Table of Contents

UNITED STATES SECURITY AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF

THE SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. 1)

| x |

Filed by the Registrant |

¨ |

Filed by a Party other than the Registrant |

Check the appropriate box:

|

¨ |

Preliminary Proxy Statement | |||

|

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). | |||

|

x |

Definitive Proxy Statement | |||

|

¨ |

Definitive Additional Materials | |||

|

¨ |

Soliciting Material Pursuant to Section 240.14a-12 | |||

|

Endo International plc | ||||

| (Name of Registrant as Specified in Its Charter) | ||||

|

| ||||

| (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | ||||

|

Payment of Filing Fee (check the appropriate box): | ||||

|

x |

No fee required | |||

|

¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

|

(1) |

Title of each class of securities to which transaction applies

| |||

|

| ||||

| (2) |

Aggregate number of securities to which transaction applies

| |||

|

| ||||

| (3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined)

| |||

|

| ||||

| (4) |

Proposed maximum aggregate value of transaction

| |||

|

| ||||

| (5) |

Total fee paid

| |||

|

| ||||

|

¨ |

Fee paid previously with preliminary materials. | |||

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) |

Amount Previously Paid

| |||

|

| ||||

| (2) |

Form, Schedule or Registration Statement No.

| |||

|

| ||||

| (3) |

Filing Party

| |||

|

| ||||

| (4) |

Date Filed

| |||

|

| ||||

Table of Contents

EXPLANATORY NOTE

On April 28, 2016, Endo International plc filed with the Securities and Exchange Commission a definitive Proxy Statement for the 2016 Annual General Meeting of Shareholders to be held on June 9, 2016. On May 3, 2016, after the filing of the definitive Proxy Statement, the Board of Directors resolved that the number of directors be fixed at eleven effective May 5, 2016 and, upon the recommendation of its Nominating & Governance Committee, appointed Douglas S. Ingram, Chief Executive Officer, Chase Pharmaceuticals Corporation, and Todd B. Sisitsky, Managing Partner, TPG Capital North America, as new directors to fill the vacancies thereby created and nominated Douglas S. Ingram and Todd B. Sisitsky for election as directors at the 2016 Annual Meeting. Messrs. Ingram and Sisitsky would have been included in the Proxy Statement had they been appointed as directors prior to the filing of the definitive Proxy Statement. We are hereby amending and restating the Proxy Statement to include information regarding Messrs. Ingram and Sisitsky. The proxy card being provided to shareholders with the amended and restated Proxy Statement includes Messrs. Ingram and Sisitsky as director nominees. Other than the revisions regarding the new directors, there are no other material changes to the information contained in the Proxy Statement.

Table of Contents

| 2016 | Notice of the 2016 Annual General Meeting of Shareholders and Proxy Statement

|

June 9, 2016 at 8:00 a.m. local time

Endo International plc

First Floor ● Minerva House ● Simmonscourt Road ● Ballsbridge ● Dublin 4, Ireland

endo.com

Table of Contents

|

|

Endo International plc

First Floor

Minerva House

Simmonscourt Road

Ballsbridge

Dublin 4, Ireland

endo.com |

|

Endo International plc is a global specialty pharmaceutical company focused on improving the lives of patients while creating value. |

Dear Fellow Endo International plc Shareholder:

It is my pleasure to invite you to the Annual General Meeting of Shareholders of Endo International plc (the Company), which will be held on June 9, 2016 at 8:00 a.m., local time, at First Floor, Minerva House, Simmonscourt Road, Ballsbridge, Dublin 4, Ireland.

At the meeting, we will be electing by separate resolutions eleven members to our Board of Directors, voting to approve the selection of PricewaterhouseCoopers LLP as our independent auditor and to authorize the Audit Committee of the Board of Directors to determine the auditors’ remuneration, conducting an advisory vote on the compensation of our named executive officers, voting to approve the amendment of the Company’s Memorandum of Association, voting to approve the amendment of the Company’s Articles of Association and voting to approve the amendment of the Company’s 2015 Stock Incentive Plan. During the Annual General Meeting, we will also review the Company’s 2015 Irish statutory financial statements. In addition to these formal items of business, we will report on our Company’s performance.

In addition to our nine current directors elected at the 2015 Annual General Meeting who are standing for reelection, we are very pleased that our Board of Directors has nominated current directors Douglas S. Ingram, Chief Executive Officer, Chase Pharmaceuticals Corporation, and Todd B. Sisitsky, Managing Partner, TPG Capital North America, for election as independent directors at the Annual General Meeting.

We look forward to seeing you at the Annual General Meeting should you be able to attend.

Your vote is important. Whether you plan to attend the meeting or not, we encourage you to read this Proxy Statement and vote your shares. Please vote by promptly completing and returning your proxy by internet, by mail or by attending the Annual General Meeting and voting in person by ballot. You may revoke your proxy at any time before it is exercised as explained in this Proxy Statement.

Thank you for your continued interest in Endo.

Very truly yours,

RAJIV DE SILVA

President and Chief Executive Officer

Dublin, Ireland

May 5, 2016

Endo International plc,

Registered Office: First Floor, Minerva House, Simmonscourt Road, Ballsbridge, Dublin 4, Ireland

Registered in Ireland: number—534814

Directors: Roger Hartley Kimmel (USA), Rajiv Kanishka Liyanaarchchie De Silva (USA), Shane Martin Cooke (Ireland),

Arthur Joseph Higgins (USA), Nancy June Hutson (USA), Michael Hyatt (USA), Douglas Stephen Ingram (USA),

William Patrick Montague (USA), Todd Benjamin Sisitsky (USA), Jill Deborah Smith (USA), William Frederick Spengler (USA).

Table of Contents

|

|

Endo International plc

First Floor

Minerva House

Simmonscourt Road

Ballsbridge

Dublin 4, Ireland

endo.com |

TO BE HELD ON JUNE 9, 2016

8:00 a.m., Local Time

First Floor, Minerva House,

Simmonscourt Road, Ballsbridge, Dublin 4, Ireland

Notice is hereby given that the 2016 Annual General Meeting of Shareholders (the Annual Meeting) of Endo International plc, an Irish public limited company, will be held on June 9, 2016 at 8:00 a.m., local time, at First Floor, Minerva House, Simmonscourt Road, Ballsbridge, Dublin 4, Ireland.

The purposes of the meeting are:

| (1) | To elect by separate resolutions eleven directors to serve until the next Annual Meeting; |

| (2) | To approve the appointment of PricewaterhouseCoopers LLP as the Company’s independent auditors for the year ending December 31, 2016 and to authorize the Audit Committee of the Board of Directors to determine the auditors’ remuneration; |

| (3) | To conduct an advisory vote on the compensation of our named executive officers; |

| (4) | To approve the amendment of the Company’s Memorandum of Association; |

| (5) | To approve the amendment of the Company’s Articles of Association; |

| (6) | To approve the amendment of the Company’s 2015 Stock Incentive Plan; and |

| (7) | To act upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

These proposals, other than proposals (4) and (5), are ordinary resolutions requiring a simple majority of the votes cast at the meeting. Proposals (4) and (5) are special resolutions requiring the approval of 75% of the votes cast at the meeting. All proposals are more fully described in this proxy statement.

The Company’s Irish statutory financial statements for the fiscal year ended December 31, 2015, including the reports of the directors and auditors thereon, will be presented at the Annual Meeting. There is no requirement under Irish law that such statements be approved by the shareholders, and no such approval will be sought at the Annual Meeting. The Annual Meeting will also include a review by the members of the Company’s affairs.

Only shareholders of record at the close of business on April 14, 2016 are entitled to notice of and to vote at the 2016 Annual Meeting and any adjournment thereof.

This year, we have elected to furnish proxy materials to our shareholders electronically so that we can both provide our shareholders with the information they need and also reduce our costs of printing and delivery and the environmental impact of our Annual Meeting.

