, a Delaware corporation (“Hyde Park”), will be held at 10:00 a.m., eastern time, on , 2014 at the offices of Katten Muchin Rosenman LLP, 575 Madison Avenue, New York, New York 10022:

| • | to adopt and approve the Agreement and Plan of Merger, dated as of November 27, 2013, among Hyde Park, Santa Maria Energy Corporation, a Delaware corporation, HPAC Merger Sub, Inc., a Delaware corporation (“HPAC Merger Sub”), SME Merger Sub, LLC, a Delaware limited liability company, and Santa Maria Energy Holdings, LLC, a Delaware limited liability company, and the transactions contemplated thereby, including the merger of HPAC Merger Sub with and into Hyde Park—we call this proposal the “merger proposal”; and |

| • | to adopt a proposal to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes at the time of the special meeting to adopt the merger proposal—we call this proposal the “Hyde Park adjournment proposal.” |

The affirmative vote of a majority of the shares of Hyde Park’s common stock issued in Hyde Park’s initial public offering, which we sometimes refer to as “IPO shares,” represented in person or by proxy and entitled to vote at the meeting and a majority of the outstanding shares of Hyde Park common stock is required to adopt the merger proposal. The affirmative vote of the holders of a majority of Hyde Park’s common stock represented in person or by proxy and entitled to vote at the meeting is required to adopt the Hyde Park adjournment proposal, if presented.

Adoption by Hyde Park stockholders of the merger proposal is not conditioned upon adoption of the Hyde Park adjournment proposal.

Hyde Park stockholders of record at the close of business on , 2014 will be entitled to receive notice of, and to vote at, the Hyde Park special meeting and any and all adjournments thereof.

Your vote is important. Please sign, date and return your proxy card as soon as possible to make sure that your shares are represented at the special meeting. If you are a stockholder of record of Hyde Park common stock, you may also cast your vote in person at the special meeting. If your shares are held in an account at a brokerage firm or bank, you must instruct your broker or bank on how to vote your shares. If you do not vote or do not instruct your broker or bank how to vote, it will have the same effect as voting against the merger proposal.

Hyde Park’s board of directors unanimously recommends that you vote “FOR” the adoption of each proposal listed above.

| By Order of the Board of Directors, | ||

| Laurence S. Levy | ||

| Executive Chairman of the Board and | ||

| Chief Executive Officer | ||

, 2014

Table of Contents

SANTA MARIA ENERGY HOLDINGS, LLC

2811 Airpark Drive

Santa Maria, California 93455

NOTICE OF SPECIAL MEETING OF UNITHOLDERS

TO BE HELD ON , 2014

TO THE UNITHOLDERS OF SANTA MARIA ENERGY HOLDINGS, LLC:

NOTICE IS HEREBY GIVEN that a special meeting of unitholders, including any adjournments or postponements thereof, of Santa Maria Energy Holdings, LLC, a Delaware limited liability company (“Santa Maria Energy”), will be held at a.m., local time, on , 2014 at the offices of Latham & Watkins LLP, 811 Main Street, Suite 3700, Houston, Texas:

| • | to adopt and approve the Agreement and Plan of Merger, dated as of November 27, 2013, among Hyde Park Acquisition Corp. II, a Delaware corporation, Santa Maria Energy Corporation, a Delaware corporation (“Santa Maria Energy Corporation”), HPAC Merger Sub, Inc., a Delaware corporation, SME Merger Sub, LLC, a Delaware limited liability company (“SME Merger Sub”), and Santa Maria Energy and the transactions contemplated thereby, including the merger of SME Merger Sub with and into Santa Maria Energy—we call this proposal the “merger proposal”; |

| • | to adopt a proposal to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes at the time of the special meeting to adopt the merger proposal—we call this proposal the “Santa Maria Energy adjournment proposal”; and |

| • | to consider and cast an advisory (non-binding) vote on a proposal to approve certain compensation that may be paid or may become payable to Santa Maria Energy’s named executive officers in connection with the merger (which we refer to as “merger-related compensation”)—we call this proposal the “Santa Maria Energy merger-related compensation proposal”. |

Adoption by Santa Maria Energy unitholders of the merger proposal is not conditioned upon adoption of any other proposal.

Santa Maria Energy unitholders of record at the close of business on , 2014 will be entitled to receive notice of, and to vote at, the Santa Maria Energy special meeting and any and all adjournments thereof.

Your vote is important. Please sign, date and return your proxy card as soon as possible to make sure that your units are represented at the special meeting. If you are a unitholder of record of Santa Maria Energy units, you may also cast your vote in person at the special meeting. If you do not vote, it will have the same effect as voting against the merger proposal.

Santa Maria Energy’s board of managers unanimously recommends that you vote “FOR” the adoption of each proposal listed above.

| By Order of the Board of Managers, | ||

| Beth Marino | ||

| VP—Legal and Corporate Affairs and Secretary | ||

, 2014

Table of Contents

REFERENCES TO ADDITIONAL INFORMATION

This joint proxy statement/prospectus incorporates important business and financial information about Hyde Park and Santa Maria Energy from documents that are not included in or delivered with this document. You can obtain these documents, other than certain exhibits to these documents, by requesting them in writing or by telephone from Hyde Park or Santa Maria Energy at the following addresses:

| Hyde Park Acquisition Corp. II 500 Fifth Avenue, 50th Floor New York, New York 10110 Attention: Laurence S. Levy, CEO (212) 644-3450 Email: HPAC@hphllc.com |

Santa Maria Energy Holdings, LLC Attention: David Pratt, President (805) 938-3320 Email: info@santamariaenergy.com |

You will not be charged for any of these documents that you request. Hyde Park stockholders requesting documents should do so by , 2014, in order to receive them before the Hyde Park special meeting. Santa Maria Energy unitholders requesting documents should do so by , 2014, in order to receive them before the Santa Maria Energy special meeting.

Table of Contents

| 1 | ||||

| 15 | ||||

| 15 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 21 | ||||

| Interests of Hyde Park Directors, Officers and Others in the Merger |

22 | |||

| Interests of Santa Maria Energy Managers, Officers and Others in the Merger |

23 | |||

| 23 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| 24 | ||||

| SUMMARY HISTORICAL FINANCIAL INFORMATION FOR SANTA MARIA ENERGY |

25 | |||

| SUMMARY HISTORICAL SANTA MARIA ENERGY OPERATING AND RESERVE DATA |

28 | |||

| UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL DATA OF SANTA MARIA ENERGY AND HYDE PARK |

31 | |||

| 41 | ||||

| 42 | ||||

| 43 | ||||

| 70 | ||||

| 72 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 74 | ||||

| 75 | ||||

| 75 | ||||

| 75 | ||||

| 75 | ||||

| 76 | ||||

| 77 | ||||

| No Additional Matters May Be Presented at the Special Meeting |

77 | |||

| 78 | ||||

| 78 | ||||

| 78 | ||||

| 80 | ||||

| 80 | ||||

| 80 | ||||

| 80 | ||||

| 80 |

i

Table of Contents

ii

Table of Contents

iii

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE MERGER

The questions and answers below highlight only selected procedural information contained this joint proxy statement/prospectus. They do not contain all of the information that may be important to you. You should read carefully this entire joint proxy statement/prospectus and the additional documents referred to herein to fully understand the voting procedures for the meetings.

