Hamilton Insurance Group, Ltd. Supplementary Financial Information For the period ended September 30, 2023 Investor Contact Investor.Relations@hamiltongroup.com

Hamilton Insurance Group, Ltd. Table of Contents Page I. Basis of Presentation 1 II. Financial Highlights Financial Highlights 3 Key Operating and Financial Metrics 4 III. Consolidated Results Statements of Operations 5 Consolidated Balance Sheets 6 Reconciliation of Consolidated GAAP Balance Sheet to Unconsolidated Balance Sheet 7 Net Investment Return 8 Fixed Maturity and Short-Term Investments 9 IV. Segment Results Consolidated Underwriting Results 10 - 11 5Q Consolidated Underwriting Results 12 5Q Underwriting Results - International 13 5Q Underwriting Results - Bermuda 14 V. Other Information Modeled Exposure to Catastrophe Losses (PML) 15 Non-GAAP Measures 16 - 17

Basis of Presentation Cautionary Note Regarding Forward-Looking Statements • our results of operations and financial condition could be adversely affected by unpredictable catastrophic events, global climate change or emerging claim and coverage issues; • our business could be materially adversely affected if we do not accurately assess our underwriting risk, our reserves are inadequate to cover our actual losses, our models or assessments and pricing of risks are incorrect or we lose important broker relationships; • the insurance and reinsurance business is historically cyclical and the pricing and terms for our products may decline, which would affect our profitability and ability to maintain or grow premiums; • we have significant foreign operations that expose us to certain additional risks, including foreign currency risks and political risk; • we do not control the allocations to and/or the performance of the Two Sigma Hamilton Fund’s investment portfolio, and its performance depends on the ability of its investment manager, Two Sigma, to select and manage appropriate investments and we have a limited ability to withdraw our capital accounts; • Two Sigma Principals, LLC, the managing member of Two Sigma Hamilton Fund, Two Sigma and their respective affiliates have potential conflicts of interest that could adversely affect us; • the historical performance of Two Sigma is not necessarily indicative of the future results of the Two Sigma Hamilton Fund’s investment portfolio or of our future results; • our ability to manage risks associated with macroeconomic conditions resulting from the global COVID-19 pandemic or any other public health crisis, current or anticipated military conflict, including the ongoing Ukraine conflict, terrorism, sanctions, rising energy prices, inflation and interest rates and other geopolitical events globally; • our ability to compete successfully with more established competitors and risks relating to consolidation in the reinsurance and insurance industries; • downgrades, potential downgrades or other negative actions by rating agencies; All financial information contained herein is unaudited, however, certain information relating to the consolidated balance sheet at the most recent year end is derived from or agrees to audited financial information. Unless otherwise noted, all data is in thousands, except for share and per share amounts and ratio information. This information is being provided for informational purposes only. It should be read in conjunction with the documents filed by Hamilton Insurance Group, Inc. ("Hamilton") with the U.S Securities and Exchange Commission, including its Prospectus filed on November 13, 2023 and its Quarterly Report on Form 10-Q. This information may contain forward-looking statements which reflect the Company's current views with respect to future events and financial performance and are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are made based on management's current expectations and beliefs concerning future developments and their potential effects upon Hamilton. There can be no assurance that future developments affecting Hamilton will be those anticipated by management. Forward-looking statements include, without limitation, all matters that are not historical facts. These forward-looking statements are not a guarantee of future performance and involve risk and uncertainties, and there are certain important factors that could cause actual results to differ, possibly materially, from expectations or estimates reflected in such forward-looking statements, including the following: 1

Cautionary Note Regarding Forward-Looking Statements (continued) • our dependence on key executives, including the potential loss of Bermudian personnel as a result of Bermuda employment restrictions, and inability to attract qualified personnel, in particular in very competitive hiring conditions; • our dependence on letter of credit facilities that may not be available on commercially acceptable terms; • our potential need for additional capital in the future and the potential unavailability of such capital to us on favorable terms or at all; • the suspension or revocation of our subsidiaries’ insurance licenses; • the potential characterization of us and/or any of our subsidiaries as a passive foreign investment company, or PFIC; • risks associated with our investment strategy being greater than those faced by competitors; • changes in the regulatory environment and the potential for greater regulatory scrutiny of the Group going forward as a result of the outsourcing arrangements; • a cyclical downturn of the reinsurance industry; • operational failures, failure of information systems or failure to protect the confidentiality of customer information, including by service providers, or losses due to defaults, errors or omissions by third parties and affiliates; • we are a holding company with no direct operations, and our insurance and reinsurance subsidiaries’ ability to pay dividends and other distributions to us is restricted by law; • risks relating to our ability to identify and execute opportunities for growth or our ability to complete transactions as planned or realize the anticipated benefits of our acquisitions or other investments; • our potentially becoming subject to U.S. federal income taxation; • our potentially becoming subject to U.S. withholding and information reporting requirements under the U.S. Foreign Account Tax Compliance Act, or FATCA, provisions; • our costs will increase as a result of operating as a public company, and our management will be required to devote substantial time to complying with public company regulations; • if we were to identify a material weakness and were unable to remediate this material weakness, or fail to achieve and maintain effective internal controls, our operating results and financial condition could be impacted and the market price of our Class B common shares may be negatively affected; • the lack of a prior public market for our Class B common shares, our share price may be volatile and anti-takeover provisions contained in our organizational documents could delay management changes; • the potential that the market price of our Class B common shares could decline due to future sales of shares by our existing shareholders; • applicable insurance laws, which could make it difficult to effect a change of control of our company; • investors may have difficulties in serving process or enforcing judgments against us in the United States; • and other factors affecting future results disclosed in the Company’s filing with the SEC, including the Prospectus and Quarterly Report on Form 10-Q. 2

Financial Highlights Three Months Ended September 30, Nine Months Ended September 30, Year Ended ($ in thousands) 2023 2022 2023 2022 2022 Net income (loss) attributable to common shareholders 43,583$ (136,117)$ 131,862$ (38,979)$ (97,999)$ Underwriting income (loss) Gross premiums written 474,123$ 400,811$ 1,517,247$ 1,305,421$ 1,646,673$ Net premiums written 383,566 300,811 1,116,772 938,488 1,221,864 Net premiums earned 337,036 294,943 952,398 831,467 1,143,714 Underwriting income (loss) 24,866$ (66,075)$ 93,823$ (70,321)$ (31,717)$ Loss and loss adjustment expense ratio: Attritional loss ratio - current year 54.8% 49.6% 51.8% 49.5% 51.8% Attritional loss ratio - prior year development (0.1%) 10.2% (0.4%) 1.4% (0.3%) Catastrophe loss ratio - current year 3.9% 28.3% 3.7% 22.7% 16.3% Catastrophe loss ratio - prior year development (1.8%) (0.6%) (0.5%) (1.8%) (1.5%) Net loss and loss adjustment expense ratio 56.8% 87.5% 54.6% 71.8% 66.3% Acquisition cost ratio 23.3% 22.3% 23.2% 23.4% 23.7% Other underwriting expense ratio 12.5% 12.7% 12.4% 13.3% 12.8% Combined ratio 92.6% 122.5% 90.2% 108.5% 102.8% Investments Total assets 6,504,604$ 5,907,550$ 6,504,604$ 5,907,550$ 5,818,965$ Total cash and invested assets(1) 3,765,160 3,496,797 3,765,160 3,496,797 3,445,802 Total investment return(2) 46,347 (57,317) 104,524 56,386 (3,194) Two Sigma Hamilton Fund Total realized and unrealized gains (losses) on investments and net investment income (loss) - TSHF 60,404 (36,602) 100,448 225,896 145,238 Net income (loss) attributable to non-controlling interest - TSHF 9,065 (15,318) 15,076 68,069 68,064 51,339$ (21,284)$ 85,372$ 157,827$ 77,174$ Two Sigma Hamilton Fund return, net of investment management fees and performance incentive allocations 3.1% (1.2%) 5.3% 9.4% 4.6% Fixed income, short term investments and cash and cash equivalents Total realized and unrealized gains (losses) on investments and net investment income (loss) - other (4,992)$ (36,033)$ 19,152$ (101,441)$ (80,368)$ (1) Total cash and total investments, plus receivables for investments sold, less payables for investments purchased. (2) Net realized and unrealized gains and (losses) on investments, plus net investment income, less non-controlling interest. 3