It is important that your shares be represented and voted at the Annual Meeting. Please vote by promptly completing and returning your proxy by internet, by mail or by attending the Annual Meeting and voting in person by ballot, so that

Table of Contents

whether you intend to be present at the Annual Meeting or not, your shares can be voted. Returning your proxy will not limit your rights to attend or vote at the Annual Meeting.

If you are a shareholder who is entitled to attend and vote, then you are entitled to appoint a proxy or proxies to attend and vote on your behalf. A proxy is not required to be a shareholder in the Company. If you wish to appoint as proxy any person other than the individuals specified on the proxy card, please specify the name(s) and address of such person(s) in the proxy card.

In addition to the above notice of the Annual General Meeting, the Board would like to draw your attention to the following notice concerning a proposed change to the Financial Reporting Standards used in the preparation of the financial statements of the ultimate holding company, Endo International plc.

Adoption of New Financial Reporting Standards

The Company prepares its stand-alone parent entity Irish statutory financial statements consistent with Irish generally accepted accounting principles (Irish GAAP). During the year ending December 31, 2015, Endo International plc adopted FRS 102 “The Financial Reporting Standard Applicable in the UK and Republic of Ireland”.

By order of the Board of Directors,

Orla Dunlea

Company Secretary

Dublin, Ireland

May 5, 2016

Endo International plc

Registered Office: First Floor, Minerva House, Simmonscourt Road, Ballsbridge, Dublin 4, Ireland

Registered in Ireland: number—534814

Directors: Roger Hartley Kimmel (USA), Rajiv Kanishka Liyanaarchchie De Silva (USA), Shane Martin Cooke (Ireland),

Arthur Joseph Higgins (USA), Nancy June Hutson (USA), Michael Hyatt (USA), Douglas Stephen Ingram (USA),

William Patrick Montague (USA), Todd Benjamin Sisitsky (USA), Jill Deborah Smith (USA), William Frederick Spengler (USA).

Table of Contents

Proxy Statement for 2016 Annual General Meeting

of Shareholders

Table of Contents

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Endo International plc, an Irish public limited company, of proxies to be voted at our 2016 Annual General Meeting or Annual Meeting to be held on June 9, 2016, beginning at 8:00 a.m., local time. The Annual Meeting will be held at First Floor, Minerva House, Simmonscourt Road, Ballsbridge, Dublin 4, Ireland.

In accordance with the rules of the Securities and Exchange Commission, we are furnishing our proxy materials (Proxy Statement for Annual Meeting, 2015 Annual Report to Shareholders, 2015 Endo International plc Form 10-K and 2015 Irish Statutory Financial Statements) by providing access to these materials electronically on the internet. As such, we are not mailing a printed copy of our proxy materials to each shareholder of record or beneficial owner, and our shareholders will not receive printed copies of the proxy materials unless they request this form of delivery. Printed copies will be provided upon request at no charge.

We are mailing a Notice of Meeting and Internet Availability of Proxy Materials (Notice of Internet Availability) to our shareholders on or about May 5, 2016. This Notice of Internet Availability is in lieu of mailing the printed proxy materials, and contains instructions for our shareholders as to how they may: (1) access and review our proxy materials on the internet; (2) submit their proxy; and (3) receive printed proxy materials. Shareholders may request to receive printed proxy materials by mail or electronically by e-mail on an ongoing basis by following the instructions in the Notice of Internet Availability. We believe that providing future proxy materials electronically will enable us to save costs associated with printing and delivering the materials and reduce the environmental impact of our annual meetings. A request to receive proxy materials in printed form by mail or by e-mail will remain in effect until such time as the shareholder elects to terminate it.

Unless otherwise indicated or the context otherwise requires, references in this proxy statement to “Endo,” “the Company,” “we,” “us,” and “our” refer to Endo International plc and its consolidated subsidiaries.

Shareholders must present a form of personal identification in order to be admitted to the Annual Meeting. For directions to the Annual Meeting, visit www.endo.com/about-us/locations.

No cameras, recording equipment or electronic devices will be permitted in the Annual Meeting.

Holders of ordinary shares at the close of business on April 14, 2016 (the record date), are entitled to receive this notice and to vote their shares at the Annual Meeting. As of that date, there were 222,660,743 issued ordinary shares of Endo entitled to vote.

Each ordinary share is entitled to one vote on each matter properly brought before the Annual Meeting. Your proxy indicates the number of votes you have.

How to Vote if You Are a Shareholder of Record

Your vote is important. Shareholders of record can vote by internet, by mail or by attending the Annual Meeting and voting in person by ballot as described below.

Vote by Internet

If you choose to vote by internet, visit www.proxyvote.com, enter the control number found on the Notice of Internet Availability and follow the steps outlined on the secure website.

Vote by Mail

You can vote by mail by requesting a paper copy of the materials, which will include a proxy card. If you choose to vote by mail, simply complete your proxy card, date and sign it, and return it in the postage-paid envelope provided.

Vote at the Annual Meeting

Voting by internet or mail will not limit your right to vote at the Annual Meeting if you decide to attend in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting.

All shares that have been properly voted and not revoked will be voted at the Annual Meeting. If you execute your proxy but do not give voting instructions, the shares represented by that proxy will be voted FOR each of the nominees for election as director, FOR the approval of the appointment of PricewaterhouseCoopers as the Company’s independent auditors for the year ending December 31, 2016 and to authorize the Audit Committee of the Board of Directors to determine the auditors’ remuneration, FOR the approval, on an advisory basis, of the compensation to be paid to Endo’s named executive officers, FOR the approval of the amendment of the Company’s Memorandum of Association, FOR the approval of the amendment of the Company’s Articles of Association and FOR the approval of the amendment of the Company’s 2015 Stock Incentive Plan.

1

Table of Contents

Electronic Access to Investor Information

|

Endo’s Proxy Statement and other investor information are available on our Company’s website at www.endo.com, under “Investors”. You can also access the Investor page of our website by scanning the QR code to the right with your smartphone. |

|

General Information on Voting and Required Vote

You are entitled to cast one vote for each ordinary share of Endo you own on the record date. Provided that a quorum is present, (1) in order for a nominee to be elected as a director, (2) the approval of the appointment of the Company’s independent auditor and the authorization of the Audit Committee of the Board of Directors to fix the auditors’ remuneration (3) the approval, on an advisory basis, of the compensation to be paid to Endo’s named executive officers and (4) the approval of the amendment of the Company’s 2015 Stock Incentive Plan will each require the majority of the votes cast at the Annual Meeting in person or by proxy. Provided that a quorum is present, (1) the approval of the amendment of the Company’s Memorandum of Association and (2) the approval of the amendment of the Company’s Articles of Association will each require 75% of the votes cast at the Annual Meeting in person or by proxy.

The presence of the holders of a majority of the issued ordinary shares as of the record date entitled to vote at the Annual Meeting, present in person or represented by proxy, is necessary to constitute a quorum. Shares represented by a proxy marked “abstain” on any matter will be considered present at the Annual Meeting for purposes of determining a quorum. Abstentions will not be considered votes cast at the Annual Meeting. The practical effect of this is that abstentions are not voted in respect of these proposals. Shares represented by a proxy as to which there is a “broker non-vote” (for example, where a broker does not have the discretionary authority to vote the shares), will be considered present for the Annual Meeting for purposes of determining a quorum, and will not have any effect on the outcome of voting on the proposals.

All ordinary shares that have been properly voted and not revoked, will be voted at the Annual Meeting in accordance with your instructions. If you execute the proxy but do not give voting instructions, the ordinary shares represented by that proxy will be voted FOR each of the nominees for election as director, FOR the approval of the appointment of PricewaterhouseCoopers as the Company’s independent auditors for the year ending December 31, 2016 and to authorize the audit committee of the Board of Directors to determine the auditors’ remuneration, FOR the approval, on an advisory basis, of the compensation to be paid to Endo’s named executive officers, FOR the approval of the amendment of the Company’s Memorandum of Association, FOR the approval of the amendment of the Company’s Articles of Association and FOR the approval of the amendment of the Company’s 2015 Stock Incentive Plan.