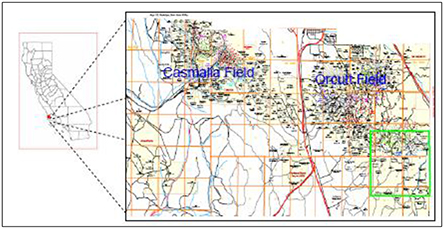

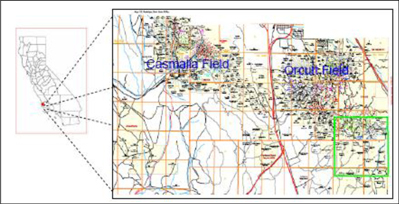

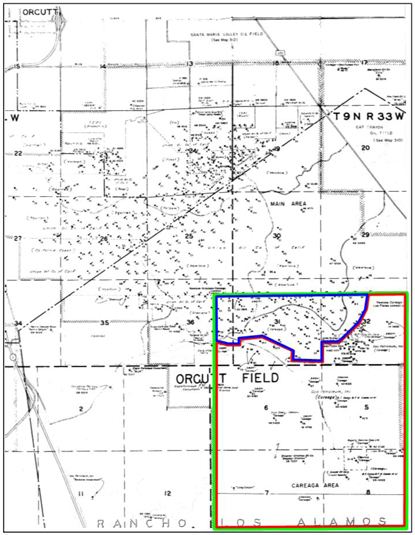

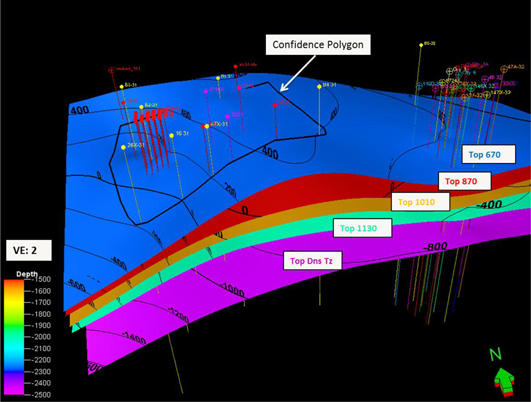

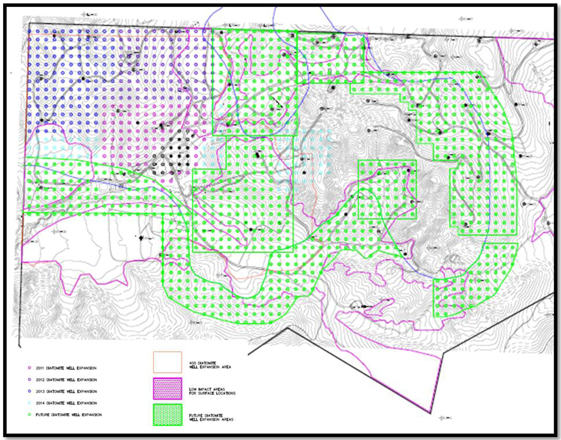

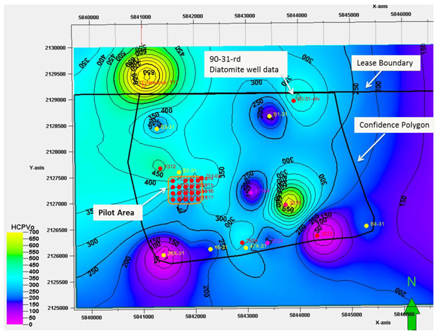

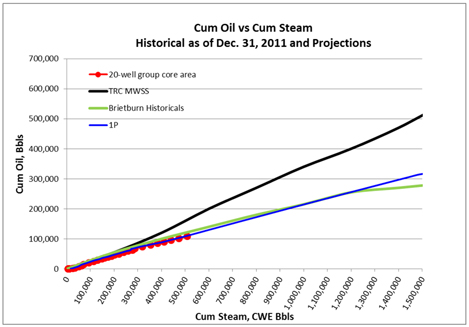

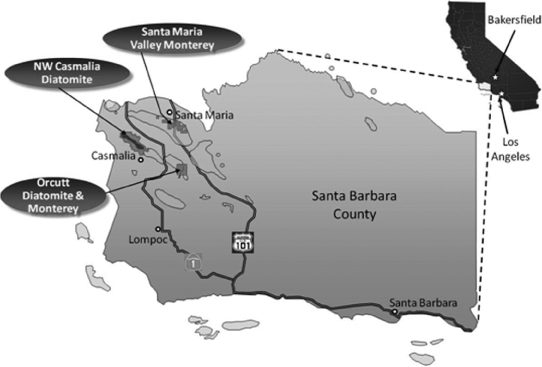

| Q. | Why am I receiving this joint proxy statement/prospectus? | A. | Hyde Park Acquisition Corp. II, a Delaware corporation (“Hyde Park”), and Santa Maria Energy Holdings, LLC, a Delaware limited liability company (“Santa Maria Energy”), will hold special meetings of their stockholders and unitholders, respectively, to consider and vote upon proposals relating to a proposed merger between Hyde Park and Santa Maria Energy. Santa Maria Energy is an independent energy company focused on the exploration and development of oil and natural gas in the Monterey formation and the Diatomite reservoir within the Sisquoc formation in northern Santa Barbara County, California. This joint proxy statement/prospectus contains important information about the proposed transactions, which we refer to as the “merger,” and the other matters to be acted upon at the special meeting of each of Hyde Park stockholders and Santa Maria Energy unitholders. The vote of the Hyde Park stockholders and Santa Maria Energy unitholders, respectively, is important. You are encouraged to read this joint proxy statement/prospectus carefully and in its entirety and to vote as soon as possible after carefully reviewing this joint proxy statement/prospectus. |

| Q. | How will the proposed merger be completed? | A. | The transaction will be effected through multiple steps: |

| • | First, HPAC Merger Sub, Inc. (“HPAC Merger Sub”), a Delaware corporation and wholly-owned subsidiary of Santa Maria Energy Corporation (“Santa Maria Energy Corporation”), will merge with and into Hyde Park with Hyde Park surviving as a wholly-owned subsidiary of Santa Maria Energy Corporation, and Hyde Park stockholders will receive Santa Maria Energy Corporation common stock in exchange for their Hyde Park common stock (the “Hyde Park Merger”). |

| • | Second, SME Merger Sub, LLC (“SME Merger Sub”), a Delaware limited liability company and wholly-owned subsidiary of Santa Maria Energy Corporation, will merge with and into Santa Maria Energy, with Santa Maria Energy surviving as a wholly-owned subsidiary of Santa Maria Energy Corporation, and Santa Maria Energy common unitholders will receive Santa Maria Energy Corporation common stock and Santa Maria Energy preferred unitholders will receive Santa Maria Energy Corporation preferred stock in exchange for their Santa Maria Energy units (the “Santa Maria Merger”). |

| • | Last, Santa Maria Energy Corporation will contribute all of its interests in Santa Maria Energy to Hyde Park, resulting in Santa Maria Energy becoming a wholly-owned subsidiary of Hyde Park (the “SME Contribution”). |