Financial Highlights Key Operating and Financial Metrics Three Months Ended September 30, Nine Months Ended September 30, Year Ended ($ in thousands, except per share amounts) 2023 2022 2023 2022 2022 Income (loss) per share attributable to common shareholders - basic 0.42$ (1.32)$ 1.27$ (0.38)$ (0.95)$ Income (loss) per share attributable to common shareholders - diluted 0.41$ (1.32)$ 1.26$ (0.38)$ (0.95)$ Weighted average common shares outstanding - basic 103,704 103,074 103,711 103,053 103,062 Weighted average common shares outstanding - diluted 105,424 103,074 104,971 103,053 103,062 Return on average common shareholders' equity - annualized 9.8% (30.4%) 10.2% (3.0%) (5.7%) September 30, 2023 December 31, 2022 Closing common shareholders' equity less intangible assets 1,710,136$ 1,577,225$ Closing common shareholders' equity 1,799,725$ 1,664,183$ Tangible book value per common share 16.49$ 15.30$ Book value per common share 17.35$ 16.14$ Year-to-date change in tangible book value per common share 7.8% (4.1%) Year-to-date change in book value per common share 7.5% (5.6%) 4

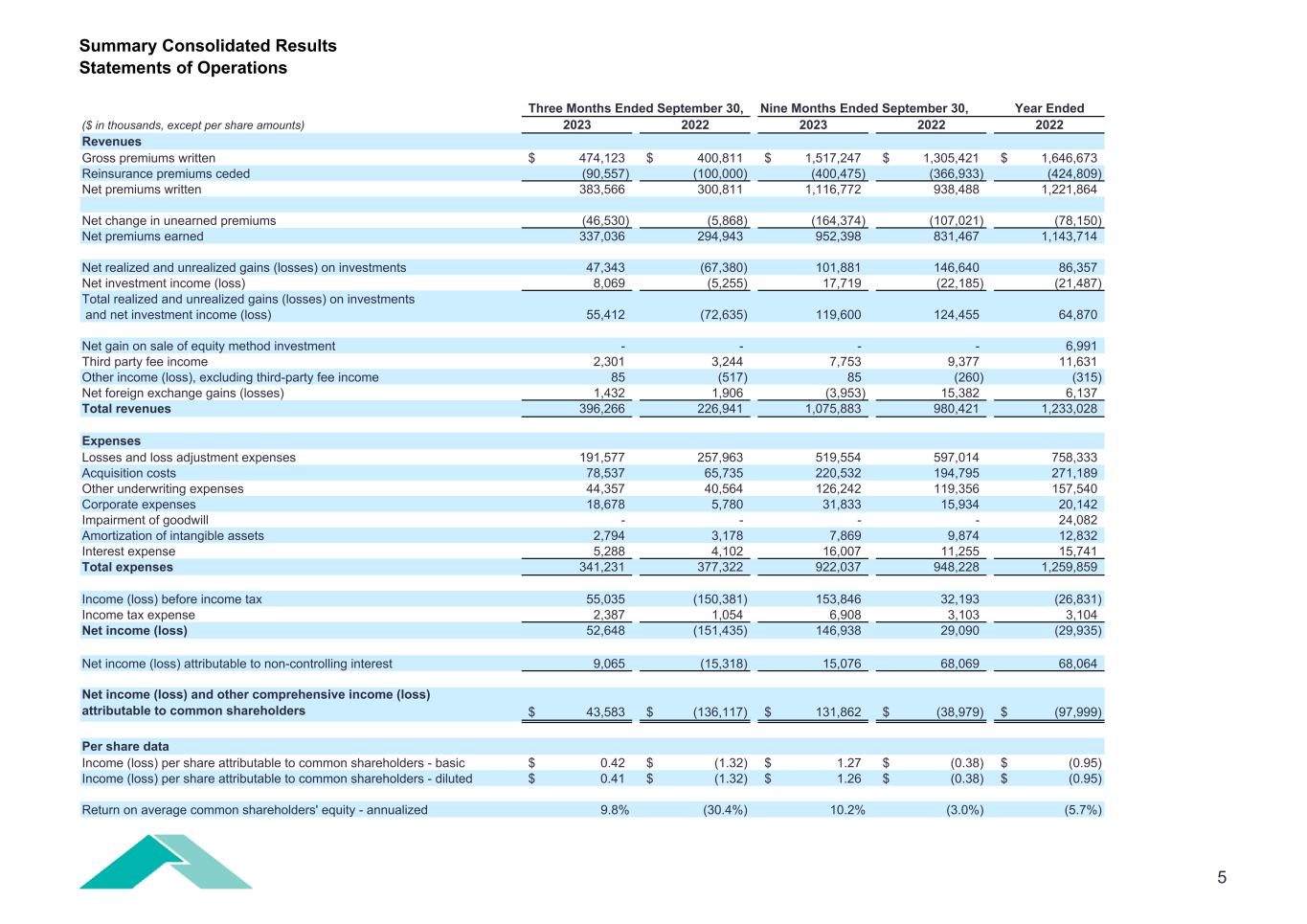

Summary Consolidated Results Statements of Operations Three Months Ended September 30, Nine Months Ended September 30, Year Ended ($ in thousands, except per share amounts) 2023 2022 2023 2022 2022 Revenues Gross premiums written 474,123$ 400,811$ 1,517,247$ 1,305,421$ 1,646,673$ Reinsurance premiums ceded (90,557) (100,000) (400,475) (366,933) (424,809) Net premiums written 383,566 300,811 1,116,772 938,488 1,221,864 Net change in unearned premiums (46,530) (5,868) (164,374) (107,021) (78,150) Net premiums earned 337,036 294,943 952,398 831,467 1,143,714 Net realized and unrealized gains (losses) on investments 47,343 (67,380) 101,881 146,640 86,357 Net investment income (loss) 8,069 (5,255) 17,719 (22,185) (21,487) Total realized and unrealized gains (losses) on investments and net investment income (loss) 55,412 (72,635) 119,600 124,455 64,870 Net gain on sale of equity method investment - - - - 6,991 Third party fee income 2,301 3,244 7,753 9,377 11,631 Other income (loss), excluding third-party fee income 85 (517) 85 (260) (315) Net foreign exchange gains (losses) 1,432 1,906 (3,953) 15,382 6,137 Total revenues 396,266 226,941 1,075,883 980,421 1,233,028 Expenses Losses and loss adjustment expenses 191,577 257,963 519,554 597,014 758,333 Acquisition costs 78,537 65,735 220,532 194,795 271,189 Other underwriting expenses 44,357 40,564 126,242 119,356 157,540 Corporate expenses 18,678 5,780 31,833 15,934 20,142 Impairment of goodwill - - - - 24,082 Amortization of intangible assets 2,794 3,178 7,869 9,874 12,832 Interest expense 5,288 4,102 16,007 11,255 15,741 Total expenses 341,231 377,322 922,037 948,228 1,259,859 Income (loss) before income tax 55,035 (150,381) 153,846 32,193 (26,831) Income tax expense 2,387 1,054 6,908 3,103 3,104 Net income (loss) 52,648 (151,435) 146,938 29,090 (29,935) Net income (loss) attributable to non-controlling interest 9,065 (15,318) 15,076 68,069 68,064 Net income (loss) and other comprehensive income (loss) attributable to common shareholders 43,583$ (136,117)$ 131,862$ (38,979)$ (97,999)$ Per share data Income (loss) per share attributable to common shareholders - basic 0.42$ (1.32)$ 1.27$ (0.38)$ (0.95)$ Income (loss) per share attributable to common shareholders - diluted 0.41$ (1.32)$ 1.26$ (0.38)$ (0.95)$ Return on average common shareholders' equity - annualized 9.8% (30.4%) 10.2% (3.0%) (5.7%) 5