Voting on Other Matters

If other matters are properly presented at the Annual Meeting for consideration, the persons named in the proxy will have the discretion to vote on those matters for you. At the date the Company began printing this Proxy Statement, no other matters had been raised for consideration at the Annual Meeting.

How You May Revoke or Change Your Vote

You can revoke your proxy at any time before it is voted at the Annual Meeting by:

| ¡ | sending written notice of revocation to the Company Secretary; |

| ¡ | timely delivering a valid, later-dated proxy; or |

| ¡ | attending the Annual Meeting and voting in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor from the holder of record, to be able to vote at the meeting. |

List of Shareholders

The names of shareholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the Annual Meeting for any purpose germane to the meeting, between the hours of 8:45 a.m. and 4:30 p.m., at our registered office at First Floor, Minerva House, Simmonscourt Road, Ballsbridge, Dublin 4, Ireland.

Cost of Proxy Solicitation

The Company will pay for preparing, printing and mailing this Proxy Statement and we will pay for the cost of soliciting proxies. Proxies may be solicited on our behalf by directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission. The Company will reimburse banks, brokers and other custodians, nominees and fiduciaries for their reasonable out-of-pocket costs of sending the proxy materials to our beneficial owners. We have also retained Innisfree M&A Inc. to assist in soliciting proxies. We will pay Innisfree M&A Inc. a base fee of approximately $25,000 plus reasonable out-of-pocket expenses for these services.

2

Table of Contents

Presentation of Irish Statutory Financial Statements

The Company’s Irish statutory financial statements for the fiscal year ended December 31, 2015, including the reports of the directors and auditors thereon, will be presented at the Annual Meeting. There is no requirement under Irish law that such financial statements be approved by shareholders, and no such approval will be sought at the Annual Meeting. The Company’s 2015 Irish statutory financial statements are available with the Proxy Statement for Annual Meeting, 2015 Annual Report to Shareholders, 2015 Endo International plc Form 10-K and other proxy materials at www.proxyvote.com.

Proposal 1: Election of Directors

The Board of Directors

The Company’s Memorandum and Articles of Association provides that the number of directors of the Company shall be not less than five nor more than twelve, the exact number of which shall be fixed from time to the time by resolution of the Board of Directors or by a resolution adopted by holders of a majority of the Company’s ordinary shares. On April 28, 2015, Mr. Delucca informed the Board of Directors that he would not stand for re-election at the 2015 Annual Meeting. The Board did not fill the vacancy left by Mr. Delucca’s departure. On May 3, 2016, the Board resolved that the number of directors be fixed at eleven effective May 5, 2016, and Douglas S. Ingram and Todd B. Sisitsky were appointed to the Board to fill the vacancies thereby created by such resolution.

Under the terms of the Company’s Memorandum and Articles of Association, directors need not be shareholders of the Company or residents of Ireland. However, pursuant to the Stock Ownership Guidelines approved by the Board of Directors, each non-employee Director should, but is not required to, have ownership of the Company’s ordinary shares equal in value to at least five times his or her current annual cash retainer to be achieved within five years of joining the Board, or in the case of non-employee Directors serving at the time the Ownership Guidelines were adopted, within five years of the date of the adoption, or December 10, 2015, as further described in the section titled “Common Stock Ownership Guidelines”. Directors are elected for a one-year term and shall retire from office unless re-elected by ordinary resolution at the next following Annual General Meeting. Non-employee Directors receive compensation for their services as determined by the Board of Directors. See “COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS — 2015 Compensation of Non-Employee Directors.” A vacancy on the Board, or a newly created directorship resulting from any increase in the authorized number of directors, may be filled by a majority of the directors then in office, even though less than a quorum remains. A director appointed to fill a vacancy remains a director until the next following Annual Meeting or his or her earlier death, resignation or removal.

Currently, the Board of Directors consists of eleven members. Currently serving as directors are Roger H. Kimmel, Rajiv De Silva, Shane M. Cooke, Arthur J. Higgins, Nancy J. Hutson, Ph.D., Michael Hyatt, Douglas S. Ingram, William P. Montague, Todd B. Sisitsky, Jill D. Smith and William F. Spengler. On April 28, 2015, Mr. Delucca resigned from the Company’s Board of Directors effective June 9, 2015. All of the current members are nominated by the Board of Directors of the Company for the election as directors of the Company.

The Board annually determines the independence of directors based on a review by the directors and the Nominating & Governance Committee. No director is considered independent unless the Board of Directors has determined that he or she has no material relationship with the Company, either directly or as a partner, shareholder or officer of an organization that has a material relationship with the Company. Material relationships can include commercial, industrial, banking, consulting, legal, accounting, charitable and familial relationships, among others. To evaluate the materiality of any such relationship, the Board has adopted categorical independence standards consistent with the NASDAQ Exchange listing guidelines. These standards are available on the Company’s website at www.endo.com, under “Investors-Corporate Governance-Nominating & Governance Committee.”

Members of the Audit, Compensation, and Nominating & Governance Committees must meet applicable independence tests of the NASDAQ.

The Board of Directors has affirmatively determined that ten of its eleven current members are independent directors under the NASDAQ rules and regulations. The ten independent directors under the NASDAQ rules and regulations are Messrs. Kimmel, Cooke, Higgins, Hyatt, Ingram, Montague, Sisitsky and Spengler, Dr. Hutson and Ms. Smith. Todd B. Sisitsky’s service as an executive officer of a shareholder was determined not to interfere with his independence. If the nominees recommended by the Board of Directors are elected at the 2016 Annual Meeting, ten of the Company’s eleven directors will be independent directors under the NASDAQ rules and regulations. Mr. De Silva is not independent due to his role as President and Chief Executive Officer.

On an annual basis and upon the nomination of any new director, the Nominating & Governance Committee and the Board review directors’ responses to a questionnaire asking about their relationships with the Company (and those of their immediate family members) and other potential conflicts of interest. The Nominating & Governance Committee has determined that the ten non-employee directors currently serving are independent, and that the members of the Audit, Compensation, and Nominating & Governance Committees also meet the independence tests referenced above. Specifically, the Nominating & Governance Committee and the Board have determined that all current non-employee directors have not had during the last three years (i) any of the relationships listed above or (ii) any other material relationship with the Company that would compromise his or her independence. The Nominating & Governance Committee recommended this determination to the Board of Directors and explained the basis for its decision, and this determination was adopted by the full Board.

3

Table of Contents

As of the date of this Proxy Statement, there are no material proceedings to which any director or executive officer of the Company, or any associate thereof, is a party that are adverse to the Company or any of its subsidiaries.

Between January 1, 2015 and December 31, 2015, the Board of Directors of the Company as a whole met nine times and did not act by written consent. All members of the Board of Directors who are standing for election attended at least 75% or more of the aggregate number of meetings of the Board and of the committees on which he or she served during 2015.

Nominees

There are eleven nominees for election as directors of the Company to serve until the 2017 Annual General Meeting of Shareholders of the Company or until his/her earlier death, resignation or removal. All of the nominees are currently serving as directors of the Company. In addition, nine of those nominees were elected to the Board at the last Annual Meeting. Douglas S. Ingram and Todd B. Sisitsky were identified and recommended to the Board by its Nominating & Governance Committee and appointed by the Board on May 3, 2016 effective May 5, 2016.

The proposed nominees for election as directors have confirmed that they are each willing to serve as directors of the Company. If, as a result of circumstances not now known or foreseen, a nominee shall be unavailable or unwilling to serve as a director, an alternate nominee may be designated by the present Board of Directors to fill the vacancy.