Table of Contents

| For more information, see the section entitled “Merger Agreement.” |

| Q. | Why are Hyde Park and Santa Maria Energy proposing the merger? | A. | Hyde Park was formed for the purpose of acquiring, through a merger, share exchange, asset acquisition, equity purchase or similar business combination, one or more operating businesses. |

| Based upon its investigation of Santa Maria Energy and its consolidated subsidiaries, Hyde Park believes that the merger with Santa Maria Energy and entering the oil and natural gas exploration and development business provides an attractive investment opportunity for Hyde Park and its stockholders. In reaching its decision to approve the merger, Hyde Park’s board of directors considered a number of factors, which are described elsewhere in this joint proxy statement/prospectus. See the sections entitled “The Merger—Factors Considered by the Hyde Park Board of Directors in Approving the Merger” and “Additional Information About Santa Maria Energy.” |

| In accordance with its amended and restated certificate of incorporation, Hyde Park is required to submit the merger proposal to holders of its shares of common stock issued in Hyde Park’s initial public offering (“IPO shares”) for their approval. In addition, because the transaction involves a merger between Hyde Park and Hyde Park Merger Sub, the Delaware General Corporation Law (the “DGCL”) requires that the transaction be submitted to all of Hyde Park’s stockholders (including Hyde Park’s sponsors) for their approval. |

| In the course of reaching its decision to approve the agreement and plan of merger providing for the merger of Hyde Park and Santa Maria Energy (the “Merger Agreement”) and the related transactions, the board of managers of Santa Maria Energy considered a number of factors in its deliberations. For a more complete discussion of the factors that the Santa Maria Energy board of managers considered, see “The Merger—Factors Considered by the Santa Maria Energy Board of Managers in Approving the Merger.” |

| Q. | What will Hyde Park stockholders receive in the merger? | A. | If the merger is completed, Hyde Park stockholders will receive one share of Santa Maria Energy Corporation common stock for each share of Hyde Park common stock that they own immediately prior to the effective time of the merger. |

| Please note that there are several risks associated with owning Santa Maria Energy Corporation shares and there are also several differences between owning Santa Maria Energy Corporation shares as compared to owning Hyde Park shares. See “Comparison of Securityholders’ Rights” for a discussion of the differences in rights of Santa Maria Energy Corporation stockholders and Hyde Park stockholders and “Risk Factors— |

2

Table of Contents

| Risks Related to Santa Maria Energy” for further discussion of the risks associated with owning Santa Maria Energy Corporation shares. |

| Q. | What will Santa Maria Energy unitholders receive in the merger? | A. | If the merger is completed, Santa Maria Energy common unitholders will receive 0.2857 shares of Santa Maria Energy Corporation common stock for each Santa Maria Energy common unit that they own immediately prior to the effective time of the merger. Kayne Anderson Energy Fund IV, L.P. and Kayne Anderson Energy Fund IV QP, L.P. (collectively the “Kayne Investors”), as the only holders of Santa Maria Energy redeemable preferred units (“preferred units”), will receive one share of Santa Maria Energy Corporation preferred stock for each Santa Maria Energy preferred unit that they own immediately prior to the effective time of the merger. |

| Please note that there are several risks associated with owning Santa Maria Energy Corporation shares and there are also several differences between owning Santa Maria Energy Corporation shares as compared to owning Santa Maria Energy units. See “Comparison of Securityholders’ Rights” for further discussion of the differences in rights of Santa Maria Energy Corporation stockholders and Santa Maria Energy unitholders and “Risk Factors—Risks Related to Hyde Park and the Merger” for further discussion of the risks associated with owning Santa Maria Energy Corporation shares. |

| Q. | What are the terms of the shares of Santa Maria Energy Corporation preferred stock that the Kayne Investors will receive in the merger? | A. | If the merger is completed, the Kayne Investors will receive one share of preferred stock for each Santa Maria Energy preferred unit that they own immediately prior to the effective time of the merger. The stated amount of these shares will be $50 million. These shares will be subject to a mandatory dividend of 8.0% per annum paid quarterly in cash or additional shares of preferred stock at the option of Santa Maria Energy Corporation. The shares must be redeemed upon (i) the fourth anniversary of the consummation of the merger or (ii) upon a change of control, whichever occurs first. Santa Maria Energy Corporation also has the option to redeem the preferred stock at any time following the consummation of the merger at 100% stated amount plus any accrued dividends, subject to certain limitations. While the preferred stock is outstanding, the Kayne Investors will have the right to appoint two members of the board of directors of Santa Maria Energy Corporation, and the Kayne Investors will have certain approval rights with respect to the business and management of Santa Maria Energy Corporation. |

| Please note that there are several risks associated with owning Santa Maria Energy Corporation shares and there are also several differences between owning Santa Maria Energy Corporation shares as compared to owning Santa Maria Energy units. See “Description of Santa Maria Energy Corporation’s Common Stock and Other Securities” for further discussion of the terms of |

3

Table of Contents

| the preferred stock in Santa Maria Energy Corporation and “Risk Factors—The Kayne Investors will receive Santa Maria Energy Corporation preferred stock in the merger, and their interests may conflict with those of the common stockholders” for further discussion of the risks associated with owning Santa Maria Energy Corporation common and preferred stock. |

| Q. | What vote is required to adopt the merger proposal? | A. | For Hyde Park stockholders, adoption of the merger proposal requires the affirmative vote of the holders of a majority of the IPO shares represented in person or by proxy and entitled to vote at the meeting and the affirmative vote of holders of a majority of outstanding shares of Hyde Park common stock. Abstentions and broker non-votes, while considered present for the purposes of establishing a quorum, will have the same effect as a vote against the merger proposal. |

| For Santa Maria Energy unitholders, adoption of the merger proposal requires the affirmative vote of the holders of a majority of the outstanding preferred units and at least 29% of the outstanding common units. As of the close of business on the record date, there were 50,000,000 common units and 50,000 preferred units outstanding and entitled to vote at the meeting. Each unit is entitled to one vote at the special meeting. Abstentions are deemed entitled to vote on the merger proposal. Therefore, they have the same effect as a vote against the merger proposal. |