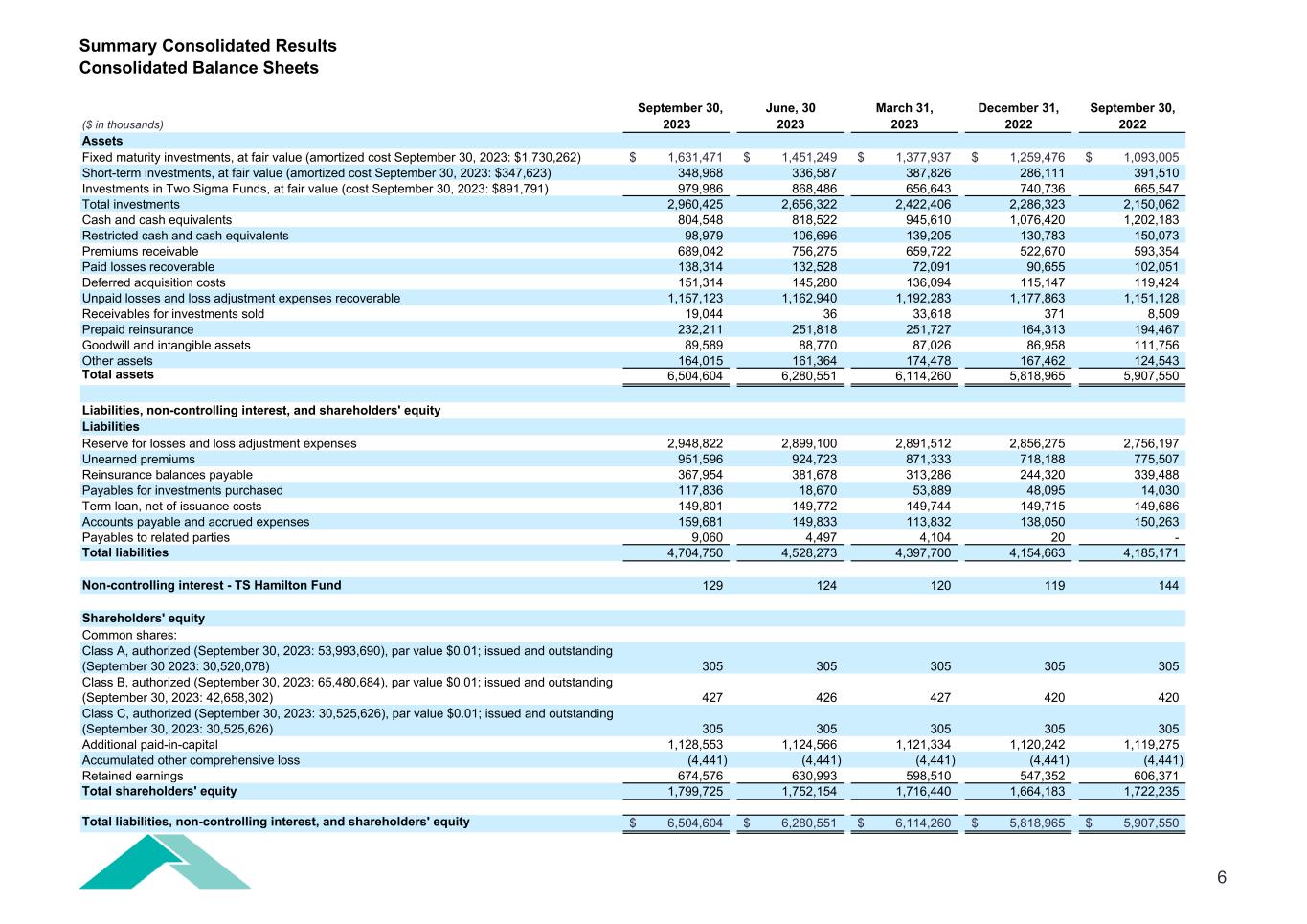

Summary Consolidated Results Consolidated Balance Sheets September 30, June, 30 March 31, December 31, September 30, ($ in thousands) 2023 2023 2023 2022 2022 Assets Fixed maturity investments, at fair value (amortized cost September 30, 2023: $1,730,262) 1,631,471$ 1,451,249$ 1,377,937$ 1,259,476$ 1,093,005$ Short-term investments, at fair value (amortized cost September 30, 2023: $347,623) 348,968 336,587 387,826 286,111 391,510 Investments in Two Sigma Funds, at fair value (cost September 30, 2023: $891,791) 979,986 868,486 656,643 740,736 665,547 Total investments 2,960,425 2,656,322 2,422,406 2,286,323 2,150,062 Cash and cash equivalents 804,548 818,522 945,610 1,076,420 1,202,183 Restricted cash and cash equivalents 98,979 106,696 139,205 130,783 150,073 Premiums receivable 689,042 756,275 659,722 522,670 593,354 Paid losses recoverable 138,314 132,528 72,091 90,655 102,051 Deferred acquisition costs 151,314 145,280 136,094 115,147 119,424 Unpaid losses and loss adjustment expenses recoverable 1,157,123 1,162,940 1,192,283 1,177,863 1,151,128 Receivables for investments sold 19,044 36 33,618 371 8,509 Prepaid reinsurance 232,211 251,818 251,727 164,313 194,467 Goodwill and intangible assets 89,589 88,770 87,026 86,958 111,756 Other assets 164,015 161,364 174,478 167,462 124,543 Total assets 6,504,604 6,280,551 6,114,260 5,818,965 5,907,550 Liabilities, non-controlling interest, and shareholders' equity Liabilities Reserve for losses and loss adjustment expenses 2,948,822 2,899,100 2,891,512 2,856,275 2,756,197 Unearned premiums 951,596 924,723 871,333 718,188 775,507 Reinsurance balances payable 367,954 381,678 313,286 244,320 339,488 Payables for investments purchased 117,836 18,670 53,889 48,095 14,030 Term loan, net of issuance costs 149,801 149,772 149,744 149,715 149,686 Accounts payable and accrued expenses 159,681 149,833 113,832 138,050 150,263 Payables to related parties 9,060 4,497 4,104 20 - Total liabilities 4,704,750 4,528,273 4,397,700 4,154,663 4,185,171 Non-controlling interest - TS Hamilton Fund 129 124 120 119 144 Shareholders' equity Common shares: Class A, authorized (September 30, 2023: 53,993,690), par value $0.01; issued and outstanding (September 30 2023: 30,520,078) 305 305 305 305 305 Class B, authorized (September 30, 2023: 65,480,684), par value $0.01; issued and outstanding (September 30, 2023: 42,658,302) 427 426 427 420 420 Class C, authorized (September 30, 2023: 30,525,626), par value $0.01; issued and outstanding (September 30, 2023: 30,525,626) 305 305 305 305 305 Additional paid-in-capital 1,128,553 1,124,566 1,121,334 1,120,242 1,119,275 Accumulated other comprehensive loss (4,441) (4,441) (4,441) (4,441) (4,441) Retained earnings 674,576 630,993 598,510 547,352 606,371 Total shareholders' equity 1,799,725 1,752,154 1,716,440 1,664,183 1,722,235 Total liabilities, non-controlling interest, and shareholders' equity 6,504,604$ 6,280,551$ 6,114,260$ 5,818,965$ 5,907,550$ 6

Reconciliation of Consolidated GAAP Balance Sheet to Unconsolidated Balance Sheet September 30, 2023 Adjusted Two Sigma Hamilton Fund ($ in thousands) Balances Assets Fixed maturity investments, at fair value 1,631,471$ -$ 1,631,471$ Short-term investments, at fair value 348,968 (347,787) 1,181 Investments in Two Sigma Funds, at fair value 979,986 715,704 1,695,690 Total investments 2,960,425 367,917 3,328,342 Cash and cash equivalents 804,548 (450,759) 353,789 Restricted cash and cash equivalents 98,979 98,979 Premiums receivable 