The Board believes that each of the Company’s directors is highly qualified to serve as a member of the Board and each has contributed to the mix of skills, core competencies and qualifications of the Board. When evaluating candidates for election to the Board, the Nominating & Governance Committee seeks candidates with certain qualities that it believes are important,

|

Set forth below

are |

including experience, skills, expertise, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest, those criteria and qualifications described in each director’s biography below and such other relevant factors that the Nominating & Governance Committee considers appropriate in the context of the needs of the Board of Directors. Although not specified in the charter, the Committee also considers ethnicity and gender when selecting candidates so that additional diversity may be represented on the Board. Our current directors are highly experienced and have diverse backgrounds and skills as well as extensive track records of success in what we believe are highly relevant positions. The Board believes that each director’s service as the Chairman, Vice Chairman, President and Chief Executive Officer, Executive Vice President & Chief Financial Officer or Senior Executive of significant companies has provided each director with skills that are important to serving on our Board. |

|

|

ROGER H. KIMMEL, 69, is Chairman of the Board of Endo and is Chairman of Endo’s Nominating & Governance Committee, a member of Endo’s Transactions Committee and an alternate member of Endo’s Audit Committee and Operations Committee. Mr. Kimmel became Chairman of the Board upon the Company’s inception in February 2014. Mr. Kimmel has been Vice Chairman of Rothschild Inc., an investment banking firm, since January 2001. Previously, Mr. Kimmel was a partner of the law firm Latham & Watkins for more than five years. Mr. Kimmel is also a Director of PG&E Corporation, a public energy-based holding company and its subsidiary Pacific Gas and Electric Company, a utility company. Mr. Kimmel was a Director of Schiff Nutrition International until 2012, and was a Director and Chairman of Endo Health Solutions Inc. from July 2000 until February 2014. Mr. Kimmel also served as the Chairman of the Board of Endo Health Solutions Inc. during part of his tenure as Director. Mr. Kimmel served as Chairman of the Board of Trustees of the University of Virginia Law School Foundation (not-for-profit) from January 2009 to June 30, 2015. He has been a public speaker on corporate governance issues and private equity transactions. | |

|

RAJIV DE SILVA, 49, is President, Chief Executive Officer and a Director of Endo. Prior to joining Endo in March 2013, Mr. De Silva has had a broad international experience, having managed businesses in the United States, Europe, Canada, Latin America, Asia, South Africa and Australia/New Zealand. He was responsible for all specialty pharmaceutical operations, including sales and marketing, research and development, manufacturing and business development while serving as the President of Valeant Pharmaceuticals International, Inc. from October 2010 to January 2013 and as its Chief Operating Officer, Specialty Pharmaceuticals from January 2009 until January 2013. Prior to joining Valeant, Mr. De Silva held various leadership positions with Novartis. He served as President of Novartis Vaccines USA and Head, Vaccines of the Americas at Novartis. During this time, he played a key leadership role at Novartis’ Vaccines & Diagnostics Division. Mr. De Silva also served as President of Novartis Pharmaceuticals Canada. He originally joined Novartis as Global Head of Strategic Planning for Novartis Pharma AG in Basel, Switzerland. Prior to his time at Novartis, Mr. De Silva was a Principal at McKinsey & Company and served as a member of the leadership group of its Pharmaceuticals and Medical Products Practice. Mr. De Silva was a Director of AMAG Pharmaceuticals, Inc. and is currently a Member of the Board of Trustees at Kent Place School in Summit, NJ. He holds a Bachelor of Science in Engineering, Honors from Princeton University, and a Master of Science from Stanford University and a Master of Business Administration with Distinction from the Wharton School at the University of Pennsylvania. | |

4

Table of Contents

| SHANE M. COOKE, 53, was appointed to the Board of Directors in July 2014 and is a member of Endo’s Audit Committee and Transactions Committee. He is currently President of Alkermes plc based in Dublin, Ireland upon completion of the merger between Elan Drug Technologies (EDT) and Alkermes, Inc. in September 2011. Previously, he was head of EDT and executive vice president of Elan from 2007 through the Alkermes merger in 2011 and concurrently served as chief financial officer of Elan Corporation from 2001 to May 2011. Mr. Cooke was appointed director of Elan in May 2005. Prior to joining Elan, he was chief executive of Pembroke Capital Limited, an aviation leasing company of which he was a founder. Mr. Cooke also previously held a number of senior positions in finance in the banking and aviation industries. Mr. Cooke is a chartered accountant and a graduate of University College Dublin, Ireland. He currently serves on the board of directors of Prothena Corporation plc. |

| |

| ARTHUR J. HIGGINS, 60, has been a member of the Board of Directors since the Company’s inception in February 2014 and is a member of Endo’s Compensation Committee, Operations Committee and Transactions Committee. He is currently a Senior Advisor to Blackstone Healthcare Partners, the dedicated healthcare team of The Blackstone Group, where he focuses on product-based healthcare acquisitions. Mr. Higgins was Chairman of the Board of Management of Bayer HealthCare AG, and Chairman of the Bayer HealthCare Executive Committee. Prior to joining Bayer HealthCare in 2004, Mr. Higgins served as Chairman, President and CEO of Enzon Pharmaceuticals, Inc. from 2001 to 2004. Prior to joining Enzon Pharmaceuticals, Mr. Higgins spent 14 years with Abbott Laboratories, including serving as President of the Pharmaceutical Products Division from 1998 to 2001. Mr. Higgins is a Director of Ecolab, Inc. and Zimmer Holdings, Inc., public companies in the healthcare field. From December 2013 until February 2014, Mr. Higgins was a Director of Endo Health Solutions Inc. He is a past member of the Board of Directors of the Pharmaceutical Research and Manufacturers of America (PhRMA), of the Council of the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA) and President of the European Federation of Pharmaceutical Industries and Associations (EFPIA). |

| |

| NANCY J. HUTSON, Ph.D., 66, has been a member of the Board of Directors since the Company’s inception in February 2014 and Chairman of Endo’s Operations Committee, a member of Endo’s Nominating & Governance Committee and an alternate member of the Transactions Committee. Dr. Hutson retired from Pfizer, Inc. in 2006 after spending 25 years in various research and leadership positions, most recently serving as Senior Vice President, Pfizer Global Research and Development and Director of Pfizer’s pharmaceutical R&D site, known as Groton/New London Laboratories, the largest R&D site of any pharmaceutical company. At Pfizer, she led 4,500 colleagues (primarily scientists) and managed a budget in excess of $1 billion. She currently is a Director of BioCryst Pharmaceuticals, Inc. Dr. Huston previously served a Director of Cubist Pharmaceuticals until January 2015, and from March 2009 until February 2014, was a Director of Endo Health Solutions Inc. Dr. Hutson owns and operates Standing Stones Farm in Ledyard, CT, which is dedicated to supporting the equestrian sport of dressage. |

| |

| MICHAEL HYATT, 70, is a Director of Endo and is Chairman of Endo’s Transactions Committee, a member of Endo’s Compensation Committee and an alternate member of the Nominating & Governance Committee since the Company’s inception in February 2014. Mr. Hyatt is currently a Senior Advisor to Irving Place Capital, a leading institutional private equity firm focused on making equity investments in middle-market companies. Until 2008, Mr. Hyatt was a Senior Managing Director of Bear Stearns & Co., Inc. Mr. Hyatt previously served as a Director of Schiff Nutrition International until 2012. From July 2000 until February 2014, Mr. Hyatt was a Director of Endo Health Solutions Inc. |