| Q. | How will Hyde Park’s initial stockholders vote in connection with the merger proposal? | A. | As of , 2014, the record date for the special meeting, Hyde Park’s initial stockholders, which are sometimes referred to herein as the “sponsors,” held an aggregate of 2,568,750 shares of Hyde Park common stock, which are sometimes referred to herein as “sponsors’ shares,” representing approximately 25.5% of the outstanding shares of Hyde Park common stock. Pursuant to agreements with Hyde Park, the sponsors have agreed to vote all of the sponsors’ shares in favor of the merger proposal. See the section entitled “Additional Information About Hyde Park—Voting Restrictions in Connection with Stockholder Meeting.” |

| Q. | How will the Kayne Investors vote in connection with the merger proposal? | A. | The Kayne Investors, who hold all of the outstanding Santa Maria Energy preferred units and approximately 30% of the outstanding Santa Maria Energy common units, have agreed to vote all of their units in favor of the merger proposal. Accordingly, the Kayne Investors possess enough votes to approve the merger proposal, even if no other unitholder votes in favor of the merger proposal. |

| Q. | Do Hyde Park stockholders have conversion rights? | A. | Yes. Pursuant to Hyde Park’s amended and restated certificate of incorporation, a holder of IPO shares may vote for or against the merger proposal and demand that Hyde Park convert such shares into cash if the merger is consummated in accordance with the procedures described in this joint proxy statement/prospectus. Hyde Park anticipates that the amount of cash held in the trust account upon the consummation of the merger will be $10.50 per IPO share. |

4

Table of Contents

| We sometimes refer herein to the right of Hyde Park stockholders to vote either for or against the merger and demand conversion of Hyde Park shares into their pro rata portion of the trust account as “conversion rights.” See “The Hyde Park Special Meeting—Conversion Rights.” |

| Q. | How do Hyde Park stockholders exercise conversion rights? | A. | A holder of Hyde Park IPO shares that wishes to exercise its conversion rights must (i) affirmatively vote either for or against the merger proposal, (ii) demand that Hyde Park convert its Hyde Park shares into cash no later than the close of the vote on the merger proposal, and (iii) deliver its stock to Hyde Park’s transfer agent physically or electronically using The Depository Trust Company’s DWAC (Deposit Withdrawal at Custodian) System prior to the vote at the special meeting. |

| A holder of IPO shares may demand conversion rights either by checking the box on the proxy card or by submitting its request in writing to Hyde Park’s chief executive officer at the address listed at the end of this section. If a holder of Hyde Park common stock (i) initially does not vote with respect to the merger proposal but then wishes to vote for or against it, or (ii) wishes to exercise its conversion rights but initially does not check the box on the proxy card providing for the exercise of its conversion rights and does not send a written request to Hyde Park to exercise its conversion rights, it may request Hyde Park to send it another proxy card on which it may indicate its intended vote or its intention to exercise its conversion rights. A Hyde Park stockholder may make such request by contacting Hyde Park at the phone number or address listed at the end of this section. |

| Any request for conversion, once made by a holder of IPO shares, may be withdrawn at any time up to the time the vote is taken with respect to the merger proposal at the special meeting. If a Hyde Park stockholder delivers its shares for conversion to Hyde Park’s transfer agent and later decides prior to the special meeting not to elect conversion, it may request that Hyde Park’s transfer agent return the shares (physically or electronically). A Hyde Park stockholder may make such request by contacting Hyde Park’s transfer agent at the phone number or address listed at the end of this section. |

| Any corrected or changed proxy card or written demand of conversion rights must be received by Hyde Park’s chief executive officer prior to the vote taken on the merger proposal at the special meeting. No demand for conversion will be honored unless the holder’s common stock has been delivered (either physically or electronically) to the transfer agent prior to the vote at the meeting. |

| If a holder of IPO shares votes for or against the merger proposal, demand is properly made and the stock is delivered as described above, then, if the merger is consummated, Hyde Park will |

5

Table of Contents

| convert these shares into a pro rata portion of funds deposited in the trust account (which is expected to be $10.50 per IPO share). If a Hyde Park stockholder exercises its conversion rights, then it will be exchanging its shares of Hyde Park common stock for cash and will no longer own such shares following the merger. See the section entitled “The Hyde Park Special Meeting—Conversion Rights.” |

| Q. | Is there a limit on the number of shares of Hyde Park common stock that may be converted? | A. | Yes. A holder of IPO shares, together with any affiliate of his or any other person with whom he is acting in concert or as a “group” (as defined in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) will be restricted from seeking conversion rights with respect to 20% or more of the aggregate IPO shares without Hyde Park’s prior written consent. Accordingly, all IPO shares in excess of 20% beneficially owned by a stockholder and its affiliates or any other person with whom such stockholder is acting in concert or as a group will not be converted into cash without Hyde Park’s consent. See the section entitled “The Hyde Park Special Meeting—Conversion Rights.” |

| In order to determine whether a stockholder is acting in concert or as a group with another stockholder, Hyde Park will require each public stockholder seeking to exercise conversion rights to certify to Hyde Park whether such stockholder is acting in concert or as a group with any other stockholder. |

| Q. | Do I have appraisal rights if I object to the proposed merger? | A. | If the Santa Maria Energy Corporation common stock issued in the merger is listed on the NASDAQ (subject only to official notice of issuance), then Hyde Park stockholders do not have appraisal rights in connection with the merger under the DGCL. However, if the Santa Maria Energy Corporation common stock is not approved for listing on the NASDAQ, Hyde Park stockholders who do not vote in favor of the merger proposal and who otherwise comply with the applicable statutory procedures will have appraisal rights. Santa Maria Energy unitholders do not have appraisal rights in connection with the merger under the Delaware Limited Liability Company Act (“DLLCA”). See the sections entitled “The Hyde Park Special Meeting—Appraisal Rights” and “The Santa Maria Energy Special Meeting—Appraisal Rights.” |

| Q. | What happens to the funds deposited in Hyde Park’s trust account after consummation of the merger? | A. | Upon consummation of the merger, the funds in the trust account will be released to Hyde Park and used by Hyde Park to pay holders of the IPO shares who exercise conversion rights, to pay expenses incurred in connection with the merger and for Santa Maria Energy Corporation’s working capital and general corporate purposes. Upon consummation of the merger, and following distribution of the funds in the trust account, the trust account will cease to exist. |