689,042 689,042 Paid losses recoverable 138,314 138,314 Deferred acquisition costs 151,314 151,314 Unpaid losses and loss adjustment expenses recoverable 1,157,123 1,157,123 Receivables for investments sold 19,044 (12,730) 6,314 Prepaid reinsurance 232,211 232,211 Goodwill and intangible assets 89,589 89,589 Other assets 164,015 (804) 163,211 Total assets 6,504,604 (96,376) 6,408,228 Liabilities, non-controlling interest, and shareholders' equity Liabilities Reserve for losses and loss adjustment expenses 2,948,822 2,948,822 Unearned premiums 951,596 951,596 Reinsurance balances payable 367,954 367,954 Payables for investments purchased 117,836 (86,933) 30,903 Term loan, net of issuance costs 149,801 149,801 Accounts payable and accrued expenses 159,681 (254) 159,427 Payables to related parties 9,060 (9,060) - Total liabilities 4,704,750 (96,247) 4,608,503 Non-controlling interest - TS Hamilton Fund 129 (129) - Shareholders' equity Common shares: Class A, par value $0.01 305 305 Class B, par value $0.01 427 427 Class C, par value $0.01 305 305 Additional paid-in-capital 1,128,553 1,128,553 Accumulated other comprehensive loss (4,441) (4,441) Retained earnings 674,576 674,576 Total shareholders' equity 1,799,725 - 1,799,725 Total liabilities, non-controlling interest, and shareholders' equity 6,504,604$ (96,376)$ 6,408,228$ Consolidated Balance Sheet GAAP Unconsolidated Balance Sheet 7

Net Investment Return Three Months Ended September 30, Nine Months Ended September 30, Year Ended 2023 2022 2023 2022 2022 Net realized gains (losses) on investments 42,403$ 115,129$ 32,363$ 267,140$ 251,662$ Fixed maturities and short-term investments (7,688) (3,313) (10,796) (13,684) (14,968) TS Hamilton Fund 50,091 118,442 42,948 279,977 266,630 Other - - 211 847 - Change in net unrealized gains (losses) on investments 4,940 (182,509) 69,518 (120,500) (165,305) Fixed maturities and short-term investments (12,818) (38,556) (9,800) (101,760) (87,254) TS Hamilton Fund 17,758 (143,953) 79,318 (18,740) (78,051) Other - - - - - Net realized and unrealized gains (losses) on investments 47,343 (67,380) 101,881 146,640 86,357 Net investment income (loss): Fixed maturities 12,208 5,880 31,178 14,343 22,375 Short-term investments 38 334 287 737 155 TS Hamilton Fund 3,121 3,095 13,033 4,603 10,395 Cash and cash equivalents 4,029 544 8,752 696 2,634 Other (104) (431) 1,015 (1,230) (1,397) Interest and other 19,292 9,422 54,265 19,149 34,162 Management fees (10,958) (14,420) (35,806) (40,601) (54,581) Fixed maturities and short-term investments (534) (375) (1,375) (1,067) (1,478) TS Hamilton Fund (10,424) (14,045) (34,431) (39,534) (53,103) Other expenses (265) (257) (740) (733) (1,068) Fixed maturities and short-term investments (123) (116) (320) (323) (435) TS Hamilton Fund (142) (141) (420) (410) (633) Net investment income (loss) 8,069 (5,255) 17,719 (22,185) (21,487) Total realized and unrealized gains (losses) on investments and net investment income (loss) 55,412 (72,635) 119,600 124,455 64,870 Net income attributable to non-controlling interest 9,065 (15,318) 15,076 68,069 68,064 Total realized and unrealized gains (losses) on investments and net investment income (loss), net of non-controlling interest 46,347$ (57,317)$ 104,524$ 56,386$ (3,194)$ Fixed income, short term investments and cash and cash equivalents return (4,992)$ (36,033)$ 19,152$ (101,441)$ (80,368)$ TS Hamilton Fund return(1) 51,339 (21,284) 85,372 157,827 77,174 (1) Net of non-controlling interest performance incentive allocation 8