| |

| DOUGLAS S. INGRAM, 53, was appointed to the Board of Directors in May 2016 and is a member of Endo’s Compensation Committee and a member of the Operations Committee. Mr. Ingram has served as the Chief Executive Officer and Director of Chase Pharmaceuticals Corporation, a clinical-stage biopharmaceutical company, since December 2015. Prior to joining Chase Pharmaceuticals, Mr. Ingram served as the President of Allergan, Inc. from July 2013 until it was acquired by Actavis in early 2015. At Allergan, he also served as President, Europe, Africa and Middle East from August 2010 to June 2013, and Executive Vice President, Chief Administrative Officer, and Secretary from October 2006 to July 2010, where he led Allergan’s Global Legal Affairs, Compliance, Internal Audit and Internal Controls, Human Resources, Regulatory Affairs and Safety, and Global Corporate Affairs and Public Relations departments. Mr. Ingram also served as General Counsel of Allergan from January 2001 to June 2009 and as Secretary and Chief Ethics Officer from July 2001 to July 2010. With the acquisition of Allergan by Actavis, Mr. Ingram consulted as a special advisor to the |

| |

5

Table of Contents

| Chief Executive Officer of Actavis. Mr. Ingram serves as a director of Pacific Mutual Holding Company and also serves on the Audit Committee, the Governance and Nominating Committee, and the Member Interests Committee. Mr. Ingram is also Vice Chairman of Nemus Biosciences. Mr. Ingram received his Juris Doctor from the University of Arizona in 1988 and his Bachelor of Science degree from Arizona State University in 1985. | ||

|

WILLIAM P. MONTAGUE, 69, has been a member of the Board of Directors since the Company’s inception in February 2014 and is Chairman of Endo’s Compensation Committee, a member of Endo’s Audit Committee and an alternate member of Endo’s Nominating & Governance Committee and Transactions Committee. Mr. Montague served as Chief Executive Officer of Mark IV Industries, Inc., a leading global diversified manufacturer of highly engineered systems and components for transportation infrastructure, vehicles and equipment, from November 2004 until his retirement on July 31, 2008 and as Director from March 1996. He joined Mark IV Industries in April 1972 as Treasurer/Controller, serving as Vice President of Finance from May 1974 to February 1986, then Executive Vice President and Chief Financial Officer from February 1986 to March 1996 and then as President from March 1996 to November 2004. Mr. Montague is also a Director of Gibraltar Industries, Inc., a publicly traded manufacturer and distributor of products for the building and industrial markets since 1993, and has served as Chairman of Gibraltar’s Board if Directors since June 2015. From February 2013 until May 2014, Mr. Montague served as a Director of Allied Motion Technologies Inc., a publicly traded company focused exclusively on serving the motion control market. From February 2009 until February 2014, Mr. Montague was a Director of Endo Health Solutions Inc. | |

|

TODD B. SISITSKY, 44, was appointed to the Board of Directors in May 2016 and is a member of Endo’s Nominating & Governance Committee and Transactions Committee. Mr. Sisitsky is a Partner of TPG, where he serves as Managing Partner of TPG Capital North America, head of the firm’s global healthcare investing platform, and a member of the firm’s Executive Committee. Mr. Sisitsky serves on the boards of directors of Adare Pharmaceuticals, IASIS Healthcare Corporation, Immucor Inc., and Surgical Care Affiliates, Inc. He previously served on the boards of directors of Aptalis Holdings, Inc. (formerly Aptalis Pharma, Inc.), Biomet Inc., HealthScope Ltd., Fenwal Inc., and Par Pharmaceuticals Companies, Inc. He also serves on the board of the Campaign for Tobacco Free Kids, a global not-for-profit organization, and the Dartmouth Medical School Board of Overseers. Prior to joining TPG in 2003, Mr. Sisitsky worked at Forstmann Little & Company and Oak Hill Capital Partners. Mr. Sisitsky earned an M.B.A. from the Stanford Graduate School of Business, where he was an Arjay Miller Scholar, and earned his undergraduate degree from Dartmouth College, where he graduated summa cum laude. | |

|

JILL D. SMITH, 58, has been a member of the Board of Directors since the Company’s inception in February 2014, a member of Endo’s Nominating & Governance Committee and Operations Committee and is an alternate member of the Audit Committee. Ms. Smith has been an international business leader for more than 25 years, including 16 years as a CEO of private and public companies in the technology and information services markets and was most recently Chairman, CEO and President of DigitalGlobe Inc., a leading provider of satellite imagery products and services to governments and companies worldwide. Ms. Smith is a Director and currently serves on the Board of Hexagon AB, a global provider of design, measurement and visualization technologies, J.M. Huber, a leader in engineered materials and Allied Minds, a United Kingdom listed technology development and commercialization company and has served on the corporate boards of SoundBite Communications, Inc., Germany-based Elster Group, Smith & Hawken and DigitalGlobe (prior to her appointment as Chairman and CEO). Ms. Smith was a Director of Endo Health Solutions Inc. from September 2012 until February 2014. | |

|

WILLIAM F. SPENGLER, 61, has been a member of the Board of Directors since the Company’s inception in February 2014, and is Chairman of Endo’s Audit Committee and an alternate member of the Compensation Committee and Operations Committee. From November 2010 until February 2012, Mr. Spengler was President of ChromaDex Corporation, a publicly traded company. From July 2008 until November 2010, Mr. Spengler served as Executive Vice President and Chief Financial Officer of Smith & Wesson Holding Corporation, a global leader in safety, security, protection and sport. Until March 2008, he was Executive Senior Vice President and Chief Financial Officer at MGI Pharmaceuticals Inc., an oncology- and acute care- focused biopharmaceutical company, where he had worked since 2005. Prior to joining MGI Pharma, Mr. Spengler was Executive Vice President and Chief Financial Officer at Guilford Pharmaceuticals Inc., a bioscience company, from July 2004 to October 2005. Mr. Spengler was previously Vice President of Finance at Black & Decker for 5 years, and prior to that spent 14 years in various finance, planning and business development positions at Bristol Myers Squibb. From 2008 until February 2014, Mr. Spengler was a Director of Endo Health Solutions Inc. | |

6

Table of Contents

Vote Required

Shareholder Communications with Directors

The Board has established a process to receive communications from shareholders. Shareholders may contact any member or all members of the Board, any Board committee, or any chair of any such committee by mail. To communicate with the Board of Directors, any individual director or any group or committee of directors, correspondence should be addressed to the Board of Directors or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent “c/o Company Secretary” to Endo International plc, First Floor, Minerva House, Simmonscourt Road, Ballsbridge, Dublin 4, Ireland.

All communications received as set forth in the preceding paragraph will be opened by the office of our Company Secretary for the sole purpose of determining whether the contents represent a message to our directors. Any contents that are not in the nature of advertising, promotions of a product or service, or patently offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Company Secretary’s office will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope or e-mail is addressed.

The Company does not have a policy on director attendance at Annual Meetings. Messrs. Kimmel, Cooke, Higgins, De Silva and Dr. Hutson attended the 2015 Annual Meeting.

Corporate Governance — Board Leadership Structure and Risk Oversight

Board Leadership Structure

We have a board leadership structure under which Mr. Kimmel serves as Chairman of the Board. Following the Annual Meeting, we will have eleven directors, each of whom is independent with the exception of our President and Chief Executive Officer, Mr. De Silva. Our Board currently has five standing committees, each of which is comprised solely of independent directors with a committee chair. In addition, the Board appoints other committees as the Board considers necessary from time to time.

The Board believes that the Chairman and the role of the President and Chief Executive Officer should be separate and that the Chairman should not be an employee of the Company. Further, the Board believes this separation serves the Company’s shareholders best for setting our strategic priorities and executing our business strategy. We believe that our Board consists of directors with significant leadership, organizational and strategic skills, as discussed above. All of our independent directors have served as the Chairman, Vice Chairman, Chief Executive Officer, Chief Financial Officer, or Senior Executive of other companies. Accordingly, we believe that our independent directors have demonstrated leadership in large enterprises, many with relevant industry experience, and are well-versed in board processes and corporate governance. We believe that having directors with such significant leadership skills benefits our Company and our shareholders.