6

Table of Contents

| Q. | What happens if a substantial number of Hyde Park public stockholders vote in favor of the merger proposal and exercise their conversion rights? | A. | Unlike some blank check companies which require public stockholders to vote against a business combination in order to exercise their conversion rights, Hyde Park’s public stockholders may vote in favor of or against the merger and still exercise conversion rights. Accordingly, the merger may be consummated even though the funds available from the trust account and the number of public stockholders are substantially reduced as a result of conversion by Hyde Park public stockholders. With fewer IPO shares and public stockholders, the trading market for Santa Maria Energy Corporation common stock may be less liquid, and Santa Maria Energy Corporation may not be able to meet the listing standards for NASDAQ or another national securities exchange. |

| Under the Merger Agreement, however, it is a condition to the consummation of the merger that after giving effect to the exercise of conversion rights by Hyde Park stockholders, Hyde Park shall have at least $40 million of cash in its trust account. With reduced funds available from the trust account, Santa Maria Energy Corporation will need to seek additional financing to fund drilling requirements. |

| Q. | What happens if the merger is not consummated? | A. | Hyde Park must redeem 100% of the outstanding IPO shares, at a per-share price, payable in cash, equal to an amount described below, if it does not consummate the merger with Santa Maria Energy or complete another business combination by May 1, 2014. If the merger or another proposed business combination that Hyde Park presents to its stockholders for approval ultimately is not completed by that deadline, the holders of the IPO shares will be entitled to receive a pro rata share of the trust account (which is expected to be $10.50 per IPO share) and any additional pro rata interest earned on the funds held in the trust account and not released to Hyde Park for its working capital requirements or to pay taxes. See the section entitled “Additional Information About Hyde Park—Liquidation if No Merger” for additional information. |

| Q. | When do you expect the merger to be completed? | A. | The Merger Agreement requires the closing to occur no later than May 1, 2014. We expect that the closing will take place on or prior to such date. See the section entitled “Merger Agreement.” |

| Q. | What are the material U.S. federal income tax consequences of the Hyde Park Merger on U.S. holders of Hyde Park common stock that receive Santa Maria Energy common stock? | A. | The merger will qualify as part of an exchange under Section 351(a) of the Internal Revenue Code of 1986, as amended (the “Code”). As a result of and subject to the assumptions and qualification set forth in “Material United States Federal Income Tax Consequences of the Merger,” for U.S. federal income tax purposes, (i) no gain or loss generally will be recognized by a U.S. holder of Hyde Park common stock that receives shares of Santa Maria Energy Corporation common stock pursuant to the Hyde Park Merger, (ii) the tax basis of the Santa Maria Energy Corporation common stock received by a U.S. holder of Hyde Park common stock in the Hyde Park Merger should be the same |

7

Table of Contents

| as the adjusted tax basis of the Hyde Park common stock surrendered in exchange therefor, and (iii) the holding period of the Santa Maria Energy Corporation common stock received in the Hyde Park Merger by a U.S. holder of Hyde Park common stock will include the period during which such Hyde Park common stock was held. Tax matters are very complicated, and the tax consequences of the Hyde Park Merger to a particular holder will depend on such holder’s circumstances. Accordingly, you are urged to consult your tax advisor for a full understanding of the tax consequences of the merger to you, including the applicability and effect of U.S. federal, state, local and foreign income and other tax laws. For a more complete discussion of the material U.S. federal income tax consequences of the merger, see “Material United States Federal Income Tax Consequences of the Merger.” |

| Q. | What are the material U.S. federal income tax consequences of the Santa Maria Energy Merger on U.S. holders of Santa Maria Energy common units that receive Santa Maria Energy Corporation common stock ? | A. | The merger will qualify as part of an exchange of property for stock constituting control of a corporation pursuant to Section 351(a) of the Code. As a result of and subject to the assumptions and qualification set forth in “Material United States Federal Income Tax Consequences of the Merger,” for U.S. federal income tax purposes, (i) no gain or loss generally will be recognized by a U.S. holder of Santa Maria Energy common units that receives shares of Santa Maria Energy Corporation common stock pursuant to the Santa Maria Merger, (ii) the tax basis of the Santa Maria Energy Corporation common stock received by a U.S. holder of Santa Maria Energy common units in the Santa Maria Merger should be the same as the adjusted tax basis of the Santa Maria Energy common units surrendered in exchange therefor, and (iii) the holding period of the Santa Maria Energy Corporation common stock received in the Santa Maria Merger by a U.S. holder of Santa Maria Energy common units will include the period during which such Santa Maria Energy common units were held. Tax matters are very complicated, and the tax consequences of the Santa Maria Energy Merger to a particular holder will depend on such holder’s circumstances. Accordingly, you are urged to consult your tax advisor for a full understanding of the tax consequences of the merger to you, including the applicability and effect of U.S. federal, state, local and foreign income and other tax laws. For a more complete discussion of the material U.S. federal income tax consequences of the merger, see “Material United States Federal Income Tax Consequences of the Merger.” |

| Q. | What constitutes a quorum? | A. | Hyde Park’s bylaws provide that that the presence, in person or by proxy, of the holders of a majority of all the outstanding capital stock entitled to vote at the meeting constitutes a quorum at all meetings of the Hyde Park stockholders. See the section entitled “The Hyde Park Special Meeting—Quorum.” |

| Santa Maria Energy’s limited liability company agreement provides that the presence, in person or by proxy, of the holders |

8

Table of Contents

| of a majority of the preferred units and at least 29% of the outstanding common units constitutes a quorum at the Santa Maria Energy special meeting. See the section entitled “The Santa Maria Energy Special Meeting—Quorum.” |

| Q. | Where and when is the special meeting of the Hyde Park stockholders? | A. | The Hyde Park special meeting will be held at the offices of Katten Muchin Rosenman LLP, located at 575 Madison Avenue, New York, New York, on , 2014, commencing at , local time. |

| Q. | When and where is the special meeting of the Santa Maria Energy unitholders? | A. | The Santa Maria Energy special meeting will be held at the offices of Latham & Watkins LLP, located at 811 Main Street, Suite 3700, Houston, Texas, on , 2014, commencing at , local time. |

| Q. | What is the other proposal being voted on by Hyde Park stockholders besides the merger proposal? | A. | Hyde Park stockholders will also be asked to adopt a proposal to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes at the time of the Hyde Park special meeting to adopt the merger proposal, which is referred to herein as the “Hyde Park adjournment proposal.” See the section entitled “Hyde Park Proposals—The Hyde Park Adjournment Proposal.” |

| Adoption by Hyde Park stockholders of the merger proposal is not conditioned upon adoption of the Hyde Park adjournment proposal. |

| Q. | Why is Hyde Park proposing the Hyde Park adjournment proposal? | A. | Hyde Park is proposing the Hyde Park adjournment proposal to allow Hyde Park’s board of directors to adjourn the special meeting at which the merger proposal will be voted on to a later date or dates, if necessary, to permit further solicitation of proxies in the event there are not sufficient votes at the time of the special meeting to approve the merger proposal. See the section entitled “Hyde Park Proposals—The Hyde Park Adjournment Proposal.” |

| Q. | What vote is required to adopt the Hyde Park adjournment proposal? | A. | Adoption of the Hyde Park adjournment proposal requires the affirmative vote of the holders of a majority of Hyde Park common stock represented in person or by proxy and entitled to vote at the meeting. Adoption of the Hyde Park adjournment proposal is not conditioned upon the adoption of the merger proposal. See the section entitled “Hyde Park Proposals—The Hyde Park Adjournment Proposal.” |

| Q. | What are the other proposals being voted on by Santa Maria Energy unitholders besides the merger proposal? | A. | In addition to the merger proposal, Santa Maria Energy unitholders will also be asked to adopt a proposal to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event there are not sufficient votes at the time of the Santa Maria Energy special meeting to adopt the merger proposal, which is referred to herein |