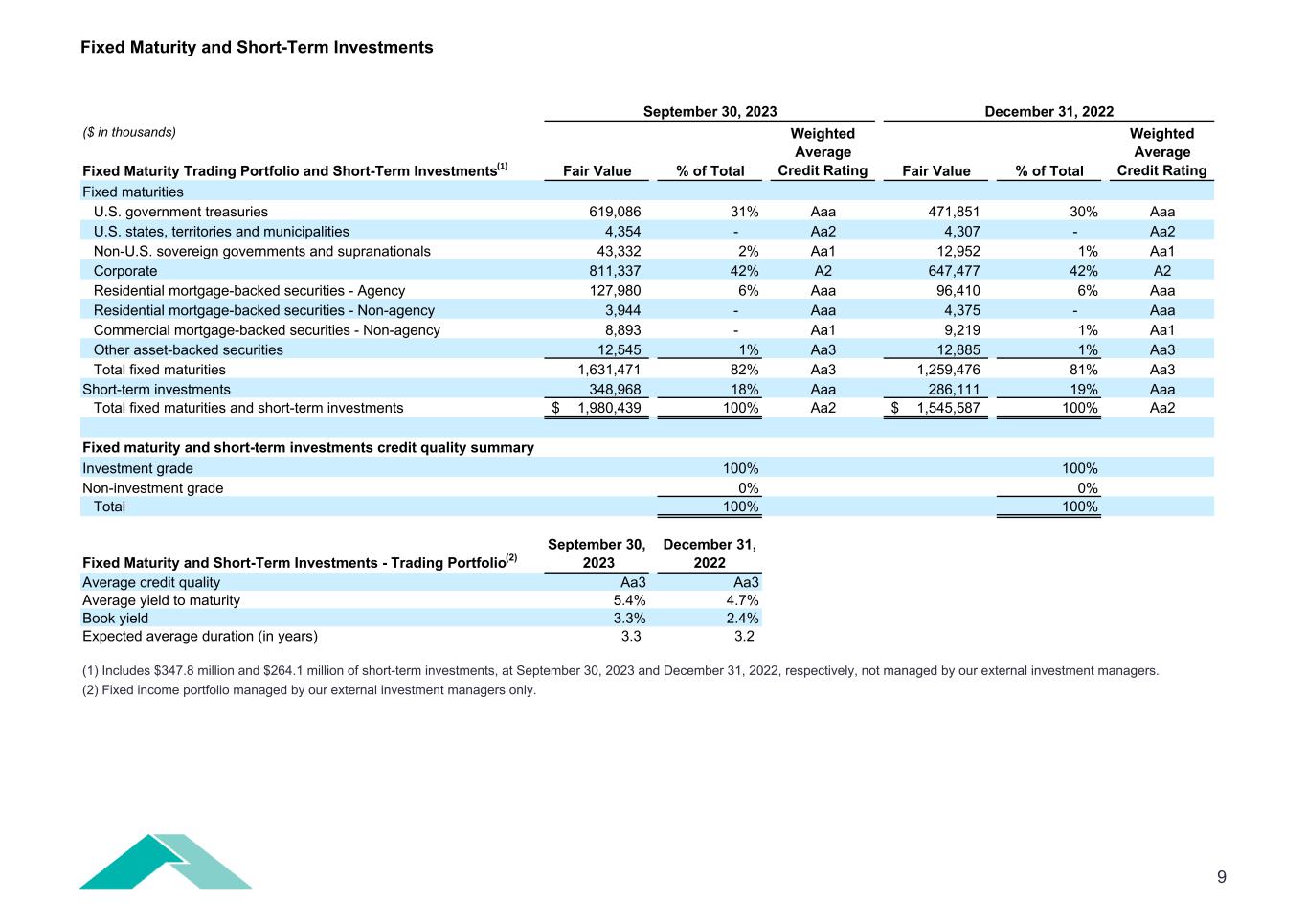

Fixed Maturity and Short-Term Investments September 30, 2023 December 31, 2022 ($ in thousands) Fixed Maturity Trading Portfolio and Short-Term Investments(1) Fair Value % of Total Weighted Average Credit Rating Fair Value % of Total Weighted Average Credit Rating Fixed maturities U.S. government treasuries 619,086 31% Aaa 471,851 30% Aaa U.S. states, territories and municipalities 4,354 - Aa2 4,307 - Aa2 Non-U.S. sovereign governments and supranationals 43,332 2% Aa1 12,952 1% Aa1 Corporate 811,337 42% A2 647,477 42% A2 Residential mortgage-backed securities - Agency 127,980 6% Aaa 96,410 6% Aaa Residential mortgage-backed securities - Non-agency 3,944 - Aaa 4,375 - Aaa Commercial mortgage-backed securities - Non-agency 8,893 - Aa1 9,219 1% Aa1 Other asset-backed securities 12,545 1% Aa3 12,885 1% Aa3 Total fixed maturities 1,631,471 82% Aa3 1,259,476 81% Aa3 Short-term investments 348,968 18% Aaa 286,111 19% Aaa Total fixed maturities and short-term investments 1,980,439$ 100% Aa2 1,545,587$ 100% Aa2 Fixed maturity and short-term investments credit quality summary Investment grade 100% 100% Non-investment grade 0% 0% Total 100% 100% Fixed Maturity and Short-Term Investments - Trading Portfolio(2) September 30, 2023 December 31, 2022 Average credit quality Aa3 Aa3 Average yield to maturity 5.4% 4.7% Book yield 3.3% 2.4% Expected average duration (in years) 3.3 3.2 (1) Includes $347.8 million and $264.1 million of short-term investments, at September 30, 2023 and December 31, 2022, respectively, not managed by our external investment managers. (2) Fixed income portfolio managed by our external investment managers only. 9

Segment Results Consolidated Underwriting Results Three Months Ended September 30, 2023 Three Months Ended September 30, 2022 ($ in thousands) International Bermuda Total International Bermuda Total Gross premiums written 307,140$ 166,983$ 474,123$ 269,228$ 131,583$ 400,811$ Net premiums written 234,621 148,945 383,566 184,319 116,492 300,811 Net premiums earned 178,632 158,404 337,036 156,307 138,636 294,943 Third party fee income 2,115 186 2,301 3,138 106 3,244 Losses and loss adjustment expenses 97,820 93,757 191,577 92,061 165,902 257,963 Acquisition costs 47,236 31,301 78,537 41,936 23,799 65,735 Other underwriting expenses 31,634 12,723 44,357 26,811 13,753 40,564 Underwriting income (loss) 4,057$ 20,809$ 24,866$ (1,363)$ (64,712)$ (66,075)$ Key Ratios: Attritional loss ratio - current year 54.6% 55.1% 54.8% 46.7% 53.0% 49.6% Attritional loss ratio - prior year development (5.3%) 5.7% (0.1%) (0.1%) 21.7% 10.2% Catastrophe loss ratio - current year 5.1% 2.6% 3.9% 11.9% 46.8% 28.3% Catastrophe loss ratio - prior year development 0.4% (4.2%) (1.8%) 0.4% (1.8%) (0.6%) Loss and loss adjustment expense ratio 54.8% 59.2% 56.8% 58.9% 119.7% 87.5% Acquisition cost ratio 26.4% 19.8% 23.3% 26.8% 17.2% 22.3% Other underwriting expense ratio 16.5% 7.9% 12.5% 15.2% 9.8% 12.7% Combined ratio 97.7% 86.9% 92.6% 100.9% 146.7% 122.5% 10