In accordance with the Company’s Memorandum and Articles of Association and our corporate governance guidelines, the Chairman is responsible for chairing Board meetings and setting the agenda for these meetings. Each director also may suggest items for inclusion on the agenda and may, at any Board meeting, raise subjects that are not on the agenda for that meeting. As required by our corporate governance guidelines, our independent directors meet separately, without management present, at each meeting of the Board. In addition, our Board committees regularly meet without members of management present.

As part of its annual self-evaluation process, the Board evaluates the Company’s governance structure. We believe that having a President and Chief Executive Officer for our Company with oversight of company operations, coupled with an experienced independent Board Chairman and experienced independent directors, with five separate independent committee chairs, is the appropriate leadership structure for Endo.

On a regular basis, the Company’s officers who are responsible for monitoring and managing the Company’s risks, including our President and Chief Executive Officer; our President, Par Pharmaceutical; our President, Branded Pharmaceuticals, our Executive Vice President & Chief Financial Officer; our Executive Vice President and Chief Legal Officer; our Executive Vice President, Chief Scientific Officer and Global Head of Research and Development and Quality; our Executive Vice President and Chief Compliance Officer; our Vice President, Controller and Principal Accounting Officer and our Director of Internal Audit, make reports to the Audit Committee. The Audit Committee, in turn, reports to the full Board. While the Audit Committee has primary responsibility for overseeing risk management, our entire Board is actively involved in overseeing risk management for the Company by engaging in periodic discussions with Company officers as the Board may deem appropriate. In addition, each of our Board committees considers the risks within its respective areas of responsibility.

7

Table of Contents

Risk Oversight

The Board of Directors believes that one of its most important responsibilities is to oversee how management manages the various risks the Company faces and has delegated primary responsibility for overseeing the Company’s Enterprise Risk Management (or ERM) program to the Audit Committee. It is management’s responsibility to manage risk and bring to the Audit Committee’s and the Board of Directors’ attention the most material risks to the Company. The Company’s head of internal audit, who reports independently to the Audit Committee, facilitates the ERM program under the sponsorship of our Executive Leadership Team (or ELT), which includes our President and Chief Executive Officer; Executive Vice President & Chief Financial Officer; Executive Vice President, Chief Legal Officer; Chief Scientific Officer and Global Head of Research & Development and Quality; Executive Vice President, Human Resources; President, International Pharmaceuticals and Executive Vice President of Corporate Development; Executive Vice President and Chief Compliance Officer; President, Par Pharmaceuticals; President, Branded Pharmaceuticals; amongst others. Enterprise risks are identified and prioritized by management, and each risk is assigned by the Board to a Board committee or the full Board for oversight based on the nature of the risk area and the committee’s charter. The committee or full Board agendas include discussions of individual risk areas throughout the year. Additionally, the Audit Committee agendas include periodic updates on the ERM process throughout the year. The Board level risk discussions are led by an assigned executive sponsor, from the ELT, for each risk area.

The Audit Committee also regularly reviews treasury risks (insurance, credit and debt), financial and accounting, legal, tax and compliance risks, information technology security risks and other risk management functions. In addition, the Compensation Committee considers risks related to succession planning and the attraction and retention of talent as well as risks relating to the design of compensation programs and arrangements. The Compensation Committee also reviews compensation and benefit plans affecting Endo employees in addition to those applicable to our executive officers. The full Board considers strategic risks and opportunities and regularly receives detailed reports from the committees regarding risk oversight in their respective areas of responsibility.

Code of Conduct

The Board of Directors has adopted a Code of Conduct that applies to the Company’s directors, executives (including its President and Chief Executive Officer and Executive Vice President & Chief Financial Officer) and employees. The Board has also adopted a Director Code of Conduct. These Codes are posted on the Company’s website at www.endo.com, under “Investors—Corporate Governance—Code of Conduct.”

Insider Trading Policy

The Board of Directors has adopted an Insider Trading Policy, which applies to all personnel, including non-employee Directors and officers, arising from our legal and ethical responsibilities as a public company. Among other restrictions, the Insider Trading Policy contains hedging restrictions prohibiting non-employee Directors, the Company’s executive officers and all other employees from purchasing any financial instrument that is designed to hedge or offset any decrease in the market value of the Company’s shares, including, but not limited to, covered calls, collars, or other derivative transactions. Non-employee Directors, the Company’s executive officers and all other employees are also restricted from engaging in short sales related to the Company’s ordinary shares, and pledging the Company’s shares as collateral for a loan, including holding shares in a margin account.

Ordinary Shares Ownership Guidelines

The Board of Directors has adopted share ownership guidelines (the Ownership Guidelines) both for non-employee Directors and for executive officers and senior management of the Company. The Board believes that non-employee directors and senior management should have a significant equity position in the Company and that the Ownership Guidelines serve to further the Board’s interest in encouraging a longer-term focus in managing the Company. The Board also believes that the Ownership Guidelines align the interests of its directors and senior management with the interests of shareholders and further promote Endo’s commitment to sound corporate governance. The Ownership Guidelines are posted on the Company’s website at www.endo.com, under “Investors—Corporate Governance—Compensation Committee.” The current Ownership Guidelines provide that non-employee directors should attain

Endo share ownership equal in value to at least five times his or her current annual cash retainer within the later of five years of joining the Board and December 10, 2015.

Review and Approval of Transactions with Related Persons

The Board of Directors has adopted written policies and procedures for review, approval and monitoring of transactions involving the Company and “related persons” (directors and executive officers or their immediate family members, or shareholders owning five percent or greater of the Company’s issued ordinary shares). The policy covers any related person transaction that meets the minimum threshold for disclosure in the Proxy Statement under the relevant rules of the U.S. Securities and Exchange Commission (the SEC) (generally, transactions involving amounts exceeding $120,000 in which a related person has a direct or indirect material interest).

8

Table of Contents

The following discussion reflects our relationships and related party transactions entered into in connection with the acquisition of Par Pharmaceutical. Todd B. Sisitsky, a director of our Board as of May 5, 2016, is affiliated with TPG, which was a shareholder of Par Pharmaceutical.

Acquisition of Par Pharmaceutical

As previously disclosed in the Company’s public filings with the Securities and Exchange Commission, on September 25, 2015, the Company acquired all of the outstanding shares of Par Pharmaceutical for total consideration of $8.14 billion, including the assumption of Par Pharmaceutical debt. The consideration included 18,069,899 of the Company’s ordinary shares valued at $1.33 billion.

Committees of the Board of Directors

The Board of Directors has a standing Audit Committee, Compensation Committee, Nominating & Governance Committee, Operations Committee and Transactions Committee. The following table shows the directors who are currently members or Chairman of each of these committees. In addition to the committee members listed below, the Board has designated other Board members as alternate members of the committees who can attend meetings in the stead of appointed members.

| Name | Audit Committee | Compensation Committee |

Nominating & Governance Committee |

Operations Committee (formerly known as the Research & Development Committee) |

Transactions Committee | |||||

| Roger H. Kimmel |

Alternate | - | Chairman | Alternate | Member | |||||

| Rajiv De Silva |

- | - | - | - | - | |||||

| Shane M. Cooke |

Member | - | - | - | Member | |||||

| Arthur J. Higgins |

- | Member | - | Member | Member | |||||

| Nancy J. Hutson, Ph.D. |

- | - | Member | Chairman | Alternate | |||||

| Michael Hyatt |

- | Member | Alternate | - | Chairman | |||||

| Douglas S. Ingram (1) |

- | Member | - | Member | - | |||||

| William P. Montague |

Member | Chairman | Alternate | - | Alternate | |||||

| Todd B. Sisitsky (1) |

- | - | Member | - | Member | |||||

| Jill D. Smith |

Alternate | - | Member | Member | - | |||||

| William F. Spengler |

Chairman | Alternate | - | Alternate | - |

| (1) | Appointed as a member of the board on May 3, 2016 effective May 5, 2016. |

Audit Committee

The Audit Committee is responsible for overseeing the Company’s financial reporting process on behalf of the Board of Directors. In addition, the Audit Committee reviews, acts on and reports to the Board of Directors with respect to various auditing and accounting matters, including the selection of the Company’s independent auditors, the scope of the annual audits, fees to be paid to the auditors, the performance of the Company’s independent registered public accounting firm and the accounting practices of the Company and the Company’s internal controls and legal compliance functions. The Audit Committee operates pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website at www.endo.com, under “Investors—Corporate Governance—Audit Committee.” The charter describes the nature and scope of responsibilities of the Audit Committee.