9

Table of Contents

| as the “Santa Maria Energy adjournment proposal.” See the section entitled “Santa Maria Energy Proposals—The Santa Maria Energy Adjournment Proposal.” |

| Furthermore, Santa Maria Energy unitholders will be asked to consider and cast an advisory (non-binding) vote on a proposal to approve certain compensation that may be paid or may become payable to Santa Maria Energy’s named executive officers in connection with the merger, which is referred to herein as the “Santa Maria Energy merger-related compensation proposal.” See the section entitled “Santa Maria Energy Proposals—The Santa Maria Energy Merger-Related Compensation Proposal.” |

| Q. | Why is Santa Maria Energy proposing the Santa Maria Energy adjournment proposal? | A. | Santa Maria Energy is proposing the Santa Maria Energy adjournment proposal to allow Santa Maria Energy’s board of managers to adjourn the special meeting at which the merger proposal will be voted on to a later date or dates, if necessary, to permit further solicitation of proxies in the event there are not sufficient votes at the time of the special meeting to approve the merger proposal. See the section entitled “Santa Maria Energy Proposals—The Santa Maria Energy Adjournment Proposal.” |

| Q. | What vote is required to adopt the Santa Maria Energy adjournment proposal? | A. | Adoption of the Santa Maria Energy adjournment proposal requires the affirmative vote of the holders of a majority of outstanding preferred units and at least 29% of the outstanding common units represented in person or by proxy and entitled to vote at the meeting. As of the close of business on the record date, there were 50,000,000 common units and 50,000 preferred units outstanding and entitled to vote at the meeting. Each unit is entitled to one vote at the special meeting. Adoption of the Santa Maria Energy adjournment proposal is not conditioned upon the adoption of the merger proposal. See the section entitled “Santa Maria Energy Proposals—The Santa Maria Energy Adjournment Proposal.” |

| The Kayne Investors, who hold all of the outstanding Santa Maria Energy preferred units and approximately 30% of the outstanding Santa Maria Energy common units, have agreed to vote all of their units in favor of the Santa Maria Energy adjournment proposal. Accordingly, the Kayne Investors possess enough votes to approve the Santa Maria Energy adjournment proposal, even if no other unitholder votes in favor of the Santa Maria Energy adjournment proposal. See “Certain Relationships and Related Transactions—Certain Santa Maria Energy Transactions.” |

| Q. | Why are the Santa Maria Energy unitholders being asked to consider and cast an advisory (non-binding) vote on the compensation that may be paid or become payable to Santa Maria Energy’s named executive officers in connection with the merger? | A. | In July 2010, the Securities and Exchange Commission (the “SEC”) adopted rules that require Santa Maria Energy to seek a non-binding, advisory vote with respect to certain compensation that may be paid or become payable to Santa Maria Energy’s named executive officers that is based on or otherwise relates to the merger. See the section entitled “Santa Maria Energy Proposals—The Santa Maria Energy Merger-Related Compensation Proposal.” |

10

Table of Contents

| Q. | What vote is required to adopt the Santa Maria Energy merger-related compensation proposal? | A. | Adoption of the Santa Maria Energy merger-related compensation proposal requires the affirmative vote of the holders of a majority of outstanding preferred units and at least 29% of the outstanding common units represented in person or by proxy and entitled to vote at the meeting. As of the close of business on the record date, there were 50,000,000 common units and 50,000 preferred units outstanding and entitled to vote at the meeting. Each unit is entitled to one vote at the special meeting. Adoption of the Santa Maria Energy merger-related compensation proposal is not conditioned upon the adoption of any other proposal. See the section entitled “Santa Maria Energy Proposals—The Santa Maria Energy Merger-Related Compensation Proposal.” |

| The Kayne Investors, who hold all of the outstanding Santa Maria Energy preferred units and approximately 30% of the outstanding Santa Maria Energy common units, have agreed to vote all of their units in favor of the Santa Maria Energy merger-related compensation proposal. Accordingly, the Kayne Investors possess enough votes to approve the Santa Maria Energy merger-related compensation proposal, even if no other unitholder votes in favor of the Santa Maria Energy merger-related compensation proposal. |

| Q. | What do I need to do now? | A. | Hyde Park and Santa Maria Energy urge you to read carefully and consider the information contained in this joint proxy statement/prospectus, including the annexes, and to consider how the merger will affect you as a stockholder of Hyde Park or a unitholder of Santa Maria Energy. Stockholders and unitholders should then vote as soon as possible in accordance with the instructions provided in this joint proxy statement/prospectus and on the enclosed proxy card. |

| Q. | How do I vote? | A. | If you are a holder of record of Hyde Park common stock, you may vote in person at the special meeting or by submitting a proxy for the special meeting. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage-paid envelope. If you hold your shares in “street name,” which means your shares are held of record by a broker, bank or nominee, you should contact your broker to ensure that votes related to the shares you beneficially own are properly counted. In this regard, you must provide the broker, bank or nominee with instructions on how to vote your shares or, if you wish to attend the meeting and vote in person, obtain a proxy from your broker, bank or nominee. See the section entitled “The Hyde Park Special Meeting.” |

| If you are a holder of record of Santa Maria Energy units, you may vote in person at the special meeting or by submitting a proxy for the special meeting. You may submit your proxy by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed postage-paid envelope. See the section entitled “The Santa Maria Energy Special Meeting.” |

11

Table of Contents

| Q. | If my Hyde Park shares are held in “street name,” will my broker, bank or nominee automatically vote my shares for me? | A. | No. Your broker, bank or nominee cannot vote your Hyde Park shares unless you provide instructions on how to vote in accordance with the information and procedures provided to you by your broker, bank or nominee. See the sections entitled “The Hyde Park Special Meeting—Abstentions and Broker Non-Votes.” |

| Q. | If I am not going to attend the special meeting in person, should I return my proxy card instead? | A. | Yes. After carefully reading and considering the information contained in this joint proxy statement/prospectus, please fill out and sign your proxy card. Then, please return the enclosed proxy card in the return envelope as soon as possible, so that your Hyde Park shares and/or Santa Maria Energy units may be represented at the corresponding special meeting. See the sections entitled “The Hyde Park Special Meeting—Voting Your Shares” and “The Santa Maria Energy Special Meeting—Voting Your Units.” |