Segment Results Consolidated Underwriting Results Nine Months Ended September 30, 2023 Nine Months Ended September 30, 2022 ($ in thousands) International Bermuda Total International Bermuda Total Gross premiums written 832,049$ 685,198$ 1,517,247$ 698,968$ 606,453$ 1,305,421$ Net premiums written 553,687 563,085 1,116,772 446,577 491,911 938,488 Net premiums earned 504,784 447,614 952,398 450,202 381,265 831,467 Third party fee income 7,417 336 7,753 9,022 355 9,377 Losses and loss adjustment expenses 255,787 263,767 519,554 249,840 347,174 597,014 Acquisition costs 131,688 88,844 220,532 122,593 72,202 194,795 Other underwriting expenses 89,635 36,607 126,242 82,256 37,100 119,356 Underwriting income (loss) 35,091$ 58,732$ 93,823$ 4,535$ (74,856)$ (70,321)$ Key Ratios: Attritional loss ratio - current year 52.6% 50.8% 51.8% 47.4% 52.1% 49.5% Attritional loss ratio - prior year development (4.3%) 4.0% (0.4%) (3.5%) 7.2% 1.4% Catastrophe loss ratio - current year 2.2% 5.4% 3.7% 10.5% 37.0% 22.7% Catastrophe loss ratio - prior year development 0.2% (1.3%) (0.5%) 1.1% (5.2%) (1.8%) Loss and loss adjustment expense ratio 50.7% 58.9% 54.6% 55.5% 91.1% 71.8% Acquisition cost ratio 26.1% 19.8% 23.2% 27.2% 18.9% 23.4% Other underwriting expense ratio 16.3% 8.1% 12.4% 16.3% 9.6% 13.3% Combined ratio 93.1% 86.8% 90.2% 99.0% 119.6% 108.5% 11

Segment Results 5Q Consolidated Underwriting Results Three Months Ended Nine Months Ended Year Ended ($ in thousands) September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 September 30, 2023 September 30, 2022 December 31, 2022 Gross premiums written 474,123$ 504,960$ 538,164$ 341,252$ 400,811$ 1,517,247$ 1,305,421$ 1,646,673$ Net premiums written 383,566 384,708 348,498 283,376 300,811 1,116,772 938,488 1,221,864 Net premiums earned 337,036 331,460 283,902 312,247 294,943 952,398 831,467 1,143,714 Third party fee income 2,301 2,449 3,004 2,254 3,244 7,753 9,377 11,631 Losses and loss adjustment expenses 191,577 179,416 148,561 161,318 257,963 519,554 597,014 758,333 Acquisition costs 78,537 76,856 65,140 76,394 65,735 220,532 194,795 271,189 Other underwriting expenses 44,357 42,743 39,142 38,184 40,564 126,242 119,356 157,540 Underwriting income (loss) 24,866$ 34,894$ 34,063$ 38,605$ (66,075)$ 93,823$ (70,321)$ (31,717)$ Key Ratios: Attritional loss ratio - current year 54.8% 51.0% 49.1% 57.8% 49.6% 51.8% 49.5% 51.8% Attritional loss ratio - prior year development (0.1%) (1.6%) 0.6% (4.7%) 10.2% (0.4%) 1.4% (0.3%) Catastrophe loss ratio - current year 3.9% 5.0% 1.8% (0.7%) 28.3% 3.7% 22.7% 16.3% Catastrophe loss ratio - prior year development (1.8%) (0.3%) 0.8% (0.8%) (0.6%) (0.5%) (1.8%) (1.5%) Loss and loss adjustment expense ratio 56.8% 54.1% 52.3% 51.6% 87.5% 54.6% 71.8% 66.3% Acquisition cost ratio 23.3% 23.2% 22.9% 24.5% 22.3% 23.2% 23.4% 23.7% Other underwriting expense ratio 12.5% 12.2% 12.7% 11.5% 12.7% 12.4% 13.3% 12.8% Combined ratio 92.6% 89.5% 87.9% 87.6% 122.5% 90.2% 108.5% 102.8% 12

Segment Results 5Q Underwriting Results - International Three Months Ended Nine Months Ended Year Ended ($ in thousands) September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 September 30, 2023 September 30, 2022 December 31, 2022 Gross premiums written 307,140$ 277,796$ 247,114$ 234,273$ 269,228$ 832,049$ 698,968$ 933,241$ Net premiums written 234,621 197,047 122,019 189,195 184,319 553,687 446,577 635,773 Net premiums earned 178,632 176,636 149,515 172,846 156,307 504,784 450,202 623,047 Third party fee income 2,115 2,401 2,902 2,408 3,138 7,417 9,022 11,430 Losses and loss adjustment expenses 97,820 87,575 70,393 85,644 92,061 255,787 249,840 335,484 Acquisition costs 47,236 47,260 37,193 47,978 41,936 131,688 122,593 170,571 Other underwriting expenses 31,634 29,540 28,461 25,982 26,811 89,635 82,256 108,239 Underwriting income (loss) 4,057$ 14,662$ 16,370$ 15,650$ (1,363)$ 35,091$ 4,535$ 20,183$ Key Ratios: Attritional loss ratio - current year 54.6% 52.9% 49.9% 60.0% 46.7% 52.6% 47.4% 50.9% Attritional loss ratio - prior year development (5.3%) (3.3%) (4.2%) (8.1%) (0.1%) (4.3%) (3.5%) (4.8%) Catastrophe loss ratio - current year 5.1% 0.9% 0.0% (1.2%) 11.9% 2.2% 10.5% 7.2% Catastrophe loss ratio - prior year development 0.4% (0.9%) 1.4% (1.2%) 0.4% 0.2% 1.1% 0.5% Loss and loss adjustment expense ratio 54.8% 49.6% 47.1% 49.5% 58.9% 50.7% 55.5% 53.8% Acquisition cost ratio 26.4% 26.8% 24.9% 27.8% 26.8% 26.1% 27.2% 27.4% Other underwriting expense ratio 16.5% 15.4% 17.1% 13.6% 15.2% 16.3% 16.3% 15.5% Combined ratio 97.7% 91.8% 89.1% 90.9% 100.9% 93.1% 99.0% 96.7% 13