Management of the Company has the primary responsibility for the Company’s financial reporting process, principles and internal controls as well as preparation of its financial statements. The Company’s independent registered public accounting firm is responsible for performing an independent audit of the Company’s financial statements and expressing an opinion as to the conformity of such financial statements with accounting principles generally accepted in the United States.

Messrs. Cooke, Montague and Spengler serve as members of the Audit Committee, while Mr. Kimmel and Ms. Smith serve as alternates. Subject to their election at the 2016 Annual Meeting, the Board of Directors expects to reappoint Messrs. Cooke, Montague and Spengler as members of the Audit Committee and Mr. Kimmel and Ms. Smith as alternates, and to reappoint Mr. Spengler as the Chair of the Audit Committee effective June 9, 2016. Between January 1, 2015 and December 31, 2015, the Audit Committee met six times, in each case including periodic meetings held separately with management, the Company’s internal auditors and the independent registered public accounting firm. The Board has determined that Messrs. Spengler and Montague are “financial experts”, as defined by the SEC regulations, and he has the related financial management expertise within the meaning of the NASDAQ rules. The Board of Directors has determined that Messrs. Kimmel, Cooke, Montague and Spengler and Ms. Smith are “independent” and financially literate in accordance with the criteria established by the SEC and the NASDAQ.

9

Table of Contents

Compensation Committee

The Compensation Committee of the Board of Directors determines the salaries and incentive compensation of the executive officers of the Company and provides broad guidance regarding the remuneration and incentive compensation of the other employees of the Company. The Compensation Committee also reviews and acts on any recommendations of the Company’s management for awards granted under the Endo International plc 2015 Stock Incentive Plan. The current members of the Compensation Committee are Messrs. Montague, Higgins, Hyatt and Ingram, while Mr. Spengler serves as an alternate. Subject to their election at the 2016 Annual Meeting, the Board of Directors expects to reappoint Messrs. Montague, Higgins, Hyatt and Ingram as members of the Compensation Committee, Mr. Spengler as an alternate, and to reappoint Mr. Montague as Chair of the Compensation Committee, effective June 9, 2016. Each of Messrs. Montague, Higgins, Hyatt, Ingram and Spengler is “independent” in accordance with the criteria established by the SEC and the NASDAQ. Between January 1, 2015 and December 31, 2015, the Compensation Committee of the Company met seven times. The Compensation Committee operates pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website at www.endo.com, under “Investors-Corporate Governance-Compensation Committee.” The charter describes the nature and scope of responsibilities of the Compensation Committee.

The primary function of the Compensation Committee is to conduct reviews of the Company’s general executive compensation policies and strategies and oversee and evaluate the Company’s overall compensation structure and programs. The Compensation Committee confirms that total compensation paid to the President and Chief Executive Officer, Executive Vice President & Chief Financial Officer and those other individuals included in the Summary Compensation Table is competitive and performance-based. All of these individuals are referred to as the named executive officers, or NEOs. Responsibilities of the Compensation Committee include, but are not limited to:

| ¡ | evaluating and approving goals and objectives relevant to compensation of the President and Chief Executive Officer and other NEOs, and evaluating the performance of the executives in light of those goals and objectives; |

| ¡ | determining and recommending for approval by the Board of Directors the compensation level of the President and Chief Executive Officer; |

| ¡ | evaluating and approving compensation levels and all grants of equity-based compensation to the NEOs (and certain other employees), as recommended by the Company’s President and CEO; |

| ¡ | recommending to the Board compensation policies for outside directors; |

| ¡ | providing general compensation oversight on significant issues affecting the Company’s compensation philosophy and/or policies; |

| ¡ | providing input to management on whether compensation arrangements for the NEOs (and certain other employees) incentivize excessive risk taking; |

| ¡ | establishing or reviewing performance-based and equity-based incentive plans for the President and Chief Executive Officer, other NEOs, and reviewing other benefit programs and perquisites for the Company’s executive officers; |

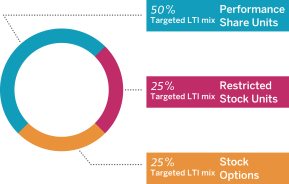

| ¡ | reviewing and approving the aggregate amount of dollars, in the case of the annual cash incentive compensation, and performance share units (PSU), restricted stock units (RSU), and stock options, in the case of the annual long-term incentive (LTI) compensation, that is available to the Company each year; |

| ¡ | reviewing at least annually the Company’s succession plan relating to Named Executive Officer (NEO) positions with a focus on the ongoing evaluation and planning related to succession for the position of President and Chief Executive Officer; and |

| ¡ | reviewing and recommending to the Board for approval the annual goals and objectives of the Company as a whole, which in turn serve as the foundation for incentive compensation. |

Endo management is required to provide reviews and recommendations for the Compensation Committee’s consideration, and to manage the Company’s executive compensation programs, policies and governance. Direct responsibilities in this regard include, but are not limited to:

| ¡ | providing an ongoing review of the effectiveness of the compensation programs for all employees, including competitiveness, and alignment with the Company’s objectives; |

| ¡ | recommending changes, if necessary, to achieve all program objectives; and |

| ¡ | recommending pay levels, payout and/or awards for NEOs and certain other employees other than the President and Chief Executive Officer. |

The Compensation Committee can exercise its discretion in modifying any recommended adjustments or awards to the NEOs, in accordance with Internal Revenue Code (IRC) 162(m) requirements related to performance-based compensation.

Use of Compensation Consultants

The Compensation Committee retains Hay Group as its consultant to provide objective, independent analysis, advice and recommendations with regard to executive compensation including, but not limited to, competitive market data and compensation analysis and recommendations related to our CEO, Board and our other senior executives. Hay Group served as the independent executive compensation consultant to the Compensation Committee for the Company’s entire 2015 fiscal year. The consultant reports to the Chairman of the Compensation Committee and has direct access to the other members of the Compensation Committee. The Compensation Committee also authorizes the consultant to share with, request and receive from management certain specified information in order to prepare for meetings with, and respond to requests from, the Compensation Committee. The Compensation Committee may retain other consultants and advisors from time to time.

10

Table of Contents

A representative of Hay Group attends meetings of the Compensation Committee, is available to participate in executive sessions and communicates directly with the Compensation Committee.