| Q. | May I change my vote after I have mailed my signed proxy card? | A. | Yes. Send a later-dated, signed proxy card to Hyde Park’s chief executive officer or Santa Maria Energy’s president, respectively, at the address of the corporate headquarters so that it is received by Hyde Park’s chief executive officer or Santa Maria Energy’s president, respectively, prior to the vote at the special meeting or attend the special meeting in person and vote. Hyde Park stockholders and Santa Maria Energy unitholders also may revoke their proxy by sending a notice of revocation to Hyde Park’s chief executive officer or Santa Maria Energy’s president, as applicable, which must be received by the respective officer prior to the vote at the respective special meeting. See the contact information at the end of this section. See the sections entitled “The Hyde Park Special Meeting—Revoking Your Proxy” and “The Santa Maria Energy Special Meeting—Revoking Your Proxy.” |

| Q. | What will happen if I abstain from voting or fail to vote? | A. | An abstention or failure to vote (including a failure to instruct your broker how to vote if you are a Hyde Park stockholder) will have the same effect as a vote against the merger proposal. An abstention or failure to vote will not result in the conversion of your shares if you are a Hyde Park stockholder. To exercise your conversion rights as a Hyde Park stockholder, you must vote either for or against the merger proposal and at the same time affirmatively elect to convert your shares by checking the appropriate box, or directing your broker to check the appropriate box, on the proxy card and ensure that the proxy card is delivered prior to the Hyde Park special meeting. See the sections entitled “The Hyde Park Special Meeting—Abstentions and Broker Non-Votes” and “The Santa Maria Energy Special Meeting—Abstentions.” |

| Q. | What should I do with my stock certificates? | A. | Hyde Park stockholders who do not elect to have their shares converted into the pro rata share of the trust account should continue to hold their stock certificates until after the merger. After the merger is completed, Hyde Park stockholders holding Hyde Park stock certificates will receive from Santa Maria |

12

Table of Contents

| Energy Corporation’s exchange agent a letter of transmittal and instructions on how to obtain the Santa Maria Energy Corporation common stock to which such holder is entitled under the Merger Agreement. |

| Each holder of record of one or more book-entry shares of Hyde Park common stock whose shares will be converted into the right to receive one share of Santa Maria Energy Corporation common stock will automatically, upon the effective time of the Hyde Park Merger, be entitled to receive, and Santa Maria Energy Corporation will cause the exchange agent to deliver to such holder as promptly as practicable after the effective time, the Santa Maria Energy Corporation common stock to which such holder is entitled under the Merger Agreement. See the section entitled “Merger Agreement.” Holders of book-entry shares will not be required to deliver a certificate or an executed letter of transmittal to the exchange agent in order to receive the Hyde Park Merger Consideration. See the section entitled “The Hyde Park Special Meeting—Conversion Rights.” |

| Q. | What should I do if I am a securityholder of both Hyde Park and Santa Maria Energy? | A. | You will receive separate proxy cards for each company and should complete, sign and date each proxy card and return each proxy card in the appropriate pre-addressed postage-paid envelope or, if available, by submitting a proxy by one of the other methods specified in your proxy card or voting instruction card for each company in order to ensure that your shares and/or units are voted. |

| Q. | What should I do if I receive more than one set of voting materials? | A. | You may receive more than one set of voting materials, including multiple copies of this joint proxy statement/prospectus and multiple proxy cards or voting instruction cards. For example, if you hold your shares in more than one brokerage account, you will receive a separate voting instruction card for each brokerage account in which you hold securities. If you are a holder of record and your shares or units are registered in more than one name, you will receive more than one proxy card. Please complete, sign, date and return each proxy card and voting instruction card that you receive in order to cast a vote with respect to all of your securities. |

| Q. | Who will pay for this proxy solicitation? | A | Hyde Park and Santa Maria will bear all expenses incurred in connection with the solicitation of proxies from their respective stockholders or unitholders. Hyde Park will, upon request, reimburse brokerage firms and other nominee holders for their reasonable expenses incurred in forwarding the proxy solicitation materials to the beneficial owners of Hyde Park shares. Hyde Park’s officers and directors may solicit proxies from Hyde Park stockholders by mail, personal contact, letter, telephone, telegram, facsimile or other electronic means. They will not receive any additional compensation for those activities, but they may be reimbursed for their out-of-pocket expenses. In addition, Hyde Park has hired to solicit proxies on its behalf. |

13

Table of Contents

| The cost of soliciting proxies on Hyde Park’s behalf will be approximately $ plus costs and expenses. See the section entitled “The Hyde Park Special Meeting—Solicitation Costs.” |

| Q. | Who can help answer my questions? | A. | If you are a Hyde Park stockholder and have questions about the merger or if you need additional copies of this joint proxy statement/prospectus or the enclosed proxy card you should contact: |

| You may also obtain additional information about Hyde Park from documents filed with the SEC by following the instructions in the section entitled “Where You Can Find More Information.” If you are a holder of IPO shares and you intend to seek conversion of your shares, you will need to deliver your stock (either physically or electronically) to Hyde Park’s transfer agent at the address below prior to the vote at the special meeting. If you have questions regarding the certification of your position or delivery of your stock, please contact: |

| Frank DiPaolo |

| Continental Stock Transfer & Trust Company |

| 17 Battery Place |

| New York, New York 10004 |

| fdipaolo@contintentalstock.com |

| If you are a Santa Maria Energy unitholder and have questions about the merger or if you need additional copies of this joint proxy statement/prospectus or the enclosed proxy card you should contact: |

| Beth Marino |

| VP—Legal and Corporate Affairs and Secretary |

| Santa Maria Energy Holdings, LLC |

| 2811 Airpark Drive |

| Santa Maria, California 93455 |

| Tel: (805) 938-3320 |

14

Table of Contents

This summary highlights selected information from this joint proxy statement/prospectus and may not contain all of the information that is important to you. To better understand the merger and related proposals you should read this entire joint proxy statement/prospectus carefully, including “Risk Factors” and the annexes. See also the section entitled “Where You Can Find Additional Information.”

Hyde Park

Hyde Park was incorporated under the laws of the State of Delaware on February 24, 2011, as a blank check company, for the purpose of acquiring, through a merger, share exchange, asset acquisition, stock purchase, plan of arrangement, recapitalization, reorganization or similar business combination, one or more operating businesses. On August 7, 2012, Hyde Park completed its initial public offering along with a private placement of its common stock. Since its incorporation, Hyde Park has not acquired an operating business.

After deducting the underwriting discounts and commissions and the public offering expenses, the total net proceeds to Hyde Park from the public offering were $72,768,238. Of these net proceeds, $71,812,500, together with $6,937,500 raised from the private sale of common stock to Hyde Park’s sponsors, for a total of $78,750,000, were deposited in a trust account at Morgan Stanley Smith Barney, with Continental Stock Transfer & Trust Company acting as trustee, which we refer to herein as the “trust account,” and the remaining proceeds of $955,738 became available to be used as working capital to provide for business, legal and accounting due diligence on prospective business combinations and continuing general and administrative expenses.

The funds held in the trust account will be released to Hyde Park upon the consummation of the merger and will be used to pay the holders of the IPO shares who exercise conversion rights and to pay expenses incurred in connection with the merger and will otherwise be available for Santa Maria Energy Corporation’s general corporate purposes.