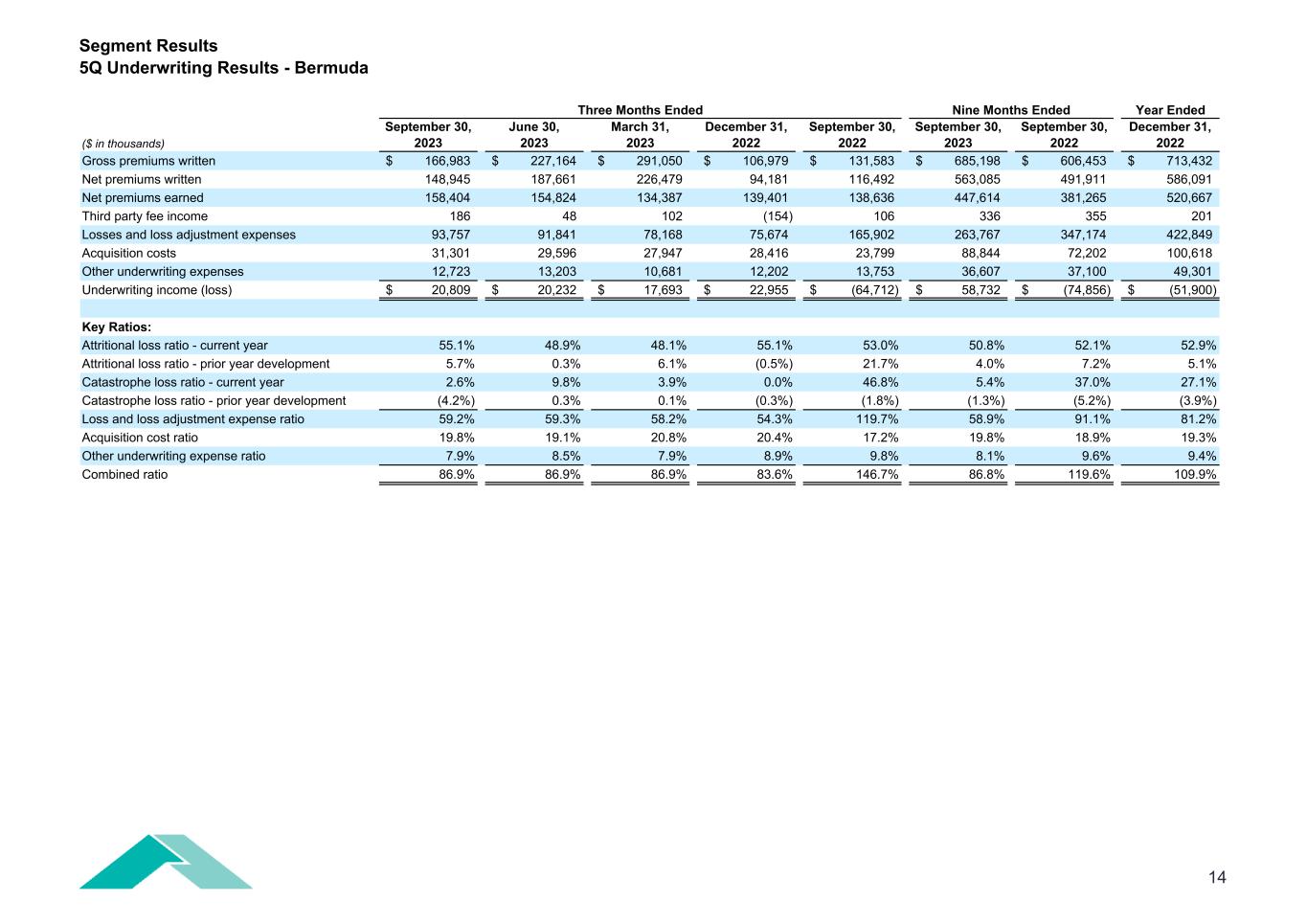

Segment Results 5Q Underwriting Results - Bermuda Three Months Ended Nine Months Ended Year Ended ($ in thousands) September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 September 30, 2022 September 30, 2023 September 30, 2022 December 31, 2022 Gross premiums written 166,983$ 227,164$ 291,050$ 106,979$ 131,583$ 685,198$ 606,453$ 713,432$ Net premiums written 148,945 187,661 226,479 94,181 116,492 563,085 491,911 586,091 Net premiums earned 158,404 154,824 134,387 139,401 138,636 447,614 381,265 520,667 Third party fee income 186 48 102 (154) 106 336 355 201 Losses and loss adjustment expenses 93,757 91,841 78,168 75,674 165,902 263,767 347,174 422,849 Acquisition costs 31,301 29,596 27,947 28,416 23,799 88,844 72,202 100,618 Other underwriting expenses 12,723 13,203 10,681 12,202 13,753 36,607 37,100 49,301 Underwriting income (loss) 20,809$ 20,232$ 17,693$ 22,955$ (64,712)$ 58,732$ (74,856)$ (51,900)$ Key Ratios: Attritional loss ratio - current year 55.1% 48.9% 48.1% 55.1% 53.0% 50.8% 52.1% 52.9% Attritional loss ratio - prior year development 5.7% 0.3% 6.1% (0.5%) 21.7% 4.0% 7.2% 5.1% Catastrophe loss ratio - current year 2.6% 9.8% 3.9% 0.0% 46.8% 5.4% 37.0% 27.1% Catastrophe loss ratio - prior year development (4.2%) 0.3% 0.1% (0.3%) (1.8%) (1.3%) (5.2%) (3.9%) Loss and loss adjustment expense ratio 59.2% 59.3% 58.2% 54.3% 119.7% 58.9% 91.1% 81.2% Acquisition cost ratio 19.8% 19.1% 20.8% 20.4% 17.2% 19.8% 18.9% 19.3% Other underwriting expense ratio 7.9% 8.5% 7.9% 8.9% 9.8% 8.1% 9.6% 9.4% Combined ratio 86.9% 86.9% 86.9% 83.6% 146.7% 86.8% 119.6% 109.9% 14

Other Information Modeled Exposure to Catastrophe Losses (PML) Net Probable Maximum Loss (PML) as of September 1, 2023 ($ in millions) Region Peril Probability of Exceedance Group Net PML ($m)(1) % of Shareholders' Equity Florida U.S. Hurricane 1 in 100 154.2$ 8.6% Northeast U.S. Hurricane 1 in 100 147.5 8.2% Gulf (TX - AL) U.S. Hurricane 1 in 100 128.4 7.1% California Earthquake 1 in 250 190.0 10.6% Pacific Northwest Earthquake 1 in 250 85.9 4.8% (1) Group Net PML is a measure of loss across all Hamilton entities net of recoveries from various reinsurance contracts and catastrophe bond we purchase to mitigate catastrophe losses and net of estimated reinstatement premium to renew coverage. Our peak natural catastrophe PMLs are derived using vendor catastrophe models that serve as a baseline and proprietary tools that allow us to make a number of significant adjustments. Adjustments are informed by periodic evaluation of vendor models and risk learning from comparing actual and modeled losses of catastrophe events, thus allowing for a view of risk that we believe is materially more complete and appropriate to the current risk landscape. Our peak natural catastrophe PMLs are measured using stochastic models that use hypothetical events of perils such as hurricanes and earthquakes. We define PML as the anticipated loss, taking into account contract terms and limits, caused by a single catastrophe affecting a broad contiguous geographical area, and are expressed at refine "return periods", such as "100-year events" and "250 year events". For example, a 100-year PML is the estimated loss to the current in-force portfolio from a single event which has a 1% probability of being exceeded in a twelve month period. Due to the uncertain nature of catastrophes and the hypothetical nature of vendor catastrophe models we use for estimating losses, there is no assurance that actual losses we experience within a time period will match the modeled PML. This approach to measuring catastrophe losses, however, is consistent with the best practice in the industry and employed by almost all of our peers. 15