In making an overall determination of the independence and lack of any conflict of interest regarding Hay Group and Hay Group’s lead advisor to the Compensation Committee, the Compensation Committee considered, among other things, the following factors:

| ¡ | the amount of Hay Group’s fees for executive compensation consulting services, noting in particular that such fees are nominal when considered in the context of Hay Group’s total revenues for the period, |

| ¡ | Hay Group’s policies and procedures concerning conflicts of interest (copies of which were made available to the Compensation Committee), |

| ¡ | there are no other business or personal relationships between any members of the Compensation Committee and Hay Group’s lead advisor to the Compensation Committee, |

| ¡ | the lead Hay Group advisor who provides executive compensation consulting services to the Company does not directly own any shares of the Company, and has agreed not purchase any such shares so long as Hay Group and the lead advisor is engaged to provide executive compensation advisory services to the Compensation Committee, |

| ¡ | there are no other business or personal relationships between the Company’s executives and the lead Hay Group advisor, and |

| ¡ | any other factors relevant to the independence of Hay Group. |

In 2015, Hay Group assisted the Compensation Committee with, among other things, (i) performing a review of the Company’s executive compensation program, including competitive market analyses, assessment of potential risks associated with compensation arrangements, policies and plans and considerations related to Endo’s CEO and our other senior executives, (ii) determining the appropriate allocation among short-term and long-term compensation, cash and non-cash compensation, and the different forms of non-cash compensation, (iii) identifying appropriate Pay Comparator Companies (as defined below in the Compensation Discussion and Analysis (CD&A) section) for purposes of benchmarking the Company’s executive compensation in the industry sectors in which Endo competes for talent, and (iv) providing competitive market information and an overview of critical issues and trends affecting the executive compensation landscape. The aggregate amount of fees for Hay Group’s services was $269,634.

On December 1, 2015, Korn/Ferry International (Korn Ferry) announced the completion of its acquisition of Hay Group. Korn Ferry, a nationally recognized global people and organizational advisory firm, has provided services to Endo in the areas of executive recruiting and leadership development over the past several years. Prior to the announcement of Korn Ferry’s acquisition of Hay Group in September of 2015, Endo engaged Korn Ferry in the first half of 2015 to provide executive recruiting services. Following the announced acquisition, Endo’s Board considered Korn Ferry-Hay Group’s Policy on Avoiding Conflicts of Interest, which confirms that Hay Group’s compensation consultants will continue to provide clients with independent, unbiased advice. Following this review, Endo’s Board determined that the policy sufficiently allows Hay Group Compensation Committee consultants to maintain independence. Endo has not incurred any fees related to services provided by Korn Ferry since the completion of its acquisition of Hay Group.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee during 2015 or as of the date of this Proxy Statement is or has been an officer or employee of the Company and no executive officer of the Company served on the compensation committee or board of any company that employed any member of the Company’s Compensation Committee or Board of Directors.

Nominating & Governance Committee

The Nominating & Governance Committee of the Board of Directors, which is comprised of independent directors, identifies and recommends to the Board individuals qualified to serve as directors of the Company, recommends to the Board directors to serve on committees of the Board and advises the Board with respect to matters of Board composition and procedures. The Nominating & Governance Committee also oversees the Company’s corporate governance.

The Nominating & Governance Committee will consider director candidates recommended by shareholders. In considering candidates submitted by shareholders, the Nominating & Governance Committee will take into consideration the needs of the Board and the qualifications of the candidate. The Nominating & Governance Committee may also take into consideration the number of shares held by the recommending shareholder and the length of time that such shares have been held. To have a candidate considered by the Nominating & Governance Committee, a shareholder must submit the recommendation in writing and must include the following information:

| ¡ | The name of the shareholder and evidence of the person’s ownership of shares in the Company, including the number of shares owned and the length of time of ownership; and |

| ¡ | The name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a director of the Company and the person’s consent to be named as a director if selected by the Nominating & Governance Committee and nominated by the Board. |

The shareholder recommendation and information described above must be sent to the Company Secretary at Endo International plc, First Floor, Minerva House, Simmonscourt Road, Ballsbridge, Dublin 4, Ireland, and must be received by the Company Secretary not less than 120 days prior to the anniversary date of the Company’s most recent Annual General Meeting.

11

Table of Contents

While the Board does not have a formal policy with respect to diversity, the Board of Directors and the Nominating & Governance Committee advocate diversity in the broadest sense. We believe that it is important that nominees for the Board represent diverse viewpoints and have diverse backgrounds. The Nominating & Governance Committee looks at a broad array of qualifications and attributes including: experience, skills, expertise, and personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and such other relevant factors that the Nominating & Governance Committee considers appropriate in the context of the needs of the Board of Directors. Although not specified in the charter, the Committee actively considers ethnicity and gender when selecting candidates so that additional diversity may be represented on the Board.

The Nominating & Governance Committee engages national search firms that specialize in identifying and evaluating director candidates. As described above, the Nominating & Governance Committee will also consider candidates recommended by shareholders for inclusion in the search process.

Once a person has been identified by the Nominating & Governance Committee as a potential candidate, the Nominating & Governance Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Nominating & Governance Committee determines that the candidate warrants further consideration, the Chairman or a member of the Nominating & Governance Committee utilizes a recognized search firm to review the candidate’s qualifications and background. Generally, if the person expresses a willingness to be considered and to serve on the Board, the Nominating & Governance Committee requests information from the candidate, reviews the person’s accomplishments and qualifications, including in light of any other candidates that the Nominating & Governance Committee might be considering, and conducts one or more interviews with the candidate. Generally, Nominating & Governance Committee members may conduct additional due diligence of the candidate. The Nominating & Governance Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a shareholder, although, as stated above, the Board may take into consideration the number of shares held by the recommending shareholder and the length of time that such shares have been held.

The Nominating & Governance Committee has established procedures under which any director who is not elected shall, if requested by the Board upon the Nominating & Governance Committee’s recommendation, tender his or her resignation to the Board of Directors. The Board of Directors will publicly disclose its decisions of whether or not to request any director to tender his or her resignation and whether or not to accept any such tendered resignation and the rationale behind such decisions within 90 days from the date of the certification of the election results.

The current members of the Nominating & Governance Committee are Mr. Kimmel, Dr. Hutson, Mr. Sisitsky and Ms. Smith, while Messrs. Hyatt and Montague serve as alternates. The Board has elected Mr. Kimmel as Chairman of the Nominating & Governance Committee. Between January 1, 2015 and December 31, 2015, the Nominating & Governance Committee of the Company met four times. Subject to their election at the 2016 Annual Meeting, the Board of Directors expects to reappoint Mr. Kimmel, Dr. Hutson, Mr. Sisitsky and Ms. Smith as members of the Nominating & Governance Committee, Messrs. Hyatt and Montague as alternates, and to re-appoint Mr. Kimmel as Chair of the Nominating & Governance Committee, effective June 9, 2016. The Board of Directors has determined that all of the members of the Nominating & Governance Committee are “independent” in accordance with the criteria established by the SEC and the NASDAQ. The Nominating & Governance Committee operates pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website at www.endo.com, under “Investors-Corporate Governance-Nominating & Governance Committee.”

Operations Committee

The purpose of the Operations Committee is to review matters relating to scientific technology, research and development activities and pipeline investments; to provide advice and counsel to the Company’s management and Transactions Committee in connection with management’s decisions regarding the allocation, deployment, utilization of, and investment in the Company’s scientific assets; to provide advice and counsel to the Company’s management in connection with decisions regarding acquiring or divesting scientific technology or otherwise investing in research or development programs; to assist the Board by providing oversight of regulatory, compliance, quality and legal matters; and to designate a subcommittee to assess and review the Company’s Compliance Program, if necessary. Between January 1, 2015 and December 31, 2015, the Operations Committee of the Company met five times. The current members of the Operations Committee are Dr. Hutson, Mr. Higgins, Mr. Ingram and Ms. Smith, while Messrs. Kimmel and Spengler serve as alternates. Subject to their election at the 2016 Annual Meeting, the Board of Directors expects to reappoint Dr. Hutson, Mr. Higgins, Mr. Ingram and Ms. Smith as members of the Operations Committee, Messrs. Kimmel and Spengler as alternates, and to reappoint Dr. Hutson as the Chair of the Operations Committee, effective June 9, 2016. The Operations Committee operates pursuant to a written charter adopted by the Board of Directors, which is available on the Company’s website at www.endo.com, under “Investors—Corporate Governance—Operations Committee.”

Transactions Committee