If Hyde Park does not complete the merger or another business combination by May 1, 2014, it will cease all operations except for the purpose of winding up, redeeming 100% of the outstanding public stock and, subject to the approval of its remaining stockholders and its board of directors, dissolving and liquidating.

Hyde Park’s common stock is traded on NASDAQ under the ticker symbol “HPAC.” The mailing address of the principal executive office of Hyde Park is 500 Fifth Avenue, 50th Floor, New York, New York 10110, and its telephone number is (212) 644-3450.

Santa Maria Energy

Santa Maria Energy is an independent energy company focused on the exploration and development of oil and natural gas in the Monterey formation and the Diatomite reservoir within the Sisquoc formation in northern Santa Barbara County, California.

As of October 31, 2013, Santa Maria Energy’s estimated aggregate proved, probable and possible reserves were 48.0 MMBoe, and of its 15.7 MMBoe of proved reserves, 13.6% were proved developed and 99.9% were oil. Santa Maria Energy’s principal executive offices are located at 2811 Airpark Drive, Santa Maria, California 93455, and its telephone number is (805) 938-3320.

15

Table of Contents

Santa Maria Energy Corporation

Santa Maria Energy Corporation is a Delaware corporation that was organized on November 27, 2013 solely for the purpose of effecting the merger. Pursuant to the Merger Agreement, HPAC Merger Sub will be merged with and into Hyde Park, and SME Merger Sub will be merged with and into Santa Maria Energy. Santa Maria Energy will then be contributed to Hyde Park. As a result, Hyde Park will become a wholly-owned subsidiary of Santa Maria Energy Corporation and Santa Maria Energy will become a wholly-owned subsidiary of Hyde Park. As a result of the transactions contemplated by the Merger Agreement, Santa Maria Energy Corporation will become a publicly traded corporation, and former Hyde Park stockholders and Santa Maria Energy unitholders will own stock in Santa Maria Energy Corporation. Santa Maria Energy Corporation has not carried on any activities other than in connection with the merger. Santa Maria Energy Corporation’s principal executive offices are located at 2811 Airpark Drive, Santa Maria, California 93455, and its telephone number is (805) 938-3320.

HPAC Merger Sub

HPAC Merger Sub is a direct wholly-owned subsidiary of Santa Maria Energy Corporation that was formed solely in contemplation of the merger. It has not commenced any operations, has only nominal assets and has no liabilities or contingent liabilities, nor any outstanding commitments other than as set forth in the Merger Agreement. HPAC Merger Sub has not incurred any obligations, engaged in any business activities or entered into any agreements or arrangements with any third parties other than the Merger Agreement. Its principal executive offices are located at 500 Fifth Avenue, 50th Floor, New York, NY 10110, and its telephone number is (212) 644-3450.

SME Merger Sub

SME Merger Sub is a direct wholly-owned subsidiary of Santa Maria Energy Corporation that was formed solely in contemplation of the merger. It has not commenced any operations, has only nominal assets and has no liabilities or contingent liabilities, nor any outstanding commitments other than as set forth in the Merger Agreement. SME Merger Sub has not incurred any obligations, engaged in any business activities or entered into any agreements or arrangements with any third parties other than the Merger Agreement. Its principal executive offices are located at 2811 Airpark Drive, Santa Maria, California 93455, and its telephone number is (805) 938-3320.

16

Table of Contents

Hyde Park and Santa Maria Energy have entered into a Merger Agreement providing for the combination of Hyde Park and Santa Maria Energy under Santa Maria Energy Corporation, a new holding company. First, in the Hyde Park Merger, HPAC Merger Sub will merge with and into Hyde Park with Hyde Park as the surviving entity, and Hyde Park stockholders will receive Santa Maria Energy Corporation common stock in exchange for their Hyde Park stock. Concurrent with the Hyde Park Merger, SME Merger Sub will merge with and into Santa Maria Energy, with Santa Maria Energy as the surviving entity, and Santa Maria Energy unitholders will receive Santa Maria Energy Corporation stock in exchange for their Santa Maria Energy units. Santa Maria Energy will then be contributed to Hyde Park so that Santa Maria Energy will be a wholly-owned subsidiary of Hyde Park. Santa Maria Energy Corporation intends to apply to list its common stock, effective following the merger, on the NASDAQ under the symbol “SMEC.”

17

Table of Contents

Merger consideration received by Hyde Park stockholders

As a result of the Hyde Park Merger, each outstanding share of Hyde Park common stock will be exchanged for one share of Santa Maria Energy Corporation common stock (the “Hyde Park Merger Consideration”). A description of the Santa Maria Energy Corporation common stock to be issued in connection with the Hyde Park Merger is set forth in the section entitled “Description of Santa Maria Energy Corporation’s Common Stock and Other Securities.”

As a result of the merger and assuming no conversion of Hyde Park common stock, Hyde Park stockholders will own 10,068,750 shares of Santa Maria Energy Corporation common stock, or approximately 38.6% of its outstanding common stock immediately following the merger and prior to the consummation of the proposed private equity financing. See “The Merger—Merger Consideration” and “Summary—Private Equity Financing by Santa Maria Energy Corporation.”

Merger consideration received by Santa Maria Energy unitholders

As a result of the Santa Maria Energy Merger, each outstanding Santa Maria Energy common unit will be exchanged for 0.2857 shares of Santa Maria Energy Corporation common stock (the “Santa Maria Energy Common Merger Consideration”). In addition, each outstanding Santa Maria Energy preferred unit will be exchanged for one share of Santa Maria Energy Corporation preferred stock (the “Santa Maria Energy Preferred Merger Consideration” and, together with the Santa Maria Energy Common Merger Consideration, the “Santa Maria Energy Merger Consideration”). The common units that will be exchanged for the Santa Maria Energy Common Merger Consideration will include the 50,000,000 common units currently outstanding and up to an additional 6,099,212 common units that will be issued to the Kayne Investors immediately prior to the Santa Maria Energy Merger in satisfaction of accrued but unpaid dividends on the preferred units and a fee payable for a guarantee (the “Kayne Guaranty”) provided by the Kayne Investors in support of Santa Maria Energy’s senior

18

Table of Contents

credit facility. A description of the Santa Maria Energy Corporation common stock to be issued in connection with the merger is set forth in the section entitled “Description of Santa Maria Energy Corporation’s Common Stock and Other Securities.”

Recommendation to Hyde Park Stockholders

Hyde Park’s board of directors has determined that the merger proposal is fair to and in the best interests of Hyde Park stockholders. Hyde Park’s board of directors has also determined that the Hyde Park adjournment proposal is in the best interests of Hyde Park’s stockholders. Hyde Park’s board of directors unanimously recommends that Hyde Park’s stockholders vote “FOR” the merger proposal and “FOR” the Hyde Park adjournment proposal, if presented.

Recommendation to Santa Maria Energy Unitholders