Other Information Non-GAAP Measures Three Months Ended September 30, ($ in thousands) 2023 2022 2023 2022 Underwriting income (loss) 24,866 (66,075) 93,823 (70,321) Total realized and unrealized gains (losses) on investments and net investment income (loss) 55,412 (72,635) 119,600 124,455 Other income (loss), excluding third party fee income 85 (517) 85 (260) Net foreign exchange gains (losses) 1,432 1,906 (3,953) 15,382 Corporate expenses (18,678) (5,780) (31,833) (15,934) Amortization of intangible assets (2,794) (3,178) (7,869) (9,874) Interest expense (5,288) (4,102) (16,007) (11,255) Income tax expense (2,387) (1,054) (6,908) (3,103) Net income (loss), prior to non-controlling interest 52,648 (151,435) 146,938 29,090 Three Months Ended September 30, ($ in thousands) 2023 2022 2023 2022 Third party fee income 2,301 3,244 7,753 9,377 Other income (loss), excluding third party fee income 85 (517) 85 (260) Other income (loss) 2,386 2,727 7,838 9,117 Third Party Fee Income Third party fee income includes income that is incremental and/or directly attributable to our underwriting operations. It is primarily comprised of fees earned by the International segment for management services provided to third party syndicates and consortia. We believe that this measure is a relevant component of our underwriting income (loss). The table below reconciles third party fee income to other income, the most comparable GAAP financial measure: We present our results of operations in a way that we believe will be the most meaningful and useful to investors, analysts, rating agencies and others who use our financial information to evaluate its performance. Some of the measurements are considered non-GAAP financial measures under SEC rules and regulations. In this Supplementary Financial Information, we present underwriting income (loss), a non-GAAP financial measure as defined in Item 10(e) of SEC Regulation S-K. We believe that non-GAAP financial measures, which may be defined and calculated differently by other companies, help explain and enhance the understanding of our results of operations. However, these measures should not be viewed as a substitute for those determined in accordance with U.S. GAAP. Where appropriate, reconciliations of our non-GAAP measures to the most comparable GAAP figures are included below. Underwriting Income (Loss) We calculate underwriting income (loss) on a pre-tax basis as net premiums earned less losses and loss adjustment expenses, acquisition costs and other underwriting expenses (net of third party fee income). We believe that this measure of our performance focuses on the core fundamental performance of the Company’s reportable segments in any given period and is not distorted by investment market conditions, corporate expense allocations or income tax effects. The table below reconciles underwriting income (loss) to net income (loss), the most comparable GAAP financial measure: Nine Months Ended September 30, Nine Months Ended September 30, 16

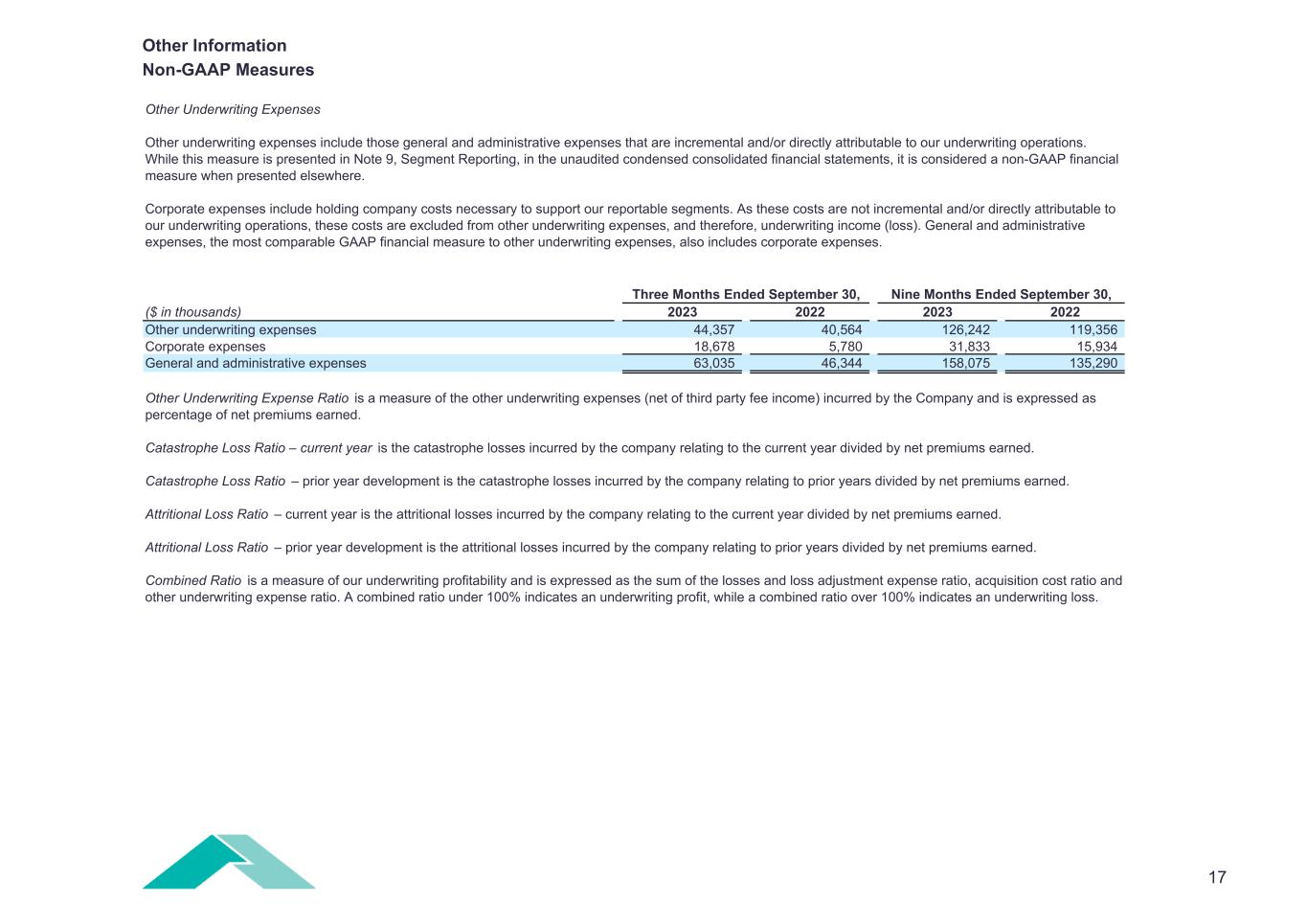

Other Information Non-GAAP Measures Three Months Ended September 30, ($ in thousands) 2023 2022 2023 2022 Other underwriting expenses 44,357 40,564 126,242 119,356 Corporate expenses 18,678 5,780 31,833 15,934 General and administrative expenses 63,035 46,344 158,075 135,290 Other Underwriting Expense Ratio is a measure of the other underwriting expenses (net of third party fee income) incurred by the Company and is expressed as percentage of net premiums earned. Catastrophe Loss Ratio – current year is the catastrophe losses incurred by the company relating to the current year divided by net premiums earned. Catastrophe Loss Ratio – prior year development is the catastrophe losses incurred by the company relating to prior years divided by net premiums earned. Attritional Loss Ratio – current year is the attritional losses incurred by the company relating to the current year divided by net premiums earned. Attritional Loss Ratio – prior year development is the attritional losses incurred by the company relating to prior years divided by net premiums earned. Combined Ratio is a measure of our underwriting profitability and is expressed as the sum of the losses and loss adjustment expense ratio, acquisition cost ratio and other underwriting expense ratio. A combined ratio under 100% indicates an underwriting profit, while a combined ratio over 100% indicates an underwriting loss. Other Underwriting Expenses Other underwriting expenses include those general and administrative expenses that are incremental and/or directly attributable to our underwriting operations. While this measure is presented in Note 9, Segment Reporting, in the unaudited condensed consolidated financial statements, it is considered a non-GAAP financial measure when presented elsewhere. Corporate expenses include holding company costs necessary to support our reportable segments. As these costs are not incremental and/or directly attributable to our underwriting operations, these costs are excluded from other underwriting expenses, and therefore, underwriting income (loss). General and administrative expenses, the most comparable GAAP financial measure to other underwriting expenses, also includes corporate expenses. Nine Months Ended September 30, 17